47b567e8b56d305838a4bfed5467fd7d.ppt

- Количество слайдов: 16

Global commercialisation of UK stem cell research Nicola Perrin

An internship project carried out for UK Trade & Investment, as part of an MPhil at the University of Cambridge April-June 2005 by Nicola Perrin, University of Cambridge Legal Disclaimer Whereas every effort has been made to ensure that the information given herein is accurate, UK Trade & Investment or its sponsoring Departments, the Departments of Trade & Industry and Foreign & Commonwealth Office, accept no responsibility for any errors, omissions or misleading statements in that information and no warranty is given or responsibility is accepted as to the standing of any firm, company or individual mentioned. Crown Copyright retained - this report maybe freely quoted by prior agreement. Attribution to UKTI / Nicola Perrin is required.

UK strengths 1 • Regulatory framework - supportive, clear, comprehensive - allows research with adult and embryonic stem cells - one of only a few countries to allow therapeutic cloning • Academic centres - world class expertise - Cambridge, Edinburgh, London, Newcastle, Sheffield • Funding - Government, Research Councils and Charities • Government support

UK strengths 2 • UK Stem Cell Bank - world-first, opened in 2004 - research and commercial use • Stem cell companies

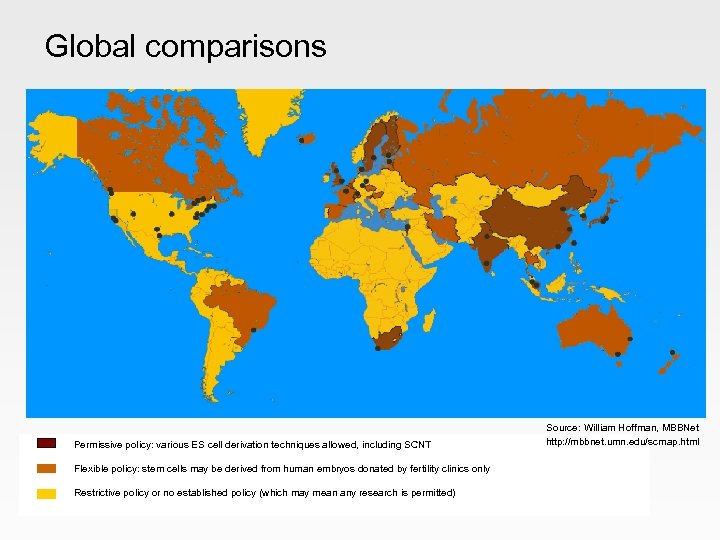

Global comparisons Permissive policy: various ES cell derivation techniques allowed, including SCNT Flexible policy: stem cells may be derived from human embryos donated by fertility clinics only Restrictive policy or no established policy (which may mean any research is permitted) Source: William Hoffman, MBBNet http: //mbbnet. umn. edu/scmap. html

United States • Federal restrictions on funding with ES cells - has limited stem cell research - recent indications the situation may begin to change • Range of State initiatives - California: Proposition 71, $3 bn fund for stem cell research - New Jersey, Massachusetts, Connecticut also supporting research - some other States have tightened restrictions • Active companies - eg Geron, ACT, Stem Cells Inc - significant resources and investment for commercialisation could catch up

Asia • Seen as a priority area • Significant government investment, supportive regulations, impressive infrastructure, worldclass expertise Main focus China South Korea Singapore clinical translation leading SCNT expertise commercial emphasis Significant threat See Global Watch Mission Report 2004

Scandinavia • • Strong research, recognised expertise Government support Favourable legislation Clear routes for commercialisation Similar position to UK Need to monitor progress in Sweden and Denmark

Europe • Much more conservative to ESC work Banned: Restrictions: Permitted: Italy, Austria, Ireland France, Germany, Greece, Netherlands Belgium, Spain, Czech Republic • Some highly-regarded adult SC research Poses little threat

Other significant players • Australia - leading centre of excellence - uncertain regulatory framework - appears to be losing strong position • Canada - Canadian Stem Cell Network particularly strong - research with surplus embryos allowed but therapeutic cloning banned • Israel - strong academic expertise - therapeutic cloning permitted - active spin-out companies

