b05218f2dec295fda522d71a9382ba87.ppt

- Количество слайдов: 61

George R. Brown School of Engineering STATISTICS Historical Backtesting vs. Real-World Positions SECOND EUBANK CONFERENCE: MODELING FINANCIAL MARKETS IN A WORLD OF FIAT MONEY John A. Dobelman Rice University October 18 -19, 2010

2

Outline • • The Asset Allocation Problem The Equity Portfolio Managing the Portfolio Conclusion and Future Work 3

Asset Allocation WSJ, October 19, 2030 4

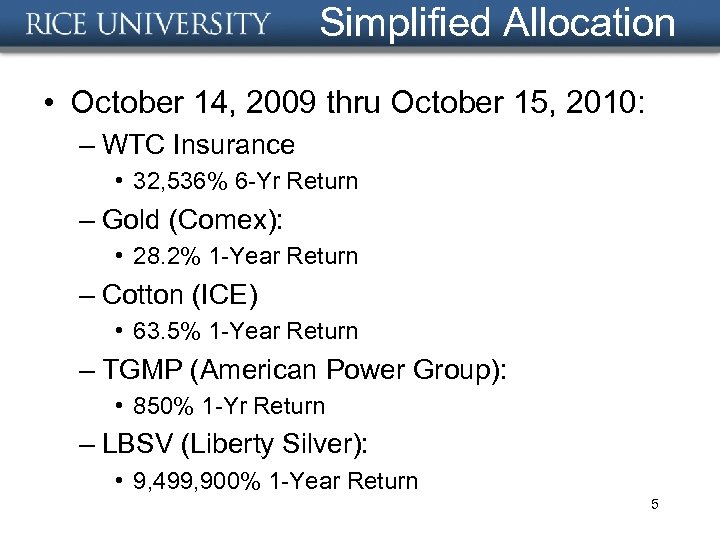

Simplified Allocation • October 14, 2009 thru October 15, 2010: – WTC Insurance • 32, 536% 6 -Yr Return – Gold (Comex): • 28. 2% 1 -Year Return – Cotton (ICE) • 63. 5% 1 -Year Return – TGMP (American Power Group): • 850% 1 -Yr Return – LBSV (Liberty Silver): • 9, 499, 900% 1 -Year Return 5

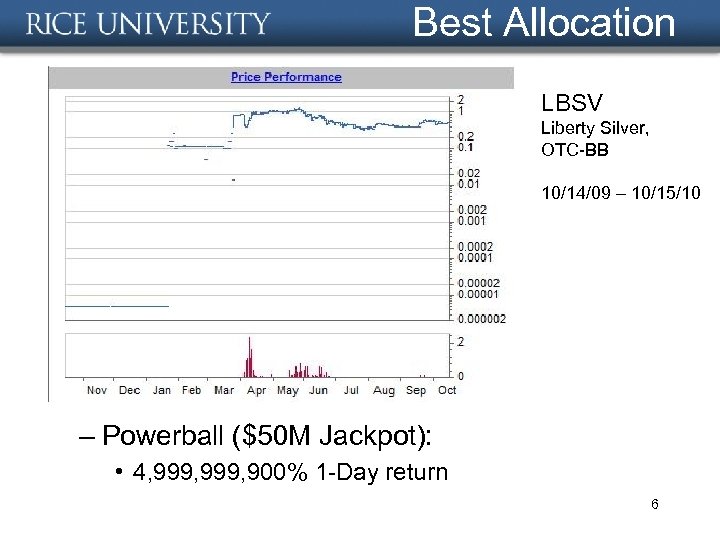

Best Allocation LBSV Liberty Silver, OTC-BB 10/14/09 – 10/15/10 – Powerball ($50 M Jackpot): • 4, 999, 900% 1 -Day return 6

Market Modeling • Primarily for Trading – Determine how much to produce/buy – Capacity allocation – Hedging application – Speculation! • Not Necessary for LT Holding – LT holding returns → GBM model – Given that, looking for w=(w 1, …, wk) 7

BAH ≠ BAH • Active portfolio management required – "Indexes are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. “ -DFA • Even the E-V portfolios require rebalancing to maintain MV construction • For – SBAH = BAH + Div. Mgt + Tender + Tax + Realloc 8

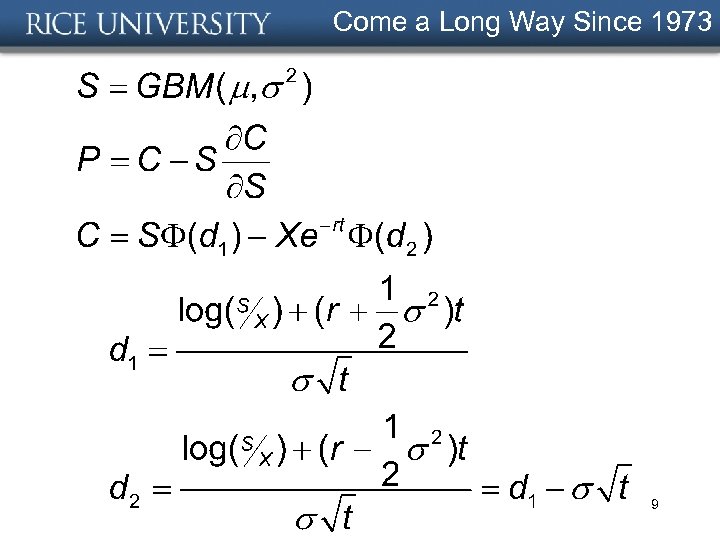

Come a Long Way Since 1973 9

ACC 2010 • 2010 American Control Conference – Operations to Finance: Opportunities for Control Theory and Application • Control Systems Methods in Finance: Modeling and Optimal Trading, Primbs, Stanford University, and Barmish, Univ. Wisconsin • Interfaces between control theory and finance • Dynamic hedging as a stochastic control problem • LQ and receding horizon control methodolgies 10

