43d3b9fdddce873aa9fae3b2e2c0c385.ppt

- Количество слайдов: 138

Global Crisis

Interest Rate Policies

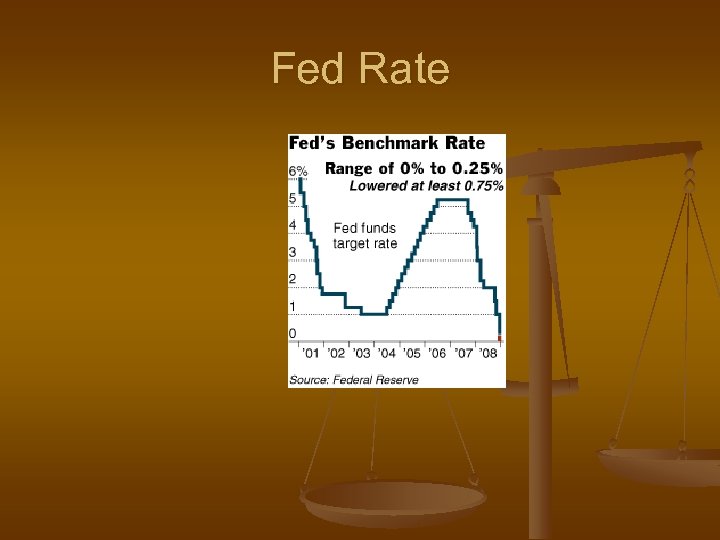

Fed Rate

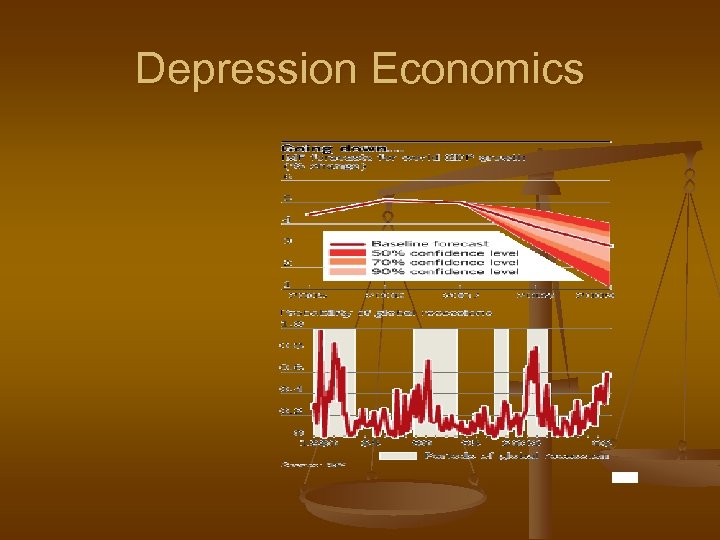

Depression Economics

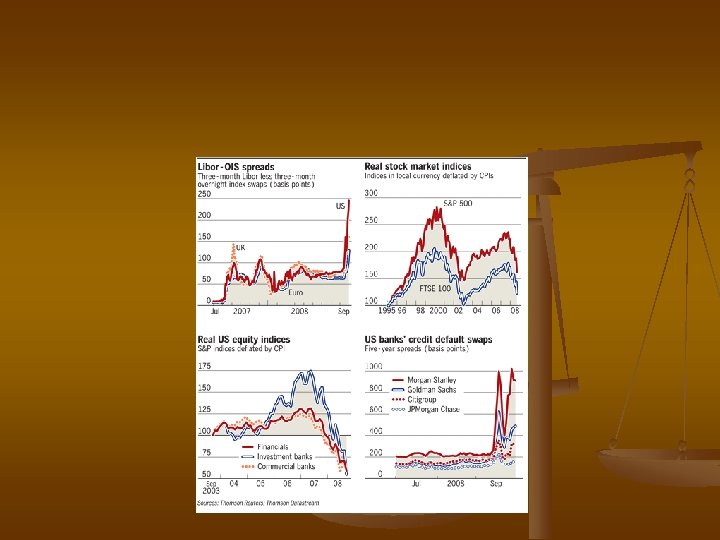

Credit Market : September 2008

Bank bailouts

Mortgage and Housing Prices

Family Costs and Lender Costs

Mortgage Finance

Mortgage-backed Securities

Mortgage as option, not loan

Akerlof’s Problem

Market illiquidity

Fire sale

Hold-to-maturity price

Sub-prime default rates

Raising new capital

Japan’s 1990 s

Japan’s Banks

Conditions set by government

Non performing loans

Sweden in the 1990 s

Capital injection and tax payers

Fed buying unsecured loans

Fed’s new scheme?

