a2929d124202981aa28a1e051c086b5b.ppt

- Количество слайдов: 73

Global Pricing Chapter 14

PRICING IN GLOBAL MARKETING

PRICING DECISIONS • The general rule is that prices must exceed costs over the long run and that prices may not exceed those of competitors • Three factors determine the boundaries for market price setting – Production cost determines the price floor – Competitive price determine the price ceiling – Market demand determines the optimum price • Pricing systems and policies that reflect the fundamental factors in each national market must be developed.

Basic Pricing Considerations in International Markets • • Does price reflect product quality? Is it competitive? What should be the pricing objective? Dicounts and allowances for interntional customers Prices in different segments Price elasticity of demand Host country governments perception of price Dumping laws of the host country

Determining prices in global markets is complicated • Exchange rates fluctuate and bear limited relationship to costs. Fluctuation may result in gains or losses • Pricing systems must be consistent with global constraints like international transportation cost, middlemen in international channels of distribution, equal price treatment regardless of location demands of global accounts • National markets vary in cost, competition and demand dimensions of pricing • Company faces varying or conflicting tax policies, price controls by governments • Different interest groups within the company may pursue different pricing objectives • Exporting companies do not run after the best price but frequently use a simple approach like cost plus

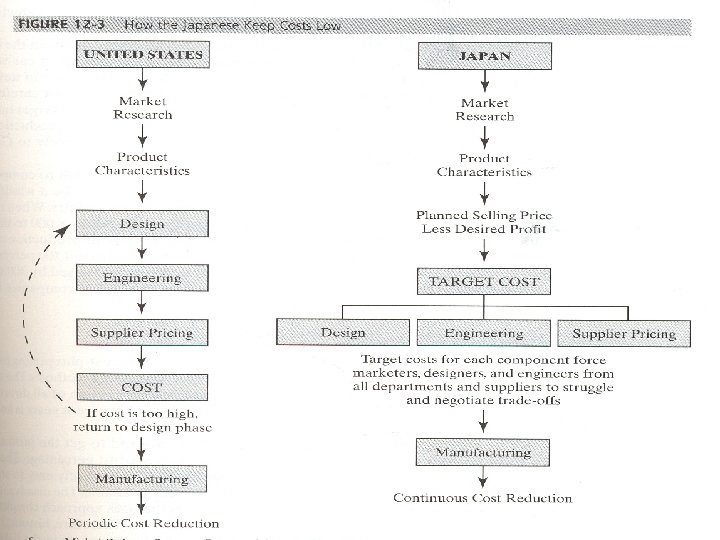

GLOBAL PRICING STRATEGIES • Availability of market information in different countries differ. Managers must rely on intuition and experience and may use analogy for determining potential demand. • Companies may adapt different approaches to pricing in different countries. US and Japanese companies • Price must be evaluated at regular intervals and adjusted if necessary

GLOBAL PRICING STRATEGIES An effective pricing strategy must take into consideration the costs, demand competition. The market must be visited and competing and substitute products must be assessed.

Given the other elements of the marketing mix For determining the base price: Determine the price elasticity of demand 2. Estimate variable and fixed costs and adaptation costs on projected sales volume 3. Determine all costs associated by the marketing program 4. Choose the price that offers the highest contribution margin 1.

Pricing • Only area of global marketing mix where policy can be changed rapidly without large direct cost implications • Decisions in global markets are affected by complexity of influential factors

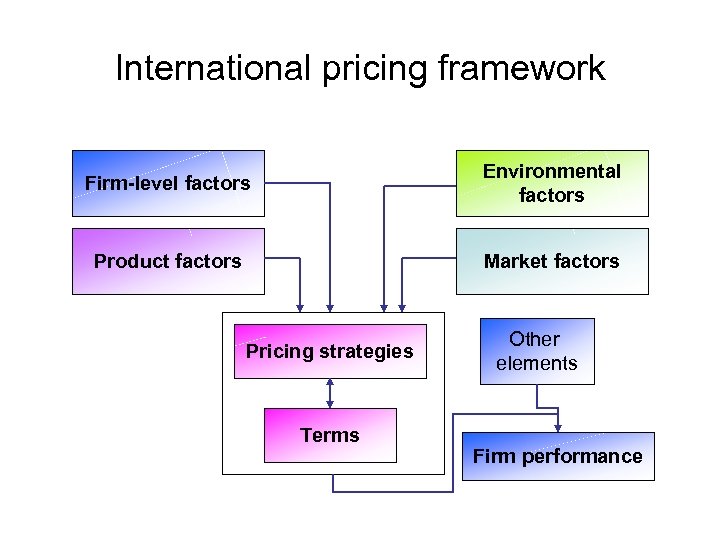

International pricing framework Firm-level factors Environmental factors Product factors Market factors Pricing strategies Terms Other elements Firm performance

