e62e4120c3db239c0ad5158de53c4201.ppt

- Количество слайдов: 111

Global Breweries Fundamental Analysis and Recommendations Cyrus Cheung Ervinna Jeff November 17, 2004 Global Breweries 1

Overview of Presentation n Industry Overview q q q n History & Background Product Industry Consumers Growth Area Key Success Factors Company Analysis and Recommendations: q q q Anheuser-Busch : Cyrus Cheung Heineken : Erivnna Molson : Jeff Global Breweries 2

Industry Overview Global Breweries 3

History & Background n Ancient History: q q q There is evidence that beer was elaborated by the Babylonian, Assyrian, Egyptian (for medical purposes), Hebrew, Chinese, and Inca cultures. 55 BC Roman legions introduce beer to Northern Europe. 500 -1000 AD the first half of the Middle Ages, brewing begins to be practiced in Europe, shifting from family tradition to centralized production in monasteries and convents (hospitality for traveling pilgrims). 1200 AD beer making is firmly established as a commercial enterprise in Germany, Austria, and England. 1420 German brewers develop the lager method of brewing. 1489 Germany's first brewing guild, Brauerei Beck, was established. Source: http: //www. beermachine. com/files/beer-science-history. htm Global Breweries 4

History & Background n Renascence History: q q 1553 Beck's Brewery founded & still brewing today. 1587 the first beer brewed in New World at Sir Walter Raleigh's colony in Virginia. 1612 the first commercial brewery opened in New Amsterdam (NYC, Manhattan). 1786 Molson brewery is founded in what is today Canada. Source: http: //www. beermachine. com/files/beer-science-history. htm Global Breweries 5

History & Background n Modern History: q q In the mid-19 th Century (1850's) German immigrant brewers introduced cold maturation lagers to the US (Anheuser-Busch, Miller, Coors, Stroh, Schlitz, and Pabst roots begin here). The modern era of brewing in the US began in the late 1800's with commercial refrigeration (1860), automatic bottling, pasteurization (1876), and railroad distribution. 1880 there were approximately 2, 300 breweries in the US. 1935 only 160 breweries survive Prohibition (see below). 1920 Prohibition (U. S) Starts for beer, even though some regions started as early as 1846, e. g. Maine. Prohibition focused more on whiskey and other distilled products. (Prohibition ends in April 7, 1933) Source: http: //www. beermachine. com/files/beer-science-history. htm Global Breweries 6

History & Background n Interesting Facts: q q q Historians speculate that prehistoric nomads may have made beer from grain & water before learning to make bread. Most Expensive Beer in the World: “Tutankhamen” - US$52 Country with the most individual brands: Belgium with 400 Average American annually consumes 23. 1 gallons of beer, more than milk or juice. Cenosillicaphobia is the fear of …. . an empty glass. Source: http: //www. beermachine. com/files/beer-trivia. htm Global Breweries 7

Product n Highly mature and standardized product q Firms try to distinguish themselves by differentiation n n Quality, Innovation, and marketing Highly segmented market q Traditional Beers: n n n n q Sub-premium Premium Malt liquor segments Super premium* Light* Ice* Dry* Specialty Beers: n n Fastest growing segment (10 -15% since 1990) They are perceived as higher quality by consumers Global Breweries 8

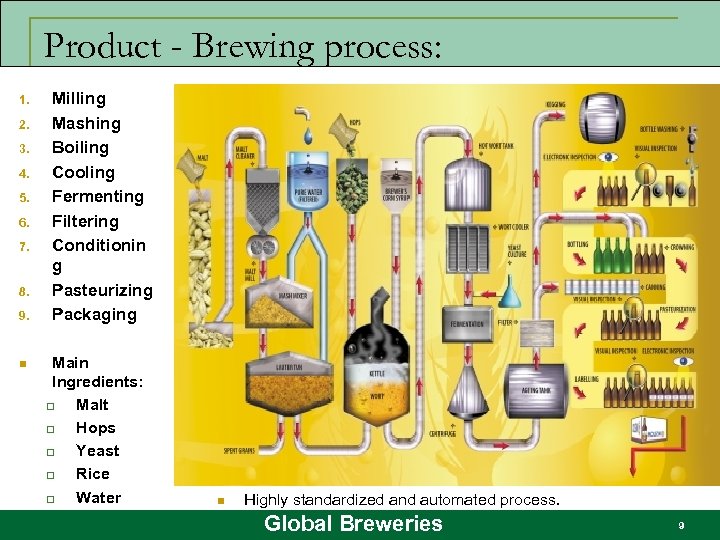

Product - Brewing process: 1. 2. 3. 4. 5. 6. 7. 8. 9. n Milling Mashing Boiling Cooling Fermenting Filtering Conditionin g Pasteurizing Packaging Main Ingredients: q Malt q Hops q Yeast q Rice q Water n Highly standardized and automated process. Global Breweries 9

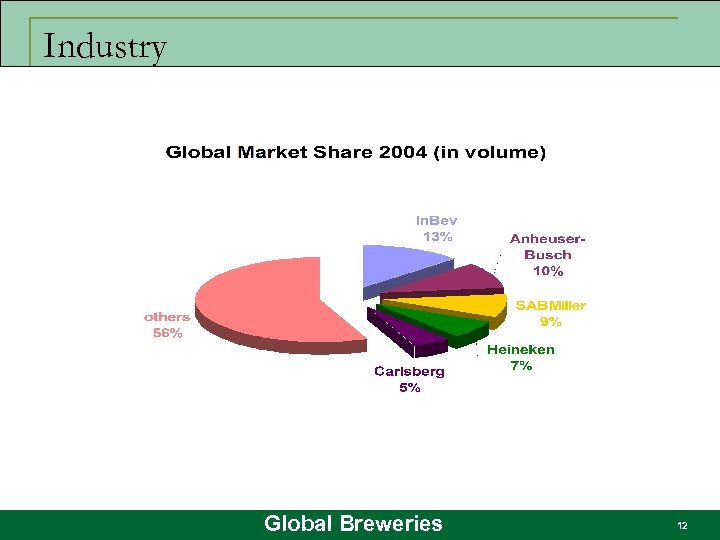

Industry n Global market share of top 20 brewers is increasing q q n Industry remains fragmented q q n 1990 – 51% 2000 – 65% 5 largest account for approx. 44% of total volume Compare this to the cigarette industry - 5 largest, 60% share Home market dependence Global Breweries 10

Industry Current trends in the industry q Consolidation led by major international brewers n q Volume growth in developing market n q Interbrew and Heineken China, Eastern Europe, Russia Big gets bigger Global Breweries 11

Industry Global Breweries 12

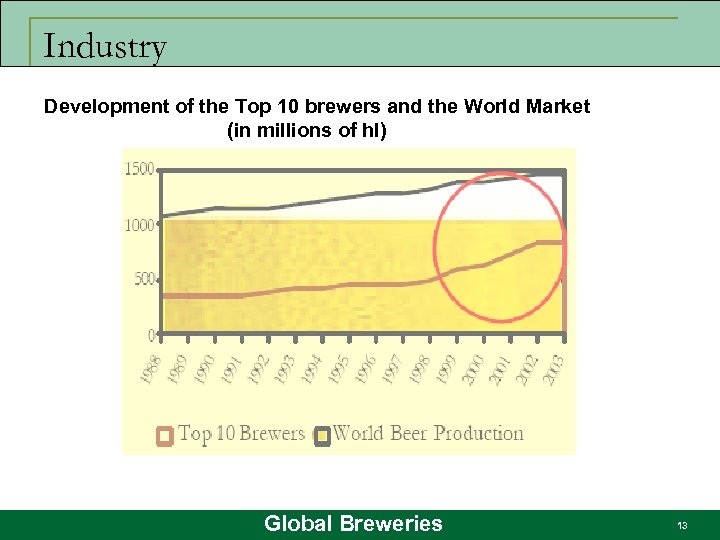

Industry Development of the Top 10 brewers and the World Market (in millions of hl) Global Breweries 13

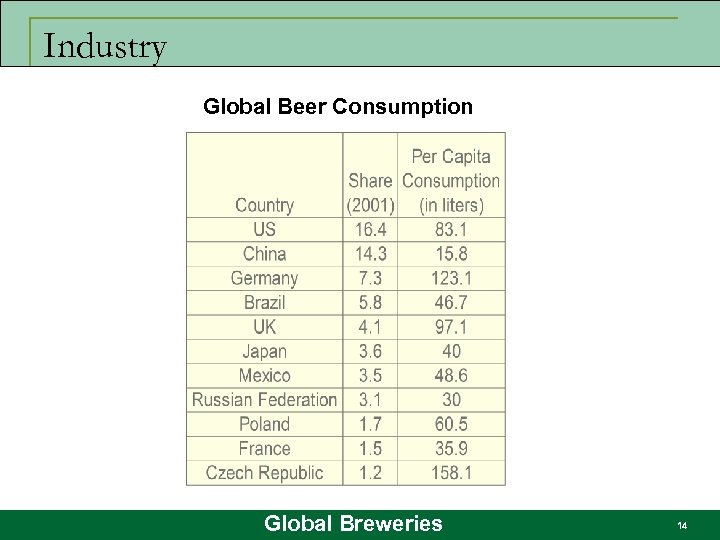

Industry Global Beer Consumption Global Breweries 14

Modern US Beer industry: n n n Oldest company date back to the 17 th century Industry dynamics traced back to the repeal of prohibition in 1933. Following the repeal of Prohibition, legislative changes required the industry to be divided into 3 distinct parts: 1. Brewers 2. Wholesale Distributors 3. Retailers Global Breweries 15

Modern US Beer industry: Business model: n High transportation cost to be offset by high quality price premium as company seek to differentiate themselves and reach larger markets. n Maturing industry highly concentrated as the result of Mergers and acquisitions ( scale economies in operation and marketing) Global Breweries 16

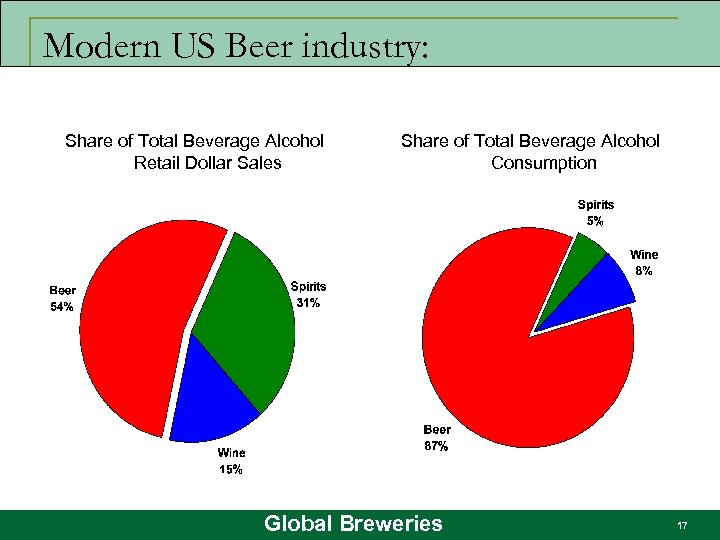

Modern US Beer industry: Share of Total Beverage Alcohol Retail Dollar Sales Share of Total Beverage Alcohol Consumption Global Breweries 17

