7baf9ddc14ef12c8b2d4d7bd3dac6af3.ppt

- Количество слайдов: 41

Global Consumer Buying Power: Segmentation and Forecasts Prepared by Chris Holling, Executive Managing Director, Business Planning Solutions May 25, 2005

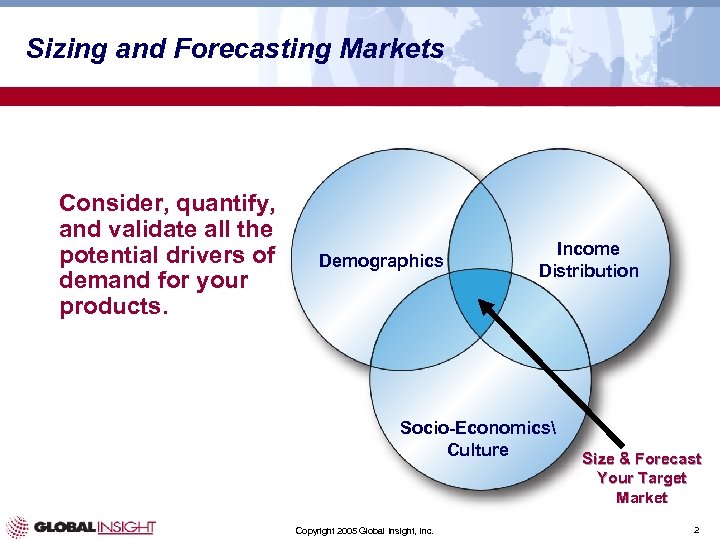

Sizing and Forecasting Markets Consider, quantify, and validate all the potential drivers of demand for your products. Demographics Income Distribution Socio-Economics Culture Copyright 2005 Global Insight, Inc. Size & Forecast Your Target Market 2

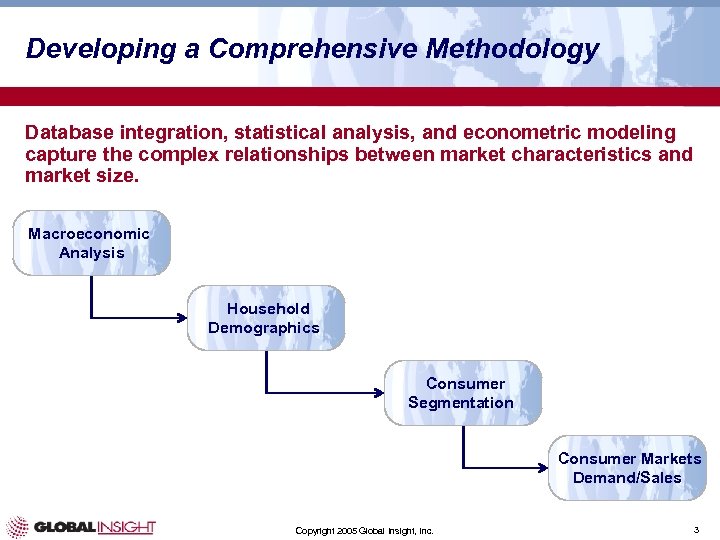

Developing a Comprehensive Methodology Database integration, statistical analysis, and econometric modeling capture the complex relationships between market characteristics and market size. Macroeconomic Analysis Household Demographics Consumer Segmentation Consumer Markets Demand/Sales Copyright 2005 Global Insight, Inc. 3

The Key to a Successful Model To be successful, a model must: u Include the appropriate concepts u Represent u Possess u Earn the true timing of reactions coefficients with the appropriate magnitudes the confidence of users Copyright 2005 Global Insight, Inc. 4 4

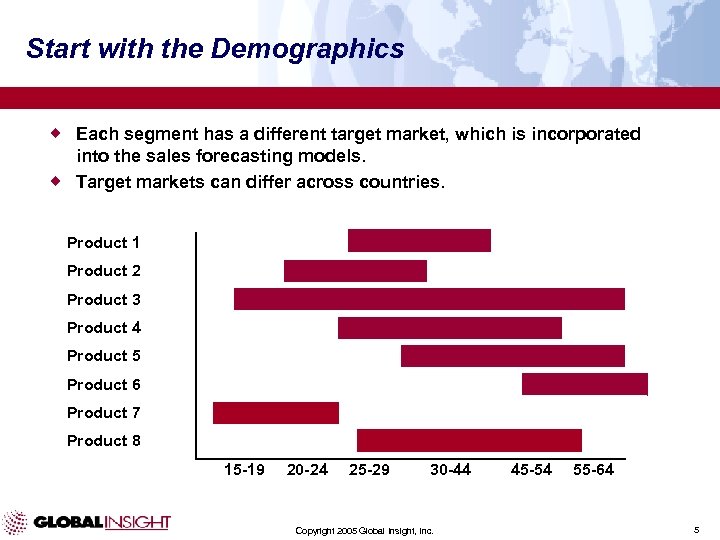

Start with the Demographics ® Each segment has a different target market, which is incorporated into the sales forecasting models. ® Target markets can differ across countries. Product 1 Product 2 Product 3 Product 4 Product 5 Product 6 Product 7 Product 8 15 -19 20 -24 25 -29 30 -44 Copyright 2005 Global Insight, Inc. 45 -54 55 -64 5

