864d9366e212807517302a50d5cf6b03.ppt

- Количество слайдов: 19

GDPCR Costs Workshop WWU’s View on Operating Costs Bob Westlake 19 th April 2007

GDPCR Costs Workshop WWU’s View on Operating Costs Bob Westlake 19 th April 2007

Agenda • Introduction to WWU • Network Characteristics • BPQ Forecasts – Capex – Repex – Opex • Main Assumptions • Opex – Assessment – Cost Pressures – Factors – Setting Allowances – Future Efficiencies - Direct - Indirect – Conclusions 2

Agenda • Introduction to WWU • Network Characteristics • BPQ Forecasts – Capex – Repex – Opex • Main Assumptions • Opex – Assessment – Cost Pressures – Factors – Setting Allowances – Future Efficiencies - Direct - Indirect – Conclusions 2

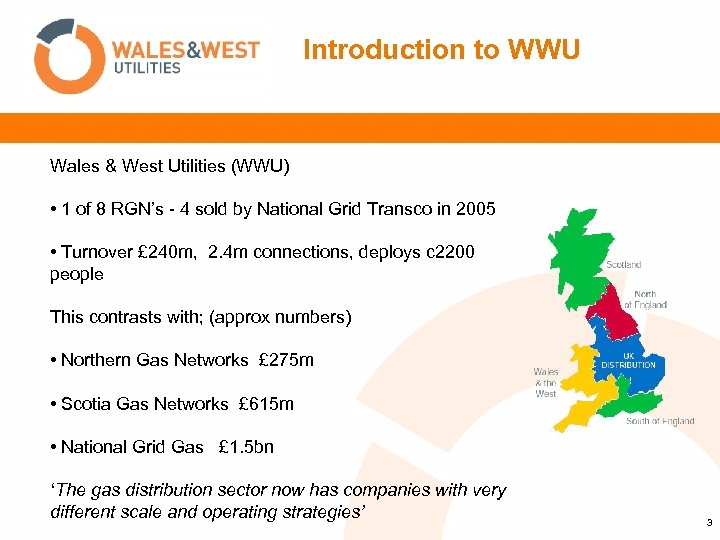

Introduction to WWU Wales & West Utilities (WWU) • 1 of 8 RGN’s - 4 sold by National Grid Transco in 2005 • Turnover £ 240 m, 2. 4 m connections, deploys c 2200 people This contrasts with; (approx numbers) • Northern Gas Networks £ 275 m • Scotia Gas Networks £ 615 m • National Grid Gas £ 1. 5 bn ‘The gas distribution sector now has companies with very different scale and operating strategies’ 3

Introduction to WWU Wales & West Utilities (WWU) • 1 of 8 RGN’s - 4 sold by National Grid Transco in 2005 • Turnover £ 240 m, 2. 4 m connections, deploys c 2200 people This contrasts with; (approx numbers) • Northern Gas Networks £ 275 m • Scotia Gas Networks £ 615 m • National Grid Gas £ 1. 5 bn ‘The gas distribution sector now has companies with very different scale and operating strategies’ 3

Significant Features • Operating region is 27% of England Wales, but with only 15% of the population • Difficult access given geography and road networks (e. g. drive from north to south is over 9 hours). • Length of LTS Network is 3. 3 times national average per customer • Distribution mains length per customer in Wales is 14% above national average 4

Significant Features • Operating region is 27% of England Wales, but with only 15% of the population • Difficult access given geography and road networks (e. g. drive from north to south is over 9 hours). • Length of LTS Network is 3. 3 times national average per customer • Distribution mains length per customer in Wales is 14% above national average 4

