14361d1db16e2da106c176402dc7eb09.ppt

- Количество слайдов: 33

GROUP 3 FINAL PRESENTATION Mother Earth Marketing Plan **Cocoy Amador ** Haydee Aunzo ** Harry Kuma** **Des Manlapaz ** Jerome Paras**Jean Reyes** Submitted to: Prof. E. Soriano July 16, 2009

GROUP 3 FINAL PRESENTATION Mother Earth Marketing Plan **Cocoy Amador ** Haydee Aunzo ** Harry Kuma** **Des Manlapaz ** Jerome Paras**Jean Reyes** Submitted to: Prof. E. Soriano July 16, 2009

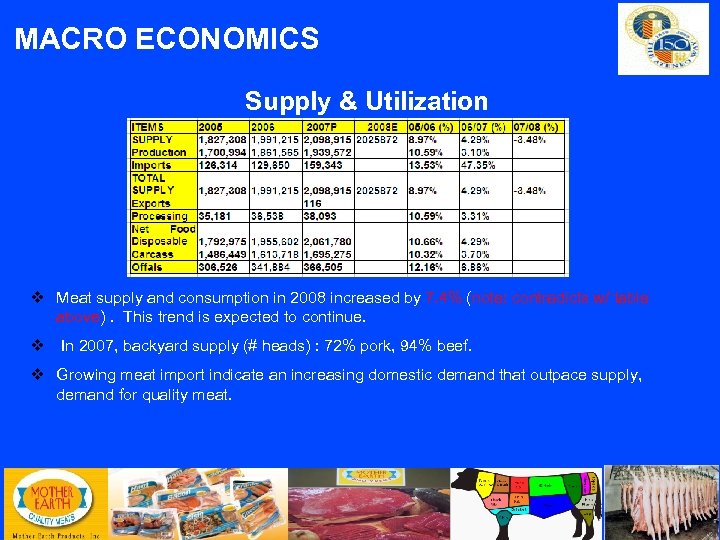

MACRO ECONOMICS Supply & Utilization Meat supply and consumption in 2008 increased by 7. 4% (note: contradicts w/ table above). This trend is expected to continue. In 2007, backyard supply (# heads) : 72% pork, 94% beef. Growing meat import indicate an increasing domestic demand that outpace supply, demand for quality meat.

MACRO ECONOMICS Supply & Utilization Meat supply and consumption in 2008 increased by 7. 4% (note: contradicts w/ table above). This trend is expected to continue. In 2007, backyard supply (# heads) : 72% pork, 94% beef. Growing meat import indicate an increasing domestic demand that outpace supply, demand for quality meat.

Supply & Utilization Philippine is a pork eating nation. Of every 10 kg of meat consumed, about 8 kg is pork. The consumption rate for pork has also steadily improved from 4. 3% in 2007 to 6. 1% in 2008.

Supply & Utilization Philippine is a pork eating nation. Of every 10 kg of meat consumed, about 8 kg is pork. The consumption rate for pork has also steadily improved from 4. 3% in 2007 to 6. 1% in 2008.

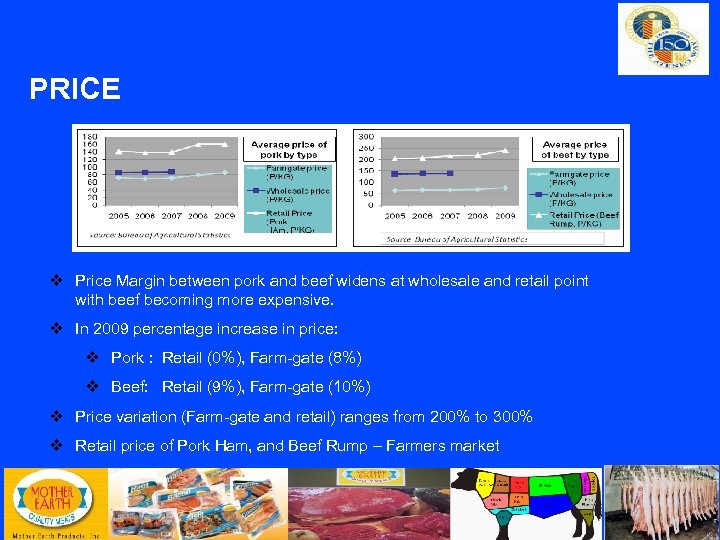

PRICE Price Margin between pork and beef widens at wholesale and retail point with beef becoming more expensive. In 2009 percentage increase in price: Pork : Retail (0%), Farm-gate (8%) Beef: Retail (9%), Farm-gate (10%) Price variation (Farm-gate and retail) ranges from 200% to 300% Retail price of Pork Ham, and Beef Rump – Farmers market

