3a0f2e1bb9eec19b67a0d20aeeb7ce9e.ppt

- Количество слайдов: 71

Gamesa Energía Nobody knows more about wind September 24, 2010, Madrid

Table of contents 1 Gamesa Energía´s history 2 Business model and value generation alternatives 3 Accounting and financial modeling 4 Gamesa Energía pipeline breakdown and balance sheet value 5 Strategy 6 Valuation 7 Financing 8 Conclusions 2

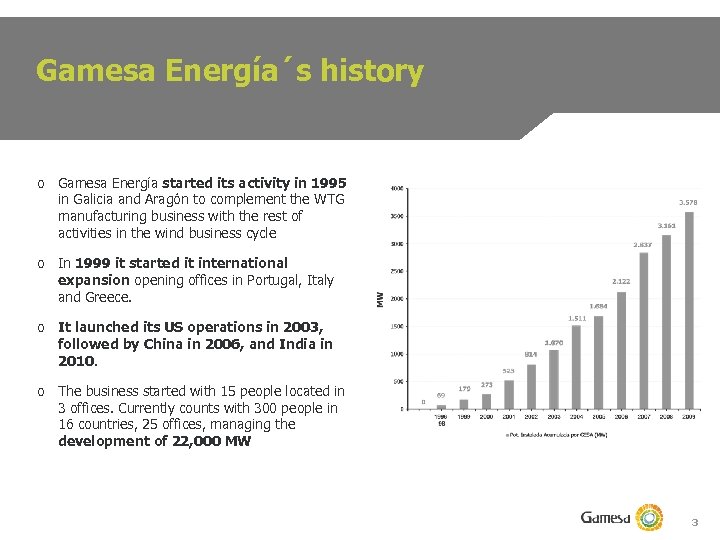

Gamesa Energía´s history o Gamesa Energía started its activity in 1995 in Galicia and Aragón to complement the WTG manufacturing business with the rest of activities in the wind business cycle o In 1999 it started it international expansion opening offices in Portugal, Italy and Greece. o It launched its US operations in 2003, followed by China in 2006, and India in 2010. o The business started with 15 people located in 3 offices. Currently counts with 300 people in 16 countries, 25 offices, managing the development of 22, 000 MW 3

Table of contents 1 History of Gamesa Energía 2 Business model and value generation alternatives 3 Accounting and financial modeling 4 Gamesa Energía pipeline breakdown and balance sheet value 5 Strategy 6 Valuation 7 Financing 8 Conclusions 4

Business model and value generation alternatives 1 Business model description 2 Key considerations in the sale of a wind farm 3 Alternatives and evolution of current business model 4 Procurement of WTG – relationship with the manufacturing business 5 Competitive advantages 6 Site selection: wind resource expertise 5

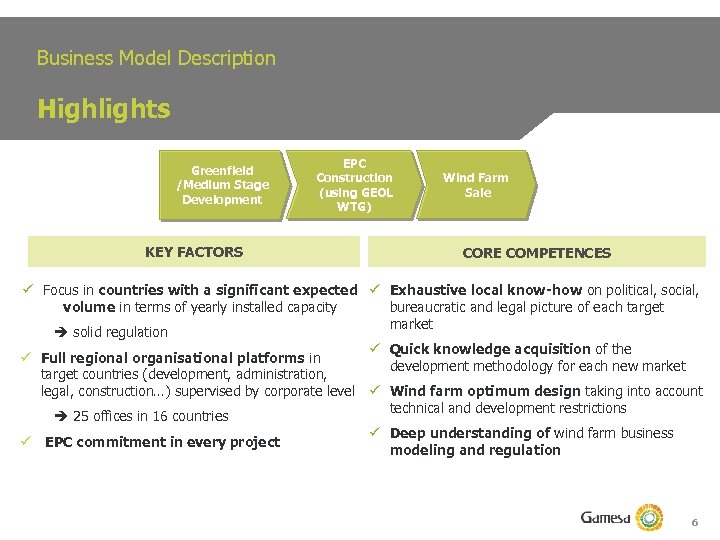

Business Model Description Highlights Greenfield /Medium Stage Development KEY FACTORS EPC Construction (using GEOL WTG) Wind Farm Sale CORE COMPETENCES ü Focus in countries with a significant expected ü Exhaustive local know-how on political, social, volume in terms of yearly installed capacity bureaucratic and legal picture of each target market solid regulation ü Quick knowledge acquisition of the ü Full regional organisational platforms in development methodology for each new market target countries (development, administration, legal, construction…) supervised by corporate level ü Wind farm optimum design taking into account technical and development restrictions 25 offices in 16 countries ü Deep understanding of wind farm business ü EPC commitment in every project modeling and regulation 6

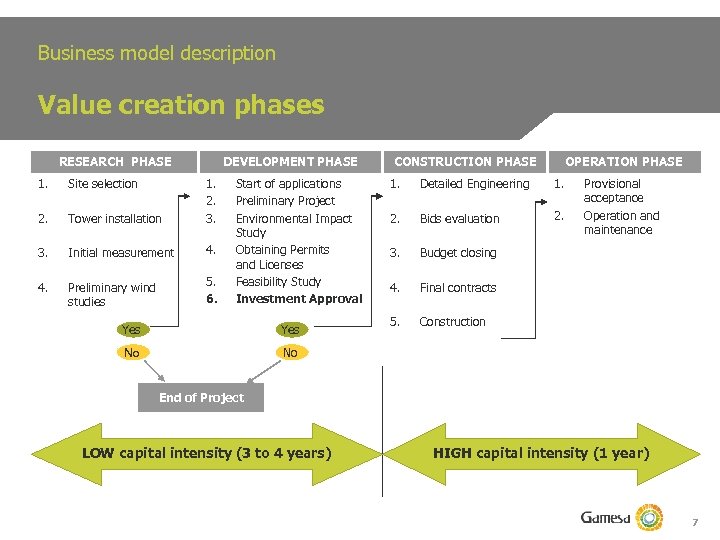

Business model description Value creation phases RESEARCH PHASE DEVELOPMENT PHASE 1. Site selection 2. Tower installation 1. 2. 3. Initial measurement 4. Preliminary wind studies 5. 6. Start of applications Preliminary Project Environmental Impact Study Obtaining Permits and Licenses Feasibility Study Investment Approval Yes No CONSTRUCTION PHASE OPERATION PHASE 1. Detailed Engineering 1. 2. Bids evaluation 2. 3. Budget closing 4. Final contracts 5. Construction Provisional acceptance Operation and maintenance No End of Project LOW capital intensity (3 to 4 years) HIGH capital intensity (1 year) 7

Business model and value generation alternatives 1 Business model description 2 Key considerations in the sale of a wind farm 3 Alternatives and evolution of current business model 4 Procurement of WTG – relationship with the manufacturing business 5 Competitive advantages 6 Site selection: wind resource expertise 8

Key considerations in the sale of wind farms We sell… A fully operational wind farm, with all permits, licences, and authorizations to allow operation during 20 to 30 years 9

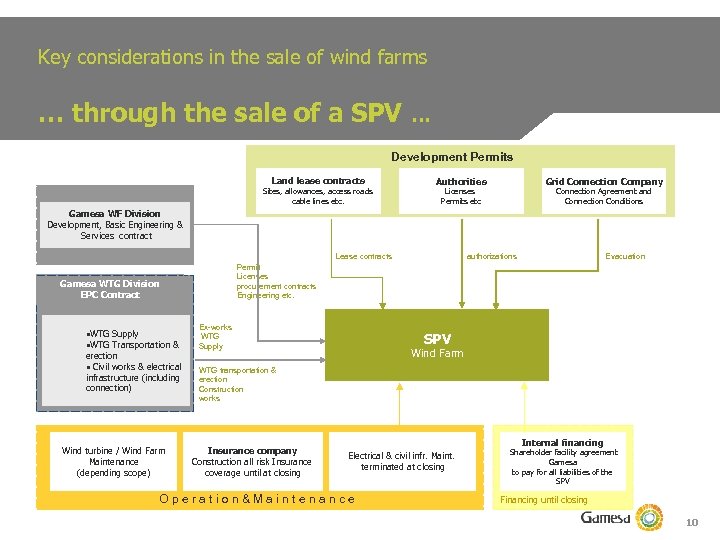

Key considerations in the sale of wind farms … through the sale of a SPV … Development Permits Land lease contracts Sites, allowances, access roads cable lines etc. Authorities Grid Connection Company Licenses Permits etc Connection Agreement and Connection Conditions Gamesa WF Division Development, Basic Engineering & Services contract Lease contracts Gamesa WTG Division EPC Contract • WTG Supply • WTG Transportation & erection • Civil works & electrical infrastructure (including connection) Wind turbine / Wind Farm Maintenance (depending scope) authorizations Evacuation Permit Licenses procurement contracts Engineering etc. Ex-works WTG Supply SPV Wind Farm WTG transportation & erection Construction works Insurance company Construction all risk Insurance coverage until at closing Internal financing Electrical & civil infr. Maint. terminated at closing Operation&Maintenance Shareholder facility agreement Gamesa to pay for all liabilities of the SPV Financing until closing 10

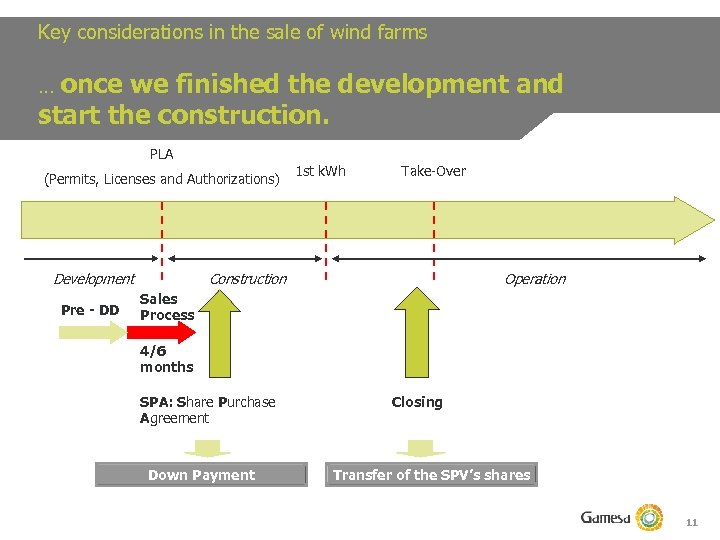

Key considerations in the sale of wind farms once we finished the development and start the construction. … PLA (Permits, Licenses and Authorizations) Development Pre - DD 1 st k. Wh Take-Over Construction Operation Sales Process 4/6 months SPA: Share Purchase Agreement Down Payment Closing Transfer of the SPV’s shares 11

