a3f2e4aa4798a5b26e97daa42c338d29.ppt

- Количество слайдов: 24

Global Financial Reporting…. Advancing Data Sharing Architecture with…. Extensible Business Reporting Language (XBRL) Presented by: Liv Watson, EDGAR Online Inc Vice President of Global Strategy Proprietary and Confidential © 2005 EDGAR Online, Inc. All rights reserved.

Agenda XBRL International Adoption Q&A 1

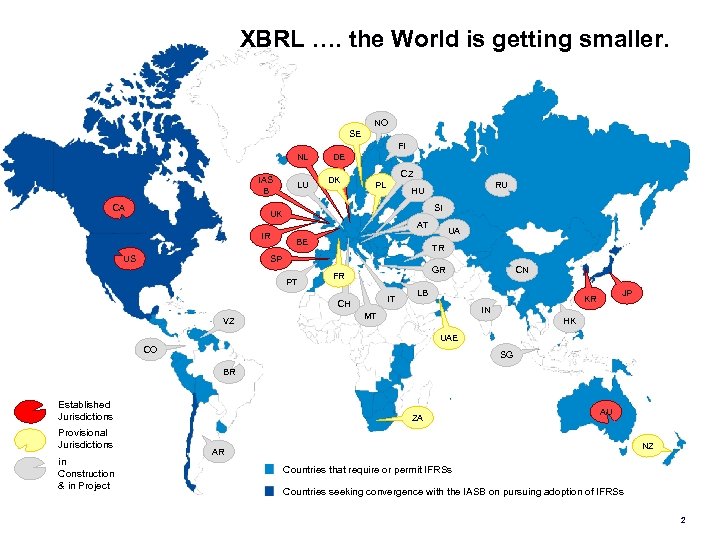

XBRL …. the World is getting smaller. NO SE FI NL IAS B CA LU DE DK CZ PL RU HU SI UK AT IR US BE UA TR SP PT GR FR IT CH VZ CN LB JP KR IN MT HK UAE CO SG BR Established Jurisdictions Provisional Jurisdictions in Construction & in Project ZA AU NZ AR Countries that require or permit IFRSs Countries seeking convergence with the IASB on pursuing adoption of IFRSs 2

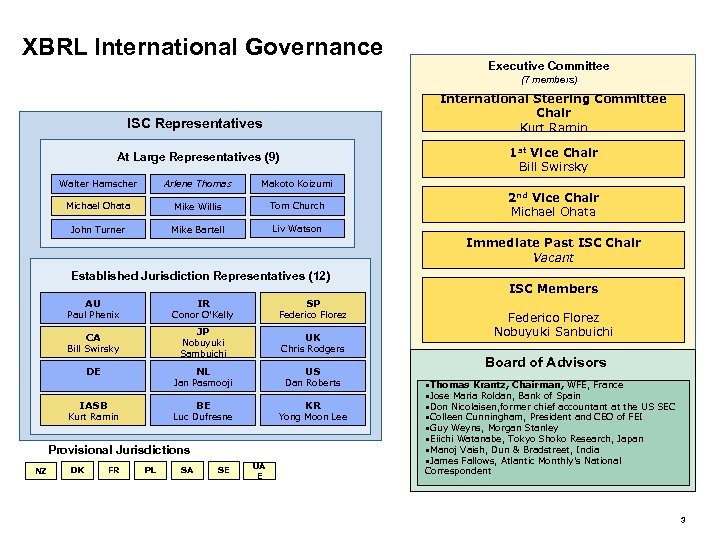

XBRL International Governance Executive Committee (7 members) International Steering Committee Chair Kurt Ramin ISC Representatives 1 st Vice Chair Bill Swirsky At Large Representatives (9) Walter Hamscher Arlene Thomas Makoto Koizumi Michael Ohata Mike Willis Tom Church John Turner Mike Bartell Liv Watson 2 nd Vice Chair Michael Ohata Immediate Past ISC Chair Vacant Established Jurisdiction Representatives (12) AU IR Paul Phenix Conor O’Kelly Federico Florez JP CA Federico Florez Nobuyuki Sanbuichi UK Bill Swirsky Nobuyuki Sambuichi Chris Rodgers DE NL US Jan Pasmooji IASB Dan Roberts BE Kurt Ramin KR Luc Dufresne Yong Moon Lee Provisional Jurisdictions NZ ISC Members SP DK FR PL SA SE UA E Board of Advisors • Thomas Krantz, Chairman, WFE, France • Jose Maria Roldan, Bank of Spain • Don Nicolaisen, former chief accountant at the US SEC • Colleen Cunningham, President and CEO of FEI • Guy Weyns, Morgan Stanley • Eiichi Watanabe, Tokyo Shoko Research, Japan • Manoj Vaish, Dun & Bradstreet, India • James Fallows, Atlantic Monthly’s National Correspondent 3

