7909e3d2b36f6f0c8ac74945f65df46f.ppt

- Количество слайдов: 16

Goods and Services Tax Seamless Integration with Existing Processes 23 Nov 2005 Cheah Chee Keong – Solution Manager, SAP South Asia chee. keong. cheah@sap. com

Goods and Services Tax Seamless Integration with Existing Processes 23 Nov 2005 Cheah Chee Keong – Solution Manager, SAP South Asia chee. keong. cheah@sap. com

Introduction Our Prime Minister 2005 Budget Speech extract : “… The Government proposes to replace both these taxes (Sales Tax and Service Tax) with a single consumption tax, based on the value-added concept. The new tax, known as the Goods and Services Tax (GST), will be more comprehensive, efficient, transparent and effective, thereby enhancing tax compliance. . ” The 2005 Budget - 10 September 2004 ã SAP AG 2002, Title of Presentation, Speaker Name 2

Introduction Our Prime Minister 2005 Budget Speech extract : “… The Government proposes to replace both these taxes (Sales Tax and Service Tax) with a single consumption tax, based on the value-added concept. The new tax, known as the Goods and Services Tax (GST), will be more comprehensive, efficient, transparent and effective, thereby enhancing tax compliance. . ” The 2005 Budget - 10 September 2004 ã SAP AG 2002, Title of Presentation, Speaker Name 2

An Overview of GST n GST is charged on the taxable supply of goods and services made by a taxable person in the course or furtherance of business in Malaysia n It is a multi stage tax on domestic consumption, similar to Value Added Tax, levied on taxable supply of goods and services in Malaysia n Imposed on majority of goods and services with minimum exemptions and zero rating n Based on net value at each stage of business transaction up to retail stage n Covers all sectors of the economy n Relies on invoiced-based tax n It is a tax on consumption and not on investment ã SAP AG 2002, Title of Presentation, Speaker Name 3

An Overview of GST n GST is charged on the taxable supply of goods and services made by a taxable person in the course or furtherance of business in Malaysia n It is a multi stage tax on domestic consumption, similar to Value Added Tax, levied on taxable supply of goods and services in Malaysia n Imposed on majority of goods and services with minimum exemptions and zero rating n Based on net value at each stage of business transaction up to retail stage n Covers all sectors of the economy n Relies on invoiced-based tax n It is a tax on consumption and not on investment ã SAP AG 2002, Title of Presentation, Speaker Name 3

Scope of GST n The GST is based on destination principle n Levied at all levels of production and distribution of goods and services supplied and consumed in Malaysia u. Made by the taxable person u. In the course of furtherance of any business made by the taxable person; and u. On the importation of goods or services in Malaysia ã SAP AG 2002, Title of Presentation, Speaker Name 4

Scope of GST n The GST is based on destination principle n Levied at all levels of production and distribution of goods and services supplied and consumed in Malaysia u. Made by the taxable person u. In the course of furtherance of any business made by the taxable person; and u. On the importation of goods or services in Malaysia ã SAP AG 2002, Title of Presentation, Speaker Name 4

How GST Works n The taxable person pays GST or input tax on his business purchases. n He then adds value to those goods and services. When the goods are sold or services are provided, GST or output tax is collected based on the selling price. n At the end of his taxable period, he submits his return declaring the output tax and claiming a credit on the input tax he paid. (Output tax - Input tax) n If tax on input exceeds the tax on output (normally zero rated goods), the difference is refunded ã SAP AG 2002, Title of Presentation, Speaker Name 5

How GST Works n The taxable person pays GST or input tax on his business purchases. n He then adds value to those goods and services. When the goods are sold or services are provided, GST or output tax is collected based on the selling price. n At the end of his taxable period, he submits his return declaring the output tax and claiming a credit on the input tax he paid. (Output tax - Input tax) n If tax on input exceeds the tax on output (normally zero rated goods), the difference is refunded ã SAP AG 2002, Title of Presentation, Speaker Name 5

