d2408687e36e6bd533150eb4fac9e820.ppt

- Количество слайдов: 12

George Moundreas & CO. SA Dry Cargo Segment – A Transition Period. . . Past – Present – Opportunities ? February 2013 George Logothetis

George Moundreas & CO. SA Dry Cargo Segment – A Transition Period. . . Past – Present – Opportunities ? February 2013 George Logothetis

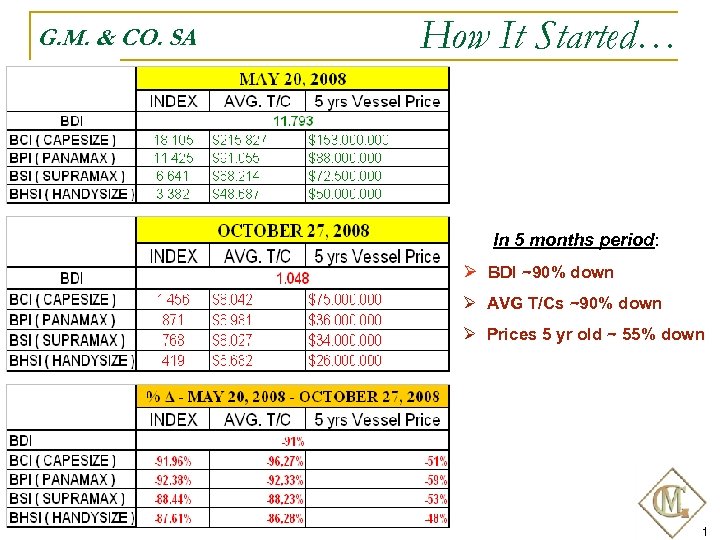

G. M. & CO. SA How It Started… In 5 months period: Ø BDI ~90% down Ø AVG T/Cs ~90% down Ø Prices 5 yr old ~ 55% down 1

G. M. & CO. SA How It Started… In 5 months period: Ø BDI ~90% down Ø AVG T/Cs ~90% down Ø Prices 5 yr old ~ 55% down 1

G. M. & CO. SA What Happened Since Then… BDI 2009: Low 773, High 4. 000, Closing 3. 000 BDI 2010: Avg. 2. 500, Closing 1. 771 BDI 2011: Avg. 1. 700 , Closing 1. 738 BDI 2012: Avg. 920 , Closing 699 World Trade expanded 2. 5% in 2012, in 2011 by 5%, a sharp deceleration from the 2010 rebound of 13. 8%. In 2009 it was 12% down. Rate of World output for 2012 at 3. 3% from 2. 4% in 2011 and 3. 8 % up in 2010. The average pace of expansion for the 20 years leading up to the financial crisis in 2008 was 3. 2 % Today, the BDI is around 750, a little higher from the lows of 2008 and an Avg. of ~ 750 pts. 2

G. M. & CO. SA What Happened Since Then… BDI 2009: Low 773, High 4. 000, Closing 3. 000 BDI 2010: Avg. 2. 500, Closing 1. 771 BDI 2011: Avg. 1. 700 , Closing 1. 738 BDI 2012: Avg. 920 , Closing 699 World Trade expanded 2. 5% in 2012, in 2011 by 5%, a sharp deceleration from the 2010 rebound of 13. 8%. In 2009 it was 12% down. Rate of World output for 2012 at 3. 3% from 2. 4% in 2011 and 3. 8 % up in 2010. The average pace of expansion for the 20 years leading up to the financial crisis in 2008 was 3. 2 % Today, the BDI is around 750, a little higher from the lows of 2008 and an Avg. of ~ 750 pts. 2

G. M. & CO. SA What is happening today… Over Supply of all types of vessels in terms of tonnage A total of about 12% gross increase of the dry cargo fleet or 7% net in 2012. Since the end of 2009 the fleet has expanded about 51% in DWT, while the volume of Dry Bulk trade increased less by 20%. Demolition activity at record levels. Estimated around 35 million tones DWT for 2012. The average demolition age has been reduced to ~ 27 years Total number of vessels about 9, 100 gross or 670 million tones. Capes and Panamaxes face the most over supply, Handymax and Handysize the least. 4

G. M. & CO. SA What is happening today… Over Supply of all types of vessels in terms of tonnage A total of about 12% gross increase of the dry cargo fleet or 7% net in 2012. Since the end of 2009 the fleet has expanded about 51% in DWT, while the volume of Dry Bulk trade increased less by 20%. Demolition activity at record levels. Estimated around 35 million tones DWT for 2012. The average demolition age has been reduced to ~ 27 years Total number of vessels about 9, 100 gross or 670 million tones. Capes and Panamaxes face the most over supply, Handymax and Handysize the least. 4

