3150b69c573d09b14434d6c61107a4b8.ppt

- Количество слайдов: 30

Glacier: Tax & Residency Software for International Students & Scholars UC Berkeley Payroll Office Berkeley International Office UC Berkeley Human Resources

Glacier: Tax & Residency Software for International Students & Scholars UC Berkeley Payroll Office Berkeley International Office UC Berkeley Human Resources

Hiring F-1 & J-1 International students for GSI/GSR and Fellowships Kristina Reyes, Payroll Rebecca Sablo, Berkeley International Office Nelcy Dwight, Human Resources

Hiring F-1 & J-1 International students for GSI/GSR and Fellowships Kristina Reyes, Payroll Rebecca Sablo, Berkeley International Office Nelcy Dwight, Human Resources

Hiring F-1 & J-1 International students for GSI/GSR and Fellowships I. III. IV. GLACIER Tax Compliance System Tax Filing Resources Review: Hiring & Paying F-1 & J-1 Students Q&A, Closing

Hiring F-1 & J-1 International students for GSI/GSR and Fellowships I. III. IV. GLACIER Tax Compliance System Tax Filing Resources Review: Hiring & Paying F-1 & J-1 Students Q&A, Closing

GLACIER Nonresident Alien Tax Compliance System Operated & maintained by Payroll On-line tax compliance software system Collects tax related information Determines residency status & tax treaty eligibility

GLACIER Nonresident Alien Tax Compliance System Operated & maintained by Payroll On-line tax compliance software system Collects tax related information Determines residency status & tax treaty eligibility

GLACIER Who requires a GLACIER record ◦ All employed foreign nationals ◦ All international students with fellowship/scholarship/stipend GLACIER records must be updated if source of funding (GSI/GSR vs. fellowship) funding changes Students will get an email from glacieradmin@berkeley. edu if a payment is held due to incomplete GLACIER record

GLACIER Who requires a GLACIER record ◦ All employed foreign nationals ◦ All international students with fellowship/scholarship/stipend GLACIER records must be updated if source of funding (GSI/GSR vs. fellowship) funding changes Students will get an email from glacieradmin@berkeley. edu if a payment is held due to incomplete GLACIER record

GLACIER Steps 1. 2. 3. Hiring/Awarding Department completes initial GLACIER Information Form to request record Provide copy or basic information to international student Student follows instructions in email from support@online-tax. net to access GLACIER To ensure accurate tax withholding, student must: q. Log-in to GLACIER website q. Complete the GLACIER record using I-20, DS-2019, I 94 within 10 days of email receipt q. Student will be instructed to sign & send or deliver forms in person to Payroll Office

GLACIER Steps 1. 2. 3. Hiring/Awarding Department completes initial GLACIER Information Form to request record Provide copy or basic information to international student Student follows instructions in email from support@online-tax. net to access GLACIER To ensure accurate tax withholding, student must: q. Log-in to GLACIER website q. Complete the GLACIER record using I-20, DS-2019, I 94 within 10 days of email receipt q. Student will be instructed to sign & send or deliver forms in person to Payroll Office

