b705d0b3eaddd1eb3628d6b1b910b7c5.ppt

- Количество слайдов: 52

Gold Dinar as an Alternative to the Current Monetary Systems Presenters: Lorena Frischeisen Nida Phettongkam Rebeka Sultana Rehan Saeed Atif Ahmed G 0517914 G 0516468 G 0515792 G 0515171

Gold Dinar as an Alternative to the Current Monetary Systems Presenters: Lorena Frischeisen Nida Phettongkam Rebeka Sultana Rehan Saeed Atif Ahmed G 0517914 G 0516468 G 0515792 G 0515171

Outline n History of Gold Dinar (payment system) Quotes from Modern Scholars Why should bring back the Gold Dinar? n FIAT System n n q q n Comparisons with the Gold Dinar q n What are its advantages and disadvantages Implementation of the Dinar q n How FIAT money is created? What are its advantages and disadvantages Domestic transactions International Trade Objections Conclusion

Outline n History of Gold Dinar (payment system) Quotes from Modern Scholars Why should bring back the Gold Dinar? n FIAT System n n q q n Comparisons with the Gold Dinar q n What are its advantages and disadvantages Implementation of the Dinar q n How FIAT money is created? What are its advantages and disadvantages Domestic transactions International Trade Objections Conclusion

Quotes from Modern Scholars n Gold is going to be part of the structure of the international monetary system for the 21 st century” Robert A. Mundell 1997 n “Gold still represents the ultimate form of payment in the world” Alan Greenspan 1999

Quotes from Modern Scholars n Gold is going to be part of the structure of the international monetary system for the 21 st century” Robert A. Mundell 1997 n “Gold still represents the ultimate form of payment in the world” Alan Greenspan 1999

Gold recognized as money in Islam n Allah (SWT) has created gold and silver to act as money. Qura'n mentioned that these precious metals will always be desired by men: q n The Prophet (s. a. w. ) has said: q n Alluring to men the love of things they covet, women, and sons, hoarded treasures of gold and silver, and highly bred horses, cattle and land. (3: 14) “A time is certainly coming over mankind in which there will be nothing left which will be of use except a dinar and a dirham” (The Musnad of Imam Ahmad ibn Hanbal) The Prophet (s. a. w. ) noticed that trade and business were appraised in gold and silver

Gold recognized as money in Islam n Allah (SWT) has created gold and silver to act as money. Qura'n mentioned that these precious metals will always be desired by men: q n The Prophet (s. a. w. ) has said: q n Alluring to men the love of things they covet, women, and sons, hoarded treasures of gold and silver, and highly bred horses, cattle and land. (3: 14) “A time is certainly coming over mankind in which there will be nothing left which will be of use except a dinar and a dirham” (The Musnad of Imam Ahmad ibn Hanbal) The Prophet (s. a. w. ) noticed that trade and business were appraised in gold and silver

Used in different times Arab-Byzantine and Arab-Sassanian

Used in different times Arab-Byzantine and Arab-Sassanian

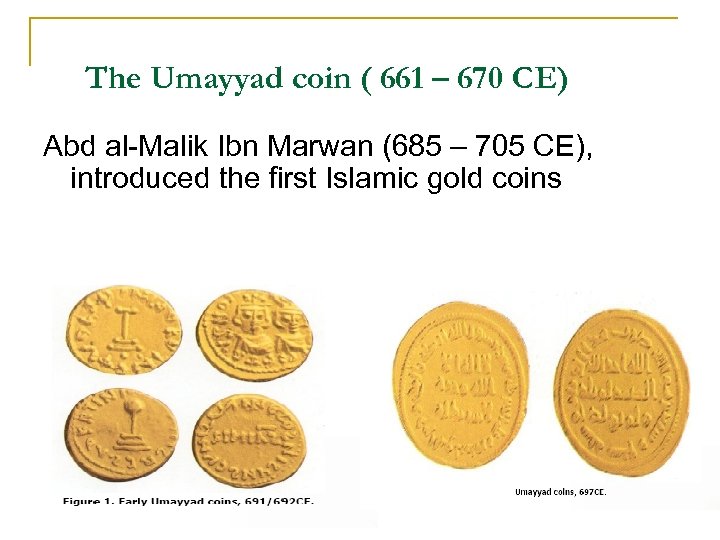

The Umayyad coin ( 661 – 670 CE) Abd al-Malik Ibn Marwan (685 – 705 CE), introduced the first Islamic gold coins

The Umayyad coin ( 661 – 670 CE) Abd al-Malik Ibn Marwan (685 – 705 CE), introduced the first Islamic gold coins

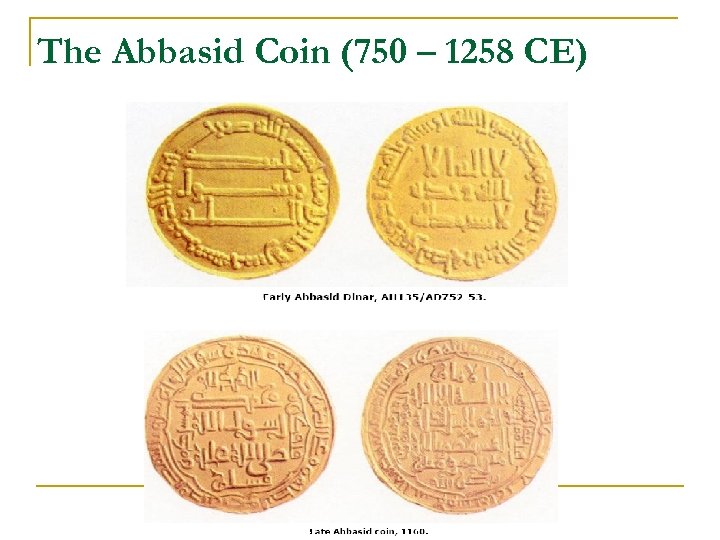

The Abbasid Coin (750 – 1258 CE)