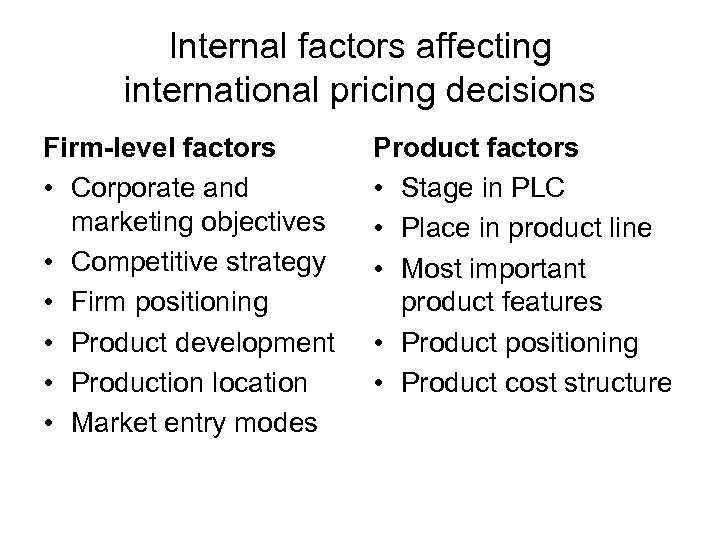

Internal factors affecting international pricing decisions Firm-level factors • Corporate and marketing objectives • Competitive strategy • Firm positioning • Product development • Production location • Market entry modes Product factors • Stage in PLC • Place in product line • Most important product features • Product positioning • Product cost structure

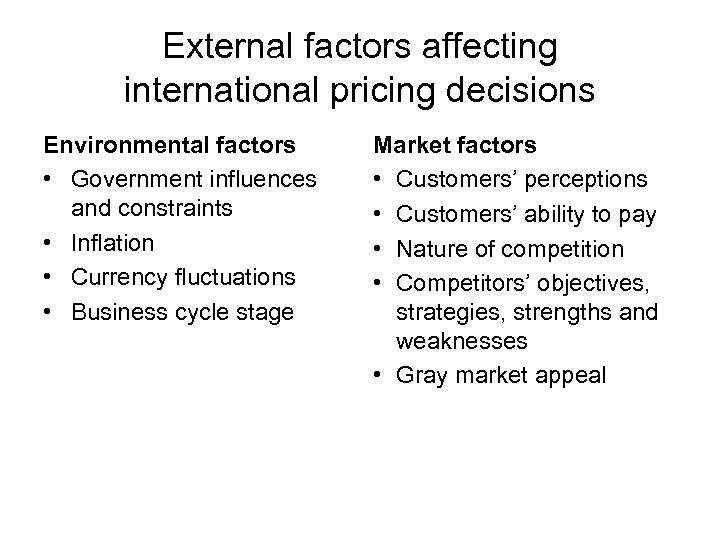

External factors affecting international pricing decisions Environmental factors • Government influences and constraints • Inflation • Currency fluctuations • Business cycle stage Market factors • Customers’ perceptions • Customers’ ability to pay • Nature of competition • Competitors’ objectives, strategies, strengths and weaknesses • Gray market appeal

Basic approaches to pricing across countries Price standardization Price differentiation

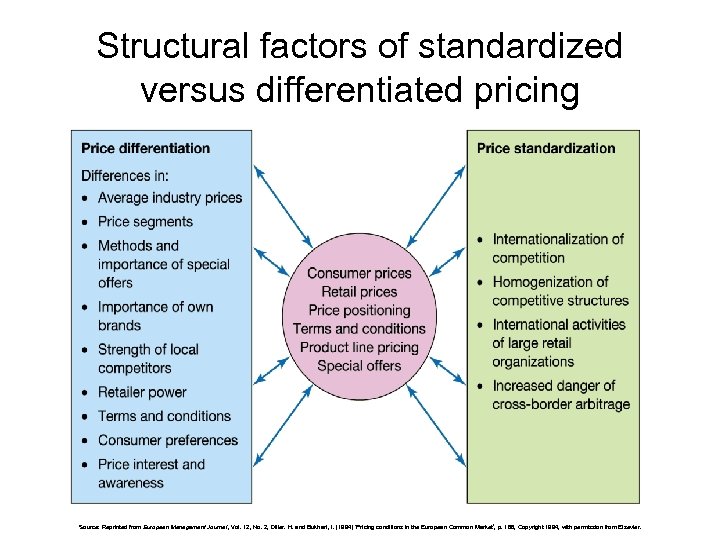

Structural factors of standardized versus differentiated pricing Source: Reprinted from European Management Journal , Vol. 12, No. 2, Diller. H. and Bukhari, I. (1994) ‘Pricing conditions in the European Common Market’, p. 168, Copyright 1994, with permission from Elsevier.

