4cd3b961fa55e8fc88ad774dea6b4bf6.ppt

- Количество слайдов: 41

Goals of the Ticket to Work Legislation Ø Increases beneficiary choice for employment services, vocational rehabilitation services & other support services Ø Gives more Americans with disabilities the opportunit to work & become moreself-sufficient Ø Allows people with disabilities to retain health coveragewhile working

Goals of the Ticket to Work Legislation Ø Increases beneficiary choice for employment services, vocational rehabilitation services & other support services Ø Gives more Americans with disabilities the opportunit to work & become moreself-sufficient Ø Allows people with disabilities to retain health coveragewhile working

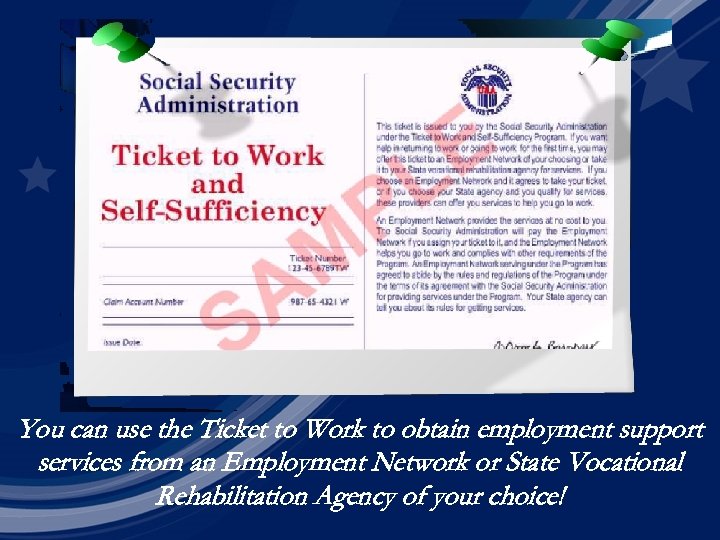

You can use the Ticket to Work to obtain employment support services from an Employment Network or State Vocational Rehabilitation Agency of your choice!

You can use the Ticket to Work to obtain employment support services from an Employment Network or State Vocational Rehabilitation Agency of your choice!

Ø The Ticket remains valid even if cash benefits end due to work or earnings ØThe Ticket expands job options but does not guarantee a job

Ø The Ticket remains valid even if cash benefits end due to work or earnings ØThe Ticket expands job options but does not guarantee a job

ØBeneficiaries between the ages of 18 - 64 who are currently receiving Social Security Disability benefits or Supplemental Security Income (SSI) disability payments.

ØBeneficiaries between the ages of 18 - 64 who are currently receiving Social Security Disability benefits or Supplemental Security Income (SSI) disability payments.

• Any qualified State, local or private organization, including the State vocational rehabilitation agency • One-stop delivery systems • Public or private schools • Independent living centers • Employers Find one at Yourtickettowork. com

• Any qualified State, local or private organization, including the State vocational rehabilitation agency • One-stop delivery systems • Public or private schools • Independent living centers • Employers Find one at Yourtickettowork. com

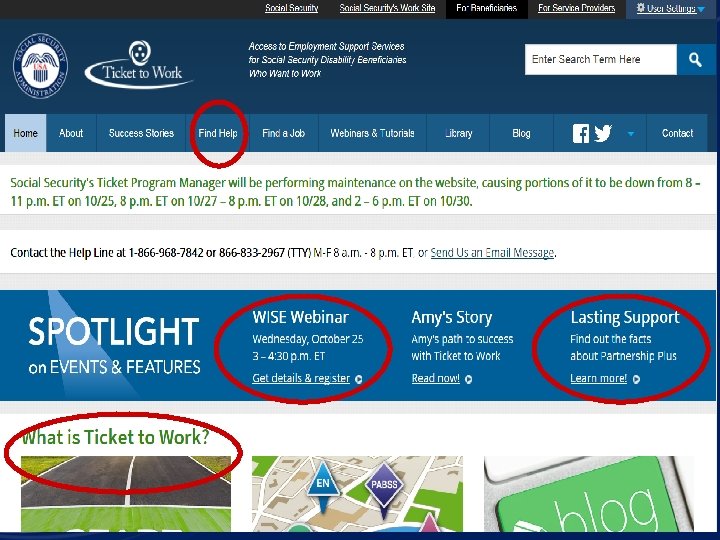

Ticket To Work Website https: //choosework. ssa. gov/

Ticket To Work Website https: //choosework. ssa. gov/

Ticket To Work Website https: //choosework. ssa. gov/

Ticket To Work Website https: //choosework. ssa. gov/

Find Help • • • EN: Employment Networks WF: Work Force Employment Networks VR: Vocational Rehabilitation WIPA: Work Incentives Planning and Assistance PABSS: Protection and Advocacy for Beneficiaries of Social Security

