6f3c4458cdd25fb87e147a68e249efce.ppt

- Количество слайдов: 80

GENERAL ETHICS BRIEFING SSG Tambling

OVERVIEW n Briefing will cover the rule on 11 subjects: Conflicts of Interest Off-Duty Employment Political Activity Fundraising Procurement Integrity Law Gifts from Outside Sources Gifts to Superiors

OVERVIEW, Cont’d. Privatization Government Property Misuse of Government Position Training Travel

OFFICIAL CAPCITY vs. PERSONAL CAPACITY n Official Capacity means that: – You are acting on behalf of the government – You may use government resources in support of your activities – You may use your government title and organization name – Military may use name and rank

PERSONAL CAPACITY n Acting in your personal capacity means that: – You are acting as a private citizen – You generally may not use government resources – You may not use your title and organization – Military members may use rank and branch of military service

Conflict of Interest - MANDATORY DISQUALIFICATION n You may not participate personally or substantially (make a decision, give advice, make a recommendation) in any government matter that affect the financial interests of: – Your spouse – Your minor child; OR – Your general partner

Conflict of Interest - MANDATORY DISQUALIFICATION n You may not participate personally & substantially in any government matter that would affect the financial interests of: • An organization in which you are serving as officer, director, trustee, general partner or employee, OR • An organization with which you are negotiating for employment (or have an arrangement for future employment) n Example: Employee who is officer in professional association may not give advice to CC on matter that affects the association’s financial interests

Conflict of Interest - DISCRETIONARY DISQUALIFICATION n A supervisor may disqualify an employee from participating in a government matter that affects the financial interests of: (1) A member of the employee’s household (2) A relative with whom the employee has a close personal relationship (3) An organization in which employee is an active participant (e. g. , committee chair)

Conflict of Interest MANDATORY DISQUALIFICATION n A supervisor may disqualify an employee from participating in a government matter that affects the financial interests of: (4) Company with which employee has business relationship in personal capacity (e. g. , customer in off-duty employment business), (5) Organization in which employee served, within the last year, as officer, director, trustee, consultant, contractor or employee, (6) Organization in which employee’s spouse is serving as officer, director, trustee, consultant, contractor or employee

Conflict of Interest - DISCRETIONARY DISQUALIFICATION n Balancing test. In above situations, supervisor should allow employee to participate in the matter only if supervisor determines that government’s need to have that employee participate in the matter outweighs the appearance problems that would result n Supervisor who makes this judgment must be commissioned officer or civilian GS-12 or above (exception: for General Officer com-manders, this determination is made by JA)

Conflict of Interest STOCK OWNERSHIP n n If you (or your spouse or minor child) own stock in a company, you may not work on: • Any contract awarded to the company, • Any source selection in which the company is competing, OR • Any other government matter in which the company has a financial interest (18 USC 208) Exception: if the stock owned by you, your spouse and your minor children in a company has market value of $5000 or less, you may work on government matters that affect the financial interests of that company (5 CFR 2640. 202(a))

Conflict of Interest REPRESENTING OTHERS n n Federal employees may not represent individuals, companies or other organizations before any Federal agency • Applies to officers & civilians (not enlisted) • Applies if representation is compensated (18 USC 203) or uncompensated (18 USC 205) • Exception for representing certain relatives Exception: You may engage in uncompensated representation of a non-profit organization if a majority of the members are Federal employees or their spouses or children, and if certain other conditions apply (18 USC 205(d))

Financial Disclosure OGE Form 450 n OGE Form 450 is “Confidential Financial Disclosure Report” n Must complete OGE Form 450 (or 450 A) if you are: • Colonel or below, or GS-15 & below, and your duties involve decision-making or significant judgment in contracting or procurement, OR • Colonel or below, and the commander of an AF installation, base, air station or activity n Form must be completed within 30 days after entering such a position and every Oct or Nov

Fundraising - Three Types n Official fundraising -- can give it full support n Unofficial fundraising -- can give it minimal support n Fundraising for unit welfare funds -- can give it a little bit more than minimal support

Fundraising Definitions n “Official fundraising” means a fundraising event or effort where all funds raised go to: • Combined Federal Campaign (CFC), OR • The military relief societies: Air Force Assistance Fund (AFAF), Army Emergency Relief, or Navy. Marine Corps Relief Society n “Unofficial fundraising” means a FR effort where less than 100 percent of funds go to efforts listed above (Do. D/GC Ltr, 14 Mar 96)

Official Fundraising n Official fundraising is official government business, and Do. D employees: • May use government time, equipment, supplies & project officers (AFI 36 -3101, Table 1, Note 1) • May officially endorse the effort (JER 3 -210 a) • May use (and allow others to use) their government title & organization name in support of the effort (5 CFR 2635. 808(b))

Unofficial Fundraising Can Do’s n In support of an unofficial fundraising event, an employee may: • Attend the event in an official capacity if he will make an official speech (but official speeches at unofficial fundraising events are discouraged) (Do. D/GC Ltr, 18 Aug 97) • Attend the event in an official capacity, if his attendance is not used to promote the event (since mere attendance at an event does not constitute “fundraising”) (Do. D/GC Ltr, 18 Aug 97)

