f564157beaaf5267be89777d38164fc8.ppt

- Количество слайдов: 58

GDP and the Standard of Living CHAPTER 21

GDP and the Standard of Living CHAPTER 21

CHAPTER CHECKLIST When you have completed your study of this chapter, you will be able to 1 Define GDP and explain why the value of production, income, and expenditure are the same for an economy. 2 Describe how economic statisticians measure GDP an distinguish between nominal GDP and real GDP. 3 Describe and explain the limitations of real GDP as a measure of the standard of living.

CHAPTER CHECKLIST When you have completed your study of this chapter, you will be able to 1 Define GDP and explain why the value of production, income, and expenditure are the same for an economy. 2 Describe how economic statisticians measure GDP an distinguish between nominal GDP and real GDP. 3 Describe and explain the limitations of real GDP as a measure of the standard of living.

21. 1 GDP, INCOME, AND EXPENDITURE

21. 1 GDP, INCOME, AND EXPENDITURE

21. 1 GDP, INCOME, AND EXPENDITURE What Produced Final good or service is a good or service that is produced for its final user and not as a component of another good or service. Intermediate good or service is a good or service that is produced by one firm, bought by another firm, and used as a component of a final good or service. GDP includes only those items that are traded in markets.

21. 1 GDP, INCOME, AND EXPENDITURE What Produced Final good or service is a good or service that is produced for its final user and not as a component of another good or service. Intermediate good or service is a good or service that is produced by one firm, bought by another firm, and used as a component of a final good or service. GDP includes only those items that are traded in markets.

21. 1 GDP, INCOME, AND EXPENDITURE Where Produced • Within a country When Produced • During a given time period.

21. 1 GDP, INCOME, AND EXPENDITURE Where Produced • Within a country When Produced • During a given time period.

21. 1 GDP, INCOME, AND EXPENDITURE

21. 1 GDP, INCOME, AND EXPENDITURE

21. 1 GDP, INCOME, AND EXPENDITURE Government expenditure on goods and services is the expenditure by all levels of government on goods and services. Net exports of goods and services is the value of exports of goods and services minus the value of imports of goods and services.

21. 1 GDP, INCOME, AND EXPENDITURE Government expenditure on goods and services is the expenditure by all levels of government on goods and services. Net exports of goods and services is the value of exports of goods and services minus the value of imports of goods and services.

21. 1 GDP, INCOME, AND EXPENDITURE Exports of goods and services are the items that firms in in the United States produce and sell to the rest of the world. Imports of goods and services are the items that households, firms, and governments in the United States buy from the rest of the world.

21. 1 GDP, INCOME, AND EXPENDITURE Exports of goods and services are the items that firms in in the United States produce and sell to the rest of the world. Imports of goods and services are the items that households, firms, and governments in the United States buy from the rest of the world.

21. 1 GDP, INCOME, AND EXPENDITURE Total expenditure is the total amount received by producers of final goods and services. Consumption expenditure: C Investment: I Government expenditure on goods and services: G Net exports: NX Total expenditure = C + I + G + NX

21. 1 GDP, INCOME, AND EXPENDITURE Total expenditure is the total amount received by producers of final goods and services. Consumption expenditure: C Investment: I Government expenditure on goods and services: G Net exports: NX Total expenditure = C + I + G + NX

21. 1 GDP, INCOME, AND EXPENDITURE Income • Labor earns wages. • Capital earns interest. • Land earns rent. • Entrepreneurship earns profits. Households receive these incomes.

21. 1 GDP, INCOME, AND EXPENDITURE Income • Labor earns wages. • Capital earns interest. • Land earns rent. • Entrepreneurship earns profits. Households receive these incomes.

21. 1 GDP, INCOME, AND EXPENDITURE

21. 1 GDP, INCOME, AND EXPENDITURE

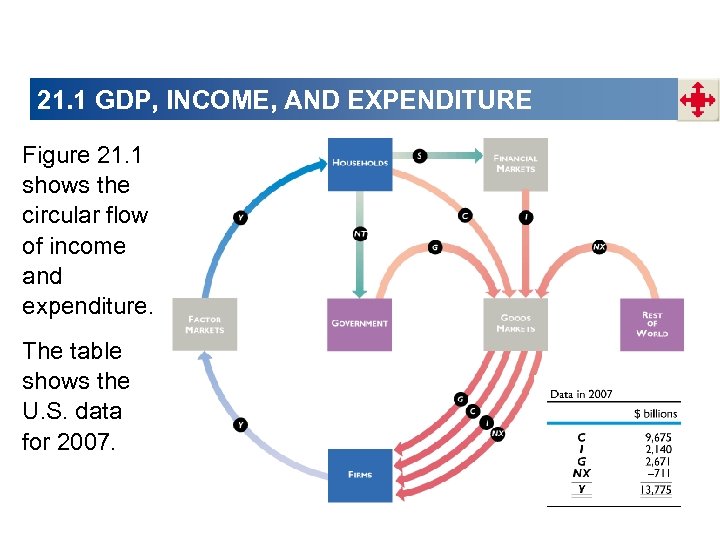

21. 1 GDP, INCOME, AND EXPENDITURE Figure 21. 1 shows the circular flow of income and expenditure. The table shows the U. S. data for 2007.

