0285d7c2d593dec22a593cb6ab982ff5.ppt

- Количество слайдов: 10

Global Forum on Trade Statistics Measuring Global Trade – Do We Have the Right Numbers? Geneva Switzerland 2 -4 February, 2011 Aaron Sydor Office of the Chief Economist Foreign Affairs and International Trade Canada 1

Overview § Trends in policy analysis and research…what’s new? • But not all gaps are due to new developments. § A user’s perspective of data gaps: • Examples of policy analysis and research; and • Notable data gaps. 2

Trends in Policy Analysis and Research § Rising importance of non-OECD countries • Strengthening of North-South and South-South linkages § Global value chains • A ‘global commerce’ approach • Increased emphasis on operations of multinationals; offshoring/outsourcing • International fragmentation of all stages of the value chain § Firm-level analysis § Link between real and financial flows 3

Strategy § Example of policy question or analysis § Data gaps 4

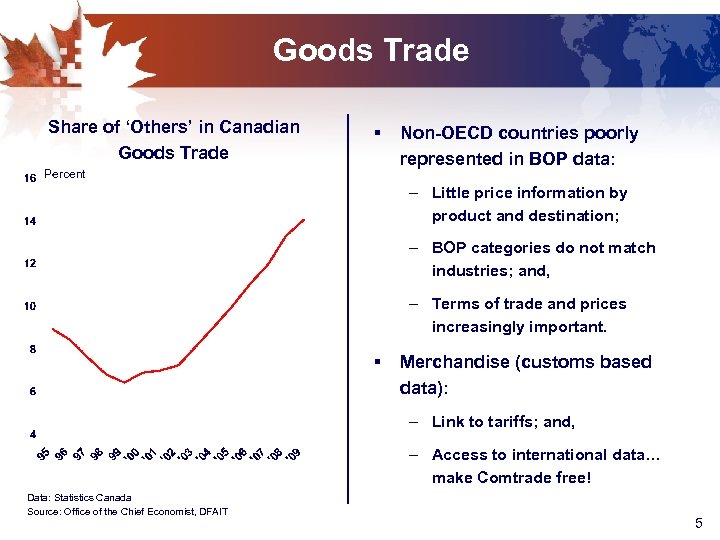

Goods Trade Share of ‘Others’ in Canadian Goods Trade § Percent Non-OECD countries poorly represented in BOP data: – Little price information by product and destination; – BOP categories do not match industries; and, – Terms of trade and prices increasingly important. § Merchandise (customs based data): – Link to tariffs; and, – Access to international data… make Comtrade free! Data: Statistics Canada Source: Office of the Chief Economist, DFAIT 5

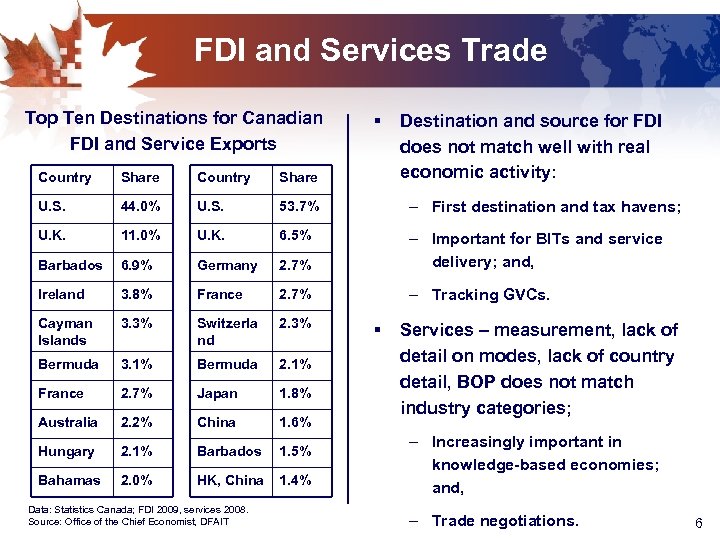

FDI and Services Trade Top Ten Destinations for Canadian FDI and Service Exports § Destination and source for FDI does not match well with real economic activity: Country Share U. S. 44. 0% U. S. 53. 7% – First destination and tax havens; U. K. 11. 0% U. K. 6. 5% Barbados 6. 9% Germany 2. 7% – Important for BITs and service delivery; and, Ireland 3. 8% France 2. 7% – Tracking GVCs. Cayman 3. 3% Islands Switzerla nd 2. 3% Bermuda 3. 1% Bermuda 2. 1% France 2. 7% Japan 1. 8% Australia . 2% 2 China 1. 6% Hungary 2. 1% Barbados 1. 5% Bahamas HK, China 2. 0% Data: Statistics Canada; FDI 2009, services 2008. Source: Office of the Chief Economist, DFAIT 1. 4% § Services – measurement, lack of detail on modes, lack of country detail, BOP does not match industry categories; – Increasingly important in knowledge-based economies; and, – Trade negotiations. 6