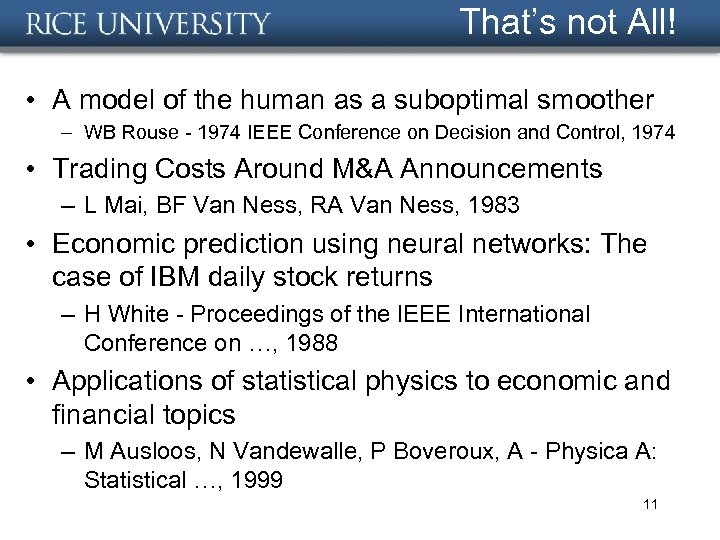

That’s not All! • A model of the human as a suboptimal smoother – WB Rouse - 1974 IEEE Conference on Decision and Control, 1974 • Trading Costs Around M&A Announcements – L Mai, BF Van Ness, RA Van Ness, 1983 • Economic prediction using neural networks: The case of IBM daily stock returns – H White - Proceedings of the IEEE International Conference on …, 1988 • Applications of statistical physics to economic and financial topics – M Ausloos, N Vandewalle, P Boveroux, A - Physica A: Statistical …, 1999 11

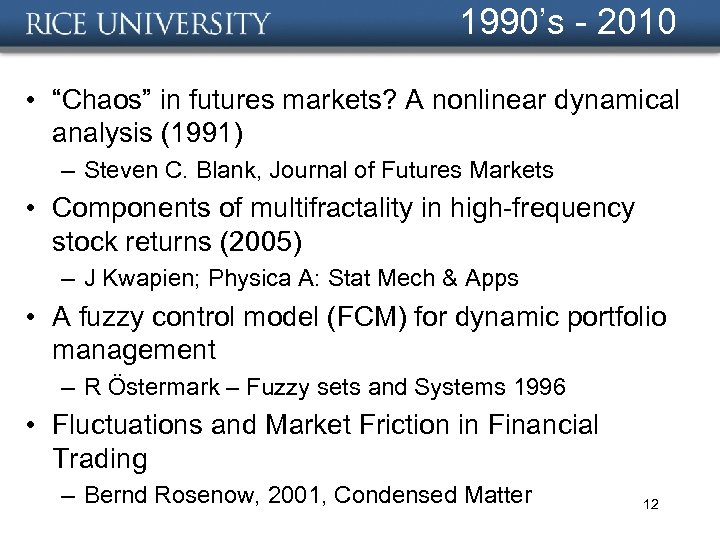

1990’s - 2010 • “Chaos” in futures markets? A nonlinear dynamical analysis (1991) – Steven C. Blank, Journal of Futures Markets • Components of multifractality in high-frequency stock returns (2005) – J Kwapien; Physica A: Stat Mech & Apps • A fuzzy control model (FCM) for dynamic portfolio management – R Östermark – Fuzzy sets and Systems 1996 • Fluctuations and Market Friction in Financial Trading – Bernd Rosenow, 2001, Condensed Matter 12

1990’s - 2010 • Stochastic Lotka-Volterra Systems of Competing Auto-Catalytic Agents Lead Generically to Truncated Pareto Power Wealth Distribution, Truncated Levy Distribution of Market Returns, Clustered Volatility, Booms and Crashes – Sorin Solomon (Hebrew University) Submitted on 30 Mar 1998) Computational Finance 97 • THE JOINT PRICING OF VOLATILITY AND LIQUIDITY! – F. Bandi, C. E. Moise, and J. Russell, 2008 • Liquidity skewness – R Roll, A Subrahmanyam - Journal of Banking & Finance, 2010 13

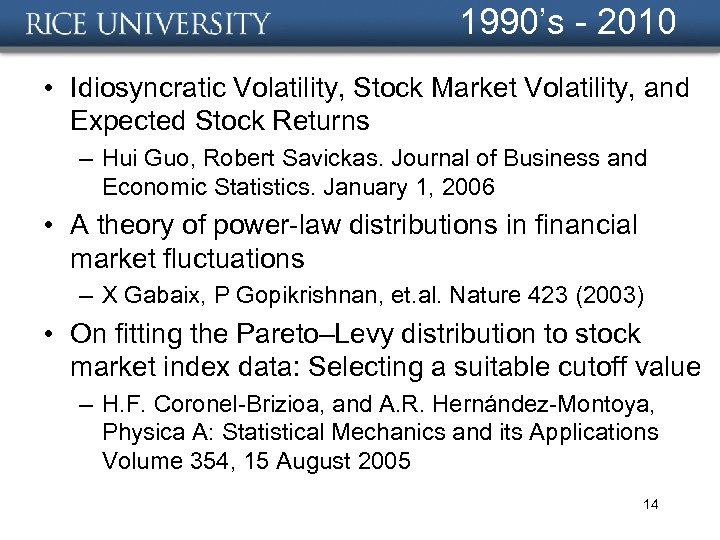

1990’s - 2010 • Idiosyncratic Volatility, Stock Market Volatility, and Expected Stock Returns – Hui Guo, Robert Savickas. Journal of Business and Economic Statistics. January 1, 2006 • A theory of power-law distributions in financial market fluctuations – X Gabaix, P Gopikrishnan, et. al. Nature 423 (2003) • On fitting the Pareto–Levy distribution to stock market index data: Selecting a suitable cutoff value – H. F. Coronel-Brizioa, and A. R. Hernández-Montoya, Physica A: Statistical Mechanics and its Applications Volume 354, 15 August 2005 14

