ef9261f1d5ceb96604ed098a511b6f69.ppt

- Количество слайдов: 106

Governor Rowland’s Budget Proposal Celebrating 150 Years of Bushnell Park, 1854 -2004 • FY 2004 -2005 Midterm Budget Adjustments February 4, 2004 Photograph of 1876 Painting of Park River, unknown painter

Budgeting In These Precarious Times • State & national economies are on the mend; stock market is rebounding and state revenues are rising • Tough decisions of the past two budget cycles mean the budget is beginning to return to balance • While economic and budget prospects are looking up, the 2004 session should not be seen as an opportunity to shift course • Lawmakers should approach 2004 with caution – FY 2004 -05 budget is in deficit – Concentrate on closing the shortfall, build on balanced approach of last few years – Resist the temptation to make wholesale changes – The economy is currently burdened by a billion dollar increase – Be wary of additional taxes that will undermine the nascent recovery – Stay well within the constitutional spending cap 2

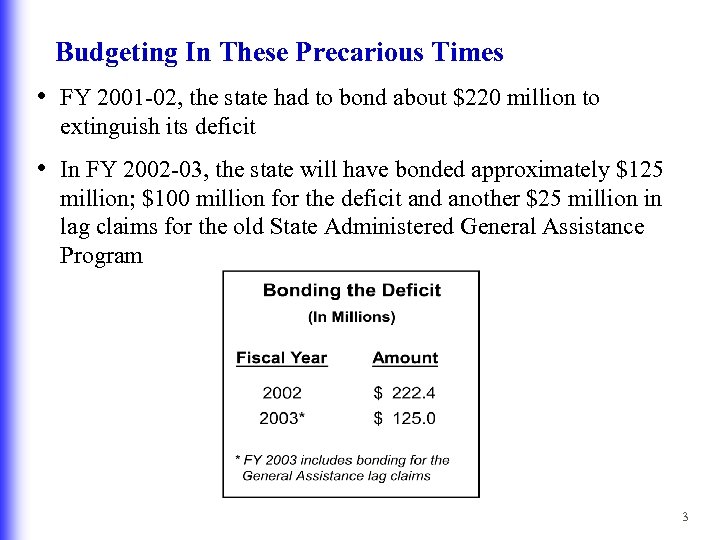

Budgeting In These Precarious Times • FY 2001 -02, the state had to bond about $220 million to extinguish its deficit • In FY 2002 -03, the state will have bonded approximately $125 million; $100 million for the deficit and another $25 million in lag claims for the old State Administered General Assistance Program 3

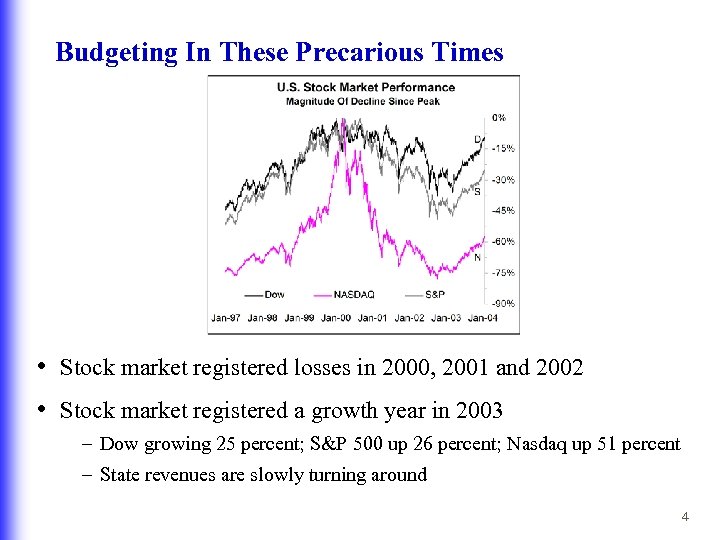

Budgeting In These Precarious Times • Stock market registered losses in 2000, 2001 and 2002 • Stock market registered a growth year in 2003 – Dow growing 25 percent; S&P 500 up 26 percent; Nasdaq up 51 percent – State revenues are slowly turning around 4

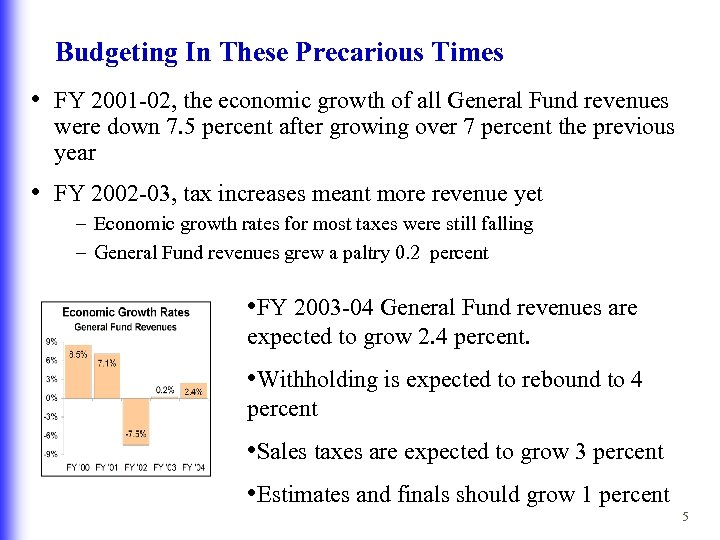

Budgeting In These Precarious Times • FY 2001 -02, the economic growth of all General Fund revenues were down 7. 5 percent after growing over 7 percent the previous year • FY 2002 -03, tax increases meant more revenue yet – Economic growth rates for most taxes were still falling – General Fund revenues grew a paltry 0. 2 percent • FY 2003 -04 General Fund revenues are expected to grow 2. 4 percent. • Withholding is expected to rebound to 4 percent • Sales taxes are expected to grow 3 percent • Estimates and finals should grow 1 percent 5

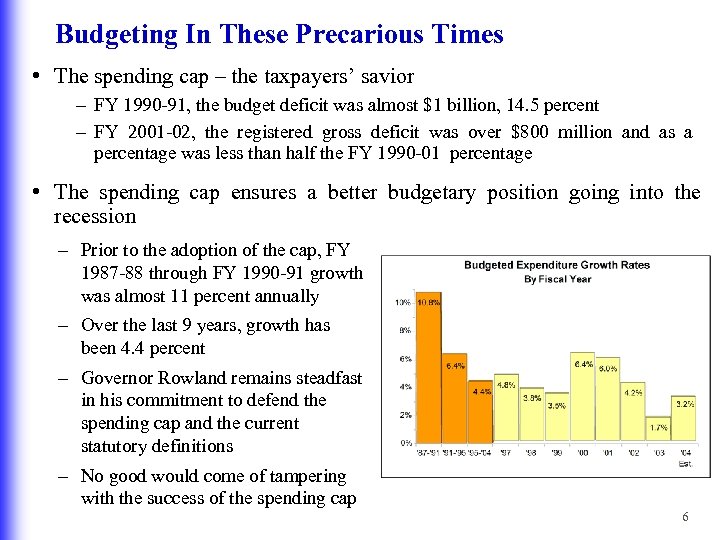

Budgeting In These Precarious Times • The spending cap – the taxpayers’ savior – FY 1990 -91, the budget deficit was almost $1 billion, 14. 5 percent – FY 2001 -02, the registered gross deficit was over $800 million and as a percentage was less than half the FY 1990 -01 percentage • The spending cap ensures a better budgetary position going into the recession – Prior to the adoption of the cap, FY 1987 -88 through FY 1990 -91 growth was almost 11 percent annually – Over the last 9 years, growth has been 4. 4 percent – Governor Rowland remains steadfast in his commitment to defend the spending cap and the current statutory definitions – No good would come of tampering with the success of the spending cap 6

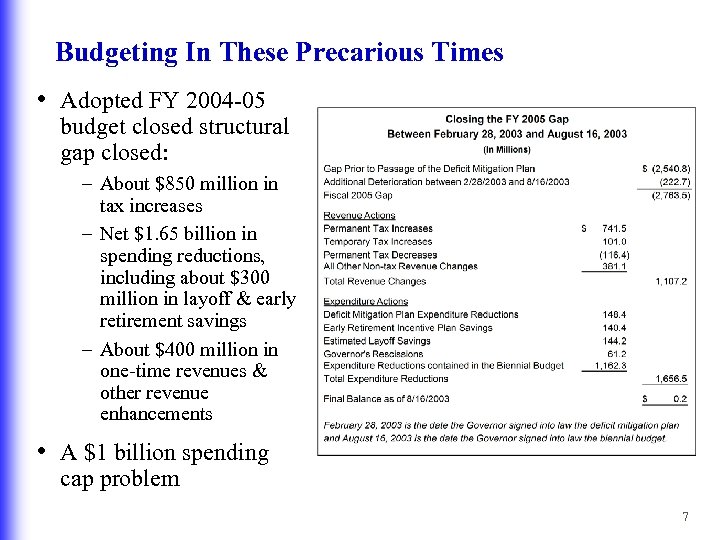

Budgeting In These Precarious Times • Adopted FY 2004 -05 budget closed structural gap closed: – About $850 million in tax increases – Net $1. 65 billion in spending reductions, including about $300 million in layoff & early retirement savings – About $400 million in one-time revenues & other revenue enhancements • A $1 billion spending cap problem 7

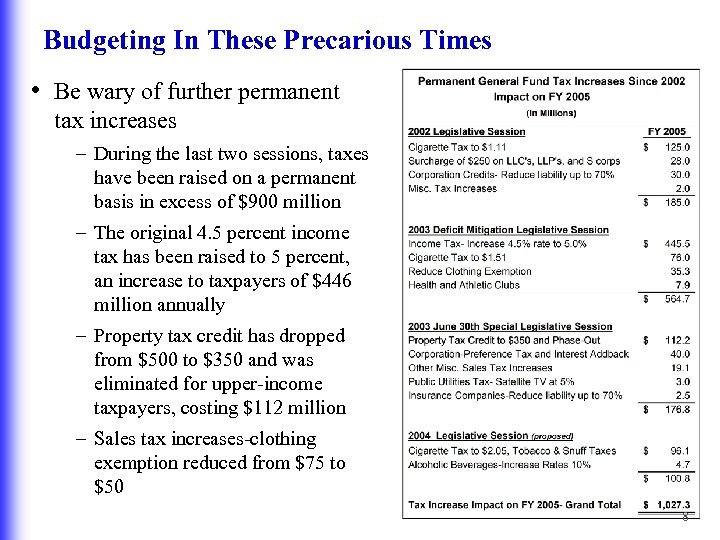

Budgeting In These Precarious Times • Be wary of further permanent tax increases – During the last two sessions, taxes have been raised on a permanent basis in excess of $900 million – The original 4. 5 percent income tax has been raised to 5 percent, an increase to taxpayers of $446 million annually – Property tax credit has dropped from $500 to $350 and was eliminated for upper-income taxpayers, costing $112 million – Sales tax increases-clothing exemption reduced from $75 to $50 8

Budgeting In These Precarious Times • Lawmakers should be wary of increasing taxes on businesses – Taxes for businesses have been increased over $100 million permanently in recent years – In 2002, tax credits were capped at 70 percent of pre-tax credit liability, costing businesses $30 million – Minimum levy of $250 was placed on S-corporations & LLCs at a cost of $28 million – Over 1, 000 companies will pay about $30 million more because of the increase for combined reporting from $25, 000 to $250, 000 – Tightening the use of interest deductions will cost businesses $10 million • Businesses paying major surcharges for income years 2003 and 2004 -- costing them $150 million temporarily 9

Budgeting In These Precarious Times • Bond raters watching Connecticut at this critical time – We must approach the adjusted budget cautiously – Moody’s has lowered the state’s rating – S&P and Fitch have held the AA rating • A lower bond rating would increase our debt costs considerably – Debt service is scheduled to increase dramatically to pay the deficit notes issued for FY 2001 -02 as well as FY 2002 -03 • Bond rating agencies review the adjusted budget – Are the revenue estimates reliable & conservative? – Moderate approach to spending growth? – Adherence to the spending cap? – Do one-time revenues and other fixes increase dramatically as a percentage of the budget? 10

Liquidating the FY 2003 -04 Deficit • Deficit currently projected at $41. 1 million • Spending expected to be about $78 million higher – Department of Social Services, net deficiency of $30. 33 million - lapse in the child care account and deficiencies in the Medicaid, SAGA and Conn. PACE accounts – Department of Children and Families, deficiency of $20 million – due to staffing mandates of the consent decree and greater than anticipated caseloads – Eight other agencies – minor deficiencies totaling $16 million – ERIP saving less than predicted – General Fund $18. 8 million less than the $153 million projected – Surplus adjustments cause a shortfall of $5. 2 million – Governor implemented $12 million in rescissions in December 11

Liquidating the FY 2003 -04 Deficit • Appropriating the deficiency – permissible only if revenue is available – Revenue increases and proposed revenue increases will bring budget into balance by year’s end – $66 million in spending needs proposed to be appropriated – Room remains under the spending cap in FY 2004 -05 to pay for the overruns • Revenues in the General Fund are up over the original budgeted estimate by about $37 million – – Offsets part of excess expenditures Corporate taxes estimated $83 million under budgeted amount Income tax estimated $124 million over budgeted amount All other revenues down a net of $4. 3 million 12

Liquidating the FY 2003 -04 Deficit • Deficit mitigation plan – Implementing on April 1 increases in cigarette tax, other tobacco products, and alcohol tax to raise $35. 4 million – Implementing on April 1 proposed bottle escheat program to raise $4. 5 million – Retaining $2 million still scheduled to be deposited in the Biomedical Research Trust Fund – Appropriating in FY 2003 -04 $11. 7 million in TANF High Performance Bonus money and the $20 million originally intercepted for tourism, arts and culture – no net impact on the deficit or CATCH-F funding • Adopting Governor’s plan will mean extinguishing the deficit and depositing $800, 000 in Rainy Day Fund 13

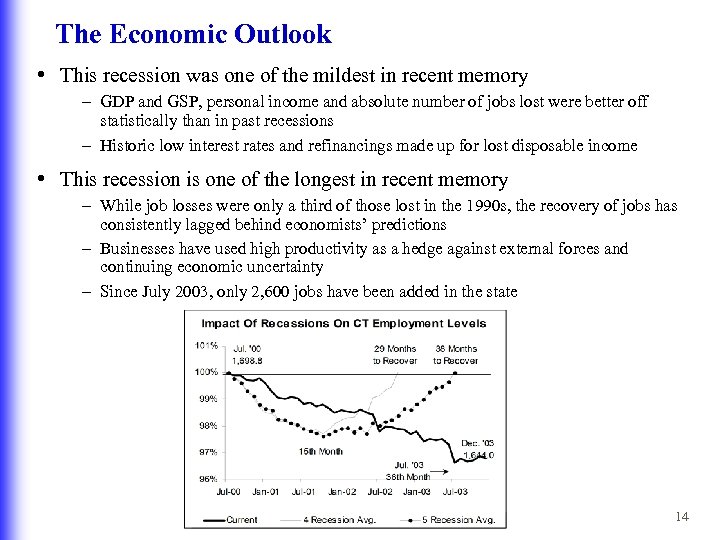

The Economic Outlook • This recession was one of the mildest in recent memory – GDP and GSP, personal income and absolute number of jobs lost were better off statistically than in past recessions – Historic low interest rates and refinancings made up for lost disposable income • This recession is one of the longest in recent memory – While job losses were only a third of those lost in the 1990 s, the recovery of jobs has consistently lagged behind economists’ predictions – Businesses have used high productivity as a hedge against external forces and continuing economic uncertainty – Since July 2003, only 2, 600 jobs have been added in the state 14