Find Help • • • EN: Employment Networks WF: Work Force Employment Networks VR: Vocational Rehabilitation WIPA: Work Incentives Planning and Assistance PABSS: Protection and Advocacy for Beneficiaries of Social Security

![] Employment services ] Vocational rehabilitation services ] Counseling & guidance ] Training ] ] Employment services ] Vocational rehabilitation services ] Counseling & guidance ] Training ]](https://present5.com/presentation/4cd3b961fa55e8fc88ad774dea6b4bf6/image-12.jpg) ] Employment services ] Vocational rehabilitation services ] Counseling & guidance ] Training ] Transportation ] Other support services necessary to find, enter & retain employment

] Employment services ] Vocational rehabilitation services ] Counseling & guidance ] Training ] Transportation ] Other support services necessary to find, enter & retain employment

Ø Ticket program is voluntary Ø No time limit for using your Ticket Ø Use your ticket to obtain services from the Employment Network (EN) of your choice or the vocational rehabilitation agency in your State if you quality for their services ØEnd your agreement at any time & choose a new EN or the State vocational rehabilitation agency ØBeneficiaries & ENs will work together only if BOTH agree they have a good match

Ø Ticket program is voluntary Ø No time limit for using your Ticket Ø Use your ticket to obtain services from the Employment Network (EN) of your choice or the vocational rehabilitation agency in your State if you quality for their services ØEnd your agreement at any time & choose a new EN or the State vocational rehabilitation agency ØBeneficiaries & ENs will work together only if BOTH agree they have a good match

o You can assign your Ticket to only one Employment Network (EN) at a time o Either you or EN can terminate agreement o EN cannot charge you for services o You & EN complete an individual work plan When You Assign Your Ticket

o You can assign your Ticket to only one Employment Network (EN) at a time o Either you or EN can terminate agreement o EN cannot charge you for services o You & EN complete an individual work plan When You Assign Your Ticket

The Individual Work Plan v Must be in writing v. Must be developed, signed & implemented in partnership by EN & beneficiary v Must outline specific employment services, vocational rehabilitation services, or other support services necessary to achieve beneficiary’s employment goal

The Individual Work Plan v Must be in writing v. Must be developed, signed & implemented in partnership by EN & beneficiary v Must outline specific employment services, vocational rehabilitation services, or other support services necessary to achieve beneficiary’s employment goal

The Individual Work Plan üConditions under which EN can amend plan or terminate relationship üBeneficiary’s rights, including right to retrieve ticket üRemedies available to beneficiary, including availability of advocacy services & assistance through Protection & Advocacy Services

The Individual Work Plan üConditions under which EN can amend plan or terminate relationship üBeneficiary’s rights, including right to retrieve ticket üRemedies available to beneficiary, including availability of advocacy services & assistance through Protection & Advocacy Services

Continuing Disability Reviews (CDRs) v. Beneficiaries using their Ticket will not be scheduled for medical CDRs v. Also, Social Security Disability beneficiaries receiving benefits for at least 24 months will not be medically reviewed solely because of work activity.

Continuing Disability Reviews (CDRs) v. Beneficiaries using their Ticket will not be scheduled for medical CDRs v. Also, Social Security Disability beneficiaries receiving benefits for at least 24 months will not be medically reviewed solely because of work activity.

