c0415bfe69cbab9d873d1852ac001e39.ppt

- Количество слайдов: 18

Green & Gold Fund Recommendation: Buy D. R. Horton, Inc. (DHI)

Key Investment Points • Housing market indicators are strong • Room for recovery • Housing recovery began in mid 2011 • Financially sound • Overall, better than competitors

Industry Overview • Homebuilders and mortgage financiers • Major companies • DHI, PHM, MDC, RYL, NVR, KBH, LEN • Home construction, sale, and financing • Also some deal in land acquisition and development

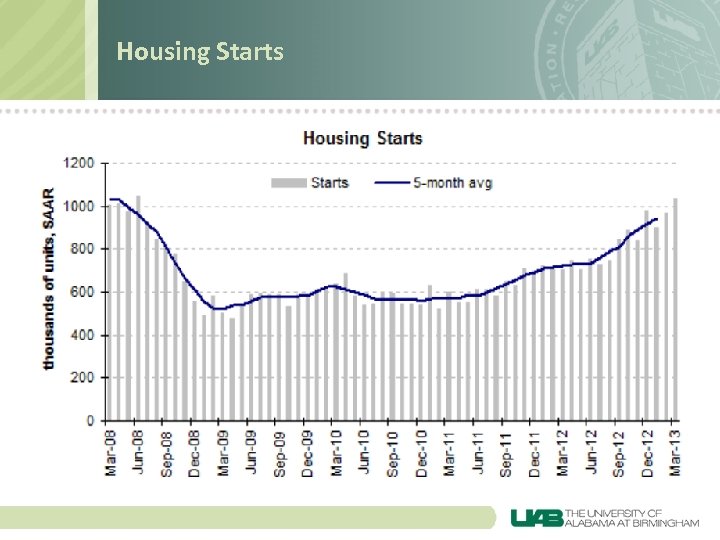

Housing Starts

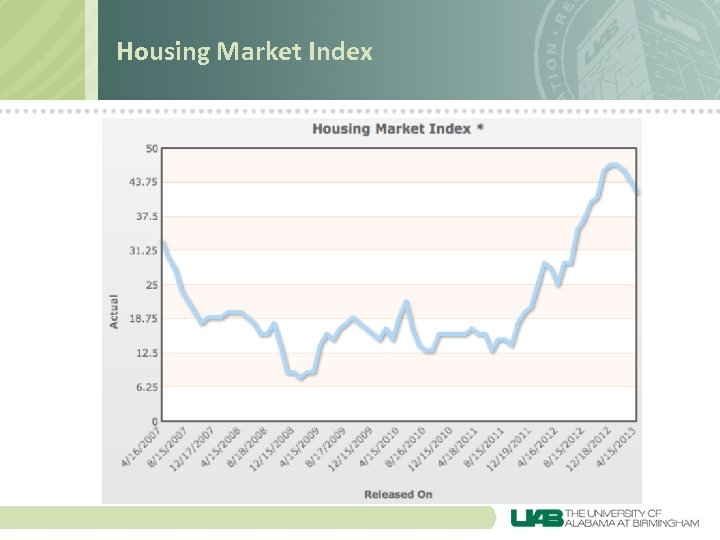

