d03bf9e257a43df5976b651dfaebc83c.ppt

- Количество слайдов: 14

Goldman Sachs ESG: Integrating ESG into Investment Research Global Investment Research AHC Group June 2006 Shareholder Value Workshop Sarah Forrest 44 -20 -7552 -9368 sarah. forrest@gs. com

Goldman Sachs ESG: Integrating ESG into Investment Research Global Investment Research AHC Group June 2006 Shareholder Value Workshop Sarah Forrest 44 -20 -7552 -9368 sarah. forrest@gs. com

Goldman Sachs ESG Research Overview § § § Vision and objectives What is ESG? ESG investment and the SRI market Goldman Sachs and ESG – why? Global Energy – Integrating ESG 10 reasons for integration of ESG and finance Goldman Sachs Global Investment Research 2

Goldman Sachs ESG Research Overview § § § Vision and objectives What is ESG? ESG investment and the SRI market Goldman Sachs and ESG – why? Global Energy – Integrating ESG 10 reasons for integration of ESG and finance Goldman Sachs Global Investment Research 2

Goldman Sachs ESG Research Vision & Objectives Vision § To integrate environmental, social and governance issues with industrial analysis and valuation on a sector-by-sector basis, and to identify investment opportunities related to carbon finance, alternative energy, and other emerging ESG issues. Long term objectives § To transfer expertise of ESG issues and research methodology to all sector teams to maintain ESG as part of ‘normal’ research § Global ESG coverage of GS universe (2000 stocks in 5 years) Goldman Sachs Global Investment Research 3

Goldman Sachs ESG Research Vision & Objectives Vision § To integrate environmental, social and governance issues with industrial analysis and valuation on a sector-by-sector basis, and to identify investment opportunities related to carbon finance, alternative energy, and other emerging ESG issues. Long term objectives § To transfer expertise of ESG issues and research methodology to all sector teams to maintain ESG as part of ‘normal’ research § Global ESG coverage of GS universe (2000 stocks in 5 years) Goldman Sachs Global Investment Research 3

Goldman Sachs ESG Research What is ESG? I. § § Environmental Inputs – Energy, Water Outputs – Climate Change, Emissions, Waste II. § § Social Leadership – Accountability, Reporting, Development Employees – Diversity, Training, Labour relations Customers – Product safety, Responsible marketing Communities – Human rights, Social investments, Transparency III. § § Governance Transparency Independence Compensation Shareholder rights Management of ESG issues = Proxy for quality of management Goldman Sachs Global Investment Research 4

Goldman Sachs ESG Research What is ESG? I. § § Environmental Inputs – Energy, Water Outputs – Climate Change, Emissions, Waste II. § § Social Leadership – Accountability, Reporting, Development Employees – Diversity, Training, Labour relations Customers – Product safety, Responsible marketing Communities – Human rights, Social investments, Transparency III. § § Governance Transparency Independence Compensation Shareholder rights Management of ESG issues = Proxy for quality of management Goldman Sachs Global Investment Research 4