The Economic Outlook • What does the future hold? • A number of business and consumer measures demonstrate that job creation should be on its way – Supply Management Index is now is the high 60 s – Index of Leading Indicators is charging – Even the Consumer Confidence Index is heading upward • Economist cautiously predict a stable recovery – Will not see the vigorous growth rates as in the mid-to-late 1990 s – Economic growth will peak in FY 2003 -04 and FY 2004 -05 – More moderate growth in FY 2005 -06 and FY 2006 -07 15

The Economic Outlook • National Outlook - Real GDP will hit 4. 4 percent in FY 2003 -04 and then drop into the 3 percent plus range - Personal income growth will grow and hit 6 percent in FY 2006 -07 - Unemployment rate will not change in foreseeable future - However, consumer confidence could show some anxiety due to the fact that many have already refinanced their homes and maxed out their credit cards • Connecticut’s Outlook - Growth will be more moderate than the nation’s - State recovery usually lags the nation’s by up to six months - Growth in Gross State Product will be more sluggish than the nation in FY 2004 -05, slightly better than the nation’s in FY 2005 -06 and FY 2006 -07 - Personal income growth will be lower than the nation’s – this will limit growth in income and sales tax receipts 16

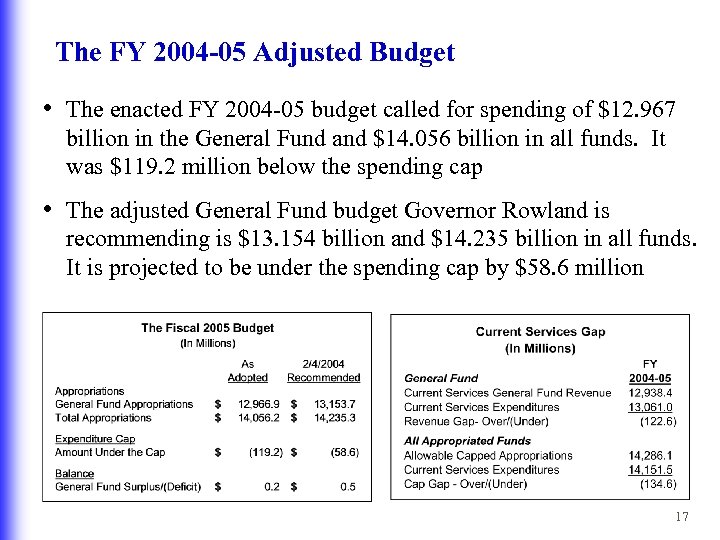

The FY 2004 -05 Adjusted Budget • The enacted FY 2004 -05 budget called for spending of $12. 967 billion in the General Fund and $14. 056 billion in all funds. It was $119. 2 million below the spending cap • The adjusted General Fund budget Governor Rowland is recommending is $13. 154 billion and $14. 235 billion in all funds. It is projected to be under the spending cap by $58. 6 million 17

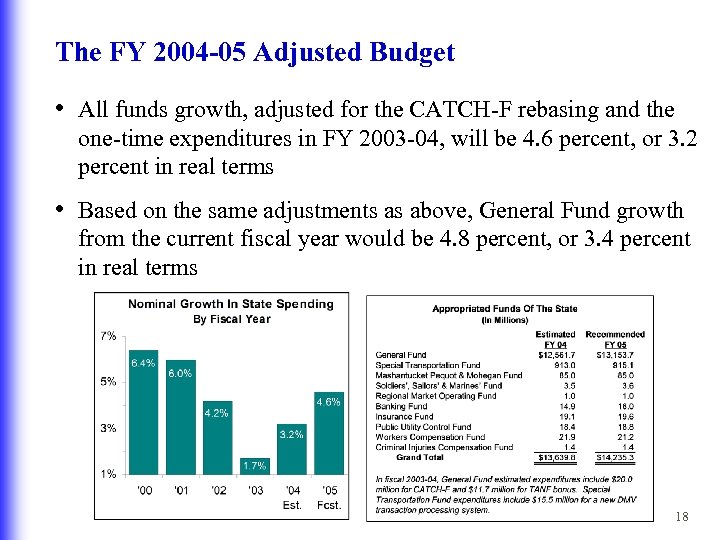

The FY 2004 -05 Adjusted Budget • All funds growth, adjusted for the CATCH-F rebasing and the one-time expenditures in FY 2003 -04, will be 4. 6 percent, or 3. 2 percent in real terms • Based on the same adjustments as above, General Fund growth from the current fiscal year would be 4. 8 percent, or 3. 4 percent in real terms 18

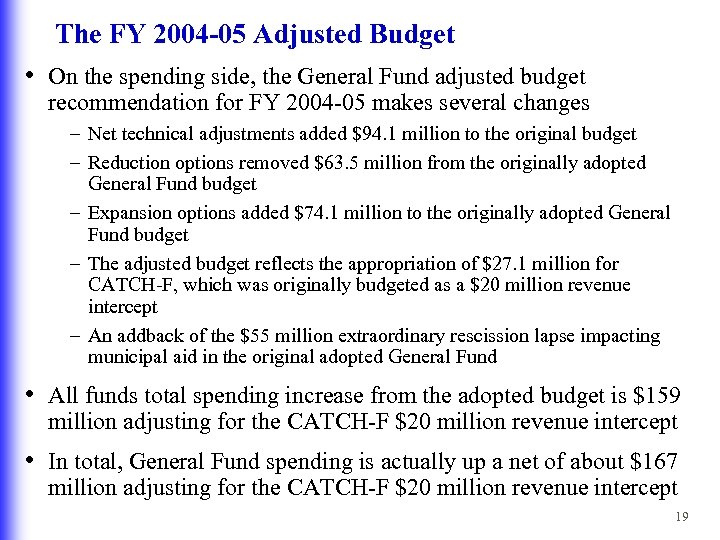

The FY 2004 -05 Adjusted Budget • On the spending side, the General Fund adjusted budget recommendation for FY 2004 -05 makes several changes – Net technical adjustments added $94. 1 million to the original budget – Reduction options removed $63. 5 million from the originally adopted General Fund budget – Expansion options added $74. 1 million to the originally adopted General Fund budget – The adjusted budget reflects the appropriation of $27. 1 million for CATCH-F, which was originally budgeted as a $20 million revenue intercept – An addback of the $55 million extraordinary rescission lapse impacting municipal aid in the original adopted General Fund • All funds total spending increase from the adopted budget is $159 million adjusting for the CATCH-F $20 million revenue intercept • In total, General Fund spending is actually up a net of about $167 million adjusting for the CATCH-F $20 million revenue intercept 19

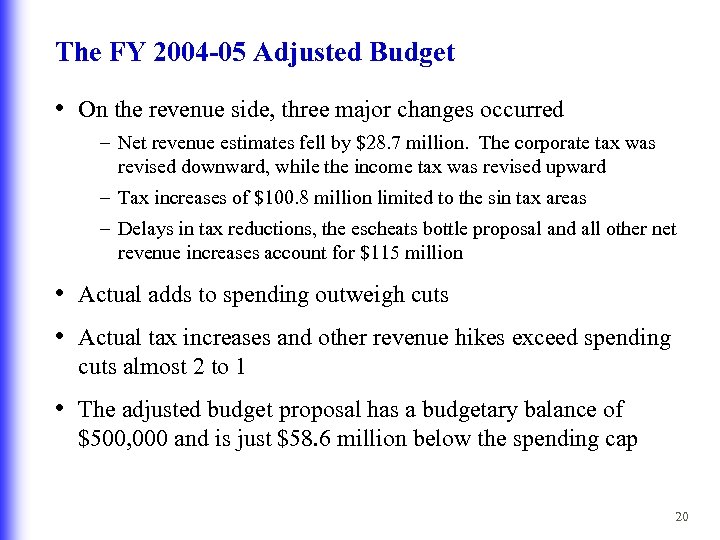

The FY 2004 -05 Adjusted Budget • On the revenue side, three major changes occurred – Net revenue estimates fell by $28. 7 million. The corporate tax was revised downward, while the income tax was revised upward – Tax increases of $100. 8 million limited to the sin tax areas – Delays in tax reductions, the escheats bottle proposal and all other net revenue increases account for $115 million • Actual adds to spending outweigh cuts • Actual tax increases and other revenue hikes exceed spending cuts almost 2 to 1 • The adjusted budget proposal has a budgetary balance of $500, 000 and is just $58. 6 million below the spending cap 20

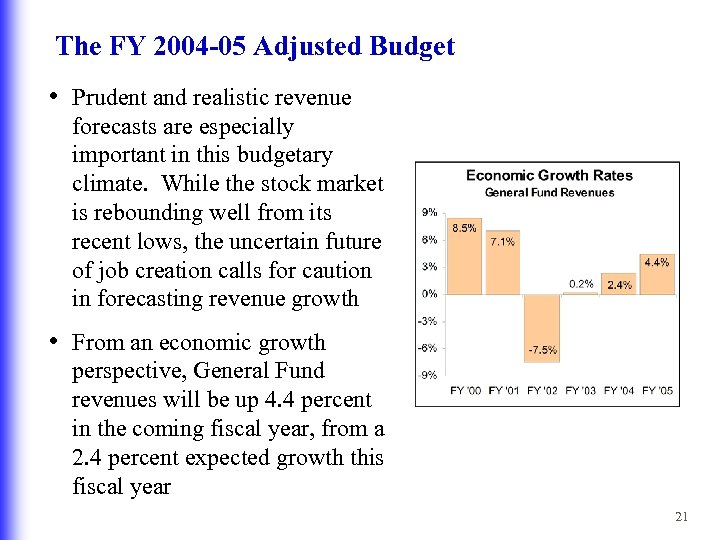

The FY 2004 -05 Adjusted Budget • Prudent and realistic revenue forecasts are especially important in this budgetary climate. While the stock market is rebounding well from its recent lows, the uncertain future of job creation calls for caution in forecasting revenue growth • From an economic growth perspective, General Fund revenues will be up 4. 4 percent in the coming fiscal year, from a 2. 4 percent expected growth this fiscal year 21

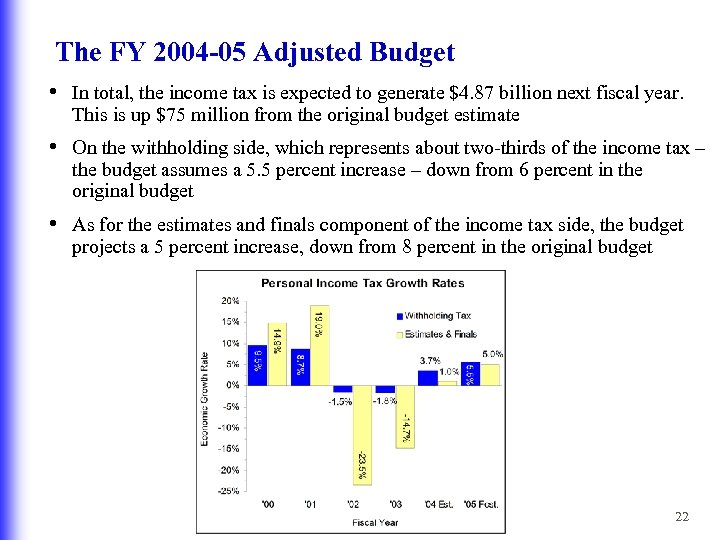

The FY 2004 -05 Adjusted Budget • In total, the income tax is expected to generate $4. 87 billion next fiscal year. This is up $75 million from the original budget estimate • On the withholding side, which represents about two-thirds of the income tax – the budget assumes a 5. 5 percent increase – down from 6 percent in the original budget • As for the estimates and finals component of the income tax side, the budget projects a 5 percent increase, down from 8 percent in the original budget 22

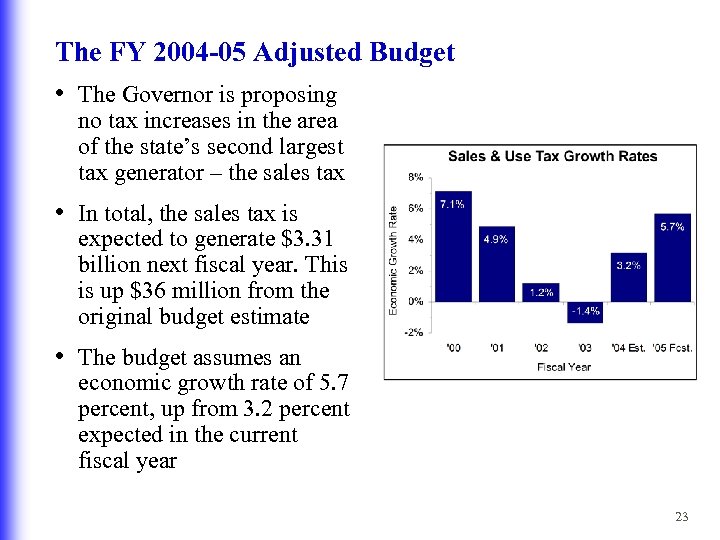

The FY 2004 -05 Adjusted Budget • The Governor is proposing no tax increases in the area of the state’s second largest tax generator – the sales tax • In total, the sales tax is expected to generate $3. 31 billion next fiscal year. This is up $36 million from the original budget estimate • The budget assumes an economic growth rate of 5. 7 percent, up from 3. 2 percent expected in the current fiscal year 23

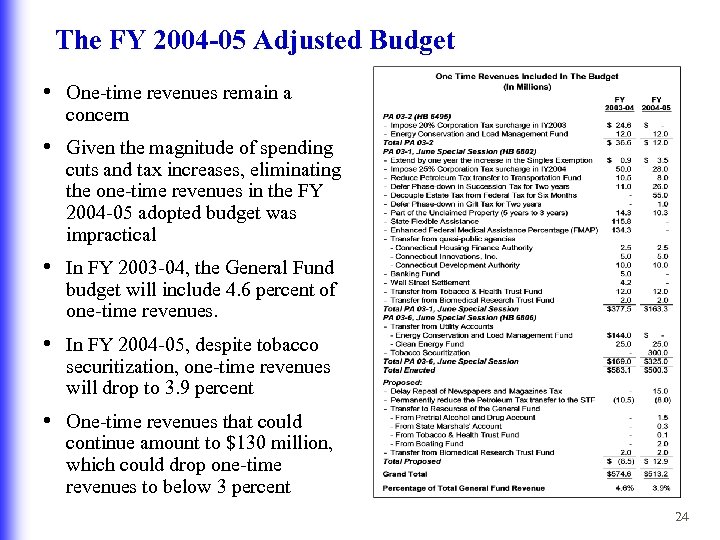

The FY 2004 -05 Adjusted Budget • One-time revenues remain a concern • Given the magnitude of spending cuts and tax increases, eliminating the one-time revenues in the FY 2004 -05 adopted budget was impractical • In FY 2003 -04, the General Fund budget will include 4. 6 percent of one-time revenues. • In FY 2004 -05, despite tobacco securitization, one-time revenues will drop to 3. 9 percent • One-time revenues that could continue amount to $130 million, which could drop one-time revenues to below 3 percent 24

