8fad4752a4dba63216dfc9e30748bbf0.ppt

- Количество слайдов: 9

GLOBAL TRENDS IN POST TRADE IMPLICATIONS TO CIS AND CEE REGION YEREVAN, OCTOBER 2011 © Copyright 2010, The NASDAQ OMX Group, Inc. All. CONFIDENTIAL STRICTLY PRIVATE AND rights reserved.

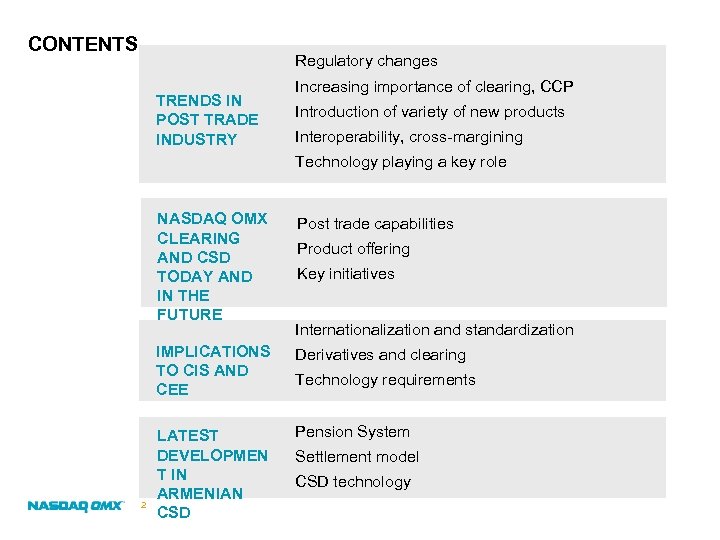

CONTENTS Regulatory changes TRENDS IN POST TRADE INDUSTRY Increasing importance of clearing, CCP Introduction of variety of new products Interoperability, cross-margining Technology playing a key role NASDAQ OMX CLEARING AND CSD TODAY AND IN THE FUTURE Post trade capabilities Product offering Key initiatives Internationalization and standardization IMPLICATIONS TO CIS AND CEE 2 Derivatives and clearing LATEST DEVELOPMEN T IN ARMENIAN CSD Pension System Technology requirements Settlement model CSD technology

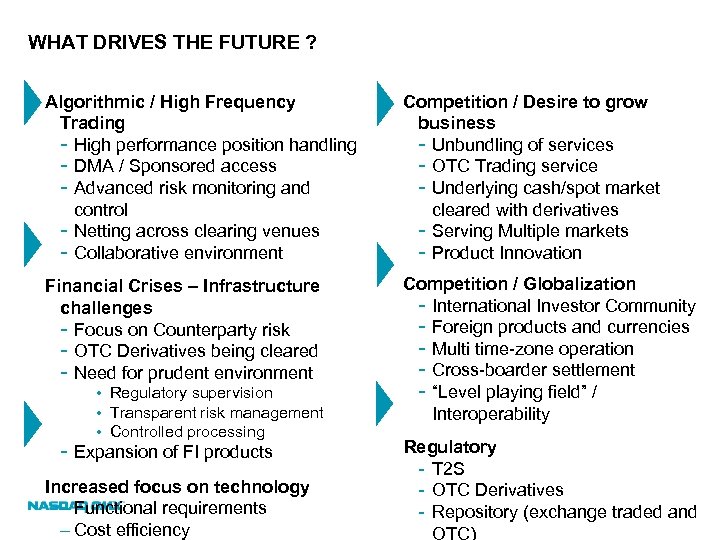

WHAT DRIVES THE FUTURE ? Algorithmic / High Frequency Trading - High performance position handling - DMA / Sponsored access - Advanced risk monitoring and control - Netting across clearing venues - Collaborative environment Competition / Desire to grow business - Unbundling of services - OTC Trading service - Underlying cash/spot market cleared with derivatives - Serving Multiple markets - Product Innovation Financial Crises – Infrastructure challenges - Focus on Counterparty risk - OTC Derivatives being cleared - Need for prudent environment Competition / Globalization - International Investor Community - Foreign products and currencies - Multi time-zone operation - Cross-boarder settlement - “Level playing field” / Interoperability • Regulatory supervision • Transparent risk management • Controlled processing - Expansion of FI products Increased focus on technology – Functional requirements – Cost efficiency Regulatory - T 2 S - OTC Derivatives - Repository (exchange traded and OTC)

