4a92de73f3d634243238271a2594eb33.ppt

- Количество слайдов: 29

GLOBAL INDUSTRY ANALYSIS AND THE QUEST FOR COMPARABILITY Philadelphia, PA December 2, 2003 Andrew B. Williams, CFA President Philadelphia International Advisors, LP

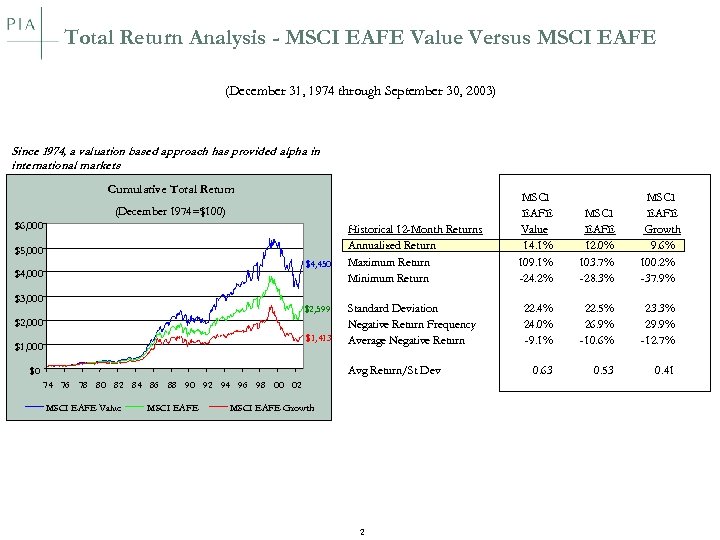

Total Return Analysis - MSCI EAFE Value Versus MSCI EAFE (December 31, 1974 through September 30, 2003) Since 1974, a valuation based approach has provided alpha in international markets Cumulative Total Return Historical 12 -Month Returns Annualized Return Maximum Return Minimum Return MSCI EAFE Value 14. 1% 109. 1% -24. 2% MSCI EAFE 12. 0% 103. 7% -28. 3% MSCI EAFE Growth 9. 6% 100. 2% -37. 9% Standard Deviation Negative Return Frequency Average Negative Return 22. 4% 24. 0% -9. 1% 22. 5% 26. 9% -10. 6% 23. 3% 29. 9% -12. 7% 0. 63 0. 53 0. 41 (December 1974=$100) $6, 000 $5, 000 $4, 450 $4, 000 $3, 000 $2, 599 $2, 000 $1, 413 $1, 000 Avg Return/St Dev $0 74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 MSCI EAFE Value MSCI EAFE Growth 2

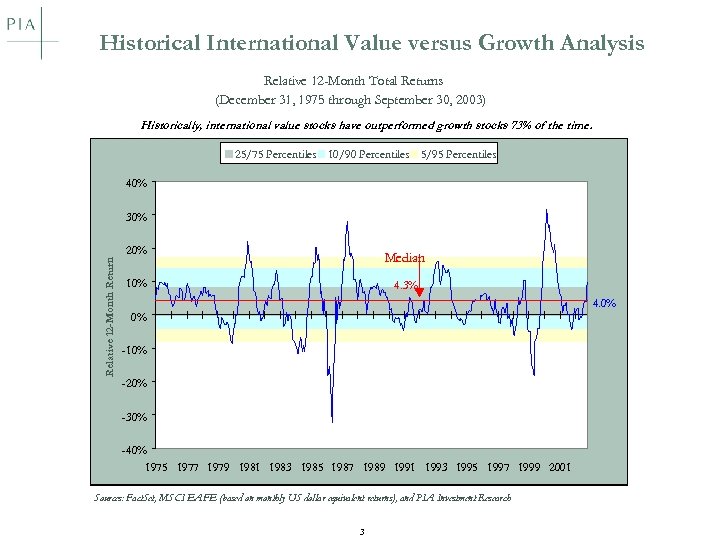

Historical International Value versus Growth Analysis Relative 12 -Month Total Returns (December 31, 1975 through September 30, 2003) Historically, international value stocks have outperformed growth stocks 73% of the time. 25/75 Percentiles 10/90 Percentiles 5/95 Percentiles 40% Relative 12 -Month Return 30% 20% Median 10% 4. 3% 4. 0% 0% -10% -20% -30% -40% 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 Sources: Fact. Set, MSCI EAFE (based on monthly US dollar equivalent returns), and PIA Investment Research 3

International Equity Research Standard Analysis Options } Restate all figures to some comparable basis - US GAPP or local GAAP } Focus on cash flow and create DCF based valuation comparisons } Analyze valuations locally, ignoring the differences between countries 4

5

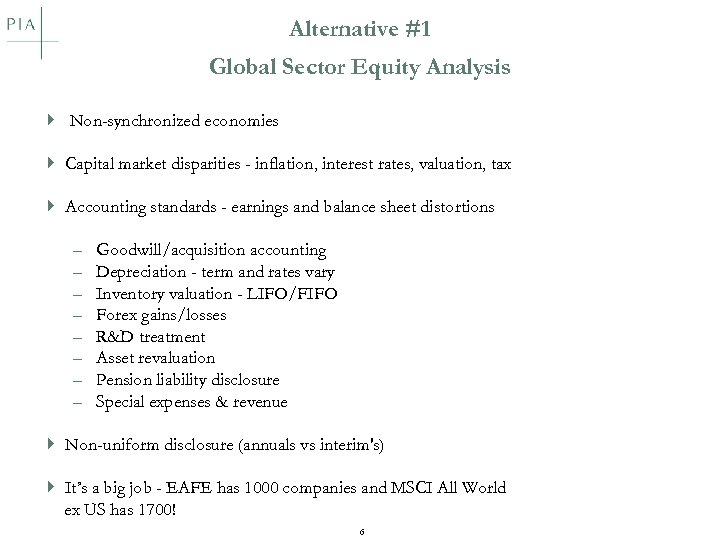

Alternative #1 Global Sector Equity Analysis } Non-synchronized economies } Capital market disparities - inflation, interest rates, valuation, tax } Accounting standards - earnings and balance sheet distortions – – – – Goodwill/acquisition accounting Depreciation - term and rates vary Inventory valuation - LIFO/FIFO Forex gains/losses R&D treatment Asset revaluation Pension liability disclosure Special expenses & revenue } Non-uniform disclosure (annuals vs interim's) } It’s a big job - EAFE has 1000 companies and MSCI All World ex US has 1700! 6