PRICE Price Margin between pork and beef widens at wholesale and retail point with beef becoming more expensive. In 2009 percentage increase in price: Pork : Retail (0%), Farm-gate (8%) Beef: Retail (9%), Farm-gate (10%) Price variation (Farm-gate and retail) ranges from 200% to 300% Retail price of Pork Ham, and Beef Rump – Farmers market

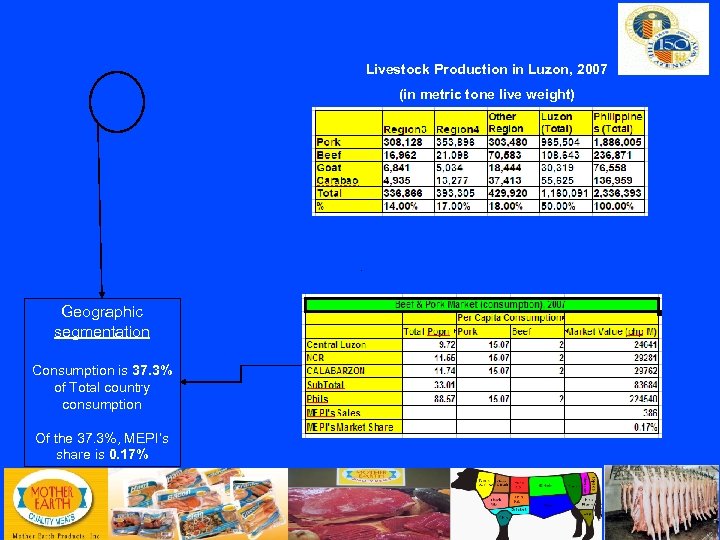

Livestock Production in Luzon, 2007 (in metric tone live weight) Geographic segmentation Consumption is 37. 3% of Total country consumption Of the 37. 3%, MEPI’s share is 0. 17%

Livestock Production in Luzon, 2007 (in metric tone live weight) Geographic segmentation Consumption is 37. 3% of Total country consumption Of the 37. 3%, MEPI’s share is 0. 17%

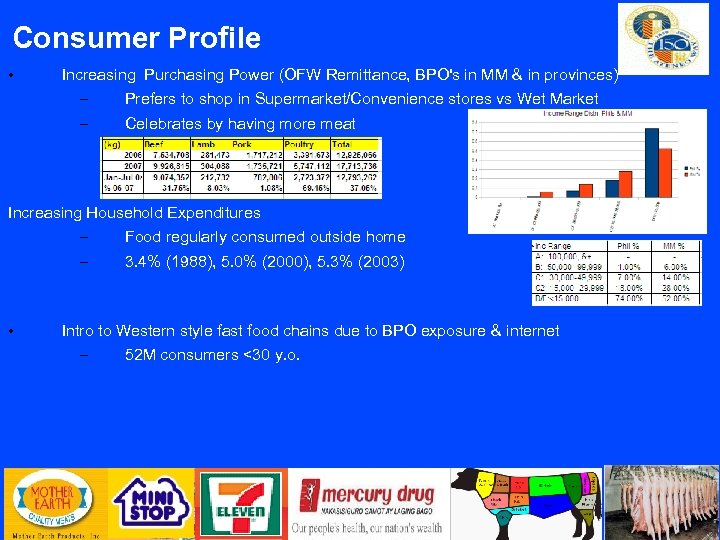

Consumer Profile • Increasing Purchasing Power (OFW Remittance, BPO's in MM & in provinces) – – Prefers to shop in Supermarket/Convenience stores vs Wet Market Celebrates by having more meat Increasing Household Expenditures – – • Food regularly consumed outside home 3. 4% (1988), 5. 0% (2000), 5. 3% (2003) Intro to Western style fast food chains due to BPO exposure & internet – 52 M consumers <30 y. o.

Consumer Profile • Increasing Purchasing Power (OFW Remittance, BPO's in MM & in provinces) – – Prefers to shop in Supermarket/Convenience stores vs Wet Market Celebrates by having more meat Increasing Household Expenditures – – • Food regularly consumed outside home 3. 4% (1988), 5. 0% (2000), 5. 3% (2003) Intro to Western style fast food chains due to BPO exposure & internet – 52 M consumers <30 y. o.