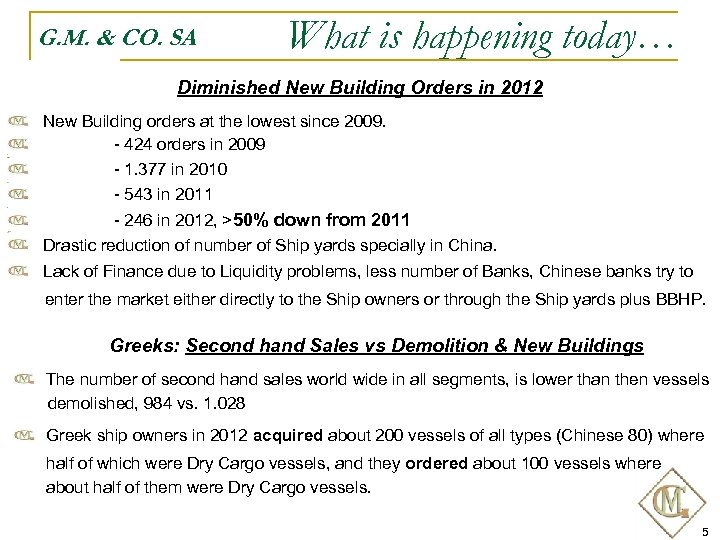

G. M. & CO. SA What is happening today… Diminished New Building Orders in 2012 New Building orders at the lowest since 2009. - 424 orders in 2009 - 1. 377 in 2010 - 543 in 2011 - 246 in 2012, >50% down from 2011 Drastic reduction of number of Ship yards specially in China. Lack of Finance due to Liquidity problems, less number of Banks, Chinese banks try to enter the market either directly to the Ship owners or through the Ship yards plus BBHP. Greeks: Second hand Sales vs Demolition & New Buildings The number of second hand sales world wide in all segments, is lower than then vessels demolished, 984 vs. 1. 028 Greek ship owners in 2012 acquired about 200 vessels of all types (Chinese 80) where half of which were Dry Cargo vessels, and they ordered about 100 vessels where about half of them were Dry Cargo vessels. 5

G. M. & CO. SA What is happening today… Diminished New Building Orders in 2012 New Building orders at the lowest since 2009. - 424 orders in 2009 - 1. 377 in 2010 - 543 in 2011 - 246 in 2012, >50% down from 2011 Drastic reduction of number of Ship yards specially in China. Lack of Finance due to Liquidity problems, less number of Banks, Chinese banks try to enter the market either directly to the Ship owners or through the Ship yards plus BBHP. Greeks: Second hand Sales vs Demolition & New Buildings The number of second hand sales world wide in all segments, is lower than then vessels demolished, 984 vs. 1. 028 Greek ship owners in 2012 acquired about 200 vessels of all types (Chinese 80) where half of which were Dry Cargo vessels, and they ordered about 100 vessels where about half of them were Dry Cargo vessels. 5

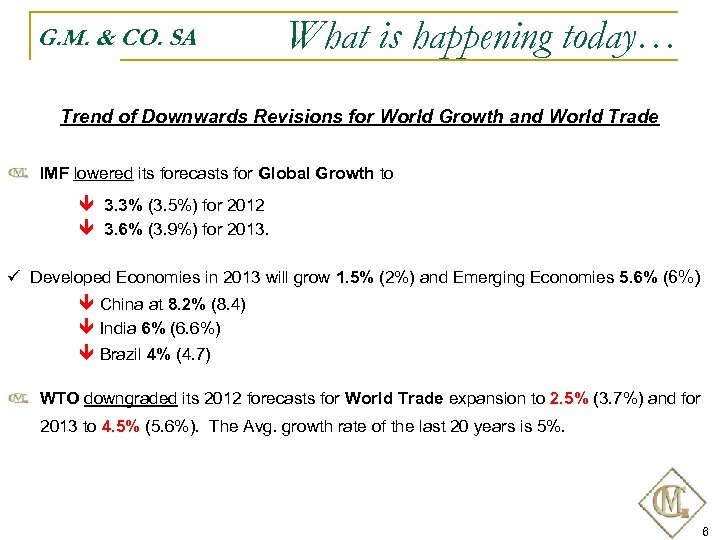

G. M. & CO. SA What is happening today… Trend of Downwards Revisions for World Growth and World Trade IMF lowered its forecasts for Global Growth to ê 3. 3% (3. 5%) for 2012 ê 3. 6% (3. 9%) for 2013. ü Developed Economies in 2013 will grow 1. 5% (2%) and Emerging Economies 5. 6% (6%) ê China at 8. 2% (8. 4) ê India 6% (6. 6%) ê Brazil 4% (4. 7) WTO downgraded its 2012 forecasts for World Trade expansion to 2. 5% (3. 7%) and for 2013 to 4. 5% (5. 6%). The Avg. growth rate of the last 20 years is 5%. 6

