c94b40a0f14a747faba609ac544f4408.ppt

- Количество слайдов: 14

Get Up to Speed with Market Manipulation – the FX Scandal Lloyd Maynard

Get Up to Speed with Market Manipulation – the FX Scandal Lloyd Maynard

The For. Ex Market • For. Ex: an unregulated market that ‘follows the sun. ’ • The London Fix: 15: 59 and 30 seconds to 16: 00 and 30 seconds • Used by banks, international equity portfolio managers, multinationals, central banks • An interbank market that runs on a credit-approved system

The For. Ex Market • For. Ex: an unregulated market that ‘follows the sun. ’ • The London Fix: 15: 59 and 30 seconds to 16: 00 and 30 seconds • Used by banks, international equity portfolio managers, multinationals, central banks • An interbank market that runs on a credit-approved system

Something about oranges • DAY 1 • DAY 2 • DAY 3 • DAY 4

Something about oranges • DAY 1 • DAY 2 • DAY 3 • DAY 4

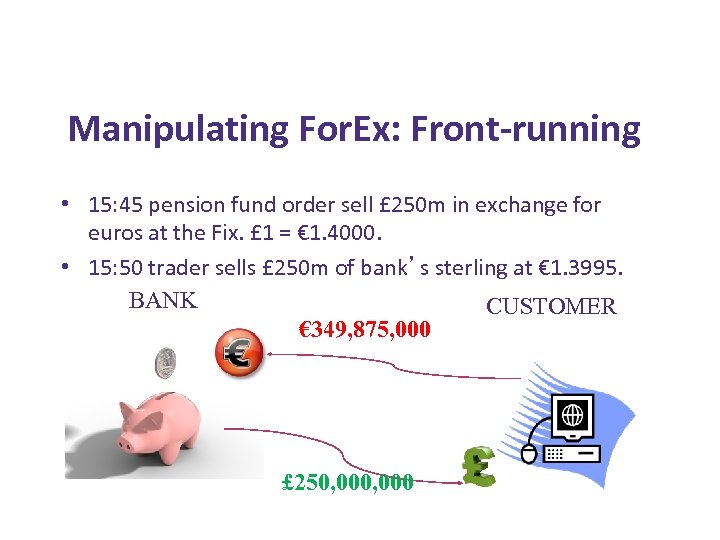

Manipulating For. Ex: Front-running • 15: 45 pension fund order sell £ 250 m in exchange for euros at the Fix. £ 1 = € 1. 4000. • 15: 50 trader sells £ 250 m of bank’s sterling at € 1. 3995. BANK CUSTOMER € 349, 875, 000 £ 250, 000

Manipulating For. Ex: Front-running • 15: 45 pension fund order sell £ 250 m in exchange for euros at the Fix. £ 1 = € 1. 4000. • 15: 50 trader sells £ 250 m of bank’s sterling at € 1. 3995. BANK CUSTOMER € 349, 875, 000 £ 250, 000

Manipulating For. Ex: Front-running • At Fix: sterling sell orders flood in, sterling weakened exchange rate £ 1 = € 1. 3975. • Trader re-purchases his sterling for € 1. 3975. € 500, 000 profit: 15: 50: £ 250 m x € 1. 3995 = € 349, 875, 000 received 16: 00: £ 250 m x € 1. 3975 = € 349, 375, 000 spent € 500, 000 £ 250, 000 € 349, 375, 000

Manipulating For. Ex: Front-running • At Fix: sterling sell orders flood in, sterling weakened exchange rate £ 1 = € 1. 3975. • Trader re-purchases his sterling for € 1. 3975. € 500, 000 profit: 15: 50: £ 250 m x € 1. 3995 = € 349, 875, 000 received 16: 00: £ 250 m x € 1. 3975 = € 349, 375, 000 spent € 500, 000 £ 250, 000 € 349, 375, 000

Manipulating For. Ex Banging the close • 15: 45: trader receives client order to sell € 1 bn for Swiss francs, at Fix price. • 15: 59 and 30 seconds: trader sells his bank’s euros (€ 1 bn if possible), driving the price down. • 16: 00 and 10 seconds: trader purchases his client’s euros at the lower FIX price. • Profit: difference in starting FX rate verses median Fix rate – 0. 02% = 200, 000 Swiss franc profit