Consumer Profile - cont • Busier & Fast-paced Lifestyle – – • Easy to prepare, ready to cook/eat food Dine Outside at full service or at speed Drive thru's/ Take out Window Preference for affordability & unique experience – – – • One-Stop Shop, merchandise +service Global Financial crisis forces “more value for money” International dishes 37% of consumer expenditure ($28. 3 B) on food, 27% increase by 2015 Increased awareness for food quality & safety – – (food-borne outbreaks, animal-human diseases, chemical residues, dietary concerns)

Consumer Profile - cont • Busier & Fast-paced Lifestyle – – • Easy to prepare, ready to cook/eat food Dine Outside at full service or at speed Drive thru's/ Take out Window Preference for affordability & unique experience – – – • One-Stop Shop, merchandise +service Global Financial crisis forces “more value for money” International dishes 37% of consumer expenditure ($28. 3 B) on food, 27% increase by 2015 Increased awareness for food quality & safety – – (food-borne outbreaks, animal-human diseases, chemical residues, dietary concerns)

Micro-Envt: Mother Earth Products Inc (MEPI) • • • Founded by the CEO/President Atty Renato Tayag, Jr. Original focus on cattle breeding & fattening but due to to Pinatubo eruption, Asian Financial Crisis, it had to diversify to prime cuts & processed meat Now located at Dau, Pampanga W/ “AAA” accreditation by NMIS (SSOP, GMP, HACCP) Customers include Robinsons, Waltermart, Max, Jollibee, Makro, Northpark Noodles & more Products & Services: – – Choice Cuts & Processed Meats, Tolling & Tesda Trng Center

Micro-Envt: Mother Earth Products Inc (MEPI) • • • Founded by the CEO/President Atty Renato Tayag, Jr. Original focus on cattle breeding & fattening but due to to Pinatubo eruption, Asian Financial Crisis, it had to diversify to prime cuts & processed meat Now located at Dau, Pampanga W/ “AAA” accreditation by NMIS (SSOP, GMP, HACCP) Customers include Robinsons, Waltermart, Max, Jollibee, Makro, Northpark Noodles & more Products & Services: – – Choice Cuts & Processed Meats, Tolling & Tesda Trng Center

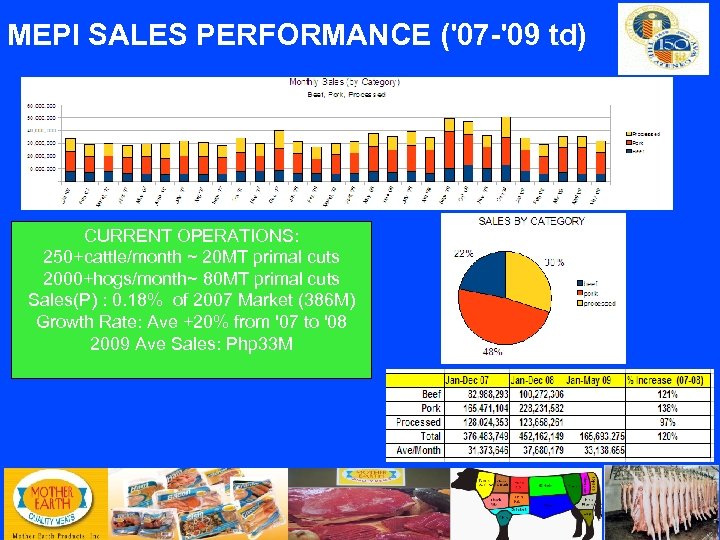

MEPI SALES PERFORMANCE ('07 -'09 td) CURRENT OPERATIONS: 250+cattle/month ~ 20 MT primal cuts 2000+hogs/month~ 80 MT primal cuts Sales(P) : 0. 18% of 2007 Market (386 M) Growth Rate: Ave +20% from '07 to '08 2009 Ave Sales: Php 33 M

MEPI SALES PERFORMANCE ('07 -'09 td) CURRENT OPERATIONS: 250+cattle/month ~ 20 MT primal cuts 2000+hogs/month~ 80 MT primal cuts Sales(P) : 0. 18% of 2007 Market (386 M) Growth Rate: Ave +20% from '07 to '08 2009 Ave Sales: Php 33 M

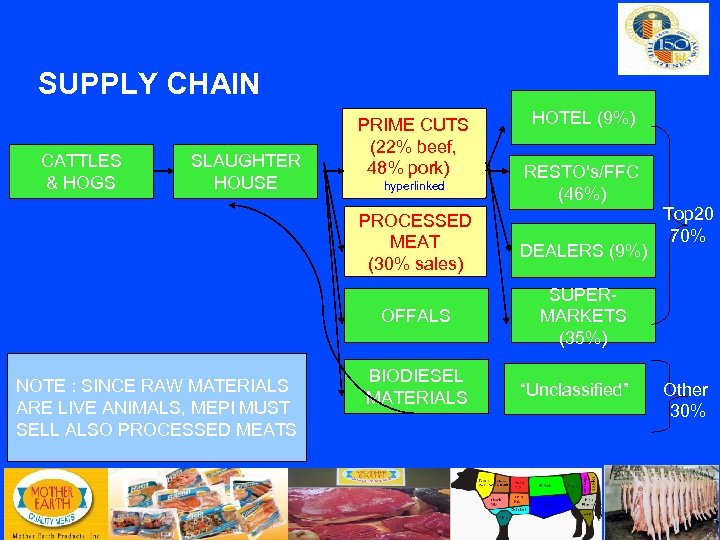

SUPPLY CHAIN CATTLES & HOGS SLAUGHTER HOUSE PRIME CUTS (22% beef, 48% pork) hyperlinked HOTEL (9%) RESTO's/FFC (46%) PROCESSED MEAT (30% sales) OFFALS NOTE : SINCE RAW MATERIALS ARE LIVE ANIMALS, MEPI MUST SELL ALSO PROCESSED MEATS DEALERS (9%) Top 20 70% SUPERMARKETS (35%) BIODIESEL MATERIALS “Unclassified” Other 30%