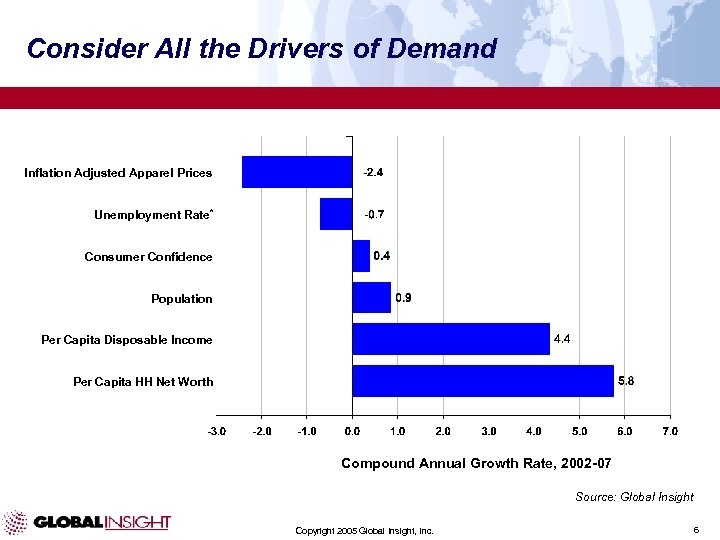

Consider All the Drivers of Demand Inflation Adjusted Apparel Prices Unemployment Rate* Consumer Confidence Population Per Capita Disposable Income Per Capita HH Net Worth Compound Annual Growth Rate, 2002 -07 Source: Global Insight Copyright 2005 Global Insight, Inc. 6

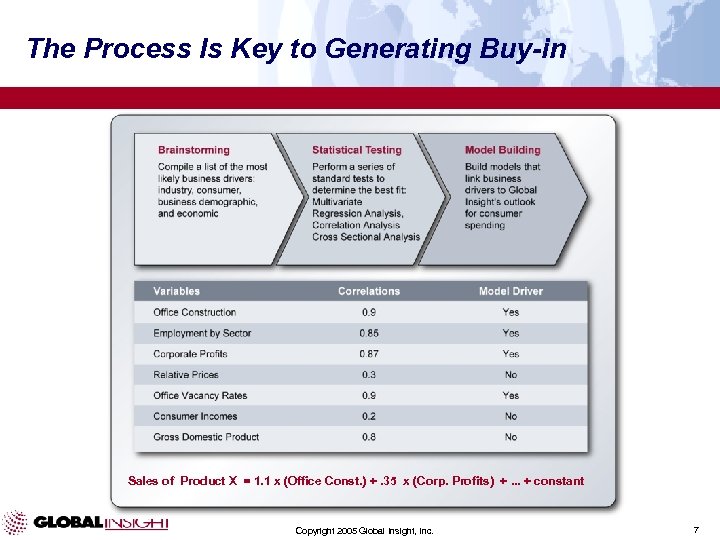

The Process Is Key to Generating Buy-in Sales of Product X = 1. 1 x (Office Const. ) +. 35 x (Corp. Profits) +. . . + constant Copyright 2005 Global Insight, Inc. 7

Data are Dumb… You Must be Smart ® Structural modeling is the most trustworthy w w Search for causation, not correlation Be clear whether you are modeling demand or supply — only one per equation ® T-statistics are often misinterpreted w w T’s measure precision of estimate, not whether a factor is important Multicolinearity must be dealt with through constraints, not exclusion of good factors Copyright 2005 Global Insight, Inc. 8 8

Benchmark Results Against Relevant Experience ® Counter-intuitive elasticities are usually a sign of spurious correlation, data errors, or multicolinearity ® Short-run income elasticities should be high for discretionary goods, particularly items that consumers can postpone purchasing ® Price elasticities should be high when close substitutes are available ® Demographic factors, often trend-like, are easily confused with penetration curves Copyright 2005 Global Insight, Inc. 9

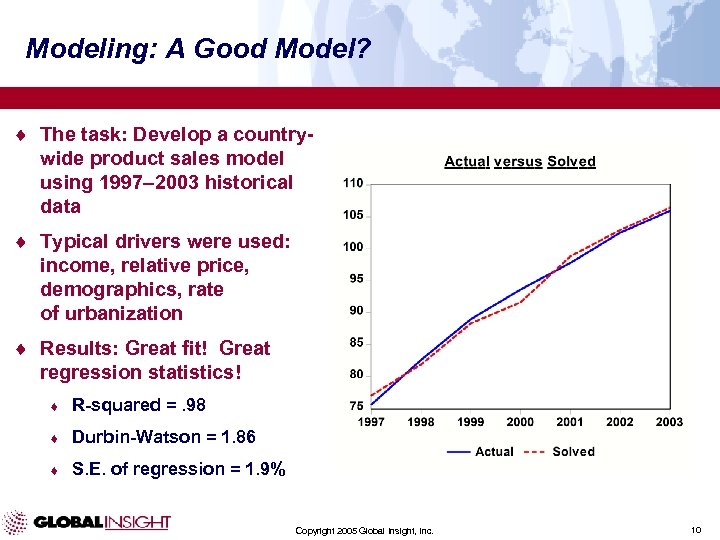

Modeling: A Good Model? ¨ The task: Develop a countrywide product sales model using 1997– 2003 historical data ¨ Typical drivers were used: income, relative price, demographics, rate of urbanization ¨ Results: Great fit! Great regression statistics! ¨ R-squared =. 98 ¨ Durbin-Watson = 1. 86 ¨ S. E. of regression = 1. 9% Copyright 2005 Global Insight, Inc. 10

Modeling: Let’s Be Careful Out There A CLOSER LOOK ¨ The equation: ¨ log(sales) = 9. 6 + (-1. 8)*log(income) + 2. 7*log(relative price) + 5. 7*log(rate of urbanization) ® A 1% increase in income suggests a 1. 8% decrease in sales? Unlikely! ® A 1% increase in the relative price suggests a 2. 7% increase in sales? Unlikely! ® A 1% increase in urbanized population suggests a 5. 7% increase in sales? Unlikely! ¨ Clearly, a good fit and excellent regression statistics do not always result in the best equation!! Copyright 2005 Global Insight, Inc. 11

Global Consumer Markets Database A Tool to … u u Assess Overall Market Attractiveness Demographics ® Size Country Markets ® Anticipate Growth by Customer Segment ® Identify Market Risk & Exposure Conduct Product Penetration Rate Analysis Income Distribution Socio-Economics Size & Forecast Your Target Market Copyright 2005 Global Insight, Inc. 12

