финансы.pptx

- Количество слайдов: 12

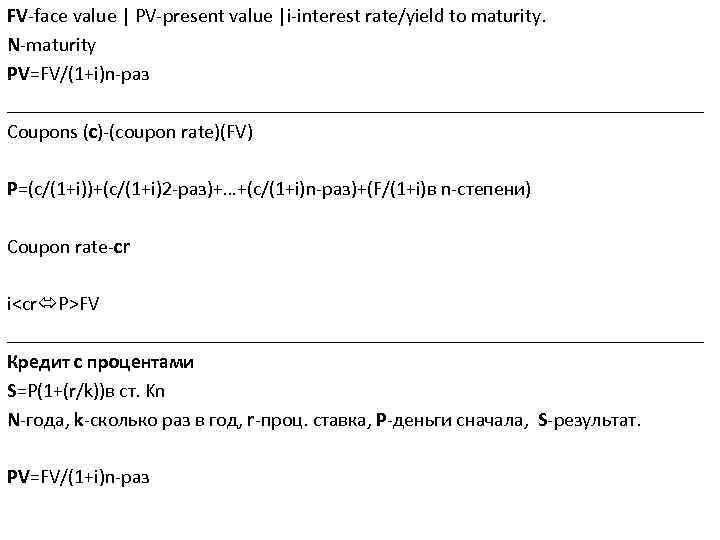

FV-face value | PV-present value |i-interest rate/yield to maturity. N-maturity PV=FV/(1+i)n-раз ___________________________________ Coupons (c)-(coupon rate)(FV) P=(c/(1+i))+(c/(1+i)2 -раз)+…+(c/(1+i)n-раз)+(F/(1+i)в n-степени) Coupon rate-cr i

FV-face value | PV-present value |i-interest rate/yield to maturity. N-maturity PV=FV/(1+i)n-раз ___________________________________ Coupons (c)-(coupon rate)(FV) P=(c/(1+i))+(c/(1+i)2 -раз)+…+(c/(1+i)n-раз)+(F/(1+i)в n-степени) Coupon rate-cr i

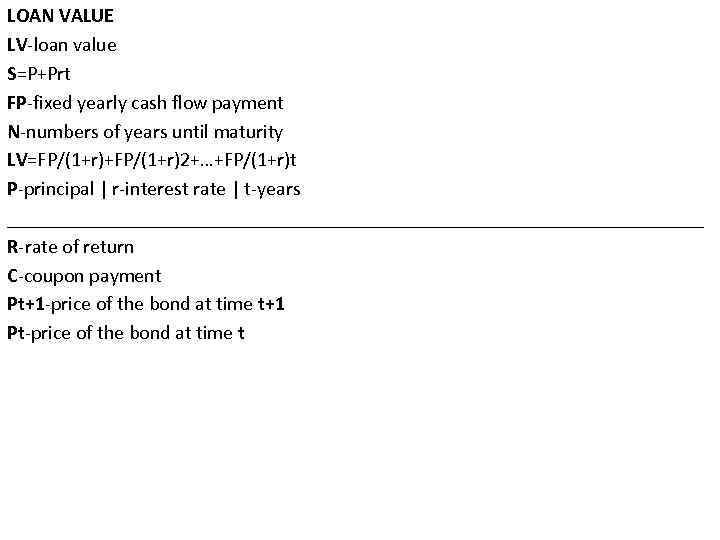

LOAN VALUE LV-loan value S=P+Prt FP-fixed yearly cash flow payment N-numbers of years until maturity LV=FP/(1+r)+FP/(1+r)2+…+FP/(1+r)t P-principal | r-interest rate | t-years ___________________________________ R-rate of return C-coupon payment Pt+1 -price of the bond at time t+1 Pt-price of the bond at time t

LOAN VALUE LV-loan value S=P+Prt FP-fixed yearly cash flow payment N-numbers of years until maturity LV=FP/(1+r)+FP/(1+r)2+…+FP/(1+r)t P-principal | r-interest rate | t-years ___________________________________ R-rate of return C-coupon payment Pt+1 -price of the bond at time t+1 Pt-price of the bond at time t

