307e41ec69d04897fb7d710a0c900fd5.ppt

- Количество слайдов: 33

GE / Alstom Merger Eduard Biller Simon Foucher

Agenda 1 2 Strategy 3 Merger Story & Roadblocks 4 1 Companies overview Aftermath

General Electric The acquirer

Company History Founded by Thomas Edison as a combination of several electric businesses Over time reinvented itself Focus on industrial engineering now Until the financial crisis the focus was on financial engineering Divesting its financial assets now (spinoffs, sales, etc) Is still divided into an industrial and financial section

Company Trivia One of the largest and well-known companies worldwide Revenue of over 148 bn $ Earnings of over 15 bn $ Almost 600 bn $ in assets But almost 500 bn $ are accounted for GE Capital When looking on the industrial arm only, it has almost no net debt

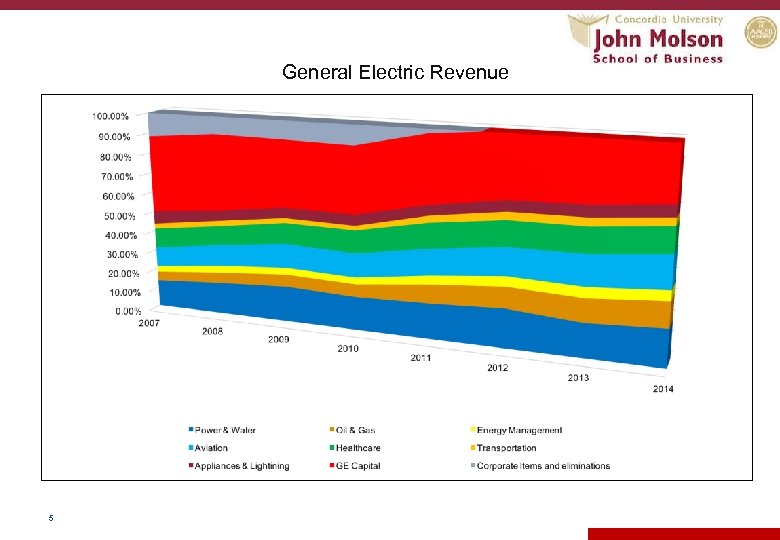

General Electric Revenue 5

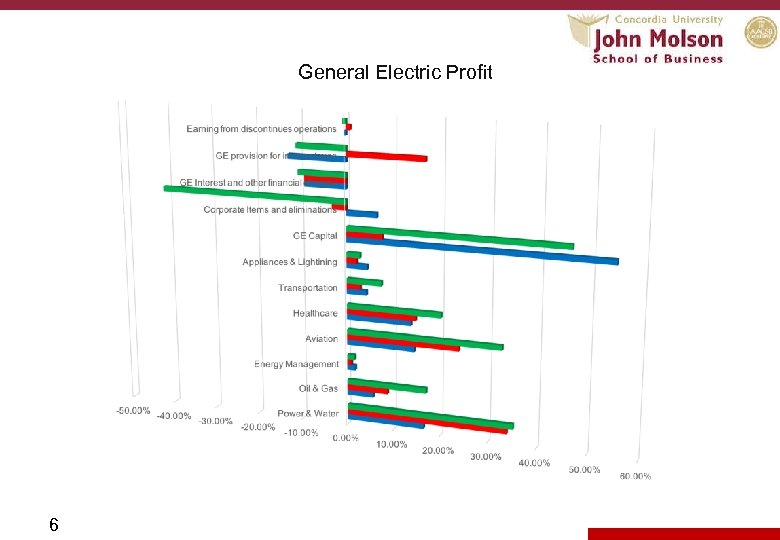

General Electric Profit 6

Strengths: • Overall change in company portfolio • Spinoff (Synchrony Financial) • Sale of NBC • Leading position in several sectors • Low restructuring costs in the following years Weaknesses: • Problem with € and Oil • Weak position in East Asia • 1/3 of all orders are from regions who are dependent on commodity prices 7