Uncover Market Opportunity & Risk Global Consumer Markets Database u Cross-country comparable data u 10 -year forecasts plus 10 or more years of history, annual frequency u 22 consumer product categories u Detailed household income distribution forecasts u 95 Countries u Population by gender and age u Semi-annual updates Copyright 2005 Global Insight, Inc. 13 13

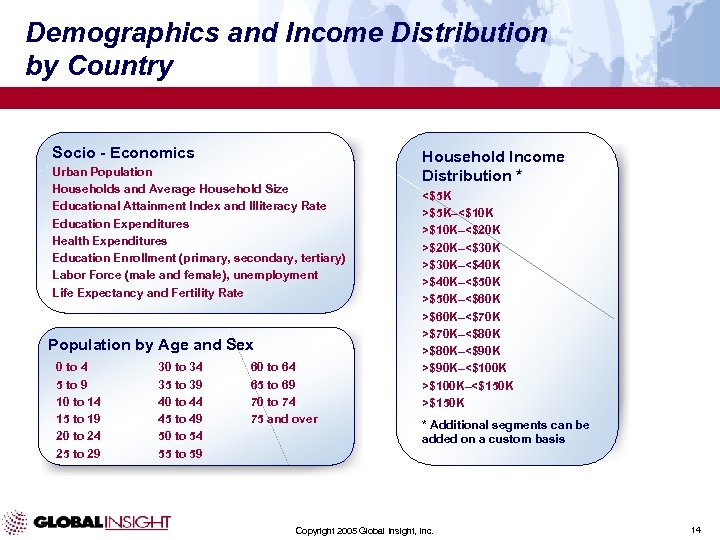

Demographics and Income Distribution by Country Socio - Economics Urban Population Households and Average Household Size Educational Attainment Index and Illiteracy Rate Education Expenditures Health Expenditures Education Enrollment (primary, secondary, tertiary) Labor Force (male and female), unemployment Life Expectancy and Fertility Rate Population by Age and Sex 0 to 4 5 to 9 10 to 14 15 to 19 20 to 24 25 to 29 30 to 34 35 to 39 40 to 44 45 to 49 50 to 54 55 to 59 60 to 64 65 to 69 70 to 74 75 and over Household Income Distribution * <$5 K >$5 K–<$10 K >$10 K–<$20 K >$20 K–<$30 K >$30 K–<$40 K >$40 K–<$50 K >$50 K–<$60 K >$60 K–<$70 K >$70 K–<$80 K >$80 K–<$90 K >$90 K–<$100 K >$100 K–<$150 K >$150 K * Additional segments can be added on a custom basis Copyright 2005 Global Insight, Inc. 14

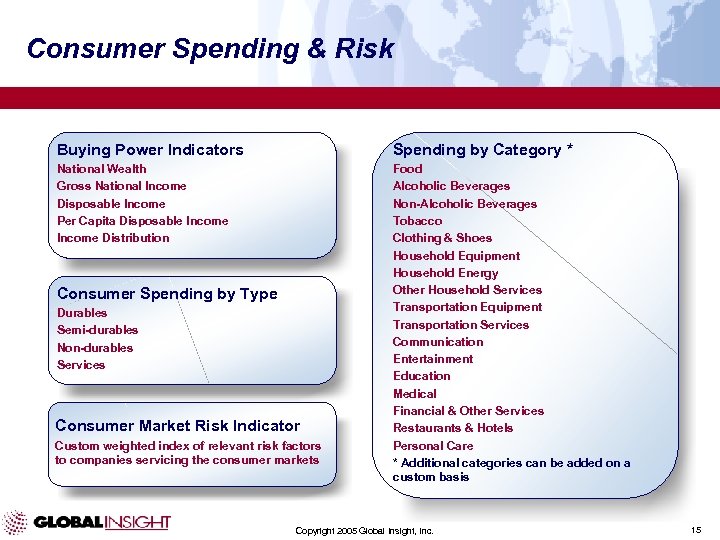

Consumer Spending & Risk Buying Power Indicators Spending by Category * National Wealth Gross National Income Disposable Income Per Capita Disposable Income Distribution Food Alcoholic Beverages Non-Alcoholic Beverages Tobacco Clothing & Shoes Household Equipment Household Energy Other Household Services Transportation Equipment Transportation Services Communication Entertainment Education Medical Financial & Other Services Restaurants & Hotels Personal Care * Additional categories can be added on a custom basis Consumer Spending by Type Durables Semi-durables Non-durables Services Consumer Market Risk Indicator Custom weighted index of relevant risk factors to companies servicing the consumer markets Copyright 2005 Global Insight, Inc. 15

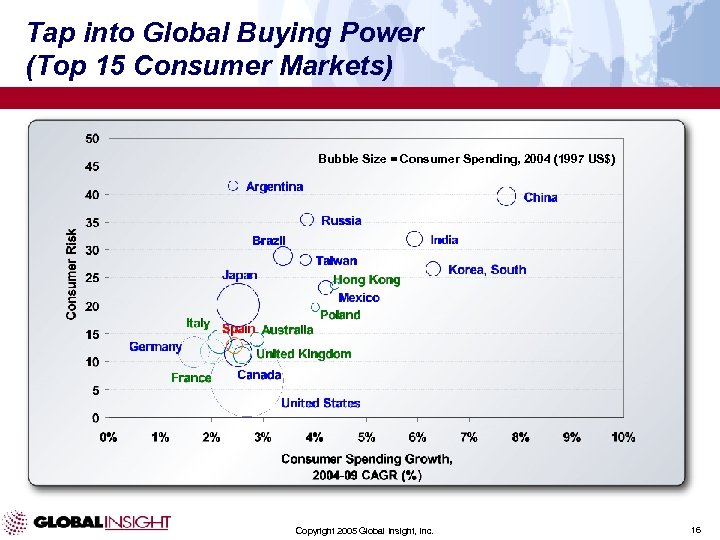

Tap into Global Buying Power (Top 15 Consumer Markets) Bubble Size = Consumer Spending, 2004 (1997 US$) Copyright 2005 Global Insight, Inc. 16