21. 1 GDP, INCOME, AND EXPENDITURE Figure 21. 1 shows the circular flow of income and expenditure. The table shows the U. S. data for 2007.

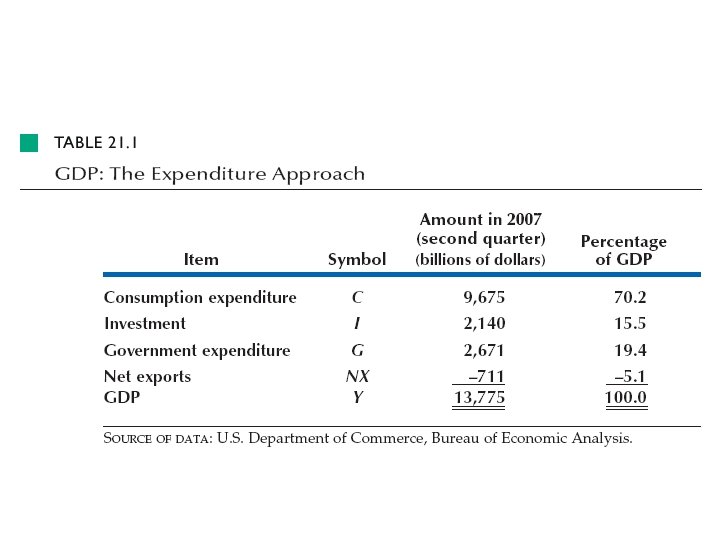

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP Expenditures Not in GDP Used Goods Expenditure on used goods is not part of GDP because these goods were part of GDP in the period in which they were produced and during which time they were new goods. Financial Assets When households buy financial assets such as bonds and stocks, they are making loans, not buying goods and services.

21. 2 MEASURING U. S. GDP Expenditures Not in GDP Used Goods Expenditure on used goods is not part of GDP because these goods were part of GDP in the period in which they were produced and during which time they were new goods. Financial Assets When households buy financial assets such as bonds and stocks, they are making loans, not buying goods and services.

