2da60f09ff0f51cb94cb1b6bb45b977c.ppt

- Количество слайдов: 16

Government of Israel The Israeli Economy: Ongoing Progress November 2007

Government of Israel The Israeli Economy: Ongoing Progress November 2007

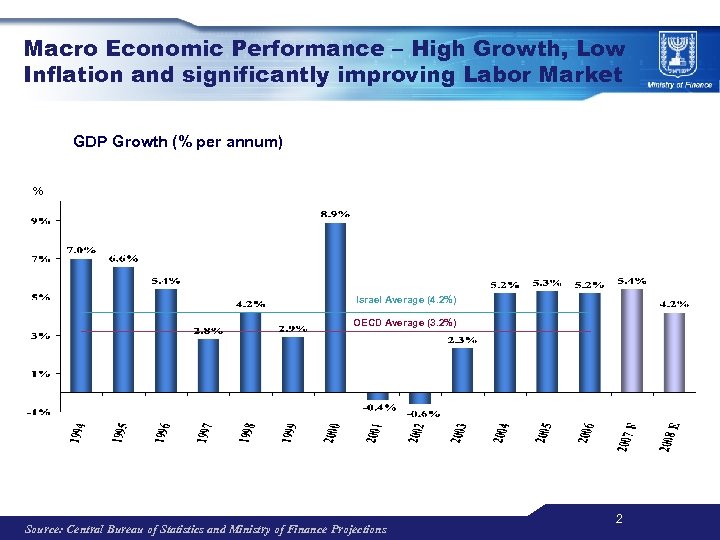

Macro Economic Performance – High Growth, Low Inflation and significantly improving Labor Market GDP Growth (% per annum) % Israel Average (4. 2%) OECD Average (3. 2%) Source: Central Bureau of Statistics and Ministry of Finance Projections 2

Macro Economic Performance – High Growth, Low Inflation and significantly improving Labor Market GDP Growth (% per annum) % Israel Average (4. 2%) OECD Average (3. 2%) Source: Central Bureau of Statistics and Ministry of Finance Projections 2

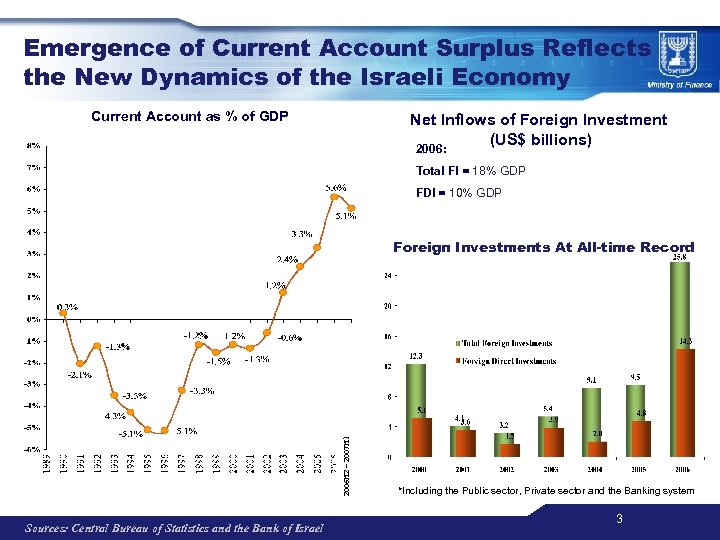

Emergence of Current Account Surplus Reflects the New Dynamics of the Israeli Economy Current Account as % of GDP Net Inflows of Foreign Investment (US$ billions) 2006: Total FI = 18% GDP FDI = 10% GDP 2006 H 2 – 2007 H 1 Foreign Investments At All-time Record Sources: Central Bureau of Statistics and the Bank of Israel *Including the Public sector, Private sector and the Banking system 3

