ce4eebd82be0447d74836009a5fc47f2.ppt

- Количество слайдов: 30

Getting Inside The Mind of the Shopper

Getting Inside The Mind of the Shopper

What’s driving the shopper • • • Unemployment still a problem Housing prices remain weak Foreclosures, foreclosures… Consumer lack-of-confidence The impact on shopping patterns

What’s driving the shopper • • • Unemployment still a problem Housing prices remain weak Foreclosures, foreclosures… Consumer lack-of-confidence The impact on shopping patterns

Where we are • The new age of frugality • The new age of simplicity • The importance of differentiation

Where we are • The new age of frugality • The new age of simplicity • The importance of differentiation

The questions we face • How are lifestyle and other pressures affecting store selection and shopping • How do today’s consumers describe their needs and how do those needs influence behavior • How do supermarkets meet today’s shoppers’ needs • How can understanding need states translate into competitive advantage

The questions we face • How are lifestyle and other pressures affecting store selection and shopping • How do today’s consumers describe their needs and how do those needs influence behavior • How do supermarkets meet today’s shoppers’ needs • How can understanding need states translate into competitive advantage

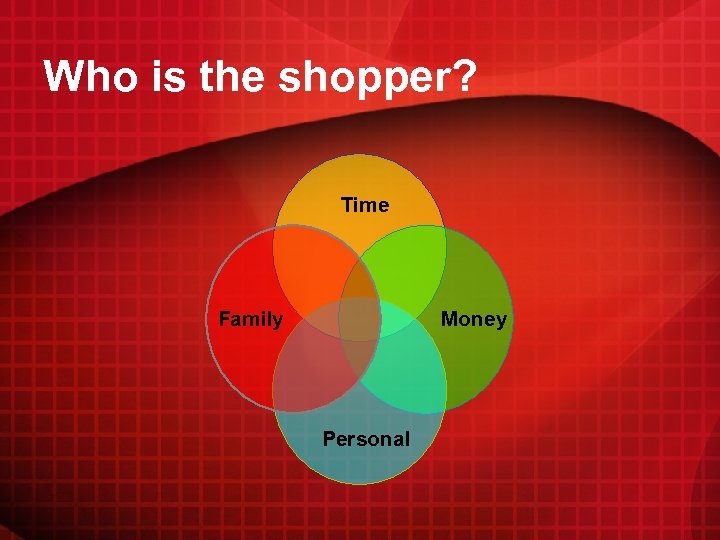

Who is the shopper? Time Family Money Personal

Who is the shopper? Time Family Money Personal

State of mind I am the KEEPER: Care for Family “I consider grocery shopping to be a very important job and take it seriously. I want to do a good job for my family. I buy what people ask for and what I think will please them, but I always make a decision that ensures it’s good for them. ”

State of mind I am the KEEPER: Care for Family “I consider grocery shopping to be a very important job and take it seriously. I want to do a good job for my family. I buy what people ask for and what I think will please them, but I always make a decision that ensures it’s good for them. ”

State of mind I am the QUARTERMASTER: Efficient Stock-Up “I don’t like to grocery shop, so on my major trips I buy everything I can. I like to have a lot of things on hand, so I can avoid making an additional trip to the store. ”

State of mind I am the QUARTERMASTER: Efficient Stock-Up “I don’t like to grocery shop, so on my major trips I buy everything I can. I like to have a lot of things on hand, so I can avoid making an additional trip to the store. ”

State of mind I am the BANKER: Smart Budget Shopper “I have a planned grocery budget that I don’t want to exceed. I’ll stock-up on bargains and I want the store to make it easy for me to find for savings. ”

State of mind I am the BANKER: Smart Budget Shopper “I have a planned grocery budget that I don’t want to exceed. I’ll stock-up on bargains and I want the store to make it easy for me to find for savings. ”

State of mind I am the SEEKER: Discovery “I like to browse during my grocery shopping trips. Every trip is a little different. I look for new ideas, new recipes, new foods–and even some nongrocery products, like clothes. ”