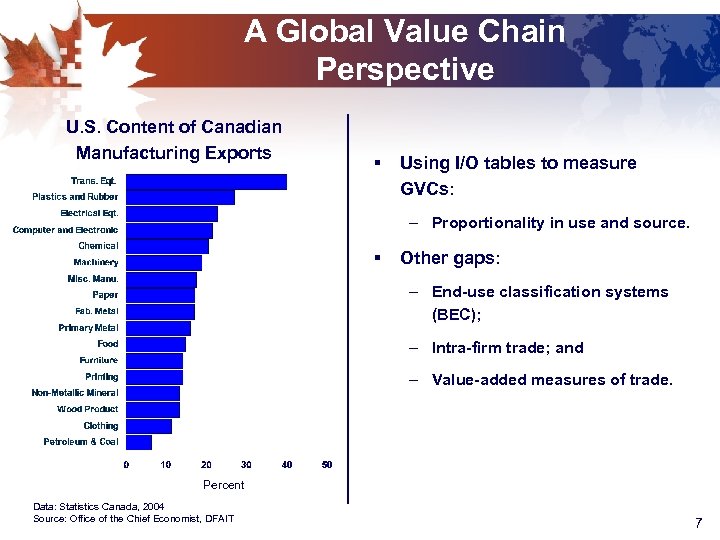

A Global Value Chain Perspective U. S. Content of Canadian Manufacturing Exports § Using I/O tables to measure GVCs: – Proportionality in use and source. § Other gaps: – End-use classification systems (BEC); – Intra-firm trade; and – Value-added measures of trade. Percent Data: Statistics Canada, 2004 Source: Office of the Chief Economist, DFAIT 7

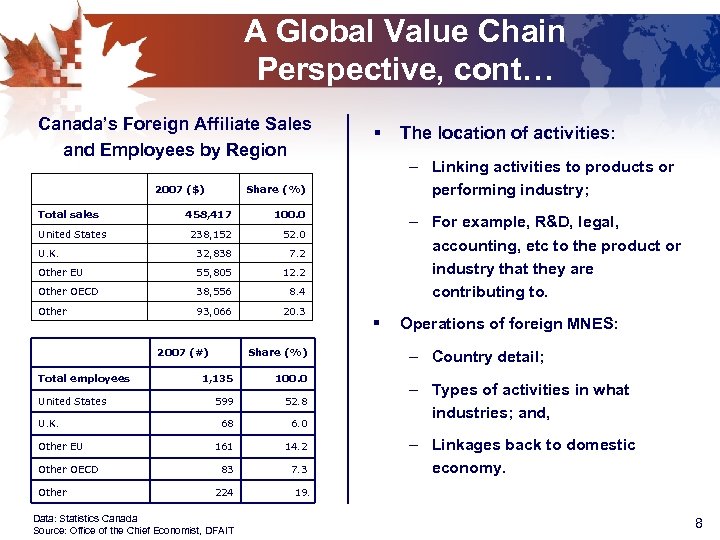

A Global Value Chain Perspective, cont… Canada’s Foreign Affiliate Sales and Employees by Region 2007 ($) Total sales § – Linking activities to products or performing industry; Share (%) 458, 417 100. 0 238, 152 52. 0 U. K. 32, 838 7. 2 Other EU 55, 805 12. 2 Other OECD 38, 556 8. 4 Other 93, 066 20. 3 United States 2007 (#) Total employees United States U. K. Other EU Other OECD Other Share (%) 1, 135 100. 0 599 52. 8 68 6. 0 161 14. 2 83 7. 3 224 Data: Statistics Canada Source: Office of the Chief Economist, DFAIT The location of activities: – For example, R&D, legal, accounting, etc to the product or industry that they are contributing to. § Operations of foreign MNES: – Country detail; – Types of activities in what industries; and, – Linkages back to domestic economy. 19. 8

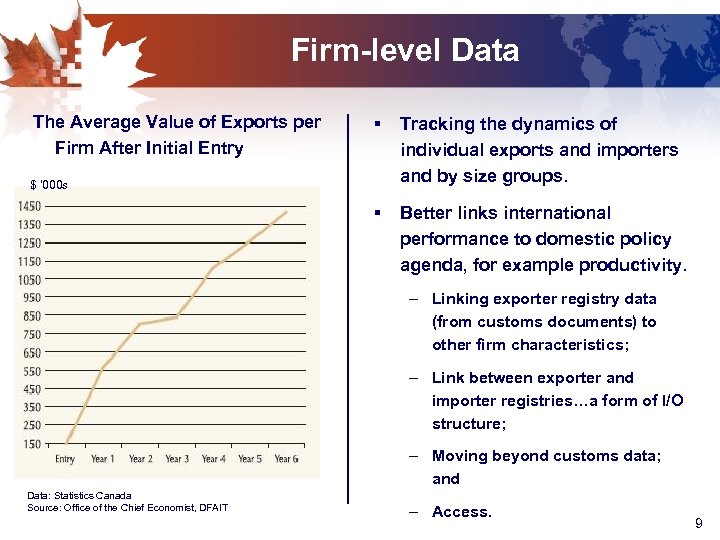

Firm-level Data The Average Value of Exports per Firm After Initial Entry § Tracking the dynamics of individual exports and importers and by size groups. § Better links international performance to domestic policy agenda, for example productivity. $ ‘ 000 s – Linking exporter registry data (from customs documents) to other firm characteristics; – Link between exporter and importer registries…a form of I/O structure; – Moving beyond customs data; and Data: Statistics Canada Source: Office of the Chief Economist, DFAIT – Access. 9

References § Fenstra et al “Report on the State of Available Data for the Study of International Trade and Foreign Direct Investment”, NBER, 2010. § Gereffi and Sturgeon “The Challenge of Global Value Chains: Why Integrative Trade Requires New Thinking and New Data”, Industry Canada, 2008. § General Accounting Office “Current Government Data Provide Limited Insight into Offshoring of Services” 2004. § Maurer and Degain “Globalization and trade flows: what you see is not what you get!”, WTO, 2010. § Nordas “International production sharing: a case for a coherent policy framework”, WTO, 2005. § Ridgeway “Data Issues on Integrative Trade between Canada and the US: Measurement Issues for Supply Chains, Trade Policy Research, 2006. § ______ “Canada’s Annual Report on The State of Trade”, Foreign Affairs and International Trade Canada. 10

0285d7c2d593dec22a593cb6ab982ff5.ppt