87444e18a064462da78dd3f0e365594b.ppt

- Количество слайдов: 82

GE Financial sm Privileged Choice and Classic Select sm Producer Product Training The best just got better! 1 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial sm Privileged Choice and Classic Select sm Producer Product Training The best just got better! 1 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Training Disclaimer The following slides constitute a complete legal and compliance approved training program. Removal of slides to shorten the existing training program is acceptable. However, no changes to any slides or use of any slides individually is permitted without resubmission to GE legal and compliance review. The following training program is subject to variation by state and does not include all state variations. For state specifications, please refer to the brochure. Strict adherence to this policy is required. 2 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Training Disclaimer The following slides constitute a complete legal and compliance approved training program. Removal of slides to shorten the existing training program is acceptable. However, no changes to any slides or use of any slides individually is permitted without resubmission to GE legal and compliance review. The following training program is subject to variation by state and does not include all state variations. For state specifications, please refer to the brochure. Strict adherence to this policy is required. 2 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

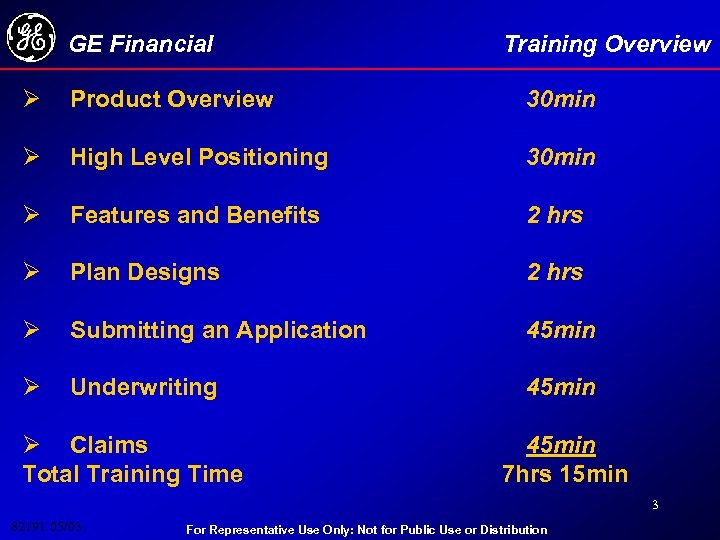

GE Financial Training Overview Ø Product Overview 30 min Ø High Level Positioning 30 min Ø Features and Benefits 2 hrs Ø Plan Designs 2 hrs Ø Submitting an Application 45 min Ø Underwriting 45 min Ø Claims Total Training Time 45 min 7 hrs 15 min 3 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Training Overview Ø Product Overview 30 min Ø High Level Positioning 30 min Ø Features and Benefits 2 hrs Ø Plan Designs 2 hrs Ø Submitting an Application 45 min Ø Underwriting 45 min Ø Claims Total Training Time 45 min 7 hrs 15 min 3 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial PRODUCT OVERVIEW 4 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial PRODUCT OVERVIEW 4 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

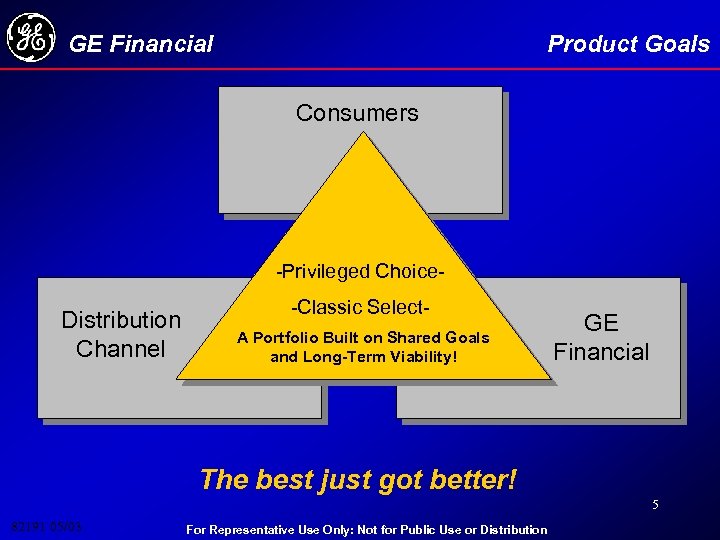

GE Financial Product Goals Consumers -Privileged Choice- Distribution Channel -Classic Select. A Portfolio Built on Shared Goals and Long-Term Viability! GE Financial The best just got better! 5 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Product Goals Consumers -Privileged Choice- Distribution Channel -Classic Select. A Portfolio Built on Shared Goals and Long-Term Viability! GE Financial The best just got better! 5 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial New Product Why Bring New Products to Market? u To bring “state of the art” answers for the increasing Baby Boomer market u To help our producers remain competitive u To address the ever changing regulatory and care delivery environment u Market Economics Long Term Price Stability & Product Competitiveness 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 6

GE Financial New Product Why Bring New Products to Market? u To bring “state of the art” answers for the increasing Baby Boomer market u To help our producers remain competitive u To address the ever changing regulatory and care delivery environment u Market Economics Long Term Price Stability & Product Competitiveness 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 6

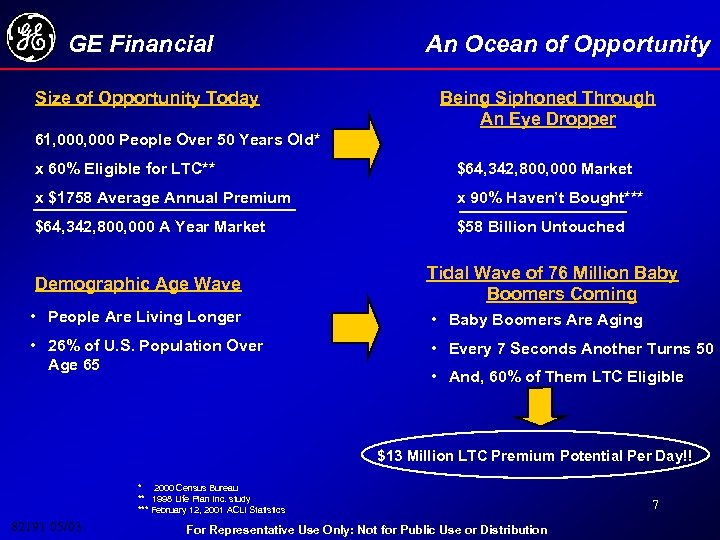

GE Financial Size of Opportunity Today An Ocean of Opportunity Being Siphoned Through An Eye Dropper 61, 000 People Over 50 Years Old* x 60% Eligible for LTC** $64, 342, 800, 000 Market x $1758 Average Annual Premium x 90% Haven’t Bought*** $64, 342, 800, 000 A Year Market $58 Billion Untouched Demographic Age Wave Tidal Wave of 76 Million Baby Boomers Coming • People Are Living Longer • Baby Boomers Are Aging • 26% of U. S. Population Over Age 65 • Every 7 Seconds Another Turns 50 • And, 60% of Them LTC Eligible $13 Million LTC Premium Potential Per Day!! * 2000 Census Bureau ** 1998 Life Plan Inc. study *** February 12, 2001 ACLI Statistics 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 7

GE Financial Size of Opportunity Today An Ocean of Opportunity Being Siphoned Through An Eye Dropper 61, 000 People Over 50 Years Old* x 60% Eligible for LTC** $64, 342, 800, 000 Market x $1758 Average Annual Premium x 90% Haven’t Bought*** $64, 342, 800, 000 A Year Market $58 Billion Untouched Demographic Age Wave Tidal Wave of 76 Million Baby Boomers Coming • People Are Living Longer • Baby Boomers Are Aging • 26% of U. S. Population Over Age 65 • Every 7 Seconds Another Turns 50 • And, 60% of Them LTC Eligible $13 Million LTC Premium Potential Per Day!! * 2000 Census Bureau ** 1998 Life Plan Inc. study *** February 12, 2001 ACLI Statistics 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 7

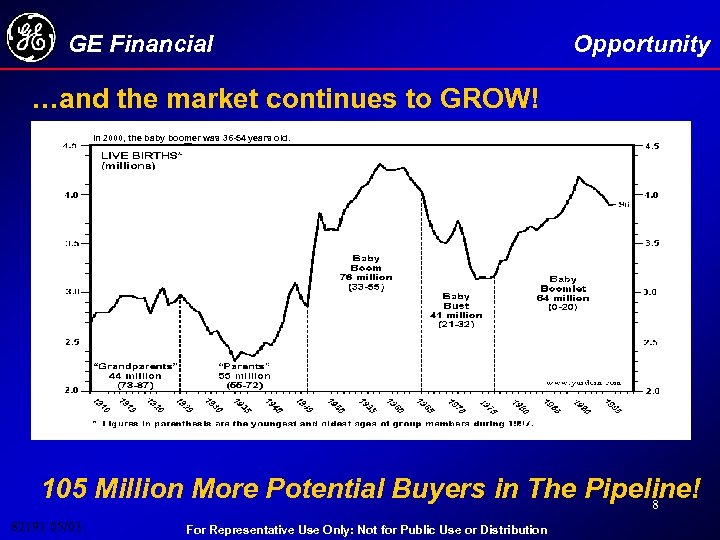

GE Financial Opportunity …and the market continues to GROW! In 2000, the baby boomer was 36 -54 years old. 105 Million More Potential Buyers in The Pipeline! 8 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Opportunity …and the market continues to GROW! In 2000, the baby boomer was 36 -54 years old. 105 Million More Potential Buyers in The Pipeline! 8 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial The Consumer What’s Good for the Consumer? u Flexibility (a la carte options) and More Choices! u Customization to meet Price and Value Needs u History of Rate Stability u Improved Contract Language - Prevailing expense limitations removed More liberal eating definition (ADL) More robust Home Health Care provision Liberalized Assisted Living Facility definition The best just got better! 9 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial The Consumer What’s Good for the Consumer? u Flexibility (a la carte options) and More Choices! u Customization to meet Price and Value Needs u History of Rate Stability u Improved Contract Language - Prevailing expense limitations removed More liberal eating definition (ADL) More robust Home Health Care provision Liberalized Assisted Living Facility definition The best just got better! 9 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial The Producer What’s Good for Distribution? u u u Tools to Help You Sell Ease of Doing Business Customized to client needs Makes competitive comparisons easier…Apples to Apples Meets Competitors Head On…Raises the bar More Choices = More Sales 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 10

GE Financial The Producer What’s Good for Distribution? u u u Tools to Help You Sell Ease of Doing Business Customized to client needs Makes competitive comparisons easier…Apples to Apples Meets Competitors Head On…Raises the bar More Choices = More Sales 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 10

GE Financial HIGH LEVEL POSITIONING 11 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial HIGH LEVEL POSITIONING 11 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

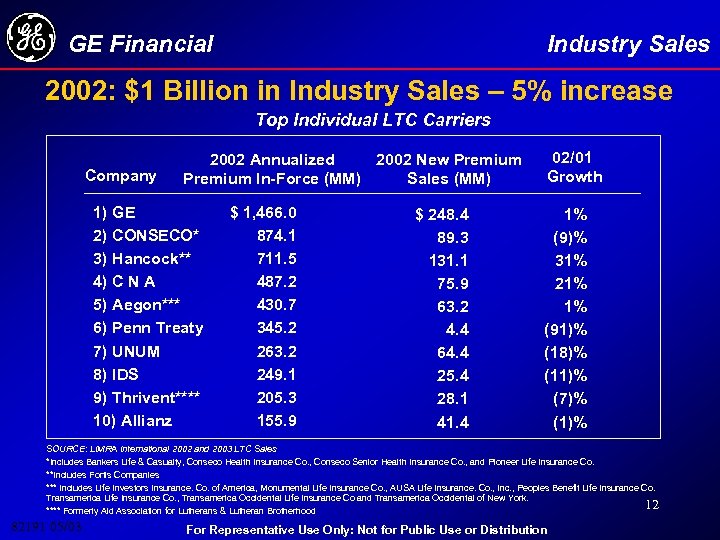

GE Financial Industry Sales 2002: $1 Billion in Industry Sales – 5% increase Top Individual LTC Carriers Company 2002 Annualized 2002 New Premium In-Force (MM) Sales (MM) 1) GE 2) CONSECO* 3) Hancock** 4) C N A 5) Aegon*** 6) Penn Treaty 7) UNUM 8) IDS 9) Thrivent**** 10) Allianz $ 1, 466. 0 874. 1 711. 5 487. 2 430. 7 345. 2 263. 2 249. 1 205. 3 155. 9 $ 248. 4 89. 3 131. 1 75. 9 63. 2 4. 4 64. 4 25. 4 28. 1 41. 4 02/01 Growth 1% (9)% 31% 21% 1% (91)% (18)% (11)% (7)% (1)% SOURCE: LIMRA International 2002 and 2003 LTC Sales *Includes Bankers Life & Casualty, Conseco Health Insurance Co. , Conseco Senior Health Insurance Co. , and Pioneer Life Insurance Co. **Includes Fortis Companies *** Includes Life Investors Insurance. Co. of America, Monumental Life Insurance Co. , AUSA Life Insurance. Co. , Inc. , Peoples Benefit Life Insurance Co. Transamerica Life Insurance Co. , Transamerica Occidental Life Insurance Co and Transamerica Occidental of New York. 12 **** Formerly Aid Association for Lutherans & Lutheran Brotherhood 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Industry Sales 2002: $1 Billion in Industry Sales – 5% increase Top Individual LTC Carriers Company 2002 Annualized 2002 New Premium In-Force (MM) Sales (MM) 1) GE 2) CONSECO* 3) Hancock** 4) C N A 5) Aegon*** 6) Penn Treaty 7) UNUM 8) IDS 9) Thrivent**** 10) Allianz $ 1, 466. 0 874. 1 711. 5 487. 2 430. 7 345. 2 263. 2 249. 1 205. 3 155. 9 $ 248. 4 89. 3 131. 1 75. 9 63. 2 4. 4 64. 4 25. 4 28. 1 41. 4 02/01 Growth 1% (9)% 31% 21% 1% (91)% (18)% (11)% (7)% (1)% SOURCE: LIMRA International 2002 and 2003 LTC Sales *Includes Bankers Life & Casualty, Conseco Health Insurance Co. , Conseco Senior Health Insurance Co. , and Pioneer Life Insurance Co. **Includes Fortis Companies *** Includes Life Investors Insurance. Co. of America, Monumental Life Insurance Co. , AUSA Life Insurance. Co. , Inc. , Peoples Benefit Life Insurance Co. Transamerica Life Insurance Co. , Transamerica Occidental Life Insurance Co and Transamerica Occidental of New York. 12 **** Formerly Aid Association for Lutherans & Lutheran Brotherhood 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial FEATURES & BENEFITS 13 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial FEATURES & BENEFITS 13 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Introducing…. Two New Products!! ip gsh t! Fla uc d Pro Privileged Choice Classic Select - Comprehensive Coverage - Inclusive Plan - Modular Design Two Products…the best just got better! 14 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Introducing…. Two New Products!! ip gsh t! Fla uc d Pro Privileged Choice Classic Select - Comprehensive Coverage - Inclusive Plan - Modular Design Two Products…the best just got better! 14 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

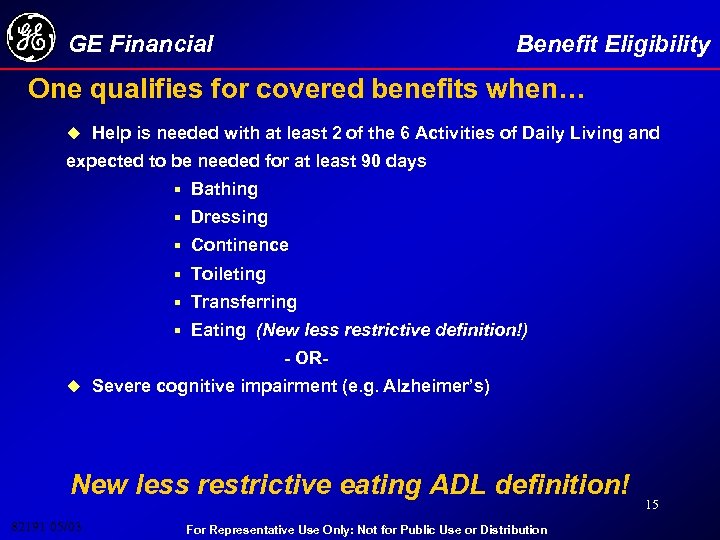

GE Financial Benefit Eligibility One qualifies for covered benefits when… u Help is needed with at least 2 of the 6 Activities of Daily Living and expected to be needed for at least 90 days § Bathing § Dressing § Continence § Toileting § Transferring § Eating (New less restrictive definition!) - ORu Severe cognitive impairment (e. g. Alzheimer’s) New less restrictive eating ADL definition! 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 15