SUPPLY CHAIN CATTLES & HOGS SLAUGHTER HOUSE PRIME CUTS (22% beef, 48% pork) hyperlinked HOTEL (9%) RESTO's/FFC (46%) PROCESSED MEAT (30% sales) OFFALS NOTE : SINCE RAW MATERIALS ARE LIVE ANIMALS, MEPI MUST SELL ALSO PROCESSED MEATS DEALERS (9%) Top 20 70% SUPERMARKETS (35%) BIODIESEL MATERIALS “Unclassified” Other 30%

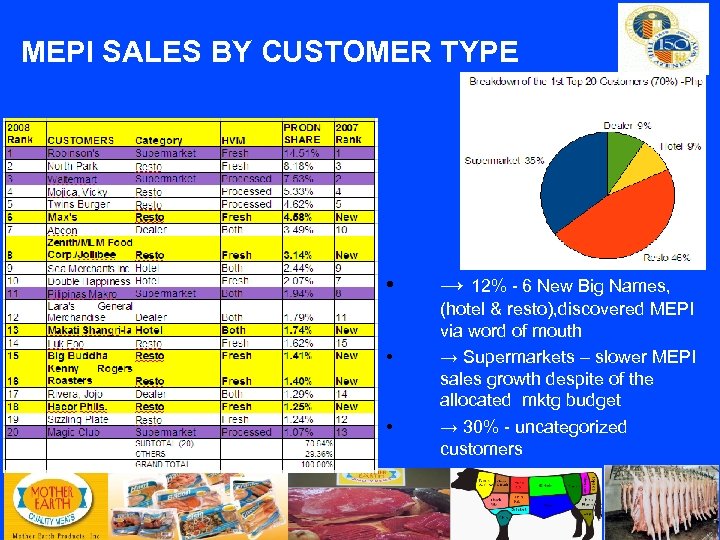

MEPI SALES BY CUSTOMER TYPE • • • → 12% - 6 New Big Names, (hotel & resto), discovered MEPI via word of mouth → Supermarkets – slower MEPI sales growth despite of the allocated mktg budget → 30% - uncategorized customers

MEPI SALES BY CUSTOMER TYPE • • • → 12% - 6 New Big Names, (hotel & resto), discovered MEPI via word of mouth → Supermarkets – slower MEPI sales growth despite of the allocated mktg budget → 30% - uncategorized customers

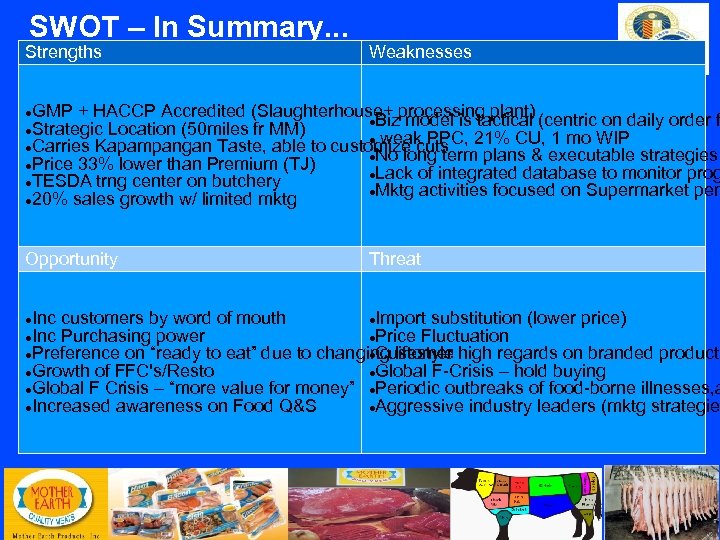

SWOT – In Summary. . . Strengths Weaknesses GMP + HACCP Accredited (Slaughterhouse+ processing plant) (centric on daily order f Biz model is tactical Strategic Location (50 miles fr MM) weak PPC, 21% CU, 1 mo WIP Carries Kapampangan Taste, able to customize cuts No long term plans & executable strategies Price 33% lower than Premium (TJ) Lack of integrated database to monitor prog TESDA trng center on butchery Mktg activities focused on Supermarket pen 20% sales growth w/ limited mktg Opportunity Threat Inc customers by word of mouth Import substitution (lower price) Inc Purchasing power Price Fluctuation Preference on “ready to eat” due to changing lifestyle high regards on branded products Customer Growth of FFC's/Resto Global F-Crisis – hold buying Global F Crisis – “more value for money” Periodic outbreaks of food-borne illnesses, a Increased awareness on Food Q&S Aggressive industry leaders (mktg strategie