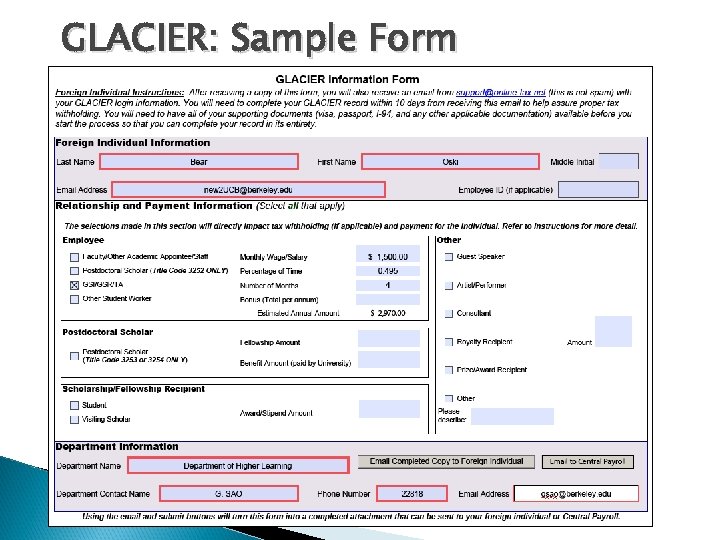

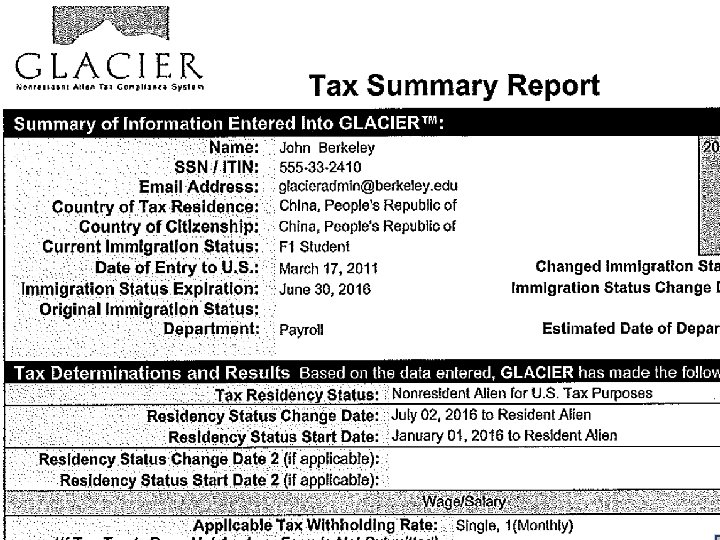

GLACIER: Sample Form

GLACIER: Sample Form

Electronic GLACIER Records ◦ ◦ Based on tax determination made by GLACIER, system may generate: W-8 BEN Tax Treaty Statement IRS Form 8223 W-7 ITIN Application (when applicable) Student can update and access their tax records online

Electronic GLACIER Records ◦ ◦ Based on tax determination made by GLACIER, system may generate: W-8 BEN Tax Treaty Statement IRS Form 8223 W-7 ITIN Application (when applicable) Student can update and access their tax records online

GLACIER Does NOT Replace the UC W 4 -NR UC W-4 NR is used to determine federal and state tax withholding Department provides UC W 4 -NR to international student to complete Return UC W-4 NR to Office of Human Resources. Records Management ◦ Intercampus Mail ◦ Fax to 642 -1882

GLACIER Does NOT Replace the UC W 4 -NR UC W-4 NR is used to determine federal and state tax withholding Department provides UC W 4 -NR to international student to complete Return UC W-4 NR to Office of Human Resources. Records Management ◦ Intercampus Mail ◦ Fax to 642 -1882

The Tax Treaty Statement Background Information GLACIER determines eligibility for Federal tax treaty exemption Only certain countries have tax treaties with the U. S. Tax treaties apply to Federal tax withholdings only Exemption is usually for a limited time

The Tax Treaty Statement Background Information GLACIER determines eligibility for Federal tax treaty exemption Only certain countries have tax treaties with the U. S. Tax treaties apply to Federal tax withholdings only Exemption is usually for a limited time

Consequences of no completed GLACIER record Possible taxation up to 30% Treaty exempt individuals do not receive exemption Social Security & Medicare Wage tax withheld University liability for incorrect tax residency status

Consequences of no completed GLACIER record Possible taxation up to 30% Treaty exempt individuals do not receive exemption Social Security & Medicare Wage tax withheld University liability for incorrect tax residency status

GLACIER: Helpful Tips Initiate GLACIER record prior to students arrival, student can complete it upon arrival Remind student to update GLACIER if type of funding changes Have students prepare photocopies of required docs for ITIN application

GLACIER: Helpful Tips Initiate GLACIER record prior to students arrival, student can complete it upon arrival Remind student to update GLACIER if type of funding changes Have students prepare photocopies of required docs for ITIN application