Manipulating For. Ex Banging the close • 15: 45: trader receives client order to sell € 1 bn for Swiss francs, at Fix price. • 15: 59 and 30 seconds: trader sells his bank’s euros (€ 1 bn if possible), driving the price down. • 16: 00 and 10 seconds: trader purchases his client’s euros at the lower FIX price. • Profit: difference in starting FX rate verses median Fix rate – 0. 02% = 200, 000 Swiss franc profit

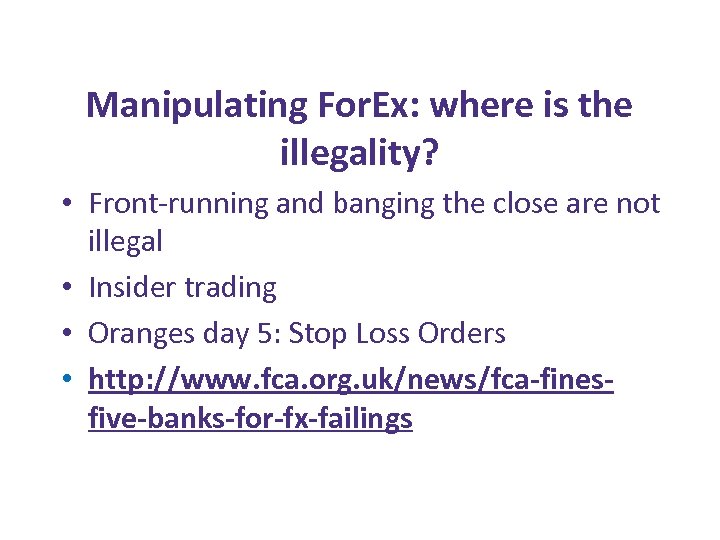

Manipulating For. Ex: where is the illegality? • Front-running and banging the close are not illegal • Insider trading • Oranges day 5: Stop Loss Orders • http: //www. fca. org. uk/news/fca-finesfive-banks-for-fx-failings

Manipulating For. Ex: where is the illegality? • Front-running and banging the close are not illegal • Insider trading • Oranges day 5: Stop Loss Orders • http: //www. fca. org. uk/news/fca-finesfive-banks-for-fx-failings

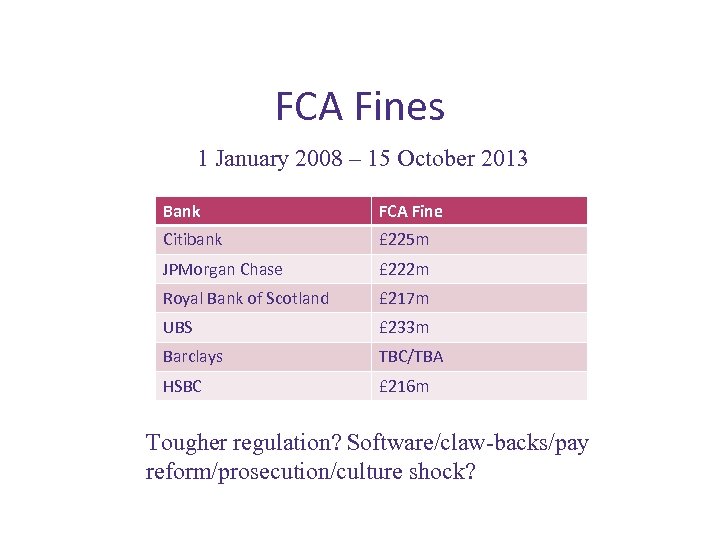

FCA Fines Principle 3 “A firm must take reasonable care to organise and control its affairs responsibly and effectively, with adequate risk management systems. ” PRIN 3. 2. 3 R(1) – principle 3 applies when regulated firms are undertaking unregulated activity. PRIN 3. 1. 1 R – principle 3 applies wherever a firm undertakes regulated activity

FCA Fines Principle 3 “A firm must take reasonable care to organise and control its affairs responsibly and effectively, with adequate risk management systems. ” PRIN 3. 2. 3 R(1) – principle 3 applies when regulated firms are undertaking unregulated activity. PRIN 3. 1. 1 R – principle 3 applies wherever a firm undertakes regulated activity

FCA Fines 1 January 2008 – 15 October 2013 Bank FCA Fine Citibank £ 225 m JPMorgan Chase £ 222 m Royal Bank of Scotland £ 217 m UBS £ 233 m Barclays TBC/TBA HSBC £ 216 m Tougher regulation? Software/claw-backs/pay reform/prosecution/culture shock?