G. M. & CO. SA What is happening today… Trend of Downwards Revisions for World Growth and World Trade IMF lowered its forecasts for Global Growth to ê 3. 3% (3. 5%) for 2012 ê 3. 6% (3. 9%) for 2013. ü Developed Economies in 2013 will grow 1. 5% (2%) and Emerging Economies 5. 6% (6%) ê China at 8. 2% (8. 4) ê India 6% (6. 6%) ê Brazil 4% (4. 7) WTO downgraded its 2012 forecasts for World Trade expansion to 2. 5% (3. 7%) and for 2013 to 4. 5% (5. 6%). The Avg. growth rate of the last 20 years is 5%. 6

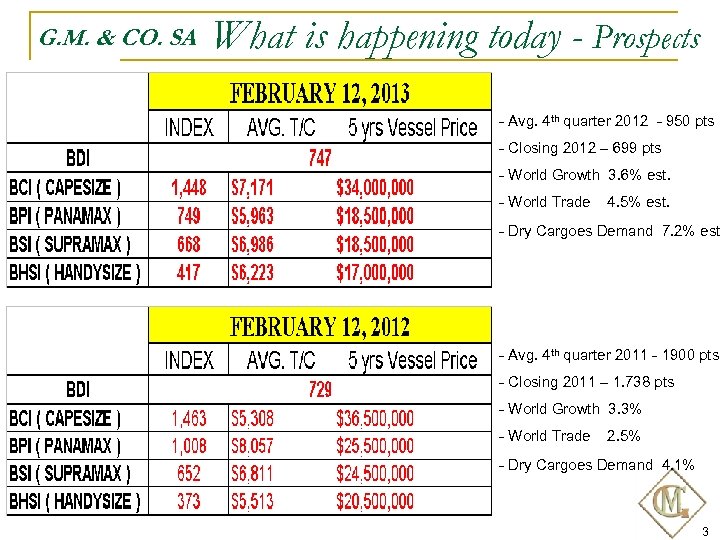

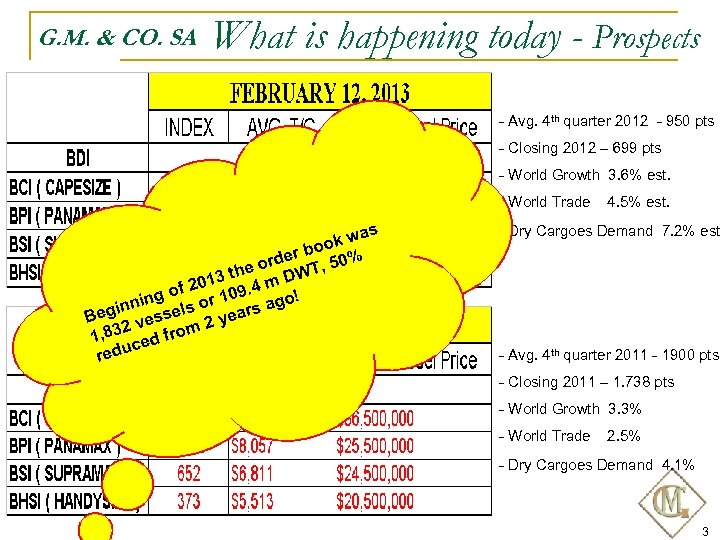

G. M. & CO. SA What is happening today - Prospects - Avg. 4 th quarter 2012 - 950 pts - Closing 2012 – 699 pts - World Growth 3. 6% est. - World Trade 4. 5% est. - Dry Cargoes Demand 7. 2% est - Avg. 4 th quarter 2011 - 1900 pts - Closing 2011 – 1. 738 pts - World Growth 3. 3% - World Trade 2. 5% - Dry Cargoes Demand 4. 1% 3

G. M. & CO. SA What is happening today - Prospects - Avg. 4 th quarter 2012 - 950 pts - Closing 2012 – 699 pts - World Growth 3. 6% est. - World Trade 4. 5% est. - Dry Cargoes Demand 7. 2% est - Avg. 4 th quarter 2011 - 1900 pts - Closing 2011 – 1. 738 pts - World Growth 3. 3% - World Trade 2. 5% - Dry Cargoes Demand 4. 1% 3

G. M. & CO. SA What is happening today - Prospects - Avg. 4 th quarter 2012 - 950 pts - Closing 2012 – 699 pts - World Growth 3. 6% est. - World Trade as ok w bo rder T, 50% eo 3 th m DW 01 of 2 109. 4 o! ng inni sels or ears ag Beg ves 2 y , 832 d from 1 ce redu 4. 5% est. - Dry Cargoes Demand 7. 2% est - Avg. 4 th quarter 2011 - 1900 pts - Closing 2011 – 1. 738 pts - World Growth 3. 3% - World Trade 2. 5% - Dry Cargoes Demand 4. 1% 3

