f64ed7917f19fabca3d1dea30953946a.ppt

- Количество слайдов: 26

Gradatim MF Resolve On Demand Utility Platform for Micro Finance Digital Pen Bio Metrics OCR Copyright Gradatim 2007 ICR

Gradatim MF Resolve On Demand Utility Platform for Micro Finance Digital Pen Bio Metrics OCR Copyright Gradatim 2007 ICR

About Gradatim IT Ventures (P) Ltd § A privately held IT company with offices in India, Australia and Singapore. § Headquartered in Bangalore and with BPU operations in Chennai § A pioneer in the area of Business Process Utility services § The company works with customers in Asia, Australia, Europe and USA § Gradatim's multi-faceted management team, drawn from world class organizations, bring together successful entrepreneurial experience, deep domain knowledge and the relevant global market exposure to support the core mission of the organization § Gradatim’s revenue model is focused on customer success and based on shared value creation

About Gradatim IT Ventures (P) Ltd § A privately held IT company with offices in India, Australia and Singapore. § Headquartered in Bangalore and with BPU operations in Chennai § A pioneer in the area of Business Process Utility services § The company works with customers in Asia, Australia, Europe and USA § Gradatim's multi-faceted management team, drawn from world class organizations, bring together successful entrepreneurial experience, deep domain knowledge and the relevant global market exposure to support the core mission of the organization § Gradatim’s revenue model is focused on customer success and based on shared value creation

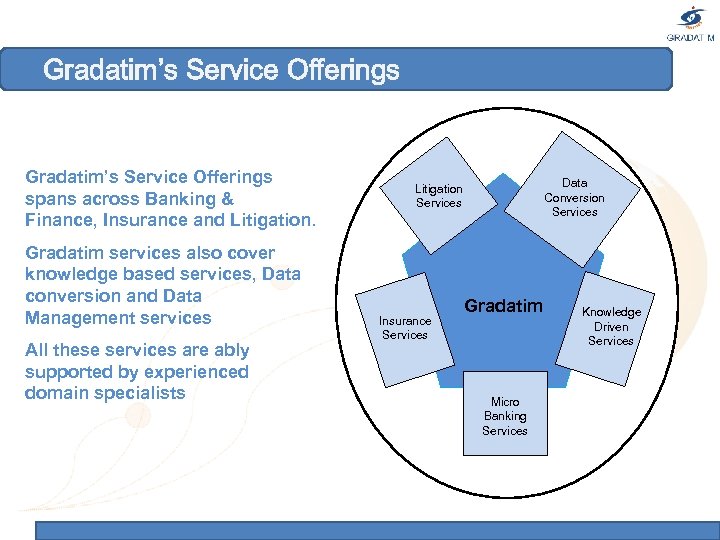

Gradatim’s Service Offerings spans across Banking & Finance, Insurance and Litigation. Gradatim services also cover knowledge based services, Data conversion and Data Management services All these services are ably supported by experienced domain specialists Data Conversion Services Litigation Services Insurance Services Gradatim Micro Banking Services Knowledge Driven Services

Gradatim’s Service Offerings spans across Banking & Finance, Insurance and Litigation. Gradatim services also cover knowledge based services, Data conversion and Data Management services All these services are ably supported by experienced domain specialists Data Conversion Services Litigation Services Insurance Services Gradatim Micro Banking Services Knowledge Driven Services