State of mind I am the SEEKER: Discovery “I like to browse during my grocery shopping trips. Every trip is a little different. I look for new ideas, new recipes, new foods–and even some nongrocery products, like clothes. ”

State of mind I am DESPERATE: Specific Item “I need something right away: a specific food, ingredient, prescription medicine, or alcoholic beverage. If it’s not on the shelf, I’m likely to go to the next store. ”

State of mind I am DESPERATE: Specific Item “I need something right away: a specific food, ingredient, prescription medicine, or alcoholic beverage. If it’s not on the shelf, I’m likely to go to the next store. ”

State of mind I am RELUCTANT: Reluctance “If I could, I’d rather have somebody else do my shopping or do it online – anything to avoid going to the store. Right now, I put little time or effort into my shopping trips. ”

State of mind I am RELUCTANT: Reluctance “If I could, I’d rather have somebody else do my shopping or do it online – anything to avoid going to the store. Right now, I put little time or effort into my shopping trips. ”

State of mind I am the HUNTER: Bargain-Hunting Among Stores “On my grocery trips, I am looking for bargains on a limited number of specific products that I want to buy. I go to the store that is offering the best deals on these products. ”

State of mind I am the HUNTER: Bargain-Hunting Among Stores “On my grocery trips, I am looking for bargains on a limited number of specific products that I want to buy. I go to the store that is offering the best deals on these products. ”

State of mind I am the COURIER: Small-Basket Grab & Go “Bread, milk, bananas, and beer. In and out in a few minutes. That’s what I’m here for. ”

State of mind I am the COURIER: Small-Basket Grab & Go “Bread, milk, bananas, and beer. In and out in a few minutes. That’s what I’m here for. ”

State of mind I am HUNGRY: Immediate Consumption “I’m thirsty, I’m hungry, or I am out of cigarettes. ”

State of mind I am HUNGRY: Immediate Consumption “I’m thirsty, I’m hungry, or I am out of cigarettes. ”

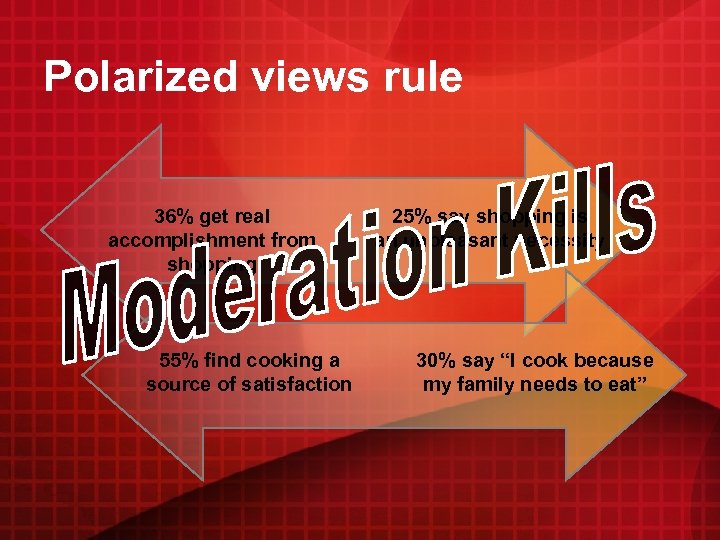

Polarized views rule 36% get real accomplishment from shopping 55% find cooking a source of satisfaction 25% say shopping is an unpleasant necessity 30% say “I cook because my family needs to eat”

Polarized views rule 36% get real accomplishment from shopping 55% find cooking a source of satisfaction 25% say shopping is an unpleasant necessity 30% say “I cook because my family needs to eat”

Polarized views rule 36% get real accomplishment from shopping 55% find cooking a source of satisfaction 25% say shopping is an unpleasant necessity 30% say “I cook because my family needs to eat”