SWOT – In Summary. . . Strengths Weaknesses GMP + HACCP Accredited (Slaughterhouse+ processing plant) (centric on daily order f Biz model is tactical Strategic Location (50 miles fr MM) weak PPC, 21% CU, 1 mo WIP Carries Kapampangan Taste, able to customize cuts No long term plans & executable strategies Price 33% lower than Premium (TJ) Lack of integrated database to monitor prog TESDA trng center on butchery Mktg activities focused on Supermarket pen 20% sales growth w/ limited mktg Opportunity Threat Inc customers by word of mouth Import substitution (lower price) Inc Purchasing power Price Fluctuation Preference on “ready to eat” due to changing lifestyle high regards on branded products Customer Growth of FFC's/Resto Global F-Crisis – hold buying Global F Crisis – “more value for money” Periodic outbreaks of food-borne illnesses, a Increased awareness on Food Q&S Aggressive industry leaders (mktg strategie

Competitors Profile – Haydee, I suggest that u capture a side-by-side comparison of the Competitors. Pls put bulletized “key messages” like which are the industry BKM Segmentize based on product. Many data but 'PUNCH” is not obvious.

Competitors Profile – Haydee, I suggest that u capture a side-by-side comparison of the Competitors. Pls put bulletized “key messages” like which are the industry BKM Segmentize based on product. Many data but 'PUNCH” is not obvious.

Purefoods CDO Mekeni

Purefoods CDO Mekeni

Garcia’s Meat Shop

Garcia’s Meat Shop

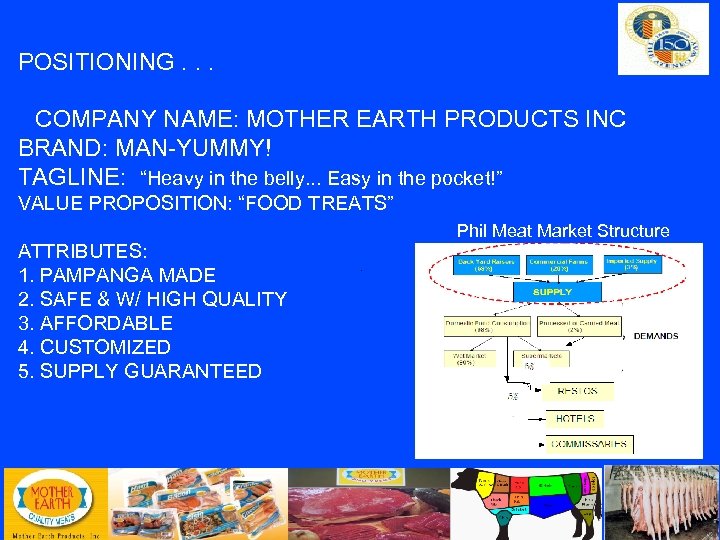

POSITIONING. . . COMPANY NAME: MOTHER EARTH PRODUCTS INC BRAND: MAN-YUMMY! TAGLINE: “Heavy in the belly. . . Easy in the pocket!” VALUE PROPOSITION: “FOOD TREATS” ATTRIBUTES: 1. PAMPANGA MADE 2. SAFE & W/ HIGH QUALITY 3. AFFORDABLE 4. CUSTOMIZED 5. SUPPLY GUARANTEED Phil Meat Market Structure

POSITIONING. . . COMPANY NAME: MOTHER EARTH PRODUCTS INC BRAND: MAN-YUMMY! TAGLINE: “Heavy in the belly. . . Easy in the pocket!” VALUE PROPOSITION: “FOOD TREATS” ATTRIBUTES: 1. PAMPANGA MADE 2. SAFE & W/ HIGH QUALITY 3. AFFORDABLE 4. CUSTOMIZED 5. SUPPLY GUARANTEED Phil Meat Market Structure

JEROME – REBRANDING (MAN-YUMMY!) • • 5 Brand Attributes & Experiences * touch on Identity, Behavior, Performance • APPLY THE SMART PRINCIPLE Objectives Short Term (1 year) Medium Term (2 to 4 years) Long Term (5 to 7 years)

JEROME – REBRANDING (MAN-YUMMY!) • • 5 Brand Attributes & Experiences * touch on Identity, Behavior, Performance • APPLY THE SMART PRINCIPLE Objectives Short Term (1 year) Medium Term (2 to 4 years) Long Term (5 to 7 years)

2 P/PRICING -DES • Pls insert here & send

2 P/PRICING -DES • Pls insert here & send

3 P/ DISTRIBUTION STRATEGIES • • • Hayds, We agreed to have a General assembly to entice the distributors. Logo's are just Supermarkets. . How abt the hotel & resto's which compose the bigger chunk of our sales.