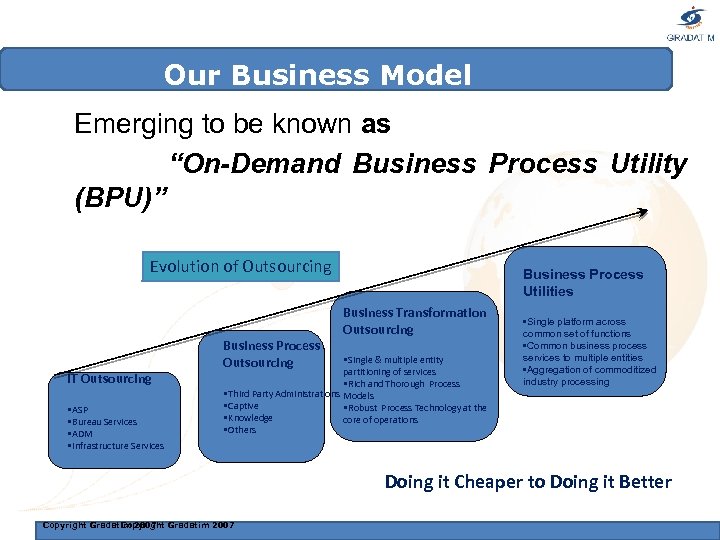

Our Business Model Emerging to be known as “On-Demand Business Process Utility (BPU)” Evolution of Outsourcing IT Outsourcing • ASP • Bureau Services • ADM • Infrastructure Services Business Process Outsourcing Business Process Utilities Business Transformation Outsourcing • Single & multiple entity partitioning of services • Rich and Thorough Process • Third Party Administrations Models • Captive • Robust Process Technology at the • Knowledge core of operations • Others • Single platform across common set of functions • Common business process services to multiple entities • Aggregation of commoditized industry processing Doing it Cheaper to Doing it Better Copyright Gradatim 2007 Copyright

Our Business Model Emerging to be known as “On-Demand Business Process Utility (BPU)” Evolution of Outsourcing IT Outsourcing • ASP • Bureau Services • ADM • Infrastructure Services Business Process Outsourcing Business Process Utilities Business Transformation Outsourcing • Single & multiple entity partitioning of services • Rich and Thorough Process • Third Party Administrations Models • Captive • Robust Process Technology at the • Knowledge core of operations • Others • Single platform across common set of functions • Common business process services to multiple entities • Aggregation of commoditized industry processing Doing it Cheaper to Doing it Better Copyright Gradatim 2007 Copyright

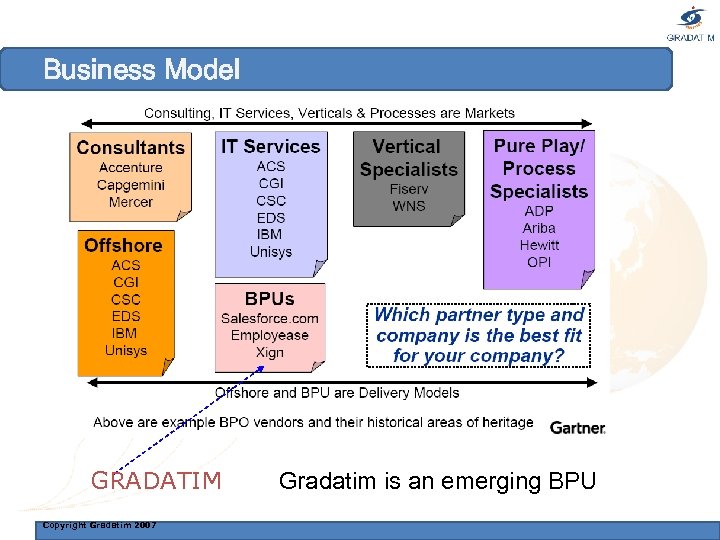

Business Model GRADATIM Copyright Gradatim 2007 Gradatim is an emerging BPU

Business Model GRADATIM Copyright Gradatim 2007 Gradatim is an emerging BPU

![Business Process Utility [BPU] § Business process utility (BPU): An externally provisioned business process Business Process Utility [BPU] § Business process utility (BPU): An externally provisioned business process](https://present5.com/presentation/f64ed7917f19fabca3d1dea30953946a/image-6.jpg) Business Process Utility [BPU] § Business process utility (BPU): An externally provisioned business process management service based on standardized processes and a unified, one-to-many technology platform. Individual service recipients fund high levels of customization (exceeding 15 percent overall). The service provider manages and executes direct business process inputs (often automated), as well as business processes. The service provider or recipient can execute outputs. Contracts typically feature per-transaction fees, with monthly minimums – – Model built not only on Labor Arbitrage Delivered from distributed network of sourcing locations Technology plays a very important factor One to Many Model Copyright Gradatim 2007 Copyright

