32cb2b271f97541c9680b9c312ec2bbe.ppt

- Количество слайдов: 23

General Anti Avoidance Rules (‘GAAR’) – Case Studies Pranav Sayta 21 September 2012

General Anti Avoidance Rules (‘GAAR’) – Case Studies Pranav Sayta 21 September 2012

Case studies Page 2 India Tax Workshop 2012

Case studies Page 2 India Tax Workshop 2012

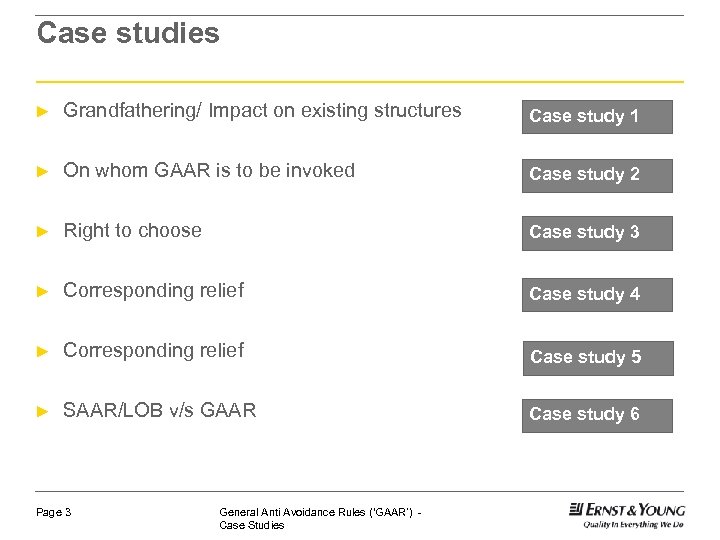

Case studies ► Grandfathering/ Impact on existing structures Case study 1 ► On whom GAAR is to be invoked Case study 2 ► Right to choose Case study 3 ► Corresponding relief Case study 4 ► Corresponding relief Case study 5 ► SAAR/LOB v/s GAAR Case study 6 Page 3 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case studies ► Grandfathering/ Impact on existing structures Case study 1 ► On whom GAAR is to be invoked Case study 2 ► Right to choose Case study 3 ► Corresponding relief Case study 4 ► Corresponding relief Case study 5 ► SAAR/LOB v/s GAAR Case study 6 Page 3 General Anti Avoidance Rules (‘GAAR’) Case Studies

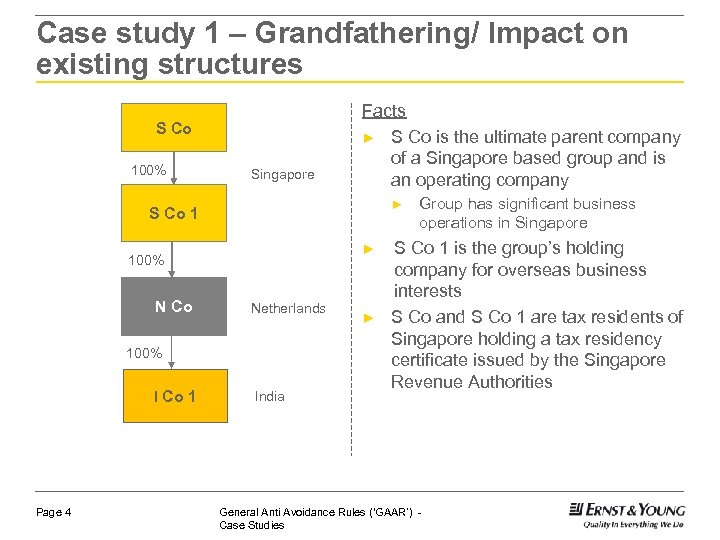

Case study 1 – Grandfathering/ Impact on existing structures S Co 100% Singapore Facts ► S Co is the ultimate parent company of a Singapore based group and is an operating company ► S Co 1 ► 100% N Co Netherlands 100% I Co 1 Page 4 India ► Group has significant business operations in Singapore S Co 1 is the group’s holding company for overseas business interests S Co and S Co 1 are tax residents of Singapore holding a tax residency certificate issued by the Singapore Revenue Authorities General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 1 – Grandfathering/ Impact on existing structures S Co 100% Singapore Facts ► S Co is the ultimate parent company of a Singapore based group and is an operating company ► S Co 1 ► 100% N Co Netherlands 100% I Co 1 Page 4 India ► Group has significant business operations in Singapore S Co 1 is the group’s holding company for overseas business interests S Co and S Co 1 are tax residents of Singapore holding a tax residency certificate issued by the Singapore Revenue Authorities General Anti Avoidance Rules (‘GAAR’) Case Studies