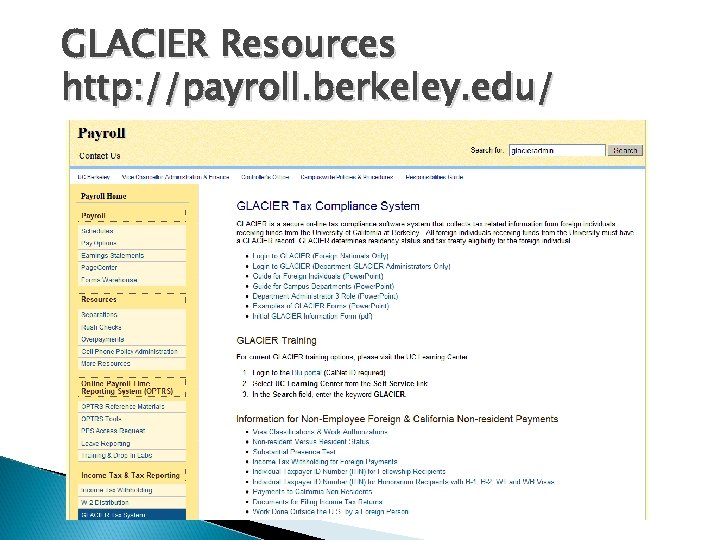

GLACIER Resources http: //payroll. berkeley. edu/

GLACIER Resources http: //payroll. berkeley. edu/

Tax Filing Resources for International Students & Scholars

Tax Filing Resources for International Students & Scholars

What is CINTAX? Nonresident alien federal tax preparation software Made available to Berkeley foreign nationals by BIO Incorporates tax treaty information Itemization for nonresident aliens Instructs how to refund social security and/or medicare taxes

What is CINTAX? Nonresident alien federal tax preparation software Made available to Berkeley foreign nationals by BIO Incorporates tax treaty information Itemization for nonresident aliens Instructs how to refund social security and/or medicare taxes

Nonresident Alien Federal Taxes Nonresidents must file if present in the US during previous tax year May be eligible for treaty exemption based on their country of tax residency

Nonresident Alien Federal Taxes Nonresidents must file if present in the US during previous tax year May be eligible for treaty exemption based on their country of tax residency

Nonresident Alien State Taxes Filing requirement if worldwide or Californiasources income is more than $11803 If income is below $11803, students and scholars can file for refund Filing not possible through CINTAX

Nonresident Alien State Taxes Filing requirement if worldwide or Californiasources income is more than $11803 If income is below $11803, students and scholars can file for refund Filing not possible through CINTAX

Accessing CINTAX Via Glacier for students with complete records Via Access Code from Berkeley International Office ◦ Email cintax@berkeley. edu

Accessing CINTAX Via Glacier for students with complete records Via Access Code from Berkeley International Office ◦ Email cintax@berkeley. edu

Tax Resources from BIO CINTAX at I House ◦ March 31 from 7 -8 pm Federal & State Tax Prep with California Franchise Tax Board ◦ April 5, 10 -12 I House Auditorium Website Resources & FAQs ◦ internationaloffice. berkeley. edu/tax_assistance

Tax Resources from BIO CINTAX at I House ◦ March 31 from 7 -8 pm Federal & State Tax Prep with California Franchise Tax Board ◦ April 5, 10 -12 I House Auditorium Website Resources & FAQs ◦ internationaloffice. berkeley. edu/tax_assistance