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

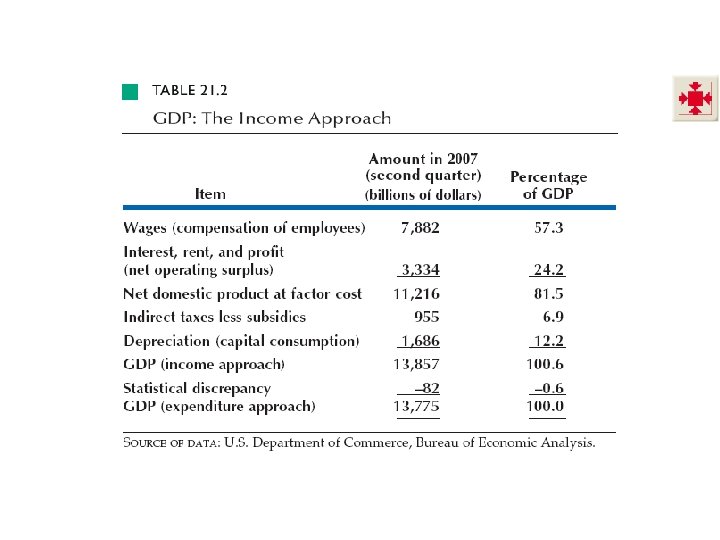

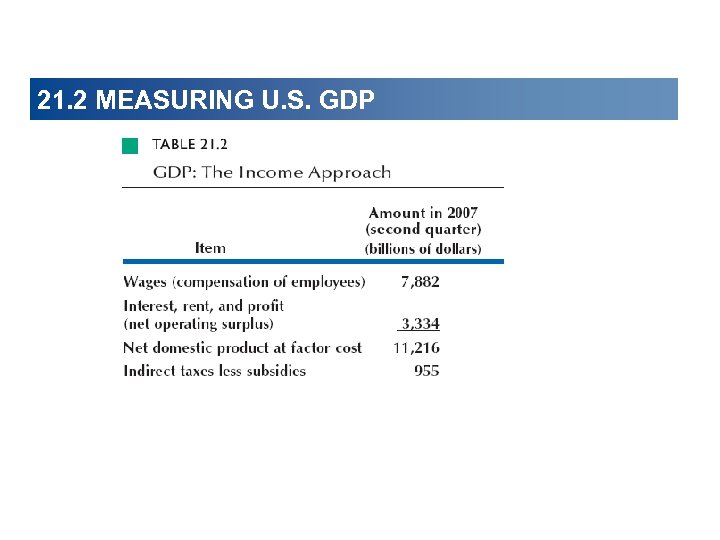

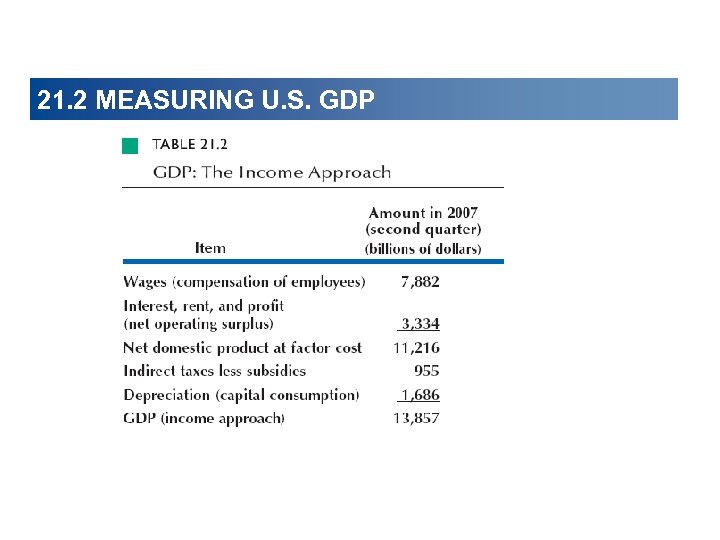

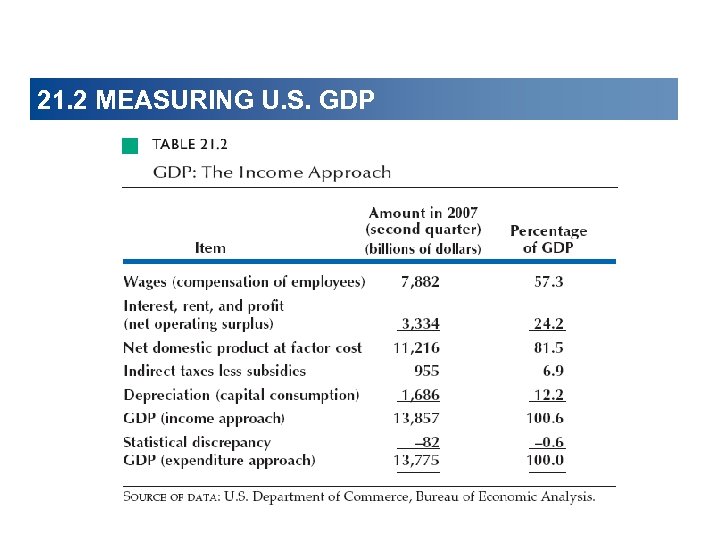

21. 2 MEASURING U. S. GDP Wages, called compensation of employees in the national accounts, is the payment for labor services. It includes net wages and salaries plus fringe benefits paid by employers such health care insurance, social security contributions, and pension fund contributions.

21. 2 MEASURING U. S. GDP Wages, called compensation of employees in the national accounts, is the payment for labor services. It includes net wages and salaries plus fringe benefits paid by employers such health care insurance, social security contributions, and pension fund contributions.

21. 2 MEASURING U. S. GDP Interest, Rent, and Profit Interest, rent, and profit, called net operating surplus in the national account, is the sum of the incomes earned by capital, land, and entrepreneurship. Interest is the income households receive on loans they make minus the interest they pay on their borrowing. Rent includes payments for the use of land other rented inputs. Profit includes the profits of corporations and small businesses.

21. 2 MEASURING U. S. GDP Interest, Rent, and Profit Interest, rent, and profit, called net operating surplus in the national account, is the sum of the incomes earned by capital, land, and entrepreneurship. Interest is the income households receive on loans they make minus the interest they pay on their borrowing. Rent includes payments for the use of land other rented inputs. Profit includes the profits of corporations and small businesses.

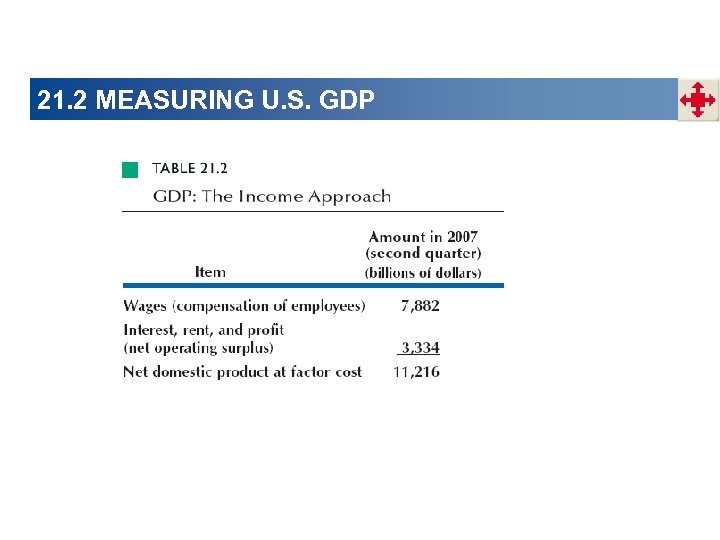

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP Net domestic product at factor cost is the sum of wages, interest, rent, and profit. Net domestic product at factor cost is not GDP. We need to make two adjustments to arrive at GDP: • One from factor cost to market prices • One from net product to gross product

