9c2fac56aa0d5c29a4fd401cd67e68d0.ppt

- Количество слайдов: 34

Government Regulation Chapter 16 • Corporations are legal entities which exist only because governments allow them to exist. • Governments impose many restrictions on firms: mergers, patents, licensing, or subsidies. • The stated intention of governments is to set restrictions that promote social welfare, but they sometimes benefit particular groups or individuals. © 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Slide 1

Government Regulation Chapter 16 • Corporations are legal entities which exist only because governments allow them to exist. • Governments impose many restrictions on firms: mergers, patents, licensing, or subsidies. • The stated intention of governments is to set restrictions that promote social welfare, but they sometimes benefit particular groups or individuals. © 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Slide 1

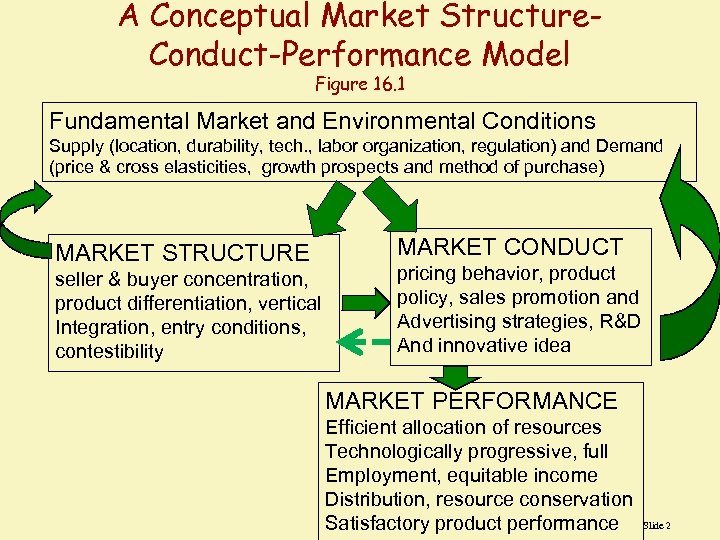

A Conceptual Market Structure. Conduct-Performance Model Figure 16. 1 Fundamental Market and Environmental Conditions Supply (location, durability, tech. , labor organization, regulation) and Demand (price & cross elasticities, growth prospects and method of purchase) MARKET STRUCTURE seller & buyer concentration, product differentiation, vertical Integration, entry conditions, contestibility MARKET CONDUCT pricing behavior, product policy, sales promotion and Advertising strategies, R&D And innovative idea MARKET PERFORMANCE Efficient allocation of resources Technologically progressive, full Employment, equitable income Distribution, resource conservation Satisfactory product performance Slide 2

A Conceptual Market Structure. Conduct-Performance Model Figure 16. 1 Fundamental Market and Environmental Conditions Supply (location, durability, tech. , labor organization, regulation) and Demand (price & cross elasticities, growth prospects and method of purchase) MARKET STRUCTURE seller & buyer concentration, product differentiation, vertical Integration, entry conditions, contestibility MARKET CONDUCT pricing behavior, product policy, sales promotion and Advertising strategies, R&D And innovative idea MARKET PERFORMANCE Efficient allocation of resources Technologically progressive, full Employment, equitable income Distribution, resource conservation Satisfactory product performance Slide 2

Good Market Performance Depends on: 1. 2. 3. 4. 5. 6. Efficient resource allocation Technologically progressive Promote full employment Equitable income distribution Resource conservation Satisfactory product performance and safety characteristics Slide 3

Good Market Performance Depends on: 1. 2. 3. 4. 5. 6. Efficient resource allocation Technologically progressive Promote full employment Equitable income distribution Resource conservation Satisfactory product performance and safety characteristics Slide 3

Market Conduct 1. Pricing behavior 2. Product policy 3. Sales promotion and advertising strategies 4. Research, development, and innovation strategies Slide 4

Market Conduct 1. Pricing behavior 2. Product policy 3. Sales promotion and advertising strategies 4. Research, development, and innovation strategies Slide 4

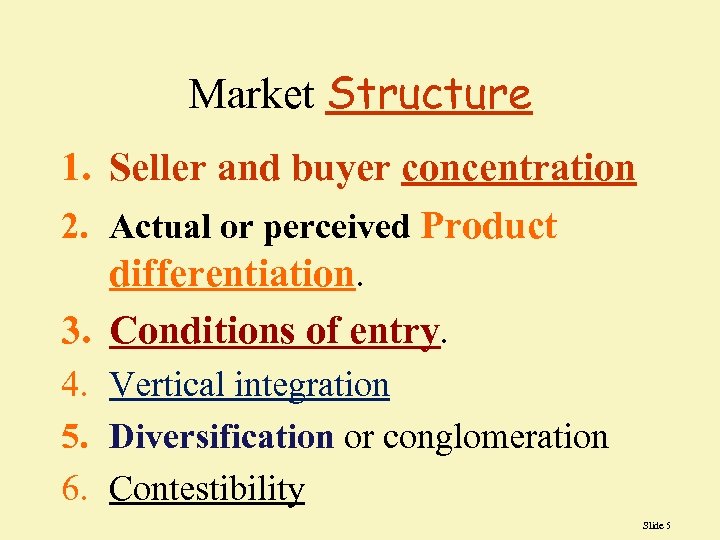

Market Structure 1. Seller and buyer concentration 2. Actual or perceived Product differentiation. 3. Conditions of entry. 4. Vertical integration 5. Diversification or conglomeration 6. Contestibility Slide 5