Emergence of Current Account Surplus Reflects the New Dynamics of the Israeli Economy Current Account as % of GDP Net Inflows of Foreign Investment (US$ billions) 2006: Total FI = 18% GDP FDI = 10% GDP 2006 H 2 – 2007 H 1 Foreign Investments At All-time Record Sources: Central Bureau of Statistics and the Bank of Israel *Including the Public sector, Private sector and the Banking system 3

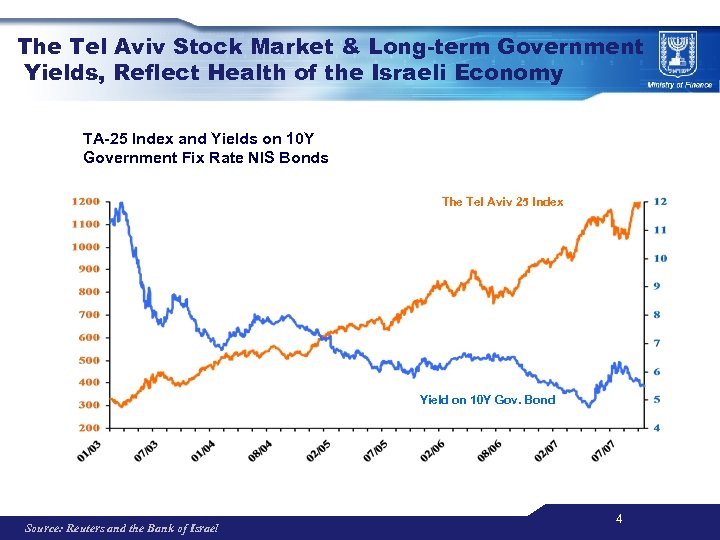

The Tel Aviv Stock Market & Long-term Government Yields, Reflect Health of the Israeli Economy TA-25 Index and Yields on 10 Y Government Fix Rate NIS Bonds The Tel Aviv 25 Index Yield on 10 Y Gov. Bond Source: Reuters and the Bank of Israel 4

The Tel Aviv Stock Market & Long-term Government Yields, Reflect Health of the Israeli Economy TA-25 Index and Yields on 10 Y Government Fix Rate NIS Bonds The Tel Aviv 25 Index Yield on 10 Y Gov. Bond Source: Reuters and the Bank of Israel 4

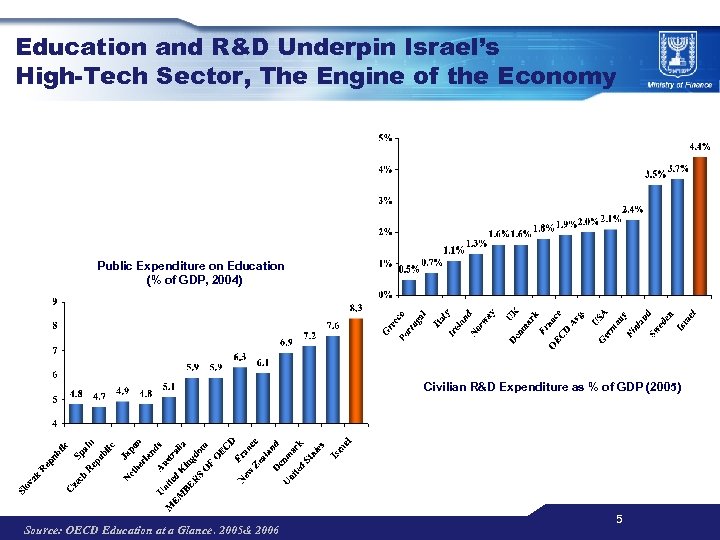

Education and R&D Underpin Israel’s High-Tech Sector, The Engine of the Economy Public Expenditure on Education (% of GDP, 2004) Civilian R&D Expenditure as % of GDP (2005) Source: OECD Education at a Glance. 2005& 2006 5