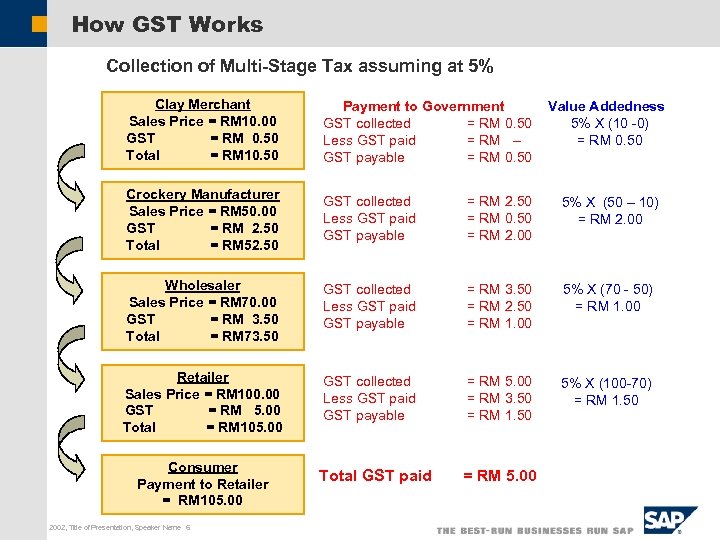

How GST Works Collection of Multi-Stage Tax assuming at 5% Clay Merchant Sales Price = RM 10. 00 GST = RM 0. 50 Total = RM 10. 50 Payment to Government GST collected = RM 0. 50 Less GST paid = RM -GST payable = RM 0. 50 Crockery Manufacturer Sales Price = RM 50. 00 GST = RM 2. 50 Total = RM 52. 50 GST collected Less GST paid GST payable = RM 2. 50 = RM 0. 50 = RM 2. 00 5% X (50 – 10) = RM 2. 00 Wholesaler Sales Price = RM 70. 00 GST = RM 3. 50 Total = RM 73. 50 GST collected Less GST paid GST payable = RM 3. 50 = RM 2. 50 = RM 1. 00 5% X (70 - 50) = RM 1. 00 Retailer Sales Price = RM 100. 00 GST = RM 5. 00 Total = RM 105. 00 GST collected Less GST paid GST payable = RM 5. 00 = RM 3. 50 = RM 1. 50 5% X (100 -70) = RM 1. 50 Total GST paid = RM 5. 00 Consumer Payment to Retailer = RM 105. 00 ã SAP AG 2002, Title of Presentation, Speaker Name 6 Value Addedness 5% X (10 -0) = RM 0. 50

How GST Works Collection of Multi-Stage Tax assuming at 5% Clay Merchant Sales Price = RM 10. 00 GST = RM 0. 50 Total = RM 10. 50 Payment to Government GST collected = RM 0. 50 Less GST paid = RM -GST payable = RM 0. 50 Crockery Manufacturer Sales Price = RM 50. 00 GST = RM 2. 50 Total = RM 52. 50 GST collected Less GST paid GST payable = RM 2. 50 = RM 0. 50 = RM 2. 00 5% X (50 – 10) = RM 2. 00 Wholesaler Sales Price = RM 70. 00 GST = RM 3. 50 Total = RM 73. 50 GST collected Less GST paid GST payable = RM 3. 50 = RM 2. 50 = RM 1. 00 5% X (70 - 50) = RM 1. 00 Retailer Sales Price = RM 100. 00 GST = RM 5. 00 Total = RM 105. 00 GST collected Less GST paid GST payable = RM 5. 00 = RM 3. 50 = RM 1. 50 5% X (100 -70) = RM 1. 50 Total GST paid = RM 5. 00 Consumer Payment to Retailer = RM 105. 00 ã SAP AG 2002, Title of Presentation, Speaker Name 6 Value Addedness 5% X (10 -0) = RM 0. 50

Important Notice n This GST Model is an initial proposal from the Tax Review Panel n Any view expressed in the discussion paper is the view of the Panel and does not represent the official view of the Government n The Government reserves the right to change and/or modify any part of this proposal ã SAP AG 2002, Title of Presentation, Speaker Name 7

Important Notice n This GST Model is an initial proposal from the Tax Review Panel n Any view expressed in the discussion paper is the view of the Panel and does not represent the official view of the Government n The Government reserves the right to change and/or modify any part of this proposal ã SAP AG 2002, Title of Presentation, Speaker Name 7

Where will GST impact? n Do you know what are the business processes areas that GST will impact? n Do you know if your System is GST Compliant? n Do you know what it takes to implement GST in your system? n How seamless is the integration with the existing processes? ã SAP AG 2002, Title of Presentation, Speaker Name 8

Where will GST impact? n Do you know what are the business processes areas that GST will impact? n Do you know if your System is GST Compliant? n Do you know what it takes to implement GST in your system? n How seamless is the integration with the existing processes? ã SAP AG 2002, Title of Presentation, Speaker Name 8

Business Process Areas where GST will Impact n Vendor invoicing and customer billing system in your system u The purchase of goods and services will give rise to GST input tax. u The sale of goods and services will give rise to GST output tax. n Payments and refunds of GST with the Kastam Diraja Malaysia u The supplier of the taxable goods or services is either eligible to refund or liable for payment of GST tax n Reports and forms for routine filing and reporting u Subject to the requirements of the Kastam Diraja, your system will need to provide the relevant reports and forms to support payments and refunds, audits and regular submissions. n Changes in configuration arising from future changes in legislation u Future budget changes may likely to affect is likely to affect vendors, customers, goods (material) and GST rates. ã SAP AG 2002, Title of Presentation, Speaker Name 9