Unofficial Fundraising Can Do’s n In support of an unofficial fundraising event, an employee may: • Participate in a personal capacity, if he acts outside scope of official position (JER 3 -300 a) • Use e-mail to notify other employees about the event (with approval of supervisor who is comm. officer or GS-12 or above) (JER 2 -301 & 3 -208) • Use (or allow the use of) military rank & branch of service (5 CFR 2635. 808(c)(2); JER 3 -300 a)

Unofficial Fundraising Can’t Do’s n In support of an unofficial fundraising event, an employee may not: • Use government time or other resources (except e -mail) (AFI 36 -3101, Table 1, Column C & Note 1) • Officially endorse the event or effort (JER 3 -210 a) • Participate actively & visibly in the event in an official capacity (e. g. , serve as host or chairperson, sit at head table, stand in reception line) (5 CFR 2635. 808)

Unofficial Fundraising Can’t Do’s n In support of an unofficial fundraising event, an employee may not: • Personally solicit funds or other support from subordinates or Do. D contractors (5 CFR 2635. 808(c)) • Ask subordinates to use official time (JER 3 -305 b) • Solicit sales to junior personnel (JER 5 -409) • Use, or permit use of, govt. title or org. name to further FR effort (5 CFR 2635. 808(c); JER 3300 a)

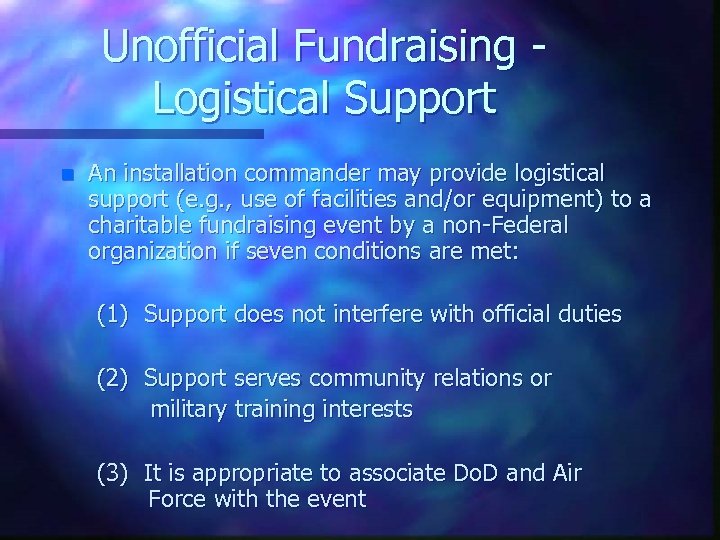

Unofficial Fundraising Logistical Support n An installation commander may provide logistical support (e. g. , use of facilities and/or equipment) to a charitable fundraising event by a non-Federal organization if seven conditions are met: (1) Support does not interfere with official duties (2) Support serves community relations or military training interests (3) It is appropriate to associate Do. D and Air Force with the event

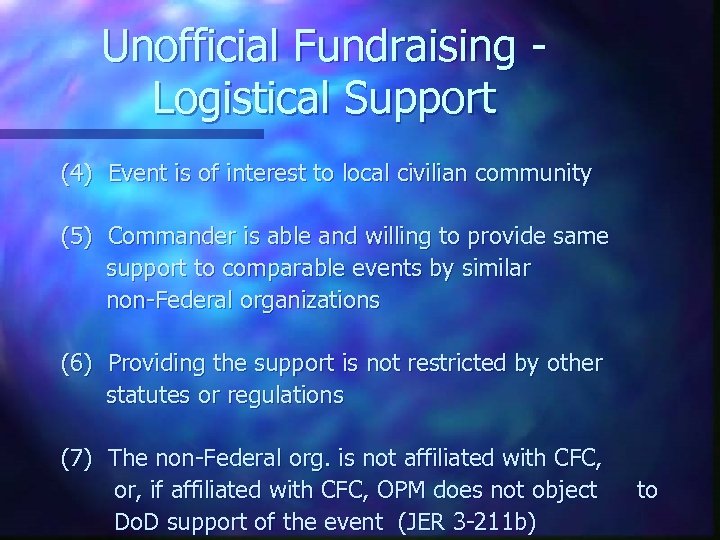

Unofficial Fundraising Logistical Support (4) Event is of interest to local civilian community (5) Commander is able and willing to provide same support to comparable events by similar non-Federal organizations (6) Providing the support is not restricted by other statutes or regulations (7) The non-Federal org. is not affiliated with CFC, or, if affiliated with CFC, OPM does not object Do. D support of the event (JER 3 -211 b) to