The FY 2004 -05 Adjusted Budget • Tobacco securitization – Section 43 of PA 03 -6 of the June 30 Special Session mandated that the State Treasurer and the Secretary of the OPM jointly develop a financing plan that would yield the state $300 million in general revenues for FY 2004 -05. The Treasurer and OPM have begun an analysis of the options available. These options include § Securitization of a future revenue stream such as Tobacco Settlement revenues, lottery revenues, casino revenues, future tax receipts or unclaimed property receipts § Issuance of pension obligation bonds to reduce the state’s unfunded liability § Debt restructuring § Private placement of state debt or the tobacco revenue stream with the pension fund 25

The FY 2004 -05 Adjusted Budget • Tobacco securitization – Because of the uncertainty of this revenue stream over time, states or other jurisdictions that seek to sell tobacco bonds are required to pay a premium in the marketplace. – Typically, states only receive 30 and 40 percent of the value of the revenue stream and, more recently, have been required to dedicate other revenue streams as backing for the sale of the bonds should the payments from the tobacco settlement be reduced or eliminated – It is highly likely that the evidence of an improving economy that we are beginning to see will continue. If that is the case, it is probable that April tax collections will exceed our current estimates and the rollout of these collections into the next fiscal year will be significant – Governor Rowland strongly believes that these revenues, should they appear, ought to be directed to the task of restoring structural balance to the budget and avoiding the inevitable task of having to cut programs or raise taxes in the next biennium in order maintain this balance. – Accordingly, as part of his budget package, Governor Rowland is proposing legislation that would replace the current reliance upon $300 million of tobacco securitized revenue with any additional growth in our current revenue sources 26

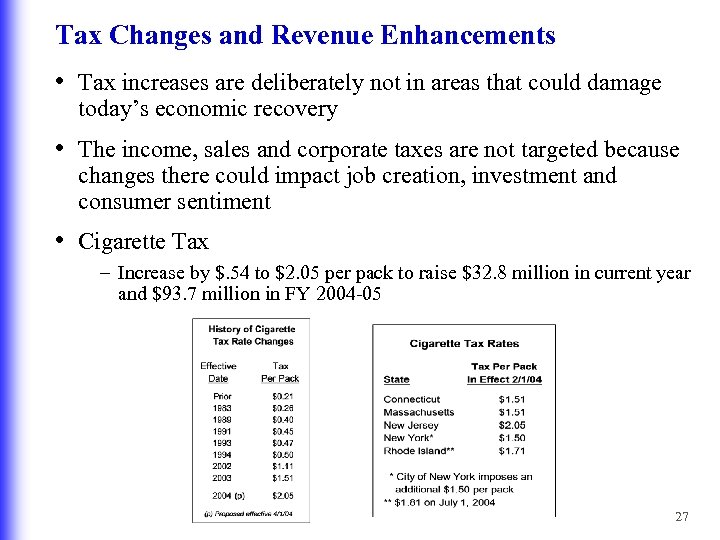

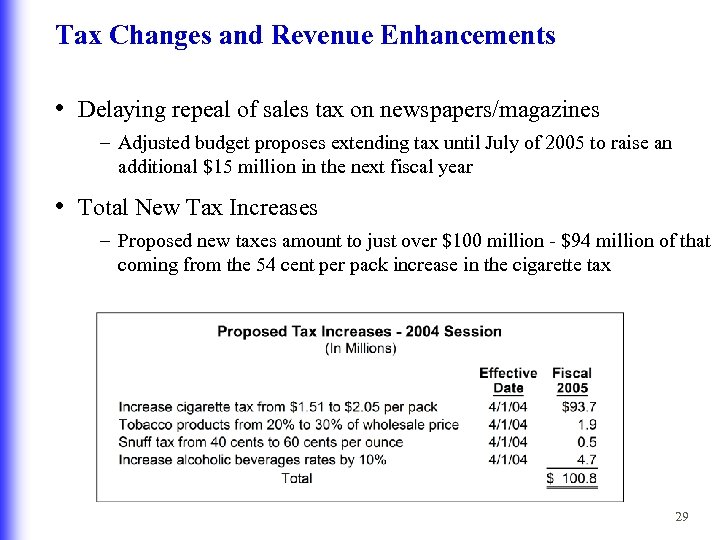

Tax Changes and Revenue Enhancements • Tax increases are deliberately not in areas that could damage today’s economic recovery • The income, sales and corporate taxes are not targeted because changes there could impact job creation, investment and consumer sentiment • Cigarette Tax – Increase by $. 54 to $2. 05 per pack to raise $32. 8 million in current year and $93. 7 million in FY 2004 -05 27

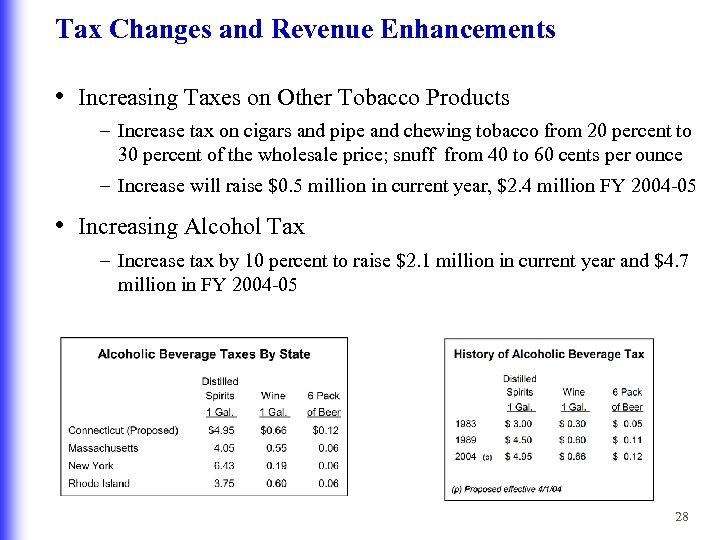

Tax Changes and Revenue Enhancements • Increasing Taxes on Other Tobacco Products – Increase tax on cigars and pipe and chewing tobacco from 20 percent to 30 percent of the wholesale price; snuff from 40 to 60 cents per ounce – Increase will raise $0. 5 million in current year, $2. 4 million FY 2004 -05 • Increasing Alcohol Tax – Increase tax by 10 percent to raise $2. 1 million in current year and $4. 7 million in FY 2004 -05 28

Tax Changes and Revenue Enhancements • Delaying repeal of sales tax on newspapers/magazines – Adjusted budget proposes extending tax until July of 2005 to raise an additional $15 million in the next fiscal year • Total New Tax Increases – Proposed new taxes amount to just over $100 million - $94 million of that coming from the 54 cent per pack increase in the cigarette tax 29

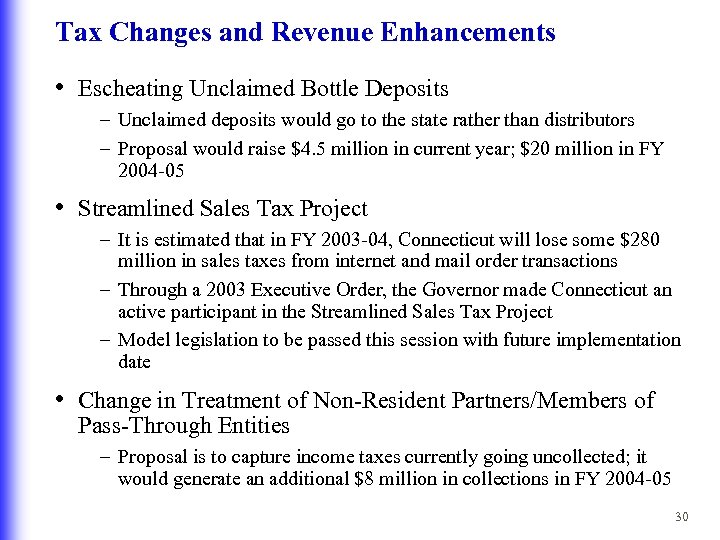

Tax Changes and Revenue Enhancements • Escheating Unclaimed Bottle Deposits – Unclaimed deposits would go to the state rather than distributors – Proposal would raise $4. 5 million in current year; $20 million in FY 2004 -05 • Streamlined Sales Tax Project – It is estimated that in FY 2003 -04, Connecticut will lose some $280 million in sales taxes from internet and mail order transactions – Through a 2003 Executive Order, the Governor made Connecticut an active participant in the Streamlined Sales Tax Project – Model legislation to be passed this session with future implementation date • Change in Treatment of Non-Resident Partners/Members of Pass-Through Entities – Proposal is to capture income taxes currently going uncollected; it would generate an additional $8 million in collections in FY 2004 -05 30

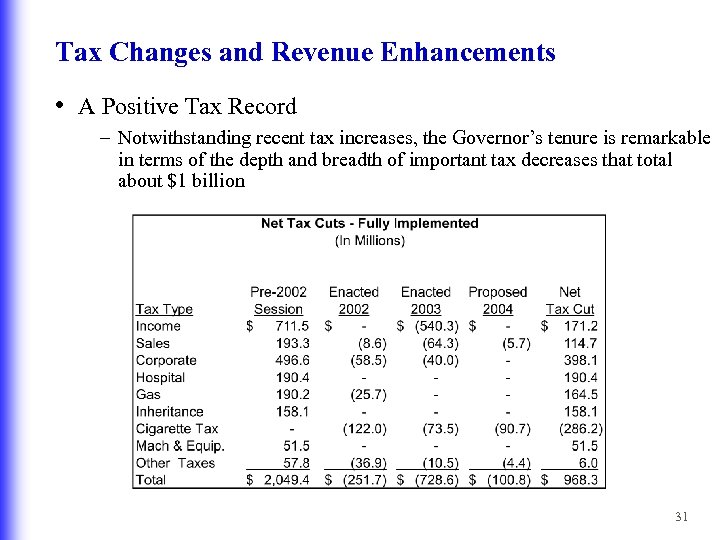

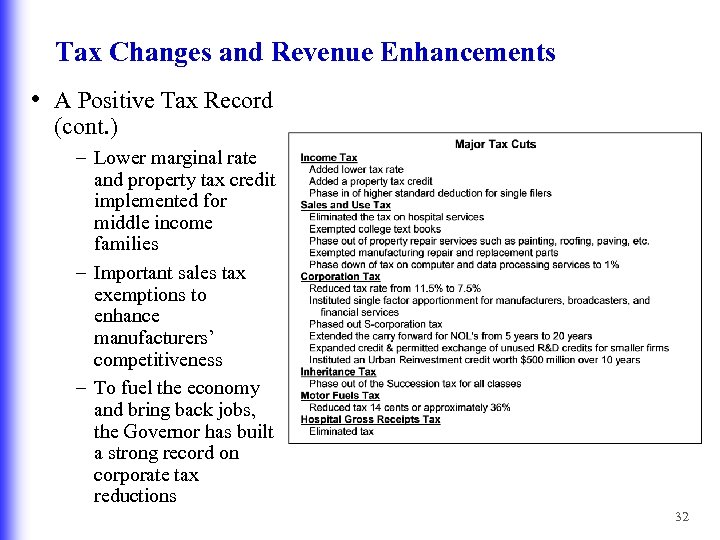

Tax Changes and Revenue Enhancements • A Positive Tax Record – Notwithstanding recent tax increases, the Governor’s tenure is remarkable in terms of the depth and breadth of important tax decreases that total about $1 billion 31

Tax Changes and Revenue Enhancements • A Positive Tax Record (cont. ) – Lower marginal rate and property tax credit implemented for middle income families – Important sales tax exemptions to enhance manufacturers’ competitiveness – To fuel the economy and bring back jobs, the Governor has built a strong record on corporate tax reductions 32

Education: Providing the Building Blocks of Success • Closing the Achievement Gap – Governor’s adjusted budget presents a strategy to assist schools designated as not making “Adequate Yearly Progress” under the federal No Child Left Behind program – The adjusted budget also assists pre-school children in those same districts to prepare them for success in school • Early Childhood Expansion – Cornerstone of program is to significantly expand fullday, full-year quality pre-school programs – Budget contains $14 million in new funding for 2, 000 additional pre-school slots in the state’s Early Child Education program – For children already in school, an additional $1 million for expansion of Early Reading Success program in grades K – 3 and $1 million for summer school programs to help children become proficient students 33

Education: Providing the Building Blocks of Success • School Improvement Grants – $75, 000 will be targeted to each of the 16 schools designated as “in need of improvement” to help to improve academic performance, for a total of $1. 2 million. State aid must be matched by $25, 000 in local aid • Funding to Reduce Racial Isolation and Improve Urban Education – Magnet Schools: $5. 9 million increase for FY 2004 -05 to total $61. 6 million – Charter Schools: $0. 8 million increase for FY 2004 -05 to total $17. 8 million – OPEN Choice: $1. 5 million increase for FY 2004 -05 to total $10. 6 million – Budget includes funding to satisfy the agreement reached in the Sheff v. O’Neill case 34

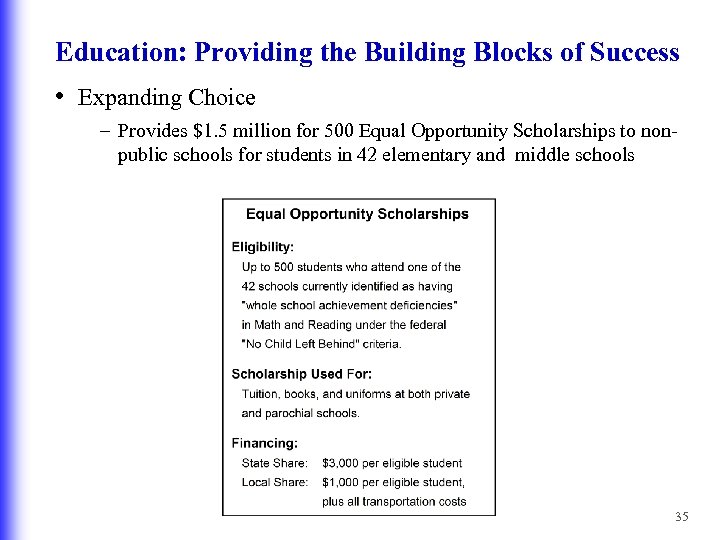

Education: Providing the Building Blocks of Success • Expanding Choice – Provides $1. 5 million for 500 Equal Opportunity Scholarships to nonpublic schools for students in 42 elementary and middle schools 35

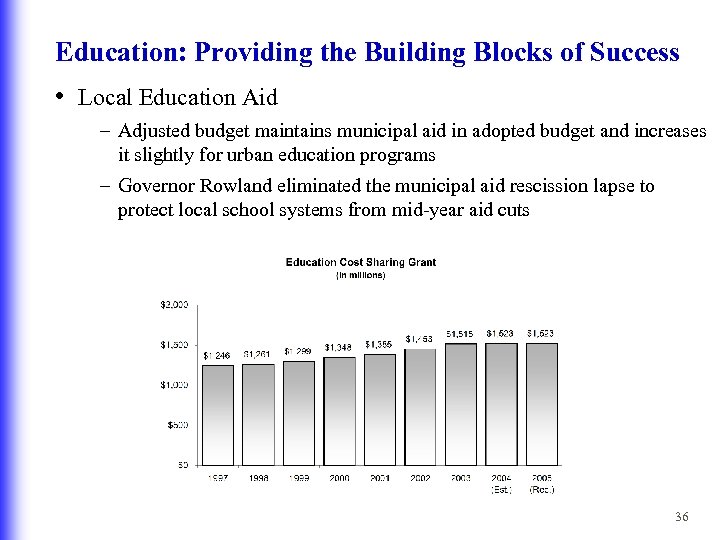

Education: Providing the Building Blocks of Success • Local Education Aid – Adjusted budget maintains municipal aid in adopted budget and increases it slightly for urban education programs – Governor Rowland eliminated the municipal aid rescission lapse to protect local school systems from mid-year aid cuts 36