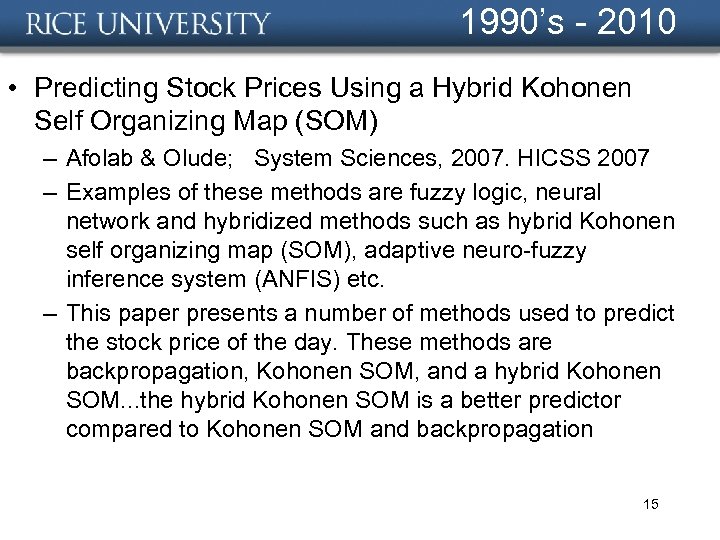

1990’s - 2010 • Predicting Stock Prices Using a Hybrid Kohonen Self Organizing Map (SOM) – Afolab & Olude; System Sciences, 2007. HICSS 2007 – Examples of these methods are fuzzy logic, neural network and hybridized methods such as hybrid Kohonen self organizing map (SOM), adaptive neuro-fuzzy inference system (ANFIS) etc. – This paper presents a number of methods used to predict the stock price of the day. These methods are backpropagation, Kohonen SOM, and a hybrid Kohonen SOM. . . the hybrid Kohonen SOM is a better predictor compared to Kohonen SOM and backpropagation 15

Orthodoxy • Departures from the EMH Market Portfolio – Market – Departure 1 – Departure 2 – Departure 3 – Departure 4 – Departure 5 – Departure 6 – Departure 7 Ω=ΩEPriv Ω=ΩS Ω=ΩIndex Ω→Your E-V portfolio, m and s Ω→Your E-V portfolio, Ω→ Some other portfolio P 16

Portfolio Construction • Remark: Ω=Ωindex – Wilshire 5000, SP 500, RUT 3000, Value-Line, DOW 30, etc. , are ALL actively determined portfolios. – Only “recently” could you buy into a mutual fund/ETF which attempts to replicate these indexes • Unless you inherit a portfolio, you must create one, or build one over time. 17

Portfolio Construction • Fundamental analysis – Slow and time-consuming • Technical Analysis – Value Line – O’Neil /Investors Business Daily – Efficacy in question • Quantitative Portfolio Management – Formulation – Management – Allows statistics-based portfolio strategies 18

