7996fd7dbddc911d7b054243ee7cfd70.ppt

- Количество слайдов: 16

Golden Shares: Principles and Alternatives Colin Mayer Saïd Business School University of Oxford

Golden Shares: Principles and Alternatives Colin Mayer Saïd Business School University of Oxford

Differential Voting Rights • GS example of general class of differential voting rights, e. g. dual class shares • Associated with disproportionate control by particular shareholders, e. g. founding families • Create private benefits at expense of other shareholders

Differential Voting Rights • GS example of general class of differential voting rights, e. g. dual class shares • Associated with disproportionate control by particular shareholders, e. g. founding families • Create private benefits at expense of other shareholders

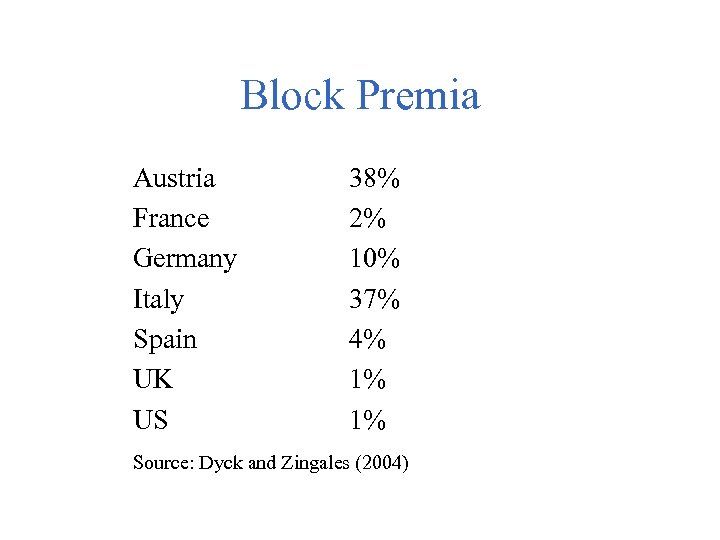

Block Premia Austria France Germany Italy Spain UK US 38% 2% 10% 37% 4% 1% 1% Source: Dyck and Zingales (2004)

Block Premia Austria France Germany Italy Spain UK US 38% 2% 10% 37% 4% 1% 1% Source: Dyck and Zingales (2004)

Consequences • In absence of private benefits, one share-one vote is optimal • Private benefits may justify deviations • GS confers disproportionate control on the state • May therefore be justified by deviation of social from market benefits • Since free rider problem of market control, primarily impediment to market for corporate control • Is this impediment warranted?

Consequences • In absence of private benefits, one share-one vote is optimal • Private benefits may justify deviations • GS confers disproportionate control on the state • May therefore be justified by deviation of social from market benefits • Since free rider problem of market control, primarily impediment to market for corporate control • Is this impediment warranted?

Bid Premia • Large gains to target shareholders in takeovers, in excess of 15% • Particularly so in hostile bids (30%) • Where do these come from - wealth transfers or efficiency gains? • Elimination of GS creates opportunities for large gains • Is this desirable?

Bid Premia • Large gains to target shareholders in takeovers, in excess of 15% • Particularly so in hostile bids (30%) • Where do these come from - wealth transfers or efficiency gains? • Elimination of GS creates opportunities for large gains • Is this desirable?

Takeover Restrictions • Yes - provided that there is not a social/ market divergence • Bid premia are prima facie but not sufficient evidence of benefits • Critical questions: – Do takeovers create social-market conflicts? – Why? – How large? – Are there better remedies than GS?

Takeover Restrictions • Yes - provided that there is not a social/ market divergence • Bid premia are prima facie but not sufficient evidence of benefits • Critical questions: – Do takeovers create social-market conflicts? – Why? – How large? – Are there better remedies than GS?