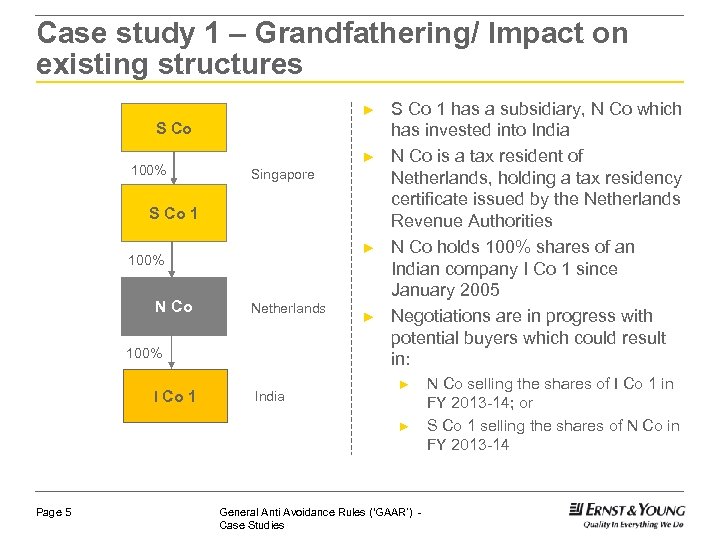

Case study 1 – Grandfathering/ Impact on existing structures ► S Co 100% ► Singapore S Co 1 ► 100% N Co Netherlands 100% I Co 1 India ► S Co 1 has a subsidiary, N Co which has invested into India N Co is a tax resident of Netherlands, holding a tax residency certificate issued by the Netherlands Revenue Authorities N Co holds 100% shares of an Indian company I Co 1 since January 2005 Negotiations are in progress with potential buyers which could result in: ► ► Page 5 General Anti Avoidance Rules (‘GAAR’) Case Studies N Co selling the shares of I Co 1 in FY 2013 -14; or S Co 1 selling the shares of N Co in FY 2013 -14

Case study 1 – Grandfathering/ Impact on existing structures ► S Co 100% ► Singapore S Co 1 ► 100% N Co Netherlands 100% I Co 1 India ► S Co 1 has a subsidiary, N Co which has invested into India N Co is a tax resident of Netherlands, holding a tax residency certificate issued by the Netherlands Revenue Authorities N Co holds 100% shares of an Indian company I Co 1 since January 2005 Negotiations are in progress with potential buyers which could result in: ► ► Page 5 General Anti Avoidance Rules (‘GAAR’) Case Studies N Co selling the shares of I Co 1 in FY 2013 -14; or S Co 1 selling the shares of N Co in FY 2013 -14

Case study 1 – Grandfathering/ Impact on existing structures Issues for discussion ► Whether any entity in the structure could be subject to Income-tax in India on gains from sale of shares of I Co 1? ► On what grounds could the tax authorities invoke GAAR to assert taxability on any entity in the structure for gains from sale of shares of I Co 1? ► What could be the consequences/Income-tax implications in the hands of the entities in the structure in case GAAR is invoked by the tax authorities? ► Is there any tax avoidance arising due to the above structure? ► Whether tax avoidance has to be looked at point of investment or divestment? ► Whethere could be any implications for the buyer wherein GAAR is invoked on the seller? Page 6 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 1 – Grandfathering/ Impact on existing structures Issues for discussion ► Whether any entity in the structure could be subject to Income-tax in India on gains from sale of shares of I Co 1? ► On what grounds could the tax authorities invoke GAAR to assert taxability on any entity in the structure for gains from sale of shares of I Co 1? ► What could be the consequences/Income-tax implications in the hands of the entities in the structure in case GAAR is invoked by the tax authorities? ► Is there any tax avoidance arising due to the above structure? ► Whether tax avoidance has to be looked at point of investment or divestment? ► Whethere could be any implications for the buyer wherein GAAR is invoked on the seller? Page 6 General Anti Avoidance Rules (‘GAAR’) Case Studies

