68da75396658ec0762d1509b0742949f.ppt

- Количество слайдов: 24

Global Trends in Telecom Restructuring Dr Tim Kelly, ITU Monday Session 1 CTO Senior management seminar: Telecoms restructuring and business change Malta, 17 -21 May, 1999 The views expressed in this paper are those of the author and do not necessarily reflect the opinions of the ITU or its membership. Dr Kelly can be contacted at Tim. Kelly@itu. int.

Agenda l The state of the Telecoms sector worldwide ð The Public Switched Telephone Network ð Mobile Communications ð The Internet l Market liberalisation / privatisation * l Separation of regulatory and operational functions l The telecoms development gap: The changing international telecoms environment ð The erosion of the accounting rate system l Key policy issues * This will be the subject of separate presentations.

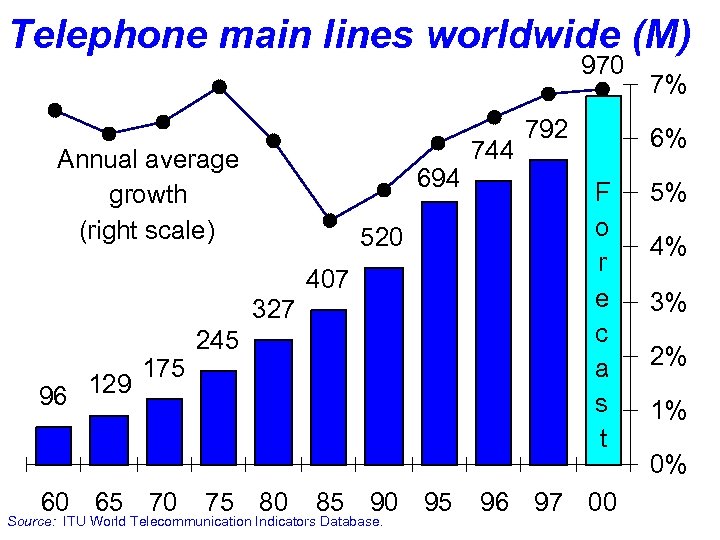

Telephone main lines worldwide (M) 970 Annual average growth (right scale) 694 520 407 327 96 129 175 60 65 70 245 75 80 85 90 95 Source: ITU World Telecommunication Indicators Database. 744 792 7% 6% F o r e c a s t 96 97 00 5% 4% 3% 2% 1% 0%

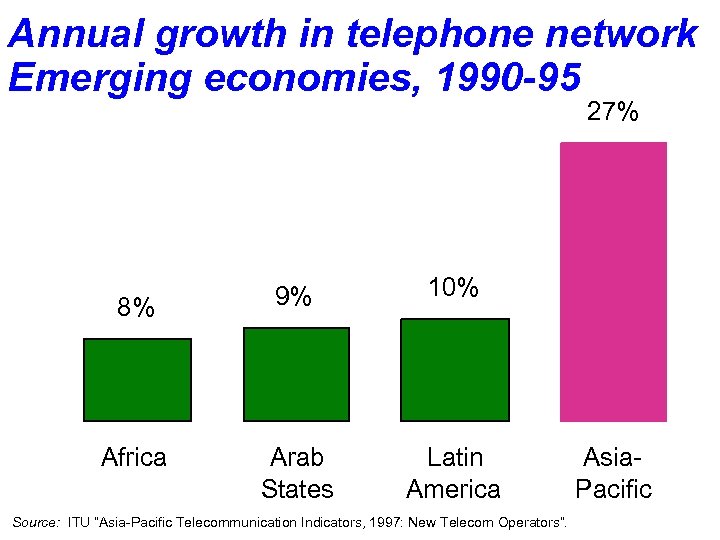

Annual growth in telephone network Emerging economies, 1990 -95 27% 8% 9% 10% Africa Arab States Latin America Source: ITU “Asia-Pacific Telecommunication Indicators, 1997: New Telecom Operators”. Asia. Pacific