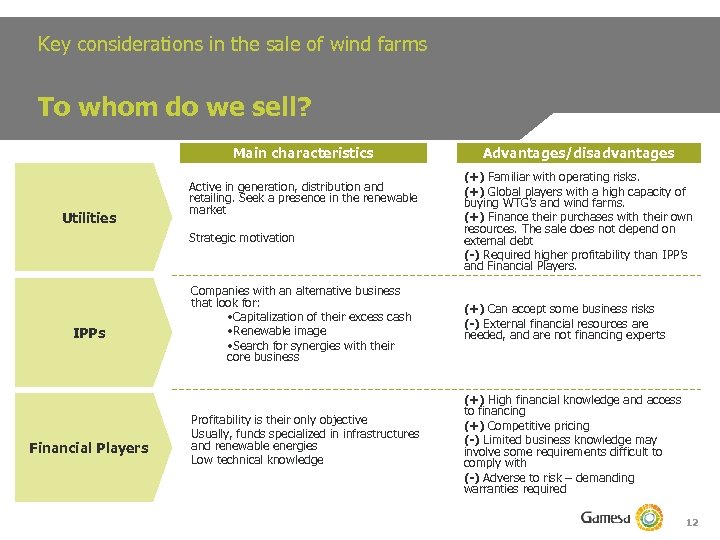

Key considerations in the sale of wind farms To whom do we sell? Main characteristics Utilities Active in generation, distribution and retailing. Seek a presence in the renewable market Strategic motivation IPPs Financial Players Advantages/disadvantages (+) Familiar with operating risks. (+) Global players with a high capacity of buying WTG’s and wind farms. (+) Finance their purchases with their own resources. The sale does not depend on external debt (-) Required higher profitability than IPP’s and Financial Players. Companies with an alternative business that look for: • Capitalization of their excess cash • Renewable image • Search for synergies with their core business (+) Can accept some business risks (-) External financial resources are needed, and are not financing experts Profitability is their only objective Usually, funds specialized in infrastructures and renewable energies Low technical knowledge (+) High financial knowledge and access to financing (+) Competitive pricing (-) Limited business knowledge may involve some requirements difficult to comply with (-) Adverse to risk – demanding warranties required 12

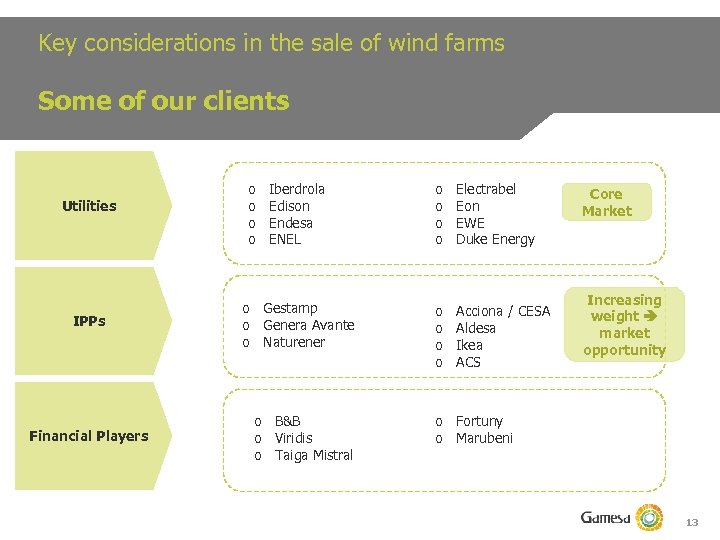

Key considerations in the sale of wind farms Some of our clients Utilities IPPs Financial Players o o Iberdrola Edison Endesa ENEL o o Electrabel Eon EWE Duke Energy o Gestamp o Genera Avante o Naturener o o Acciona / CESA Aldesa Ikea ACS o B&B o Viridis o Taiga Mistral Core Market Increasing weight market opportunity o Fortuny o Marubeni 13

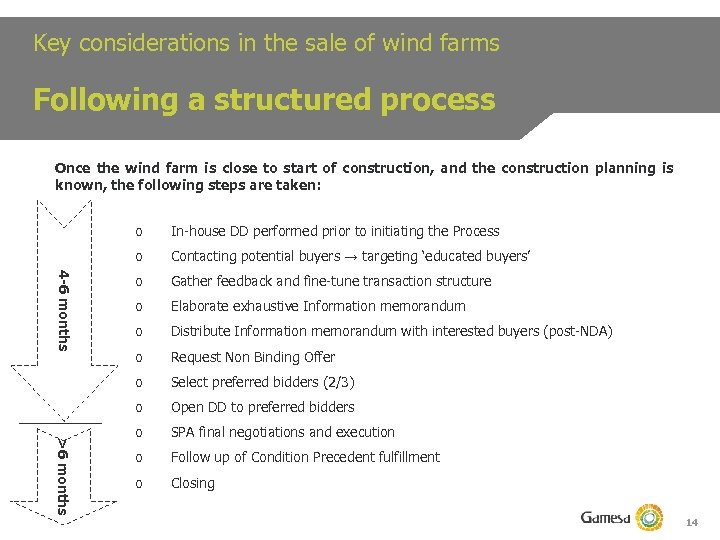

Key considerations in the sale of wind farms Following a structured process Once the wind farm is close to start of construction, and the construction planning is known, the following steps are taken: Contacting potential buyers → targeting ‘educated buyers’ o Gather feedback and fine-tune transaction structure o Elaborate exhaustive Information memorandum o Distribute Information memorandum with interested buyers (post-NDA) o Request Non Binding Offer o Select preferred bidders (2/3) o >6 months In-house DD performed prior to initiating the Process o 4 -6 months o Open DD to preferred bidders o SPA final negotiations and execution o Follow up of Condition Precedent fulfillment o Closing 14

Business model and value generation alternatives 1 Business model description 2 Key considerations in the sale of a wind farm 3 Alternatives and evolution of current business model 4 Procurement of WTG – relationship with the manufacturing business 5 Competitive advantages 6 Site selection: wind resource expertise 15

Alternatives and evolution of current business model GESA does not intend to become an IPP 16

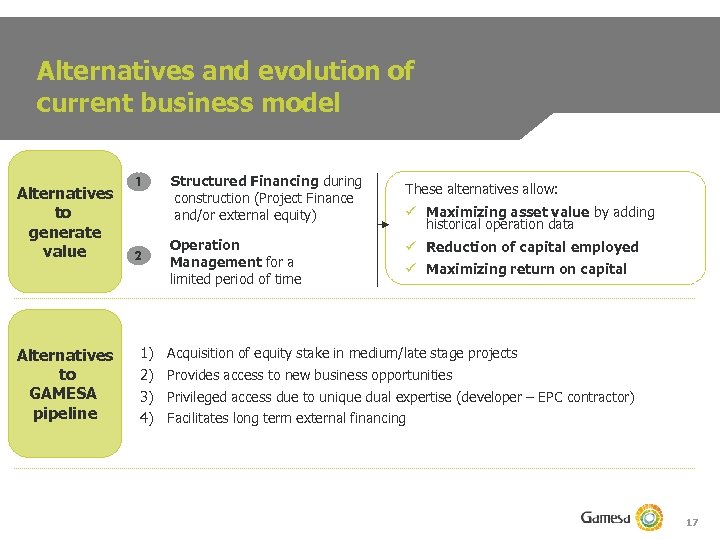

Alternatives and evolution of current business model Alternatives to generate value Alternatives to GAMESA pipeline 1 2 Structured Financing during construction (Project Finance and/or external equity) Operation Management for a limited period of time These alternatives allow: ü Maximizing asset value by adding historical operation data ü Reduction of capital employed ü Maximizing return on capital 1) Acquisition of equity stake in medium/late stage projects 2) Provides access to new business opportunities 3) Privileged access due to unique dual expertise (developer – EPC contractor) 4) Facilitates long term external financing 17

Business model and value generation alternatives 1 Business model description 2 Key considerations in the sale of a wind farm 3 Alternatives and evolution of current business model 4 Procurement of WTG – relationship with the manufacturing business 5 Competitive advantages 6 Site selection: wind resource expertise 18

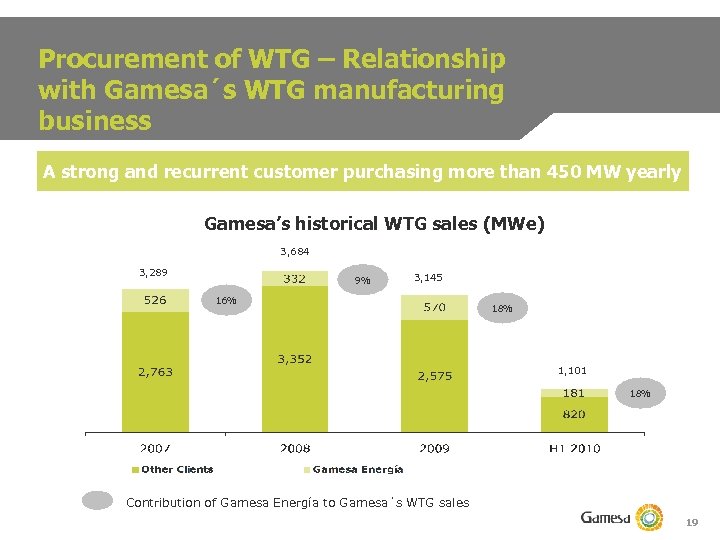

Procurement of WTG – Relationship with Gamesa´s WTG manufacturing business A strong and recurrent customer purchasing more than 450 MW yearly Gamesa’s historical WTG sales (MWe) 3, 684 3, 289 9% 3, 145 16% 18% 1, 101 18% Contribution of Gamesa Energía to Gamesa´s WTG sales 19