Review: Hiring & Paying F-1 & J-1 Students

Review: Hiring & Paying F-1 & J-1 Students

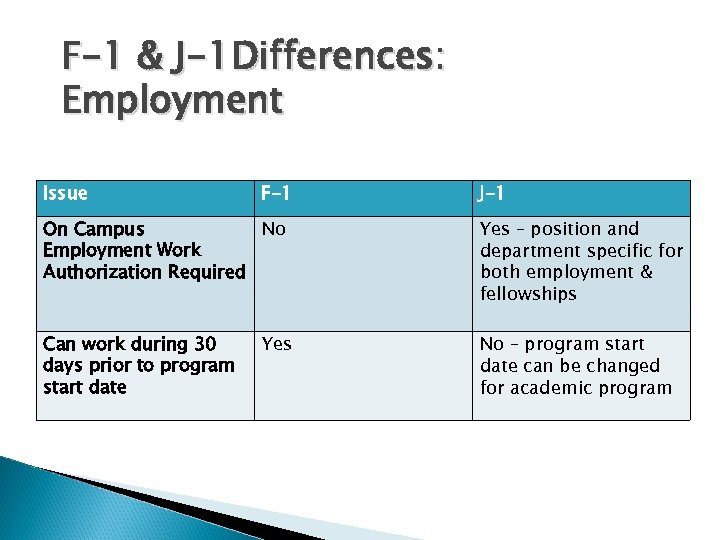

F-1 & J-1 Differences: Employment Issue F-1 J-1 On Campus No Employment Work Authorization Required Yes – position and department specific for both employment & fellowships Can work during 30 days prior to program start date No – program start date can be changed for academic program Yes

F-1 & J-1 Differences: Employment Issue F-1 J-1 On Campus No Employment Work Authorization Required Yes – position and department specific for both employment & fellowships Can work during 30 days prior to program start date No – program start date can be changed for academic program Yes

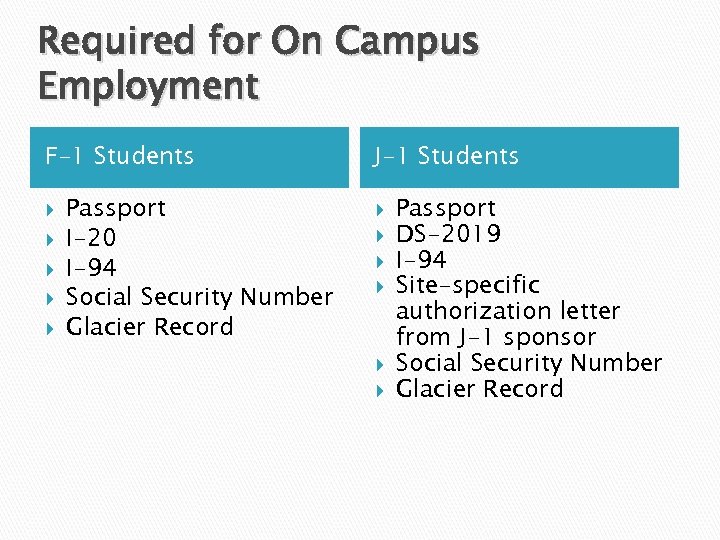

Required for On Campus Employment F-1 Students Passport I-20 I-94 Social Security Number Glacier Record J-1 Students Passport DS-2019 I-94 Site-specific authorization letter from J-1 sponsor Social Security Number Glacier Record

Required for On Campus Employment F-1 Students Passport I-20 I-94 Social Security Number Glacier Record J-1 Students Passport DS-2019 I-94 Site-specific authorization letter from J-1 sponsor Social Security Number Glacier Record