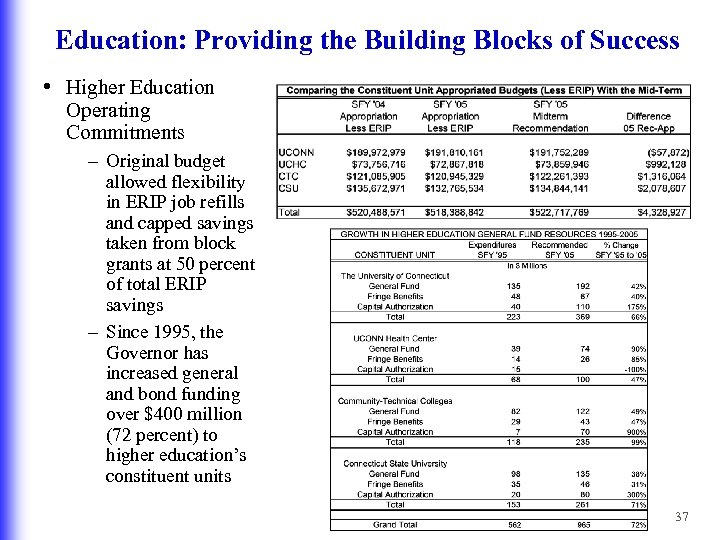

Education: Providing the Building Blocks of Success • Higher Education Operating Commitments – Original budget allowed flexibility in ERIP job refills and capped savings taken from block grants at 50 percent of total ERIP savings – Since 1995, the Governor has increased general and bond funding over $400 million (72 percent) to higher education’s constituent units 37

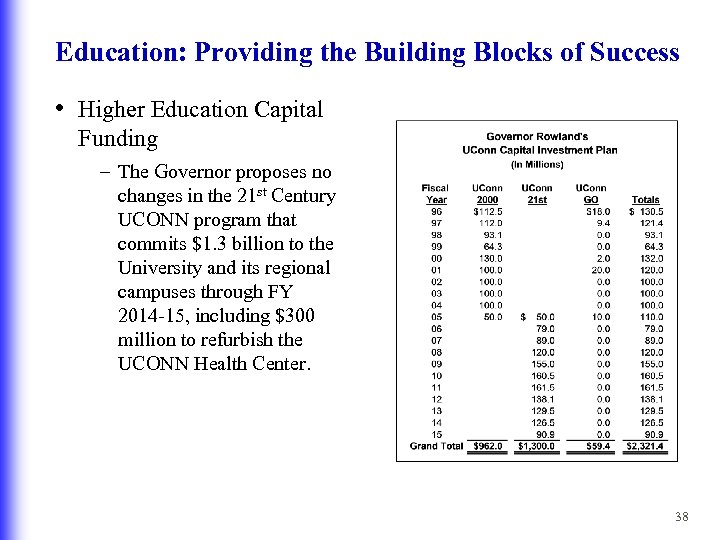

Education: Providing the Building Blocks of Success • Higher Education Capital Funding – The Governor proposes no changes in the 21 st Century UCONN program that commits $1. 3 billion to the University and its regional campuses through FY 2014 -15, including $300 million to refurbish the UCONN Health Center. 38

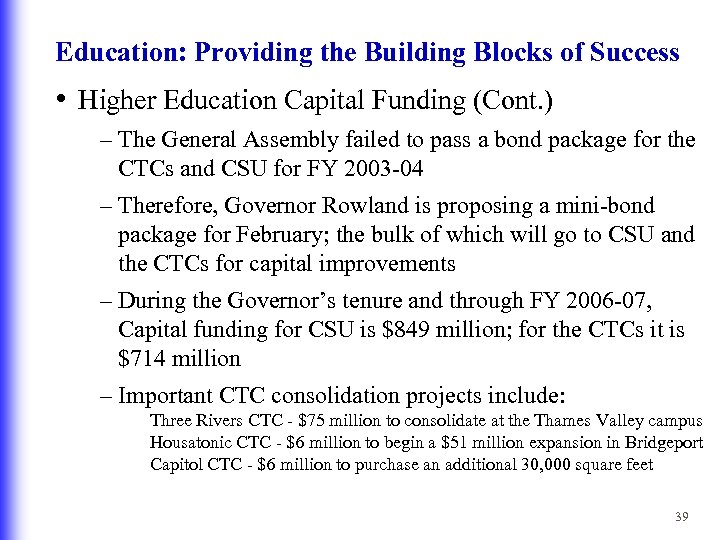

Education: Providing the Building Blocks of Success • Higher Education Capital Funding (Cont. ) – The General Assembly failed to pass a bond package for the CTCs and CSU for FY 2003 -04 – Therefore, Governor Rowland is proposing a mini-bond package for February; the bulk of which will go to CSU and the CTCs for capital improvements – During the Governor’s tenure and through FY 2006 -07, Capital funding for CSU is $849 million; for the CTCs it is $714 million – Important CTC consolidation projects include: Three Rivers CTC - $75 million to consolidate at the Thames Valley campus Housatonic CTC - $6 million to begin a $51 million expansion in Bridgeport Capitol CTC - $6 million to purchase an additional 30, 000 square feet 39

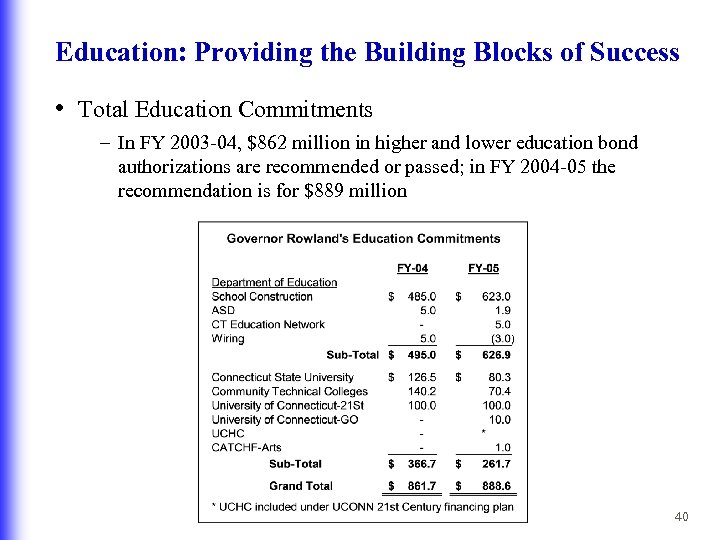

Education: Providing the Building Blocks of Success • Total Education Commitments – In FY 2003 -04, $862 million in higher and lower education bond authorizations are recommended or passed; in FY 2004 -05 the recommendation is for $889 million 40

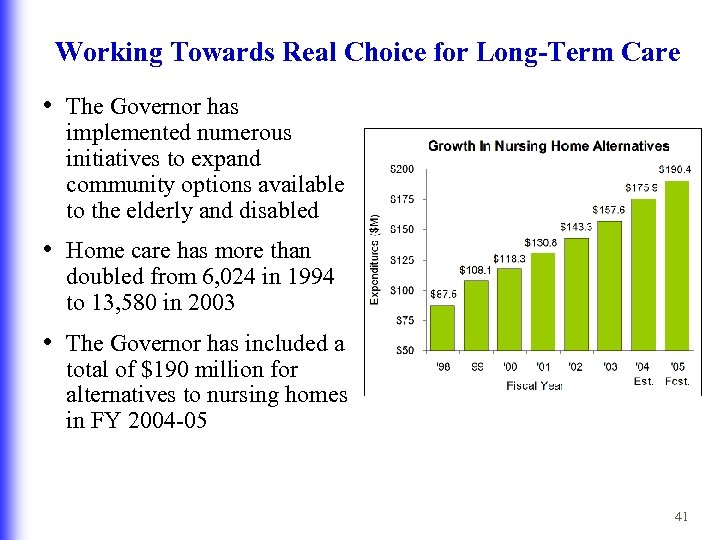

Working Towards Real Choice for Long-Term Care • The Governor has implemented numerous initiatives to expand community options available to the elderly and disabled • Home care has more than doubled from 6, 024 in 1994 to 13, 580 in 2003 • The Governor has included a total of $190 million for alternatives to nursing homes in FY 2004 -05 41

Working Towards Real Choice for Long-Term Care • Expand Assisted Living Options – Increase Congregate Housing Units § $1. 3 million to continue assisted living and other services in congregate housing § 95 units in Bridgeport, Danbury and New Haven over next 3 years § $2. 5 million in new bond funds for a 50 -person facility in Waterbury § Assisted living to be included in these units – Expand Assisted Living in HUD Complexes § $588, 903 included to continue program § $50, 000 in new funds for expanded enrollment, mainly in New Haven § Proposed development of 4 th pilot for CHC clients – Continue Private Pay Pilot § Adjust Cap on Medicaid and State-Funded Pilots § Allow continued enrollment in both pilots up to 75 combined § Savings of $2. 6 million assumed for FY 2004 -05 – Freestanding Units § 219 of the 300 units should be coming on line in summer 2004 § $3 million included for rental subsidies and services in FY 2004 -05 • Personal Care Assistance Waiver – $2. 2 million in new funds are included in FY 2004 -05 to expand enrollment from 498 to 700 42

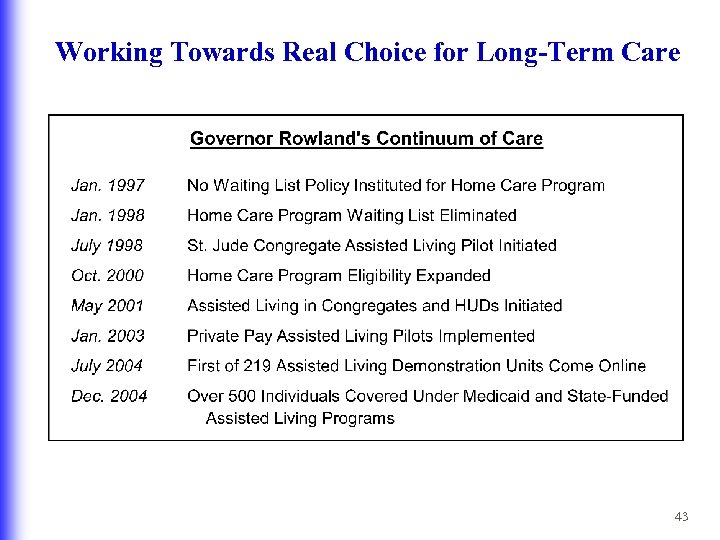

Working Towards Real Choice for Long-Term Care 43

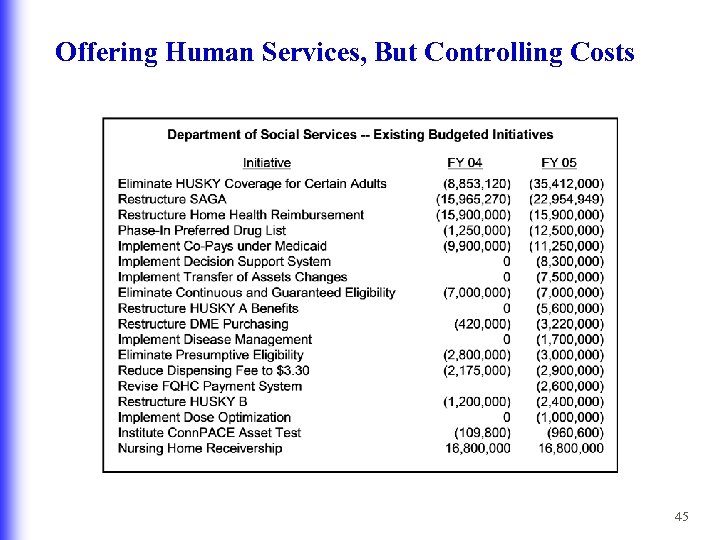

Offering Human Services, But Controlling Costs • The Governor’s budget does not unravel the recent changes to human services – Changes were necessary both to balance the budget and ensure the continuance of the safety net over the long term – Changes mirror strategies used in the private sector – Health care costs are still skyrocketing and account for 40 -50 percent of state budget – Connecticut still offers some of the best services and programs to people in need • The Governor is making additional investments, especially in child care and DMR waiting list services 44

Offering Human Services, But Controlling Costs 45

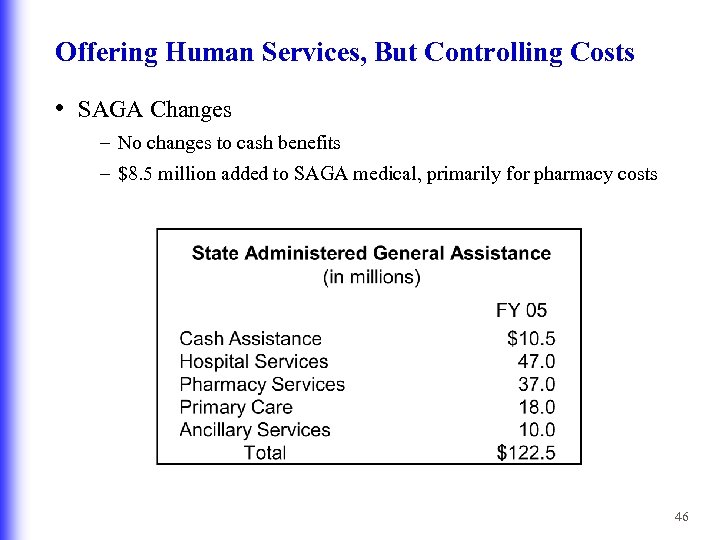

Offering Human Services, But Controlling Costs • SAGA Changes – No changes to cash benefits – $8. 5 million added to SAGA medical, primarily for pharmacy costs 46

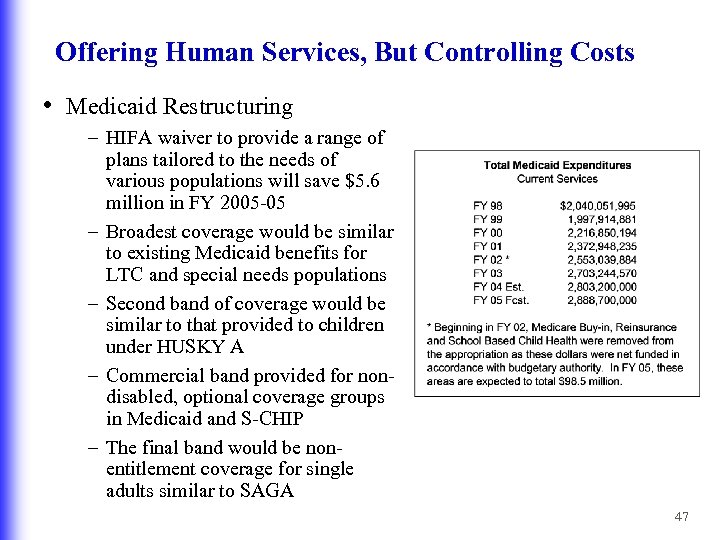

Offering Human Services, But Controlling Costs • Medicaid Restructuring – HIFA waiver to provide a range of plans tailored to the needs of various populations will save $5. 6 million in FY 2005 -05 – Broadest coverage would be similar to existing Medicaid benefits for LTC and special needs populations – Second band of coverage would be similar to that provided to children under HUSKY A – Commercial band provided for nondisabled, optional coverage groups in Medicaid and S-CHIP – The final band would be nonentitlement coverage for single adults similar to SAGA 47