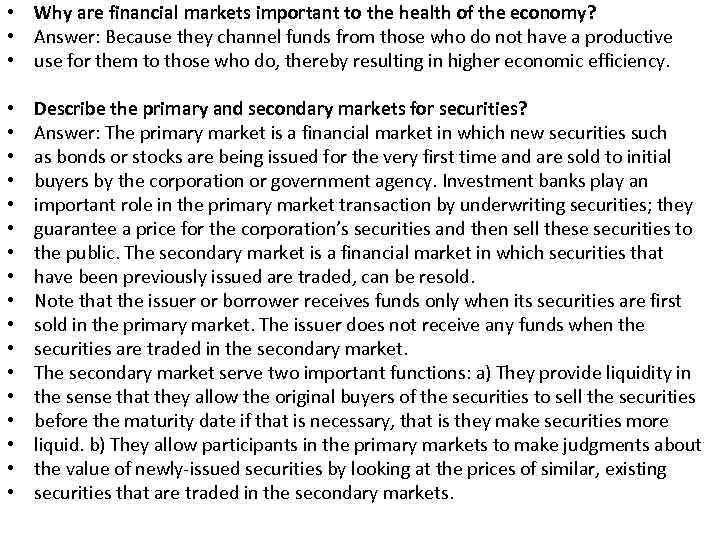

• Why are financial markets important to the health of the economy? • Answer: Because they channel funds from those who do not have a productive • use for them to those who do, thereby resulting in higher economic efficiency. • • • • • Describe the primary and secondary markets for securities? Answer: The primary market is a financial market in which new securities such as bonds or stocks are being issued for the very first time and are sold to initial buyers by the corporation or government agency. Investment banks play an important role in the primary market transaction by underwriting securities; they guarantee a price for the corporation’s securities and then sell these securities to the public. The secondary market is a financial market in which securities that have been previously issued are traded, can be resold. Note that the issuer or borrower receives funds only when its securities are first sold in the primary market. The issuer does not receive any funds when the securities are traded in the secondary market. The secondary market serve two important functions: a) They provide liquidity in the sense that they allow the original buyers of the securities to sell the securities before the maturity date if that is necessary, that is they make securities more liquid. b) They allow participants in the primary markets to make judgments about the value of newly-issued securities by looking at the prices of similar, existing securities that are traded in the secondary markets.

• Why are financial markets important to the health of the economy? • Answer: Because they channel funds from those who do not have a productive • use for them to those who do, thereby resulting in higher economic efficiency. • • • • • Describe the primary and secondary markets for securities? Answer: The primary market is a financial market in which new securities such as bonds or stocks are being issued for the very first time and are sold to initial buyers by the corporation or government agency. Investment banks play an important role in the primary market transaction by underwriting securities; they guarantee a price for the corporation’s securities and then sell these securities to the public. The secondary market is a financial market in which securities that have been previously issued are traded, can be resold. Note that the issuer or borrower receives funds only when its securities are first sold in the primary market. The issuer does not receive any funds when the securities are traded in the secondary market. The secondary market serve two important functions: a) They provide liquidity in the sense that they allow the original buyers of the securities to sell the securities before the maturity date if that is necessary, that is they make securities more liquid. b) They allow participants in the primary markets to make judgments about the value of newly-issued securities by looking at the prices of similar, existing securities that are traded in the secondary markets.