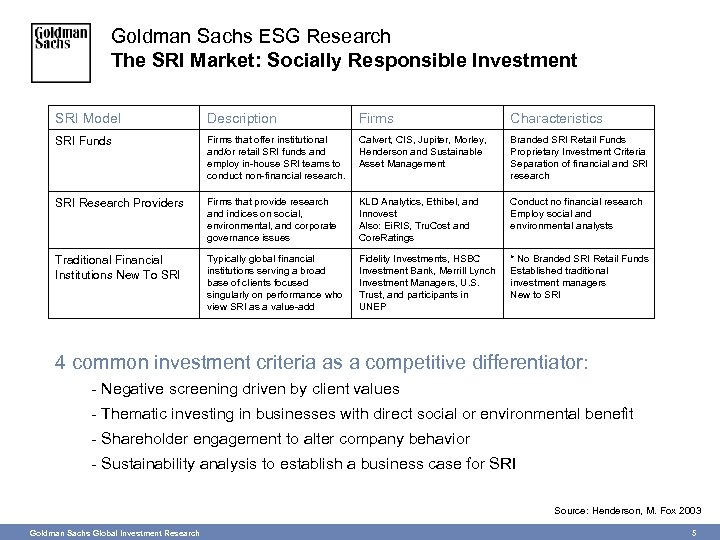

Goldman Sachs ESG Research The SRI Market: Socially Responsible Investment SRI Model Description Firms Characteristics SRI Funds Firms that offer institutional and/or retail SRI funds and employ in-house SRI teams to conduct non-financial research. Calvert, CIS, Jupiter, Morley, Henderson and Sustainable Asset Management Branded SRI Retail Funds Proprietary Investment Criteria Separation of financial and SRI research SRI Research Providers Firms that provide research and indices on social, environmental, and corporate governance issues KLD Analytics, Ethibel, and Innovest Also: Ei. RIS, Tru. Cost and Core. Ratings Conduct no financial research Employ social and environmental analysts Traditional Financial Institutions New To SRI Typically global financial institutions serving a broad base of clients focused singularly on performance who view SRI as a value-add Fidelity Investments, HSBC Investment Bank, Merrill Lynch Investment Managers, U. S. Trust, and participants in UNEP * No Branded SRI Retail Funds Established traditional investment managers New to SRI 4 common investment criteria as a competitive differentiator: - Negative screening driven by client values - Thematic investing in businesses with direct social or environmental benefit - Shareholder engagement to alter company behavior - Sustainability analysis to establish a business case for SRI Source: Henderson, M. Fox 2003 Goldman Sachs Global Investment Research 5

Goldman Sachs ESG Research The SRI Market: Socially Responsible Investment SRI Model Description Firms Characteristics SRI Funds Firms that offer institutional and/or retail SRI funds and employ in-house SRI teams to conduct non-financial research. Calvert, CIS, Jupiter, Morley, Henderson and Sustainable Asset Management Branded SRI Retail Funds Proprietary Investment Criteria Separation of financial and SRI research SRI Research Providers Firms that provide research and indices on social, environmental, and corporate governance issues KLD Analytics, Ethibel, and Innovest Also: Ei. RIS, Tru. Cost and Core. Ratings Conduct no financial research Employ social and environmental analysts Traditional Financial Institutions New To SRI Typically global financial institutions serving a broad base of clients focused singularly on performance who view SRI as a value-add Fidelity Investments, HSBC Investment Bank, Merrill Lynch Investment Managers, U. S. Trust, and participants in UNEP * No Branded SRI Retail Funds Established traditional investment managers New to SRI 4 common investment criteria as a competitive differentiator: - Negative screening driven by client values - Thematic investing in businesses with direct social or environmental benefit - Shareholder engagement to alter company behavior - Sustainability analysis to establish a business case for SRI Source: Henderson, M. Fox 2003 Goldman Sachs Global Investment Research 5

