77a23dc496cd8787368c173f493fc460.ppt

- Количество слайдов: 19

Going Public Abroad How, Where and When November 2006

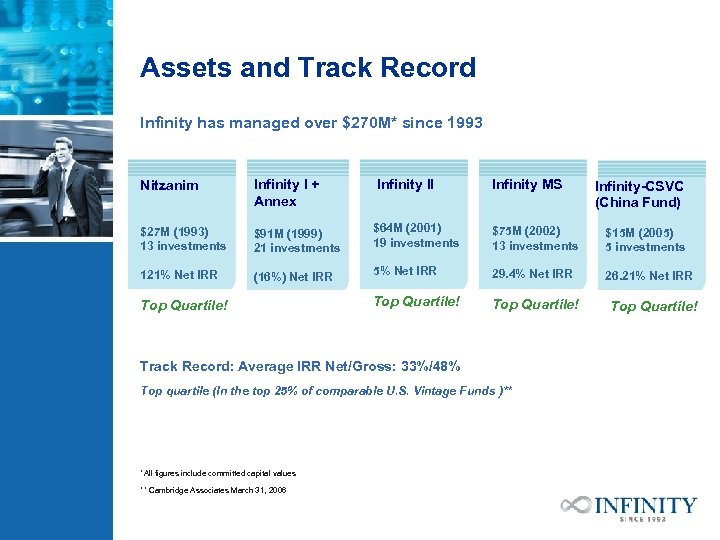

Assets and Track Record Infinity has managed over $270 M* since 1993 Infinity II Nitzanim Infinity I + Annex $27 M (1993) 13 investments $91 M (1999) 21 investments $64 M (2001) 19 investments $75 M (2002) 13 investments $15 M (2005) 5 investments 121% Net IRR (16%) Net IRR 5% Net IRR 29. 4% Net IRR 26. 21% Net IRR Top Quartile! Infinity MS Track Record: Average IRR Net/Gross: 33%/48% Top quartile (In the top 25% of comparable U. S. Vintage Funds )** *All figures include committed capital values ** Cambridge Associates March 31, 2006 Infinity-CSVC (China Fund) Top Quartile!

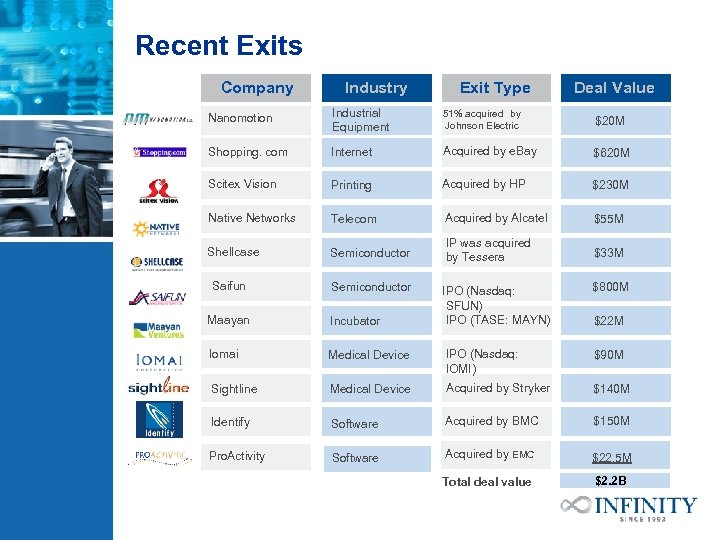

Recent Exits Company Industry Exit Type Deal Value Nanomotion Industrial Equipment 51% acquired by Johnson Electric $20 M Shopping. com Internet Acquired by e. Bay $620 M Scitex Vision Printing Acquired by HP $230 M Native Networks Telecom Acquired by Alcatel $55 M Shellcase Semiconductor IP was acquired by Tessera $33 M Saifun Semiconductor IPO (Nasdaq: SFUN) IPO (TASE: MAYN) $800 M Maayan Incubator Iomai Medical Device IPO (Nasdaq: IOMI) $90 M Sightline Medical Device Acquired by Stryker $140 M Identify Software Acquired by BMC $150 M Pro. Activity Software Acquired by EMC $22. 5 M Total deal value $2. 2 B $22 M