Portfolio Formulation You Must Pick 10 Stocks 19

How Much Would You Pay? 20

For This? 21

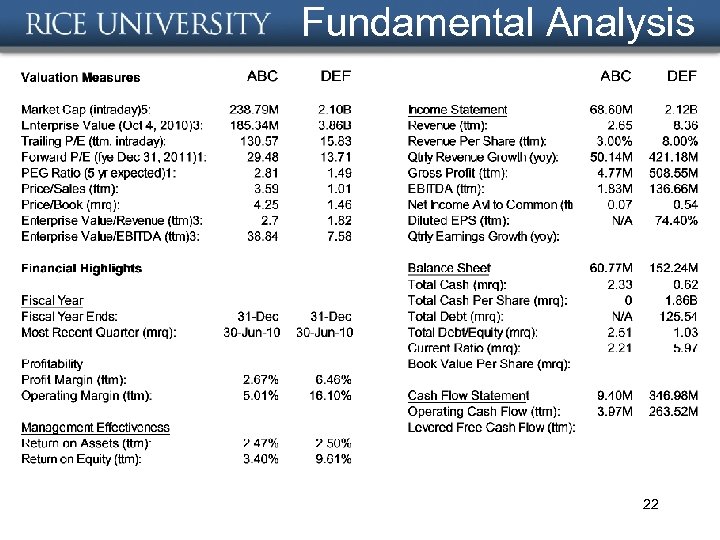

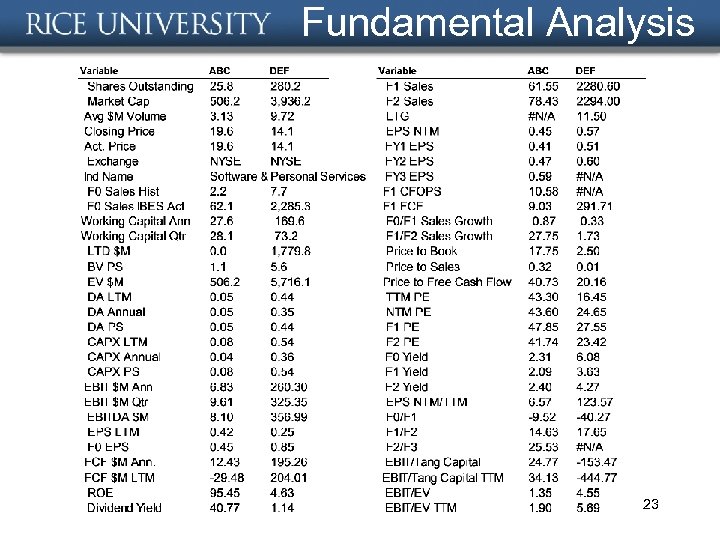

Fundamental Analysis 22

Fundamental Analysis 23

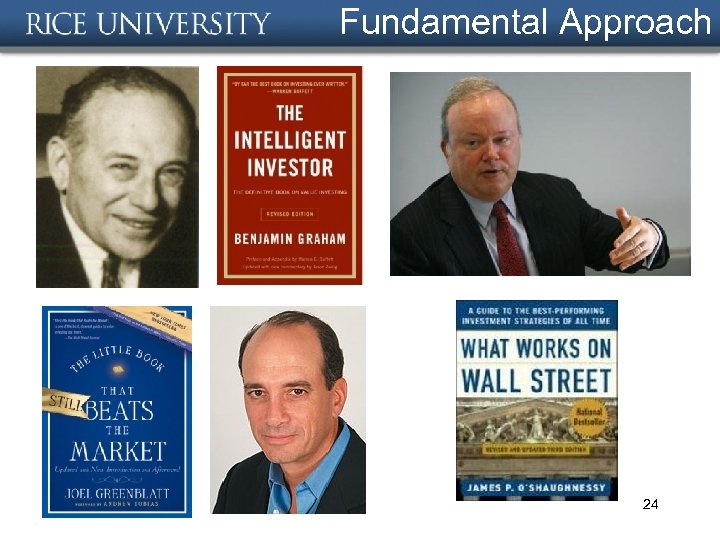

Fundamental Approach 24

Outliers/Outliars 25

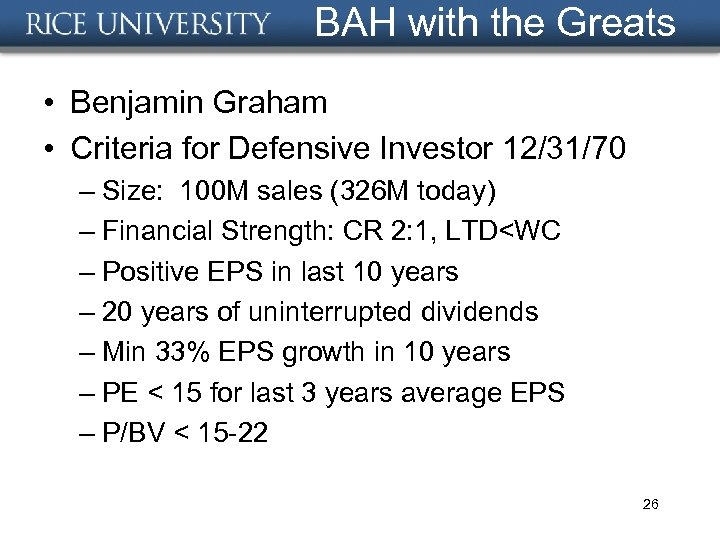

BAH with the Greats • Benjamin Graham • Criteria for Defensive Investor 12/31/70 – Size: 100 M sales (326 M today) – Financial Strength: CR 2: 1, LTD<WC – Positive EPS in last 10 years – 20 years of uninterrupted dividends – Min 33% EPS growth in 10 years – PE < 15 for last 3 years average EPS – P/BV < 15 -22 26

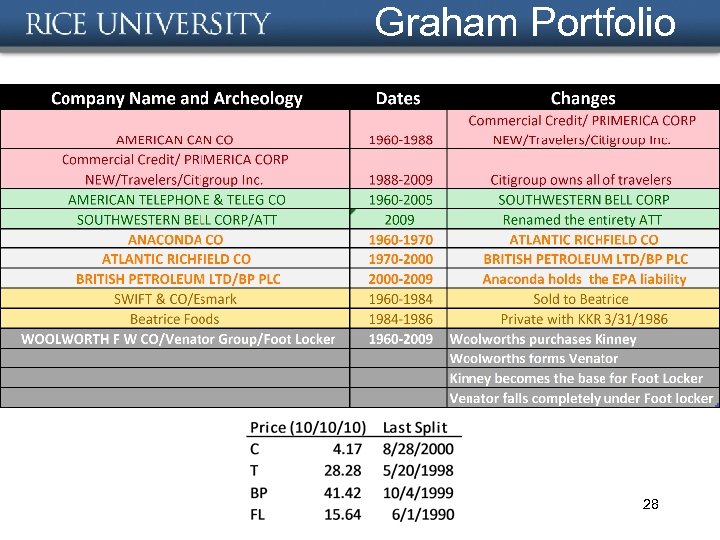

Graham Portfolio • As of 12/31/1970, this was the portoflio – AC, American Can – T, AT&T – A, Anaconda – SWX, Swift – Z, F. W. Woolworth • Bring up to the present – 1/4/1971 - End 27

Graham Portfolio 28

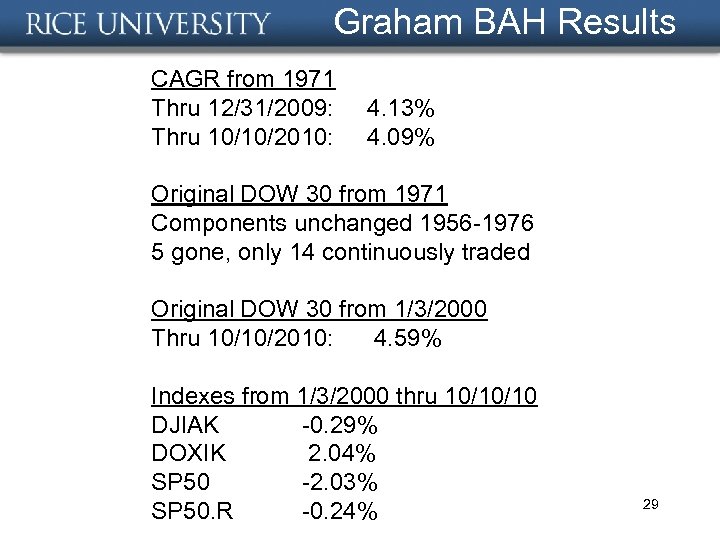

Graham BAH Results CAGR from 1971 Thru 12/31/2009: Thru 10/10/2010: 4. 13% 4. 09% Original DOW 30 from 1971 Components unchanged 1956 -1976 5 gone, only 14 continuously traded Original DOW 30 from 1/3/2000 Thru 10/10/2010: 4. 59% Indexes from 1/3/2000 thru 10/10/10 DJIAK -0. 29% DOXIK 2. 04% SP 50 -2. 03% SP 50. R -0. 24% 29

