eae786de9b4a761ae3978be5a0f50cd5.ppt

- Количество слайдов: 38

GRAP FOR DEPARTMENTS MCS, AMD and Specimen Updates Presenter: Technical Support Services | March 2017

GRAP FOR DEPARTMENTS MCS, AMD and Specimen Updates Presenter: Technical Support Services | March 2017

Overview • Background • Key Changes in MCS, AMD and Specimen AFS • Annual Report Guide • Future interactions 2

Overview • Background • Key Changes in MCS, AMD and Specimen AFS • Annual Report Guide • Future interactions 2

Background • Departments' post-audit comments – Due date for comments 30 September 2016 • Draft updates to MCS, AMD and Specimen AFS published in October 2016 • Comment period ended in November 2016 • Final Publication of MCS, AMD and Specimen AFS in December 2016 • A comments register is maintained and updated with responses. Although the comment period has lapsed NT continued to accommodate late comments. Once updates are finalised, it will be availed to departments and the AGSA. 3

Background • Departments' post-audit comments – Due date for comments 30 September 2016 • Draft updates to MCS, AMD and Specimen AFS published in October 2016 • Comment period ended in November 2016 • Final Publication of MCS, AMD and Specimen AFS in December 2016 • A comments register is maintained and updated with responses. Although the comment period has lapsed NT continued to accommodate late comments. Once updates are finalised, it will be availed to departments and the AGSA. 3

The SCOA and Systems AMD: SCOA and BAS Re-implementation Page 6 Para 3 Update Added a note on SCOA and BAS Re-implementation The SCo. A and BAS Re-implementation is underway. From 01 st April 2017, some of the contents of this chapter will no longer be applicable. Observations: • Delayed processing times due to financial system overload (BAS) • BAS had numerous accounts that stayed unused for extended periods • Incorrect allocations = incorrect reporting in the AFS and other key documents used for finance decisions 4

The SCOA and Systems AMD: SCOA and BAS Re-implementation Page 6 Para 3 Update Added a note on SCOA and BAS Re-implementation The SCo. A and BAS Re-implementation is underway. From 01 st April 2017, some of the contents of this chapter will no longer be applicable. Observations: • Delayed processing times due to financial system overload (BAS) • BAS had numerous accounts that stayed unused for extended periods • Incorrect allocations = incorrect reporting in the AFS and other key documents used for finance decisions 4

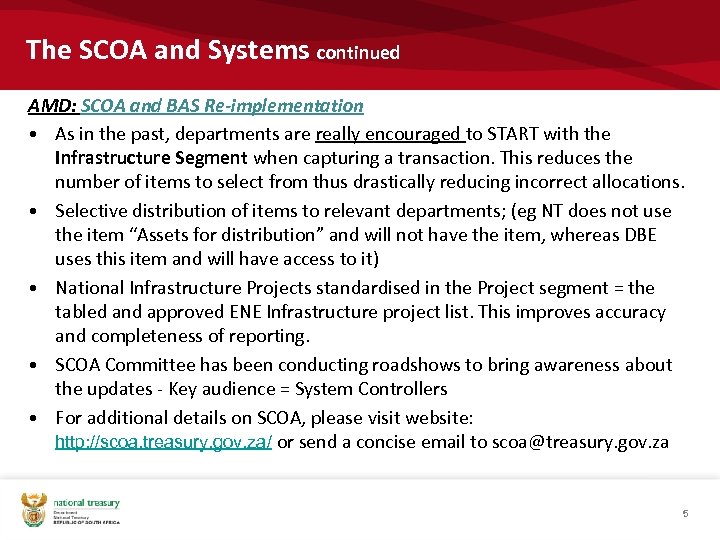

The SCOA and Systems continued AMD: SCOA and BAS Re-implementation • As in the past, departments are really encouraged to START with the Infrastructure Segment when capturing a transaction. This reduces the number of items to select from thus drastically reducing incorrect allocations. • Selective distribution of items to relevant departments; (eg NT does not use the item “Assets for distribution” and will not have the item, whereas DBE uses this item and will have access to it) • National Infrastructure Projects standardised in the Project segment = the tabled and approved ENE Infrastructure project list. This improves accuracy and completeness of reporting. • SCOA Committee has been conducting roadshows to bring awareness about the updates - Key audience = System Controllers • For additional details on SCOA, please visit website: http: //scoa. treasury. gov. za/ or send a concise email to scoa@treasury. gov. za 5

The SCOA and Systems continued AMD: SCOA and BAS Re-implementation • As in the past, departments are really encouraged to START with the Infrastructure Segment when capturing a transaction. This reduces the number of items to select from thus drastically reducing incorrect allocations. • Selective distribution of items to relevant departments; (eg NT does not use the item “Assets for distribution” and will not have the item, whereas DBE uses this item and will have access to it) • National Infrastructure Projects standardised in the Project segment = the tabled and approved ENE Infrastructure project list. This improves accuracy and completeness of reporting. • SCOA Committee has been conducting roadshows to bring awareness about the updates - Key audience = System Controllers • For additional details on SCOA, please visit website: http: //scoa. treasury. gov. za/ or send a concise email to scoa@treasury. gov. za 5

Financial Statement Presentation AMD and Specimen: Note 49 and Annexure 1 A Page Para 9 3. 3. 4 Update Added FAQ 2. 3. 1 for 2015/16 on conditional grants and other transfers paid to municipalities. The requirements of Note 49 and Annexure 1 A are similar but not identical. Note 49 is auditable and does not include the amounts spent by municipalities. Annexure 1 A requires the amounts spent by municipalities and this is information required by other National Treasury divisions. Therefore, both Note 49 of the financial statements and Annexure 1 A to the financial statements should be completed. 6

Financial Statement Presentation AMD and Specimen: Note 49 and Annexure 1 A Page Para 9 3. 3. 4 Update Added FAQ 2. 3. 1 for 2015/16 on conditional grants and other transfers paid to municipalities. The requirements of Note 49 and Annexure 1 A are similar but not identical. Note 49 is auditable and does not include the amounts spent by municipalities. Annexure 1 A requires the amounts spent by municipalities and this is information required by other National Treasury divisions. Therefore, both Note 49 of the financial statements and Annexure 1 A to the financial statements should be completed. 6

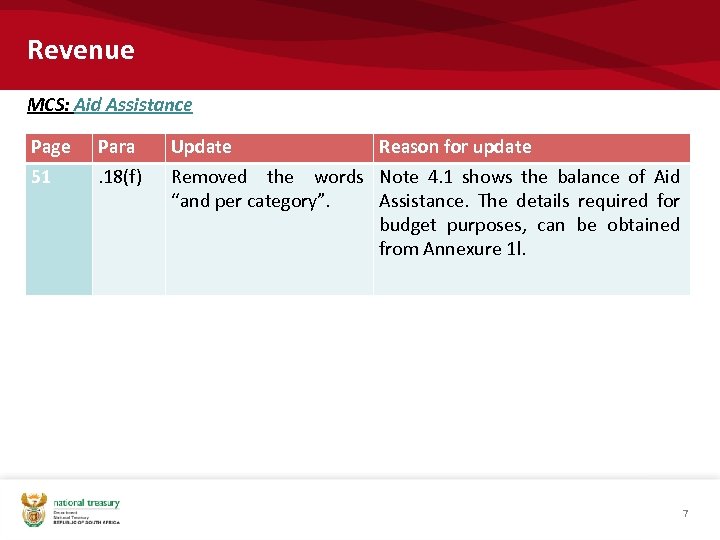

Revenue MCS: Aid Assistance Page 51 Para. 18(f) Update Reason for update Removed the words Note 4. 1 shows the balance of Aid “and per category”. Assistance. The details required for budget purposes, can be obtained from Annexure 1 l. 7