Recapitalization of banks

Mark to market and illiquidity

Keynes’ Metaphor for a Bubble

Written in 1859, in a history of the commercial crisis of 1857 -58.

History

THE LENDER OF LAST RESORT

Fannie Mae and Freddie Mac

Asia

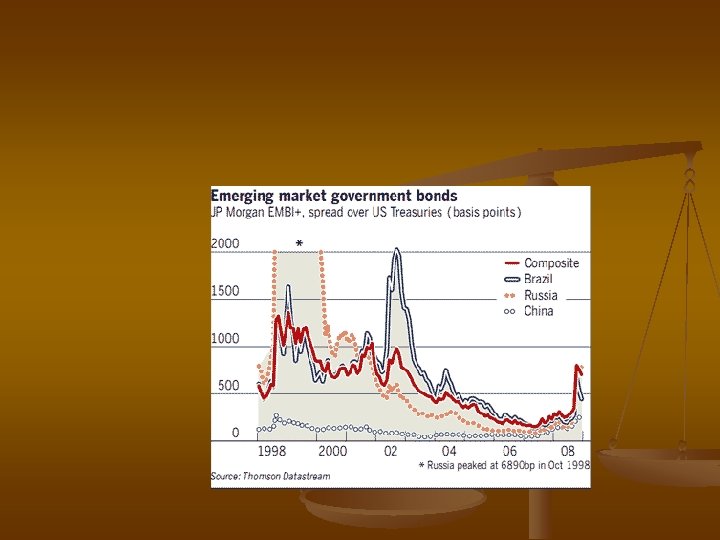

Emerging Markets

Index of Financial Instability

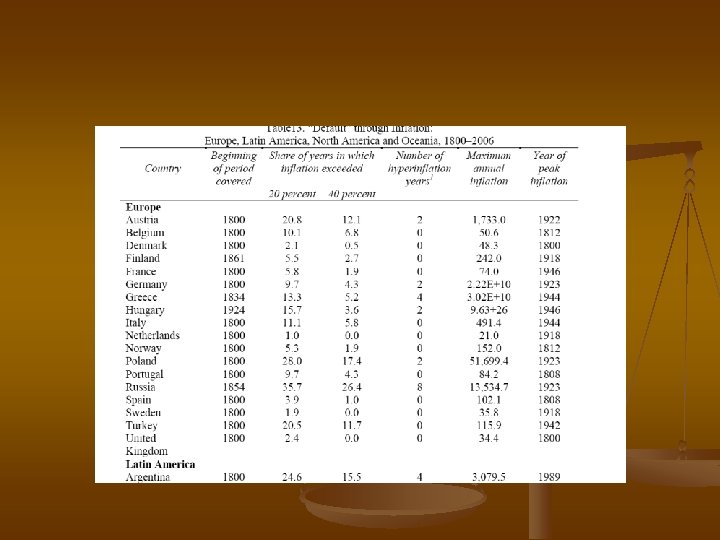

An Historical Perspective

the portion of the house price rises explained by fundamentals was larger in, UK, Australia, France and Spain