Business Process Utility [BPU] § Business process utility (BPU): An externally provisioned business process management service based on standardized processes and a unified, one-to-many technology platform. Individual service recipients fund high levels of customization (exceeding 15 percent overall). The service provider manages and executes direct business process inputs (often automated), as well as business processes. The service provider or recipient can execute outputs. Contracts typically feature per-transaction fees, with monthly minimums – – Model built not only on Labor Arbitrage Delivered from distributed network of sourcing locations Technology plays a very important factor One to Many Model Copyright Gradatim 2007 Copyright

Benefits of BPU Model § Regulated processes simplify aggregation § Unit-costs continue to decline with each new tenant added to the shared platform. § Financial alignment between participants ensures that all parties benefit from continuous operational improvement § Ease of deployment. § Remove higher cost human element of BPO § Technology as the process “actor” Copyright Gradatim 2007

Benefits of BPU Model § Regulated processes simplify aggregation § Unit-costs continue to decline with each new tenant added to the shared platform. § Financial alignment between participants ensures that all parties benefit from continuous operational improvement § Ease of deployment. § Remove higher cost human element of BPO § Technology as the process “actor” Copyright Gradatim 2007

Our BPU – Gradatim– BPU incorporates the concepts of Component Business Model (CBM) – Multi Client, On Demand Utility – Performance and scalability for any-size business – Focus on Knowledge Process & Change Management – Delivering value to users Copyright Gradatim 2007

Our BPU – Gradatim– BPU incorporates the concepts of Component Business Model (CBM) – Multi Client, On Demand Utility – Performance and scalability for any-size business – Focus on Knowledge Process & Change Management – Delivering value to users Copyright Gradatim 2007

What is Micro Finance? Micro-Finance Providing Financial Services such as Micro Credit, Micro Savings, Micro Insurance to the impoverished and poor, who don’t have access to the formal banking system. Objective Alleviating poverty and providing financial aid to the rural poor Origin Concept of Micro. Finance was born in Bangladesh in mid-1970 s Journey so far With help from Philanthropists, Donor and Funding agencies, the concept of Micro. Finance steadily gained momentum and spread across the globe Where are we Today? Presently, we have specialized Micro Finance Banks and Institutes providing advanced offerings such as remittances, insurance and investments

What is Micro Finance? Micro-Finance Providing Financial Services such as Micro Credit, Micro Savings, Micro Insurance to the impoverished and poor, who don’t have access to the formal banking system. Objective Alleviating poverty and providing financial aid to the rural poor Origin Concept of Micro. Finance was born in Bangladesh in mid-1970 s Journey so far With help from Philanthropists, Donor and Funding agencies, the concept of Micro. Finance steadily gained momentum and spread across the globe Where are we Today? Presently, we have specialized Micro Finance Banks and Institutes providing advanced offerings such as remittances, insurance and investments

What ails Micro Finance today? • Limited Outreach • Customer Identification • High Operational Cost • Compliance with Regulatory Bodies • Scalability

What ails Micro Finance today? • Limited Outreach • Customer Identification • High Operational Cost • Compliance with Regulatory Bodies • Scalability

Technology is the Solution… How MFIs benefit from Technology: • Increased Outreach. Access to more rural customers • Customer Identification made easy. • De-Duping and Biometric Identification mechanisms alleviate the issue. • Better Reporting. Helps Informed Decisions. • Branchless Banking • Increased Efficiency • Lower Operating Cost • Scalability

Technology is the Solution… How MFIs benefit from Technology: • Increased Outreach. Access to more rural customers • Customer Identification made easy. • De-Duping and Biometric Identification mechanisms alleviate the issue. • Better Reporting. Helps Informed Decisions. • Branchless Banking • Increased Efficiency • Lower Operating Cost • Scalability

MF-Resolve Unleashing the power of Technology… • A feature-rich solution with Business Intelligence Features of Risk Analysis, Performance Analysis, Profit-Loss Analysis, etc. • Developed from our long experience of working closely with MFIs to cater to the specific needs of the industry • Highly parameterized to support varied nature of operations in Micro. Finance across the globe • Facilitates enhanced market penetration in reaching out to more customers, BIO Verification for customer identification • Enables to achieve increased productivity, better operational efficiency and improved customer service • Helps to minimize operational cost • Scalability