Revenue MCS: Aid Assistance Page 51 Para. 18(f) Update Reason for update Removed the words Note 4. 1 shows the balance of Aid “and per category”. Assistance. The details required for budget purposes, can be obtained from Annexure 1 l. 7

Expenditure AMD: GEHS Page 9 Para 5. 2 Update Added note on Accounting for transactions related to the Government Employees Housing Scheme Accounting For Transactions Related To The Government Employees Housing Scheme (GEHS) Please refer to the instruction note issued by National Treasury on the OAG website. Link: Office of the Accountant-General > Publications > 05. Discussion Papers and Other Documents for Comment > Draft Treasury Instructions 8

Expenditure AMD: GEHS Page 9 Para 5. 2 Update Added note on Accounting for transactions related to the Government Employees Housing Scheme Accounting For Transactions Related To The Government Employees Housing Scheme (GEHS) Please refer to the instruction note issued by National Treasury on the OAG website. Link: Office of the Accountant-General > Publications > 05. Discussion Papers and Other Documents for Comment > Draft Treasury Instructions 8

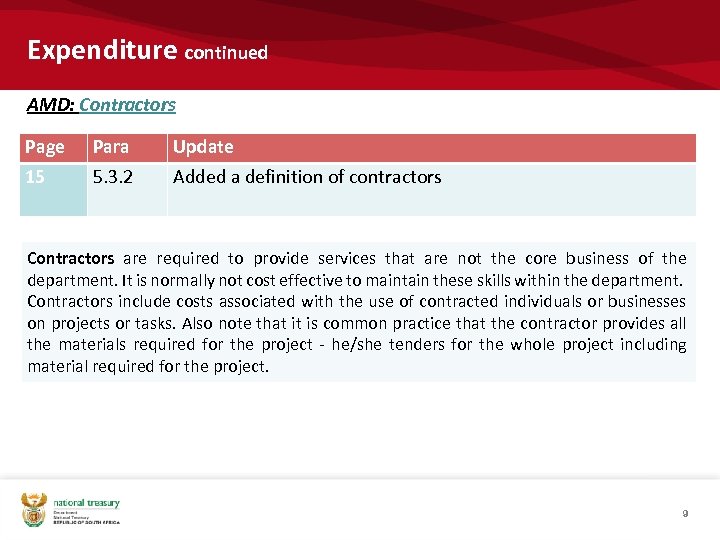

Expenditure continued AMD: Contractors Page 15 Para 5. 3. 2 Update Added a definition of contractors Contractors are required to provide services that are not the core business of the department. It is normally not cost effective to maintain these skills within the department. Contractors include costs associated with the use of contracted individuals or businesses on projects or tasks. Also note that it is common practice that the contractor provides all the materials required for the project - he/she tenders for the whole project including material required for the project. 9

Expenditure continued AMD: Contractors Page 15 Para 5. 3. 2 Update Added a definition of contractors Contractors are required to provide services that are not the core business of the department. It is normally not cost effective to maintain these skills within the department. Contractors include costs associated with the use of contracted individuals or businesses on projects or tasks. Also note that it is common practice that the contractor provides all the materials required for the project - he/she tenders for the whole project including material required for the project. 9

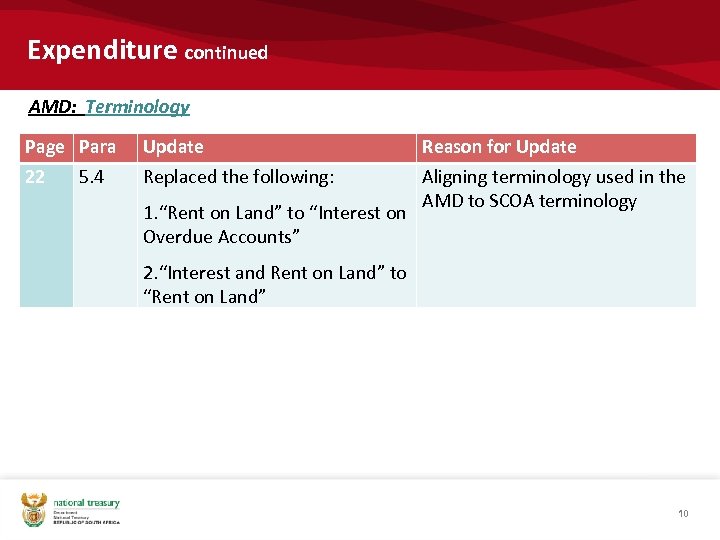

Expenditure continued AMD: Terminology Page Para 22 5. 4 Update Replaced the following: 1. “Rent on Land” to “Interest on Overdue Accounts” Reason for Update Aligning terminology used in the AMD to SCOA terminology 2. “Interest and Rent on Land” to “Rent on Land” 10

Expenditure continued AMD: Terminology Page Para 22 5. 4 Update Replaced the following: 1. “Rent on Land” to “Interest on Overdue Accounts” Reason for Update Aligning terminology used in the AMD to SCOA terminology 2. “Interest and Rent on Land” to “Rent on Land” 10

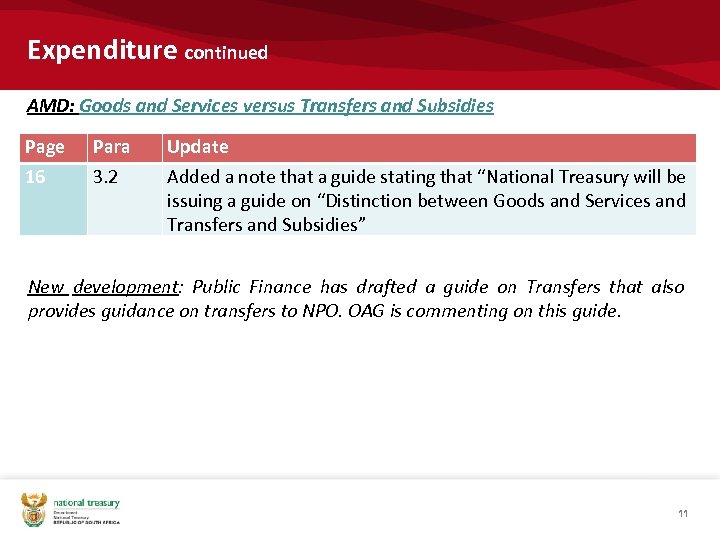

Expenditure continued AMD: Goods and Services versus Transfers and Subsidies Page 16 Para 3. 2 Update Added a note that a guide stating that “National Treasury will be issuing a guide on “Distinction between Goods and Services and Transfers and Subsidies” New development: Public Finance has drafted a guide on Transfers that also provides guidance on transfers to NPO. OAG is commenting on this guide. 11

Expenditure continued AMD: Goods and Services versus Transfers and Subsidies Page 16 Para 3. 2 Update Added a note that a guide stating that “National Treasury will be issuing a guide on “Distinction between Goods and Services and Transfers and Subsidies” New development: Public Finance has drafted a guide on Transfers that also provides guidance on transfers to NPO. OAG is commenting on this guide. 11

Expenditure continued AMD: Unspent portion of funds transferred Page 27 Para 6 Update Departments are required to disclose the unspent portion of funds transferred to certain beneficiaries in the Transfers and subsidies note. This disclosure only applies to transfers and subsidies made to the categories of transfer payments listed below where the funds are due back to the department at the end of the financial year: • Provinces and municipalities; and • Departmental agencies and accounts The department should also indicate whether these amounts have been received by year-end or before the financial statements were authorised for issue. In determining the amount to be disclosed, the department should also consider the amount that will be rolled over. 12