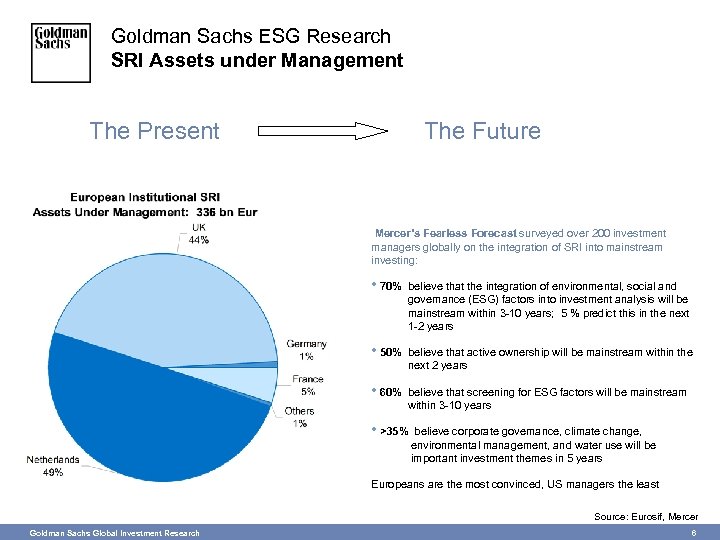

Goldman Sachs ESG Research SRI Assets under Management The Present The Future Mercer’s Fearless Forecast surveyed over 200 investment managers globally on the integration of SRI into mainstream investing: • 70% believe that the integration of environmental, social and governance (ESG) factors into investment analysis will be mainstream within 3 -10 years; 5 % predict this in the next 1 -2 years • 50% believe that active ownership will be mainstream within the next 2 years • 60% believe that screening for ESG factors will be mainstream within 3 -10 years • >35% believe corporate governance, climate change, environmental management, and water use will be important investment themes in 5 years Europeans are the most convinced, US managers the least Goldman Sachs Global Investment Research Source: Eurosif, Mercer 6

Goldman Sachs ESG Research SRI Assets under Management The Present The Future Mercer’s Fearless Forecast surveyed over 200 investment managers globally on the integration of SRI into mainstream investing: • 70% believe that the integration of environmental, social and governance (ESG) factors into investment analysis will be mainstream within 3 -10 years; 5 % predict this in the next 1 -2 years • 50% believe that active ownership will be mainstream within the next 2 years • 60% believe that screening for ESG factors will be mainstream within 3 -10 years • >35% believe corporate governance, climate change, environmental management, and water use will be important investment themes in 5 years Europeans are the most convinced, US managers the least Goldman Sachs Global Investment Research Source: Eurosif, Mercer 6

Goldman Sachs ESG Research Why ESG? Why Goldman Sachs has launched ESG Research: I. Client demand § § II. Increased focus on corporate governance (Global) Mainstream investors, Pension and SRI funds (US/Europe) United Nations Environment Programme Finance Initiative (UNEPFI) § MAT 1 – The Materiality of Environment, Social and Governance Issues to Equity Pricing III. Enhanced Analytics Initiative (EAI) § Consortium of buy-side funds allocating commissions to encourage ESG research Goldman Sachs response • • • Feb 2004: Introducing the Goldman Sachs Global Energy Environmental and Social Index (UNEPFI) April 2005: Launch of ESG Research team August 2005, Feb 2006: Global Energy ESG and European Media ESG published United Nations Global Compact keynote address by Anthony Ling on behalf of financial community Participation in Global Reporting Initiative, UN Principles for Responsible Investment, and IPIECA/API Energy industry sustainability reporting guidelines Goldman Sachs Global Investment Research 7

Goldman Sachs ESG Research Why ESG? Why Goldman Sachs has launched ESG Research: I. Client demand § § II. Increased focus on corporate governance (Global) Mainstream investors, Pension and SRI funds (US/Europe) United Nations Environment Programme Finance Initiative (UNEPFI) § MAT 1 – The Materiality of Environment, Social and Governance Issues to Equity Pricing III. Enhanced Analytics Initiative (EAI) § Consortium of buy-side funds allocating commissions to encourage ESG research Goldman Sachs response • • • Feb 2004: Introducing the Goldman Sachs Global Energy Environmental and Social Index (UNEPFI) April 2005: Launch of ESG Research team August 2005, Feb 2006: Global Energy ESG and European Media ESG published United Nations Global Compact keynote address by Anthony Ling on behalf of financial community Participation in Global Reporting Initiative, UN Principles for Responsible Investment, and IPIECA/API Energy industry sustainability reporting guidelines Goldman Sachs Global Investment Research 7

