Gift of IRA During Life: after age 70 ½ You may donate up to $100, 000 of your RMD directly to the Long Beach Century Club without income tax. IRA Testamentary: Designate the Long Beach Century Club as a beneficiary of part or all of your IRA.

Gift of IRA During Life: after age 70 ½ You may donate up to $100, 000 of your RMD directly to the Long Beach Century Club without income tax. IRA Testamentary: Designate the Long Beach Century Club as a beneficiary of part or all of your IRA.

Lifetime Gift of Life Insurance • • • For a person that does not need the life insurance anymore. You can gift the policy to Long Beach Century Club and receive an income tax deduction. You can donate the annual premiums and receive an income tax deduction. Life Insurance Gift of Policy

Lifetime Gift of Life Insurance • • • For a person that does not need the life insurance anymore. You can gift the policy to Long Beach Century Club and receive an income tax deduction. You can donate the annual premiums and receive an income tax deduction. Life Insurance Gift of Policy

Testamentary Gift of Life Insurance • Any estate that leaves a bequest to the Long Beach Century Club will receive a charitable deduction from estate tax! • You can designate a percentage. 50% to Century Club Life Insurance 50% to Family

Testamentary Gift of Life Insurance • Any estate that leaves a bequest to the Long Beach Century Club will receive a charitable deduction from estate tax! • You can designate a percentage. 50% to Century Club Life Insurance 50% to Family

Wills & Trusts Leaving a Legacy • Any estate that leaves a bequest to the Long Beach Century Club will receive a charitable deduction from estate tax! • You can designate a specific amount or leave a percentage. Will or Trust $100, 000 bequest

Wills & Trusts Leaving a Legacy • Any estate that leaves a bequest to the Long Beach Century Club will receive a charitable deduction from estate tax! • You can designate a specific amount or leave a percentage. Will or Trust $100, 000 bequest

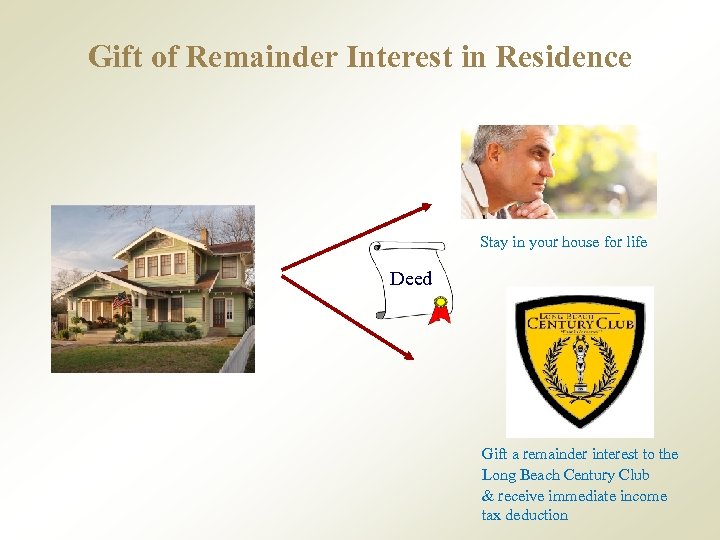

Gift of Remainder Interest in Residence Stay in your house for life Deed Gift a remainder interest to the Long Beach Century Club & receive immediate income tax deduction

Gift of Remainder Interest in Residence Stay in your house for life Deed Gift a remainder interest to the Long Beach Century Club & receive immediate income tax deduction

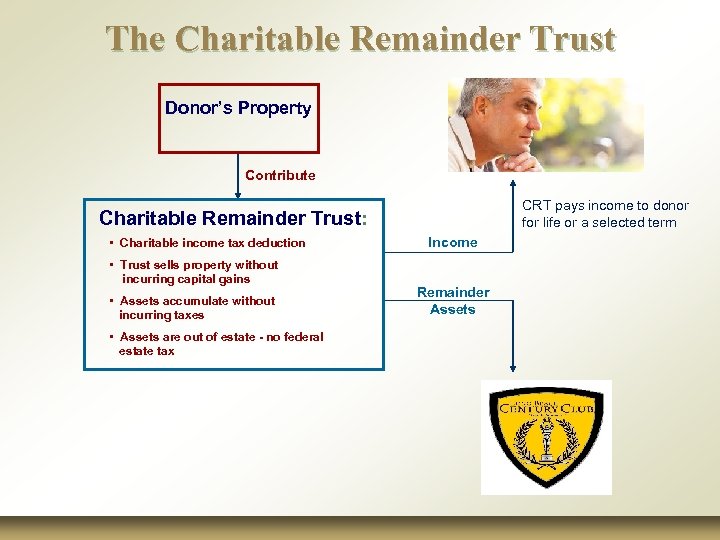

The Charitable Remainder Trust Donor’s Property Contribute CRT pays income to donor for life or a selected term Charitable Remainder Trust: • Charitable income tax deduction • Trust sells property without incurring capital gains • Assets accumulate without incurring taxes • Assets are out of estate - no federal estate tax Income Remainder Assets

The Charitable Remainder Trust Donor’s Property Contribute CRT pays income to donor for life or a selected term Charitable Remainder Trust: • Charitable income tax deduction • Trust sells property without incurring capital gains • Assets accumulate without incurring taxes • Assets are out of estate - no federal estate tax Income Remainder Assets