Housing Market Index

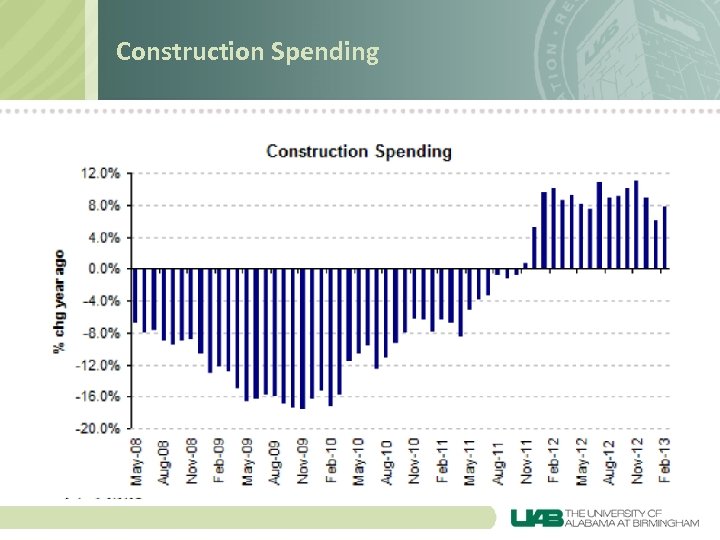

Construction Spending

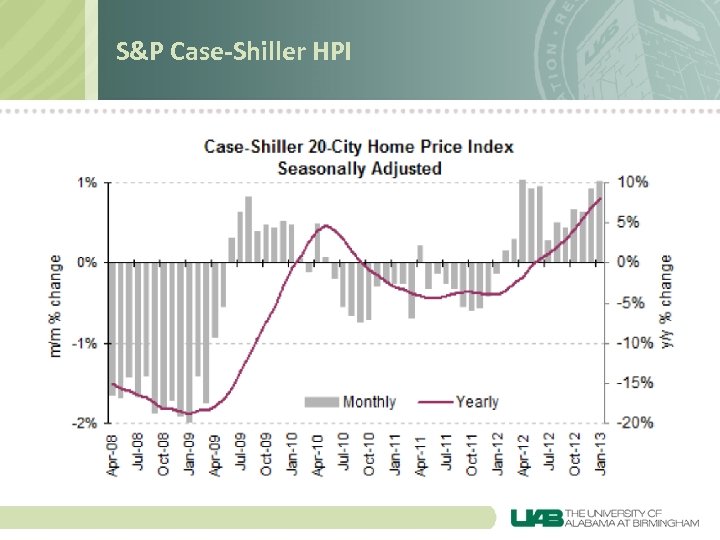

S&P Case-Shiller HPI

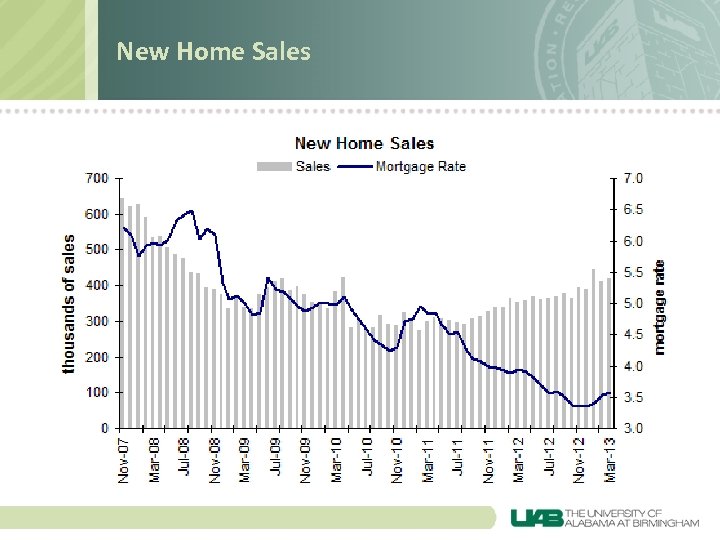

New Home Sales

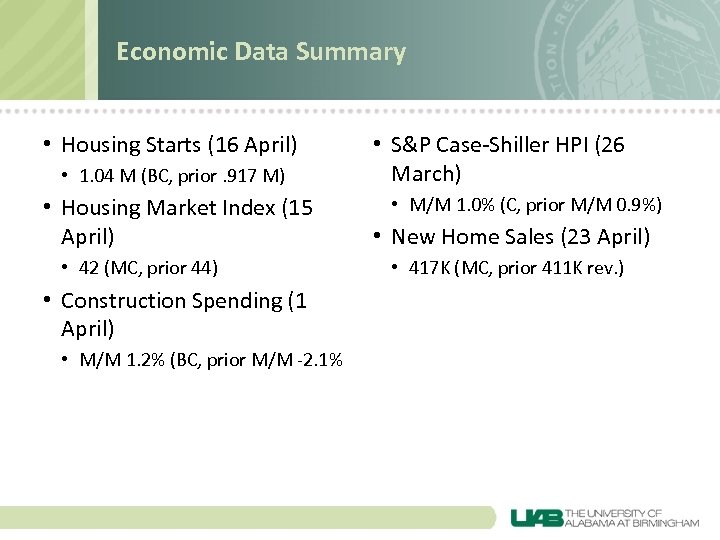

Economic Data Summary • Housing Starts (16 April) • 1. 04 M (BC, prior. 917 M) • Housing Market Index (15 April) • 42 (MC, prior 44) • Construction Spending (1 April) • M/M 1. 2% (BC, prior M/M -2. 1% • S&P Case-Shiller HPI (26 March) • M/M 1. 0% (C, prior M/M 0. 9%) • New Home Sales (23 April) • 417 K (MC, prior 411 K rev. )

