f7f508e9eb3e9d419ca91dce2aec39b5.ppt

- Количество слайдов: 14

Global Structured Finance Gordon Branston Head of Global Structured Finance Australia and New Zealand Banking Group Limited 20 July 2001

Global capabilities in selected niche markets • What we do? • Financial performance • Risk and portfolio management • Leveraging core competencies and intellectual capital to drive growth • Goals for Global Structured Finance Page 2

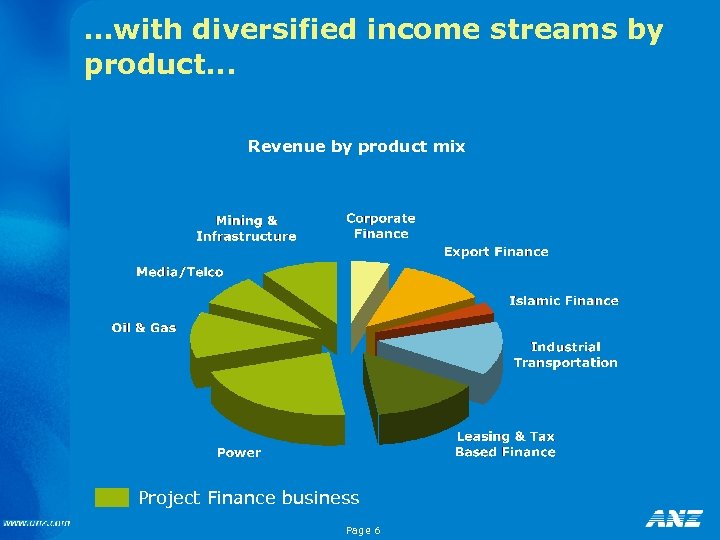

GSF: integrated product delivery • Project Finance • Export Finance • Corporate Finance • Leasing & Tax Based Finance • Islamic Finance • Industrial Transportation Page 3

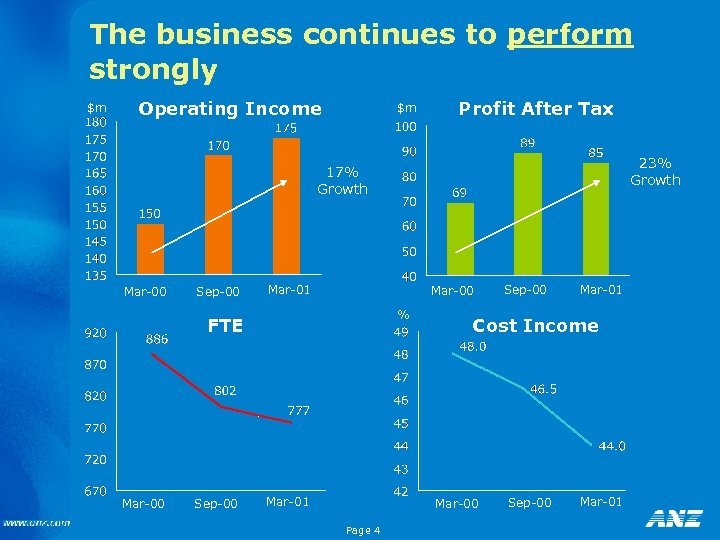

The business continues to perform strongly $m Operating Income $m Profit After Tax 23% Growth 17% Growth Mar-00 Sep-00 Mar-01 Mar-00 % FTE Mar-00 Sep-00 Mar-01 Cost Income Mar-00 Page 4 Sep-00 Mar-01

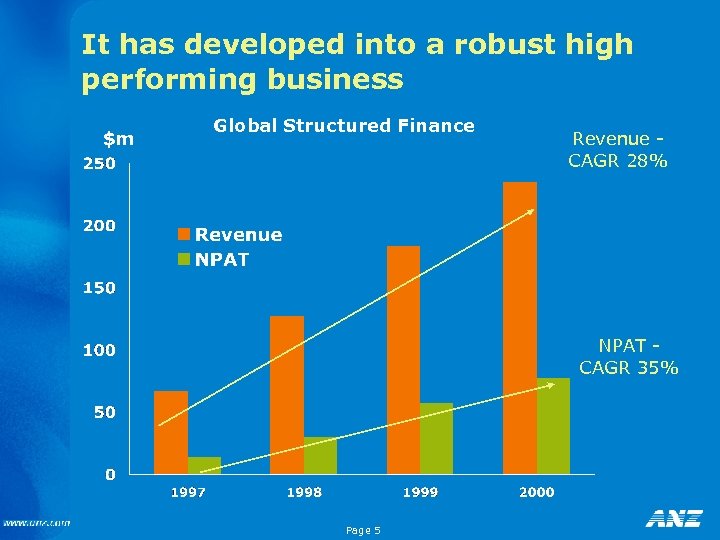

It has developed into a robust high performing business $m Global Structured Finance Revenue CAGR 28% NPAT CAGR 35% Page 5

…with diversified income streams by product. . . Revenue by product mix Project Finance business Page 6