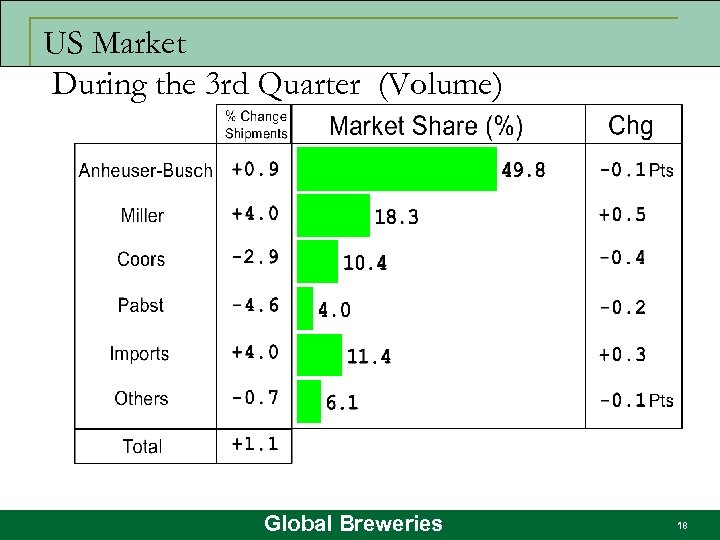

US Market During the 3 rd Quarter (Volume) Global Breweries 18

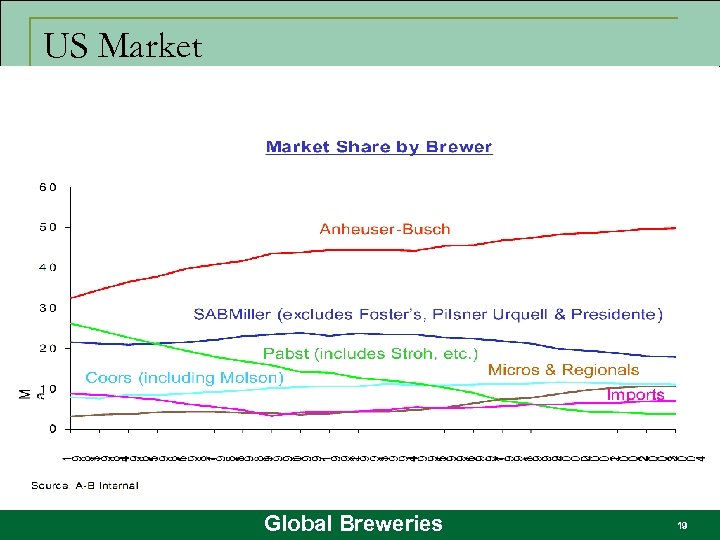

US Market Global Breweries 19

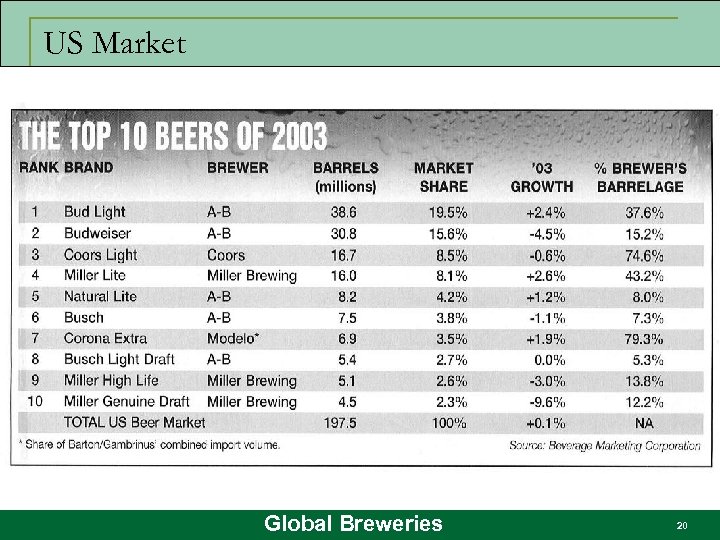

US Market Global Breweries 20

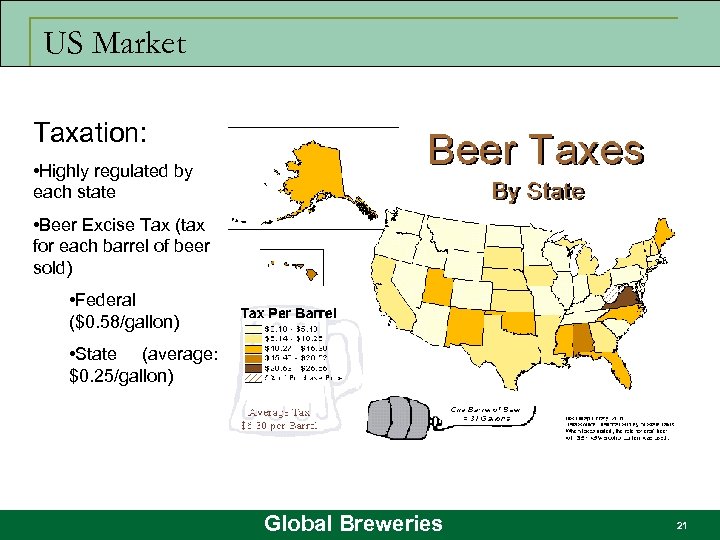

US Market Taxation: • Highly regulated by each state • Beer Excise Tax (tax for each barrel of beer sold) • Federal ($0. 58/gallon) • State (average: $0. 25/gallon) Global Breweries 21

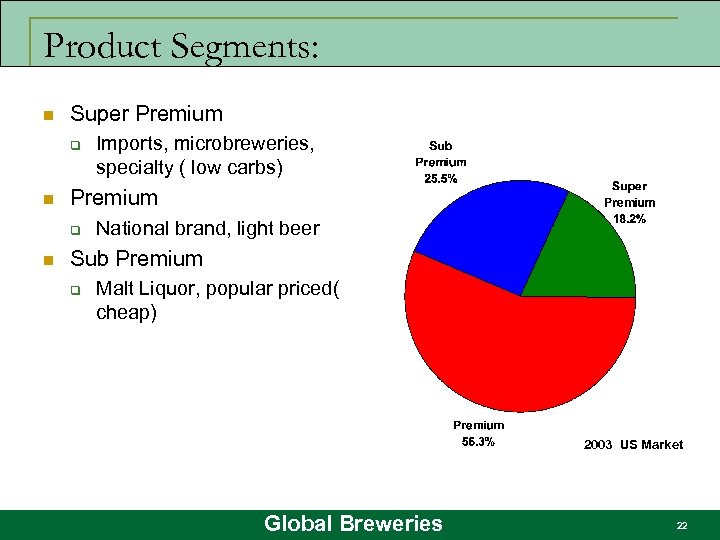

Product Segments: n Super Premium q n Imports, microbreweries, specialty ( low carbs) National brand, light beer Sub Premium q Malt Liquor, popular priced( cheap) 2003 US Market Global Breweries 22

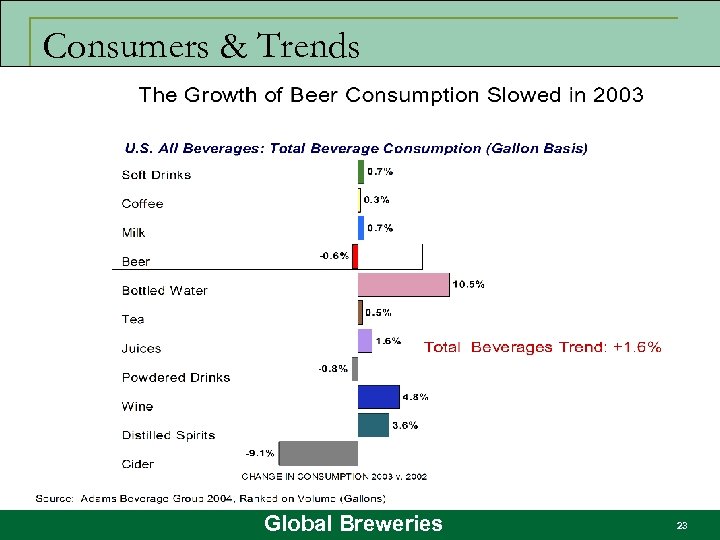

Consumers & Trends Global Breweries 23

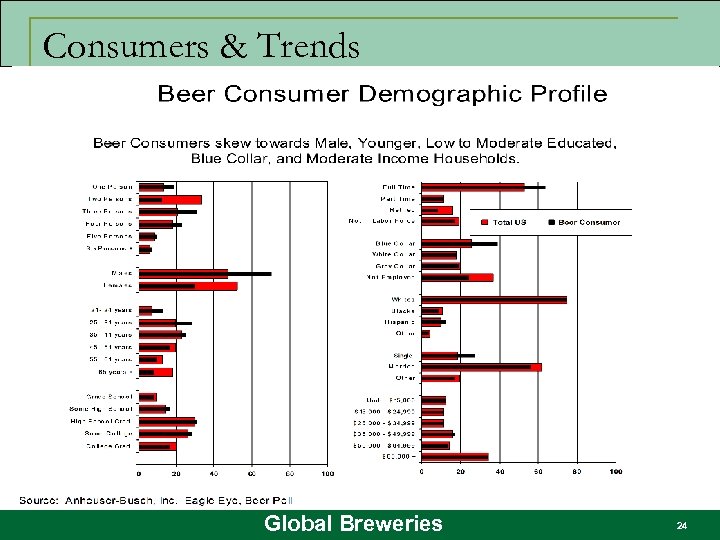

Consumers & Trends Global Breweries 24

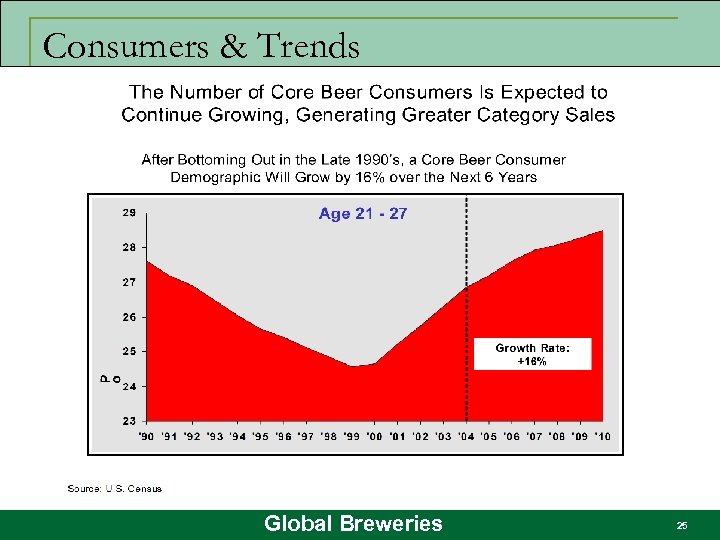

Consumers & Trends Global Breweries 25

Consumers & Trends n Health Conscious Consumers q n Changing Taste q n Rise of the low Carb diets, light beers Looking for more sweet taste Fads in the market: q Cider, Wine cooler, microbreweries… n q Latest : “Malternatives” ___%growth Non malt based alcoholic beverages (ie: coolers, hard lemonade, spirit based and others) Global Breweries 26

Consumers & Trends Global Breweries 27

Global Expansions Potential markets: Growing middle class n South America q q n East Europe q n High Consumption Concentrated market ( Brazil (65%) , Argentina (80%), Switching from spirit Asia ( China) q q China has the largest Beer consumption by volume One of the world most competitive market Global Breweries 28

Key Success Factors n n n Low Cost Structure ( efficient Scale) Effective Marketing & Advertising Strategy Successful Brand loyalty Product Innovation Distribution Global player Global Breweries 29

Anheuser-Busch Companies Inc. Global Breweries 30

Presentation Overview: n n n n n Company Background Management Core Business Strategy Value Drivers Financial Statements Analysis Stock Price Performance Recent News Analyst Recommendation My Recommendation Global Breweries 31

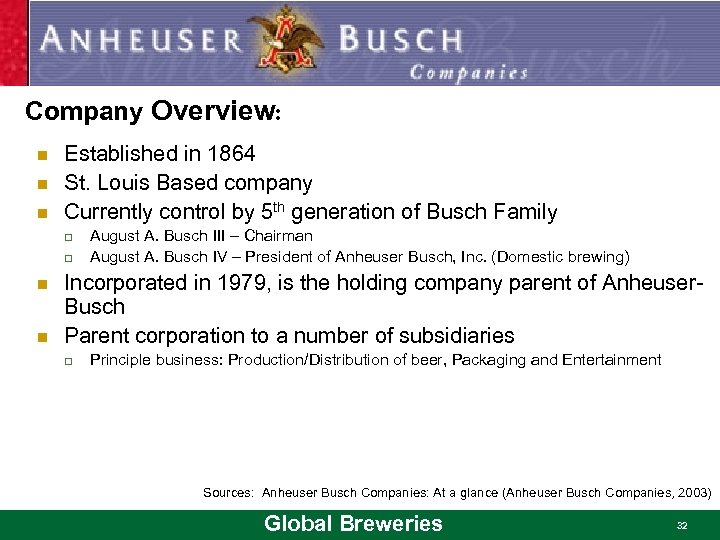

Company Overview: n n n Established in 1864 St. Louis Based company Currently control by 5 th generation of Busch Family q q n n August A. Busch III – Chairman August A. Busch IV – President of Anheuser Busch, Inc. (Domestic brewing) Incorporated in 1979, is the holding company parent of Anheuser. Busch Parent corporation to a number of subsidiaries q Principle business: Production/Distribution of beer, Packaging and Entertainment Sources: Anheuser Busch Companies: At a glance (Anheuser Busch Companies, 2003) Global Breweries 32

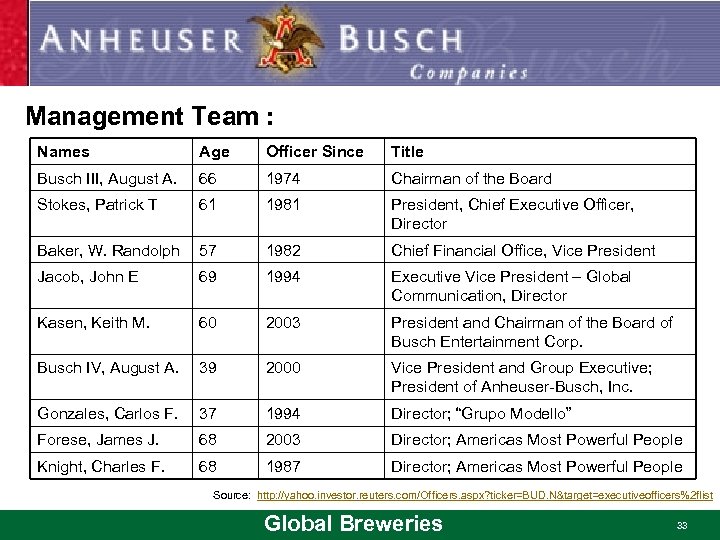

Management Team : Names Age Officer Since Title Busch III, August A. 66 1974 Chairman of the Board Stokes, Patrick T 61 1981 President, Chief Executive Officer, Director Baker, W. Randolph 57 1982 Chief Financial Office, Vice President Jacob, John E 69 1994 Executive Vice President – Global Communication, Director Kasen, Keith M. 60 2003 President and Chairman of the Board of Busch Entertainment Corp. Busch IV, August A. 39 2000 Vice President and Group Executive; President of Anheuser-Busch, Inc. Gonzales, Carlos F. 37 1994 Director; “Grupo Modello” Forese, James J. 68 2003 Director; Americas Most Powerful People Knight, Charles F. 68 1987 Director; Americas Most Powerful People Source: http: //yahoo. investor. reuters. com/Officers. aspx? ticker=BUD. N&target=executiveofficers%2 flist Global Breweries 33

Compensation package: Top 5 Executives For Fiscal Year Ending 12/31/2003 Names Total Annual All Other Compensation Fiscal Year Total Options Total Exercised Stokes, Patrick T $4. 91 M $0. 15 M $5. 06 M $46. 21 M $6. 56 M Busch III, August A. $2. 14 M $0. 11 M $2. 24 M $46. 10 M $6. 41 M Busch IV, August A. $1. 81 M $0. 07 M $1. 88 M $8. 34 M $1. 32 M Baker, W. Randolph $1. 24 M $0. 06 M $1. 30 M $28. 34 M $2. 26 M Lambright, Stephen K. $1. 18 M $0. 07 M $1. 25 M $13. 66 M $2. 87 M Source: http: //yahoo. investor. reuters. com/Officers. Comp. aspx? ticker=BUD. N&target=executiveofficers%2 fbasiccompensation Global Breweries 34