GE Financial Benefit Eligibility One qualifies for covered benefits when… u Help is needed with at least 2 of the 6 Activities of Daily Living and expected to be needed for at least 90 days § Bathing § Dressing § Continence § Toileting § Transferring § Eating (New less restrictive definition!) - ORu Severe cognitive impairment (e. g. Alzheimer’s) New less restrictive eating ADL definition! 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 15

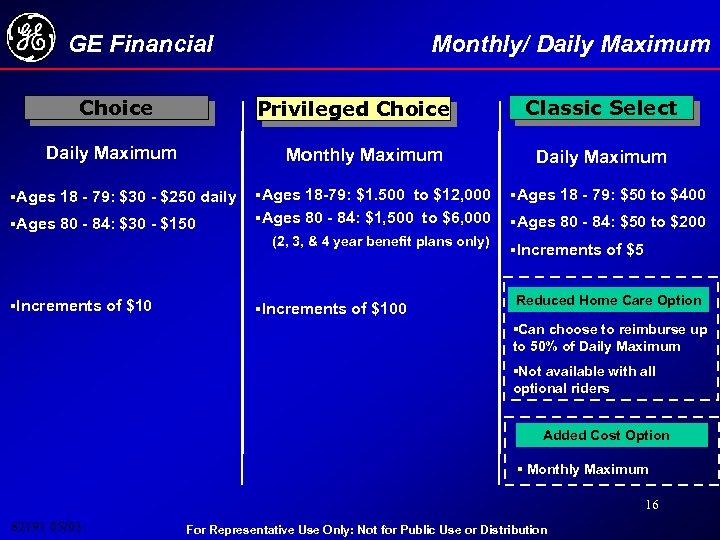

GE Financial Choice Monthly/ Daily Maximum Privileged Choice Daily Maximum Monthly Maximum Classic Select Daily Maximum §Ages 18 - 79: $30 - $250 daily §Ages 18 -79: $1. 500 to $12, 000 §Ages 18 - 79: $50 to $400 §Ages 80 - 84: $30 - $150 §Ages 80 - 84: $1, 500 to $6, 000 §Ages 80 - 84: $50 to $200 (2, 3, & 4 year benefit plans only) §Increments of $100 §Increments of $5 Reduced Home Care Option §Can choose to reimburse up to 50% of Daily Maximum §Not available with all optional riders Added Cost Option § Monthly Maximum 16 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Monthly/ Daily Maximum Privileged Choice Daily Maximum Monthly Maximum Classic Select Daily Maximum §Ages 18 - 79: $30 - $250 daily §Ages 18 -79: $1. 500 to $12, 000 §Ages 18 - 79: $50 to $400 §Ages 80 - 84: $30 - $150 §Ages 80 - 84: $1, 500 to $6, 000 §Ages 80 - 84: $50 to $200 (2, 3, & 4 year benefit plans only) §Increments of $100 §Increments of $5 Reduced Home Care Option §Can choose to reimburse up to 50% of Daily Maximum §Not available with all optional riders Added Cost Option § Monthly Maximum 16 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

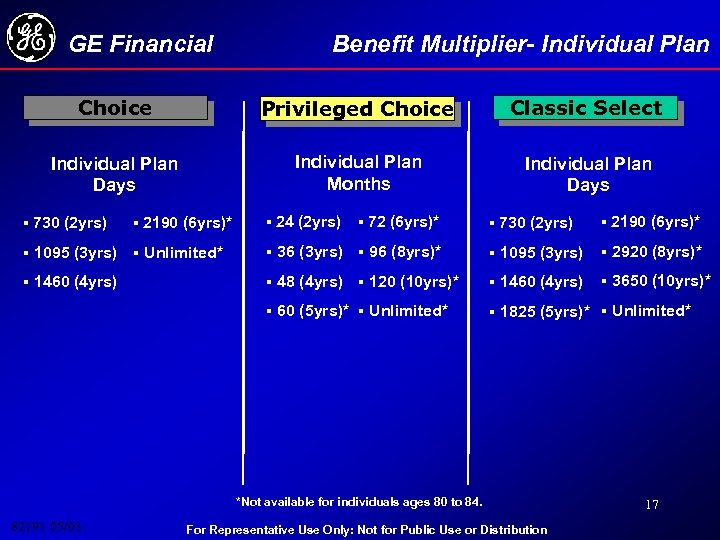

GE Financial Benefit Multiplier- Individual Plan Choice Classic Select Individual Plan Days § Privileged Choice Individual Plan Months Individual Plan Days 730 (2 yrs) § 1095 (3 yrs) § 1460 (4 yrs) § 2190 (6 yrs)* § 24 (2 yrs) § 72 (6 yrs)* § 730 (2 yrs) 2190 (6 yrs)* § 36 (3 yrs) § 96 (8 yrs)* § 1095 (3 yrs) § 2920 (8 yrs)* § 48 (4 yrs) § Unlimited* § 120 (10 yrs)* § 1460 (4 yrs) § 3650 (10 yrs)* § 60 (5 yrs)* § Unlimited* § 1825 (5 yrs)* § Unlimited* *Not available for individuals ages 80 to 84. 82191 05/03 § For Representative Use Only: Not for Public Use or Distribution 17

GE Financial Benefit Multiplier- Individual Plan Choice Classic Select Individual Plan Days § Privileged Choice Individual Plan Months Individual Plan Days 730 (2 yrs) § 1095 (3 yrs) § 1460 (4 yrs) § 2190 (6 yrs)* § 24 (2 yrs) § 72 (6 yrs)* § 730 (2 yrs) 2190 (6 yrs)* § 36 (3 yrs) § 96 (8 yrs)* § 1095 (3 yrs) § 2920 (8 yrs)* § 48 (4 yrs) § Unlimited* § 120 (10 yrs)* § 1460 (4 yrs) § 3650 (10 yrs)* § 60 (5 yrs)* § Unlimited* § 1825 (5 yrs)* § Unlimited* *Not available for individuals ages 80 to 84. 82191 05/03 § For Representative Use Only: Not for Public Use or Distribution 17

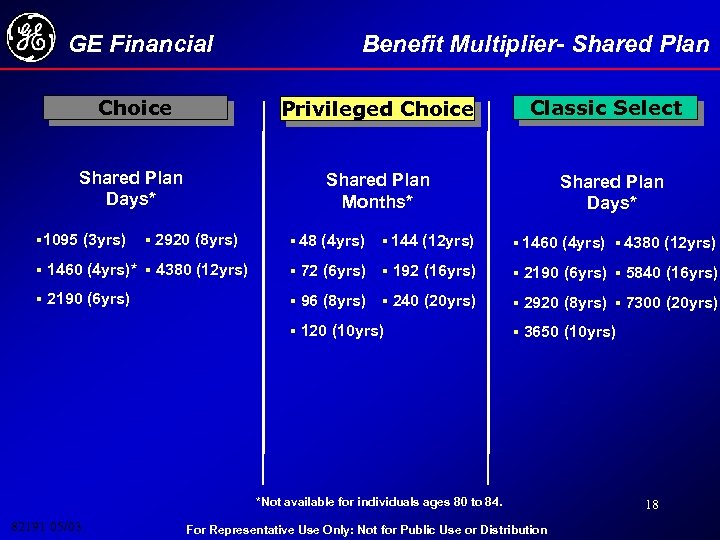

GE Financial Benefit Multiplier- Shared Plan Choice Privileged Choice Shared Plan Days* Shared Plan Months* § 1095 (3 yrs) § 2920 (8 yrs) § 48 (4 yrs) § 144 (12 yrs) Classic Select Shared Plan Days* § 1460 (4 yrs) § 4380 (12 yrs) § 1460 (4 yrs)* § 4380 (12 yrs) § 72 (6 yrs) § 192 (16 yrs) § 2190 (6 yrs) § 5840 (16 yrs) § 2190 (6 yrs) § 96 (8 yrs) § 240 (20 yrs) § 2920 (8 yrs) § 7300 (20 yrs) § 120 (10 yrs) § 3650 (10 yrs) *Not available for individuals ages 80 to 84. 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 18

GE Financial Benefit Multiplier- Shared Plan Choice Privileged Choice Shared Plan Days* Shared Plan Months* § 1095 (3 yrs) § 2920 (8 yrs) § 48 (4 yrs) § 144 (12 yrs) Classic Select Shared Plan Days* § 1460 (4 yrs) § 4380 (12 yrs) § 1460 (4 yrs)* § 4380 (12 yrs) § 72 (6 yrs) § 192 (16 yrs) § 2190 (6 yrs) § 5840 (16 yrs) § 2190 (6 yrs) § 96 (8 yrs) § 240 (20 yrs) § 2920 (8 yrs) § 7300 (20 yrs) § 120 (10 yrs) § 3650 (10 yrs) *Not available for individuals ages 80 to 84. 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 18

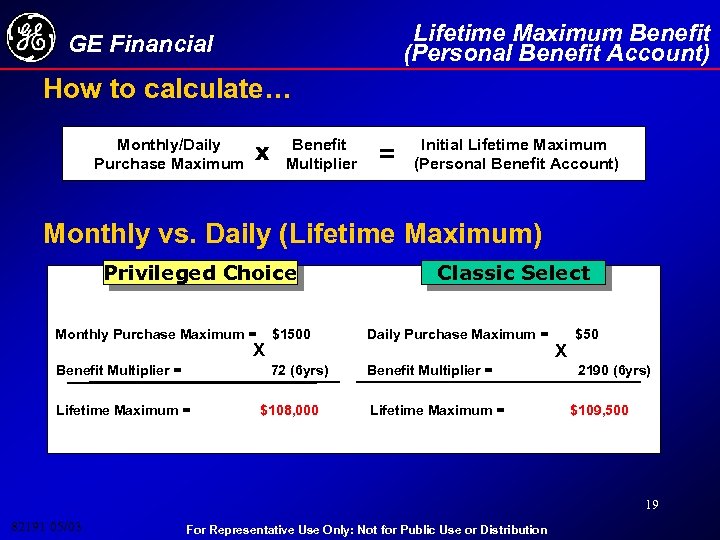

Lifetime Maximum Benefit (Personal Benefit Account) GE Financial How to calculate… Monthly/Daily Purchase Maximum x Benefit Multiplier = Initial Lifetime Maximum (Personal Benefit Account) Monthly vs. Daily (Lifetime Maximum) Privileged Choice Classic Select Monthly Purchase Maximum = $1500 Daily Purchase Maximum = Benefit Multiplier = 72 (6 yrs) Benefit Multiplier = X Lifetime Maximum = $108, 000 Lifetime Maximum = X $50 2190 (6 yrs) $109, 500 19 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

Lifetime Maximum Benefit (Personal Benefit Account) GE Financial How to calculate… Monthly/Daily Purchase Maximum x Benefit Multiplier = Initial Lifetime Maximum (Personal Benefit Account) Monthly vs. Daily (Lifetime Maximum) Privileged Choice Classic Select Monthly Purchase Maximum = $1500 Daily Purchase Maximum = Benefit Multiplier = 72 (6 yrs) Benefit Multiplier = X Lifetime Maximum = $108, 000 Lifetime Maximum = X $50 2190 (6 yrs) $109, 500 19 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

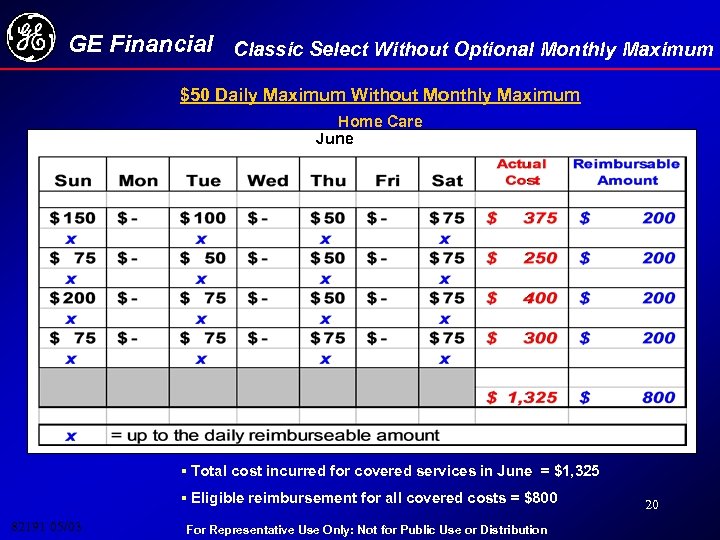

GE Financial Classic Select Without Optional Monthly Maximum $50 Daily Maximum Without Monthly Maximum Home Care June § Total cost incurred for covered services in June = $1, 325 § Eligible reimbursement for all covered costs = $800 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 20

GE Financial Classic Select Without Optional Monthly Maximum $50 Daily Maximum Without Monthly Maximum Home Care June § Total cost incurred for covered services in June = $1, 325 § Eligible reimbursement for all covered costs = $800 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 20

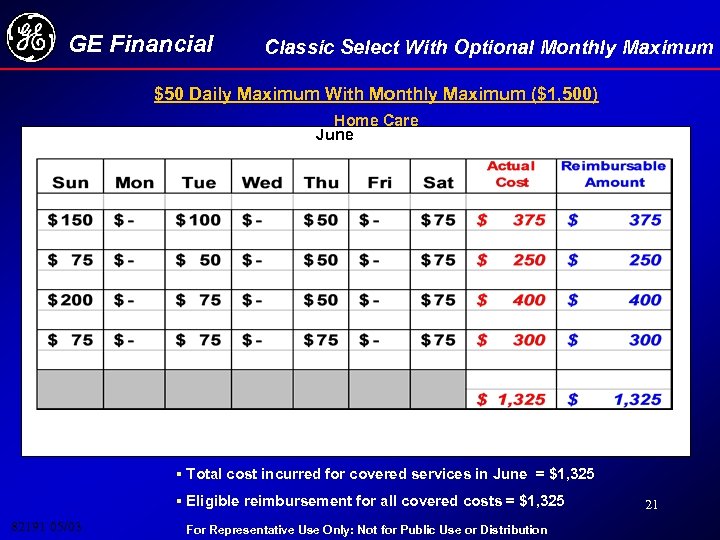

GE Financial Classic Select With Optional Monthly Maximum $50 Daily Maximum With Monthly Maximum ($1, 500) Home Care June § Total cost incurred for covered services in June = $1, 325 § Eligible reimbursement for all covered costs = $1, 325 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 21

GE Financial Classic Select With Optional Monthly Maximum $50 Daily Maximum With Monthly Maximum ($1, 500) Home Care June § Total cost incurred for covered services in June = $1, 325 § Eligible reimbursement for all covered costs = $1, 325 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 21

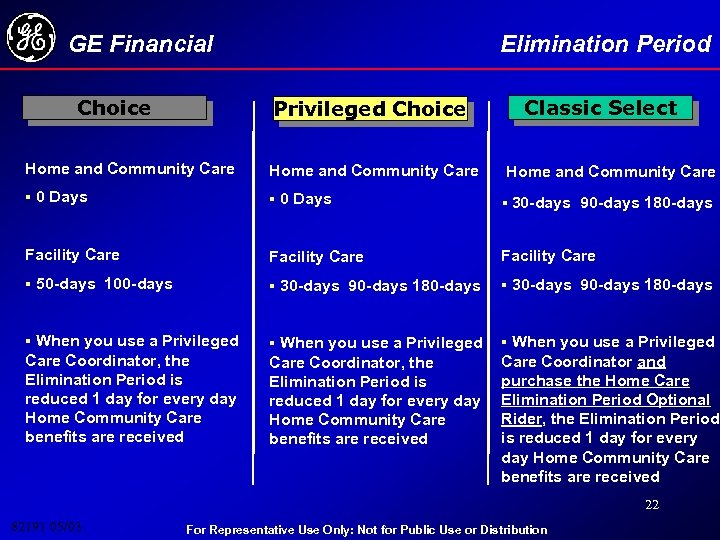

GE Financial Choice Elimination Period Classic Select Privileged Choice Home and Community Care § 0 Days § Facility Care § 50 -days 100 -days § 30 -days 90 -days 180 -days § When you use a Privileged Care Coordinator, the Elimination Period is reduced 1 day for every day Home Community Care benefits are received Care Coordinator and purchase the Home Care Elimination Period Optional Rider, the Elimination Period is reduced 1 day for every day Home Community Care benefits are received Care Coordinator, the Elimination Period is reduced 1 day for every day Home Community Care benefits are received Home and Community Care 30 -days 90 -days 180 -days 22 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Elimination Period Classic Select Privileged Choice Home and Community Care § 0 Days § Facility Care § 50 -days 100 -days § 30 -days 90 -days 180 -days § When you use a Privileged Care Coordinator, the Elimination Period is reduced 1 day for every day Home Community Care benefits are received Care Coordinator and purchase the Home Care Elimination Period Optional Rider, the Elimination Period is reduced 1 day for every day Home Community Care benefits are received Care Coordinator, the Elimination Period is reduced 1 day for every day Home Community Care benefits are received Home and Community Care 30 -days 90 -days 180 -days 22 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

