a5b71c947d4126706f1dd7e189a33b34.ppt

- Количество слайдов: 25

Global Commerce. Zone Case Study Entrepreneurship Course 2001 Shani Shalgi Pini Reisman Ziv Yirmeyahu Itai Ra’anan Nocham Ohana Ze’ev Getner

Teaser 75 Employees 7 Branches Around the World $10 M~ Investment • 14 employees • 2 Branches: Israel, US. • $150 K Burn Rate Keep existing without a major customer. . .

Agenda • • • The Problem Company History The Solution The Shift The Target Market Business Model Competition Our Input Thanks

The Problem • Clearing international deliveries through customs – Customs classification is complex. – Regulations are updated frequently. – The chain of pain.

Chain of Pain - Buyer • Unknown import charges • Two payment points Buyer

Chain of Pain - Retailer • Dissatisfied customers Retailer • Customer service costs • Lost revenues • Cost of exceptions Buyer

Chain of Pain - Carrier Retailer • Merchant complaints • Customs collection Buyer Carrier

Company History • • • Foundation: 1999 Founders: Haim Chasman, Richard Demb Investors: BRM, Yazam. Original name: v. Ship inc. Investment: ~$10 M.

The Solution Technical infrastructure to: • Provide automated, guaranteed landed cost quotes and documentation for international parcel shipments. • Enable single payment point for all charges. • Seamless transfer of customs funds from the merchant to the carrier clearing the shipment through customs.

How Does It Works? • GCZ classifies each product on the client’s catalog for every destination country. • When a consumer makes an order, an XML query is sent to GCZ’s server. • GCZ returns a quote of the full product price including customs duties and NTBs for the product, plus commission. • GCZ guarantees the given quote. • The consumer pre-pays whole landed cost. • GCZ receives the custom costs plus commission from the retailer. • GCZ transfers the customs to the carrier after he fronts the customs for the consumer.

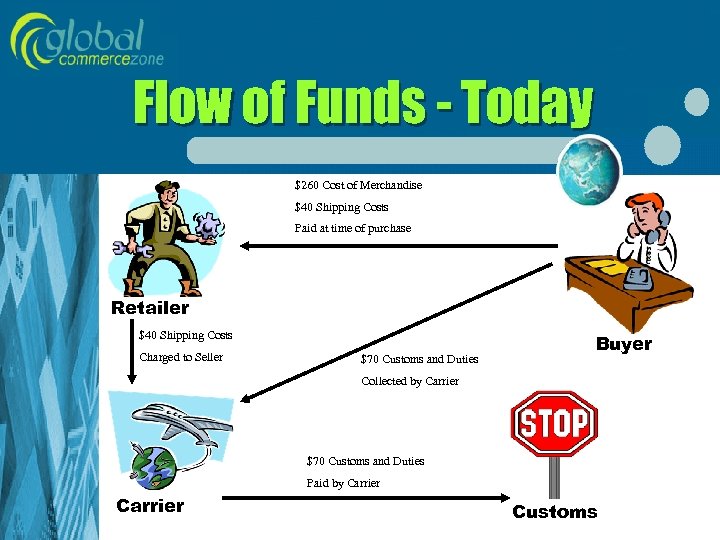

Flow of Funds - Today $260 Cost of Merchandise $40 Shipping Costs Paid at time of purchase Retailer $40 Shipping Costs Charged to Seller $70 Customs and Duties Buyer Collected by Carrier $70 Customs and Duties Paid by Carrier Customs