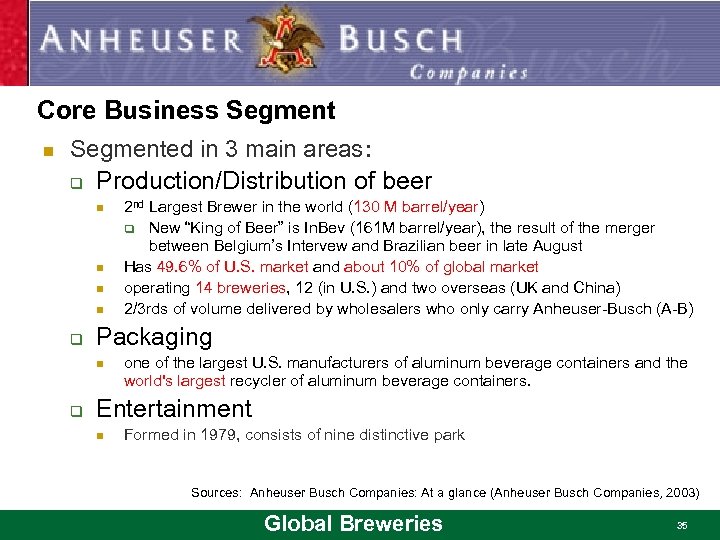

Core Business Segment n Segmented in 3 main areas: q Production/Distribution of beer n n q Packaging n q 2 nd Largest Brewer in the world (130 M barrel/year) q New “King of Beer” is In. Bev (161 M barrel/year), the result of the merger between Belgium’s Intervew and Brazilian beer in late August Has 49. 6% of U. S. market and about 10% of global market operating 14 breweries, 12 (in U. S. ) and two overseas (UK and China) 2/3 rds of volume delivered by wholesalers who only carry Anheuser-Busch (A-B) one of the largest U. S. manufacturers of aluminum beverage containers and the world's largest recycler of aluminum beverage containers. Entertainment n Formed in 1979, consists of nine distinctive park Sources: Anheuser Busch Companies: At a glance (Anheuser Busch Companies, 2003) Global Breweries 35

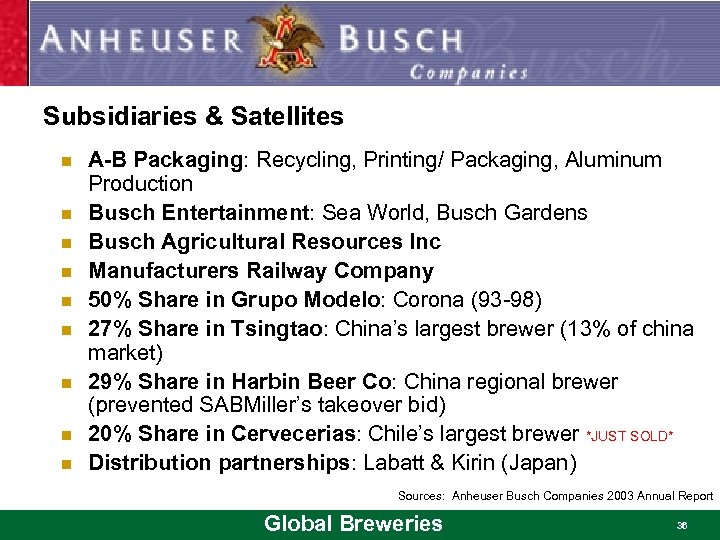

Subsidiaries & Satellites n n n n n A-B Packaging: Recycling, Printing/ Packaging, Aluminum Production Busch Entertainment: Sea World, Busch Gardens Busch Agricultural Resources Inc Manufacturers Railway Company 50% Share in Grupo Modelo: Corona (93 -98) 27% Share in Tsingtao: China’s largest brewer (13% of china market) 29% Share in Harbin Beer Co: China regional brewer (prevented SABMiller’s takeover bid) 20% Share in Cervecerias: Chile’s largest brewer *JUST SOLD* Distribution partnerships: Labatt & Kirin (Japan) Sources: Anheuser Busch Companies 2003 Annual Report Global Breweries 36

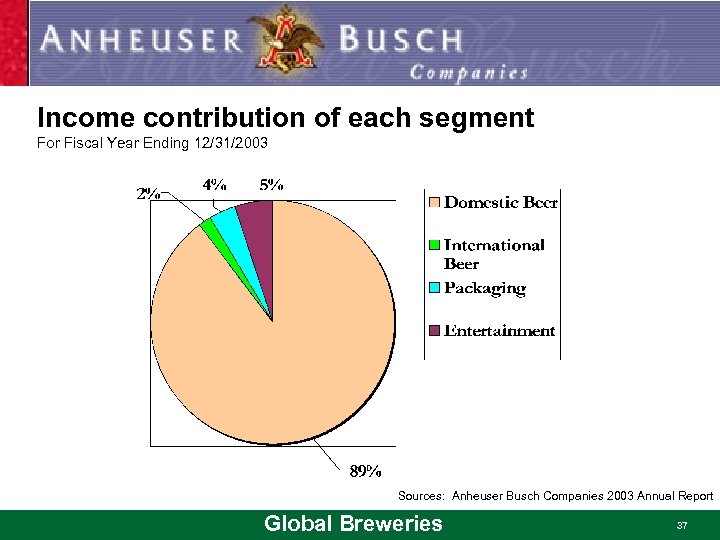

Income contribution of each segment For Fiscal Year Ending 12/31/2003 Sources: Anheuser Busch Companies 2003 Annual Report Global Breweries 37

Beer Products n n The company currently brews approximately 30 beers for sale in the United States World’s No. 1 and No. 2 brand: Budweiser & Bud Light q n n Budweiser – about 3% of world market Bud light has 19. 5% of U. S. market Other Brands: q q q q Budweiser Family: Bud Dry, Bud Ice Light Michelob Family: Michelob, Michelob Ultra, etc Busch Family: Busch, Busch Light, etc Specialty Beers: World Select, etc Nonalcohol Brews: O’Doul’s, etc Natural Family: Natural Light, etc Malt Liquors: Hurricane, etc Specialty Malt Beverags: Bacardi Silver Limon, etc Sources: Anheuser Busch Companies: At a glance (Anheuser Busch Companies, 2003) Global Breweries 38

Business Strategy n Missions q Be the world's beer company Enrich and entertain a global audience q Deliver superior returns to our shareholders q n Objectives / Strategies q Increasing domestic beer segment volume and per barrel profitability n q Increasing international beer segment profit growth. n q Economies of Scale Made significant marketing investments to build brand recognition outside the United States and owns and operates breweries in China Continued growth in profit and free cash flow in the packaging and entertainment segments. n Provide significant efficiencies, cost savings and quality assurance for domestic beer operations Sources: Anheuser Busch Companies 2003 Annual Report Global Breweries 39

Value Drivers n Home market dominance (49. 6% market share) q q n Twice as large as nearest competitors Economies of scale Extensive exclusive distribution q n Brand recognition and Innovation q n 2/3 rds of volume delivered by wholesalers who only carry Anheuser-Busch (A-B) First to introduce low carb beers Marketing and manufacturing efficiency q Leverage 49. 6% market share into 75% of markets operating profit Sources: Anheuser Busch Companies 2003 Annual Report Global Breweries 40

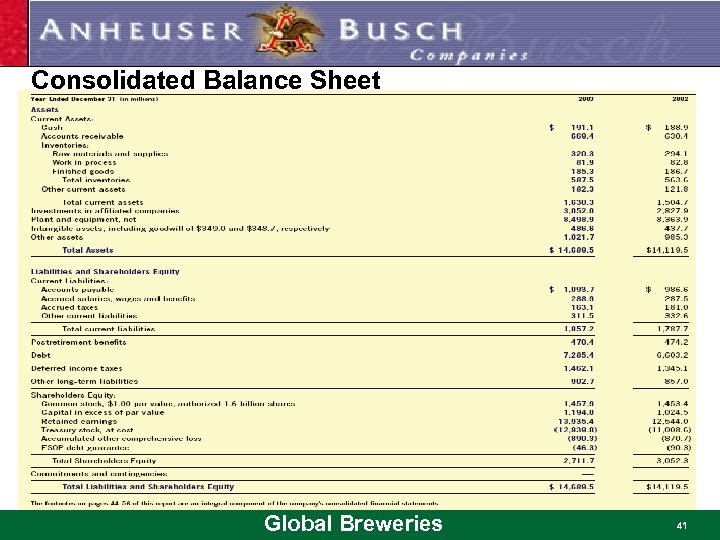

Consolidated Balance Sheet Global Breweries 41

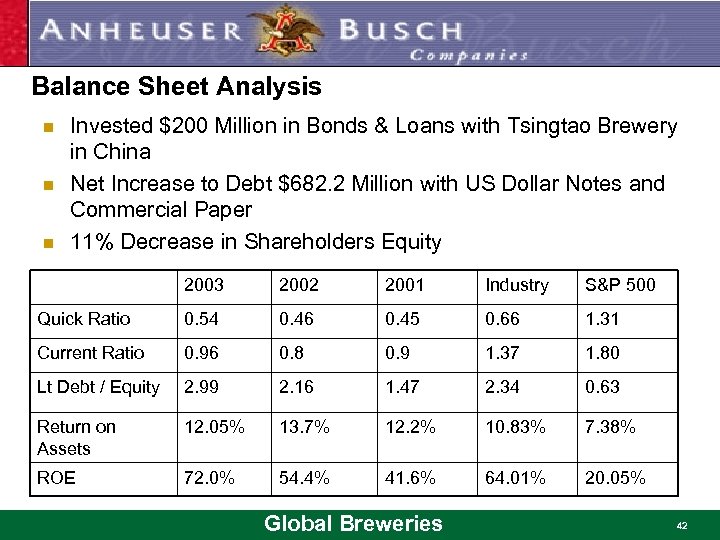

Balance Sheet Analysis n n n Invested $200 Million in Bonds & Loans with Tsingtao Brewery in China Net Increase to Debt $682. 2 Million with US Dollar Notes and Commercial Paper 11% Decrease in Shareholders Equity 2003 2002 2001 Industry S&P 500 Quick Ratio 0. 54 0. 46 0. 45 0. 66 1. 31 Current Ratio 0. 96 0. 8 0. 9 1. 37 1. 80 Lt Debt / Equity 2. 99 2. 16 1. 47 2. 34 0. 63 Return on Assets 12. 05% 13. 7% 12. 2% 10. 83% 7. 38% ROE 72. 0% 54. 4% 41. 6% 64. 01% 20. 05% Global Breweries 42

Debt Analysis Global Breweries 43

Consolidated Statement of Income Global Breweries 44

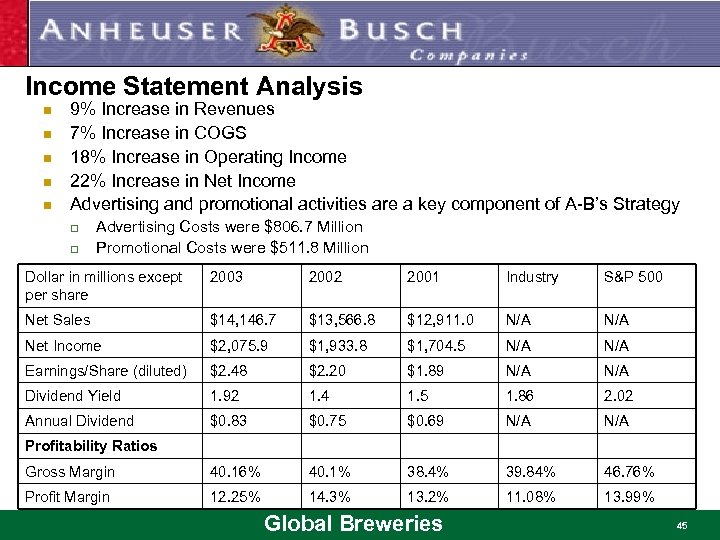

Income Statement Analysis n n n 9% Increase in Revenues 7% Increase in COGS 18% Increase in Operating Income 22% Increase in Net Income Advertising and promotional activities are a key component of A-B’s Strategy q q Advertising Costs were $806. 7 Million Promotional Costs were $511. 8 Million Dollar in millions except per share 2003 2002 2001 Industry S&P 500 Net Sales $14, 146. 7 $13, 566. 8 $12, 911. 0 N/A Net Income $2, 075. 9 $1, 933. 8 $1, 704. 5 N/A Earnings/Share (diluted) $2. 48 $2. 20 $1. 89 N/A Dividend Yield 1. 92 1. 4 1. 5 1. 86 2. 02 Annual Dividend $0. 83 $0. 75 $0. 69 N/A Gross Margin 40. 16% 40. 1% 38. 4% 39. 84% 46. 76% Profit Margin 12. 25% 14. 3% 13. 2% 11. 08% 13. 99% Profitability Ratios Global Breweries 45

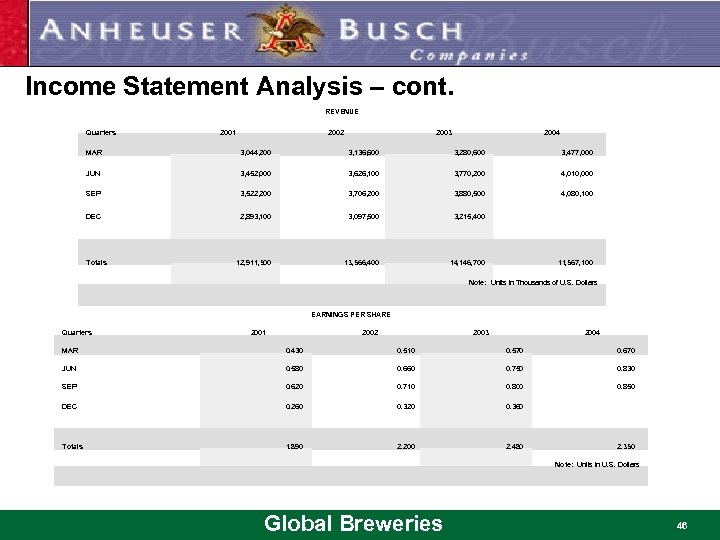

Income Statement Analysis – cont. REVENUE Quarters 2001 2002 2003 2004 MAR 3, 044, 200 3, 136, 600 3, 280, 600 3, 477, 000 JUN 3, 452, 000 3, 626, 100 3, 770, 200 4, 010, 000 SEP 3, 522, 200 3, 706, 200 3, 880, 500 4, 080, 100 DEC 2, 893, 100 3, 097, 500 3, 215, 400 12, 911, 500 13, 566, 400 14, 146, 700 11, 567, 100 Totals Note: Units in Thousands of U. S. Dollars EARNINGS PER SHARE Quarters 2001 2002 2003 2004 MAR 0. 430 0. 510 0. 570 0. 670 JUN 0. 580 0. 660 0. 750 0. 830 SEP 0. 620 0. 710 0. 800 0. 850 DEC 0. 260 0. 320 0. 360 1. 890 2. 200 2. 480 2. 350 Totals Note: Units in U. S. Dollars Global Breweries 46