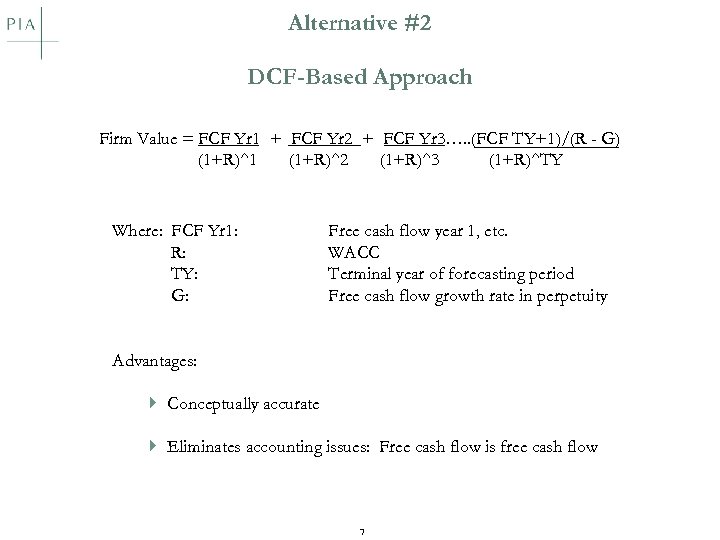

Alternative #2 DCF-Based Approach Firm Value = FCF Yr 1 + FCF Yr 2 + FCF Yr 3…. . (FCF TY+1)/(R - G) (1+R)^1 (1+R)^2 (1+R)^3 (1+R)^TY Where: FCF Yr 1: R: TY: G: Free cash flow year 1, etc. WACC Terminal year of forecasting period Free cash flow growth rate in perpetuity Advantages: } Conceptually accurate } Eliminates accounting issues: Free cash flow is free cash flow 7

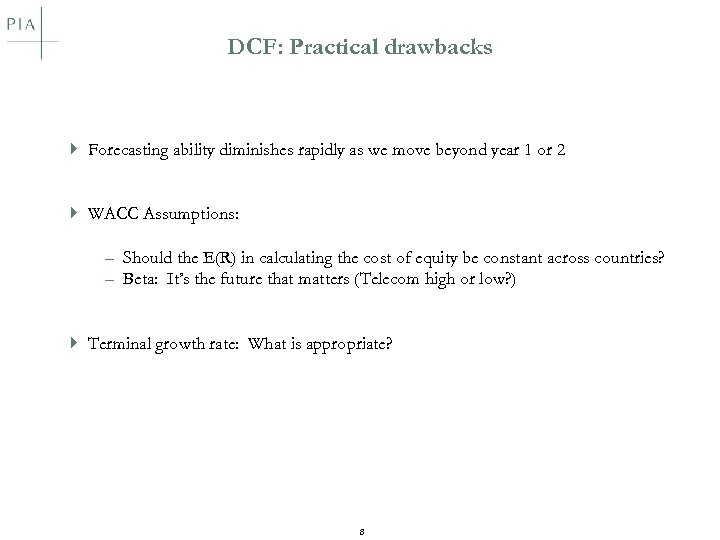

DCF: Practical drawbacks } Forecasting ability diminishes rapidly as we move beyond year 1 or 2 } WACC Assumptions: – Should the E(R) in calculating the cost of equity be constant across countries? – Beta: It’s the future that matters (Telecom high or low? ) } Terminal growth rate: What is appropriate? 8

Alternative #3 } Control variables utilizing country based analysis } Identify attractive stocks within markets } Allocate portfolio between countries 9

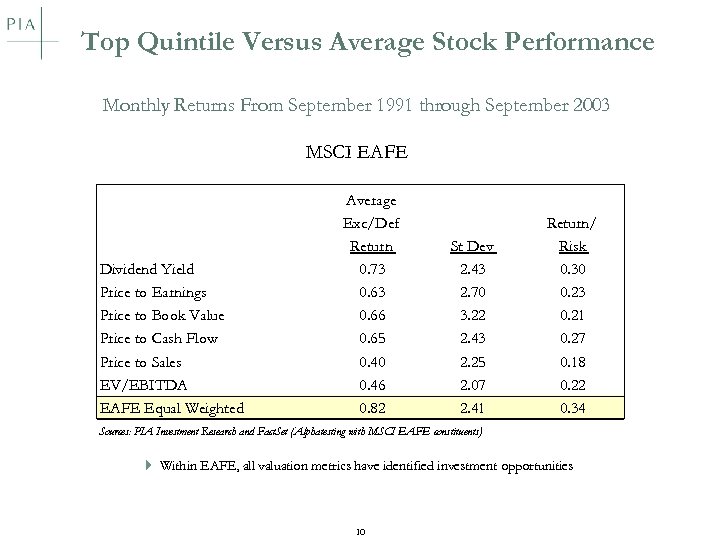

Top Quintile Versus Average Stock Performance Monthly Returns From September 1991 through September 2003 MSCI EAFE Dividend Yield Price to Earnings Price to Book Value Price to Cash Flow Price to Sales EV/EBITDA EAFE Equal Weighted Average Exc/Def Return 0. 73 0. 66 0. 65 0. 40 0. 46 0. 82 St Dev 2. 43 2. 70 3. 22 2. 43 2. 25 2. 07 2. 41 Return/ Risk 0. 30 0. 23 0. 21 0. 27 0. 18 0. 22 0. 34 Sources: PIA Investment Research and Fact. Set (Alphatesting with MSCI EAFE constituents) } Within EAFE, all valuation metrics have identified investment opportunities 10

