Futures Markets, Forward contracts - копия.ppt

- Количество слайдов: 70

FUTURES MARKETS DERIVATIVES OPTIONS Alexandrina Yurjevna Skorokhod associate professor Chair - Corporate finance and estimation of business a. skor 1@yandex. ru

FUTURES MARKETS DERIVATIVES OPTIONS Alexandrina Yurjevna Skorokhod associate professor Chair - Corporate finance and estimation of business a. skor 1@yandex. ru

Aims of the course: To Provide an overview of various Derivative Products; To Understand the specifics of OTC and the Exchange-Traded Markets; To discuss a way in which exchanges organize the trading of futures contracts and options; To Know what is Hedging, Speculation and Arbitrage at Derivative Markets; To Learn Important Terminology.

Aims of the course: To Provide an overview of various Derivative Products; To Understand the specifics of OTC and the Exchange-Traded Markets; To discuss a way in which exchanges organize the trading of futures contracts and options; To Know what is Hedging, Speculation and Arbitrage at Derivative Markets; To Learn Important Terminology.

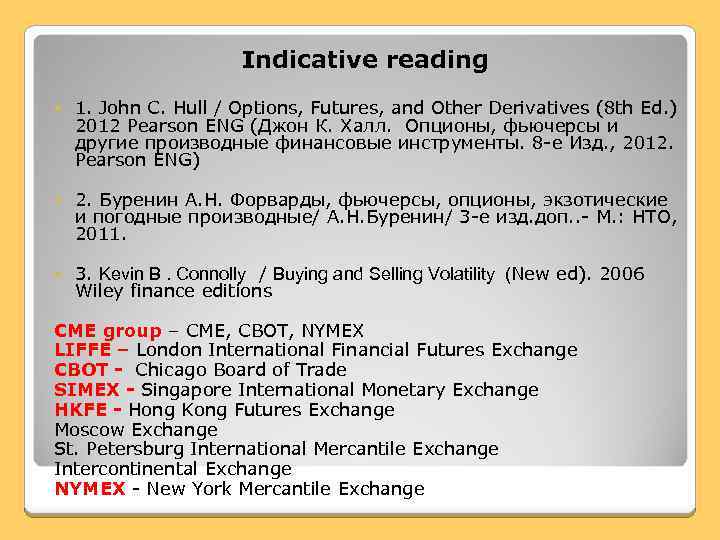

Indicative reading 1. John C. Hull / Options, Futures, and Other Derivatives (8 th Ed. ) 2012 Pearson ENG (Джон К. Халл. Опционы, фьючерсы и другие производные финансовые инструменты. 8 -е Изд. , 2012. Pearson ENG) 2. Буренин А. Н. Форварды, фьючерсы, опционы, экзотические и погодные производные/ А. Н. Буренин/ 3 -е изд. доп. . - М. : НТО, 2011. 3. Kevin B. Connolly / Buying and Selling Volatility (New ed). 2006 Wiley finance editions CME group – CME, CBOT, NYMEX LIFFE – London International Financial Futures Exchange CBOT - Chicago Board of Trade SIMEX - Singapore International Monetary Exchange HKFE - Hong Kong Futures Exchange Moscow Exchange St. Petersburg International Mercantile Exchange Intercontinental Exchange NYMEX - New York Mercantile Exchange

Indicative reading 1. John C. Hull / Options, Futures, and Other Derivatives (8 th Ed. ) 2012 Pearson ENG (Джон К. Халл. Опционы, фьючерсы и другие производные финансовые инструменты. 8 -е Изд. , 2012. Pearson ENG) 2. Буренин А. Н. Форварды, фьючерсы, опционы, экзотические и погодные производные/ А. Н. Буренин/ 3 -е изд. доп. . - М. : НТО, 2011. 3. Kevin B. Connolly / Buying and Selling Volatility (New ed). 2006 Wiley finance editions CME group – CME, CBOT, NYMEX LIFFE – London International Financial Futures Exchange CBOT - Chicago Board of Trade SIMEX - Singapore International Monetary Exchange HKFE - Hong Kong Futures Exchange Moscow Exchange St. Petersburg International Mercantile Exchange Intercontinental Exchange NYMEX - New York Mercantile Exchange

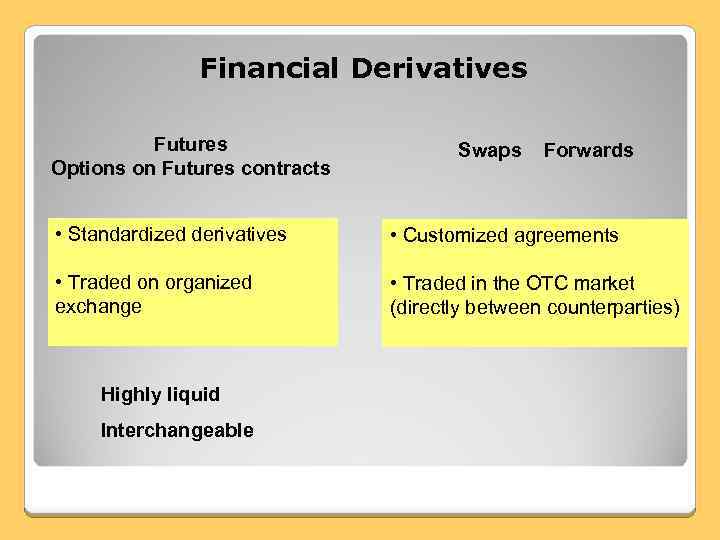

Financial Derivatives Futures Options on Futures contracts Swaps Forwards • Standardized derivatives • Customized agreements • Traded on organized exchange • Traded in the OTC market (directly between counterparties) Highly liquid Interchangeable

Financial Derivatives Futures Options on Futures contracts Swaps Forwards • Standardized derivatives • Customized agreements • Traded on organized exchange • Traded in the OTC market (directly between counterparties) Highly liquid Interchangeable

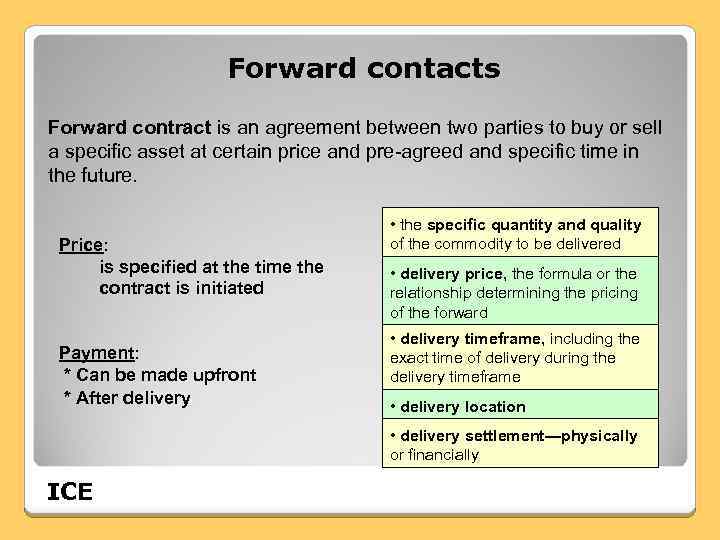

Forward contacts Forward contract is an agreement between two parties to buy or sell a specific asset at certain price and pre-agreed and specific time in the future. Price: is specified at the time the contract is initiated Payment: * Can be made upfront * After delivery • the specific quantity and quality of the commodity to be delivered • delivery price, the formula or the relationship determining the pricing of the forward • delivery timeframe, including the exact time of delivery during the delivery timeframe • delivery location • delivery settlement—physically or financially ICE

Forward contacts Forward contract is an agreement between two parties to buy or sell a specific asset at certain price and pre-agreed and specific time in the future. Price: is specified at the time the contract is initiated Payment: * Can be made upfront * After delivery • the specific quantity and quality of the commodity to be delivered • delivery price, the formula or the relationship determining the pricing of the forward • delivery timeframe, including the exact time of delivery during the delivery timeframe • delivery location • delivery settlement—physically or financially ICE

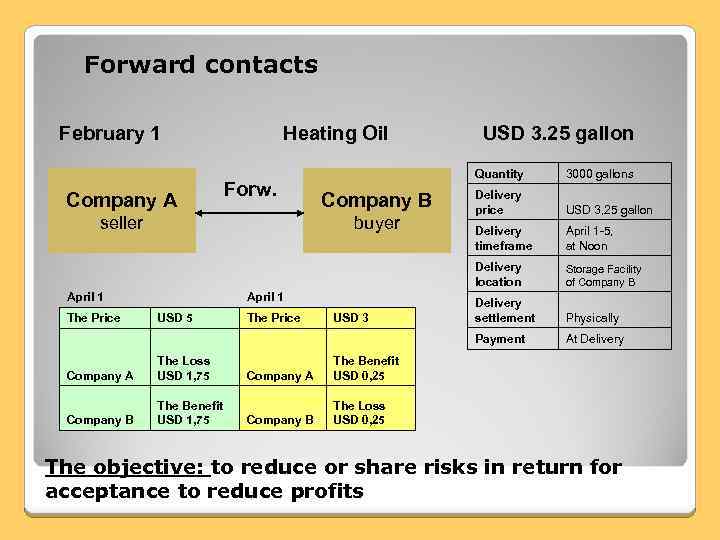

Forward contacts February 1 Heating Oil USD 3. 25 gallon seller buyer April 1 The Price Company B April 1 USD 5 Company A The Loss USD 1, 75 Company B The Benefit USD 1, 75 The Price USD 3 Company A USD 3, 25 gallon Delivery timeframe April 1 -5, at Noon Storage Facility of Company B Delivery settlement Physically At Delivery The Benefit USD 0, 25 Company B Delivery price Payment Forw. 3000 gallons Delivery location Company A Quantity The Loss USD 0, 25 The objective: to reduce or share risks in return for acceptance to reduce profits

Forward contacts February 1 Heating Oil USD 3. 25 gallon seller buyer April 1 The Price Company B April 1 USD 5 Company A The Loss USD 1, 75 Company B The Benefit USD 1, 75 The Price USD 3 Company A USD 3, 25 gallon Delivery timeframe April 1 -5, at Noon Storage Facility of Company B Delivery settlement Physically At Delivery The Benefit USD 0, 25 Company B Delivery price Payment Forw. 3000 gallons Delivery location Company A Quantity The Loss USD 0, 25 The objective: to reduce or share risks in return for acceptance to reduce profits

Futures Contracts are exchange-traded instruments where one party agrees to buy an asset at a future time for a certain price and the other party agrees to sell the asset at the same time for the same price. Trading Futures contracts The investor who agreed to buy has long futures position. The investor who agreed to sell has short futures position. If they agree on a price, the deal would be done. The price agreed to on the exchange is the current futures price for the asset. This price is determined by the laws of supply and demand.

Futures Contracts are exchange-traded instruments where one party agrees to buy an asset at a future time for a certain price and the other party agrees to sell the asset at the same time for the same price. Trading Futures contracts The investor who agreed to buy has long futures position. The investor who agreed to sell has short futures position. If they agree on a price, the deal would be done. The price agreed to on the exchange is the current futures price for the asset. This price is determined by the laws of supply and demand.

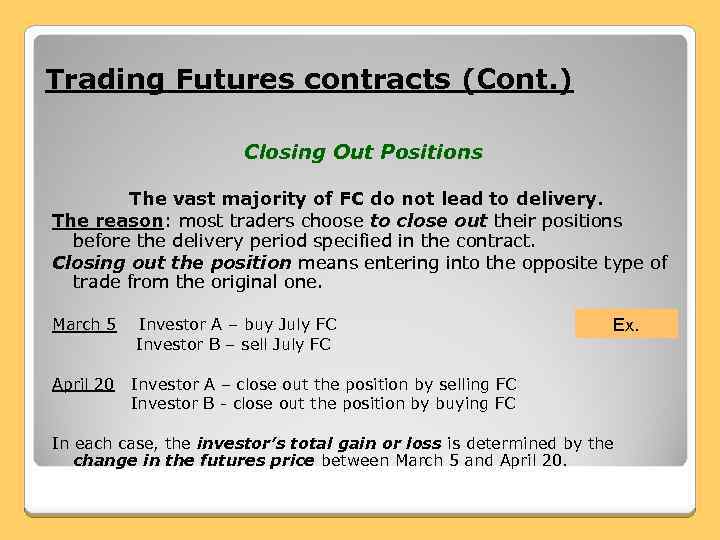

Trading Futures contracts (Cont. ) Closing Out Positions The vast majority of FC do not lead to delivery. The reason: most traders choose to close out their positions before the delivery period specified in the contract. Closing out the position means entering into the opposite type of trade from the original one. March 5 Investor A – buy July FC Investor B – sell July FC Ex. April 20 Investor A – close out the position by selling FC Investor B - close out the position by buying FC In each case, the investor’s total gain or loss is determined by the change in the futures price between March 5 and April 20.

Trading Futures contracts (Cont. ) Closing Out Positions The vast majority of FC do not lead to delivery. The reason: most traders choose to close out their positions before the delivery period specified in the contract. Closing out the position means entering into the opposite type of trade from the original one. March 5 Investor A – buy July FC Investor B – sell July FC Ex. April 20 Investor A – close out the position by selling FC Investor B - close out the position by buying FC In each case, the investor’s total gain or loss is determined by the change in the futures price between March 5 and April 20.

