dd2d5b0664ac4f33dd322c9311c4bc21.ppt

- Количество слайдов: 23

Game Theory Topic 7 Information “A little knowledge is a dangerous thing. So is a lot. ” - Albert Einstein

Game Theory Topic 7 Information “A little knowledge is a dangerous thing. So is a lot. ” - Albert Einstein

Strategic Use of Information n Incentive Schemes q Creating situations in which observable outcomes reveal the unobservable actions of the opponents. n Screening q Creating situations in which the better-informed opponents’ observable actions reveal their unobservable traits. 2 Mike Shor

Strategic Use of Information n Incentive Schemes q Creating situations in which observable outcomes reveal the unobservable actions of the opponents. n Screening q Creating situations in which the better-informed opponents’ observable actions reveal their unobservable traits. 2 Mike Shor

Signaling n Definition q Using actions that other players would interpret in a way that would favor you in the game play n Requires q It is not in the best interest for people to signal falsely q Implies signaling must be costly! 3 Mike Shor

Signaling n Definition q Using actions that other players would interpret in a way that would favor you in the game play n Requires q It is not in the best interest for people to signal falsely q Implies signaling must be costly! 3 Mike Shor

Auto Insurance n A $1, 000 deductible? n High risk drivers: q 30% chance of claim q Risk aversion: willing to pay $500 n Low risk drivers: q 10% chance of claim q Risk aversion: willing to pay $200 4 Mike Shor

Auto Insurance n A $1, 000 deductible? n High risk drivers: q 30% chance of claim q Risk aversion: willing to pay $500 n Low risk drivers: q 10% chance of claim q Risk aversion: willing to pay $200 4 Mike Shor

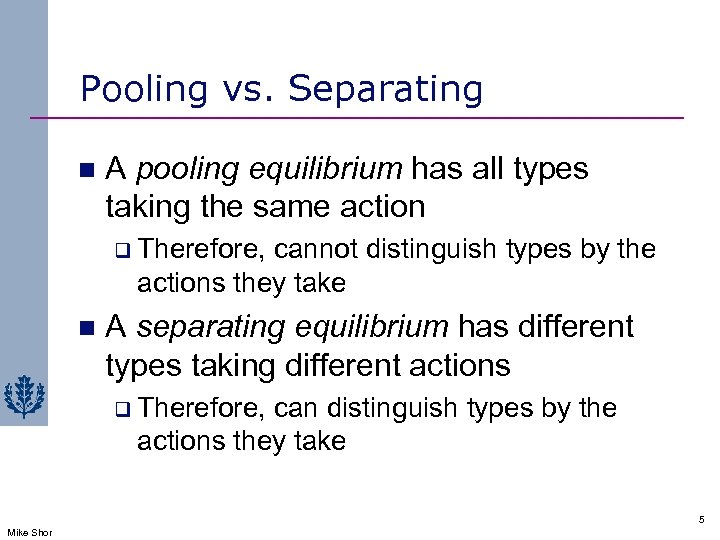

Pooling vs. Separating n A pooling equilibrium has all types taking the same action q Therefore, cannot distinguish types by the actions they take n A separating equilibrium has different types taking different actions q Therefore, can distinguish types by the actions they take 5 Mike Shor

Pooling vs. Separating n A pooling equilibrium has all types taking the same action q Therefore, cannot distinguish types by the actions they take n A separating equilibrium has different types taking different actions q Therefore, can distinguish types by the actions they take 5 Mike Shor