Polarized views rule 36% get real accomplishment from shopping 55% find cooking a source of satisfaction 25% say shopping is an unpleasant necessity 30% say “I cook because my family needs to eat”

Supermarkets are facing strong competition Consumer Commitment Across Competition (TRI*M Index, by Channel) Limited Assortment 106 Warehouse Club 101 Dollar 100 Mass Merchandiser 93 Supercenter 93 Total Supermarkets 91 Drug Stores Convenience Stores 87 80 TRI*M Index 70 – 100 = Strong Relationship | Over 100 = Very Strong Relationship

Supermarkets are facing strong competition Consumer Commitment Across Competition (TRI*M Index, by Channel) Limited Assortment 106 Warehouse Club 101 Dollar 100 Mass Merchandiser 93 Supercenter 93 Total Supermarkets 91 Drug Stores Convenience Stores 87 80 TRI*M Index 70 – 100 = Strong Relationship | Over 100 = Very Strong Relationship

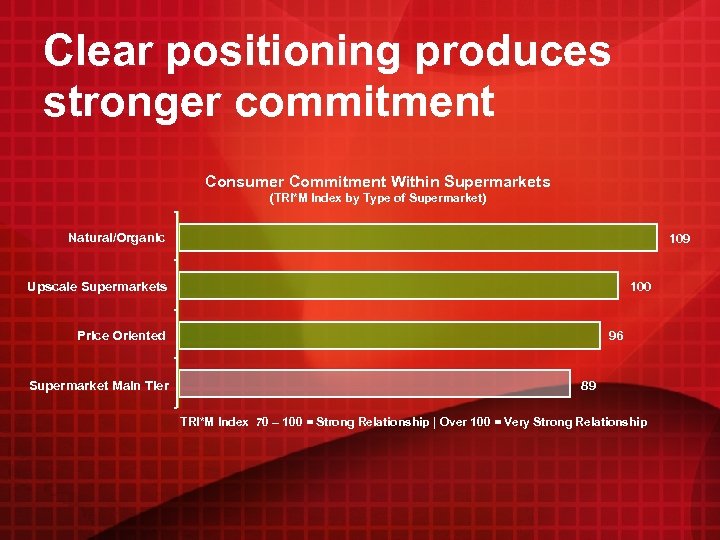

Clear positioning produces stronger commitment Consumer Commitment Within Supermarkets (TRI*M Index by Type of Supermarket) Natural/Organic 109 Upscale Supermarkets 100 Price Oriented Supermarket Main Tier 96 89 TRI*M Index 70 – 100 = Strong Relationship | Over 100 = Very Strong Relationship

Clear positioning produces stronger commitment Consumer Commitment Within Supermarkets (TRI*M Index by Type of Supermarket) Natural/Organic 109 Upscale Supermarkets 100 Price Oriented Supermarket Main Tier 96 89 TRI*M Index 70 – 100 = Strong Relationship | Over 100 = Very Strong Relationship

Overview of the Tool Step 1 Need State Overview Step 2 Step 3 Step 4 Step 5 Store Experience Need State Opportunity Need State Prioritization Need State Selection

Overview of the Tool Step 1 Need State Overview Step 2 Step 3 Step 4 Step 5 Store Experience Need State Opportunity Need State Prioritization Need State Selection

Step 1 Overview of the nine shopping-occasion-based need states

Step 1 Overview of the nine shopping-occasion-based need states

Step 2 How do you compare to your competition?

Step 2 How do you compare to your competition?

Your store experience vs. (insert competitor here) • • • Atmosphere Product Price/Promotion Store Service Convenience

Your store experience vs. (insert competitor here) • • • Atmosphere Product Price/Promotion Store Service Convenience

Step 3 How well are you satisfying the needs of shoppers?

Step 3 How well are you satisfying the needs of shoppers?