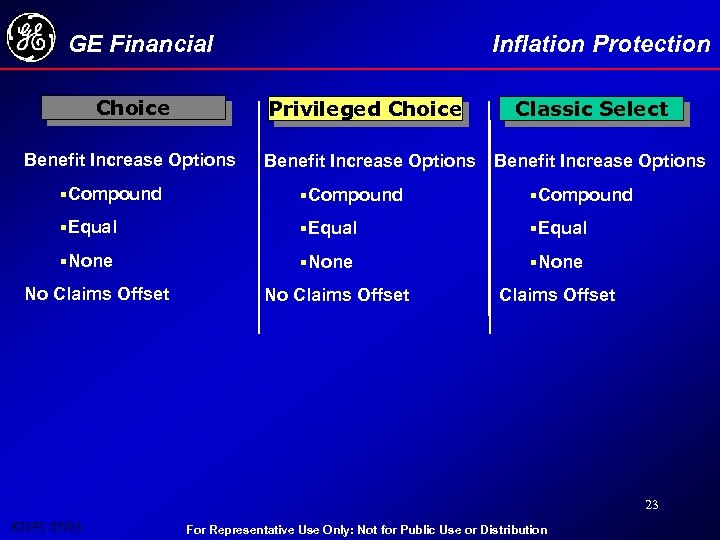

GE Financial Inflation Protection Choice Privileged Choice Benefit Increase Options Classic Select Benefit Increase Options §Compound §Equal §None No Claims Offset 23 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Inflation Protection Choice Privileged Choice Benefit Increase Options Classic Select Benefit Increase Options §Compound §Equal §None No Claims Offset 23 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

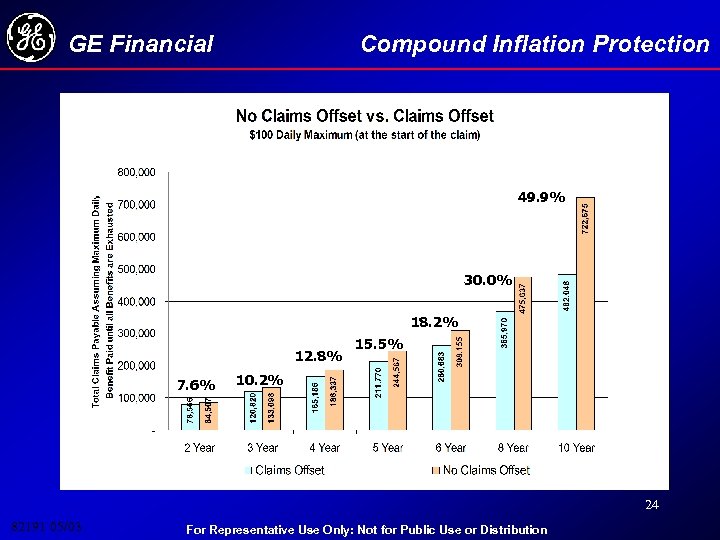

GE Financial Compound Inflation Protection 49. 9% 30. 0% 18. 2% 12. 8% 7. 6% 15. 5% 10. 2% 24 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Compound Inflation Protection 49. 9% 30. 0% 18. 2% 12. 8% 7. 6% 15. 5% 10. 2% 24 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Restoration of Benefits How does it work? u Restoration of Benefits restores the depleted portion of the personal benefit account if, after benefits are paid, the policyholder is not benefit eligible for 180 consecutive days Example – Individual Policy Original policy amount = $146, 000 Reduced by claims paid ($50, 000) to $96, 000 Restored after 180 days without benefit eligibility- $146, 000 25 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Restoration of Benefits How does it work? u Restoration of Benefits restores the depleted portion of the personal benefit account if, after benefits are paid, the policyholder is not benefit eligible for 180 consecutive days Example – Individual Policy Original policy amount = $146, 000 Reduced by claims paid ($50, 000) to $96, 000 Restored after 180 days without benefit eligibility- $146, 000 25 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

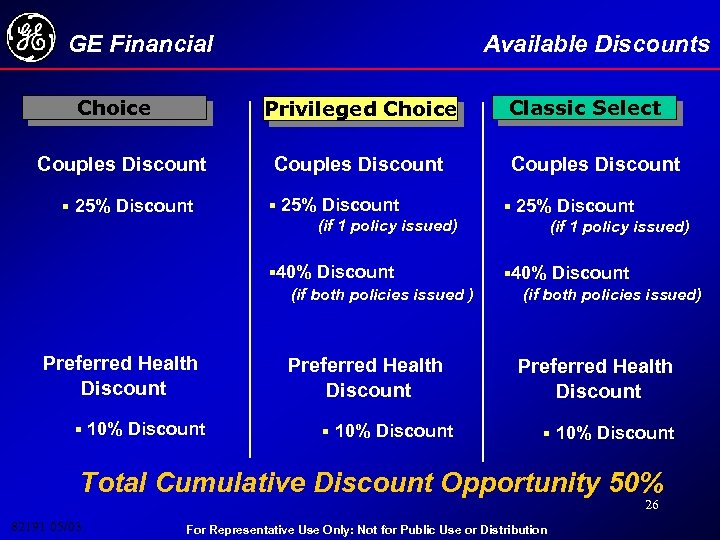

GE Financial Choice Available Discounts Privileged Choice Couples Discount Classic Select Preferred Health Discount § 10% Discount Couples Discount § 25% Discount (if 1 policy issued) § 40% Discount (if both policies issued ) § 25% Discount Couples Discount § 40% Discount (if both policies issued) Preferred Health Discount § 10% Discount Total Cumulative Discount Opportunity 50% 26 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Available Discounts Privileged Choice Couples Discount Classic Select Preferred Health Discount § 10% Discount Couples Discount § 25% Discount (if 1 policy issued) § 40% Discount (if both policies issued ) § 25% Discount Couples Discount § 40% Discount (if both policies issued) Preferred Health Discount § 10% Discount Total Cumulative Discount Opportunity 50% 26 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Preferred Health Discount How does it work? u Preferred Health Discount may be determined at the time of application u Determined by the first 10 questions on the application u For Shared Coverage plans each applicant is eligible for this discount 27 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Preferred Health Discount How does it work? u Preferred Health Discount may be determined at the time of application u Determined by the first 10 questions on the application u For Shared Coverage plans each applicant is eligible for this discount 27 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

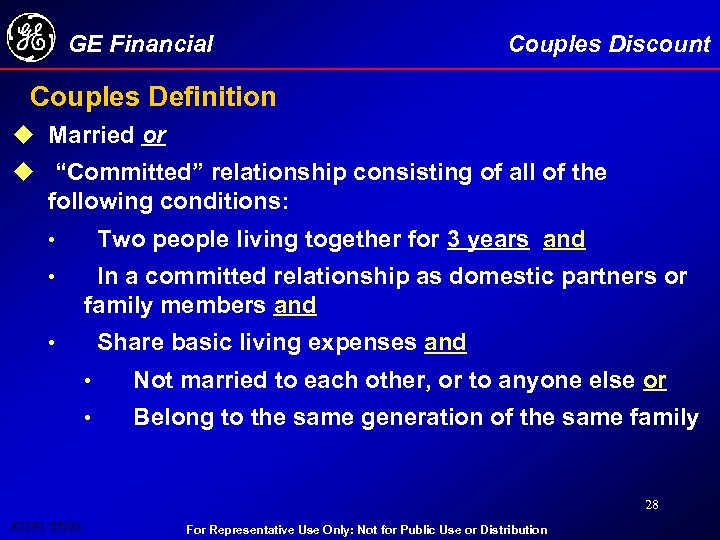

GE Financial Couples Discount Couples Definition u Married or u “Committed” relationship consisting of all of the following conditions: Two people living together for 3 years and • • In a committed relationship as domestic partners or family members and Share basic living expenses and • • Not married to each other, or to anyone else or • Belong to the same generation of the same family 28 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Couples Discount Couples Definition u Married or u “Committed” relationship consisting of all of the following conditions: Two people living together for 3 years and • • In a committed relationship as domestic partners or family members and Share basic living expenses and • • Not married to each other, or to anyone else or • Belong to the same generation of the same family 28 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

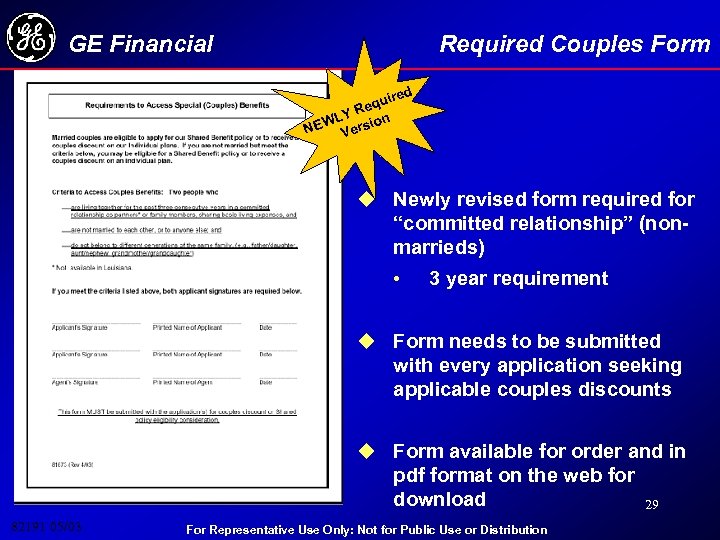

GE Financial Required Couples Form ired equ YR WL rsion NE Ve u Newly revised form required for “committed relationship” (nonmarrieds) • 3 year requirement u Form needs to be submitted with every application seeking applicable couples discounts u Form available for order and in pdf format on the web for download 29 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Required Couples Form ired equ YR WL rsion NE Ve u Newly revised form required for “committed relationship” (nonmarrieds) • 3 year requirement u Form needs to be submitted with every application seeking applicable couples discounts u Form available for order and in pdf format on the web for download 29 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

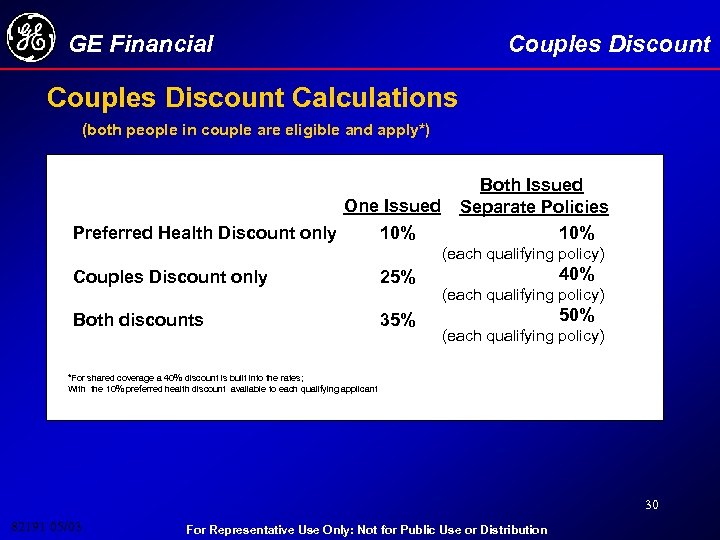

GE Financial Couples Discount Calculations (both people in couple are eligible and apply*) One Issued Preferred Health Discount only 10% Both Issued Separate Policies 10% (each qualifying policy) Couples Discount only 25% Both discounts 35% 40% (each qualifying policy) 50% (each qualifying policy) *For shared coverage a 40% discount is built into the rates; With the 10% preferred health discount available to each qualifying applicant 30 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Couples Discount Calculations (both people in couple are eligible and apply*) One Issued Preferred Health Discount only 10% Both Issued Separate Policies 10% (each qualifying policy) Couples Discount only 25% Both discounts 35% 40% (each qualifying policy) 50% (each qualifying policy) *For shared coverage a 40% discount is built into the rates; With the 10% preferred health discount available to each qualifying applicant 30 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

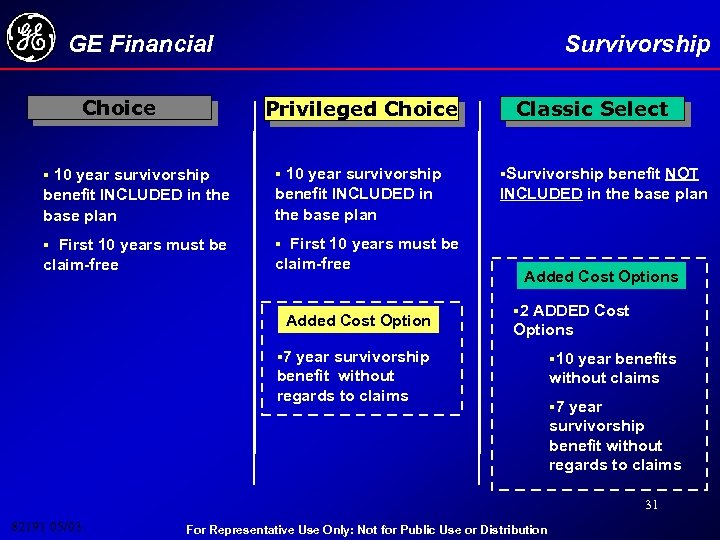

GE Financial Choice Survivorship Privileged Choice Classic Select § 10 year survivorship §Survivorship benefit NOT benefit INCLUDED in the base plan § First 10 years must be claim-free Added Cost Options § 2 ADDED Cost Options § 7 year survivorship benefit without regards to claims § 10 year benefits without claims § 7 year survivorship benefit without regards to claims 31 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Survivorship Privileged Choice Classic Select § 10 year survivorship §Survivorship benefit NOT benefit INCLUDED in the base plan § First 10 years must be claim-free Added Cost Options § 2 ADDED Cost Options § 7 year survivorship benefit without regards to claims § 10 year benefits without claims § 7 year survivorship benefit without regards to claims 31 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

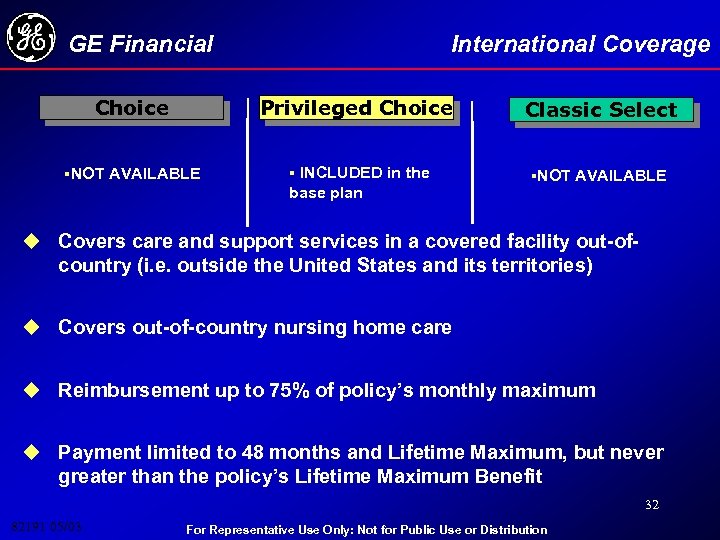

GE Financial International Coverage Choice Privileged Choice Classic Select §NOT AVAILABLE § INCLUDED in the §NOT AVAILABLE base plan u Covers care and support services in a covered facility out-ofcountry (i. e. outside the United States and its territories) u Covers out-of-country nursing home care u Reimbursement up to 75% of policy’s monthly maximum u Payment limited to 48 months and Lifetime Maximum, but never greater than the policy’s Lifetime Maximum Benefit 32 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial International Coverage Choice Privileged Choice Classic Select §NOT AVAILABLE § INCLUDED in the §NOT AVAILABLE base plan u Covers care and support services in a covered facility out-ofcountry (i. e. outside the United States and its territories) u Covers out-of-country nursing home care u Reimbursement up to 75% of policy’s monthly maximum u Payment limited to 48 months and Lifetime Maximum, but never greater than the policy’s Lifetime Maximum Benefit 32 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