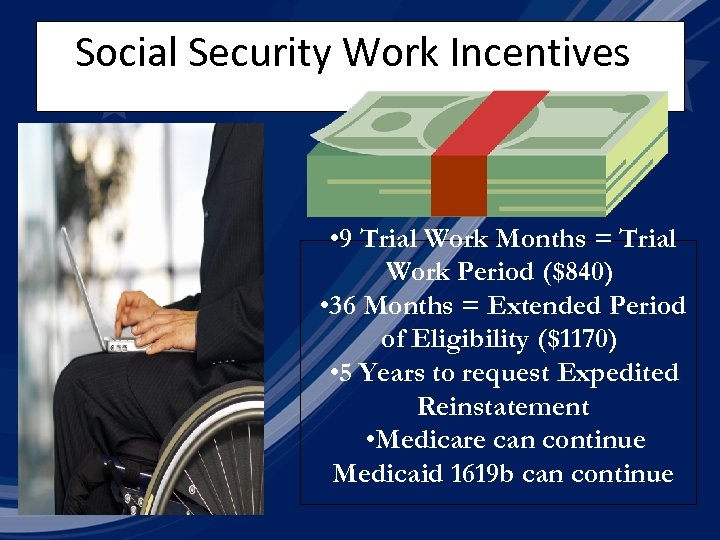

Social Security Work Incentives • 9 Trial Work Months = Trial Work Period ($840) • 36 Months = Extended Period of Eligibility ($1170) • 5 Years to request Expedited Reinstatement • Medicare can continue Medicaid 1619 b can continue

Social Security Work Incentives • 9 Trial Work Months = Trial Work Period ($840) • 36 Months = Extended Period of Eligibility ($1170) • 5 Years to request Expedited Reinstatement • Medicare can continue Medicaid 1619 b can continue

Expedited Reinstatement of Benefits Terminated for Work Ø Terminated Social Security Disability Insurance & Supplemental Security Income disability benefits can be reinstated within 5 years Ø Medical decision needed to determine if condition has not improved Ø 6 months of provisional benefits are payable during Social Security’s reinstatement decision

Expedited Reinstatement of Benefits Terminated for Work Ø Terminated Social Security Disability Insurance & Supplemental Security Income disability benefits can be reinstated within 5 years Ø Medical decision needed to determine if condition has not improved Ø 6 months of provisional benefits are payable during Social Security’s reinstatement decision

§Beneficiaries with disabilities who work will continue to be covered by Medicare for 8 1/2 years after they first return to work (Part A & B) Health Insurance Improvements §They may also be able to buy into Medicaid even though they are no longer eligible for SSI cash benefits. Each State program is different.

§Beneficiaries with disabilities who work will continue to be covered by Medicare for 8 1/2 years after they first return to work (Part A & B) Health Insurance Improvements §They may also be able to buy into Medicaid even though they are no longer eligible for SSI cash benefits. Each State program is different.

Community Work Incentive Coordinators üProvide services to beneficiaries in all 50 States, the District of Columbia & 5 territories üProvide beneficiaries with disabilities accurate & timely info about Social Security work incentives & other Federal benefits www. social security. gov/w ork

Community Work Incentive Coordinators üProvide services to beneficiaries in all 50 States, the District of Columbia & 5 territories üProvide beneficiaries with disabilities accurate & timely info about Social Security work incentives & other Federal benefits www. social security. gov/w ork

PASS (PLAN FOR ACHIEVING SELF-SUPPORT)

PASS (PLAN FOR ACHIEVING SELF-SUPPORT)

What is a PASS? ØPASS (Plan for Achieving Self-Support) is a plan for your future. Ø It is a program to assist people with disabilities to set aside income or resources to put towards a work goal. Ø It is an SSI provision to help individuals with disabilities return to work.

What is a PASS? ØPASS (Plan for Achieving Self-Support) is a plan for your future. Ø It is a program to assist people with disabilities to set aside income or resources to put towards a work goal. Ø It is an SSI provision to help individuals with disabilities return to work.

You can have a PASS if: Ø You want to work Ø You get SSI (or can qualify for SSI) because of blindness or a disability; or Ø You have or expect to receive income (other than SSI) and/or resources to set aside toward a work goal.

You can have a PASS if: Ø You want to work Ø You get SSI (or can qualify for SSI) because of blindness or a disability; or Ø You have or expect to receive income (other than SSI) and/or resources to set aside toward a work goal.

Ø HOW WILL A PLAN AFFECT MY SSI BENEFIT? Ø Under regular SSI rules, your SSI benefit is reduced by the other income you have. But the income you set aside for a PASS doesn’t reduce your SSI benefit. This means you can get a higher SSI benefit when you have a PASS. But you can’t get more than the maximum SS benefit. Ø Money you save or things you own, such as property or equipment that you set aside for a PASS won’t count against the resource limit of $2, 000 (or $3, 000 for a couple). Under regular SSI rules, you wouldn’t be eligible for SSI if your resources are above 2, 000.

Ø HOW WILL A PLAN AFFECT MY SSI BENEFIT? Ø Under regular SSI rules, your SSI benefit is reduced by the other income you have. But the income you set aside for a PASS doesn’t reduce your SSI benefit. This means you can get a higher SSI benefit when you have a PASS. But you can’t get more than the maximum SS benefit. Ø Money you save or things you own, such as property or equipment that you set aside for a PASS won’t count against the resource limit of $2, 000 (or $3, 000 for a couple). Under regular SSI rules, you wouldn’t be eligible for SSI if your resources are above 2, 000.