Education and R&D Underpin Israel’s High-Tech Sector, The Engine of the Economy Public Expenditure on Education (% of GDP, 2004) Civilian R&D Expenditure as % of GDP (2005) Source: OECD Education at a Glance. 2005& 2006 5

Clear and Consistent Economic Policy 4 Main Pillars Budget discipline Tax reduction From welfare to work Market economy – privatization & reforms 6

Clear and Consistent Economic Policy 4 Main Pillars Budget discipline Tax reduction From welfare to work Market economy – privatization & reforms 6

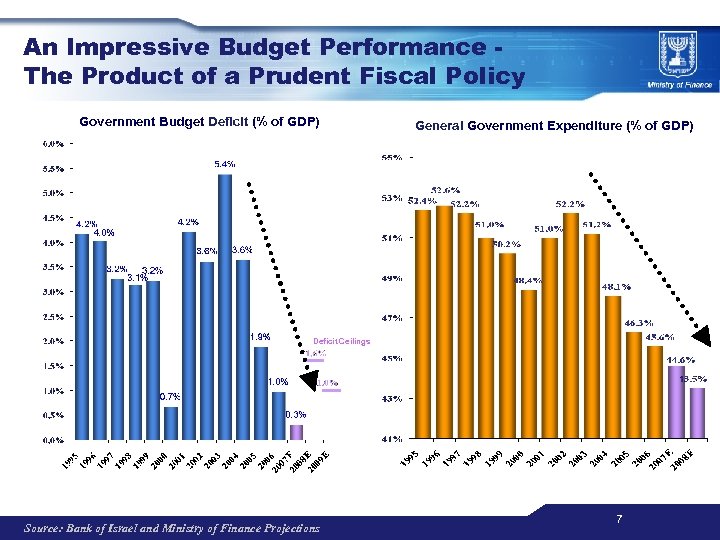

An Impressive Budget Performance The Product of a Prudent Fiscal Policy Government Budget Deficit (% of GDP) General Government Expenditure (% of GDP) Deficit Ceilings Source: Bank of Israel and Ministry of Finance Projections 7

An Impressive Budget Performance The Product of a Prudent Fiscal Policy Government Budget Deficit (% of GDP) General Government Expenditure (% of GDP) Deficit Ceilings Source: Bank of Israel and Ministry of Finance Projections 7

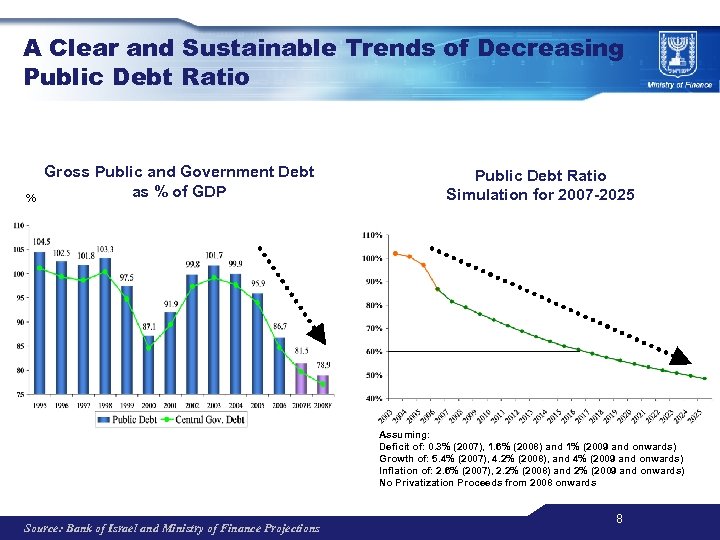

A Clear and Sustainable Trends of Decreasing Public Debt Ratio % Gross Public and Government Debt as % of GDP Public Debt Ratio Simulation for 2007 -2025 Assuming: Deficit of: 0. 3% (2007), 1. 6% (2008) and 1% (2009 and onwards) Growth of: 5. 4% (2007), 4. 2% (2008), and 4% (2009 and onwards) Inflation of: 2. 6% (2007), 2. 2% (2008) and 2% (2009 and onwards) No Privatization Proceeds from 2008 onwards Source: Bank of Israel and Ministry of Finance Projections 8