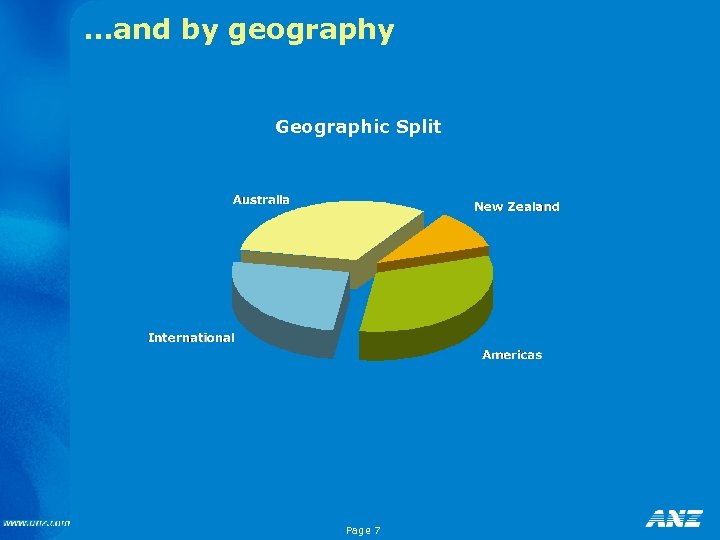

…and by geography Geographic Split Page 7

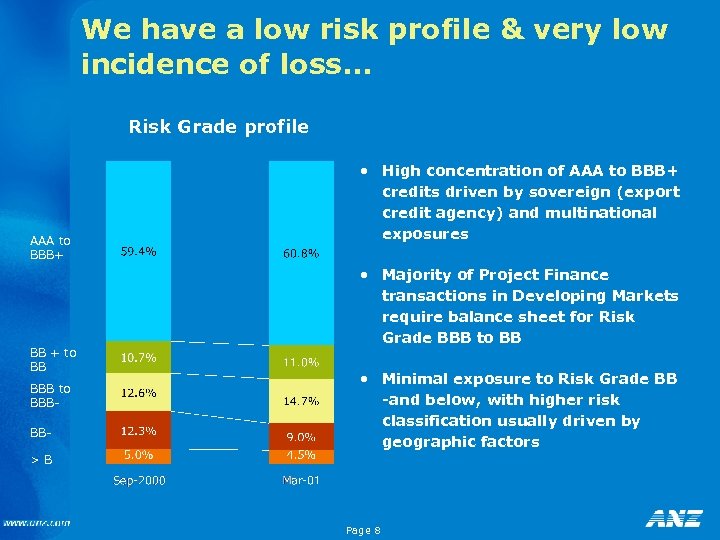

We have a low risk profile & very low incidence of loss. . . Risk Grade profile AAA to BBB+ BB + to BB BBB to BBBBB- • High concentration of AAA to BBB+ credits driven by sovereign (export credit agency) and multinational exposures • Majority of Project Finance transactions in Developing Markets require balance sheet for Risk Grade BBB to BB • Minimal exposure to Risk Grade BB -and below, with higher risk classification usually driven by geographic factors >B Page 8

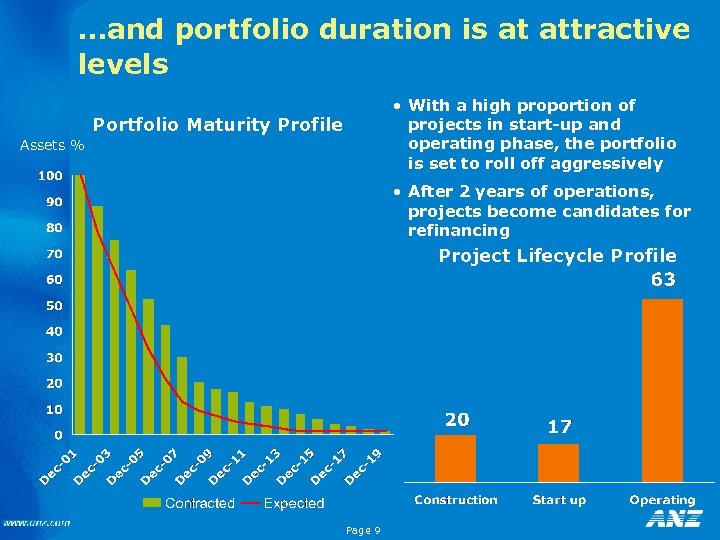

…and portfolio duration is at attractive levels • With a high proportion of projects in start-up and operating phase, the portfolio is set to roll off aggressively Portfolio Maturity Profile Assets % • After 2 years of operations, projects become candidates for refinancing Project Lifecycle Profile Page 9