Business model and value generation alternatives 1 Business model description 2 Key considerations in the sale of a wind farm 3 Alternatives and evolution of current business model 4 Procurement of WTG – relationship with the manufacturing business 5 Competitive advantages 6 Site selection: wind resource expertise 20

Competitive advantages o Our unique global presence (Europe, US, Lat-Am, China) allows a natural hedge to slow downs of specific markets due to regulatory changes o Preferential access to WTGs during a sellers market cycle o Advantages related with recurrent nature of selling wind farms vs one spot seller: ü Professional DD and negotiation process ü Can remain involved in all relationships with the local authorities in order to allow a smooth transition ü The reputational factor ensures fair terms and conditions o Deep in house expertise in all aspects of wind development (lands, permitting, wind resource evaluation, micrositing, EPC) 21

Business model and value generation alternatives 1 Business model description 2 Key considerations in the sale of a wind farm 3 Alternatives and evolution of current business model 4 Procurement of WTG – relationship with the manufacturing business 5 Competitive advantages 6 Site selection: wind resource expertise 22

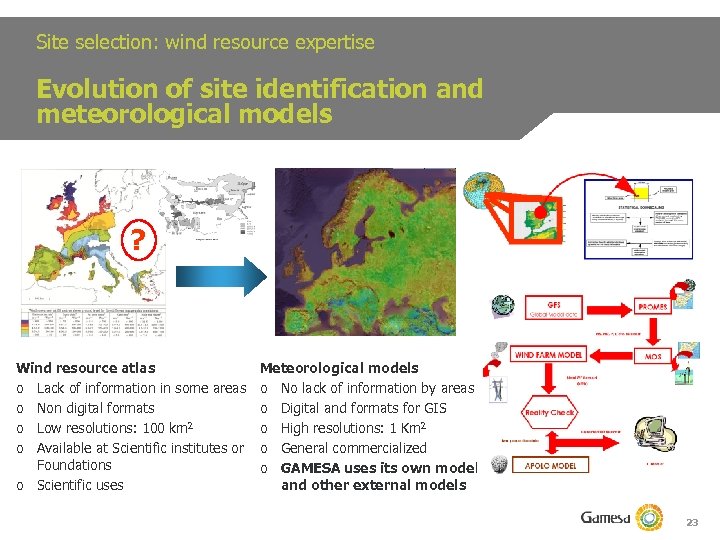

Site selection: wind resource expertise Evolution of site identification and meteorological models ? Wind resource atlas o Lack of information in some areas o Non digital formats o Low resolutions: 100 km 2 o Available at Scientific institutes or Foundations o Scientific uses Meteorological models o No lack of information by areas o Digital and formats for GIS o High resolutions: 1 Km 2 o General commercialized o GAMESA uses its own model and other external models 23

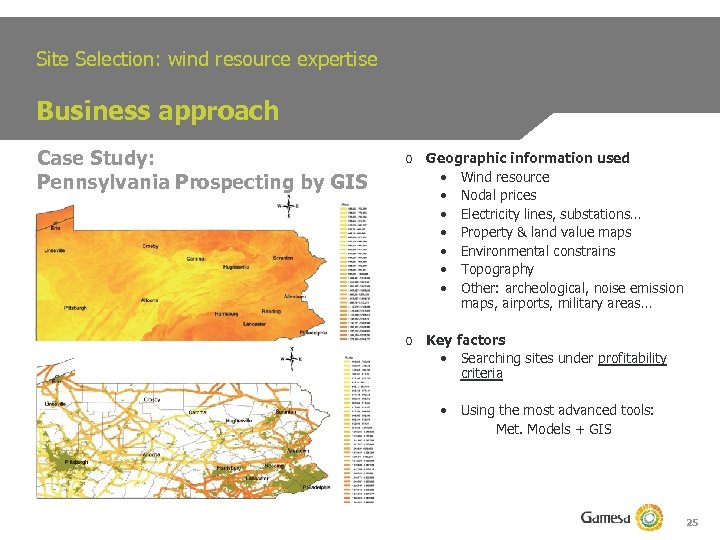

Site selection: wind resource expertise GIS for prospecting uses o GIS: Geographic Information System It is an application that manages digital geographic information at different levels, permitting operations: 1. Additions, subtracts, multiplications… 2. Delete areas under constrains criteria o The • • o We can match with other criteria: • Distances to electrical lines / substations • Distances to restricted areas: airports, environmental… • Delete areas with less than… 5 m/s, for example main geographic information used are the following: Wind resource Electricity lines, substations… Property & land value maps Environmental constrains Topography Nodal prices (USA) Other: archeological, noise emission maps… 24

Site Selection: wind resource expertise Business approach Case Study: Pennsylvania Prospecting by GIS o Geographic information used • Wind resource • Nodal prices • Electricity lines, substations… • Property & land value maps • Environmental constrains • Topography • Other: archeological, noise emission maps, airports, military areas… o Key factors • Searching sites under profitability criteria • Using the most advanced tools: Met. Models + GIS 25

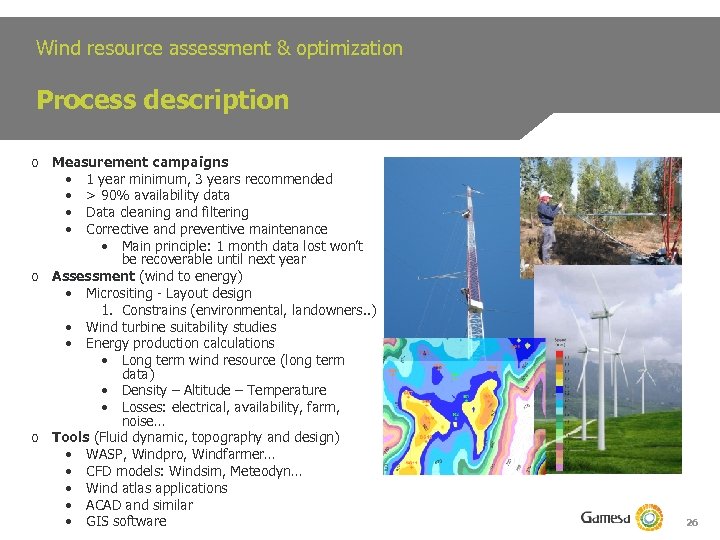

Wind resource assessment & optimization Process description o Measurement campaigns • 1 year minimum, 3 years recommended • > 90% availability data • Data cleaning and filtering • Corrective and preventive maintenance • Main principle: 1 month data lost won’t be recoverable until next year o Assessment (wind to energy) • Micrositing - Layout design 1. Constrains (environmental, landowners. . ) • Wind turbine suitability studies • Energy production calculations • Long term wind resource (long term data) • Density – Altitude – Temperature • Losses: electrical, availability, farm, noise… o Tools (Fluid dynamic, topography and design) • WASP, Windpro, Windfarmer… • CFD models: Windsim, Meteodyn… • Wind atlas applications • ACAD and similar • GIS software 26

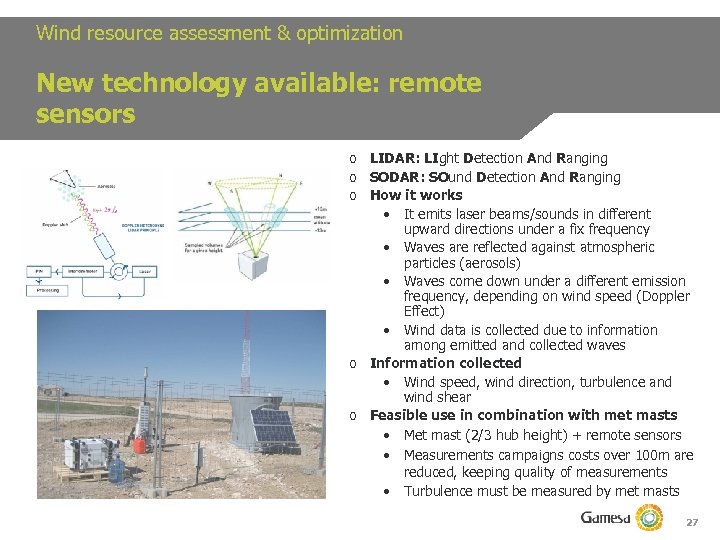

Wind resource assessment & optimization New technology available: remote sensors o LIDAR: LIght Detection And Ranging o SODAR: SOund Detection And Ranging o How it works • It emits laser beams/sounds in different upward directions under a fix frequency • Waves are reflected against atmospheric particles (aerosols) • Waves come down under a different emission frequency, depending on wind speed (Doppler Effect) • Wind data is collected due to information among emitted and collected waves o Information collected • Wind speed, wind direction, turbulence and wind shear o Feasible use in combination with met masts • Met mast (2/3 hub height) + remote sensors • Measurements campaigns costs over 100 m are reduced, keeping quality of measurements • Turbulence must be measured by met masts 27