The Abbasid Coin (750 – 1258 CE)

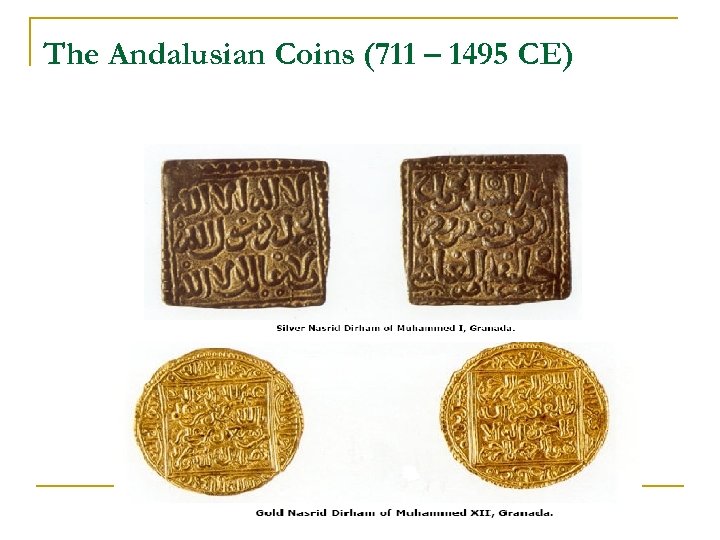

The Andalusian Coins (711 – 1495 CE)

The Andalusian Coins (711 – 1495 CE)

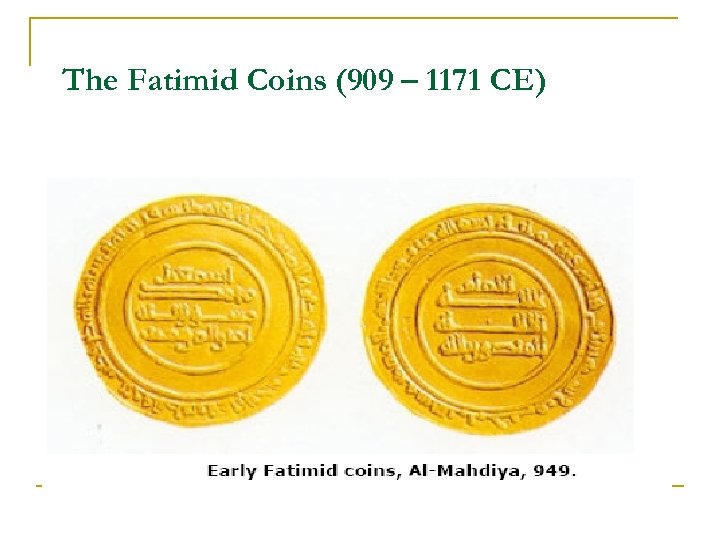

The Fatimid Coins (909 – 1171 CE)

The Fatimid Coins (909 – 1171 CE)

This gold dinar, minted by King Offa of Mercia (Kent, England) between 758 -796 CE. , was probably the first gold coin minted in England.

This gold dinar, minted by King Offa of Mercia (Kent, England) between 758 -796 CE. , was probably the first gold coin minted in England.

Why bring Gold Dinar back? n n To avoid Riba, Major Sin in Islam We will attain the Maqasid Al Shariah Our sovereignty will return… Will not be subservient to other nations.

Why bring Gold Dinar back? n n To avoid Riba, Major Sin in Islam We will attain the Maqasid Al Shariah Our sovereignty will return… Will not be subservient to other nations.

Prohibitions of Riba from Authentic Sources

Prohibitions of Riba from Authentic Sources

People of Riba at war with God n Quran q q 2: 278. “… give up what remains (due to you) from Ribâ (usury), if you are (really) believers. ” 2: 279. “And if you do not do it, then take a notice of war from Allâh and His Messenger…”

People of Riba at war with God n Quran q q 2: 278. “… give up what remains (due to you) from Ribâ (usury), if you are (really) believers. ” 2: 279. “And if you do not do it, then take a notice of war from Allâh and His Messenger…”

Riba worse than fornication n Sunnah q ‘Abdullaah ibn Mas’ood (may Allaah be pleased with him) reported that the Prophet (peace and blessings of Allaah be upon him) said: “There are seventy-three types of riba, the least of which is as abhorrent as a man having intercourse with his own mother and worst of which is [violating] a Muslim's honor and sanctity. (al-Haakim in al-Mustadrak, 2/37; Saheeh al-Jaami’, 3533).

Riba worse than fornication n Sunnah q ‘Abdullaah ibn Mas’ood (may Allaah be pleased with him) reported that the Prophet (peace and blessings of Allaah be upon him) said: “There are seventy-three types of riba, the least of which is as abhorrent as a man having intercourse with his own mother and worst of which is [violating] a Muslim's honor and sanctity. (al-Haakim in al-Mustadrak, 2/37; Saheeh al-Jaami’, 3533).