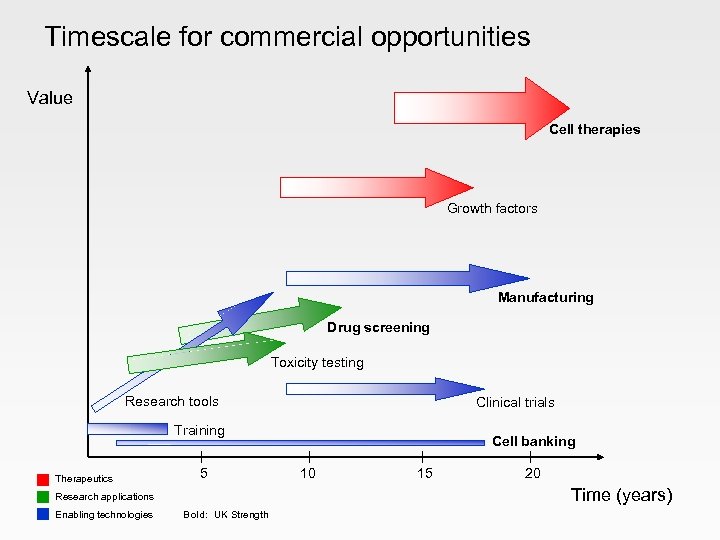

Commercial opportunities Therapeutics • • cell therapies growth factors Research applications • • • disease models drug screening toxicity testing Enabling technologies • • • research consumables manufacturing licensing cell lines • cell banking • clinical trials • training

Timescale for commercial opportunities Value Cell therapies Growth factors Manufacturing Drug screening Toxicity testing Research tools Training Therapeutics Clinical trials Cell banking 5 10 15 20 Research applications Enabling technologies Bold: UK Strength Time (years)

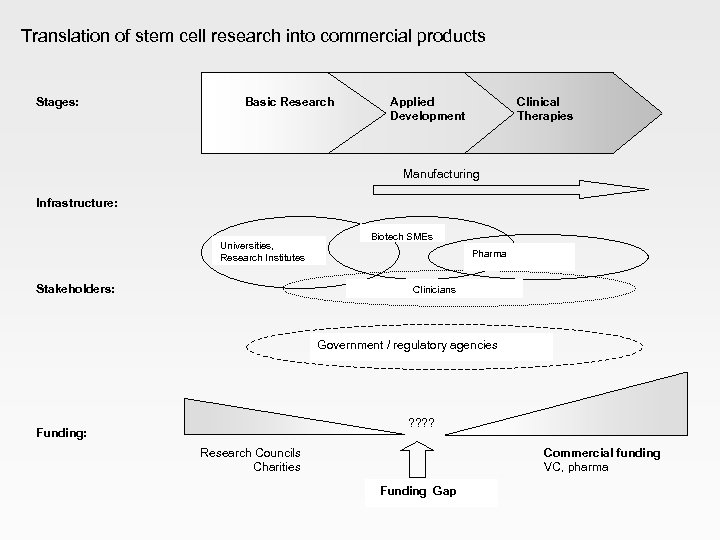

Challenges • IP: lack of clarity • Lack of venture capital investment • Caution from Big Pharma • Need for translational funding

Translation of stem cell research into commercial products Stages: Basic Research Applied Development Clinical Therapies Manufacturing Infrastructure: Universities, Research Institutes Stakeholders: Biotech SMEs Pharma Clinicians Government / regulatory agencies ? ? Funding: Research Councils Charities Funding Gap Commercial funding VC, pharma

Conclusions • Beware of hype • UK needs to maintain competitive advantage • Opportunities and threats from overseas • Global collaborations crucial • Important to raise profile of stem cell companies abroad

For further information • A full version of the report is available on the UKTI portal at: www. uktradeinvest. gov. uk/ukti/biotechnology • Alternatively, please contact Nicola Perrin: N. M. R. Perrin. 04@cantab. net Ian Bunker: Ian. bunker@uktradeinvest. gov. uk

47b567e8b56d305838a4bfed5467fd7d.ppt