A Clear and Sustainable Trends of Decreasing Public Debt Ratio % Gross Public and Government Debt as % of GDP Public Debt Ratio Simulation for 2007 -2025 Assuming: Deficit of: 0. 3% (2007), 1. 6% (2008) and 1% (2009 and onwards) Growth of: 5. 4% (2007), 4. 2% (2008), and 4% (2009 and onwards) Inflation of: 2. 6% (2007), 2. 2% (2008) and 2% (2009 and onwards) No Privatization Proceeds from 2008 onwards Source: Bank of Israel and Ministry of Finance Projections 8

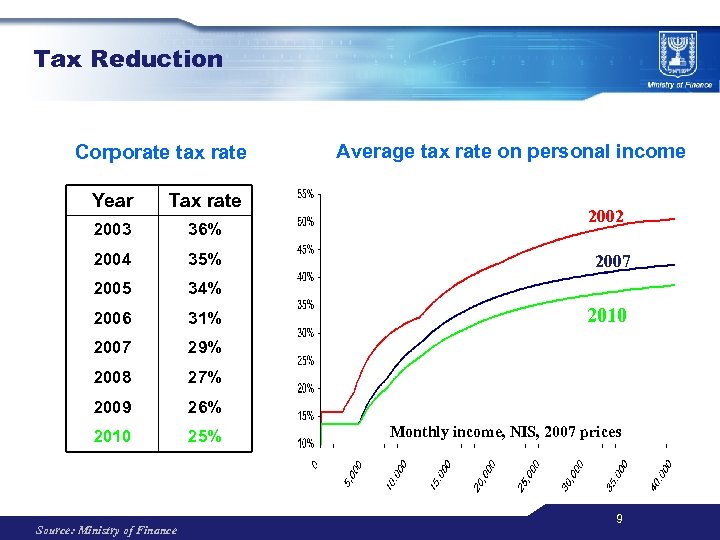

Tax Reduction Corporate tax rate Year Tax rate 2003 36% 2004 35% 2005 34% 2006 31% 2007 29% 2008 27% 2009 26% 2010 25% Average tax rate on personal income Source: Ministry of Finance 2002 2007 2010 Monthly income, NIS, 2007 prices 9

Tax Reduction Corporate tax rate Year Tax rate 2003 36% 2004 35% 2005 34% 2006 31% 2007 29% 2008 27% 2009 26% 2010 25% Average tax rate on personal income Source: Ministry of Finance 2002 2007 2010 Monthly income, NIS, 2007 prices 9

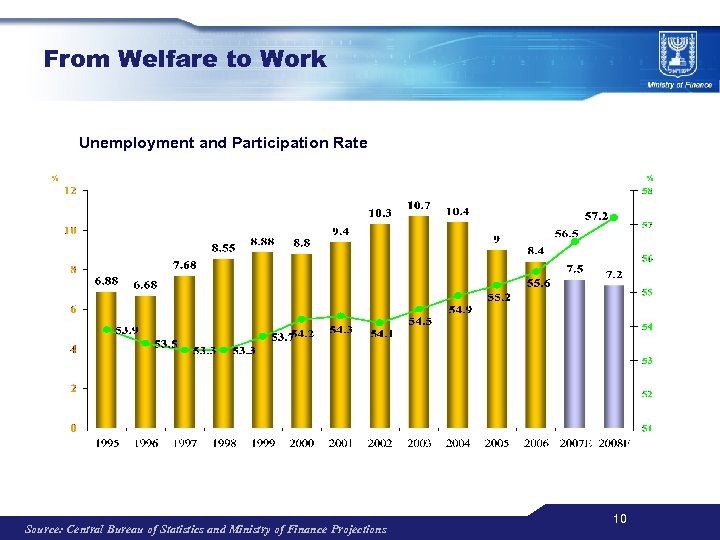

From Welfare to Work Unemployment and Participation Rate % Source: Central Bureau of Statistics and Ministry of Finance Projections % 10