Expenditure continued AMD: Unspent portion of funds transferred Page 27 Para 6 Update Departments are required to disclose the unspent portion of funds transferred to certain beneficiaries in the Transfers and subsidies note. This disclosure only applies to transfers and subsidies made to the categories of transfer payments listed below where the funds are due back to the department at the end of the financial year: • Provinces and municipalities; and • Departmental agencies and accounts The department should also indicate whether these amounts have been received by year-end or before the financial statements were authorised for issue. In determining the amount to be disclosed, the department should also consider the amount that will be rolled over. 12

General Departmental Assets and Liabilities MCS: Transfers and subsidies due and payable Page 62 Para. 20 Update Reason for update Added the underlined words to Departments can be in a the paragraph: position where they have an obligation to pay another Accrued expenditure payable is entity or household money at recorded when goods are the end of the year. received or, in the case of services, when they are delivered to the department or, in the case of transfers and subsidies, when they are due and payable. 13

General Departmental Assets and Liabilities MCS: Transfers and subsidies due and payable Page 62 Para. 20 Update Reason for update Added the underlined words to Departments can be in a the paragraph: position where they have an obligation to pay another Accrued expenditure payable is entity or household money at recorded when goods are the end of the year. received or, in the case of services, when they are delivered to the department or, in the case of transfers and subsidies, when they are due and payable. 13

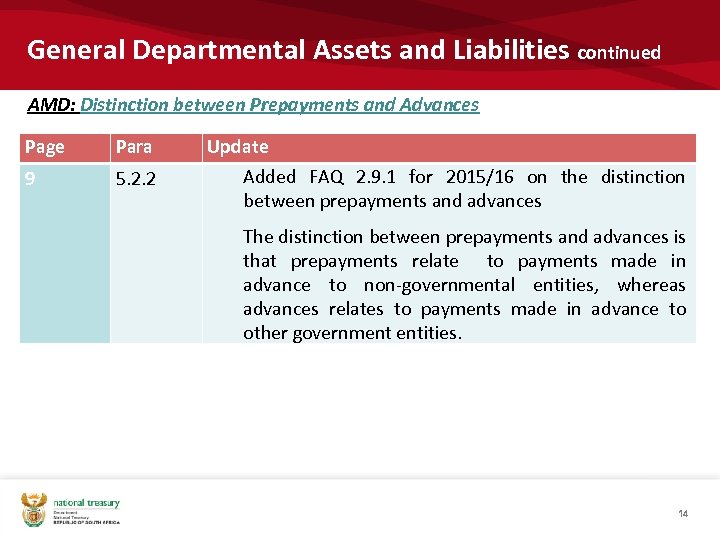

General Departmental Assets and Liabilities continued AMD: Distinction between Prepayments and Advances Page Para 9 5. 2. 2 Update Added FAQ 2. 9. 1 for 2015/16 on the distinction between prepayments and advances The distinction between prepayments and advances is that prepayments relate to payments made in advance to non-governmental entities, whereas advances relates to payments made in advance to other government entities. 14

General Departmental Assets and Liabilities continued AMD: Distinction between Prepayments and Advances Page Para 9 5. 2. 2 Update Added FAQ 2. 9. 1 for 2015/16 on the distinction between prepayments and advances The distinction between prepayments and advances is that prepayments relate to payments made in advance to non-governmental entities, whereas advances relates to payments made in advance to other government entities. 14

Capital Assets AMD: CD’s as Intangible Assets – Page 12, Para 5. 2. 2 The department buys 20 CD’s for the library so they can be borrowed and listened to, similar to the books being borrowed to be read. Should the CD be damaged in any way, it will be replaced by a new CD which must be bought. In this instance the ‘asset’ is the tangible CD as there is no right to the information contained on the CD other than to listen to it. Although the cost of the CD in question is greater than that of an ‘empty’ one, the price paid is not for the ‘right’ to the information contained thereon but merely for the use thereof. This is the same with a book. If you buy a book full of information you do not ‘own’ the information but a physical representation of the information for own use. The information cannot be utilised for future benefit or copied or sold without specific authorisation. Where the department buys a CD with the rights to copy it and distribute and place in the library, the ‘asset’ would be the ‘right to copy’ which, gives a right to the information on the CD and the ‘asset’ will be intangible. In this instance the CD is the incidental physical embodiment of the right to the information. 15

Capital Assets AMD: CD’s as Intangible Assets – Page 12, Para 5. 2. 2 The department buys 20 CD’s for the library so they can be borrowed and listened to, similar to the books being borrowed to be read. Should the CD be damaged in any way, it will be replaced by a new CD which must be bought. In this instance the ‘asset’ is the tangible CD as there is no right to the information contained on the CD other than to listen to it. Although the cost of the CD in question is greater than that of an ‘empty’ one, the price paid is not for the ‘right’ to the information contained thereon but merely for the use thereof. This is the same with a book. If you buy a book full of information you do not ‘own’ the information but a physical representation of the information for own use. The information cannot be utilised for future benefit or copied or sold without specific authorisation. Where the department buys a CD with the rights to copy it and distribute and place in the library, the ‘asset’ would be the ‘right to copy’ which, gives a right to the information on the CD and the ‘asset’ will be intangible. In this instance the CD is the incidental physical embodiment of the right to the information. 15

Capital Assets continued AMD: Use of expert – Page 21, Para 6. 6 Determining whether or not the heritage portion is significant or not is a judgement that should be made by management. This determination does not have to be performed by an expert though the management is not prohibited from contracting one. Departments are encouraged to err on the side of caution and protection (Heritage assets classification) where it is not clear, rather than allowing disposal that might be costly or impossible to reverse in the future. This judgement should be applied consistently over all the assets. To ensure consistent application of the criteria, it is recommended that management include the judgement criteria as part of their asset management policy. The asset management policy is also expected to indicate the identification and the valuation criteria of these heritage assets. The valuation technique will depend on the type of asset as some will have active markets, such as paintings, or the restoration or reproduction cost can be determined for constructed heritage assets such as buildings and monuments. 16

Capital Assets continued AMD: Use of expert – Page 21, Para 6. 6 Determining whether or not the heritage portion is significant or not is a judgement that should be made by management. This determination does not have to be performed by an expert though the management is not prohibited from contracting one. Departments are encouraged to err on the side of caution and protection (Heritage assets classification) where it is not clear, rather than allowing disposal that might be costly or impossible to reverse in the future. This judgement should be applied consistently over all the assets. To ensure consistent application of the criteria, it is recommended that management include the judgement criteria as part of their asset management policy. The asset management policy is also expected to indicate the identification and the valuation criteria of these heritage assets. The valuation technique will depend on the type of asset as some will have active markets, such as paintings, or the restoration or reproduction cost can be determined for constructed heritage assets such as buildings and monuments. 16