Offering Human Services, But Controlling Costs • Additional Medicaid Restructuring – Small Employer Health Insurance. As part of the HIFA waiver and restructuring concept, Governor Rowland has directed both DSS and OHCA to start the process of establishing a subsidy program as a way to improve access to health care while focusing on the need to reduce cost. The program would be a capped nonentitlement for up to 6, 000 enrollees. Federal reimbursement could be up to 65 percent – Restructure managed care pharmacy, dental and behavioral health benefits. This restructuring, which will coincide with the anticipated October 2004 managed care contract renewal, will result in distinct pharmacy, dental and behavioral health services for the approximately 300, 000 individuals enrolled in managed care under HUSKY 48

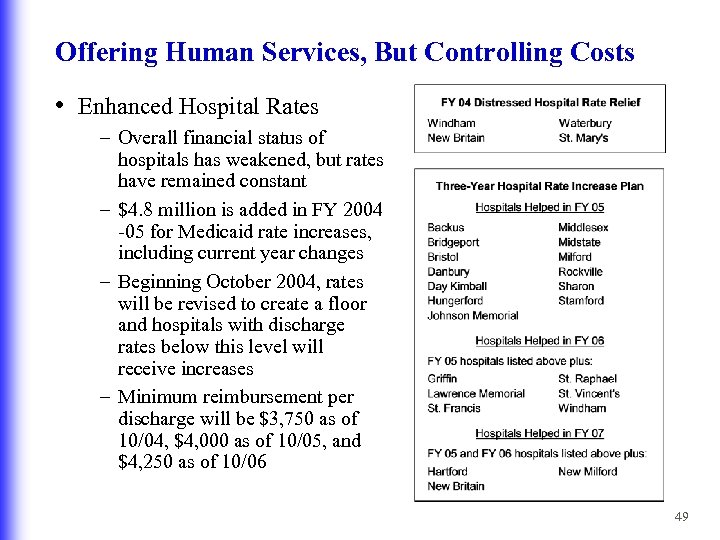

Offering Human Services, But Controlling Costs • Enhanced Hospital Rates – Overall financial status of hospitals has weakened, but rates have remained constant – $4. 8 million is added in FY 2004 -05 for Medicaid rate increases, including current year changes – Beginning October 2004, rates will be revised to create a floor and hospitals with discharge rates below this level will receive increases – Minimum reimbursement per discharge will be $3, 750 as of 10/04, $4, 000 as of 10/05, and $4, 250 as of 10/06 49

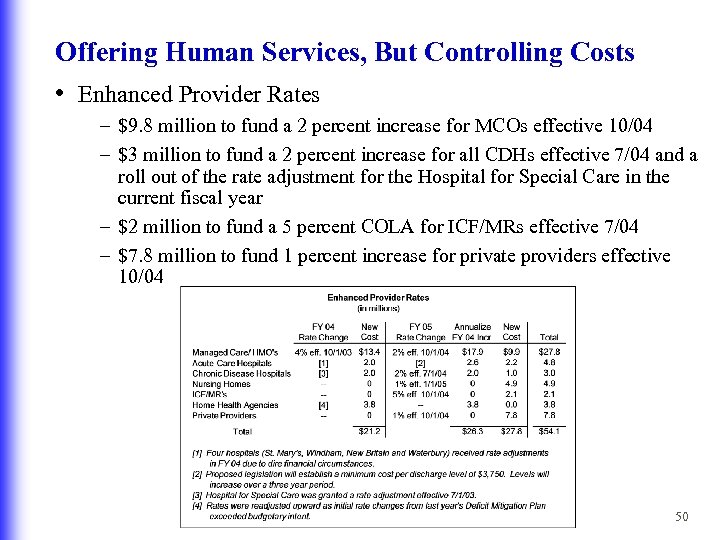

Offering Human Services, But Controlling Costs • Enhanced Provider Rates – $9. 8 million to fund a 2 percent increase for MCOs effective 10/04 – $3 million to fund a 2 percent increase for all CDHs effective 7/04 and a roll out of the rate adjustment for the Hospital for Special Care in the current fiscal year – $2 million to fund a 5 percent COLA for ICF/MRs effective 7/04 – $7. 8 million to fund 1 percent increase for private providers effective 10/04 50

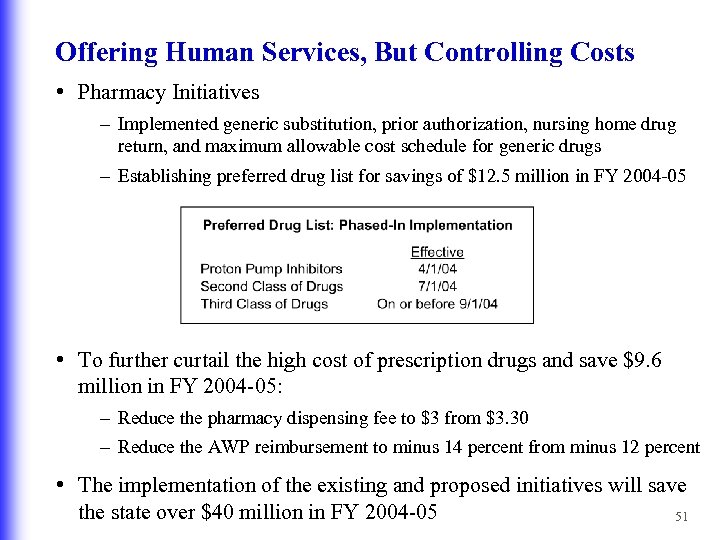

Offering Human Services, But Controlling Costs • Pharmacy Initiatives – Implemented generic substitution, prior authorization, nursing home drug return, and maximum allowable cost schedule for generic drugs – Establishing preferred drug list for savings of $12. 5 million in FY 2004 -05 • To further curtail the high cost of prescription drugs and save $9. 6 million in FY 2004 -05: – Reduce the pharmacy dispensing fee to $3 from $3. 30 – Reduce the AWP reimbursement to minus 14 percent from minus 12 percent • The implementation of the existing and proposed initiatives will save the state over $40 million in FY 2004 -05 51

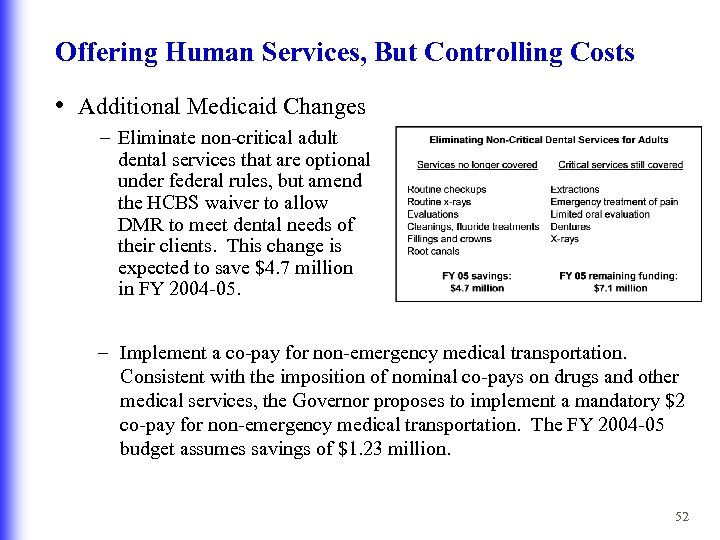

Offering Human Services, But Controlling Costs • Additional Medicaid Changes – Eliminate non-critical adult dental services that are optional under federal rules, but amend the HCBS waiver to allow DMR to meet dental needs of their clients. This change is expected to save $4. 7 million in FY 2004 -05. – Implement a co-pay for non-emergency medical transportation. Consistent with the imposition of nominal co-pays on drugs and other medical services, the Governor proposes to implement a mandatory $2 co-pay for non-emergency medical transportation. The FY 2004 -05 budget assumes savings of $1. 23 million. 52

Offering Human Services, But Controlling Costs • Nursing Home Changes – Competitively bid long-term nursing home care in the Medicaid program to determine which nursing homes are best able to provide cost effective care over the long run – Governor is sponsoring legislation to lift the absolute moratorium on interim rates passed in 2003 – No change in the $5 million already in budget for a 1 percent rate increase for nursing homes in January 2005 – Additional $260, 000 is included as an adjustment to nursing home rates to amortize the installation cost of fire sprinkler systems over 25 years 53

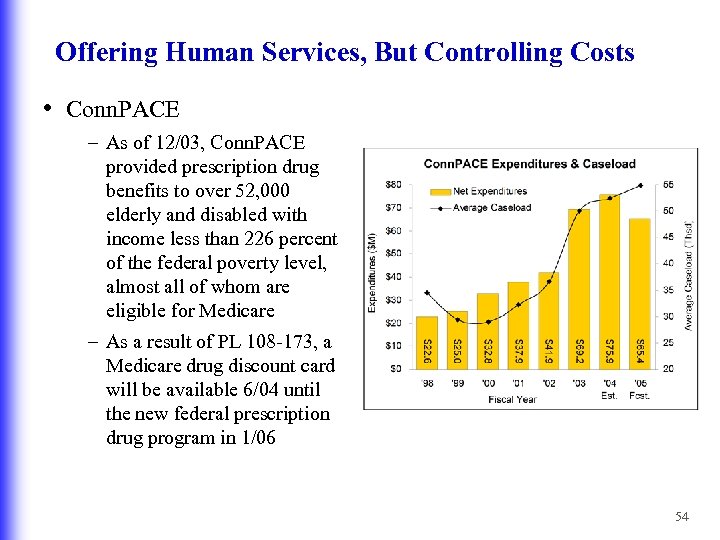

Offering Human Services, But Controlling Costs • Conn. PACE – As of 12/03, Conn. PACE provided prescription drug benefits to over 52, 000 elderly and disabled with income less than 226 percent of the federal poverty level, almost all of whom are eligible for Medicare – As a result of PL 108 -173, a Medicare drug discount card will be available 6/04 until the new federal prescription drug program in 1/06 54

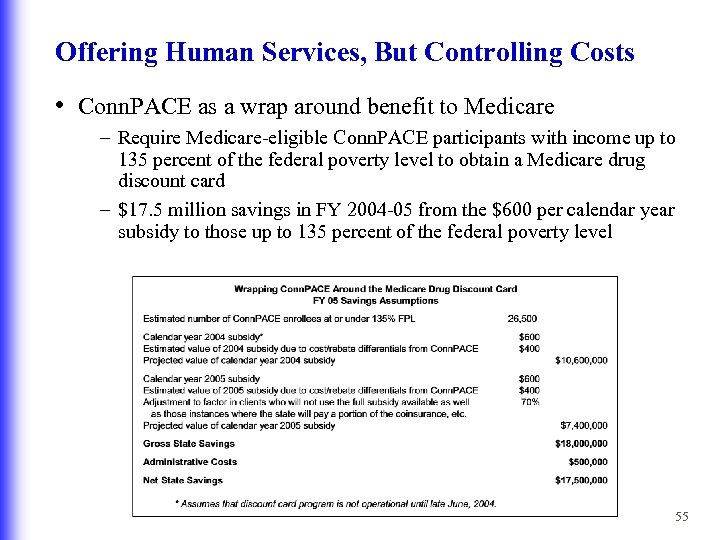

Offering Human Services, But Controlling Costs • Conn. PACE as a wrap around benefit to Medicare – Require Medicare-eligible Conn. PACE participants with income up to 135 percent of the federal poverty level to obtain a Medicare drug discount card – $17. 5 million savings in FY 2004 -05 from the $600 per calendar year subsidy to those up to 135 percent of the federal poverty level 55

Offering Human Services, But Controlling Costs • Temporary Assistance to Needy Families (TANF) – Require employability plan as a condition of granting TANF application. Savings of $1. 1 million are reallocated to DOL’s Jobs First for additional employment services to TANF clients. – Appropriate $11. 7 million TANF High Performance Bonus for spending in FY 2003 -04, FY 2004 -05 and FY 2005 -06: § $4 million for child care certificates (plus $2 million carried forward) § $1. 6 million for two new DOL initiatives to enhance job entry and implement a child care apprenticeship program § $1. 6 million for T-RAP and $1. 4 million for family supportive housing § $700, 000 for welfare-to-work transportation § $700, 000 for DSS employment success program § $600, 000 for Good News Garage to provide transportation to work § $500, 000 in new funding for the Women in Transition program to assist single mothers in completing their college degrees § $900, 000 for emergency shelters, faith-based funding, and the Fatherhood Initiative 56

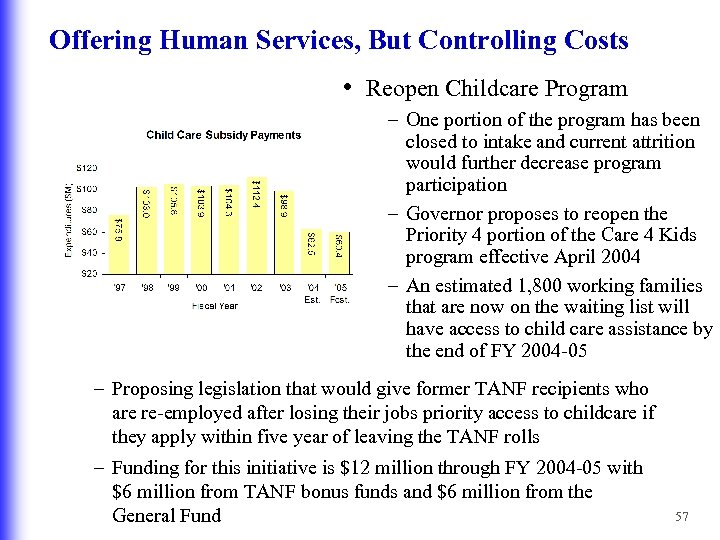

Offering Human Services, But Controlling Costs • Reopen Childcare Program – One portion of the program has been closed to intake and current attrition would further decrease program participation – Governor proposes to reopen the Priority 4 portion of the Care 4 Kids program effective April 2004 – An estimated 1, 800 working families that are now on the waiting list will have access to child care assistance by the end of FY 2004 -05 – Proposing legislation that would give former TANF recipients who are re-employed after losing their jobs priority access to childcare if they apply within five year of leaving the TANF rolls – Funding for this initiative is $12 million through FY 2004 -05 with $6 million from TANF bonus funds and $6 million from the General Fund 57

Offering Human Services, But Controlling Costs • Freeze rates and COLA in Aid to the Aged, Blind and Disabled – No rate increase for RCHs to save $2. 2 million and no COLA for AABD • Provide additional funds for emergency shelters – Continue $550, 000 extra in General Funds and provide additional $200, 000 in TANF bonus funding in FY 2004 -05 • Reopen DSS office in Willimantic • Enhance support services to veterans – Reallocate $200, 000 in savings for transportation, community improvements, recreation, and other programs • Support Faith-Based Initiatives – $290, 000 General Fund and $460, 000 federal funds for a Faith. Works office, regional intermediaries, and Faith. Works grants to fund prisoner reentry into the community, employment services, substance abuse reduction, health and aging, and early childhood development 58

Offering Human Services, But Controlling Costs • Board of Education and Services for the Blind (BESB) – A total of $800, 000 to fund the development of employment opportunities. Currently 60 percent of the former Industries clients are being served through community agencies. $500, 000 in General Fund monies are provided, with $300, 000 coming from vending machine monies. The contractors assist clients in achieving competitive employment when possible, and supported or sheltered employment when necessary and as selected by the individual. The remainder of clients are either being served by DMR, through traditional BESB voc rehab services, or have chosen to no longer participate – Additional $50, 000 to support the Connecticut Radio Information System (CRIS) broadcasts -- via radio, television, and telephone – of extensive readings from newspapers and current magazines 59