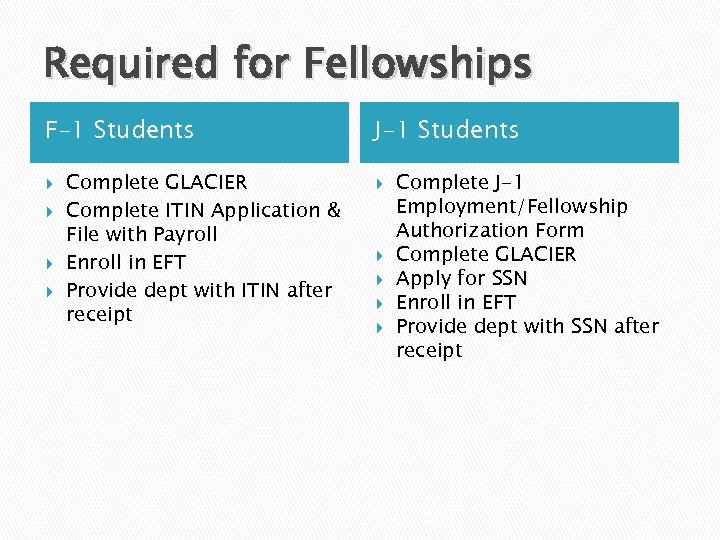

Required for Fellowships F-1 Students Complete GLACIER Complete ITIN Application & File with Payroll Enroll in EFT Provide dept with ITIN after receipt J-1 Students Complete J-1 Employment/Fellowship Authorization Form Complete GLACIER Apply for SSN Enroll in EFT Provide dept with SSN after receipt

Required for Fellowships F-1 Students Complete GLACIER Complete ITIN Application & File with Payroll Enroll in EFT Provide dept with ITIN after receipt J-1 Students Complete J-1 Employment/Fellowship Authorization Form Complete GLACIER Apply for SSN Enroll in EFT Provide dept with SSN after receipt

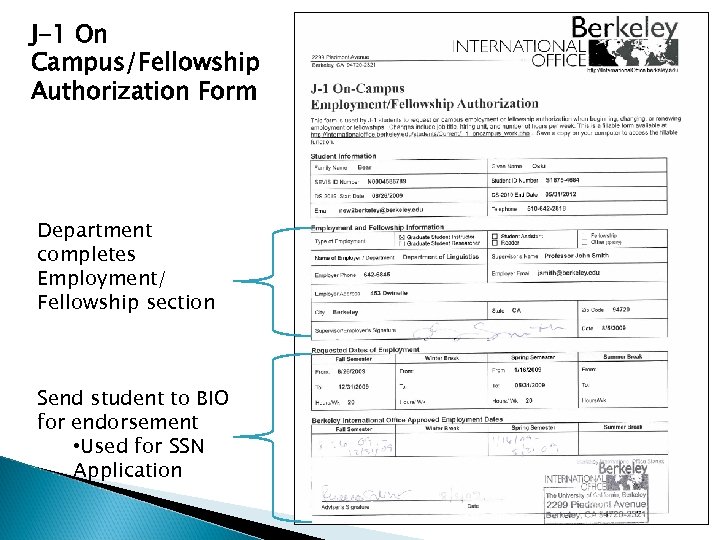

J-1 On Campus/Fellowship Authorization Form Department completes Employment/ Fellowship section Send student to BIO for endorsement • Used for SSN Application

J-1 On Campus/Fellowship Authorization Form Department completes Employment/ Fellowship section Send student to BIO for endorsement • Used for SSN Application