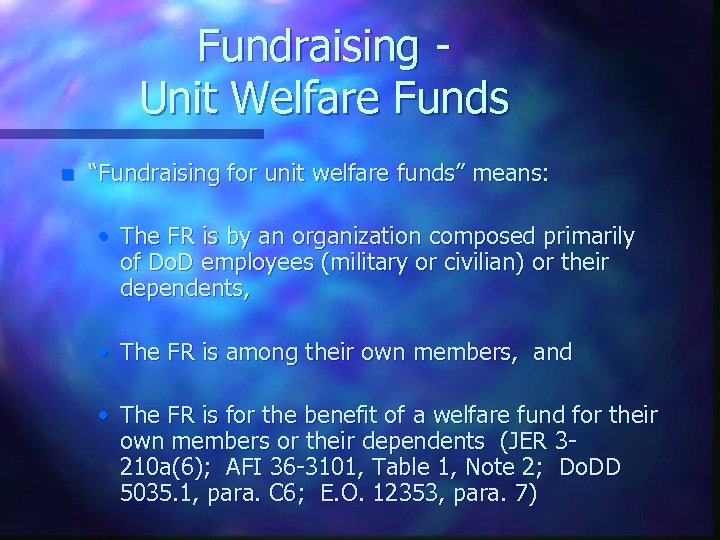

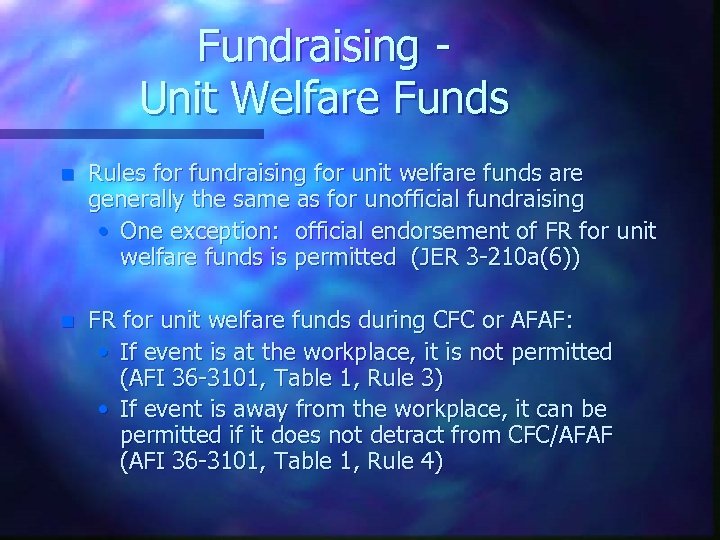

Fundraising Unit Welfare Funds n “Fundraising for unit welfare funds” means: • The FR is by an organization composed primarily of Do. D employees (military or civilian) or their dependents, • The FR is among their own members, and • The FR is for the benefit of a welfare fund for their own members or their dependents (JER 3210 a(6); AFI 36 -3101, Table 1, Note 2; Do. DD 5035. 1, para. C 6; E. O. 12353, para. 7)

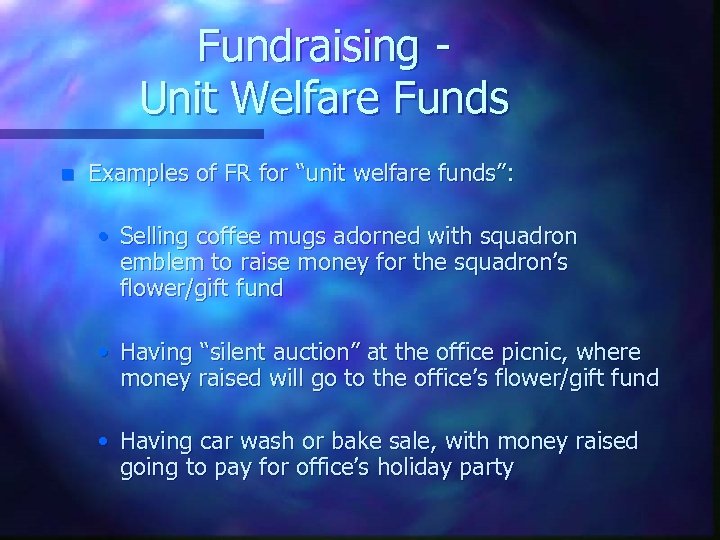

Fundraising Unit Welfare Funds n Examples of FR for “unit welfare funds”: • Selling coffee mugs adorned with squadron emblem to raise money for the squadron’s flower/gift fund • Having “silent auction” at the office picnic, where money raised will go to the office’s flower/gift fund • Having car wash or bake sale, with money raised going to pay for office’s holiday party

Fundraising Unit Welfare Funds n Rules for fundraising for unit welfare funds are generally the same as for unofficial fundraising • One exception: official endorsement of FR for unit welfare funds is permitted (JER 3 -210 a(6)) n FR for unit welfare funds during CFC or AFAF: • If event is at the workplace, it is not permitted (AFI 36 -3101, Table 1, Rule 3) • If event is away from the workplace, it can be permitted if it does not detract from CFC/AFAF (AFI 36 -3101, Table 1, Rule 4)