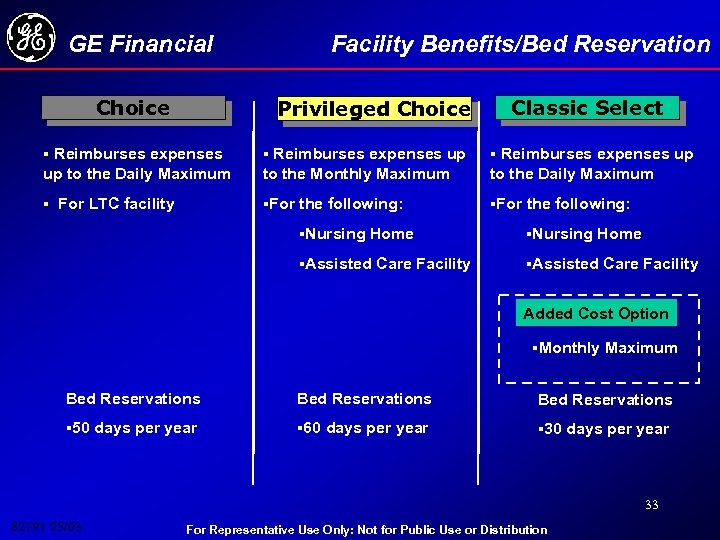

GE Financial Choice Facility Benefits/Bed Reservation Privileged Choice Classic Select § Reimburses expenses up up to the Daily Maximum to the Monthly Maximum to the Daily Maximum § For LTC facility §For the following: §Nursing Home §Assisted Care Facility Added Cost Option §Monthly Maximum Bed Reservations § 50 days per year § 60 days per year § 30 days per year 33 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Facility Benefits/Bed Reservation Privileged Choice Classic Select § Reimburses expenses up up to the Daily Maximum to the Monthly Maximum to the Daily Maximum § For LTC facility §For the following: §Nursing Home §Assisted Care Facility Added Cost Option §Monthly Maximum Bed Reservations § 50 days per year § 60 days per year § 30 days per year 33 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

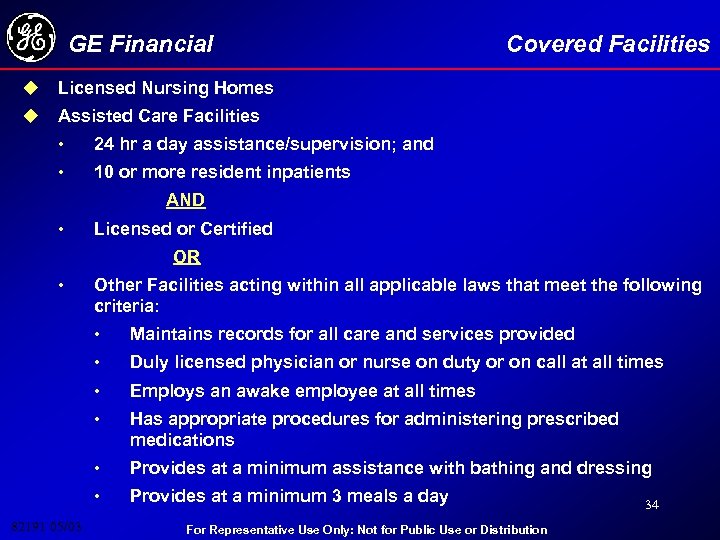

GE Financial u Licensed Nursing Homes u Covered Facilities Assisted Care Facilities • 24 hr a day assistance/supervision; and • 10 or more resident inpatients AND • Licensed or Certified OR • Other Facilities acting within all applicable laws that meet the following criteria: • • Duly licensed physician or nurse on duty or on call at all times • Employs an awake employee at all times • Has appropriate procedures for administering prescribed medications • Provides at a minimum assistance with bathing and dressing • 82191 05/03 Maintains records for all care and services provided Provides at a minimum 3 meals a day For Representative Use Only: Not for Public Use or Distribution 34

GE Financial u Licensed Nursing Homes u Covered Facilities Assisted Care Facilities • 24 hr a day assistance/supervision; and • 10 or more resident inpatients AND • Licensed or Certified OR • Other Facilities acting within all applicable laws that meet the following criteria: • • Duly licensed physician or nurse on duty or on call at all times • Employs an awake employee at all times • Has appropriate procedures for administering prescribed medications • Provides at a minimum assistance with bathing and dressing • 82191 05/03 Maintains records for all care and services provided Provides at a minimum 3 meals a day For Representative Use Only: Not for Public Use or Distribution 34

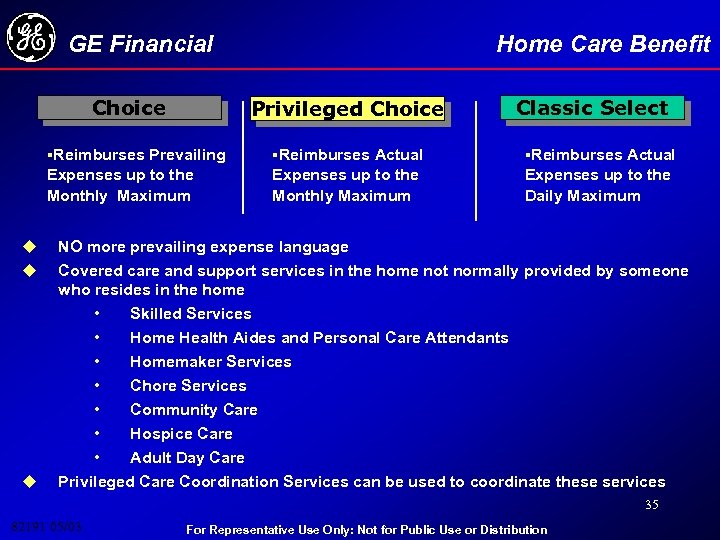

GE Financial Choice Home Care Benefit Privileged Choice Classic Select §Reimburses Prevailing u §Reimburses Actual Expenses up to the Monthly Maximum Expenses up to the Daily Maximum NO more prevailing expense language Covered care and support services in the home not normally provided by someone who resides in the home • Skilled Services Home Health Aides and Personal Care Attendants • Homemaker Services • Chore Services • Community Care • Hospice Care • Adult Day Care Privileged Care Coordination Services can be used to coordinate these services • u 35 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Home Care Benefit Privileged Choice Classic Select §Reimburses Prevailing u §Reimburses Actual Expenses up to the Monthly Maximum Expenses up to the Daily Maximum NO more prevailing expense language Covered care and support services in the home not normally provided by someone who resides in the home • Skilled Services Home Health Aides and Personal Care Attendants • Homemaker Services • Chore Services • Community Care • Hospice Care • Adult Day Care Privileged Care Coordination Services can be used to coordinate these services • u 35 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

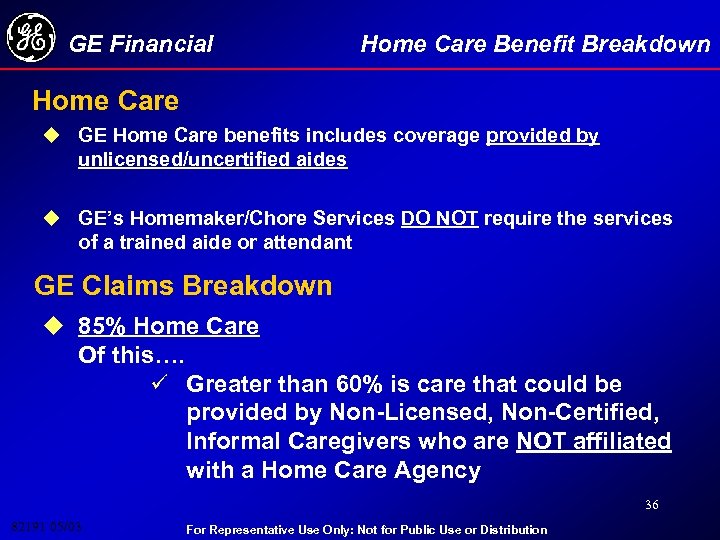

GE Financial Home Care Benefit Breakdown Home Care u GE Home Care benefits includes coverage provided by unlicensed/uncertified aides u GE’s Homemaker/Chore Services DO NOT require the services of a trained aide or attendant GE Claims Breakdown u 85% Home Care Of this…. ü Greater than 60% is care that could be provided by Non-Licensed, Non-Certified, Informal Caregivers who are NOT affiliated with a Home Care Agency 36 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Home Care Benefit Breakdown Home Care u GE Home Care benefits includes coverage provided by unlicensed/uncertified aides u GE’s Homemaker/Chore Services DO NOT require the services of a trained aide or attendant GE Claims Breakdown u 85% Home Care Of this…. ü Greater than 60% is care that could be provided by Non-Licensed, Non-Certified, Informal Caregivers who are NOT affiliated with a Home Care Agency 36 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

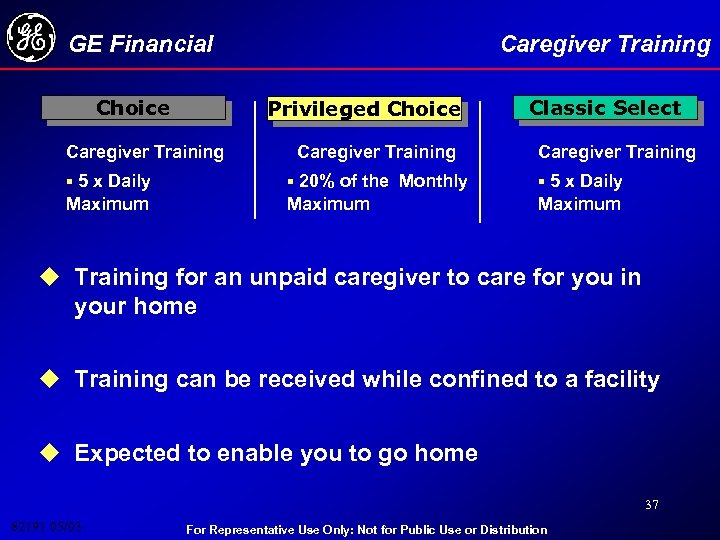

GE Financial Choice Caregiver Training Privileged Choice Caregiver Training Classic Select Caregiver Training § 5 x Daily § 20% of the Monthly § 5 x Daily Maximum u Training for an unpaid caregiver to care for you in your home u Training can be received while confined to a facility u Expected to enable you to go home 37 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Caregiver Training Privileged Choice Caregiver Training Classic Select Caregiver Training § 5 x Daily § 20% of the Monthly § 5 x Daily Maximum u Training for an unpaid caregiver to care for you in your home u Training can be received while confined to a facility u Expected to enable you to go home 37 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

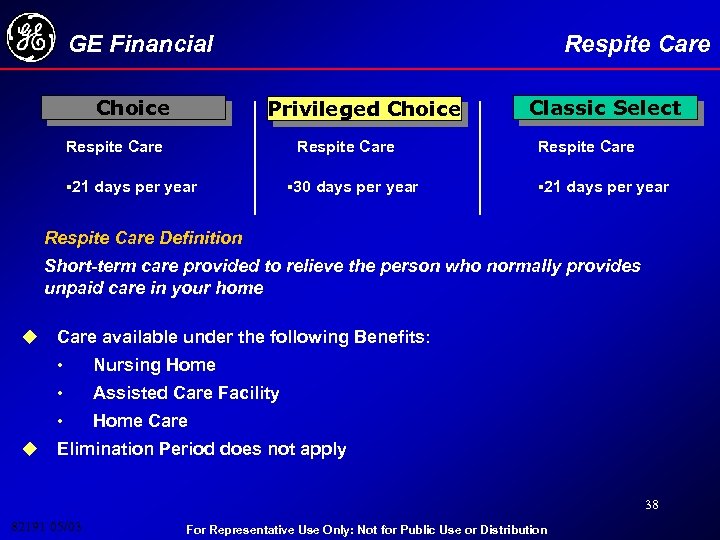

GE Financial Choice Respite Care Privileged Choice Respite Care § 21 days per year § 30 days per year Classic Select Respite Care § 21 days per year Respite Care Definition Short-term care provided to relieve the person who normally provides unpaid care in your home u Care available under the following Benefits: • • Assisted Care Facility • u Nursing Home Care Elimination Period does not apply 38 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Respite Care Privileged Choice Respite Care § 21 days per year § 30 days per year Classic Select Respite Care § 21 days per year Respite Care Definition Short-term care provided to relieve the person who normally provides unpaid care in your home u Care available under the following Benefits: • • Assisted Care Facility • u Nursing Home Care Elimination Period does not apply 38 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

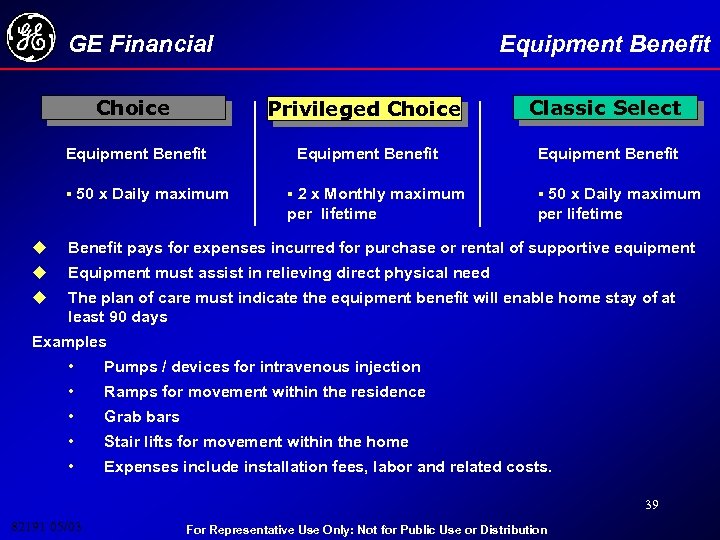

GE Financial Equipment Benefit Choice Privileged Choice Classic Select Equipment Benefit § 50 x Daily maximum § 2 x Monthly maximum § 50 x Daily maximum per lifetime u Benefit pays for expenses incurred for purchase or rental of supportive equipment u Equipment must assist in relieving direct physical need u The plan of care must indicate the equipment benefit will enable home stay of at least 90 days Examples • Pumps / devices for intravenous injection • Ramps for movement within the residence • Grab bars • Stair lifts for movement within the home • Expenses include installation fees, labor and related costs. 39 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Equipment Benefit Choice Privileged Choice Classic Select Equipment Benefit § 50 x Daily maximum § 2 x Monthly maximum § 50 x Daily maximum per lifetime u Benefit pays for expenses incurred for purchase or rental of supportive equipment u Equipment must assist in relieving direct physical need u The plan of care must indicate the equipment benefit will enable home stay of at least 90 days Examples • Pumps / devices for intravenous injection • Ramps for movement within the residence • Grab bars • Stair lifts for movement within the home • Expenses include installation fees, labor and related costs. 39 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