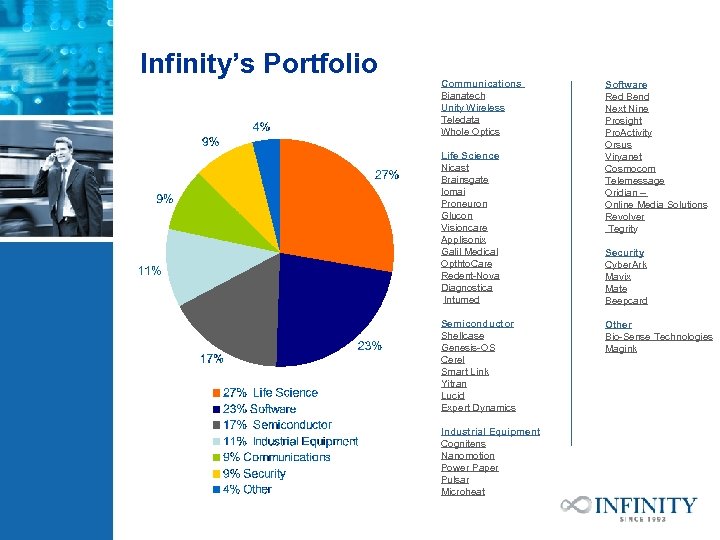

Infinity’s Portfolio Communications Bianatech Unity Wireless Teledata Whole Optics Life Science Nicast Brainsgate Iomai Proneuron Glucon Visioncare Applisonix Galil Medical Opthto. Care Redent-Nova Diagnostica Intumed Semiconductor Shellcase Genesis-OS Cerel Smart Link Yitran Lucid Expert Dynamics Industrial Equipment Cognitens Nanomotion Power Paper Pulsar Microheat Software Red Bend Next Nine Prosight Pro. Activity Orsus Viryanet Cosmocom Telemessage Oridian – Online Media Solutions Revolver Tegrity Security Cyber. Ark Mavix Mate Beepcard Other Bio-Sense Technologies Magink

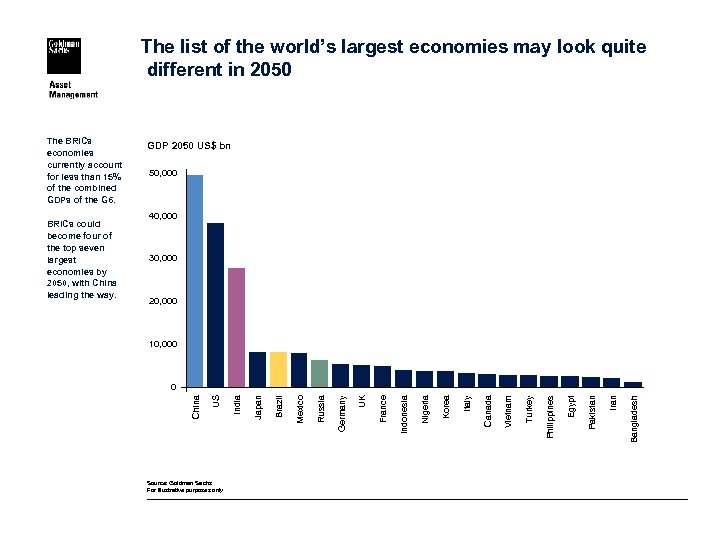

The list of the world’s largest economies may look quite different in 2050 50, 000 40, 000 30, 000 20, 000 10, 000 Source: Goldman Sachs For illustrative purposes only Bangladesh Iran Pakistan Egypt Philippines Turkey Vietnam Canada Italy Korea Nigeria Indonesia France UK Germany Russia Mexico Brazil Japan India 0 US BRICs could become four of the top seven largest economies by 2050, with China leading the way. GDP 2050 US$ bn China The BRICs economies currently account for less than 15% of the combined GDPs of the G 6.

Infinity: First in China In May 2004, Infinity and IDB/Clal cofounded the first Chinese registered foreign-invested VC fund (No. 00001). Infinity/Clal’s partner is the Chinese Government via investment arms: CSVC (China Singapore Venture Capital) and SIP (Suzhou Industrial Park). The event was monumental for pioneering venture capital in China and international business relations between Israel and China. The signing ceremony was attended by government leaders Ehud Olmert from Israel and the Deputy Prime Minister of China.