Market Structure 1. Seller and buyer concentration 2. Actual or perceived Product differentiation. 3. Conditions of entry. 4. Vertical integration 5. Diversification or conglomeration 6. Contestibility Slide 5

open Threat of Entry 1. Product differentiation closed • Advertising, patent control, distributional control 2. Absolute cost advantages • Superior techniques, control of inputs, superior access to financing 3. Scale Economies • Capital intensive technology, high start-up costs 4. Limited access to distribution channels Slide 6

open Threat of Entry 1. Product differentiation closed • Advertising, patent control, distributional control 2. Absolute cost advantages • Superior techniques, control of inputs, superior access to financing 3. Scale Economies • Capital intensive technology, high start-up costs 4. Limited access to distribution channels Slide 6

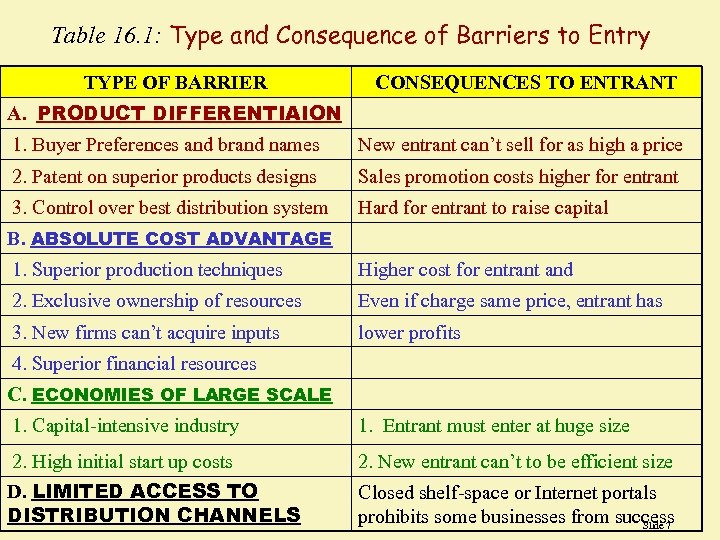

Table 16. 1: Type and Consequence of Barriers to Entry TYPE OF BARRIER CONSEQUENCES TO ENTRANT A. PRODUCT DIFFERENTIAION 1. Buyer Preferences and brand names New entrant can’t sell for as high a price 2. Patent on superior products designs Sales promotion costs higher for entrant 3. Control over best distribution system Hard for entrant to raise capital B. ABSOLUTE COST ADVANTAGE 1. Superior production techniques Higher cost for entrant and 2. Exclusive ownership of resources Even if charge same price, entrant has 3. New firms can’t acquire inputs lower profits 4. Superior financial resources C. ECONOMIES OF LARGE SCALE 1. Capital-intensive industry 1. Entrant must enter at huge size 2. High initial start up costs 2. New entrant can’t to be efficient size D. LIMITED ACCESS TO DISTRIBUTION CHANNELS Closed shelf-space or Internet portals prohibits some businesses from success Slide 7

Table 16. 1: Type and Consequence of Barriers to Entry TYPE OF BARRIER CONSEQUENCES TO ENTRANT A. PRODUCT DIFFERENTIAION 1. Buyer Preferences and brand names New entrant can’t sell for as high a price 2. Patent on superior products designs Sales promotion costs higher for entrant 3. Control over best distribution system Hard for entrant to raise capital B. ABSOLUTE COST ADVANTAGE 1. Superior production techniques Higher cost for entrant and 2. Exclusive ownership of resources Even if charge same price, entrant has 3. New firms can’t acquire inputs lower profits 4. Superior financial resources C. ECONOMIES OF LARGE SCALE 1. Capital-intensive industry 1. Entrant must enter at huge size 2. High initial start up costs 2. New entrant can’t to be efficient size D. LIMITED ACCESS TO DISTRIBUTION CHANNELS Closed shelf-space or Internet portals prohibits some businesses from success Slide 7

Antitrust Regulation and their Enforcement • In trusts, the voting rights to the several firms are conveyed to a legal trust to manage the group of firms as if it were one firm. This tends to create monopolization of an industry. • The Sherman Antitrust Act (1890) outlawed monopolies per se and attempted monopolization. Slide 8

Antitrust Regulation and their Enforcement • In trusts, the voting rights to the several firms are conveyed to a legal trust to manage the group of firms as if it were one firm. This tends to create monopolization of an industry. • The Sherman Antitrust Act (1890) outlawed monopolies per se and attempted monopolization. Slide 8

The Clayton Act • The Clayton Act (1914) extended the list of conduct that was anti-competitive: a. price discrimination. (section 2) b. tying contracts force customers to buy added products with one product. (section 3) c. purchasing shares of competing firms as an anti-merger section. (section 7) d. corporate directorship interlocks occur when the same people are in directorships of competing firms. (section 8) • The Federal Trade Commission was established in 1914 to prohibit unfair methods of competition. Slide 9