Any Involvement with Riba - Cursed n Sunnah q Jaabir (RA) reported that the Messenger of Allah (SAW) cursed “the one who consumes riba, the one who gives it to others, the one who writes it down and the one who witnesses it. ” He said: “They are all the same. ” (Reported by Muslim, 3/1219)

Any Involvement with Riba - Cursed n Sunnah q Jaabir (RA) reported that the Messenger of Allah (SAW) cursed “the one who consumes riba, the one who gives it to others, the one who writes it down and the one who witnesses it. ” He said: “They are all the same. ” (Reported by Muslim, 3/1219)

Riba prohibited in Other faiths n n Non-Abrahamic prohibitions of “usury”: q Code of Hammurabi (ca 2100 BC): interest ceilings of 33% and 20% on loans-in-kind. q Hindu law: total interest may not exceed principal. q Plato, …: Capital not viewed as a valid “factor of production”. Judeo-Christian-Islamic prohibition of “Ribā”: q Exodus [22: 25], Leviticus [25: 35 -7], Deuteronomy [23: 19 -20], Bava Metzia, Chapter 5, Mishna 2. q Luke [6: 27 -36], Benedict XIV (De Synodo Diocesana, X. iv, n. 6), First Council of Carthage (345)-until-Fourth Council of the Lateran (1215). q Qur’an [30: 39], [3: 130], [2: 275 -279], various Prophetic traditions. Source: Mahmoud A. El-Gamal, http: //www. ruf. rice. edu/~elgamal/files/Islamic%20 Finance%20101_files/frame. htm

Riba prohibited in Other faiths n n Non-Abrahamic prohibitions of “usury”: q Code of Hammurabi (ca 2100 BC): interest ceilings of 33% and 20% on loans-in-kind. q Hindu law: total interest may not exceed principal. q Plato, …: Capital not viewed as a valid “factor of production”. Judeo-Christian-Islamic prohibition of “Ribā”: q Exodus [22: 25], Leviticus [25: 35 -7], Deuteronomy [23: 19 -20], Bava Metzia, Chapter 5, Mishna 2. q Luke [6: 27 -36], Benedict XIV (De Synodo Diocesana, X. iv, n. 6), First Council of Carthage (345)-until-Fourth Council of the Lateran (1215). q Qur’an [30: 39], [3: 130], [2: 275 -279], various Prophetic traditions. Source: Mahmoud A. El-Gamal, http: //www. ruf. rice. edu/~elgamal/files/Islamic%20 Finance%20101_files/frame. htm

Maqasid Al Shariah n Protection of q Faith q Life q Intellect q Posterity q Wealth Indispensable for the establishment of Islam itself on earth Imam Ghazali

Maqasid Al Shariah n Protection of q Faith q Life q Intellect q Posterity q Wealth Indispensable for the establishment of Islam itself on earth Imam Ghazali

Poverty leads to disbelief Sunnah: n Poverty in all probability leads to unbelief (kufr) (Baihaqi and Tabarani)

Poverty leads to disbelief Sunnah: n Poverty in all probability leads to unbelief (kufr) (Baihaqi and Tabarani)

Slogans of Global Institutions World Bank n “Our dream is a world free of poverty” IMF n “Until There is a Cure. . . There is the IMF” Source: http: //www. worldbank. org/ Source: http: //www. teamcontinuum. net/s_imf. asp

Slogans of Global Institutions World Bank n “Our dream is a world free of poverty” IMF n “Until There is a Cure. . . There is the IMF” Source: http: //www. worldbank. org/ Source: http: //www. teamcontinuum. net/s_imf. asp

Transferring of Wealth (Sovereignty) n n Current banking policies is to lend to the rich and wealthy (ie high credit ratings). Inequitable distribution of wealth q q n n Rich and poor gap increases Socio-economic problem occur (ie Crime) Quran: In order that it (wealth) may not (merely) make a circuit between the wealthy among you (Al-Hashr 59: 7)

Transferring of Wealth (Sovereignty) n n Current banking policies is to lend to the rich and wealthy (ie high credit ratings). Inequitable distribution of wealth q q n n Rich and poor gap increases Socio-economic problem occur (ie Crime) Quran: In order that it (wealth) may not (merely) make a circuit between the wealthy among you (Al-Hashr 59: 7)

Fiat Monetary System

Fiat Monetary System

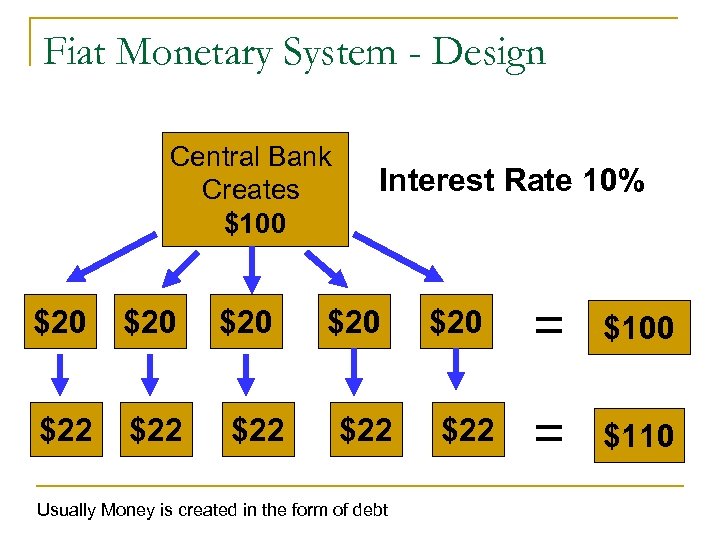

Fiat Monetary System - Design Central Bank Creates $100 $20 $22 Interest Rate 10% $20 $22 Usually Money is created in the form of debt $20 $22 = $100 = $110