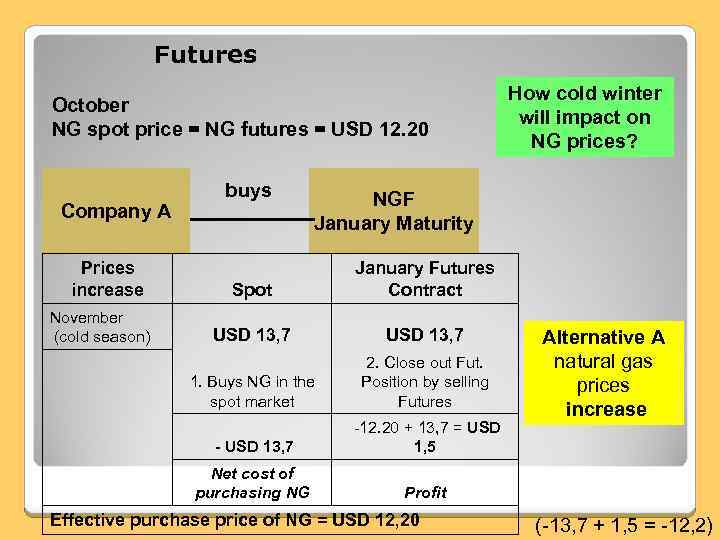

Futures October NG spot price = NG futures = USD 12. 20 Company A Prices increase buys How cold winter will impact on NG prices? NGF January Maturity Spot January Futures Contract USD 13, 7 1. Buys NG in the spot market 2. Close out Fut. Position by selling Futures - USD 13, 7 -12. 20 + 13, 7 = USD 1, 5 Net cost of purchasing NG Profit November (cold season) Effective purchase price of NG = USD 12, 20 Alternative A natural gas prices increase (-13, 7 + 1, 5 = -12, 2)

Futures October NG spot price = NG futures = USD 12. 20 Company A Prices increase buys How cold winter will impact on NG prices? NGF January Maturity Spot January Futures Contract USD 13, 7 1. Buys NG in the spot market 2. Close out Fut. Position by selling Futures - USD 13, 7 -12. 20 + 13, 7 = USD 1, 5 Net cost of purchasing NG Profit November (cold season) Effective purchase price of NG = USD 12, 20 Alternative A natural gas prices increase (-13, 7 + 1, 5 = -12, 2)

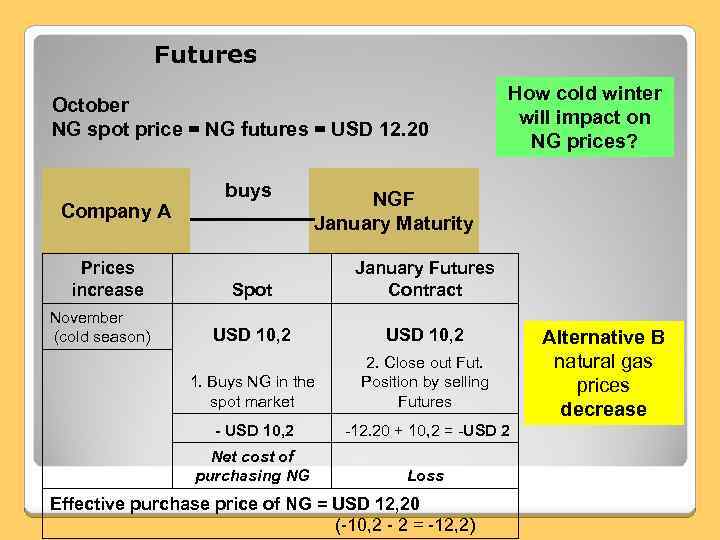

Futures October NG spot price = NG futures = USD 12. 20 Company A Prices increase buys How cold winter will impact on NG prices? NGF January Maturity Spot January Futures Contract USD 10, 2 1. Buys NG in the spot market 2. Close out Fut. Position by selling Futures - USD 10, 2 -12. 20 + 10, 2 = -USD 2 Net cost of purchasing NG Loss November (cold season) Effective purchase price of NG = USD 12, 20 (-10, 2 - 2 = -12, 2) Alternative B natural gas prices decrease

Futures October NG spot price = NG futures = USD 12. 20 Company A Prices increase buys How cold winter will impact on NG prices? NGF January Maturity Spot January Futures Contract USD 10, 2 1. Buys NG in the spot market 2. Close out Fut. Position by selling Futures - USD 10, 2 -12. 20 + 10, 2 = -USD 2 Net cost of purchasing NG Loss November (cold season) Effective purchase price of NG = USD 12, 20 (-10, 2 - 2 = -12, 2) Alternative B natural gas prices decrease

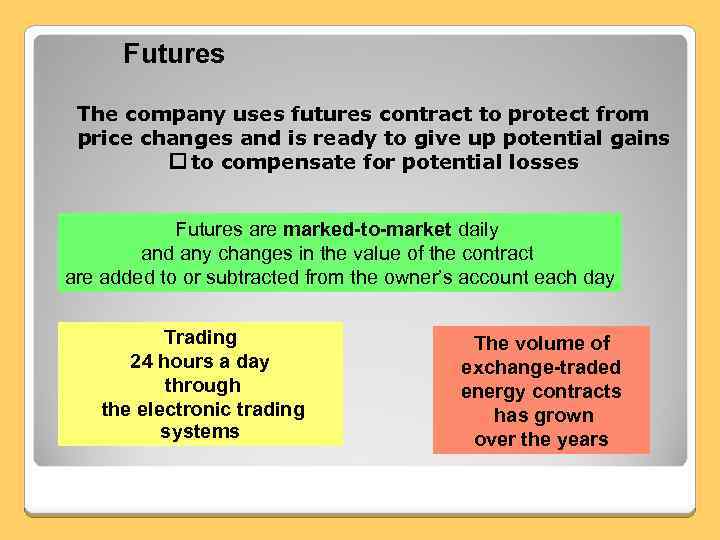

Futures The company uses futures contract to protect from price changes and is ready to give up potential gains to compensate for potential losses Futures are marked-to-market daily and any changes in the value of the contract are added to or subtracted from the owner’s account each day Trading 24 hours a day through the electronic trading systems The volume of exchange-traded energy contracts has grown over the years

Futures The company uses futures contract to protect from price changes and is ready to give up potential gains to compensate for potential losses Futures are marked-to-market daily and any changes in the value of the contract are added to or subtracted from the owner’s account each day Trading 24 hours a day through the electronic trading systems The volume of exchange-traded energy contracts has grown over the years

For the exchange-traded marketplace to operate effectively, the underlying market for the exchange contract must meet three broad criteria: 1. The prices of the underlying commodities must be volatile. 2. There must be a large number of buyers and sellers. 3. The underlying physical products must be fungible (interchangeable) for purposes of shipment or storage.

For the exchange-traded marketplace to operate effectively, the underlying market for the exchange contract must meet three broad criteria: 1. The prices of the underlying commodities must be volatile. 2. There must be a large number of buyers and sellers. 3. The underlying physical products must be fungible (interchangeable) for purposes of shipment or storage.

Major Features of Futures Contracts Organized Exchanges not OTC markets. Standardization : Amount of asset, Expiry dates, Deliverable grades etc. Clearing House: A party to all contracts. Guarantees performance. Mitigates/Eliminates Credit Risk Daily mark-to-market and a system of margins. Actual delivery is rare.

Major Features of Futures Contracts Organized Exchanges not OTC markets. Standardization : Amount of asset, Expiry dates, Deliverable grades etc. Clearing House: A party to all contracts. Guarantees performance. Mitigates/Eliminates Credit Risk Daily mark-to-market and a system of margins. Actual delivery is rare.

Futures Contracts Specifications • Contract specifications are established by the exchange on which futures are traded. • Major features that are standardized are: – Asset – quality of the asset, grade of the commodity; – Contract Size – amount of the asset that has to be delivered; – Maturity Date - date when a financial instrument’s contractual term expires; – Last Trading Day - the final day when trading may occur in a given futures or option contract month; – Delivery Arrangements – the place where delivery will be made. (Important for commodities where may be significant transportation costs); – Price Quotes – the future prices is quoted in a way that is convenient and easy to understand. Tick Size: the minimum price movement of a trading instrument;

Futures Contracts Specifications • Contract specifications are established by the exchange on which futures are traded. • Major features that are standardized are: – Asset – quality of the asset, grade of the commodity; – Contract Size – amount of the asset that has to be delivered; – Maturity Date - date when a financial instrument’s contractual term expires; – Last Trading Day - the final day when trading may occur in a given futures or option contract month; – Delivery Arrangements – the place where delivery will be made. (Important for commodities where may be significant transportation costs); – Price Quotes – the future prices is quoted in a way that is convenient and easy to understand. Tick Size: the minimum price movement of a trading instrument;

Futures Contracts Specifications (Cont. ) – Daily Price Movement Limits – limit down, limit up. (for preventing large price movements because of speculative excesses; - Collateral and Maintenance margins – deposits at special account to minimize contracts defaults; - Settlement – Futures contracts outstanding at the end of the last trading day must be settled by delivery of the underlying asset or by agreement for monetary settlement; - - Commissions – Trading commission (registration of a deal), for expiration a contract.

Futures Contracts Specifications (Cont. ) – Daily Price Movement Limits – limit down, limit up. (for preventing large price movements because of speculative excesses; - Collateral and Maintenance margins – deposits at special account to minimize contracts defaults; - Settlement – Futures contracts outstanding at the end of the last trading day must be settled by delivery of the underlying asset or by agreement for monetary settlement; - - Commissions – Trading commission (registration of a deal), for expiration a contract.

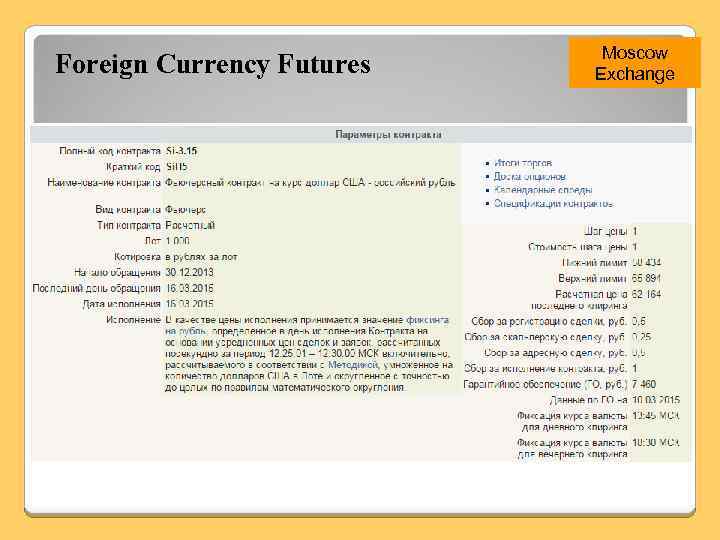

Foreign Currency Futures Moscow Exchange

Foreign Currency Futures Moscow Exchange

FUTURES CONTRACTS Global Futures Exchanges 1) CME group – CME, CBOT, NYMEX CME – Chicago Mercantile Exchange CBOT - Chicago Board of Trade NYMEX - New York Mercantile Exchange 2) LIFFE – London International Financial Futures Exchange 3) SIMEX - Singapore International Monetary Exchange 4) HKFE - Hong Kong Futures Exchange 5) ICE - Intercontinental Exchange -------------------------------------------------6) MOEX - Moscow Exchange St. Petersburg International Mercantile Exchange

FUTURES CONTRACTS Global Futures Exchanges 1) CME group – CME, CBOT, NYMEX CME – Chicago Mercantile Exchange CBOT - Chicago Board of Trade NYMEX - New York Mercantile Exchange 2) LIFFE – London International Financial Futures Exchange 3) SIMEX - Singapore International Monetary Exchange 4) HKFE - Hong Kong Futures Exchange 5) ICE - Intercontinental Exchange -------------------------------------------------6) MOEX - Moscow Exchange St. Petersburg International Mercantile Exchange

FUTURES CONTRACTS Forward vs. Futures Contracts • Basic differences: • • • 1) Trading Locations 2) Regulation 3) Size of contract 4) Transaction Costs 5) Margins 6) Credit Risk

FUTURES CONTRACTS Forward vs. Futures Contracts • Basic differences: • • • 1) Trading Locations 2) Regulation 3) Size of contract 4) Transaction Costs 5) Margins 6) Credit Risk

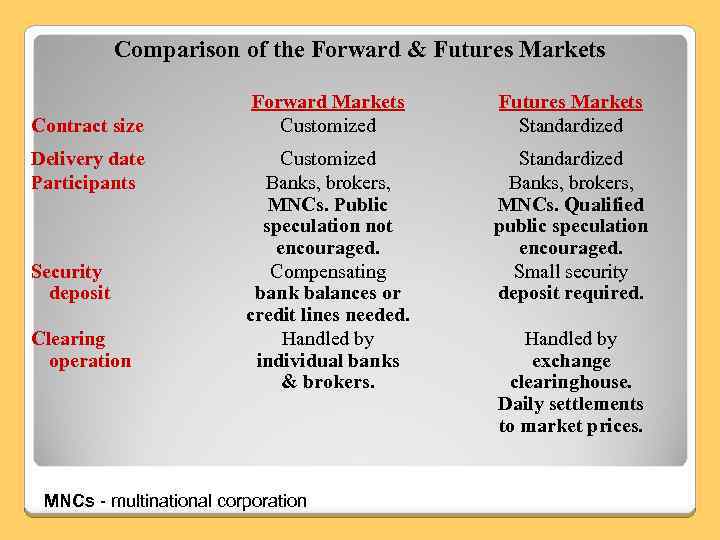

Comparison of the Forward & Futures Markets Contract size Delivery date Participants Security deposit Clearing operation Forward Markets Customized Futures Markets Standardized Customized Banks, brokers, MNCs. Public speculation not encouraged. Compensating bank balances or credit lines needed. Handled by individual banks & brokers. Standardized Banks, brokers, MNCs. Qualified public speculation encouraged. Small security deposit required. MNCs - multinational corporation Handled by exchange clearinghouse. Daily settlements to market prices.