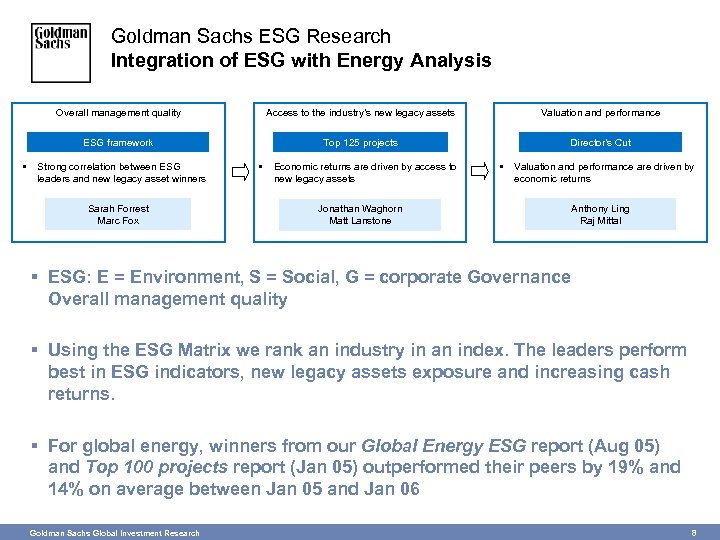

Goldman Sachs ESG Research Integration of ESG with Energy Analysis Overall management quality Valuation and performance ESG framework • Access to the industry’s new legacy assets Top 125 projects Director’s Cut Strong correlation between ESG leaders and new legacy asset winners Sarah Forrest Marc Fox • Economic returns are driven by access to new legacy assets • Valuation and performance are driven by economic returns Jonathan Waghorn Matt Lanstone Anthony Ling Raj Mittal § ESG: E = Environment, S = Social, G = corporate Governance Overall management quality § Using the ESG Matrix we rank an industry in an index. The leaders perform best in ESG indicators, new legacy assets exposure and increasing cash returns. § For global energy, winners from our Global Energy ESG report (Aug 05) and Top 100 projects report (Jan 05) outperformed their peers by 19% and 14% on average between Jan 05 and Jan 06 Goldman Sachs Global Investment Research 8

Goldman Sachs ESG Research Integration of ESG with Energy Analysis Overall management quality Valuation and performance ESG framework • Access to the industry’s new legacy assets Top 125 projects Director’s Cut Strong correlation between ESG leaders and new legacy asset winners Sarah Forrest Marc Fox • Economic returns are driven by access to new legacy assets • Valuation and performance are driven by economic returns Jonathan Waghorn Matt Lanstone Anthony Ling Raj Mittal § ESG: E = Environment, S = Social, G = corporate Governance Overall management quality § Using the ESG Matrix we rank an industry in an index. The leaders perform best in ESG indicators, new legacy assets exposure and increasing cash returns. § For global energy, winners from our Global Energy ESG report (Aug 05) and Top 100 projects report (Jan 05) outperformed their peers by 19% and 14% on average between Jan 05 and Jan 06 Goldman Sachs Global Investment Research 8