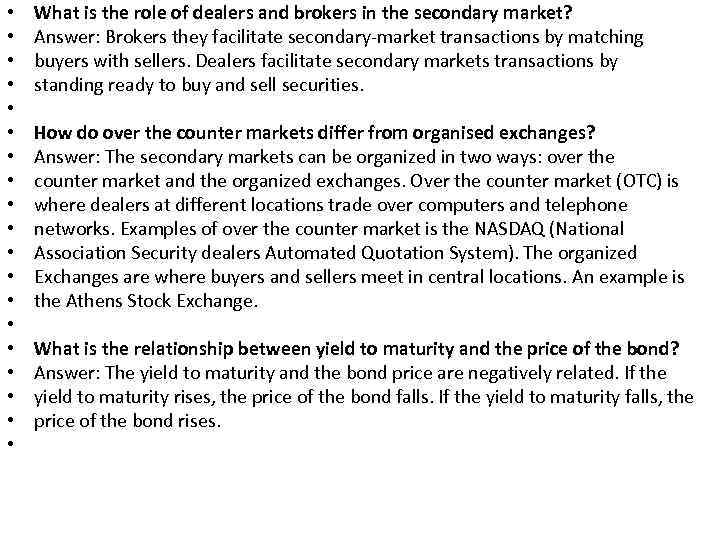

• • • • • What is the role of dealers and brokers in the secondary market? Answer: Brokers they facilitate secondary-market transactions by matching buyers with sellers. Dealers facilitate secondary markets transactions by standing ready to buy and sell securities. How do over the counter markets differ from organised exchanges? Answer: The secondary markets can be organized in two ways: over the counter market and the organized exchanges. Over the counter market (OTC) is where dealers at different locations trade over computers and telephone networks. Examples of over the counter market is the NASDAQ (National Association Security dealers Automated Quotation System). The organized Exchanges are where buyers and sellers meet in central locations. An example is the Athens Stock Exchange. What is the relationship between yield to maturity and the price of the bond? Answer: The yield to maturity and the bond price are negatively related. If the yield to maturity rises, the price of the bond falls. If the yield to maturity falls, the price of the bond rises.

• • • • • What is the role of dealers and brokers in the secondary market? Answer: Brokers they facilitate secondary-market transactions by matching buyers with sellers. Dealers facilitate secondary markets transactions by standing ready to buy and sell securities. How do over the counter markets differ from organised exchanges? Answer: The secondary markets can be organized in two ways: over the counter market and the organized exchanges. Over the counter market (OTC) is where dealers at different locations trade over computers and telephone networks. Examples of over the counter market is the NASDAQ (National Association Security dealers Automated Quotation System). The organized Exchanges are where buyers and sellers meet in central locations. An example is the Athens Stock Exchange. What is the relationship between yield to maturity and the price of the bond? Answer: The yield to maturity and the bond price are negatively related. If the yield to maturity rises, the price of the bond falls. If the yield to maturity falls, the price of the bond rises.

• • • • • Describe what it means if a bond sells at a discount, a premium, and at its face value. Answer: 1) A bond selling when the bond price is smaller than the at discount face value. It implies that the yield of maturity is greater than the coupon rate. 2) A bond selling at Par value (at Face Value) when the coupon rate is equal to the yield to maturity. 3) A bond selling when the bond price is greater than the at premium face value. It implies that the yield to maturity is smaller than the coupon rate. A zero coupon bond has a par value (face value) of 1000 Euros and matures in 20 years. Investors require a 10% annual return on these bonds. For what price should the bond sell? Answer: Zero coupon bonds do not pay any interest (no coupon payments)

• • • • • Describe what it means if a bond sells at a discount, a premium, and at its face value. Answer: 1) A bond selling when the bond price is smaller than the at discount face value. It implies that the yield of maturity is greater than the coupon rate. 2) A bond selling at Par value (at Face Value) when the coupon rate is equal to the yield to maturity. 3) A bond selling when the bond price is greater than the at premium face value. It implies that the yield to maturity is smaller than the coupon rate. A zero coupon bond has a par value (face value) of 1000 Euros and matures in 20 years. Investors require a 10% annual return on these bonds. For what price should the bond sell? Answer: Zero coupon bonds do not pay any interest (no coupon payments)

• What is the difference between a simple loan and a fixed-payment loan? • Answer: In the simple loan the lender provides the borrower with the principal • that must be repaid to the lender at the maturity date along with an additional • payment for the interest. Fixed-Payment Loans are loans where the loan • principal and interest are repaid in several payments, often monthly, in equal • Euro amounts over the loan e. g. . car loans or home mortgages. Basically on a • fixed-payment loan the borrower makes the same payment to the bank every • month until the maturity date when the loan will be completely paid off. To • calculate the yield to maturity for a fixed payment loan we equates today’s value • with the sum of the present value of all cash flows. • A simple loan when a principal P was provided by the lender to the borrower with • a simple interest rate rfor t years can be calculated as follows: S = P+P r t