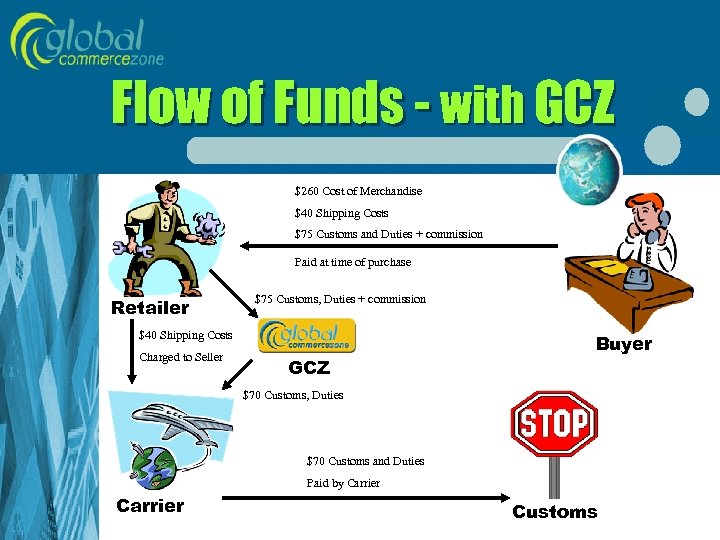

Flow of Funds - with GCZ $260 Cost of Merchandise $40 Shipping Costs $75 Customs and Duties + commission Paid at time of purchase Retailer $75 Customs, Duties + commission $40 Shipping Costs Charged to Seller GCZ Buyer $70 Customs, Duties $70 Customs and Duties Paid by Carrier Customs

The Shift • Bubble expectations: there will be several “Amazons”, they were the target clients. • The bubble popped, no new “Amazons”: – New focus: • B 2 B and B 2 C market, not necessarily e-commerce. • Go to where the money is. – Structural reorganization. – The solution was not changed.

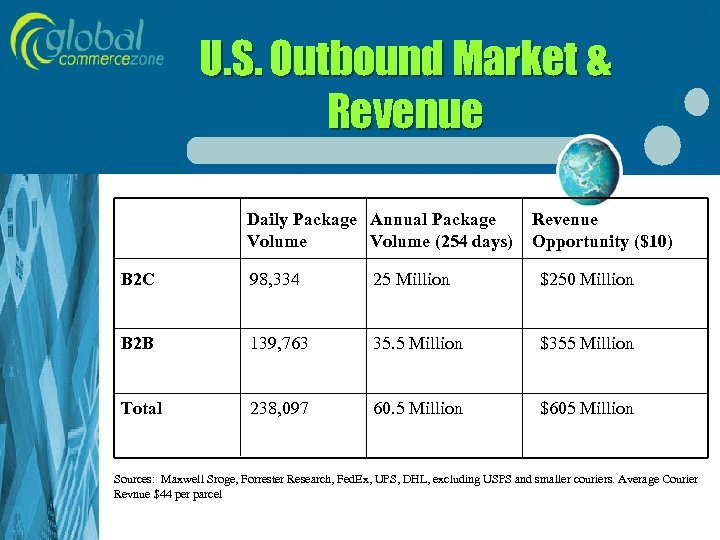

U. S. Outbound Market & Revenue Daily Package Annual Package Volume (254 days) Revenue Opportunity ($10) B 2 C 98, 334 25 Million $250 Million B 2 B 139, 763 35. 5 Million $355 Million Total 238, 097 60. 5 Million $605 Million Sources: Maxwell Sroge, Forrester Research, Fed. Ex, UPS, DHL, excluding USPS and smaller couriers. Average Courier Revnue $44 per parcel

Business Model • Catalog classification outsourced and charged at costs. • Commission on each transaction for the quote, insurance and money handling. • Buying insurance for guaranteeing the landed cost. • Making profits on the money during the time gap between collection from the retailer and payment of carrier. • Marketing model (big clients only): – Using the carriers as a channel to the market. – Direct approach to other big clients.

Competition • Direct: Landed cost Calculations – Vastera, Nextlinx, Open. Harbor, Xporta, Clear. Cross • Indirect: Portal and B 2 C – Borderfree, Douwantit • Inhouse Solutions – Branching (Amazon) • Financial Transaction Focus – Global Commerce. Zone

, , Risks • Changes in custom taxes rates • Changes in exchange rates – (GCZ buys insurance and updates its classification database frequently) • Carriers can become hard competitors by providing the solution themselves. • Globalization: free trade agreements, moving towards making the world a global village.

The Vision • Like the American payroll market model. • Clients will avoid distraction from core business. • Developing and maintaining a system takes customs experts and a lot of energy. • Advantages to scale: – The system learns and corrects mistakes – One classification can serve several clients • High loyalty expected with big clients. Conclusion: the market has place for only one or two ‘gorillas’.