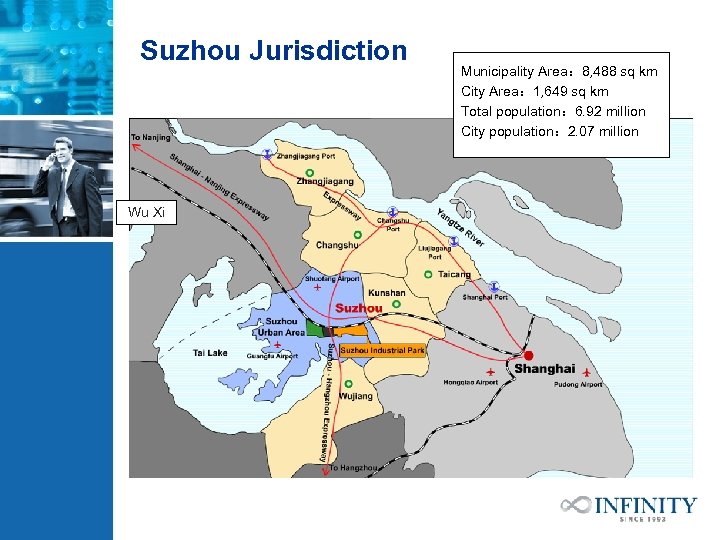

Key China Partnership – SIP/CSVC China-Singapore Suzhou Industrial Park )SIP) and Venture Capital (CSVC) § CSVC is a $455 M VC fund, investment arm of SIP (Suzhou Industrial Park ). § Most advanced hi-tech park in China, created in 1994 by the Chinese and Singapore governments. § Four thousand companies operating in the park including 100 Fortune 500 companies. § Total land area of the park is 300 sq km. § Ten universities established campuses with post graduate school and hi-tech R&D industrial park. § Has its own government and tax authority.

China Partnership Achievements • Five investments in Israel-related companies one profitable exit. • Three years of Israeli and Chinese team experience and cooperation. • Leveraging both government and corporate relationships. • Full risk sharing and alignment of interests with Chinese Government partners. • Both onshore and offshore financial flexibility. • Infinity’s portfolio company received the first ever direct equity investment by the Chinese government in an Israeli company. • Exclusive $30 M commitment from the China Development Bank to co-investment with us.

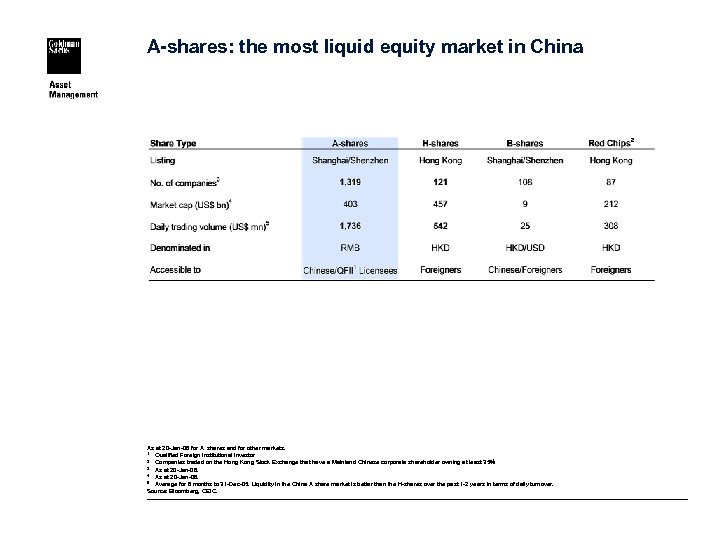

A-shares: the most liquid equity market in China As at 20 -Jan-06 for A shares and for other markets. 1 Qualified Foreign Institutional Investor 2 Companies traded on the Hong Kong Stock Exchange that have a Mainland Chinese corporate shareholder owning at least 35% 3 As at 20 -Jan-06. 4 As at 20 -Jan-06. 5 Average for 6 months to 31 -Dec-05. Liquidity in the China A share market is better than the H-shares over the past 1 -2 years in terms of daily turnover. Source: Bloomberg, CEIC.