Fundraising - Misc. Rules n Collection boxes -- Putting out boxes to collect toys, canned goods, clothing, etc. , in public areas (e. g. , entrances or lobbies of buildings) is not considered fundraising and can be approved by the Installation Commander (Do. DD 5035. 1, para. C 7; OGE Memorandum, 23 Mar 94) n Military ball fundraisers -- For guidance on this subject, see Do. D/GC Ltr, 14 Mar 96

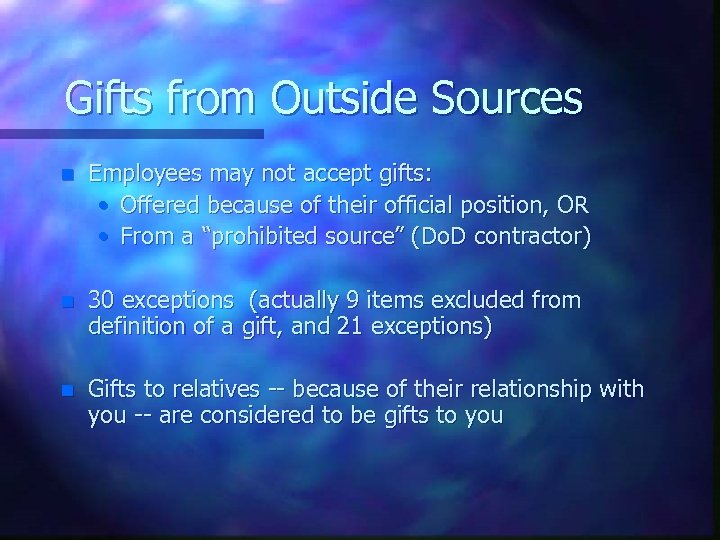

Gifts from Outside Sources n Employees may not accept gifts: • Offered because of their official position, OR • From a “prohibited source” (Do. D contractor) n 30 exceptions (actually 9 items excluded from definition of a gift, and 21 exceptions) n Gifts to relatives -- because of their relationship with you -- are considered to be gifts to you

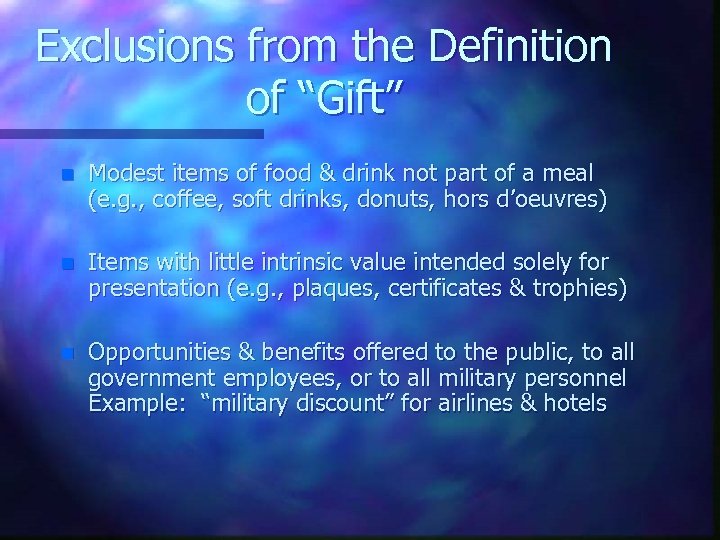

Exclusions from the Definition of “Gift” n Modest items of food & drink not part of a meal (e. g. , coffee, soft drinks, donuts, hors d’oeuvres) n Items with little intrinsic value intended solely for presentation (e. g. , plaques, certificates & trophies) n Opportunities & benefits offered to the public, to all government employees, or to all military personnel Example: “military discount” for airlines & hotels

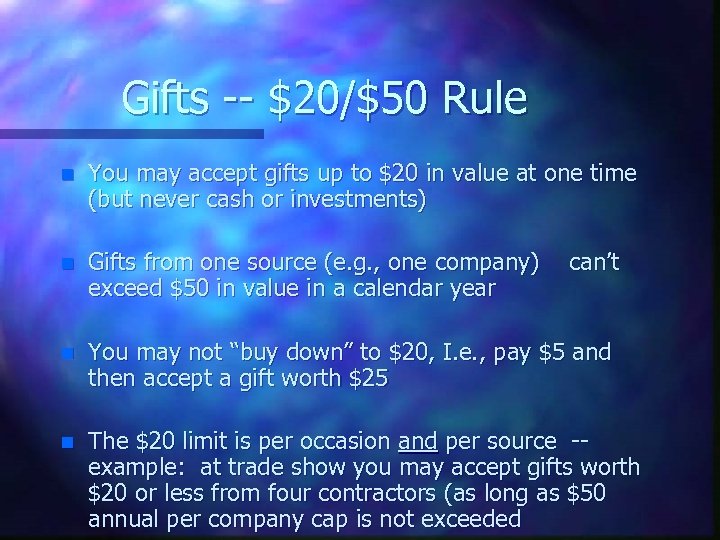

Gifts -- $20/$50 Rule n You may accept gifts up to $20 in value at one time (but never cash or investments) n Gifts from one source (e. g. , one company) exceed $50 in value in a calendar year n You may not “buy down” to $20, I. e. , pay $5 and then accept a gift worth $25 n The $20 limit is per occasion and per source -example: at trade show you may accept gifts worth $20 or less from four contractors (as long as $50 annual per company cap is not exceeded can’t