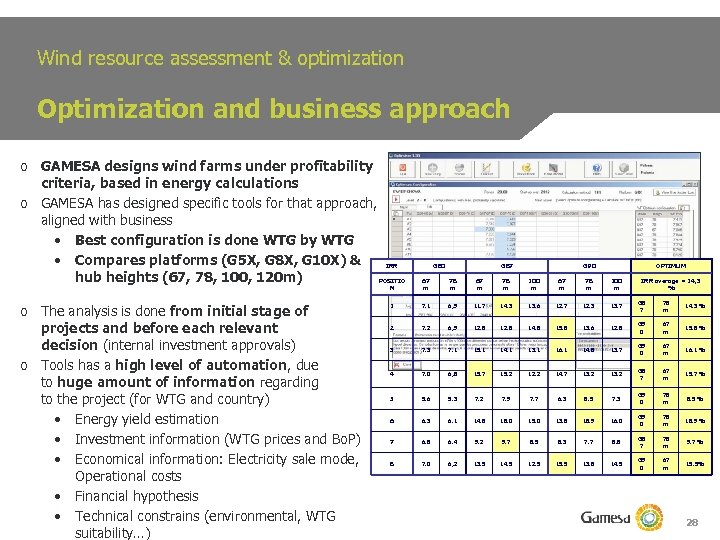

Wind resource assessment & optimization Optimization and business approach o GAMESA designs wind farms under profitability criteria, based in energy calculations o GAMESA has designed specific tools for that approach, aligned with business • Best configuration is done WTG by WTG • Compares platforms (G 5 X, G 8 X, G 10 X) & IRR hub heights (67, 78, 100, 120 m) POSITIO G 80 G 87 G 90 OPTIMUM N o The analysis is done from initial stage of projects and before each relevant decision (internal investment approvals) o Tools has a high level of automation, due to huge amount of information regarding to the project (for WTG and country) • Energy yield estimation • Investment information (WTG prices and Bo. P) • Economical information: Electricity sale mode, Operational costs • Financial hypothesis • Technical constrains (environmental, WTG suitability…) 67 m 78 m 100 m IRR average = 14, 3 % 1 7. 1 6, 9 11. 7 14. 3 13. 6 12. 7 12. 3 13. 7 G 8 7 78 m 14. 3 % 2 7. 2 6, 9 12. 8 14. 8 15. 8 13. 6 12. 8 G 9 0 67 m 15. 8 % 3 7. 1 15. 1 14. 1 13. 1 16. 1 14. 8 13. 7 G 9 0 67 m 16. 1 % 4 7. 0 6, 8 15. 7 15. 2 12. 2 14. 7 13. 2 G 8 7 67 m 15. 7 % 5 5. 6 5. 3 7. 2 7. 9 7. 7 6. 3 8. 5 7. 3 G 9 0 78 m 8. 5 % 6 6. 3 6. 1 14. 8 18. 0 15. 0 13. 8 18. 9 16. 0 G 9 0 78 m 18. 9 % 7 6. 8 6. 4 9. 2 9. 7 8. 5 8. 3 7. 7 8. 8 G 8 7 78 m 9. 7 % 8 7. 0 6, 2 13. 5 14. 5 12. 5 15. 5 13. 8 14. 5 G 9 0 67 m 15. 5% 28

The importance of wind resource expertise o Gamesa introduces maximizing profitability criteria from initial stages of the projects o Site selection and wind resource assessment are difficult tasks which requires complex computer tools and internal know-how o Gamesa has the needed internal knowledge and expertise to design internal tools, always improving profitability of projects o Gamesa invests in knowledge to test new technologies for client support with a business approach 29

Table of contents 1 History of Gamesa Energía 2 Business model and value generation alternatives 3 Accounting and financial modeling 4 Gamesa Energía pipeline breakdown and balance sheet value 5 Strategy 6 Valuation 7 Financing 8 Conclusions 30

Accounting and financial modeling 1 Accounting process 2 Cash flow and P&L through the project life 3 Accounting example 4 Example of a recent transaction 31

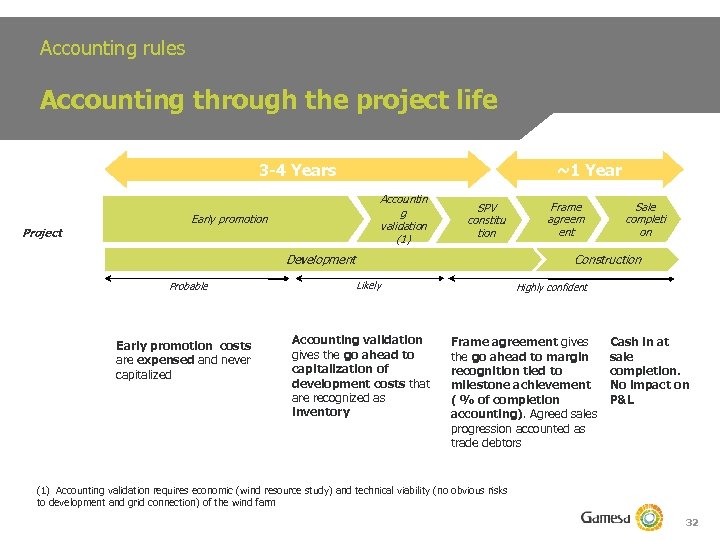

Accounting rules Accounting through the project life ~1 Year 3 -4 Years Project Accountin g validation (1) Early promotion SPV constitu tion Development Probable Early promotion costs are expensed and never capitalized Frame agreem ent Sale completi on Construction Likely Accounting validation gives the go ahead to capitalization of development costs that are recognized as inventory Highly confident Frame agreement gives the go ahead to margin recognition tied to milestone achievement ( % of completion accounting). Agreed sales progression accounted as trade debtors Cash in at sale completion. No impact on P&L (1) Accounting validation requires economic (wind resource study) and technical viability (no obvious risks to development and grid connection) of the wind farm 32

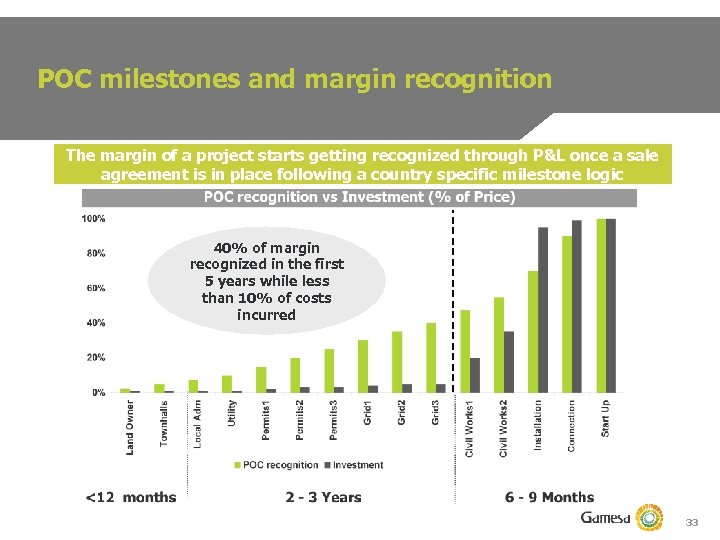

POC milestones and margin recognition The margin of a project starts getting recognized through P&L once a sale agreement is in place following a country specific milestone logic 40% of margin recognized in the first 5 years while less than 10% of costs incurred 33

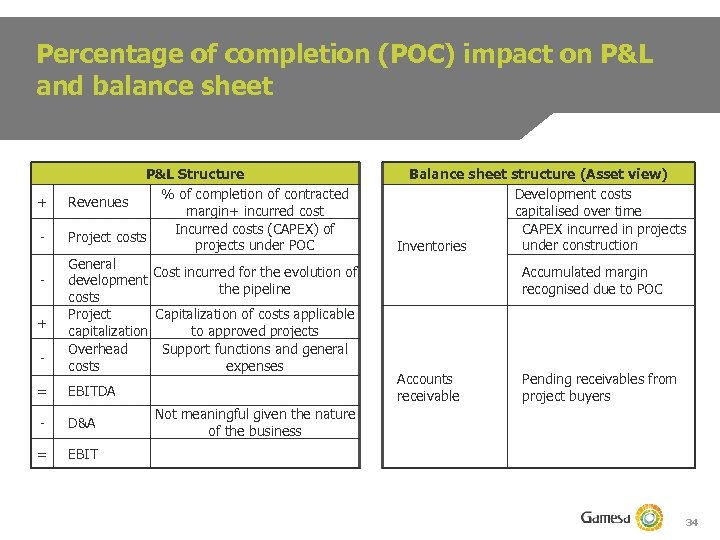

Percentage of completion (POC) impact on P&L and balance sheet + + - P&L Structure % of completion of contracted Revenues margin+ incurred cost Incurred costs (CAPEX) of Project costs projects under POC General Cost incurred for the evolution of development the pipeline costs Project Capitalization of costs applicable capitalization to approved projects Overhead Support functions and general costs expenses = EBITDA - D&A = Balance sheet structure (Asset view) Development costs capitalised over time CAPEX incurred in projects under construction Inventories Accumulated margin recognised due to POC Accounts receivable Pending receivables from project buyers EBIT Not meaningful given the nature of the business 34

Accounting and financial modeling 1 Accounting process 2 Cash flow and P&L through the project life 3 Accounting example 4 Example of a recent transaction 35

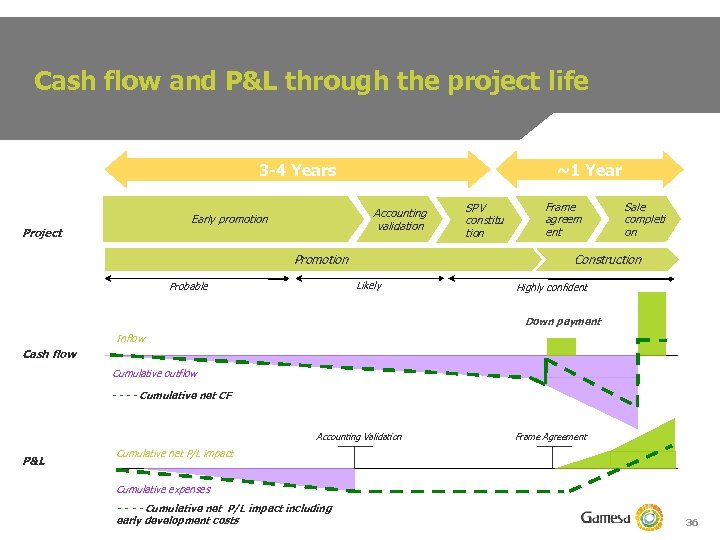

Cash flow and P&L through the project life ~1 Year 3 -4 Years Accounting validation Early promotion Project Promotion Frame agreem ent Sale completi on Construction Likely Probable SPV constitu tion Highly confident Down payment Inflow Cash flow Cumulative outflow - - Cumulative net CF Accounting Validation P&L Frame Agreement Cumulative net P/L impact Cumulative expenses - - Cumulative net P/L impact including early development costs 36

Accounting and financial modeling 1 Accounting process 2 Cash flow and P&L through the project life 3 Accounting example 4 Example of a recent transaction 37