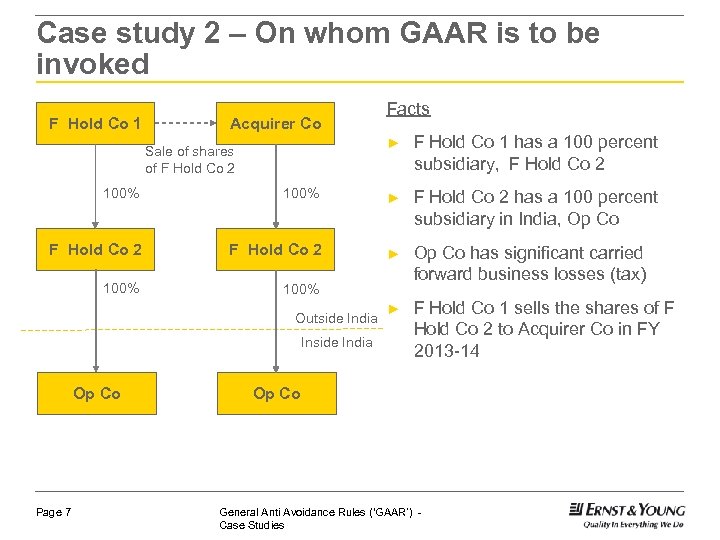

Case study 2 – On whom GAAR is to be invoked F Hold Co 1 Acquirer Co Facts ► Sale of shares of F Hold Co 2 F Hold Co 1 has a 100 percent subsidiary, F Hold Co 2 100% ► F Hold Co 2 has a 100 percent subsidiary in India, Op Co F Hold Co 2 ► 100% Op Co has significant carried forward business losses (tax) ► F Hold Co 1 sells the shares of F Hold Co 2 to Acquirer Co in FY 2013 -14 Outside India Inside India Op Co Page 7 Op Co General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 2 – On whom GAAR is to be invoked F Hold Co 1 Acquirer Co Facts ► Sale of shares of F Hold Co 2 F Hold Co 1 has a 100 percent subsidiary, F Hold Co 2 100% ► F Hold Co 2 has a 100 percent subsidiary in India, Op Co F Hold Co 2 ► 100% Op Co has significant carried forward business losses (tax) ► F Hold Co 1 sells the shares of F Hold Co 2 to Acquirer Co in FY 2013 -14 Outside India Inside India Op Co Page 7 Op Co General Anti Avoidance Rules (‘GAAR’) Case Studies

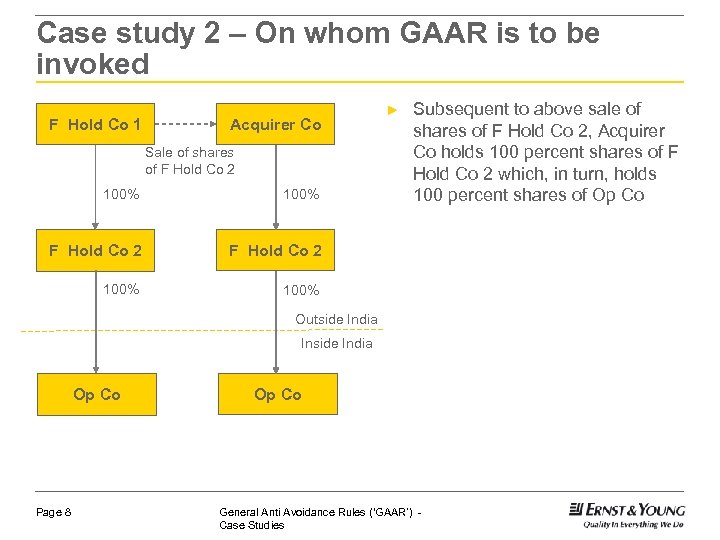

Case study 2 – On whom GAAR is to be invoked F Hold Co 1 Acquirer Co Sale of shares of F Hold Co 2 100% F Hold Co 2 Subsequent to above sale of shares of F Hold Co 2, Acquirer Co holds 100 percent shares of F Hold Co 2 which, in turn, holds 100 percent shares of Op Co F Hold Co 2 100% ► 100% Outside India Inside India Op Co Page 8 Op Co General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 2 – On whom GAAR is to be invoked F Hold Co 1 Acquirer Co Sale of shares of F Hold Co 2 100% F Hold Co 2 Subsequent to above sale of shares of F Hold Co 2, Acquirer Co holds 100 percent shares of F Hold Co 2 which, in turn, holds 100 percent shares of Op Co F Hold Co 2 100% ► 100% Outside India Inside India Op Co Page 8 Op Co General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 2 – On whom GAAR is to be invoked Issues for discussion ► Is there a tax benefit to any of the entities in the given case? And to whom? ► On what grounds could the tax authorities invoke GAAR in respect of the above transaction of sale of shares of F Hold Co 2? ► What would be the impact on set-off of carried forward losses of Op Co? ► What could be the consequences/ Income-tax implications in case GAAR is invoked by the tax authorities? Page 9 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 2 – On whom GAAR is to be invoked Issues for discussion ► Is there a tax benefit to any of the entities in the given case? And to whom? ► On what grounds could the tax authorities invoke GAAR in respect of the above transaction of sale of shares of F Hold Co 2? ► What would be the impact on set-off of carried forward losses of Op Co? ► What could be the consequences/ Income-tax implications in case GAAR is invoked by the tax authorities? Page 9 General Anti Avoidance Rules (‘GAAR’) Case Studies