Comparison of the Forward & Futures Markets Contract size Delivery date Participants Security deposit Clearing operation Forward Markets Customized Futures Markets Standardized Customized Banks, brokers, MNCs. Public speculation not encouraged. Compensating bank balances or credit lines needed. Handled by individual banks & brokers. Standardized Banks, brokers, MNCs. Qualified public speculation encouraged. Small security deposit required. MNCs - multinational corporation Handled by exchange clearinghouse. Daily settlements to market prices.

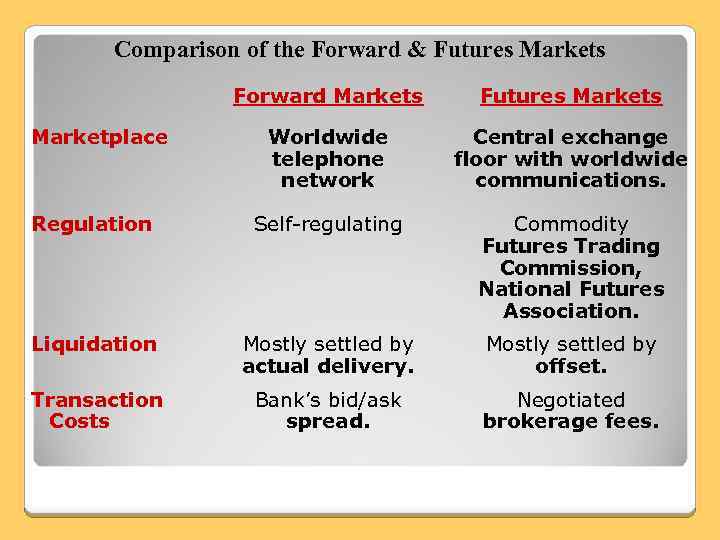

Comparison of the Forward & Futures Markets Forward Markets Futures Markets Worldwide telephone network Central exchange floor with worldwide communications. Regulation Self-regulating Commodity Futures Trading Commission, National Futures Association. Liquidation Mostly settled by actual delivery. Mostly settled by offset. Transaction Costs Bank’s bid/ask spread. Negotiated brokerage fees. Marketplace

Comparison of the Forward & Futures Markets Forward Markets Futures Markets Worldwide telephone network Central exchange floor with worldwide communications. Regulation Self-regulating Commodity Futures Trading Commission, National Futures Association. Liquidation Mostly settled by actual delivery. Mostly settled by offset. Transaction Costs Bank’s bid/ask spread. Negotiated brokerage fees. Marketplace

FUTURES CONTRACTS • Advantages of Futures: • 1) Easy liquidation • 2) Well- organized and stable market. • 3) No credit risk • Disadvantages of Futures: • 1) Limited to a few currencies, assets • 2) Limited dates of delivery • 3) Strict contract sizes

FUTURES CONTRACTS • Advantages of Futures: • 1) Easy liquidation • 2) Well- organized and stable market. • 3) No credit risk • Disadvantages of Futures: • 1) Limited to a few currencies, assets • 2) Limited dates of delivery • 3) Strict contract sizes

Organization of Financial Markets The exchange-traded market • Centralized market • Buyers and Sellers interact through Brokers • Financial Products • The exchange guarantees that each trade is executed and the contract is settled The over-the-counter market (OTC market) • Buyers and Sellers interact by individual negotiations (by phone or electronically) • Physical products • Credit risk

Organization of Financial Markets The exchange-traded market • Centralized market • Buyers and Sellers interact through Brokers • Financial Products • The exchange guarantees that each trade is executed and the contract is settled The over-the-counter market (OTC market) • Buyers and Sellers interact by individual negotiations (by phone or electronically) • Physical products • Credit risk

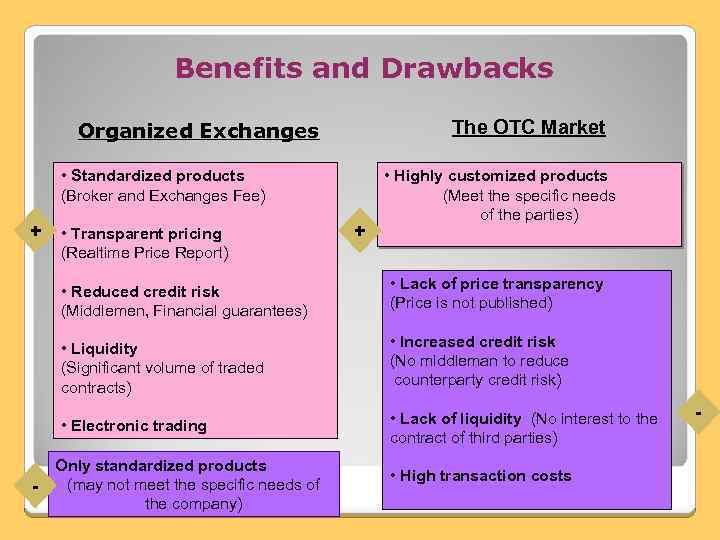

Benefits and Drawbacks The OTC Market Organized Exchanges • Standardized products (Broker and Exchanges Fee) + • Transparent pricing + • Highly customized products (Meet the specific needs of the parties) (Realtime Price Report) • Reduced credit risk (Middlemen, Financial guarantees) • Liquidity (Significant volume of traded contracts) • Increased credit risk (No middleman to reduce counterparty credit risk) • Electronic trading - • Lack of price transparency (Price is not published) • Lack of liquidity (No interest to the contract of third parties) Only standardized products (may not meet the specific needs of the company) • High transaction costs -

Benefits and Drawbacks The OTC Market Organized Exchanges • Standardized products (Broker and Exchanges Fee) + • Transparent pricing + • Highly customized products (Meet the specific needs of the parties) (Realtime Price Report) • Reduced credit risk (Middlemen, Financial guarantees) • Liquidity (Significant volume of traded contracts) • Increased credit risk (No middleman to reduce counterparty credit risk) • Electronic trading - • Lack of price transparency (Price is not published) • Lack of liquidity (No interest to the contract of third parties) Only standardized products (may not meet the specific needs of the company) • High transaction costs -

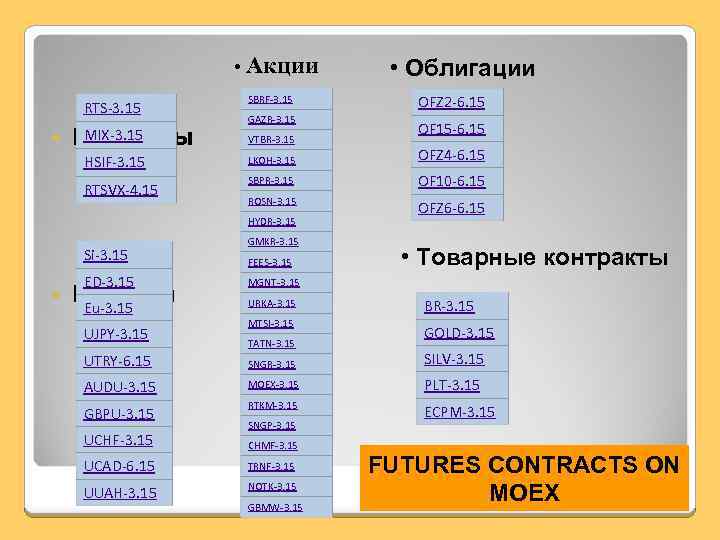

• Акции RTS-3. 15 MIX-3. 15 Индексы HSIF-3. 15 RTSVX-4. 15 SBRF-3. 15 GAZR-3. 15 VTBR-3. 15 ED-3. 15 Валюта Eu-3. 15 UJPY-3. 15 OFZ 2 -6. 15 OF 15 -6. 15 LKOH-3. 15 OFZ 4 -6. 15 SBPR-3. 15 OF 10 -6. 15 ROSN-3. 15 OFZ 6 -6. 15 HYDR-3. 15 Si-3. 15 • Облигации GMKR-3. 15 FEES-3. 15 • Товарные контракты MGNT-3. 15 URKA-3. 15 MTSI-3. 15 TATN-3. 15 BR-3. 15 GOLD-3. 15 UTRY-6. 15 SNGR-3. 15 SILV-3. 15 AUDU-3. 15 MOEX-3. 15 PLT-3. 15 GBPU-3. 15 RTKM-3. 15 ECPM-3. 15 UCHF-3. 15 SNGP-3. 15 CHMF-3. 15 UCAD-6. 15 TRNF-3. 15 UUAH-3. 15 NOTK-3. 15 GBMW-3. 15 FUTURES CONTRACTS ON MOEX

• Акции RTS-3. 15 MIX-3. 15 Индексы HSIF-3. 15 RTSVX-4. 15 SBRF-3. 15 GAZR-3. 15 VTBR-3. 15 ED-3. 15 Валюта Eu-3. 15 UJPY-3. 15 OFZ 2 -6. 15 OF 15 -6. 15 LKOH-3. 15 OFZ 4 -6. 15 SBPR-3. 15 OF 10 -6. 15 ROSN-3. 15 OFZ 6 -6. 15 HYDR-3. 15 Si-3. 15 • Облигации GMKR-3. 15 FEES-3. 15 • Товарные контракты MGNT-3. 15 URKA-3. 15 MTSI-3. 15 TATN-3. 15 BR-3. 15 GOLD-3. 15 UTRY-6. 15 SNGR-3. 15 SILV-3. 15 AUDU-3. 15 MOEX-3. 15 PLT-3. 15 GBPU-3. 15 RTKM-3. 15 ECPM-3. 15 UCHF-3. 15 SNGP-3. 15 CHMF-3. 15 UCAD-6. 15 TRNF-3. 15 UUAH-3. 15 NOTK-3. 15 GBMW-3. 15 FUTURES CONTRACTS ON MOEX

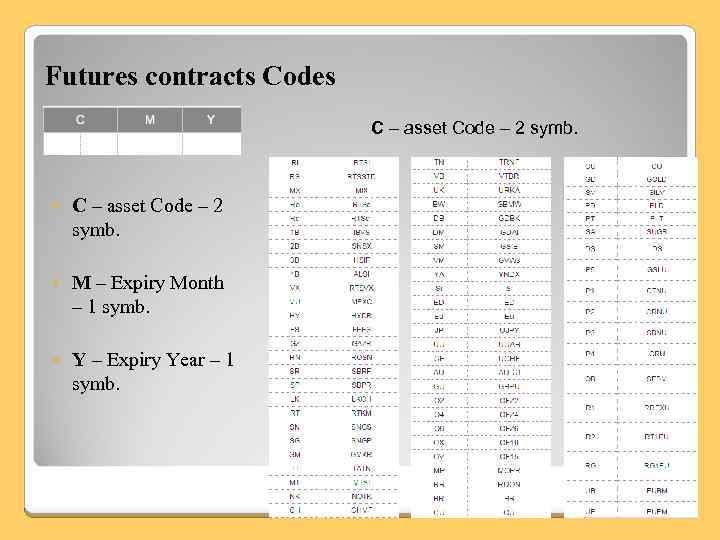

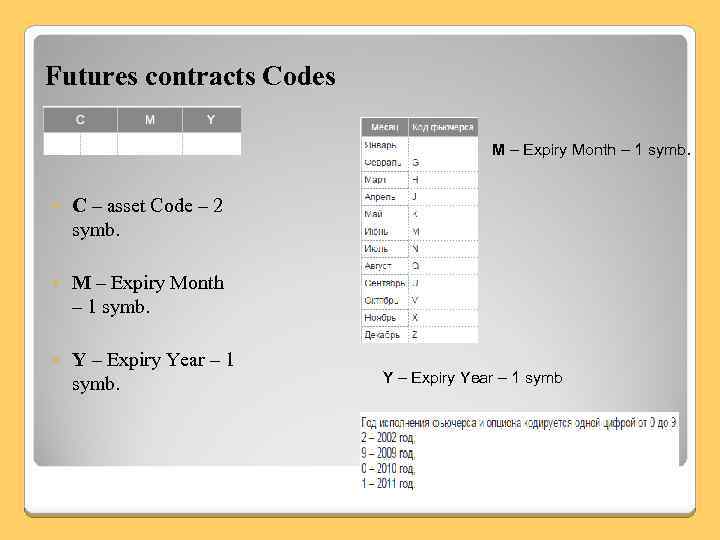

Futures contracts Codes C – asset Code – 2 symb. M – Expiry Month – 1 symb. Y – Expiry Year – 1 symb.

Futures contracts Codes C – asset Code – 2 symb. M – Expiry Month – 1 symb. Y – Expiry Year – 1 symb.

Futures contracts Codes M – Expiry Month – 1 symb. C – asset Code – 2 symb. M – Expiry Month – 1 symb. Y – Expiry Year – 1 symb

Futures contracts Codes M – Expiry Month – 1 symb. C – asset Code – 2 symb. M – Expiry Month – 1 symb. Y – Expiry Year – 1 symb

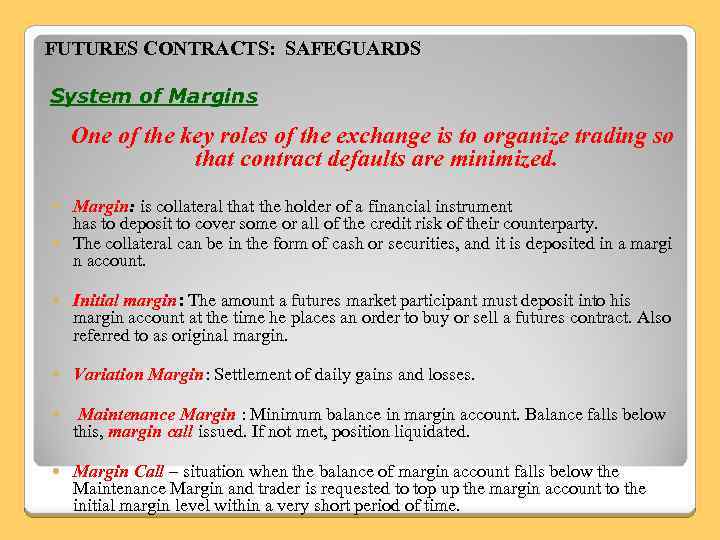

FUTURES CONTRACTS: SAFEGUARDS System of Margins One of the key roles of the exchange is to organize trading so that contract defaults are minimized. Margin: is collateral that the holder of a financial instrument has to deposit to cover some or all of the credit risk of their counterparty. The collateral can be in the form of cash or securities, and it is deposited in a margi n account. Initial margin: The amount a futures market participant must deposit into his margin account at the time he places an order to buy or sell a futures contract. Also referred to as original margin. Variation Margin: Settlement of daily gains and losses. Maintenance Margin : Minimum balance in margin account. Balance falls below this, margin call issued. If not met, position liquidated. Margin Call – situation when the balance of margin account falls below the Maintenance Margin and trader is requested to top up the margin account to the initial margin level within a very short period of time.

