7e866d6129cc5cca6728bf5d3aa476a0.ppt

- Количество слайдов: 16

Greater Milwaukee Chapter of the APA Presented by WACHA The Premier Payments Resource Luann S. Kohlmann, AAP, NCP Vice President 262 -345 -1245 or 800 -453 -1843 www. wacha. org info@wacha. org 2012

Disclaimer • This material is not intended to provide any warranties or legal advice, and is intended for educational purposes only • NACHA owns the copyright for the NACHA Operating Rules & Guidelines • The Accredited ACH Professional (AAP) is a registered service mark of NACHA © 2012 WACHA All rights reserved – This material is derived from collaborative work product developed by NACHA ─ The Electronic Payments Association and its member Regional Payments Associations

WACHA The Premier Payments Resource • Wisconsin Automated Clearing House Association • Not for Profit Trade Association – Membership Driven (FIs and Corporations) • Specialize in training and education for electronic payments – 17 similar associations in US • Help Desk • New Compliance arm called Payments Advisory Resource (PAR) – Covers Audit and Compliance 3

Level Setting • • 4 How many of you use Direct Deposit? Do you mandate Direct Deposit? How many of you use ACH for Payroll Taxes? How many companies use Direct Payment for bill payments?

Direct Deposit • SIMPLE • SAFE • SMART 5

Direct Deposit Savings Calculator http: //www. electronicpayments. org/c/bus_ddep_calculator. cfm? hp=bus 6

Authorizations • • Give a copy Reversal clause DFI request for proof Retention – 2 years after final payroll settlement date 7

Reversals • In case of error a “Reversal” file or entry can be sent • Reversal is not guaranteed! 8

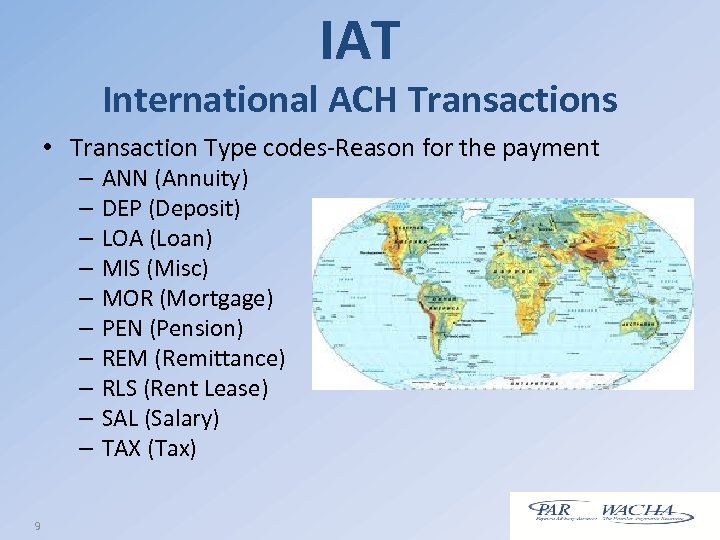

IAT International ACH Transactions • Transaction Type codes-Reason for the payment – – – – – 9 ANN (Annuity) DEP (Deposit) LOA (Loan) MIS (Misc) MOR (Mortgage) PEN (Pension) REM (Remittance) RLS (Rent Lease) SAL (Salary) TAX (Tax)

IAT International ACH Transactions • Authorization and entry needs many more details – Foreign Payment Amt /Receiver’s Name – Originator’s Name /Street/ City / State/ Country/ Postal Code – ODFI Name / ID/ Branch Country Code – RDFI Name / ID / Branch Country Code – Receiver’s ID Number / Street /City / State / Country/ Postal Code • OFAC Compliance 10

Payroll cards How many of you use payroll cards? You can use Direct Deposit to fund payroll cards 11

Availability • Payroll needs to be available by 9 am – Consumer credits available to the RDFI by 5 pm the day before Settlement Date must be available for cash withdrawal by opening of business on settlement date • Effective Date vs Settlement Date 12

Corporate Account Takeover How do you get you payroll files to your financial institution? Security agreements between you and your FI? Security in your office? Security with your service providers? 13

Retirees • Social Security Direct Deposit mandate • Pensions – Reclamations 14

Expedited Processing & Settlement (EPS) • NACHA Rules initiative to enable a premium ACH processing and settlement window – – Faster and more flexible settlement ACH Network-wide solution All endpoints participating Same-day processing and settlement, not “real-time” • Vision in Current Rules Proposal – Consumer & commercial ACH debit, credit, reversing, and return entries – Originated, processed, settled and made available same-day – Addition of an afternoon window, with participation from both ACH Operators, for EPS premium clearing 15

Resources • WACHA- The Premier Payments Resource • PAR- Payment Advisory Resource HELP DESK – Phone: 262 -345 -1245 – Toll Free: 800 -453 -1843 – Fax: 262 -345 -1246 – info@wacha. org – info@paymentadvisoryresource. com

7e866d6129cc5cca6728bf5d3aa476a0.ppt