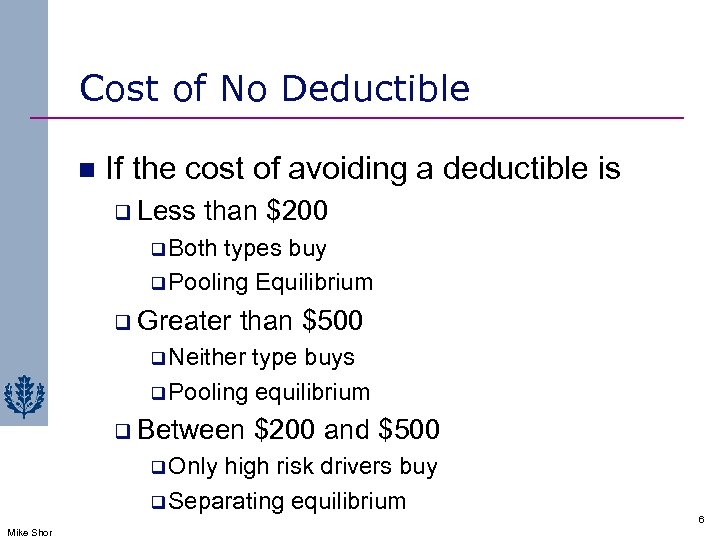

Cost of No Deductible n If the cost of avoiding a deductible is q Less than $200 q Both types buy q Pooling Equilibrium q Greater than $500 q Neither type buys q Pooling equilibrium q Between $200 and $500 q Only high risk drivers buy q Separating equilibrium 6 Mike Shor

Cost of No Deductible n If the cost of avoiding a deductible is q Less than $200 q Both types buy q Pooling Equilibrium q Greater than $500 q Neither type buys q Pooling equilibrium q Between $200 and $500 q Only high risk drivers buy q Separating equilibrium 6 Mike Shor

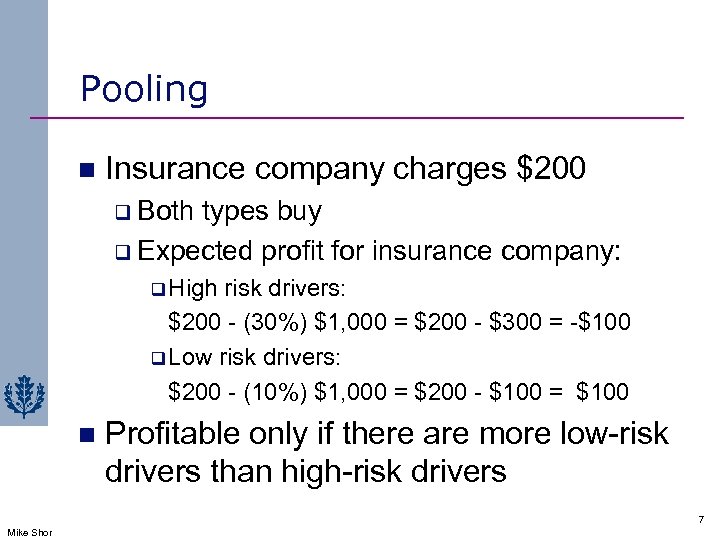

Pooling n Insurance company charges $200 q Both types buy q Expected profit for insurance company: q High risk drivers: $200 - (30%) $1, 000 = $200 - $300 = -$100 q Low risk drivers: $200 - (10%) $1, 000 = $200 - $100 = $100 n Profitable only if there are more low-risk drivers than high-risk drivers 7 Mike Shor

Pooling n Insurance company charges $200 q Both types buy q Expected profit for insurance company: q High risk drivers: $200 - (30%) $1, 000 = $200 - $300 = -$100 q Low risk drivers: $200 - (10%) $1, 000 = $200 - $100 = $100 n Profitable only if there are more low-risk drivers than high-risk drivers 7 Mike Shor