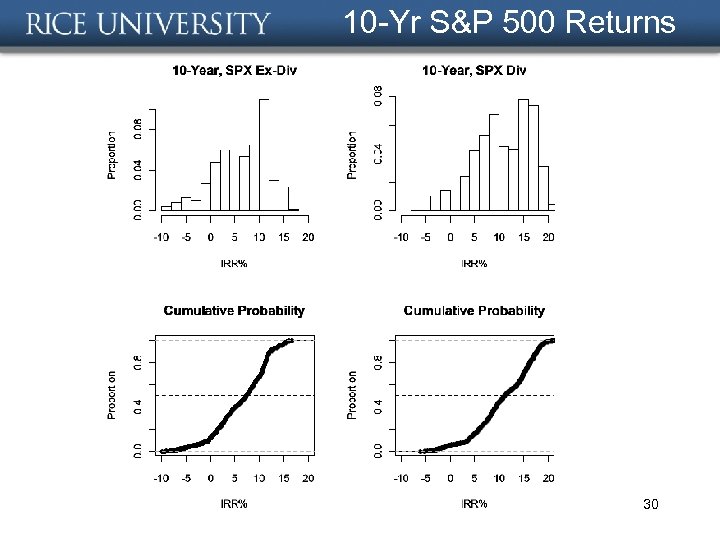

10 -Yr S&P 500 Returns 30

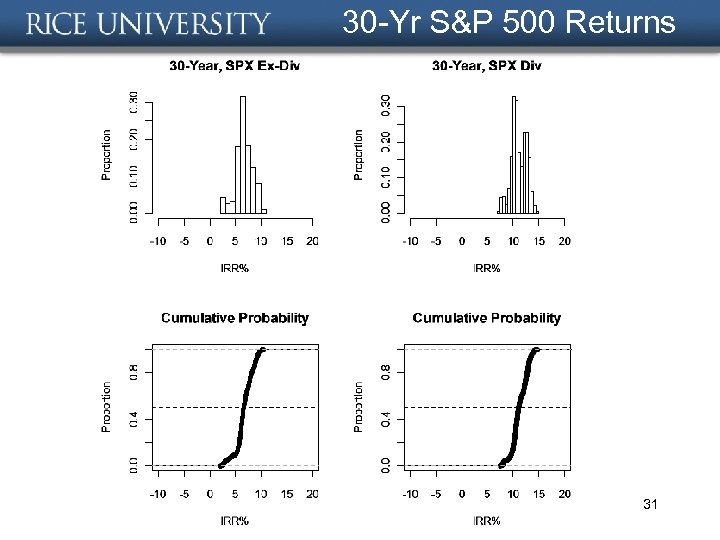

30 -Yr S&P 500 Returns 31

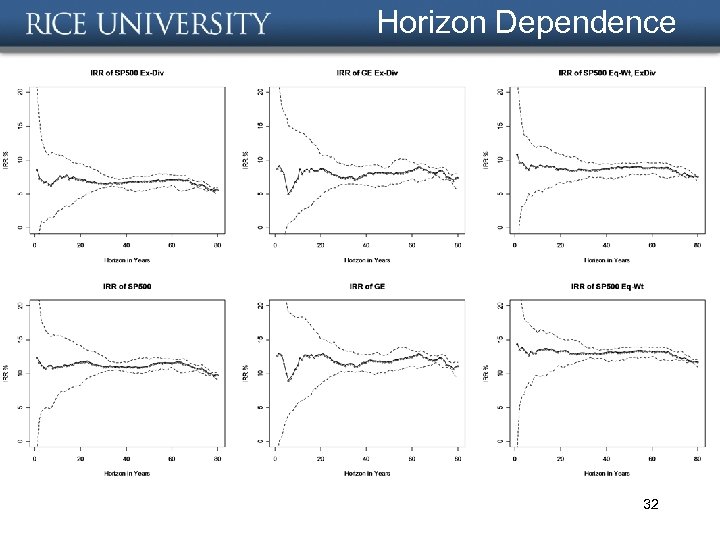

Horizon Dependence 32

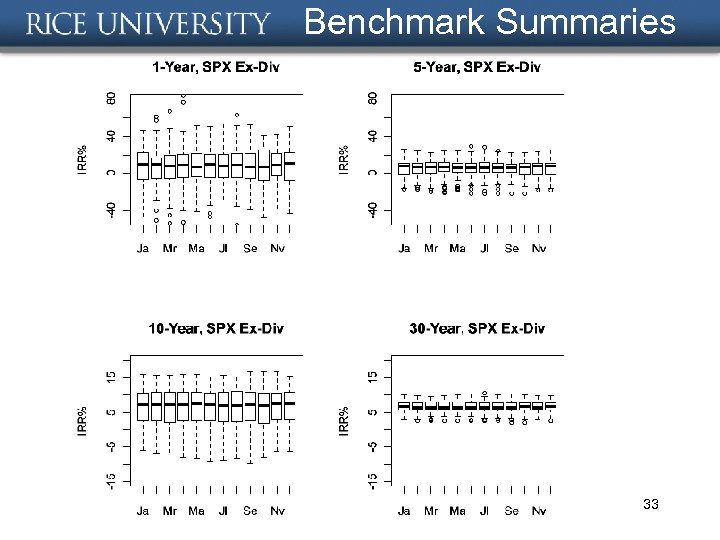

Benchmark Summaries 33

Benchmarks • 50 -Year Real Returns of 7% (Siegel, 2002) – 1802 – 1870 (Schwert) – 1871 – 1925 (Cowles) – 1926 – 2001 (CRSP, all NYSE/AMEX/NASD) – Post WWII 1946 – 2001 • Most inflation has been during this period 34