Gifts -Widely Attended Gatherings A Do. D employee may accept free attendance at an event (e. g. , dinner, reception, conference, seminar, training course) if it is determined that: (1) Large number of persons expected to attend, (2) His attendance would further Do. D programs or operations, (3) Attendees have diversity of views or interests, and

Gifts -Widely Attended Gatherings (4) Cost of employee’s free attendance is paid for by: (A) the sponsor of the event, OR (B) a non-sponsor that pays for one or more government employees, but doesn’t choose which employee(s) it will pay for, OR (C) a non-sponsor that picks which government employee(s) it will pay for, if more than 100 people are expected to attend, and the value of free atten-dance (for the employee & spouse) is $250 or less

Gifts - Social Invitation NOT from a prohibited source n Do. D employees may accept food, refreshments and entertainment at a social event if: • The invitation is not from a “prohibited source; ” • Several persons will attend the event, and • No fee is charged to anyone who attends n You may not accept travel or lodging under this rule n Example: Base commander & spouse are invited to dinner party hosted by local real estate developer

Gifts from Foreign Governments n You generally may keep a gift from a foreign govt. , if it has a market value of $260 or less (AFI 51 -901) n Gift worth more than $260 • Personal property items belong to government • Travel expenses can accepted with CC approval n If foreign government is engaged in selling to Do. D, you should seek advice before retaining the gift n Rules apply to active duty, reservists, civilian employees, and the dependents of each

Gifts to Superiors General Rules n Superiors: An employee may not give a gift to his or her superior, except: • Under the rule for occasional gifts, OR • Under the rule for special occasion gifts n Non-superiors: An employee may not give a gift to a non-superior who receives more pay, except: • Under the rule for occasional gifts, • Under the rule for special occasion gifts, OR • The two employees have a personal relationship that would justify the gift

Gifts to Superiors - Definitions n “Superior” means: • Your supervisor, • Your supervisor’s supervisor, and • Everyone up the chain of command n “Gift” does not include cards, plaques or certificates, if they have little intrinsic value

Gifts to Superiors Occasional Gifts n You may give to a superior on an occasional basis (e. g. , birthday, Boss’ Day, promotion): • Item(s) worth $10 or less (but not cash), • Food and/or beverage that is shared in office, • Hospitality provided at your home, • Item(s) customarily given when receiving hospitality from your superior (e. g. , bottle of wine when boss invites you to dinner), OR • Leave transferred under Vol. Leave Transfer Program to non-supervisor (civilians only)

Gifts to Superiors on Special Occasions n More liberal rules for gifts on special occasions n “Special occasion” means: • Infrequent & significant personal occasions (e. g. , marriage, illness, birth or adoption of a child), OR • Termination of the superior-subordinate relationship (e. g. , retirement, PCS, transfer)

Gifts on Special Occasions from You n Gift to superior. If the gift is from you only, and is to a superior, there is no dollar limit, but the gift must be “appropriate to the occasion” n Gift to non-superior who receives more pay. If the gift is from you only, and the gift is to someone who is not your superior (I. e. , not in your chain of command), but who receives more pay than you, there is no dollar limit, but the gift must be “appropriate to the occasion”

Gifts to Superiors from a Group n If a special occasion gift to a superior is from a group containing one or more subordinates, then: • Group members may not solicit contributions of more than $10 from other group members. • There is no legal prohibition on group members contributing more than $10 toward the group gift. However, the person or committee in charge of collecting for the gift may inform group members that contributions of more than $10 are not desired and will not be accepted.

Gifts to Superiors from a Group n If a special occasion gift (or gifts) to a superior is from a group containing one or more subordinates, then: • The market value of the gift (or gifts) cannot exceed $300 (JER 2 -203 a) • The cost of food, refreshments & entertainment provided to the employee and his personal guests to mark the special occasion does not count toward the $300 limit (JER 2 -203 a(2))

Government Propertyl n Basic rule: Employees shall not use government property for “other than authorized purposes” (5 CFR 2635. 704) -- so look to specific legal rules n Rules on government vehicles (AFI 24 -301, Chap. 3) n Rules on use of internet (AFI 33 -129, 1 Jan 97) n Rules on government postage (AF Supplement to Do. D Official Mail Manual; Op. JAGAF 1995/103)