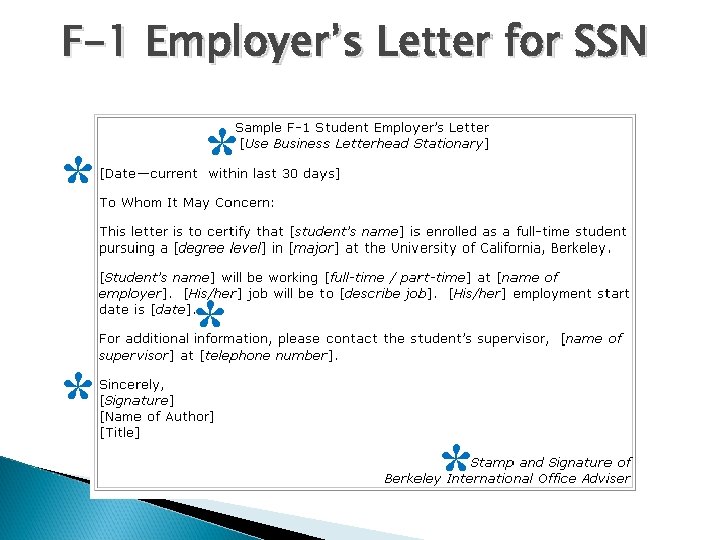

F-1 Employer’s Letter for SSN * * *

F-1 Employer’s Letter for SSN * * *

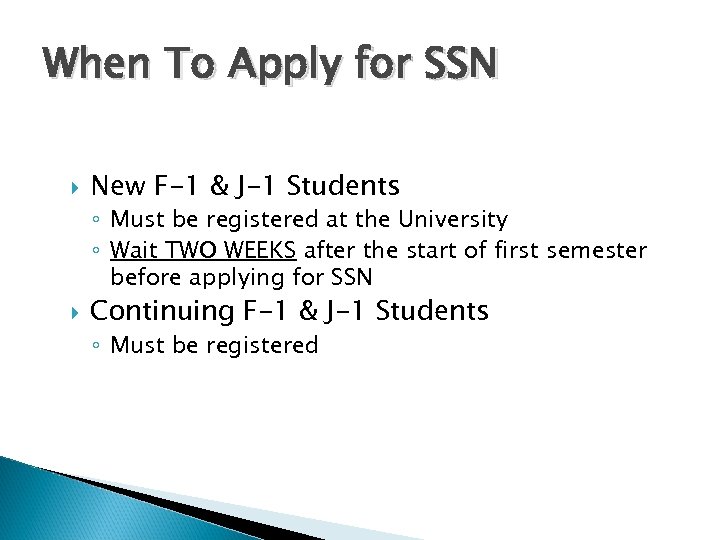

When To Apply for SSN New F-1 & J-1 Students ◦ Must be registered at the University ◦ Wait TWO WEEKS after the start of first semester before applying for SSN Continuing F-1 & J-1 Students ◦ Must be registered

When To Apply for SSN New F-1 & J-1 Students ◦ Must be registered at the University ◦ Wait TWO WEEKS after the start of first semester before applying for SSN Continuing F-1 & J-1 Students ◦ Must be registered

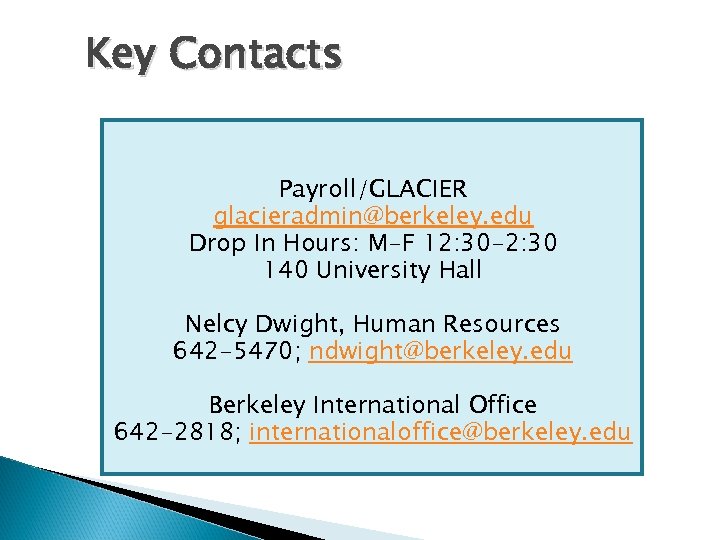

Key Contacts Payroll/GLACIER glacieradmin@berkeley. edu Drop In Hours: M-F 12: 30 -2: 30 140 University Hall Nelcy Dwight, Human Resources 642 -5470; ndwight@berkeley. edu Berkeley International Office 642 -2818; internationaloffice@berkeley. edu

Key Contacts Payroll/GLACIER glacieradmin@berkeley. edu Drop In Hours: M-F 12: 30 -2: 30 140 University Hall Nelcy Dwight, Human Resources 642 -5470; ndwight@berkeley. edu Berkeley International Office 642 -2818; internationaloffice@berkeley. edu

Questions?

Questions?

Thank you!

Thank you!