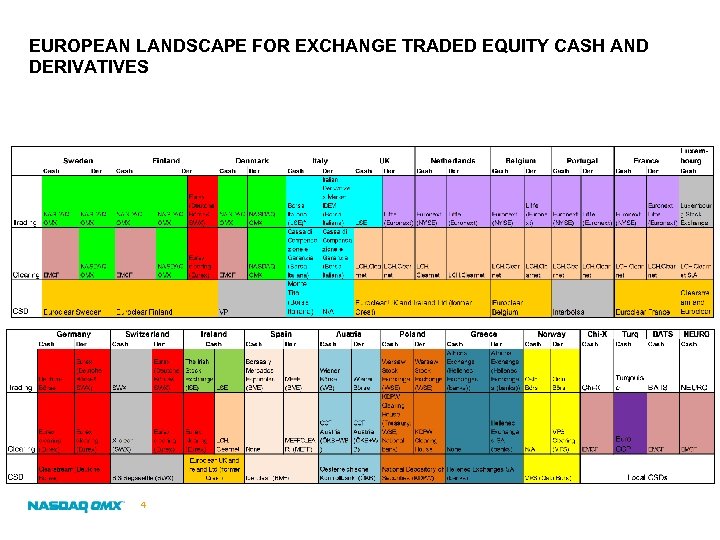

EUROPEAN LANDSCAPE FOR EXCHANGE TRADED EQUITY CASH AND DERIVATIVES 4

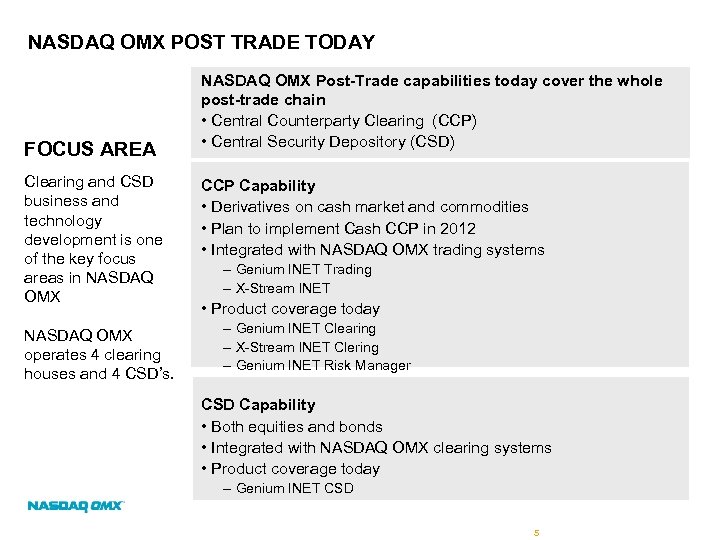

NASDAQ OMX POST TRADE TODAY FOCUS AREA Clearing and CSD business and technology development is one of the key focus areas in NASDAQ OMX operates 4 clearing houses and 4 CSD’s. NASDAQ OMX Post-Trade capabilities today cover the whole post-trade chain • Central Counterparty Clearing (CCP) • Central Security Depository (CSD) CCP Capability • Derivatives on cash market and commodities • Plan to implement Cash CCP in 2012 • Integrated with NASDAQ OMX trading systems – Genium INET Trading – X-Stream INET • Product coverage today – Genium INET Clearing – X-Stream INET Clering – Genium INET Risk Manager CSD Capability • Both equities and bonds • Integrated with NASDAQ OMX clearing systems • Product coverage today – Genium INET CSD 5

NASDAQ OMX CLEARING CURRENT PRODUCT SCOPE NASDAQ OMX Nordic Derivatives Markets Clearing, Europe’s 3 rd largest derivatives clearinghouse Nordic, Baltic and Russian Equities (Standardized and Flex/Tailor Made) Futures, Forwards and Options on Single Stocks and Depository Receipts Futures, Forwards and Options on Tradable Indexes Futures, Forwards and Options on Custom Made Indexes Nordic Fixed Income (Standardized and Flex/Tailor Made) Forward Rate Agreements Bond Forwards and Futures Policy Rate Futures Options on Bond Forwards IRS Clearing for NASDAQ OMX Commodities Europe, the world’s largest power derivative exchange Nordic, German, Dutch and UK Commodities (Standardized) Futures, Forwards and Options on Electricity Contracts for Difference (Cf. Ds) on Electricity Futures, Forwards, Options and Spot Contracts on Carbon Allowances 6