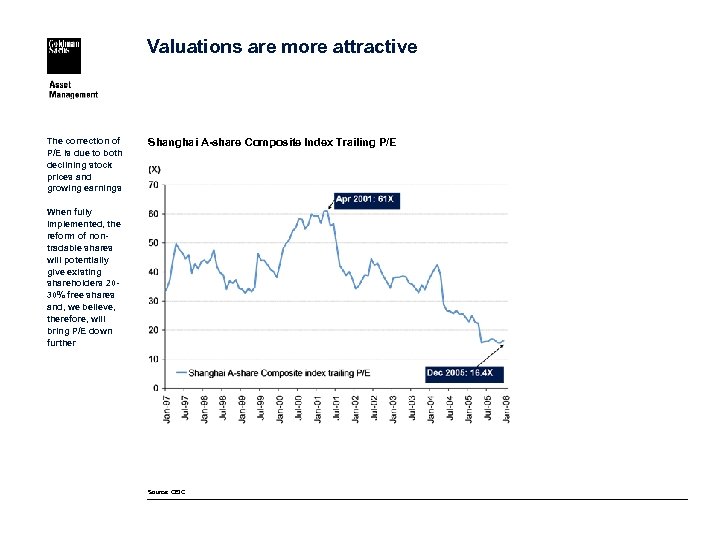

Valuations are more attractive The correction of P/E is due to both declining stock prices and growing earnings Shanghai A-share Composite Index Trailing P/E When fully implemented, the reform of nontradable shares will potentially give existing shareholders 2030% free shares and, we believe, therefore, will bring P/E down further Source: CEIC

Shellcase - Infinity-led Recovery Wafer-level electronic product packaging technologies Then (2004) Now § $20 million debt § Change of business model to an IP company separated from manufacturing § Lack of focus, investors losing faith § Build a manufacturing facility in § On the verge of shutdown “Infinity’s leadership and creativity saved Shellcase. It created and boosted a new industry” Shalom Daskal, CEO Shellcase § Problem with order fulfillment § Problematic capital structure China – profitable, a leader in wafer level manufacturing, received $20 M China government support § Sale of the company’s patents to Tessera (NASDAQ –TSRA) for $33 M § Created $80 M value in one year

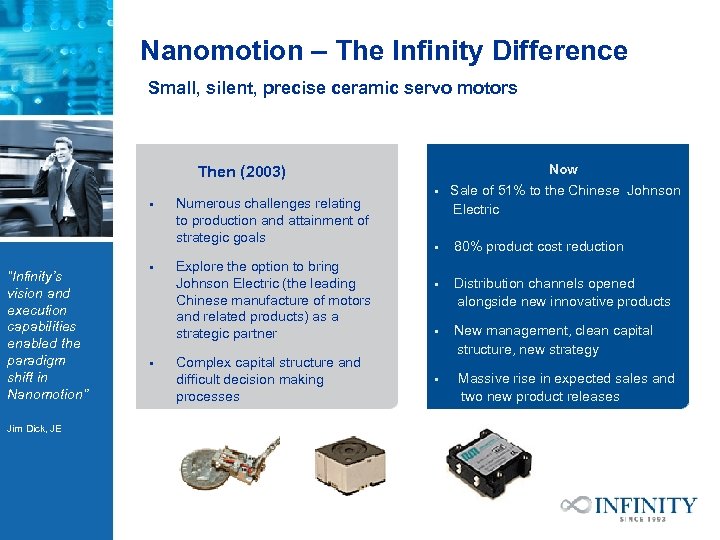

Nanomotion – The Infinity Difference Small, silent, precise ceramic servo motors Now Then (2003) § “Infinity’s vision and execution capabilities enabled the paradigm shift in Nanomotion” Jim Dick, JE § § Numerous challenges relating to production and attainment of strategic goals Explore the option to bring Johnson Electric (the leading Chinese manufacture of motors and related products) as a strategic partner Complex capital structure and difficult decision making processes § Sale of 51% to the Chinese Johnson Electric § 80% product cost reduction § Distribution channels opened alongside new innovative products § New management, clean capital structure, new strategy § Massive rise in expected sales and two new product releases

Infinity Israel China Fund Investment Strategy § The Infinity Israel China Fund will invest primarily in late stage/pre exit Israeli companies with strong technology IP and grow them into global companies with a China focus. § Sector focus: medical devices, semiconductor, telecom, software, and materials arenas. § Pragmatic exit and return oriented strategy with an activist approach. § Prime investment criteria are quality of management & Infinity’s added value mainly in China.

