e6ddf45000eda05353bdf8c697341003.ppt

- Количество слайдов: 18

Geo-politics & Oil Russia’s changing investment landscape Chris Weafer Senior Partner, Macro-Advisory Ltd cjw@macro-advisory. com

Geo-politics & Oil Russia’s changing investment landscape Chris Weafer Senior Partner, Macro-Advisory Ltd cjw@macro-advisory. com

Cutting though the noise q Russia’s economy is in a transition phase…The old economic model started to falter from mid-2012 q The falling oil price and sanctions have exacerbated the downward trend but have also made more obvious and more urgent the need for changes q To return to targeted growth of 4% the country will need to attract a higher volume of investment …and progress in creating a more diversified economy q The response from government agencies has been mainly encouraging and pragmatic q The message to western investors has evolved from mid 2014…. it is now recognized (by most)) that western expertise is necessary 2

Cutting though the noise q Russia’s economy is in a transition phase…The old economic model started to falter from mid-2012 q The falling oil price and sanctions have exacerbated the downward trend but have also made more obvious and more urgent the need for changes q To return to targeted growth of 4% the country will need to attract a higher volume of investment …and progress in creating a more diversified economy q The response from government agencies has been mainly encouraging and pragmatic q The message to western investors has evolved from mid 2014…. it is now recognized (by most)) that western expertise is necessary 2

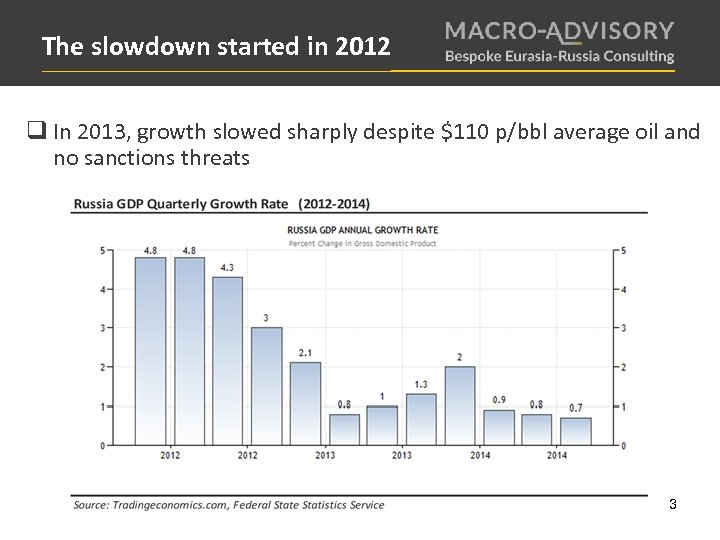

The slowdown started in 2012 q In 2013, growth slowed sharply despite $110 p/bbl average oil and no sanctions threats 3

The slowdown started in 2012 q In 2013, growth slowed sharply despite $110 p/bbl average oil and no sanctions threats 3

What’s Changing? q Change in monetary policy is very significant…. creating a more competitive economy is emerging as a key strategy q Language from government has become more realistic : q Some long standing problems and structural weaknesses, e. g. in the banking sector, are being dealt with q Greater effort to create greater diversification of trade and investment partners q Budget spending reform is now a more serious issue…. and that will eventually lead to pensions reform 4

What’s Changing? q Change in monetary policy is very significant…. creating a more competitive economy is emerging as a key strategy q Language from government has become more realistic : q Some long standing problems and structural weaknesses, e. g. in the banking sector, are being dealt with q Greater effort to create greater diversification of trade and investment partners q Budget spending reform is now a more serious issue…. and that will eventually lead to pensions reform 4