GLOBAL PRICING POLICY ALTERNATIVES The global company can take three alternative positions to worldwide pricing. Extension/Ethnocentric Pricing – The same price all around the world usually based on a full cost formula – Typical for large-ticket items in industrial goods (aircraft, main frame computers) – Freight and import duties absorbed by the importer – Simple to use – Doesn’t respond to market and competitive conditions in each country market – It is not possible to maximize profit in each national market

GLOBAL PRICING POLICY ALTERNATIVES • Adaptation/Polycentric Pricing Prices are set at appropriate levelin each local market. Useful when price sensitivity differs btwn markets & problen of gray trade is minimal. – Subidiary or affiliate managers establish the price – Sensitive to local conditions – No control or coordination in prices from one country to another – Creates difficulty in setting transfer prices in the system – Experience and knowledge regarding effective price strategies within the corporate system is not shared and is not applied to local pricing problems – Can create product arbitrage opportunities for affiliate managers

GLOBAL PRICING POLICY ALTERNATIVES • Invention/Geocentric Pricing – Prices are set to support global strategy objectives rather than to maximize performance in a single country – Global or regional standart plus a markup that is variable across countries is used – The company consciously and systematically seeks to leverage accumulated pricing experience and apply it wherever relevant – The company in geocentric approach takes an intermediary position and assumes that it is necesary to respond to unique local market conditions • • Local costs Income levels Competition Local marketing strategy in pricing decisions

– Long term price floor is fixed by local costs plus a return on invested capital and personnel – The company may set the price lower than cost plus return in the short term if it pursues market penetration or other objective like estimating the size of a market at a price – It is believed that hedquarter price coordination is necessary in dealing with international accounts and product arbitrage – Geocentric approach is the only pricing policy that lends itself to global competition

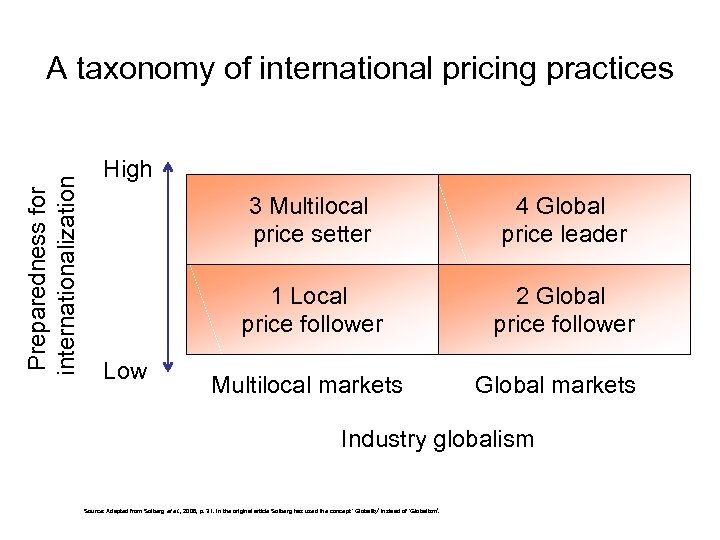

Preparedness for internationalization A taxonomy of international pricing practices High 3 Multilocal price setter 1 Local price follower Low 4 Global price leader 2 Global price follower Multilocal markets Global markets Industry globalism Source: Adapted from Solberg et al. , 2006, p. 31. In the original article Solberg has used the concept ‘ Globality’ instead of ‘Globalism’.

International pricing practices (1) Prototype 1: Local price follower • Limited resources and leverage • Dependent on local export intermediary • Cost-oriented, standard prices • Unexposed to global forces Prototype 2: Global price follower • Newcomers to global markets • Market-oriented, standard prices • Global competition but local differences

International pricing practices (2) Prototype 3: Multilocal price setter • Local market leaders in selected markets • Market-oriented, adapted prices • Local competition Prototype 4: Global price leader • Global market leaders • Market and costoriented ‘global’ prices • Global competition but local differences

When a customer requires one global price per product from the supplier for all its foreign SBUs and subsidiaries, a Global pricing contract has been requested.