Government Property - E-mail Govt. e-mail may be used for personal communications if supervisor (who is commissioned officer or GS-11 or above) determines: (1) No adverse effect on performance of duties, (2) Use is of reasonable duration & frequency, (3) Use serves a legitimate public interest, (4) Use does not reflect adversely on Air Force, (5) Use does not overburden the system, and (6) Use does not create significant additional cost [JER ¶ 2 -301 a; AFI 33 -119, 1 Mar 99, ¶ 3. 3. 2. ]

Government Property - E-mail Govt. e-mail cannot be used for the following: (1) Sending items in violation of copyright laws (2) Sending e-mail for personal financial gain (3) Misrepresenting your identity or affiliation (4) Sending harassing or offensive material, including humor in poor taste, political or religious lobbying, & pornographic items (5) Using someone else’s user ID w/o authority (6) Causing congestion on the network [JER ¶ 2 -301 a; AFI 33 -119, 1 Mar 99, ¶ 3. 3. 1. ]

Misuse of Position n n Do. D employees must use official time to perform official duties (5 CFR 2635. 705(a)) Do. D employees may not ask or direct their subordinates to use official time for other than official duties (5 CFR 2635. 705(b)) Do. D employees may not use government property for other than authorized purposes (5 CFR 2635. 704) Do. D employees may not use non-public information to further their own private interests, or the private interests of others (5 CFR 2635. 703)

Letters of Recommendation n n When writing a letter of recommendation (or a character reference), you may use official stationery and may sign using your official title, only if the letter is based upon your personal knowledge of the ability or character of: • An individual with whom you have dealt in the course of Federal employment, OR • An individual whom you are recommending for Federal employment (5 CFR 2635. 702(b)) Otherwise, you may not use official stationery and you may not sign the letter using your official title

Letters of Appreciation to Contractors n Appropriated fund contracts -- there is no prohibition on writing letters of appreciation to contractor employees on appropriated fund contracts, but check with the contracting officer first to make sure he/she agrees concerning the quality of contractor employee’s performance n NAF contracts -- Air Force Manual 64 -302, Nonappropriated Fund Contracting, para. 1. 4 states: “Letters of Appreciation to Commercial Firms. Do not send formal or informal letters of appreciation to contractors. A job well done and timely payments

Misuse of Position Sales to Junior Personnel n Active duty, civilians and reservists may not knowingly solicit, or make solicited sales to, personnel junior in rank, grade, or position, or their family members, on or off duty (JER 5 -409) n If there is no coercion or intimidation by the senior employee, the following is permitted: • Retail sales made during off-duty employment, • Sale or lease of non-commercial personal or real property (e. g. , a car or house), and • Sales made because junior approaches senior

Off-Duty Employment n Certain employees required to get prior approval of ODE -- rule may depend on what MAJCOM you work for -- use AF Form 3902 to get approval n ODE can be disapproved only if it: • Is prohibited by statute or regulation, • Would detract from readiness, OR • Would create a security risk (JER 2 -206, 2 -303) n AFMC employees (military and civilian) are required to obtain prior written approval for ODE (AFMC Instruction 51 -201)

Off-Duty Employment Teaching, Speaking, Writing n Do. D employees may not receive compensation for teaching, speaking or writing if: • It’s part of their official duties, • They’re invited because of their official position or invitation is from a prohibited source, • Activity draws on non-public information, • Subject deals with matter they’re assigned to now or during previous 1 -year period, OR • Subject deals with any announced or ongoing Do. D policy, program or operation (5 CFR 2635. 807(a))

Off-Duty Employment Teaching, Speaking, Writing n Compensation ban does not apply to: • Teaching a course requiring multiple presentations at elementary/secondary school or college • Teaching, speaking or writing on a subject within one’s discipline or inherent area of expertise, based on educational background or experience n Definition of “compensation” • Includes any form of income and travel expenses • Does not include waiver of attendance fee, meals furnished as part of event where speech takes place, course materials, or videotape of speech

Political Activity n n n Rules for military in Do. DD 1344. 10 and AFI 51 -902 Rules for civilians in Hatch Act and 5 CFR Part 734 • Hatch Act (5 USC 7321 -7326) amended in 1993 • Hatch Act implementing regulation (Part 734) revised in 1996; Part 734 in hard-bound copy of JER is out-of-date, so look in CFR • Hatch Act guidance available at www. osc. gov Military advisory committee of Member of Congress • Military may not serve (Op. JAGAF 1996/146) • Civilians may not serve (Op. JAGAF 1997/130)

Procurement Integrity n n Ban on Federal employees receiving gifts from competing contractors (but all the gift restrictions in the Joint Ethics Regulation still apply) Requirement for Federal employees to receive Procurement Integrity training (but requirement for initial & annual ethics training still applies) Requirement for anyone to complete PI certificates The 2 -year post-government employment rule, & the terms “procurement official” & “competing contractor”

Procurement Integrity n Ban on disclosing procurement information n Ban on obtaining procurement information n Requirement to report employment contacts n The 1 -year ban on accepting compensation from a contractor that was awarded a contract over $10, 000