3 P/ DISTRIBUTION STRATEGIES • • • Hayds, We agreed to have a General assembly to entice the distributors. Logo's are just Supermarkets. . How abt the hotel & resto's which compose the bigger chunk of our sales.

Strategy #1 Mother Earth Products INC. (MEPI) needs to strengthen strategic partnership with retailers. MEPI also needs to take the option of joining the SM bandwagon. The strategy will realize the household penetration in Metro Manila area.

Strategy #1 Mother Earth Products INC. (MEPI) needs to strengthen strategic partnership with retailers. MEPI also needs to take the option of joining the SM bandwagon. The strategy will realize the household penetration in Metro Manila area.

Strategy #2 Establish strong presence in provincial areas through Distributorship. Target areas are Central Luzon, Northern Luzon and the Metro Manila areas for the first year. Second Year conceration will cover on Luzon provinces. Five years target is to have nationwide Distribution.

Strategy #2 Establish strong presence in provincial areas through Distributorship. Target areas are Central Luzon, Northern Luzon and the Metro Manila areas for the first year. Second Year conceration will cover on Luzon provinces. Five years target is to have nationwide Distribution.

Strategy #3 • Capitalize on the fast pace life and changing lifestyle of the Filipinos. Introduce a kiosk type food outlets in schools, BPO and Call Center areas that will showcase Mother Earth Products. FOOTLONG VALUE MEALS

Strategy #3 • Capitalize on the fast pace life and changing lifestyle of the Filipinos. Introduce a kiosk type food outlets in schools, BPO and Call Center areas that will showcase Mother Earth Products. FOOTLONG VALUE MEALS

4 P/ PROMOTION – COCOY Promotions Decisions • Sales Promotions • Advertising • Public relations • Personal Selling • Direct Marketing Application: Integrated Marketing Communications to the plan

4 P/ PROMOTION – COCOY Promotions Decisions • Sales Promotions • Advertising • Public relations • Personal Selling • Direct Marketing Application: Integrated Marketing Communications to the plan

Promotions Factors considered for the development of an optimum promotion mix: 1. Product factors – Relates principally to the way a product is bought, consumed, and perceived by the customer. Alternative to the common brands in the market USP – Proudly made in Pampanga. Tastes just as good (if not better) yet more affordable! 2. Market Factors – The position of the product in its life cycle. Growth Stage Sampling – most common strategy employed by its competitors 3. Consumer Factors – Marketed for household consumption or organization Primary target are mothers

Promotions Factors considered for the development of an optimum promotion mix: 1. Product factors – Relates principally to the way a product is bought, consumed, and perceived by the customer. Alternative to the common brands in the market USP – Proudly made in Pampanga. Tastes just as good (if not better) yet more affordable! 2. Market Factors – The position of the product in its life cycle. Growth Stage Sampling – most common strategy employed by its competitors 3. Consumer Factors – Marketed for household consumption or organization Primary target are mothers

4. Budget factors – Influences the types of promotions to be undertaken Below the line advertising Communication Model (AIDA) Attention --> Interest --> Desire --> Action • Attention - Below the line advertising (flyers, leaflets, discount coupons) • Interest – Proudly Made in Pampanga. Tastes just as good (if not better) and more affordable • Desire – Through sampling at supermarkets and selected occasions/events • Action – Conveniently available (through strategic distribution channels) for customers to purchase

4. Budget factors – Influences the types of promotions to be undertaken Below the line advertising Communication Model (AIDA) Attention --> Interest --> Desire --> Action • Attention - Below the line advertising (flyers, leaflets, discount coupons) • Interest – Proudly Made in Pampanga. Tastes just as good (if not better) and more affordable • Desire – Through sampling at supermarkets and selected occasions/events • Action – Conveniently available (through strategic distribution channels) for customers to purchase