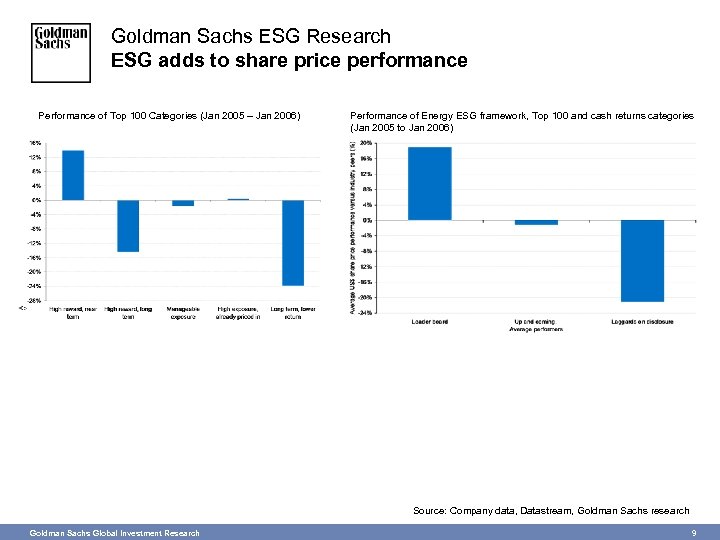

Goldman Sachs ESG Research ESG adds to share price performance Performance of Top 100 Categories (Jan 2005 – Jan 2006) Performance of Energy ESG framework, Top 100 and cash returns categories (Jan 2005 to Jan 2006) Source: Company data, Datastream, Goldman Sachs research Goldman Sachs Global Investment Research 9

Goldman Sachs ESG Research ESG adds to share price performance Performance of Top 100 Categories (Jan 2005 – Jan 2006) Performance of Energy ESG framework, Top 100 and cash returns categories (Jan 2005 to Jan 2006) Source: Company data, Datastream, Goldman Sachs research Goldman Sachs Global Investment Research 9

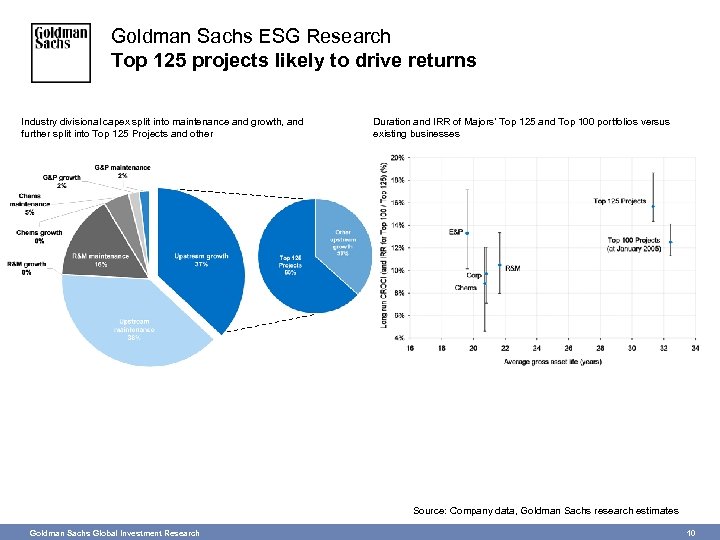

Goldman Sachs ESG Research Top 125 projects likely to drive returns Industry divisional capex split into maintenance and growth, and further split into Top 125 Projects and other Duration and IRR of Majors’ Top 125 and Top 100 portfolios versus existing businesses Source: Company data, Goldman Sachs research estimates Goldman Sachs Global Investment Research 10

Goldman Sachs ESG Research Top 125 projects likely to drive returns Industry divisional capex split into maintenance and growth, and further split into Top 125 Projects and other Duration and IRR of Majors’ Top 125 and Top 100 portfolios versus existing businesses Source: Company data, Goldman Sachs research estimates Goldman Sachs Global Investment Research 10