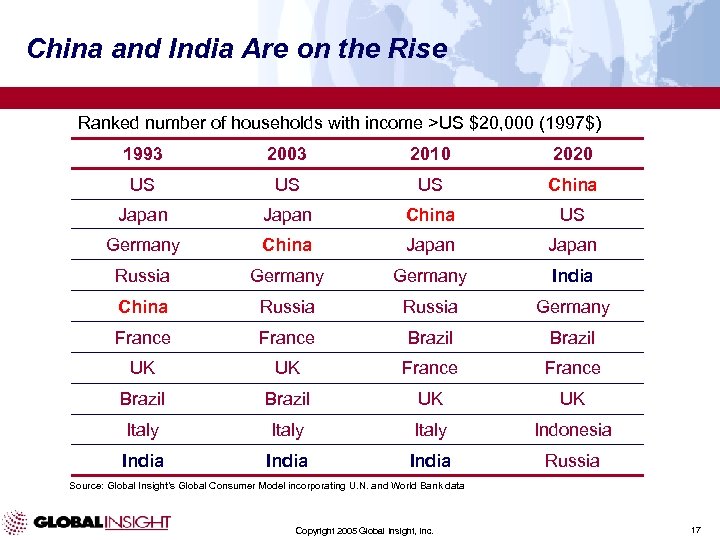

China and India Are on the Rise Ranked number of households with income >US $20, 000 (1997$) 1993 2003 2010 2020 US US US China Japan China US Germany China Japan Russia Germany India China Russia Germany France Brazil UK UK Italy Indonesia India Russia Source: Global Insight’s Global Consumer Model incorporating U. N. and World Bank data Copyright 2005 Global Insight, Inc. 17

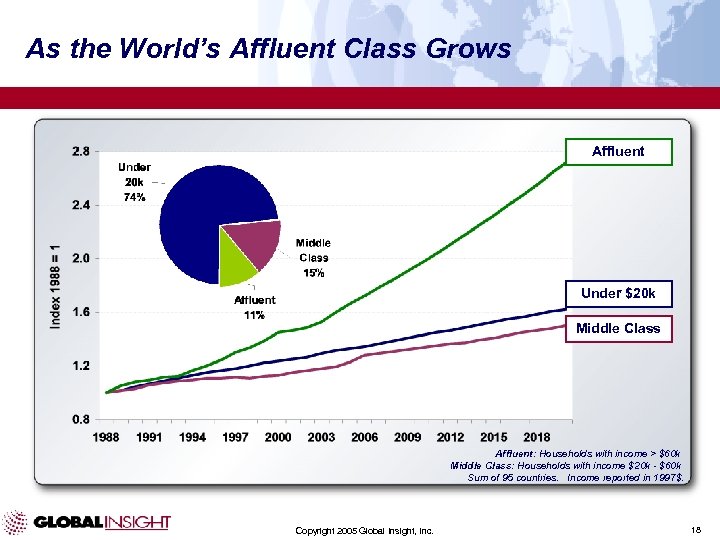

As the World’s Affluent Class Grows Affluent Under $20 k Middle Class Affluent: Households with income > $60 k Middle Class: Households with income $20 k - $60 k Sum of 95 countries. Income reported in 1997$. Copyright 2005 Global Insight, Inc. 18

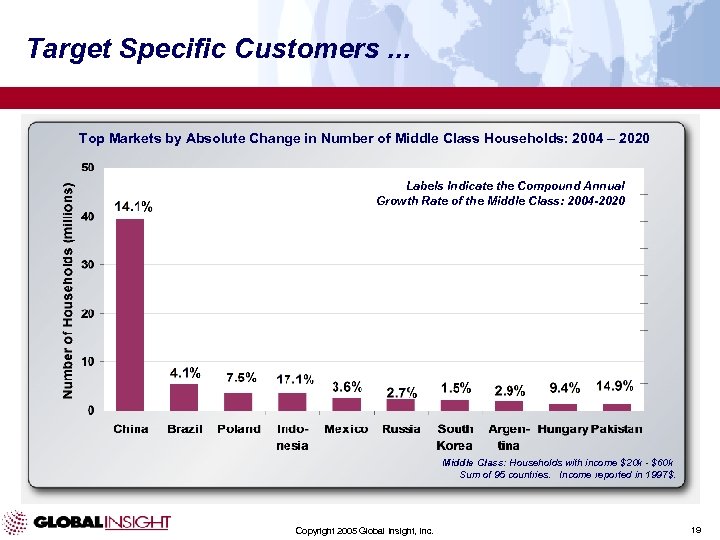

Target Specific Customers. . . Top Markets by Absolute Change in Number of Middle Class Households: 2004 – 2020 Labels Indicate the Compound Annual Growth Rate of the Middle Class: 2004 -2020 Middle Class: Households with income $20 k - $60 k Sum of 95 countries. Income reported in 1997$. Copyright 2005 Global Insight, Inc. 19