21. 2 MEASURING U. S. GDP Net domestic product at factor cost is the sum of wages, interest, rent, and profit. Net domestic product at factor cost is not GDP. We need to make two adjustments to arrive at GDP: • One from factor cost to market prices • One from net product to gross product

21. 2 MEASURING U. S. GDP From Factor Cost to Market Price The expenditure approach values goods at market prices; the income approach values them at factor cost. Indirect taxes (such as sales taxes) make market prices exceed factor cost. Subsidies (payments by government to firms) make factor cost exceed market prices. To convert the value at factor cost to the value at market prices, we must: • Add indirect taxes and subtract subsidies

21. 2 MEASURING U. S. GDP From Factor Cost to Market Price The expenditure approach values goods at market prices; the income approach values them at factor cost. Indirect taxes (such as sales taxes) make market prices exceed factor cost. Subsidies (payments by government to firms) make factor cost exceed market prices. To convert the value at factor cost to the value at market prices, we must: • Add indirect taxes and subtract subsidies

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP From Gross to Net The expenditure approach measures gross product; the income approach measures net product. Gross profit is a firm’s profit before subtracting the depreciation of capital. Net profit is a firm’s profit after subtracting the depreciation of capital. Depreciation is the decrease in the value of capital that results from its use and from obsolescence.

21. 2 MEASURING U. S. GDP From Gross to Net The expenditure approach measures gross product; the income approach measures net product. Gross profit is a firm’s profit before subtracting the depreciation of capital. Net profit is a firm’s profit after subtracting the depreciation of capital. Depreciation is the decrease in the value of capital that results from its use and from obsolescence.

21. 2 MEASURING U. S. GDP Income includes net profit, so the income approach gives a net measure. Expenditure includes investment. Because some new capital is purchased to replace depreciated capital, the expenditure approach gives a gross measure. To get gross domestic product from the income approach, we must add depreciation to total income. After making these two adjustments the income approach almost gives the same estimate of GDP as the expenditure approach.

21. 2 MEASURING U. S. GDP Income includes net profit, so the income approach gives a net measure. Expenditure includes investment. Because some new capital is purchased to replace depreciated capital, the expenditure approach gives a gross measure. To get gross domestic product from the income approach, we must add depreciation to total income. After making these two adjustments the income approach almost gives the same estimate of GDP as the expenditure approach.

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP Statistical Discrepancy The income approach and the expenditure approach do not deliver exactly the same estimate of GDP—there is a statistical discrepancy. Statistical discrepancy is the discrepancy between the expenditure approach and income approach estimates of GDP, calculated as the GDP expenditure total minus the GDP income total.

21. 2 MEASURING U. S. GDP Statistical Discrepancy The income approach and the expenditure approach do not deliver exactly the same estimate of GDP—there is a statistical discrepancy. Statistical discrepancy is the discrepancy between the expenditure approach and income approach estimates of GDP, calculated as the GDP expenditure total minus the GDP income total.

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP Disposable Personal Income Consumption expenditure is one of the largest components of aggregate expenditure and one of the main influences on it is disposable personal income. Disposable personal income is the income received by households minus personal income taxes paid.

21. 2 MEASURING U. S. GDP Disposable Personal Income Consumption expenditure is one of the largest components of aggregate expenditure and one of the main influences on it is disposable personal income. Disposable personal income is the income received by households minus personal income taxes paid.

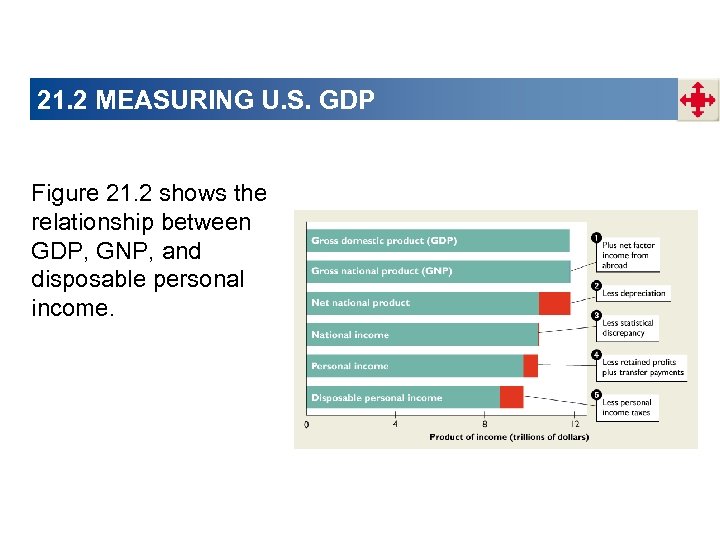

21. 2 MEASURING U. S. GDP Figure 21. 2 shows the relationship between GDP, GNP, and disposable personal income.

21. 2 MEASURING U. S. GDP Figure 21. 2 shows the relationship between GDP, GNP, and disposable personal income.