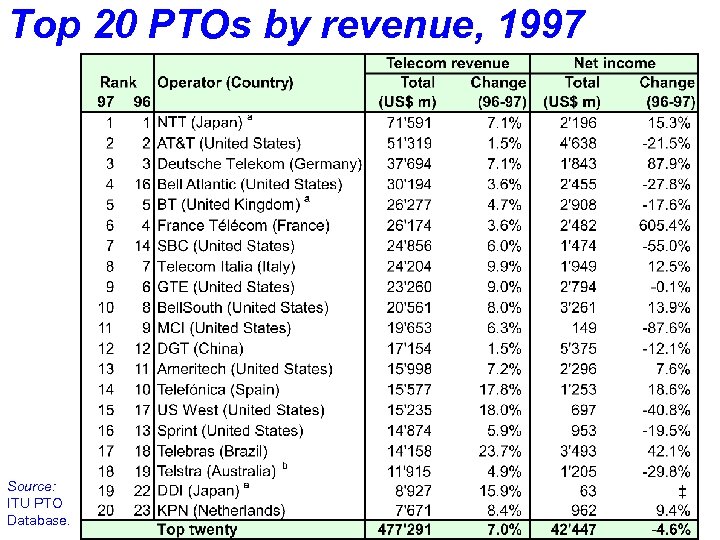

Top 20 PTOs by revenue, 1997 Source: ITU PTO Database.

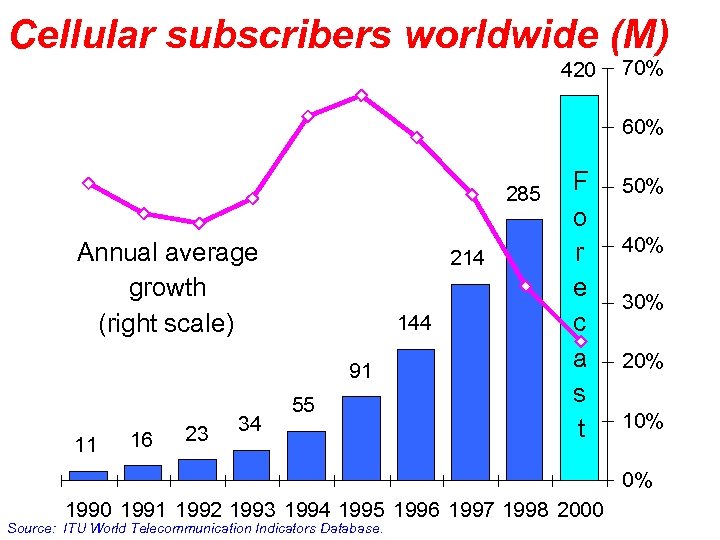

Cellular subscribers worldwide (M) 420 70% 60% 285 Annual average growth (right scale) 214 144 91 11 16 23 34 55 F o r e c a s t 50% 40% 30% 20% 10% 0% 1990 1991 1992 1993 1994 1995 1996 1997 1998 2000 Source: ITU World Telecommunication Indicators Database.

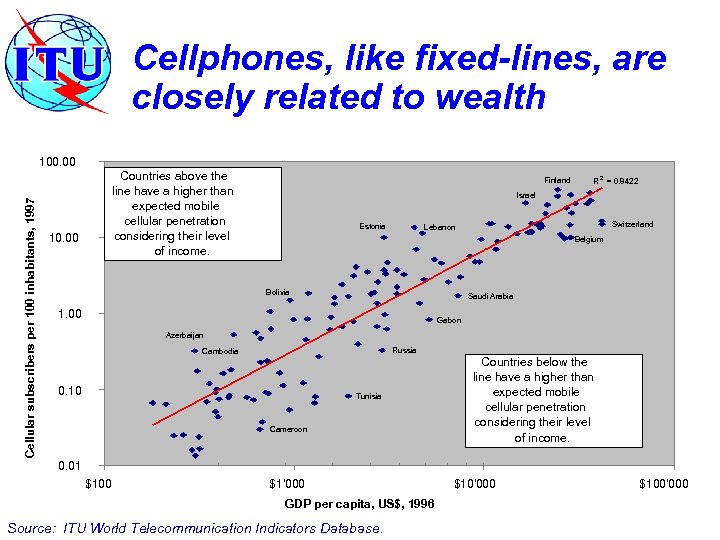

Cellphones, like fixed-lines, are closely related to wealth Cellular subscribers per 100 inhabitants, 1997 100. 00 Countries above the line have a higher than expected mobile cellular penetration considering their level of income. 10. 00 Finland R 2 = 0. 8422 Israel Estonia Switzerland Lebanon Belgium Bolivia Saudi Arabia 1. 00 Gabon Azerbaijan Russia Cambodia 0. 10 Tunisia Cameroon Countries below the line have a higher than expected mobile cellular penetration considering their level of income. 0. 01 $100 $1'000 GDP per capita, US$, 1996 Source: ITU World Telecommunication Indicators Database. $10'000 $100'000