Rogoff: ft sept 18 2007

Investment Banks

Bail Outs

Moral Hazard

CDS

overshooting

Regulatory arbitrage

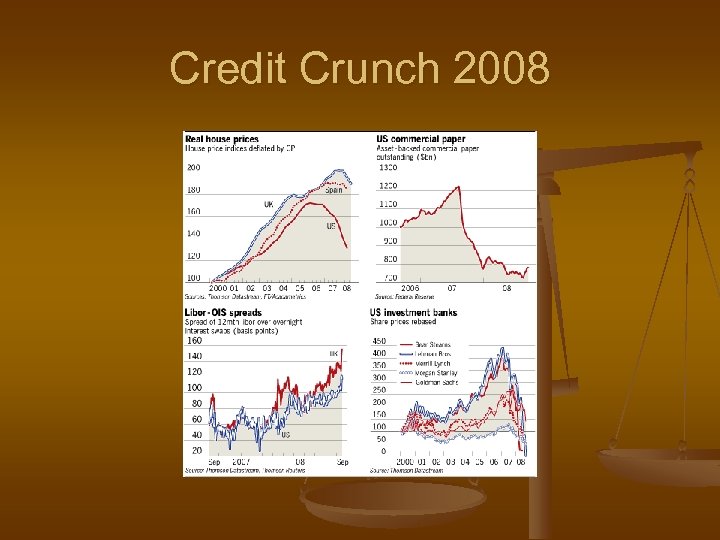

Credit Crunch 2008

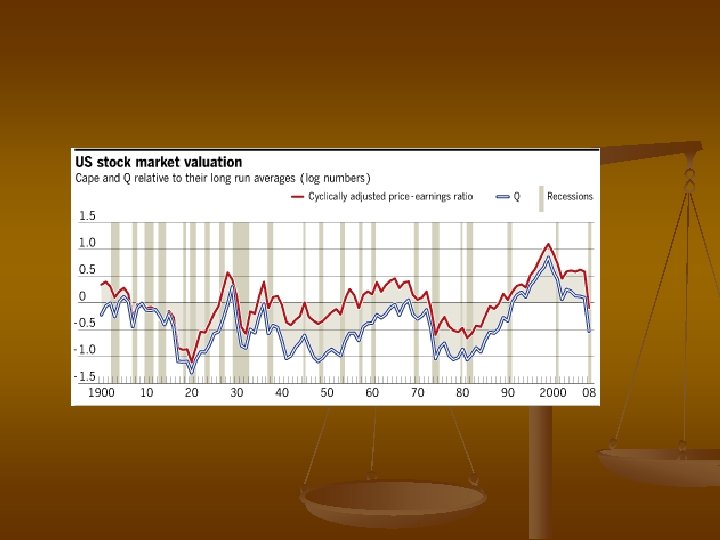

Market efficiency?

Financial boom and bust cycle

Four vicious cycles

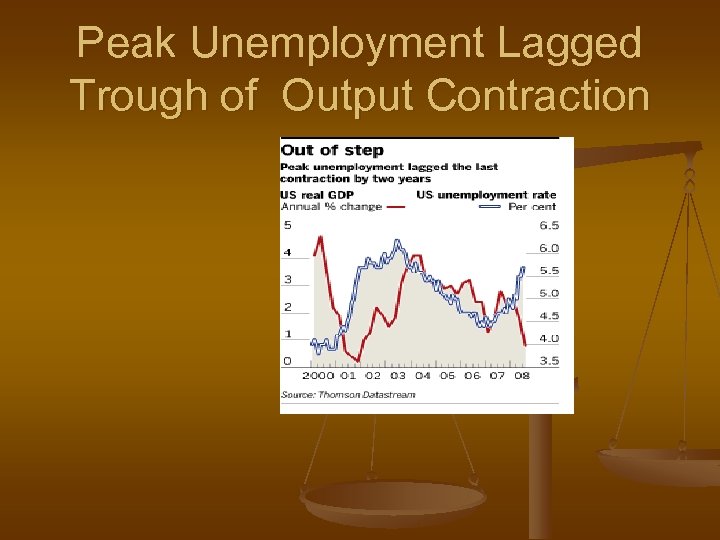

Peak Unemployment Lagged Trough of Output Contraction

Residential Property Prices

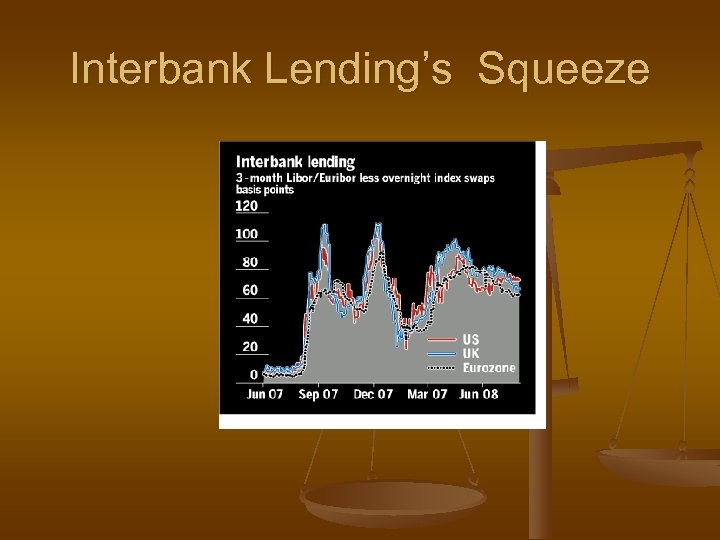

Interbank Lending’s Squeeze

Early Warnings?