• What is the difference between a simple loan and a fixed-payment loan? • Answer: In the simple loan the lender provides the borrower with the principal • that must be repaid to the lender at the maturity date along with an additional • payment for the interest. Fixed-Payment Loans are loans where the loan • principal and interest are repaid in several payments, often monthly, in equal • Euro amounts over the loan e. g. . car loans or home mortgages. Basically on a • fixed-payment loan the borrower makes the same payment to the bank every • month until the maturity date when the loan will be completely paid off. To • calculate the yield to maturity for a fixed payment loan we equates today’s value • with the sum of the present value of all cash flows. • A simple loan when a principal P was provided by the lender to the borrower with • a simple interest rate rfor t years can be calculated as follows: S = P+P r t

1. P 0=D 0(1+g)/ke-g Where P 0= the current price of the share. The zero subscript refers to time period zero or the present value. D 0= the most recent dividend paid g=the expected growth rate in dividends ke= the required return on investments in equity. 2. Compute the price of a share of stock that pays a 1 Euro per year dividend and that you expect to be able to sell in one year for 15 Euro, assuming you require a 14% return. P 0=Div 1/1+ke+P 1/1+ke=(1/(1+0, 14))+(15/(1+0, 14)) 3. Price=(P/E)*E Where P/E: price earning ratio E: earnings per share • •

1. P 0=D 0(1+g)/ke-g Where P 0= the current price of the share. The zero subscript refers to time period zero or the present value. D 0= the most recent dividend paid g=the expected growth rate in dividends ke= the required return on investments in equity. 2. Compute the price of a share of stock that pays a 1 Euro per year dividend and that you expect to be able to sell in one year for 15 Euro, assuming you require a 14% return. P 0=Div 1/1+ke+P 1/1+ke=(1/(1+0, 14))+(15/(1+0, 14)) 3. Price=(P/E)*E Where P/E: price earning ratio E: earnings per share • •

26. Give the definition of a stock. Describe the differences between common and preferred stocks. Answer: A stock represents a share of ownership in a corporation. It is a security that is a claim on the earnings and assets of the corporation. We have two types of stocks the common stock (ordinary share) and preferred stock: Common stockholders vote, receive dividends. Preferred stockholders receive fixed dividends that never changes and do not usually have the right to vote. Preferred stockholders have a priority over the claims of common shareholders but after that of creditors such as bondholders. 27. Why companies issue shares? Answer: Issuing a share and selling it to the public is a way for corporation to raise funds which can be used to buy production facilities and equipment 28. What is the potential income stemming from owing a share? Answer: Investors can earn a return from a share as follows: Either the price of the share rises over time or the firm pays the shareholder dividends. Frequently, investors earn a return from both sources. 29. What distinguish ordinary shares from bonds? Answer: Ordinary shares do not mature, do not pay a fixed amount every period, and normally give holders the right to vote on management issues. Also stocks are riskier than bonds when the firm is in trouble, the returns to investors are less assured because dividends can be easily changed, and share price increases are not guaranteed. Despite these risks it is possible to make a great deal of money by investing in shares, whereas that is very unlikely by investing in bonds. 30. What is a stock market index? Give two examples of stock market indexes. Answer: Stock market indexes are frequently used to monitor the behaviour of a group of shares. Two major indexes are: Dow Jones Industrial Average and Standard &Poor’s 500.

26. Give the definition of a stock. Describe the differences between common and preferred stocks. Answer: A stock represents a share of ownership in a corporation. It is a security that is a claim on the earnings and assets of the corporation. We have two types of stocks the common stock (ordinary share) and preferred stock: Common stockholders vote, receive dividends. Preferred stockholders receive fixed dividends that never changes and do not usually have the right to vote. Preferred stockholders have a priority over the claims of common shareholders but after that of creditors such as bondholders. 27. Why companies issue shares? Answer: Issuing a share and selling it to the public is a way for corporation to raise funds which can be used to buy production facilities and equipment 28. What is the potential income stemming from owing a share? Answer: Investors can earn a return from a share as follows: Either the price of the share rises over time or the firm pays the shareholder dividends. Frequently, investors earn a return from both sources. 29. What distinguish ordinary shares from bonds? Answer: Ordinary shares do not mature, do not pay a fixed amount every period, and normally give holders the right to vote on management issues. Also stocks are riskier than bonds when the firm is in trouble, the returns to investors are less assured because dividends can be easily changed, and share price increases are not guaranteed. Despite these risks it is possible to make a great deal of money by investing in shares, whereas that is very unlikely by investing in bonds. 30. What is a stock market index? Give two examples of stock market indexes. Answer: Stock market indexes are frequently used to monitor the behaviour of a group of shares. Two major indexes are: Dow Jones Industrial Average and Standard &Poor’s 500.