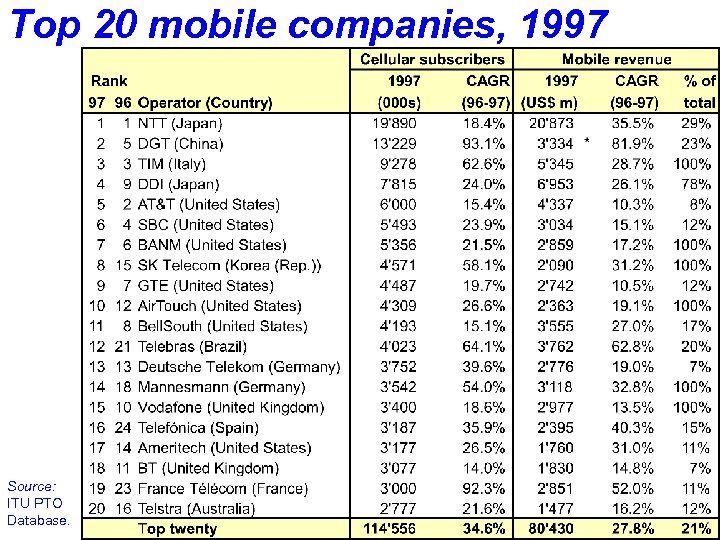

Top 20 mobile companies, 1997 Source: ITU PTO Database.

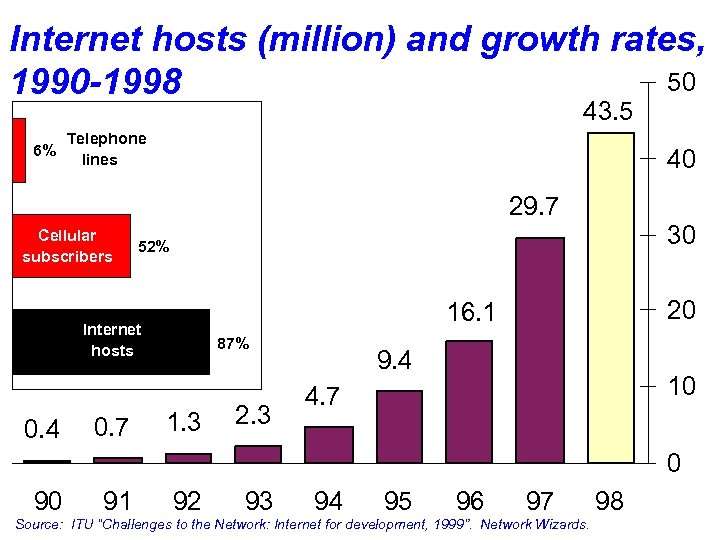

Internet hosts (million) and growth rates, 50 1990 -1998 43. 5 Telephone 6% lines 40 29. 7 Cellular subscribers 0. 4 20 16. 1 Internet hosts 0. 7 30 52% 87% 1. 3 2. 3 9. 4 10 4. 7 0 90 91 92 93 94 95 96 97 Source: ITU “Challenges to the Network: Internet for development, 1999”. Network Wizards. 98

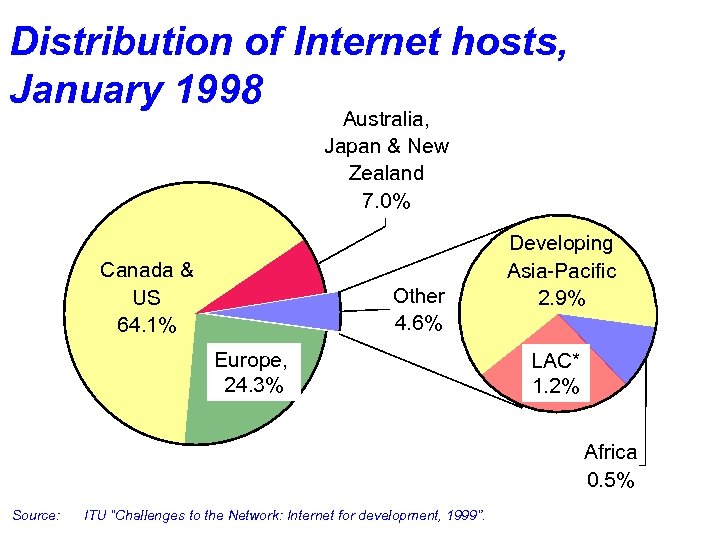

Distribution of Internet hosts, January 1998 Australia, Japan & New Zealand 7. 0% Canada & US 64. 1% Other 4. 6% Europe, 24. 3% Developing Asia-Pacific 2. 9% LAC* 1. 2% Africa 0. 5% Source: ITU “Challenges to the Network: Internet for development, 1999”.