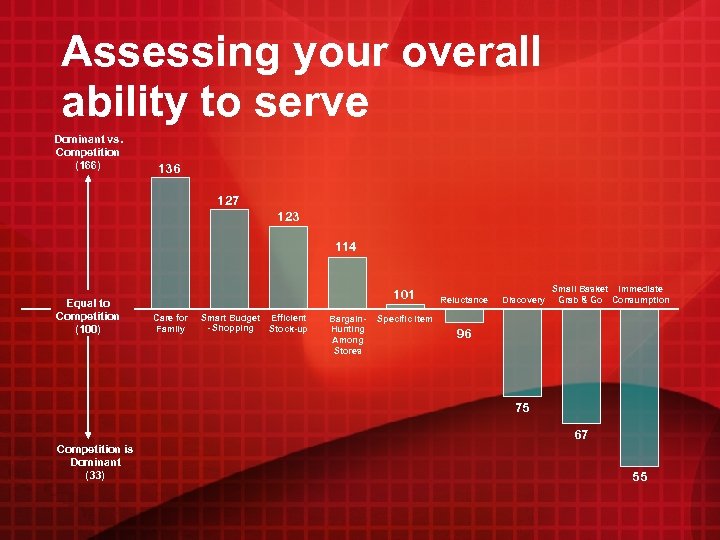

Assessing your overall ability to serve Dominant vs. Competition (166) 136 127 123 114 Equal to Competition (100) 101 Care for Family Smart Budget - Shopping Efficient Stock-up Bargain. Hunting Among Stores Reluctance Discovery Small Basket Immediate Grab & Go Consumption Specific Item 96 75 67 Competition is Dominant (33) 55

Assessing your overall ability to serve Dominant vs. Competition (166) 136 127 123 114 Equal to Competition (100) 101 Care for Family Smart Budget - Shopping Efficient Stock-up Bargain. Hunting Among Stores Reluctance Discovery Small Basket Immediate Grab & Go Consumption Specific Item 96 75 67 Competition is Dominant (33) 55

Step 4 Which need states fit you best?

Step 4 Which need states fit you best?

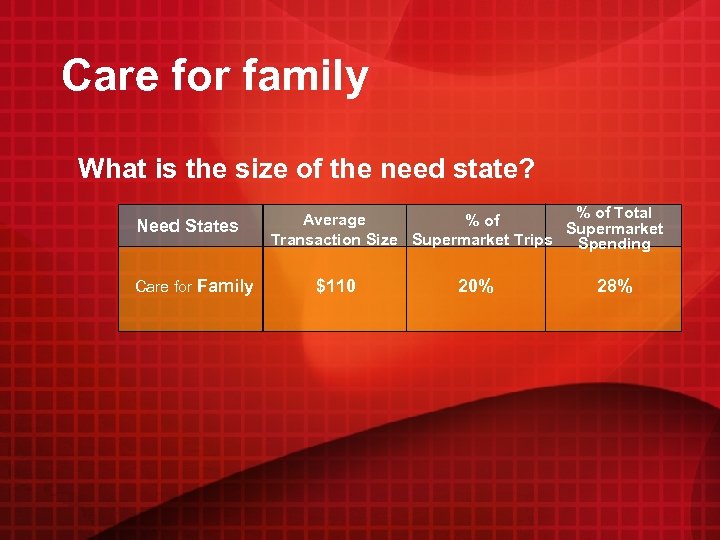

Care for family What is the size of the need state? Need States Care for Family % of Total Average % of Supermarket Transaction Size Supermarket Trips Spending $110 20% 28%

Care for family What is the size of the need state? Need States Care for Family % of Total Average % of Supermarket Transaction Size Supermarket Trips Spending $110 20% 28%

Step 5 Which need state do you want to own?

Step 5 Which need state do you want to own?

Beginning to position and brand your store(s) • Select your primary need state • Review the details in this tool to be sure you have a comprehensive understanding of all the information related to this need state

Beginning to position and brand your store(s) • Select your primary need state • Review the details in this tool to be sure you have a comprehensive understanding of all the information related to this need state

From more information visit: www. CCRRC. org

From more information visit: www. CCRRC. org