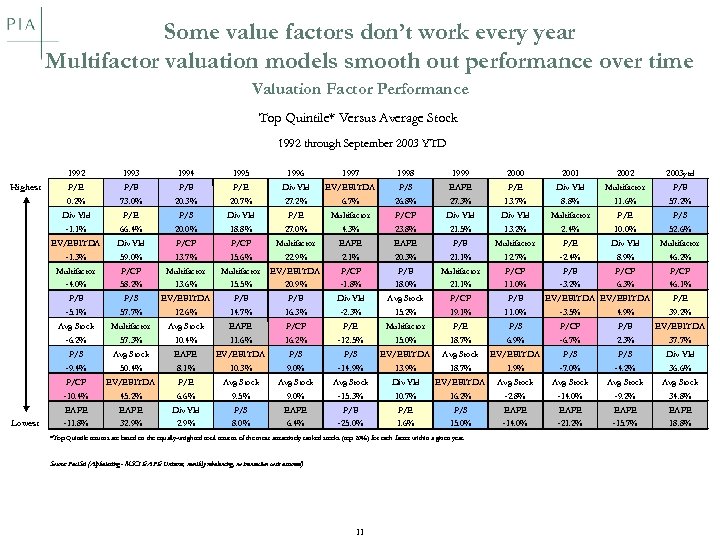

Some value factors don’t work every year Multifactor valuation models smooth out performance over time Valuation Factor Performance Top Quintile* Versus Average Stock 1992 through September 2003 YTD 1992 Highest 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 ytd P/E P/B P/E Div Yld EV/EBITDA P/S EAFE P/E Div Yld Multifactor P/B 57. 2% 0. 2% 73. 0% 20. 3% 20. 7% 27. 2% 6. 7% 26. 8% 27. 3% 13. 7% 8. 8% 11. 6% Div Yld P/E P/S Div Yld P/E Multifactor P/CF Div Yld Multifactor P/E P/S -1. 1% 66. 4% 20. 0% 18. 8% 27. 0% 4. 3% 23. 8% 21. 5% 13. 2% 2. 4% 10. 0% 52. 6% EV/EBITDA Div Yld P/CF Multifactor EAFE P/B Multifactor P/E Div Yld Multifactor -1. 3% 59. 0% 13. 7% 15. 6% 22. 9% 2. 1% 20. 3% 21. 1% 12. 7% -2. 4% 8. 9% 46. 2% Multifactor P/CF Multifactor EV/EBITDA P/CF P/B Multifactor P/CF P/B P/CF -4. 0% 58. 2% 13. 6% 15. 5% 20. 9% -1. 8% 18. 0% 21. 1% 11. 0% -3. 2% 6. 3% 46. 1% P/B P/S EV/EBITDA P/B Div Yld Avg Stock P/CF P/B -5. 1% 57. 7% 12. 6% 14. 7% 16. 3% -2. 3% 15. 2% 19. 1% 11. 0% EV/EBITDA -3. 5% Avg Stock Multifactor Avg Stock EAFE P/CF P/E Multifactor P/E P/S -6. 2% 57. 3% 10. 4% 11. 6% 16. 2% -12. 5% 15. 0% 18. 7% 6. 9% P/E 4. 9% 39. 2% P/CF P/B EV/EBITDA -6. 7% 2. 3% 37. 7% P/S Avg Stock EAFE EV/EBITDA P/S EV/EBITDA Avg Stock EV/EBITDA P/S Div Yld -9. 4% 50. 4% 8. 1% 10. 3% 9. 0% -14. 9% 13. 9% 18. 7% 1. 9% -7. 0% -4. 2% 36. 6% P/CF P/E Avg Stock Div Yld EV/EBITDA Avg Stock 45. 2% 6. 6% 9. 5% 9. 0% -15. 3% 10. 7% 16. 2% -2. 8% -14. 0% -9. 2% 34. 8% EAFE Lowest EV/EBITDA -10. 4% EAFE Div Yld P/S EAFE P/B P/E P/S EAFE -11. 8% 32. 9% 8. 0% 6. 4% -25. 0% 1. 6% 15. 0% -14. 0% -21. 2% -15. 7% 18. 8% *Top Quintile returns are based on the equally-weighted total returns of the most attractively ranked stocks (top 20%) for each factor within a given year. Source: Fact. Set (Alphatesting - MSCI EAFE Universe, monthly rebalancing, no transaction costs assumed) 11