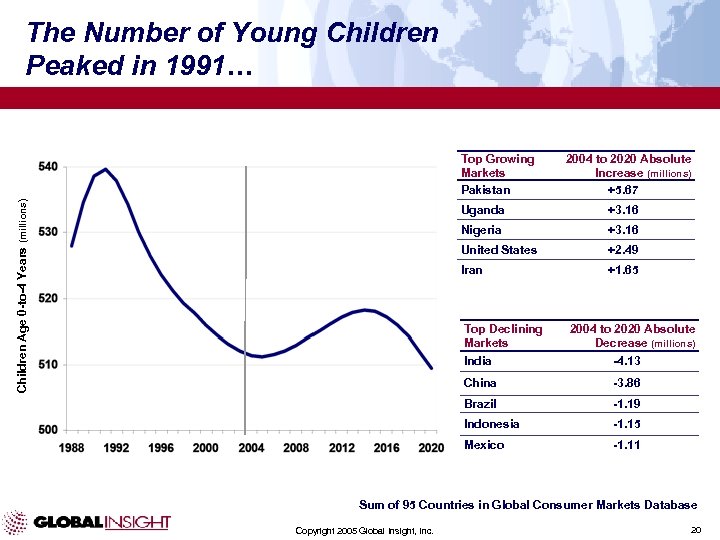

The Number of Young Children Peaked in 1991… Children Age 0 -to-4 Years (millions) Top Growing Markets Pakistan 2004 to 2020 Absolute Increase (millions) +5. 67 Uganda +3. 16 Nigeria +3. 16 United States +2. 49 Iran +1. 65 Top Declining Markets 2004 to 2020 Absolute Decrease (millions) India -4. 13 China -3. 86 Brazil -1. 19 Indonesia -1. 15 Mexico -1. 11 Sum of 95 Countries in Global Consumer Markets Database Copyright 2005 Global Insight, Inc. 20

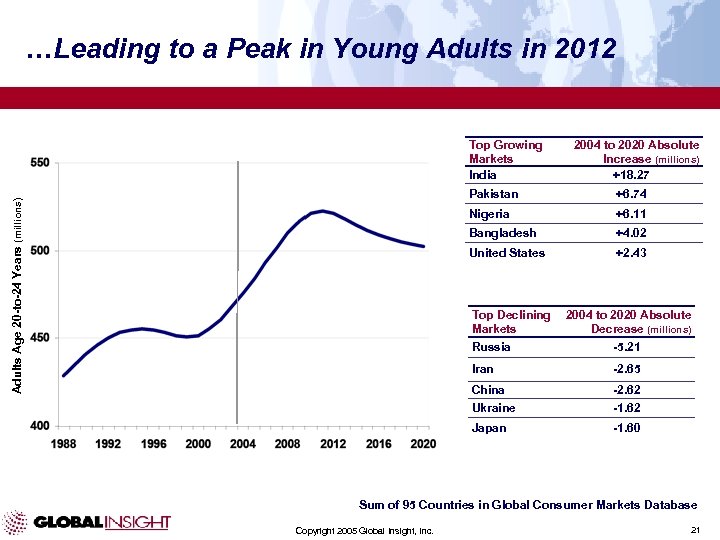

…Leading to a Peak in Young Adults in 2012 Top Growing Markets India 2004 to 2020 Absolute Increase (millions) +18. 27 +6. 74 Nigeria +6. 11 Bangladesh +4. 02 United States Adults Age 20 -to-24 Years (millions) Pakistan +2. 43 Top Declining Markets 2004 to 2020 Absolute Decrease (millions) Russia -5. 21 Iran -2. 65 China -2. 62 Ukraine -1. 62 Japan -1. 60 Sum of 95 Countries in Global Consumer Markets Database Copyright 2005 Global Insight, Inc. 21

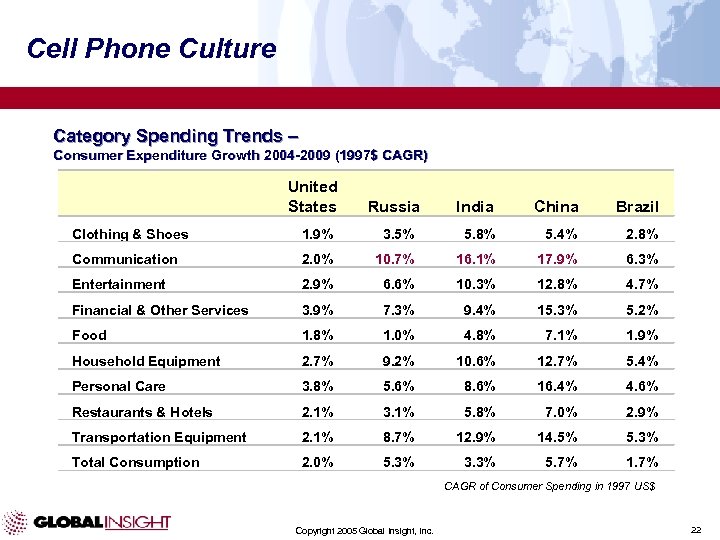

Cell Phone Culture Category Spending Trends – Consumer Expenditure Growth 2004 -2009 (1997$ CAGR) United States Russia India China Brazil Clothing & Shoes 1. 9% 3. 5% 5. 8% 5. 4% 2. 8% Communication 2. 0% 10. 7% 16. 1% 17. 9% 6. 3% Entertainment 2. 9% 6. 6% 10. 3% 12. 8% 4. 7% Financial & Other Services 3. 9% 7. 3% 9. 4% 15. 3% 5. 2% Food 1. 8% 1. 0% 4. 8% 7. 1% 1. 9% Household Equipment 2. 7% 9. 2% 10. 6% 12. 7% 5. 4% Personal Care 3. 8% 5. 6% 8. 6% 16. 4% 4. 6% Restaurants & Hotels 2. 1% 3. 1% 5. 8% 7. 0% 2. 9% Transportation Equipment 2. 1% 8. 7% 12. 9% 14. 5% 5. 3% Total Consumption 2. 0% 5. 3% 3. 3% 5. 7% 1. 7% CAGR of Consumer Spending in 1997 US$ Copyright 2005 Global Insight, Inc. 22