Fiat Monetary System - Design Central Bank Creates $100 $20 $22 Interest Rate 10% $20 $22 Usually Money is created in the form of debt $20 $22 = $100 = $110

Fiat Monetary System - Design n Problem q q n Extra 10% interest does not exist. So loan is not repayable in aggregate System is designed to default Options for Banks (Lenders) q q q Reschedule / Restructure Loans Print more money, and role it into the economy Confiscate real wealth

Fiat Monetary System - Design n Problem q q n Extra 10% interest does not exist. So loan is not repayable in aggregate System is designed to default Options for Banks (Lenders) q q q Reschedule / Restructure Loans Print more money, and role it into the economy Confiscate real wealth

Fiat Monetary System - Advantages n Advantages q q More Liquid Easily Tradable n q q Money is easier to divide than many trade goods Easily Transportable Standardized Medium of exchange n n One dollar is worth the same as another dollar It is easier to add up and count money

Fiat Monetary System - Advantages n Advantages q q More Liquid Easily Tradable n q q Money is easier to divide than many trade goods Easily Transportable Standardized Medium of exchange n n One dollar is worth the same as another dollar It is easier to add up and count money

Fiat Monetary System - Disadvantages n Disadvantages q q q Seigniorage Inflation Easy to Destroy Easy to Forge No Intrinsic Value Currency Crisis

Fiat Monetary System - Disadvantages n Disadvantages q q q Seigniorage Inflation Easy to Destroy Easy to Forge No Intrinsic Value Currency Crisis

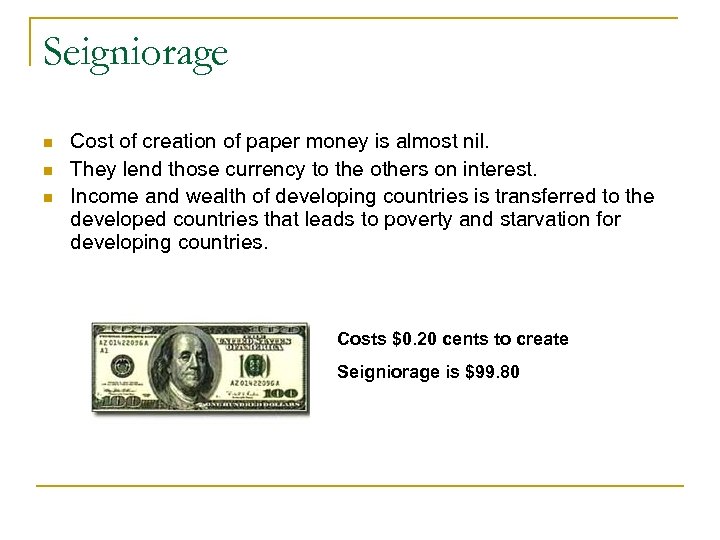

Seigniorage n n n Cost of creation of paper money is almost nil. They lend those currency to the others on interest. Income and wealth of developing countries is transferred to the developed countries that leads to poverty and starvation for developing countries. Costs $0. 20 cents to create Seigniorage is $99. 80

Seigniorage n n n Cost of creation of paper money is almost nil. They lend those currency to the others on interest. Income and wealth of developing countries is transferred to the developed countries that leads to poverty and starvation for developing countries. Costs $0. 20 cents to create Seigniorage is $99. 80

Sources of Seigniorage 1. 2. 3. n n Fiat Money Fractional Reserve Requirement Interest (Riba Al-Nasiah) All of these are forms of Riba Money is never questioned by the society, even in the modern literature

Sources of Seigniorage 1. 2. 3. n n Fiat Money Fractional Reserve Requirement Interest (Riba Al-Nasiah) All of these are forms of Riba Money is never questioned by the society, even in the modern literature

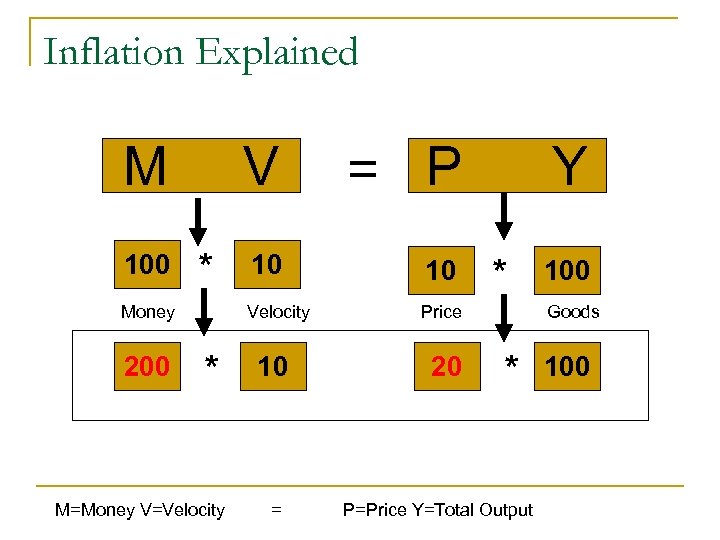

Inflation Explained M 100 V Money 200 * M=Money V=Velocity 10 10 Velocity * = P Price 10 = 20 Y * 100 Goods * P=Price Y=Total Output 100