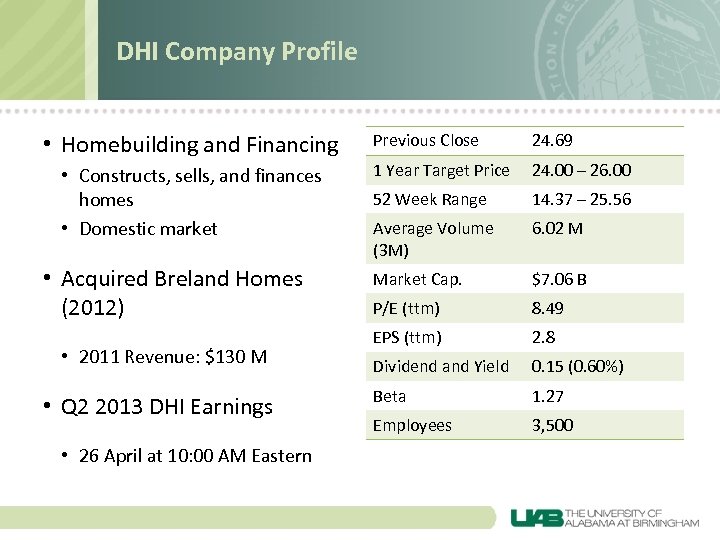

DHI Company Profile • Homebuilding and Financing • Constructs, sells, and finances homes • Domestic market • Acquired Breland Homes (2012) • 2011 Revenue: $130 M • Q 2 2013 DHI Earnings • 26 April at 10: 00 AM Eastern Previous Close 24. 69 1 Year Target Price 24. 00 – 26. 00 52 Week Range 14. 37 – 25. 56 Average Volume (3 M) 6. 02 M Market Cap. $7. 06 B P/E (ttm) 8. 49 EPS (ttm) 2. 8 Dividend and Yield 0. 15 (0. 60%) Beta 1. 27 Employees 3, 500