Alstom Target

9

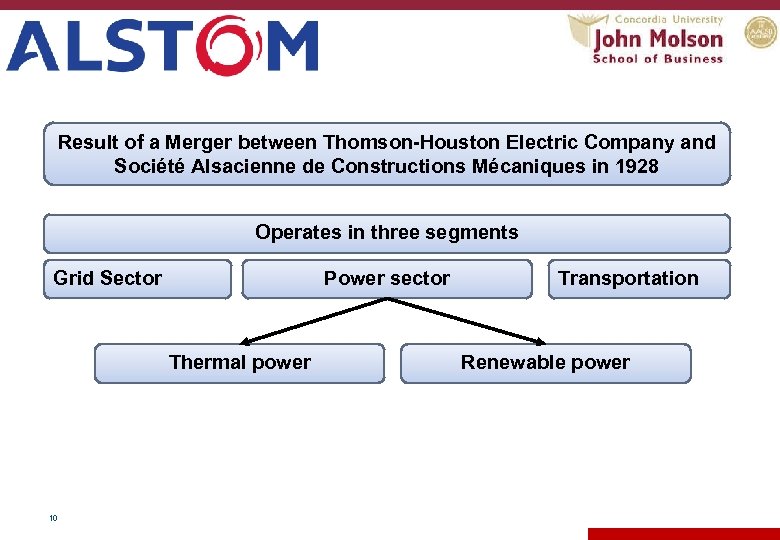

Result of a Merger between Thomson-Houston Electric Company and Société Alsacienne de Constructions Mécaniques in 1928 Operates in three segments Grid Sector Power sector Thermal power 10 Transportation Renewable power

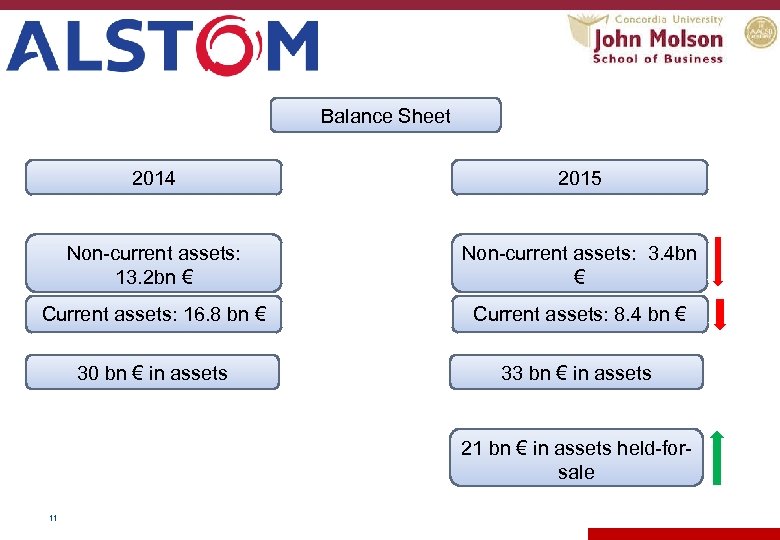

Balance Sheet 2014 2015 Non-current assets: 13. 2 bn € Non-current assets: 3. 4 bn € Current assets: 16. 8 bn € Current assets: 8. 4 bn € 30 bn € in assets 33 bn € in assets 21 bn € in assets held-forsale 11

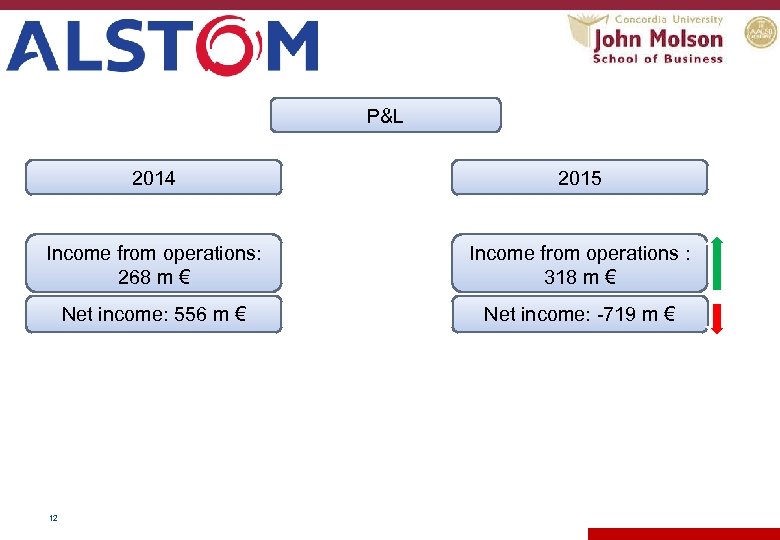

P&L 2014 2015 Income from operations: 268 m € Income from operations : 318 m € Net income: 556 m € Net income: -719 m € 12