Inflation Explained M 100 V Money 200 * M=Money V=Velocity 10 10 Velocity * = P Price 10 = 20 Y * 100 Goods * P=Price Y=Total Output 100

Inflation n “A persistence and appreciable increase in general level of prices” – Sapiro Surplus of money supply exceeding the real needs of the economy. Some Socio-Economic Effects of Money Creation q q q Disparity in Income Distribution and Creation of Poverty Effects on Housing Effects of Price Control on Agriculture Effects on Society Effects on Environment

Inflation n “A persistence and appreciable increase in general level of prices” – Sapiro Surplus of money supply exceeding the real needs of the economy. Some Socio-Economic Effects of Money Creation q q q Disparity in Income Distribution and Creation of Poverty Effects on Housing Effects of Price Control on Agriculture Effects on Society Effects on Environment

Easy to destroy n The Fragile nature of paper q Ex. Fire, Water and natural disasters

Easy to destroy n The Fragile nature of paper q Ex. Fire, Water and natural disasters

Easy to Forge n n Easy to counterfeit the paper money. Nation have used counterfeiting as a means of warfare. q Ex. Great Britain did this during Revolutionary War to reduce value of the Continental Dollar.

Easy to Forge n n Easy to counterfeit the paper money. Nation have used counterfeiting as a means of warfare. q Ex. Great Britain did this during Revolutionary War to reduce value of the Continental Dollar.

No intrinsic value n n Cannot be utilized in direct fulfillment of human needs. Can be used for acquiring goods and services.

No intrinsic value n n Cannot be utilized in direct fulfillment of human needs. Can be used for acquiring goods and services.

Currency Crisis n Crisis from inflation q Artificial lowering of purchasing power, by increasing supply of fiat money beyond the real need of economy.

Currency Crisis n Crisis from inflation q Artificial lowering of purchasing power, by increasing supply of fiat money beyond the real need of economy.

Gold Dinar System

Gold Dinar System

Gold Dinar - Advantages n q q q Durable Valuable Stable Currency Reduce Foreign Exchange fluctuation Excellent Medium of exchange

Gold Dinar - Advantages n q q q Durable Valuable Stable Currency Reduce Foreign Exchange fluctuation Excellent Medium of exchange

Gold Dinar - Advantages n Durable n n Valuable n n can’t be destroyed has intrinsic value Stable Currency n n The creation and destruction of gold is impossible Hedge risk No speculation No Inflation

Gold Dinar - Advantages n Durable n n Valuable n n can’t be destroyed has intrinsic value Stable Currency n n The creation and destruction of gold is impossible Hedge risk No speculation No Inflation

Gold Dinar - Advantages n Reduce Foreign Exchange fluctuation n The exchange rates constantly fluctuate, but gold dinar does not fluctuate. This would further strengthen and stabilize the economy Excellent Medium of exchange n n Since gold is priced and revered globally, it is something that it always valued by people of all nations Owing to its inherent value and its easy divisibility, gold is an excellent medium of exchange

Gold Dinar - Advantages n Reduce Foreign Exchange fluctuation n The exchange rates constantly fluctuate, but gold dinar does not fluctuate. This would further strengthen and stabilize the economy Excellent Medium of exchange n n Since gold is priced and revered globally, it is something that it always valued by people of all nations Owing to its inherent value and its easy divisibility, gold is an excellent medium of exchange

Gold Dinar - Disadvantages n Rare q Gold is too rare and it creates an undesirable effects in the society n q q Not evenly distributed in the world Not easy to carry q q n n q Economic activity will slow down Unemployment will rise Heavy metal Less secure Time consuming

Gold Dinar - Disadvantages n Rare q Gold is too rare and it creates an undesirable effects in the society n q q Not evenly distributed in the world Not easy to carry q q n n q Economic activity will slow down Unemployment will rise Heavy metal Less secure Time consuming

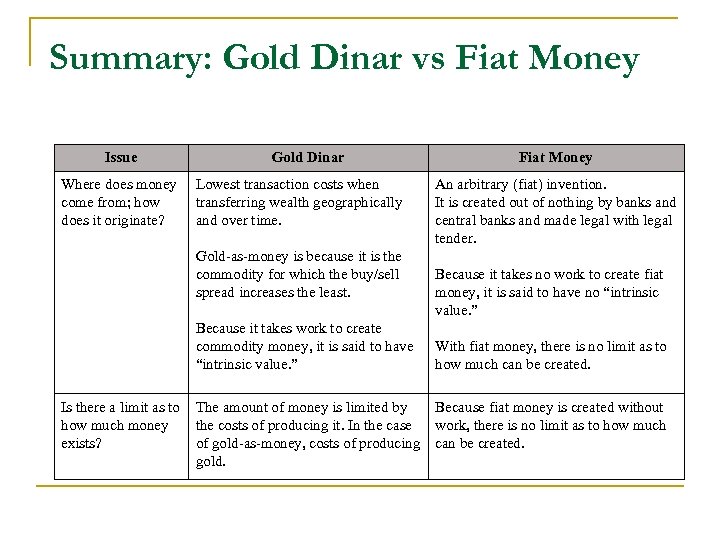

Summary: Gold Dinar vs Fiat Money Issue Where does money come from; how does it originate? Gold Dinar Lowest transaction costs when transferring wealth geographically and over time. Gold-as-money is because it is the commodity for which the buy/sell spread increases the least. Because it takes work to create commodity money, it is said to have “intrinsic value. ” Fiat Money An arbitrary (fiat) invention. It is created out of nothing by banks and central banks and made legal with legal tender. Because it takes no work to create fiat money, it is said to have no “intrinsic value. ” With fiat money, there is no limit as to how much can be created. Is there a limit as to The amount of money is limited by Because fiat money is created without how much money the costs of producing it. In the case work, there is no limit as to how much exists? of gold-as-money, costs of producing can be created. gold.