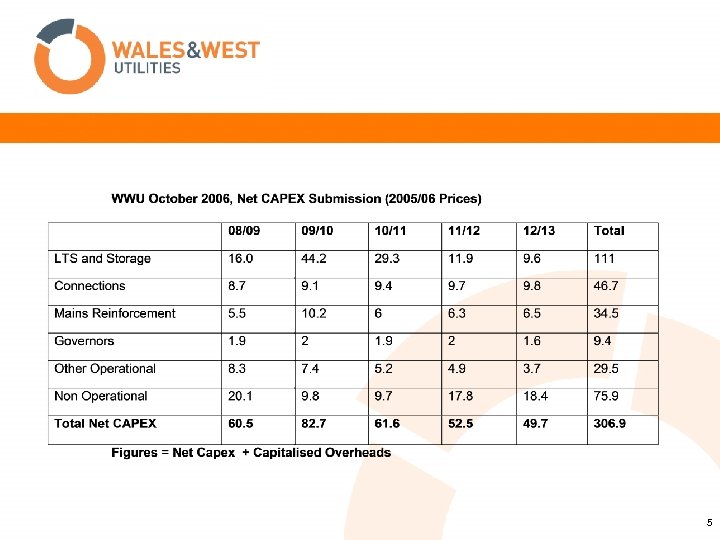

5

5

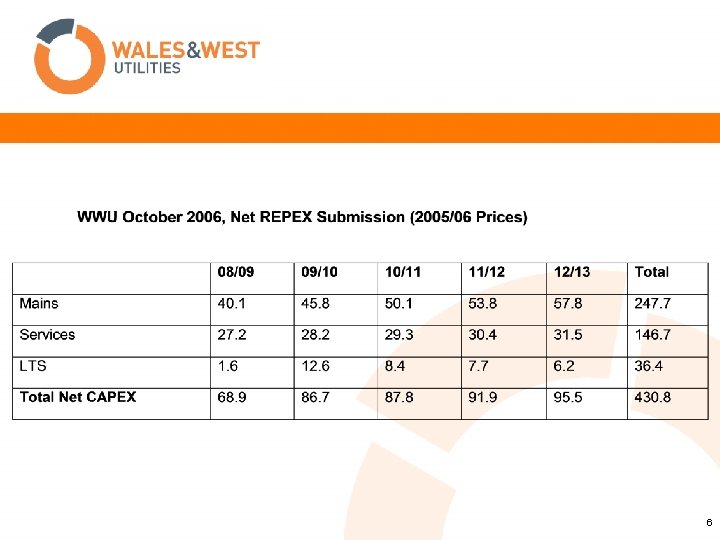

6

6

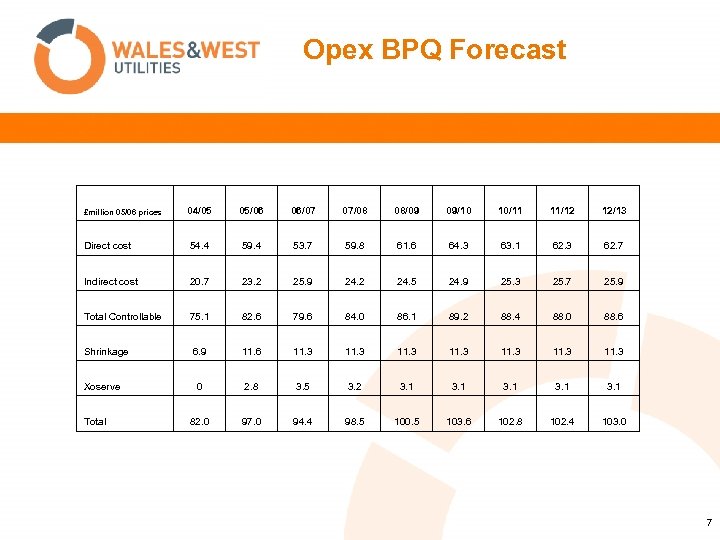

Opex BPQ Forecast 04/05 05/06 06/07 07/08 08/09 09/10 10/11 11/12 12/13 Direct cost 54. 4 59. 4 53. 7 59. 8 61. 6 64. 3 63. 1 62. 3 62. 7 Indirect cost 20. 7 23. 2 25. 9 24. 2 24. 5 24. 9 25. 3 25. 7 25. 9 Total Controllable 75. 1 82. 6 79. 6 84. 0 86. 1 89. 2 88. 4 88. 0 88. 6 Shrinkage 6. 9 11. 6 11. 3 11. 3 0 2. 8 3. 5 3. 2 3. 1 3. 1 82. 0 97. 0 94. 4 98. 5 100. 5 103. 6 102. 8 102. 4 103. 0 £million 05/06 prices Xoserve Total 7