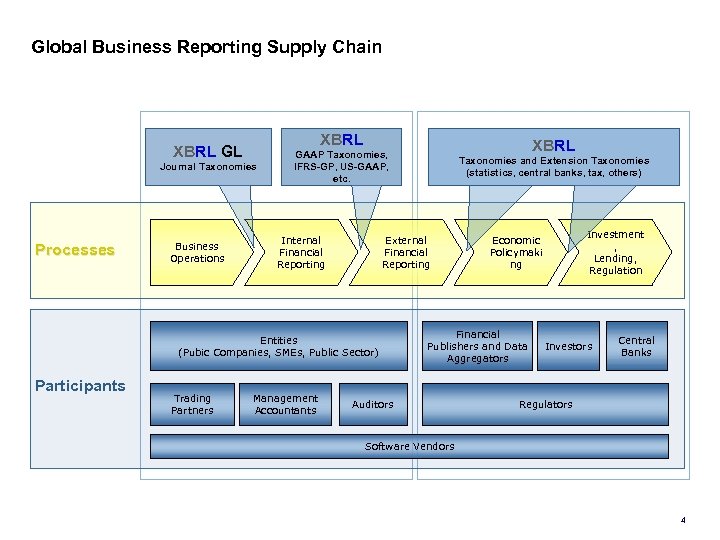

Global Business Reporting Supply Chain XBRL GL Journal Taxonomies Processes Business Operations Internal Financial Reporting Trading Partners Management Accountants Taxonomies and Extension Taxonomies (statistics, central banks, tax, others) External Financial Reporting Entities (Pubic Companies, SMEs, Public Sector) Participants XBRL GAAP Taxonomies, IFRS-GP, US-GAAP, etc. Financial Publishers and Data Aggregators Auditors Investment , Lending, Regulation Economic Policymaki ng Investors Central Banks Regulators Software Vendors 4

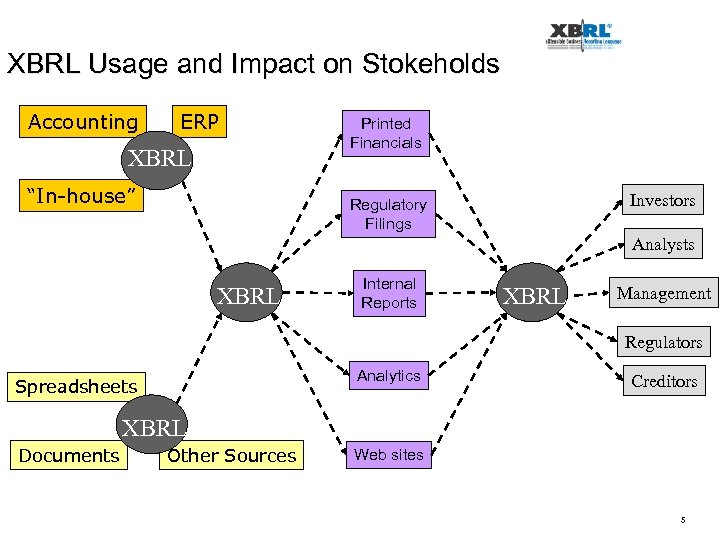

XBRL Usage and Impact on Stokeholds Accounting ERP XBRL “In-house” Printed Financials Investors Regulatory Filings Analysts XBRL Internal Reports XBRL Management Regulators Analytics Spreadsheets Creditors XBRL Documents Other Sources Web sites 5