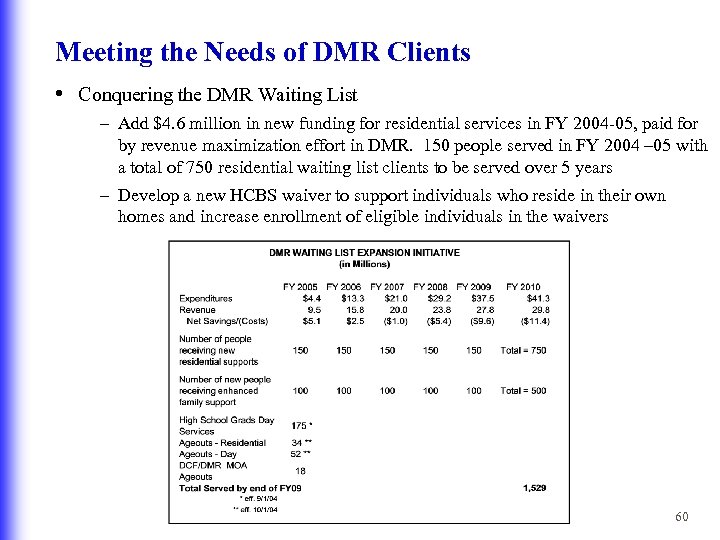

Meeting the Needs of DMR Clients • Conquering the DMR Waiting List – Add $4. 6 million in new funding for residential services in FY 2004 -05, paid for by revenue maximization effort in DMR. 150 people served in FY 2004 – 05 with a total of 750 residential waiting list clients to be served over 5 years – Develop a new HCBS waiver to support individuals who reside in their own homes and increase enrollment of eligible individuals in the waivers 60

Meeting the Needs of DMR Clients • Providing resources for high school graduates and ageouts – Additional $5. 4 million to support 175 new high school grads and 86 individuals aging into DMR care – Not funded in originally adopted budget • DMR conversion plan – Continue the conversion of publicly operated homes to private operation for a net savings to the state of $450, 000 • Birth to Three private insurance billing changes – No changes to Birth to Three eligibility or services – Allow providers to keep 100 percent of insurance billings, but not bill DMR for 10 percent of each claim. DMR will give providers funds to cover administrative costs and the state will save $300, 000 • Total new initiatives of about $10 million in DMR to serve clients 61

Investing in Behavioral Health and Alternatives to Incarceration • Implementing the Behavioral Health Partnership – DSS, DMHAS, and DCF will coordinate the clinical management and administration of behavioral health services covered under Medicaid Fee For Service, HUSKY, DCF Voluntary Services and DMHAS GABHP – Contract with an Administrative Services Organization to manage administrative functions by October 2004 – these costs will be covered by existing administrative resources – Children to be moved from managed care risk contracts to non-risk community-based state programs – DCF will pilot new services for children effective October 2004, including assessments, behavior management services and behavioral health consultation. – No rate changes are proposed – No resources are added and no savings are assumed – Still working with the legislature on details of the BHP 62

Investing in Behavioral Health and Alternatives to Incarceration • Why the BHP is important – Integration of adult and children’s behavioral health will ease the transition from one system to the other – Many adults languish in the Medicaid FFS system due to little or no case management and access to preventive, community-based services – The community-based model in GABHP works: § 62 percent decrease in the number of high utilizers, 48 percent decrease in emergency department visits, 46 percent decrease in inpatient admissions, 44 percent decrease in inpatient days, and 8 percent decrease in inpatient readmission rate – The rate of ED visits is more than 80 percent higher for Medicaid FFS than in GABHP – We have a dual system in Connecticut and Medicaid FFS clients will be robbed of the chance for stability, success and dignity without BHP – $2. 4 million in additional revenue under the rehab option is expected to accrue to the Community Mental Health Strategic Investment Fund – However, if we implement BHP, rehab option can be expanded and more money will be dedicated to community programs 63

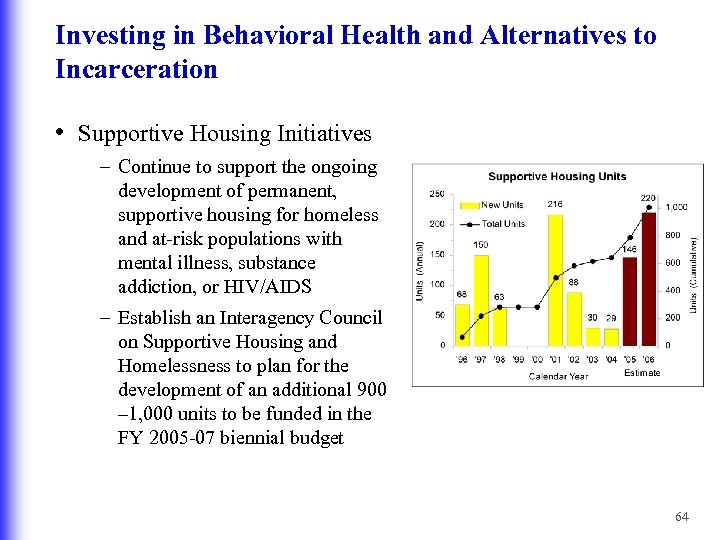

Investing in Behavioral Health and Alternatives to Incarceration • Supportive Housing Initiatives – Continue to support the ongoing development of permanent, supportive housing for homeless and at-risk populations with mental illness, substance addiction, or HIV/AIDS – Establish an Interagency Council on Supportive Housing and Homelessness to plan for the development of an additional 900 – 1, 000 units to be funded in the FY 2005 -07 biennial budget 64

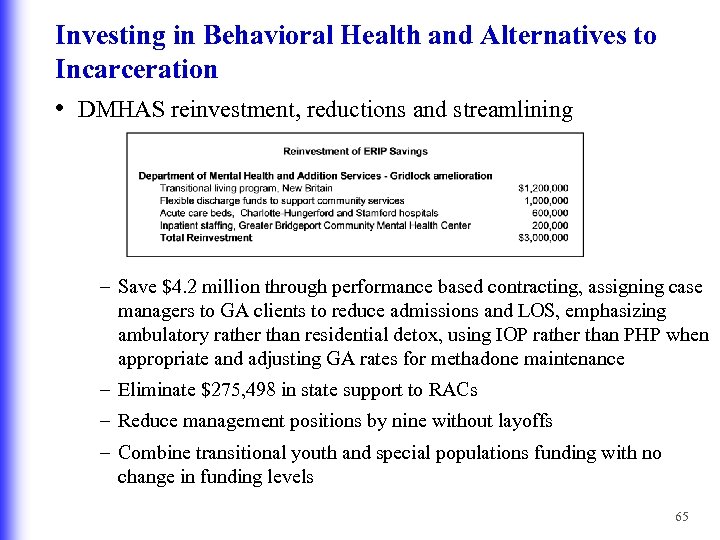

Investing in Behavioral Health and Alternatives to Incarceration • DMHAS reinvestment, reductions and streamlining – Save $4. 2 million through performance based contracting, assigning case managers to GA clients to reduce admissions and LOS, emphasizing ambulatory rather than residential detox, using IOP rather than PHP when appropriate and adjusting GA rates for methadone maintenance – Eliminate $275, 498 in state support to RACs – Reduce management positions by nine without layoffs – Combine transitional youth and special populations funding with no change in funding levels 65

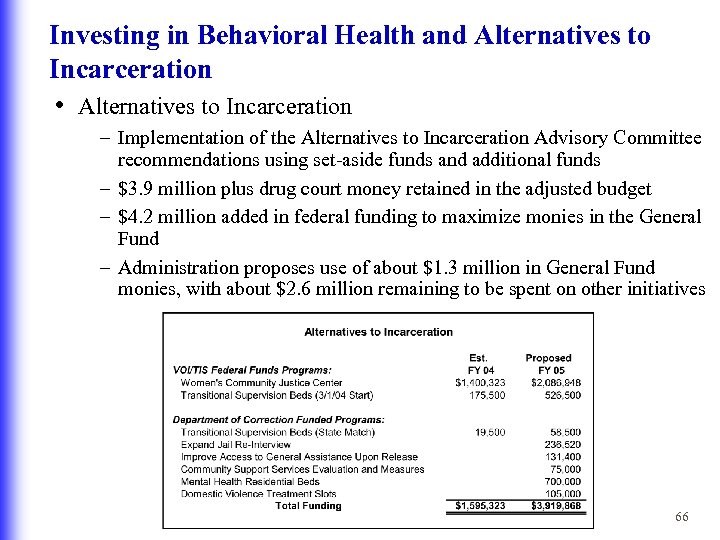

Investing in Behavioral Health and Alternatives to Incarceration • Alternatives to Incarceration – Implementation of the Alternatives to Incarceration Advisory Committee recommendations using set-aside funds and additional funds – $3. 9 million plus drug court money retained in the adjusted budget – $4. 2 million added in federal funding to maximize monies in the General Fund – Administration proposes use of about $1. 3 million in General Fund monies, with about $2. 6 million remaining to be spent on other initiatives 66

Investing in Behavioral Health and Alternatives to Incarceration • Transitional Housing – Use $1. 2 million VOITIS funding to contract for 45 transitional beds • Contract for Jail Re-Interview Positions within CSSD – Fund three additional positions through DOC with $236, 500 • Improved Access to General Assistance – Fund 2 DSS positions to expedite pre-release applications • Mental Health Residential Beds – Establish community based residential beds for offenders with $700, 000 • Domestic Violence Treatment Slots – Add 30 slots to community based DV programs with $105, 000 • Community Support Services Evaluation – DOC will conduct a review and establish performance measures 67

Investing in Behavioral Health and Alternatives to Incarceration • Community Justice Centers – DOC will solicit proposals in early 2004 from nonprofits for the operation of a male CJC to provide short-term housing and treatment for offenders in the community, provide release planning for offenders leaving incarceration, and serve as a pre-trial alternative to incarceration – Given construction time, operations will not begin until the FY 2006 -07 biennial budget. $880, 000 in state General Funds are allocated in FY 2004 -05 • Women’s Community Justice Center – Ease crowding at York and facilitate integration into the community through the operation of a CJC for female offenders – Use over $3. 4 million in VOITIS funding in FY 2003 -04 and FY 200405 for start-up and operating costs 68

Investing in Behavioral Health and Alternatives to Incarceration • DOC medical and mental health consolidation – Add $3 million to roll out the deficiency in the Inmate Medical Services Account to continue to provide an acceptable level of medical and mental health services to the state’s prison population – Add $1. 4 million to more effectively allocate staff and improve services by concentrating inmates needing special care. One facility will house male offenders with acute or chronic mental illness. One facility will house male offenders with medical or less intensive mental health needs. Medical services will continue to be available to inmates at all locations 69

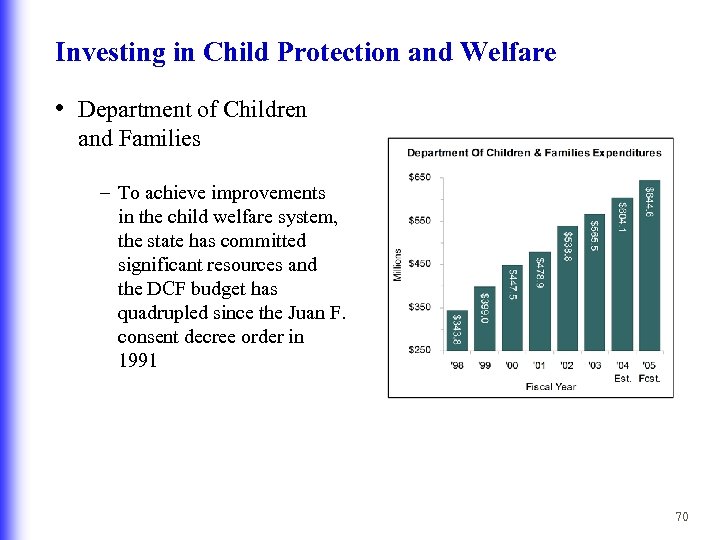

Investing in Child Protection and Welfare • Department of Children and Families – To achieve improvements in the child welfare system, the state has committed significant resources and the DCF budget has quadrupled since the Juan F. consent decree order in 1991 70

Investing in Child Protection and Welfare • Transition Task Force and Exit Plan – In October 2003, the state entered an agreement to further improve child welfare services and end Judicial oversight of DCF by November 2006 – A Transition Task Force (TTF) was established to assume decision making at DCF and implement a three year Exit Plan. – Since October, the TTF has lowered caseloads by hiring additional caseworkers, increased field time for caseworkers by acquiring additional vehicles, and established a $1 million pool of flexible funding to meet unique and emergency needs of children. – The court monitor was given full authority to develop the Exit Plan. – The Exit Plan ordered by the court is unrealistic in many of its expectations such as speeding adoptions and reducing the number of children in residential placement. Worse, it may usurp legislative appropriation authority and violate the state constitutional spending cap by requiring the provision of carte blanche funding by the court 71

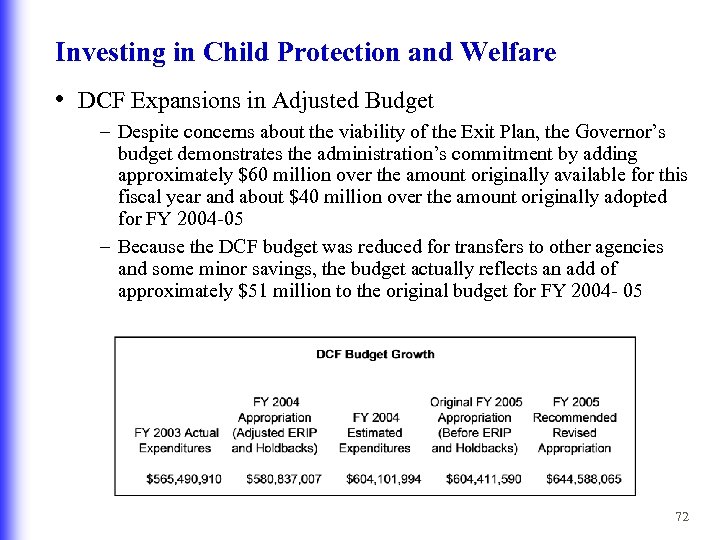

Investing in Child Protection and Welfare • DCF Expansions in Adjusted Budget – Despite concerns about the viability of the Exit Plan, the Governor’s budget demonstrates the administration’s commitment by adding approximately $60 million over the amount originally available for this fiscal year and about $40 million over the amount originally adopted for FY 2004 -05 – Because the DCF budget was reduced for transfers to other agencies and some minor savings, the budget actually reflects an add of approximately $51 million to the original budget for FY 2004 - 05 72

Investing in Child Protection and Welfare • $51 million in additional funding for: – $11 million to fund 145 new social workers and reduce other vacancies to meet caseload standards of the Exit Plan – $1. 9 million for other expenses related to these positions and increased operating costs due to increased energy prices – $19. 7 million for residential placement needs over those originally budgeted due to a growth in caseload, an increased cost for more intensive clients, and to annualize unbudgeted residential rate increases – $5. 9 million to annualize and fund anticipated growth in foster and adoptive care – $1 million to continue providing flexible funds to meet family needs – $3. 4 million for workers’ compensation – $8. 5 million for new initiatives to reduce residential caseloads through community investments, increase adoptions and reduce delays, expand family supportive housing, and increase recruitment of foster and adoptive families 73