Opex BPQ Forecast 04/05 05/06 06/07 07/08 08/09 09/10 10/11 11/12 12/13 Direct cost 54. 4 59. 4 53. 7 59. 8 61. 6 64. 3 63. 1 62. 3 62. 7 Indirect cost 20. 7 23. 2 25. 9 24. 2 24. 5 24. 9 25. 3 25. 7 25. 9 Total Controllable 75. 1 82. 6 79. 6 84. 0 86. 1 89. 2 88. 4 88. 0 88. 6 Shrinkage 6. 9 11. 6 11. 3 11. 3 0 2. 8 3. 5 3. 2 3. 1 3. 1 82. 0 97. 0 94. 4 98. 5 100. 5 103. 6 102. 8 102. 4 103. 0 £million 05/06 prices Xoserve Total 7

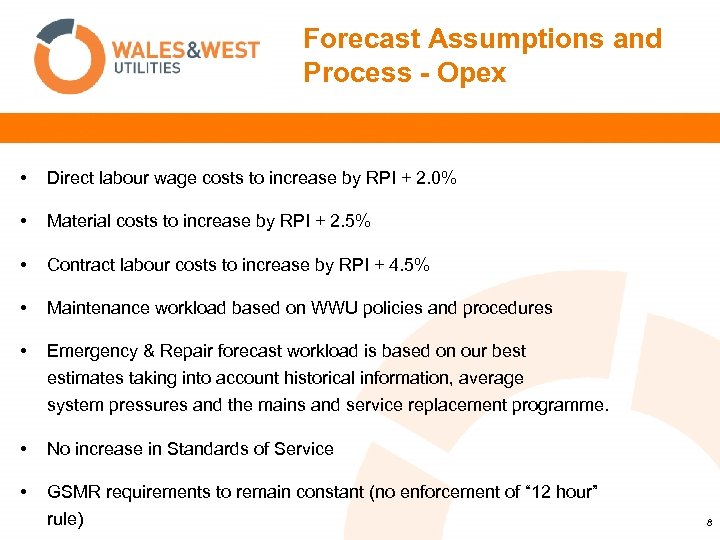

Forecast Assumptions and Process - Opex • Direct labour wage costs to increase by RPI + 2. 0% • Material costs to increase by RPI + 2. 5% • Contract labour costs to increase by RPI + 4. 5% • Maintenance workload based on WWU policies and procedures • Emergency & Repair forecast workload is based on our best estimates taking into account historical information, average system pressures and the mains and service replacement programme. • No increase in Standards of Service • GSMR requirements to remain constant (no enforcement of “ 12 hour” rule) 8

Forecast Assumptions and Process - Opex • Direct labour wage costs to increase by RPI + 2. 0% • Material costs to increase by RPI + 2. 5% • Contract labour costs to increase by RPI + 4. 5% • Maintenance workload based on WWU policies and procedures • Emergency & Repair forecast workload is based on our best estimates taking into account historical information, average system pressures and the mains and service replacement programme. • No increase in Standards of Service • GSMR requirements to remain constant (no enforcement of “ 12 hour” rule) 8

Assessment • Different Drivers – Different Environment – for example • London – London Weighting, congestion, customer density (high) • WWU – geography, customer density (low), more assets all = higher costs 9

Assessment • Different Drivers – Different Environment – for example • London – London Weighting, congestion, customer density (high) • WWU – geography, customer density (low), more assets all = higher costs 9

Network Features • Greater length of pipe means: • • • more inspection work more emergency work more repairs more materials More work requires: • more people • more vehicles • more travel time • more time for working • more records • This effect also puts a cap on the potential efficiencies that can be achieved. 10

Network Features • Greater length of pipe means: • • • more inspection work more emergency work more repairs more materials More work requires: • more people • more vehicles • more travel time • more time for working • more records • This effect also puts a cap on the potential efficiencies that can be achieved. 10