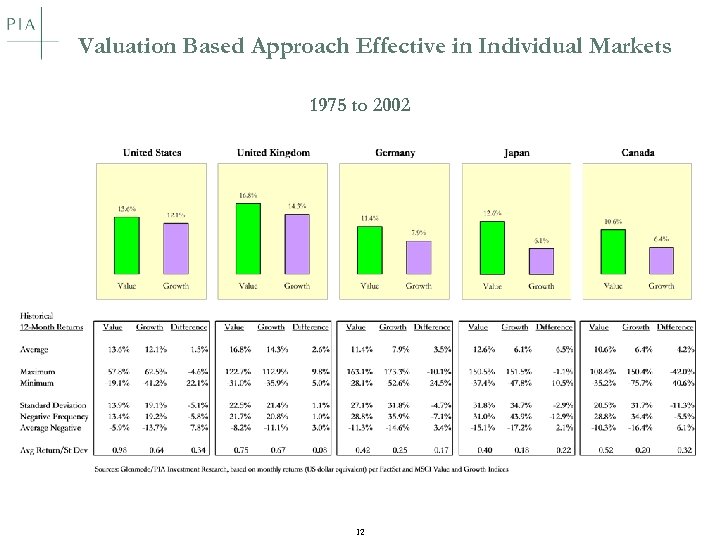

Valuation Based Approach Effective in Individual Markets 1975 to 2002 12

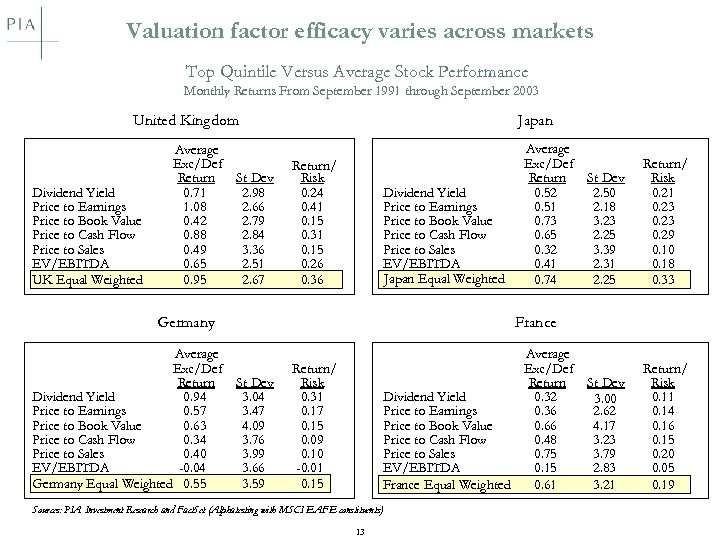

Valuation factor efficacy varies across markets Top Quintile Versus Average Stock Performance Monthly Returns From September 1991 through September 2003 United Kingdom Dividend Yield Price to Earnings Price to Book Value Price to Cash Flow Price to Sales EV/EBITDA UK Equal Weighted Average Exc/Def Return St Dev 0. 71 2. 98 1. 08 2. 66 0. 42 2. 79 0. 88 2. 84 0. 49 3. 36 0. 65 2. 51 0. 95 2. 67 Japan Return/ Risk 0. 24 0. 41 0. 15 0. 31 0. 15 0. 26 0. 36 Dividend Yield Price to Earnings Price to Book Value Price to Cash Flow Price to Sales EV/EBITDA Japan Equal Weighted Germany Average Exc/Def Return St Dev Dividend Yield 0. 94 3. 04 Price to Earnings 0. 57 3. 47 Price to Book Value 0. 63 4. 09 Price to Cash Flow 0. 34 3. 76 Price to Sales 0. 40 3. 99 EV/EBITDA -0. 04 3. 66 Germany Equal Weighted 0. 55 3. 59 Average Exc/Def Return St Dev 0. 52 2. 50 0. 51 2. 18 0. 73 3. 23 0. 65 2. 25 0. 32 3. 39 0. 41 2. 31 0. 74 2. 25 Return/ Risk 0. 21 0. 23 0. 29 0. 10 0. 18 0. 33 France Average Exc/Def Return St Dev Dividend Yield 0. 32 3. 00 Price to Earnings 0. 36 2. 62 Price to Book Value 0. 66 4. 17 Price to Cash Flow 0. 48 3. 23 Price to Sales 0. 75 3. 79 EV/EBITDA 0. 15 2. 83 France Equal Weighted 0. 61 3. 21 Return/ Risk 0. 31 0. 17 0. 15 0. 09 0. 10 -0. 01 0. 15 Sources: PIA Investment Research and Fact. Set (Alphatesting with MSCI EAFE constituents) 13 Return/ Risk 0. 11 0. 14 0. 16 0. 15 0. 20 0. 05 0. 19

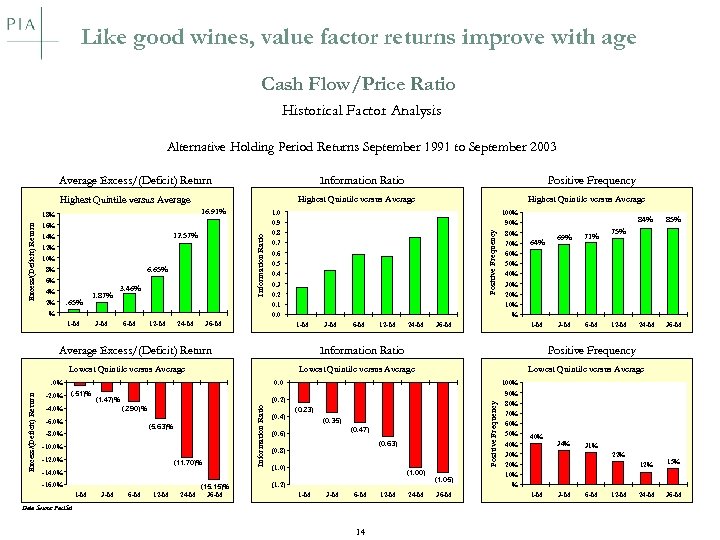

Like good wines, value factor returns improve with age Cash Flow/Price Ratio Historical Factor Analysis Alternative Holding Period Returns September 1991 to September 2003 Average Excess/(Deficit) Return Information Ratio Highest Quintile versus Average 12. 57% 14% Information Ratio 12% 10% 6. 65% 8% 6% 4% . 65% 2% 1. 87% 3. 46% % 1 -M 3 -M 6 -M 12 -M 24 -M 36 -M 1 -M Average Excess/(Deficit) Return 12 -M 24 -M 36 -M (1. 47)% -6. 0% (5. 63)% -8. 0% -10. 0% -12. 0% (11. 70)% -14. 0% -16. 0% 1 -M 3 -M 6 -M 12 -M (15. 15)% 24 -M 36 -M (0. 4) (0. 23) (0. 35) (0. 47) (0. 63) (0. 8) (1. 00) (1. 2) 1 -M 3 -M 6 -M Data Source: Fact. Set 14 12 -M 69% 71% 3 -M 6 -M 12 -M 24 -M 36 -M Lowest Quintile versus Average (0. 2) (2. 90)% Information Ratio -4. 0% 64% 85% 75% Positive Frequency 0. 0 (. 51)% 84% 1 -M Lowest Quintile versus Average . 0% Excess/(Deficit) Return 6 -M 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% % Information Ratio Lowest Quintile versus Average -2. 0% 3 -M Positive Frequency Excess/(Deficit) Return 16% Highest Quintile versus Average 1. 0 0. 9 0. 8 0. 7 0. 6 0. 5 0. 4 0. 3 0. 2 0. 1 0. 0 Positive Frequency 16. 91% 18% Positive Frequency 24 -M (1. 05) 36 -M 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% % 40% 34% 31% 22% 1 -M 3 -M 6 -M 12 -M 15% 24 -M 36 -M