From Welfare to Work Unemployment and Participation Rate % Source: Central Bureau of Statistics and Ministry of Finance Projections % 10

Highlights of Structural Reforms and Privatization from The Last Years Bank Leumi Tax Reforms Pension Fund Reforms Domestic Government Bonds Reforms Capital Market Reforms Discount Bank Bezeq (telecom corp) Oil Refinery Ashdod & Haifa El Al Israel Airlines, Ltd ZIM (Israel navigation corp) Investment in Infrastructure Sea Ports Structural Reform 11

Highlights of Structural Reforms and Privatization from The Last Years Bank Leumi Tax Reforms Pension Fund Reforms Domestic Government Bonds Reforms Capital Market Reforms Discount Bank Bezeq (telecom corp) Oil Refinery Ashdod & Haifa El Al Israel Airlines, Ltd ZIM (Israel navigation corp) Investment in Infrastructure Sea Ports Structural Reform 11

Many More Structural Reforms and Privatizations are on The Agenda Electricity Sector Reform Education Reform Bank Leumi (The remaining 10%) Israel Postal Company Israel Electric Corp. Labor Market Reform Land Reform Industrial Development bank Israel Gov’s Coins and Medals Corp. Enhance Competition In Public Transportation Capital Market committee Israel Aircraft Industries Israel Military Industries 12

Many More Structural Reforms and Privatizations are on The Agenda Electricity Sector Reform Education Reform Bank Leumi (The remaining 10%) Israel Postal Company Israel Electric Corp. Labor Market Reform Land Reform Industrial Development bank Israel Gov’s Coins and Medals Corp. Enhance Competition In Public Transportation Capital Market committee Israel Aircraft Industries Israel Military Industries 12

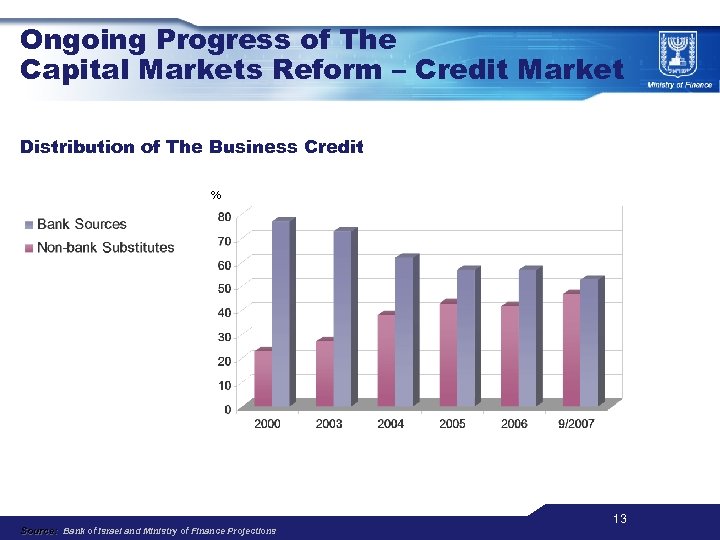

Ongoing Progress of The Capital Markets Reform – Credit Market Distribution of The Business Credit % Source: Bank of Israel and Ministry of Finance Projections 13

Ongoing Progress of The Capital Markets Reform – Credit Market Distribution of The Business Credit % Source: Bank of Israel and Ministry of Finance Projections 13