FUTURES CONTRACTS: SAFEGUARDS System of Margins One of the key roles of the exchange is to organize trading so that contract defaults are minimized. Margin: is collateral that the holder of a financial instrument has to deposit to cover some or all of the credit risk of their counterparty. The collateral can be in the form of cash or securities, and it is deposited in a margi n account. Initial margin: The amount a futures market participant must deposit into his margin account at the time he places an order to buy or sell a futures contract. Also referred to as original margin. Variation Margin: Settlement of daily gains and losses. Maintenance Margin : Minimum balance in margin account. Balance falls below this, margin call issued. If not met, position liquidated. Margin Call – situation when the balance of margin account falls below the Maintenance Margin and trader is requested to top up the margin account to the initial margin level within a very short period of time.

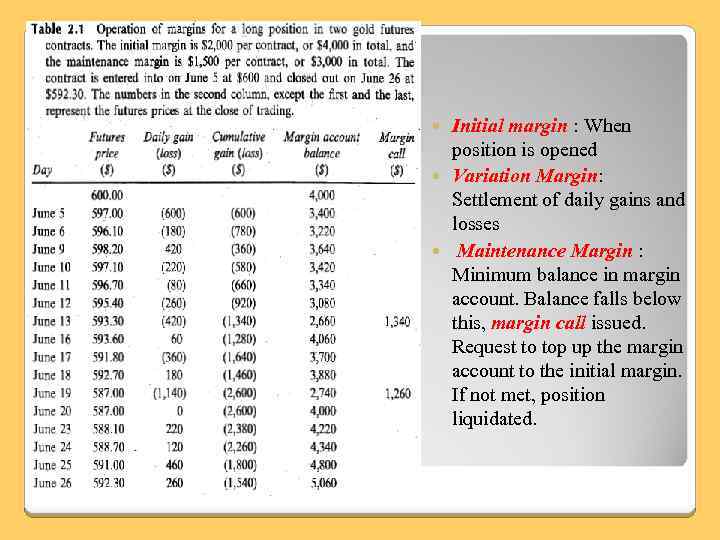

Initial margin : When position is opened Variation Margin: Settlement of daily gains and losses Maintenance Margin : Minimum balance in margin account. Balance falls below this, margin call issued. Request to top up the margin account to the initial margin. If not met, position liquidated.

Initial margin : When position is opened Variation Margin: Settlement of daily gains and losses Maintenance Margin : Minimum balance in margin account. Balance falls below this, margin call issued. Request to top up the margin account to the initial margin. If not met, position liquidated.

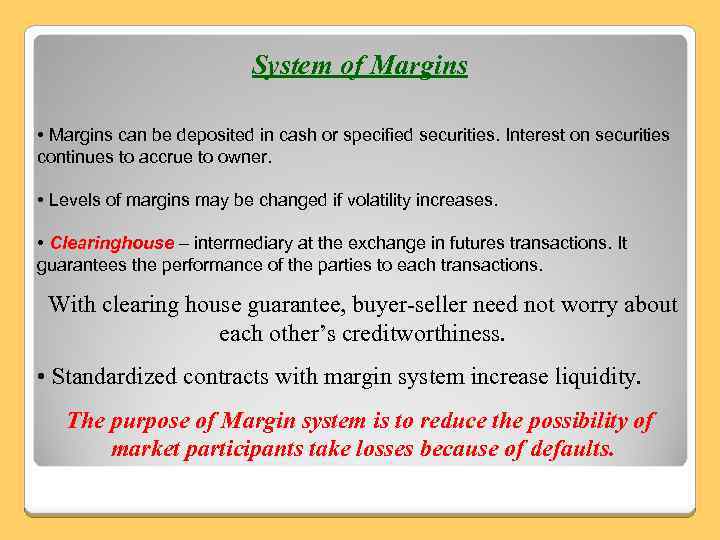

System of Margins • Margins can be deposited in cash or specified securities. Interest on securities continues to accrue to owner. • Levels of margins may be changed if volatility increases. • Clearinghouse – intermediary at the exchange in futures transactions. It guarantees the performance of the parties to each transactions. With clearing house guarantee, buyer-seller need not worry about each other’s creditworthiness. • Standardized contracts with margin system increase liquidity. The purpose of Margin system is to reduce the possibility of market participants take losses because of defaults.

System of Margins • Margins can be deposited in cash or specified securities. Interest on securities continues to accrue to owner. • Levels of margins may be changed if volatility increases. • Clearinghouse – intermediary at the exchange in futures transactions. It guarantees the performance of the parties to each transactions. With clearing house guarantee, buyer-seller need not worry about each other’s creditworthiness. • Standardized contracts with margin system increase liquidity. The purpose of Margin system is to reduce the possibility of market participants take losses because of defaults.

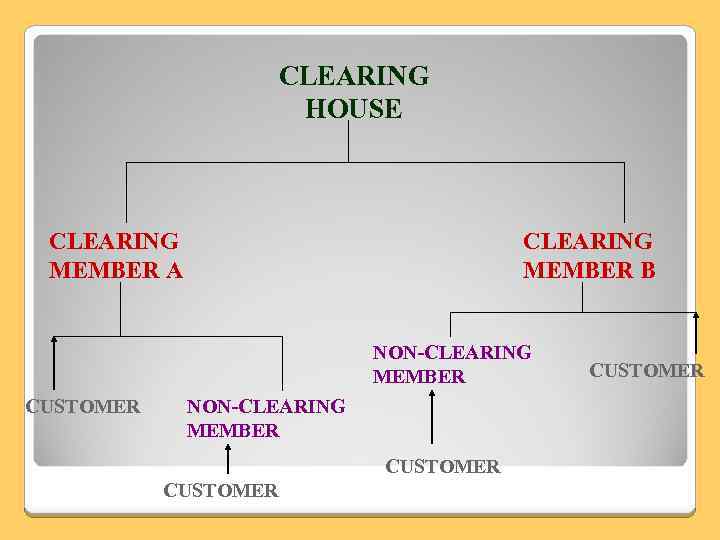

CLEARING HOUSE CLEARING MEMBER A CLEARING MEMBER B NON-CLEARING MEMBER CUSTOMER

CLEARING HOUSE CLEARING MEMBER A CLEARING MEMBER B NON-CLEARING MEMBER CUSTOMER

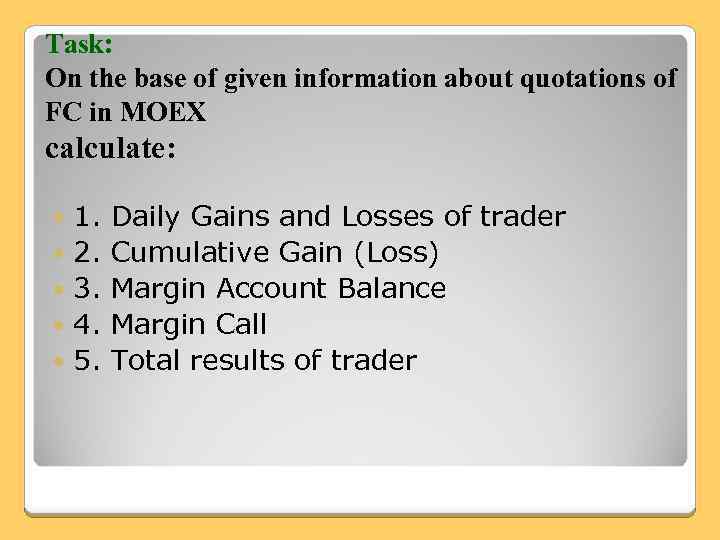

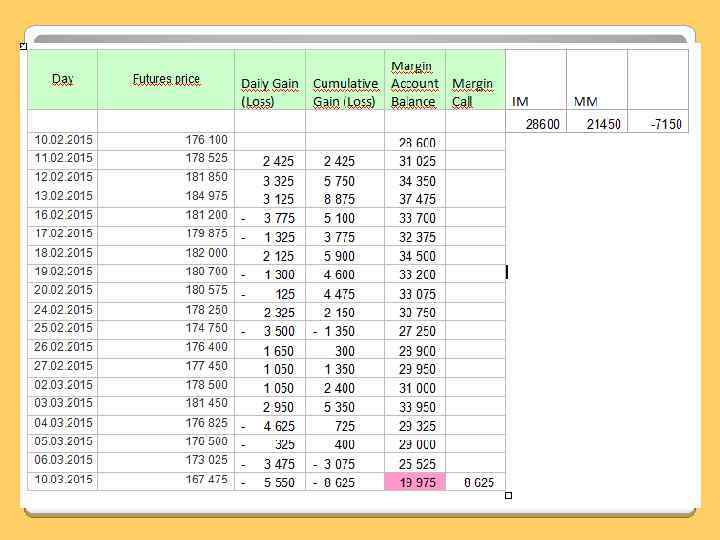

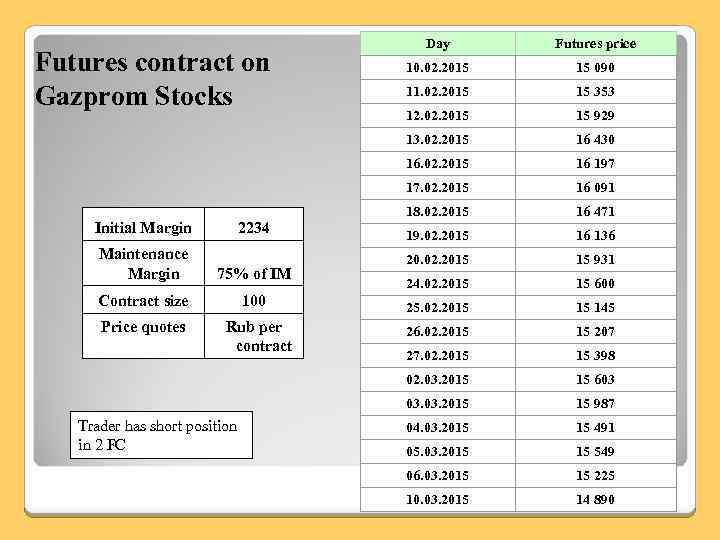

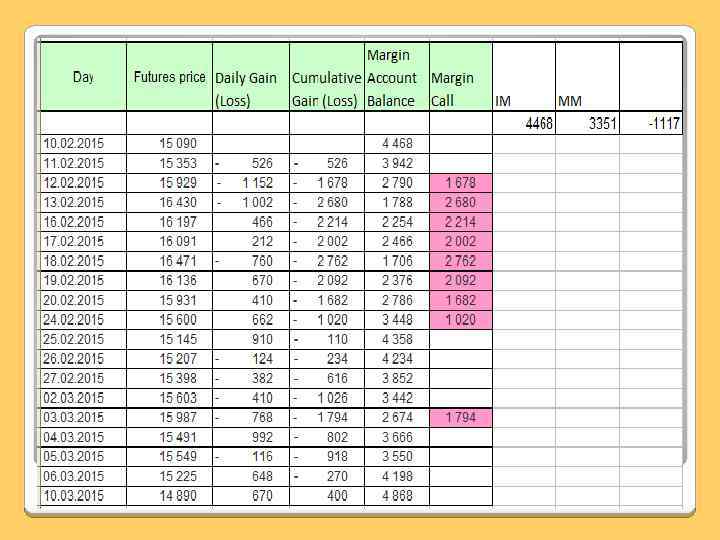

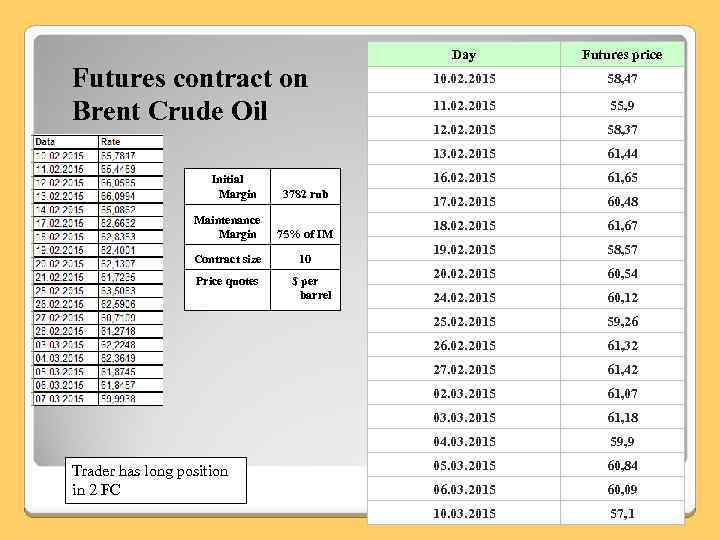

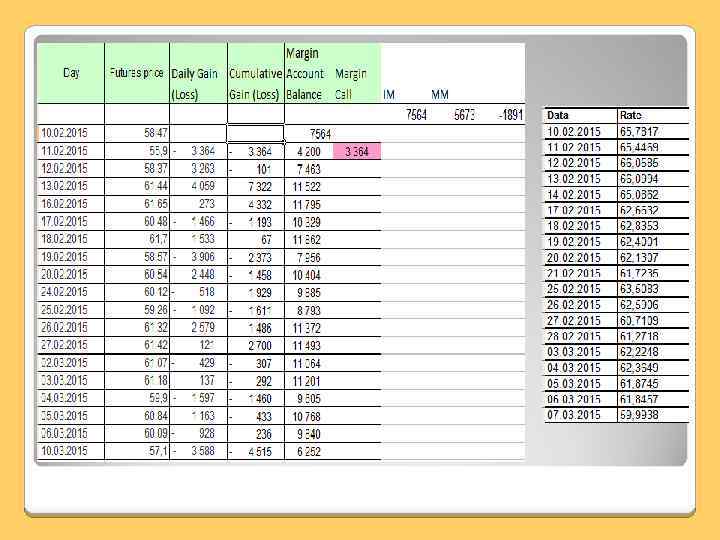

Task: On the base of given information about quotations of FC in MOEX calculate: 1. Daily Gains and Losses of trader 2. Cumulative Gain (Loss) 3. Margin Account Balance 4. Margin Call 5. Total results of trader