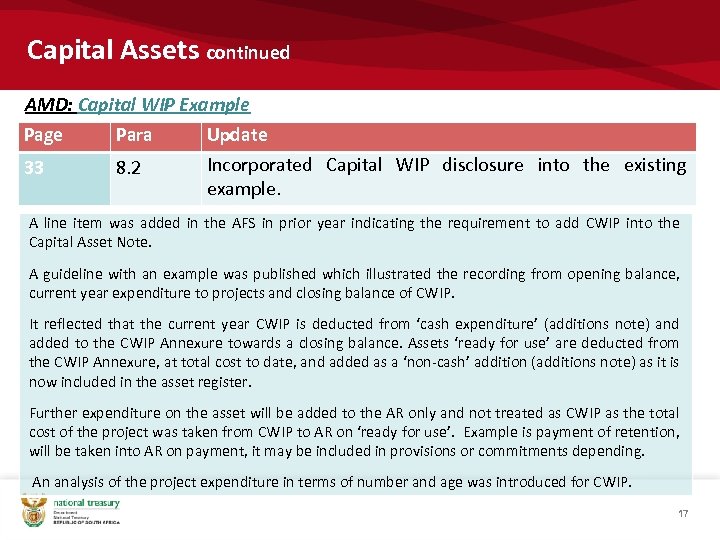

Capital Assets continued AMD: Capital WIP Example Page Para 33 8. 2 Update Incorporated Capital WIP disclosure into the existing example. A line item was added in the AFS in prior year indicating the requirement to add CWIP into the Capital Asset Note. A guideline with an example was published which illustrated the recording from opening balance, current year expenditure to projects and closing balance of CWIP. It reflected that the current year CWIP is deducted from ‘cash expenditure’ (additions note) and added to the CWIP Annexure towards a closing balance. Assets ‘ready for use’ are deducted from the CWIP Annexure, at total cost to date, and added as a ‘non-cash’ addition (additions note) as it is now included in the asset register. Further expenditure on the asset will be added to the AR only and not treated as CWIP as the total cost of the project was taken from CWIP to AR on ‘ready for use’. Example is payment of retention, will be taken into AR on payment, it may be included in provisions or commitments depending. An analysis of the project expenditure in terms of number and age was introduced for CWIP. 17

Capital Assets continued AMD: Capital WIP Example Page Para 33 8. 2 Update Incorporated Capital WIP disclosure into the existing example. A line item was added in the AFS in prior year indicating the requirement to add CWIP into the Capital Asset Note. A guideline with an example was published which illustrated the recording from opening balance, current year expenditure to projects and closing balance of CWIP. It reflected that the current year CWIP is deducted from ‘cash expenditure’ (additions note) and added to the CWIP Annexure towards a closing balance. Assets ‘ready for use’ are deducted from the CWIP Annexure, at total cost to date, and added as a ‘non-cash’ addition (additions note) as it is now included in the asset register. Further expenditure on the asset will be added to the AR only and not treated as CWIP as the total cost of the project was taken from CWIP to AR on ‘ready for use’. Example is payment of retention, will be taken into AR on payment, it may be included in provisions or commitments depending. An analysis of the project expenditure in terms of number and age was introduced for CWIP. 17

Inventory AMD: Inventory Page Para Update 10 5. 2. 2 Definition The implementation reporting on inventory is not required from 1 April 2017. Departments must review the split between Inventory and Consumables done to date against the definition of Inventory. It was noted that expenditure on Consumables increased dramatically indicating that incorrect allocations have been made. The use of the SCo. A item ‘Consumables’ must be motivated to the relevant Treasury before it will be allowed for use. Departments must continue with preparation for implementation and plans finalised as an Instruction will be issued in due course to define the reporting date. 18

Inventory AMD: Inventory Page Para Update 10 5. 2. 2 Definition The implementation reporting on inventory is not required from 1 April 2017. Departments must review the split between Inventory and Consumables done to date against the definition of Inventory. It was noted that expenditure on Consumables increased dramatically indicating that incorrect allocations have been made. The use of the SCo. A item ‘Consumables’ must be motivated to the relevant Treasury before it will be allowed for use. Departments must continue with preparation for implementation and plans finalised as an Instruction will be issued in due course to define the reporting date. 18

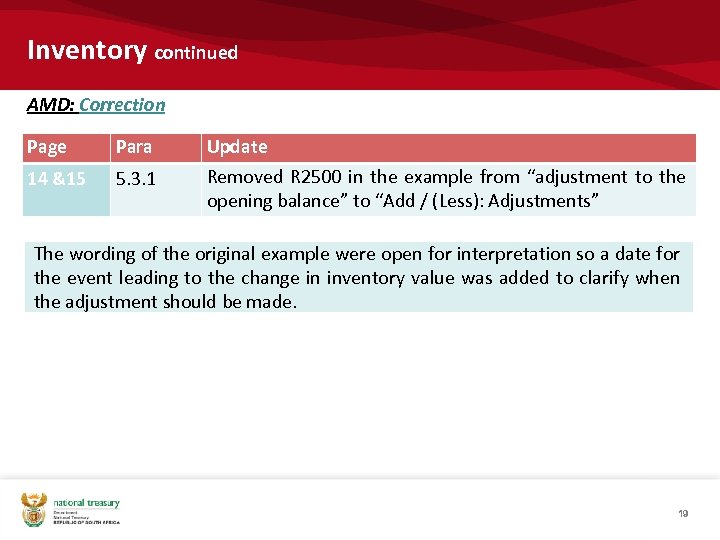

Inventory continued AMD: Correction Page Para 14 &15 5. 3. 1 Update Removed R 2500 in the example from “adjustment to the opening balance” to “Add / (Less): Adjustments” The wording of the original example were open for interpretation so a date for the event leading to the change in inventory value was added to clarify when the adjustment should be made. 19

Inventory continued AMD: Correction Page Para 14 &15 5. 3. 1 Update Removed R 2500 in the example from “adjustment to the opening balance” to “Add / (Less): Adjustments” The wording of the original example were open for interpretation so a date for the event leading to the change in inventory value was added to clarify when the adjustment should be made. 19

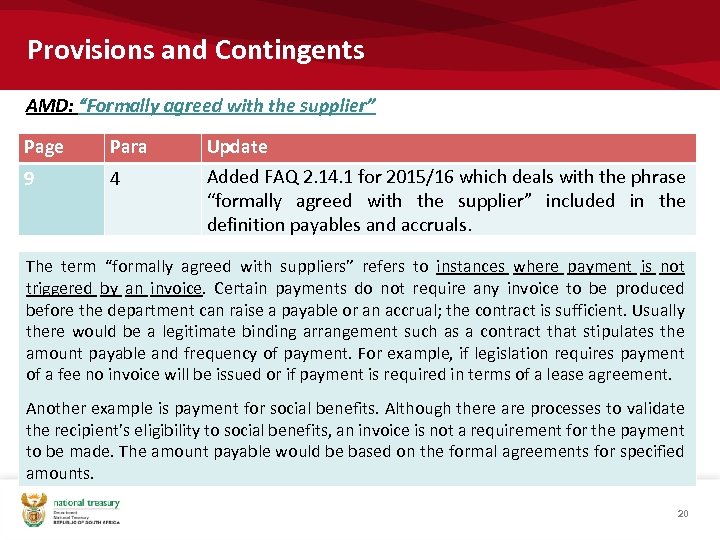

Provisions and Contingents AMD: “Formally agreed with the supplier” Page Para 9 4 Update Added FAQ 2. 14. 1 for 2015/16 which deals with the phrase “formally agreed with the supplier” included in the definition payables and accruals. The term “formally agreed with suppliers” refers to instances where payment is not triggered by an invoice. Certain payments do not require any invoice to be produced before the department can raise a payable or an accrual; the contract is sufficient. Usually there would be a legitimate binding arrangement such as a contract that stipulates the amount payable and frequency of payment. For example, if legislation requires payment of a fee no invoice will be issued or if payment is required in terms of a lease agreement. Another example is payment for social benefits. Although there are processes to validate the recipient’s eligibility to social benefits, an invoice is not a requirement for the payment to be made. The amount payable would be based on the formal agreements for specified amounts. 20

