5f0d1de64fdac2514682a6b099d1545a.ppt

- Количество слайдов: 32

Golden Gate Regional Center Participant. Directed Program Onsite Enrollment Sessions www. publicpartnerships. com

Golden Gate Regional Center Participant. Directed Program Onsite Enrollment Sessions www. publicpartnerships. com

Agenda 1. 2. 3. 4. 5. 6. 7. 8. Emergency Regulation & Impact of FMS Differences in Voucher Program vs. an FMS Program Guidelines Enrollment Process Worker Packet Overview Employer Packet Overview Q&A Enrollment Assistance 2

Agenda 1. 2. 3. 4. 5. 6. 7. 8. Emergency Regulation & Impact of FMS Differences in Voucher Program vs. an FMS Program Guidelines Enrollment Process Worker Packet Overview Employer Packet Overview Q&A Enrollment Assistance 2

Emergency Regulation & Benefits of using PPL • CA Department of Developmental Services (DSS) issued Emergency Regulations stating that to receive federal funds for voucher services Regional Centers must contract with Financial Management Service (FMS) providers. • Public Partnerships (PPL) is the FMS provider for the Golden Gate Regional Center Participant-Directed Program • Benefits of using PPL: • • • PPL withholds all necessary taxes and files them with the state and federal governments PPL issues annual W-2 statements to your workers Customer Service Staff available in multiple languages Online timesheet and invoice submission with instant feedback 24/7 access to timesheet and invoice statuses through PPL’s Web Portal 3

Emergency Regulation & Benefits of using PPL • CA Department of Developmental Services (DSS) issued Emergency Regulations stating that to receive federal funds for voucher services Regional Centers must contract with Financial Management Service (FMS) providers. • Public Partnerships (PPL) is the FMS provider for the Golden Gate Regional Center Participant-Directed Program • Benefits of using PPL: • • • PPL withholds all necessary taxes and files them with the state and federal governments PPL issues annual W-2 statements to your workers Customer Service Staff available in multiple languages Online timesheet and invoice submission with instant feedback 24/7 access to timesheet and invoice statuses through PPL’s Web Portal 3

Differences in Voucher Program vs PPL • • Vendorized individuals are set up as Employers Worker timesheets and invoices are submitted to and paid out by PPL • • • PPL will assist you with resolving any pending timesheets or invoices PPL takes care of all payroll and tax duties on behalf of the Employer including workers compensation and year-end W-2 s PPL tracks employer and worker progress throughout the enrollment process . 4

Differences in Voucher Program vs PPL • • Vendorized individuals are set up as Employers Worker timesheets and invoices are submitted to and paid out by PPL • • • PPL will assist you with resolving any pending timesheets or invoices PPL takes care of all payroll and tax duties on behalf of the Employer including workers compensation and year-end W-2 s PPL tracks employer and worker progress throughout the enrollment process . 4

Program Guidelines • Service cannot begin through PPL until both the Employer and Worker are “Good to Go” and the Social Worker updates the IPP and SANDIS authorization. • • • Workers are not allowed to work more than 40 hours per week or 8 hours per day (no Over Time) Timesheets need to be submitted within 30 days from the date worked • • • Employers will receive a copy of the revised IPP and authorization Submit timesheets according to payroll schedule Workers performing nursing services need to provide proof of their license(s), and the license expiration date(s) along with their registration packet. Workers submitting invoices for Transportation Services (470) need to provide appropriate backup documentation along with the invoice • The exception is Mileage reimbursements: The Worker must instead enter the start and end addresses of each location and the travel must be to and from approved destinations only. 5

Program Guidelines • Service cannot begin through PPL until both the Employer and Worker are “Good to Go” and the Social Worker updates the IPP and SANDIS authorization. • • • Workers are not allowed to work more than 40 hours per week or 8 hours per day (no Over Time) Timesheets need to be submitted within 30 days from the date worked • • • Employers will receive a copy of the revised IPP and authorization Submit timesheets according to payroll schedule Workers performing nursing services need to provide proof of their license(s), and the license expiration date(s) along with their registration packet. Workers submitting invoices for Transportation Services (470) need to provide appropriate backup documentation along with the invoice • The exception is Mileage reimbursements: The Worker must instead enter the start and end addresses of each location and the travel must be to and from approved destinations only. 5