Task: On the base of given information about quotations of FC in MOEX calculate: 1. Daily Gains and Losses of trader 2. Cumulative Gain (Loss) 3. Margin Account Balance 4. Margin Call 5. Total results of trader

Futures contract on Micex Index Day Futures price Trader has long position in 1 FC Daily Gain (Loss) Cumulative Gain (Loss) Margin Account Balance Margin Call 10. 02. 2015 176 100 11. 02. 2015 178 525 12. 02. 2015 181 850 13. 02. 2015 184 975 16. 02. 2015 181 200 17. 02. 2015 179 875 18. 02. 2015 182 000 19. 02. 2015 180 700 20. 02. 2015 180 575 24. 02. 2015 178 250 25. 02. 2015 174 750 26. 02. 2015 176 400 27. 02. 2015 177 450 02. 03. 2015 178 500 03. 2015 181 450 04. 03. 2015 176 825 05. 03. 2015 176 500 06. 03. 2015 173 025 10. 03. 2015 167 475

Futures contract on Micex Index Day Futures price Trader has long position in 1 FC Daily Gain (Loss) Cumulative Gain (Loss) Margin Account Balance Margin Call 10. 02. 2015 176 100 11. 02. 2015 178 525 12. 02. 2015 181 850 13. 02. 2015 184 975 16. 02. 2015 181 200 17. 02. 2015 179 875 18. 02. 2015 182 000 19. 02. 2015 180 700 20. 02. 2015 180 575 24. 02. 2015 178 250 25. 02. 2015 174 750 26. 02. 2015 176 400 27. 02. 2015 177 450 02. 03. 2015 178 500 03. 2015 181 450 04. 03. 2015 176 825 05. 03. 2015 176 500 06. 03. 2015 173 025 10. 03. 2015 167 475

Contract size 100 Price quotes Rub per contract Trader has short position in 2 FC 15 353 12. 02. 2015 15 929 16 430 16 197 16 091 18. 02. 2015 16 471 19. 02. 2015 16 136 20. 02. 2015 15 931 24. 02. 2015 15 600 25. 02. 2015 15 145 26. 02. 2015 15 207 27. 02. 2015 15 398 15 603 03. 2015 75% of IM 11. 02. 2015 02. 03. 2015 Maintenance Margin 15 090 17. 02. 2015 2234 10. 02. 2015 16. 02. 2015 Initial Margin Futures price 13. 02. 2015 Futures contract on Gazprom Stocks Day 15 987 04. 03. 2015 15 491 05. 03. 2015 15 549 06. 03. 2015 15 225 10. 03. 2015 14 890

Contract size 100 Price quotes Rub per contract Trader has short position in 2 FC 15 353 12. 02. 2015 15 929 16 430 16 197 16 091 18. 02. 2015 16 471 19. 02. 2015 16 136 20. 02. 2015 15 931 24. 02. 2015 15 600 25. 02. 2015 15 145 26. 02. 2015 15 207 27. 02. 2015 15 398 15 603 03. 2015 75% of IM 11. 02. 2015 02. 03. 2015 Maintenance Margin 15 090 17. 02. 2015 2234 10. 02. 2015 16. 02. 2015 Initial Margin Futures price 13. 02. 2015 Futures contract on Gazprom Stocks Day 15 987 04. 03. 2015 15 491 05. 03. 2015 15 549 06. 03. 2015 15 225 10. 03. 2015 14 890

Trader has long position in 2 FC $ per barrel 61, 44 61, 65 17. 02. 2015 60, 48 18. 02. 2015 61, 67 19. 02. 2015 58, 57 20. 02. 2015 60, 54 24. 02. 2015 60, 12 59, 26 61, 32 61, 42 61, 07 61, 18 04. 03. 2015 Price quotes 58, 37 03. 2015 10 12. 02. 2015 02. 03. 2015 Contract size 55, 9 27. 02. 2015 75% of IM 11. 02. 2015 26. 02. 2015 Maintenance Margin 58, 47 16. 02. 2015 3782 rub 10. 02. 2015 25. 02. 2015 Initial Margin Futures price 13. 02. 2015 Futures contract on Brent Crude Oil Day 59, 9 05. 03. 2015 60, 84 06. 03. 2015 60, 09 10. 03. 2015 57, 1

Trader has long position in 2 FC $ per barrel 61, 44 61, 65 17. 02. 2015 60, 48 18. 02. 2015 61, 67 19. 02. 2015 58, 57 20. 02. 2015 60, 54 24. 02. 2015 60, 12 59, 26 61, 32 61, 42 61, 07 61, 18 04. 03. 2015 Price quotes 58, 37 03. 2015 10 12. 02. 2015 02. 03. 2015 Contract size 55, 9 27. 02. 2015 75% of IM 11. 02. 2015 26. 02. 2015 Maintenance Margin 58, 47 16. 02. 2015 3782 rub 10. 02. 2015 25. 02. 2015 Initial Margin Futures price 13. 02. 2015 Futures contract on Brent Crude Oil Day 59, 9 05. 03. 2015 60, 84 06. 03. 2015 60, 09 10. 03. 2015 57, 1

TYPES OF ORDERS IN FUTURES MARKETS Market Orders : Execute at best available price Limit Orders: Sell above or buy below stated limits Stop-Loss Orders : Sell if price falls below a limit; buy if it rises above a limit. Used to limit losses on existing positions Day Orders: An order to buy or sell stock that automatically expires if it can’t be executed on the day. Participants : Brokers, Floor Traders, Hedgers and speculators.

TYPES OF ORDERS IN FUTURES MARKETS Market Orders : Execute at best available price Limit Orders: Sell above or buy below stated limits Stop-Loss Orders : Sell if price falls below a limit; buy if it rises above a limit. Used to limit losses on existing positions Day Orders: An order to buy or sell stock that automatically expires if it can’t be executed on the day. Participants : Brokers, Floor Traders, Hedgers and speculators.

Exchange Futures Quotations Prices Opening price Highest price Lowest price Settlement price Open Interest Volume of trading

Exchange Futures Quotations Prices Opening price Highest price Lowest price Settlement price Open Interest Volume of trading

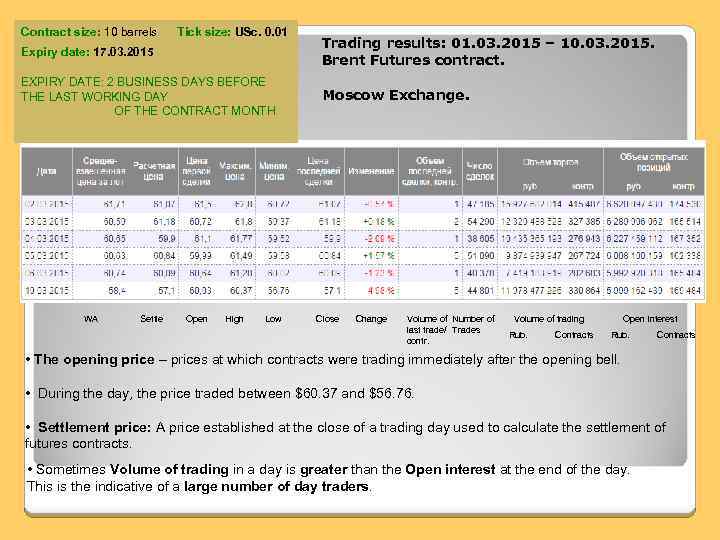

Contract size: 10 barrels Tick size: USc. 0. 01 Expiry date: 17. 03. 2015 Trading results: 01. 03. 2015 – 10. 03. 2015. Brent Futures contract. EXPIRY DATE: 2 BUSINESS DAYS BEFORE THE LAST WORKING DAY OF THE CONTRACT MONTH Moscow Exchange. WA Settle Open High Low Close Change Volume of Number of last trade/ Trades contr. Volume of trading Open interest Rub. Contracts • The opening price – prices at which contracts were trading immediately after the opening bell. • During the day, the price traded between $60. 37 and $56. 76. • Settlement price: A price established at the close of a trading day used to calculate the settlement of futures contracts. • Sometimes Volume of trading in a day is greater than the Open interest at the end of the day. This is the indicative of a large number of day traders.

Contract size: 10 barrels Tick size: USc. 0. 01 Expiry date: 17. 03. 2015 Trading results: 01. 03. 2015 – 10. 03. 2015. Brent Futures contract. EXPIRY DATE: 2 BUSINESS DAYS BEFORE THE LAST WORKING DAY OF THE CONTRACT MONTH Moscow Exchange. WA Settle Open High Low Close Change Volume of Number of last trade/ Trades contr. Volume of trading Open interest Rub. Contracts • The opening price – prices at which contracts were trading immediately after the opening bell. • During the day, the price traded between $60. 37 and $56. 76. • Settlement price: A price established at the close of a trading day used to calculate the settlement of futures contracts. • Sometimes Volume of trading in a day is greater than the Open interest at the end of the day. This is the indicative of a large number of day traders.

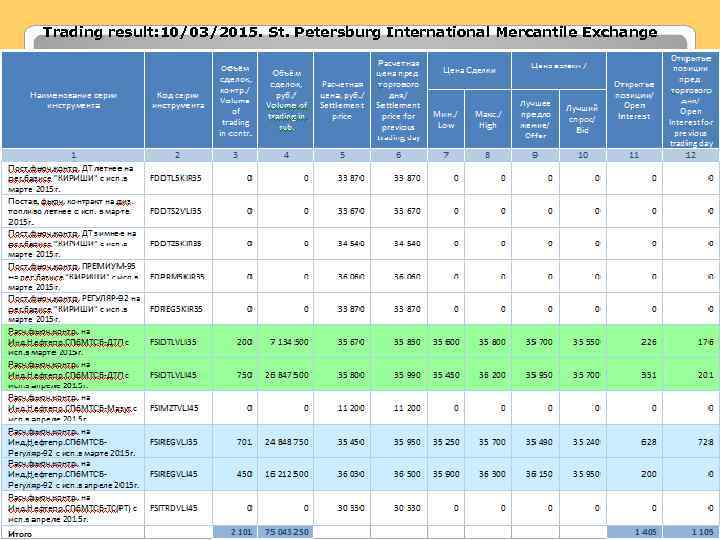

Trading result: 10/03/2015. St. Petersburg International Mercantile Exchange

Trading result: 10/03/2015. St. Petersburg International Mercantile Exchange

Hedging using Futures Short hedge 1) A company that knows it is due to sell an asset at a particular time in the future can hedge by taking a short futures position. If the price of the asset goes down – not good at spot market/gain on the short futures position. If the price of the asset goes up – gain at spot market/loss on futures position. Long hedge 2) A company that knows it is due to buy an asset at a particular time in the future can hedge by taking a long futures position. If the price of the asset goes up – not good at spot market/gain on the futures position. If the price of the asset goes down – gain at spot market/loss on futures position. Futures hedging does not exactly improve the overall financial outcome. Futures hedge reduces risk by making the outcome more certain.

Hedging using Futures Short hedge 1) A company that knows it is due to sell an asset at a particular time in the future can hedge by taking a short futures position. If the price of the asset goes down – not good at spot market/gain on the short futures position. If the price of the asset goes up – gain at spot market/loss on futures position. Long hedge 2) A company that knows it is due to buy an asset at a particular time in the future can hedge by taking a long futures position. If the price of the asset goes up – not good at spot market/gain on the futures position. If the price of the asset goes down – gain at spot market/loss on futures position. Futures hedging does not exactly improve the overall financial outcome. Futures hedge reduces risk by making the outcome more certain.

Reasons why hedging using futures works not perfectly in practice: 1. The asset whose price is to be hedged may not be exactly the same as the asset underlying the futures contract. 2. The hedger may be uncertain as to the exact date when the asset will be bought of sold. 3. The hedge may require the futures contract to be closed out well before its expiration date. These problems give rise to what is termed basis risk.

Reasons why hedging using futures works not perfectly in practice: 1. The asset whose price is to be hedged may not be exactly the same as the asset underlying the futures contract. 2. The hedger may be uncertain as to the exact date when the asset will be bought of sold. 3. The hedge may require the futures contract to be closed out well before its expiration date. These problems give rise to what is termed basis risk.