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

21. 2 MEASURING U. S. GDP

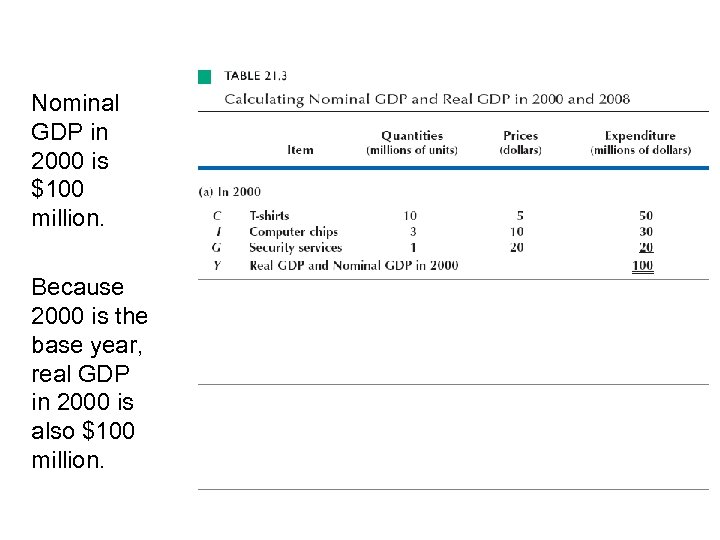

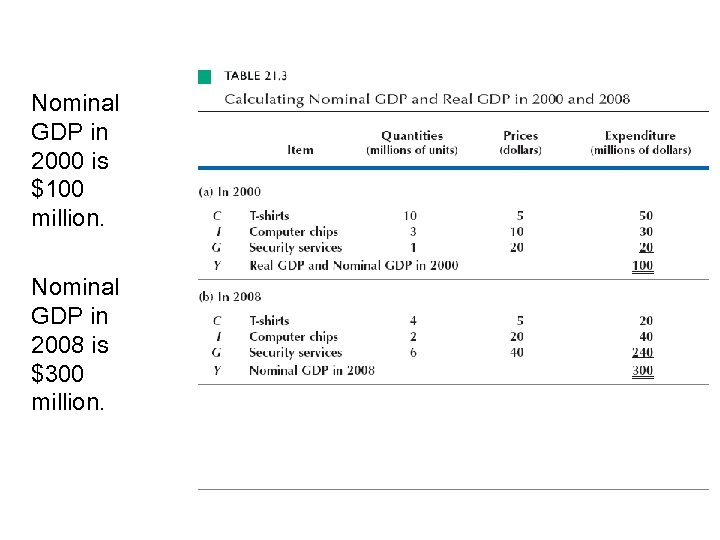

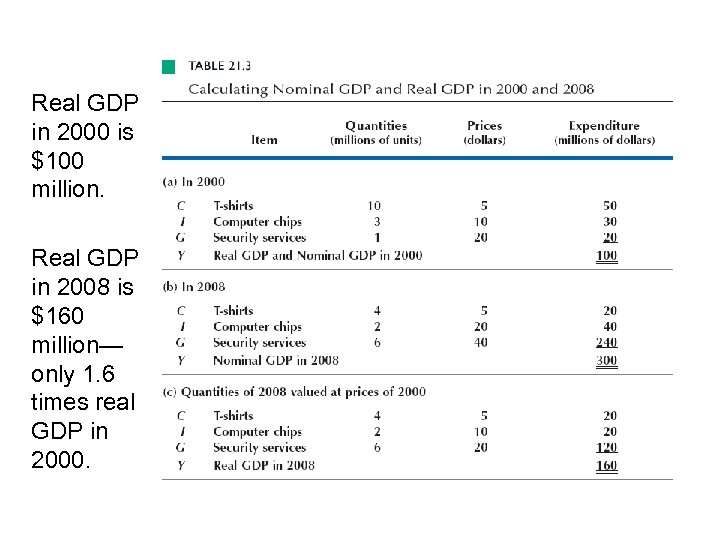

21. 2 MEASURING U. S. GDP Table 21. 3 shows the calculation with 2000 (base year) and 2008. To find the total expenditure in 2000 multiply the quantity of each item produced in 2000 by its price in 2000. Then sum the expenditures to find nominal GDP in 2000. The next slide shows the data.

21. 2 MEASURING U. S. GDP Table 21. 3 shows the calculation with 2000 (base year) and 2008. To find the total expenditure in 2000 multiply the quantity of each item produced in 2000 by its price in 2000. Then sum the expenditures to find nominal GDP in 2000. The next slide shows the data.

Nominal GDP in 2000 is $100 million. Because 2000 is the base year, real GDP in 2000 is also $100 million.

Nominal GDP in 2000 is $100 million. Because 2000 is the base year, real GDP in 2000 is also $100 million.

21. 2 MEASURING U. S. GDP In part (b) of Table 21. 3, we calculate nominal GDP in 2008. Again, we calculate nominal GDP by multiplying the quantity of each item produced by its price and then sum the expenditures to find nominal GDP in 2008.