6

7

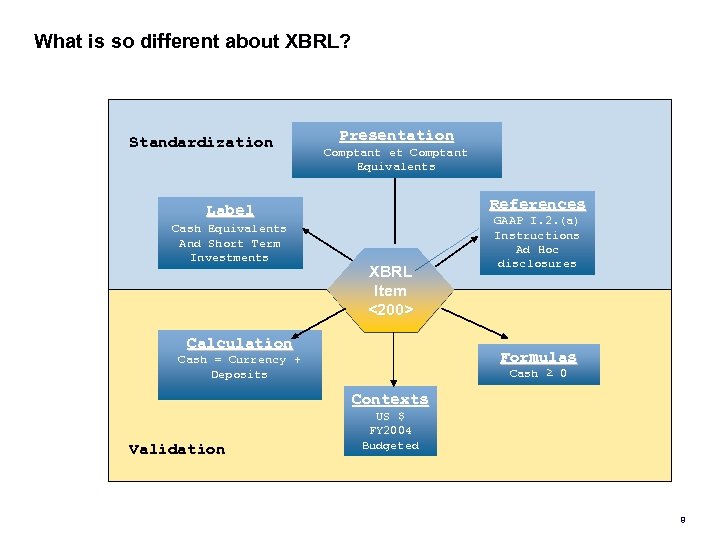

What is so different about XBRL? Standardization Presentation Comptant et Comptant Cash & Cash Equivalents References Label Cash Equivalents And Short Term Investments XBRL XML XBRL Item <200> Calculation GAAP I. 2. (a) Instructions Ad Hoc disclosures Formulas Cash = Currency + Deposits Cash ≥ 0 Contexts Validation US $ FY 2004 Budgeted 8

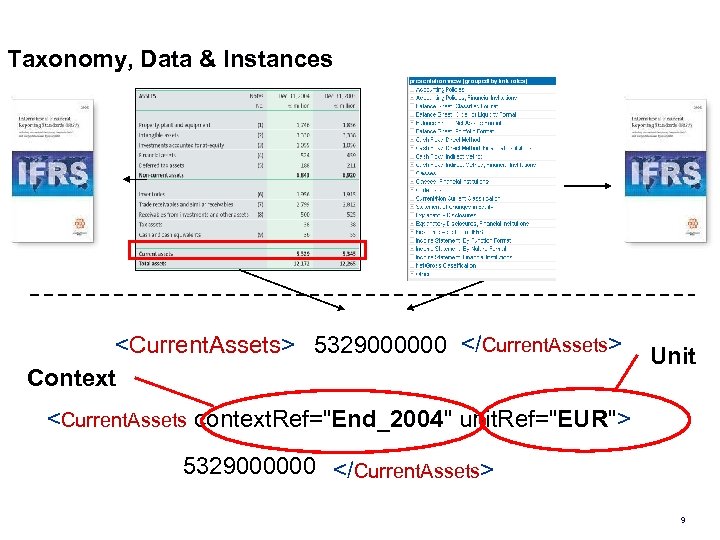

Taxonomy, Data & Instances <Current. Assets> 5329000000 </Current. Assets> Context Unit <Current. Assets context. Ref="End_2004" unit. Ref="EUR"> 5329000000 </Current. Assets> 9