Summary: Gold Dinar vs Fiat Money Issue Where does money come from; how does it originate? Gold Dinar Lowest transaction costs when transferring wealth geographically and over time. Gold-as-money is because it is the commodity for which the buy/sell spread increases the least. Because it takes work to create commodity money, it is said to have “intrinsic value. ” Fiat Money An arbitrary (fiat) invention. It is created out of nothing by banks and central banks and made legal with legal tender. Because it takes no work to create fiat money, it is said to have no “intrinsic value. ” With fiat money, there is no limit as to how much can be created. Is there a limit as to The amount of money is limited by Because fiat money is created without how much money the costs of producing it. In the case work, there is no limit as to how much exists? of gold-as-money, costs of producing can be created. gold.

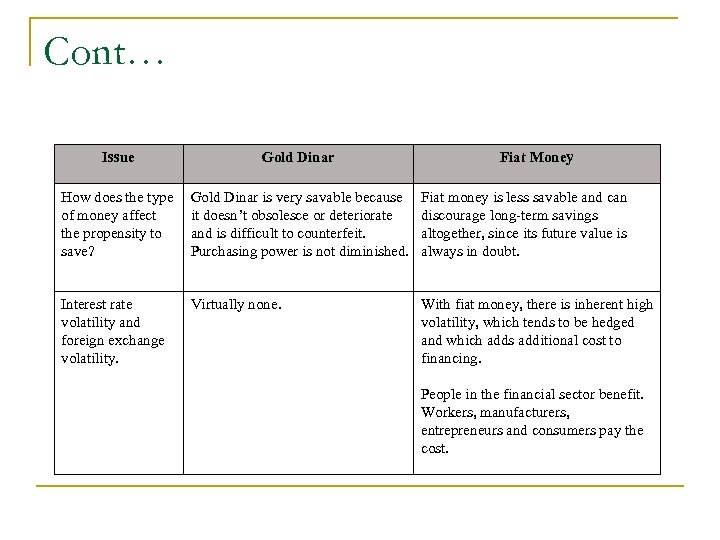

Cont… Issue Gold Dinar Fiat Money How does the type of money affect the propensity to save? Gold Dinar is very savable because it doesn’t obsolesce or deteriorate and is difficult to counterfeit. Purchasing power is not diminished. Fiat money is less savable and can discourage long-term savings altogether, since its future value is always in doubt. Interest rate volatility and foreign exchange volatility. Virtually none. With fiat money, there is inherent high volatility, which tends to be hedged and which adds additional cost to financing. People in the financial sector benefit. Workers, manufacturers, entrepreneurs and consumers pay the cost.

Cont… Issue Gold Dinar Fiat Money How does the type of money affect the propensity to save? Gold Dinar is very savable because it doesn’t obsolesce or deteriorate and is difficult to counterfeit. Purchasing power is not diminished. Fiat money is less savable and can discourage long-term savings altogether, since its future value is always in doubt. Interest rate volatility and foreign exchange volatility. Virtually none. With fiat money, there is inherent high volatility, which tends to be hedged and which adds additional cost to financing. People in the financial sector benefit. Workers, manufacturers, entrepreneurs and consumers pay the cost.

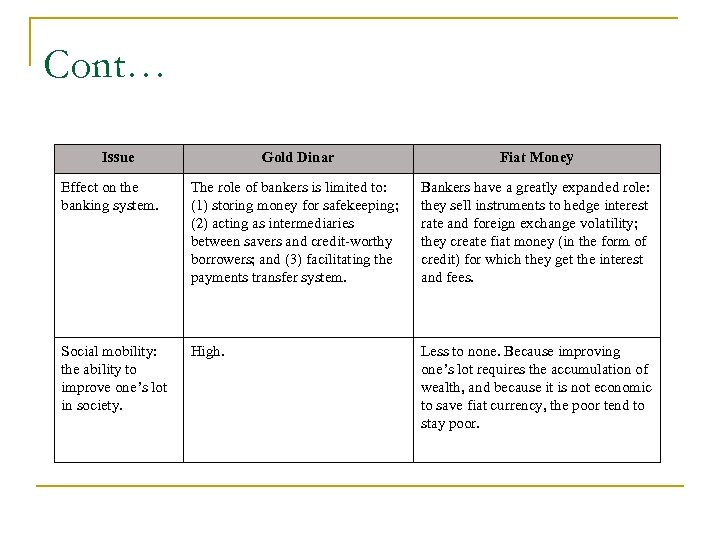

Cont… Issue Gold Dinar Fiat Money Effect on the banking system. The role of bankers is limited to: (1) storing money for safekeeping; (2) acting as intermediaries between savers and credit-worthy borrowers; and (3) facilitating the payments transfer system. Bankers have a greatly expanded role: they sell instruments to hedge interest rate and foreign exchange volatility; they create fiat money (in the form of credit) for which they get the interest and fees. Social mobility: the ability to improve one’s lot in society. High. Less to none. Because improving one’s lot requires the accumulation of wealth, and because it is not economic to save fiat currency, the poor tend to stay poor.