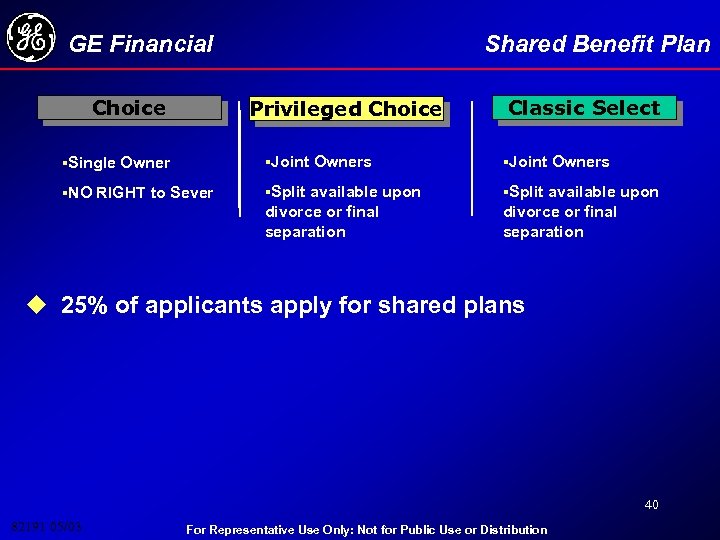

GE Financial Choice Shared Benefit Plan Privileged Choice Classic Select §Single Owner §Joint Owners §NO RIGHT to Sever §Split available upon divorce or final separation u 25% of applicants apply for shared plans 40 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Choice Shared Benefit Plan Privileged Choice Classic Select §Single Owner §Joint Owners §NO RIGHT to Sever §Split available upon divorce or final separation u 25% of applicants apply for shared plans 40 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial PRICING AND PLAN DESIGNS 41 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial PRICING AND PLAN DESIGNS 41 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

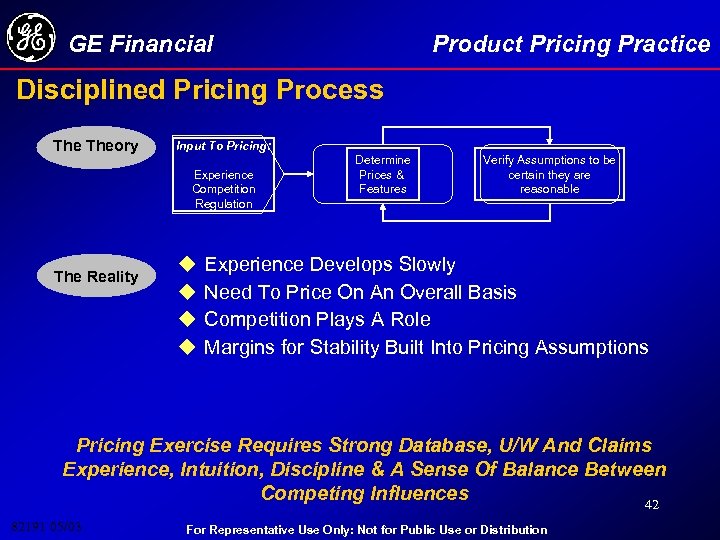

GE Financial Product Pricing Practice Disciplined Pricing Process Theory Input To Pricing: Experience Competition Regulation The Reality u u Determine Prices & Features Verify Assumptions to be certain they are reasonable Experience Develops Slowly Need To Price On An Overall Basis Competition Plays A Role Margins for Stability Built Into Pricing Assumptions Pricing Exercise Requires Strong Database, U/W And Claims Experience, Intuition, Discipline & A Sense Of Balance Between Competing Influences 42 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Product Pricing Practice Disciplined Pricing Process Theory Input To Pricing: Experience Competition Regulation The Reality u u Determine Prices & Features Verify Assumptions to be certain they are reasonable Experience Develops Slowly Need To Price On An Overall Basis Competition Plays A Role Margins for Stability Built Into Pricing Assumptions Pricing Exercise Requires Strong Database, U/W And Claims Experience, Intuition, Discipline & A Sense Of Balance Between Competing Influences 42 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

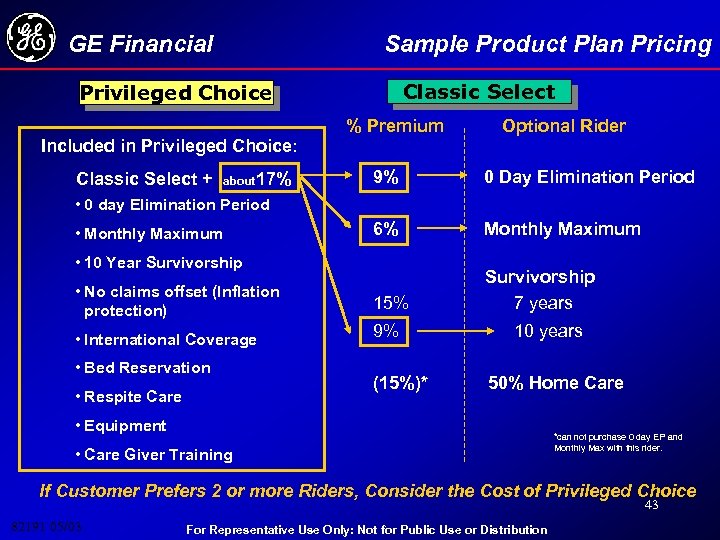

GE Financial Sample Product Plan Pricing Classic Select Privileged Choice % Premium Optional Rider Included in Privileged Choice: 9% 0 Day Elimination Period 6% Monthly Maximum • No claims offset (Inflation protection) 15% Survivorship 7 years • International Coverage 9% Classic Select + about 17% • 0 day Elimination Period • Monthly Maximum • 10 Year Survivorship • Bed Reservation • Respite Care (15%)* 10 years 50% Home Care • Equipment • Care Giver Training *can not purchase 0 day EP and Monthly Max with this rider. If Customer Prefers 2 or more Riders, Consider the Cost of Privileged Choice 43 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Sample Product Plan Pricing Classic Select Privileged Choice % Premium Optional Rider Included in Privileged Choice: 9% 0 Day Elimination Period 6% Monthly Maximum • No claims offset (Inflation protection) 15% Survivorship 7 years • International Coverage 9% Classic Select + about 17% • 0 day Elimination Period • Monthly Maximum • 10 Year Survivorship • Bed Reservation • Respite Care (15%)* 10 years 50% Home Care • Equipment • Care Giver Training *can not purchase 0 day EP and Monthly Max with this rider. If Customer Prefers 2 or more Riders, Consider the Cost of Privileged Choice 43 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

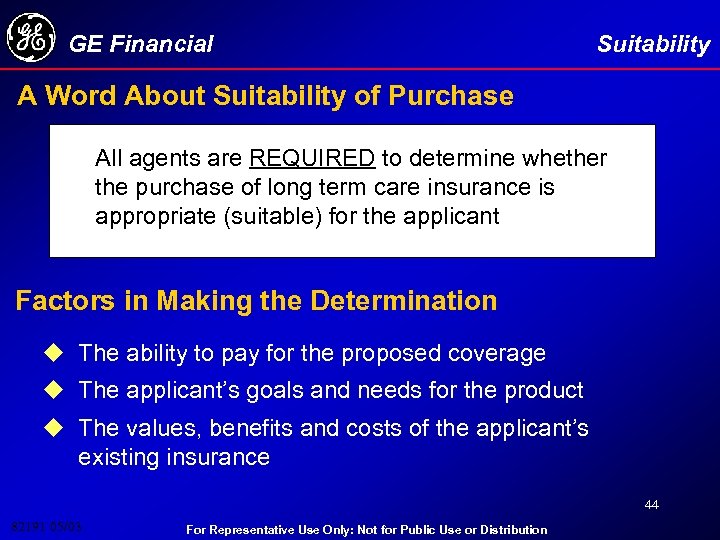

GE Financial Suitability A Word About Suitability of Purchase All agents are REQUIRED to determine whether the purchase of long term care insurance is appropriate (suitable) for the applicant Factors in Making the Determination u The ability to pay for the proposed coverage u The applicant’s goals and needs for the product u The values, benefits and costs of the applicant’s existing insurance 44 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Suitability A Word About Suitability of Purchase All agents are REQUIRED to determine whether the purchase of long term care insurance is appropriate (suitable) for the applicant Factors in Making the Determination u The ability to pay for the proposed coverage u The applicant’s goals and needs for the product u The values, benefits and costs of the applicant’s existing insurance 44 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

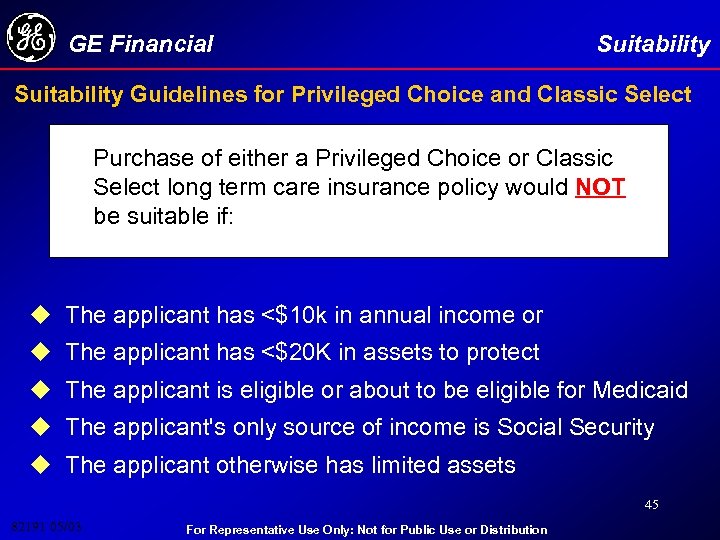

GE Financial Suitability Guidelines for Privileged Choice and Classic Select Purchase of either a Privileged Choice or Classic Select long term care insurance policy would NOT be suitable if: u The applicant has <$10 k in annual income or u The applicant has <$20 K in assets to protect u The applicant is eligible or about to be eligible for Medicaid u The applicant's only source of income is Social Security u The applicant otherwise has limited assets 45 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Suitability Guidelines for Privileged Choice and Classic Select Purchase of either a Privileged Choice or Classic Select long term care insurance policy would NOT be suitable if: u The applicant has <$10 k in annual income or u The applicant has <$20 K in assets to protect u The applicant is eligible or about to be eligible for Medicaid u The applicant's only source of income is Social Security u The applicant otherwise has limited assets 45 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

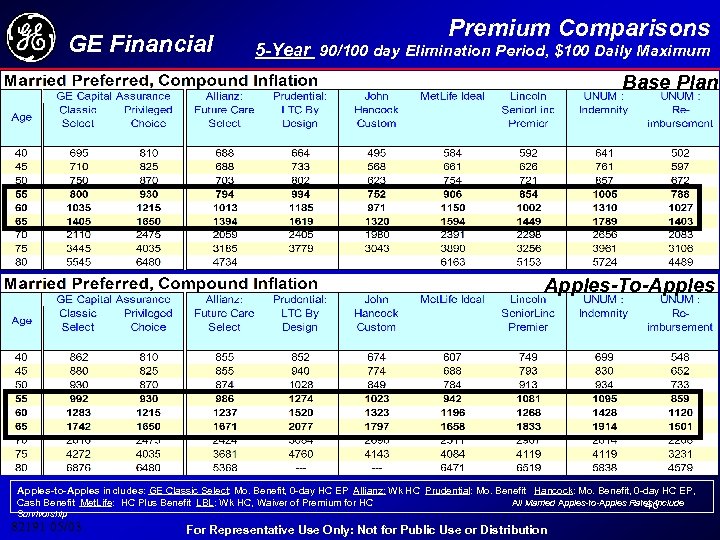

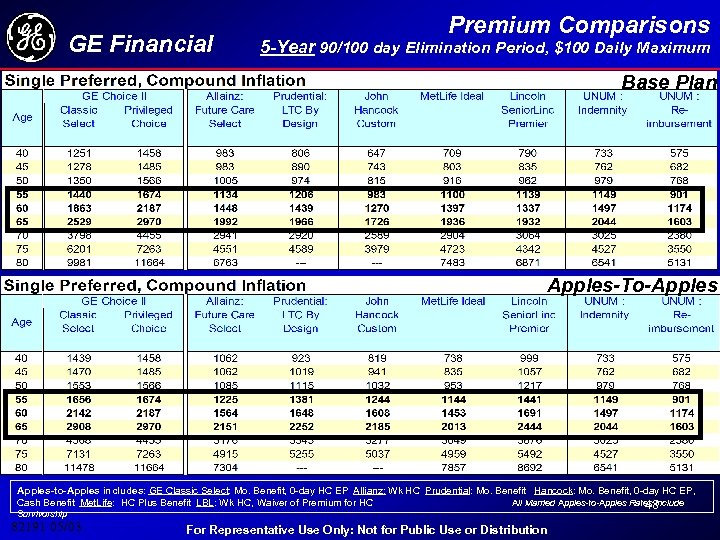

GE Financial Premium Comparisons 5 -Year 90/100 day Elimination Period, $100 Daily Maximum Base Plan Apples-To-Apples-to-Apples includes: GE Classic Select: Mo. Benefit, 0 -day HC EP Allianz: Wk HC Prudential: Mo. Benefit Hancock: Mo. Benefit, 0 -day HC EP, Cash Benefit Met. Life: HC Plus Benefit LBL: Wk HC, Waiver of Premium for HC All Married Apples-to-Apples Rates Include 46 Survivorship 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Premium Comparisons 5 -Year 90/100 day Elimination Period, $100 Daily Maximum Base Plan Apples-To-Apples-to-Apples includes: GE Classic Select: Mo. Benefit, 0 -day HC EP Allianz: Wk HC Prudential: Mo. Benefit Hancock: Mo. Benefit, 0 -day HC EP, Cash Benefit Met. Life: HC Plus Benefit LBL: Wk HC, Waiver of Premium for HC All Married Apples-to-Apples Rates Include 46 Survivorship 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

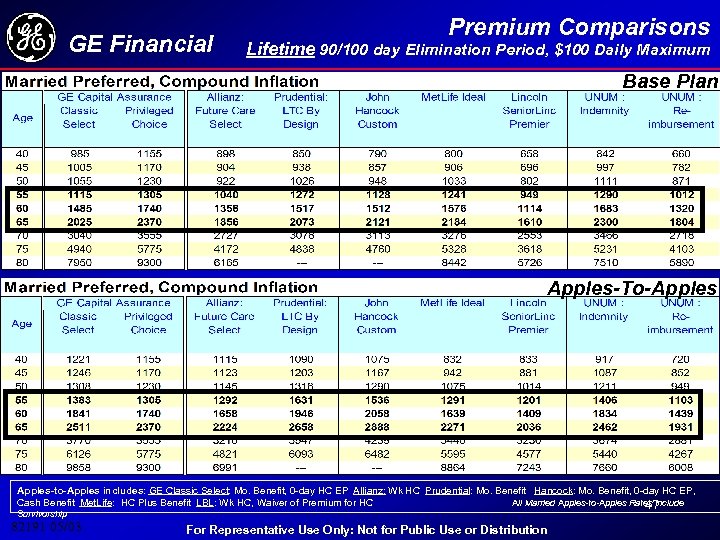

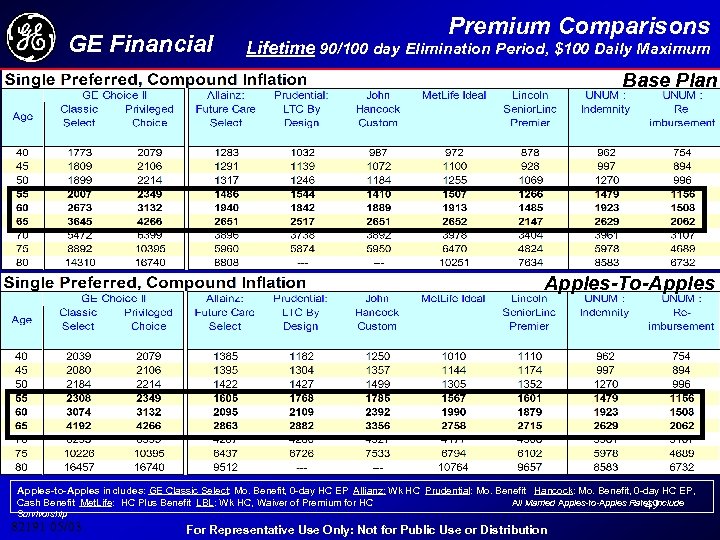

GE Financial Premium Comparisons Lifetime 90/100 day Elimination Period, $100 Daily Maximum Base Plan Apples-To-Apples-to-Apples includes: GE Classic Select: Mo. Benefit, 0 -day HC EP Allianz: Wk HC Prudential: Mo. Benefit Hancock: Mo. Benefit, 0 -day HC EP, Cash Benefit Met. Life: HC Plus Benefit LBL: Wk HC, Waiver of Premium for HC All Married Apples-to-Apples Rates Include 47 Survivorship 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Premium Comparisons Lifetime 90/100 day Elimination Period, $100 Daily Maximum Base Plan Apples-To-Apples-to-Apples includes: GE Classic Select: Mo. Benefit, 0 -day HC EP Allianz: Wk HC Prudential: Mo. Benefit Hancock: Mo. Benefit, 0 -day HC EP, Cash Benefit Met. Life: HC Plus Benefit LBL: Wk HC, Waiver of Premium for HC All Married Apples-to-Apples Rates Include 47 Survivorship 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Premium Comparisons 5 -Year 90/100 day Elimination Period, $100 Daily Maximum Base Plan Apples-To-Apples-to-Apples includes: GE Classic Select: Mo. Benefit, 0 -day HC EP Allianz: Wk HC Prudential: Mo. Benefit Hancock: Mo. Benefit, 0 -day HC EP, Cash Benefit Met. Life: HC Plus Benefit LBL: Wk HC, Waiver of Premium for HC All Married Apples-to-Apples Rates Include 48 Survivorship 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Premium Comparisons 5 -Year 90/100 day Elimination Period, $100 Daily Maximum Base Plan Apples-To-Apples-to-Apples includes: GE Classic Select: Mo. Benefit, 0 -day HC EP Allianz: Wk HC Prudential: Mo. Benefit Hancock: Mo. Benefit, 0 -day HC EP, Cash Benefit Met. Life: HC Plus Benefit LBL: Wk HC, Waiver of Premium for HC All Married Apples-to-Apples Rates Include 48 Survivorship 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Premium Comparisons Lifetime 90/100 day Elimination Period, $100 Daily Maximum Base Plan Apples-To-Apples-to-Apples includes: GE Classic Select: Mo. Benefit, 0 -day HC EP Allianz: Wk HC Prudential: Mo. Benefit Hancock: Mo. Benefit, 0 -day HC EP, Cash Benefit Met. Life: HC Plus Benefit LBL: Wk HC, Waiver of Premium for HC All Married Apples-to-Apples Rates Include 49 Survivorship 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Premium Comparisons Lifetime 90/100 day Elimination Period, $100 Daily Maximum Base Plan Apples-To-Apples-to-Apples includes: GE Classic Select: Mo. Benefit, 0 -day HC EP Allianz: Wk HC Prudential: Mo. Benefit Hancock: Mo. Benefit, 0 -day HC EP, Cash Benefit Met. Life: HC Plus Benefit LBL: Wk HC, Waiver of Premium for HC All Married Apples-to-Apples Rates Include 49 Survivorship 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial SUBMITTING AN APPLICATION 50 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial SUBMITTING AN APPLICATION 50 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