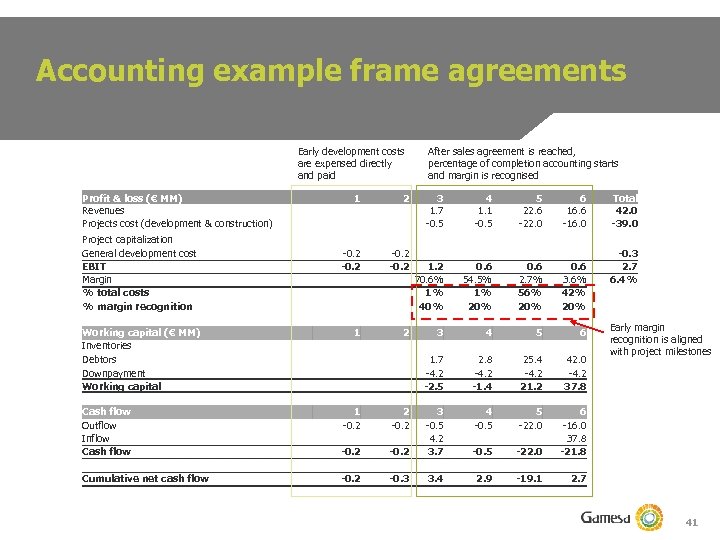

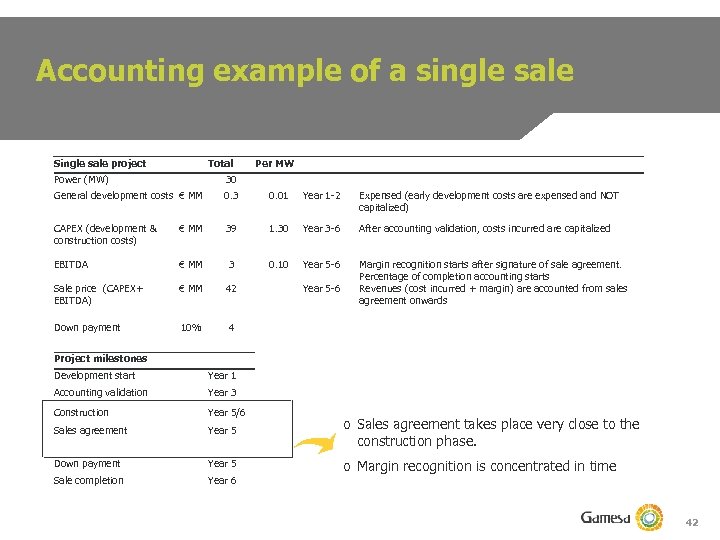

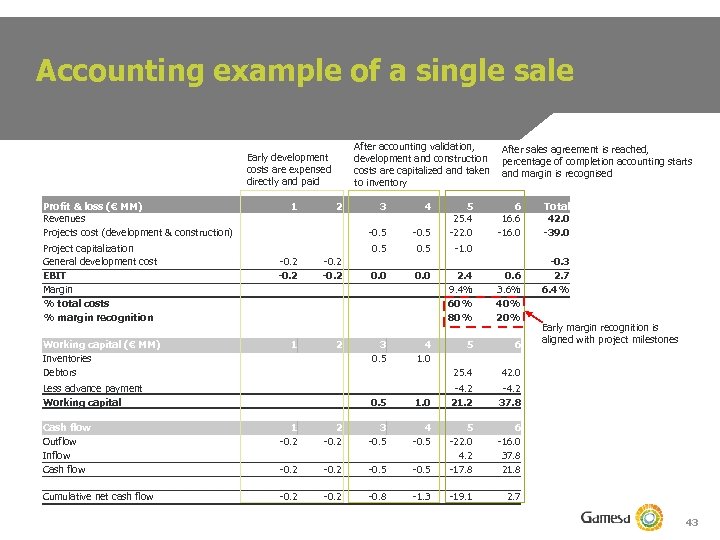

Accounting example o Accounting methodology is POC once the sale agreement has been signed • Early development costs are expensed • Accounting validation gives the go ahead to cost capitalization and wind farm inventory • Margin recognition starts after sales agreement is reached (percentage of completion accounting); recognition of trade debtors starts • o Sale completion: cash in, trade debtors out, no impact on P&L This accounting methodology (POC) is applied to both large framework agreements or single sale contracts but signature timings differ affecting when P&L impact occurs: • For large framework agreements sale signature and beginning of margin recognition is close to validation date and far from sale completion Margin recognition starts earlier and is spread over more years (historic business model) • For single sales, signature is very close to the construction stage and further away from validation date margin recognition starts later and is more concentrated in time • Except for downpayments at signing, the cash flow line is identical, as costs incurred do not vary and cash inflow happens mainly at completion of the sale 38

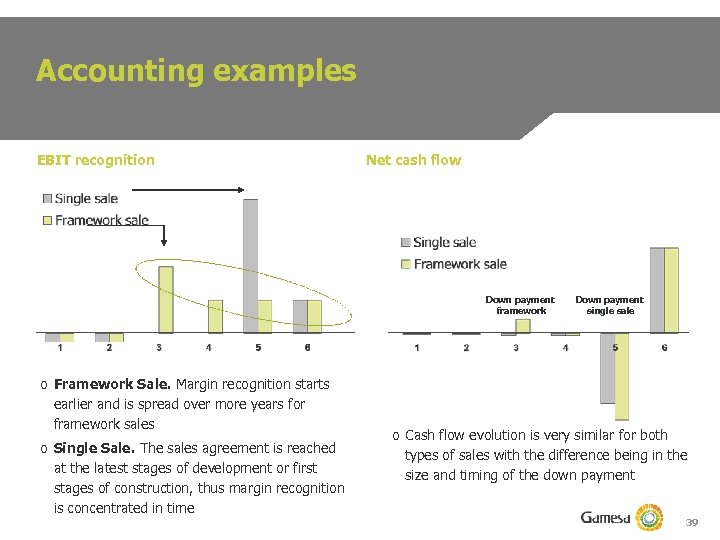

Accounting examples EBIT recognition Net cash flow x X Down payment framework o Framework Sale. Margin recognition starts earlier and is spread over more years for framework sales o Single Sale. The sales agreement is reached at the latest stages of development or first stages of construction, thus margin recognition is concentrated in time Down payment single sale o Cash flow evolution is very similar for both types of sales with the difference being in the size and timing of the down payment 39

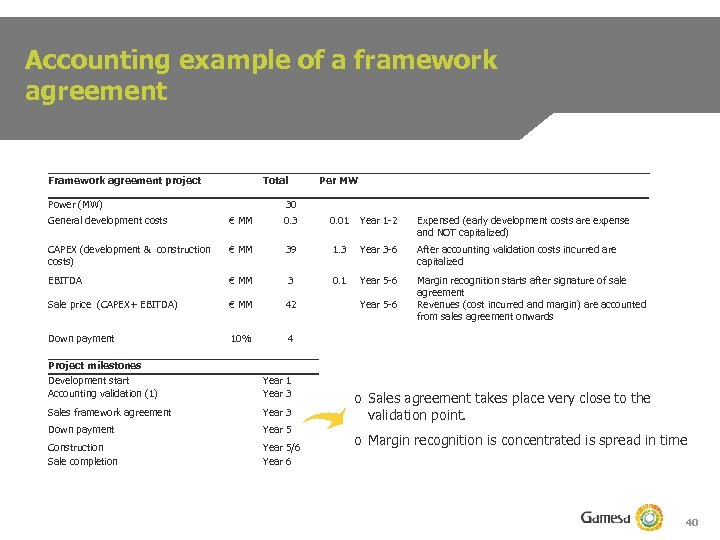

Accounting example of a framework agreement Framework agreement project Total Power (MW) Per MW 30 General development costs € MM 0. 3 0. 01 Year 1 -2 Expensed (early development costs are expense and NOT capitalized) CAPEX (development & construction costs) € MM 39 1. 3 Year 3 -6 After accounting validation costs incurred are capitalized EBITDA € MM 3 0. 1 Year 5 -6 Sale price (CAPEX+ EBITDA) € MM 42 Margin recognition starts after signature of sale agreement Revenues (cost incurred and margin) are accounted from sales agreement onwards Down payment 10% 4 Project milestones Development start Accounting validation (1) Year 1 Year 3 Sales framework agreement Year 3 Down payment Year 5 Construction Sale completion Year 5/6 Year 5 -6 o Sales agreement takes place very close to the validation point. o Margin recognition is concentrated is spread in time 40

Accounting example frame agreements Early development costs are expensed directly and paid Profit & loss (€ MM) Revenues Projects cost (development & construction) Project capitalization General development cost EBIT Margin % total costs % margin recognition Working capital (€ MM) Inventories Debtors Downpayment Working capital 1 2 -0. 2 1 2 After sales agreement is reached, percentage of completion accounting starts and margin is recognised 3 1. 7 -0. 5 4 1. 1 -0. 5 5 22. 6 -22. 0 6 16. 6 -16. 0 1. 2 70. 6% 1% 40% 0. 6 54. 5% 1% 20% 0. 6 2. 7% 56% 20% 0. 6 3. 6% 42% 20% 3 4 5 6 1. 7 -4. 2 -2. 5 2. 8 -4. 2 -1. 4 25. 4 -4. 2 21. 2 42. 0 -4. 2 37. 8 4 -0. 5 5 -22. 0 -0. 5 -22. 0 6 -16. 0 37. 8 -21. 8 2. 9 -19. 1 2. 7 Cash flow Outflow Inflow Cash flow 1 -0. 2 2 -0. 2 3 -0. 5 4. 2 3. 7 Cumulative net cash flow -0. 2 -0. 3 3. 4 Total 42. 0 -39. 0 -0. 3 2. 7 6. 4% Early margin recognition is aligned with project milestones 41

Accounting example of a single sale Single sale project Total Per MW Power (MW) 30 General development costs € MM 0. 3 0. 01 Year 1 -2 Expensed (early development costs are expensed and NOT capitalized) CAPEX (development & construction costs) € MM 39 1. 30 Year 3 -6 After accounting validation, costs incurred are capitalized EBITDA € MM 3 0. 10 Year 5 -6 Sale price (CAPEX+ EBITDA) € MM 42 Margin recognition starts after signature of sale agreement. Percentage of completion accounting starts Revenues (cost incurred + margin) are accounted from sales agreement onwards Down payment 10% 4 Year 5 -6 Project milestones Development start Year 1 Accounting validation Year 3 Construction Year 5/6 Sales agreement Year 5 o Sales agreement takes place very close to the construction phase. Down payment Year 5 Sale completion Year 6 o Margin recognition is concentrated in time 42