Ø A plan may be used to pay for a variety of expenses that are necessary to help you obtain your work goal. For example: Ø Supplies to start a business; What kinds of expenses can a Plan help pay for? Ø Tuition, fees, books and supplies that are needed for school or training; Ø Employment services, such as payments for a job coach. Ø Attendant care or child care Ø Equipment and tools to do the job Ø Transportation to and from school or work; Ø Uniforms, special clothing and safety equipment

Ø A plan may be used to pay for a variety of expenses that are necessary to help you obtain your work goal. For example: Ø Supplies to start a business; What kinds of expenses can a Plan help pay for? Ø Tuition, fees, books and supplies that are needed for school or training; Ø Employment services, such as payments for a job coach. Ø Attendant care or child care Ø Equipment and tools to do the job Ø Transportation to and from school or work; Ø Uniforms, special clothing and safety equipment

SSA-545 (PASS APPLICATION) v Must be in writing v Must state a work goal (Must be specific) e. g. nurse v Contain a reasonable time frame v Have expenses necessary to achieve the work goal v. Google “SSA-545”

SSA-545 (PASS APPLICATION) v Must be in writing v Must state a work goal (Must be specific) e. g. nurse v Contain a reasonable time frame v Have expenses necessary to achieve the work goal v. Google “SSA-545”

o A vocational rehabilitation counselor o Social Security employee o An organization that helps people with disabilities; o An employer Who May Help Me Set Up A Plan?

o A vocational rehabilitation counselor o Social Security employee o An organization that helps people with disabilities; o An employer Who May Help Me Set Up A Plan?

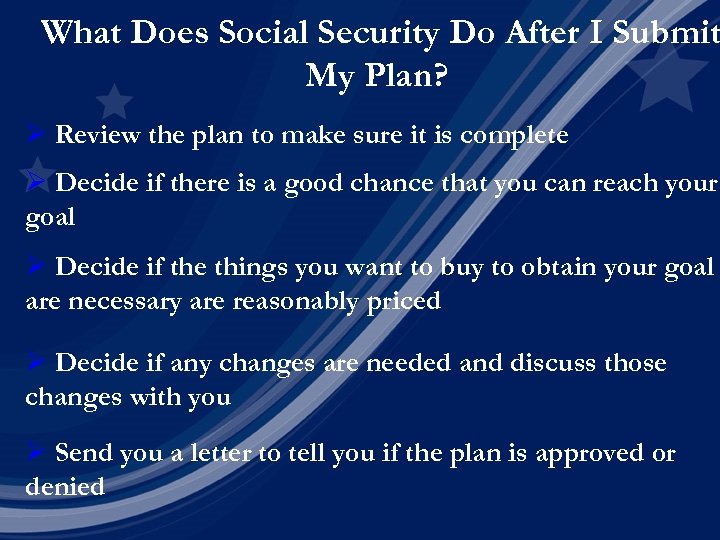

What Does Social Security Do After I Submit My Plan? Ø Review the plan to make sure it is complete Ø Decide if there is a good chance that you can reach your goal Ø Decide if the things you want to buy to obtain your goal are necessary are reasonably priced Ø Decide if any changes are needed and discuss those changes with you Ø Send you a letter to tell you if the plan is approved or denied

What Does Social Security Do After I Submit My Plan? Ø Review the plan to make sure it is complete Ø Decide if there is a good chance that you can reach your goal Ø Decide if the things you want to buy to obtain your goal are necessary are reasonably priced Ø Decide if any changes are needed and discuss those changes with you Ø Send you a letter to tell you if the plan is approved or denied