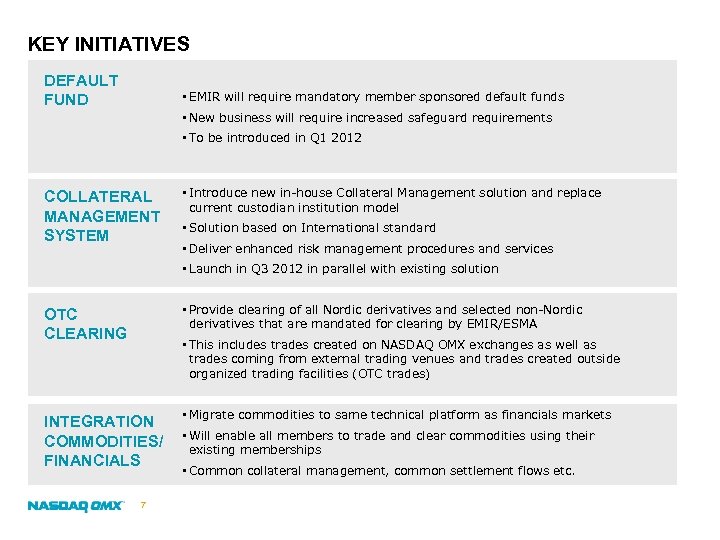

KEY INITIATIVES DEFAULT FUND • EMIR will require mandatory member sponsored default funds • New business will require increased safeguard requirements • To be introduced in Q 1 2012 COLLATERAL MANAGEMENT SYSTEM • Introduce new in-house Collateral Management solution and replace current custodian institution model • Solution based on International standard • Deliver enhanced risk management procedures and services • Launch in Q 3 2012 in parallel with existing solution OTC CLEARING • Provide clearing of all Nordic derivatives and selected non-Nordic derivatives that are mandated for clearing by EMIR/ESMA INTEGRATION COMMODITIES/ FINANCIALS • Migrate commodities to same technical platform as financials markets • This includes trades created on NASDAQ OMX exchanges as well as trades coming from external trading venues and trades created outside organized trading facilities (OTC trades) 7 • Will enable all members to trade and clear commodities using their existing memberships • Common collateral management, common settlement flows etc.

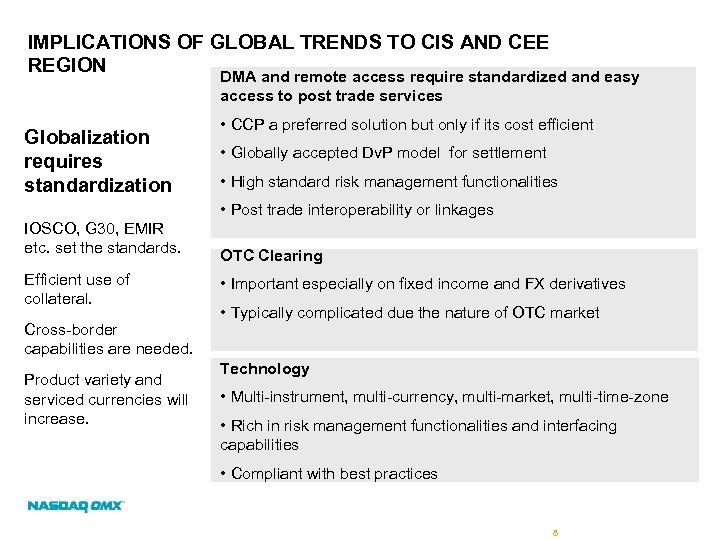

IMPLICATIONS OF GLOBAL TRENDS TO CIS AND CEE REGION DMA and remote access require standardized and easy access to post trade services Globalization requires standardization • CCP a preferred solution but only if its cost efficient • Globally accepted Dv. P model for settlement • High standard risk management functionalities • Post trade interoperability or linkages IOSCO, G 30, EMIR etc. set the standards. Efficient use of collateral. Cross-border capabilities are needed. Product variety and serviced currencies will increase. OTC Clearing • Important especially on fixed income and FX derivatives • Typically complicated due the nature of OTC market Technology • Multi-instrument, multi-currency, multi-market, multi-time-zone • Rich in risk management functionalities and interfacing capabilities • Compliant with best practices 8

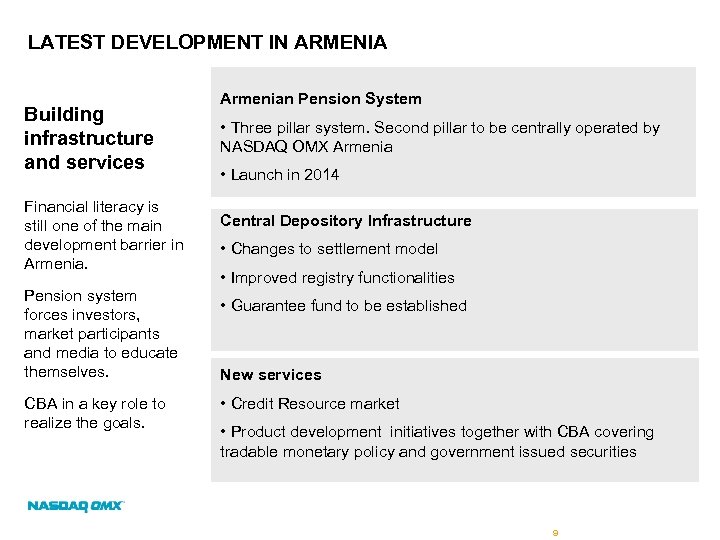

LATEST DEVELOPMENT IN ARMENIA Building infrastructure and services Financial literacy is still one of the main development barrier in Armenia. Pension system forces investors, market participants and media to educate themselves. CBA in a key role to realize the goals. Armenian Pension System • Three pillar system. Second pillar to be centrally operated by NASDAQ OMX Armenia • Launch in 2014 Central Depository Infrastructure • Changes to settlement model • Improved registry functionalities • Guarantee fund to be established New services • Credit Resource market • Product development initiatives together with CBA covering tradable monetary policy and government issued securities 9

8fad4752a4dba63216dfc9e30748bbf0.ppt