The Clayton Act • The Clayton Act (1914) extended the list of conduct that was anti-competitive: a. price discrimination. (section 2) b. tying contracts force customers to buy added products with one product. (section 3) c. purchasing shares of competing firms as an anti-merger section. (section 7) d. corporate directorship interlocks occur when the same people are in directorships of competing firms. (section 8) • The Federal Trade Commission was established in 1914 to prohibit unfair methods of competition. Slide 9

Robinson-Patman Act of 1936 Section 2(a) prohibits price discrimination which "substantially lessen competition". Section (2 b) provides a cost justification for price discrimination. Section (2 c) prohibits some kinds of brokerage commissions. Sections (2 d-2 e) prohibits discounts to buyers not afforded to other customers. • The Hart-Scott-Rodino Antitrust Improvement Act (1976) requires notification by large firms to the Justice Department of impending mergers. Slide 10

Robinson-Patman Act of 1936 Section 2(a) prohibits price discrimination which "substantially lessen competition". Section (2 b) provides a cost justification for price discrimination. Section (2 c) prohibits some kinds of brokerage commissions. Sections (2 d-2 e) prohibits discounts to buyers not afforded to other customers. • The Hart-Scott-Rodino Antitrust Improvement Act (1976) requires notification by large firms to the Justice Department of impending mergers. Slide 10

Antitrust Prohibitions of Selected Business Decisions Collusion to fix prices (airlines and grocery stores have been penalized) Mergers that substantially lessen competition (mergers raise 4 CR and the HHI) » If HHI > 1, 800, mergers are usually challenged » If 1, 000 < HHI < 1, 8000, mergers tend to be challenged if raise the HHI by more than 100 points » If HHI < 1, 000, most mergers are not challenged • 4 CR and HHI are two ways to measure changes in market structure caused by mergers. Slide 11

Antitrust Prohibitions of Selected Business Decisions Collusion to fix prices (airlines and grocery stores have been penalized) Mergers that substantially lessen competition (mergers raise 4 CR and the HHI) » If HHI > 1, 800, mergers are usually challenged » If 1, 000 < HHI < 1, 8000, mergers tend to be challenged if raise the HHI by more than 100 points » If HHI < 1, 000, most mergers are not challenged • 4 CR and HHI are two ways to measure changes in market structure caused by mergers. Slide 11

Measuring the impact of mergers • A relevant market is a group of economic agents that interact in a buyerseller relationship. The nature of that relationship is affected by the number and size distribution of the buyers and sellers. • A popular measure of seller concentration is the percentage of an industry comprised of the top 4 firms. • Similarly, the top 4 buyers is a popular measure of buyer concentration. Slide 12

Measuring the impact of mergers • A relevant market is a group of economic agents that interact in a buyerseller relationship. The nature of that relationship is affected by the number and size distribution of the buyers and sellers. • A popular measure of seller concentration is the percentage of an industry comprised of the top 4 firms. • Similarly, the top 4 buyers is a popular measure of buyer concentration. Slide 12

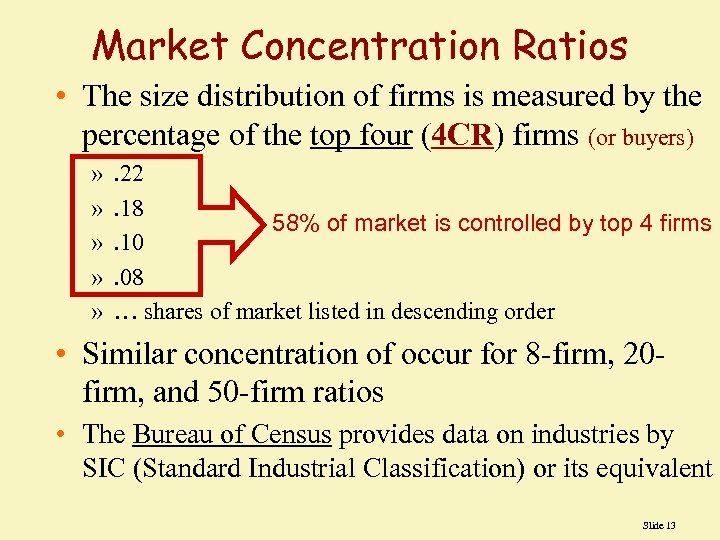

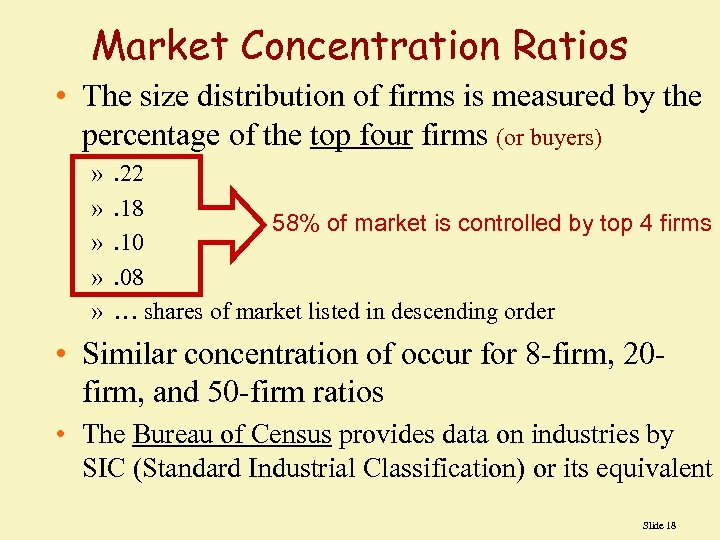

Market Concentration Ratios • The size distribution of firms is measured by the percentage of the top four (4 CR) firms (or buyers) » » » . 22. 18 58% of market is controlled by top 4 firms. 10. 08 … shares of market listed in descending order • Similar concentration of occur for 8 -firm, 20 firm, and 50 -firm ratios • The Bureau of Census provides data on industries by SIC (Standard Industrial Classification) or its equivalent Slide 13