Benchmarks 35

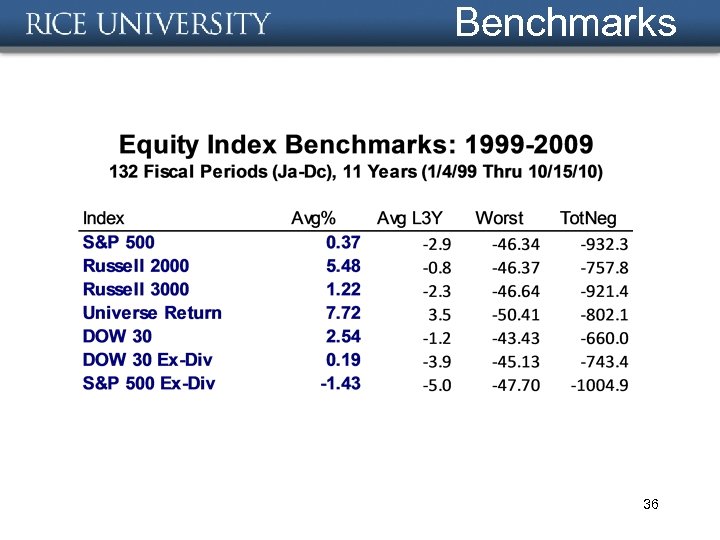

Benchmarks 36

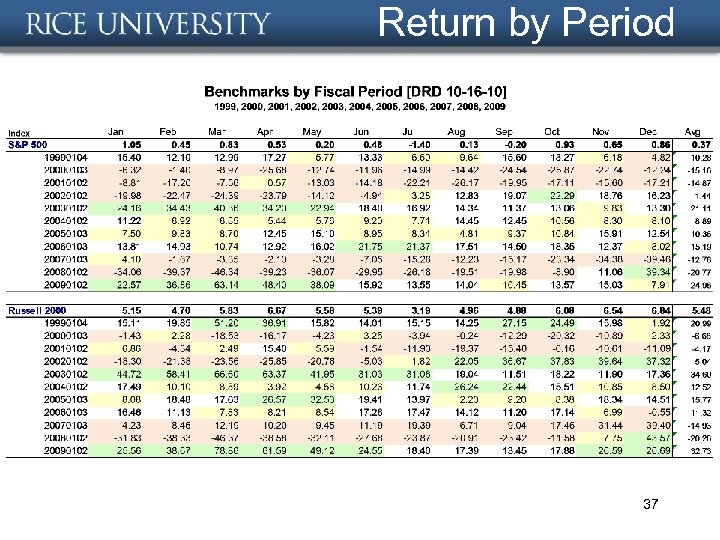

Return by Period 37

QPM • Anomalies Research • Ripe with Outperformance Goal – Market Outperformance: 433, 000 – "Seeking Alpha“: 922, 000 • Poor performance of mutual funds • Quantitative Portfolio Management – Matching market index – Outperforming market index – “Beat the Index” 38

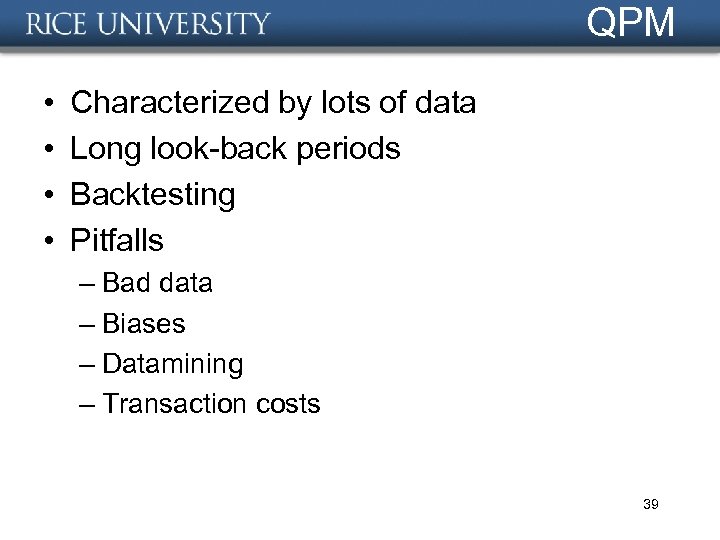

QPM • • Characterized by lots of data Long look-back periods Backtesting Pitfalls – Bad data – Biases – Datamining – Transaction costs 39

Statistical QPM • Lots and lots of quantitative funds – Good job prospects, BTW: E. g. , • Quantitative Portfolio Analyst - Asset Manager for a Leading Hedge Fund – Diversification and expansion has seen them create a traditional asset management fund. – New York; Up to $200 k + standard benefits and excellent bonus potential • Options Strategy • Public Domain • Simugram 40