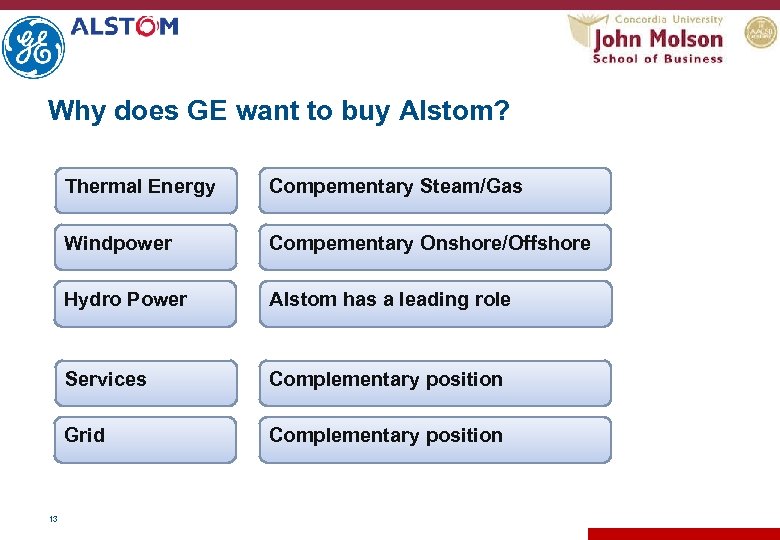

Why does GE want to buy Alstom? Thermal Energy Windpower Compementary Onshore/Offshore Hydro Power Alstom has a leading role Services Complementary position Grid 13 Compementary Steam/Gas Complementary position

Acquisition Timeline

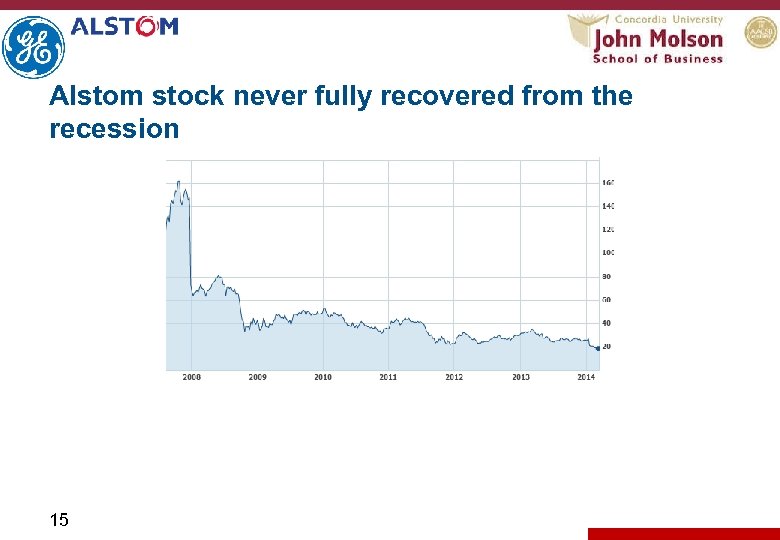

Alstom stock never fully recovered from the recession 15

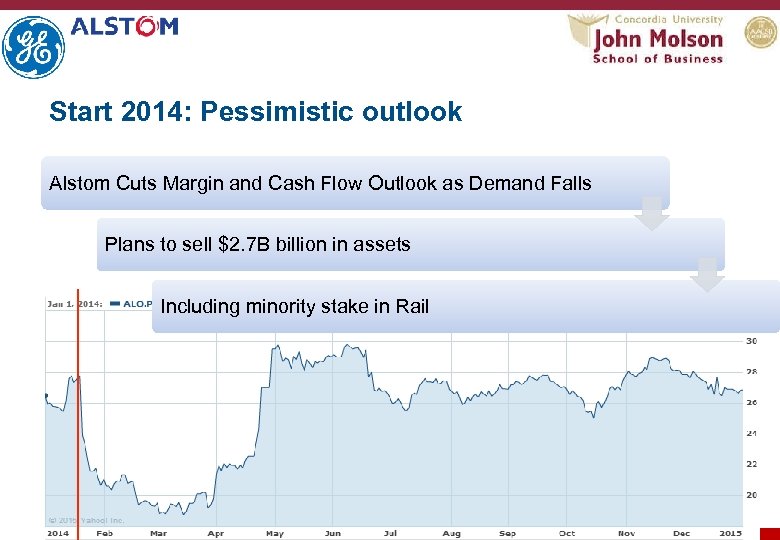

Start 2014: Pessimistic outlook Alstom Cuts Margin and Cash Flow Outlook as Demand Falls Plans to sell $2. 7 B billion in assets Including minority stake in Rail 16