Cont… Issue Gold Dinar Fiat Money Effect on the banking system. The role of bankers is limited to: (1) storing money for safekeeping; (2) acting as intermediaries between savers and credit-worthy borrowers; and (3) facilitating the payments transfer system. Bankers have a greatly expanded role: they sell instruments to hedge interest rate and foreign exchange volatility; they create fiat money (in the form of credit) for which they get the interest and fees. Social mobility: the ability to improve one’s lot in society. High. Less to none. Because improving one’s lot requires the accumulation of wealth, and because it is not economic to save fiat currency, the poor tend to stay poor.

How to bring it back? n International Trade q q n Bilateral Payment Arrangements (BPA) Multilateral Payment Arrangements (MPA) Domestic Trade q q Investments Savings

How to bring it back? n International Trade q q n Bilateral Payment Arrangements (BPA) Multilateral Payment Arrangements (MPA) Domestic Trade q q Investments Savings

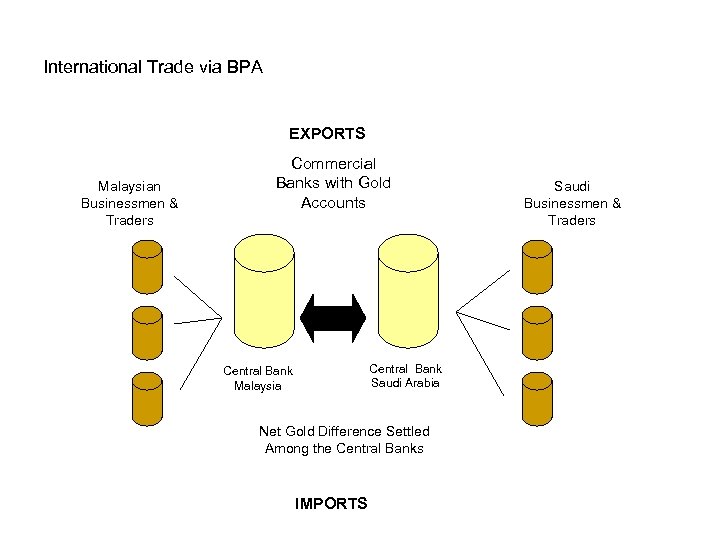

International Trade via BPA EXPORTS Malaysian Businessmen & Traders Commercial Banks with Gold Accounts Central Bank Saudi Arabia Central Bank Malaysia Net Gold Difference Settled Among the Central Banks IMPORTS Saudi Businessmen & Traders

International Trade via BPA EXPORTS Malaysian Businessmen & Traders Commercial Banks with Gold Accounts Central Bank Saudi Arabia Central Bank Malaysia Net Gold Difference Settled Among the Central Banks IMPORTS Saudi Businessmen & Traders

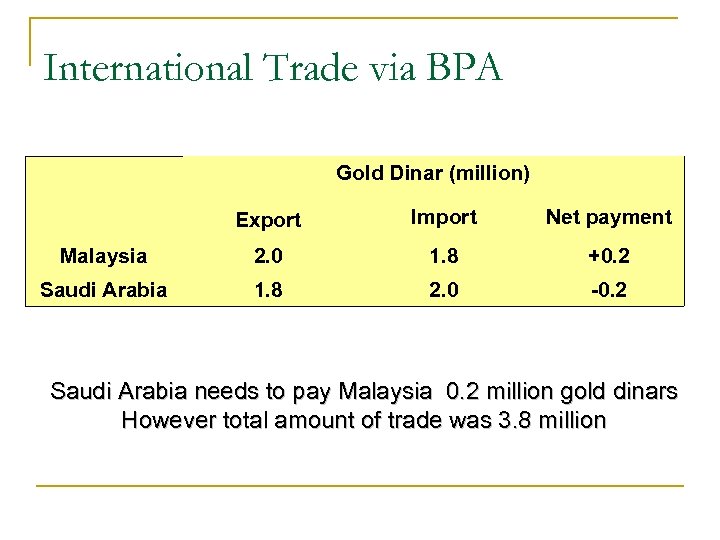

International Trade via BPA Gold Dinar (million) Export Import Net payment Malaysia 2. 0 1. 8 +0. 2 Saudi Arabia 1. 8 2. 0 -0. 2 Saudi Arabia needs to pay Malaysia 0. 2 million gold dinars However total amount of trade was 3. 8 million

International Trade via BPA Gold Dinar (million) Export Import Net payment Malaysia 2. 0 1. 8 +0. 2 Saudi Arabia 1. 8 2. 0 -0. 2 Saudi Arabia needs to pay Malaysia 0. 2 million gold dinars However total amount of trade was 3. 8 million

The Gold Dinar in Domestic Transactions n n n Initially for savings, investments Payment of mahr, zakat etc. Transform savings into payment system

The Gold Dinar in Domestic Transactions n n n Initially for savings, investments Payment of mahr, zakat etc. Transform savings into payment system