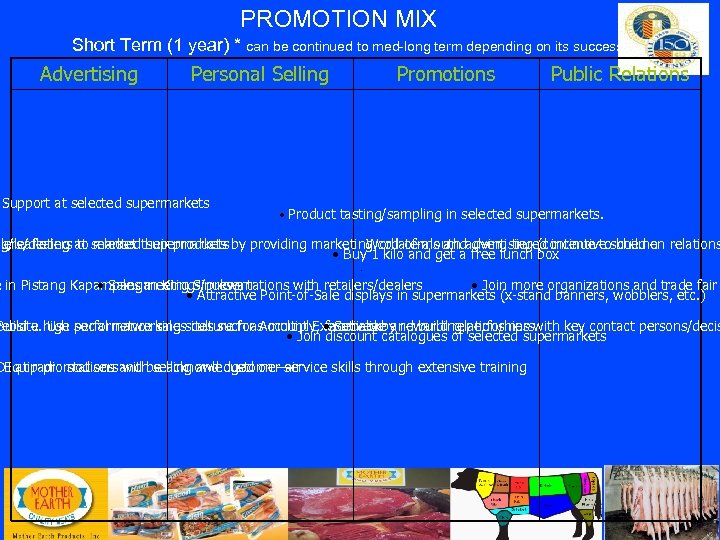

PROMOTION MIX Short Term (1 year) * can be continued to med-long term depending on its success Advertising Personal Selling Support at selected supermarkets Promotions Public Relations • Product tasting/sampling in selected supermarkets. ng/leafleting at selectedtheir products by providing marketing collaterals andadvertising (continue toscheme relations ilers/dealers to market supermarkets Word-of-mouth giving tiered incentive build on • Buy 1 kilo and get a free lunch box e in Pistang Kapampangan King Sinukwan • Sales meetings/presentations with retailers/dealers • Join more organizations and trade fair • Attractive Point-of-Sale displays in supermarkets (x-stand banners, wobblers, etc. ) website. high performance salessites such as multiply, • Socialize and build relationships with key contact persons/decis Build a Use social networking culture for Account Executives by rewarding performers facebook. • Join discount catalogues of selected supermarkets DJ at radio stations and be acknowledged on –air Equip promodisers with selling and customer service skills through extensive training

PROMOTION MIX Short Term (1 year) * can be continued to med-long term depending on its success Advertising Personal Selling Support at selected supermarkets Promotions Public Relations • Product tasting/sampling in selected supermarkets. ng/leafleting at selectedtheir products by providing marketing collaterals andadvertising (continue toscheme relations ilers/dealers to market supermarkets Word-of-mouth giving tiered incentive build on • Buy 1 kilo and get a free lunch box e in Pistang Kapampangan King Sinukwan • Sales meetings/presentations with retailers/dealers • Join more organizations and trade fair • Attractive Point-of-Sale displays in supermarkets (x-stand banners, wobblers, etc. ) website. high performance salessites such as multiply, • Socialize and build relationships with key contact persons/decis Build a Use social networking culture for Account Executives by rewarding performers facebook. • Join discount catalogues of selected supermarkets DJ at radio stations and be acknowledged on –air Equip promodisers with selling and customer service skills through extensive training

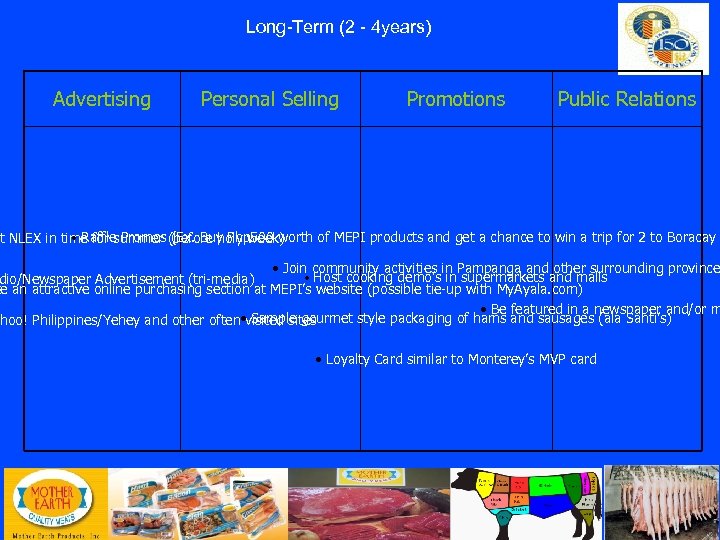

Long-Term (2 - 4 years) Advertising Personal Selling Promotions Public Relations • Raffle Promos (Ex. Buy Php 500 worth of MEPI products and get a chance to win a trip for 2 to Boracay t NLEX in time for summer (before holy week) • Join community activities in Pampanga and other surrounding province • Host cooking demo’s in supermarkets and malls dio/Newspaper Advertisement (tri-media) te an attractive online purchasing section at MEPI’s website (possible tie-up with My. Ayala. com) • Be featured in a newspaper and/or m Sample gourmet style packaging of hams and sausages (ala Santi’s) ahoo! Philippines/Yehey and other often • visited sites • Loyalty Card similar to Monterey’s MVP card