MF-Resolve Unleashing the power of Technology… • A feature-rich solution with Business Intelligence Features of Risk Analysis, Performance Analysis, Profit-Loss Analysis, etc. • Developed from our long experience of working closely with MFIs to cater to the specific needs of the industry • Highly parameterized to support varied nature of operations in Micro. Finance across the globe • Facilitates enhanced market penetration in reaching out to more customers, BIO Verification for customer identification • Enables to achieve increased productivity, better operational efficiency and improved customer service • Helps to minimize operational cost • Scalability

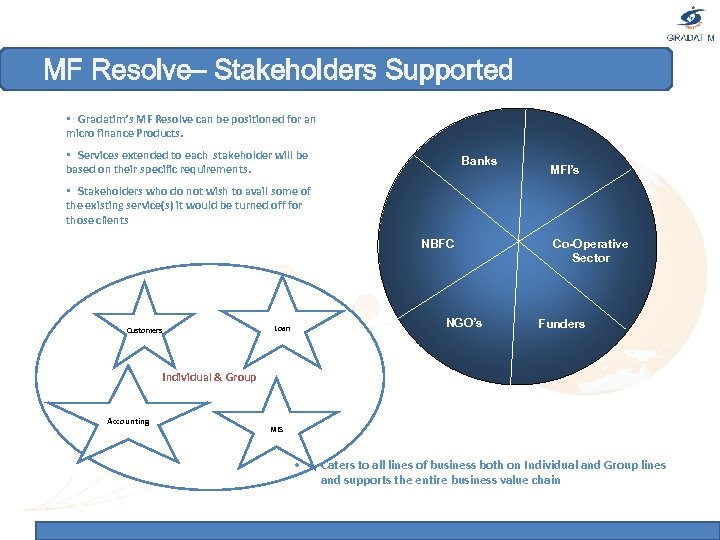

MF Resolve– Stakeholders Supported • Gradatim’s MF Resolve can be positioned for an micro finance Products. • Services extended to each stakeholder will be based on their specific requirements. Banks MFI’s • Stakeholders who do not wish to avail some of the existing service(s) it would be turned off for those clients NBFC NGO’s Loan Customers Co-Operative Sector Funders Individual & Group Accounting MIS • Caters to all lines of business both on Individual and Group lines and supports the entire business value chain

MF Resolve– Stakeholders Supported • Gradatim’s MF Resolve can be positioned for an micro finance Products. • Services extended to each stakeholder will be based on their specific requirements. Banks MFI’s • Stakeholders who do not wish to avail some of the existing service(s) it would be turned off for those clients NBFC NGO’s Loan Customers Co-Operative Sector Funders Individual & Group Accounting MIS • Caters to all lines of business both on Individual and Group lines and supports the entire business value chain

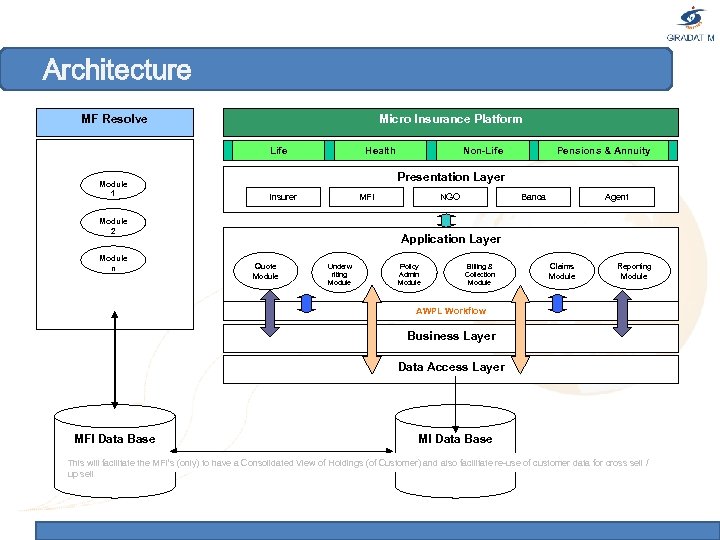

Architecture MF Resolve Micro Insurance Platform Life Module 1 Health Pensions & Annuity Presentation Layer Insurer MFI Module 2 Module n Non-Life NGO Banca Agent Application Layer Quote Module Underw riting Module Policy Admin Module Billing & Collection Module Claims Module Reporting Module AWPL Workflow Business Layer Data Access Layer MFI Data Base MI Data Base This will facilitate the MFI’s (only) to have a Consolidated View of Holdings (of Customer) and also facilitate re-use of customer data for cross sell / up sell