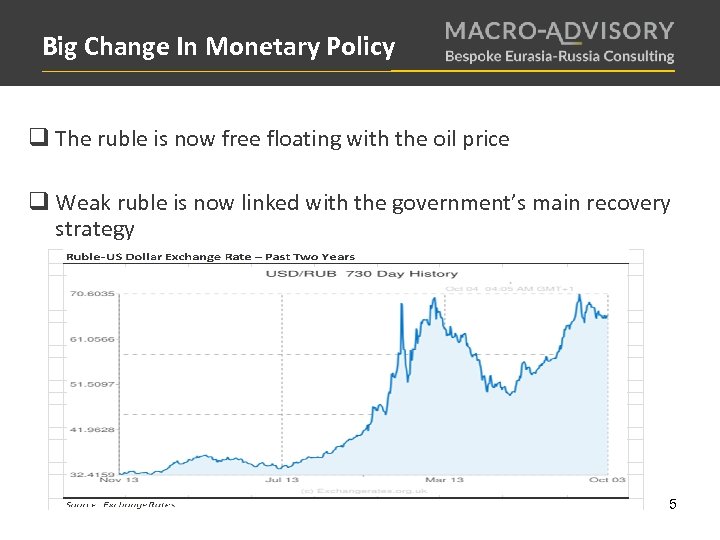

Big Change In Monetary Policy q The ruble is now free floating with the oil price q Weak ruble is now linked with the government’s main recovery strategy 5

Big Change In Monetary Policy q The ruble is now free floating with the oil price q Weak ruble is now linked with the government’s main recovery strategy 5

Crisis created opportunities 6

Crisis created opportunities 6

Localization is the new buzzword q Import substitution has emerged as the most important policy priority. q Key industries targeted are: q Agriculture services q food q Healthcare q pharmaceuticals q auto parts q machinery and machinery parts q defence industry equipment q oil field services, etc. 7

Localization is the new buzzword q Import substitution has emerged as the most important policy priority. q Key industries targeted are: q Agriculture services q food q Healthcare q pharmaceuticals q auto parts q machinery and machinery parts q defence industry equipment q oil field services, etc. 7

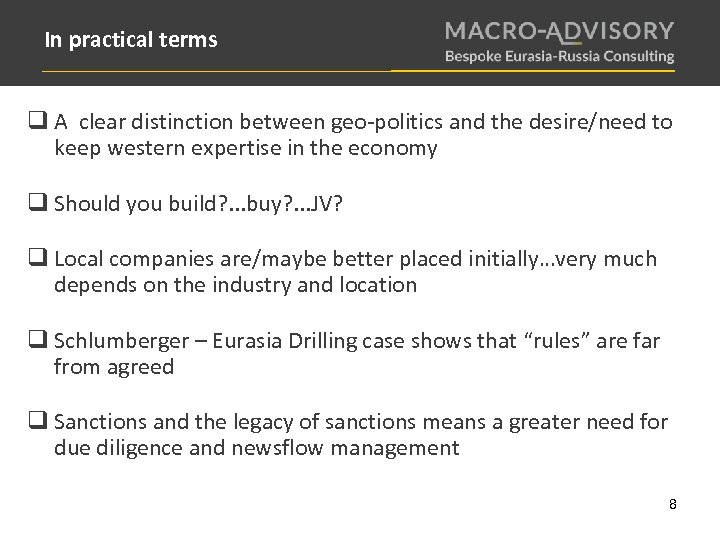

In practical terms q A clear distinction between geo-politics and the desire/need to keep western expertise in the economy q Should you build? . . . buy? . . . JV? q Local companies are/maybe better placed initially…very much depends on the industry and location q Schlumberger – Eurasia Drilling case shows that “rules” are far from agreed q Sanctions and the legacy of sanctions means a greater need for due diligence and newsflow management 8

In practical terms q A clear distinction between geo-politics and the desire/need to keep western expertise in the economy q Should you build? . . . buy? . . . JV? q Local companies are/maybe better placed initially…very much depends on the industry and location q Schlumberger – Eurasia Drilling case shows that “rules” are far from agreed q Sanctions and the legacy of sanctions means a greater need for due diligence and newsflow management 8