Opex Cost Pressures • Environmental spend – clean up of contaminated sites – WWU statutory liability in excess of £ 25 m. • c. £ 6 m of costs already removed from WWU business in 06/07 • Landfill tax increases of £ 8 per tonne for next 4 years – will be £ 53 tonne in 10/11 • Traffic Management Act – potential costs of £ 5 m per annum (not part of BPQ costs) • Age profile of Industrial workforce requires investment in recruitment and training • Skilled labour shortage – NTS pipeline projects and major construction schemes pushing up contract prices. 11

Opex Cost Pressures • Environmental spend – clean up of contaminated sites – WWU statutory liability in excess of £ 25 m. • c. £ 6 m of costs already removed from WWU business in 06/07 • Landfill tax increases of £ 8 per tonne for next 4 years – will be £ 53 tonne in 10/11 • Traffic Management Act – potential costs of £ 5 m per annum (not part of BPQ costs) • Age profile of Industrial workforce requires investment in recruitment and training • Skilled labour shortage – NTS pipeline projects and major construction schemes pushing up contract prices. 11

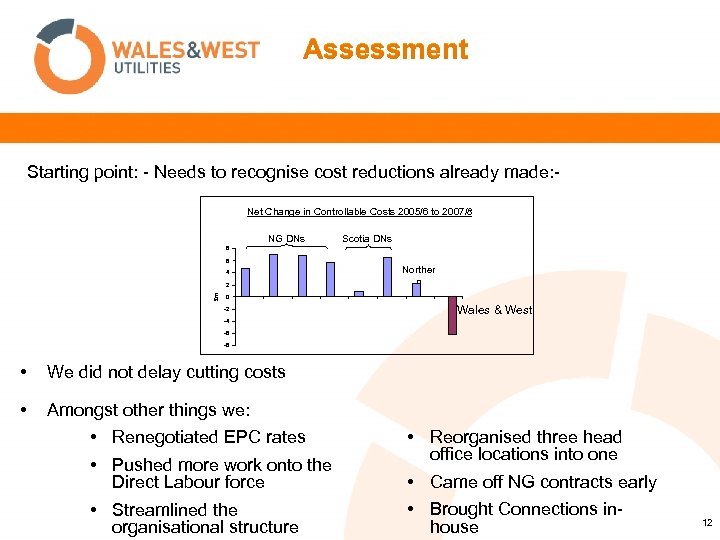

Assessment Starting point: - Needs to recognise cost reductions already made: Net Change in Controllable Costs 2005/6 to 2007/8 NG DNs Scotia DNs 8 6 4 £m 2 Norther n 0 -2 Wales & West -4 -6 -8 • We did not delay cutting costs • Amongst other things we: • Renegotiated EPC rates • Pushed more work onto the Direct Labour force • Streamlined the organisational structure • Reorganised three head office locations into one • Came off NG contracts early • Brought Connections inhouse 12

Assessment Starting point: - Needs to recognise cost reductions already made: Net Change in Controllable Costs 2005/6 to 2007/8 NG DNs Scotia DNs 8 6 4 £m 2 Norther n 0 -2 Wales & West -4 -6 -8 • We did not delay cutting costs • Amongst other things we: • Renegotiated EPC rates • Pushed more work onto the Direct Labour force • Streamlined the organisational structure • Reorganised three head office locations into one • Came off NG contracts early • Brought Connections inhouse 12