Architecture MF Resolve Micro Insurance Platform Life Module 1 Health Pensions & Annuity Presentation Layer Insurer MFI Module 2 Module n Non-Life NGO Banca Agent Application Layer Quote Module Underw riting Module Policy Admin Module Billing & Collection Module Claims Module Reporting Module AWPL Workflow Business Layer Data Access Layer MFI Data Base MI Data Base This will facilitate the MFI’s (only) to have a Consolidated View of Holdings (of Customer) and also facilitate re-use of customer data for cross sell / up sell

MF Resolve – Solution Objectives • Effective Use of Technology to reduce operational overhead, improve business practices, provide audit trail & increase revenue • Aimed to support Microfinance Institutions, Banks that are seeking to make micro-credit and micro-Lending financially viable and penetrate to new customer areas. • Provide Means to Scale, Simplify and Overcome the “rural outreach” challenge • Reduce the cost of Micro-finance transactions • Solutions and services that can be used globally

MF Resolve – Solution Objectives • Effective Use of Technology to reduce operational overhead, improve business practices, provide audit trail & increase revenue • Aimed to support Microfinance Institutions, Banks that are seeking to make micro-credit and micro-Lending financially viable and penetrate to new customer areas. • Provide Means to Scale, Simplify and Overcome the “rural outreach” challenge • Reduce the cost of Micro-finance transactions • Solutions and services that can be used globally

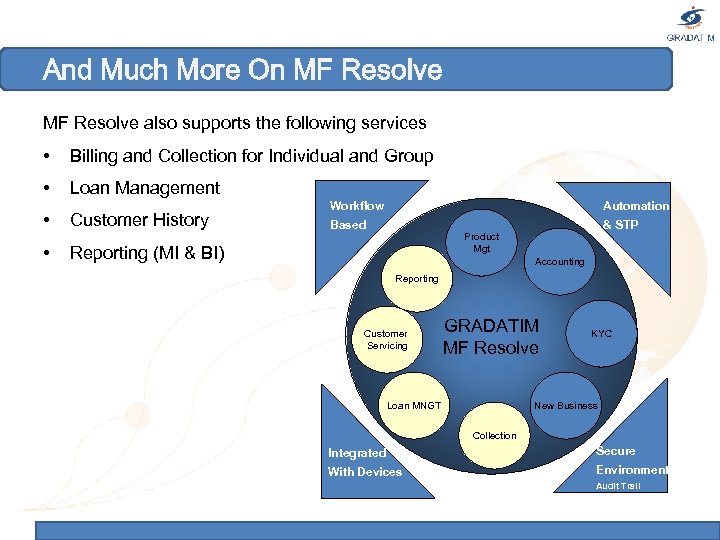

And Much More On MF Resolve also supports the following services • Billing and Collection for Individual and Group • Loan Management • • Customer History Workflow Automation Based & STP Product Mgt Reporting (MI & BI) Accounting Reporting Customer Servicing GRADATIM MF Resolve Loan MNGT KYC New Business Collection Integrated Secure With Devices Environment Audit Trail

And Much More On MF Resolve also supports the following services • Billing and Collection for Individual and Group • Loan Management • • Customer History Workflow Automation Based & STP Product Mgt Reporting (MI & BI) Accounting Reporting Customer Servicing GRADATIM MF Resolve Loan MNGT KYC New Business Collection Integrated Secure With Devices Environment Audit Trail