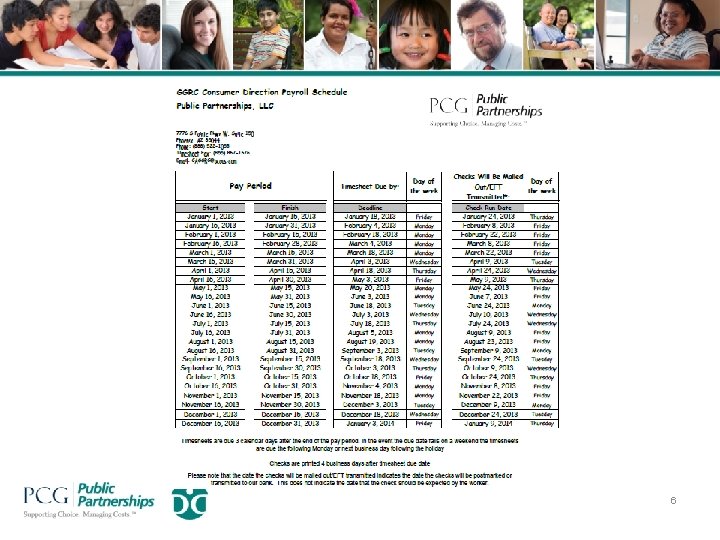

6

6

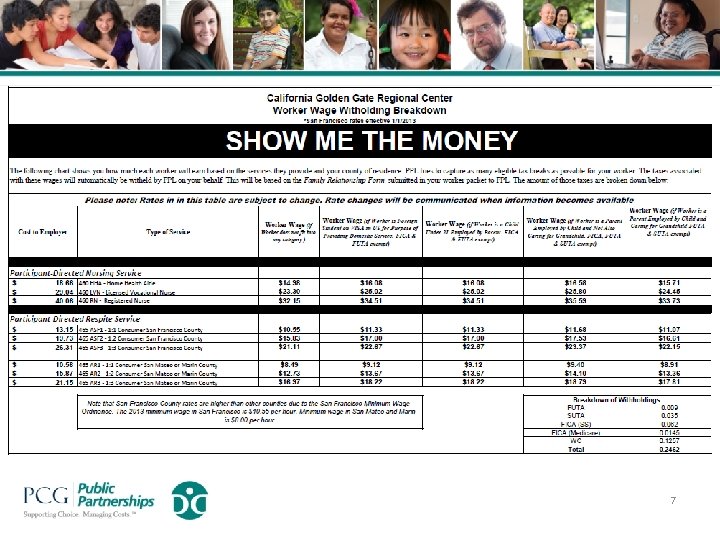

7

7

Enrollment Process • • Release of Information form submitted to Regional Center - complete PPL pre-populates forms required for program enrollment – complete today • Once all Employer forms and Worker forms are returned to PPL, we will notify the Regional Center that you are “Good to Go”. • • Your Social Worker amends the IPP and SANDIS authorization for use with PPL • • You will also receive a call from Customer Service to notify you of your G 2 G status You will receive an updated copy of these from your Social Worker You can start submitting timesheets and invoices for the time period stated on your amended auth. 8

Enrollment Process • • Release of Information form submitted to Regional Center - complete PPL pre-populates forms required for program enrollment – complete today • Once all Employer forms and Worker forms are returned to PPL, we will notify the Regional Center that you are “Good to Go”. • • Your Social Worker amends the IPP and SANDIS authorization for use with PPL • • You will also receive a call from Customer Service to notify you of your G 2 G status You will receive an updated copy of these from your Social Worker You can start submitting timesheets and invoices for the time period stated on your amended auth. 8

Worker Packet Overview 9

Worker Packet Overview 9

Worker Packet Overview – Respite 465 and Nursing 460 • Required Forms: The following forms must be completed and submitted to PPL Ø Worker Application Ø Employment Agreement Ø Criminal Background check preference form Ø USCIS Form I-9 – Employment Eligibility Verification (Employer fills out) Ø IRS Form W-4 – Employee Withholding Certificate Ø CA Form DE 4 – Employee’s Withholding Allowance Certificate Ø Family Relationship Federal Tax Exemption Information Form Ø Training Form • If an individual works for more than one person, a new packet must be completed. A complete packet must be submitted for each participant the individual is working for. 10

Worker Packet Overview – Respite 465 and Nursing 460 • Required Forms: The following forms must be completed and submitted to PPL Ø Worker Application Ø Employment Agreement Ø Criminal Background check preference form Ø USCIS Form I-9 – Employment Eligibility Verification (Employer fills out) Ø IRS Form W-4 – Employee Withholding Certificate Ø CA Form DE 4 – Employee’s Withholding Allowance Certificate Ø Family Relationship Federal Tax Exemption Information Form Ø Training Form • If an individual works for more than one person, a new packet must be completed. A complete packet must be submitted for each participant the individual is working for. 10