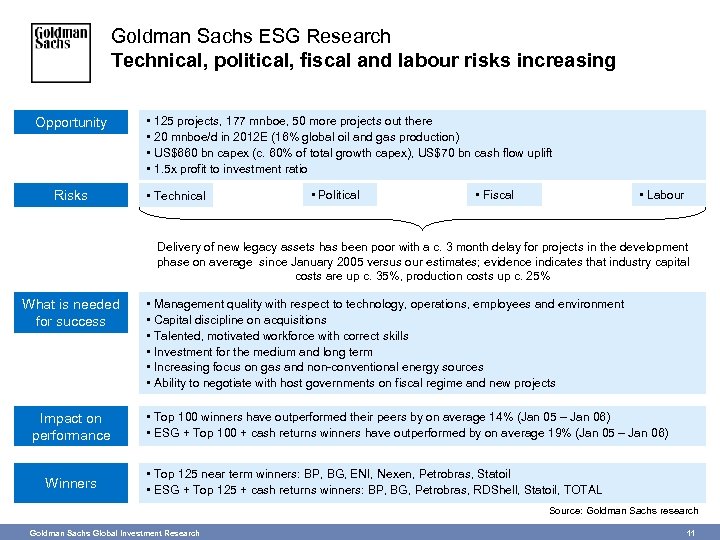

Goldman Sachs ESG Research Technical, political, fiscal and labour risks increasing Opportunity Risks • 125 projects, 177 mnboe, 50 more projects out there • 20 mnboe/d in 2012 E (16% global oil and gas production) • US$660 bn capex (c. 60% of total growth capex), US$70 bn cash flow uplift • 1. 5 x profit to investment ratio • Technical • Political • Fiscal • Labour Delivery of new legacy assets has been poor with a c. 3 month delay for projects in the development phase on average since January 2005 versus our estimates; evidence indicates that industry capital costs are up c. 35%, production costs up c. 25% What is needed for success Impact on performance Winners • Management quality with respect to technology, operations, employees and environment • Capital discipline on acquisitions • Talented, motivated workforce with correct skills • Investment for the medium and long term • Increasing focus on gas and non-conventional energy sources • Ability to negotiate with host governments on fiscal regime and new projects • Top 100 winners have outperformed their peers by on average 14% (Jan 05 – Jan 06) • ESG + Top 100 + cash returns winners have outperformed by on average 19% (Jan 05 – Jan 06) • Top 125 near term winners: BP, BG, ENI, Nexen, Petrobras, Statoil • ESG + Top 125 + cash returns winners: BP, BG, Petrobras, RDShell, Statoil, TOTAL Source: Goldman Sachs research Goldman Sachs Global Investment Research 11

Goldman Sachs ESG Research Technical, political, fiscal and labour risks increasing Opportunity Risks • 125 projects, 177 mnboe, 50 more projects out there • 20 mnboe/d in 2012 E (16% global oil and gas production) • US$660 bn capex (c. 60% of total growth capex), US$70 bn cash flow uplift • 1. 5 x profit to investment ratio • Technical • Political • Fiscal • Labour Delivery of new legacy assets has been poor with a c. 3 month delay for projects in the development phase on average since January 2005 versus our estimates; evidence indicates that industry capital costs are up c. 35%, production costs up c. 25% What is needed for success Impact on performance Winners • Management quality with respect to technology, operations, employees and environment • Capital discipline on acquisitions • Talented, motivated workforce with correct skills • Investment for the medium and long term • Increasing focus on gas and non-conventional energy sources • Ability to negotiate with host governments on fiscal regime and new projects • Top 100 winners have outperformed their peers by on average 14% (Jan 05 – Jan 06) • ESG + Top 100 + cash returns winners have outperformed by on average 19% (Jan 05 – Jan 06) • Top 125 near term winners: BP, BG, ENI, Nexen, Petrobras, Statoil • ESG + Top 125 + cash returns winners: BP, BG, Petrobras, RDShell, Statoil, TOTAL Source: Goldman Sachs research Goldman Sachs Global Investment Research 11