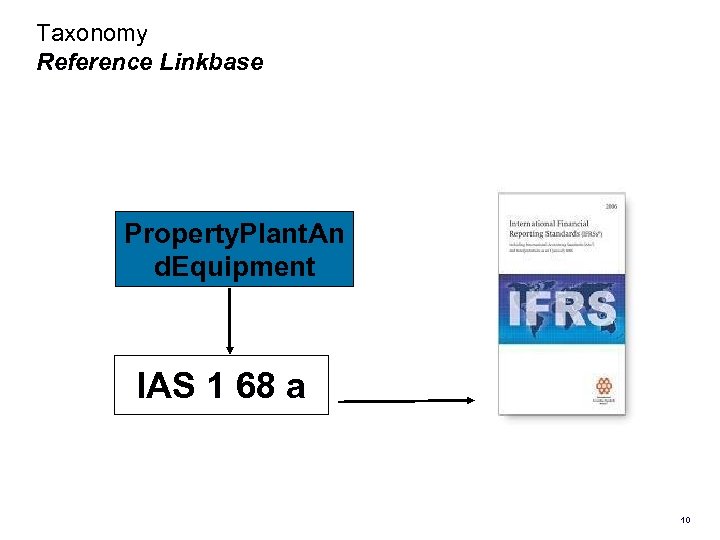

Taxonomy Reference Linkbase Property. Plant. An d. Equipment IAS 1 68 a 10

XBRL in Europe Projects, users and… 11

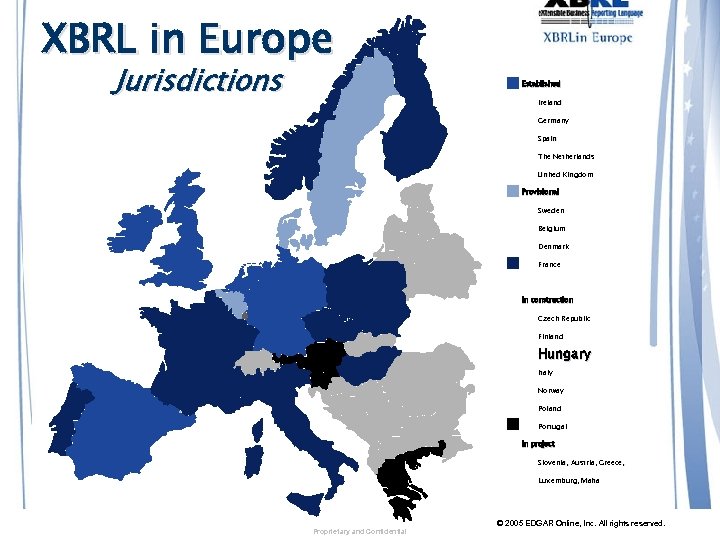

XBRL in Europe Jurisdictions Established Ireland Germany Spain The Netherlands United Kingdom Provisional Sweden Belgium Denmark France In construction Czech Republic Finland Hungary Italy Norway Poland Portugal In project Slovenia, Austria, Greece, Luxemburg, Malta Proprietary and Confidential © 2005 EDGAR Online, Inc. All rights reserved.

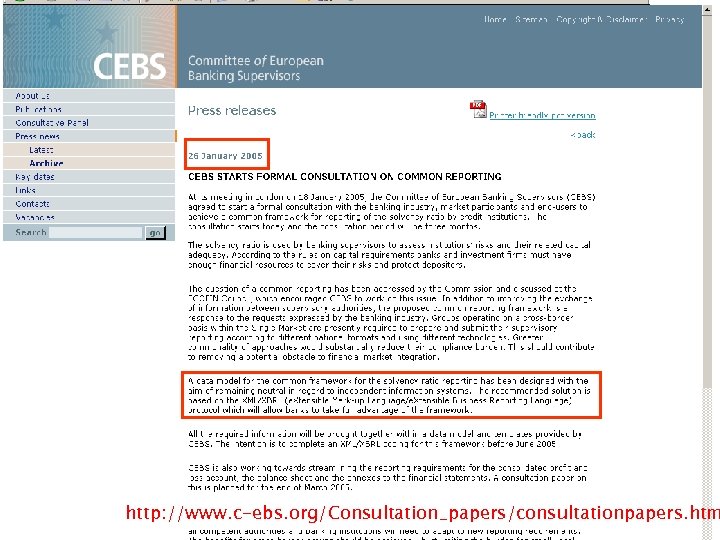

http: //www. c-ebs. org/Consultation_papers/consultationpapers. htm 13

XBRL projects in Europe National UK Inland Revenue ! ts c je o r p + 0 3 UK Financial Services Authority UK Companies House Datev/Bundesbank Danish Commerce & Companies (DCCA) Bank of Spain Bank of Belgium – Balance sheet office Belgian Banking supervisors Dutch Water Boards Dutch Statistics agency (CBS) Dutch government Pan-european XBRL in Europe – FP 6 ICISA (CRAS group) Eurostat (feasability study) IASB CEBS – COREP (Basel II) 14