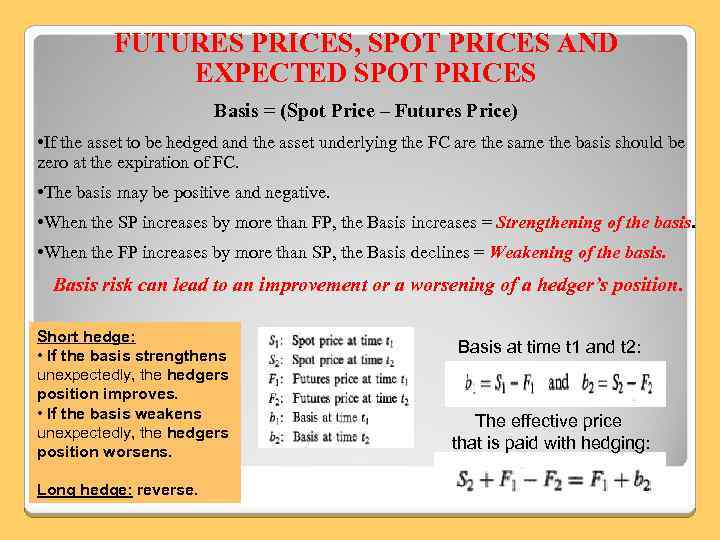

FUTURES PRICES, SPOT PRICES AND EXPECTED SPOT PRICES Basis = (Spot Price – Futures Price) • If the asset to be hedged and the asset underlying the FC are the same the basis should be zero at the expiration of FC. • The basis may be positive and negative. • When the SP increases by more than FP, the Basis increases = Strengthening of the basis. • When the FP increases by more than SP, the Basis declines = Weakening of the basis. Basis risk can lead to an improvement or a worsening of a hedger’s position. Short hedge: • If the basis strengthens unexpectedly, the hedgers position improves. • If the basis weakens unexpectedly, the hedgers position worsens. Long hedge: reverse. Basis at time t 1 and t 2: The effective price that is paid with hedging:

FUTURES PRICES, SPOT PRICES AND EXPECTED SPOT PRICES Basis = (Spot Price – Futures Price) • If the asset to be hedged and the asset underlying the FC are the same the basis should be zero at the expiration of FC. • The basis may be positive and negative. • When the SP increases by more than FP, the Basis increases = Strengthening of the basis. • When the FP increases by more than SP, the Basis declines = Weakening of the basis. Basis risk can lead to an improvement or a worsening of a hedger’s position. Short hedge: • If the basis strengthens unexpectedly, the hedgers position improves. • If the basis weakens unexpectedly, the hedgers position worsens. Long hedge: reverse. Basis at time t 1 and t 2: The effective price that is paid with hedging:

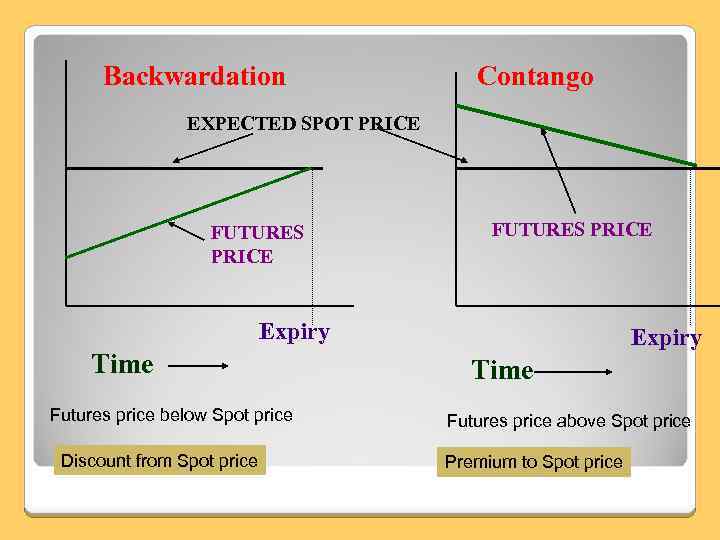

Backwardation Contango EXPECTED SPOT PRICE FUTURES PRICE Expiry Time Futures price below Spot price Discount from Spot price Expiry Time Futures price above Spot price Premium to Spot price

Backwardation Contango EXPECTED SPOT PRICE FUTURES PRICE Expiry Time Futures price below Spot price Discount from Spot price Expiry Time Futures price above Spot price Premium to Spot price

Choice of Contract The choice has two components: 1. The choice of the asset underlying the futures contract. If the asset being hedged exactly matches an asset underlying a futures contract If not – make analysis to determine which of the available futures contracts has futures prices that are most closely correlated with the price of the asset being hedged. 2. The choice of the delivery month. To choose a delivery month that is as close as possible to (but later than) the expiration of the hedge.

Choice of Contract The choice has two components: 1. The choice of the asset underlying the futures contract. If the asset being hedged exactly matches an asset underlying a futures contract If not – make analysis to determine which of the available futures contracts has futures prices that are most closely correlated with the price of the asset being hedged. 2. The choice of the delivery month. To choose a delivery month that is as close as possible to (but later than) the expiration of the hedge.

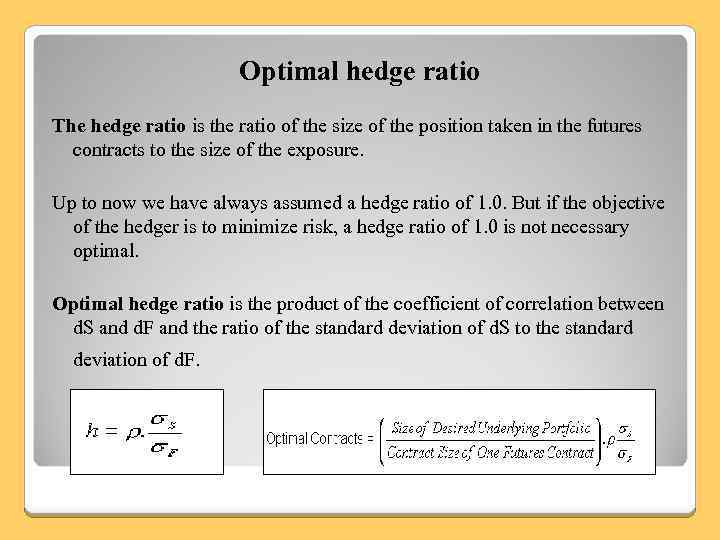

Optimal hedge ratio The hedge ratio is the ratio of the size of the position taken in the futures contracts to the size of the exposure. Up to now we have always assumed a hedge ratio of 1. 0. But if the objective of the hedger is to minimize risk, a hedge ratio of 1. 0 is not necessary optimal. Optimal hedge ratio is the product of the coefficient of correlation between d. S and d. F and the ratio of the standard deviation of d. S to the standard deviation of d. F.

Optimal hedge ratio The hedge ratio is the ratio of the size of the position taken in the futures contracts to the size of the exposure. Up to now we have always assumed a hedge ratio of 1. 0. But if the objective of the hedger is to minimize risk, a hedge ratio of 1. 0 is not necessary optimal. Optimal hedge ratio is the product of the coefficient of correlation between d. S and d. F and the ratio of the standard deviation of d. S to the standard deviation of d. F.

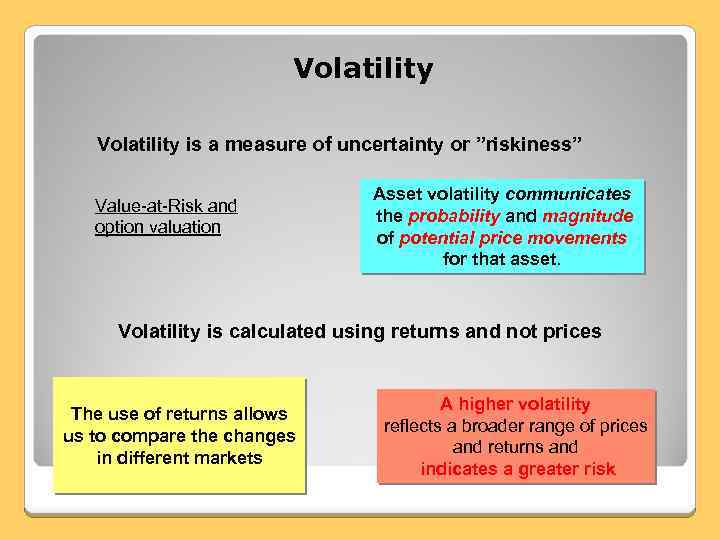

Volatility is a measure of uncertainty or ”riskiness” Value-at-Risk and option valuation Asset volatility communicates the probability and magnitude of potential price movements for that asset. Volatility is calculated using returns and not prices The use of returns allows us to compare the changes in different markets A higher volatility reflects a broader range of prices and returns and indicates a greater risk

Volatility is a measure of uncertainty or ”riskiness” Value-at-Risk and option valuation Asset volatility communicates the probability and magnitude of potential price movements for that asset. Volatility is calculated using returns and not prices The use of returns allows us to compare the changes in different markets A higher volatility reflects a broader range of prices and returns and indicates a greater risk

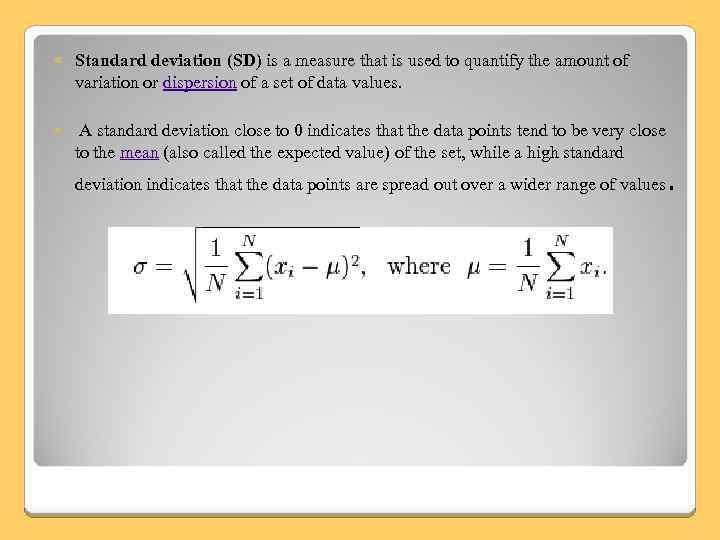

Standard deviation (SD) is a measure that is used to quantify the amount of variation or dispersion of a set of data values. A standard deviation close to 0 indicates that the data points tend to be very close to the mean (also called the expected value) of the set, while a high standard deviation indicates that the data points are spread out over a wider range of values.

Standard deviation (SD) is a measure that is used to quantify the amount of variation or dispersion of a set of data values. A standard deviation close to 0 indicates that the data points tend to be very close to the mean (also called the expected value) of the set, while a high standard deviation indicates that the data points are spread out over a wider range of values.

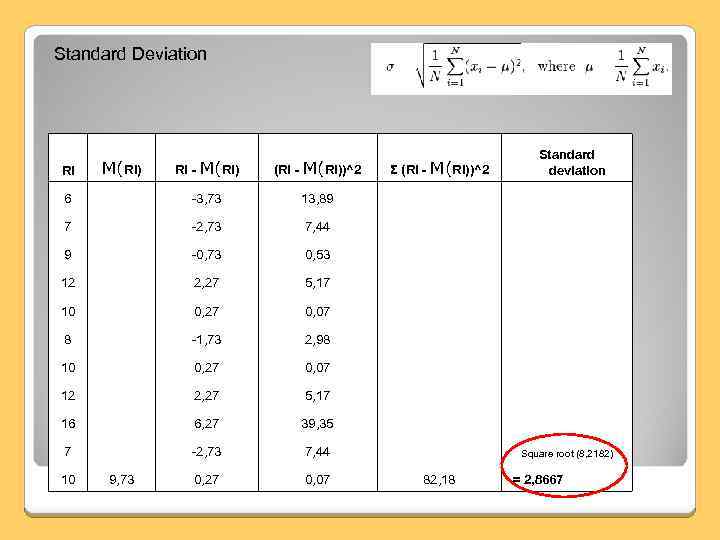

Standard Deviation Standard deviation Ri M(Ri) Ri - M(Ri) (Ri - M(Ri))^2 Σ (Ri - M(Ri))^2 6 -3, 73 13, 89 7 -2, 73 7, 44 9 -0, 73 0, 53 12 2, 27 5, 17 10 0, 27 0, 07 8 -1, 73 2, 98 10 0, 27 0, 07 12 2, 27 5, 17 16 6, 27 39, 35 7 -2, 73 7, 44 Square root (8, 2182) 10 9, 73 0, 27 0, 07 82, 18 = 2, 8667

Standard Deviation Standard deviation Ri M(Ri) Ri - M(Ri) (Ri - M(Ri))^2 Σ (Ri - M(Ri))^2 6 -3, 73 13, 89 7 -2, 73 7, 44 9 -0, 73 0, 53 12 2, 27 5, 17 10 0, 27 0, 07 8 -1, 73 2, 98 10 0, 27 0, 07 12 2, 27 5, 17 16 6, 27 39, 35 7 -2, 73 7, 44 Square root (8, 2182) 10 9, 73 0, 27 0, 07 82, 18 = 2, 8667