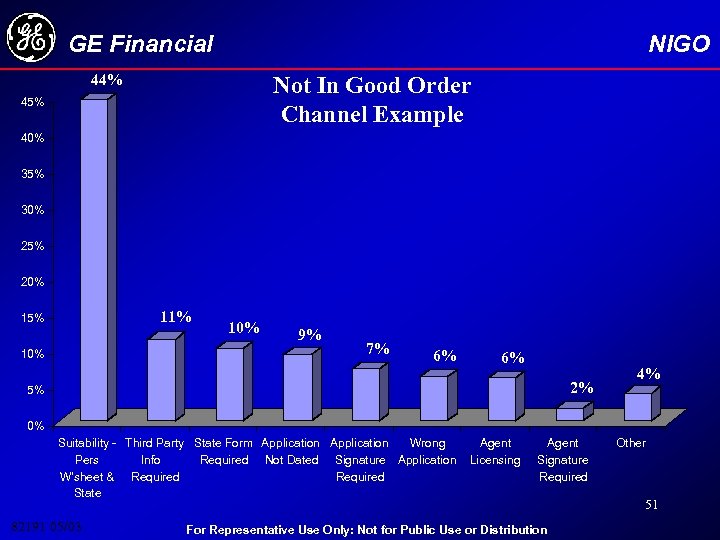

GE Financial NIGO 44% Not In Good Order Channel Example 45% 40% 35% 30% 25% 20% 11% 15% 10% 9% 7% 6% 6% 2% 5% 4% 0% Suitability - Third Party State Form Application Wrong Pers Info Required Not Dated Signature Application W'sheet & Required State 82191 05/03 Agent Licensing Agent Signature Required For Representative Use Only: Not for Public Use or Distribution Other 51

GE Financial NIGO 44% Not In Good Order Channel Example 45% 40% 35% 30% 25% 20% 11% 15% 10% 9% 7% 6% 6% 2% 5% 4% 0% Suitability - Third Party State Form Application Wrong Pers Info Required Not Dated Signature Application W'sheet & Required State 82191 05/03 Agent Licensing Agent Signature Required For Representative Use Only: Not for Public Use or Distribution Other 51

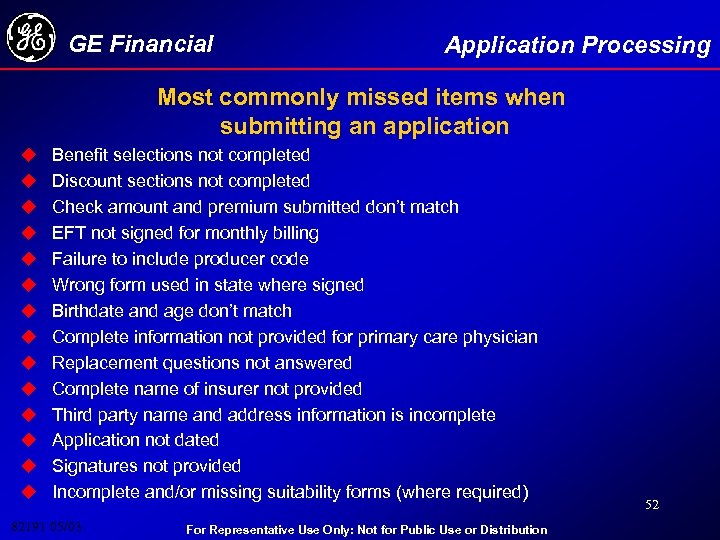

GE Financial Application Processing Most commonly missed items when submitting an application u u u u Benefit selections not completed Discount sections not completed Check amount and premium submitted don’t match EFT not signed for monthly billing Failure to include producer code Wrong form used in state where signed Birthdate and age don’t match Complete information not provided for primary care physician Replacement questions not answered Complete name of insurer not provided Third party name and address information is incomplete Application not dated Signatures not provided Incomplete and/or missing suitability forms (where required) 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 52

GE Financial Application Processing Most commonly missed items when submitting an application u u u u Benefit selections not completed Discount sections not completed Check amount and premium submitted don’t match EFT not signed for monthly billing Failure to include producer code Wrong form used in state where signed Birthdate and age don’t match Complete information not provided for primary care physician Replacement questions not answered Complete name of insurer not provided Third party name and address information is incomplete Application not dated Signatures not provided Incomplete and/or missing suitability forms (where required) 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 52

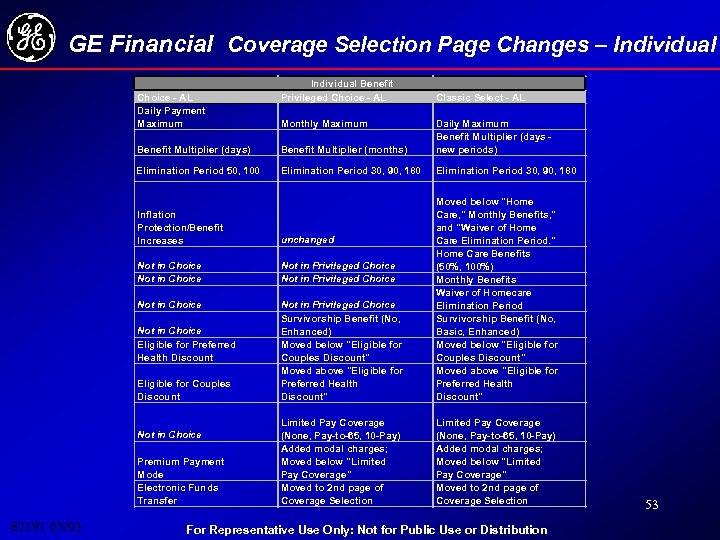

GE Financial Coverage Selection Page Changes – Individual Choice - AL Daily Payment Maximum Individual Benefit Privileged Choice - AL Monthly Maximum Classic Select - AL Benefit Multiplier (days) Benefit Multiplier (months) Daily Maximum Benefit Multiplier (days new periods) Elimination Period 50, 100 Elimination Period 30, 90, 180 Inflation Protection/Benefit Increases unchanged Not in Choice Not in Privileged Choice Survivorship Benefit (No, Enhanced) Moved below "Eligible for Couples Discount" Moved above "Eligible for Preferred Health Discount" Moved below "Home Care, " Monthly Benefits, " and "Waiver of Home Care Elimination Period. " Home Care Benefits (50%, 100%) Monthly Benefits Waiver of Homecare Elimination Period Survivorship Benefit (No, Basic, Enhanced) Moved below "Eligible for Couples Discount" Moved above "Eligible for Preferred Health Discount" Limited Pay Coverage (None, Pay-to-65, 10 -Pay) Added modal charges; Moved below "Limited Pay Coverage" Moved to 2 nd page of Coverage Selection Not in Choice Eligible for Preferred Health Discount Eligible for Couples Discount Not in Choice Premium Payment Mode Electronic Funds Transfer 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 53

GE Financial Coverage Selection Page Changes – Individual Choice - AL Daily Payment Maximum Individual Benefit Privileged Choice - AL Monthly Maximum Classic Select - AL Benefit Multiplier (days) Benefit Multiplier (months) Daily Maximum Benefit Multiplier (days new periods) Elimination Period 50, 100 Elimination Period 30, 90, 180 Inflation Protection/Benefit Increases unchanged Not in Choice Not in Privileged Choice Survivorship Benefit (No, Enhanced) Moved below "Eligible for Couples Discount" Moved above "Eligible for Preferred Health Discount" Moved below "Home Care, " Monthly Benefits, " and "Waiver of Home Care Elimination Period. " Home Care Benefits (50%, 100%) Monthly Benefits Waiver of Homecare Elimination Period Survivorship Benefit (No, Basic, Enhanced) Moved below "Eligible for Couples Discount" Moved above "Eligible for Preferred Health Discount" Limited Pay Coverage (None, Pay-to-65, 10 -Pay) Added modal charges; Moved below "Limited Pay Coverage" Moved to 2 nd page of Coverage Selection Not in Choice Eligible for Preferred Health Discount Eligible for Couples Discount Not in Choice Premium Payment Mode Electronic Funds Transfer 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 53

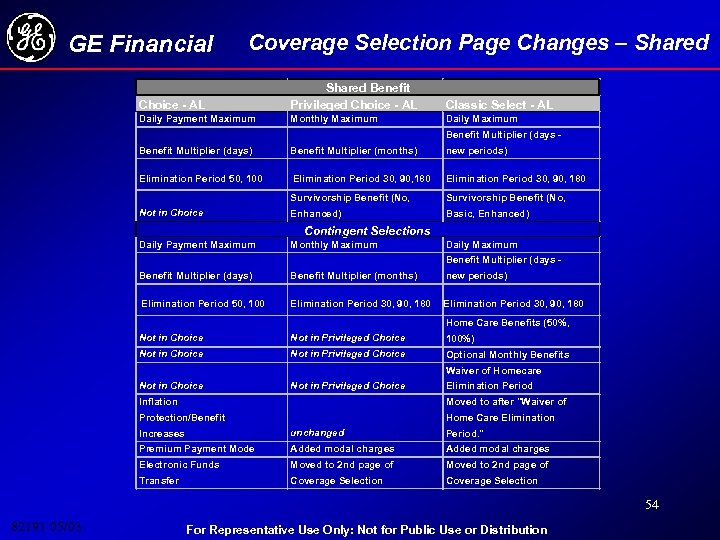

GE Financial Coverage Selection Page Changes – Shared Choice - AL Shared Benefit Privileged Choice - AL Classic Select - AL Daily Payment Maximum Monthly Maximum Daily Maximum Benefit Multiplier (days - Benefit Multiplier (days) Benefit Multiplier (months) new periods) Elimination Period 50, 100 Elimination Period 30, 90, 180 Survivorship Benefit (No, Not in Choice Enhanced) Basic, Enhanced) Daily Payment Maximum Monthly Maximum Contingent Selections Daily Maximum Benefit Multiplier (days) Benefit Multiplier (months) new periods) Elimination Period 50, 100 Elimination Period 30, 90, 180 Home Care Benefits (50%, Not in Choice Not in Privileged Choice 100%) Not in Choice Not in Privileged Choice Optional Monthly Benefits Waiver of Homecare Not in Choice Not in Privileged Choice Inflation Elimination Period Moved to after "Waiver of Protection/Benefit Home Care Elimination Increases unchanged Period. " Premium Payment Mode Added modal charges Electronic Funds Moved to 2 nd page of Transfer Coverage Selection 54 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Coverage Selection Page Changes – Shared Choice - AL Shared Benefit Privileged Choice - AL Classic Select - AL Daily Payment Maximum Monthly Maximum Daily Maximum Benefit Multiplier (days - Benefit Multiplier (days) Benefit Multiplier (months) new periods) Elimination Period 50, 100 Elimination Period 30, 90, 180 Survivorship Benefit (No, Not in Choice Enhanced) Basic, Enhanced) Daily Payment Maximum Monthly Maximum Contingent Selections Daily Maximum Benefit Multiplier (days) Benefit Multiplier (months) new periods) Elimination Period 50, 100 Elimination Period 30, 90, 180 Home Care Benefits (50%, Not in Choice Not in Privileged Choice 100%) Not in Choice Not in Privileged Choice Optional Monthly Benefits Waiver of Homecare Not in Choice Not in Privileged Choice Inflation Elimination Period Moved to after "Waiver of Protection/Benefit Home Care Elimination Increases unchanged Period. " Premium Payment Mode Added modal charges Electronic Funds Moved to 2 nd page of Transfer Coverage Selection 54 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial UNDERWRITING 55 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial UNDERWRITING 55 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

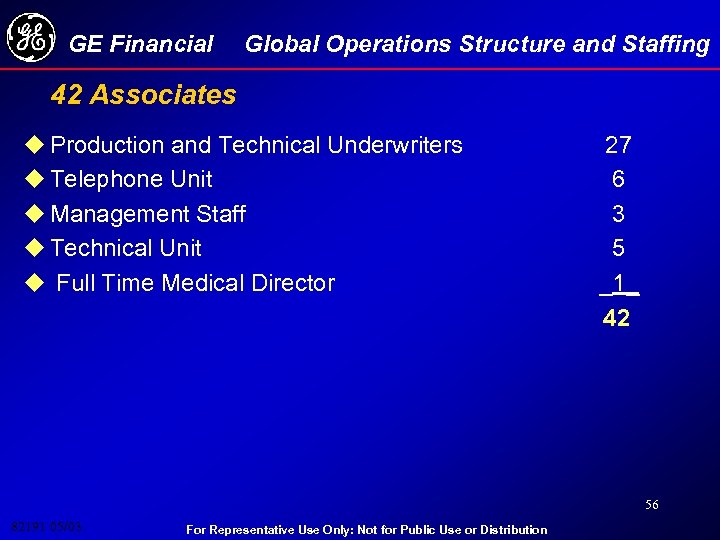

GE Financial Global Operations Structure and Staffing 42 Associates u Production and Technical Underwriters u Telephone Unit u Management Staff u Technical Unit u Full Time Medical Director 27 6 3 5 _1_ 42 56 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Global Operations Structure and Staffing 42 Associates u Production and Technical Underwriters u Telephone Unit u Management Staff u Technical Unit u Full Time Medical Director 27 6 3 5 _1_ 42 56 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