15

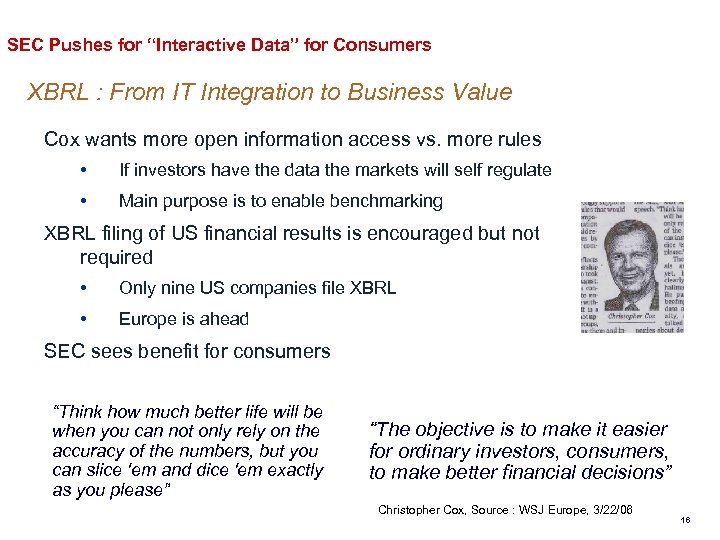

SEC Pushes for “Interactive Data” for Consumers XBRL : From IT Integration to Business Value Cox wants more open information access vs. more rules • If investors have the data the markets will self regulate • Main purpose is to enable benchmarking XBRL filing of US financial results is encouraged but not required • Only nine US companies file XBRL • Europe is ahead SEC sees benefit for consumers “Think how much better life will be when you can not only rely on the accuracy of the numbers, but you can slice 'em and dice 'em exactly as you please” “The objective is to make it easier for ordinary investors, consumers, to make better financial decisions” Christopher Cox, Source : WSJ Europe, 3/22/06 16

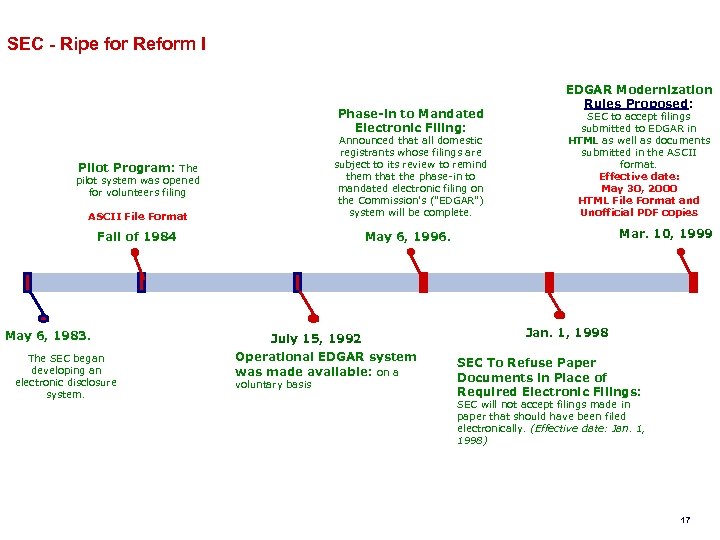

SEC - Ripe for Reform I Phase-in to Mandated Electronic Filing: ASCII File Format Announced that all domestic registrants whose filings are subject to its review to remind them that the phase-in to mandated electronic filing on the Commission's ("EDGAR") system will be complete. Fall of 1984 EDGAR Modernization Rules Proposed: SEC to accept filings submitted to EDGAR in HTML as well as documents submitted in the ASCII format. Effective date: May 30, 2000 HTML File Format and Unofficial PDF copies May 6, 1996. Pilot Program: The pilot system was opened for volunteers filing May 6, 1983. The SEC began developing an electronic disclosure system. July 15, 1992 Operational EDGAR system was made available: on a voluntary basis Mar. 10, 1999 Jan. 1, 1998 SEC To Refuse Paper Documents in Place of Required Electronic Filings: SEC will not accept filings made in paper that should have been filed electronically. (Effective date: Jan. 1, 1998) 17