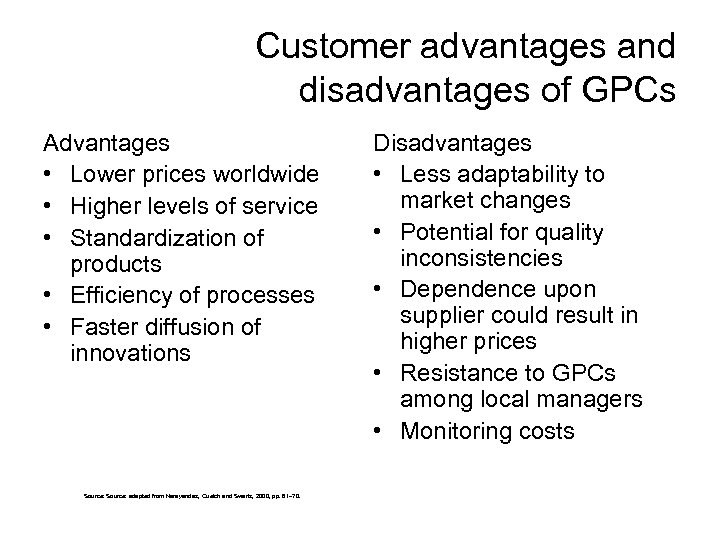

Customer advantages and disadvantages of GPCs Advantages • Lower prices worldwide • Higher levels of service • Standardization of products • Efficiency of processes • Faster diffusion of innovations Source: adapted from Narayandas, Quelch and Swartz, 2000, pp. 61– 70. Disadvantages • Less adaptability to market changes • Potential for quality inconsistencies • Dependence upon supplier could result in higher prices • Resistance to GPCs among local managers • Monitoring costs

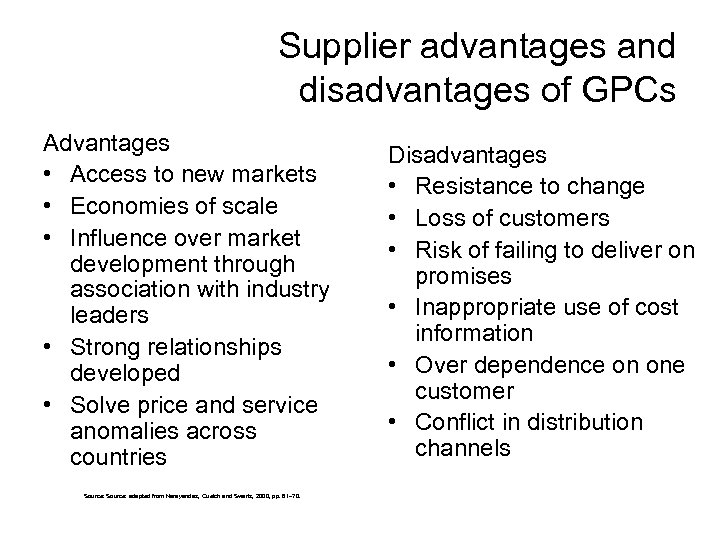

Supplier advantages and disadvantages of GPCs Advantages • Access to new markets • Economies of scale • Influence over market development through association with industry leaders • Strong relationships developed • Solve price and service anomalies across countries Source: adapted from Narayandas, Quelch and Swartz, 2000, pp. 61– 70. Disadvantages • Resistance to change • Loss of customers • Risk of failing to deliver on promises • Inappropriate use of cost information • Over dependence on one customer • Conflict in distribution channels

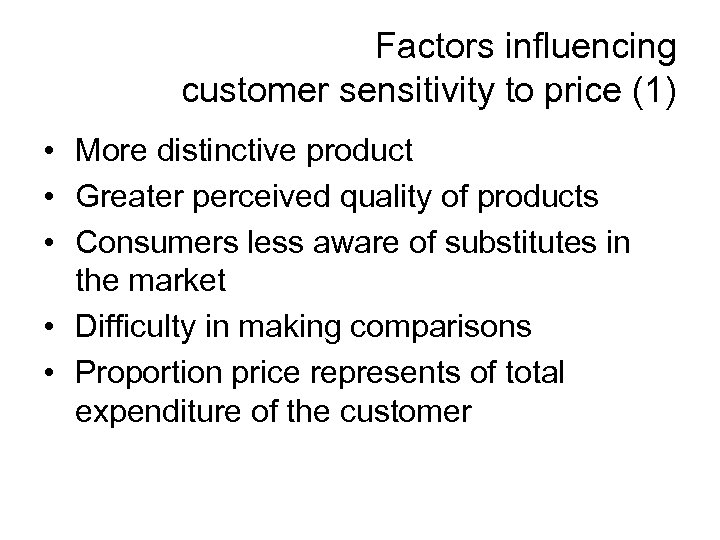

Factors influencing customer sensitivity to price (1) • More distinctive product • Greater perceived quality of products • Consumers less aware of substitutes in the market • Difficulty in making comparisons • Proportion price represents of total expenditure of the customer