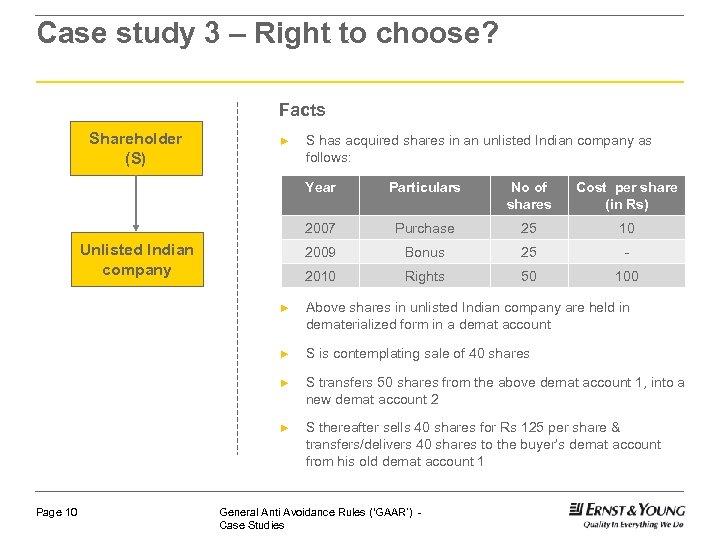

Case study 3 – Right to choose? Facts Shareholder (S) ► S has acquired shares in an unlisted Indian company as follows: Year No of shares Cost per share (in Rs) 2007 Purchase 25 10 2009 Bonus 25 - 2010 Unlisted Indian company Particulars Rights 50 100 ► ► S is contemplating sale of 40 shares ► S transfers 50 shares from the above demat account 1, into a new demat account 2 ► Page 10 Above shares in unlisted Indian company are held in dematerialized form in a demat account S thereafter sells 40 shares for Rs 125 per share & transfers/delivers 40 shares to the buyer’s demat account from his old demat account 1 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 3 – Right to choose? Facts Shareholder (S) ► S has acquired shares in an unlisted Indian company as follows: Year No of shares Cost per share (in Rs) 2007 Purchase 25 10 2009 Bonus 25 - 2010 Unlisted Indian company Particulars Rights 50 100 ► ► S is contemplating sale of 40 shares ► S transfers 50 shares from the above demat account 1, into a new demat account 2 ► Page 10 Above shares in unlisted Indian company are held in dematerialized form in a demat account S thereafter sells 40 shares for Rs 125 per share & transfers/delivers 40 shares to the buyer’s demat account from his old demat account 1 General Anti Avoidance Rules (‘GAAR’) Case Studies

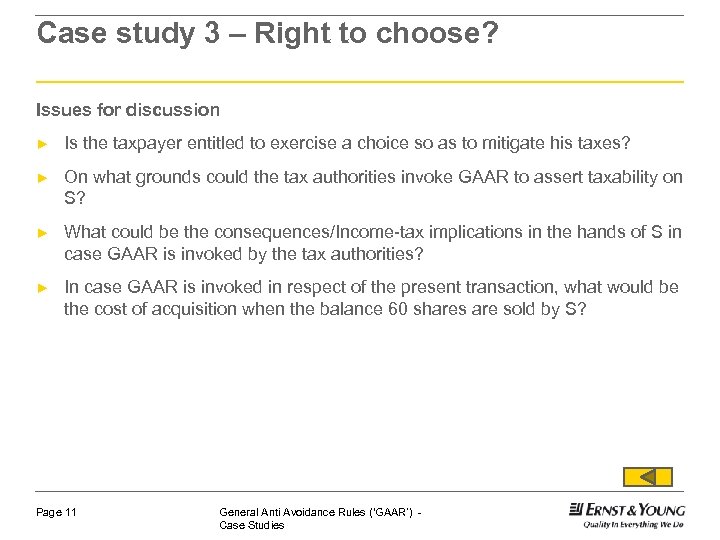

Case study 3 – Right to choose? Issues for discussion ► Is the taxpayer entitled to exercise a choice so as to mitigate his taxes? ► On what grounds could the tax authorities invoke GAAR to assert taxability on S? ► What could be the consequences/Income-tax implications in the hands of S in case GAAR is invoked by the tax authorities? ► In case GAAR is invoked in respect of the present transaction, what would be the cost of acquisition when the balance 60 shares are sold by S? Page 11 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 3 – Right to choose? Issues for discussion ► Is the taxpayer entitled to exercise a choice so as to mitigate his taxes? ► On what grounds could the tax authorities invoke GAAR to assert taxability on S? ► What could be the consequences/Income-tax implications in the hands of S in case GAAR is invoked by the tax authorities? ► In case GAAR is invoked in respect of the present transaction, what would be the cost of acquisition when the balance 60 shares are sold by S? Page 11 General Anti Avoidance Rules (‘GAAR’) Case Studies