Provisions and Contingents AMD: “Formally agreed with the supplier” Page Para 9 4 Update Added FAQ 2. 14. 1 for 2015/16 which deals with the phrase “formally agreed with the supplier” included in the definition payables and accruals. The term “formally agreed with suppliers” refers to instances where payment is not triggered by an invoice. Certain payments do not require any invoice to be produced before the department can raise a payable or an accrual; the contract is sufficient. Usually there would be a legitimate binding arrangement such as a contract that stipulates the amount payable and frequency of payment. For example, if legislation requires payment of a fee no invoice will be issued or if payment is required in terms of a lease agreement. Another example is payment for social benefits. Although there are processes to validate the recipient’s eligibility to social benefits, an invoice is not a requirement for the payment to be made. The amount payable would be based on the formal agreements for specified amounts. 20

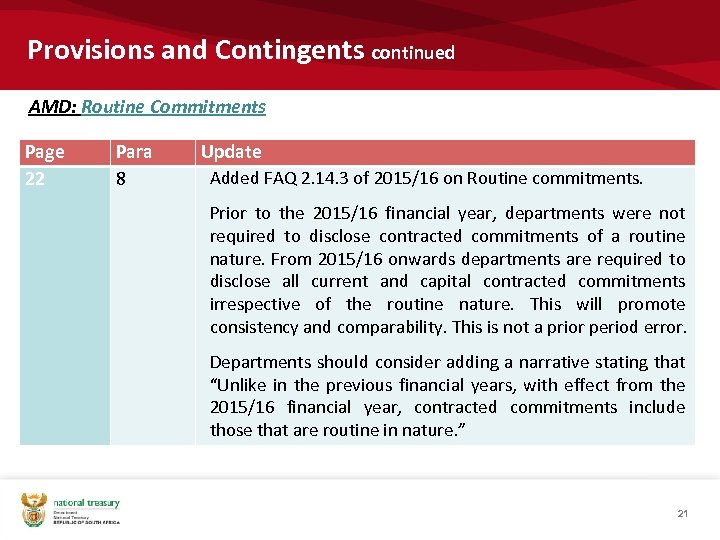

Provisions and Contingents continued AMD: Routine Commitments Page 22 Para 8 Update Added FAQ 2. 14. 3 of 2015/16 on Routine commitments. Prior to the 2015/16 financial year, departments were not required to disclose contracted commitments of a routine nature. From 2015/16 onwards departments are required to disclose all current and capital contracted commitments irrespective of the routine nature. This will promote consistency and comparability. This is not a prior period error. Departments should consider adding a narrative stating that “Unlike in the previous financial years, with effect from the 2015/16 financial year, contracted commitments include those that are routine in nature. ” 21

Provisions and Contingents continued AMD: Routine Commitments Page 22 Para 8 Update Added FAQ 2. 14. 3 of 2015/16 on Routine commitments. Prior to the 2015/16 financial year, departments were not required to disclose contracted commitments of a routine nature. From 2015/16 onwards departments are required to disclose all current and capital contracted commitments irrespective of the routine nature. This will promote consistency and comparability. This is not a prior period error. Departments should consider adding a narrative stating that “Unlike in the previous financial years, with effect from the 2015/16 financial year, contracted commitments include those that are routine in nature. ” 21

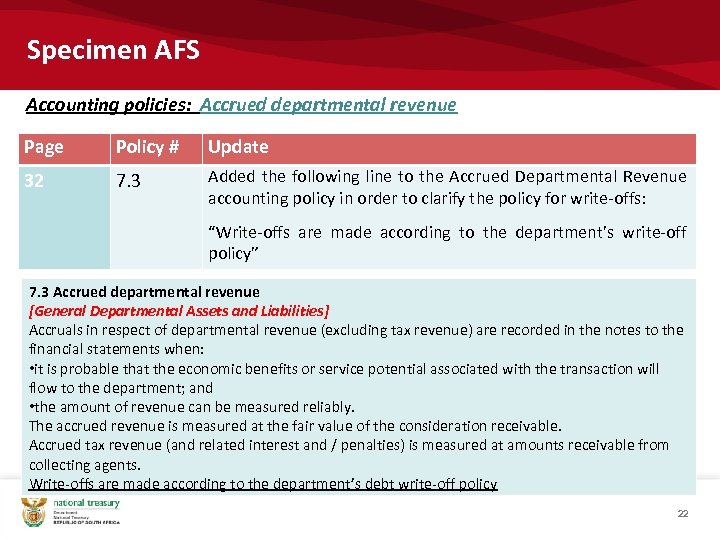

Specimen AFS Accounting policies: Accrued departmental revenue Page Policy # Update 32 7. 3 Added the following line to the Accrued Departmental Revenue accounting policy in order to clarify the policy for write-offs: “Write-offs are made according to the department’s write-off policy” 7. 3 Accrued departmental revenue [General Departmental Assets and Liabilities] Accruals in respect of departmental revenue (excluding tax revenue) are recorded in the notes to the financial statements when: • it is probable that the economic benefits or service potential associated with the transaction will flow to the department; and • the amount of revenue can be measured reliably. The accrued revenue is measured at the fair value of the consideration receivable. Accrued tax revenue (and related interest and / penalties) is measured at amounts receivable from collecting agents. Write-offs are made according to the department’s debt write-off policy 22

Specimen AFS Accounting policies: Accrued departmental revenue Page Policy # Update 32 7. 3 Added the following line to the Accrued Departmental Revenue accounting policy in order to clarify the policy for write-offs: “Write-offs are made according to the department’s write-off policy” 7. 3 Accrued departmental revenue [General Departmental Assets and Liabilities] Accruals in respect of departmental revenue (excluding tax revenue) are recorded in the notes to the financial statements when: • it is probable that the economic benefits or service potential associated with the transaction will flow to the department; and • the amount of revenue can be measured reliably. The accrued revenue is measured at the fair value of the consideration receivable. Accrued tax revenue (and related interest and / penalties) is measured at amounts receivable from collecting agents. Write-offs are made according to the department’s debt write-off policy 22

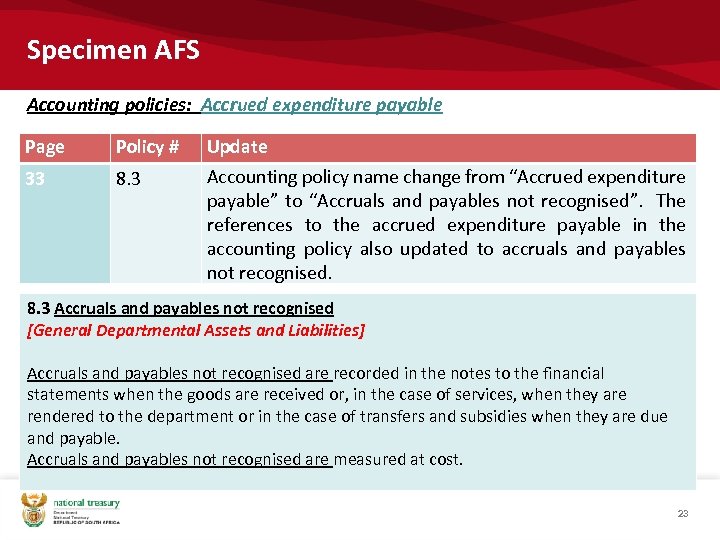

Specimen AFS Accounting policies: Accrued expenditure payable Page Policy # 33 8. 3 Update Accounting policy name change from “Accrued expenditure payable” to “Accruals and payables not recognised”. The references to the accrued expenditure payable in the accounting policy also updated to accruals and payables not recognised. 8. 3 Accruals and payables not recognised [General Departmental Assets and Liabilities] Accruals and payables not recognised are recorded in the notes to the financial statements when the goods are received or, in the case of services, when they are rendered to the department or in the case of transfers and subsidies when they are due and payable. Accruals and payables not recognised are measured at cost. 23