Market Concentration Ratios • The size distribution of firms is measured by the percentage of the top four (4 CR) firms (or buyers) » » » . 22. 18 58% of market is controlled by top 4 firms. 10. 08 … shares of market listed in descending order • Similar concentration of occur for 8 -firm, 20 firm, and 50 -firm ratios • The Bureau of Census provides data on industries by SIC (Standard Industrial Classification) or its equivalent Slide 13

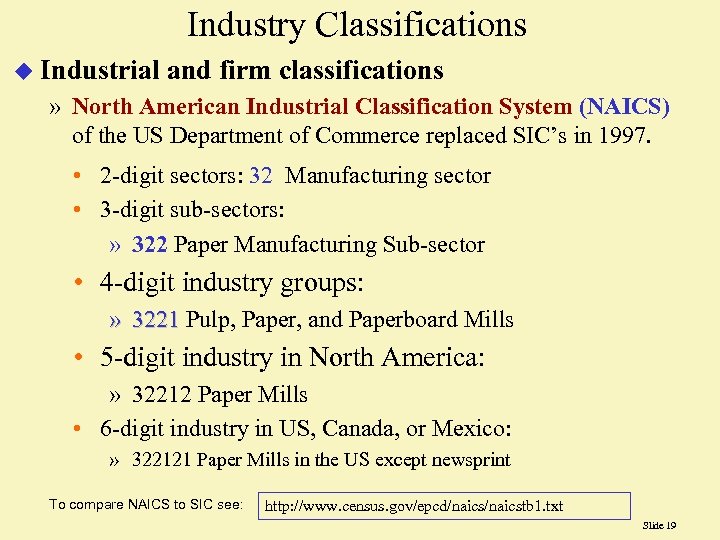

Industry Classifications u Industrial and firm classifications » North American Industrial Classification System (NAICS) of the US Department of Commerce replaced SIC’s in 1997. • 2 -digit sectors: 32 Manufacturing sector • 3 -digit sub-sectors: » 322 Paper Manufacturing Sub-sector • 4 -digit industry groups: » 3221 Pulp, Paper, and Paperboard Mills • 5 -digit industry in North America: » 32212 Paper Mills • 6 -digit industry in US, Canada, or Mexico: » 322121 Paper Mills in the US except newsprint To compare NAICS to SIC see: http: //www. census. gov/epcd/naicstb 1. txt Slide 14

Industry Classifications u Industrial and firm classifications » North American Industrial Classification System (NAICS) of the US Department of Commerce replaced SIC’s in 1997. • 2 -digit sectors: 32 Manufacturing sector • 3 -digit sub-sectors: » 322 Paper Manufacturing Sub-sector • 4 -digit industry groups: » 3221 Pulp, Paper, and Paperboard Mills • 5 -digit industry in North America: » 32212 Paper Mills • 6 -digit industry in US, Canada, or Mexico: » 322121 Paper Mills in the US except newsprint To compare NAICS to SIC see: http: //www. census. gov/epcd/naicstb 1. txt Slide 14

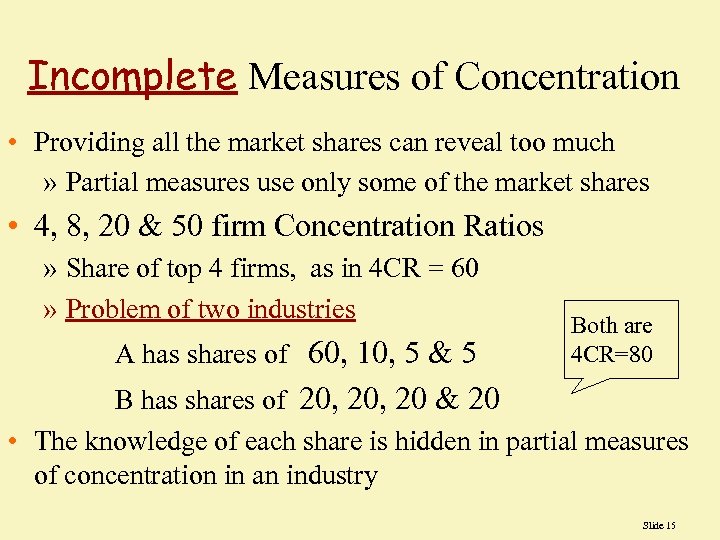

Incomplete Measures of Concentration • Providing all the market shares can reveal too much » Partial measures use only some of the market shares • 4, 8, 20 & 50 firm Concentration Ratios » Share of top 4 firms, as in 4 CR = 60 » Problem of two industries A has shares of 60, 10, 5 & 5 Both are 4 CR=80 B has shares of 20, 20 & 20 • The knowledge of each share is hidden in partial measures of concentration in an industry Slide 15