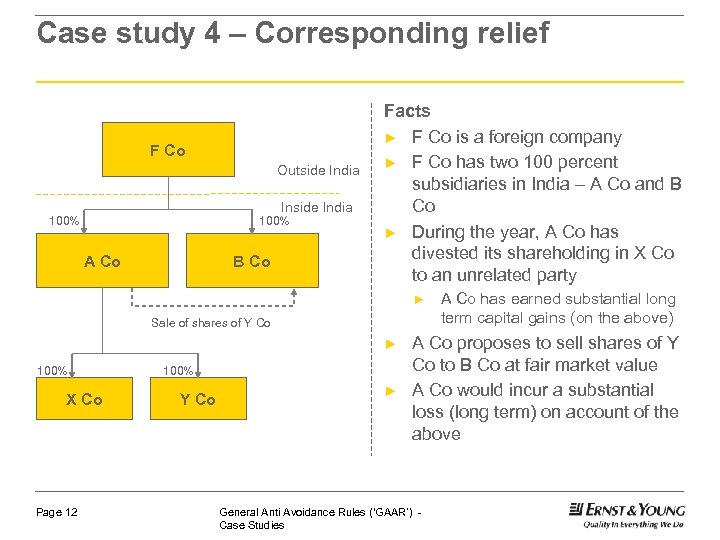

Case study 4 – Corresponding relief F Co Outside India Inside India 100% A Co B Co Facts ► F Co is a foreign company ► F Co has two 100 percent subsidiaries in India – A Co and B Co ► During the year, A Co has divested its shareholding in X Co to an unrelated party ► Sale of shares of Y Co ► 100% X Co Page 12 100% Y Co ► A Co has earned substantial long term capital gains (on the above) A Co proposes to sell shares of Y Co to B Co at fair market value A Co would incur a substantial loss (long term) on account of the above General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 4 – Corresponding relief F Co Outside India Inside India 100% A Co B Co Facts ► F Co is a foreign company ► F Co has two 100 percent subsidiaries in India – A Co and B Co ► During the year, A Co has divested its shareholding in X Co to an unrelated party ► Sale of shares of Y Co ► 100% X Co Page 12 100% Y Co ► A Co has earned substantial long term capital gains (on the above) A Co proposes to sell shares of Y Co to B Co at fair market value A Co would incur a substantial loss (long term) on account of the above General Anti Avoidance Rules (‘GAAR’) Case Studies

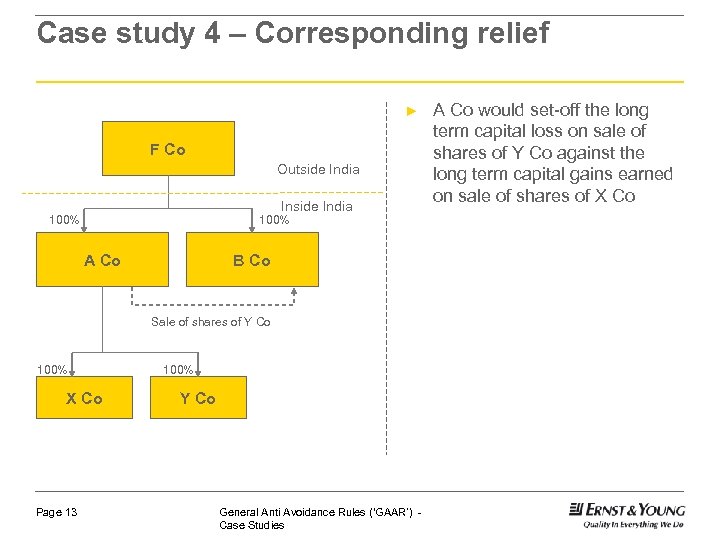

Case study 4 – Corresponding relief ► F Co Outside India Inside India 100% A Co B Co Sale of shares of Y Co 100% X Co Page 13 100% Y Co General Anti Avoidance Rules (‘GAAR’) Case Studies A Co would set-off the long term capital loss on sale of shares of Y Co against the long term capital gains earned on sale of shares of X Co

Case study 4 – Corresponding relief ► F Co Outside India Inside India 100% A Co B Co Sale of shares of Y Co 100% X Co Page 13 100% Y Co General Anti Avoidance Rules (‘GAAR’) Case Studies A Co would set-off the long term capital loss on sale of shares of Y Co against the long term capital gains earned on sale of shares of X Co

Case study 4 – Corresponding relief Issues for discussion ► Whether the tax authorities can invoke GAAR on the above transaction of sale of shares of Y Co? ► What could be the Income-tax implications in the hands of A Co on the above transaction of sale of shares of Y Co? ► What could be the Income-tax implications in the hands of B Co if they were to divest these shares eventually? Page 14 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 4 – Corresponding relief Issues for discussion ► Whether the tax authorities can invoke GAAR on the above transaction of sale of shares of Y Co? ► What could be the Income-tax implications in the hands of A Co on the above transaction of sale of shares of Y Co? ► What could be the Income-tax implications in the hands of B Co if they were to divest these shares eventually? Page 14 General Anti Avoidance Rules (‘GAAR’) Case Studies