Accounting example of a single sale After accounting validation, development and construction costs are capitalized and taken to inventory Early development costs are expensed directly and paid Profit & loss (€ MM) Revenues Projects cost (development & construction) Project capitalization General development cost EBIT Margin % total costs % margin recognition Working capital (€ MM) Inventories Debtors 1 2 Less advance payment Working capital -0. 5 5 25. 4 -22. 0 0. 5 -1. 0 0. 0 2. 4 9. 4% 60% 80% 0. 6 3. 6% 40% 20% 5 6 25. 4 1 4 0. 5 -0. 2 3 -0. 5 -0. 2 2 After sales agreement is reached, percentage of completion accounting starts and margin is recognised 42. 0 -4. 2 21. 2 -4. 2 37. 8 6 -16. 0 37. 8 21. 8 2. 7 3 0. 5 4 1. 0 0. 5 1. 0 Cash flow Outflow Inflow Cash flow 1 -0. 2 2 -0. 2 3 -0. 5 4 -0. 5 -0. 2 -0. 5 5 -22. 0 4. 2 -17. 8 Cumulative net cash flow -0. 2 -0. 8 -1. 3 -19. 1 6 16. 6 -16. 0 Total 42. 0 -39. 0 -0. 3 2. 7 6. 4% Early margin recognition is aligned with project milestones 43

Accounting and financial modeling 1 Accounting process 2 Cash flow and P&L through the project life 3 Accounting example 4 Example of a recent transaction 44

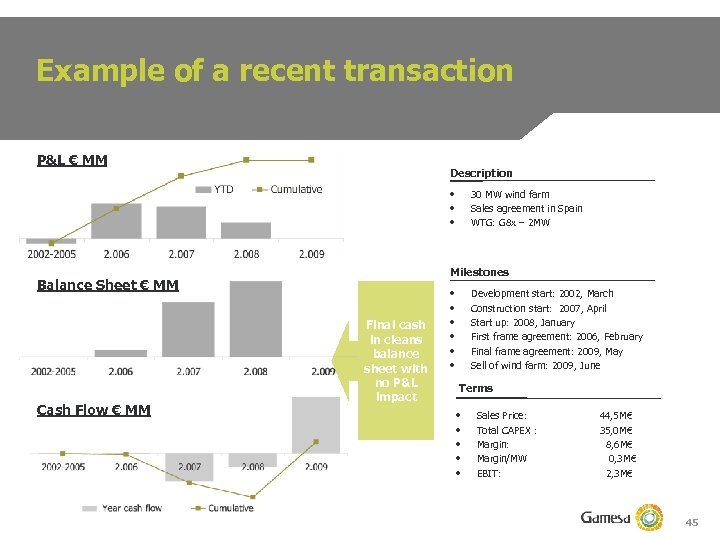

Example of a recent transaction P&L € MM Description • • • Milestones Balance Sheet € MM Cash Flow € MM 30 MW wind farm Sales agreement in Spain WTG: G 8 x – 2 MW Final cash in cleans balance sheet with no P&L impact • • • Development start: 2002, March Construction start: 2007, April Start up: 2008, January First frame agreement: 2006, February Final frame agreement: 2009, May Sell of wind farm: 2009, June Terms • • • Sales Price: Total CAPEX : Margin/MW EBIT: 44, 5 M€ 35, 0 M€ 8, 6 M€ 0, 3 M€ 2, 3 M€ 45

Table of contents 1 History of Gamesa Energía 2 Business model and value generation alternatives 3 Accounting and financial modeling 4 Gamesa Energía pipeline breakdown and balance sheet value 5 Strategy 6 Valuation 7 Financing 8 Conclusions 46

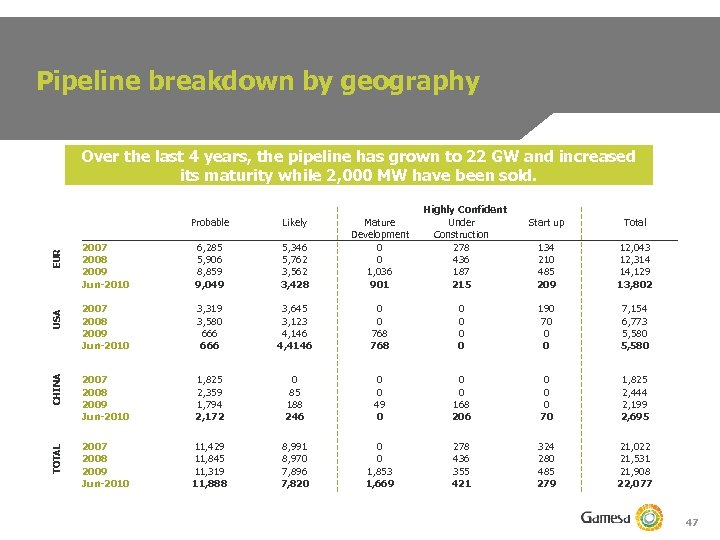

Pipeline breakdown by geography Likely 2007 2008 2009 Jun-2010 6, 285 5, 906 8, 859 9, 049 5, 346 5, 762 3, 562 3, 428 Mature Development 0 0 1, 036 901 2007 2008 2009 Jun-2010 3, 319 3, 580 666 3, 645 3, 123 4, 146 4, 4146 0 0 768 CHINA 2007 2008 2009 Jun-2010 1, 825 2, 359 1, 794 2, 172 0 85 188 246 2007 2008 2009 Jun-2010 11, 429 11, 845 11, 319 11, 888 8, 991 8, 970 7, 896 7, 820 USA EUR Probable TOTAL Over the last 4 years, the pipeline has grown to 22 GW and increased its maturity while 2, 000 MW have been sold. Highly Confident Under Construction 278 436 187 215 Start up Total 134 210 485 209 12, 043 12, 314 14, 129 13, 802 0 0 190 70 0 0 7, 154 6, 773 5, 580 0 0 49 0 0 0 168 206 0 0 0 70 1, 825 2, 444 2, 199 2, 695 0 0 1, 853 1, 669 278 436 355 421 324 280 485 279 21, 022 21, 531 21, 908 22, 077 47

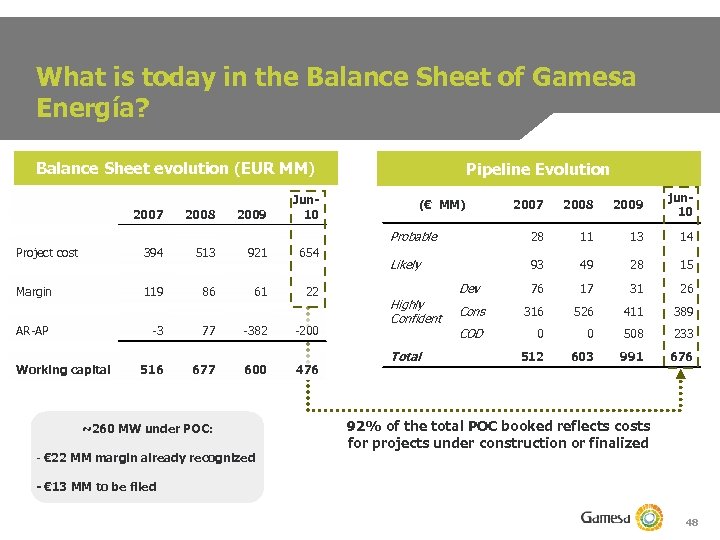

What is today in the Balance Sheet of Gamesa Energía? Balance Sheet evolution (EUR MM) Pipeline Evolution 2008 2009 Project cost 394 513 921 654 Margin 119 86 61 22 AR-AP -3 Working capital 77 -382 -200 516 677 600 476 ~260 MW under POC: - € 22 MM margin already recognized 2007 2008 2009 jun 10 Probable 2007 Jun 10 28 11 13 14 Likely 93 49 28 15 Dev 76 17 31 26 Cons 316 526 411 389 COD 0 0 508 233 512 603 991 676 (€ MM) Highly Confident Total 92% of the total POC booked reflects costs for projects under construction or finalized - € 13 MM to be filed 48

Table of contents 1 History of Gamesa Energía 2 Business model and value generation alternatives 3 Accounting and financial modeling 4 Gamesa Energía pipeline description and evolution 5 Strategy 6 Valuation 7 Financing 8 Conclusions 49

Gamesa Energia strategy 1 Integration vs. pure play 2 Value creation opportunities 3 Strategy by geographic area 4 Agreement with Iberdrola Renovables 50

Integration vs. pure play The synergies of integration Synergies for the development business ü Better project planning due to turbine knowledge (existing and future products). ü Stronger balance sheet. ü Better brand image towards clients, banks and administration. ü Leverage on supply chain related investments and job creation to secure tender awarding. ü Ability to provide EPC solutions to project buyers. Synergies for the OEM business ü More feedback for product design and improvement (efficiency, O&M, environmental issues, permitting issues, …). ü Improved visibility of order book. ü Good value added product for customers willing to enter the industry (start buying projects, then buying turbines for own developments). ü Project development as a low cost tool to enter new markets. ü Better know-how on grid connection and civil works implications on the turbine. 51

Gamesa Energia strategy 1 Integration vs. pure play 2 Value creation opportunities 3 Strategy by geographic area 4 Agreement with Iberdrola Renovables 52

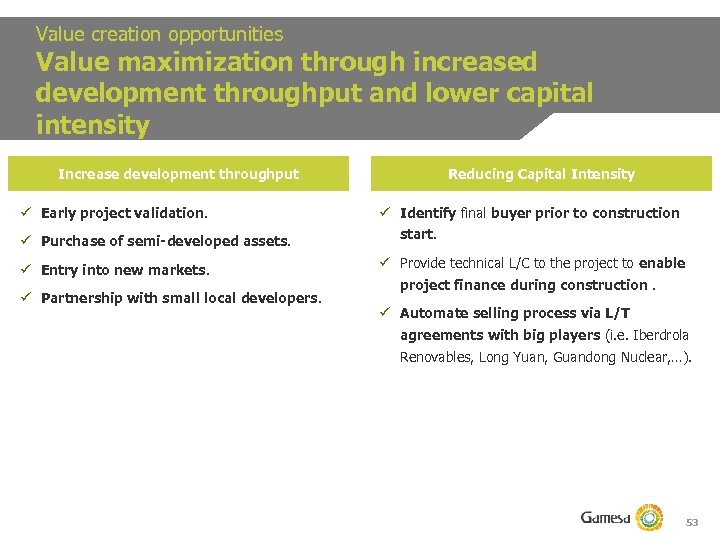

Value creation opportunities Value maximization through increased development throughput and lower capital intensity Increase development throughput ü Early project validation. ü Purchase of semi-developed assets. ü Entry into new markets. ü Partnership with small local developers. Reducing Capital Intensity ü Identify final buyer prior to construction start. ü Provide technical L/C to the project to enable project finance during construction. ü Automate selling process via L/T agreements with big players (i. e. Iberdrola Renovables, Long Yuan, Guandong Nuclear, …). 53