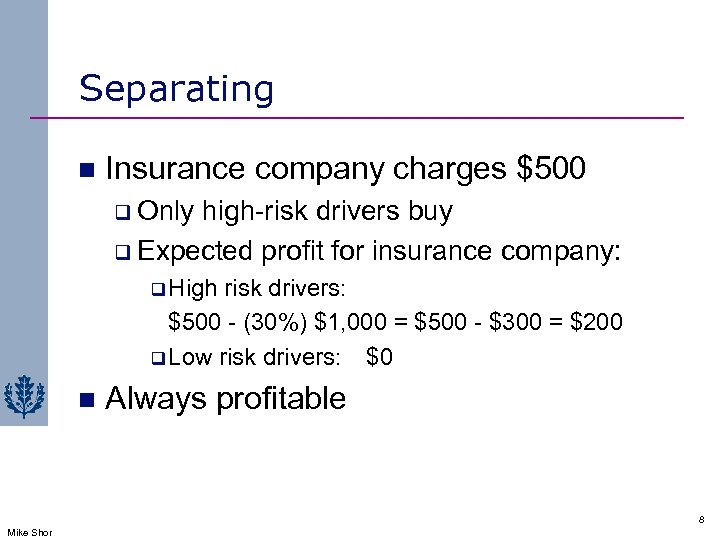

Separating n Insurance company charges $500 q Only high-risk drivers buy q Expected profit for insurance company: q High risk drivers: $500 - (30%) $1, 000 = $500 - $300 = $200 q Low risk drivers: $0 n Always profitable 8 Mike Shor

Separating n Insurance company charges $500 q Only high-risk drivers buy q Expected profit for insurance company: q High risk drivers: $500 - (30%) $1, 000 = $500 - $300 = $200 q Low risk drivers: $0 n Always profitable 8 Mike Shor

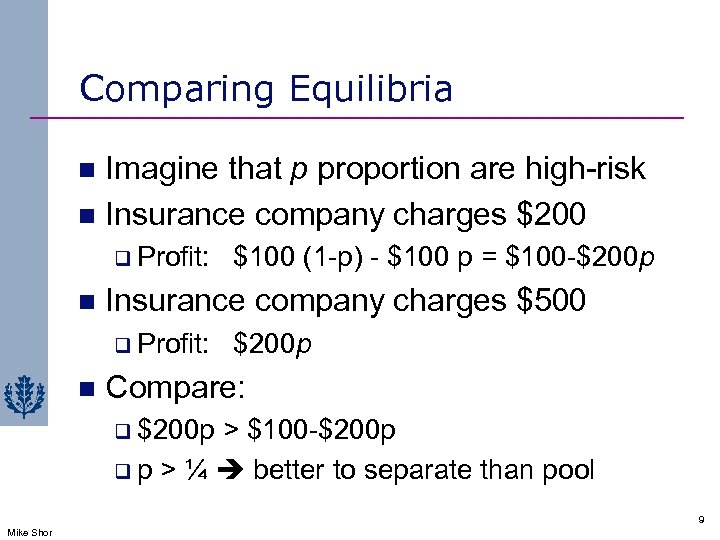

Comparing Equilibria Imagine that p proportion are high-risk n Insurance company charges $200 n q Profit: n Insurance company charges $500 q Profit: n $100 (1 -p) - $100 p = $100 -$200 p Compare: q $200 p > $100 -$200 p q p > ¼ better to separate than pool 9 Mike Shor

Comparing Equilibria Imagine that p proportion are high-risk n Insurance company charges $200 n q Profit: n Insurance company charges $500 q Profit: n $100 (1 -p) - $100 p = $100 -$200 p Compare: q $200 p > $100 -$200 p q p > ¼ better to separate than pool 9 Mike Shor

Self-Selection n Only high risk drivers “self-select” into the contract to buy insurance Screening sets up the proper incentives for individuals to self-select Pooling has the danger of adverse selection 10 Mike Shor

Self-Selection n Only high risk drivers “self-select” into the contract to buy insurance Screening sets up the proper incentives for individuals to self-select Pooling has the danger of adverse selection 10 Mike Shor