News Flash !!! Here’s what ING Netherlands has to say about Gradatim’s MF-Resolve: MF Resolve / Gradatim Advice : Positive (+) § Most professional organization amongst all suppliers § Many partnerships with established professional companies § Advisory Board with IBM, Wipro, Citi Group and RBI § Has a clear and well defined strategy § Innovation, globalization and bancalization of the poor § Technology driven, simplify business processes for retail banking § Use and re-use of existing technology § Re-using previous experiences in BPO sector § Complete solution ASP at very low cost for MFI § Opening training center and lab for new customers § Has started also a BPO initiative on non-profit basis MF Resolve will help the MFIs : § To rapidly scale up and add Microfinance products § To reduce their operational costs § To become more transparent

News Flash !!! Here’s what ING Netherlands has to say about Gradatim’s MF-Resolve: MF Resolve / Gradatim Advice : Positive (+) § Most professional organization amongst all suppliers § Many partnerships with established professional companies § Advisory Board with IBM, Wipro, Citi Group and RBI § Has a clear and well defined strategy § Innovation, globalization and bancalization of the poor § Technology driven, simplify business processes for retail banking § Use and re-use of existing technology § Re-using previous experiences in BPO sector § Complete solution ASP at very low cost for MFI § Opening training center and lab for new customers § Has started also a BPO initiative on non-profit basis MF Resolve will help the MFIs : § To rapidly scale up and add Microfinance products § To reduce their operational costs § To become more transparent

MF-Resolve Services § MF-Resolve is a complete “Switch On” Service § Rapidly setup of existing or new products with full profiles § Global distribution though any channel § Immediate local or global deployment: shortest route to writing Immediate business § “Full end to end” real time management and control”

MF-Resolve Services § MF-Resolve is a complete “Switch On” Service § Rapidly setup of existing or new products with full profiles § Global distribution though any channel § Immediate local or global deployment: shortest route to writing Immediate business § “Full end to end” real time management and control”

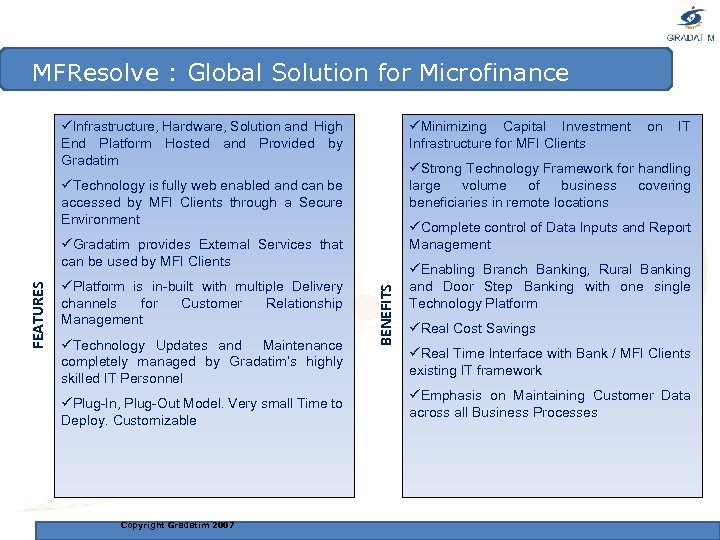

MFResolve : Global Solution for Microfinance üInfrastructure, Hardware, Solution and High End Platform Hosted and Provided by Gradatim üMinimizing Capital Investment Infrastructure for MFI Clients üComplete control of Data Inputs and Report Management üPlug-In, Plug-Out Model. Very small Time to Deploy. Customizable Copyright Gradatim 2007 BENEFITS FEATURES üGradatim provides External Services that can be used by MFI Clients üTechnology Updates and Maintenance completely managed by Gradatim’s highly skilled IT Personnel IT üStrong Technology Framework for handling large volume of business covering beneficiaries in remote locations üTechnology is fully web enabled and can be accessed by MFI Clients through a Secure Environment üPlatform is in-built with multiple Delivery channels for Customer Relationship Management on üEnabling Branch Banking, Rural Banking and Door Step Banking with one single Technology Platform üReal Cost Savings üReal Time Interface with Bank / MFI Clients existing IT framework üEmphasis on Maintaining Customer Data across all Business Processes