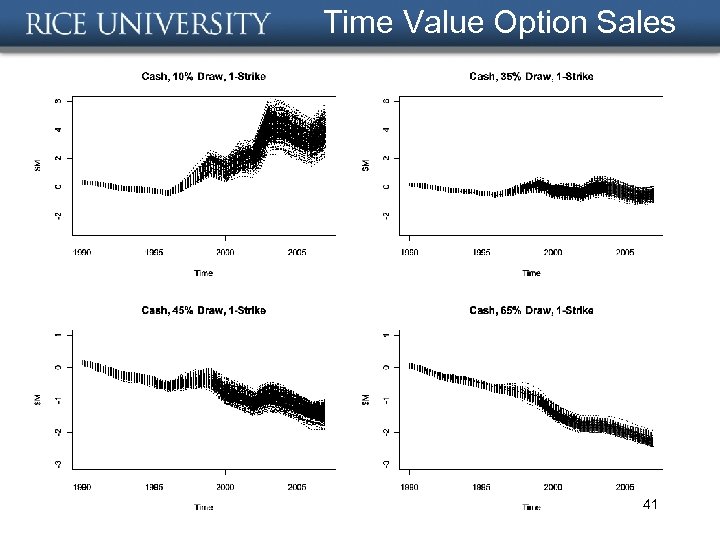

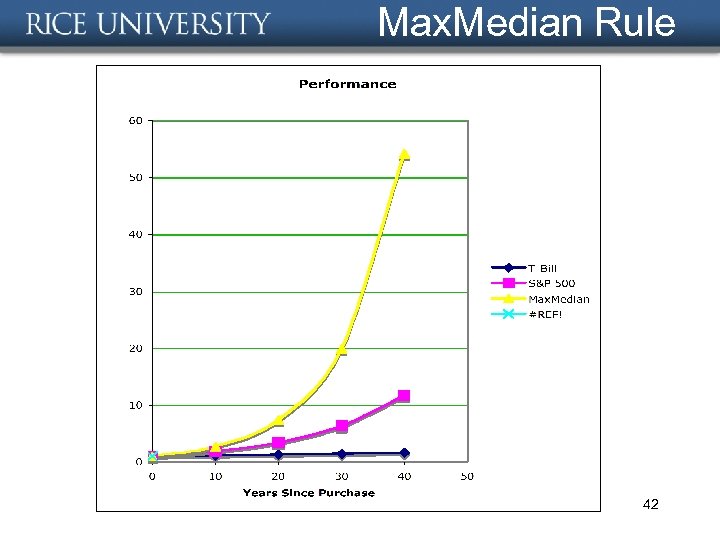

Time Value Option Sales 41

Max. Median Rule 42

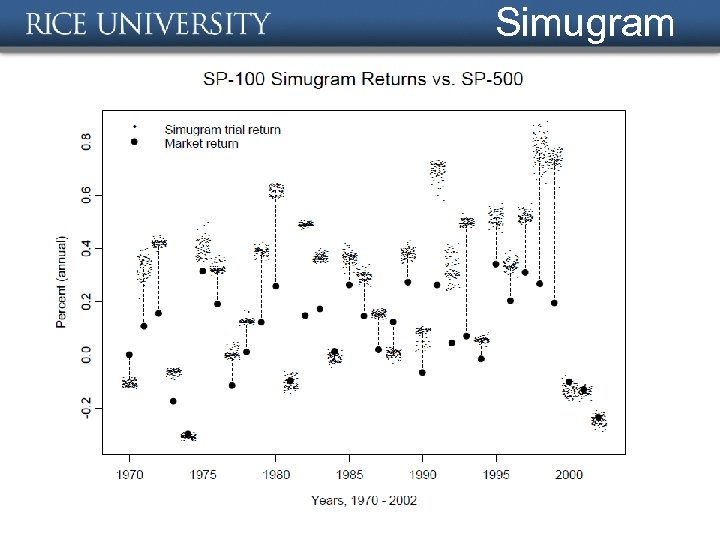

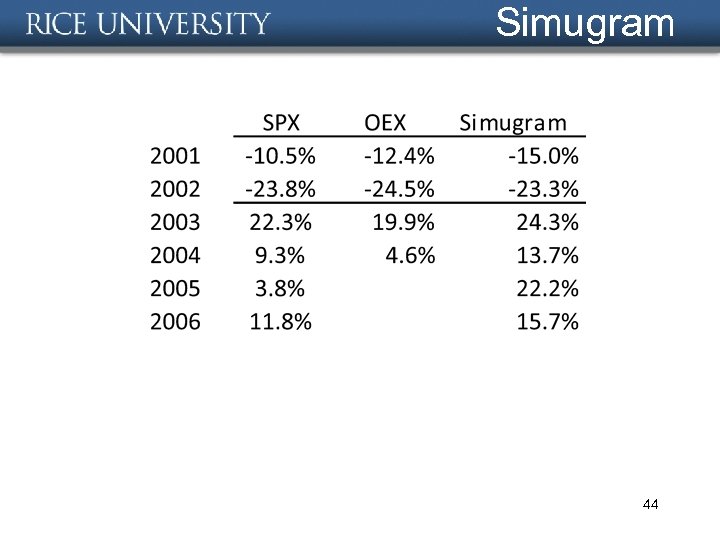

Simugram 43

Simugram 44

Fundamentals QPM • • Graham-Dodd on Steroids Exploit available data Try and sell for OPM Examples: – O'Shaughnessy – Greenblatt – Homegrown • What happens in real life 45

James P. O'Shaughnessy • c 1920: Ignatius Aloysius O'Shaughnessy – $110 million, I A O'Shaughnessy Foundation – Avoided 20’s stocks, fed his own companies – 66 years > $10 M > $5. 4 B (at 10%) • 1960: Jim O'Shaughnessy's Investment Horizon began • 1986: BA Econ, University of Minnesota – Began work at the family's VC firm • 1988: O'Shaughnessy Capital Mgmt, Inc. – Consulting to Institutional Investors 46

O'Shaughnessy (CONT’D) • • 1995: Compustat (Standard & Poor's) 1996: Cornerstone Growth and Value Funds 1997: "What Works on Wall Street“, RBC 2000: Sold Cornerstone to Hennessey – $200 M Assets as of 6/30/00 • 2001: Sold O'Shaughnessy Capital to BSC – About $500 M • 2005: Updated WWOWS 47

O'Shaughnessy (CONT’D) • 3 Q 2007: O'Shaughnessy Asset Mgmt, LLC – Unwound in BSCM sale to JPM – Taking $8 B out BSAM's $44 B • Strategy – Benchmark: RUT 2000 – No regard for sector – Growth: EPS Growth, 52 W Price Increase, P/S – Value: Div Yield, LTM P/S , LTM P/CF 48

O'Shaughnessy (CONT’D) • Dreyfus Premier Alpha Growth Fund – 1, 600 companies – 300 largest-market-cap – 130 after P/E, 52 W Price Incr, then by P/S – Quarterly validation – Dumping rules • • loss of 50% of market value takeover that doesn't meet the screens' criteria allegations of fraud bankruptcy 49

O'Shaughnessy-esgue • Recall 11 -year benchmarks: 50

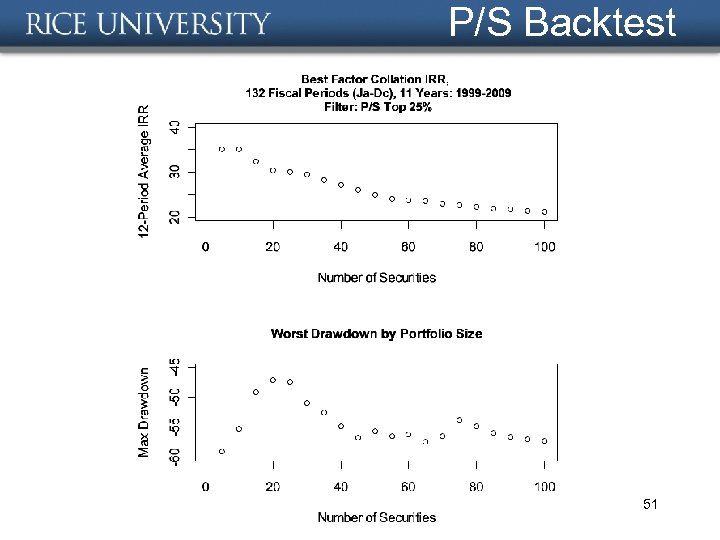

P/S Backtest 51

Starting and Stopping Times • • Backtested 1950 thru 1996 (47 years) Selected best factors (e. g. , P/S) Started his funds Got lucky? In 4 years up about 166% vs. 75% for the market • Got lucky? Sold to Hennessey at peak • Got bad rap, 2000 -2002 worse than market 52