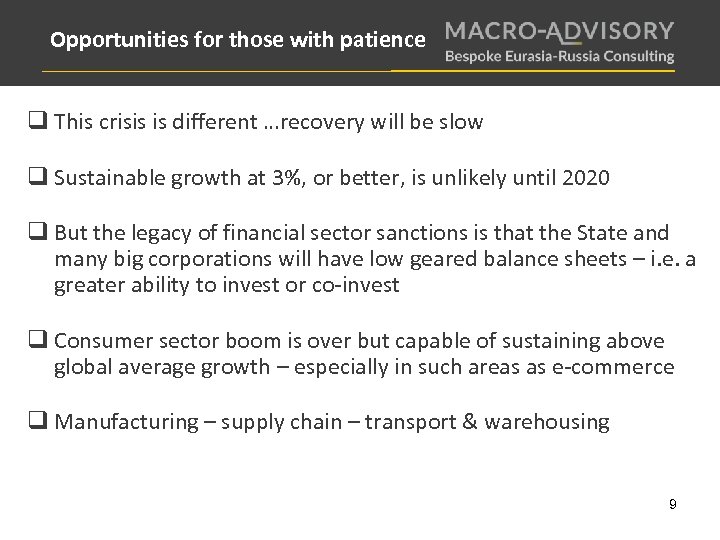

Opportunities for those with patience q This crisis is different …recovery will be slow q Sustainable growth at 3%, or better, is unlikely until 2020 q But the legacy of financial sector sanctions is that the State and many big corporations will have low geared balance sheets – i. e. a greater ability to invest or co-invest q Consumer sector boom is over but capable of sustaining above global average growth – especially in such areas as e-commerce q Manufacturing – supply chain – transport & warehousing 9

Opportunities for those with patience q This crisis is different …recovery will be slow q Sustainable growth at 3%, or better, is unlikely until 2020 q But the legacy of financial sector sanctions is that the State and many big corporations will have low geared balance sheets – i. e. a greater ability to invest or co-invest q Consumer sector boom is over but capable of sustaining above global average growth – especially in such areas as e-commerce q Manufacturing – supply chain – transport & warehousing 9

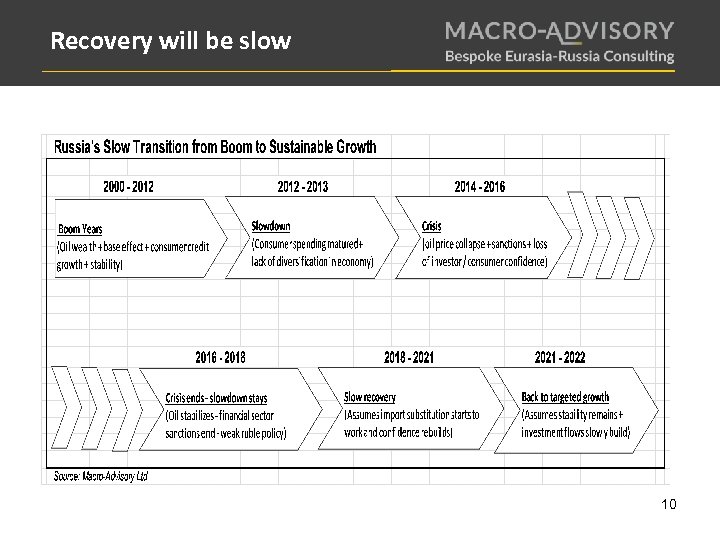

Recovery will be slow 10

Recovery will be slow 10

Problems can no longer be ignored • Pension reforms • Retirement age • Budget spending • Taxation changes • State enterprises • Privatizations • Regional budgets Ø But very likely to be delayed until after the Presidential election 11

Problems can no longer be ignored • Pension reforms • Retirement age • Budget spending • Taxation changes • State enterprises • Privatizations • Regional budgets Ø But very likely to be delayed until after the Presidential election 11

Still plenty of risks • Corruption – actual & perceived • Bureaucracy • Local competitors • State company dominance • Unclear government priorities • Geo-Politics • Reputation management • Greater need for due diligence • Hydrocarbon dependency 12

Still plenty of risks • Corruption – actual & perceived • Bureaucracy • Local competitors • State company dominance • Unclear government priorities • Geo-Politics • Reputation management • Greater need for due diligence • Hydrocarbon dependency 12

Drive you mad & make you money Russia will remain both frustrating and profitable for investors with the right strategy and patience 13

Drive you mad & make you money Russia will remain both frustrating and profitable for investors with the right strategy and patience 13