Worker Packet Overview – Transportation Only 470 • • This applies to workers/participants who will only be submitting for Transportation reimbursement. Required Forms: The following forms must be completed and submitted to PPL Ø Worker Application Ø Employment Agreement Ø US Form W-9 – Request for Taxpayer Identification Number and Certification Ø Criminal Background check preference form • In the event that a Participant will submit for transportation reimbursement themselves, the Participant will need to be set up as a worker in PPL’s Web Portal. They will need to fill out the required forms above in addition to their Employer packet. 11

Worker Packet Overview – Transportation Only 470 • • This applies to workers/participants who will only be submitting for Transportation reimbursement. Required Forms: The following forms must be completed and submitted to PPL Ø Worker Application Ø Employment Agreement Ø US Form W-9 – Request for Taxpayer Identification Number and Certification Ø Criminal Background check preference form • In the event that a Participant will submit for transportation reimbursement themselves, the Participant will need to be set up as a worker in PPL’s Web Portal. They will need to fill out the required forms above in addition to their Employer packet. 11

Worker Packet Overview (Cont. ) • Forms to Keep : The following forms contain important information about the program Ø Payroll Schedule Ø PPL Customer Service Ø Timesheet Instructions Ø Invoice instructions • Optional Forms: The following forms are not required to be filled out Ø EFT Application Ø Change of Address/Name Form 12

Worker Packet Overview (Cont. ) • Forms to Keep : The following forms contain important information about the program Ø Payroll Schedule Ø PPL Customer Service Ø Timesheet Instructions Ø Invoice instructions • Optional Forms: The following forms are not required to be filled out Ø EFT Application Ø Change of Address/Name Form 12

Worker Application Worker Packet Page: 6 • This is a one page form. The Worker is asked to review, sign, and date the form. • This form is used to confirm the worker’s demographics and inform them of the mandatory Office of the Inspector General check. 13

Worker Application Worker Packet Page: 6 • This is a one page form. The Worker is asked to review, sign, and date the form. • This form is used to confirm the worker’s demographics and inform them of the mandatory Office of the Inspector General check. 13

Employment Agreement Worker Packet Pages: 7 -9 • This is a three page form. The Worker and Employer are asked to review this form together, sign, and date page 9. The Employer should select the applicable services from page 8. • This form is used to facilitate a conversation between the Employer and their Worker(s). It is designed to prompt a discussion where both parties outline their expectations for the position. • This form also informs PPL which services the Worker will be providing. 14

Employment Agreement Worker Packet Pages: 7 -9 • This is a three page form. The Worker and Employer are asked to review this form together, sign, and date page 9. The Employer should select the applicable services from page 8. • This form is used to facilitate a conversation between the Employer and their Worker(s). It is designed to prompt a discussion where both parties outline their expectations for the position. • This form also informs PPL which services the Worker will be providing. 14

W-9 Request for Taxpayer Identification Number and Certification **Return this form if you will ONLY be providing Transportation (470) services** Worker Packet Pages: 10 -13 • This is a four page form. The Worker is asked to review, sign, and date page 10. • This form is used to document the individuals SSN or Tax Identification Number. 15

W-9 Request for Taxpayer Identification Number and Certification **Return this form if you will ONLY be providing Transportation (470) services** Worker Packet Pages: 10 -13 • This is a four page form. The Worker is asked to review, sign, and date page 10. • This form is used to document the individuals SSN or Tax Identification Number. 15

Criminal Background Check Preference Form Worker Packet Page: 14 • This is a one page form. The Employer is asked to select their preference for a criminal check of their worker. They also need to sign, and date the form. • Please note: These checks are not required, this form only designates the Employer’s preference. In the event that a check is required, the Employer must cover the costs and report a pass or fail status to PPL. 16

Criminal Background Check Preference Form Worker Packet Page: 14 • This is a one page form. The Employer is asked to select their preference for a criminal check of their worker. They also need to sign, and date the form. • Please note: These checks are not required, this form only designates the Employer’s preference. In the event that a check is required, the Employer must cover the costs and report a pass or fail status to PPL. 16

Form I-9 Employment Eligibility Verification Worker Packet Page: 19 -20 • This is a two page form. The Employer is asked to review, sign, and date the bottom of page 19. The “Title” box must read “Eo. R”, “Employer” or “Household Employer”. • The worker is asked to select a box in Section I to declare US resident status and also sign and date the bottom of Section I. • This form is used to confirm your immigration and US citizenship information. Federal law requires that all employers & workers complete this form. 17