Consolidated Statement of Cash Flow Global Breweries 47

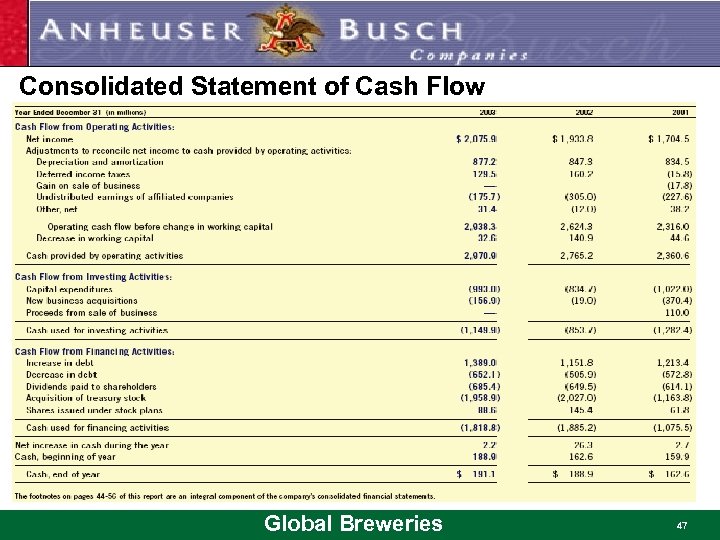

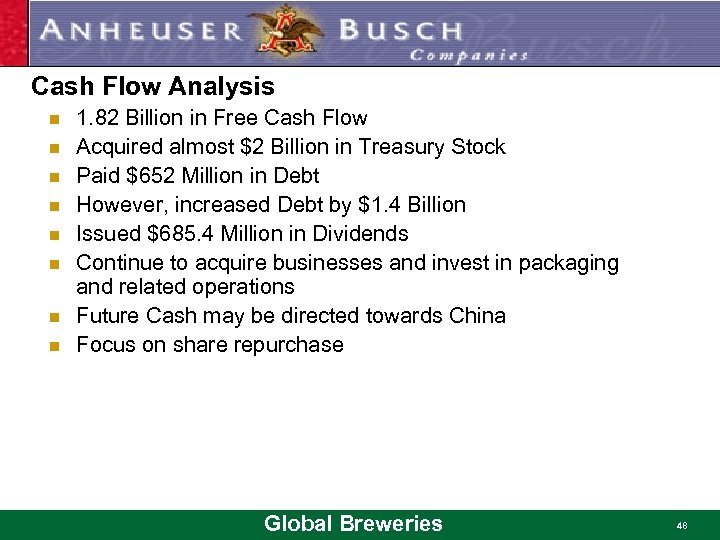

Cash Flow Analysis n n n n 1. 82 Billion in Free Cash Flow Acquired almost $2 Billion in Treasury Stock Paid $652 Million in Debt However, increased Debt by $1. 4 Billion Issued $685. 4 Million in Dividends Continue to acquire businesses and invest in packaging and related operations Future Cash may be directed towards China Focus on share repurchase Global Breweries 48

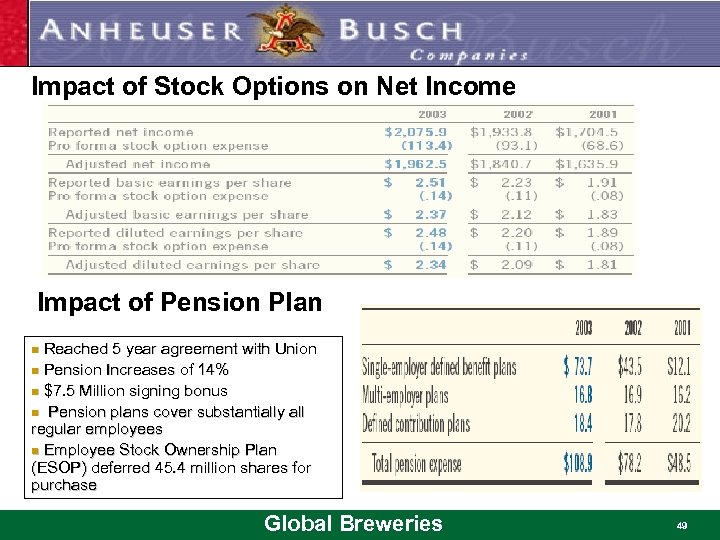

Impact of Stock Options on Net Income Impact of Pension Plan n Reached 5 year agreement with Union n Pension Increases of 14% n $7. 5 Million signing bonus n Pension plans cover substantially all regular employees n Employee Stock Ownership Plan (ESOP) deferred 45. 4 million shares for purchase Global Breweries 49

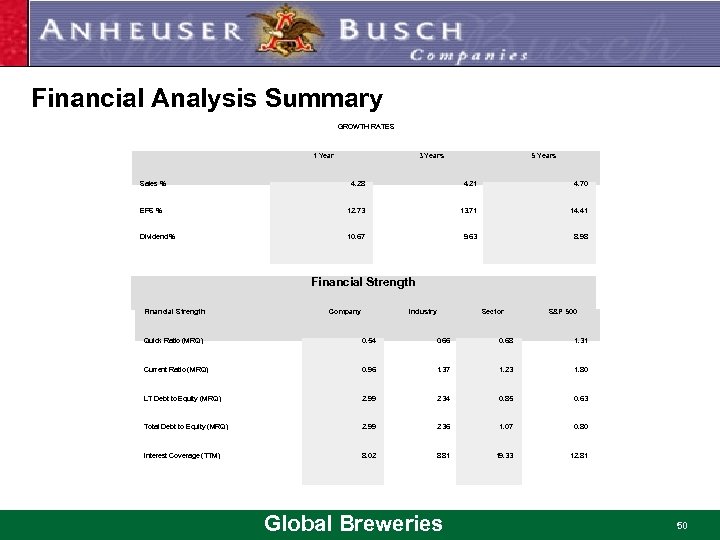

Financial Analysis Summary GROWTH RATES 1 Year 3 Years 5 Years Sales % 4. 28 4. 21 4. 70 EPS % 12. 73 13. 71 14. 41 Dividend % 10. 67 9. 63 8. 98 Financial Strength Company Industry Sector S&P 500 Quick Ratio (MRQ) 0. 54 0. 66 0. 68 1. 31 Current Ratio (MRQ) 0. 96 1. 37 1. 23 1. 80 LT Debt to Equity (MRQ) 2. 99 2. 34 0. 85 0. 63 Total Debt to Equity (MRQ) 2. 99 2. 36 1. 07 0. 80 Interest Coverage (TTM) 8. 02 8. 81 19. 33 12. 81 Global Breweries 50

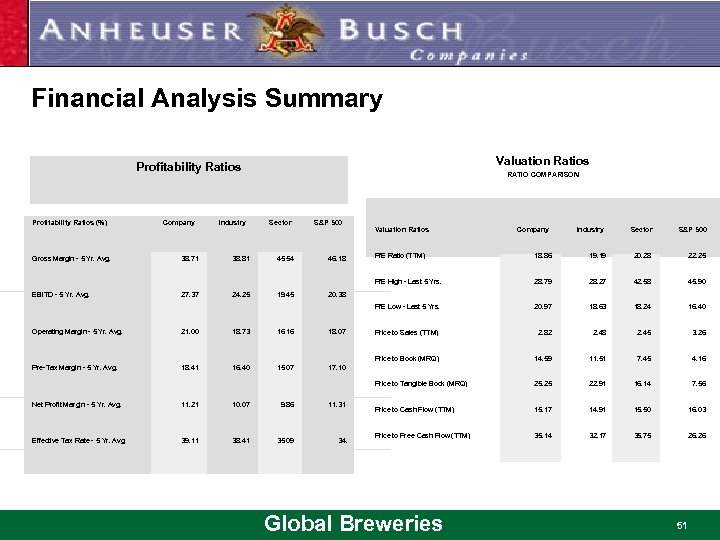

Financial Analysis Summary Valuation Ratios Profitability Ratios RATIO COMPARISON Profitability Ratios (%) Company Industry Sector S&P 500 Valuation Ratios Company Industry Sector S&P 500 19. 45 46. 18 22. 25 28. 79 28. 27 42. 58 45. 90 20. 97 18. 63 18. 24 16. 40 Price to Sales (TTM) 2. 82 2. 48 2. 45 3. 26 14. 59 11. 51 7. 45 4. 16 25. 25 22. 91 16. 14 7. 56 Price to Cash Flow (TTM) 15. 17 14. 91 15. 50 16. 03 Price to Free Cash Flow (TTM) 35. 14 32. 17 35. 75 26. 26 20. 38 Operating Margin - 5 Yr. Avg. 21. 00 18. 73 16. 16 18. 07 Pre-Tax Margin - 5 Yr. Avg. 18. 41 16. 40 15. 07 17. 10 Net Profit Margin - 5 Yr. Avg. 11. 21 10. 07 9. 86 11. 31 Effective Tax Rate - 5 Yr. Avg. 20. 28 Price to Tangible Book (MRQ) 24. 25 45. 54 19. 19 Price to Book (MRQ) 27. 37 38. 81 18. 86 P/E Low - Last 5 Yrs. EBITD - 5 Yr. Avg. 38. 71 P/E Ratio (TTM) P/E High - Last 5 Yrs. Gross Margin - 5 Yr. Avg. 39. 11 38. 41 35. 09 34. Global Breweries 51

Stock Price Summary As of 11/16/04 4: 00 PM n Traded on NYSE q q Symbol: BUD. N 790, 067, 968 units outstanding Market Capitalization of $40. 246 Billions US Instit. Ownership $467. 2 Million (58. 3%) Current Price: 50. 73 Change: Open: 50. 92 High: 51. 09 Low: 50. 70 Volume: 1, 251, 900 Yield: 1. 90% P/E Ratio: 18. 74 52 Week Range: 49. 42 to 54. 74 -0. 21 Percent Change: -0. 41% Sources: Globeinvestor. com Global Breweries 52

Stock Price Performance: One Year Chart Sources: http: //yahoo. investor. reuters. com Global Breweries 53

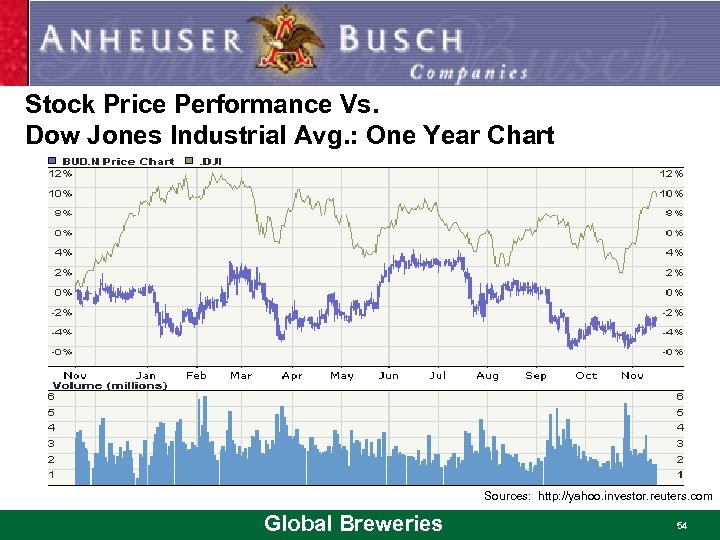

Stock Price Performance Vs. Dow Jones Industrial Avg. : One Year Chart Sources: http: //yahoo. investor. reuters. com Global Breweries 54

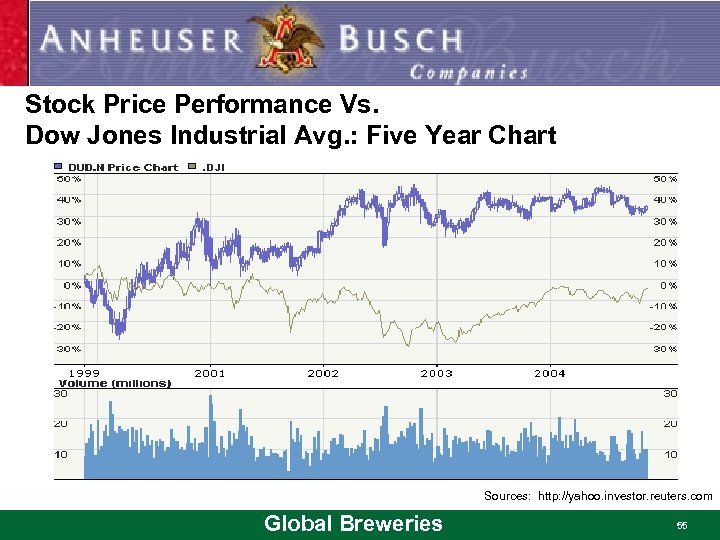

Stock Price Performance Vs. Dow Jones Industrial Avg. : Five Year Chart Sources: http: //yahoo. investor. reuters. com Global Breweries 55

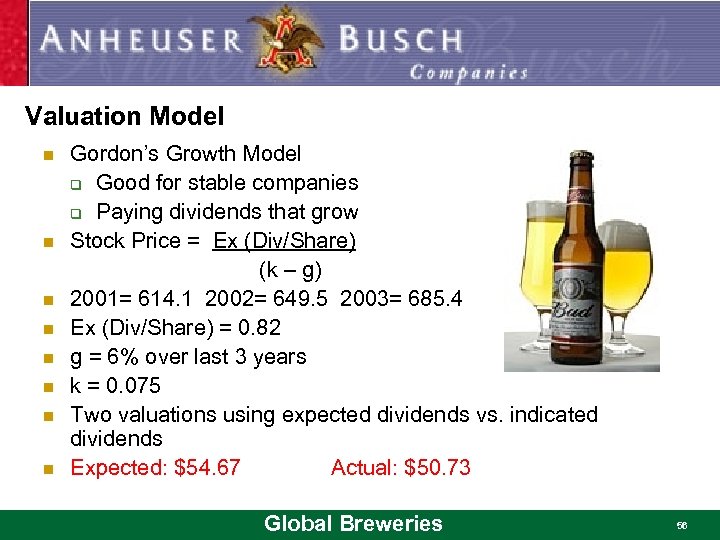

Valuation Model n n n n Gordon’s Growth Model q Good for stable companies q Paying dividends that grow Stock Price = Ex (Div/Share) (k – g) 2001= 614. 1 2002= 649. 5 2003= 685. 4 Ex (Div/Share) = 0. 82 g = 6% over last 3 years k = 0. 075 Two valuations using expected dividends vs. indicated dividends Expected: $54. 67 Actual: $50. 73 Global Breweries 56