38. Which one of the following is a riskier asset: a corporate bond, a share or a Government bond? Justify your answer. Answer: The riskier asset is the share. Shareholders have lower priority than the bondholders when the firm is in trouble. The corporation must pay all its debt holders before it pays its equity holders. Also the returns to investors are less assured because dividends can be easily changed and share price increases are not guaranteed. Comparing with Government bonds, a share is more risky since the Government can print money to pay off the debt. 39. What are three characteristics of the money market securities? Answer: The money market securities have three characteristics in common: They are usually sold in large denominations They have low default risk. They mature in one year or less. 40. What is the purpose of money markets? Answer: The money market is an ideal place for a firm or financial institution to “warehouse” excess funds for a short period of time. Similarly the money market provide a low cost source of funds to firm, the government that need funds for a short period of time. Returns are low because of low risk and high liquidity. 41. Which are the participants in the money market? Answer: Federal Reserve System Business Commercial Banks Insurance Companies Investment and Finance Companies 42. Give three money market securities and give a short description for each. Answer: Three money markets securities are the below: Treasury Bills (T-Bills): have 28 -day maturities through 12 - month maturities. Government bills issued by the Greek government have a maturity date 3, 6 or 12 months. Government bills are basically a way for the government uses to raise money from the public. Repurchase Agreements (repo): A firm sells government securities, but agrees to buy them back at a certain date (usually 3– 14 days later) for a certain price. Eurodollars: represent Dollar denominated deposits held in foreign banks (U. S. currency that is held in foreign banks).

38. Which one of the following is a riskier asset: a corporate bond, a share or a Government bond? Justify your answer. Answer: The riskier asset is the share. Shareholders have lower priority than the bondholders when the firm is in trouble. The corporation must pay all its debt holders before it pays its equity holders. Also the returns to investors are less assured because dividends can be easily changed and share price increases are not guaranteed. Comparing with Government bonds, a share is more risky since the Government can print money to pay off the debt. 39. What are three characteristics of the money market securities? Answer: The money market securities have three characteristics in common: They are usually sold in large denominations They have low default risk. They mature in one year or less. 40. What is the purpose of money markets? Answer: The money market is an ideal place for a firm or financial institution to “warehouse” excess funds for a short period of time. Similarly the money market provide a low cost source of funds to firm, the government that need funds for a short period of time. Returns are low because of low risk and high liquidity. 41. Which are the participants in the money market? Answer: Federal Reserve System Business Commercial Banks Insurance Companies Investment and Finance Companies 42. Give three money market securities and give a short description for each. Answer: Three money markets securities are the below: Treasury Bills (T-Bills): have 28 -day maturities through 12 - month maturities. Government bills issued by the Greek government have a maturity date 3, 6 or 12 months. Government bills are basically a way for the government uses to raise money from the public. Repurchase Agreements (repo): A firm sells government securities, but agrees to buy them back at a certain date (usually 3– 14 days later) for a certain price. Eurodollars: represent Dollar denominated deposits held in foreign banks (U. S. currency that is held in foreign banks).