Form I-9 Employment Eligibility Verification Worker Packet Page: 19 -20 • This is a two page form. The Employer is asked to review, sign, and date the bottom of page 19. The “Title” box must read “Eo. R”, “Employer” or “Household Employer”. • The worker is asked to select a box in Section I to declare US resident status and also sign and date the bottom of Section I. • This form is used to confirm your immigration and US citizenship information. Federal law requires that all employers & workers complete this form. 17

Form W-4 Worker Packet Page: 21 -22 • This is a two page form. The Worker is asked to fill in Lines A-H using the instructions provided. They are also asked to fill in lines 5 -7 and sign and date at the bottom of page 21. • This form is used to determine federal tax withholdings for the worker. 18

Form W-4 Worker Packet Page: 21 -22 • This is a two page form. The Worker is asked to fill in Lines A-H using the instructions provided. They are also asked to fill in lines 5 -7 and sign and date at the bottom of page 21. • This form is used to determine federal tax withholdings for the worker. 18

CA DE-4 Employee's Withholding Allowance Certificate Worker Packet Page: 23 -26 • This is a four page form. The Worker is asked to select their marital status and fill in lines 1 -3 using the instructions provided. Please also sign and date the bottom of page 23. • This form is used to determine state tax withholdings for the worker. 19

CA DE-4 Employee's Withholding Allowance Certificate Worker Packet Page: 23 -26 • This is a four page form. The Worker is asked to select their marital status and fill in lines 1 -3 using the instructions provided. Please also sign and date the bottom of page 23. • This form is used to determine state tax withholdings for the worker. 19

Family Relationship Form Worker Packet Page: 27 • This is a one page form. The Worker is asked to answer questions 1 - 6, sign, and date the form. • This form is designed to capture any tax exemptions the worker may be eligible for based on the relationship of the Employer and worker. 20

Family Relationship Form Worker Packet Page: 27 • This is a one page form. The Worker is asked to answer questions 1 - 6, sign, and date the form. • This form is designed to capture any tax exemptions the worker may be eligible for based on the relationship of the Employer and worker. 20

GGRC Specific Participant Training Form Worker Packet Page: 30 • This is a one page form. The Employer is asked to select any trainings that they will require from the worker, sign, and date the bottom of the page. • The Worker is asked to review, sign, and date the form. • This form is used to confirm if the Employer requires any additional trainings or certifications from their workers. 21

GGRC Specific Participant Training Form Worker Packet Page: 30 • This is a one page form. The Employer is asked to select any trainings that they will require from the worker, sign, and date the bottom of the page. • The Worker is asked to review, sign, and date the form. • This form is used to confirm if the Employer requires any additional trainings or certifications from their workers. 21

Employer Packet Overview 22

Employer Packet Overview 22

Role of the Employer • The Employer must be either the vendorized family member living with the participant or the participant (transportation only), and cannot be under the age of 18. He or she is responsible for: • • • Completing initial employer paperwork; Hiring, interviewing, training, managing and firing workers; Certifying employee eligibility via Form I-9; Defining job, schedule; Reviewing and approving timesheets; Monitor use of authorized services. . 23

Role of the Employer • The Employer must be either the vendorized family member living with the participant or the participant (transportation only), and cannot be under the age of 18. He or she is responsible for: • • • Completing initial employer paperwork; Hiring, interviewing, training, managing and firing workers; Certifying employee eligibility via Form I-9; Defining job, schedule; Reviewing and approving timesheets; Monitor use of authorized services. . 23

Pre-Populated Forms from the Web Portal The Web Portal fills out the forms for the Employer 1. Web Portal pre-populates the following Employer forms required to set up the vendorized family member as an Employer: ü ü IRS Form SS-4 – Application for Employer Identification Number IRS Form 2678 - Employer Appointment of Agent IRS Form 8821 – Tax Information Authorization CA Form DE 1 HW – CA Registration Form for Employers of Household Workers ü CA Form DE 48 – CA Power of Attorney We will walk you through signing these forms today 24

Pre-Populated Forms from the Web Portal The Web Portal fills out the forms for the Employer 1. Web Portal pre-populates the following Employer forms required to set up the vendorized family member as an Employer: ü ü IRS Form SS-4 – Application for Employer Identification Number IRS Form 2678 - Employer Appointment of Agent IRS Form 8821 – Tax Information Authorization CA Form DE 1 HW – CA Registration Form for Employers of Household Workers ü CA Form DE 48 – CA Power of Attorney We will walk you through signing these forms today 24