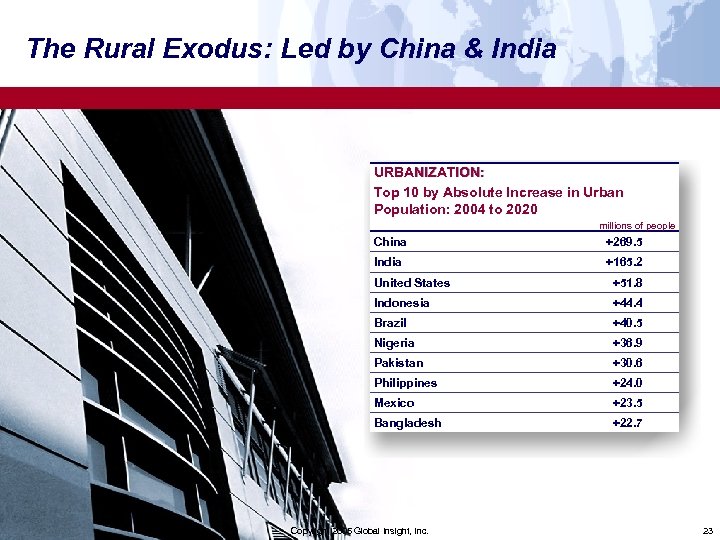

The Rural Exodus: Led by China & India URBANIZATION: Top 10 by Absolute Increase in Urban Population: 2004 to 2020 millions of people China +269. 5 India +165. 2 United States +51. 8 Indonesia +44. 4 Brazil +40. 5 Nigeria +36. 9 Pakistan +30. 6 Philippines +24. 0 Mexico +23. 5 Bangladesh +22. 7 Copyright 2005 Global Insight, Inc. 23 23

Take it to the Next Level Copyright 2005 Global Insight, Inc. 24

® Case Study 1: Calculating market opportunity by country based on household income distribution. ® Case Study 2: Developing market attractiveness indexes to rank country markets and prioritize resource allocation decisions. ® Case Study 3: Producing sales forecasting models to predict market demand by country. Copyright 2005 Global Insight, Inc. 25

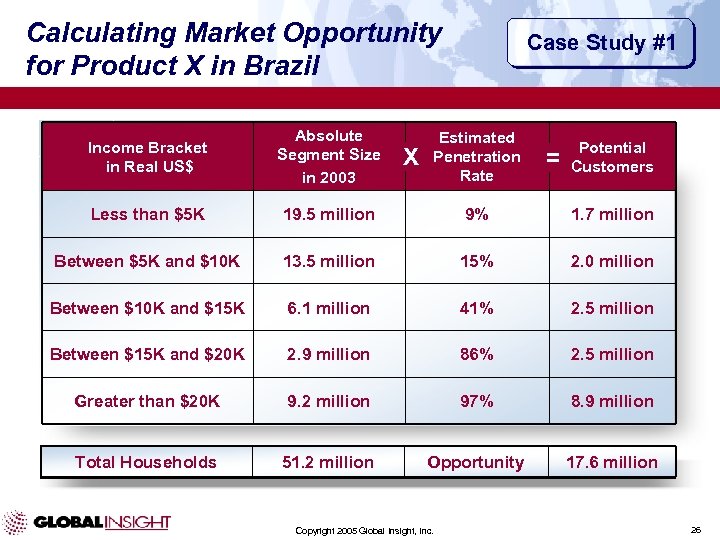

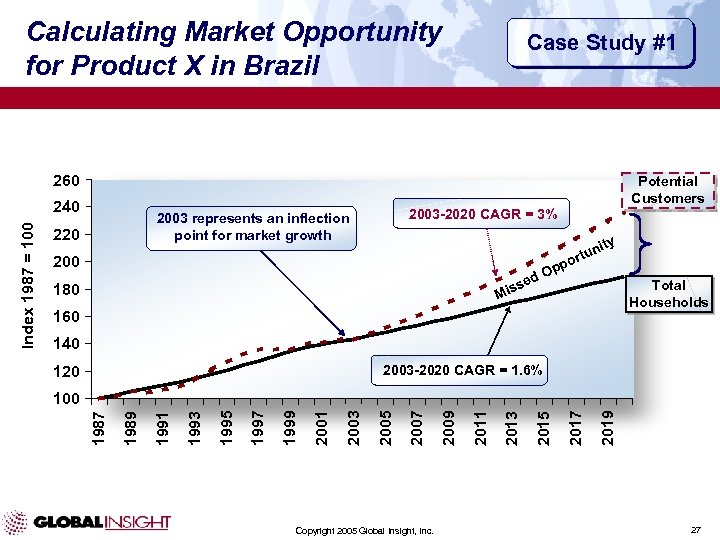

Calculating Market Opportunity for Product X in Brazil Case Study #1 Income Bracket in Real US$ Absolute Segment Size in 2003 Less than $5 K 19. 5 million 9% 1. 7 million Between $5 K and $10 K 13. 5 million 15% 2. 0 million Between $10 K and $15 K 6. 1 million 41% 2. 5 million Between $15 K and $20 K 2. 9 million 86% 2. 5 million Greater than $20 K 9. 2 million 97% 8. 9 million Total Households 51. 2 million Opportunity 17. 6 million X Estimated Penetration Rate Copyright 2005 Global Insight, Inc. = Potential Customers 26

Calculating Market Opportunity for Product X in Brazil Case Study #1 260 Potential Customers 2003 -2020 CAGR = 3% 2003 represents an inflection point for market growth 220 200 ed iss M 180 ity un rt po Op Total Households 160 140 120 2003 -2020 CAGR = 1. 6% Copyright 2005 Global Insight, Inc. 2019 2017 2015 2013 2011 2009 2007 2005 2003 2001 1999 1997 1995 1993 1991 1989 100 1987 Index 1987 = 100 240 27