Why Our China Strategy Wins. … § Alignment of interests - our Chinese partners invest with us both in the Israeli company (minority) and in the Chinese companies (majority). § We operate in China as “Chinese” as opposed to foreigners - the result is significant government support (financial , regulations, customers, first license). § We create value by structuring companies which bring together real businesses and proven technologies at attractive valuations. § We create Chinese IP and get government IP protection. § We have a government ruling enabling the fund to transfer capital in and out of China as needed. § We have the China Development Bank and SIP as our true partners along side top government support. § We already have two exits (Nanomotion- 2 X, Shellcase - 2 X).

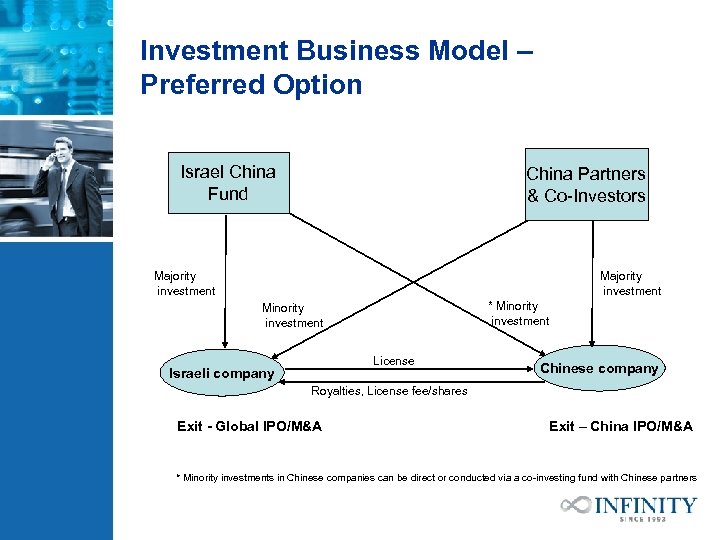

Investment Business Model – Preferred Option A Israel China Fund China Partners & Co-Investors Majority investment * Minority investment License Israeli company Chinese company Royalties, License fee/shares Exit - Global IPO/M&A Exit – China IPO/M&A * Minority investments in Chinese companies can be direct or conducted via a co-investing fund with Chinese partners

Our Mapping of Technologies for China:

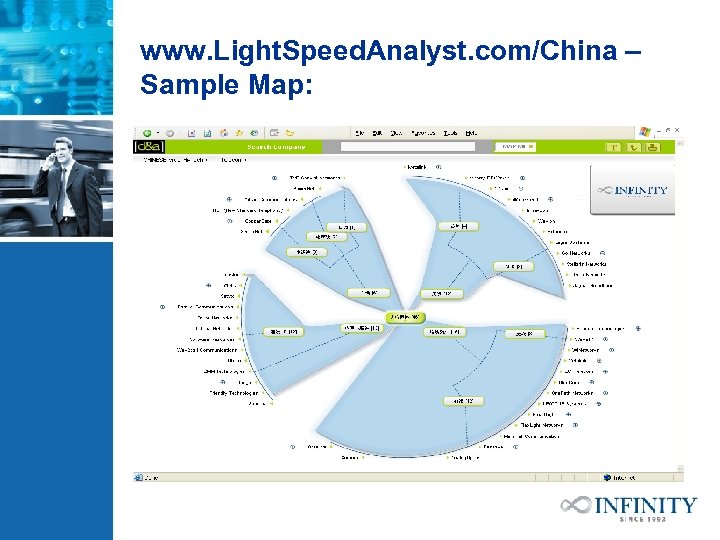

www. Light. Speed. Analyst. com/China – Sample Map:

Suzhou Jurisdiction Wu Xi Municipality Area: 8, 488 sq km City Area: 1, 649 sq km Total population: 6. 92 million City population: 2. 07 million

Shellcase's Entrance in China

77a23dc496cd8787368c173f493fc460.ppt