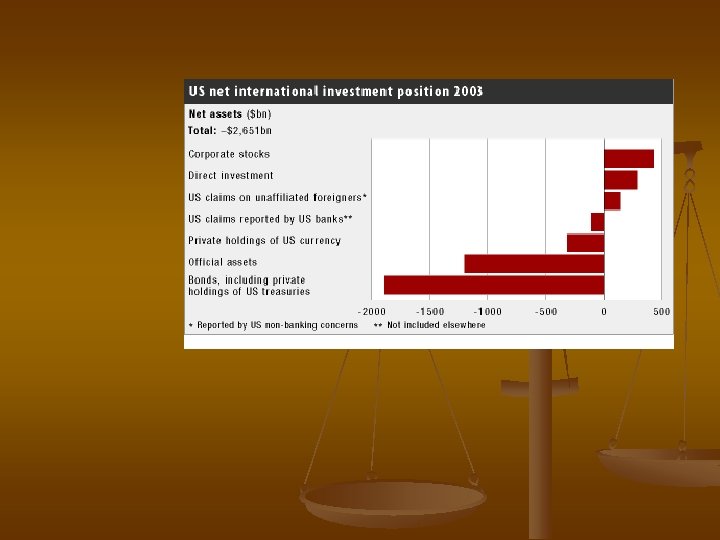

Global Saving Glut

Capital Flows Destabilizing

Two Global Shocks

US Growth

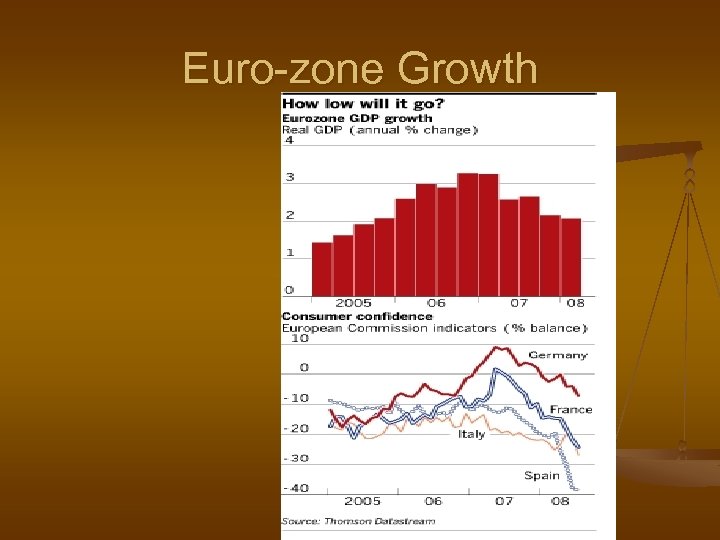

Euro-zone Growth

Monetary tightening?