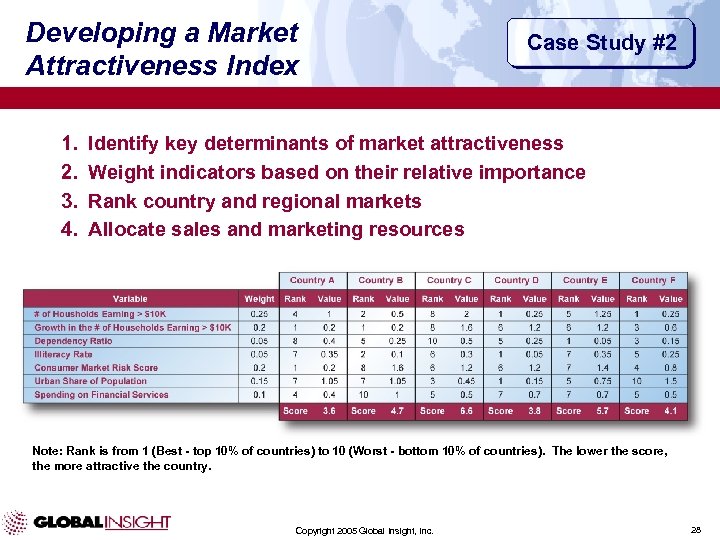

Developing a Market Attractiveness Index 1. 2. 3. 4. Case Study #2 Identify key determinants of market attractiveness Weight indicators based on their relative importance Rank country and regional markets Allocate sales and marketing resources Note: Rank is from 1 (Best - top 10% of countries) to 10 (Worst - bottom 10% of countries). The lower the score, the more attractive the country. Copyright 2005 Global Insight, Inc. 28

China Demographic Variables: Age-Specific Weighting Copyright 2005 Global Insight, Inc. Case Study #3 29

China: Weighted Demographic Indices Copyright 2005 Global Insight, Inc. Case Study #3 30

United States: Weighted Demographic Indices Copyright 2005 Global Insight, Inc. Case Study #3 31

Brazil: Weighted Demographic Indices Copyright 2005 Global Insight, Inc. Case Study #3 32

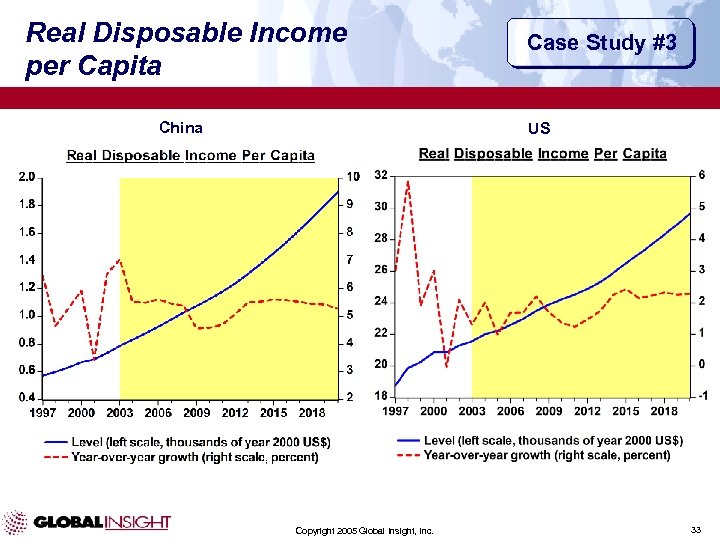

Real Disposable Income per Capita China Case Study #3 US Copyright 2005 Global Insight, Inc. 33

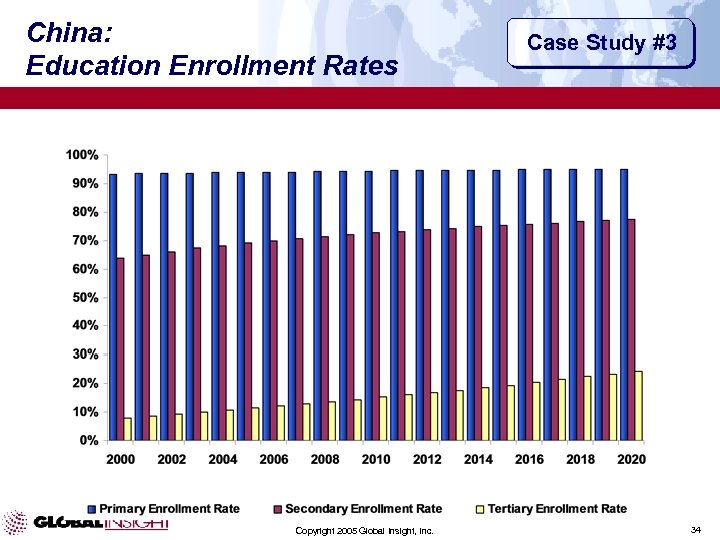

China: Education Enrollment Rates Copyright 2005 Global Insight, Inc. Case Study #3 34

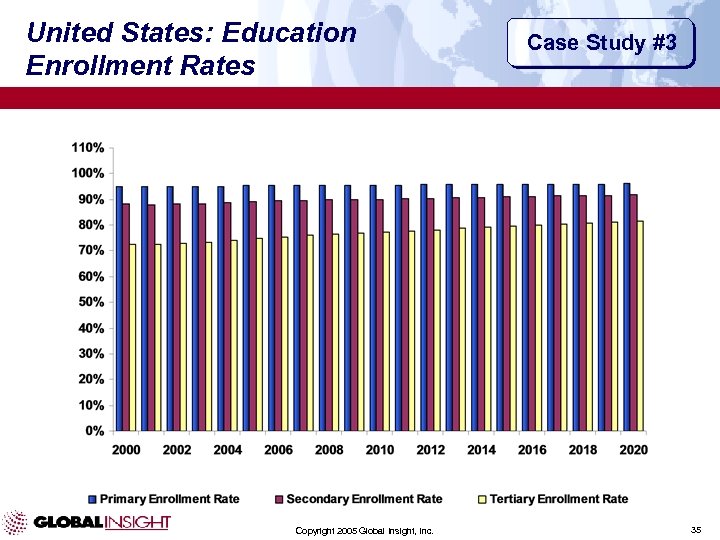

United States: Education Enrollment Rates Copyright 2005 Global Insight, Inc. Case Study #3 35