Importance of Ownership • Ownership confers control rights • Significance in relation to investment and reinvestment decisions • Important where there is contract incompleteness • If possible to specify national objectives completely in, for example, regulatory contract then ownership is irrelevant • But if not then ownership matters

Importance of Ownership • Ownership confers control rights • Significance in relation to investment and reinvestment decisions • Important where there is contract incompleteness • If possible to specify national objectives completely in, for example, regulatory contract then ownership is irrelevant • But if not then ownership matters

Alternative Forms • • State ownership Partially privatized Private firm with GS Private regulated firm

Alternative Forms • • State ownership Partially privatized Private firm with GS Private regulated firm

GS versus State Ownership • Large share blocks threaten minorities • Divergence of interests, particularly so when large shareholder is state • Discourages private investment and raises cost of capital • GS lessen this problem by restricting the rights of the state to intervene • Nevertheless, impede beneficial restructurings and undermine market integration

GS versus State Ownership • Large share blocks threaten minorities • Divergence of interests, particularly so when large shareholder is state • Discourages private investment and raises cost of capital • GS lessen this problem by restricting the rights of the state to intervene • Nevertheless, impede beneficial restructurings and undermine market integration

Market Integration • Free flow of corporate control natural extension of free flow of capital • Should avoid impediments to international markets for corporate control • Analogous to takeover directive and breakthrough provisions • Important distinction – differential voting rights consistent with freedom of contracting, GS are not. Are there alternatives?

Market Integration • Free flow of corporate control natural extension of free flow of capital • Should avoid impediments to international markets for corporate control • Analogous to takeover directive and breakthrough provisions • Important distinction – differential voting rights consistent with freedom of contracting, GS are not. Are there alternatives?

Regulation • Can social-market divergences be corrected through regulation? • Can social obligations be specified in licences and contracts? • Can bonds and covenants be used to provide appropriate incentives and protection?

Regulation • Can social-market divergences be corrected through regulation? • Can social obligations be specified in licences and contracts? • Can bonds and covenants be used to provide appropriate incentives and protection?

Examples • BAA – GS governs changes in holdings of more than 15% and airport closure decisions • Spanish legislation regarding major corporate decisions, e. g. winding up, mergers and change in control of such companies as Endesa, Repsol and Telefonica • ECJ ruled against British government in relation to BAA and Spanish government in relation to Tabacelera and Argentaria

Examples • BAA – GS governs changes in holdings of more than 15% and airport closure decisions • Spanish legislation regarding major corporate decisions, e. g. winding up, mergers and change in control of such companies as Endesa, Repsol and Telefonica • ECJ ruled against British government in relation to BAA and Spanish government in relation to Tabacelera and Argentaria

Issue • Concerns relate to delivery of services to customers (quality, efficiency, price) • Can be specified in licences and regulatory contracts • But more legitimate concern in relation to new services - would rival airport owner seek to develop London or domestic base? • Where there is limited innovation, e. g. in water and electricity, regulatory contracts easy to specify but less so in e. g. telecoms

Issue • Concerns relate to delivery of services to customers (quality, efficiency, price) • Can be specified in licences and regulatory contracts • But more legitimate concern in relation to new services - would rival airport owner seek to develop London or domestic base? • Where there is limited innovation, e. g. in water and electricity, regulatory contracts easy to specify but less so in e. g. telecoms

Investor Protection • Efficient operation of market for corporate control requires regulation to protect investors as well as customers • In particular, market in corporate control requires takeover legislation to protect minorities

Investor Protection • Efficient operation of market for corporate control requires regulation to protect investors as well as customers • In particular, market in corporate control requires takeover legislation to protect minorities

Conclusions • GS debate should be considered in context of literature on ownership and control • Points to benefits of free market in control as well as capital • GS should only be justified on basis of clear public interest case and absence of alternative contractual remedies

Conclusions • GS debate should be considered in context of literature on ownership and control • Points to benefits of free market in control as well as capital • GS should only be justified on basis of clear public interest case and absence of alternative contractual remedies

Conclusions • Implication is that GS should only be permitted in limited number of cases and sectors • Prohibition on state control does not however have implications for differential voting rights in private sector

Conclusions • Implication is that GS should only be permitted in limited number of cases and sectors • Prohibition on state control does not however have implications for differential voting rights in private sector