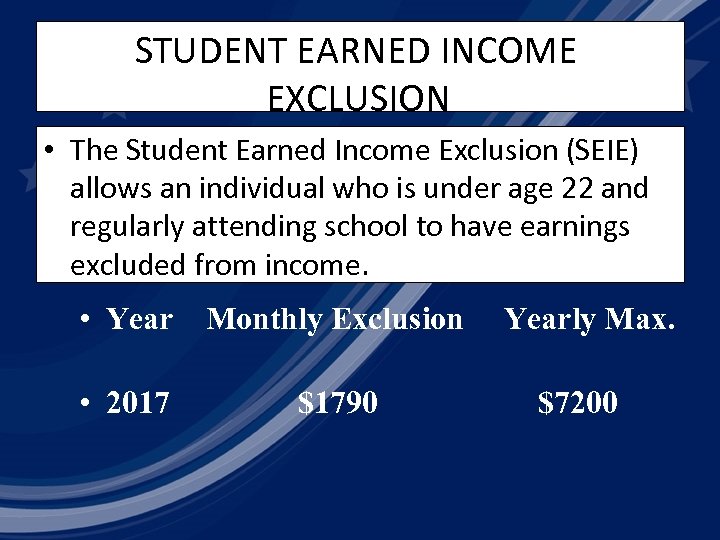

STUDENT EARNED INCOME EXCLUSION • The Student Earned Income Exclusion (SEIE) allows an individual who is under age 22 and regularly attending school to have earnings excluded from income. • Year Monthly Exclusion • 2017 $1790 Yearly Max. $7200

STUDENT EARNED INCOME EXCLUSION • The Student Earned Income Exclusion (SEIE) allows an individual who is under age 22 and regularly attending school to have earnings excluded from income. • Year Monthly Exclusion • 2017 $1790 Yearly Max. $7200

Qualifying for the SEIE Effective 04/01/05 • Under Age 22 • A student regularly attending school This exclusion may apply to an eligible or ineligible: • Individual • Child • spouse

Qualifying for the SEIE Effective 04/01/05 • Under Age 22 • A student regularly attending school This exclusion may apply to an eligible or ineligible: • Individual • Child • spouse

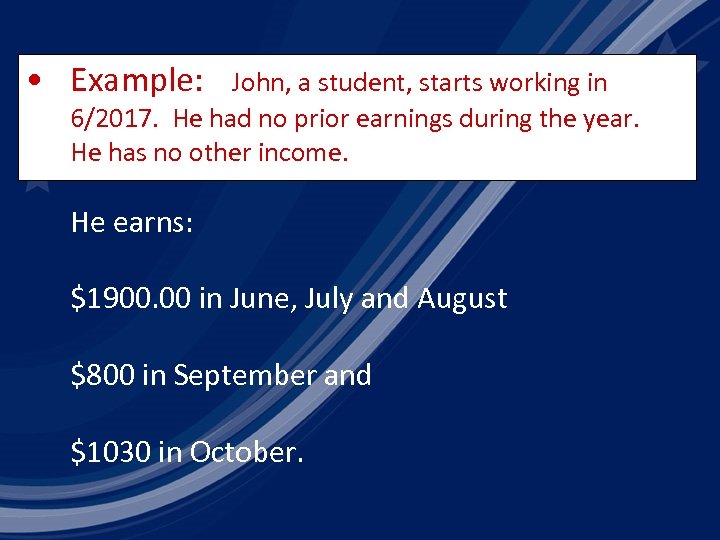

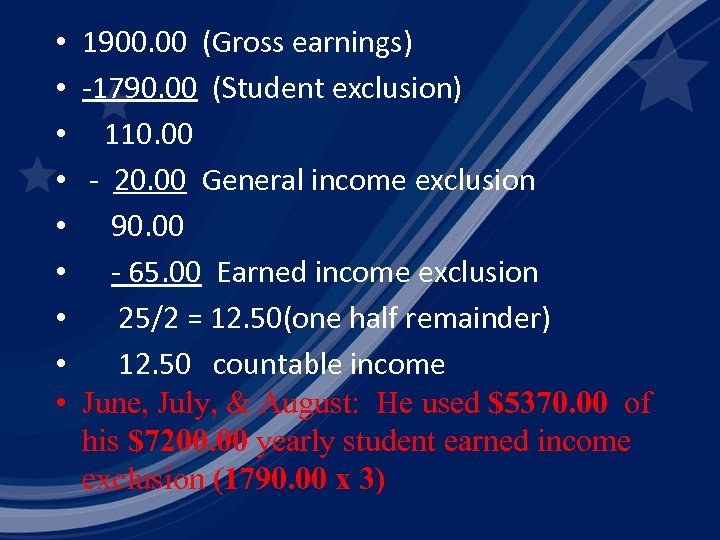

• Example: John, a student, starts working in 6/2017. He had no prior earnings during the year. He has no other income. He earns: $1900. 00 in June, July and August $800 in September and $1030 in October.

• Example: John, a student, starts working in 6/2017. He had no prior earnings during the year. He has no other income. He earns: $1900. 00 in June, July and August $800 in September and $1030 in October.