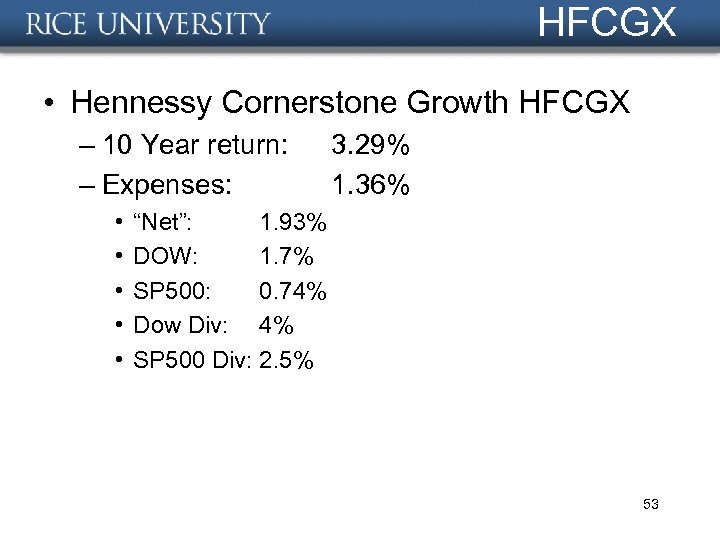

HFCGX • Hennessy Cornerstone Growth HFCGX – 10 Year return: – Expenses: • • • 3. 29% 1. 36% “Net”: 1. 93% DOW: 1. 7% SP 500: 0. 74% Dow Div: 4% SP 500 Div: 2. 5% 53

HFCGX 54

Rules of the Game • • How much can your investors stomach Restrictions on redemptions Success begets loyalty Success depends on starting time 55

Another Example • 10 year horizon • Backtested 99 -06, 12 fiscal periods (without drawdown constraint) • Selected best factors (Screen#1) • Out-of-sample returns were still good; (encouraging) • Drawdowns horrible • Developed Screen#2 with drawdown constraint 56

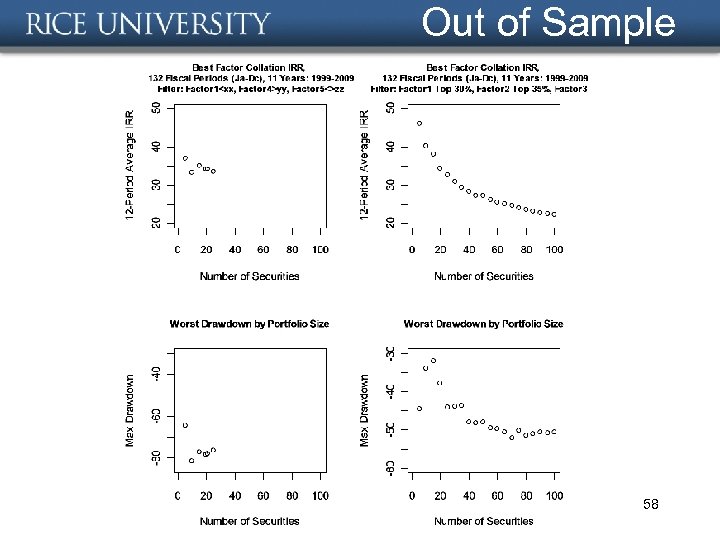

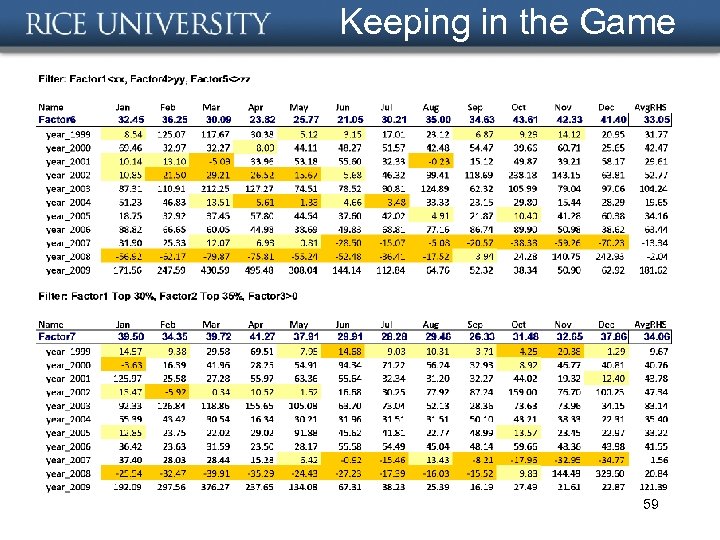

Real Example, CONT’D • In 99 -06 backtest, best return factor had drawdowns of: – Screen#1 – Screen#2 31% 20% • In 99 -09 OOS sample testing, best return factors remained the same (and equal IRR’s of 33 -34%), but with drawdowns of: – Screen#1 – Screen#2 79. 9% 39% 57

Out of Sample 58

Keeping in the Game 59

SYWTBAMM? • Survival • This is not an easy undertaking • Survival depends on your starting time and redemption restrictions • Young funds can have the least restrictive redemption requirements 60

A Special Thanks To: • • • Eubank Benefactors Profs. J. R. Thompson and E. E. Williams K. B. Ensor, Chair of Co. FES TRU – Dept. of Statistics Collaborators 61

b05218f2dec295fda522d71a9382ba87.ppt