Specimen AFS Accounting policies: Accrued expenditure payable Page Policy # 33 8. 3 Update Accounting policy name change from “Accrued expenditure payable” to “Accruals and payables not recognised”. The references to the accrued expenditure payable in the accounting policy also updated to accruals and payables not recognised. 8. 3 Accruals and payables not recognised [General Departmental Assets and Liabilities] Accruals and payables not recognised are recorded in the notes to the financial statements when the goods are received or, in the case of services, when they are rendered to the department or in the case of transfers and subsidies when they are due and payable. Accruals and payables not recognised are measured at cost. 23

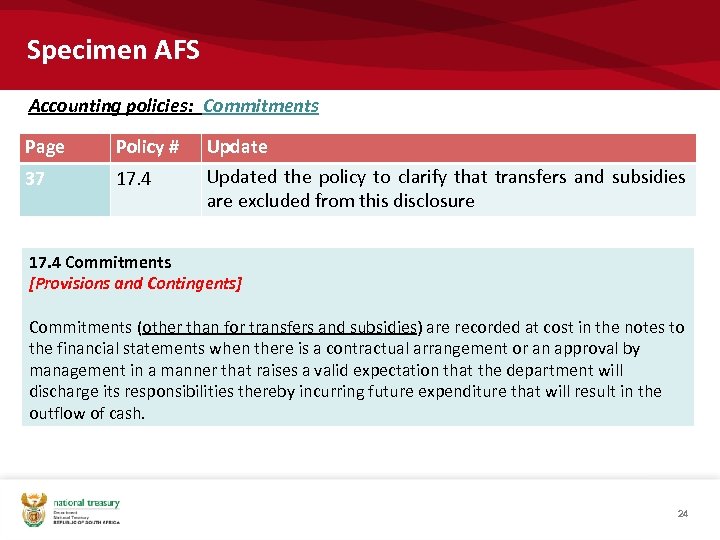

Specimen AFS Accounting policies: Commitments Page Policy # 37 17. 4 Updated the policy to clarify that transfers and subsidies are excluded from this disclosure 17. 4 Commitments [Provisions and Contingents] Commitments (other than for transfers and subsidies) are recorded at cost in the notes to the financial statements when there is a contractual arrangement or an approval by management in a manner that raises a valid expectation that the department will discharge its responsibilities thereby incurring future expenditure that will result in the outflow of cash. 24

Specimen AFS Accounting policies: Commitments Page Policy # 37 17. 4 Updated the policy to clarify that transfers and subsidies are excluded from this disclosure 17. 4 Commitments [Provisions and Contingents] Commitments (other than for transfers and subsidies) are recorded at cost in the notes to the financial statements when there is a contractual arrangement or an approval by management in a manner that raises a valid expectation that the department will discharge its responsibilities thereby incurring future expenditure that will result in the outflow of cash. 24

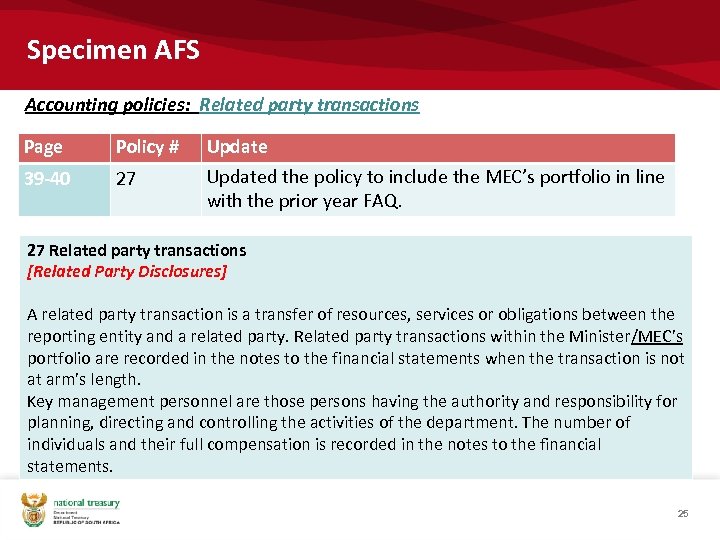

Specimen AFS Accounting policies: Related party transactions Page Policy # 39 -40 27 Updated the policy to include the MEC’s portfolio in line with the prior year FAQ. 27 Related party transactions [Related Party Disclosures] A related party transaction is a transfer of resources, services or obligations between the reporting entity and a related party. Related party transactions within the Minister/MEC’s portfolio are recorded in the notes to the financial statements when the transaction is not at arm’s length. Key management personnel are those persons having the authority and responsibility for planning, directing and controlling the activities of the department. The number of individuals and their full compensation is recorded in the notes to the financial statements. 25

Specimen AFS Accounting policies: Related party transactions Page Policy # 39 -40 27 Updated the policy to include the MEC’s portfolio in line with the prior year FAQ. 27 Related party transactions [Related Party Disclosures] A related party transaction is a transfer of resources, services or obligations between the reporting entity and a related party. Related party transactions within the Minister/MEC’s portfolio are recorded in the notes to the financial statements when the transaction is not at arm’s length. Key management personnel are those persons having the authority and responsibility for planning, directing and controlling the activities of the department. The number of individuals and their full compensation is recorded in the notes to the financial statements. 25

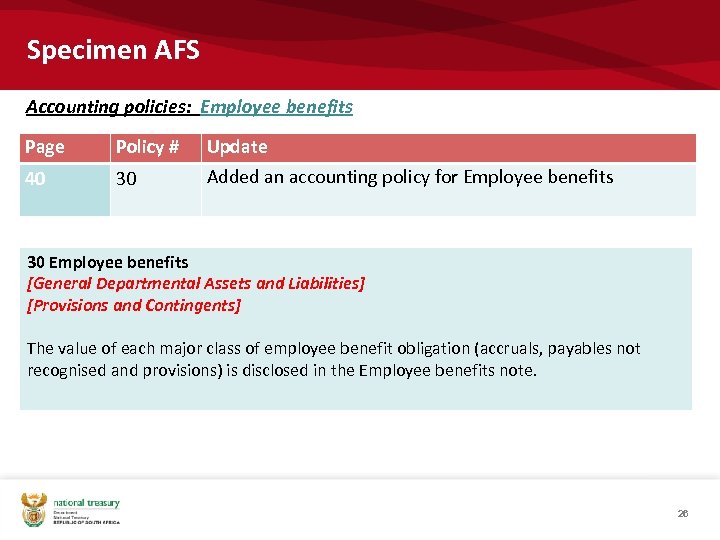

Specimen AFS Accounting policies: Employee benefits Page Policy # 40 30 Update Added an accounting policy for Employee benefits 30 Employee benefits [General Departmental Assets and Liabilities] [Provisions and Contingents] The value of each major class of employee benefit obligation (accruals, payables not recognised and provisions) is disclosed in the Employee benefits note. 26

Specimen AFS Accounting policies: Employee benefits Page Policy # 40 30 Update Added an accounting policy for Employee benefits 30 Employee benefits [General Departmental Assets and Liabilities] [Provisions and Contingents] The value of each major class of employee benefit obligation (accruals, payables not recognised and provisions) is disclosed in the Employee benefits note. 26