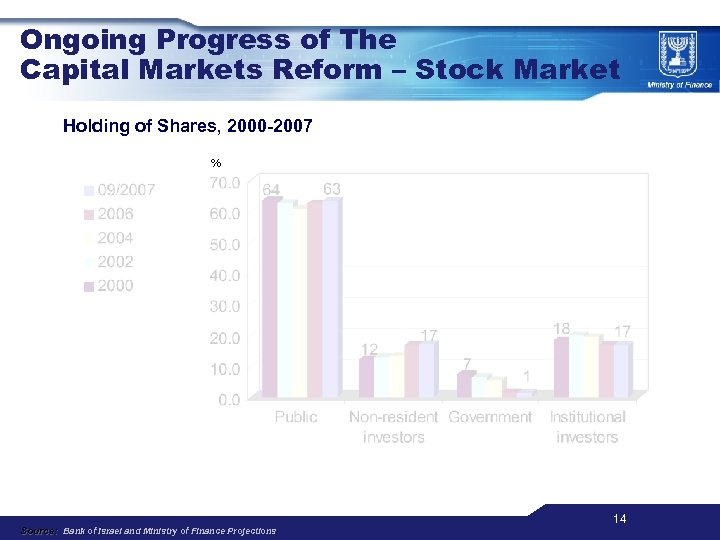

Ongoing Progress of The Capital Markets Reform – Stock Market Holding of Shares, 2000 -2007 % Source: Bank of Israel and Ministry of Finance Projections 14

Ongoing Progress of The Capital Markets Reform – Stock Market Holding of Shares, 2000 -2007 % Source: Bank of Israel and Ministry of Finance Projections 14

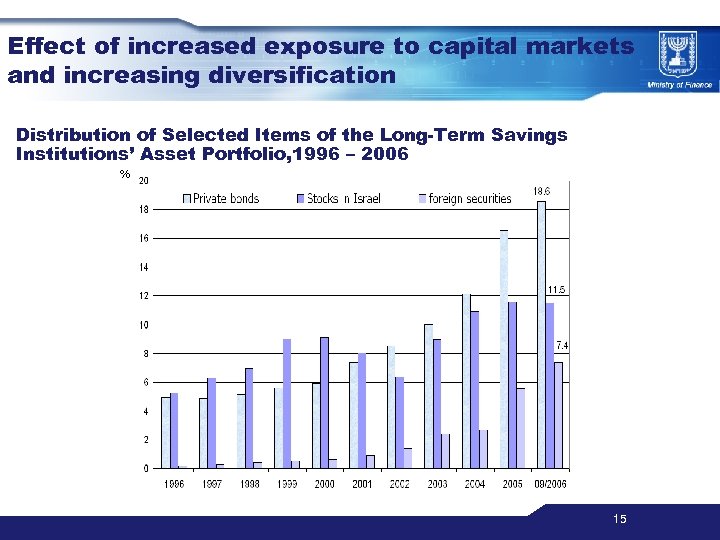

Effect of increased exposure to capital markets and increasing diversification Distribution of Selected Items of the Long-Term Savings Institutions’ Asset Portfolio, 1996 – 2006 % 15

Effect of increased exposure to capital markets and increasing diversification Distribution of Selected Items of the Long-Term Savings Institutions’ Asset Portfolio, 1996 – 2006 % 15

Summary § Clear and consistent economic policy § Commitment to budget discipline, tax reduction and debt reduction § Commitment to structural reforms § Investing in human and capital infrastructure § Impressive economic performance 4 consecutive years § Economy has proven highly resilient to external shocks § Commitment to establish a competitive basis in the Israeli capital markets § Increasing investment flexibility help to improve the Israeli capital markets 16

Summary § Clear and consistent economic policy § Commitment to budget discipline, tax reduction and debt reduction § Commitment to structural reforms § Investing in human and capital infrastructure § Impressive economic performance 4 consecutive years § Economy has proven highly resilient to external shocks § Commitment to establish a competitive basis in the Israeli capital markets § Increasing investment flexibility help to improve the Israeli capital markets 16