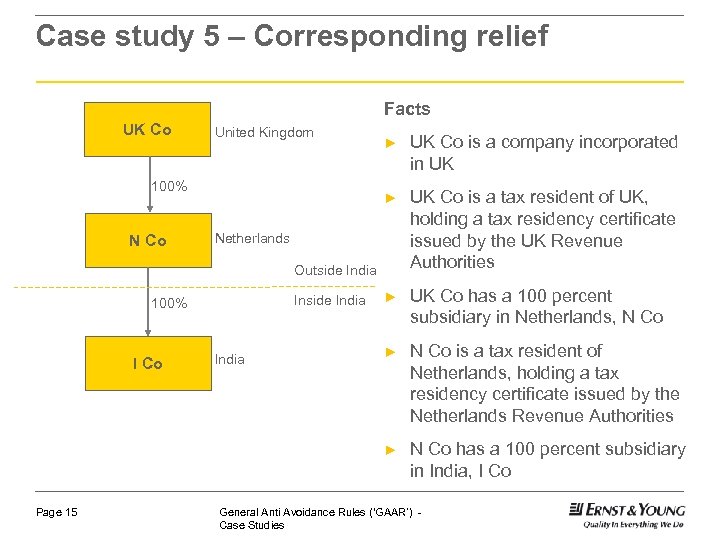

Case study 5 – Corresponding relief Facts UK Co United Kingdom UK Co is a tax resident of UK, holding a tax residency certificate issued by the UK Revenue Authorities ► UK Co has a 100 percent subsidiary in Netherlands, N Co ► N Co is a tax resident of Netherlands, holding a tax residency certificate issued by the Netherlands Revenue Authorities ► N Co UK Co is a company incorporated in UK ► 100% ► N Co has a 100 percent subsidiary in India, I Co Netherlands Outside India Inside India 100% I Co Page 15 India General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 5 – Corresponding relief Facts UK Co United Kingdom UK Co is a tax resident of UK, holding a tax residency certificate issued by the UK Revenue Authorities ► UK Co has a 100 percent subsidiary in Netherlands, N Co ► N Co is a tax resident of Netherlands, holding a tax residency certificate issued by the Netherlands Revenue Authorities ► N Co UK Co is a company incorporated in UK ► 100% ► N Co has a 100 percent subsidiary in India, I Co Netherlands Outside India Inside India 100% I Co Page 15 India General Anti Avoidance Rules (‘GAAR’) Case Studies

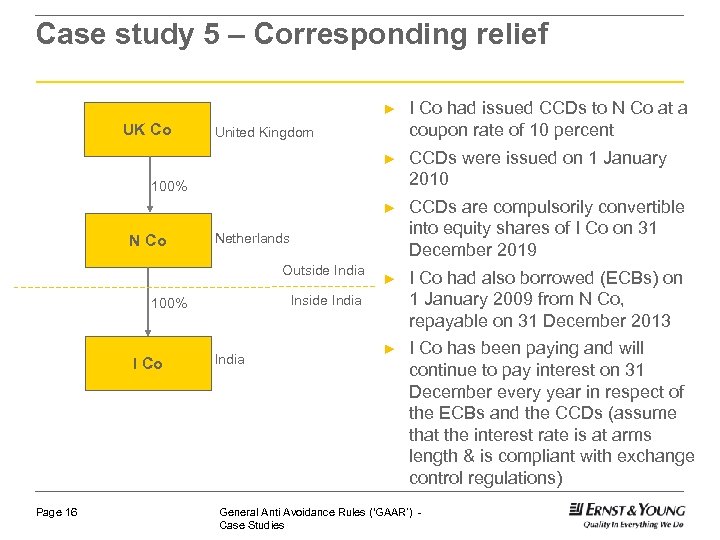

Case study 5 – Corresponding relief ► ► CCDs were issued on 1 January 2010 ► UK Co I Co had issued CCDs to N Co at a coupon rate of 10 percent CCDs are compulsorily convertible into equity shares of I Co on 31 December 2019 ► I Co had also borrowed (ECBs) on 1 January 2009 from N Co, repayable on 31 December 2013 ► I Co has been paying and will continue to pay interest on 31 December every year in respect of the ECBs and the CCDs (assume that the interest rate is at arms length & is compliant with exchange control regulations) United Kingdom 100% N Co Netherlands Outside India Inside India 100% I Co Page 16 India General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 5 – Corresponding relief ► ► CCDs were issued on 1 January 2010 ► UK Co I Co had issued CCDs to N Co at a coupon rate of 10 percent CCDs are compulsorily convertible into equity shares of I Co on 31 December 2019 ► I Co had also borrowed (ECBs) on 1 January 2009 from N Co, repayable on 31 December 2013 ► I Co has been paying and will continue to pay interest on 31 December every year in respect of the ECBs and the CCDs (assume that the interest rate is at arms length & is compliant with exchange control regulations) United Kingdom 100% N Co Netherlands Outside India Inside India 100% I Co Page 16 India General Anti Avoidance Rules (‘GAAR’) Case Studies