Incomplete Measures of Concentration • Providing all the market shares can reveal too much » Partial measures use only some of the market shares • 4, 8, 20 & 50 firm Concentration Ratios » Share of top 4 firms, as in 4 CR = 60 » Problem of two industries A has shares of 60, 10, 5 & 5 Both are 4 CR=80 B has shares of 20, 20 & 20 • The knowledge of each share is hidden in partial measures of concentration in an industry Slide 15

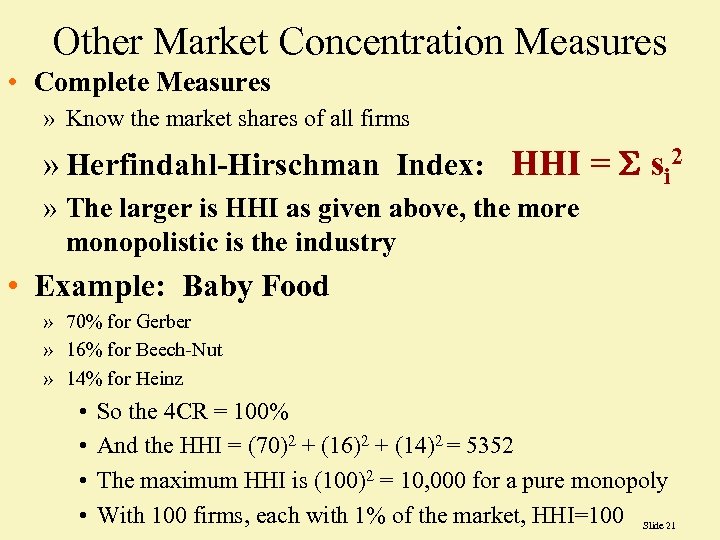

Complete Concentration Measures • For complete measures » You must know the market shares of all firms » Herfindahl-Hirschman Index: HHI = S si 2 » The larger is HHI as given above, the more monopolistic is the industry • Example: Baby Food » 70% for Gerber » 16% for Beech-Nut » 14% for Heinz • • So the 4 CR = 100% And the HHI = (70)2 + (16)2 + (14)2 = 5, 352 The maximum HHI is (100)2 = 10, 000 for a pure monopoly With 100 firms, each with 1% of the market, HHI=100 Slide 16

Complete Concentration Measures • For complete measures » You must know the market shares of all firms » Herfindahl-Hirschman Index: HHI = S si 2 » The larger is HHI as given above, the more monopolistic is the industry • Example: Baby Food » 70% for Gerber » 16% for Beech-Nut » 14% for Heinz • • So the 4 CR = 100% And the HHI = (70)2 + (16)2 + (14)2 = 5, 352 The maximum HHI is (100)2 = 10, 000 for a pure monopoly With 100 firms, each with 1% of the market, HHI=100 Slide 16

Measuring the impact of mergers • A relevant market is a group of economic agents that interact in a buyerseller relationship. The nature of that relationship is affected by the number and size distribution of the buyers and sellers. • A popular measure of seller concentration is the percentage of an industry comprised of the top 4 firms. • Similarly, the top 4 buyers is a popular measure of buyer concentration. Slide 17

Measuring the impact of mergers • A relevant market is a group of economic agents that interact in a buyerseller relationship. The nature of that relationship is affected by the number and size distribution of the buyers and sellers. • A popular measure of seller concentration is the percentage of an industry comprised of the top 4 firms. • Similarly, the top 4 buyers is a popular measure of buyer concentration. Slide 17

Market Concentration Ratios • The size distribution of firms is measured by the percentage of the top four firms (or buyers) » » » . 22. 18 58% of market is controlled by top 4 firms. 10. 08 … shares of market listed in descending order • Similar concentration of occur for 8 -firm, 20 firm, and 50 -firm ratios • The Bureau of Census provides data on industries by SIC (Standard Industrial Classification) or its equivalent Slide 18

Market Concentration Ratios • The size distribution of firms is measured by the percentage of the top four firms (or buyers) » » » . 22. 18 58% of market is controlled by top 4 firms. 10. 08 … shares of market listed in descending order • Similar concentration of occur for 8 -firm, 20 firm, and 50 -firm ratios • The Bureau of Census provides data on industries by SIC (Standard Industrial Classification) or its equivalent Slide 18

Industry Classifications u Industrial and firm classifications » North American Industrial Classification System (NAICS) of the US Department of Commerce replaced SIC’s in 1997. • 2 -digit sectors: 32 Manufacturing sector • 3 -digit sub-sectors: » 322 Paper Manufacturing Sub-sector • 4 -digit industry groups: » 3221 Pulp, Paper, and Paperboard Mills • 5 -digit industry in North America: » 32212 Paper Mills • 6 -digit industry in US, Canada, or Mexico: » 322121 Paper Mills in the US except newsprint To compare NAICS to SIC see: http: //www. census. gov/epcd/naicstb 1. txt Slide 19

Industry Classifications u Industrial and firm classifications » North American Industrial Classification System (NAICS) of the US Department of Commerce replaced SIC’s in 1997. • 2 -digit sectors: 32 Manufacturing sector • 3 -digit sub-sectors: » 322 Paper Manufacturing Sub-sector • 4 -digit industry groups: » 3221 Pulp, Paper, and Paperboard Mills • 5 -digit industry in North America: » 32212 Paper Mills • 6 -digit industry in US, Canada, or Mexico: » 322121 Paper Mills in the US except newsprint To compare NAICS to SIC see: http: //www. census. gov/epcd/naicstb 1. txt Slide 19