Long-Term (2 - 4 years) Advertising Personal Selling Promotions Public Relations • Raffle Promos (Ex. Buy Php 500 worth of MEPI products and get a chance to win a trip for 2 to Boracay t NLEX in time for summer (before holy week) • Join community activities in Pampanga and other surrounding province • Host cooking demo’s in supermarkets and malls dio/Newspaper Advertisement (tri-media) te an attractive online purchasing section at MEPI’s website (possible tie-up with My. Ayala. com) • Be featured in a newspaper and/or m Sample gourmet style packaging of hams and sausages (ala Santi’s) ahoo! Philippines/Yehey and other often • visited sites • Loyalty Card similar to Monterey’s MVP card

Establishing the Budget The Group recommends the combined use of % of sales and the objective-andtask method to establish the budget. It is imperative that stakeholders would like to make sure that the cost-benefit of each project is advantageous to the company. Projected results of Marketing Promos The effectiveness of Marketing campaigns is projected to increase sales slowly by 15% on the first year and up to 40% on the 4 th year. Break-Even Analysis and justification of Promotion Mix To be detailed in the Marketing Plan

Establishing the Budget The Group recommends the combined use of % of sales and the objective-andtask method to establish the budget. It is imperative that stakeholders would like to make sure that the cost-benefit of each project is advantageous to the company. Projected results of Marketing Promos The effectiveness of Marketing campaigns is projected to increase sales slowly by 15% on the first year and up to 40% on the 4 th year. Break-Even Analysis and justification of Promotion Mix To be detailed in the Marketing Plan

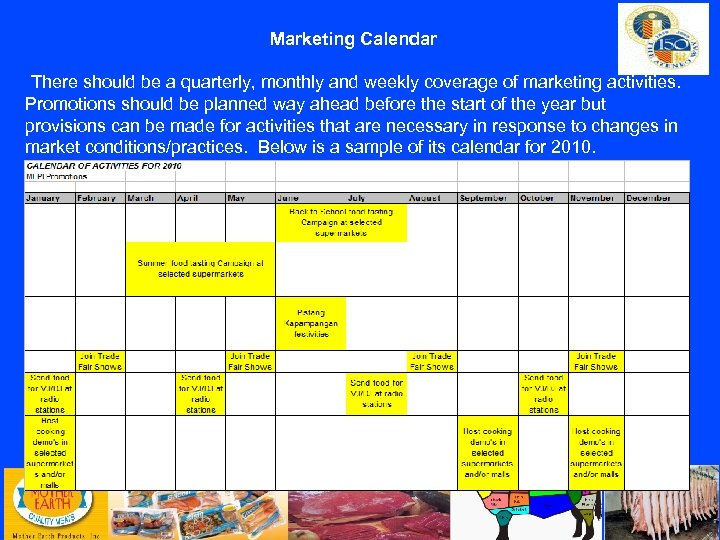

Marketing Calendar There should be a quarterly, monthly and weekly coverage of marketing activities. Promotions should be planned way ahead before the start of the year but provisions can be made for activities that are necessary in response to changes in market conditions/practices. Below is a sample of its calendar for 2010.

Marketing Calendar There should be a quarterly, monthly and weekly coverage of marketing activities. Promotions should be planned way ahead before the start of the year but provisions can be made for activities that are necessary in response to changes in market conditions/practices. Below is a sample of its calendar for 2010.

CRISIS MGT , ECONOMY/CSR/GREEN ADVOCACIES/ – JEROME or COCOY? • • • Crisis Mgt – sent by Jerome (word file) Jerome, I suggest you define the roles & responsibilities of each member of the CMT. Define Escalation procedure also based on gravity of the issue. To whom are they going to report the issue, at what time (ex: after 2 hrs) upon detection of issue. Who among the CMT is to stand as spokesperson to assess whether a closelooping w/ the concerned party is required? What is the operating philosophy among them? Drop everything & convene at the conference room or via conference call?

CRISIS MGT , ECONOMY/CSR/GREEN ADVOCACIES/ – JEROME or COCOY? • • • Crisis Mgt – sent by Jerome (word file) Jerome, I suggest you define the roles & responsibilities of each member of the CMT. Define Escalation procedure also based on gravity of the issue. To whom are they going to report the issue, at what time (ex: after 2 hrs) upon detection of issue. Who among the CMT is to stand as spokesperson to assess whether a closelooping w/ the concerned party is required? What is the operating philosophy among them? Drop everything & convene at the conference room or via conference call?

BACK UP FILES

BACK UP FILES

ORGANIZATION & BIZ MODEL CEO CFO COO QC PRODN MEAT PROC TRNG CTR SLAUGHTER HOUSE R&D MAINT HR Sales & Mktg Cashier Acctg Credit Purchasing Internal Audit

ORGANIZATION & BIZ MODEL CEO CFO COO QC PRODN MEAT PROC TRNG CTR SLAUGHTER HOUSE R&D MAINT HR Sales & Mktg Cashier Acctg Credit Purchasing Internal Audit