MFResolve : Global Solution for Microfinance üInfrastructure, Hardware, Solution and High End Platform Hosted and Provided by Gradatim üMinimizing Capital Investment Infrastructure for MFI Clients üComplete control of Data Inputs and Report Management üPlug-In, Plug-Out Model. Very small Time to Deploy. Customizable Copyright Gradatim 2007 BENEFITS FEATURES üGradatim provides External Services that can be used by MFI Clients üTechnology Updates and Maintenance completely managed by Gradatim’s highly skilled IT Personnel IT üStrong Technology Framework for handling large volume of business covering beneficiaries in remote locations üTechnology is fully web enabled and can be accessed by MFI Clients through a Secure Environment üPlatform is in-built with multiple Delivery channels for Customer Relationship Management on üEnabling Branch Banking, Rural Banking and Door Step Banking with one single Technology Platform üReal Cost Savings üReal Time Interface with Bank / MFI Clients existing IT framework üEmphasis on Maintaining Customer Data across all Business Processes

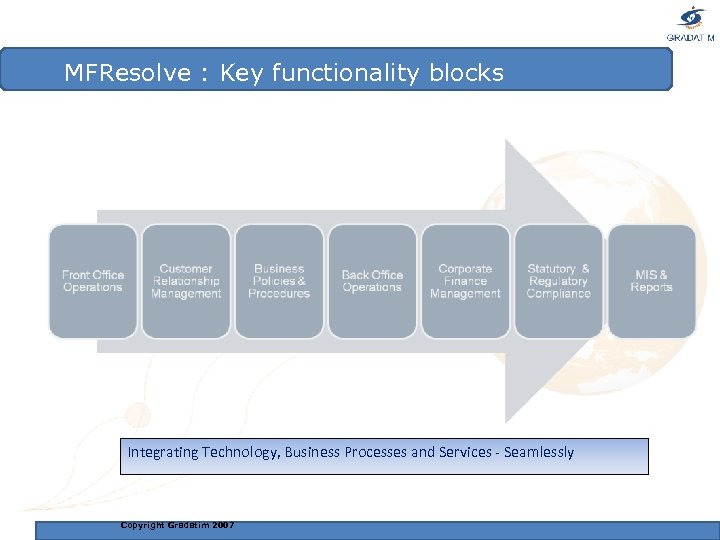

MFResolve : Key functionality blocks Integrating Technology, Business Processes and Services - Seamlessly Copyright Gradatim 2007

MFResolve : Key functionality blocks Integrating Technology, Business Processes and Services - Seamlessly Copyright Gradatim 2007

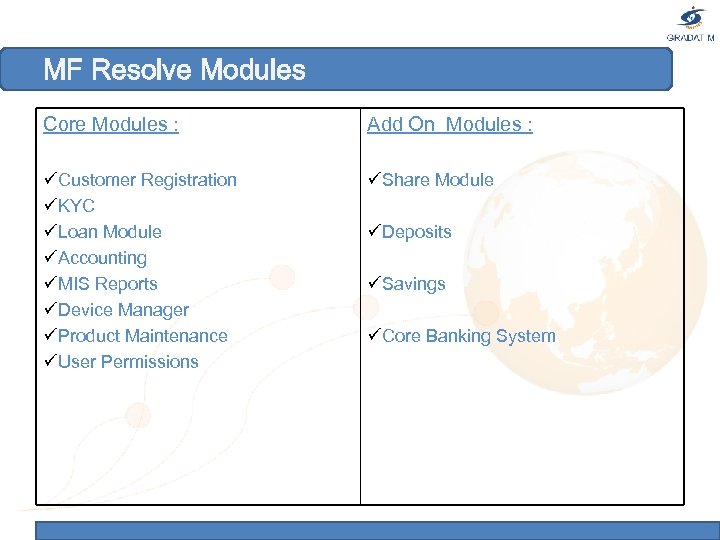

MF Resolve Modules Core Modules : Add On Modules : üCustomer Registration üKYC üLoan Module üAccounting üMIS Reports üDevice Manager üProduct Maintenance üUser Permissions üShare Module üDeposits üSavings üCore Banking System

MF Resolve Modules Core Modules : Add On Modules : üCustomer Registration üKYC üLoan Module üAccounting üMIS Reports üDevice Manager üProduct Maintenance üUser Permissions üShare Module üDeposits üSavings üCore Banking System