Business Process Areas where GST will Impact n Vendor invoicing and customer billing system in your system u The purchase of goods and services will give rise to GST input tax. u The sale of goods and services will give rise to GST output tax. n Payments and refunds of GST with the Kastam Diraja Malaysia u The supplier of the taxable goods or services is either eligible to refund or liable for payment of GST tax n Reports and forms for routine filing and reporting u Subject to the requirements of the Kastam Diraja, your system will need to provide the relevant reports and forms to support payments and refunds, audits and regular submissions. n Changes in configuration arising from future changes in legislation u Future budget changes may likely to affect is likely to affect vendors, customers, goods (material) and GST rates. ã SAP AG 2002, Title of Presentation, Speaker Name 9

Business Process Areas where GST will Impact n Seeking refunds from Kastam Di. Raja u. Tax reports must be able to match eligible input tax credits against taxable output tax n Bad Debts u. GST paid for goods and services sold, but bills cannot be collected. u. Tax reports and invoices must support tax paid for customer n Business conducted in FTZs, ICDs, outside country, etc. ã SAP AG 2002, Title of Presentation, Speaker Name 10

Business Process Areas where GST will Impact n Seeking refunds from Kastam Di. Raja u. Tax reports must be able to match eligible input tax credits against taxable output tax n Bad Debts u. GST paid for goods and services sold, but bills cannot be collected. u. Tax reports and invoices must support tax paid for customer n Business conducted in FTZs, ICDs, outside country, etc. ã SAP AG 2002, Title of Presentation, Speaker Name 10

Where in your system will GST impact? n It will impact all major system areas: u. Inventory u. Purchase orders, Debit Notes u. Sales Orders, Credit Notes u. Accounts Receivable, Accounts Payable u. General Ledger n Configure the relevant tax procedures, tax codes and tax rates n Configured the relevant account determination for GST postings n GST impact on existing forms n GST impact on existing reports ã SAP AG 2002, Title of Presentation, Speaker Name 11

Where in your system will GST impact? n It will impact all major system areas: u. Inventory u. Purchase orders, Debit Notes u. Sales Orders, Credit Notes u. Accounts Receivable, Accounts Payable u. General Ledger n Configure the relevant tax procedures, tax codes and tax rates n Configured the relevant account determination for GST postings n GST impact on existing forms n GST impact on existing reports ã SAP AG 2002, Title of Presentation, Speaker Name 11

Transitional Issues Actions required NOW n All existing contracts extending beyond 1 January 2007 should be reviewed n The GST implications on all existing contracts should be checked n The GST implications of new contracts entered into from now until 1 January 2007 should be considered n Consider what further actions may be needed as a result of the above, for example, contact a solicitor ã SAP AG 2002, Title of Presentation, Speaker Name 12

Transitional Issues Actions required NOW n All existing contracts extending beyond 1 January 2007 should be reviewed n The GST implications on all existing contracts should be checked n The GST implications of new contracts entered into from now until 1 January 2007 should be considered n Consider what further actions may be needed as a result of the above, for example, contact a solicitor ã SAP AG 2002, Title of Presentation, Speaker Name 12

Impact of not having a GST compliant system n All GST tax input and outputs forms and reports will have to be manually generated u. Risk of miscalculation, prone to errors u. Strenuous and laborious task if the volume is high n Confidence of your customers and suppliers n More scrutiny from the relevant authorities e. g. IRD, auditors ã SAP AG 2002, Title of Presentation, Speaker Name 13

Impact of not having a GST compliant system n All GST tax input and outputs forms and reports will have to be manually generated u. Risk of miscalculation, prone to errors u. Strenuous and laborious task if the volume is high n Confidence of your customers and suppliers n More scrutiny from the relevant authorities e. g. IRD, auditors ã SAP AG 2002, Title of Presentation, Speaker Name 13

Some thots …. Businesses that had the least problems with the GST were those that used a computer package. … …. Businesses that fared the worst relied on the show box method or a system of their own design …. …. The most common error relating to input tax credits arose from not having a system in place to correctly record the GST charged by suppliers …. . Excerpts from the article ‘Adjustment to GST keeps accountants on their toes’ Max Newnham July 15, 2002 The Age, Australia ã SAP AG 2002, Title of Presentation, Speaker Name 15