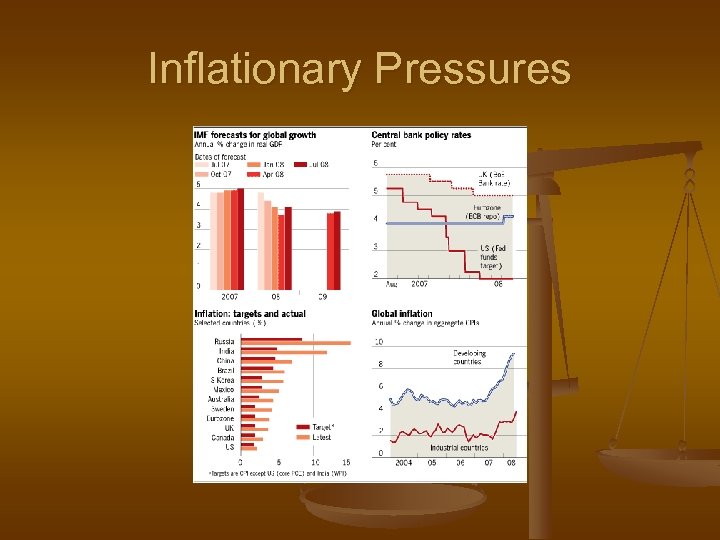

Inflationary Pressures

The euro zone has a stronger economy but much tighter monetary conditions

China’s Growth Rates

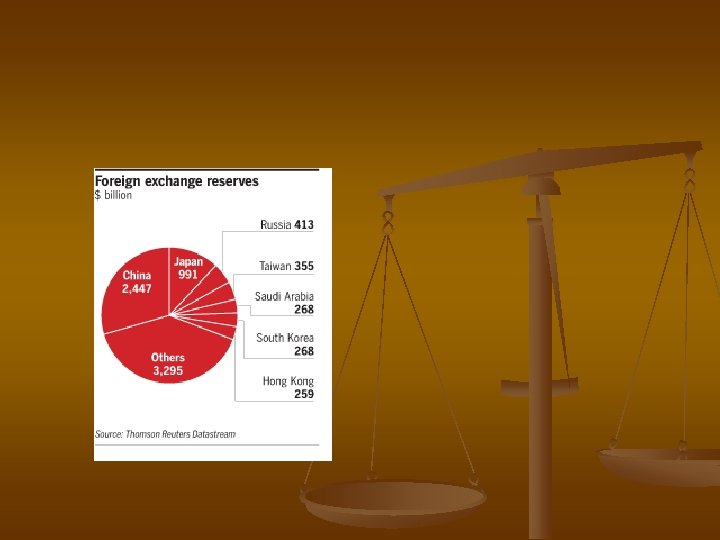

Official reserves and Inflation

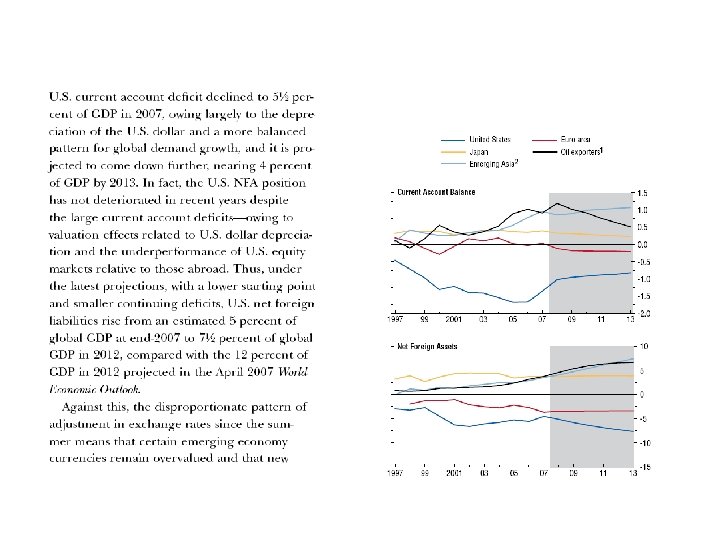

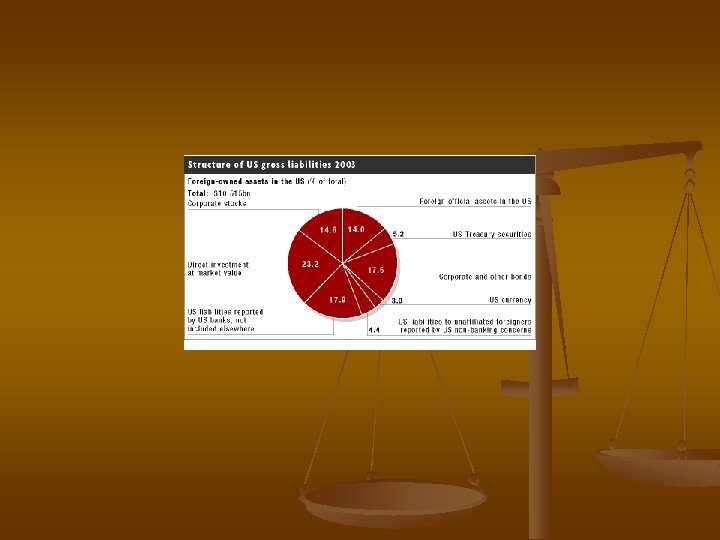

Current account, capital account and Reserves’ account

Outward and inward capital flows

Round-tripping of capital and low domestic wages

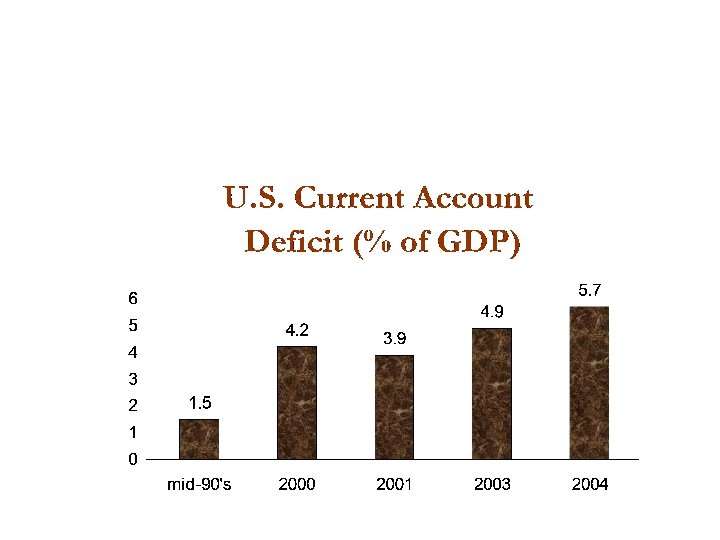

current account surplus

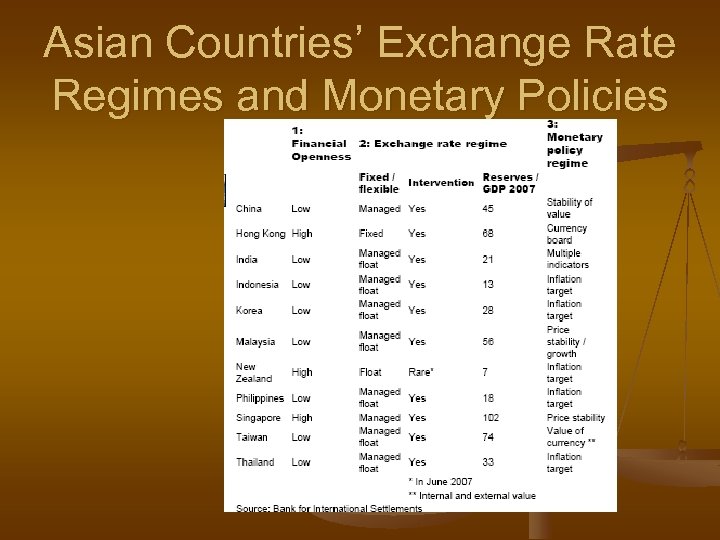

Asian Countries’ Exchange Rate Regimes and Monetary Policies

Appreciation of Asian Currencies in the first Half of 2008

China’s exports are growing more slowly than America’s

Food and Energy Prices: Inflation

Three historical precedents

US SAVING AND LOANS CRISIS: The saving and Loan Crisis of the Late 1980 s—the macro economic effects are hinged on the extent to which financial institutions need to reduce balance sheets and recapitalize their assets.