Incomplete Measures of Concentration • Providing all the market shares can reveal too much » Partial measures use only some of the market shares • 4, 8, 20 & 50 firm Concentration Ratios » Share of top 4 firms, as in 4 CR = 60 » Problem of two industries A has shares of 60, 10, 5 & 5 Both are 4 CR=80 B has shares of 20, 20 & 20 • The knowledge of each share is hidden in partial measures of concentration in an industry Slide 20

Incomplete Measures of Concentration • Providing all the market shares can reveal too much » Partial measures use only some of the market shares • 4, 8, 20 & 50 firm Concentration Ratios » Share of top 4 firms, as in 4 CR = 60 » Problem of two industries A has shares of 60, 10, 5 & 5 Both are 4 CR=80 B has shares of 20, 20 & 20 • The knowledge of each share is hidden in partial measures of concentration in an industry Slide 20

Other Market Concentration Measures • Complete Measures » Know the market shares of all firms » Herfindahl-Hirschman Index: HHI = S si 2 » The larger is HHI as given above, the more monopolistic is the industry • Example: Baby Food » 70% for Gerber » 16% for Beech-Nut » 14% for Heinz • • So the 4 CR = 100% And the HHI = (70)2 + (16)2 + (14)2 = 5352 The maximum HHI is (100)2 = 10, 000 for a pure monopoly With 100 firms, each with 1% of the market, HHI=100 Slide 21

Other Market Concentration Measures • Complete Measures » Know the market shares of all firms » Herfindahl-Hirschman Index: HHI = S si 2 » The larger is HHI as given above, the more monopolistic is the industry • Example: Baby Food » 70% for Gerber » 16% for Beech-Nut » 14% for Heinz • • So the 4 CR = 100% And the HHI = (70)2 + (16)2 + (14)2 = 5352 The maximum HHI is (100)2 = 10, 000 for a pure monopoly With 100 firms, each with 1% of the market, HHI=100 Slide 21

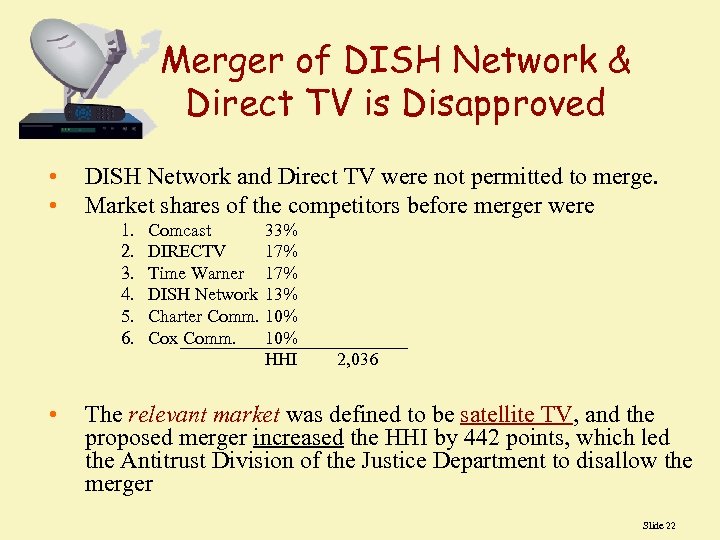

Merger of DISH Network & Direct TV is Disapproved • • DISH Network and Direct TV were not permitted to merge. Market shares of the competitors before merger were 1. 2. 3. 4. 5. 6. • Comcast 33% DIRECTV 17% Time Warner 17% DISH Network 13% Charter Comm. 10% Cox Comm. 10% HHI 2, 036 The relevant market was defined to be satellite TV, and the proposed merger increased the HHI by 442 points, which led the Antitrust Division of the Justice Department to disallow the merger Slide 22

Merger of DISH Network & Direct TV is Disapproved • • DISH Network and Direct TV were not permitted to merge. Market shares of the competitors before merger were 1. 2. 3. 4. 5. 6. • Comcast 33% DIRECTV 17% Time Warner 17% DISH Network 13% Charter Comm. 10% Cox Comm. 10% HHI 2, 036 The relevant market was defined to be satellite TV, and the proposed merger increased the HHI by 442 points, which led the Antitrust Division of the Justice Department to disallow the merger Slide 22

More Antitrust Prohibitions: Monopolization (attempted monopolization is a violation of the Sherman Antitrust Act) Wholesale Price Discrimination (forms of price discrimination that injured other competitors, not necessarily customers) » Penguin Books sold books at lower prices to Barnes & Noble than to other bookstores Refusals to Deal (when not based on legitimate business justifications) Slide 23

More Antitrust Prohibitions: Monopolization (attempted monopolization is a violation of the Sherman Antitrust Act) Wholesale Price Discrimination (forms of price discrimination that injured other competitors, not necessarily customers) » Penguin Books sold books at lower prices to Barnes & Noble than to other bookstores Refusals to Deal (when not based on legitimate business justifications) Slide 23

The Deregulation Movement • Airlines and the trucking industries have been deregulated. • They are no longer "infant industries". • Deregulation of long-distance occurred due in large part to technological changes in transmitting phone messages by microwave. Slide 24