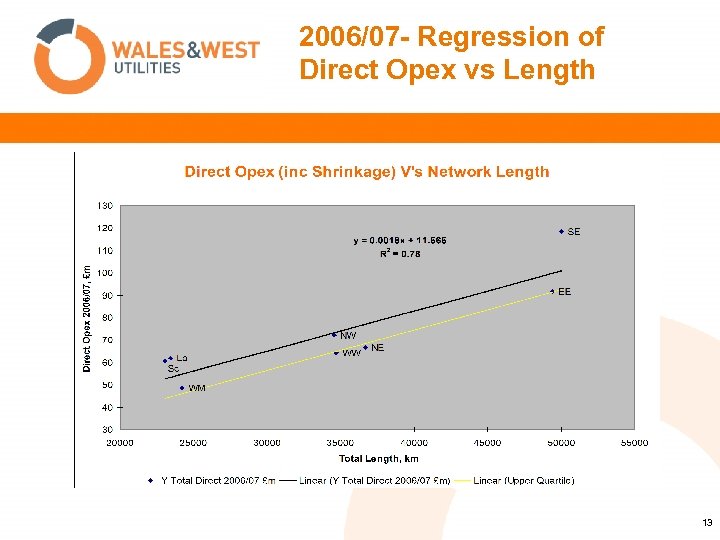

2006/07 - Regression of Direct Opex vs Length 13

2006/07 - Regression of Direct Opex vs Length 13

Indirect Opex – Main Points • LECG cherry-picked a combination of external and internal benchmarks throughout the report creating an artificially efficient GDN. • It is too early to effectively benchmark GDN’s internally due to the short period that the management teams have been in place. • External benchmarks should be used for Indirect Opex Costs as they are independent and represent best practice in private industry. WWU has commissioned an independent study of appropriate external benchmarking. • WWU has built the management and support functions from scratch with no inherent inefficiency. 14

Indirect Opex – Main Points • LECG cherry-picked a combination of external and internal benchmarks throughout the report creating an artificially efficient GDN. • It is too early to effectively benchmark GDN’s internally due to the short period that the management teams have been in place. • External benchmarks should be used for Indirect Opex Costs as they are independent and represent best practice in private industry. WWU has commissioned an independent study of appropriate external benchmarking. • WWU has built the management and support functions from scratch with no inherent inefficiency. 14

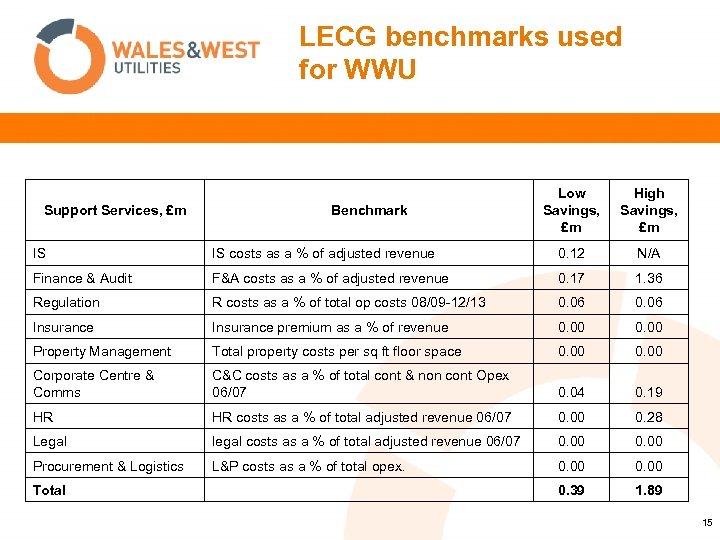

LECG benchmarks used for WWU Support Services, £m Benchmark Low Savings, £m High Savings, £m IS IS costs as a % of adjusted revenue 0. 12 N/A Finance & Audit F&A costs as a % of adjusted revenue 0. 17 1. 36 Regulation R costs as a % of total op costs 08/09 -12/13 0. 06 Insurance premium as a % of revenue 0. 00 Property Management Total property costs per sq ft floor space 0. 00 Corporate Centre & Comms C&C costs as a % of total cont & non cont Opex 06/07 0. 04 0. 19 HR HR costs as a % of total adjusted revenue 06/07 0. 00 0. 28 Legal legal costs as a % of total adjusted revenue 06/07 0. 00 Procurement & Logistics L&P costs as a % of total opex. 0. 00 Total 0. 39 1. 89 15