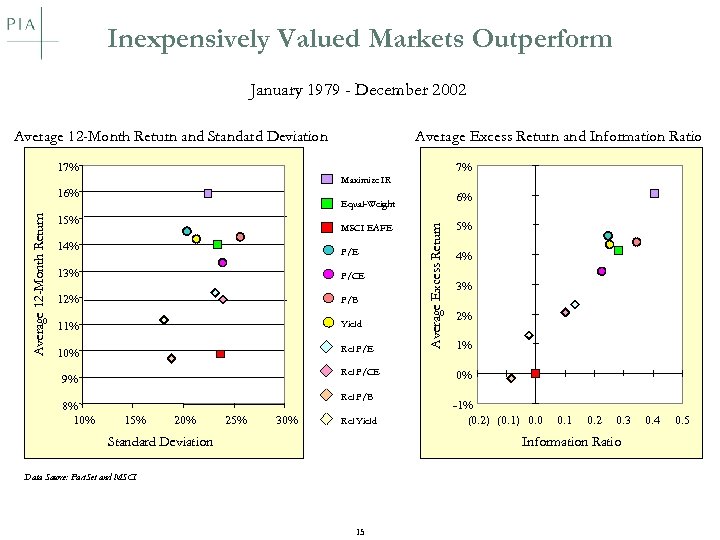

Inexpensively Valued Markets Outperform January 1979 - December 2002 Average 12 -Month Return and Standard Deviation Average Excess Return and Information Ratio 17% 7% Maximize IR 15% MSCI EAFE 14% P/E 13% P/CE 12% P/B 11% Yield 10% Rel P/E Rel P/CE 9% 8% 10% 6% Equal-Weight Rel P/B 15% 20% 25% 30% Rel Yield Standard Deviation Average Excess Return Average 12 -Month Return 16% 5% 4% 3% 2% 1% 0% -1% (0. 2) (0. 1) 0. 0 0. 1 0. 2 0. 3 Information Ratio Data Source: Fact. Set and MSCI 15 0. 4 0. 5

16

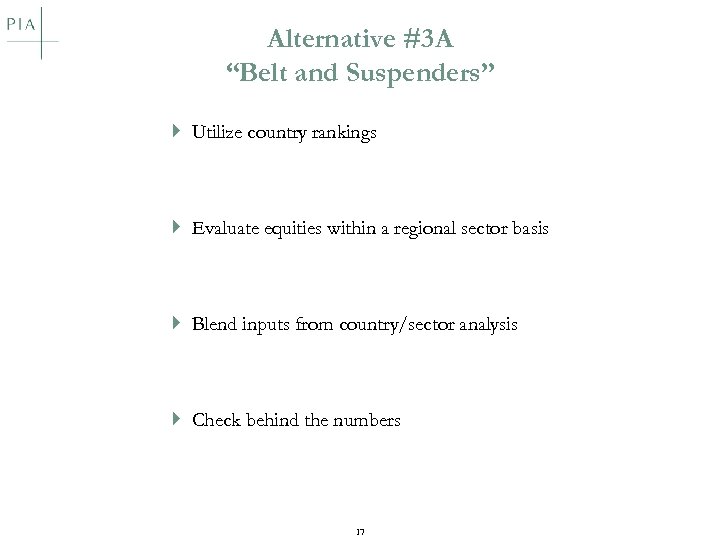

Alternative #3 A “Belt and Suspenders” } Utilize country rankings } Evaluate equities within a regional sector basis } Blend inputs from country/sector analysis } Check behind the numbers 17

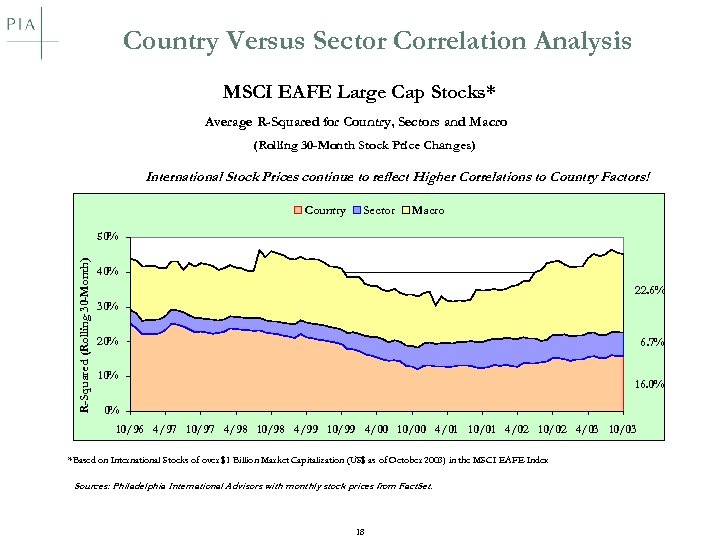

Country Versus Sector Correlation Analysis MSCI EAFE Large Cap Stocks* Average R-Squared for Country, Sectors and Macro (Rolling 30 -Month Stock Price Changes) International Stock Prices continue to reflect Higher Correlations to Country Factors! Country Sector Macro R-Squared (Rolling 30 -Month) 50% 40% 22. 6% 30% 20% 6. 7% 10% 16. 0% 0% 10/96 4/97 10/97 4/98 10/98 4/99 10/99 4/00 10/00 4/01 10/01 4/02 10/02 4/03 10/03 *Based on International Stocks of over $1 Billion Market Capitalization (US$ as of October 2003) in the MSCI EAFE Index Sources: Philadelphia International Advisors with monthly stock prices from Fact. Set. 18