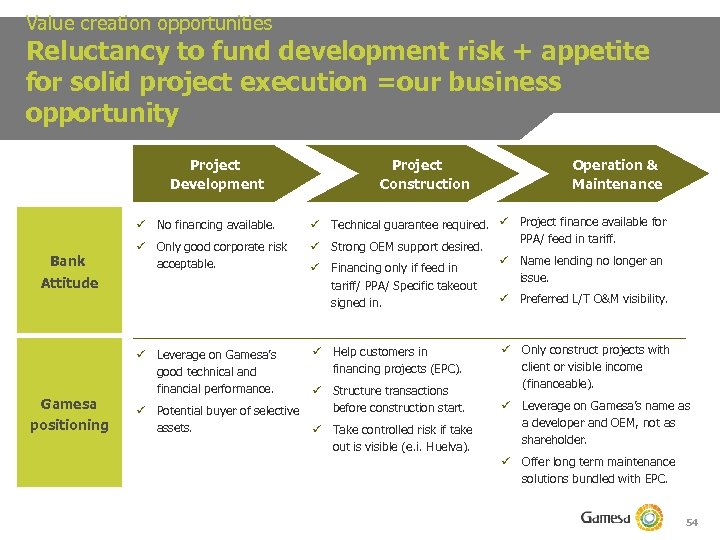

Value creation opportunities Reluctancy to fund development risk + appetite for solid project execution =our business opportunity Project Development ü No financing available. Bank ü Only good corporate risk acceptable. Attitude Gamesa positioning ü Leverage on Gamesa’s good technical and financial performance. Project Construction Operation & Maintenance ü Technical guarantee required. ü Project finance available for PPA/ feed in tariff. ü Strong OEM support desired. ü Name lending no longer an ü Financing only if feed in issue. tariff/ PPA/ Specific takeout ü Preferred L/T O&M visibility. signed in. ü Help customers in financing projects (EPC). ü Structure transactions before construction start. ü Potential buyer of selective assets. ü Take controlled risk if take out is visible (e. i. Huelva). ü Only construct projects with client or visible income (financeable). ü Leverage on Gamesa’s name as a developer and OEM, not as shareholder. ü Offer long term maintenance solutions bundled with EPC. 54

Gamesa Energia strategy 1 Integration vs. pure play 2 Value creation opportunities 3 Strategy by geographic area 4 Agreement with Iberdrola Renovables 55

Europe Good risk/return profile The European market offers a good risk/return profile for investors, but outsiders and banks do not want to take development risk Current Market Situation ü Developers structure to finalize developments/start construction due to lack of bank support. ü Feed in tariff systems provide good visibility for projects once finalized. ü Carbon trading pick up has created a new set of investors. Business Tactics ü Selecting purchase of projects to finalize and sell. ü Leverage on Gamesa’s track record and technical strength to provide EPC solutions. ü Offer projects to new IPP’s (IKEA). ü Sign up for long term relationships with local utilities (Edisson) ü Some utilities want to catch up as late entrants to the market. 56

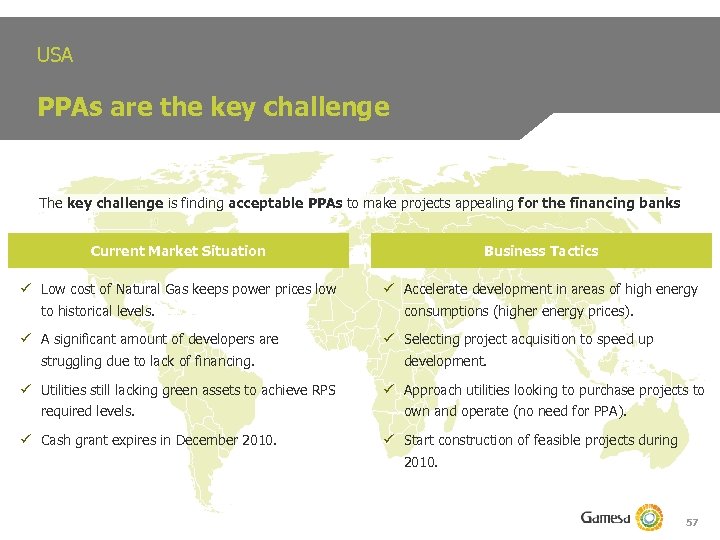

USA PPAs are the key challenge The key challenge is finding acceptable PPAs to make projects appealing for the financing banks Current Market Situation Business Tactics ü Low cost of Natural Gas keeps power prices low ü Accelerate development in areas of high energy to historical levels. ü A significant amount of developers are struggling due to lack of financing. ü Utilities still lacking green assets to achieve RPS required levels. ü Cash grant expires in December 2010. consumptions (higher energy prices). ü Selecting project acquisition to speed up development. ü Approach utilities looking to purchase projects to own and operate (no need for PPA). ü Start construction of feasible projects during 2010. 57

China Under-penetrated market with strong growth opportunities The Chinese market is booking with very few players and new local utilities starting to grow Current Market Situation Business Tactics ü Only 4 utilities investing in projects massively. ü Offer our projects as a tool to accelerate ü New utilities starting to develop from scratch entrance to a sizeable installed base. want to catch up. ü Turbine demand foreign manufacturers limited to 20% of total local demand. ü Kyoto protocol (CDM) forces to have Chinese ü Increase turbine demand by selling projects developed by Gamesa. ü Continue talks to foreign investors to measure the value of the project without CDM. company controlling the project to access Green Certificates. 58

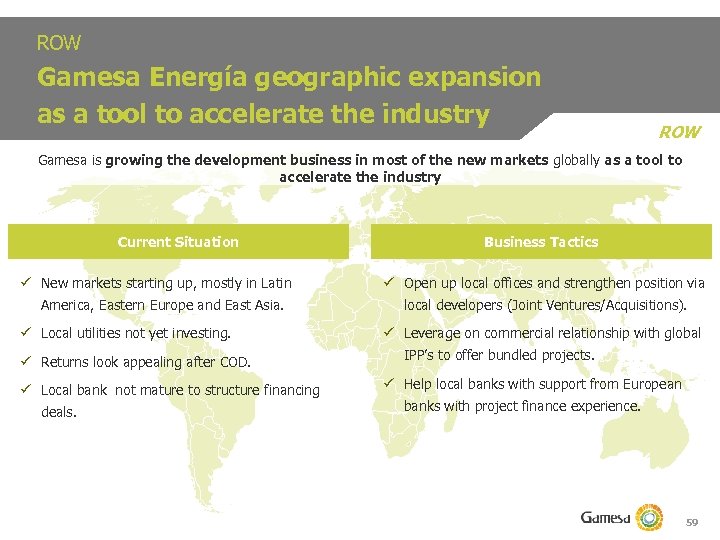

ROW Gamesa Energía geographic expansion as a tool to accelerate the industry ROW Gamesa is growing the development business in most of the new markets globally as a tool to accelerate the industry Current Situation ü New markets starting up, mostly in Latin America, Eastern Europe and East Asia. ü Local utilities not yet investing. ü Returns look appealing after COD. ü Local bank not mature to structure financing deals. Business Tactics ü Open up local offices and strengthen position via local developers (Joint Ventures/Acquisitions). ü Leverage on commercial relationship with global IPP’s to offer bundled projects. ü Help local banks with support from European banks with project finance experience. 59

Gamesa Energia strategy 1 Integration vs. pure play 2 Value creation opportunities 3 Strategy by geographic area 4 Agreement with Iberdrola Renovables 60

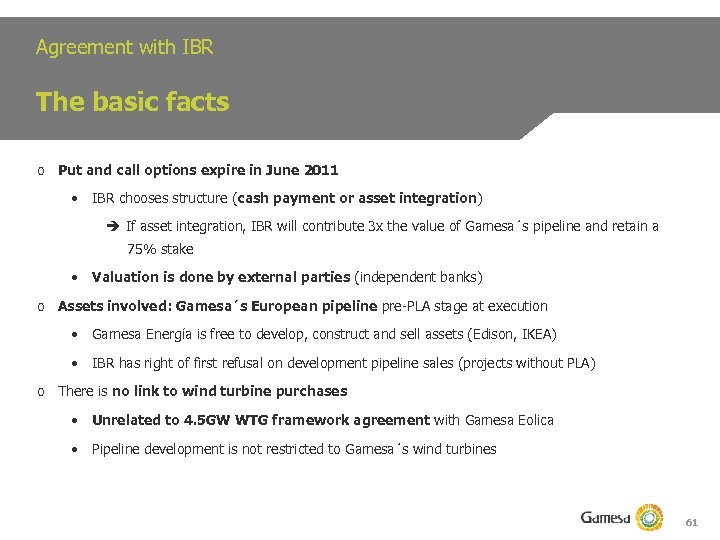

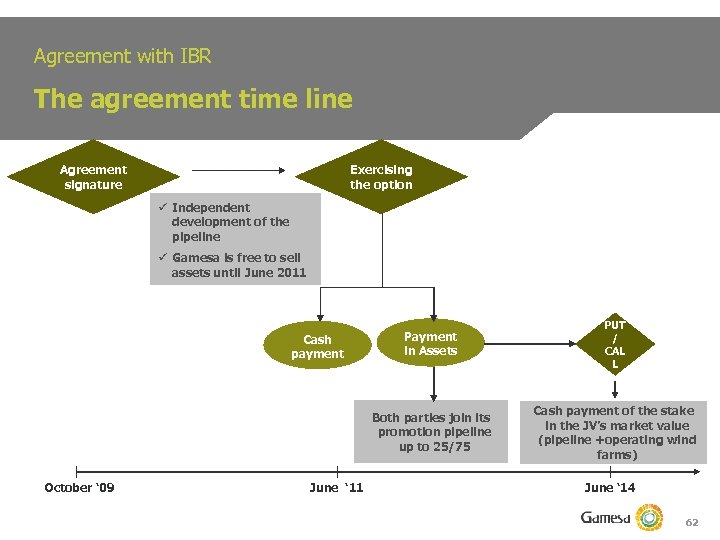

Agreement with IBR The basic facts o Put and call options expire in June 2011 • IBR chooses structure (cash payment or asset integration) If asset integration, IBR will contribute 3 x the value of Gamesa´s pipeline and retain a 75% stake • Valuation is done by external parties (independent banks) o Assets involved: Gamesa´s European pipeline pre-PLA stage at execution • Gamesa Energía is free to develop, construct and sell assets (Edison, IKEA) • IBR has right of first refusal on development pipeline sales (projects without PLA) o There is no link to wind turbine purchases • Unrelated to 4. 5 GW WTG framework agreement with Gamesa Eolica • Pipeline development is not restricted to Gamesa´s wind turbines 61