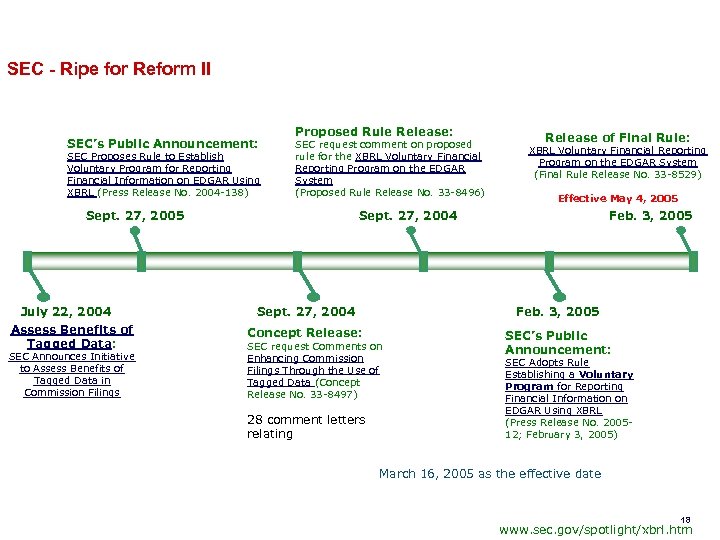

SEC - Ripe for Reform II SEC’s Public Announcement: SEC Proposes Rule to Establish Voluntary Program for Reporting Financial Information on EDGAR Using XBRL (Press Release No. 2004 -138) Proposed Rule Release: SEC request comment on proposed rule for the XBRL Voluntary Financial Reporting Program on the EDGAR System (Proposed Rule Release No. 33 -8496) Sept. 27, 2005 July 22, 2004 Assess Benefits of Tagged Data: SEC Announces Initiative to Assess Benefits of Tagged Data in Commission Filings Release of Final Rule: XBRL Voluntary Financial Reporting Program on the EDGAR System (Final Rule Release No. 33 -8529) Effective May 4, 2005 Sept. 27, 2004 Feb. 3, 2005 Concept Release: SEC’s Public Announcement: SEC request Comments on Enhancing Commission Filings Through the Use of Tagged Data (Concept Release No. 33 -8497) 28 comment letters relating SEC Adopts Rule Establishing a Voluntary Program for Reporting Financial Information on EDGAR Using XBRL (Press Release No. 200512; February 3, 2005) March 16, 2005 as the effective date 18 www. sec. gov/spotlight/xbrl. htm

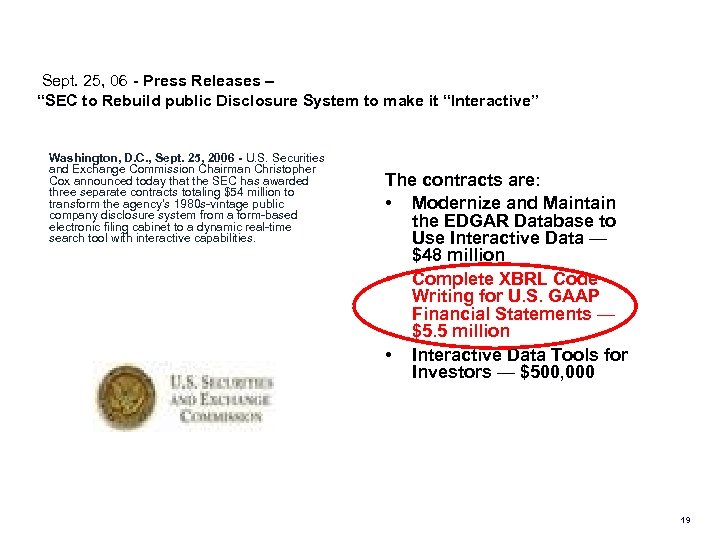

Sept. 25, 06 - Press Releases – “SEC to Rebuild public Disclosure System to make it “Interactive” Washington, D. C. , Sept. 25, 2006 - U. S. Securities and Exchange Commission Chairman Christopher Cox announced today that the SEC has awarded three separate contracts totaling $54 million to transform the agency’s 1980 s-vintage public company disclosure system from a form-based electronic filing cabinet to a dynamic real-time search tool with interactive capabilities. The contracts are: • Modernize and Maintain the EDGAR Database to Use Interactive Data — $48 million • Complete XBRL Code Writing for U. S. GAAP Financial Statements — $5. 5 million • Interactive Data Tools for Investors — $500, 000 19