Recent News n Nov 12, 2004 q n Nov 9, 2004 q n The company sold its 20 percent stake in Chile's biggest brewer CCU for $299 million in an auction on the Santiago Stock Exchange The compnay expects 2004 profit to grow at a previously forecast rate of 10 percent to 11 percent, which would result in earnings per share of $2. 73 to $2. 75, excluding a 1. 5 cent gain from a commodity hedge. Jun 3, 2004 q Anheuser-Busch Companies Proceeds with Tender Offer for China's Harbin Brewery; SABMiller Withdraws Bid Sources: http: //yahoo. investor. reuters. com Global Breweries 57

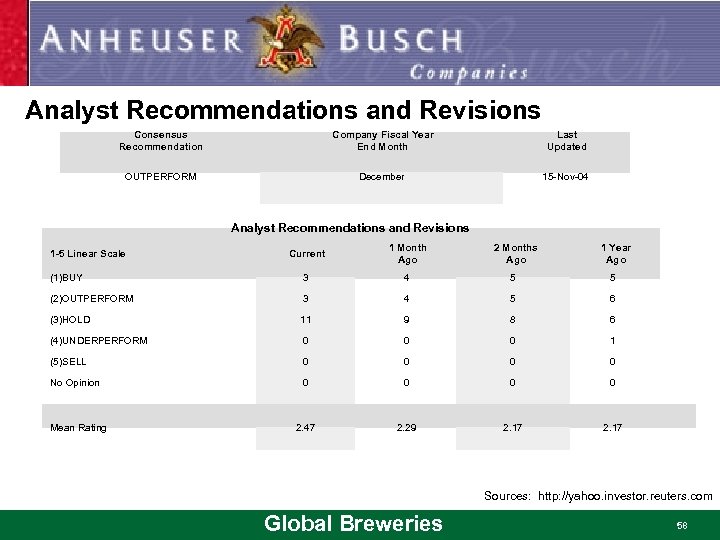

Analyst Recommendations and Revisions Consensus Recommendation Company Fiscal Year End Month Last Updated OUTPERFORM December 15 -Nov-04 Analyst Recommendations and Revisions Current 1 Month Ago (1)BUY 3 4 5 5 (2)OUTPERFORM 3 4 5 6 (3)HOLD 11 9 8 6 (4)UNDERPERFORM 0 0 0 1 (5)SELL 0 0 No Opinion 0 0 2. 29 2. 17 1 -5 Linear Scale 2 Months Ago 1 Year Ago Mean Rating 2. 47 Sources: http: //yahoo. investor. reuters. com Global Breweries 58

My recommendation n Analysis: q q q q q Sound Management Favourable treatment of stockholders Dominant Domestic Market Share Distribution competitive advantage Strong International growth potential Dividend model value $54. 67 Intense International competition Slowing growth in the Domestic Market Questionable International Investment Global Breweries 59

My recommendation n Conclusion Buy Global Breweries 60

Heineken N. V. “Respect, Enjoyment, Passion for quality. ” Global Breweries 61

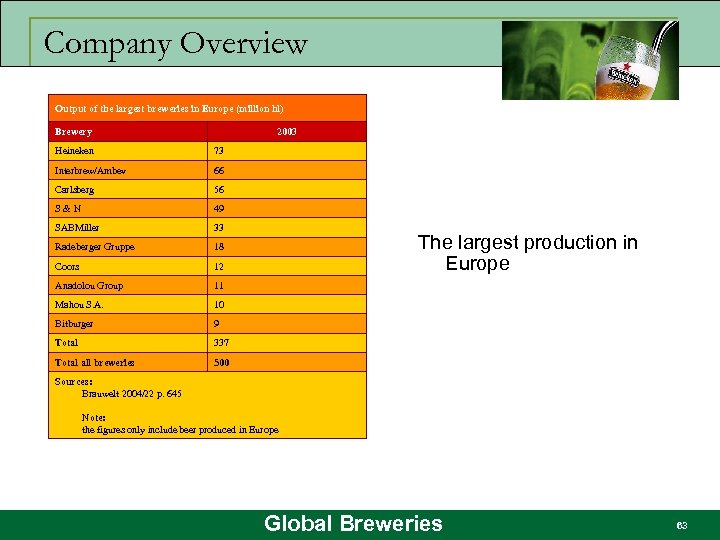

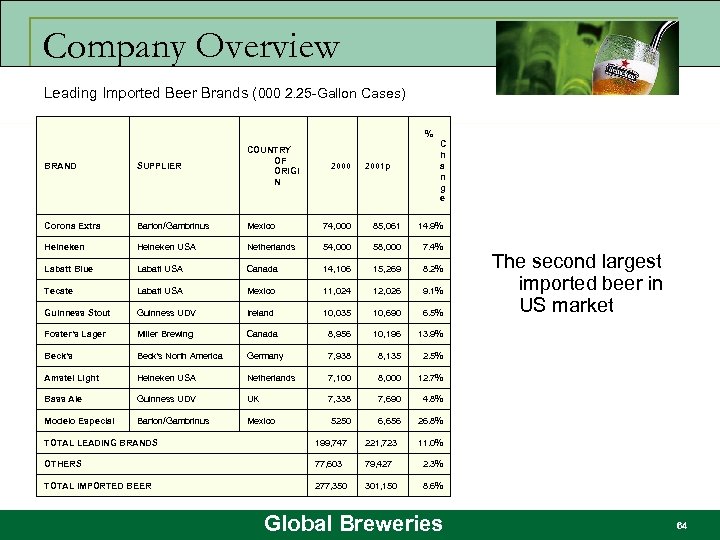

Company Overview n History: q q n Originated in Amsterdam, Netherlands (Head Office) 1873: Heineken Breweries (HBM) is incorporated (Gerard Heineken is appointed President) 1980 s: Start global expansion International brewing groups (over 170 countries with 61, 000 employees. ) Facts: q q q The fourth largest market share in the world The largest production in Europe The second largest imported beer in US market Global Breweries 62

Company Overview Output of the largest breweries in Europe (million hl) Brewery 2003 Heineken 73 Interbrew/Ambev 66 Carlsberg 56 S&N 49 SABMiller 33 Radeberger Gruppe 18 Coors 12 Anadolou Group 11 Mahou S. A. 10 Bitburger 9 Total 337 Total all breweries 500 The largest production in Europe Sources: Brauwelt 2004/22 p. 645 Note: the figures only include beer produced in Europe Global Breweries 63

Company Overview Leading Imported Beer Brands (000 2. 25 -Gallon Cases) % C h a n g e BRAND SUPPLIER COUNTRY OF ORIGI N Corona Extra Barton/Gambrinus Mexico 74, 000 85, 061 14. 9% Heineken USA Netherlands 54, 000 58, 000 7. 4% Labatt Blue Labatt USA Canada 14, 106 15, 269 8. 2% Tecate Labatt USA Mexico 11, 024 12, 026 9. 1% Guinness Stout Guinness UDV Ireland 10, 035 10, 690 6. 5% Foster's Lager Miller Brewing Canada 8, 956 10, 196 13. 9% Beck's North America Germany 7, 938 8, 135 2. 5% Amstel Light Heineken USA Netherlands 7, 100 8, 000 12. 7% Bass Ale Guinness UDV UK 7, 338 7, 690 4. 8% Modelo Especial Barton/Gambrinus Mexico 5250 6, 656 26. 8% 2000 2001 p TOTAL LEADING BRANDS 199, 747 221, 723 11. 0% OTHERS 77, 603 79, 427 2. 3% TOTAL IMPORTED BEER 277, 350 301, 150 The second largest imported beer in US market 8. 6% Global Breweries 64

Company Overview n Investment Snapshot: q Major Shareholder: n Heineken Holding NV (50. 005% of Heineken NV) Heineken Family (50. 005% of Heineken Holding NV) q q Traded in US OTC under symbol HINKY or HINKY. PK Number of shares outstanding: 489, 974, 594 Average daily trade: 1. 8 millions Market capitalization: 15. 73 billions Global Breweries 65

Company Overview n Management: q Executive Board: n n q A. Ruys, Chairman (since 2000). Joined in 1993. M. J. Bolland, Executive Board (since 2001). Joined in 1986. J. F. M. van Boxmeer, Executive Board (since 2001). Joined in 1984. D. R. H. Graafland, Executive Board (since 2002). Joined in 1981. Supervisory Board: n n n n J. M. de Jong, Chairman (since 2002) M. Das, Supervisory Board and Chairman of Management Board (since 1994) H. de Ruiter, Supervisory Board (since 1993) M. R. de Carvalho, Supervisory Board (since 1996) A. H. J. Risseeuw, Supervisory Board (since 2000) J. M. Hessels, Supervisory Board (since 2001) C. J. A. van Lede, Supervisory Board (since 2002) Global Breweries 66

Operation n Product: q q 80% beer, 10% soft drinks, 3% spirits and wines. International: n n q National and regional brands n q q Heineken (premium) Amstel (main stream) Tiger (China), Primus (Africa), Guinness (Africa), Kaiser (Brazil), Murphy’s Irish (Europe), etc. Limited in low-price segment International and local include lagers, specialty beers, light beers, and alcohol free beers Global Breweries 67

Operation n Segmentation by region: q Europe: n n q Western: market leader in Netherlands, Spain, Italy, and Greece Central and Eastern: 31% increase in sales due to the acquisition in 2003 of BBAG Americas: n n n United States: modest growth (Amstel Light) Canada: 9% increase in sales as imported beer South America: interest in CCU (Chile and Argentina), 20% interest in Kaiser (Brazil) Central America: alliance with FIFCO and 25% interest in Cervecaria (Costa Rica) Caribbean: has 5 breweries in the region Global Breweries 68

Operation n Segmentation by region: q Africa/Middle East: n n q Amstel beer is brewed in some countries Produce and market soft drinks Heineken and Diageo together acquired a 28% stake in Namibia Breweries Consolidation with Al Ahram Beverages Company (Egypt) Asia/Pacific: n n Joint venture with Fraser & Neave (Singapore) 43. 9% indirect interest in HAPBC (China market) Global Breweries 69

Operation n Distribution: q q n Alliances with independent distributors Has its own beverage wholesalers Partnership and Acquisitions: q q Gain market share in innovation, production, distribution and marketing 2002/2003: Bravo International (Russia), Kaiser (Brazil), Al Ahram (Egypt), Florida Bebidas (Costa Rica), Karlsberg (Germany), CCU (Chile), NBL (Namibia) Global Breweries 70

Operation n Partnership and Acquisitions: q Recent: n n n n Combine operations with APB in China Introduce “Beer. Tender” (drought beer system used at home) with Krups Joint venture with Lion Nathan (Australia) Joint venture with Diageo and Namibia Breweries (South Africa) Combine operations with FEMSA in US market Acquire Sobol Beer, Shikhan and Volga Breweries (Rusia) Acquire Furstenbergische Brauerei KG and Brewery Hoepfner (Germany) Global Breweries 71

Objectives n Company’s goal: q q Remain one of the top global brewers Being more profitable per hectolitre than other international brewers Building the most valuable brand portfolio, with Heineken as the international flagship brand Remain independent Global Breweries 72

Business Strategy n n n Maintain strong local market position, a good sales mix and an efficient cost structure by combining the sale and distribution of the international Heineken premium brand with that of strong local brands Fulfill its corporate social responsibility Segment Leadership: q q Acquire and combine strong brands into a new, larger company In the market that is already in the hands of other brewers, promote the premium sector and specialty beers (e. g. US market) Global Breweries 73

Key Success Factor n n Strong brand name (internationally well-known) Consolidation with strong local brands (gain market share and distribution channel) Low cost structure (through joint venture) Innovation and new marketing strategy (new packaging) Global Breweries 74

Financial Analysis n Financial Statements: q q q Balance Sheet Income Statement Cash Flow Statement Global Breweries 75

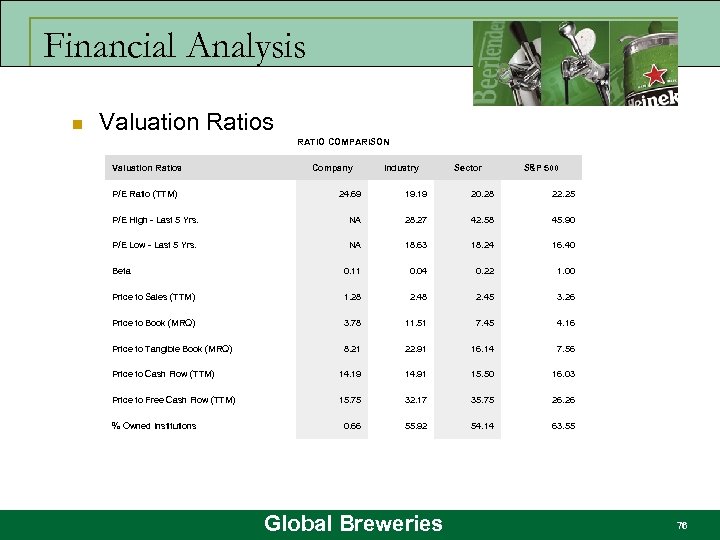

Financial Analysis n Valuation Ratios RATIO COMPARISON Valuation Ratios P/E Ratio (TTM) Company Industry Sector S&P 500 24. 69 19. 19 20. 28 22. 25 P/E High - Last 5 Yrs. NA 28. 27 42. 58 45. 90 P/E Low - Last 5 Yrs. NA 18. 63 18. 24 16. 40 Beta 0. 11 0. 04 0. 22 1. 00 Price to Sales (TTM) 1. 28 2. 45 3. 26 Price to Book (MRQ) 3. 78 11. 51 7. 45 4. 16 Price to Tangible Book (MRQ) 8. 21 22. 91 16. 14 7. 56 Price to Cash Flow (TTM) 14. 19 14. 91 15. 50 16. 03 Price to Free Cash Flow (TTM) 15. 75 32. 17 35. 75 26. 26 0. 66 55. 92 54. 14 63. 55 % Owned Institutions Global Breweries 76