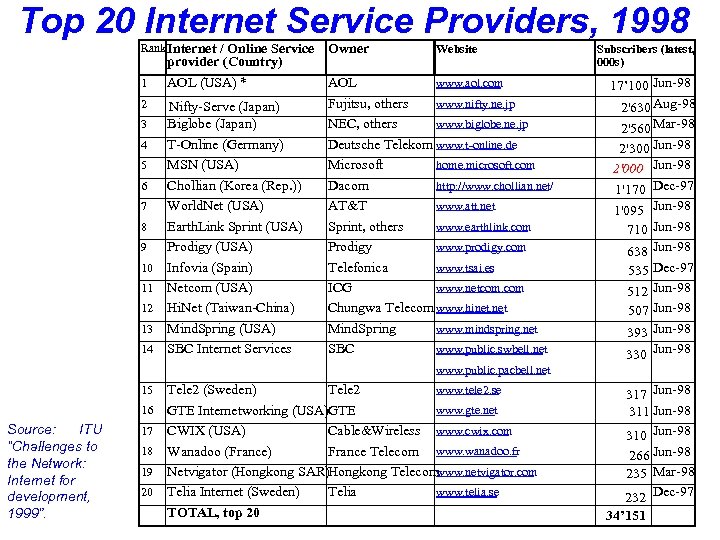

Top 20 Internet Service Providers, 1998 Rank Internet / Online Service provider (Country) 1 AOL (USA) * 2 Nifty-Serve (Japan) Biglobe (Japan) T-Online (Germany) MSN (USA) Chollian (Korea (Rep. )) World. Net (USA) Earth. Link Sprint (USA) Prodigy (USA) Infovia (Spain) Netcom (USA) Hi. Net (Taiwan-China) Mind. Spring (USA) SBC Internet Services 3 4 5 6 7 8 9 10 11 12 13 14 Owner Website www. aol. com AOL www. nifty. ne. jp Fujitsu, others www. biglobe. ne. jp NEC, others Deutsche Telekom www. t-online. de home. microsoft. com Microsoft http: //www. chollian. net/ Dacom www. att. net AT&T www. earthlink. com Sprint, others www. prodigy. com Prodigy www. tsai. es Telefonica www. netcom. com ICG Chungwa Telecom www. hinet. net www. mindspring. net Mind. Spring www. public. swbell. net SBC Subscribers (latest, 000 s) 17’ 100 Jun-98 2'630 Aug-98 2'560 Mar-98 2'300 Jun-98 2'000 Jun-98 1'170 Dec-97 1'095 Jun-98 710 Jun-98 638 Jun-98 535 Dec-97 512 Jun-98 507 Jun-98 393 Jun-98 330 Jun-98 www. public. pacbell. net 15 16 Source: ITU “Challenges to the Network: Internet for development, 1999”. 17 18 19 20 www. tele 2. se Tele 2 (Sweden) Tele 2 www. gte. net GTE Internetworking (USA)GTE CWIX (USA) Cable&Wireless www. cwix. com Wanadoo (France) France Telecom www. wanadoo. fr www. netvigator. com Netvigator (Hongkong SAR)Hongkong Telecom www. telia. se Telia Internet (Sweden) Telia TOTAL, top 20 317 Jun-98 311 Jun-98 310 Jun-98 266 Jun-98 235 Mar-98 232 Dec-97 34’ 151

Market liberalisation and corporatisation/privatisation of incumbents l Process and impact of liberalisation: worldwide trends (Tuesday, Session 1) l Process and impact of commercialisation/privatisation: worldwide trends (Tuesday, Session 2) l Towards the future: what next for telecoms businesses? (Wednesday, Session 1)