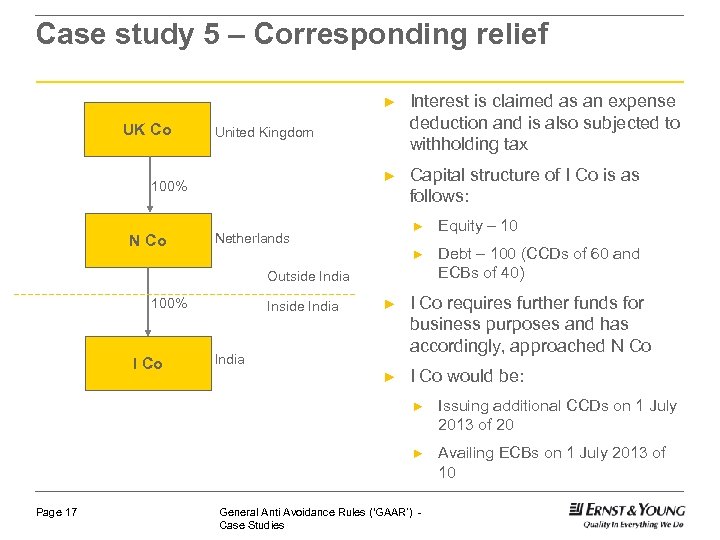

Case study 5 – Corresponding relief ► UK Co ► Capital structure of I Co is as follows: United Kingdom 100% N Co Interest is claimed as an expense deduction and is also subjected to withholding tax ► Equity – 10 ► Netherlands Debt – 100 (CCDs of 60 and ECBs of 40) Outside India I Co Inside India ► I Co requires further funds for business purposes and has accordingly, approached N Co ► 100% I Co would be: India ► ► Page 17 Issuing additional CCDs on 1 July 2013 of 20 Availing ECBs on 1 July 2013 of 10 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 5 – Corresponding relief ► UK Co ► Capital structure of I Co is as follows: United Kingdom 100% N Co Interest is claimed as an expense deduction and is also subjected to withholding tax ► Equity – 10 ► Netherlands Debt – 100 (CCDs of 60 and ECBs of 40) Outside India I Co Inside India ► I Co requires further funds for business purposes and has accordingly, approached N Co ► 100% I Co would be: India ► ► Page 17 Issuing additional CCDs on 1 July 2013 of 20 Availing ECBs on 1 July 2013 of 10 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 5 – Corresponding relief Issues for consideration ► What could be the Income-tax implications in the hands of N Co/ I Co/ UK Co in respect of interest payout by I Co? ► Whether GAAR could be invoked in respect of past transactions of CCDs and ECBs? ► On what grounds could the tax authorities invoke GAAR in respect of CCDs as well as ECBs inspite interest payout being at arm’s length? ► In whose hands can GAAR be invoked in respect of CCDs and ECBs? ► What could be the consequences/ Income-tax implications in the hands of N Co/ I Co/ UK Co in case GAAR is invoked by the tax authorities? Page 18 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 5 – Corresponding relief Issues for consideration ► What could be the Income-tax implications in the hands of N Co/ I Co/ UK Co in respect of interest payout by I Co? ► Whether GAAR could be invoked in respect of past transactions of CCDs and ECBs? ► On what grounds could the tax authorities invoke GAAR in respect of CCDs as well as ECBs inspite interest payout being at arm’s length? ► In whose hands can GAAR be invoked in respect of CCDs and ECBs? ► What could be the consequences/ Income-tax implications in the hands of N Co/ I Co/ UK Co in case GAAR is invoked by the tax authorities? Page 18 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 6 – SAAR/LOB v/s GAAR Facts ► US Co is a company incorporated in USA and a tax resident of USA ► US Co has a 100 percent subsidiary in Mauritius, M Co ► M Co is a tax resident of Mauritius, holding a tax residency certificate issued by the Mauritius Revenue Authorities ► M Co has a 100 percent subsidiary in India, I Co ► Page 19 I Co is an operating company General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 6 – SAAR/LOB v/s GAAR Facts ► US Co is a company incorporated in USA and a tax resident of USA ► US Co has a 100 percent subsidiary in Mauritius, M Co ► M Co is a tax resident of Mauritius, holding a tax residency certificate issued by the Mauritius Revenue Authorities ► M Co has a 100 percent subsidiary in India, I Co ► Page 19 I Co is an operating company General Anti Avoidance Rules (‘GAAR’) Case Studies

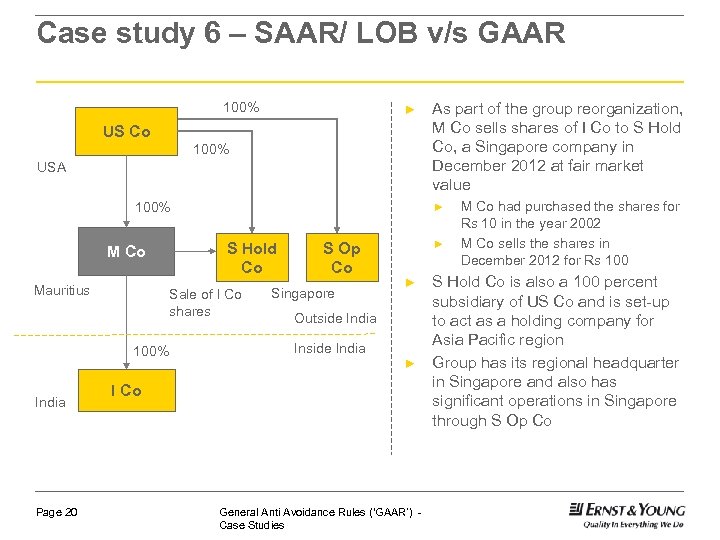

Case study 6 – SAAR/ LOB v/s GAAR 100% ► US Co 100% USA 100% M Co Mauritius India Page 20 ► S Hold Co Sale of I Co shares 100% As part of the group reorganization, M Co sells shares of I Co to S Hold Co, a Singapore company in December 2012 at fair market value S Op Co Singapore ► ► Outside India Inside India ► I Co General Anti Avoidance Rules (‘GAAR’) Case Studies M Co had purchased the shares for Rs 10 in the year 2002 M Co sells the shares in December 2012 for Rs 100 S Hold Co is also a 100 percent subsidiary of US Co and is set-up to act as a holding company for Asia Pacific region Group has its regional headquarter in Singapore and also has significant operations in Singapore through S Op Co