DHI Price Chart

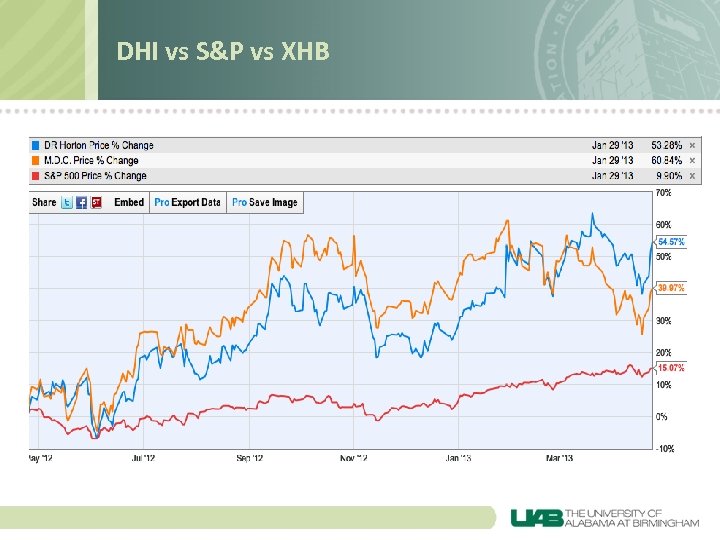

DHI vs S&P vs XHB

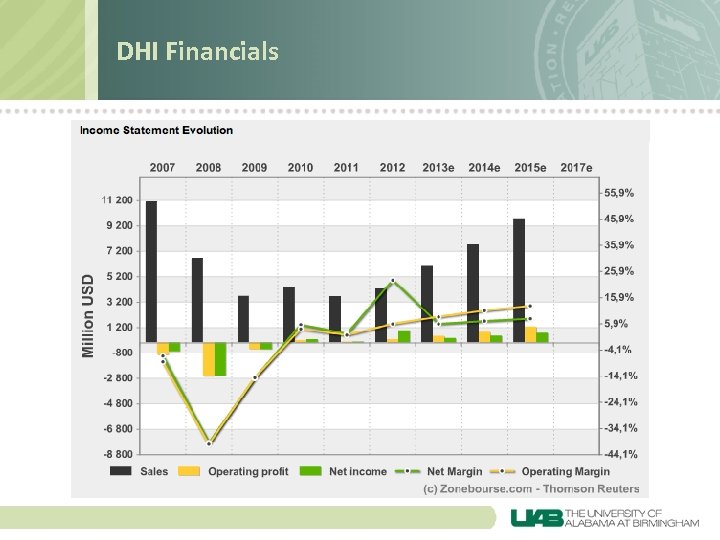

DHI Financials

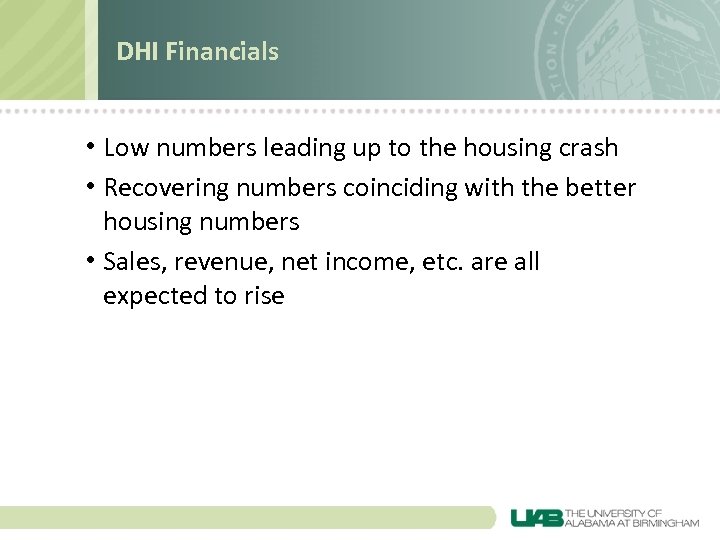

DHI Financials • Low numbers leading up to the housing crash • Recovering numbers coinciding with the better housing numbers • Sales, revenue, net income, etc. are all expected to rise

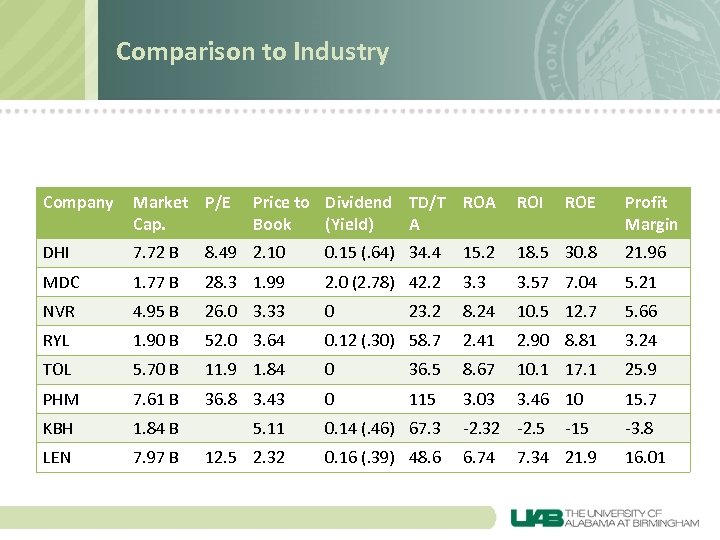

Comparison to Industry Company Market P/E Cap. Price to Dividend TD/T ROA Book (Yield) A ROI ROE DHI 7. 72 B 8. 49 2. 10 0. 15 (. 64) 34. 4 15. 2 18. 5 30. 8 21. 96 MDC 1. 77 B 28. 3 1. 99 2. 0 (2. 78) 42. 2 3. 3 3. 57 7. 04 5. 21 NVR 4. 95 B 26. 0 3. 33 0 23. 2 8. 24 10. 5 12. 7 5. 66 RYL 1. 90 B 52. 0 3. 64 0. 12 (. 30) 58. 7 2. 41 2. 90 8. 81 3. 24 TOL 5. 70 B 11. 9 1. 84 0 36. 5 8. 67 10. 1 17. 1 25. 9 PHM 7. 61 B 36. 8 3. 43 0 115 3. 03 3. 46 10 15. 7 KBH 1. 84 B 5. 11 0. 14 (. 46) 67. 3 -2. 32 -2. 5 LEN 7. 97 B 12. 5 2. 32 0. 16 (. 39) 48. 6 6. 74 -15 7. 34 21. 9 Profit Margin -3. 8 16. 01