Apr 2014: Industrial sector showing strength Alstom to Sell Steam Parts Unit for 1 B$ S&P 500 Climbs to Record as Treasuries Fall, Oil Tumbles 17

April : Early rumors of GE bid 24 th: Public news that GE and Alstom discussing potential deal 13 B€ Transition; largest GE acquisition Bouygues (29% shareholder of Alstom) on board 18

April: Followed by rumors of competitive bids 27 th: News of alternative bid from Siemens Exchange for part of its rail transport arm plus a cash offer as good as GE's 30 th: GE confirms 12. 4 B€ (17 B$) bid for Alstom SA’s energy business 19

May: Government steps in 5 th: French government states that it will not back GE’s bid GE must improve bid and combine two companies’ rail businesses; lobbies Siemens to participate in auction 7 th: Siemens CEO says he won't be forced into a white knight bid for Alstom 20

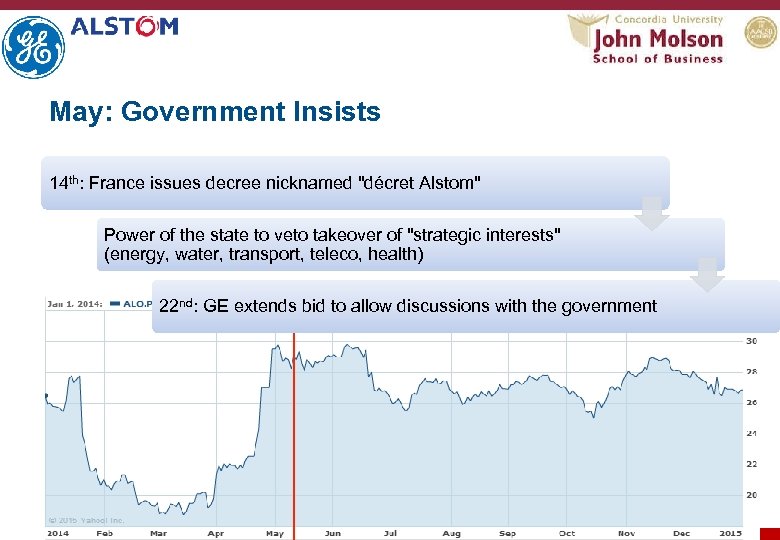

May: Government Insists 14 th: France issues decree nicknamed "décret Alstom" Power of the state to veto takeover of "strategic interests" (energy, water, transport, teleco, health) 22 nd: GE extends bid to allow discussions with the government 21

June: Competition becomes official 16 th: Siemens &Mitsubishi submit a competing proposal Siemens acquire Alstom's gas turbine activities for 3. 9 B€ MHI to form JV with Alstom , acquiring stakes in power for 3. 1 B€ 22

June: Bidding heats up 19 th: GE revised its bid, same price, but with a lower cash transaction value. Form a 50: 50 JV combining in renewable and electric grid business and another JV in steam turbine and nuclear power. GE to sell its rail signaling business to Alstom 23

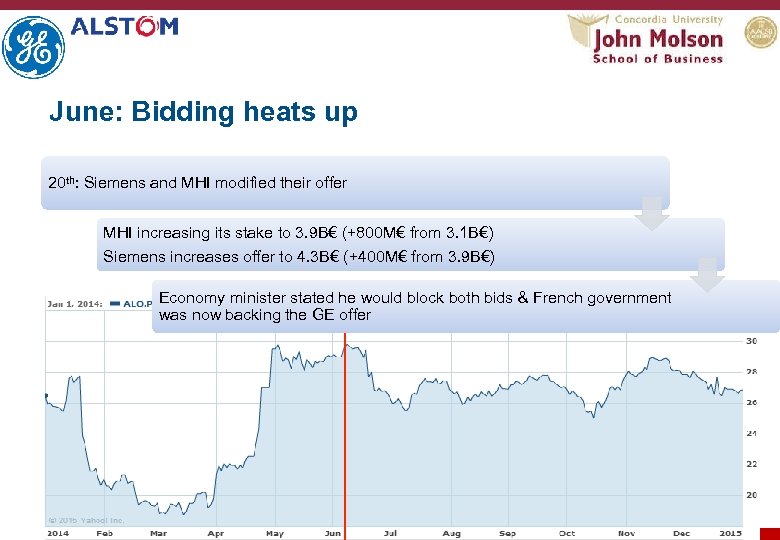

June: Bidding heats up 20 th: Siemens and MHI modified their offer MHI increasing its stake to 3. 9 B€ (+800 M€ from 3. 1 B€) Siemens increases offer to 4. 3 B€ (+400 M€ from 3. 9 B€) Economy minister stated he would block both bids & French government was now backing the GE offer 24