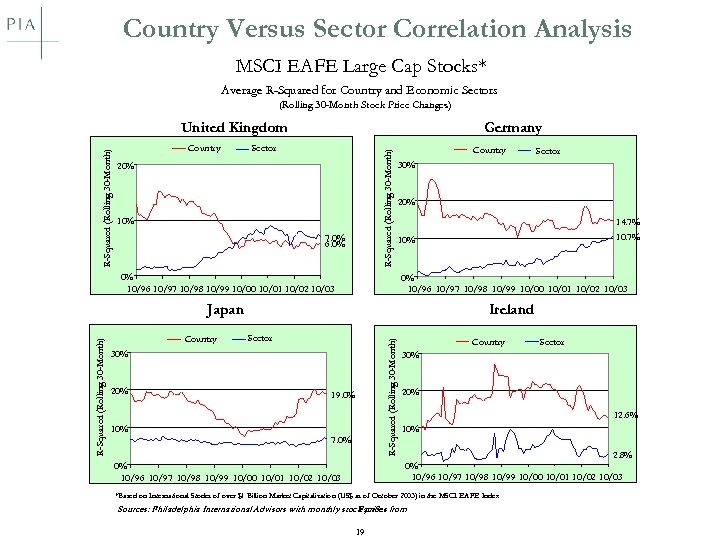

Country Versus Sector Correlation Analysis MSCI EAFE Large Cap Stocks* Average R-Squared for Country and Economic Sectors (Rolling 30 -Month Stock Price Changes) Germany Country Sector R-Squared (Rolling 30 -Month) United Kingdom 20% 10% 7. 0% 6. 0% 0% 10/96 10/97 10/98 10/99 10/00 10/01 10/02 10/03 Country 20% 14. 7% 0% 10/96 10/97 10/98 10/99 10/00 10/01 10/02 10/03 Sector 19. 0% 10% 7. 0% 0% 10/96 10/97 10/98 10/99 10/00 10/01 10/02 10/03 R-Squared (Rolling 30 -Month) Ireland 30% 20% 10. 7% 10% Japan Country Sector 30% Country 20% 12. 6% 10% 2. 8% 0% 10/96 10/97 10/98 10/99 10/00 10/01 10/02 10/03 *Based on International Stocks of over $1 Billion Market Capitalization (US$ as of October 2003) in the MSCI EAFE Index Sources: Philadelphia International Advisors with monthly stock prices from Fact. Set. 19 Sector 30%

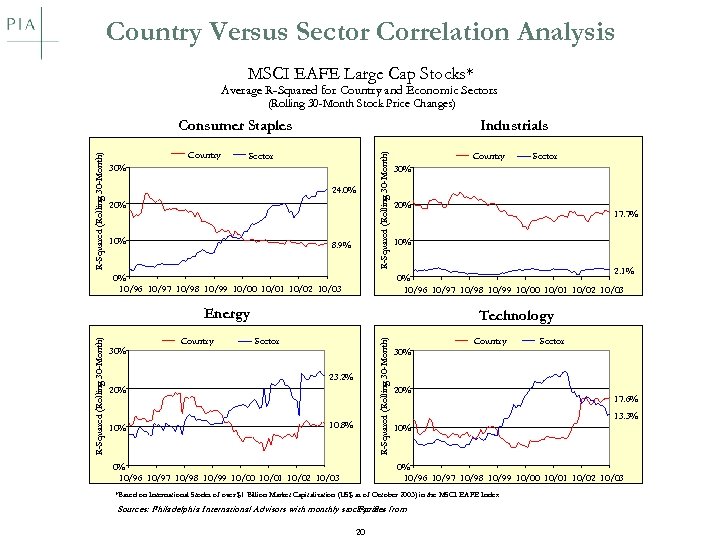

Country Versus Sector Correlation Analysis MSCI EAFE Large Cap Stocks* Average R-Squared for Country and Economic Sectors (Rolling 30 -Month Stock Price Changes) Country Industrials Sector 30% 24. 0% 20% 10% 8. 9% R-Squared (Rolling 30 -Month) Consumer Staples Country Sector 30% 20% 17. 7% 10% 2. 1% 0% 10/96 10/97 10/98 10/99 10/00 10/01 10/02 10/03 Energy Technology 30% Country Sector R-Squared (Rolling 30 -Month) 0% 10/96 10/97 10/98 10/99 10/00 10/01 10/02 10/03 23. 2% 20% 10. 8% 0% 10/96 10/97 10/98 10/99 10/00 10/01 10/02 10/03 30% Country 20% Sector 17. 6% 13. 3% 10% 0% 10/96 10/97 10/98 10/99 10/00 10/01 10/02 10/03 *Based on International Stocks of over $1 Billion Market Capitalization (US$ as of October 2003) in the MSCI EAFE Index Sources: Philadelphia International Advisors with monthly stock prices from Fact. Set. 20