LECG benchmarks used for WWU Support Services, £m Benchmark Low Savings, £m High Savings, £m IS IS costs as a % of adjusted revenue 0. 12 N/A Finance & Audit F&A costs as a % of adjusted revenue 0. 17 1. 36 Regulation R costs as a % of total op costs 08/09 -12/13 0. 06 Insurance premium as a % of revenue 0. 00 Property Management Total property costs per sq ft floor space 0. 00 Corporate Centre & Comms C&C costs as a % of total cont & non cont Opex 06/07 0. 04 0. 19 HR HR costs as a % of total adjusted revenue 06/07 0. 00 0. 28 Legal legal costs as a % of total adjusted revenue 06/07 0. 00 Procurement & Logistics L&P costs as a % of total opex. 0. 00 Total 0. 39 1. 89 15

Total Opex- Europe Economics • WWU support the use of 2006/07 data, 2005/06 is not fully representative. • Network length as a cost driver must be included. • The NISEC 02 data set for the TFP analysis is outdated and does not reflect current UK productivity trends and has a 7 year credibility gap as it ends in 1999. • Too many assumptions made without supporting evidence – placing considerable doubt on the output. • Privatisation effect does not exist over 20 years on. • Future savings not credible. 16

Total Opex- Europe Economics • WWU support the use of 2006/07 data, 2005/06 is not fully representative. • Network length as a cost driver must be included. • The NISEC 02 data set for the TFP analysis is outdated and does not reflect current UK productivity trends and has a 7 year credibility gap as it ends in 1999. • Too many assumptions made without supporting evidence – placing considerable doubt on the output. • Privatisation effect does not exist over 20 years on. • Future savings not credible. 16

Future Efficiencies • Privatisation over 20 years ago - inconceivable there is still a privatisation effect • Why are utilities expected to out perform private industry? • RPI captures efficiencies in the economy as a whole – therefore to match economy efficiency need to match RPI • To outperform RPI is to out perform private industries – no sound or credible basis for this presumption 17

Future Efficiencies • Privatisation over 20 years ago - inconceivable there is still a privatisation effect • Why are utilities expected to out perform private industry? • RPI captures efficiencies in the economy as a whole – therefore to match economy efficiency need to match RPI • To outperform RPI is to out perform private industries – no sound or credible basis for this presumption 17

Conclusions • Direct opex is driven by geography, network characteristics, customer density and levels of performance, therefore network length must be taken into account • Indirect opex is suitable for benchmarking, should be assessed externally against best practise • Economies of scale are real and exist • Top down regressions useful cross check • Must use appropriate drivers and normalised 06/07 costs • Future efficiencies should match RPI • Can not expect utilities to constantly outperform general economy cost efficiencies in perpetu • Future allowances must recognise legitimate cost pressures 18

Conclusions • Direct opex is driven by geography, network characteristics, customer density and levels of performance, therefore network length must be taken into account • Indirect opex is suitable for benchmarking, should be assessed externally against best practise • Economies of scale are real and exist • Top down regressions useful cross check • Must use appropriate drivers and normalised 06/07 costs • Future efficiencies should match RPI • Can not expect utilities to constantly outperform general economy cost efficiencies in perpetu • Future allowances must recognise legitimate cost pressures 18

Appendix 1 - Key Statistics • 2, 400 kms of Local Transmission Pipelines • 15 NTS Offtakes + 2 proposed as part of SW Reinforcement • 316 LTS Pressure Reduction Stations and Above Ground Installations • Holders – 15 HP vessels on 3 sites – 20 LP holders on 15 sites • 3, 478 District Governor Installations • 95, 000 Internal Public Reported Escapes per annum • 24, 500 External Public Reported Escapes per annum • 19, 200 Mains and Service Repairs per annum 19

Appendix 1 - Key Statistics • 2, 400 kms of Local Transmission Pipelines • 15 NTS Offtakes + 2 proposed as part of SW Reinforcement • 316 LTS Pressure Reduction Stations and Above Ground Installations • Holders – 15 HP vessels on 3 sites – 20 LP holders on 15 sites • 3, 478 District Governor Installations • 95, 000 Internal Public Reported Escapes per annum • 24, 500 External Public Reported Escapes per annum • 19, 200 Mains and Service Repairs per annum 19