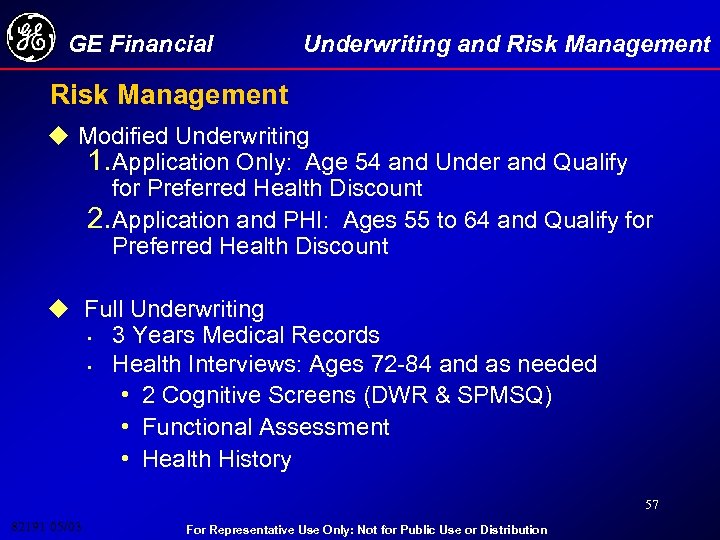

GE Financial Underwriting and Risk Management u Modified Underwriting 1. Application Only: Age 54 and Under and Qualify for Preferred Health Discount 2. Application and PHI: Ages 55 to 64 and Qualify for Preferred Health Discount u Full Underwriting • 3 Years Medical Records • Health Interviews: Ages 72 -84 and as needed • 2 Cognitive Screens (DWR & SPMSQ) • Functional Assessment • Health History 57 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Underwriting and Risk Management u Modified Underwriting 1. Application Only: Age 54 and Under and Qualify for Preferred Health Discount 2. Application and PHI: Ages 55 to 64 and Qualify for Preferred Health Discount u Full Underwriting • 3 Years Medical Records • Health Interviews: Ages 72 -84 and as needed • 2 Cognitive Screens (DWR & SPMSQ) • Functional Assessment • Health History 57 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

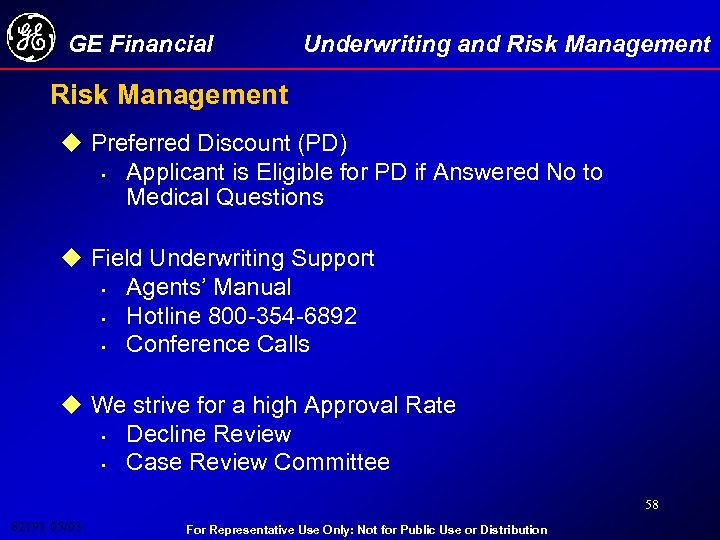

GE Financial Underwriting and Risk Management u Preferred Discount (PD) • Applicant is Eligible for PD if Answered No to Medical Questions u Field Underwriting Support • Agents’ Manual • Hotline 800 -354 -6892 • Conference Calls u We strive for a high Approval Rate • Decline Review • Case Review Committee 58 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Underwriting and Risk Management u Preferred Discount (PD) • Applicant is Eligible for PD if Answered No to Medical Questions u Field Underwriting Support • Agents’ Manual • Hotline 800 -354 -6892 • Conference Calls u We strive for a high Approval Rate • Decline Review • Case Review Committee 58 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Underwriting and Risk Management Statistics u Declines Rate 2002 • 14. 5% u Approval Rate 2002 • 85. 5% 59 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Underwriting and Risk Management Statistics u Declines Rate 2002 • 14. 5% u Approval Rate 2002 • 85. 5% 59 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

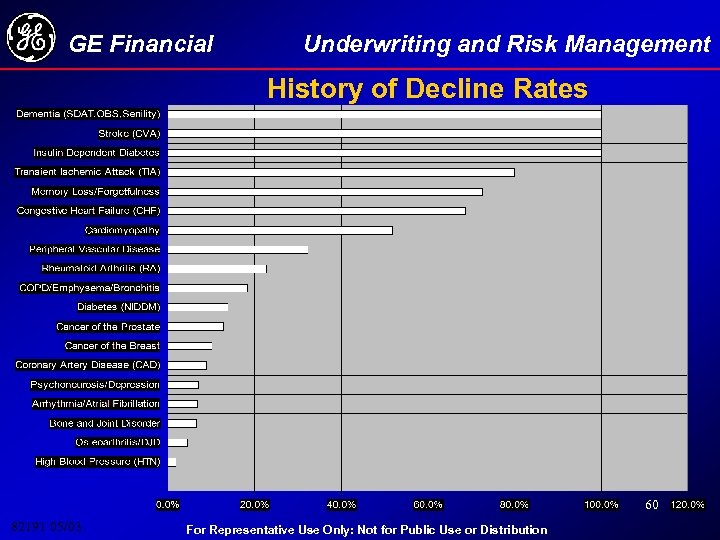

GE Financial Underwriting and Risk Management History of Decline Rates 60 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Underwriting and Risk Management History of Decline Rates 60 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

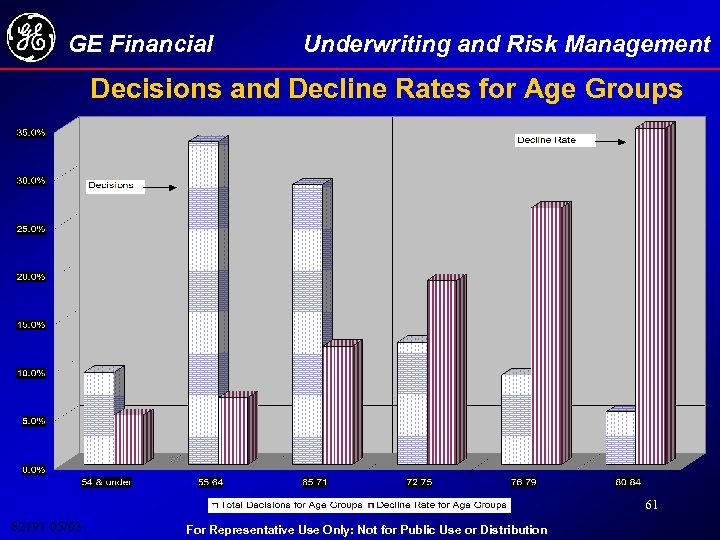

GE Financial Underwriting and Risk Management Decisions and Decline Rates for Age Groups 61 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Underwriting and Risk Management Decisions and Decline Rates for Age Groups 61 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial CLAIMS 62 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial CLAIMS 62 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

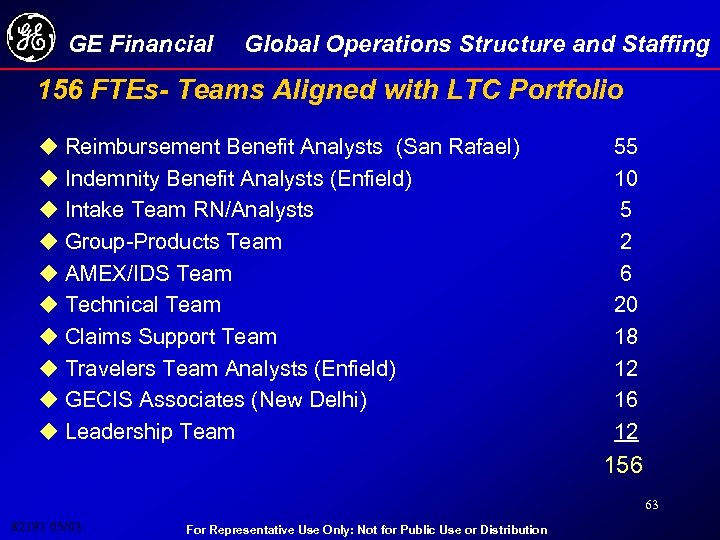

GE Financial Global Operations Structure and Staffing 156 FTEs- Teams Aligned with LTC Portfolio u Reimbursement Benefit Analysts (San Rafael) u Indemnity Benefit Analysts (Enfield) u Intake Team RN/Analysts u Group-Products Team u AMEX/IDS Team u Technical Team u Claims Support Team u Travelers Team Analysts (Enfield) u GECIS Associates (New Delhi) u Leadership Team 55 10 5 2 6 20 18 12 16 12 156 63 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Global Operations Structure and Staffing 156 FTEs- Teams Aligned with LTC Portfolio u Reimbursement Benefit Analysts (San Rafael) u Indemnity Benefit Analysts (Enfield) u Intake Team RN/Analysts u Group-Products Team u AMEX/IDS Team u Technical Team u Claims Support Team u Travelers Team Analysts (Enfield) u GECIS Associates (New Delhi) u Leadership Team 55 10 5 2 6 20 18 12 16 12 156 63 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

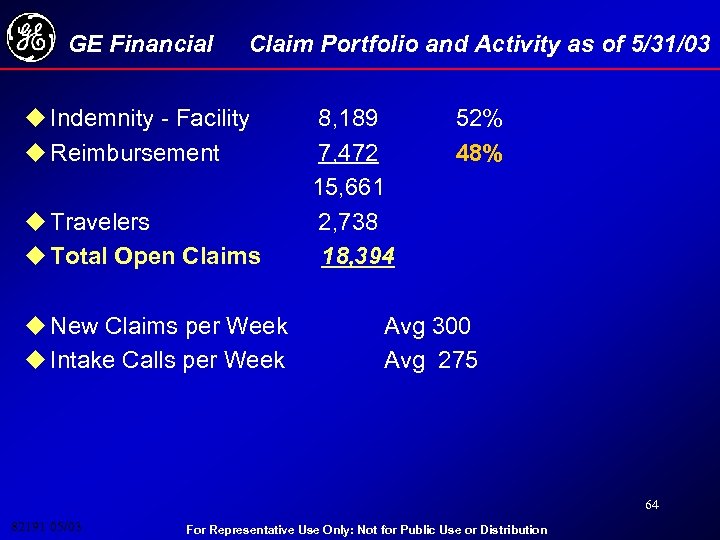

GE Financial Claim Portfolio and Activity as of 5/31/03 u Indemnity - Facility u Reimbursement u Travelers u Total Open Claims u New Claims per Week u Intake Calls per Week 8, 189 7, 472 15, 661 2, 738 18, 394 52% 48% Avg 300 Avg 275 64 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Claim Portfolio and Activity as of 5/31/03 u Indemnity - Facility u Reimbursement u Travelers u Total Open Claims u New Claims per Week u Intake Calls per Week 8, 189 7, 472 15, 661 2, 738 18, 394 52% 48% Avg 300 Avg 275 64 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

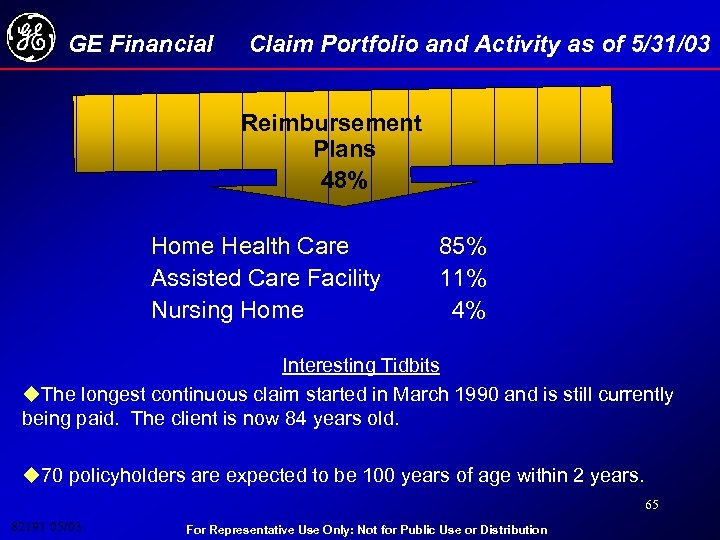

GE Financial Claim Portfolio and Activity as of 5/31/03 Reimbursement Plans 48% Home Health Care Assisted Care Facility Nursing Home 85% 11% 4% Interesting Tidbits u. The longest continuous claim started in March 1990 and is still currently being paid. The client is now 84 years old. u 70 policyholders are expected to be 100 years of age within 2 years. 65 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Claim Portfolio and Activity as of 5/31/03 Reimbursement Plans 48% Home Health Care Assisted Care Facility Nursing Home 85% 11% 4% Interesting Tidbits u. The longest continuous claim started in March 1990 and is still currently being paid. The client is now 84 years old. u 70 policyholders are expected to be 100 years of age within 2 years. 65 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Quality Tools and Enhanced Servicing u IMAGE Technology - no paper, workstation fax capability, sophisticated diary systems CALYPSO! u Audit Program - measures quality and links performance to standard operating procedures u Call Recording/Monitoring - technical accuracy, documentation, courtesy, quality customer service u Voice of Customer - monthly telephone claimant surveys 66 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Quality Tools and Enhanced Servicing u IMAGE Technology - no paper, workstation fax capability, sophisticated diary systems CALYPSO! u Audit Program - measures quality and links performance to standard operating procedures u Call Recording/Monitoring - technical accuracy, documentation, courtesy, quality customer service u Voice of Customer - monthly telephone claimant surveys 66 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Claims Services Support u Dedicated toll free telephone coverage 6: 00 am - 5: 00 pm PST - 18, 000 + Inbound calls monthly (800 -876 -4582) u Inbound/Outbound Claims Correspondence u GECIS Management of reduced handling Facility claims, confinement calls and benefit payments - 5000 + per month 67 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Claims Services Support u Dedicated toll free telephone coverage 6: 00 am - 5: 00 pm PST - 18, 000 + Inbound calls monthly (800 -876 -4582) u Inbound/Outbound Claims Correspondence u GECIS Management of reduced handling Facility claims, confinement calls and benefit payments - 5000 + per month 67 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Indemnity Products u Per Diem Contracts u Traditional Claims Processing • Claim Adjudication • Routine Monthly Claim Payment • Facility Inquiry Service u More Disabled Claimant / Less Direct Communication 68 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Indemnity Products u Per Diem Contracts u Traditional Claims Processing • Claim Adjudication • Routine Monthly Claim Payment • Facility Inquiry Service u More Disabled Claimant / Less Direct Communication 68 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Reimbursement Products: Choice II u Reimbursement Contract u Unique Claims Processing 1. “Intake Calls” - claim initiation over the phone 2. Care Coordinator Assignment, Onsite Functional Assessment, Care Services Placement, Plan of Care 3. Claim Adjudication & Reimbursement Payment monthly u Less Disabled Claimant / Frequent & Direct Communication 69 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Reimbursement Products: Choice II u Reimbursement Contract u Unique Claims Processing 1. “Intake Calls” - claim initiation over the phone 2. Care Coordinator Assignment, Onsite Functional Assessment, Care Services Placement, Plan of Care 3. Claim Adjudication & Reimbursement Payment monthly u Less Disabled Claimant / Frequent & Direct Communication 69 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Benefit Analyst and Nurse u The Clinical World in concert with the Claim World u Benefits of the “R. N. ” Designation u Balancing the Roles u Training and Mentoring 70 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Benefit Analyst and Nurse u The Clinical World in concert with the Claim World u Benefits of the “R. N. ” Designation u Balancing the Roles u Training and Mentoring 70 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Care Coordinators - Our Business Partners u Administer various components of care management and other specialized services / product complexities u Heightened expectation for • Performance and Turn-Around • Accountability • Empowerment 71 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Care Coordinators - Our Business Partners u Administer various components of care management and other specialized services / product complexities u Heightened expectation for • Performance and Turn-Around • Accountability • Empowerment 71 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

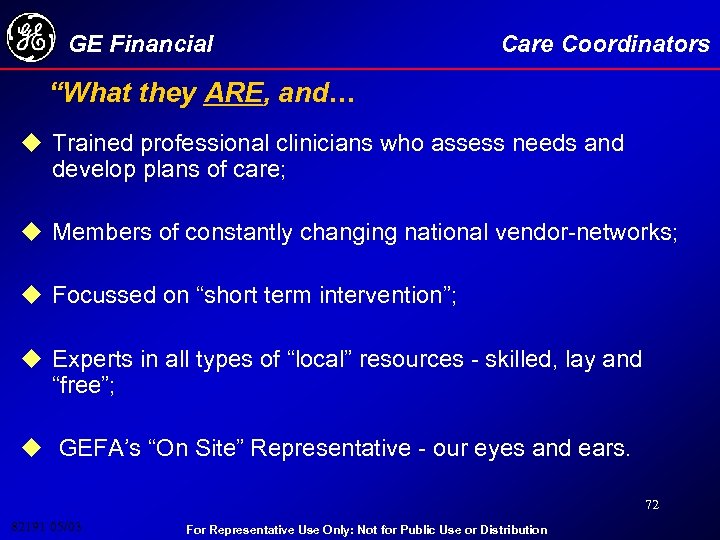

GE Financial Care Coordinators “What they ARE, and… u Trained professional clinicians who assess needs and develop plans of care; u Members of constantly changing national vendor-networks; u Focussed on “short term intervention”; u Experts in all types of “local” resources - skilled, lay and “free”; u GEFA’s “On Site” Representative - our eyes and ears. 72 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Care Coordinators “What they ARE, and… u Trained professional clinicians who assess needs and develop plans of care; u Members of constantly changing national vendor-networks; u Focussed on “short term intervention”; u Experts in all types of “local” resources - skilled, lay and “free”; u GEFA’s “On Site” Representative - our eyes and ears. 72 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