IRS FORM SS-4: Application for Employer ID Number • • • This is a one page form. The Employer is asked to review, sign, and date the form. (Section 18 and the bottom signature line) This form tells the IRS that the vendorized family member is going to be an Employer. After PPL submits this form, the IRS will assign the Employer an Employer Identification Number. This is what the IRS uses to identify employers when filing tax returns and depositing withholding taxes. We have entered PPL’s address in lines 4 a and 4 b so that IRS paperwork relating to this program will not be sent to the Employer’s home. 25

IRS FORM SS-4: Application for Employer ID Number • • • This is a one page form. The Employer is asked to review, sign, and date the form. (Section 18 and the bottom signature line) This form tells the IRS that the vendorized family member is going to be an Employer. After PPL submits this form, the IRS will assign the Employer an Employer Identification Number. This is what the IRS uses to identify employers when filing tax returns and depositing withholding taxes. We have entered PPL’s address in lines 4 a and 4 b so that IRS paperwork relating to this program will not be sent to the Employer’s home. 25

IRS FORM 2678: Employer Appointment of Agent • • • This is a one page form. The Employer is asked to review, sign, and date the bottom of the form. This form tells the IRS that the Employer is giving PPL permission to complete tax processes on their behalf for this program. This form only allows us to withhold taxes from the worker’s paychecks and deposit those taxes with the IRS. It does not allow PPL access to any personal income tax information. 26

IRS FORM 2678: Employer Appointment of Agent • • • This is a one page form. The Employer is asked to review, sign, and date the bottom of the form. This form tells the IRS that the Employer is giving PPL permission to complete tax processes on their behalf for this program. This form only allows us to withhold taxes from the worker’s paychecks and deposit those taxes with the IRS. It does not allow PPL access to any personal income tax information. 26

IRS FORM 8821: Tax Information Authorization • • • This is a one page form. The Employer is asked to review, sign, and date the bottom of the page. This form allows PPL to discuss their employer withholding account with the IRS. PPL will only be able to discuss the employer forms listed on the document. We will never be able to obtain any personal income tax information. 27

IRS FORM 8821: Tax Information Authorization • • • This is a one page form. The Employer is asked to review, sign, and date the bottom of the page. This form allows PPL to discuss their employer withholding account with the IRS. PPL will only be able to discuss the employer forms listed on the document. We will never be able to obtain any personal income tax information. 27

CA Form DE 1 HW: CA Registration Form for Employers of Household Workers • • This form is one page. The Employer is asked to review it and then sign and date the bottom of page. This form will register the Employer with the California Employment Development Department for the purposes of withholding taxes from workers & the Employer’s state employment taxes. 28

CA Form DE 1 HW: CA Registration Form for Employers of Household Workers • • This form is one page. The Employer is asked to review it and then sign and date the bottom of page. This form will register the Employer with the California Employment Development Department for the purposes of withholding taxes from workers & the Employer’s state employment taxes. 28

CA Form DE 48: CA Power of Attorney Declaration • • This form is one page. The Employer is asked to review it and then sign and date the bottom of page. This form allows Public Partnerships to represent the Employer before the State of California Employment Development Department (EDD). 29

CA Form DE 48: CA Power of Attorney Declaration • • This form is one page. The Employer is asked to review it and then sign and date the bottom of page. This form allows Public Partnerships to represent the Employer before the State of California Employment Development Department (EDD). 29

OPTIONAL: Point of Contact Form • • • This form is one page. The Employer is asked to fill out the Participant Information section on the top of the page, sign and date. The non-family member designee is asked to fill out the bottom of the page with their information, sign, and date. This form allows Public Partnerships to discuss Participant, Employer and Worker information with a designated non-family member. 30

OPTIONAL: Point of Contact Form • • • This form is one page. The Employer is asked to fill out the Participant Information section on the top of the page, sign and date. The non-family member designee is asked to fill out the bottom of the page with their information, sign, and date. This form allows Public Partnerships to discuss Participant, Employer and Worker information with a designated non-family member. 30

Questions? Feel free to contact us with question in the future: (English) 877 -522 -1053 (Spanish) 877 -522 -1054 (Cantonese) 877 -522 -1055 Email: CAGGRC@pcgus. com 31

Questions? Feel free to contact us with question in the future: (English) 877 -522 -1053 (Spanish) 877 -522 -1054 (Cantonese) 877 -522 -1055 Email: CAGGRC@pcgus. com 31

32

32