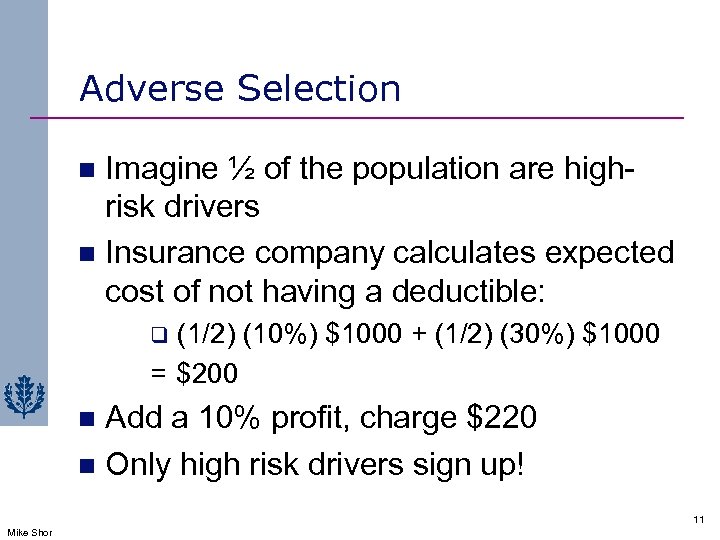

Adverse Selection Imagine ½ of the population are highrisk drivers n Insurance company calculates expected cost of not having a deductible: n (1/2) (10%) $1000 + (1/2) (30%) $1000 = $200 q Add a 10% profit, charge $220 n Only high risk drivers sign up! n 11 Mike Shor

Adverse Selection Imagine ½ of the population are highrisk drivers n Insurance company calculates expected cost of not having a deductible: n (1/2) (10%) $1000 + (1/2) (30%) $1000 = $200 q Add a 10% profit, charge $220 n Only high risk drivers sign up! n 11 Mike Shor

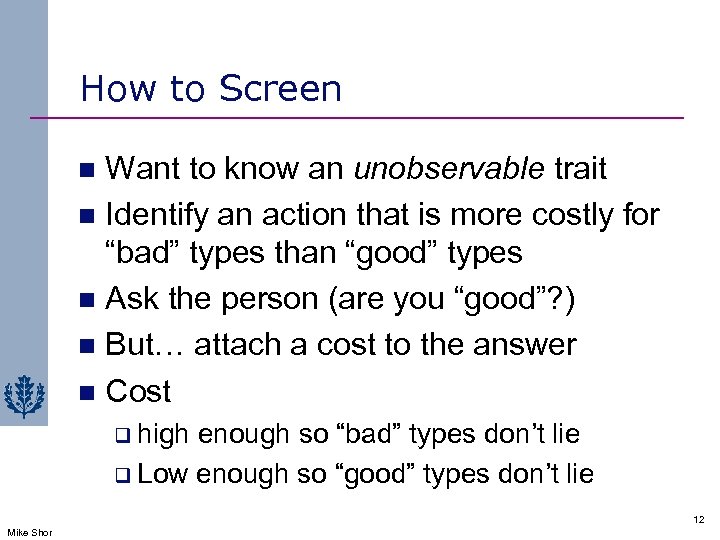

How to Screen Want to know an unobservable trait n Identify an action that is more costly for “bad” types than “good” types n Ask the person (are you “good”? ) n But… attach a cost to the answer n Cost n q high enough so “bad” types don’t lie q Low enough so “good” types don’t lie 12 Mike Shor

How to Screen Want to know an unobservable trait n Identify an action that is more costly for “bad” types than “good” types n Ask the person (are you “good”? ) n But… attach a cost to the answer n Cost n q high enough so “bad” types don’t lie q Low enough so “good” types don’t lie 12 Mike Shor