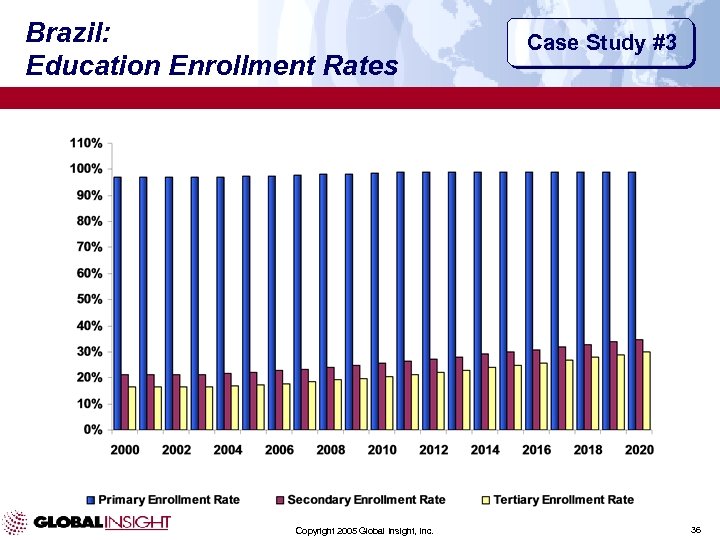

Brazil: Education Enrollment Rates Copyright 2005 Global Insight, Inc. Case Study #3 36

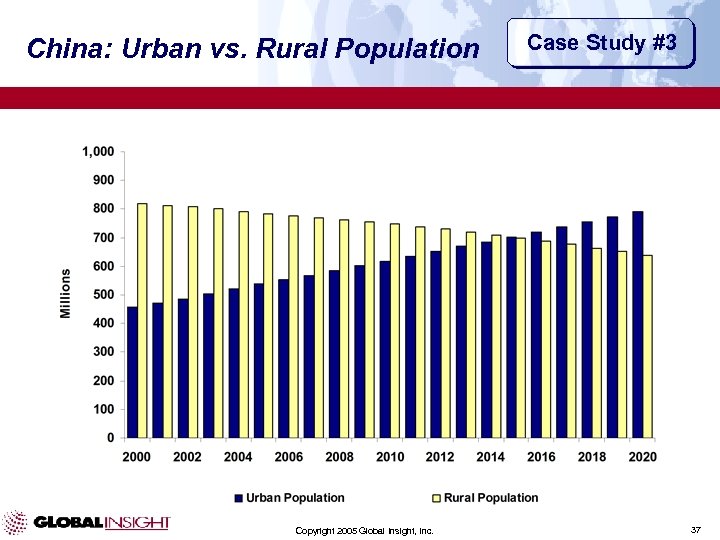

China: Urban vs. Rural Population Copyright 2005 Global Insight, Inc. Case Study #3 37

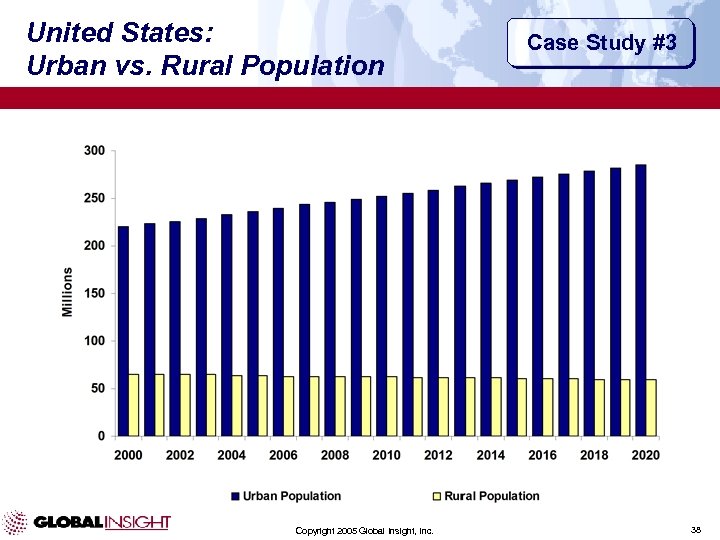

United States: Urban vs. Rural Population Copyright 2005 Global Insight, Inc. Case Study #3 38

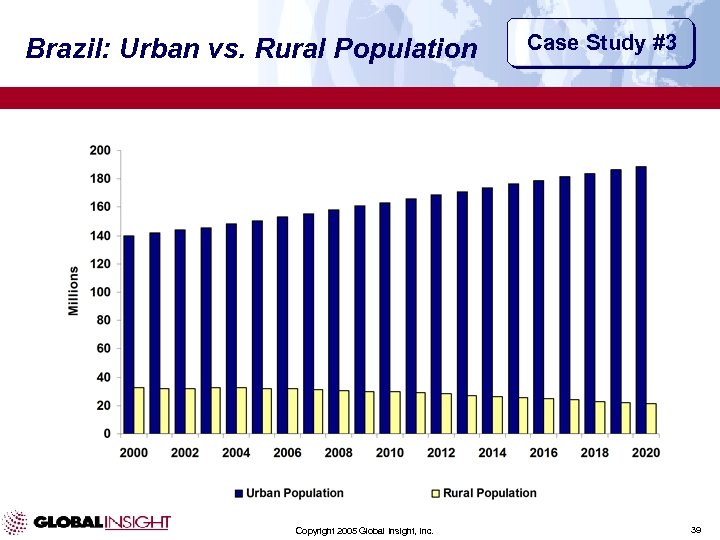

Brazil: Urban vs. Rural Population Copyright 2005 Global Insight, Inc. Case Study #3 39

China: Driver and Forecast Comparisons Copyright 2005 Global Insight, Inc. Case Study #3 40

Thank you. For Additional Information: Chris Holling, 416 -682 -7303 chris. holling@globalinsight. com Copyright 2005 Global Insight, Inc. 41

7baf9ddc14ef12c8b2d4d7bd3dac6af3.ppt