FCA Fines 1 January 2008 – 15 October 2013 Bank FCA Fine Citibank £ 225 m JPMorgan Chase £ 222 m Royal Bank of Scotland £ 217 m UBS £ 233 m Barclays TBC/TBA HSBC £ 216 m Tougher regulation? Software/claw-backs/pay reform/prosecution/culture shock?

For. Ex Manipulation: the losers? • • • You? Pension and Hedge Funds Multinational companies Central banks The Bank of England Bank employees

For. Ex Manipulation: the losers? • • • You? Pension and Hedge Funds Multinational companies Central banks The Bank of England Bank employees

![For. Ex claims: misrepresentation • Graiseley Properties and Unitech Global [2013] EWCA Civ 1372 For. Ex claims: misrepresentation • Graiseley Properties and Unitech Global [2013] EWCA Civ 1372](https://present5.com/presentation/c94b40a0f14a747faba609ac544f4408/image-11.jpg) For. Ex claims: misrepresentation • Graiseley Properties and Unitech Global [2013] EWCA Civ 1372 • Offer alone sufficient conduct: restaurant customer – [28] • Fraud unravels all (disclaimers redundant) – [29] • Representations as to other bank’s conduct weaker but arguable – [31]

For. Ex claims: misrepresentation • Graiseley Properties and Unitech Global [2013] EWCA Civ 1372 • Offer alone sufficient conduct: restaurant customer – [28] • Fraud unravels all (disclaimers redundant) – [29] • Representations as to other bank’s conduct weaker but arguable – [31]

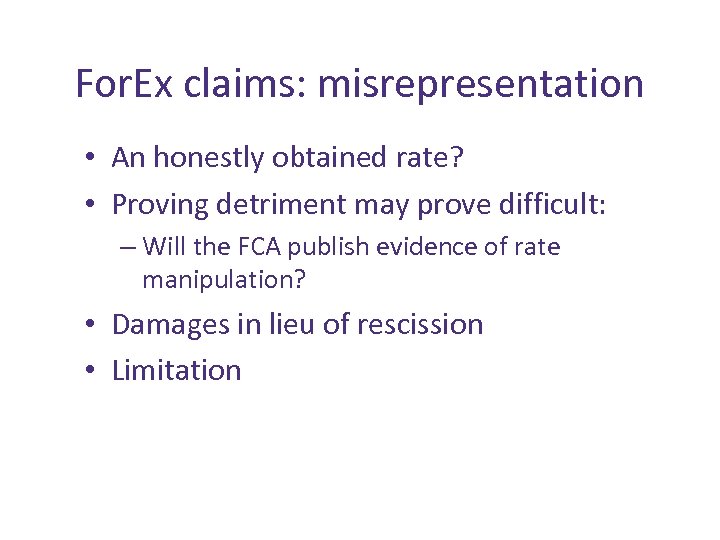

For. Ex claims: misrepresentation • An honestly obtained rate? • Proving detriment may prove difficult: – Will the FCA publish evidence of rate manipulation? • Damages in lieu of rescission • Limitation

For. Ex claims: misrepresentation • An honestly obtained rate? • Proving detriment may prove difficult: – Will the FCA publish evidence of rate manipulation? • Damages in lieu of rescission • Limitation

![For. Ex claims: breach of confidence • Seager v Copydex Ltd [1967] 2 All For. Ex claims: breach of confidence • Seager v Copydex Ltd [1967] 2 All](https://present5.com/presentation/c94b40a0f14a747faba609ac544f4408/image-13.jpg) For. Ex claims: breach of confidence • Seager v Copydex Ltd [1967] 2 All ER 415 at 417: • “The law on this subject does not depend on any implied contract. It depends on the broad principle of equity that he who has received information in confidence shall not take unfair advantage of it. He must not make use of it to the prejudice of him who gave it without obtaining his consent. ”

For. Ex claims: breach of confidence • Seager v Copydex Ltd [1967] 2 All ER 415 at 417: • “The law on this subject does not depend on any implied contract. It depends on the broad principle of equity that he who has received information in confidence shall not take unfair advantage of it. He must not make use of it to the prejudice of him who gave it without obtaining his consent. ”

Questions and Answers Lloyd Maynard LMaynard@forumchambers. com

Questions and Answers Lloyd Maynard LMaynard@forumchambers. com