Agreement with IBR The agreement time line Agreement signature Exercising the option ü Independent development of the pipeline ü Gamesa is free to sell assets until June 2011 October ‘ 09 June ‘ 11 Payment in Assets PUT / CAL L Both parties join its promotion pipeline up to 25/75 Cash payment of the stake in the JV’s market value (pipeline +operating wind farms) June ‘ 14 62

Table of contents 1 History of Gamesa Energía 2 Business model and value generation alternatives 3 Gamesa Energía pipeline description and evolution 4 Accounting and financial modelling 5 Strategy 6 Valuation 7 Financing 8 Conclusions 63

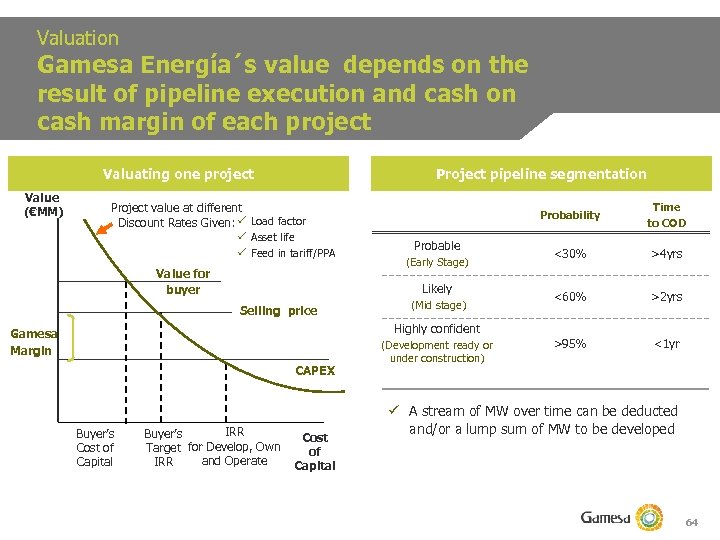

Valuation Gamesa Energía´s value depends on the result of pipeline execution and cash on cash margin of each project Valuating one project Value (€MM) Project pipeline segmentation Project value at different Discount Rates Given: ü Load factor ü Asset life ü Feed in tariff/PPA Value for buyer Probability Probable (Early Stage) Likely Selling price (Mid stage) Time to COD <30% >4 yrs <60% >2 yrs >95% <1 yr Highly confident Gamesa Margin CAPEX Buyer’s Cost of Capital IRR Buyer’s Target for Develop, Own and Operate IRR Cost of Capital (Development ready or under construction) ü A stream of MW over time can be deducted and/or a lump sum of MW to be developed 64

Valuation Valuing Gamesa Energía through precedent transactions multiples ü Example of B&B acquiring Enersys in Dec 2005 ü Firm Value announced: € 1, 000 MM (€ 468 MM EV + € 532 MM Debt) ü Pipeline acquired: ü ü In operation Under construction In advanced development In early development 344 MW 276 MW 360 MW - MW ü Assumptions required ü Success ratio of each pipeline segment: 100% - 70% - 30% ü CAPEX per MW: € 1. 2 MM ü % of cost incurred of MW under construction: 75% ü Calculations ü Invested Capital at sale= € 661 MM (MW in operation x CAPEX per MW + MW in construction x % of cost incurred x CAPEX per MW) ü Value added paid= € 339 MM ( Firm Value – Invested Capital) ü Total MW throughput of pipeline: 872 MW (product of segments and success ratios) ü Value added paid by B&B per MW= € 0. 4 MM/MW (Value added paid / Total MW throughput) ü Implicit Firm Value of Gamesa Energía= Total MW throughput of Gamesa pipeline x Value added paid by B&B 65

Table of contents 1 History of Gamesa Energía 2 Business model and value generation alternatives 3 Accounting and financial modelling 4 Gamesa Energía pipeline description and evolution 5 Strategy 6 Valuation 7 Financing 8 Conclusions 66

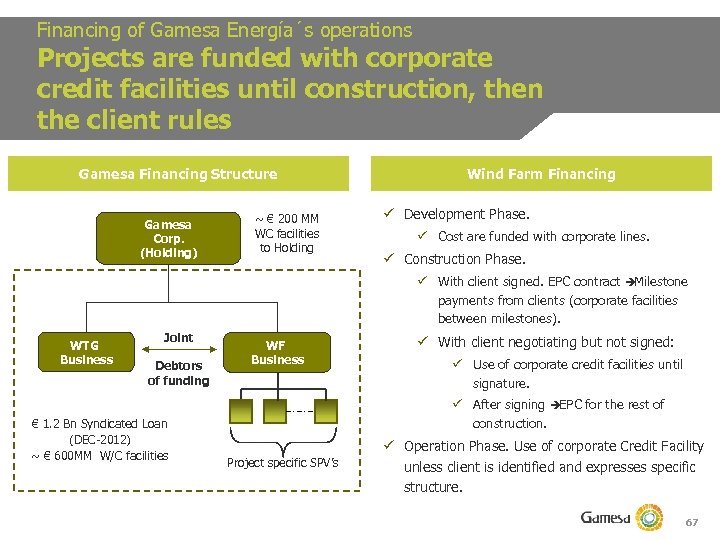

Financing of Gamesa Energía´s operations Projects are funded with corporate credit facilities until construction, then the client rules Gamesa Financing Structure Gamesa Corp. (Holding) ~ € 200 MM WC facilities to Holding Wind Farm Financing ü Development Phase. ü Cost are funded with corporate lines. ü Construction Phase. ü With client signed. EPC contract Milestone payments from clients (corporate facilities between milestones). WTG Business Joint Debtors of funding € 1. 2 Bn Syndicated Loan (DEC-2012) ~ € 600 MM W/C facilities WF Business ü With client negotiating but not signed: ü Use of corporate credit facilities until signature. ü After signing EPC for the rest of construction. Project specific SPV’s ü Operation Phase. Use of corporate Credit Facility unless client is identified and expresses specific structure. 67

Table of contents 1 History of Gamesa Energía 2 Business model and value generation alternatives 3 Accounting and financial modelling 4 Gamesa Energía pipeline description and evolution 5 Strategy 6 Valuation 7 Financing 8 Conclusions 68

Conclusions o Gamesa Energía is a leading WF developer with 3, 500 MW constructed over 15 years and strong synergies with the OEM business o The value of Gamesa Energía relies on a 22 GW pipeline and a track record of more than 450 MW developed and constructed per year o The company has a strong balance sheet with assets (€ 476 MM) associated to mature projects under construction or in operation (680 MW) o The strategy of the company is to sell projects recurrently, not being an IPP o The geographical spread of the pipeline mitigates risks o The company is seeking value enhancing strategies through geographical growth, selective development pipeline acquisition and new financing structures 69

Questions & Answers Muchas Gracias Thank you 70

Disclaimer “This material has been prepared by Gamesa Corporación Tecnológica, S. A. , and is disclosed solely as information. This material may contain declarations which constitute forward-looking statements, and includes references to our current intentions, beliefs or expectations regarding future events and trends that may affect our financial condition, earnings and share value. These forward-looking statements do not constitute a warranty as to future performance and imply risks and uncertainties. Therefore, actual results may differ materially from those expressed or implied by the forward-looking statements, due to different factors, risks an uncertainties, such as economical, competitive, regulatory or commercial changes. The potential investor should assume the fact that the value of any investment may rise or go down, and furthermore, it may not be recovered, partially or completely. Likewise, past performance is not indicative of future results. The facts, opinions, and forecasts included in this material are furnished as to the date of this document, and are based on the company’s estimations and on sources believed to be reliable by Gamesa Corporación Tecnológica, S. A. , but the company does not warrant its completeness, timeliness or accuracy, and therefore it should not be relied upon as if it were. Both the information and the conclusions contained in this document are subject to changes without notice. Gamesa Corporación Tecnológica, S. A. undertakes no obligation to update forward-looking statements to reflect events or circumstances that occur after the date the statements were made. The results and evolution of the company may differ materially from those expressed in this material. None of the information contained in this document constitutes a recommendation, solicitation or offer to buy or sell any securities, futures, options or other financial instruments or provide any investment advice or service. This material does not provide any recommendation of investment, or legal, tax or any other type of advise, and it should not be relied upon to make any investment or decision. Any and all the decisions taken by any third party as a result of the information, materials or reports contained in this document, are the sole and exclusive risk and responsibility of that third party, and Gamesa Corporación Tecnológica, S. A. shall not be responsible for any damages derived from the use of this document or its content. This document has been furnished exclusively as information, and it must not be disclosed, published or distributed, partially or totally, without the prior written consent of Gamesa Corporación Tecnológica, S. A. The images captured by Gamesa in the work environment or at corporate events are solely used for professional purposes to inform third parties about corporate activities and to illustrate them. English version for information purposes only. In case of doubt the Spanish version will prevail. ” 71

3a0f2e1bb9eec19b67a0d20aeeb7ce9e.ppt