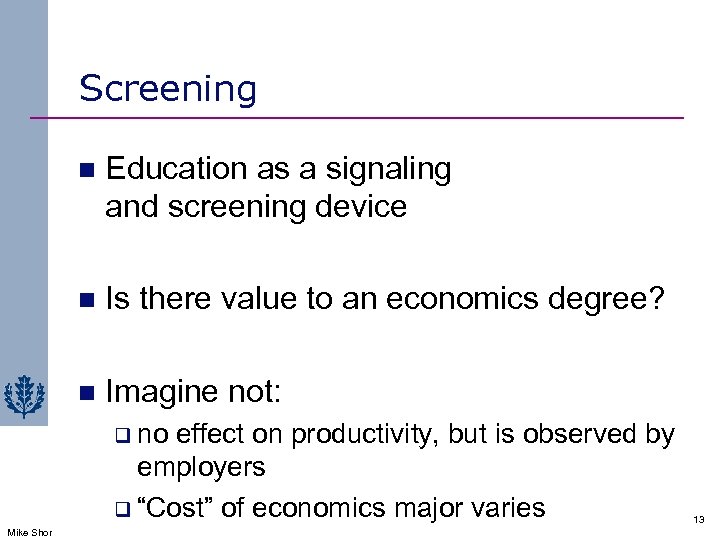

Screening n Education as a signaling and screening device n Is there value to an economics degree? n Imagine not: q no effect on productivity, but is observed by employers q “Cost” of economics major varies Mike Shor 13

Screening n Education as a signaling and screening device n Is there value to an economics degree? n Imagine not: q no effect on productivity, but is observed by employers q “Cost” of economics major varies Mike Shor 13

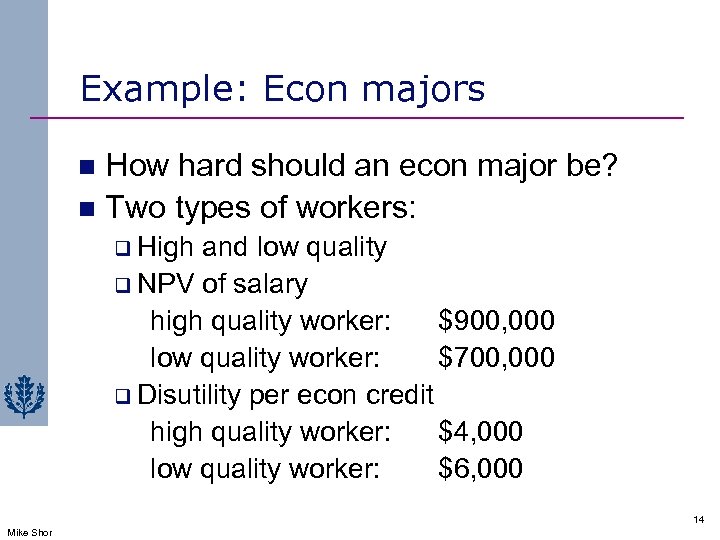

Example: Econ majors How hard should an econ major be? n Two types of workers: n q High and low quality q NPV of salary high quality worker: $900, 000 low quality worker: $700, 000 q Disutility per econ credit high quality worker: $4, 000 low quality worker: $6, 000 14 Mike Shor

Example: Econ majors How hard should an econ major be? n Two types of workers: n q High and low quality q NPV of salary high quality worker: $900, 000 low quality worker: $700, 000 q Disutility per econ credit high quality worker: $4, 000 low quality worker: $6, 000 14 Mike Shor

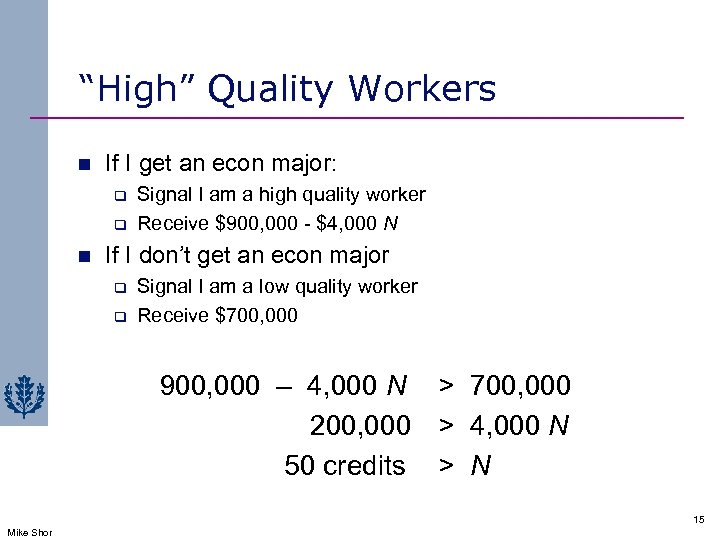

“High” Quality Workers n If I get an econ major: q q n Signal I am a high quality worker Receive $900, 000 - $4, 000 N If I don’t get an econ major q q Signal I am a low quality worker Receive $700, 000 900, 000 – 4, 000 N > 700, 000 200, 000 > 4, 000 N 50 credits > N 15 Mike Shor