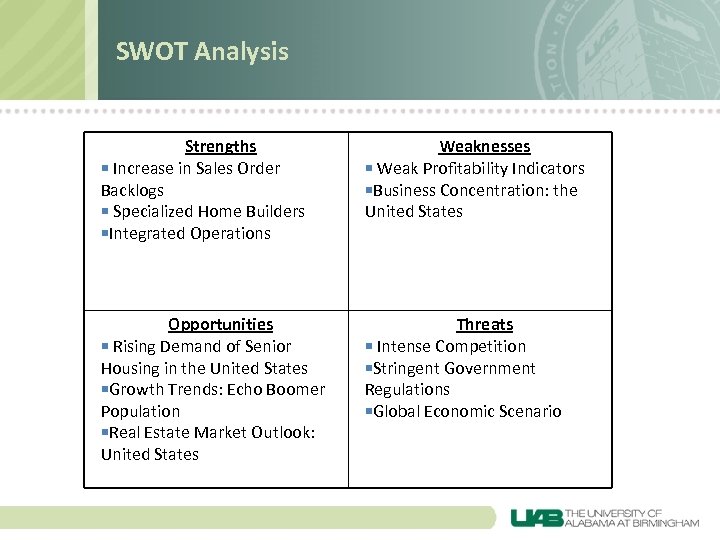

SWOT Analysis Strengths Increase in Sales Order Backlogs Specialized Home Builders Integrated Operations Weaknesses Weak Profitability Indicators Business Concentration: the United States Opportunities Rising Demand of Senior Housing in the United States Growth Trends: Echo Boomer Population Real Estate Market Outlook: United States Threats Intense Competition Stringent Government Regulations Global Economic Scenario

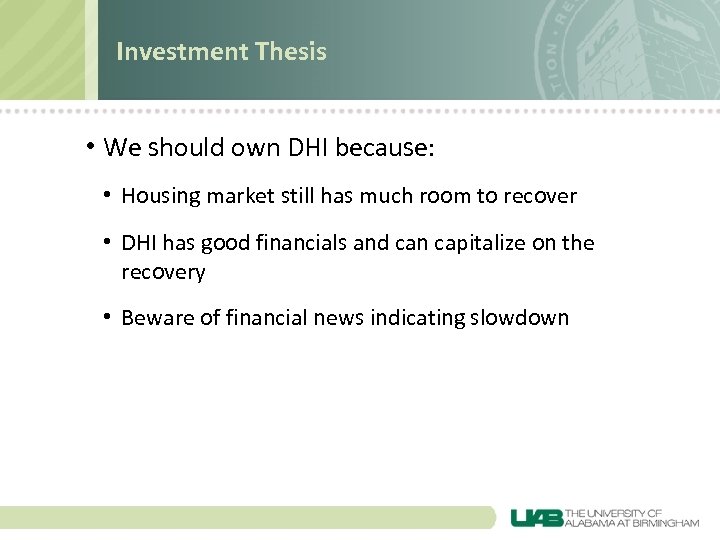

Investment Thesis • We should own DHI because: • Housing market still has much room to recover • DHI has good financials and can capitalize on the recovery • Beware of financial news indicating slowdown

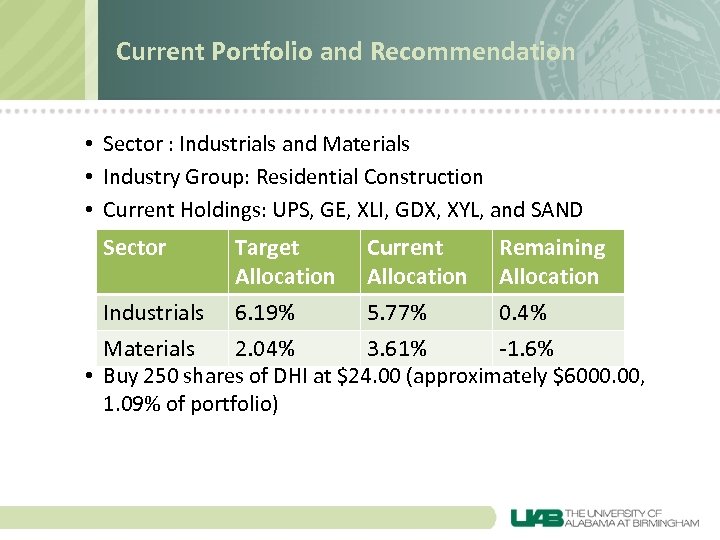

Current Portfolio and Recommendation • Sector : Industrials and Materials • Industry Group: Residential Construction • Current Holdings: UPS, GE, XLI, GDX, XYL, and SAND Sector Target Current Remaining Allocation Industrials 6. 19% 5. 77% 0. 4% Materials 2. 04% 3. 61% -1. 6% • Buy 250 shares of DHI at $24. 00 (approximately $6000. 00, 1. 09% of portfolio)

c0415bfe69cbab9d873d1852ac001e39.ppt