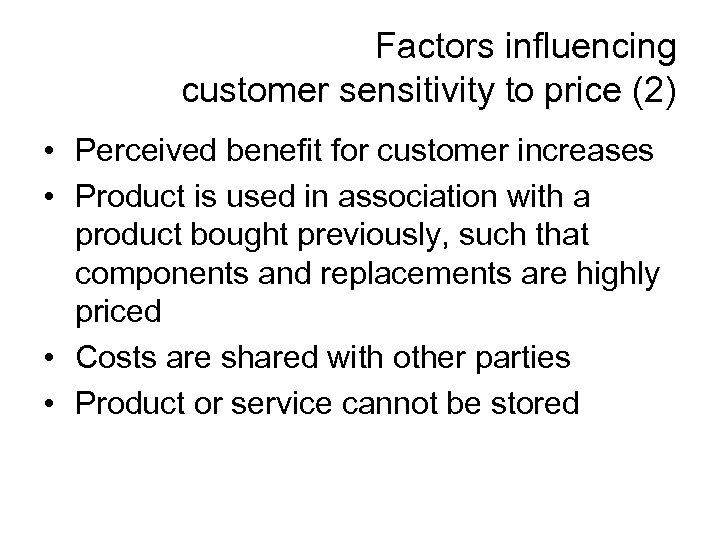

Factors influencing customer sensitivity to price (2) • Perceived benefit for customer increases • Product is used in association with a product bought previously, such that components and replacements are highly priced • Costs are shared with other parties • Product or service cannot be stored

GLOBAL PRICING STRATEGIES Pricing Objectives Pricing objectives must try to contribute to overall sales and profit objectives worldwide Market Skimming strategy involves charging a high price at the top end of the market with the objective of achieving the highest possible contribution in a short time • Deliberate attempt to reach a segment that is willing to pay a premium price • Often used in introductory phase of product life cycle • Goal is to maximize revenue on limited volume reinforce customer’s perception of high product value and match demand to available supply ex. Sony Betamax.

Problems with skimming • Having a small market share makes the firm vulnerable to aggressive local competition • Maintenance of a high-quality product requires a lot of resources • If product is sold more cheaply at home or in another country gray marketing is likely

GLOBAL PRICING STRATEGIES Pricing Objectives Penetration Pricing Penetration pricing strategy involves charging a low price with the objective of achieving the highest possible sales • Uses price as a competitive wheapon to gain market position • Practised by many companies at the Pacific Rim • Means that the product may be sold at a loss for a certain time to gain market share • Companies new to exporting cannot absorb such losses

Motives for penetration pricing Intensive local competition Lower income levels of locals View of exporting as marginal activity

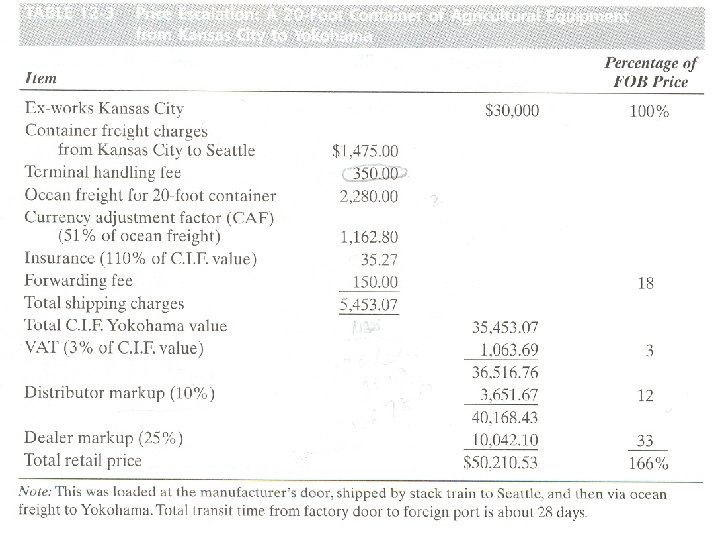

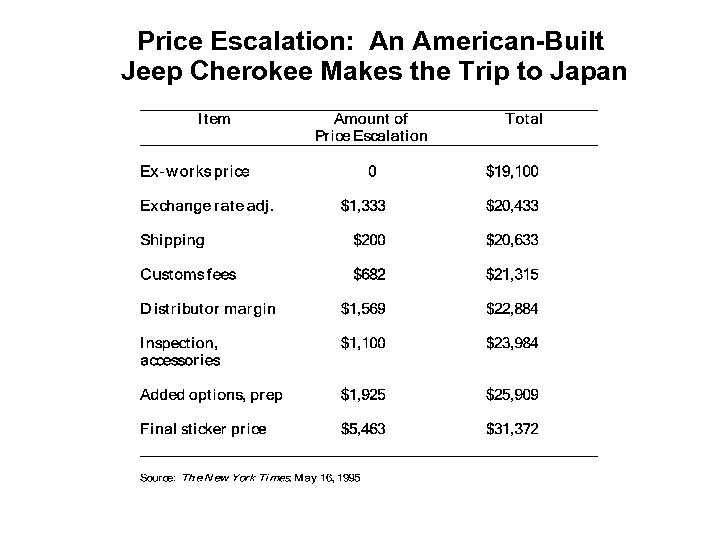

Price escalation phenomenon is caused by the summation of all cost factors in the distribution channel including ex-works price, shipping costs, tariffs, and distributor mark-up