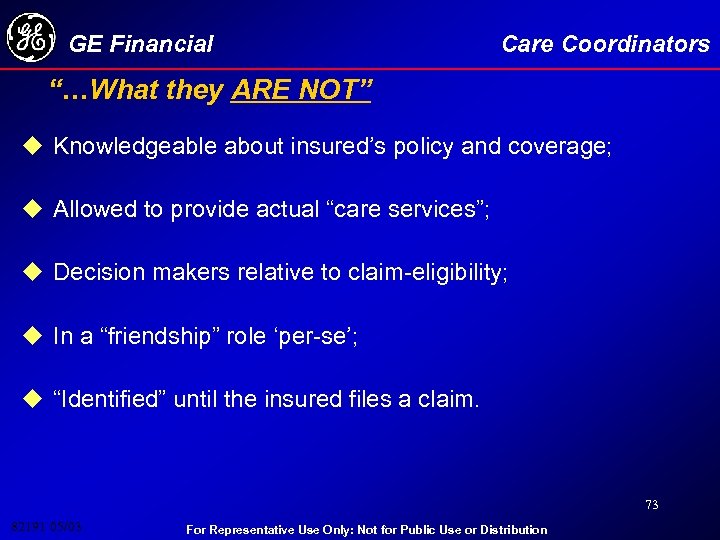

GE Financial Care Coordinators “…What they ARE NOT” u Knowledgeable about insured’s policy and coverage; u Allowed to provide actual “care services”; u Decision makers relative to claim-eligibility; u In a “friendship” role ‘per-se’; u “Identified” until the insured files a claim. 73 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial Care Coordinators “…What they ARE NOT” u Knowledgeable about insured’s policy and coverage; u Allowed to provide actual “care services”; u Decision makers relative to claim-eligibility; u In a “friendship” role ‘per-se’; u “Identified” until the insured files a claim. 73 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

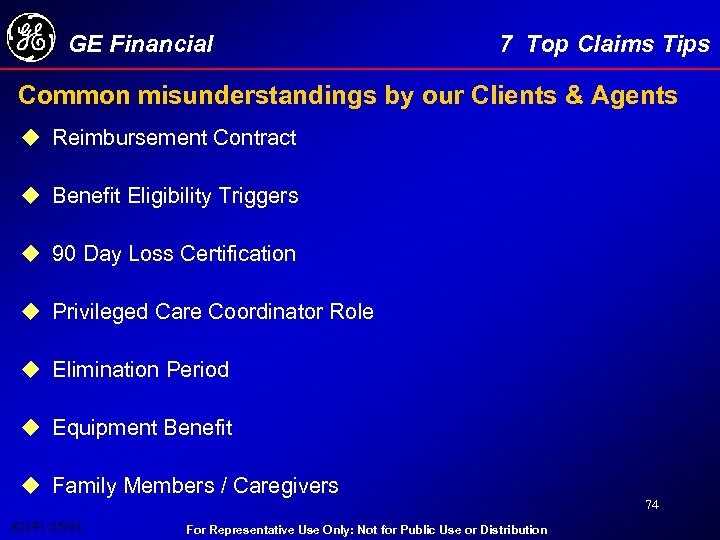

GE Financial 7 Top Claims Tips Common misunderstandings by our Clients & Agents u Reimbursement Contract u Benefit Eligibility Triggers u 90 Day Loss Certification u Privileged Care Coordinator Role u Elimination Period u Equipment Benefit u Family Members / Caregivers 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 74

GE Financial 7 Top Claims Tips Common misunderstandings by our Clients & Agents u Reimbursement Contract u Benefit Eligibility Triggers u 90 Day Loss Certification u Privileged Care Coordinator Role u Elimination Period u Equipment Benefit u Family Members / Caregivers 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 74

GE Financial APPENDIX 75 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial APPENDIX 75 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

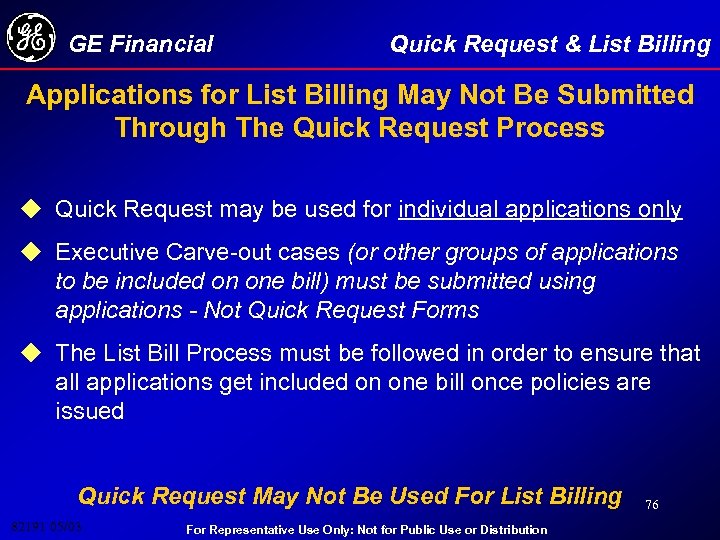

GE Financial Quick Request & List Billing Applications for List Billing May Not Be Submitted Through The Quick Request Process u Quick Request may be used for individual applications only u Executive Carve-out cases (or other groups of applications to be included on one bill) must be submitted using applications - Not Quick Request Forms u The List Bill Process must be followed in order to ensure that all applications get included on one bill once policies are issued Quick Request May Not Be Used For List Billing 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 76

GE Financial Quick Request & List Billing Applications for List Billing May Not Be Submitted Through The Quick Request Process u Quick Request may be used for individual applications only u Executive Carve-out cases (or other groups of applications to be included on one bill) must be submitted using applications - Not Quick Request Forms u The List Bill Process must be followed in order to ensure that all applications get included on one bill once policies are issued Quick Request May Not Be Used For List Billing 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 76

GE Financial List Bill – 2 -Step Process Submitting Applications To Be Placed On A List Bill Is A 2 -Step Process 1. Approval of the List Bill Case 2. Submission of Applications Following The Process Each Time Ensures Timely & Correct Processing 77 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial List Bill – 2 -Step Process Submitting Applications To Be Placed On A List Bill Is A 2 -Step Process 1. Approval of the List Bill Case 2. Submission of Applications Following The Process Each Time Ensures Timely & Correct Processing 77 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

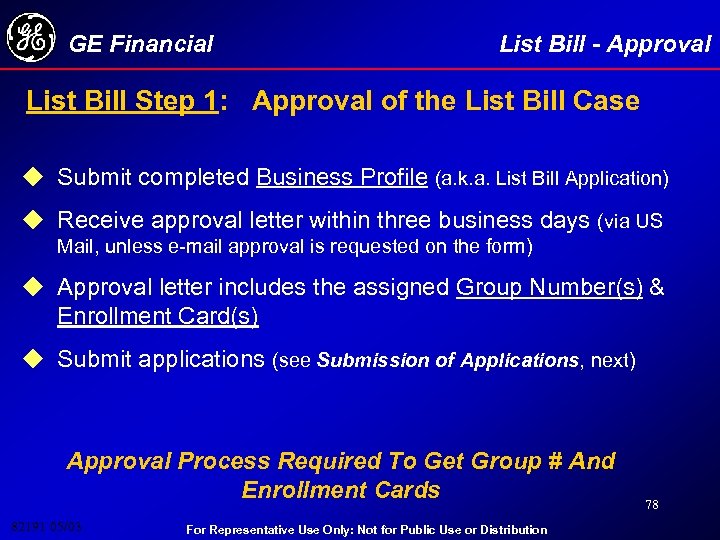

GE Financial List Bill - Approval List Bill Step 1: Approval of the List Bill Case u Submit completed Business Profile (a. k. a. List Bill Application) u Receive approval letter within three business days (via US Mail, unless e-mail approval is requested on the form) u Approval letter includes the assigned Group Number(s) & Enrollment Card(s) u Submit applications (see Submission of Applications, next) Approval Process Required To Get Group # And Enrollment Cards 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 78

GE Financial List Bill - Approval List Bill Step 1: Approval of the List Bill Case u Submit completed Business Profile (a. k. a. List Bill Application) u Receive approval letter within three business days (via US Mail, unless e-mail approval is requested on the form) u Approval letter includes the assigned Group Number(s) & Enrollment Card(s) u Submit applications (see Submission of Applications, next) Approval Process Required To Get Group # And Enrollment Cards 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 78

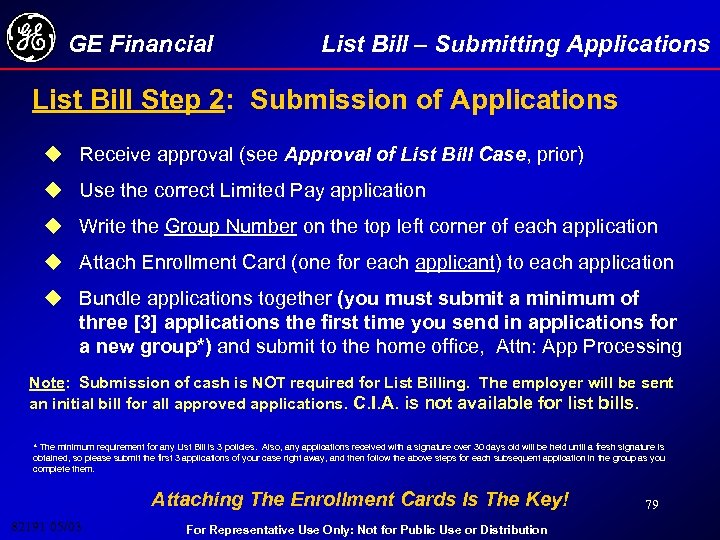

GE Financial List Bill – Submitting Applications List Bill Step 2: Submission of Applications u Receive approval (see Approval of List Bill Case, prior) u Use the correct Limited Pay application u Write the Group Number on the top left corner of each application u Attach Enrollment Card (one for each applicant) to each application u Bundle applications together (you must submit a minimum of three [3] applications the first time you send in applications for a new group*) and submit to the home office, Attn: App Processing Note: Submission of cash is NOT required for List Billing. The employer will be sent an initial bill for all approved applications. C. I. A. is not available for list bills. * The minimum requirement for any List Bill is 3 policies. Also, any applications received with a signature over 30 days old will be held until a fresh signature is obtained, so please submit the first 3 applications of your case right away, and then follow the above steps for each subsequent application in the group as you complete them. Attaching The Enrollment Cards Is The Key! 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 79

GE Financial List Bill – Submitting Applications List Bill Step 2: Submission of Applications u Receive approval (see Approval of List Bill Case, prior) u Use the correct Limited Pay application u Write the Group Number on the top left corner of each application u Attach Enrollment Card (one for each applicant) to each application u Bundle applications together (you must submit a minimum of three [3] applications the first time you send in applications for a new group*) and submit to the home office, Attn: App Processing Note: Submission of cash is NOT required for List Billing. The employer will be sent an initial bill for all approved applications. C. I. A. is not available for list bills. * The minimum requirement for any List Bill is 3 policies. Also, any applications received with a signature over 30 days old will be held until a fresh signature is obtained, so please submit the first 3 applications of your case right away, and then follow the above steps for each subsequent application in the group as you complete them. Attaching The Enrollment Cards Is The Key! 82191 05/03 For Representative Use Only: Not for Public Use or Distribution 79

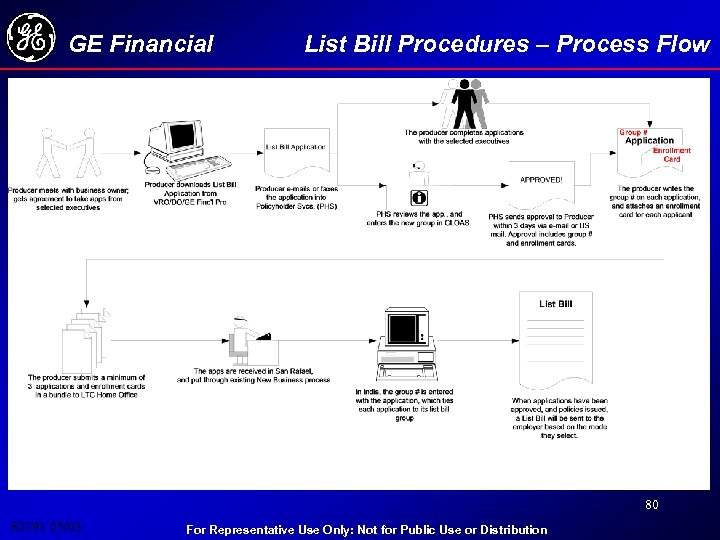

GE Financial List Bill Procedures – Process Flow 80 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial List Bill Procedures – Process Flow 80 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

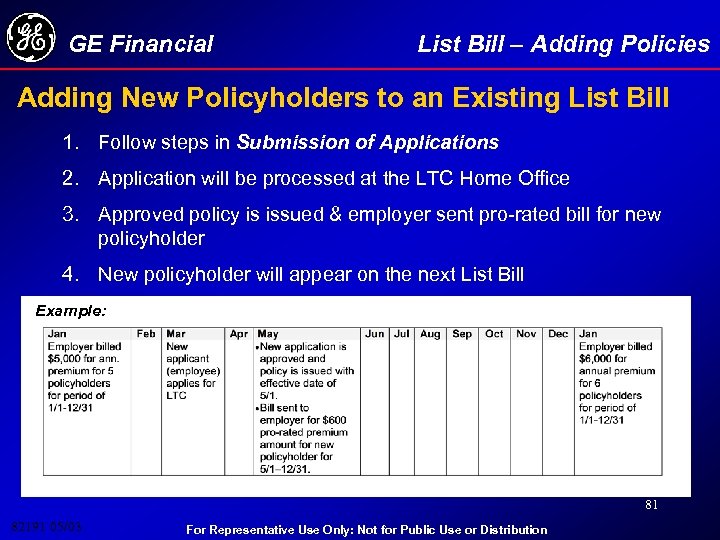

GE Financial List Bill – Adding Policies Adding New Policyholders to an Existing List Bill 1. Follow steps in Submission of Applications 2. Application will be processed at the LTC Home Office 3. Approved policy is issued & employer sent pro-rated bill for new policyholder 4. New policyholder will appear on the next List Bill Example: 81 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial List Bill – Adding Policies Adding New Policyholders to an Existing List Bill 1. Follow steps in Submission of Applications 2. Application will be processed at the LTC Home Office 3. Approved policy is issued & employer sent pro-rated bill for new policyholder 4. New policyholder will appear on the next List Bill Example: 81 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial List Bill – Adding Policies Adding Existing Policyholders to a New/Existing List Bill 1. Complete a Coverage Change Request (CCR) form, including a signature from the policyholder 2. Complete an Enrollment Card for the policyholder 3. Policyholder is refunded any premium overpayment (from effective date of the list Bill group, forward) 4. A confirmation letter is sent to the policyholder and employer 5. Policyholder will now appear on the next List Bill 82 82191 05/03 For Representative Use Only: Not for Public Use or Distribution

GE Financial List Bill – Adding Policies Adding Existing Policyholders to a New/Existing List Bill 1. Complete a Coverage Change Request (CCR) form, including a signature from the policyholder 2. Complete an Enrollment Card for the policyholder 3. Policyholder is refunded any premium overpayment (from effective date of the list Bill group, forward) 4. A confirmation letter is sent to the policyholder and employer 5. Policyholder will now appear on the next List Bill 82 82191 05/03 For Representative Use Only: Not for Public Use or Distribution