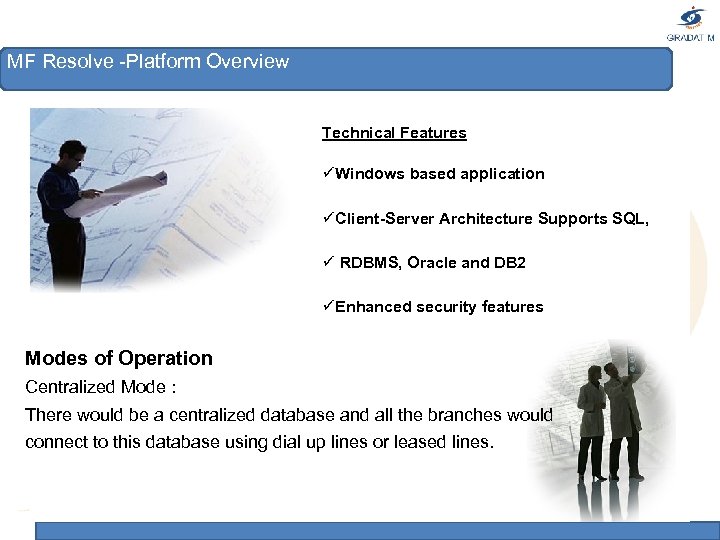

MF Resolve -Platform Overview Technical Features üWindows based application üClient-Server Architecture Supports SQL, ü RDBMS, Oracle and DB 2 üEnhanced security features Modes of Operation Centralized Mode : There would be a centralized database and all the branches would connect to this database using dial up lines or leased lines.

MF Resolve -Platform Overview Technical Features üWindows based application üClient-Server Architecture Supports SQL, ü RDBMS, Oracle and DB 2 üEnhanced security features Modes of Operation Centralized Mode : There would be a centralized database and all the branches would connect to this database using dial up lines or leased lines.

Add On Devices Features: • Client registration Digital Pen Bio Metrics • KYC Details • Loan Application • Repayment History PDA OCR • Transactions ICR

Add On Devices Features: • Client registration Digital Pen Bio Metrics • KYC Details • Loan Application • Repayment History PDA OCR • Transactions ICR

Client Base § § § § § Vedika Credit Capital Limited , Ranchi Bhoomika, Bhubaneswar Society for promotion of youth and masses, Delhi Friends for women's world Banking Planned Social Concern, Delhi CRe. SA, Rajahmundry Bazaari Global Finance Limited, Jodhpur Micro Insurance Academy Indian School Finance Company Lot more at final stage of agreement

Client Base § § § § § Vedika Credit Capital Limited , Ranchi Bhoomika, Bhubaneswar Society for promotion of youth and masses, Delhi Friends for women's world Banking Planned Social Concern, Delhi CRe. SA, Rajahmundry Bazaari Global Finance Limited, Jodhpur Micro Insurance Academy Indian School Finance Company Lot more at final stage of agreement

Alliances § Gradatim has established partnerships with companies in similar service lines. Following are some of our partnerships: Infrasoft. Tech is a global organization focused on delivering high quality IPR based software products, solutions & specialized software services; in the domains of retail banking, investment banking, e. Channels, trading, wealth management, Islamic finance and Anti Money Laundering Kofax is the leading provider of Intelligent Capture & Exchange solutions, including de facto standard products for information capture, device connectivity and image processing.

Alliances § Gradatim has established partnerships with companies in similar service lines. Following are some of our partnerships: Infrasoft. Tech is a global organization focused on delivering high quality IPR based software products, solutions & specialized software services; in the domains of retail banking, investment banking, e. Channels, trading, wealth management, Islamic finance and Anti Money Laundering Kofax is the leading provider of Intelligent Capture & Exchange solutions, including de facto standard products for information capture, device connectivity and image processing.

Thanks you for your time. For further Information contact – Vishal Anand Ph: + 91 9900161120 EMail: vishal. a@gradatimin. com URL : www. gradatimin. com

Thanks you for your time. For further Information contact – Vishal Anand Ph: + 91 9900161120 EMail: vishal. a@gradatimin. com URL : www. gradatimin. com