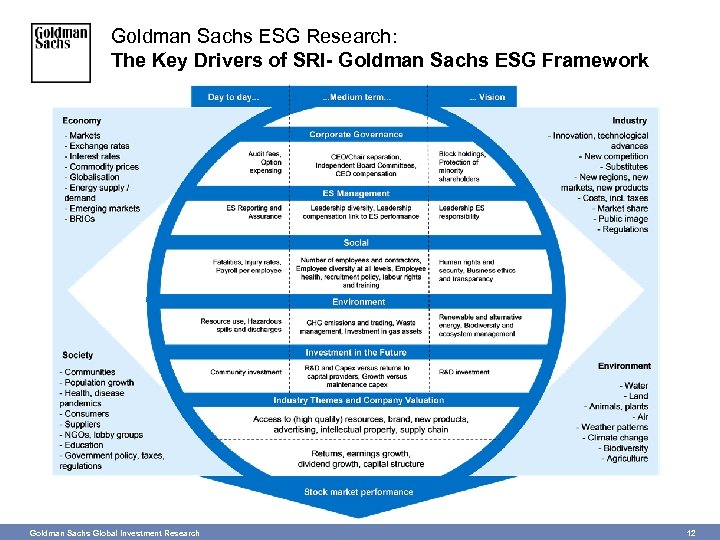

Goldman Sachs ESG Research: The Key Drivers of SRI- Goldman Sachs ESG Framework Goldman Sachs Global Investment Research 12

Goldman Sachs ESG Research: The Key Drivers of SRI- Goldman Sachs ESG Framework Goldman Sachs Global Investment Research 12

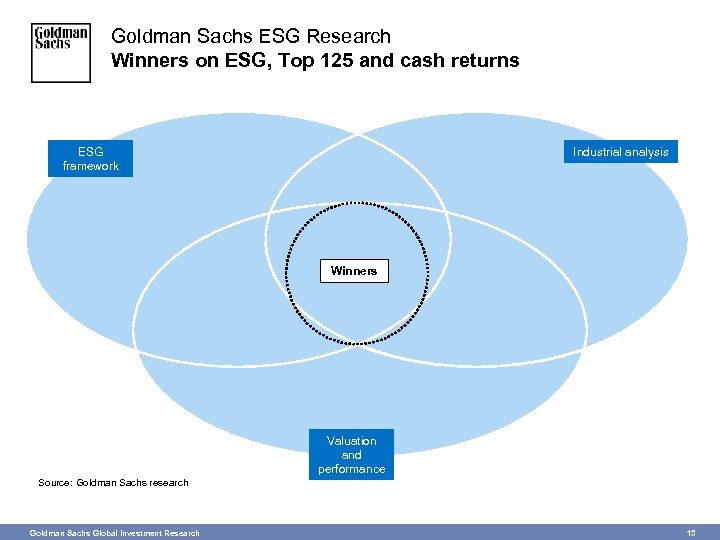

Goldman Sachs ESG Research Winners on ESG, Top 125 and cash returns ESG framework Industrial analysis Winners Valuation and performance Source: Goldman Sachs research Goldman Sachs Global Investment Research 13

Goldman Sachs ESG Research Winners on ESG, Top 125 and cash returns ESG framework Industrial analysis Winners Valuation and performance Source: Goldman Sachs research Goldman Sachs Global Investment Research 13

Goldman Sachs ESG Research 10 reasons for integration of ESG in finance § § § § § Unique role of finance between companies and investors Experience with risk and return balance, meeting liabilities ESG as foundation for sustainable and strong economy UN Global Compact initiative in 2000 Global social and environmental challenges, e. g. secure energy supply, climate change, water shortages, BRICs growth Increasing awareness of ESG issues by analysts and investors Increasing availability of ESG data UNEP-FI working group of investors request ESG research World Bank Equator Principles Sector-specific technical, political and product-related risks Goldman Sachs Global Investment Research 14

Goldman Sachs ESG Research 10 reasons for integration of ESG in finance § § § § § Unique role of finance between companies and investors Experience with risk and return balance, meeting liabilities ESG as foundation for sustainable and strong economy UN Global Compact initiative in 2000 Global social and environmental challenges, e. g. secure energy supply, climate change, water shortages, BRICs growth Increasing awareness of ESG issues by analysts and investors Increasing availability of ESG data UNEP-FI working group of investors request ESG research World Bank Equator Principles Sector-specific technical, political and product-related risks Goldman Sachs Global Investment Research 14