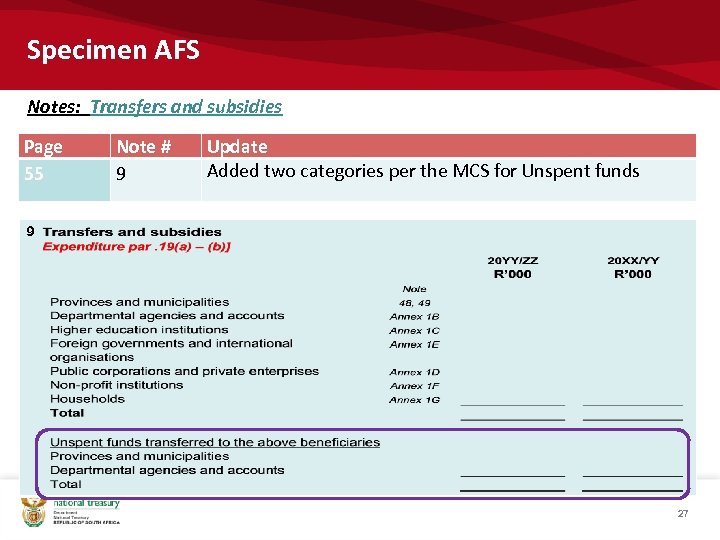

Specimen AFS Notes: Transfers and subsidies Page 55 Note # 9 Update Added two categories per the MCS for Unspent funds 9 27

Specimen AFS Notes: Transfers and subsidies Page 55 Note # 9 Update Added two categories per the MCS for Unspent funds 9 27

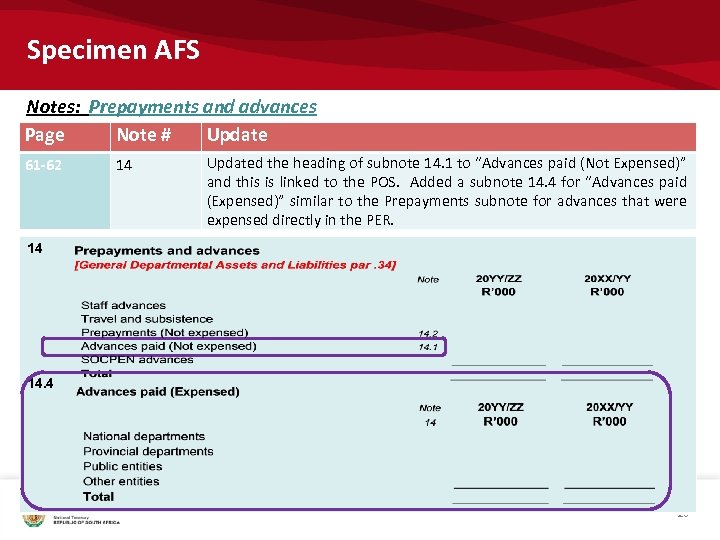

Specimen AFS Notes: Prepayments and advances Page Note # Update 61 -62 14 Updated the heading of subnote 14. 1 to “Advances paid (Not Expensed)” and this is linked to the POS. Added a subnote 14. 4 for “Advances paid (Expensed)” similar to the Prepayments subnote for advances that were expensed directly in the PER. 14 14. 4 28

Specimen AFS Notes: Prepayments and advances Page Note # Update 61 -62 14 Updated the heading of subnote 14. 1 to “Advances paid (Not Expensed)” and this is linked to the POS. Added a subnote 14. 4 for “Advances paid (Expensed)” similar to the Prepayments subnote for advances that were expensed directly in the PER. 14 14. 4 28

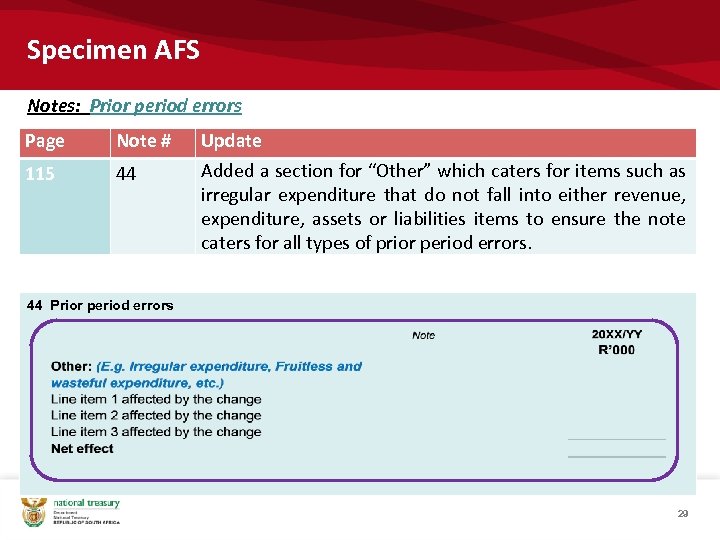

Specimen AFS Notes: Prior period errors Page Note # 115 44 Update Added a section for “Other” which caters for items such as irregular expenditure that do not fall into either revenue, expenditure, assets or liabilities items to ensure the note caters for all types of prior period errors. 44 Prior period errors 29

Specimen AFS Notes: Prior period errors Page Note # 115 44 Update Added a section for “Other” which caters for items such as irregular expenditure that do not fall into either revenue, expenditure, assets or liabilities items to ensure the note caters for all types of prior period errors. 44 Prior period errors 29

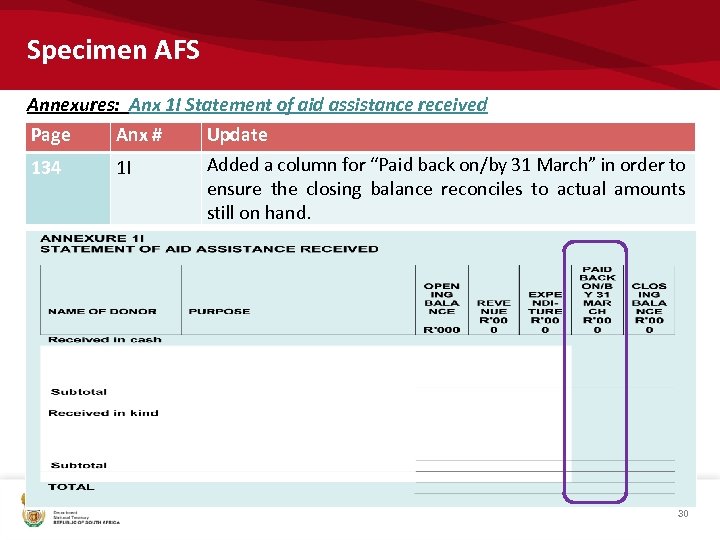

Specimen AFS Annexures: Anx 1 I Statement of aid assistance received Page Anx # 134 1 I Update Added a column for “Paid back on/by 31 March” in order to ensure the closing balance reconciles to actual amounts still on hand. 30

Specimen AFS Annexures: Anx 1 I Statement of aid assistance received Page Anx # 134 1 I Update Added a column for “Paid back on/by 31 March” in order to ensure the closing balance reconciles to actual amounts still on hand. 30

Specimen AFS Annexures: Anx 7 Movement in capital work in progress Page Anx # 148 -149 7 Update Added a table for the age analysis on ongoing capital projects for the current year. 31

Specimen AFS Annexures: Anx 7 Movement in capital work in progress Page Anx # 148 -149 7 Update Added a table for the age analysis on ongoing capital projects for the current year. 31