First Doubt The Question of Need • Is the financial feature really necessary to the clients? • GCZ’s clients are expected to pay for the classifications, the updates and the quoting system as they would any competitor. • In addition, GCZ’s clients need to pay commission per transaction that covers the insurance. • Our opinion: prepayment and guarantee of landed cost is necessary and valuable.

Second Doubt The Question of Differentiation • What does it take for competitors to develop the financial and insurance services? – GCZ insures itself externally, by signing a contract with an insurance company. • Our opinion: – This can be done by the competitors as well. – Transaction handling is more complicated and will require a strategic change.

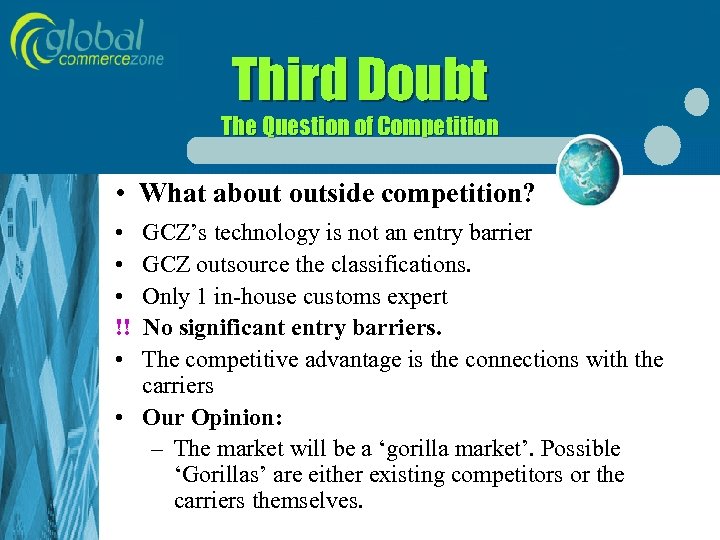

Third Doubt The Question of Competition • What about outside competition? • • • !! • GCZ’s technology is not an entry barrier GCZ outsource the classifications. Only 1 in-house customs expert No significant entry barriers. The competitive advantage is the connections with the carriers • Our Opinion: – The market will be a ‘gorilla market’. Possible ‘Gorillas’ are either existing competitors or the carriers themselves.

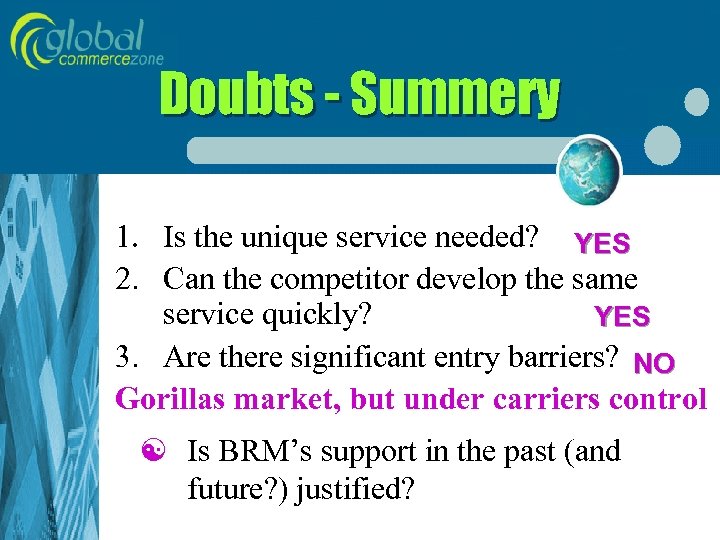

Doubts - Summery 1. Is the unique service needed? YES 2. Can the competitor develop the same service quickly? YES 3. Are there significant entry barriers? NO Gorillas market, but under carriers control [ Is BRM’s support in the past (and future? ) justified?

Survival Secrets 4 A lot of faith 4 A little help from personal connections 4 One big client at advanced stage of negotiations

Once the Client Signs… • Radical cash flow improvement. • Validating the vision & business model: – Further funding rounds possible • A reference to other big clients.

Thanks • GCZ – Herb Zlotogorski - CEO – Ze’ev Frimer - CIT expert – Arie Kadosh - CTO • BRM – Nir Barkat – Johnny Klair

a5b71c947d4126706f1dd7e189a33b34.ppt