Tactics for countering price escalation • Rationalizing the distribution process • Lowering the export price from the factory • Establishing local production of the product • Pressurizing channel members to accept lower profit margins

GLOBAL PRICING STRATEGIES Pricing Objectives Cost-Plus Price Escalation Ignores demand • Adding up the costs required to get the product to where it is sold. All costs incurred in getting a product to an international market are taken into account • Sometimes ignores competitive conditions • Mostly used by companies new to foreign business

Price Escalation: An American-Built Jeep Cherokee Makes the Trip to Japan

GLOBAL PRICING STRATEGIES Sourcing as a Strategic Tool in Pricing In dealing with price escalations the marketers of domestically manufactured finished products: – May be forced to switch to offshore sourcing of certain componenents to keep costs and prices competitive – May source 100% of the finished products offshore in near or in local markets – May audit and try to rationalize the distribution structure by • Selecting new intermediaries • Assigning new responsibilities • Establishing direct marketing operations (Toys “R”Us in Japan)

Market pricing strategy involves charging a final price based on competitive prices

GLOBAL PRICING STRATEGIES Pricing Objectives Market Holding Applied by companies that want to maintain their market share • Dictates source-country currency appreciation will not be automatically passed on in the form of higher prices (price sensitivity in markets) • May accept lower margins for competitive prices • May have to shift production to other countries or to licensing (eg IKEA, BMW and Mercedes) Weak currency of country leads to profits for global companies producing in that country (Indonesia)

In experience curve pricing, price changes are based on the idea that total unit costs of a product in real terms can be reduced by a certain percentage with each doubling of cumulative production

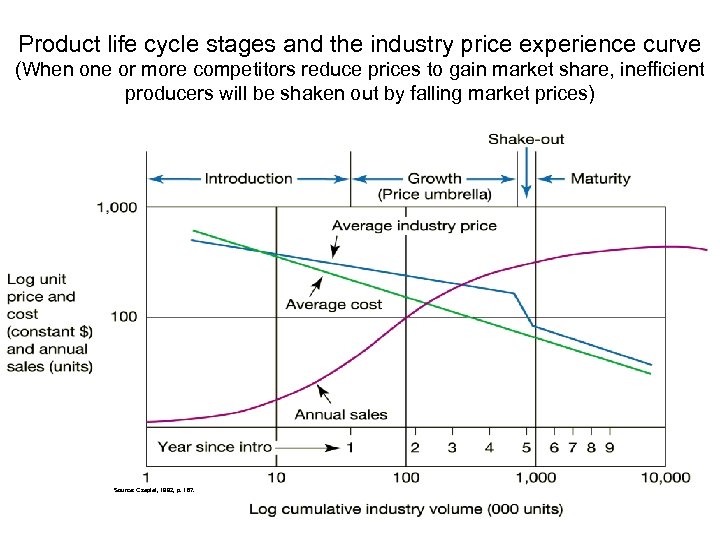

Product life cycle stages and the industry price experience curve (When one or more competitors reduce prices to gain market share, inefficient producers will be shaken out by falling market prices) Source: Czepiel, 1992, p. 167.

Bundle pricing strategy is based on grouping products and services in a system-solution product in order to overcome possible customer price concerns In systems selling/turnkey sales the firm is not only selling a particular product or offering a sibgle saervice but also providing the buyer with a complete ‘package’, a solution

ADDITIONAL PRICING ISSUES Gray Market Goods / Parallel Importing When a company manufactures in several countries & sells the product in many countries the same product may appear in he market in different countries at widely different prices This may be due to parallel imports/ gray trade where trademarked products exported from one country to another where they are sold by unauthorized persons or organizations other than the authorized importer. A coordinated pricing policy is required bu not easily implemented. Fluctuating exchange rates are usually

Gray market occurs when: • The product is short in supply • Producer attempts to set high prices • The company produces in both the home market and a foreign country. -the foreign affiliate may sell to foreign distributers who in return may sell to gray marketers -who bring the product to the home market and -sell at lower prices. Eg. Caterpillar in US market competed with European origin Cat products due to the strong USD

What to do • Change laws so that gray market goods bear labels clearly explaining any differences between them & goods that come from authorized channels • Develop proactive strategies like improved market segmentation & product differentiation to make gray market goods less attractive • Aggressively identify & terminate distributors involved in selling to gray marketers

ADDITIONAL PRICING ISSUES Countertrade A transaction by taking full or partial payment in some other form than money. The transaction initiates the flow of goods in both directions • May result from – Scarce hard currency – Exchange controls on expatriating earnings – Decreasing ability of developing countries to finance imports through bank loans