“High” Quality Workers n If I get an econ major: q q n Signal I am a high quality worker Receive $900, 000 - $4, 000 N If I don’t get an econ major q q Signal I am a low quality worker Receive $700, 000 900, 000 – 4, 000 N > 700, 000 200, 000 > 4, 000 N 50 credits > N 15 Mike Shor

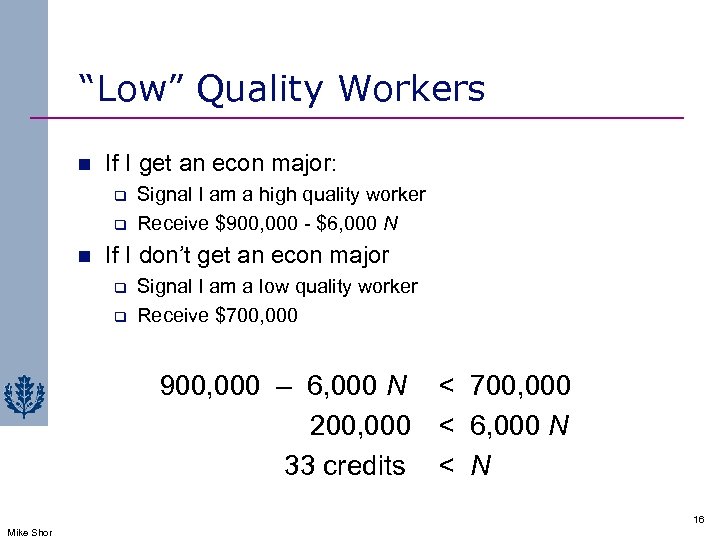

“Low” Quality Workers n If I get an econ major: q q n Signal I am a high quality worker Receive $900, 000 - $6, 000 N If I don’t get an econ major q q Signal I am a low quality worker Receive $700, 000 900, 000 – 6, 000 N < 700, 000 200, 000 < 6, 000 N 33 credits < N 16 Mike Shor

“Low” Quality Workers n If I get an econ major: q q n Signal I am a high quality worker Receive $900, 000 - $6, 000 N If I don’t get an econ major q q Signal I am a low quality worker Receive $700, 000 900, 000 – 6, 000 N < 700, 000 200, 000 < 6, 000 N 33 credits < N 16 Mike Shor

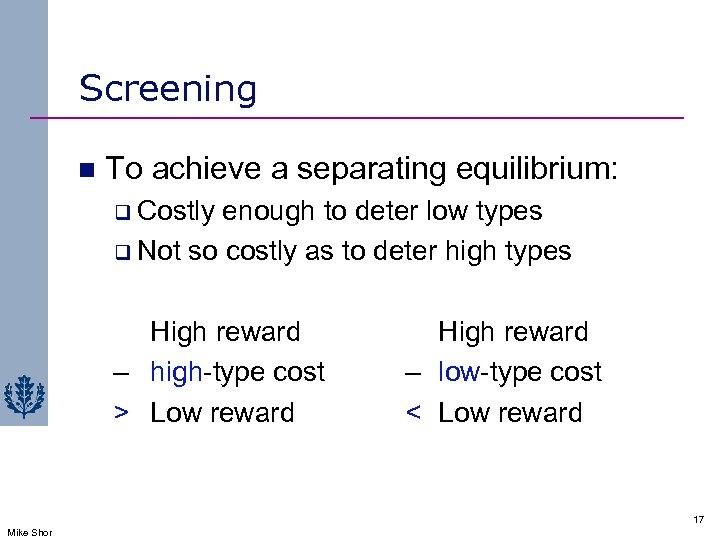

Screening n To achieve a separating equilibrium: q Costly enough to deter low types q Not so costly as to deter high types High reward – high-type cost > Low reward High reward – low-type cost < Low reward 17 Mike Shor