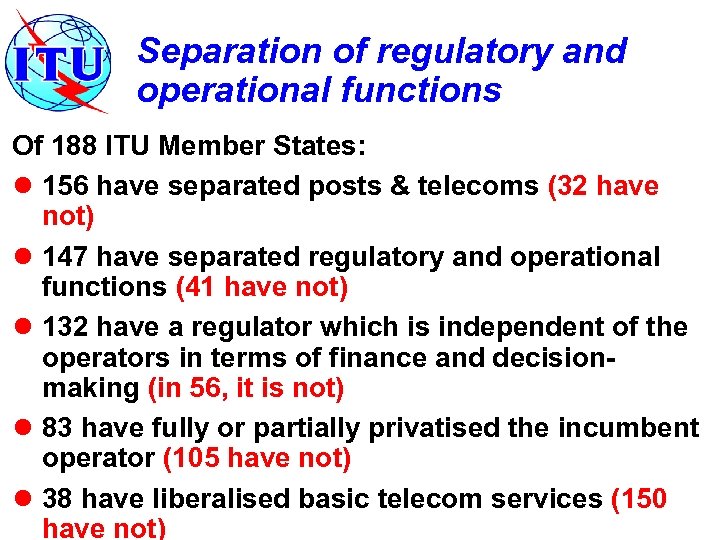

Separation of regulatory and operational functions Of 188 ITU Member States: l 156 have separated posts & telecoms (32 have not) l 147 have separated regulatory and operational functions (41 have not) l 132 have a regulator which is independent of the operators in terms of finance and decisionmaking (in 56, it is not) l 83 have fully or partially privatised the incumbent operator (105 have not) l 38 have liberalised basic telecom services (150 have not)

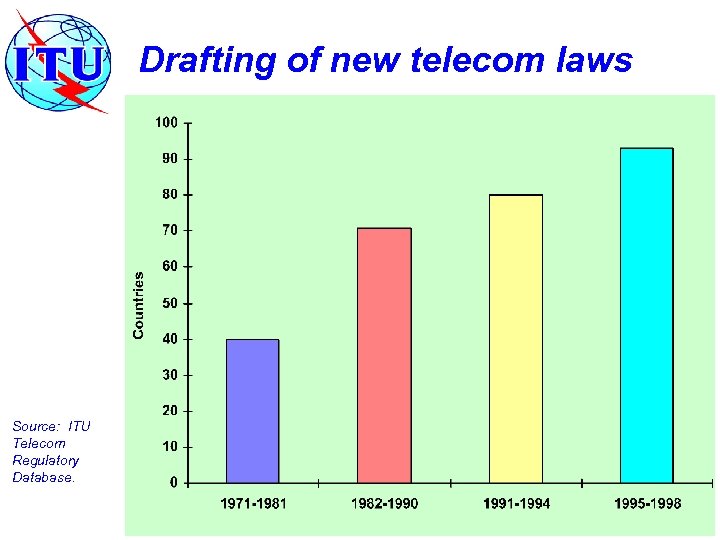

Drafting of new telecom laws Source: ITU Telecom Regulatory Database.

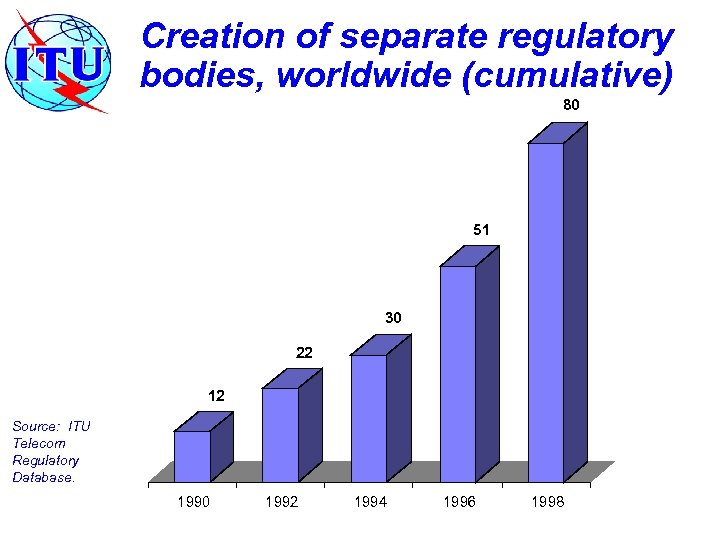

Creation of separate regulatory bodies, worldwide (cumulative) 80 51 30 22 12 Source: ITU Telecom Regulatory Database. 1990 1992 1994 1996 1998