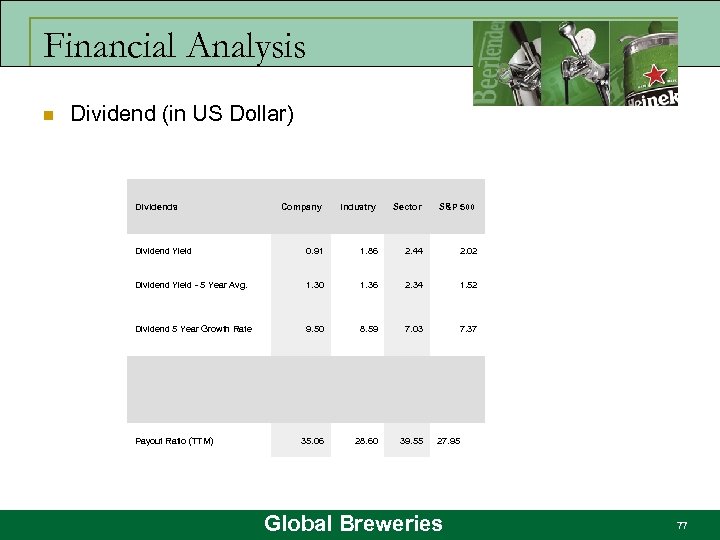

Financial Analysis n Dividend (in US Dollar) Dividends Company Industry Sector S&P 500 Dividend Yield 0. 91 1. 86 2. 44 2. 02 Dividend Yield - 5 Year Avg. 1. 30 1. 36 2. 34 1. 52 Dividend 5 Year Growth Rate 9. 50 8. 59 7. 03 7. 37 35. 06 28. 60 39. 55 Payout Ratio (TTM) 27. 95 Global Breweries 77

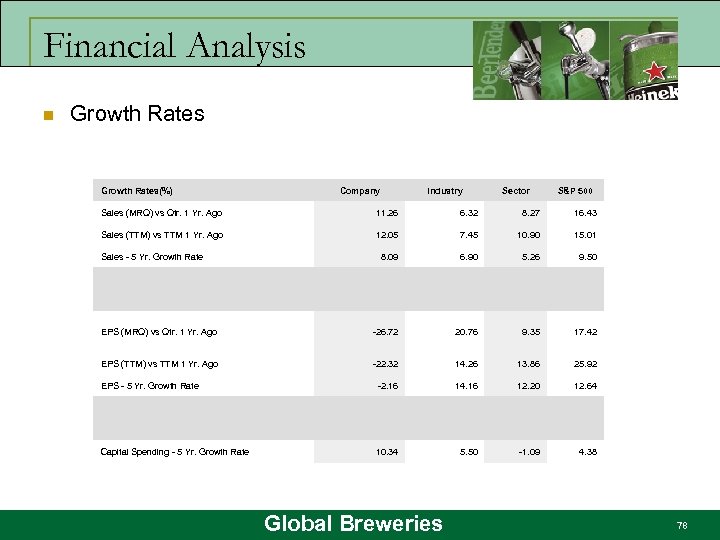

Financial Analysis n Growth Rates(%) Company Industry Sector S&P 500 Sales (MRQ) vs Qtr. 1 Yr. Ago 11. 26 6. 32 8. 27 16. 43 Sales (TTM) vs TTM 1 Yr. Ago 12. 05 7. 45 10. 90 15. 01 8. 09 6. 90 5. 26 9. 50 EPS (MRQ) vs Qtr. 1 Yr. Ago -26. 72 20. 76 9. 35 17. 42 EPS (TTM) vs TTM 1 Yr. Ago -22. 32 14. 26 13. 86 25. 92 EPS - 5 Yr. Growth Rate -2. 16 14. 16 12. 20 12. 64 Capital Spending - 5 Yr. Growth Rate 10. 34 5. 50 -1. 09 4. 38 Sales - 5 Yr. Growth Rate Global Breweries 78

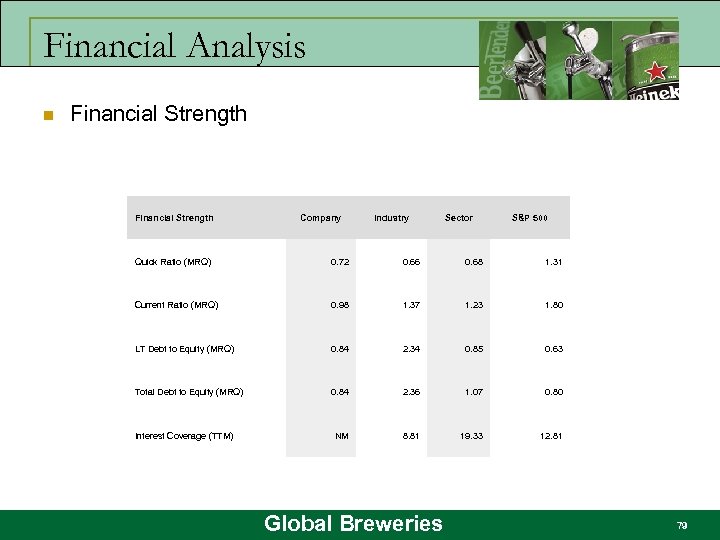

Financial Analysis n Financial Strength Company Industry Sector S&P 500 Quick Ratio (MRQ) 0. 72 0. 66 0. 68 1. 31 Current Ratio (MRQ) 0. 98 1. 37 1. 23 1. 80 LT Debt to Equity (MRQ) 0. 84 2. 34 0. 85 0. 63 Total Debt to Equity (MRQ) 0. 84 2. 36 1. 07 0. 80 NM 8. 81 19. 33 12. 81 Interest Coverage (TTM) Global Breweries 79

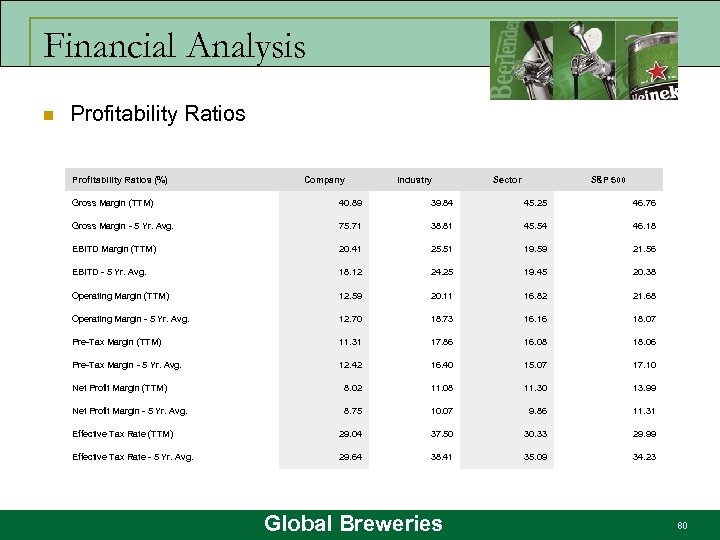

Financial Analysis n Profitability Ratios (%) Company Industry Sector S&P 500 Gross Margin (TTM) 40. 89 39. 84 45. 25 46. 76 Gross Margin - 5 Yr. Avg. 75. 71 38. 81 45. 54 46. 18 EBITD Margin (TTM) 20. 41 25. 51 19. 59 21. 56 EBITD - 5 Yr. Avg. 18. 12 24. 25 19. 45 20. 38 Operating Margin (TTM) 12. 59 20. 11 16. 82 21. 68 Operating Margin - 5 Yr. Avg. 12. 70 18. 73 16. 16 18. 07 Pre-Tax Margin (TTM) 11. 31 17. 86 16. 08 18. 06 Pre-Tax Margin - 5 Yr. Avg. 12. 42 16. 40 15. 07 17. 10 Net Profit Margin (TTM) 8. 02 11. 08 11. 30 13. 99 Net Profit Margin - 5 Yr. Avg. 8. 75 10. 07 9. 86 11. 31 Effective Tax Rate (TTM) 29. 04 37. 50 30. 33 29. 99 Effective Tax Rate - 5 Yr. Avg. 29. 64 38. 41 35. 09 34. 23 Global Breweries 80

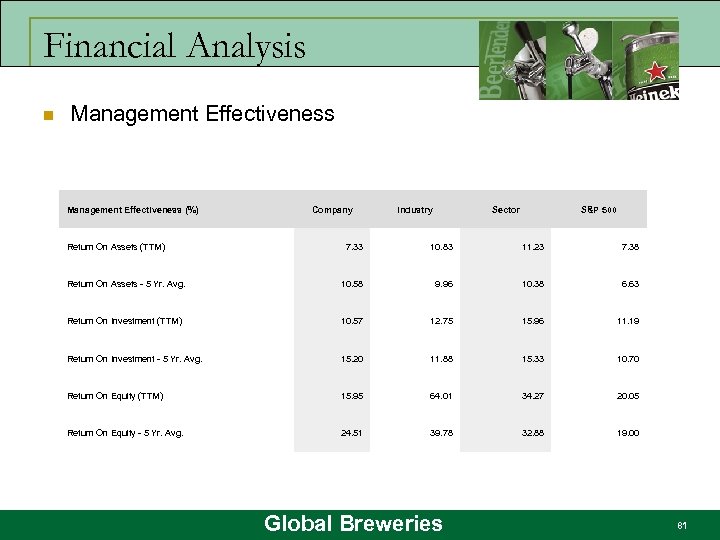

Financial Analysis n Management Effectiveness (%) Return On Assets (TTM) Company Industry Sector S&P 500 7. 33 10. 83 11. 23 7. 38 Return On Assets - 5 Yr. Avg. 10. 58 9. 96 10. 38 6. 63 Return On Investment (TTM) 10. 57 12. 75 15. 96 11. 19 Return On Investment - 5 Yr. Avg. 15. 20 11. 88 15. 33 10. 70 Return On Equity (TTM) 15. 95 64. 01 34. 27 20. 05 Return On Equity - 5 Yr. Avg. 24. 51 39. 78 32. 88 19. 00 Global Breweries 81

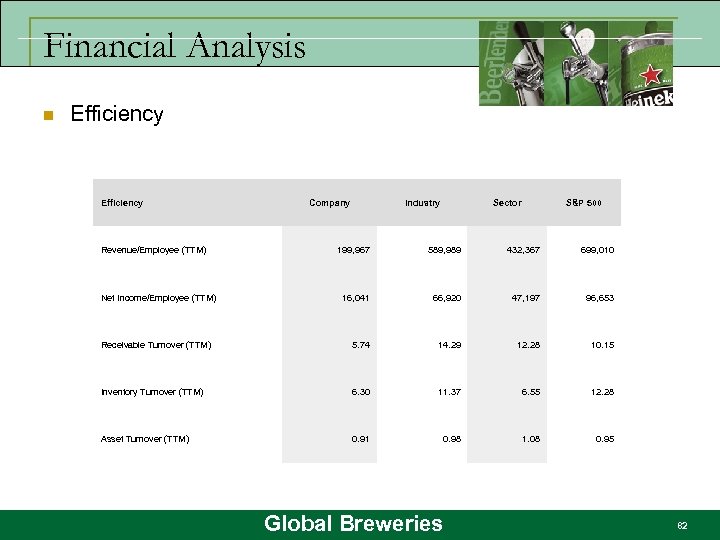

Financial Analysis n Efficiency Revenue/Employee (TTM) Company Industry Sector S&P 500 199, 967 589, 989 432, 367 699, 010 16, 041 66, 920 47, 197 96, 653 Receivable Turnover (TTM) 5. 74 14. 29 12. 28 10. 15 Inventory Turnover (TTM) 6. 30 11. 37 6. 55 12. 28 Asset Turnover (TTM) 0. 91 0. 98 1. 08 0. 95 Net Income/Employee (TTM) Global Breweries 82

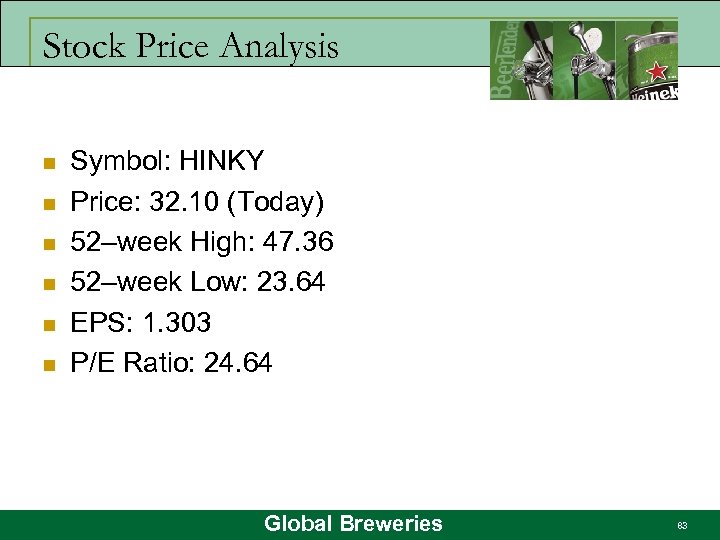

Stock Price Analysis n n n Symbol: HINKY Price: 32. 10 (Today) 52–week High: 47. 36 52–week Low: 23. 64 EPS: 1. 303 P/E Ratio: 24. 64 Global Breweries 83