G. M. & CO. SA What is happening today - Prospects - Avg. 4 th quarter 2012 - 950 pts - Closing 2012 – 699 pts - World Growth 3. 6% est. - World Trade as ok w bo rder T, 50% eo 3 th m DW 01 of 2 109. 4 o! ng inni sels or ears ag Beg ves 2 y , 832 d from 1 ce redu 4. 5% est. - Dry Cargoes Demand 7. 2% est - Avg. 4 th quarter 2011 - 1900 pts - Closing 2011 – 1. 738 pts - World Growth 3. 3% - World Trade 2. 5% - Dry Cargoes Demand 4. 1% 3

G. M. & CO. SA Opportunities ? SWOT ANALYSIS Strengths: Weaknesses: Determined by the current Financial position of each company. Opportunities: High Demolition prices (Minimization of Losses – Cash Injection). Fleet expansion - Low Second Hand & New Building Prices with favourable payment terms, back-end loaded. Reduction in average fleet. Diversification in size. Market Leader in new ECO type vessels and tonnage. Threats: Eurozone Crisis. USA – Debt – Tax Reform – Budget approval. Chinese growth stabilized at current levels. Geopolitical issues – China & Japan - Arab Spring Rising of Protectionism – For. Ex. 7

G. M. & CO. SA Opportunities ? SWOT ANALYSIS Strengths: Weaknesses: Determined by the current Financial position of each company. Opportunities: High Demolition prices (Minimization of Losses – Cash Injection). Fleet expansion - Low Second Hand & New Building Prices with favourable payment terms, back-end loaded. Reduction in average fleet. Diversification in size. Market Leader in new ECO type vessels and tonnage. Threats: Eurozone Crisis. USA – Debt – Tax Reform – Budget approval. Chinese growth stabilized at current levels. Geopolitical issues – China & Japan - Arab Spring Rising of Protectionism – For. Ex. 7

G. M. & CO. SA Opportunities ? SWOT ANALYSIS CS SI BA E H NG” T TO IS KI K AC A$H B “C Strengths: Weaknesses: Determined by the current Financial position of each company. Opportunities: High Demolition prices (Minimization of Losses – Cash Injection). Fleet expansion - Low Second Hand & New Building Prices with favourable payment terms, back-end loaded. Reduction in average fleet. Diversification in size. Market Leader in new ECO type vessels and tonnage. Threats: Eurozone Crisis. USA – Debt – Tax Reform – Budget approval. Chinese growth stabilized at current levels. Geopolitical issues – China & Japan - Arab Spring Rising of Protectionism – For. Ex. 7

G. M. & CO. SA Opportunities ? SWOT ANALYSIS CS SI BA E H NG” T TO IS KI K AC A$H B “C Strengths: Weaknesses: Determined by the current Financial position of each company. Opportunities: High Demolition prices (Minimization of Losses – Cash Injection). Fleet expansion - Low Second Hand & New Building Prices with favourable payment terms, back-end loaded. Reduction in average fleet. Diversification in size. Market Leader in new ECO type vessels and tonnage. Threats: Eurozone Crisis. USA – Debt – Tax Reform – Budget approval. Chinese growth stabilized at current levels. Geopolitical issues – China & Japan - Arab Spring Rising of Protectionism – For. Ex. 7

G. M. & CO. SA What about us…The Greeks According to the latest data by UNCTAD, Greece continues to be the leader in the World Shipping Industry in terms of Carrying (Transport) Capacity. The World fleet consists of 46, 901 vessels with Carrying Capacity of 1. 518. 109, 503 DWT Greece has the fourth largest fleet in terms of number of vessels (3, 321), but the volume of the fleet is primarily measured in terms of deadweight tonnage, in which Greece comes first (224, 051, 881 dwt), granting it thus the largest estimated share in the transport of global seaborne trade (16, 10% market share). Following Greece are Japan in 2 nd positon, Germany, China and South Korea in 3 rd, 4 th and 5 th respectively.

G. M. & CO. SA What about us…The Greeks According to the latest data by UNCTAD, Greece continues to be the leader in the World Shipping Industry in terms of Carrying (Transport) Capacity. The World fleet consists of 46, 901 vessels with Carrying Capacity of 1. 518. 109, 503 DWT Greece has the fourth largest fleet in terms of number of vessels (3, 321), but the volume of the fleet is primarily measured in terms of deadweight tonnage, in which Greece comes first (224, 051, 881 dwt), granting it thus the largest estimated share in the transport of global seaborne trade (16, 10% market share). Following Greece are Japan in 2 nd positon, Germany, China and South Korea in 3 rd, 4 th and 5 th respectively.

George Moundreas & CO. SA February 2013 George Logothetis

George Moundreas & CO. SA February 2013 George Logothetis