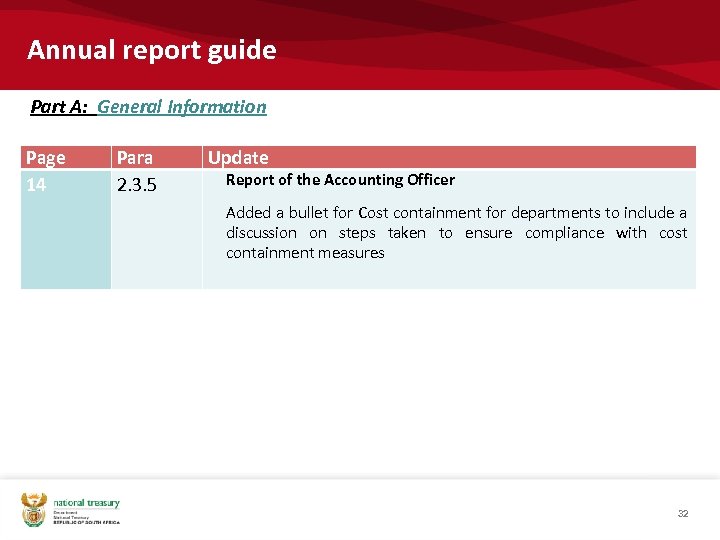

Annual report guide Part A: General Information Page 14 Para 2. 3. 5 Update Report of the Accounting Officer Added a bullet for Cost containment for departments to include a discussion on steps taken to ensure compliance with cost containment measures 32

Annual report guide Part A: General Information Page 14 Para 2. 3. 5 Update Report of the Accounting Officer Added a bullet for Cost containment for departments to include a discussion on steps taken to ensure compliance with cost containment measures 32

Annual report guide Part B: Performance Information Page Para 17 2. 4. 4 Update DPME changes • Added the following per the request of DPSA, to the second par under the “Strategic objectives, performance indicators planned targets and actual achievements”: “In instances, where the Annual Performance Plan has been revised in-year, additional tables must also be provided where departments must report on revised strategic objectives, performance indicators and targets for each programme or every subprogramme as specified in the revised Annual Performance Plan. ” • Updated the wording of the third bullet to read: “Include the actual outputs achieved in the previous year, which must agree to the previous annual reports. ” 33

Annual report guide Part B: Performance Information Page Para 17 2. 4. 4 Update DPME changes • Added the following per the request of DPSA, to the second par under the “Strategic objectives, performance indicators planned targets and actual achievements”: “In instances, where the Annual Performance Plan has been revised in-year, additional tables must also be provided where departments must report on revised strategic objectives, performance indicators and targets for each programme or every subprogramme as specified in the revised Annual Performance Plan. ” • Updated the wording of the third bullet to read: “Include the actual outputs achieved in the previous year, which must agree to the previous annual reports. ” 33

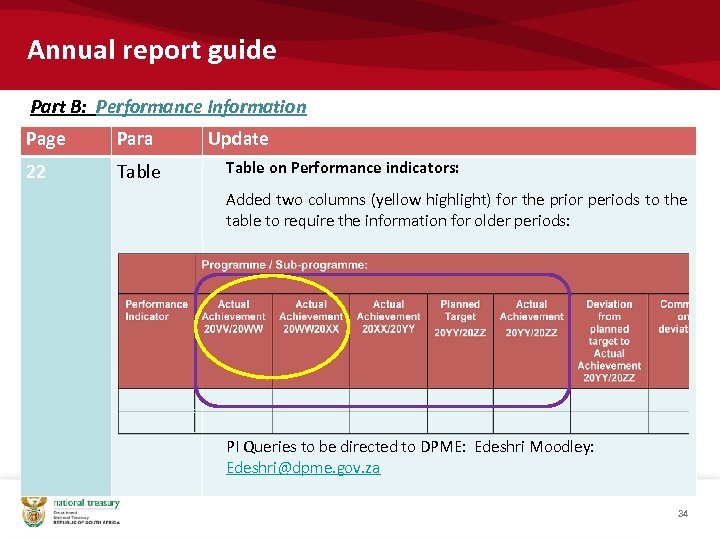

Annual report guide Part B: Performance Information Page Para 22 Table Update Table on Performance indicators: Added two columns (yellow highlight) for the prior periods to the table to require the information for older periods: PI Queries to be directed to DPME: Edeshri Moodley: Edeshri@dpme. gov. za 34

Annual report guide Part B: Performance Information Page Para 22 Table Update Table on Performance indicators: Added two columns (yellow highlight) for the prior periods to the table to require the information for older periods: PI Queries to be directed to DPME: Edeshri Moodley: Edeshri@dpme. gov. za 34

Annual report guide Part D: Human Resource Management Page Para 38 Table 3. 3. 3 Update Per previous year Errata: Table 3. 3. 3. was replaced with the following: 35

Annual report guide Part D: Human Resource Management Page Para 38 Table 3. 3. 3 Update Per previous year Errata: Table 3. 3. 3. was replaced with the following: 35

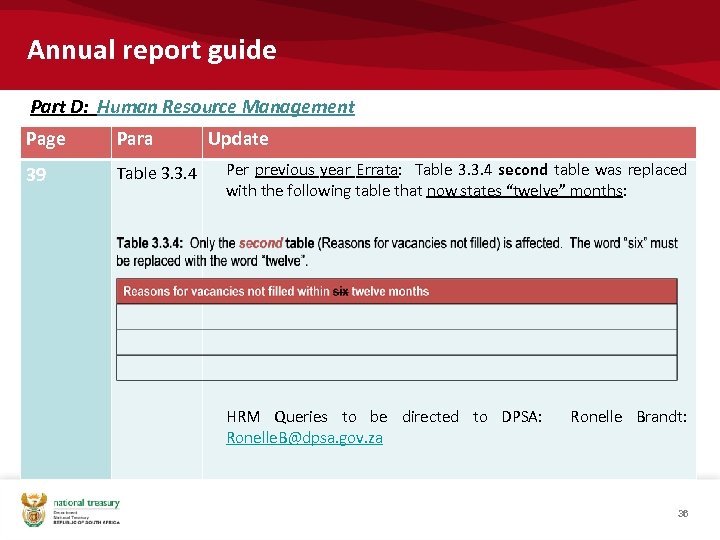

Annual report guide Part D: Human Resource Management Page Para 39 Table 3. 3. 4 Update Per previous year Errata: Table 3. 3. 4 second table was replaced with the following table that now states “twelve” months: HRM Queries to be directed to DPSA: Ronelle Brandt: Ronelle. B@dpsa. gov. za 36

Annual report guide Part D: Human Resource Management Page Para 39 Table 3. 3. 4 Update Per previous year Errata: Table 3. 3. 4 second table was replaced with the following table that now states “twelve” months: HRM Queries to be directed to DPSA: Ronelle Brandt: Ronelle. B@dpsa. gov. za 36

Future interactions • TSS will prepare FAQs to accommodate pervasive 2016/17 issues emanating from comments received recently. • ASR Client Support Manager will inform National Departments and Provincial Treasuries (PAG’s) about future comment periods. • Submit comments to ASR Client Support Manager on or before the due date (late comments affect planning and timeous implementation) • ASR will address year-end submission deadlines 37

Future interactions • TSS will prepare FAQs to accommodate pervasive 2016/17 issues emanating from comments received recently. • ASR Client Support Manager will inform National Departments and Provincial Treasuries (PAG’s) about future comment periods. • Submit comments to ASR Client Support Manager on or before the due date (late comments affect planning and timeous implementation) • ASR will address year-end submission deadlines 37

Thank you

Thank you