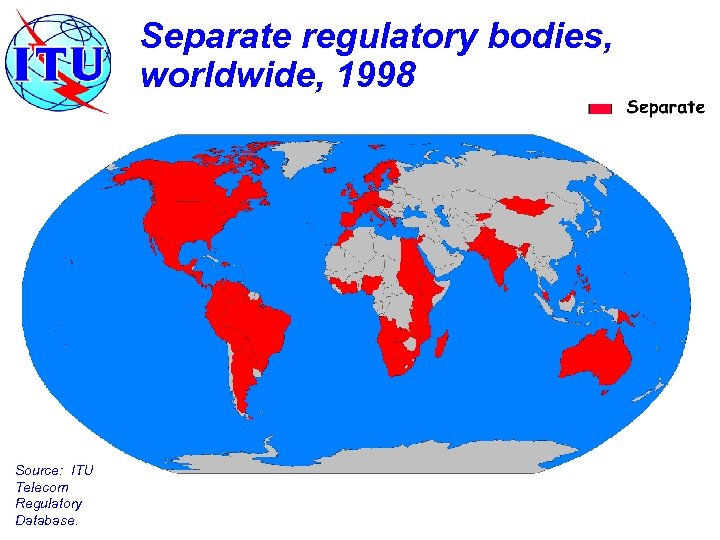

Separate regulatory bodies, worldwide, 1998 Source: ITU Telecom Regulatory Database.

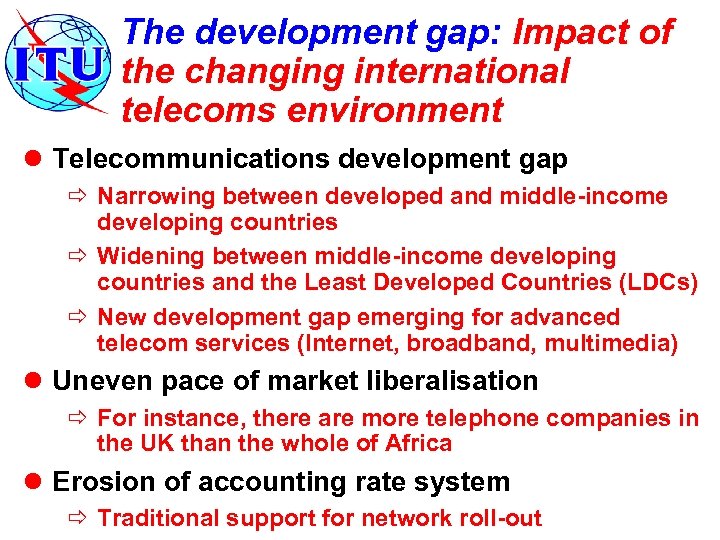

The development gap: Impact of the changing international telecoms environment l Telecommunications development gap ð Narrowing between developed and middle-income developing countries ð Widening between middle-income developing countries and the Least Developed Countries (LDCs) ð New development gap emerging for advanced telecom services (Internet, broadband, multimedia) l Uneven pace of market liberalisation ð For instance, there are more telephone companies in the UK than the whole of Africa l Erosion of accounting rate system ð Traditional support for network roll-out

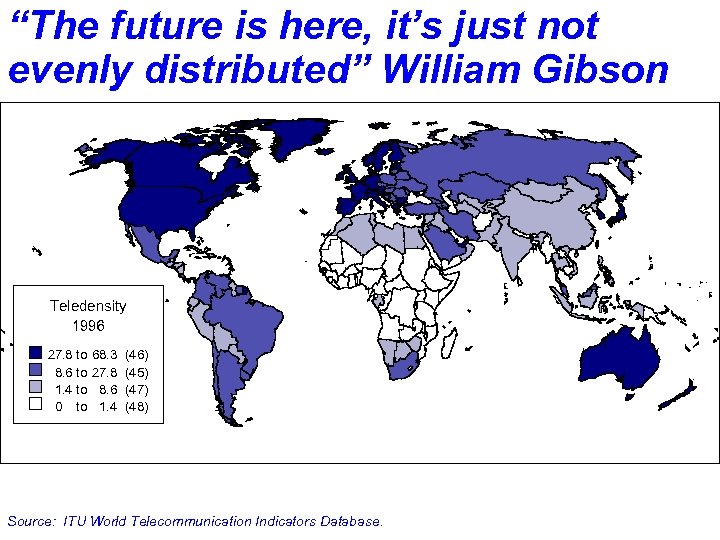

“The future is here, it’s just not evenly distributed” William Gibson Teledensity 1996 27. 8 to 8. 6 to 1. 4 to 0 to 68. 3 27. 8 8. 6 1. 4 (46) (45) (47) (48) Source: ITU World Telecommunication Indicators Database.