Case study 6 – SAAR/ LOB v/s GAAR 100% ► US Co 100% USA 100% M Co Mauritius India Page 20 ► S Hold Co Sale of I Co shares 100% As part of the group reorganization, M Co sells shares of I Co to S Hold Co, a Singapore company in December 2012 at fair market value S Op Co Singapore ► ► Outside India Inside India ► I Co General Anti Avoidance Rules (‘GAAR’) Case Studies M Co had purchased the shares for Rs 10 in the year 2002 M Co sells the shares in December 2012 for Rs 100 S Hold Co is also a 100 percent subsidiary of US Co and is set-up to act as a holding company for Asia Pacific region Group has its regional headquarter in Singapore and also has significant operations in Singapore through S Op Co

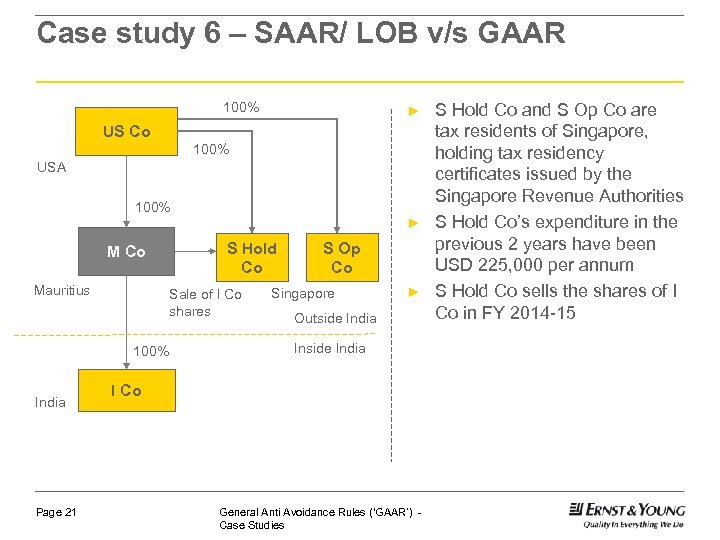

Case study 6 – SAAR/ LOB v/s GAAR 100% ► US Co 100% USA 100% ► M Co Mauritius Sale of I Co shares 100% India Page 21 S Hold Co S Op Co Singapore ► Outside India Inside India I Co General Anti Avoidance Rules (‘GAAR’) Case Studies S Hold Co and S Op Co are tax residents of Singapore, holding tax residency certificates issued by the Singapore Revenue Authorities S Hold Co’s expenditure in the previous 2 years have been USD 225, 000 per annum S Hold Co sells the shares of I Co in FY 2014 -15

Case study 6 – SAAR/ LOB v/s GAAR 100% ► US Co 100% USA 100% ► M Co Mauritius Sale of I Co shares 100% India Page 21 S Hold Co S Op Co Singapore ► Outside India Inside India I Co General Anti Avoidance Rules (‘GAAR’) Case Studies S Hold Co and S Op Co are tax residents of Singapore, holding tax residency certificates issued by the Singapore Revenue Authorities S Hold Co’s expenditure in the previous 2 years have been USD 225, 000 per annum S Hold Co sells the shares of I Co in FY 2014 -15

Case study 6 – SAAR/ LOB v/s GAAR Issues for discussion ► Whether US Co or M Co or S Hold Co could be subject to Income-tax in India on gains from sale of shares of I Co? ► On what grounds could the tax authorities invoke GAAR to assert taxability on US Co or M Co or S Hold Co for gains from sale of shares of I Co? ► What would be the cost of acquisition for the transferor in respect of the transaction of sale of shares in FY 2014 -15? ► Can the intra-group reorganization of December 2012 and subsequent sale of shares in FY 2014 -15 be considered as “pre-ordained” and subject to GAAR? ► Can the tax authorities invoke GAAR in the above case, even though S Hold Co meets the “limitation of benefit” test under the India-Singapore tax treaty? ► What could be the consequences/Income-tax implications in the hands of US Co/M Co/S Hold Co in case GAAR is invoked by the tax authorities? Page 22 General Anti Avoidance Rules (‘GAAR’) Case Studies

Case study 6 – SAAR/ LOB v/s GAAR Issues for discussion ► Whether US Co or M Co or S Hold Co could be subject to Income-tax in India on gains from sale of shares of I Co? ► On what grounds could the tax authorities invoke GAAR to assert taxability on US Co or M Co or S Hold Co for gains from sale of shares of I Co? ► What would be the cost of acquisition for the transferor in respect of the transaction of sale of shares in FY 2014 -15? ► Can the intra-group reorganization of December 2012 and subsequent sale of shares in FY 2014 -15 be considered as “pre-ordained” and subject to GAAR? ► Can the tax authorities invoke GAAR in the above case, even though S Hold Co meets the “limitation of benefit” test under the India-Singapore tax treaty? ► What could be the consequences/Income-tax implications in the hands of US Co/M Co/S Hold Co in case GAAR is invoked by the tax authorities? Page 22 General Anti Avoidance Rules (‘GAAR’) Case Studies

Thank you This presentation contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Neither Ernst & Young Pvt. Ltd. nor any other member of the global Ernst & Young organization can accept any responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication. On any specific matter, reference should be made to the appropriate advisor.

Thank you This presentation contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Neither Ernst & Young Pvt. Ltd. nor any other member of the global Ernst & Young organization can accept any responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication. On any specific matter, reference should be made to the appropriate advisor.