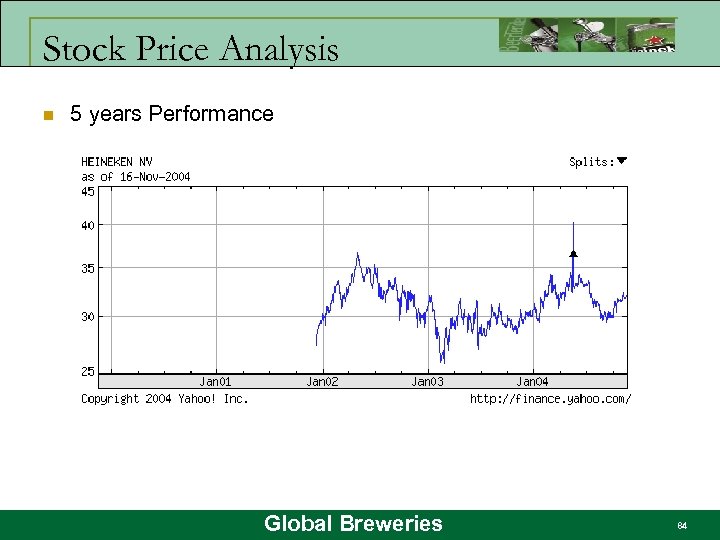

Stock Price Analysis n 5 years Performance Global Breweries 84

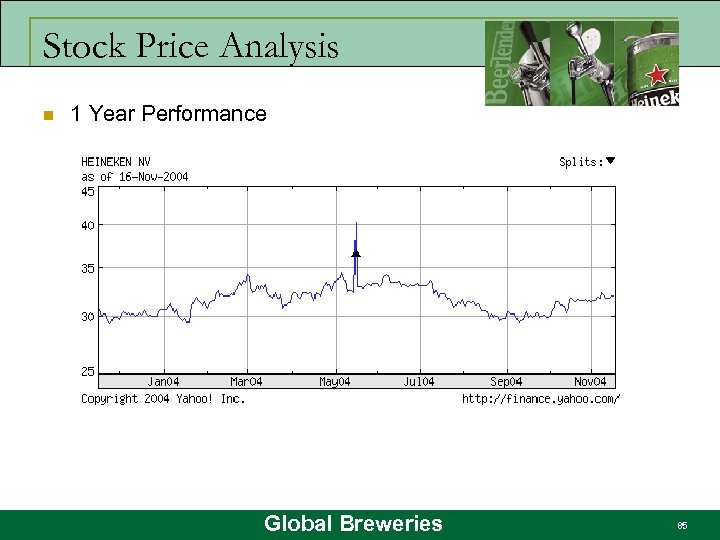

Stock Price Analysis n 1 Year Performance Global Breweries 85

Valuation n n n Gordon model: DPS/ (k-g) DPS= 0. 42 g= 5% k= 0. 5109 Value of stock = 38. 53 Actual = 32. 10 Global Breweries 86

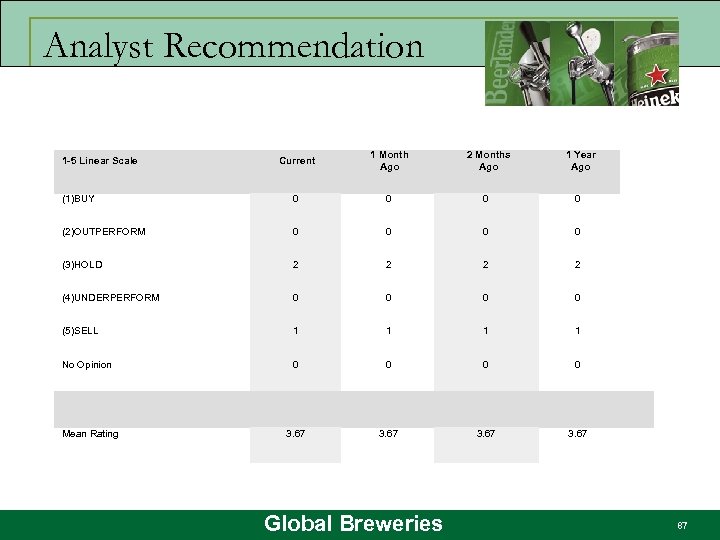

Analyst Recommendation Current 1 Month Ago 2 Months Ago 1 Year Ago (1)BUY 0 0 (2)OUTPERFORM 0 0 (3)HOLD 2 2 (4)UNDERPERFORM 0 0 (5)SELL 1 1 No Opinion 0 0 3. 67 1 -5 Linear Scale Mean Rating 3. 67 Global Breweries 87

Conclusion n n n n Tight competition in global market (In. Bev and A-B) US economy slowdown Flat growth in total beer volume Operating profit is decreased Long-term debt is increased Employment cost is increased No new strategy to expand in Asia (the current fastest growth market) Recommendation: HOLD Global Breweries 88

Global Breweries 89

Molson Global Breweries 90

Molson: Company Overview n n n Founded in 1786 by John Molson who establish his first brewery in Montreal. Incorporated in 1930 Became a public corporation in 1945: Molson's Brewery Limited Canada's oldest consumer brand names North America's oldest beer brand Today: q q q q Canada’s largest brewer headquartered in Montreal 3, 800 employees Five breweries across Canada: Vancouver, Edmonton, Toronto, Montreal and St. John’s Operations in Canada, Brazil, and the United States Global gross sales of $3. 5 billion Traded on TSX : MOL. A-T & MOL. B-T Global Breweries 91

Molson: Senior Management n Daniel J. O'Neill ( Joined Molson in 1999 as CEO) n Brian Burden ( Joined Molson in 2003) n Kevin T. Boyce ( Joined Molson in 2004) n Robert Coallier( Joined Molson in 2000) n Raynald H. Doin ( Joined Molson in 1997) n Marie Giguère ( Joined Molson in 1999) n Peter L. Amirault ( Joined Molson in 2002) President and Chief Executive Officer (2004: Salary $983, 333 bonus $ 1, 008, 167) Executive Vice President and Chief Financial Officer (2004: Salary $408, 333 bonus $154, 202) President and Chief Operating Officer, North America President and Chief Executive Officer, Cervejarias Kaiser & Executive VP, Molson Inc. (2004: salary $ 459, 375) Senior Vice-President Strategy and Integration, Human Resources (2004: Salary $311, 583 bonus $128, 807) Senior Vice President, Chief Legal Officer and Secretary Senior Vice-President Business Development and Innovation n Les Hine ( Joined Molson in 2003) Chief Marketing Officer Global Breweries 92

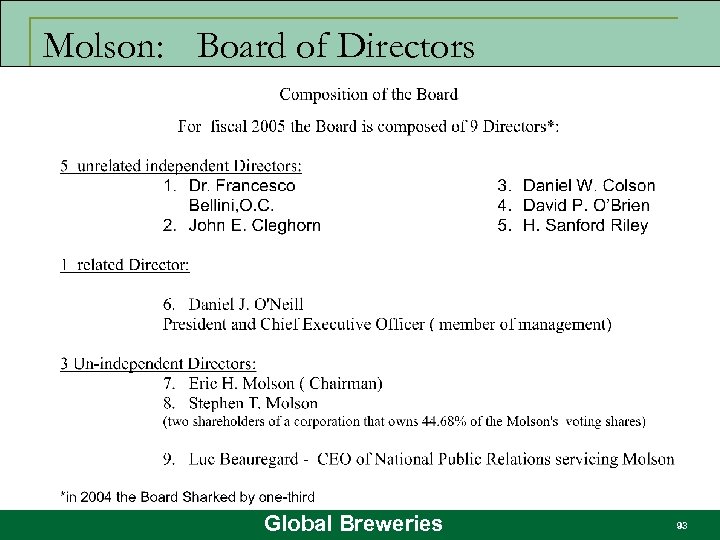

Molson: Board of Directors Global Breweries 93

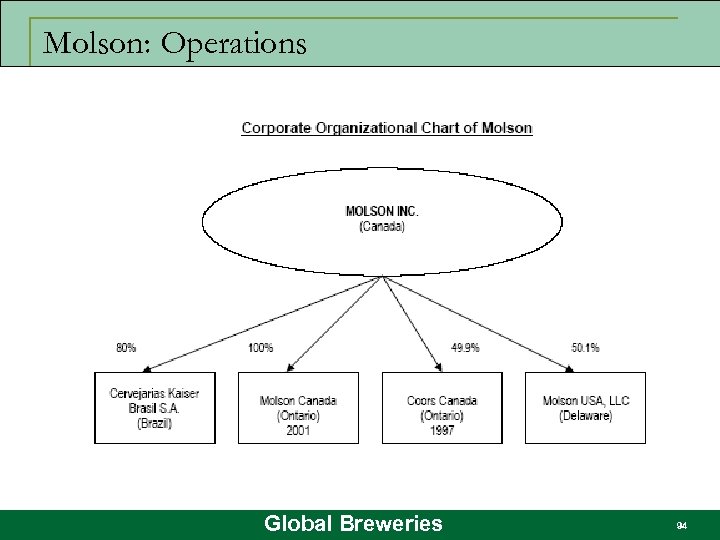

Molson: Operations Global Breweries 94

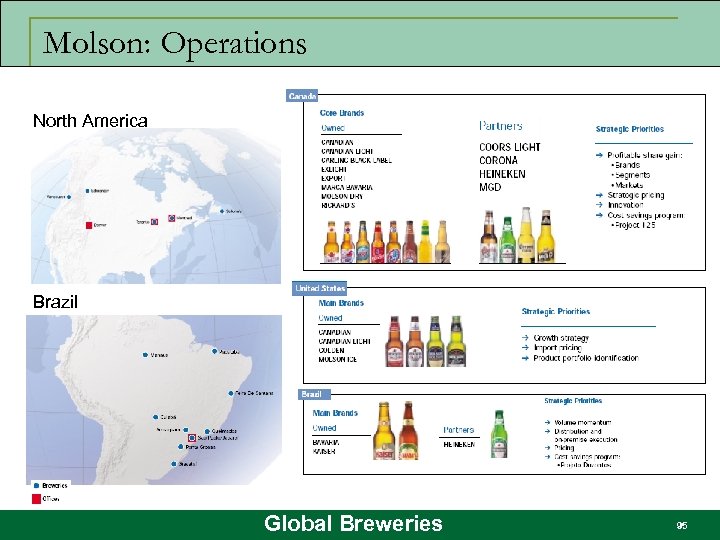

Molson: Operations North America Brazil Global Breweries 95

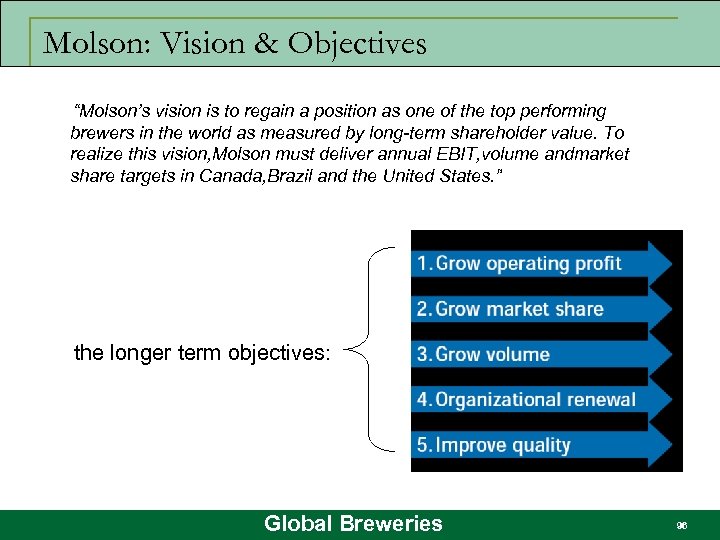

Molson: Vision & Objectives “Molson’s vision is to regain a position as one of the top performing brewers in the world as measured by long-term shareholder value. To realize this vision, Molson must deliver annual EBIT, volume andmarket share targets in Canada, Brazil and the United States. ” the longer term objectives: Global Breweries 96

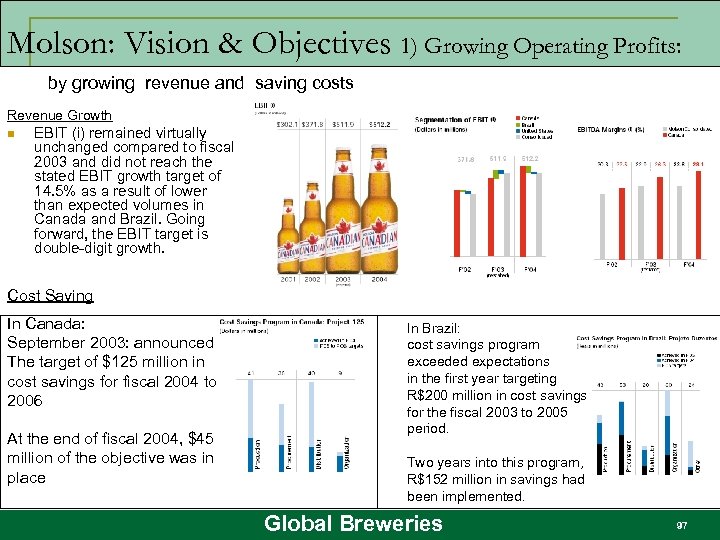

Molson: Vision & Objectives 1) Growing Operating Profits: by growing revenue and saving costs Revenue Growth n EBIT (i) remained virtually unchanged compared to fiscal 2003 and did not reach the stated EBIT growth target of 14. 5% as a result of lower than expected volumes in Canada and Brazil. Going forward, the EBIT target is double-digit growth. Cost Saving In Canada: September 2003: announced The target of $125 million in cost savings for fiscal 2004 to 2006 At the end of fiscal 2004, $45 million of the objective was in place In Brazil: cost savings program exceeded expectations in the first year targeting R$200 million in cost savings for the fiscal 2003 to 2005 period. Two years into this program, R$152 million in savings had been implemented. Global Breweries 97