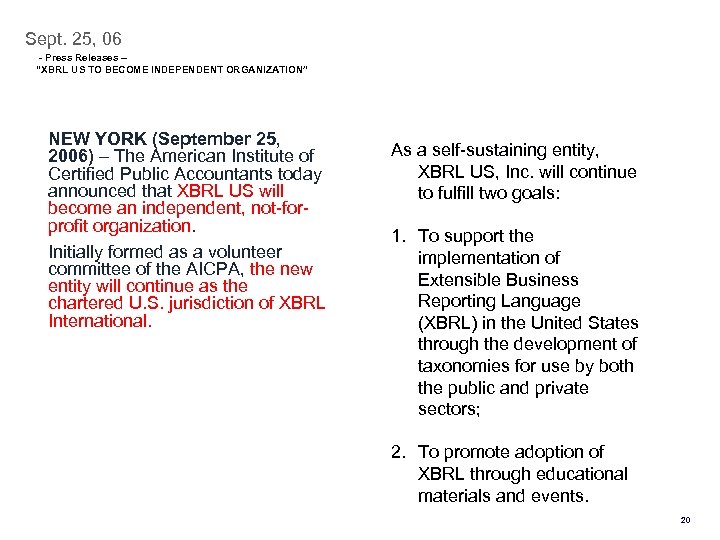

Sept. 25, 06 - Press Releases – “XBRL US TO BECOME INDEPENDENT ORGANIZATION” NEW YORK (September 25, 2006) – The American Institute of Certified Public Accountants today announced that XBRL US will become an independent, not-forprofit organization. Initially formed as a volunteer committee of the AICPA, the new entity will continue as the chartered U. S. jurisdiction of XBRL International. As a self-sustaining entity, XBRL US, Inc. will continue to fulfill two goals: 1. To support the implementation of Extensible Business Reporting Language (XBRL) in the United States through the development of taxonomies for use by both the public and private sectors; 2. To promote adoption of XBRL through educational materials and events. 20

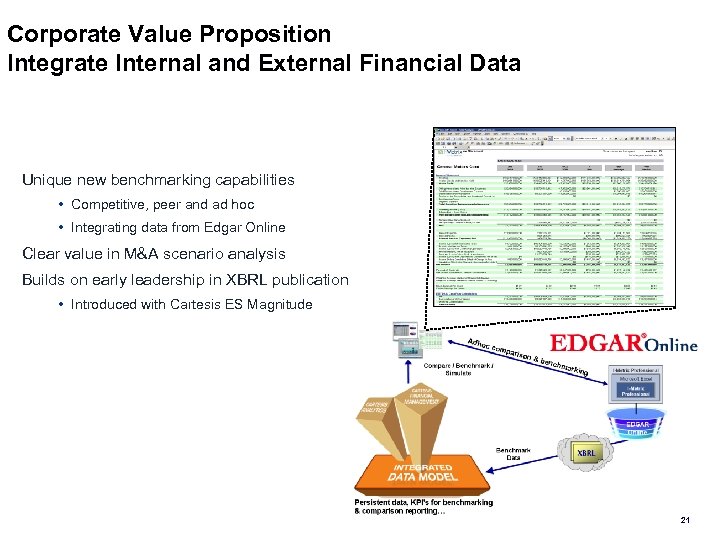

Corporate Value Proposition Integrate Internal and External Financial Data Unique new benchmarking capabilities • Competitive, peer and ad hoc • Integrating data from Edgar Online Clear value in M&A scenario analysis Builds on early leadership in XBRL publication • Introduced with Cartesis ES Magnitude 21

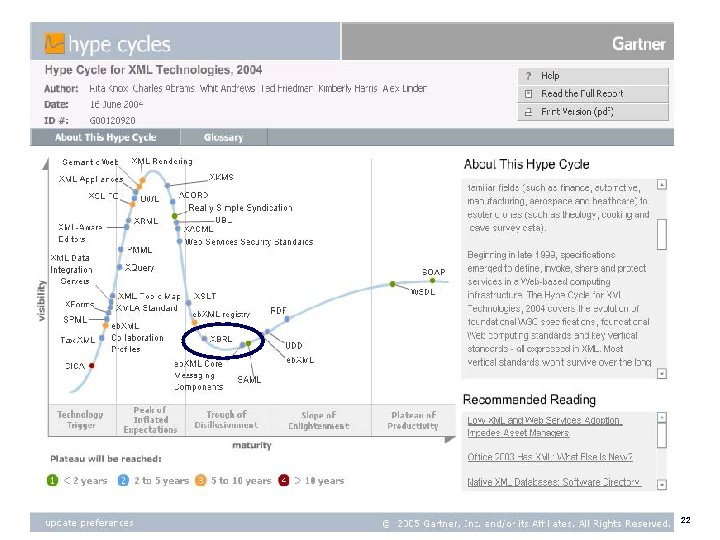

But where are we in the life cycle? 22

Thank you! Presented by: Liv A. Watson XBRL — Why Should the CFO Care? Vice President of Global Strategies Vice-Chair: XBRL US, Inc. Chair: XBRL US Adoption Group Chair: XBRL International Jurisdiction Development Committee XBRL International Steering Committee Member E-mail: lwatson@edgar-online. com Phone: (203) 852 -5703 23

a3f2e4aa4798a5b26e97daa42c338d29.ppt