43. Define the foreign exchange rates. Answer: Foreign exchange rates are the price of one country’s currency in terms of another’s. 44. When the currency of your country appreciates relative to another country what is happening to your country ‘s good prices abroad and what to the foreign good prices in your country? What are the effects of currency appreciation? Answer: When the currency of your country appreciates relative to another country, your country's goods prices rises abroad and foreign goods prices fall in your country. The effects of currency appreciations are: Makes domestic businesses less competitive Benefits domestic consumers (you). 45. State the Law of one Price. Answer: The Law of one Price: If two countries produce an identical good, and transportation costs and trade barriers are very low, the price of the good should be the same throughout the world no matter which country produces it. 46. What does theory of Power Purchasing Parity (PPP) states? What are the problems with the PPP. Answer: The theory of Power Purchasing Parity states that exchange rates between any two currencies will adjust to reflect changes in the price levels of the two countries. Namely if one country’s price level rises relative to another’s, its currency should depreciate and the other country’s currency should appreciate. Problems with the PPP are Many goods and services are not traded All goods are not identical in both countries 47. A country is always worse off when its currency is weak (fall in value). Is this statement true, false? Explain your answer. Answer: False. Although a weak currency has the negative effect of making it more expensive to buy foreign goods or to travel abroad, it may help domestic industry. Domestic goods become cheaper relative to foreign goods, Foreign goods become more expensive hence foreign good are less competitive in the domestic market. The country’s which the currency depreciated its good become cheaper abroad The demand for domestically produced goods increases.

43. Define the foreign exchange rates. Answer: Foreign exchange rates are the price of one country’s currency in terms of another’s. 44. When the currency of your country appreciates relative to another country what is happening to your country ‘s good prices abroad and what to the foreign good prices in your country? What are the effects of currency appreciation? Answer: When the currency of your country appreciates relative to another country, your country's goods prices rises abroad and foreign goods prices fall in your country. The effects of currency appreciations are: Makes domestic businesses less competitive Benefits domestic consumers (you). 45. State the Law of one Price. Answer: The Law of one Price: If two countries produce an identical good, and transportation costs and trade barriers are very low, the price of the good should be the same throughout the world no matter which country produces it. 46. What does theory of Power Purchasing Parity (PPP) states? What are the problems with the PPP. Answer: The theory of Power Purchasing Parity states that exchange rates between any two currencies will adjust to reflect changes in the price levels of the two countries. Namely if one country’s price level rises relative to another’s, its currency should depreciate and the other country’s currency should appreciate. Problems with the PPP are Many goods and services are not traded All goods are not identical in both countries 47. A country is always worse off when its currency is weak (fall in value). Is this statement true, false? Explain your answer. Answer: False. Although a weak currency has the negative effect of making it more expensive to buy foreign goods or to travel abroad, it may help domestic industry. Domestic goods become cheaper relative to foreign goods, Foreign goods become more expensive hence foreign good are less competitive in the domestic market. The country’s which the currency depreciated its good become cheaper abroad The demand for domestically produced goods increases.

54. Explain what we mean with the term liabilities of a bank. Determine liabilities of the bank and give a small description for each. Answer: Liabilities are the source of funds for a bank. Liabilities of the bank Deposits: Checkable deposit are bank accounts that allow the owner to write checks to third parties. Nontransactions deposits. Owners cannot write checks and the interest paid on these deposit are higher than those on checkable deposits. (i. e. savings account and time deposits) Borrowings: Banks also obtain funds from the Central Bank , other banks and corporations Bank capital: The difference between total assets and liabilities. Bank capital is raised by selling new stock. 55. Determine assets of the bank and give a small description for each. Answer: Asset of a bank is the use of funds. Assets of the bank include Loans (student loans, mortgage loans) Cash reserves: All banks hold some of the funds they acquire as deposits in an account at the Central Bank Deposits at other banks, Cash items in process of Collection, Securities Physical assets (computer, buildings) 56. What is the asset transformation? Give an example that describes this. Answer: The bank sells liabilities and uses this proceeds to acquire assets. An example is that the bank assets deposits and use the proceeds, the funds, to make a loan to another customer. 57. How do the banks make profit? Answer: By engaging in asset transformation the bank make profit by charging a higher interest rate on their assets (e. g. loans) comparing with the interest rate that they pay for their liabilities (e. g. deposits). 58. What are the basic principles of bank management? Answer: A bank manager has four basic concerns. Liquidity management: making sure that the banks has enough cash to cover depositor’s request for withdrawals (deposit outflows) Asset management: requiring assets with the highest return and lower risk Liability management: getting funds with the lowest cost Capital adequacy management: having enough capital while still providing decent returns to shareholders.