May take the form of – Barter - Counter purchase/parallel barter where a cash payment is made in each transaction during the course of the countertrade relation. Two contracts are made. One to sell the product at an agreed upon cash price & a secont to buy the goods from the purchaser at an amount equal to the bill in the initial agreement – Product buy-backs build a plant & buy the output as full or partial payment. – Offset a form of buy back, the seller contracts to invest in local production or procurement to partially offset the sale price. Governments try to recover large sums of hard currency pend on import by forcing the exporting country government to import. Eg. F 16 deal of TC government a total of 1 billion USD was offsetted on a transaction that totalled 4. 2 billion

– Compensation deals /involves payment in both goods & cash – Cooperation agreement /trying to avoid the link between the buying and selling by making cooperative agreements like using a foreign trade company. Usually for non market economy company trading with a market economy company – Switch trading/triangular trade A professional switch trader steps in the agreement in return for a fee when one of the parties is not willing to accept all the good received in the barter or countertrade transaction. The switch trader trades the goods in a secondary market in return for a fee.

ADDITIONAL PRICING ISSUES Dumping • A company exports a product at a price lower than the price it normally charges in its own home market • Dumping is an important global pricing issue, because it is sometimes regarded as unfair competition • Organizations like the WTO or OECD have issued guidelines on how to treat these problematic situations • Dumping legislation may be used to – Protect local enterprise – As a device for limiting foreign competition • Companies can deal with antidumping legislation by – Differentiating the product sold from that in the home market (auto accessory/add a tool &manual, XP as tools and get lower tariffs) – Making nonprice competitive adjustments in arrangements with the affiliates and distributor (eg. Extend credit that has the same effect as price reduction)

ADDITIONAL PRICING ISSUES Transfer pricing (TP) Prices charged for intracompany movement of goods & services The use of TP for profit repatriation is heavily scrutinized by governments who’s tax revenues have diminished due to this practice

TRANSFER PRICING APROACHES Cost –Based Transfer Prices Transfer at cost prices set at production cost, the buying unit is credited with the entire profit • • No profit expectations on transfer sales Assumes that low cost leads to better affiliate performance Helps to keep duties minimum Scale economies at domestic manufacturing operations and profitability are sought through the sales of affiliates • Cost definition ? / VC & FC (manufacturing) or full cost (overheads from marketing, R&D)

TRANSFER PRICING APPROACHES Transfer at Direct Cost plus Overhead and Margin Transfer at cost plus Usual compromise, profits are split between production and international divisions • The company believes that profit must be earned for a product at every stage of movement in the corporate system • May result in price unrelated to competitive & demand conditions

TRANSFER PRICING APPROACHES Market Based Transfer Prices Transfer at arms lenght The subsidiary is charged the same as any outside buyer, at market prices (if they exist) • Transfer price is derived from the market price required to be competitive in the international market. • Definition of cost is important as the constraint on market based transfer price is costs which decline by volume / costs for the current or planned volume?

TRANSFER PRICING APPROACHES Negotiated Transfer Prices • Organization’s affiliates negotiate transfer prices.

TRANSFER PRICING • Transfer pricing leads to complications and policies are required • Corporate profit centers emerged and became an important component of corporate financial management as companies expanded and decentralized operations • These centers are useful in – Mesuring and evaluating performance – Motivating divisional management

TRANSFER PRICING • Transfer pricing has important impact on profitability at every level, • Appropriate transfer pricing systems & policies are required to ensure profitability at each level • The company must consider – Taxes, duties, tariffs – Market conditions – Customer’s ability to pay – Profit transfer rules – Conflicting objectives of joint venture partners – Government regulations when setting transfer prices to subsidiaries

TRANSFER PRICING APPROACHES • The advantages and disadvantages of the transfer pricing approach varies with the nature of – The firm – The products – Markets – Historical circumstances

• • TRANSFER PRICING Tax Regulations & Transfer Prices The company faces different corporate tax rates in different countries Companies sometimes use transfer prices to shift profits from high-tax to low-tax countries The global firm tries to maximize income in countries with lowest tax rates and minimize income in countries with high tax rates Governments try to maximize tax revenues and try to regulate transfer pricing

TRANSFER PRICING Other Constraints on Transfer Pricing • Company Controls and Information Systems – Transfer pricing policies aiming to minimize tax liabilities may create distortions and difficulty in assessing performance of subsidiaries – Company control systems must incorporte the effect of transfer pricing on performance – Managerial and subsidiary performance must be monitored and evaluated in reference to the transfer pricing policy

• Duty and Tariff Constraints – Lower transfer prices are desirable if duty rates are high – Low income tax rate implies high transfer price • Government Controls can affect transfer pricing decisions – Cash deposit requirements for importer – Market price dictation – Profit transfer rules-transfer pricing can be a tool for transferring profits