• • • 1900. 00 (Gross earnings) -1790. 00 (Student exclusion) 110. 00 - 20. 00 General income exclusion 90. 00 - 65. 00 Earned income exclusion 25/2 = 12. 50(one half remainder) 12. 50 countable income June, July, & August: He used $5370. 00 of his $7200. 00 yearly student earned income exclusion (1790. 00 x 3)

• • • 1900. 00 (Gross earnings) -1790. 00 (Student exclusion) 110. 00 - 20. 00 General income exclusion 90. 00 - 65. 00 Earned income exclusion 25/2 = 12. 50(one half remainder) 12. 50 countable income June, July, & August: He used $5370. 00 of his $7200. 00 yearly student earned income exclusion (1790. 00 x 3)

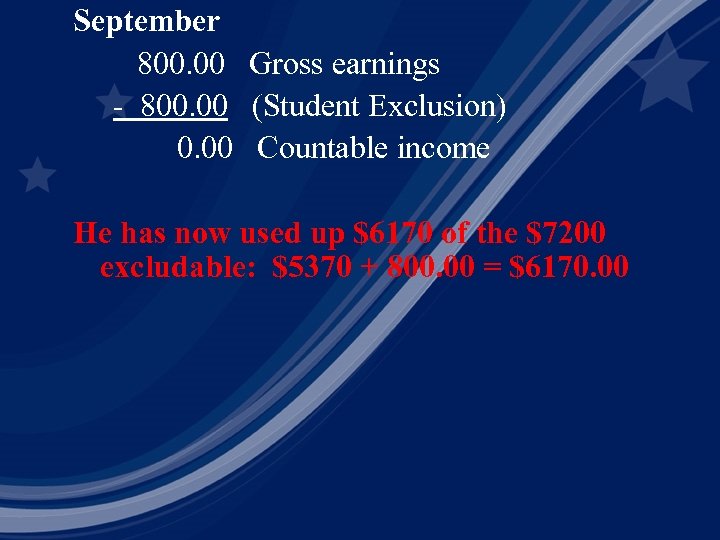

September 800. 00 Gross earnings - 800. 00 (Student Exclusion) 0. 00 Countable income He has now used up $6170 of the $7200 excludable: $5370 + 800. 00 = $6170. 00

September 800. 00 Gross earnings - 800. 00 (Student Exclusion) 0. 00 Countable income He has now used up $6170 of the $7200 excludable: $5370 + 800. 00 = $6170. 00

October 1030. 00 Gross earnings - 1030. 00 (Student Exclusion left to use) 0. 00 He has now used $7200 (all of his SEIE) $5370 +800 + 1030 = $7200

October 1030. 00 Gross earnings - 1030. 00 (Student Exclusion left to use) 0. 00 He has now used $7200 (all of his SEIE) $5370 +800 + 1030 = $7200

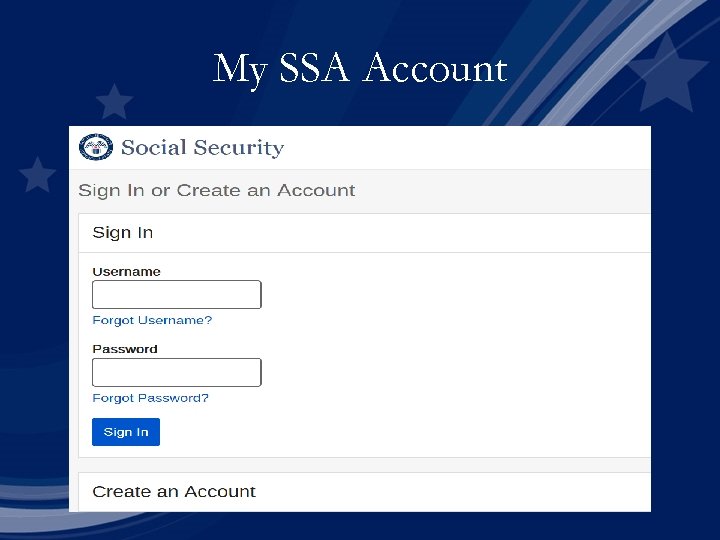

My SSA Account

My SSA Account

My SSA Account

My SSA Account

Laurene Gonzales • 500 Lead SW • Albuquerque, NM 87102 • Tel No: 866 -931 -2876 x 14671 • Laurene. Gonzales@SSA. GOV

Laurene Gonzales • 500 Lead SW • Albuquerque, NM 87102 • Tel No: 866 -931 -2876 x 14671 • Laurene. Gonzales@SSA. GOV