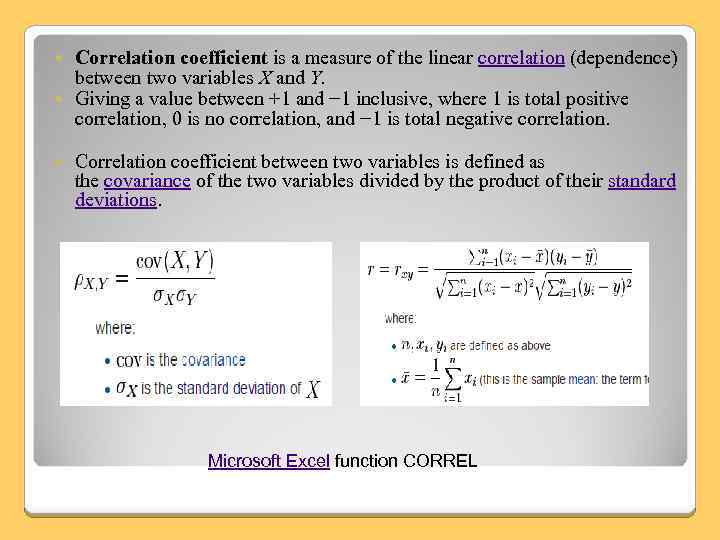

Correlation coefficient is a measure of the linear correlation (dependence) between two variables X and Y. Giving a value between +1 and − 1 inclusive, where 1 is total positive correlation, 0 is no correlation, and − 1 is total negative correlation. Correlation coefficient between two variables is defined as the covariance of the two variables divided by the product of their standard deviations. Microsoft Excel function CORREL

Correlation coefficient is a measure of the linear correlation (dependence) between two variables X and Y. Giving a value between +1 and − 1 inclusive, where 1 is total positive correlation, 0 is no correlation, and − 1 is total negative correlation. Correlation coefficient between two variables is defined as the covariance of the two variables divided by the product of their standard deviations. Microsoft Excel function CORREL

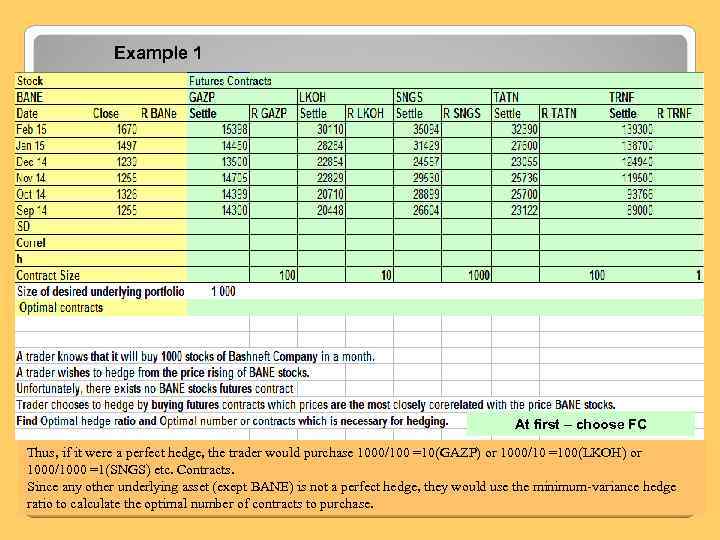

Example 1 At first – choose FC Thus, if it were a perfect hedge, the trader would purchase 1000/100 =10(GAZP) or 1000/10 =100(LKOH) or 1000/1000 =1(SNGS) etc. Contracts. Since any other underlying asset (exept BANE) is not a perfect hedge, they would use the minimum-variance hedge ratio to calculate the optimal number of contracts to purchase.

Example 1 At first – choose FC Thus, if it were a perfect hedge, the trader would purchase 1000/100 =10(GAZP) or 1000/10 =100(LKOH) or 1000/1000 =1(SNGS) etc. Contracts. Since any other underlying asset (exept BANE) is not a perfect hedge, they would use the minimum-variance hedge ratio to calculate the optimal number of contracts to purchase.

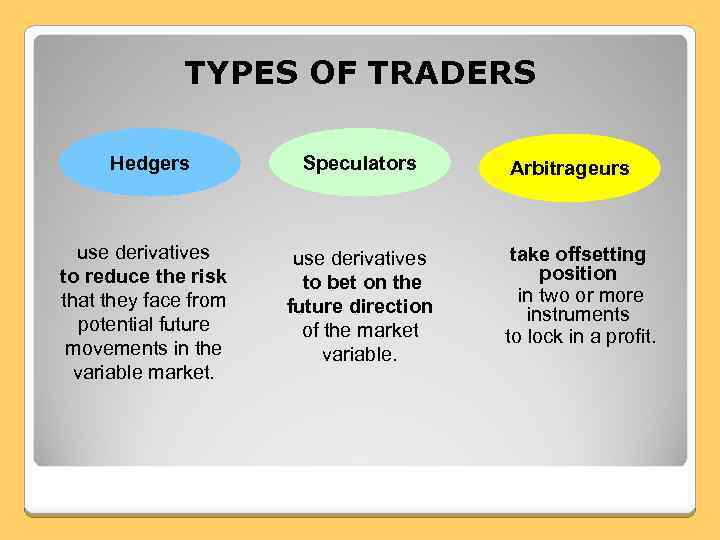

TYPES OF TRADERS Hedgers Speculators use derivatives to reduce the risk that they face from potential future movements in the variable market. use derivatives to bet on the future direction of the market variable. Arbitrageurs take offsetting position in two or more instruments to lock in a profit.

TYPES OF TRADERS Hedgers Speculators use derivatives to reduce the risk that they face from potential future movements in the variable market. use derivatives to bet on the future direction of the market variable. Arbitrageurs take offsetting position in two or more instruments to lock in a profit.

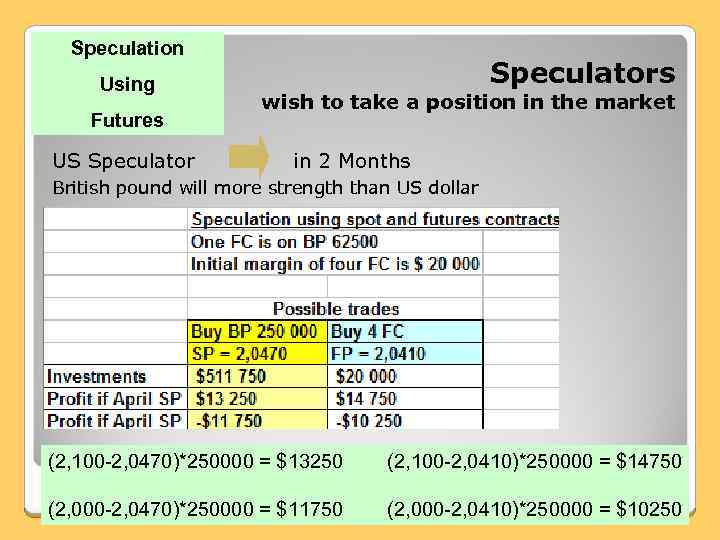

Speculation Using Futures Speculators wish to take a position in the market US Speculator in 2 Months British pound will more strength than US dollar (2, 100 -2, 0470)*250000 = $13250 (2, 100 -2, 0410)*250000 = $14750 (2, 000 -2, 0470)*250000 = $11750 (2, 000 -2, 0410)*250000 = $10250

Speculation Using Futures Speculators wish to take a position in the market US Speculator in 2 Months British pound will more strength than US dollar (2, 100 -2, 0470)*250000 = $13250 (2, 100 -2, 0410)*250000 = $14750 (2, 000 -2, 0470)*250000 = $11750 (2, 000 -2, 0410)*250000 = $10250

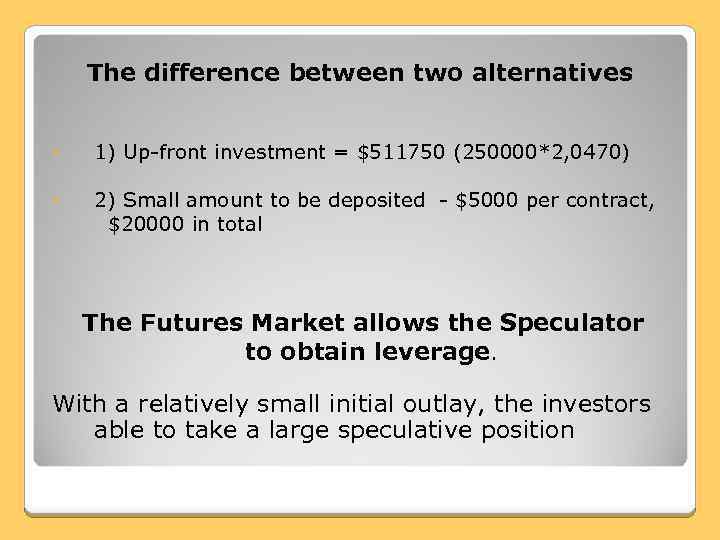

The difference between two alternatives 1) Up-front investment = $511750 (250000*2, 0470) 2) Small amount to be deposited - $5000 per contract, $20000 in total The Futures Market allows the Speculator to obtain leverage. With a relatively small initial outlay, the investors able to take a large speculative position

The difference between two alternatives 1) Up-front investment = $511750 (250000*2, 0470) 2) Small amount to be deposited - $5000 per contract, $20000 in total The Futures Market allows the Speculator to obtain leverage. With a relatively small initial outlay, the investors able to take a large speculative position

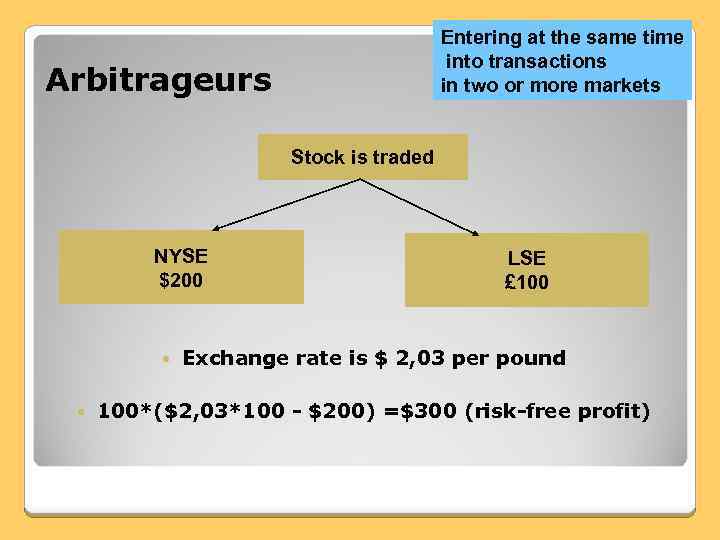

Entering at the same time into transactions in two or more markets Arbitrageurs Stock is traded NYSE $200 LSE £ 100 Exchange rate is $ 2, 03 per pound 100*($2, 03*100 - $200) =$300 (risk-free profit)

Entering at the same time into transactions in two or more markets Arbitrageurs Stock is traded NYSE $200 LSE £ 100 Exchange rate is $ 2, 03 per pound 100*($2, 03*100 - $200) =$300 (risk-free profit)

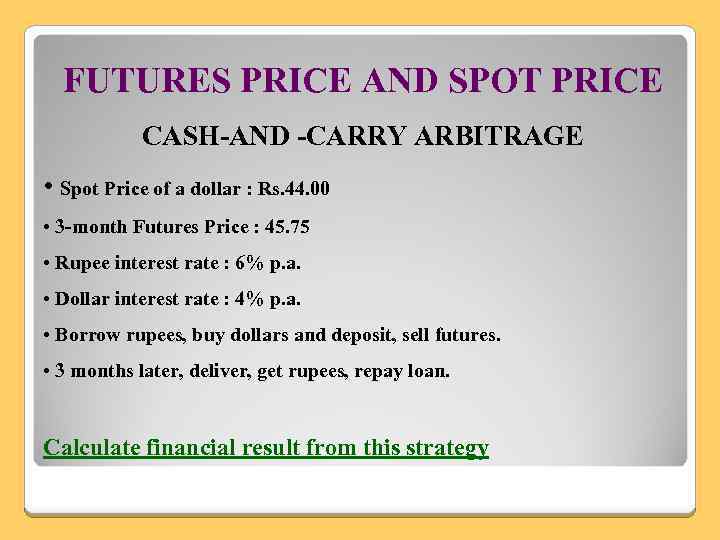

FUTURES PRICE AND SPOT PRICE CASH-AND -CARRY ARBITRAGE • Spot Price of a dollar : Rs. 44. 00 • 3 -month Futures Price : 45. 75 • Rupee interest rate : 6% p. a. • Dollar interest rate : 4% p. a. • Borrow rupees, buy dollars and deposit, sell futures. • 3 months later, deliver, get rupees, repay loan. Calculate financial result from this strategy

FUTURES PRICE AND SPOT PRICE CASH-AND -CARRY ARBITRAGE • Spot Price of a dollar : Rs. 44. 00 • 3 -month Futures Price : 45. 75 • Rupee interest rate : 6% p. a. • Dollar interest rate : 4% p. a. • Borrow rupees, buy dollars and deposit, sell futures. • 3 months later, deliver, get rupees, repay loan. Calculate financial result from this strategy

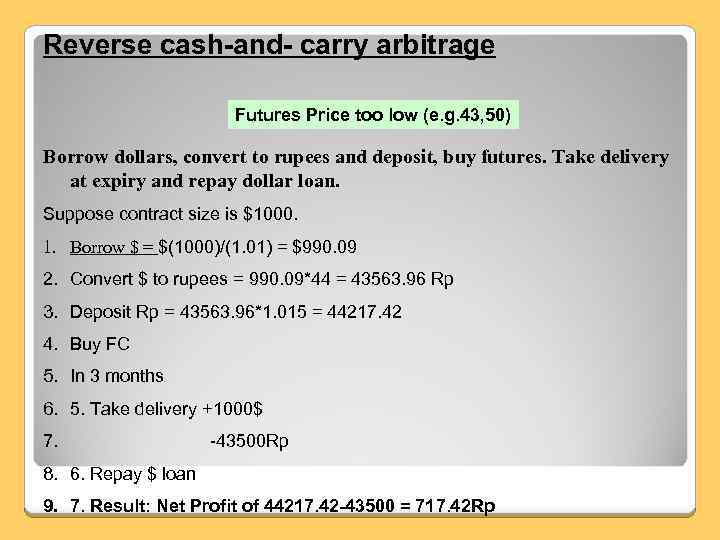

Reverse cash-and- carry arbitrage Futures Price too low (e. g. 43, 50) Borrow dollars, convert to rupees and deposit, buy futures. Take delivery at expiry and repay dollar loan. Suppose contract size is $1000. 1. Borrow $ = $(1000)/(1. 01) = $990. 09 2. Convert $ to rupees = 990. 09*44 = 43563. 96 Rp 3. Deposit Rp = 43563. 96*1. 015 = 44217. 42 4. Buy FC 5. In 3 months 6. 5. Take delivery +1000$ 7. -43500 Rp 8. 6. Repay $ loan 9. 7. Result: Net Profit of 44217. 42 -43500 = 717. 42 Rp