21. 2 MEASURING U. S. GDP In part (b) of Table 21. 3, we calculate nominal GDP in 2008. Again, we calculate nominal GDP by multiplying the quantity of each item produced by its price and then sum the expenditures to find nominal GDP in 2008.

Nominal GDP in 2000 is $100 million. Nominal GDP in 2008 is $300 million.

Nominal GDP in 2000 is $100 million. Nominal GDP in 2008 is $300 million.

21. 2 MEASURING U. S. GDP Nominal GDP in 2000 is $100 million and in 2008 it is $300 million. Nominal GDP in 2008 is three times its value in 2000. But by how much has the quantity of final goods and services produced increased?

21. 2 MEASURING U. S. GDP Nominal GDP in 2000 is $100 million and in 2008 it is $300 million. Nominal GDP in 2008 is three times its value in 2000. But by how much has the quantity of final goods and services produced increased?

21. 2 MEASURING U. S. GDP The increase in real GDP will tell by how much the quantity of good and services has increased. Real GDP in 2008 is what the total expenditure would have been in 2008 if prices had remained the same as they were in 2000. To calculate real GDP in 2008 multiply the quantities produced in 2008 by the price in 2000 and the sum these expenditures to find real GDP in 2008. Part (c) of Table 21. 3 shows the details.

21. 2 MEASURING U. S. GDP The increase in real GDP will tell by how much the quantity of good and services has increased. Real GDP in 2008 is what the total expenditure would have been in 2008 if prices had remained the same as they were in 2000. To calculate real GDP in 2008 multiply the quantities produced in 2008 by the price in 2000 and the sum these expenditures to find real GDP in 2008. Part (c) of Table 21. 3 shows the details.

Real GDP in 2000 is $100 million. Real GDP in 2008 is $160 million— only 1. 6 times real GDP in 2000.

Real GDP in 2000 is $100 million. Real GDP in 2008 is $160 million— only 1. 6 times real GDP in 2000.

21. 3 THE USE AND LIMITATIONS OF REAL GDP We use estimates of real GDP for two main purposes: • To compare the standard of living over time • To compare the standard of living among countries

21. 3 THE USE AND LIMITATIONS OF REAL GDP We use estimates of real GDP for two main purposes: • To compare the standard of living over time • To compare the standard of living among countries

21. 3 THE USE AND LIMITATIONS OF REAL GDP In 1967, real GDP in the United States was $3, 485 billion and the population of the United States was 198. 7 million. Real GDP person = $3, 485 billion ÷ 198. 7 million Real GDP person = $17, 536 In most years, real GDP person increases, but sometimes it doesn’t change.

21. 3 THE USE AND LIMITATIONS OF REAL GDP In 1967, real GDP in the United States was $3, 485 billion and the population of the United States was 198. 7 million. Real GDP person = $3, 485 billion ÷ 198. 7 million Real GDP person = $17, 536 In most years, real GDP person increases, but sometimes it doesn’t change.

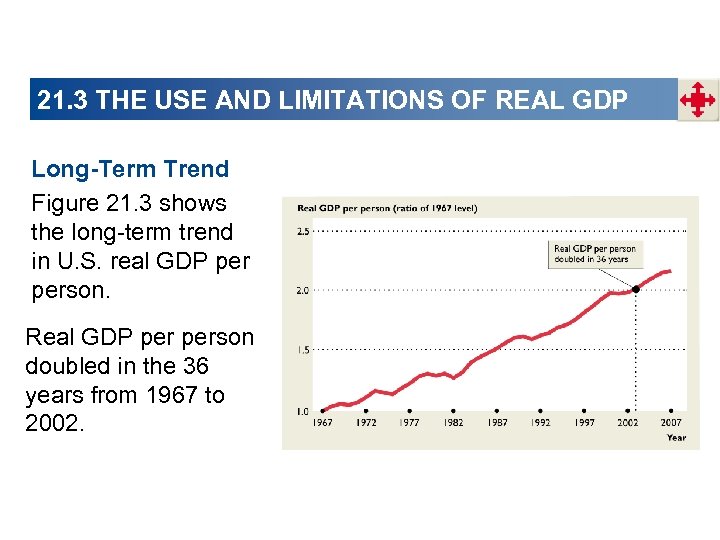

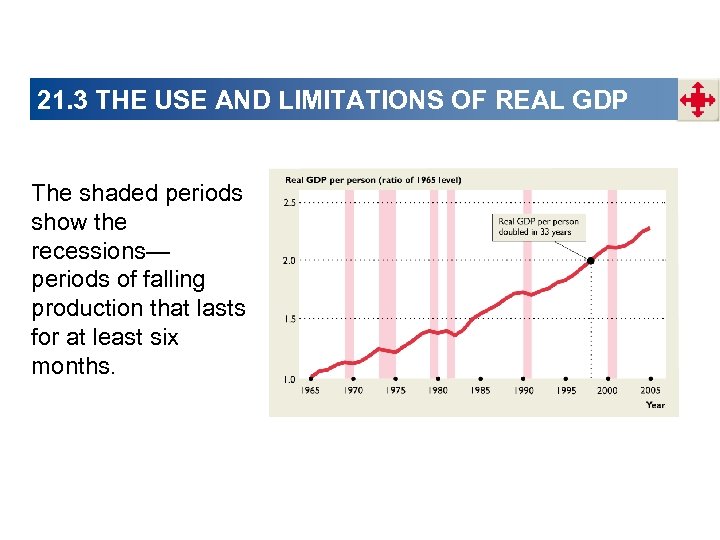

21. 3 THE USE AND LIMITATIONS OF REAL GDP Long-Term Trend Figure 21. 3 shows the long-term trend in U. S. real GDP person. Real GDP person doubled in the 36 years from 1967 to 2002.