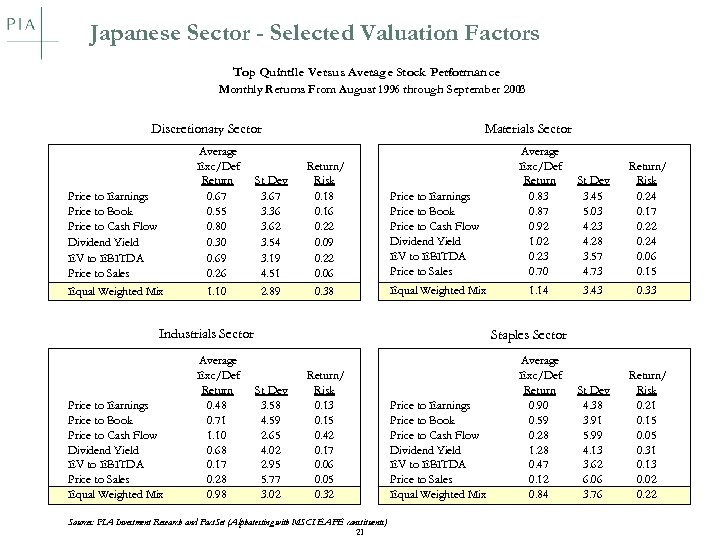

Japanese Sector - Selected Valuation Factors Top Quintile Versus Average Stock Performance Monthly Returns From August 1996 through September 2003 Discretionary Sector Price to Earnings Price to Book Price to Cash Flow Dividend Yield EV to EBITDA Price to Sales Equal Weighted Mix Average Exc/Def Return 0. 67 0. 55 0. 80 0. 30 0. 69 0. 26 1. 10 St Dev 3. 67 3. 36 3. 62 3. 54 3. 19 4. 51 2. 89 Materials Sector Return/ Risk 0. 18 0. 16 0. 22 0. 09 0. 22 0. 06 0. 38 Price to Earnings Price to Book Price to Cash Flow Dividend Yield EV to EBITDA Price to Sales Average Exc/Def Return 0. 83 0. 87 0. 92 1. 02 0. 23 0. 70 St Dev 3. 45 5. 03 4. 28 3. 57 4. 73 Return/ Risk 0. 24 0. 17 0. 22 0. 24 0. 06 0. 15 Equal Weighted Mix 1. 14 3. 43 0. 33 St Dev 4. 38 3. 91 5. 99 4. 13 3. 62 6. 06 3. 76 Return/ Risk 0. 21 0. 15 0. 05 0. 31 0. 13 0. 02 0. 22 Industrials Sector Price to Earnings Price to Book Price to Cash Flow Dividend Yield EV to EBITDA Price to Sales Equal Weighted Mix Average Exc/Def Return 0. 48 0. 71 1. 10 0. 68 0. 17 0. 28 0. 98 Staples Sector St Dev 3. 58 4. 59 2. 65 4. 02 2. 95 5. 77 3. 02 Return/ Risk 0. 13 0. 15 0. 42 0. 17 0. 06 0. 05 0. 32 Sources: PIA Investment Research and Fact. Set (Alphatesting with MSCI EAFE constituents) 21 Price to Earnings Price to Book Price to Cash Flow Dividend Yield EV to EBITDA Price to Sales Equal Weighted Mix Average Exc/Def Return 0. 90 0. 59 0. 28 1. 28 0. 47 0. 12 0. 84

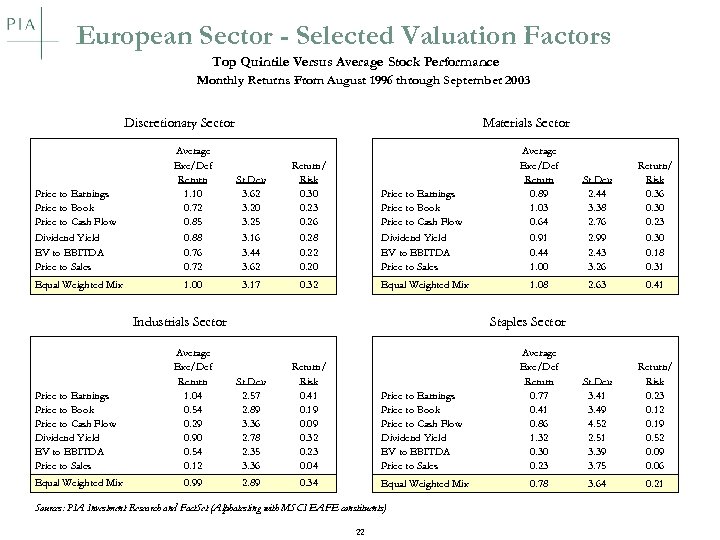

European Sector - Selected Valuation Factors Top Quintile Versus Average Stock Performance Monthly Returns From August 1996 through September 2003 Discretionary Sector Materials Sector Price to Earnings Price to Book Price to Cash Flow Dividend Yield EV to EBITDA Price to Sales Average Exc/Def Return 1. 10 0. 72 0. 85 0. 88 0. 76 0. 72 St Dev 3. 62 3. 20 3. 25 3. 16 3. 44 3. 62 Return/ Risk 0. 30 0. 23 0. 26 0. 28 0. 22 0. 20 Equal Weighted Mix 1. 00 3. 17 Price to Earnings Price to Book Price to Cash Flow Dividend Yield EV to EBITDA Price to Sales 0. 32 Average Exc/Def Return 0. 89 1. 03 0. 64 0. 91 0. 44 1. 00 St Dev 2. 44 3. 38 2. 76 2. 99 2. 43 3. 26 Return/ Risk 0. 36 0. 30 0. 23 0. 30 0. 18 0. 31 Equal Weighted Mix 1. 08 2. 63 0. 41 St Dev 3. 41 3. 49 4. 52 2. 51 3. 39 3. 75 Return/ Risk 0. 23 0. 12 0. 19 0. 52 0. 09 0. 06 3. 64 0. 21 Industrials Sector Price to Earnings Price to Book Price to Cash Flow Dividend Yield EV to EBITDA Price to Sales Average Exc/Def Return 1. 04 0. 54 0. 29 0. 90 0. 54 0. 12 Equal Weighted Mix 0. 99 Staples Sector St Dev 2. 57 2. 89 3. 36 2. 78 2. 35 3. 36 Return/ Risk 0. 41 0. 19 0. 09 0. 32 0. 23 0. 04 Price to Earnings Price to Book Price to Cash Flow Dividend Yield EV to EBITDA Price to Sales Average Exc/Def Return 0. 77 0. 41 0. 86 1. 32 0. 30 0. 23 2. 89 0. 34 Equal Weighted Mix 0. 78 Sources: PIA Investment Research and Fact. Set (Alphatesting with MSCI EAFE constituents) 22