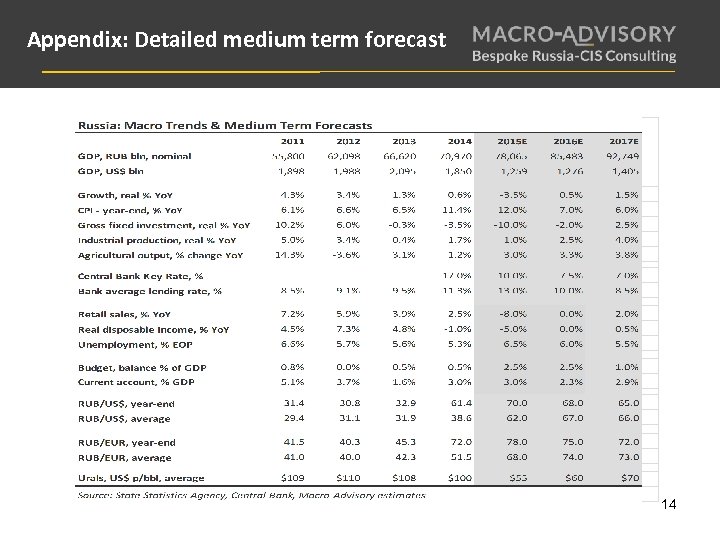

Appendix: Detailed medium term forecast 14

Appendix: Detailed medium term forecast 14

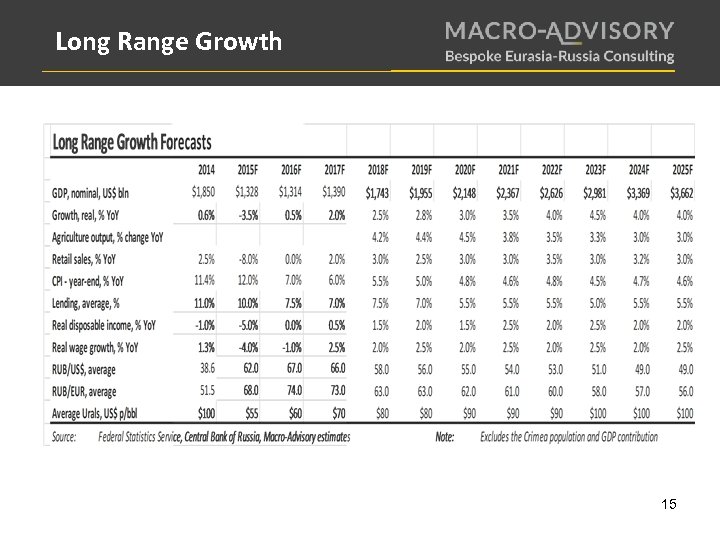

Long Range Growth 15

Long Range Growth 15

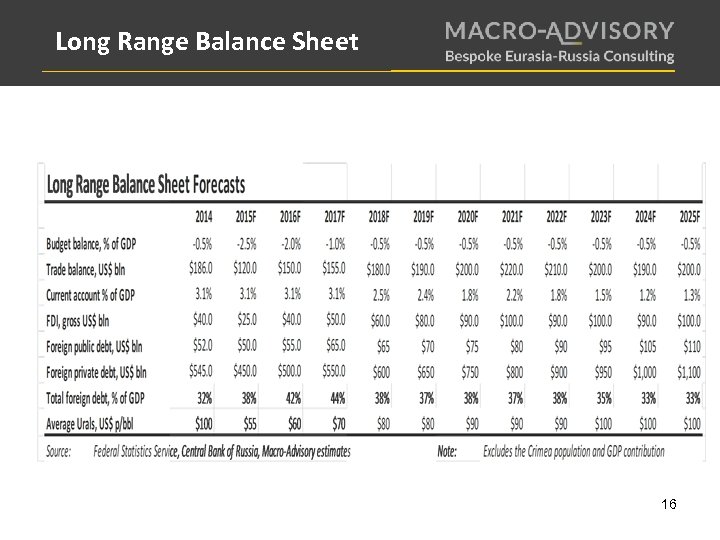

Long Range Balance Sheet 16

Long Range Balance Sheet 16

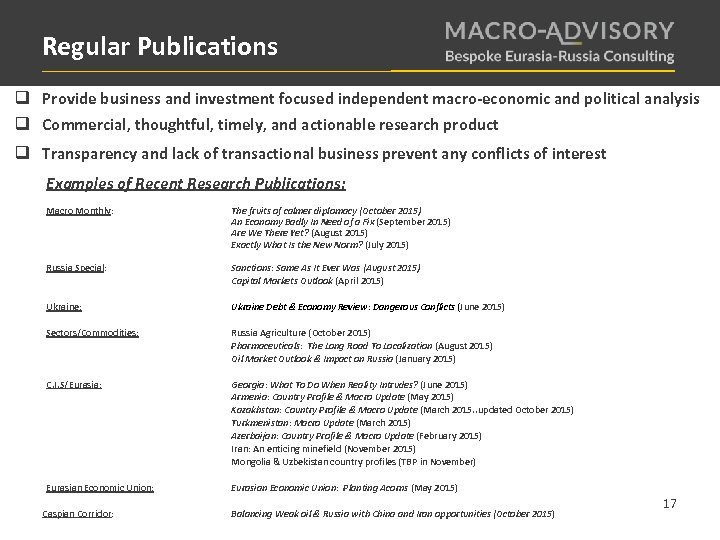

Regular Publications q Provide business and investment focused independent macro-economic and political analysis q Commercial, thoughtful, timely, and actionable research product q Transparency and lack of transactional business prevent any conflicts of interest Examples of Recent Research Publications: Macro Monthly: The fruits of calmer diplomacy (October 2015) An Economy Badly In Need of a Fix (September 2015) Are We There Yet? (August 2015) Exactly What Is the New Norm? (July 2015) Russia Special: Sanctions: Same As It Ever Was (August 2015) Capital Markets Outlook (April 2015) Ukraine: Ukraine Debt & Economy Review: Dangerous Conflicts (June 2015) Sectors/Commodities: Russia Agriculture (October 2015) Pharmaceuticals: The Long Road To Localization (August 2015) Oil Market Outlook & Impact on Russia (January 2015) C. I. S/Eurasia: Georgia: What To Do When Reality Intrudes? (June 2015) Armenia: Country Profile & Macro Update (May 2015) Kazakhstan: Country Profile & Macro Update (March 2015. . updated October 2015) Turkmenistan: Macro Update (March 2015) Azerbaijan: Country Profile & Macro Update (February 2015) Iran: An enticing minefield (November 2015) Mongolia & Uzbekistan country profiles (TBP in November) Eurasian Economic Union: Planting Acorns (May 2015) Caspian Corridor: Balancing Weak oil & Russia with China and Iran opportunities (October 2015) 17

Regular Publications q Provide business and investment focused independent macro-economic and political analysis q Commercial, thoughtful, timely, and actionable research product q Transparency and lack of transactional business prevent any conflicts of interest Examples of Recent Research Publications: Macro Monthly: The fruits of calmer diplomacy (October 2015) An Economy Badly In Need of a Fix (September 2015) Are We There Yet? (August 2015) Exactly What Is the New Norm? (July 2015) Russia Special: Sanctions: Same As It Ever Was (August 2015) Capital Markets Outlook (April 2015) Ukraine: Ukraine Debt & Economy Review: Dangerous Conflicts (June 2015) Sectors/Commodities: Russia Agriculture (October 2015) Pharmaceuticals: The Long Road To Localization (August 2015) Oil Market Outlook & Impact on Russia (January 2015) C. I. S/Eurasia: Georgia: What To Do When Reality Intrudes? (June 2015) Armenia: Country Profile & Macro Update (May 2015) Kazakhstan: Country Profile & Macro Update (March 2015. . updated October 2015) Turkmenistan: Macro Update (March 2015) Azerbaijan: Country Profile & Macro Update (February 2015) Iran: An enticing minefield (November 2015) Mongolia & Uzbekistan country profiles (TBP in November) Eurasian Economic Union: Planting Acorns (May 2015) Caspian Corridor: Balancing Weak oil & Russia with China and Iran opportunities (October 2015) 17

Contacts Macro-Advisory provides a bespoke macro consulting service for companies and investors working in Russia and other countries across the C. I. S. and Eurasia region Our service options include access to regular published reports, special project work, on -site presentations and other bespoke work. For further information contact JP Natkin at jpn@macro-advisory. com Our web site is www. macro-advisory. com No warranties, promises, and/or representations of any kind, expressed or implied are given as to the nature, standard, accuracy, or likewise of the information provided in this material nor to the suitability or otherwise of the information to your particular circumstances. Macro-Advisory Limited does not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the content contained in this note. © Copyright Macro-Advisory Limited 18

Contacts Macro-Advisory provides a bespoke macro consulting service for companies and investors working in Russia and other countries across the C. I. S. and Eurasia region Our service options include access to regular published reports, special project work, on -site presentations and other bespoke work. For further information contact JP Natkin at jpn@macro-advisory. com Our web site is www. macro-advisory. com No warranties, promises, and/or representations of any kind, expressed or implied are given as to the nature, standard, accuracy, or likewise of the information provided in this material nor to the suitability or otherwise of the information to your particular circumstances. Macro-Advisory Limited does not accept any responsibility or liability for the accuracy, content, completeness, legality, or reliability of the content contained in this note. © Copyright Macro-Advisory Limited 18