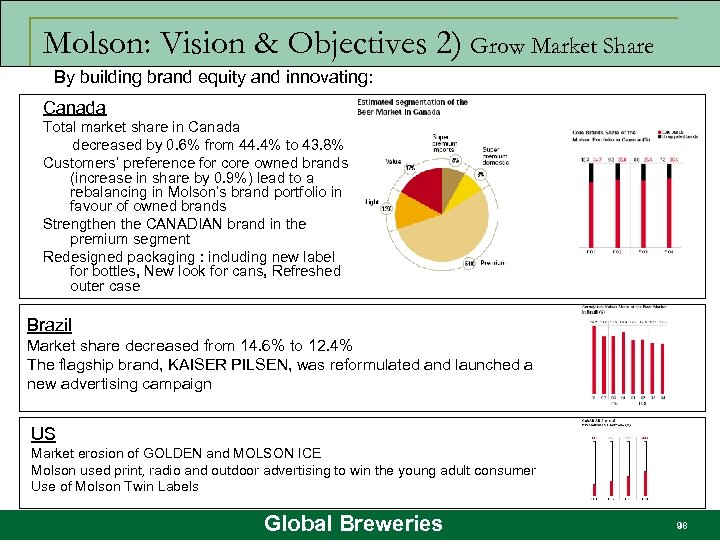

Molson: Vision & Objectives 2) Grow Market Share By building brand equity and innovating: Canada Total market share in Canada decreased by 0. 6% from 44. 4% to 43. 8% Customers’ preference for core owned brands (increase in share by 0. 9%) lead to a rebalancing in Molson’s brand portfolio in favour of owned brands Strengthen the CANADIAN brand in the premium segment Redesigned packaging : including new label for bottles, New look for cans, Refreshed outer case Brazil Market share decreased from 14. 6% to 12. 4% The flagship brand, KAISER PILSEN, was reformulated and launched a new advertising campaign US Market erosion of GOLDEN and MOLSON ICE Molson used print, radio and outdoor advertising to win the young adult consumer Use of Molson Twin Labels Global Breweries 98

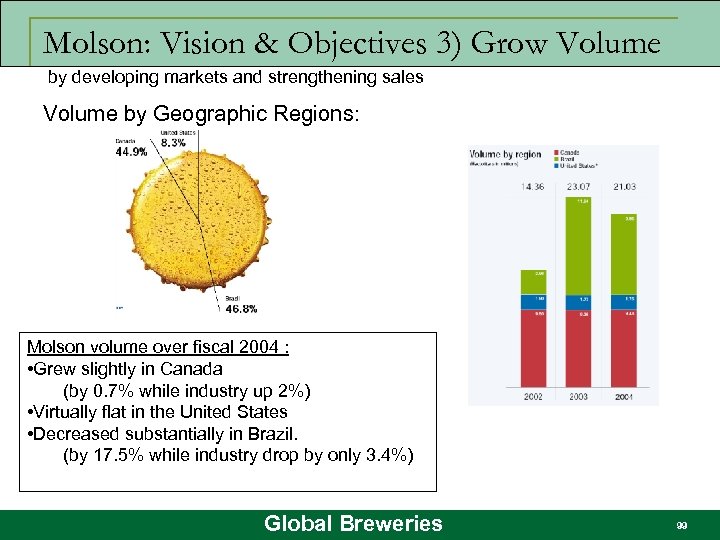

Molson: Vision & Objectives 3) Grow Volume by developing markets and strengthening sales Volume by Geographic Regions: Molson volume over fiscal 2004 : • Grew slightly in Canada (by 0. 7% while industry up 2%) • Virtually flat in the United States • Decreased substantially in Brazil. (by 17. 5% while industry drop by only 3. 4%) Global Breweries 99

Molson: Vision & Objectives 4) Organizational Renewal by leveraging and developing talent: New structure of an integrated but decentralized sales force connected to local markets. Brazil: hiring of more than 1, 200 experienced sales people in six regional sales centres Leadership Development and Succession Planning Production Leadership Program New program for development of talent in strategic marketing function Optimal Work Environment philosophy Global Breweries 100

Molson: Vision & Objectives 5) Improve Quality n Molson made great strides in fiscal 2004 toward the achievement of best-in-class brewer status in all performance measures. n Molson is evaluating investments in brewing capabilities, improved maintenance practices, additional line upgrades, reduced utilities consumption, and, as always, improved quality and a safer workplace. Global Breweries 101

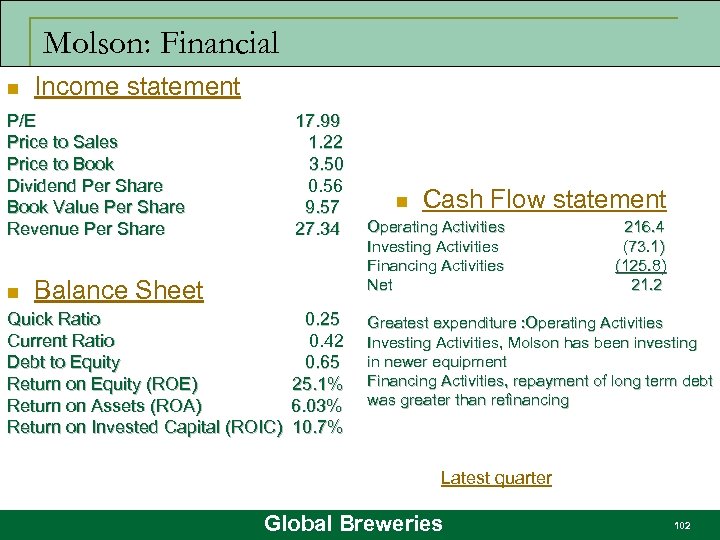

Molson: Financial n Income statement P/E 17. 99 Price to Sales 1. 22 Price to Book 3. 50 Dividend Per Share 0. 56 Book Value Per Share 9. 57 Revenue Per Share 27. 34 n Balance Sheet Quick Ratio 0. 25 Current Ratio 0. 42 Debt to Equity 0. 65 Return on Equity (ROE) 25. 1% Return on Assets (ROA) 6. 03% Return on Invested Capital (ROIC) 10. 7% n Cash Flow statement Operating Activities 216. 4 Investing Activities (73. 1) Financing Activities (125. 8) Net 21. 2 Greatest expenditure : Operating Activities Investing Activities, Molson has been investing in newer equipment Financing Activities, repayment of long term debt was greater than refinancing Latest quarter Global Breweries 102

Molson : In the News n November 8, 2004 Molson to Build New $35 Million Brewery in New Brunswick Cost of $35 million Located in Moncton, New Brunswick Completed by January 2007 Capacity of 6 million 12 packs annually Implementation of distribution system $3. 5 million forgivable loan Global Breweries 103

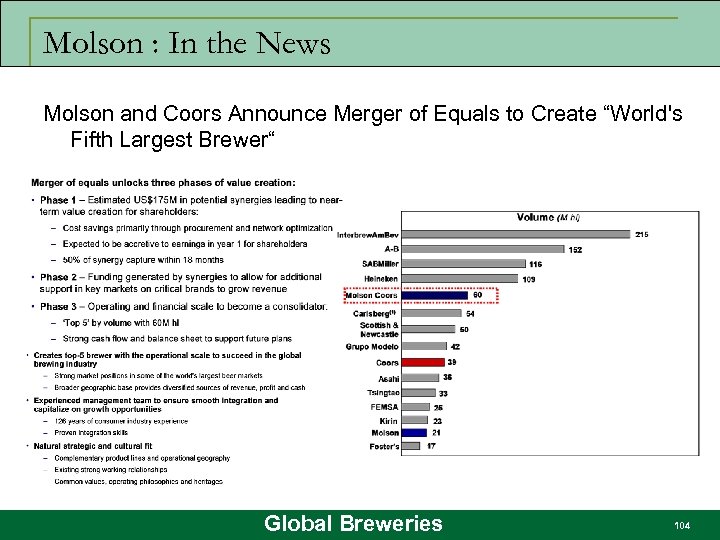

Molson : In the News Molson and Coors Announce Merger of Equals to Create “World's Fifth Largest Brewer“ Global Breweries 104

Molson : In the News Transaction Summary: Global Breweries 105

Molson : In the News Nov 5 th: Molson and Coors Announce Agreement to Pay Special Dividend to Molson Shareholders Molson to Build New $35 Million Brewery in New Brunswick As part of Molson and Coors merger Pentland ( owned by will forego special dividend As a result, dividend will be $3. 26 rather than $3. 00 Both Molson Class A non-voting and Class B common shareholders, excluding Pentland, will receive C$ 3. 26 per share, or a total of approximately C$ 381 million (US$ 316 million), payable as part of the plan of arrangement to Molson shareholders of record as of the last trading day immediately prior to the date of closing of the merger transaction. Assuming these approvals, and approval by the Quebec Superior Court, the companies expect to close the transaction later this year or early next year. Molson Inc. Coors shareholders of record at the close of business on Monday, November 22, 2004, will be entitled to notice of the special meeting and to vote on the proposal. The date of the special meeting has not been set. Global Breweries 106

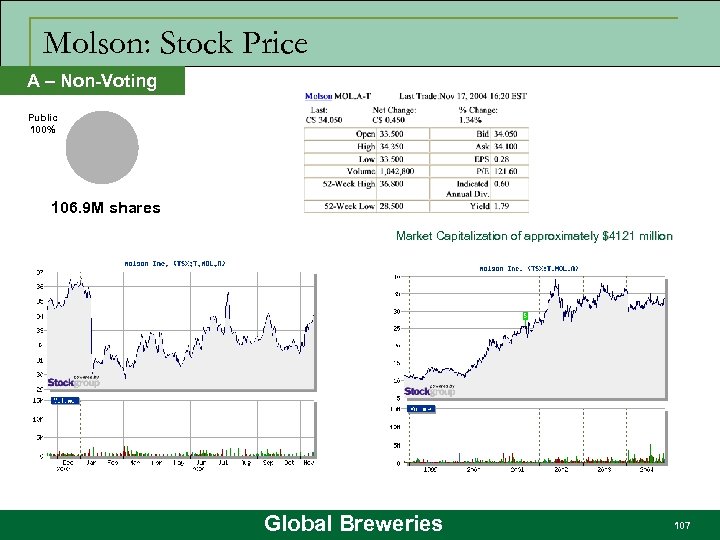

Molson: Stock Price A – Non-Voting Public 100% 106. 9 M shares Market Capitalization of approximately $4121 million Global Breweries 107

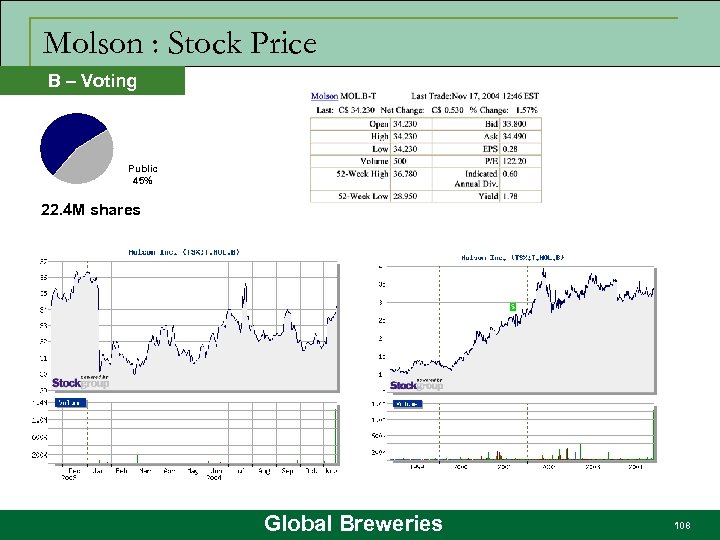

Molson : Stock Price B – Voting Public 45% 22. 4 M shares Global Breweries 108

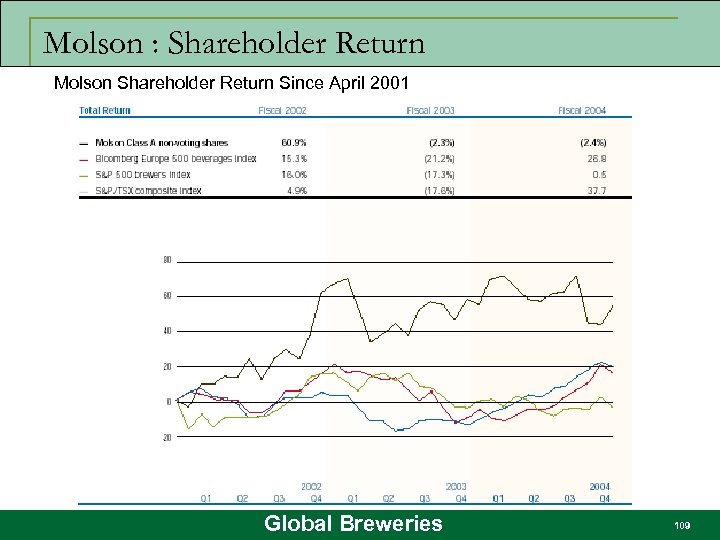

Molson : Shareholder Return Molson Shareholder Return Since April 2001 Global Breweries 109

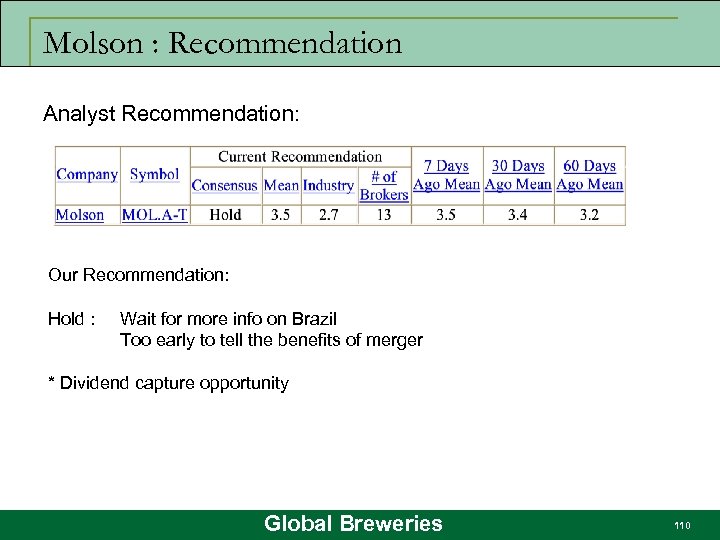

Molson : Recommendation Analyst Recommendation: Our Recommendation: Hold : Wait for more info on Brazil Too early to tell the benefits of merger * Dividend capture opportunity Global Breweries 110

Global Breweries 111

e62e4120c3db239c0ad5158de53c4201.ppt