Some thots …. Businesses that had the least problems with the GST were those that used a computer package. … …. Businesses that fared the worst relied on the show box method or a system of their own design …. …. The most common error relating to input tax credits arose from not having a system in place to correctly record the GST charged by suppliers …. . Excerpts from the article ‘Adjustment to GST keeps accountants on their toes’ Max Newnham July 15, 2002 The Age, Australia ã SAP AG 2002, Title of Presentation, Speaker Name 15

Thank you

Thank you

Copyright 2005 SAP AG. All Rights Reserved No part of this publication may be reproduced or transmitted in any form or for any purpose without the express permission of SAP AG. The information contained herein may be changed without prior notice. Some software products marketed by SAP AG and its distributors contain proprietary software components of other software vendors. Microsoft, Windows, Outlook, and Power. Point are registered trademarks of Microsoft Corporation. IBM, DB 2 Universal Database, OS/2, Parallel Sysplex, MVS/ESA, AIX, S/390, AS/400, OS/390, OS/400, i. Series, p. Series, x. Series, z/OS, AFP, Intelligent Miner, Web. Sphere, Netfinity, Tivoli, and Informix are trademarks or registered trademarks of IBM Corporation in the United States and/or other countries. Oracle is a registered trademark of Oracle Corporation. UNIX, X/Open, OSF/1, and Motif are registered trademarks of the Open Group. Citrix, ICA, Program Neighborhood, Meta. Frame, Win. Frame, Video. Frame, and Multi. Win are trademarks or registered trademarks of Citrix Systems, Inc. HTML, XHTML and W 3 C are trademarks or registered trademarks of W 3 C®, World Wide Web Consortium, Massachusetts Institute of Technology. Java is a registered trademark of Sun Microsystems, Inc. Java. Script is a registered trademark of Sun Microsystems, Inc. , used under license for technology invented and implemented by Netscape. Max. DB is a trademark of My. SQL AB, Sweden. SAP, R/3, my. SAP. com, x. Apps, x. App, SAP Net. Weaver and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP AG in Germany and in several other countries all over the world. All other product and service names mentioned are the trademarks of their respective companies. Data contained in this document serves informational purposes only. National product specifications may vary. These materials are subject to change without notice. These materials are provided by SAP AG and its affiliated companies ("SAP Group") for informational purposes only, without representation or warranty of any kind, and SAP Group shall not be liable for errors or omissions with respect to the materials. The only warranties for SAP Group products and services are those that are set forth in the express warranty statements accompanying such products and services, if any. Nothing herein should be construed as constituting an additional warranty. ã SAP AG 2002, Title of Presentation, Speaker Name 17

Copyright 2005 SAP AG. All Rights Reserved No part of this publication may be reproduced or transmitted in any form or for any purpose without the express permission of SAP AG. The information contained herein may be changed without prior notice. Some software products marketed by SAP AG and its distributors contain proprietary software components of other software vendors. Microsoft, Windows, Outlook, and Power. Point are registered trademarks of Microsoft Corporation. IBM, DB 2 Universal Database, OS/2, Parallel Sysplex, MVS/ESA, AIX, S/390, AS/400, OS/390, OS/400, i. Series, p. Series, x. Series, z/OS, AFP, Intelligent Miner, Web. Sphere, Netfinity, Tivoli, and Informix are trademarks or registered trademarks of IBM Corporation in the United States and/or other countries. Oracle is a registered trademark of Oracle Corporation. UNIX, X/Open, OSF/1, and Motif are registered trademarks of the Open Group. Citrix, ICA, Program Neighborhood, Meta. Frame, Win. Frame, Video. Frame, and Multi. Win are trademarks or registered trademarks of Citrix Systems, Inc. HTML, XHTML and W 3 C are trademarks or registered trademarks of W 3 C®, World Wide Web Consortium, Massachusetts Institute of Technology. Java is a registered trademark of Sun Microsystems, Inc. Java. Script is a registered trademark of Sun Microsystems, Inc. , used under license for technology invented and implemented by Netscape. Max. DB is a trademark of My. SQL AB, Sweden. SAP, R/3, my. SAP. com, x. Apps, x. App, SAP Net. Weaver and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP AG in Germany and in several other countries all over the world. All other product and service names mentioned are the trademarks of their respective companies. Data contained in this document serves informational purposes only. National product specifications may vary. These materials are subject to change without notice. These materials are provided by SAP AG and its affiliated companies ("SAP Group") for informational purposes only, without representation or warranty of any kind, and SAP Group shall not be liable for errors or omissions with respect to the materials. The only warranties for SAP Group products and services are those that are set forth in the express warranty statements accompanying such products and services, if any. Nothing herein should be construed as constituting an additional warranty. ã SAP AG 2002, Title of Presentation, Speaker Name 17