The Deregulation Movement • Airlines and the trucking industries have been deregulated. • They are no longer "infant industries". • Deregulation of long-distance occurred due in large part to technological changes in transmitting phone messages by microwave. Slide 24

Regulation of Externalities • Externalities: » Externalities exist when benefits or costs fall on others who do not contribute or are reimbursed. » Some externalities are welcome and others are disliked. • Pecuniary Externalities: » When the spillover are purely reflected in prices » Example: The fear of mad cow disease reduces beef prices and raises chicken prices, but no inefficiency occurs as they are reflected in market prices • Resource Misallocation: » When not pecuniary, externalities harm resource allocation. Urban blight leads to too little investment. 2005 South-Western Publishing Slide 25

Regulation of Externalities • Externalities: » Externalities exist when benefits or costs fall on others who do not contribute or are reimbursed. » Some externalities are welcome and others are disliked. • Pecuniary Externalities: » When the spillover are purely reflected in prices » Example: The fear of mad cow disease reduces beef prices and raises chicken prices, but no inefficiency occurs as they are reflected in market prices • Resource Misallocation: » When not pecuniary, externalities harm resource allocation. Urban blight leads to too little investment. 2005 South-Western Publishing Slide 25

The Coase Theorem argues that, if the transaction costs for private contracting between parties are very low, the problems of externalities will be resolved without governmental intervention efficiently. Even if governments and the courts can assign property rights or duties however they wish, the solution is unaffected when transaction costs are low. Consider a railroad that burns crops planted nearby. Slide 26

The Coase Theorem argues that, if the transaction costs for private contracting between parties are very low, the problems of externalities will be resolved without governmental intervention efficiently. Even if governments and the courts can assign property rights or duties however they wish, the solution is unaffected when transaction costs are low. Consider a railroad that burns crops planted nearby. Slide 26

Coase’s Railroad • Table 16. 4 panel A, when the RR has property rights. Farmer’s profits in the upper triangle. Without contracting, the RR would run 2 trains per day and the Farmer would plant 10 acres. • With contracting, Coase predicts that farmer would bribe the RR about $501 to reduce the number of trains to 1 per day. The farmer gets $900 - $401 = $499 which is better $300; RR gets $1, 501 better than $1, 500. Farmer’s Gross Profits By acres planted 0 10 0 1, 500 0 0 Railroad’s Gross Profits 1 1, 000 By trains per day 2 1, 600 0 900 1, 000 0 1, 500 20 400 1, 000 300 1, 500 -800 1, 500

Coase’s Railroad • Table 16. 4 panel A, when the RR has property rights. Farmer’s profits in the upper triangle. Without contracting, the RR would run 2 trains per day and the Farmer would plant 10 acres. • With contracting, Coase predicts that farmer would bribe the RR about $501 to reduce the number of trains to 1 per day. The farmer gets $900 - $401 = $499 which is better $300; RR gets $1, 501 better than $1, 500. Farmer’s Gross Profits By acres planted 0 10 0 1, 500 0 0 Railroad’s Gross Profits 1 1, 000 By trains per day 2 1, 600 0 900 1, 000 0 1, 500 20 400 1, 000 300 1, 500 -800 1, 500

Coase’s Railroad • Table 16 A. 1 panel B, when the RR has the liabilities. Without contracting, the Farmer would plant 20 acres & the RR would not run. • With contracting, Coase predicts that RR would bribe the RR about $101 to reduce the acreage to 10. The farmer gets $1, 500 + $101 = $1, 601 which is better $1, 600; RR gets $400 - $101 better than without contracting. Farmer’s Gross Profits By acres planted 0 10 0 1, 500 0 0 Railroad’s Gross Profits 1 1, 000 By trains per day 2 1, 600 0 1, 500 400 0 1, 500 20 1, 600 -200 300 1, 600 -900

Coase’s Railroad • Table 16 A. 1 panel B, when the RR has the liabilities. Without contracting, the Farmer would plant 20 acres & the RR would not run. • With contracting, Coase predicts that RR would bribe the RR about $101 to reduce the acreage to 10. The farmer gets $1, 500 + $101 = $1, 601 which is better $1, 600; RR gets $400 - $101 better than without contracting. Farmer’s Gross Profits By acres planted 0 10 0 1, 500 0 0 Railroad’s Gross Profits 1 1, 000 By trains per day 2 1, 600 0 1, 500 400 0 1, 500 20 1, 600 -200 300 1, 600 -900