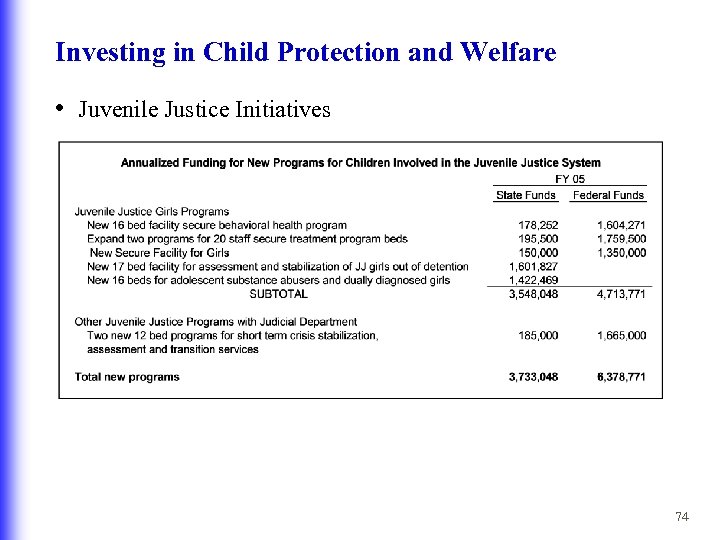

Investing in Child Protection and Welfare • Juvenile Justice Initiatives 74

Keeping Connecticut Moving • Transportation Strategy Board – Recommended budget authorizes funding, from TSB project account, to continue on-going initiatives originally funded by the TSB, including: § Extension of Shore Line East services to Bridgeport and Stamford; § Expanding bus service to and from train stations § Enhancing commuter bus service in Fairfield County § Expanding express bus service into downtown Hartford § Continuing funding for Tweed-New Haven Airport § Continuing Southeastern Connecticut Jobs Access/Dial-a-Ride – New TSB Initiatives § Incident Management Expand CHAMP Motorist Assistance Service Preparation and Distribution of Diversion Plans § Maritime Affairs – Commission and DOT Office 75

Keeping Connecticut Moving • Rail and Bus Fare Increases – Rail Fares will increase by 5. 5 percent on July 1, 2004 – Bus Fares will increase by 15 cents on July 1, 2004, rather than January 1, 2005, as originally scheduled – Fare increases are necessary because of rapidly increasing operating costs and operating deficits. Transit users are only being asked to pay their fair share 76

Economic and Workforce Development • Next Generation Manufacturing – Authorizes $5 million for a DECD Program in MAA to help manufacturers and workers meet the needs of the future § Help manufacturers apply new technologies needed for advancing new products and increasing productivity § Pilot a manufacturing-focused, skills training program collaboratively with manufacturers and labor unions • Knowledge Economy – Designate OWC as the lead state agency for workforce initiatives required to support Connecticut’s position in the knowledge economy; establish Council of Advisors on Strategies for the Knowledge Economy – Initiate capital and operating “Innovation Challenge Grants” in FY 200506 to encourage collaboration between higher education and vo-tech schools and business and industry 77

Economic and Workforce Development • Economic Development Initiatives – Urban Agenda § Funding for Urban Act ($43 million); STEAP ($10 million) and housing development and redevelopment ($10 million) – Urban Tax Credit § Lower Threshold for $20 million to $5 million to make the program more flexible and attractive to small scale development in urban areas – Recapitalize and enhance new and existing regional loan funds – Carry forward $200, 000 for the successful entrepreneurial training initiative – Make R&D tax credit exchange fix permanent – Facilitate two new private investment funds with $200, 000 in funding § Seed Capital Fund § Inner City Investment Fund 78

Economic and Workforce Development • Take Steps to dramatically increase the state’s share of grants under federal Small Business Innovation Research Program – Create Center for the Advancement of Science and Technology within OWC to serve as a statewide clearinghouse, conduct outreach and marketing, and provide technical assistance, mentoring and proposal development funding -- $250, 000 in funding carried forward • Workforce Development Initiatives – Jobs Funnel program funded with $1 million carryforward – Connecticut Career Choices program funded with $800, 000 carryforward 79

Protecting the Homeland Ensuring Public Safety • Homeland Security Investments – $2. 4 million to properly equip Connecticut’s new Urban Search and Rescue (USa. R) team – $7. 9 million in funding for Phase III expansion and improvements at DPS’ Forensic Lab – $300, 000 for capital equipment funding for the Military Department to enhance their emergency operations center, and $800, 000 to the Department of Public Health to provide equipment and instrumentation for the state public health lab – $10 million for the purchase of a 100 -bed mobile and surge hospital and equipment and HEPA filtering for hospital ERs – $45 million in additional funding for a new Public Health lab with Level 3 capacity, capable of detecting any bioterrorism agents thereby greatly aiding in the rapid response of the public health community to any incident 80

Protecting the Homeland Ensuring Public Safety • Continued Support for Implementation of the Criminal Justice Information System (CJIS) – $11. 3 million in funding in capital budget • New Trooper Class of between 23 and 56 officers at a cost of $2. 58 million • DNA Testing Program – Governor making over $1 million in federal funds available for implementation • Sending Prisoners Out of State – Governor proposing to make legislation allowing up to 2, 500 prisoners out of state permanent – RFP to be issued shortly with prisoners leaving in early FY 2004 -05 81

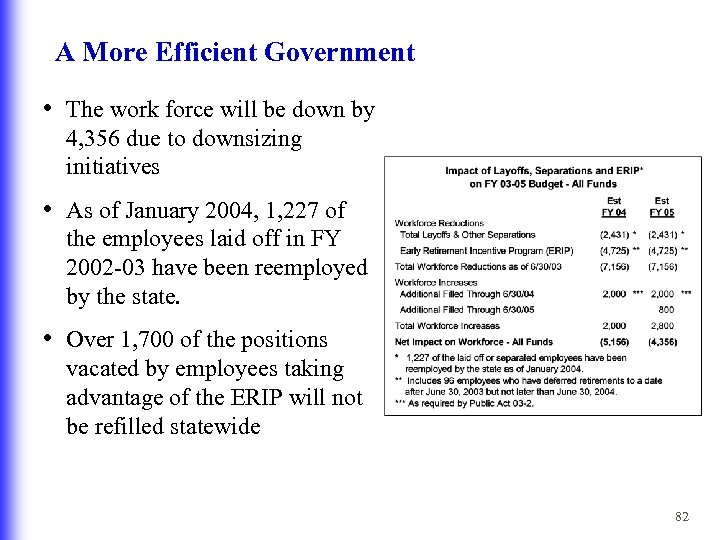

A More Efficient Government • The work force will be down by 4, 356 due to downsizing initiatives • As of January 2004, 1, 227 of the employees laid off in FY 2002 -03 have been reemployed by the state. • Over 1, 700 of the positions vacated by employees taking advantage of the ERIP will not be refilled statewide 82

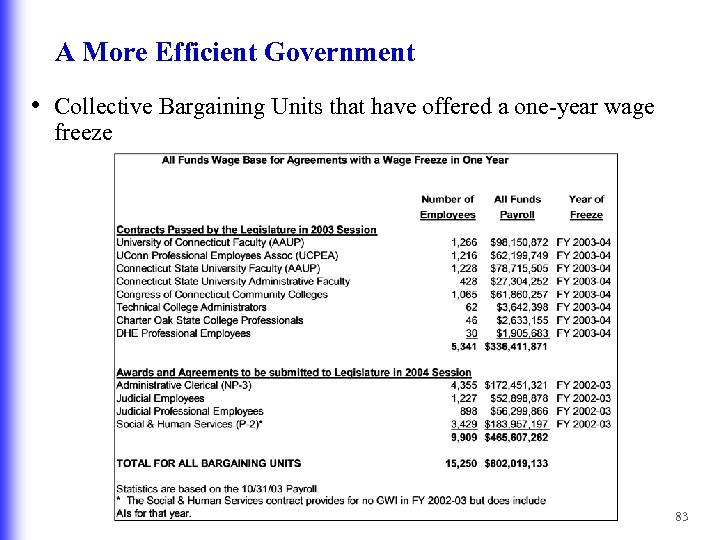

A More Efficient Government • Collective Bargaining Units that have offered a one-year wage freeze 83

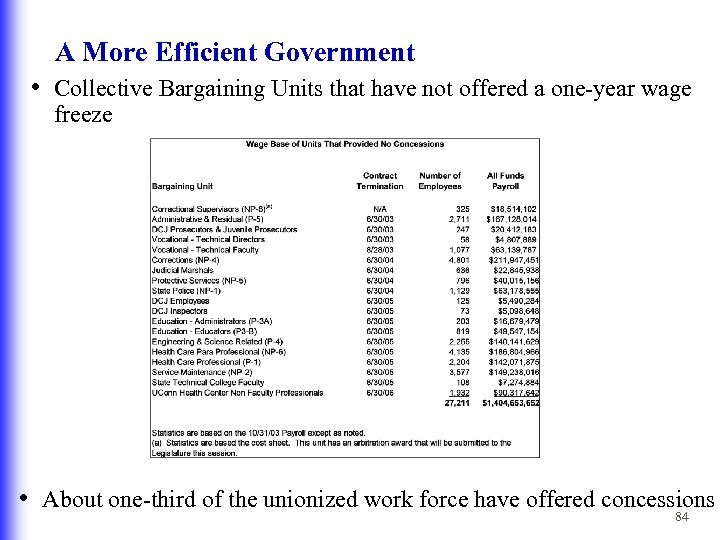

A More Efficient Government • Collective Bargaining Units that have not offered a one-year wage freeze • About one-third of the unionized work force have offered concessions 84

A More Efficient Government • DOIT centralization would strengthen the state IT work force, leverage investments to benefit all agencies and continue development and deployment of enterprise-wide solutions • A transfer of $4. 4 million and a new $4 million appropriation will be used to fund both staff and other operating costs associated with the CORE-CT project • The merger of the Department of Consumer Protection and the Department of Agriculture will be effective July 1, 2004 • While just $20 million in funding was intercepted for CATCH-F in the adopted budget, Governor Rowland’s adjusted budget makes $26 million available to CATCH-F, with an additional $1. 1 million budgeted on behalf of the agency in fringe benefit accounts. This will now be an appropriation not a revenue intercept 85

A More Accountable and Responsible Government • In the wake of last fiscal year’s budget difficulties, there have been many calls for reform of the state budget process, including a report by the Legislative Program Review and Investigations Committee and the legislature’s ACE Committee • Governor Rowland has studied many of the ideas and as part of his adjusted budget proposal is recommending a series of initiatives. They are: – Requiring the Secretary of the OPM and the Director OFA to prepare status reports on the state budget each November and to present them to the Appropriations and Finance, Revenue and Bonding Committees. The report would mean a thorough look at the status of the budget for the current biennium & into the future – Requiring that legislative fiscal notes reflect all of the costs and revenue impacts of legislation, including those that do not occur until future fiscal years – Beginning July 1, 2005, mandating the transfer of $50 million a year to the Rainy Day Fund anytime the balance in the fund drops below five percent ($100 million in the out-years) – Requiring that the state budget be passed fourteen days before the mandatory adjournment deadline in odd numbered years and seven days before the deadline in even numbered years and prohibiting action on all other bills if these deadlines are not met 86

General Government Changes and Efficiencies • Judicial e-filing – Adds over $600, 000 for costs related to the Case & Document Management system – Electronic filing for civil cases allowing attorneys access to court files and the official court record • Increasing judges’ salaries – Judges salaries’ would rise by 8 percent a year for three years – Compensation more in line with federal judges & the private sector – Magistrates, family support referees, retired judges that continue to serve and workers’ compensation commissioners salaries would also increase – $2. 5 million is added for these increases in both the Judicial Branch & the Workers’ Compensation Commission 87

General Government Changes and Efficiencies • Buying smart – spend management – An analysis initiative that allows Department of Administrative Services to fully understand what the state purchases in good and services – Identify opportunities to apply spending best practices in order to get the most value – An opportunity to fully maximize the spending power of the state through a process known as leveraged purchasing – Specific goals include § Analyze spending § Review supplier contracts, master purchasing agreements § Review all specifications, pricing & purchasing policies § Assess opportunities to leverage spending – $3. 75 million in anticipated savings achieved during FY 2004 -05 88

General Government Changes and Efficiencies • Fleet savings – Fleet services recalled 650 underutilized vehicles – Requests for vehicle purchases were reviewed & reduced resulting in $2. 5 million in savings – DAS is proceeding with its efforts to outsource fleet maintenance and daily motor pool resulting in an additional $2. 5 million in savings 89

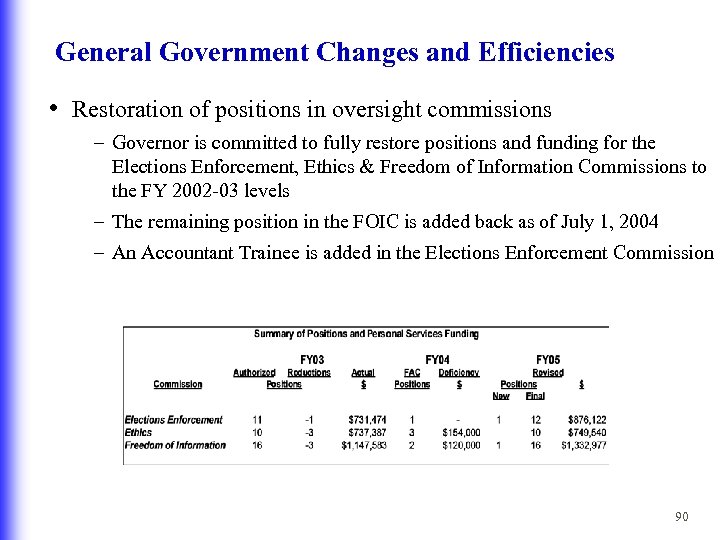

General Government Changes and Efficiencies • Restoration of positions in oversight commissions – Governor is committed to fully restore positions and funding for the Elections Enforcement, Ethics & Freedom of Information Commissions to the FY 2002 -03 levels – The remaining position in the FOIC is added back as of July 1, 2004 – An Accountant Trainee is added in the Elections Enforcement Commission 90

General Government Changes and Efficiencies • Council on Environmental Quality – Funding was found to continue the services of the Executive Director of the Council on Environmental Quality – The funding arrangement will be a three-way split between the General Fund, federal funds and private sources - $50, 000 from each funding source • Rehabilitation Services – As a result of layoffs & ERIP, no staff remained in the Rehabilitation Services Division of the Workers’ Compensation Commission – The Commission was allowed to fill all five positions in this division – The refills allow services to continue at a much reduced level – Reduction of $1 million in adjusted budget 91