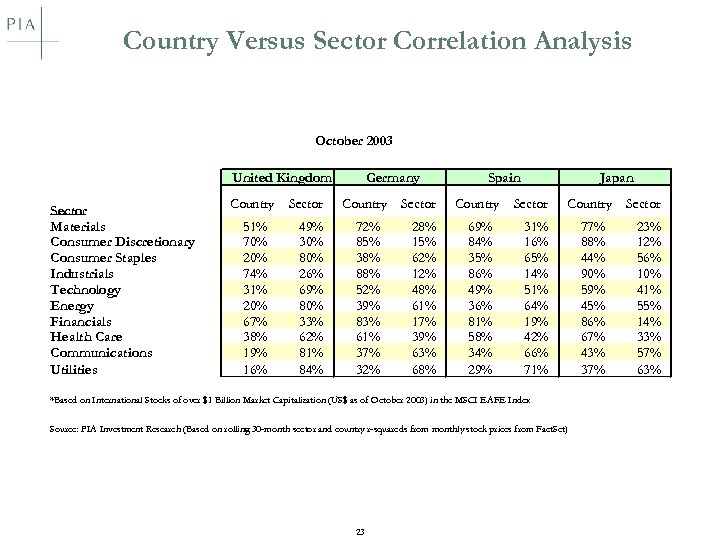

Country Versus Sector Correlation Analysis October 2003 United Kingdom Sector Materials Consumer Discretionary Consumer Staples Industrials Technology Energy Financials Health Care Communications Utilities Country 51% 70% 20% 74% 31% 20% 67% 38% 19% 16% Sector 49% 30% 80% 26% 69% 80% 33% 62% 81% 84% Germany Country 72% 85% 38% 88% 52% 39% 83% 61% 37% 32% Sector 28% 15% 62% 12% 48% 61% 17% 39% 63% 68% Spain Country 69% 84% 35% 86% 49% 36% 81% 58% 34% 29% Japan Sector Country 31% 16% 65% 14% 51% 64% 19% 42% 66% 71% *Based on International Stocks of over $1 Billion Market Capitalization (US$ as of October 2003) in the MSCI EAFE Index Source: PIA Investment Research (Based on rolling 30 -month sector and country r-squareds from monthly stock prices from Fact. Set) 23 77% 88% 44% 90% 59% 45% 86% 67% 43% 37% Sector 23% 12% 56% 10% 41% 55% 14% 33% 57% 63%

24

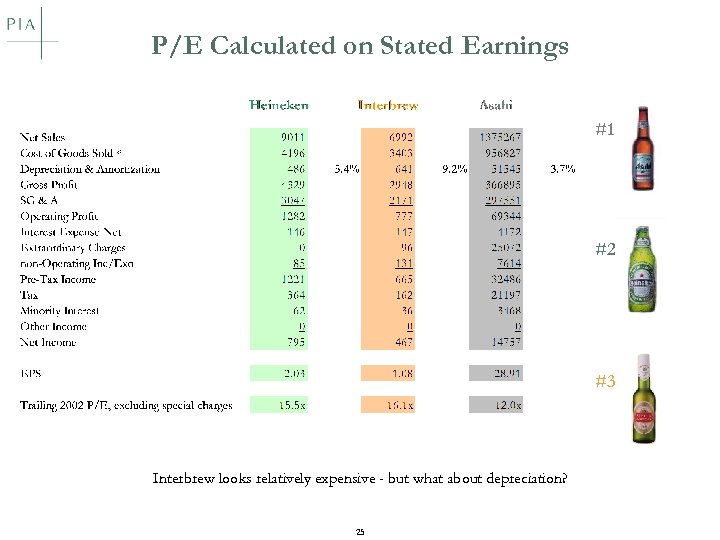

P/E Calculated on Stated Earnings #1 #2 #3 Interbrew looks relatively expensive - but what about depreciation? 25

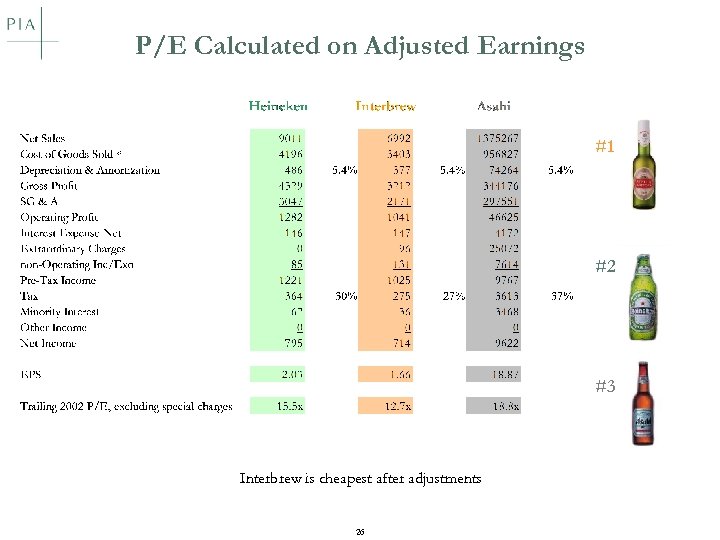

P/E Calculated on Adjusted Earnings #1 #2 #3 Interbrew is cheapest after adjustments 26

Coming soon……. IAS International Accounting Standards Board } Mandates convergence of various standards closer to U. S. GAAP, but differences will remain. } Investor friendly reforms will facilitate global sector analysis and company comparisons. } European Union adoption 1/1/05. } Accounting Standards Board of Japan (ASBJ) has not agreed to converge. } To state compliance with IAS standards, a company must comply with all provisions. 27

Summary } Fundamental valuation analysis can exploit pricing inefficiencies in international stocks } Multi factor approach raises return, lowers risk } Country and sector based approaches are both effective } Effectiveness of country and sector models varies across regions and sectors } Further “hands-on” analysis can add insight beyond database } IAS will facilitate cross border analysis, but issues remain 28

29

4a92de73f3d634243238271a2594eb33.ppt