Screening n To achieve a separating equilibrium: q Costly enough to deter low types q Not so costly as to deter high types High reward – high-type cost > Low reward High reward – low-type cost < Low reward 17 Mike Shor

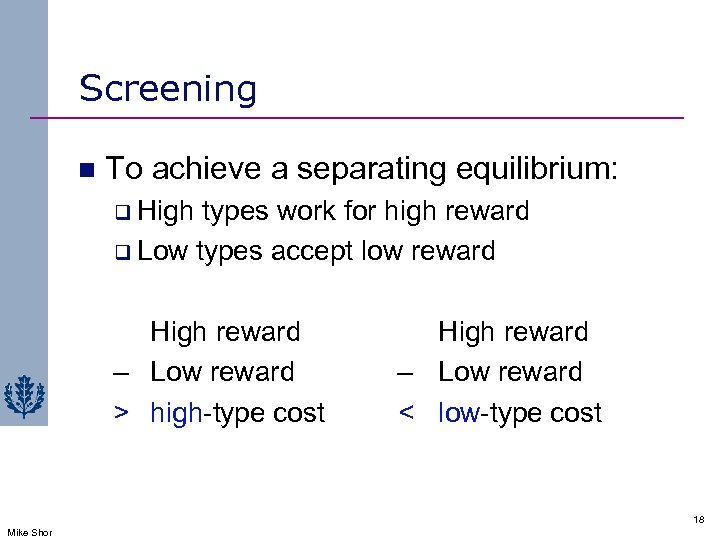

Screening n To achieve a separating equilibrium: q High types work for high reward q Low types accept low reward High reward – Low reward > high-type cost High reward – Low reward < low-type cost 18 Mike Shor

Screening n To achieve a separating equilibrium: q High types work for high reward q Low types accept low reward High reward – Low reward > high-type cost High reward – Low reward < low-type cost 18 Mike Shor

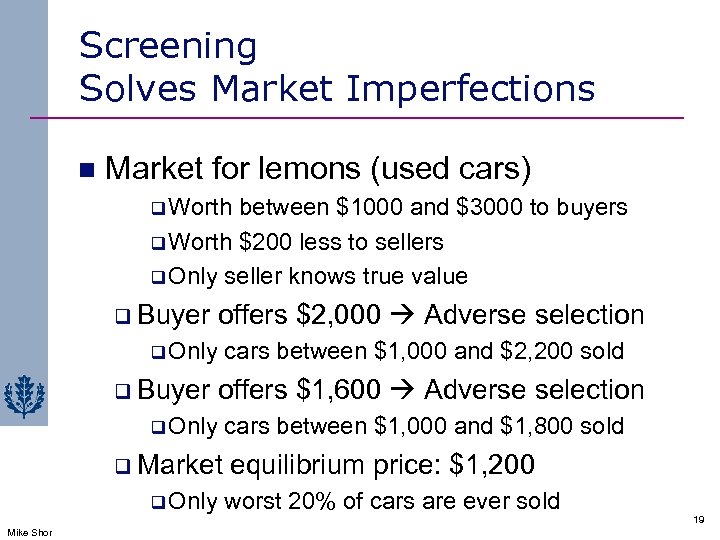

Screening Solves Market Imperfections n Market for lemons (used cars) q Worth between $1000 and $3000 to buyers q Worth $200 less to sellers q Only seller knows true value q Buyer offers $2, 000 Adverse selection q Only q Buyer cars between $1, 000 and $2, 200 sold offers $1, 600 Adverse selection q Only q Market q Only cars between $1, 000 and $1, 800 sold equilibrium price: $1, 200 worst 20% of cars are ever sold 19 Mike Shor