Procurement Integrity n The new Procurement Integrity law prohibits, before contract award, the disclosure of: • Source selection information, & • Contractor bid or proposal information n The ban (41 USC 423(a)) applies to: • Current and former Federal employees, & • Anyone who is advising or has advised the U. S. Government regarding the procurement (i. e. , contractor employees & consultants)

Procurement Integrity - Ban on Obtaining Procurement Information n The new Procurement Integrity law provides that a person may not knowingly obtain “source selection information” or “contractor bid or proposal information” before contract award, other than as provided by law n The ban (41 USC 423(b)) applies to everyone, including Federal employees and contractor employees

Procurement Integrity Employment Contact Reporting Rule If an employee (officer, enlisted or civilian) is - • Participating personally & substantially in a procurement, and • Contacts, or is contacted by, a bidder or offeror regarding possible employment, then the employee must - • Give written report to supervisor & Designated Agency Ethics Official or designee, and • Either (1) reject the possibility of employment, or (2) be disqualified from working on procurement until job discussions end & there is no arrangement for employment

Procurement Integrity Employment Contact Reporting Rule If an employee (officer, enlisted or civilian) is - • Participating personally & substantially in a procurement, and • Contacts, or is contacted by, a bidder or offeror regarding possible employment, then the employee must - • Give written report to supervisor & Designated Agency Ethics Official or designee, and • Either (1) reject the possibility of employment, or (2) be disqualified from working on procurement until job discussions end & there is no arrangement for employment

Procurement Integrity Employment Contact Reporting Rule n Rule applies only to contracts in excess of simplified acquisition threshold ($100, 000) n Rule applies only between date when bids or proposals are received & contract award date • Rule applies to contacts with “bidders” & “offerors” • A company is not a “bidder” or “offeror” until it submits a bid or offer

Procurement Integrity One Year Compensation Ban n People who serve in one of seven positions, or who make one of seven types of decisions, on a contract over $10 million, may not accept compensation from the contractor for 1 year n 1 -year ban is on accepting compensation from the contractor as an employee, consultant, officer or director n Ban can apply to officers, enlisted & civilians

Procurement Integrity - Positions Resulting in 1 Year Compensation Ban n n n Procuring Contracting Officer Source Selection Authority Member of Source Selection Evaluation Board Chief of financial or technical evaluation team Program Manager Deputy Program Manager Administrative Contracting Officer

Procurement Integrity - Decisions Resulting in 1 Year Compensation Ban n Decision to award a contract over $10 million n Decision to award a subcontract over $10 million n Decision to award a modification that is over $10 million of a contract or subcontract n Decision to award a task order or delivery order over $10 million

Procurement Integrity - Decisions Resulting in 1 Year Compensation Ban n Decision to establish overhead or other rates applicable to a contract or contracts valued over $10 million n Decision to approve issuance of a contract payment or payments over $10 million n Decision to pay or settle claim over $10 million

Procurement Integrity 1 Year Compensation Ban n 1 -year ban does not apply to accepting compensation from any division or affiliate of a contractor that does not produce the “same or similar products or services” as the entity of the contractor that has the contract the person worked on n People can request legal opinion on whether ban applies (“ 30 -day letter”) -- must be issued within 30 days after receipt of written request (or as soon thereafter as practicable)

Post-Government Employment Lifetime Representation Ban n If a Federal employee participates personally & substantially in a contract, he may go to work for the contractor, but may never act as contractor’s negotiator or representative before any Federal agency on that contract (18 USC 207(a)(1)) n Applies to officers & civilians, but not enlisted n Applies to contracts & other “particular matters” (asset sales, environmental claims, personnel actions)

Post-Government Employment 2 Year Representation Ban n If a Federal employee has a contract under her official responsibility during her last year in the government, she may go to work for the contractor, but may not, for 2 years, act as contractor’s negotiator or representative before any Federal agency on that contract (18 USC 207(a)(2)) n Applies to officers & civilians, but not enlisted n Applies to contracts & other “particular matters” (asset sales, environ. claims, personnel actions)

What is Prohibited by Lifetime & 2 -Year Representation Rules n What is prohibited: communicating with or appearing before any Federal employee, with the intent to influence the employee, regarding the contract (or other matter) that the ban applies to n Examples: • Acting as company’s negotiator • Speaking for company in contract dispute • Seeking for the company a discretionary ruling, benefit, action or approval by the govt. (e. g. , a contract claim, modification, ECP, etc. )

What is Permitted under Lifetime & 2 -Year Representation Rules n What is permitted: communicating with or appearing before Federal employees regard-ing a contract (or other matter) where there is no intent to influence (i. e. , merely providing or obtaining information). Examples: • Providing purely factual information to govt. personnel regarding a contract • Requesting purely factual information from govt. personnel regarding a contract • Requesting from the govt. publicly available documents related to a contract

One-Year No Contact Rule n n “Senior employees” may not, for 1 year, communicate with, or appear before, any employee of their former agency, on behalf of a third party, in connection with any matter on which the third party seeks official action by their former agency The rule (18 USC 207(c)) applies to: • General / Flag Officers (O-7 to O-10), • SES employees at Levels 5 & 6, and • SES-equivalent employees (e. g. , ST & SL) whose basic rate of pay (excluding locality-based pay) is equal to or greater than basic pay of SES Level 5 ($118, 400)