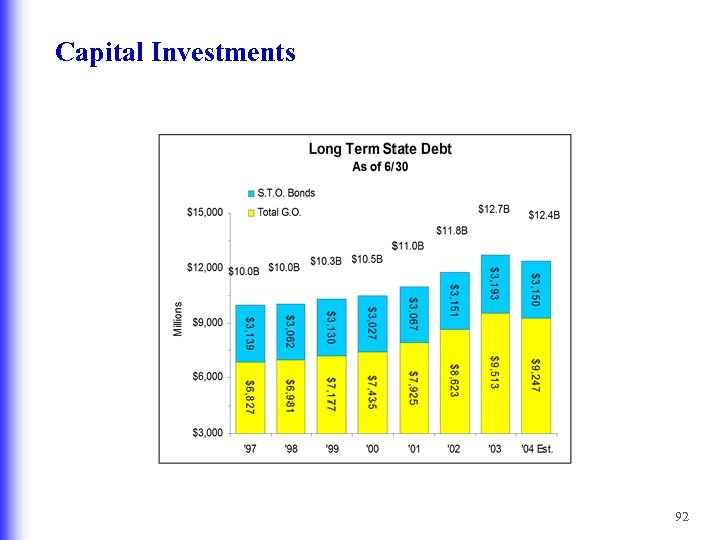

Capital Investments 92

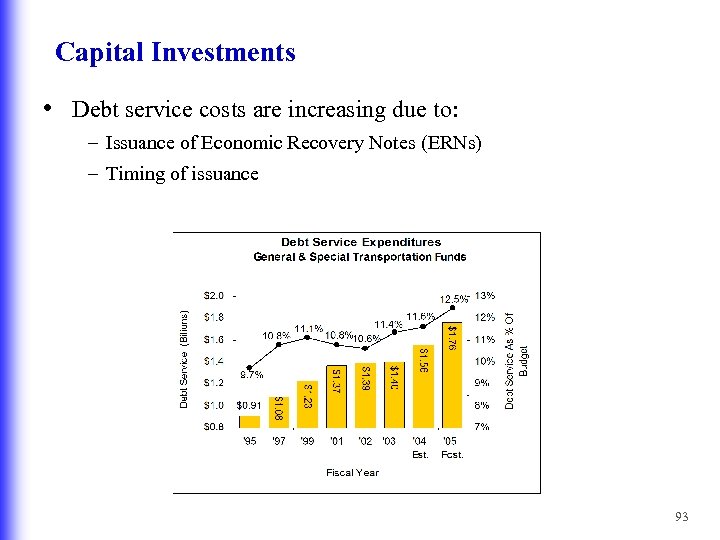

Capital Investments • Debt service costs are increasing due to: – Issuance of Economic Recovery Notes (ERNs) – Timing of issuance 93

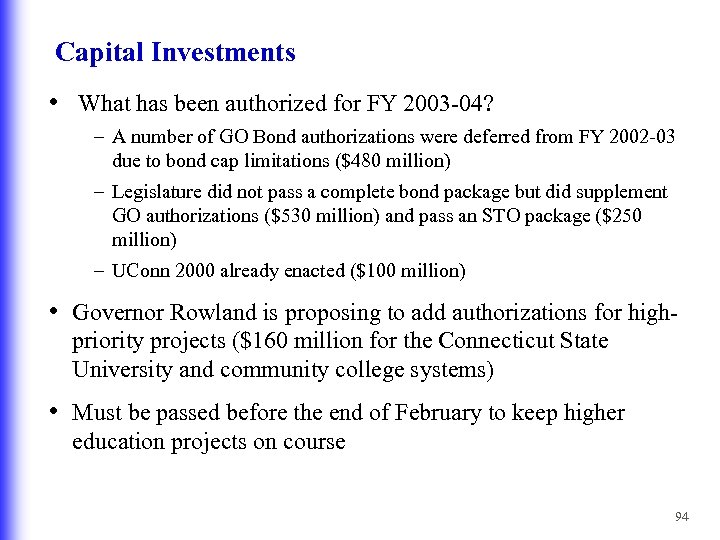

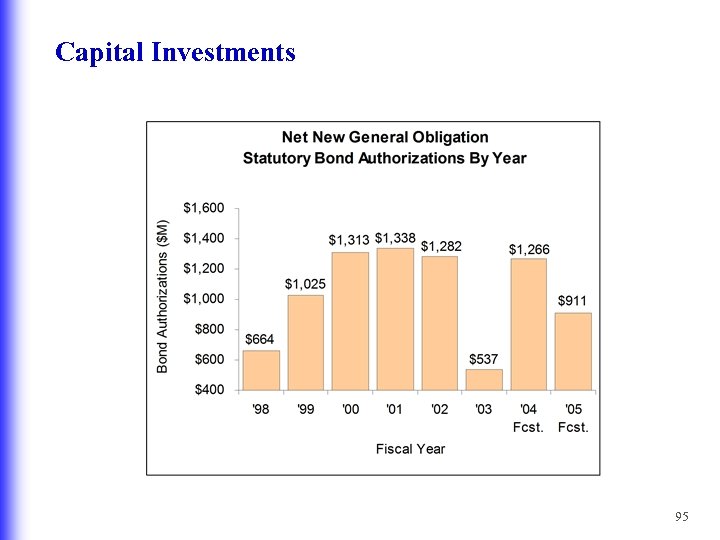

Capital Investments • What has been authorized for FY 2003 -04? – A number of GO Bond authorizations were deferred from FY 2002 -03 due to bond cap limitations ($480 million) – Legislature did not pass a complete bond package but did supplement GO authorizations ($530 million) and pass an STO package ($250 million) – UConn 2000 already enacted ($100 million) • Governor Rowland is proposing to add authorizations for highpriority projects ($160 million for the Connecticut State University and community college systems) • Must be passed before the end of February to keep higher education projects on course 94

Capital Investments 95

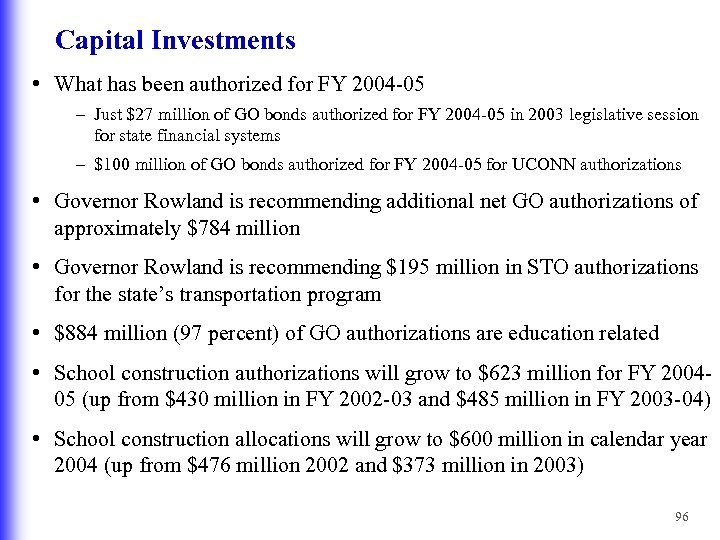

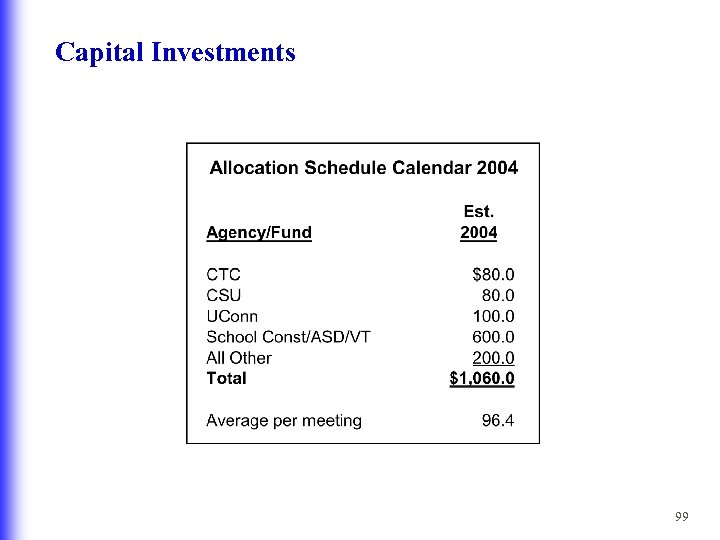

Capital Investments • What has been authorized for FY 2004 -05 – Just $27 million of GO bonds authorized for FY 2004 -05 in 2003 legislative session for state financial systems – $100 million of GO bonds authorized for FY 2004 -05 for UCONN authorizations • Governor Rowland is recommending additional net GO authorizations of approximately $784 million • Governor Rowland is recommending $195 million in STO authorizations for the state’s transportation program • $884 million (97 percent) of GO authorizations are education related • School construction authorizations will grow to $623 million for FY 200405 (up from $430 million in FY 2002 -03 and $485 million in FY 2003 -04) • School construction allocations will grow to $600 million in calendar year 2004 (up from $476 million 2002 and $373 million in 2003) 96

Capital Investments • Vast majority of capital bonding will be for school construction and higher education • Other projects include: – $16 million for affordable housing projects – Almost $10 million for UConn Law School – A net of $43 million for the Urban Act – $10 million for the Small Town Economic Assistance Program – $15 million for improvements at the Veterans’ Home and Hospital (will match over $27 million of federal funds) – $5 million for the Connecticut Education Network • No new bond authorizations, but $20 million available for allocation for open space acquisitions 97

Capital Investments • Over $225 million in bond cancellations • Major cancellations include: – $10 million from the Manufacturing Assistance Act – $60 million from Clean Water GO bond authorizations – $5 million for Tweed airport improvements – Almost $10 million for state building parking – Almost $21 million for York Correctional remediation – $5 million from bio-tech expansion funds – $9 million from CDA for loan guarantees 98

Capital Investments 99

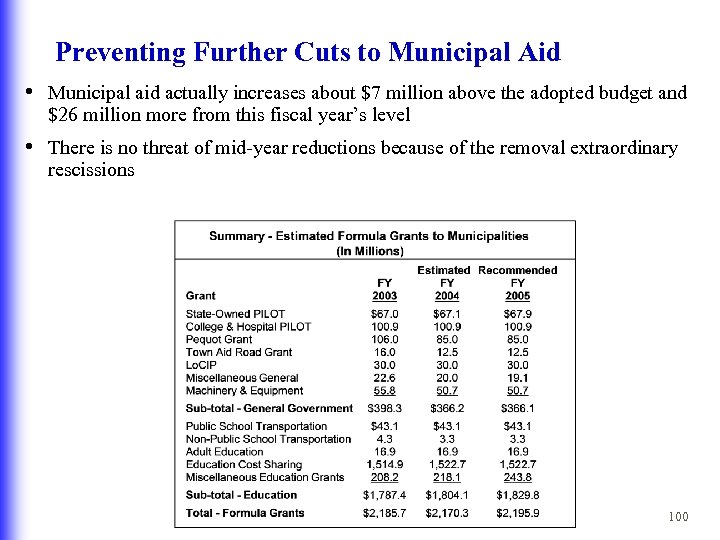

Preventing Further Cuts to Municipal Aid • Municipal aid actually increases about $7 million above the adopted budget and $26 million more from this fiscal year’s level • There is no threat of mid-year reductions because of the removal extraordinary rescissions 100

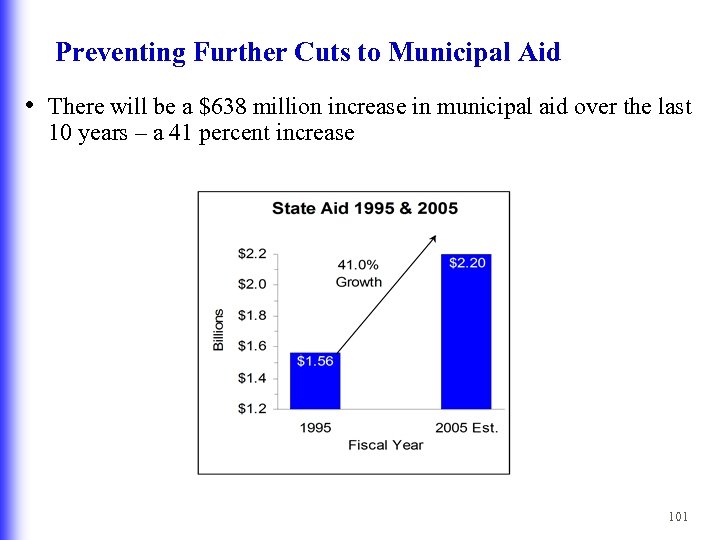

Preventing Further Cuts to Municipal Aid • There will be a $638 million increase in municipal aid over the last 10 years – a 41 percent increase 101

Preventing Further Cuts to Municipal Aid • Significant collective bargaining relief • As a means to reduce unfunded mandates, Governor Rowland is proposing collective bargaining reform for towns – Give towns the ability (exercised through local option) to suspend collective bargaining on any open contract as long as current wage and benefits package and work rules remain in effect – Require arbitrators to disregard the presence of a fund balance in determining a town’s ability to pay – Require arbitrators to consider, at a town’s request, the town’s high effective tax rate as published by OPM – Require return to a full arbitration hearing when a town’s legislative body rejects a first award, and give weight and deference to the legislative body’s reasoning – Strengthen the ability of towns to seek court relief from awards where arbitrators haven’t weighed or considered financial capability issues • Similar provisions proposed for state collective bargaining 102

Preventing Further Cuts to Municipal Aid • Local option on conveyance tax • During the 2003 session, the legislature increased the local conveyance tax for: – All towns from 0. 11 percent to 0. 25 percent through June 30, 2004 – Distressed communities could vote to further increase the rate to 0. 5 percent through June 30, 2004 • Governor Rowland proposes: – Allowing the temporary increase for all towns to sunset – Enabling certain distressed communities to make permanent the additional 0. 25 percent above the base through local option (new rate for these communities would become 0. 36 percent if they choose to do so) 103

Conclusion • Pragmatic budget submission – Gives priority to keeping tax increases limited and limiting further spending reductions – Responds to needs of education in distressed communities, DMR waiting list, DCF abuse and neglect, and child care for the working poor – Reaches out to towns – no further local aid cuts occurring up front or mid-year – Tax increases ensure further reductions are not needed • Budget about fiscal stability – providing certainty to: – Clients and providers of government programs and services – Citizens and businesses concerned about taxes and the economy – Investors and bond rating agencies looking for a balanced approach/balanced budget • Timely passage of the adjusted budget is critical 104

For More Information • This is the link to the Midterm Budget Homepage http: //www. opm. state. ct. us/budget/2005 Midterm. Budget. Books/2005 Midterm. Budget. Home. htm • Governor Rowland’s FY 2004 -05 Midterm Budget Document • The Economic Report of the Governor • 3 Year Forecast • Midterm Budget Power. Point Presentation 105

Index (Midterm 2004 -05) • Budgeting In These Precarious Times …. . . 2 • Investing in Child Protection and Welfare. . 70 • Liquidating the FY 03 -04 Deficit ……… 11 • Keeping Connecticut Moving …………… 76 • The Economic Outlook ……………. . … 14 • Economic and Workforce Development…. 77 • The FY 2004 -05 Adjusted Budget …. . . … 17 • Protecting the Homeland Ensuring Public • Tax Changes and Revenue Enhancements ……………. … 27 • Education ……………. . 33 • Working Towards Real Choice for Long. Term Care ……………. . …. 41 • Offering Human Services, But Controlling Costs …………………. . . 44 • Meeting the Needs of DMR Clients …. . . 60 • Investing in Behavioral Health and Alternatives to Incarceration ………. . … 63 Safety …. . ……………. 80 • A More Efficient Government. . …………… 82 • A More Accountable and Responsible Government …………. . 86 • General Government Changes and Efficiencies …. ……………………. . . 87 • Capital Investments ………………. . 92 • Municipal Aid…………………. . . 100 • Conclusion ……………. . . ……………… 104 106

ef9261f1d5ceb96604ed098a511b6f69.ppt