21. 3 THE USE AND LIMITATIONS OF REAL GDP Long-Term Trend Figure 21. 3 shows the long-term trend in U. S. real GDP person. Real GDP person doubled in the 36 years from 1967 to 2002.

21. 3 THE USE AND LIMITATIONS OF REAL GDP Short-Term Fluctuations in the pace of expansion of real GDP is called the business cycle. The business cycle is a periodic irregular up-and down movement of total production and other measure of economic activity. The four stages of a business cycle are expansion, peak, recession, and trough.

21. 3 THE USE AND LIMITATIONS OF REAL GDP Short-Term Fluctuations in the pace of expansion of real GDP is called the business cycle. The business cycle is a periodic irregular up-and down movement of total production and other measure of economic activity. The four stages of a business cycle are expansion, peak, recession, and trough.

21. 3 THE USE AND LIMITATIONS OF REAL GDP The shaded periods show the recessions— periods of falling production that lasts for at least six months.

21. 3 THE USE AND LIMITATIONS OF REAL GDP The shaded periods show the recessions— periods of falling production that lasts for at least six months.

21. 3 THE USE AND LIMITATIONS OF REAL GDP

21. 3 THE USE AND LIMITATIONS OF REAL GDP

21. 3 THE USE AND LIMITATIONS OF REAL GDP Household Production • Real GDP omits household production, it underestimates the value of the production of many people, most of them women. Underground Production • Hidden from government to avoid taxes and regulations or illegal. • Because underground economic activity is unreported, it is omitted from GDP.

21. 3 THE USE AND LIMITATIONS OF REAL GDP Household Production • Real GDP omits household production, it underestimates the value of the production of many people, most of them women. Underground Production • Hidden from government to avoid taxes and regulations or illegal. • Because underground economic activity is unreported, it is omitted from GDP.

21. 3 THE USE AND LIMITATIONS OF REAL GDP Leisure Time • Our working time is valued as part of GDP, but our leisure time is not. Environment Quality • Pollution is not subtracted from GDP. • We do not count the deteriorating atmosphere as a negative part of GDP. • If our standard of living is adversely affected by pollution, our GDP measure does not show this fact.

21. 3 THE USE AND LIMITATIONS OF REAL GDP Leisure Time • Our working time is valued as part of GDP, but our leisure time is not. Environment Quality • Pollution is not subtracted from GDP. • We do not count the deteriorating atmosphere as a negative part of GDP. • If our standard of living is adversely affected by pollution, our GDP measure does not show this fact.