Screening Solves Market Imperfections n Market for lemons (used cars) q Worth between $1000 and $3000 to buyers q Worth $200 less to sellers q Only seller knows true value q Buyer offers $2, 000 Adverse selection q Only q Buyer cars between $1, 000 and $2, 200 sold offers $1, 600 Adverse selection q Only q Market q Only cars between $1, 000 and $1, 800 sold equilibrium price: $1, 200 worst 20% of cars are ever sold 19 Mike Shor

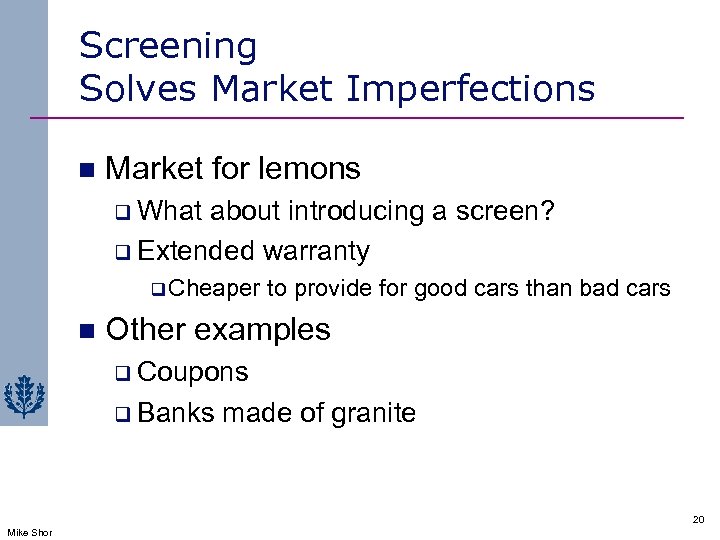

Screening Solves Market Imperfections n Market for lemons q What about introducing a screen? q Extended warranty q Cheaper n to provide for good cars than bad cars Other examples q Coupons q Banks made of granite 20 Mike Shor

Screening Solves Market Imperfections n Market for lemons q What about introducing a screen? q Extended warranty q Cheaper n to provide for good cars than bad cars Other examples q Coupons q Banks made of granite 20 Mike Shor

Hiding from Signals n The opportunity to signal may prevent some types from hiding their characteristics n Examples: q Financial disclosures q GPA on résumé q Taking classes pass / fail 21 Mike Shor

Hiding from Signals n The opportunity to signal may prevent some types from hiding their characteristics n Examples: q Financial disclosures q GPA on résumé q Taking classes pass / fail 21 Mike Shor

Hiding from Signals n Suppose students can take a course pass/fail or for a letter grade. n An A student should signal her abilities by taking the course for a letter grade – separating herself from the population of B’s and C’s. n This leaves B’s and C’s taking the course pass/fail. Now, B students have incentive to take the course for a letter grade to separate from C’s. n Ultimately, only C students take the course pass/fail. n If employers are rational – will know how to read pass/fail grades. C students cannot hide! 22 Mike Shor

Hiding from Signals n Suppose students can take a course pass/fail or for a letter grade. n An A student should signal her abilities by taking the course for a letter grade – separating herself from the population of B’s and C’s. n This leaves B’s and C’s taking the course pass/fail. Now, B students have incentive to take the course for a letter grade to separate from C’s. n Ultimately, only C students take the course pass/fail. n If employers are rational – will know how to read pass/fail grades. C students cannot hide! 22 Mike Shor

Summary n Enticing high effort is hard work q Leakages q Global vs. individual incentives q Rewarding the right people n Screening q Identify unobservable cost differences q Exploit them (carefully) 23 Mike Shor

Summary n Enticing high effort is hard work q Leakages q Global vs. individual incentives q Rewarding the right people n Screening q Identify unobservable cost differences q Exploit them (carefully) 23 Mike Shor