1 -Year Ban on Advising Foreign Entities (18 USC 207(f)) n “Senior employees” may not, for 1 year: • Represent a foreign entity before any Government agency with intent to influence a decision by that agency, OR • Aid or advise a foreign entity with intent to influence a decision by a U. S. Government agency n “Foreign entity” means foreign government or foreign political party; “senior employee” has same definition as for 1 -year no-contact rule

Retired Military Members Working for a Foreign Government n Retired Air Force (AF) officers & enlisted may not work for a foreign government without prior approval by AF Personnel Center (AFI 36 -2913) • Applies to reservists receiving retired pay • Applies to educational & commercial institutions owned or controlled by foreign government n On 4 Feb 99, HQ AFPC/DPPTU advised that requests for approval will not be accepted until requester has approved retirement date, and approval can take up to one year (about a month by Air Force and 6 -12 months by State Dept. )

Training n All new Air Force employees must receive an initial ethics briefing (HQ USAF/JAG message, 11 Feb 98) • Civilians & officers must receive within 90 days • Enlisted must receive within 180 days n Some Air Force employees must also receive an annual ethics briefing (JER 11 -301) • People who file SF 278 (I. e. , G. O. /SES/ST/SL) must receive a verbal briefing every year • People who file OGE Form 450 or 450 A must get verbal briefing every 3 years (1997, 2000, 2003); training by written materials OK in other years

Travel Government Frequent Flyer Miles n Can use to obtain: • Ticket that is used in government travel • Upgrade to business class on government travel n Cannot use for: • Personal travel (or permissive TDY travel) • Upgrade to first class on government travel • Gift to charity • Travel after retirement or separation • Any other purpose

Travel Government Frequent Flyer Miles n n If you use personal credit card (I. e. , affinity card) to pay for costs of official travel (e. g. , rental car & hotel), and credit card company has arrangement with an airline, under which you earn frequent flyer miles for every dollar you charge on your credit card, you may keep those frequent flyer miles for personal use (TJAG Policy Ltr # 8, 4 Feb 98) Summary: • Frequent flyer miles earned from a flight that is paid for by the government belong to the government • Frequent flyer miles earned while on official travel because you pay for your hotel or rental car with your affinity card belong to you

Travel Upgrades to 1 st Class on Government Travel n You may upgrade to first class on government travel if: • Promotional offer (ex: for opening account), • It’s an on the spot upgrade, OR • Because of membership in club (such as Gold Card Club) for people with certain number of miles (even if all miles are from government travel) n But you may not accept upgrade based on rank

Travel Overbooked Flights n Involuntary bump -- you may not keep the compensation n Voluntary surrender of seat (JER 4 -202 d) • You may volunteer to take a later flight if it doesn’t interfere with the mission • You may keep compensation, as long as taking the later flight does not result in any additional cost to the government (i. e. , you may not claim extra per diem for extra time you spent away from home because you took the later flight)

Travel Payment from Non-Federal Source n n n You may accept a travel payment (e. g. , a plane ticket) from a non-Federal source if you will attend a meeting or similar function in your official capacity away from your duty station (31 USC 1353) Travel payment may not be accepted if: (1) meeting is required to carry out statutory or regulatory functions (audits, inspections, site visits, negotiations, litigation), or (2) primary purpose of meeting is to market non-Federal source’s products or services Payments not reported on financial disclosure form, but must report payments over $250 per event to JA

Reporting Travel Payments n In 1998, GSA announced the creation of a form (SF 326) for reporting travel payments accepted from non-Federal sources n SF 326 can be printed directly from GSA website (http: //www. gsa. gov/forms/pdf_files/sf 326. pdf) n On 6 Nov 1998, HQ USAF/JAG issued a memo stating that use of the SF 326 by Air Force personnel is mandatory

Travel in Contractor Vehicles n n If the transportation is duty-related (I. e. , received in connection with official duty & having the effect of reducing government expenditures), it is gift to the agency, not to the individual. The government generally should not accept such travel unless: • It is permitted in the terms of the contract, • Government has agreed to reimburse the contractor, or • Acceptance was approved in advance under statutory gift authority If contractor offers travel after working hours, it would be gift to the individual & could potentially be accepted under $20 / $50 rule

Travel with Spouse at Government Expense n Spouses may not accompany Do. D employees on official business at government expense, unless: • Unquestionable official requirement for spouse to participate in a function, or • Deemed in national interest because of diplomatic or public relations benefit to U. S. n Approval authority: 4 -star MAJCOM commanders in certain cases & HQ USAF/CV in all others (AFI 24101, ¶ 1. 15; 9 Sep 98 CSAF/CV message)

CONCLUSION QUESTIONS?

6f3c4458cdd25fb87e147a68e249efce.ppt