54. Explain what we mean with the term liabilities of a bank. Determine liabilities of the bank and give a small description for each. Answer: Liabilities are the source of funds for a bank. Liabilities of the bank Deposits: Checkable deposit are bank accounts that allow the owner to write checks to third parties. Nontransactions deposits. Owners cannot write checks and the interest paid on these deposit are higher than those on checkable deposits. (i. e. savings account and time deposits) Borrowings: Banks also obtain funds from the Central Bank , other banks and corporations Bank capital: The difference between total assets and liabilities. Bank capital is raised by selling new stock. 55. Determine assets of the bank and give a small description for each. Answer: Asset of a bank is the use of funds. Assets of the bank include Loans (student loans, mortgage loans) Cash reserves: All banks hold some of the funds they acquire as deposits in an account at the Central Bank Deposits at other banks, Cash items in process of Collection, Securities Physical assets (computer, buildings) 56. What is the asset transformation? Give an example that describes this. Answer: The bank sells liabilities and uses this proceeds to acquire assets. An example is that the bank assets deposits and use the proceeds, the funds, to make a loan to another customer. 57. How do the banks make profit? Answer: By engaging in asset transformation the bank make profit by charging a higher interest rate on their assets (e. g. loans) comparing with the interest rate that they pay for their liabilities (e. g. deposits). 58. What are the basic principles of bank management? Answer: A bank manager has four basic concerns. Liquidity management: making sure that the banks has enough cash to cover depositor’s request for withdrawals (deposit outflows) Asset management: requiring assets with the highest return and lower risk Liability management: getting funds with the lowest cost Capital adequacy management: having enough capital while still providing decent returns to shareholders.

59. What are the four basic principles for the bank asset management? Answer: Finding borrowers who will pay high interest rates but who are unlikely to default (unlikely not to repay back their loans) Finding securities with high returns and low risk Diversifying banks assets holdings to minimize risk: making different types of loans offers protection when there are losses in one type of loan. Holding some liquid assets e. g. excess reserves to protect against deposits outflows (cash withdrawals). 60. If a bank is falling short of meeting its capital requirements by 1 million Euros, what four things can it do to face the situation? Answer: It can raise 1 million Euros of capital by issuing new share. Can borrow money from the central bank Ιt can cut its dividend payments by 1 million Euros, thereby increasing its retained earnings by 1 million Euros. It can decrease its loans so that the amount of its capital relative to its assets increases, thereby meeting the capital requirements. 61. Explain what is a debit card and credit card. Answer: Debit card: An electronic card issued by the banks or other business. This card immediately deducts money from the card holder’s account. You must have funds in your account or an agreed overdraft to cover the transactions. Credit card: It is not linked to your current account and is credit facility is to allow you to buy things immediately up to a pre-arranged limit but you pay them back at a later stage. The cost of the purchase is added to your credit card account which you must repay back usually by the end of each month.

59. What are the four basic principles for the bank asset management? Answer: Finding borrowers who will pay high interest rates but who are unlikely to default (unlikely not to repay back their loans) Finding securities with high returns and low risk Diversifying banks assets holdings to minimize risk: making different types of loans offers protection when there are losses in one type of loan. Holding some liquid assets e. g. excess reserves to protect against deposits outflows (cash withdrawals). 60. If a bank is falling short of meeting its capital requirements by 1 million Euros, what four things can it do to face the situation? Answer: It can raise 1 million Euros of capital by issuing new share. Can borrow money from the central bank Ιt can cut its dividend payments by 1 million Euros, thereby increasing its retained earnings by 1 million Euros. It can decrease its loans so that the amount of its capital relative to its assets increases, thereby meeting the capital requirements. 61. Explain what is a debit card and credit card. Answer: Debit card: An electronic card issued by the banks or other business. This card immediately deducts money from the card holder’s account. You must have funds in your account or an agreed overdraft to cover the transactions. Credit card: It is not linked to your current account and is credit facility is to allow you to buy things immediately up to a pre-arranged limit but you pay them back at a later stage. The cost of the purchase is added to your credit card account which you must repay back usually by the end of each month.