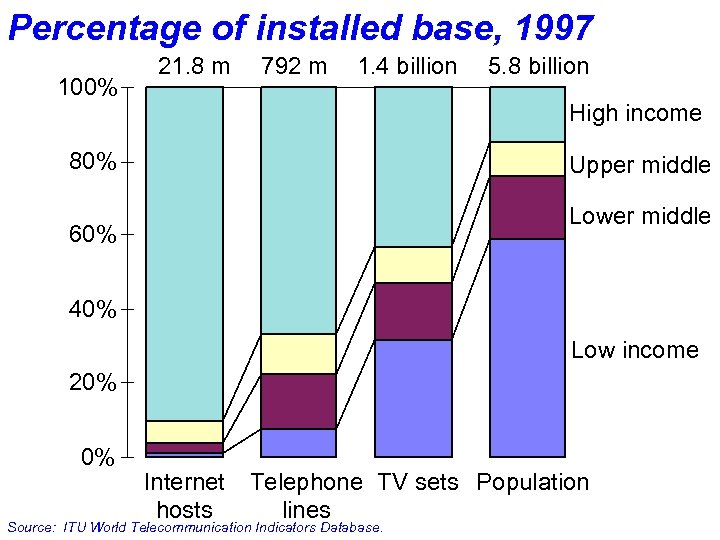

Percentage of installed base, 1997 100% 21. 8 m 792 m 1. 4 billion 5. 8 billion High income 80% Upper middle Lower middle 60% 40% Low income 20% 0% Internet hosts Telephone TV sets Population lines Source: ITU World Telecommunication Indicators Database.

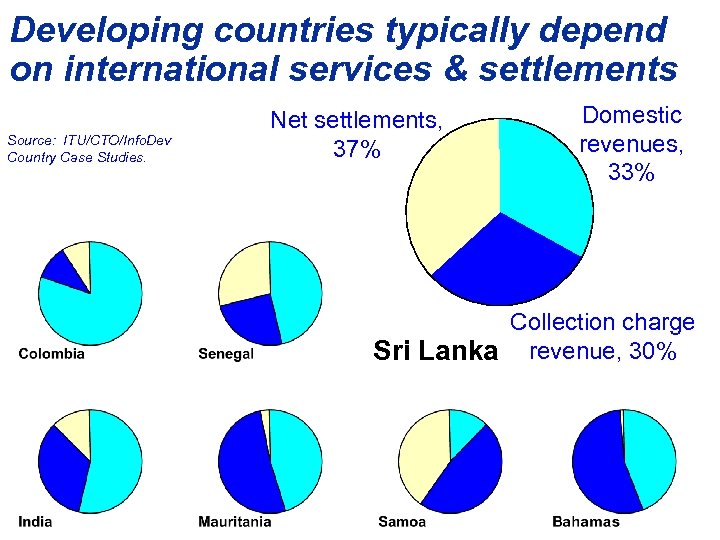

Developing countries typically depend on international services & settlements Source: ITU/CTO/Info. Dev Country Case Studies. Net settlements, 37% Domestic revenues, 33% Collection charge Sri Lanka revenue, 30%

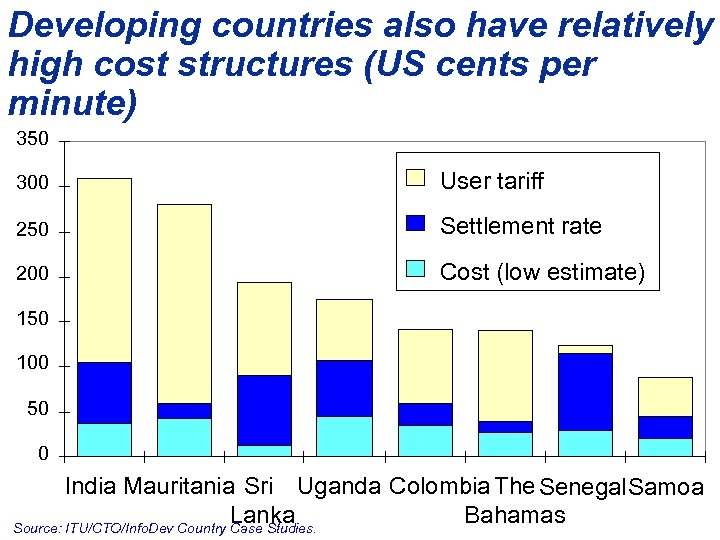

Developing countries also have relatively high cost structures (US cents per minute) 350 300 User tariff 250 Settlement rate 200 Cost (low estimate) 150 100 50 0 India Mauritania Sri Uganda Colombia The Senegal. Samoa Lanka Bahamas Source: ITU/CTO/Info. Dev Country Case Studies.