TRANSFER PRICING Other Constraints on Transfer Pricing • Joint Ventures As profit are shared in joint ventures, the companies tend to set higher transfer prices relative to wholly owned affiliates To avoid conflict, price agreements acceptable to both parties must be worked out in advance – The agreements may cover: • Exchange rate change and responding transfer pricing • Learning curve improvements resulting in cost savings and their reflection on transfer prices • Shifts in sourcing from parent companies to alternative sources • Volume and overall margin changes due to competition

ENVIRONMENTAL INFLUENCES ON PRICING DECISIONS • Currency fluctuations (may not be related/reflected to costs) – Two positions: • Fix prices in country target markets / may lead to losses or gains for seller when appreciation / depreciation • Fix prices in home-country / currency-losses and gains to the customer – Pricing should be consistent with the company’s marketing strategy •

Currency decisions in pricing Quote price in foreign currency of buyer’s country Quote price in currency of exporter’s country Quote price in currency of a third country Quote price in currency unit (euro)

Benefits to quoting price in buyer’s country currency • Quoting in foreign currency could be a condition of the contract • Access to finance abroad at lower interest rates • Good currency management may be a means of gaining additional profits • Customer preference for quotes in their currency

GLOBAL PRICING STRATEGIES When Domestic Currency is Weak 1. 2. 3. 4. 5. 6. 7. 8. 9. Stress price benefits Expand product line and add more costly features Shift sourcing to domestic market Exploit market opportunities in all markets Use full-costing approach but employ marginal-cost pricing to penetrate new or competitive markets Speed penetration of foreign earned income and collections Minimize expenditures in local host-country currency Buy advertising, insurance, transportation, and other services in domestic market. Bill foreign customers in their own currency

GLOBAL PRICING STRATEGIES When Domestic Currency is Strong 1. 2. 3. 4. 5. 6. 7. 8. 9. Engage in nonprice competition by improving quality, delivery, and after sales service Improve productivity and engage in cost reduction Shift sourcing outside home country Give priority to exports to countries with stronger currencies Trim profit margins and use marginal cost pricing Keep the foreign-earned income in host country; slow down collections Maximize expenditures in local or host country currency Buy needed services abroad and pay for them in local currencies Bill foreign customers in the domestic currency

ENVIRONMENTAL INFLUENCES ON PRICING DECISIONS Review exchange rates periodically by a clause: • Exchange Rate Clause in sales contracts: – Allows the buyer and the seller to agree to supply and purchase at fixed prices in each company’s national currency – Designed to protect parties from unforseen large swings in currencies – Comparison basis is the three month daily average and initial average – Exchange rate review is made quarterly to determine possible adjustments for the next period

• Hedging involves the purchase of insurance against currency fluctuations • Can take the form of buying or selling forward cotracts or engaging in currency swaps • A forward contract refers to the sale or purchase of a specified amount of foreign currency at a fixed exchange rate for delivery or settlement on an agreed upon date in future, or under an options contract between agreed upon dates in future • Currency swap involves the exchange of one currency for another for a fixed period of time. At the expiration of the swap each party returns the currency initially received

ENVIRONMENTAL INFLUENCES ON PRICING DECISIONS • Devaluation and Revaluation. . . devaluation leads to an increase in price of imported goods thus putting an upward pressure on costs and prices of the importing country with devaluated currency. This leads to partial loss of price decrease advantage for the countries importing from the country with devaluated currency. . . if the competitive position is strong and demand is price inelastic, the company sourcing from or exporting from the country with devaluated currency maintain prices

. . . in case of revaluation the international marketer must decide whether – Pass the price increase to customer in countries importing from the country with revalued currency – Absorb price increases and work on expenses to maintain profit levels – Absorb price increases by reducing prices for the country with revalued currency

ENVIRONMENTAL INFLUENCES ON PRICING DECISIONS • Inflationary Environment – Require periodic adjustments due to rising costs – Must maintain operating profits – LIFO-last in-first out is more appropriate P&G in Peru: increased detergent prices 20 -30% biweekly • Government Controls and Subsidies – In countries with severe financial difficulties, governments may restrict price increases or prescribe fixed prices eg. Brazil – When govenment controls limit freedom in pricing decisions this usually leads to a threat for maintaining margins – Govenment subsidies also challenge companies and may lead them to source strategically to be price competitive Keegan Global Mrketing Management

ENVIRONMENTAL INFLUENCES ON PRICING DECISIONS • Competitive Behavior – Pricing decisions are also dependent on the nature of demand competive action – Price adjustment and sourcing decisions of competitors affect pricing in the firm • Market Demand – Survival and overall profitability objectives may affect gross and operating margin objectives given the demand conditions

a2929d124202981aa28a1e051c086b5b.ppt