Reverse cash-and- carry arbitrage Futures Price too low (e. g. 43, 50) Borrow dollars, convert to rupees and deposit, buy futures. Take delivery at expiry and repay dollar loan. Suppose contract size is $1000. 1. Borrow $ = $(1000)/(1. 01) = $990. 09 2. Convert $ to rupees = 990. 09*44 = 43563. 96 Rp 3. Deposit Rp = 43563. 96*1. 015 = 44217. 42 4. Buy FC 5. In 3 months 6. 5. Take delivery +1000$ 7. -43500 Rp 8. 6. Repay $ loan 9. 7. Result: Net Profit of 44217. 42 -43500 = 717. 42 Rp

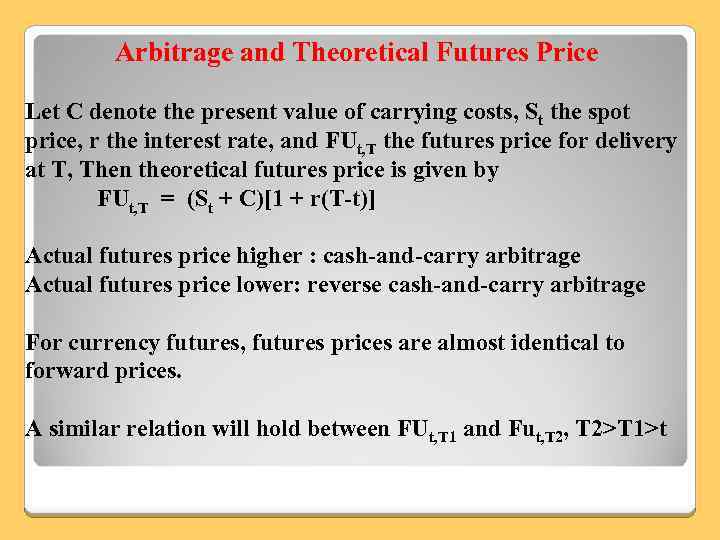

Arbitrage and Theoretical Futures Price Let C denote the present value of carrying costs, St the spot price, r the interest rate, and FUt, T the futures price for delivery at T, Then theoretical futures price is given by FUt, T = (St + C)[1 + r(T-t)] Actual futures price higher : cash-and-carry arbitrage Actual futures price lower: reverse cash-and-carry arbitrage For currency futures, futures prices are almost identical to forward prices. A similar relation will hold between FUt, T 1 and Fut, T 2>T 1>t

Arbitrage and Theoretical Futures Price Let C denote the present value of carrying costs, St the spot price, r the interest rate, and FUt, T the futures price for delivery at T, Then theoretical futures price is given by FUt, T = (St + C)[1 + r(T-t)] Actual futures price higher : cash-and-carry arbitrage Actual futures price lower: reverse cash-and-carry arbitrage For currency futures, futures prices are almost identical to forward prices. A similar relation will hold between FUt, T 1 and Fut, T 2>T 1>t

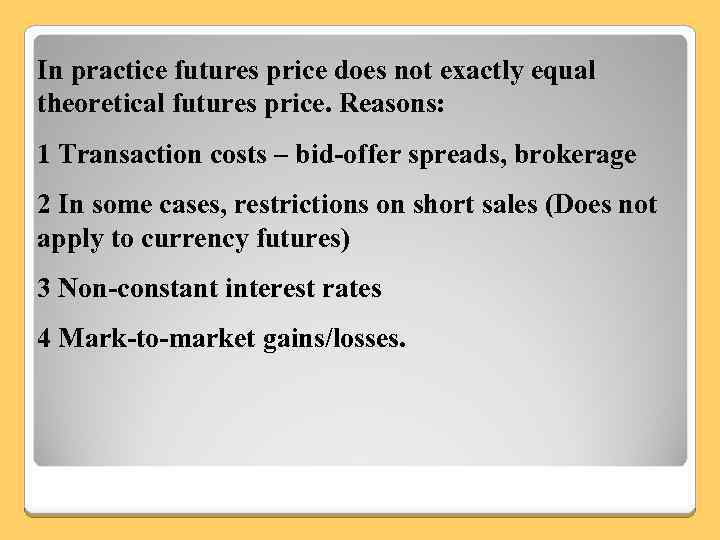

In practice futures price does not exactly equal theoretical futures price. Reasons: 1 Transaction costs – bid-offer spreads, brokerage 2 In some cases, restrictions on short sales (Does not apply to currency futures) 3 Non-constant interest rates 4 Mark-to-market gains/losses.

In practice futures price does not exactly equal theoretical futures price. Reasons: 1 Transaction costs – bid-offer spreads, brokerage 2 In some cases, restrictions on short sales (Does not apply to currency futures) 3 Non-constant interest rates 4 Mark-to-market gains/losses.

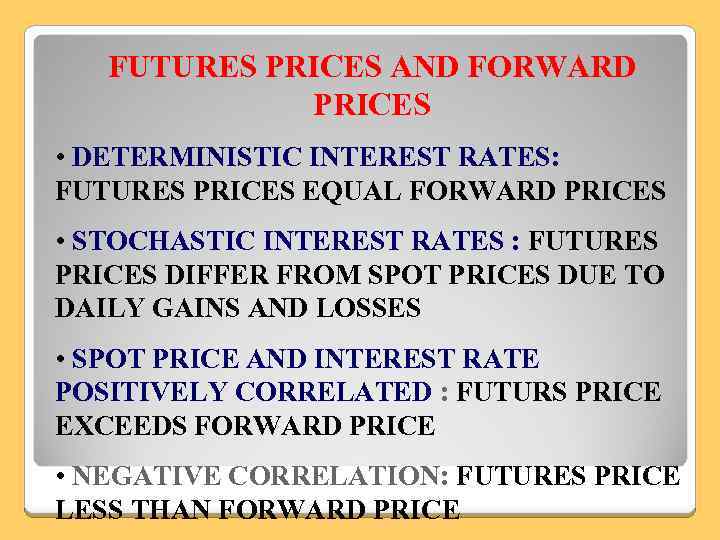

FUTURES PRICES AND FORWARD PRICES • DETERMINISTIC INTEREST RATES: FUTURES PRICES EQUAL FORWARD PRICES • STOCHASTIC INTEREST RATES : FUTURES PRICES DIFFER FROM SPOT PRICES DUE TO DAILY GAINS AND LOSSES • SPOT PRICE AND INTEREST RATE POSITIVELY CORRELATED : FUTURS PRICE EXCEEDS FORWARD PRICE • NEGATIVE CORRELATION: FUTURES PRICE LESS THAN FORWARD PRICE

FUTURES PRICES AND FORWARD PRICES • DETERMINISTIC INTEREST RATES: FUTURES PRICES EQUAL FORWARD PRICES • STOCHASTIC INTEREST RATES : FUTURES PRICES DIFFER FROM SPOT PRICES DUE TO DAILY GAINS AND LOSSES • SPOT PRICE AND INTEREST RATE POSITIVELY CORRELATED : FUTURS PRICE EXCEEDS FORWARD PRICE • NEGATIVE CORRELATION: FUTURES PRICE LESS THAN FORWARD PRICE

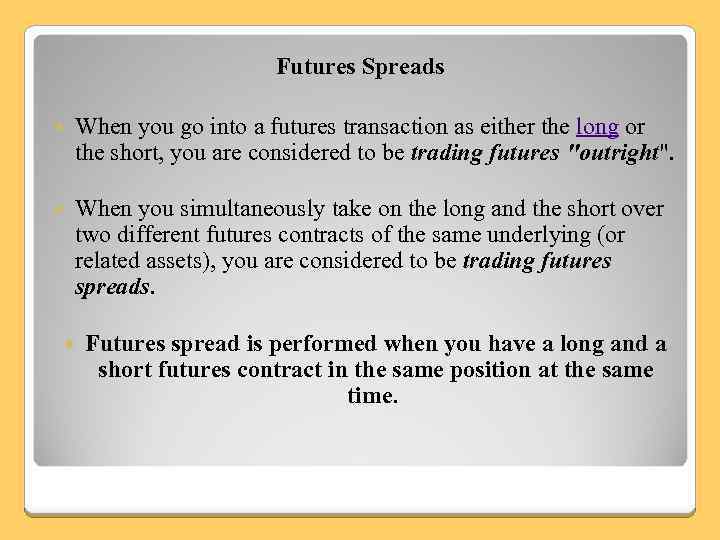

Futures Spreads When you go into a futures transaction as either the long or the short, you are considered to be trading futures "outright". When you simultaneously take on the long and the short over two different futures contracts of the same underlying (or related assets), you are considered to be trading futures spreads. Futures spread is performed when you have a long and a short futures contract in the same position at the same time.

Futures Spreads When you go into a futures transaction as either the long or the short, you are considered to be trading futures "outright". When you simultaneously take on the long and the short over two different futures contracts of the same underlying (or related assets), you are considered to be trading futures spreads. Futures spread is performed when you have a long and a short futures contract in the same position at the same time.

Why Use Futures Spreads? Two main reasons: 1. Increase In Profit Avenues 2. Lowering of Margin Requirement and risk.

Why Use Futures Spreads? Two main reasons: 1. Increase In Profit Avenues 2. Lowering of Margin Requirement and risk.

Increasing Avenues of Profit 1. When the long leg rises and short leg falls. 2. When the long leg rises and the short leg remained unchanged. 3. When the long leg rises and short leg rises at a lower rate. 4. When the short leg falls faster than the long leg. 5. When the long leg remains unchanged and short leg falls.

Increasing Avenues of Profit 1. When the long leg rises and short leg falls. 2. When the long leg rises and the short leg remained unchanged. 3. When the long leg rises and short leg rises at a lower rate. 4. When the short leg falls faster than the long leg. 5. When the long leg remains unchanged and short leg falls.

Lowering Margin and Risk Futures spreads are valued for their ability to limit risk. Futures spreads are really trading the difference in price (the "Spread") between the long and short legs and such price difference tends to trade within a determinable range. This makes trading futures spreads a lot more predictable and subject the futures trader to much lower risk. As a rule, putting on a spread also decreases your initial margin requirement.

Lowering Margin and Risk Futures spreads are valued for their ability to limit risk. Futures spreads are really trading the difference in price (the "Spread") between the long and short legs and such price difference tends to trade within a determinable range. This makes trading futures spreads a lot more predictable and subject the futures trader to much lower risk. As a rule, putting on a spread also decreases your initial margin requirement.

Types of Futures Spreads 1. Intramarket Spreads ("Calendar Spreads", "Intracommodity Spreads" or "Interdelivery Spreads“). Futures contracts of the same underlying but different expiration months. 2. Intermarket Spreads ("Intercommodity Spread“) Futures contracts of different but somewhat related underlying assets. Gold/Silver, Soybean/Corn, Wheat/Corn, Soybean/Soybean Meal and Crude Oil/Heating Oil. 3. Interexchange Spreads Futures contracts of the same underlying traded in different exchanges.

Types of Futures Spreads 1. Intramarket Spreads ("Calendar Spreads", "Intracommodity Spreads" or "Interdelivery Spreads“). Futures contracts of the same underlying but different expiration months. 2. Intermarket Spreads ("Intercommodity Spread“) Futures contracts of different but somewhat related underlying assets. Gold/Silver, Soybean/Corn, Wheat/Corn, Soybean/Soybean Meal and Crude Oil/Heating Oil. 3. Interexchange Spreads Futures contracts of the same underlying traded in different exchanges.

Bull Spreads These are futures spreads that are structured to speculate on a spread price narrowing when the underlying asset is expected to move higher. This is done by being long on near term futures contracts and short on far term futures contracts. Bear Spreads These are futures spreads that are structured to speculate on a spread price widening when the underlying asset is expected to move lower. This is done by being short on near term futures contracts and long on far term futures contracts. Calendar Spreads These are any futures spreads that go long and short on futures contracts of different expiration months. In fact, both Bull Spreads and Bear Spreads are calendar spreads as well. Butterfly Spreads These are futures spreads that consist of three legs instead of the traditionally used two legged futures spreads. It is a combination of a bull spread and a bear spread on the same underlying asset.

Bull Spreads These are futures spreads that are structured to speculate on a spread price narrowing when the underlying asset is expected to move higher. This is done by being long on near term futures contracts and short on far term futures contracts. Bear Spreads These are futures spreads that are structured to speculate on a spread price widening when the underlying asset is expected to move lower. This is done by being short on near term futures contracts and long on far term futures contracts. Calendar Spreads These are any futures spreads that go long and short on futures contracts of different expiration months. In fact, both Bull Spreads and Bear Spreads are calendar spreads as well. Butterfly Spreads These are futures spreads that consist of three legs instead of the traditionally used two legged futures spreads. It is a combination of a bull spread and a bear spread on the same underlying asset.

Disadvantages of Futures Spreads More legs take up more commission Futures Spreads do not make the kind of explosive profit during a price breakout that outright futures positions can.

Disadvantages of Futures Spreads More legs take up more commission Futures Spreads do not make the kind of explosive profit during a price breakout that outright futures positions can.