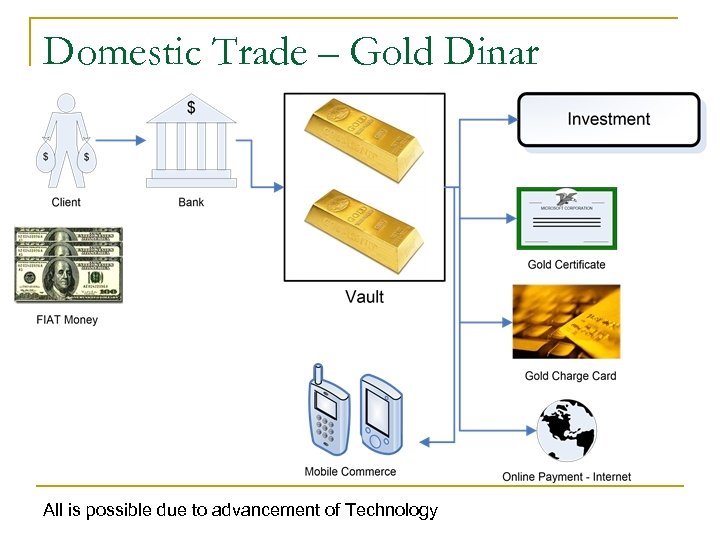

Domestic Trade – Gold Dinar All is possible due to advancement of Technology

Domestic Trade – Gold Dinar All is possible due to advancement of Technology

Investment Account and Charge Card Balance Savings Account Current Account Gold Dinar Account

Investment Account and Charge Card Balance Savings Account Current Account Gold Dinar Account

Pricing in Gold Dinars n Start pricing items in Dinar instead of local currency

Pricing in Gold Dinars n Start pricing items in Dinar instead of local currency

Common Objections: Gold n Failure of gold-backed system q n Gold producing countries at an advantage q n Today only US is at advantage Price of gold fluctuates q n Not true, it is used as money through out history More stable than FIAT Not enough gold to support the volume of international trade q Really?

Common Objections: Gold n Failure of gold-backed system q n Gold producing countries at an advantage q n Today only US is at advantage Price of gold fluctuates q n Not true, it is used as money through out history More stable than FIAT Not enough gold to support the volume of international trade q Really?

Conclusion: Sustenance Predestined (Rizq) n n Your wealth (Rizq) has been written. Sunnah q Abdullah b. 'Amr b. al-'As reported: I heard Allah's Messenger (may peace be upon him) as saying: Allah ordained the measures (of quality) of the creation fifty thousand years before He created the heavens and the earth, as His Throne was upon water. (Bk 33, Number 6416: Sahih Muslim)

Conclusion: Sustenance Predestined (Rizq) n n Your wealth (Rizq) has been written. Sunnah q Abdullah b. 'Amr b. al-'As reported: I heard Allah's Messenger (may peace be upon him) as saying: Allah ordained the measures (of quality) of the creation fifty thousand years before He created the heavens and the earth, as His Throne was upon water. (Bk 33, Number 6416: Sahih Muslim)

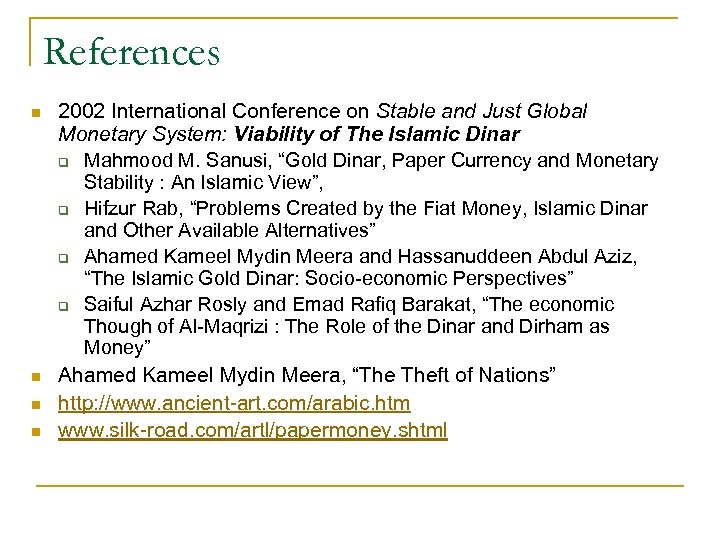

References n n 2002 International Conference on Stable and Just Global Monetary System: Viability of The Islamic Dinar q Mahmood M. Sanusi, “Gold Dinar, Paper Currency and Monetary Stability : An Islamic View”, q Hifzur Rab, “Problems Created by the Fiat Money, Islamic Dinar and Other Available Alternatives” q Ahamed Kameel Mydin Meera and Hassanuddeen Abdul Aziz, “The Islamic Gold Dinar: Socio-economic Perspectives” q Saiful Azhar Rosly and Emad Rafiq Barakat, “The economic Though of Al-Maqrizi : The Role of the Dinar and Dirham as Money” Ahamed Kameel Mydin Meera, “The Theft of Nations” http: //www. ancient-art. com/arabic. htm www. silk-road. com/artl/papermoney. shtml

References n n 2002 International Conference on Stable and Just Global Monetary System: Viability of The Islamic Dinar q Mahmood M. Sanusi, “Gold Dinar, Paper Currency and Monetary Stability : An Islamic View”, q Hifzur Rab, “Problems Created by the Fiat Money, Islamic Dinar and Other Available Alternatives” q Ahamed Kameel Mydin Meera and Hassanuddeen Abdul Aziz, “The Islamic Gold Dinar: Socio-economic Perspectives” q Saiful Azhar Rosly and Emad Rafiq Barakat, “The economic Though of Al-Maqrizi : The Role of the Dinar and Dirham as Money” Ahamed Kameel Mydin Meera, “The Theft of Nations” http: //www. ancient-art. com/arabic. htm www. silk-road. com/artl/papermoney. shtml