21. 3 THE USE AND LIMITATIONS OF REAL GDP

21. 3 THE USE AND LIMITATIONS OF REAL GDP

APPENDIX: MEASURING REAL GDP

APPENDIX: MEASURING REAL GDP

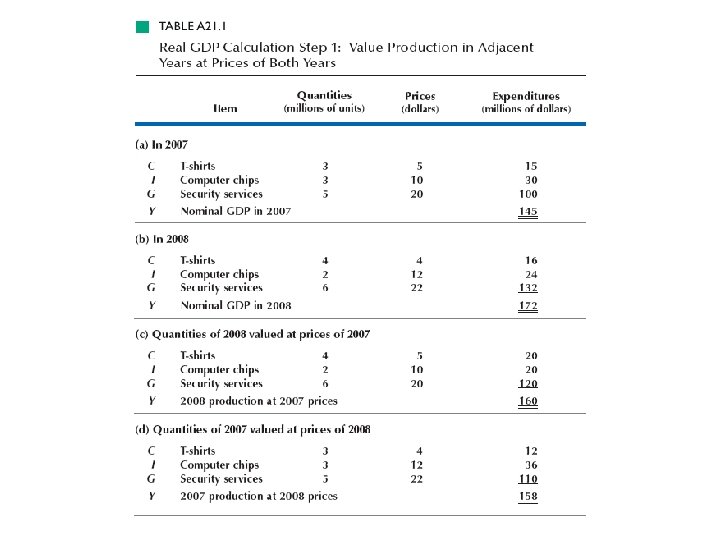

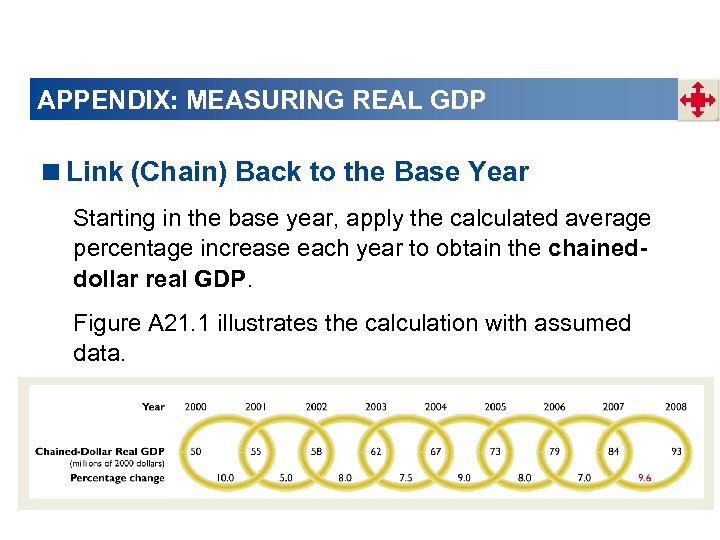

APPENDIX: MEASURING REAL GDP The BEA method uses the prices of both years. The three steps in the method are • Value production in the prices of adjacent years. • Find the average of the two percentage changes. • Link (chain) back to the base year.

APPENDIX: MEASURING REAL GDP The BEA method uses the prices of both years. The three steps in the method are • Value production in the prices of adjacent years. • Find the average of the two percentage changes. • Link (chain) back to the base year.

APPENDIX: MEASURING REAL GDP

APPENDIX: MEASURING REAL GDP

APPENDIX: MEASURING REAL GDP The table gives • Value of production in 2007 at 2007 prices is $145. • Value of production in 2008 at 2007 prices is $160. • Value of production in 2007 at 2008 prices is $158. • Value of production in 2008 at 2008 prices is $172. The next step is the find the percentage increases using 2007 prices and 2008 prices and then average these two percentages.

APPENDIX: MEASURING REAL GDP The table gives • Value of production in 2007 at 2007 prices is $145. • Value of production in 2008 at 2007 prices is $160. • Value of production in 2007 at 2008 prices is $158. • Value of production in 2008 at 2008 prices is $172. The next step is the find the percentage increases using 2007 prices and 2008 prices and then average these two percentages.

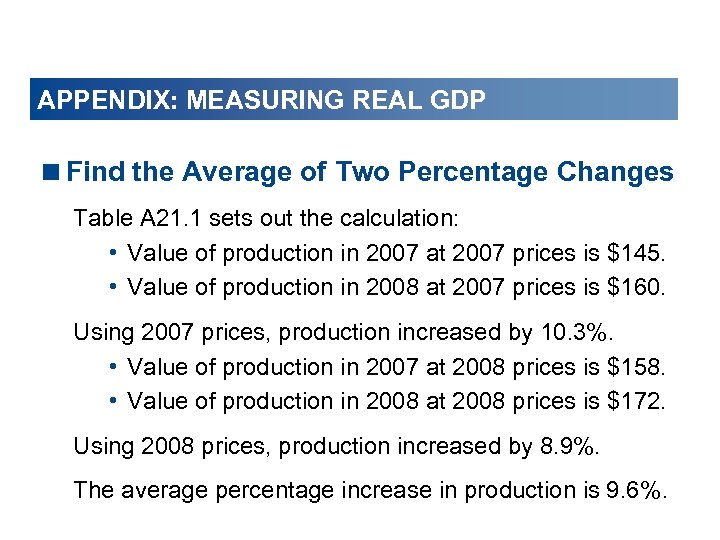

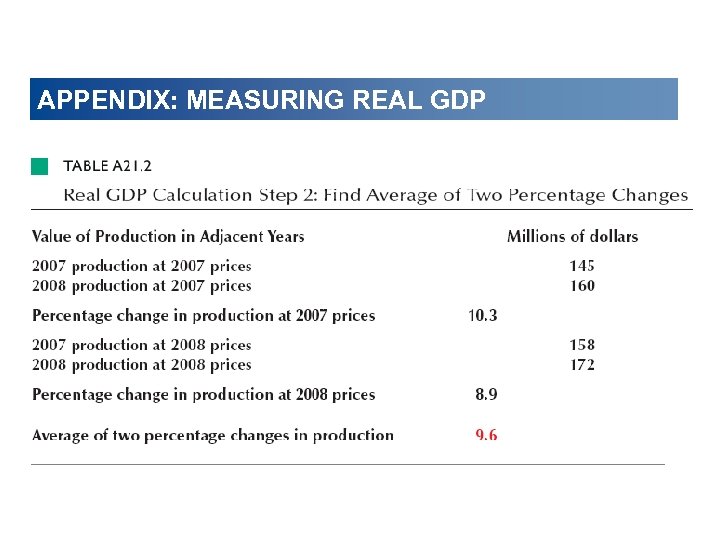

APPENDIX: MEASURING REAL GDP

APPENDIX: MEASURING REAL GDP

APPENDIX: MEASURING REAL GDP

APPENDIX: MEASURING REAL GDP

APPENDIX: MEASURING REAL GDP

APPENDIX: MEASURING REAL GDP