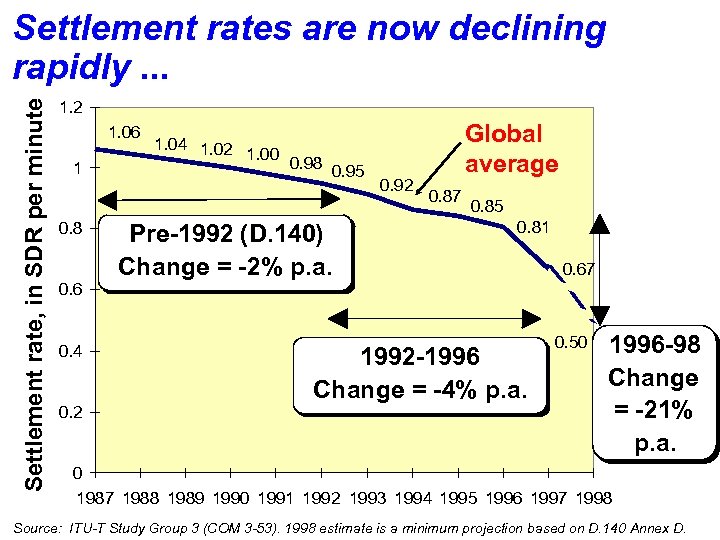

Settlement rate, in SDR per minute Settlement rates are now declining rapidly. . . 1. 2 1. 06 1 0. 8 0. 6 0. 4 0. 2 1. 04 1. 02 1. 00 0. 98 0. 95 Pre-1992 (D. 140) Change = -2% p. a. 0. 92 Global average 0. 87 0. 85 0. 81 1992 -1996 Change = -4% p. a. 0. 67 0. 50 1996 -98 Change = -21% p. a. 0 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 Source: ITU-T Study Group 3 (COM 3 -53). 1998 estimate is a minimum projection based on D. 140 Annex D.

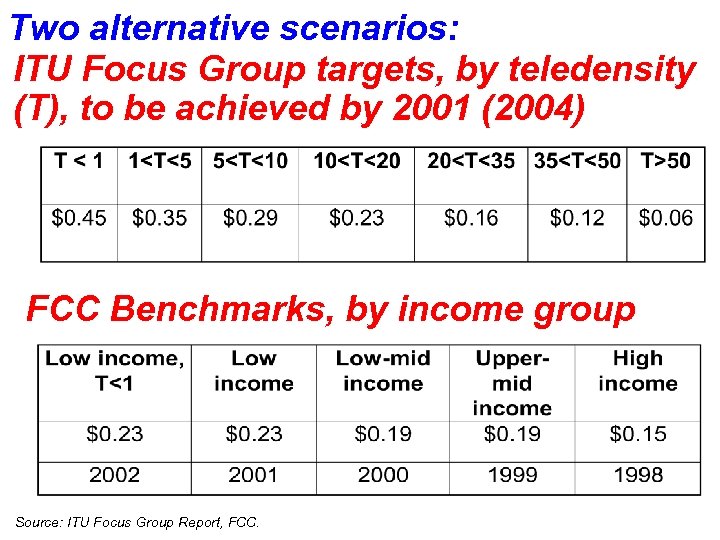

Two alternative scenarios: ITU Focus Group targets, by teledensity (T), to be achieved by 2001 (2004) FCC Benchmarks, by income group Source: ITU Focus Group Report, FCC.

Key policy issues to be tackled l Interconnection ð How to manage the transition to a multi-player environment? l Internet ð Who really sets the rules? Who really gets benefits? l International settlements ð How to transition to a cost-oriented system while providing a “soft-landing” for developing countries? l International infrastructures ð How to ensure equal access at competitive rates? l Investment ð How to increase investment, esp in LDCs?

68da75396658ec0762d1509b0742949f.ppt