The Dollar Strengthening

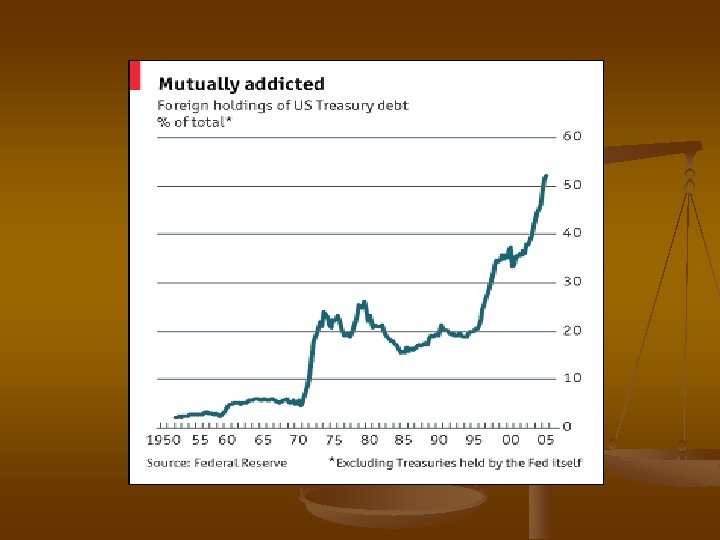

Dollar as a Reserve Currency

As the dollar falls, there is an upward pressure on US import prices and more inflationary pressure generally. In response, the Federal Reserve will have to raise interest rates faster than currently expected. Higher interest rates will make borrowing more expensive and slow investment growth.

Can Dollar loses its status as a Reserve Currency? At present, foreigners’ desire to hold dollar cash and bonds as a store of value allows the US to finance its debt at low cost. A loss of that status would mean a permanent loss of wealth for the US.

Booming Credit Growth Fuels Demand for Goods

Why the US saving rate is so low?

US Inequality

Who is paying for the growth of the consumption of oldsters?

43d3b9fdddce873aa9fae3b2e2c0c385.ppt