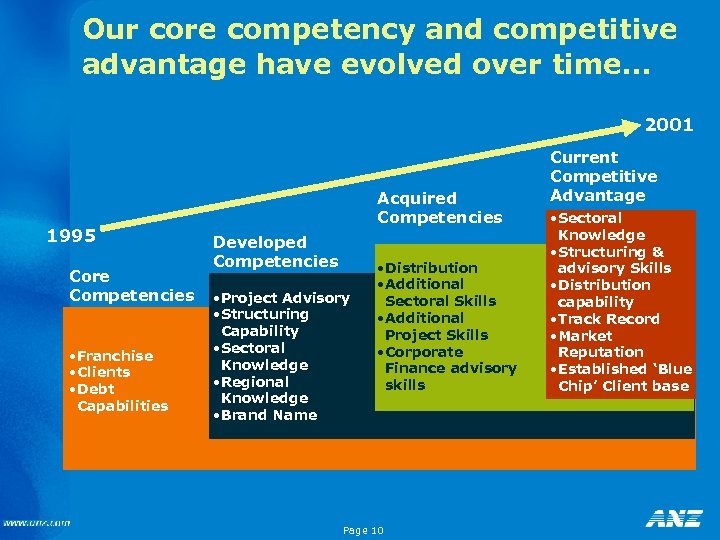

Our core competency and competitive advantage have evolved over time… 2001 1995 Core Competencies • Franchise • Clients • Debt Capabilities Acquired Competencies Developed Competencies • Project Advisory • Structuring Capability • Sectoral Knowledge • Regional Knowledge • Brand Name • Distribution • Additional Sectoral Skills • Additional Project Skills • Corporate Finance advisory skills Page 10 Current Competitive Advantage • Sectoral Knowledge • Structuring & advisory Skills • Distribution capability • Track Record • Market Reputation • Established ‘Blue Chip’ Client base

…and we are leveraging these to drive growth… • Consolidate GSF’s position as a market leader in chosen niches • Increase geographic coverage (developed and developing markets) • Increase industry sector coverage • Acquire teams to complement the current skill base • Manage the balance sheet actively Page 11

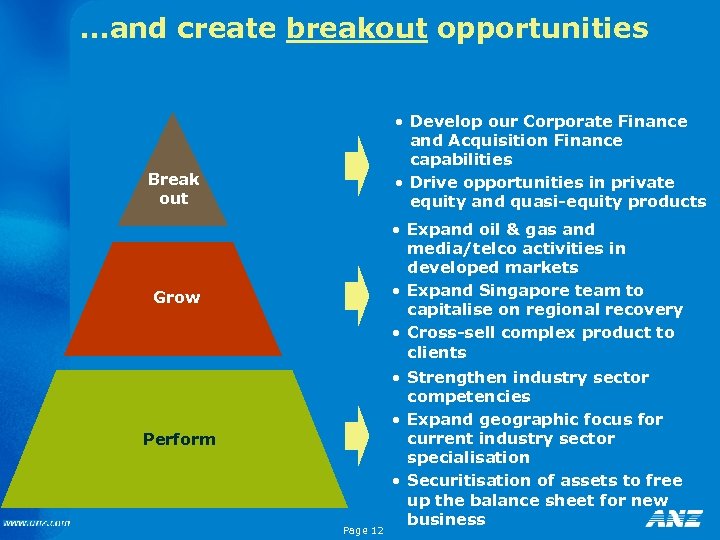

…and create breakout opportunities • Develop our Corporate Finance and Acquisition Finance capabilities • Drive opportunities in private equity and quasi-equity products Break out • Expand oil & gas and media/telco activities in developed markets • Expand Singapore team to capitalise on regional recovery • Cross-sell complex product to clients Grow Perform Page 12 • Strengthen industry sector competencies • Expand geographic focus for current industry sector specialisation • Securitisation of assets to free up the balance sheet for new business

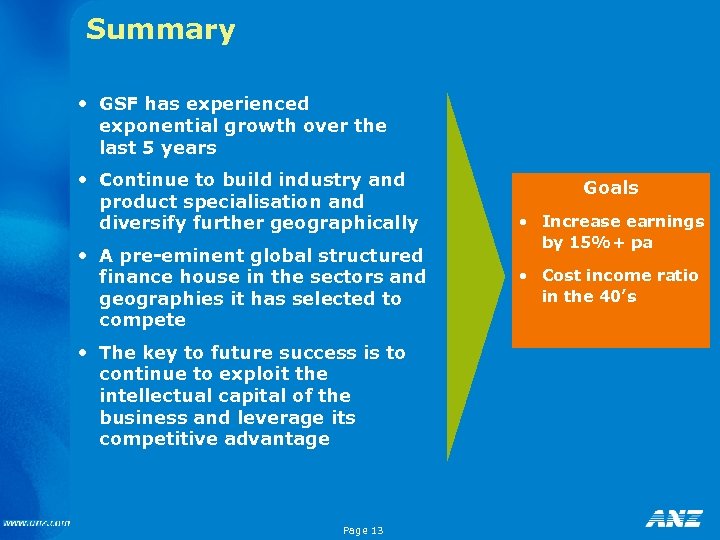

Summary • GSF has experienced exponential growth over the last 5 years • Continue to build industry and product specialisation and diversify further geographically • A pre-eminent global structured finance house in the sectors and geographies it has selected to compete • The key to future success is to continue to exploit the intellectual capital of the business and leverage its competitive advantage Page 13 Goals • Increase earnings by 15%+ pa • Cost income ratio in the 40’s

Copy of presentation available on www. anz. com Page 14

f7f508e9eb3e9d419ca91dce2aec39b5.ppt