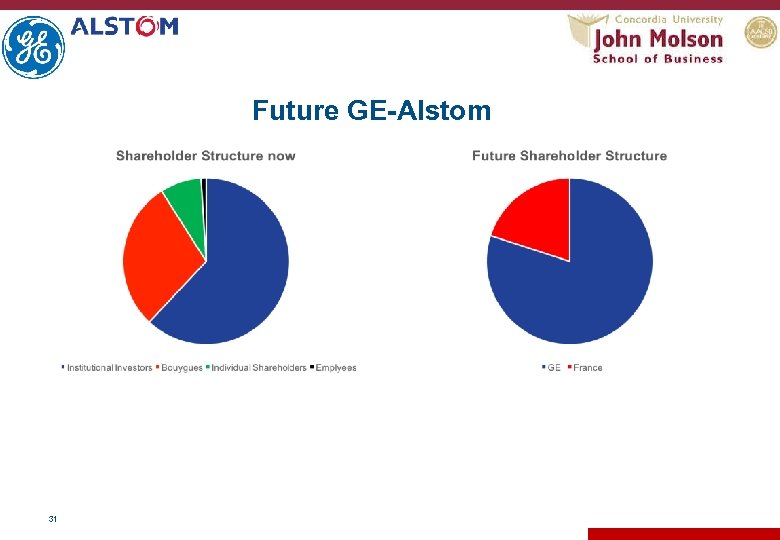

June: GE Wins 21 st: Alstom board met and backed GE's revised bid 22 nd: French government agreed terms with Bouygues Taking a 20% stake in Alstom from Bouygues shares at a 2– 5% discount on a value of a minimum of ≈€ 35 25

Dec: Almost final approvals 19 th: Shareholders approved the transaction by 99. 2% Bouygues under pressure to make a deal with government due to regulation issues in the teleco sector 26

EU Steps in Early 2015 the EU Competition Commission began an examination process Deal leaves only Siemens as GE’s main rival in Europe Concerns of stifling innovation price rises 27

Sep 2015: Final regulatory approvals 8 th European Union and US DOJ approved the deal Subject to divestiture of Alstom's gas turbine manufacturing and parts Closing targeted in Q 4 2015 28

This Monday 2015: Deal closes Completion of the transaction follows regulatory approval in over 20 countries Changes in the deal structure (price adjustments for remedies, net cash at close & forex); the purchase price is € 9. 7 B ($10. 6 B) GE also announced completed sale of rail signaling business to Alsom for $800 M 29 29

Aftermath

Future GE-Alstom 31

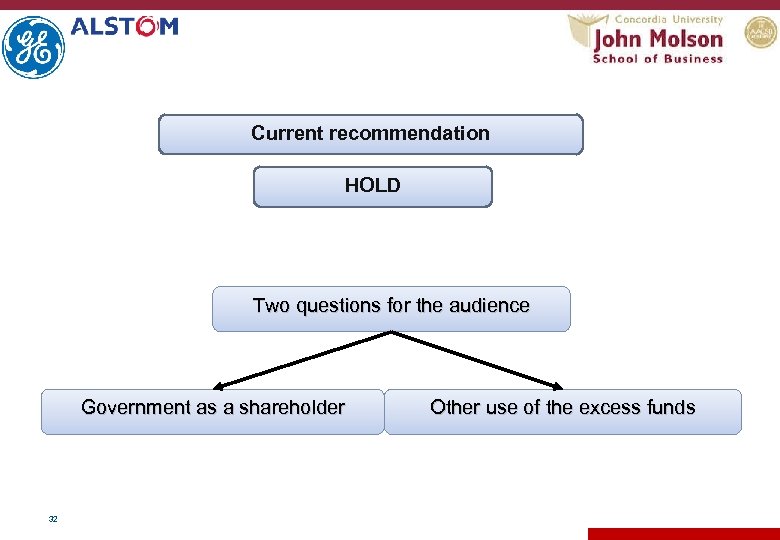

Current recommendation HOLD Two questions for the audience Government as a shareholder 32 Other use of the excess funds

307e41ec69d04897fb7d710a0c900fd5.ppt