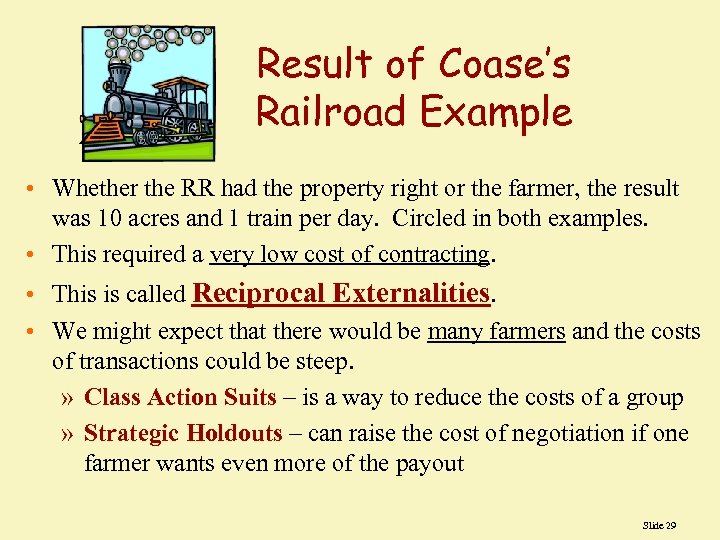

Result of Coase’s Railroad Example • Whether the RR had the property right or the farmer, the result was 10 acres and 1 train per day. Circled in both examples. • This required a very low cost of contracting. • This is called Reciprocal Externalities. • We might expect that there would be many farmers and the costs of transactions could be steep. » Class Action Suits – is a way to reduce the costs of a group » Strategic Holdouts – can raise the cost of negotiation if one farmer wants even more of the payout Slide 29

Result of Coase’s Railroad Example • Whether the RR had the property right or the farmer, the result was 10 acres and 1 train per day. Circled in both examples. • This required a very low cost of contracting. • This is called Reciprocal Externalities. • We might expect that there would be many farmers and the costs of transactions could be steep. » Class Action Suits – is a way to reduce the costs of a group » Strategic Holdouts – can raise the cost of negotiation if one farmer wants even more of the payout Slide 29

Coase Theorem with Farmers & Ranchers: another example • Cattle Ranchers • Corn Farmers » Suppose a fence costs $500, 000 to keep cattle out of farmland » Suppose damage to corn is $100, 000 by cattle » What should happen? • No fence will be built » Now suppose that a fence costs only $100, 000 » Suppose damage to corn is $500, 000 by the cattle » What should happen? • A fence will be built Slide 30

Coase Theorem with Farmers & Ranchers: another example • Cattle Ranchers • Corn Farmers » Suppose a fence costs $500, 000 to keep cattle out of farmland » Suppose damage to corn is $100, 000 by cattle » What should happen? • No fence will be built » Now suppose that a fence costs only $100, 000 » Suppose damage to corn is $500, 000 by the cattle » What should happen? • A fence will be built Slide 30

But Property Rights Matter in a world with transaction costs • It is often costly to arrange contracts between ranchers and farmers • Suppose the fence costs more than the damage » If the property right to safe crops is established, the farmer will want a fence regardless of cost. An costly fence is constructed. » If the property right is for open range grazing, the rancher will not want a fence. No fence is built. • Therefore, who gets the property right matters! Slide 31

But Property Rights Matter in a world with transaction costs • It is often costly to arrange contracts between ranchers and farmers • Suppose the fence costs more than the damage » If the property right to safe crops is established, the farmer will want a fence regardless of cost. An costly fence is constructed. » If the property right is for open range grazing, the rancher will not want a fence. No fence is built. • Therefore, who gets the property right matters! Slide 31

Other Solutions to Externalities • • • Solution by Prohibition. Solution by Regulatory Directive. Solution by Taxes and Subsidies. Solution by Sale of Pollution Rights. Solution by Merger Slide 32

Other Solutions to Externalities • • • Solution by Prohibition. Solution by Regulatory Directive. Solution by Taxes and Subsidies. Solution by Sale of Pollution Rights. Solution by Merger Slide 32

Government Protection of Business • Governments historically have helped some companies by restricting or eliminating competition. • Examples » Licensing of professions (or businesses) » Permission to run a business in a community » Patents of ideas or processes restricts use of the idea » Import quotas Slide 33

Government Protection of Business • Governments historically have helped some companies by restricting or eliminating competition. • Examples » Licensing of professions (or businesses) » Permission to run a business in a community » Patents of ideas or processes restricts use of the idea » Import quotas Slide 33

Debate on Patent Protection • How long should a patent run? • 20 years in US may be too long • But patents reward R&D work • Consider: Motorola & Lucent who can come up with a patent or imitate (copy) the other firm’s idea Motorola’s payoffs are in the upper triangles. » Strategy choices: Patent means develop and patent. Imitate means imitate by licensing. • If Motorola develops a process and patents it, Lucent will imitate and license it, so Motorola will see this as a poor outcome. • If Lucent develops and a process and patents, it is best for Motorola to imitate with a license. Lucent Imitate Patent • Table 16. 7 page 687 Motorola (in upper triangles) Patent Imitate $1 B $3 B $5 B $4 B -$1 B $9 B $0 B » This outcome in the dashed oval is the iterative dominant strategy pair that will likely occur and is a Nash Equilibrium Slide 34

Debate on Patent Protection • How long should a patent run? • 20 years in US may be too long • But patents reward R&D work • Consider: Motorola & Lucent who can come up with a patent or imitate (copy) the other firm’s idea Motorola’s payoffs are in the upper triangles. » Strategy choices: Patent means develop and patent. Imitate means imitate by licensing. • If Motorola develops a process and patents it, Lucent will imitate and license it, so Motorola will see this as a poor outcome. • If Lucent develops and a process and patents, it is best for Motorola to imitate with a license. Lucent Imitate Patent • Table 16. 7 page 687 Motorola (in upper triangles) Patent Imitate $1 B $3 B $5 B $4 B -$1 B $9 B $0 B » This outcome in the dashed oval is the iterative dominant strategy pair that will likely occur and is a Nash Equilibrium Slide 34