4c846ba1e64478ed037ad36a929aa714.ppt

- Количество слайдов: 12

Futures FX Market Dr. J. D. Han King’s College University of Western Ontario 1

Futures FX Market Dr. J. D. Han King’s College University of Western Ontario 1

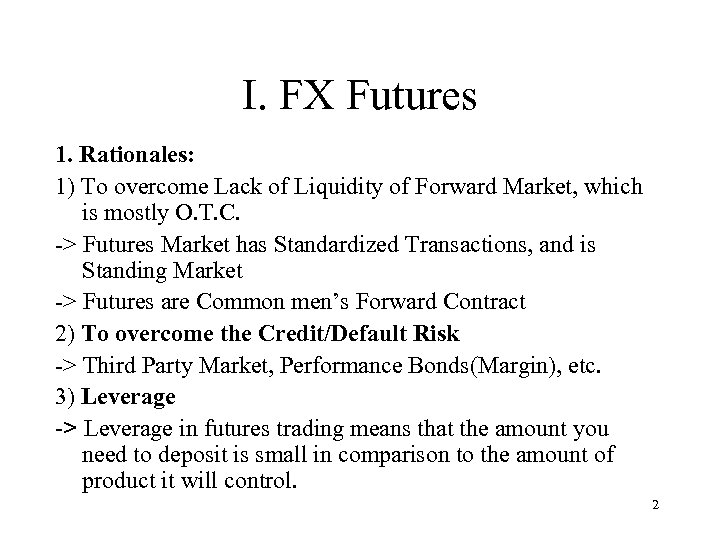

I. FX Futures 1. Rationales: 1) To overcome Lack of Liquidity of Forward Market, which is mostly O. T. C. -> Futures Market has Standardized Transactions, and is Standing Market -> Futures are Common men’s Forward Contract 2) To overcome the Credit/Default Risk -> Third Party Market, Performance Bonds(Margin), etc. 3) Leverage -> Leverage in futures trading means that the amount you need to deposit is small in comparison to the amount of product it will control. 2

I. FX Futures 1. Rationales: 1) To overcome Lack of Liquidity of Forward Market, which is mostly O. T. C. -> Futures Market has Standardized Transactions, and is Standing Market -> Futures are Common men’s Forward Contract 2) To overcome the Credit/Default Risk -> Third Party Market, Performance Bonds(Margin), etc. 3) Leverage -> Leverage in futures trading means that the amount you need to deposit is small in comparison to the amount of product it will control. 2

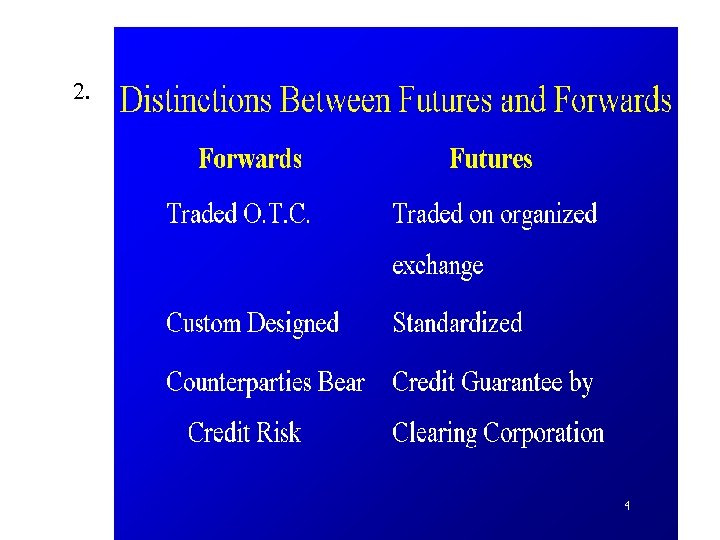

2. 3

2. 3

3. History and Currents of the Futures Market: • Chicago Mercantile Exchange started FOREX Future Trading in 1972 • Daily average trading volume exceeds US $ 100 billion • Website of FX futures in CME http: //www. cmegroup. com/trading/fx/ 4

3. History and Currents of the Futures Market: • Chicago Mercantile Exchange started FOREX Future Trading in 1972 • Daily average trading volume exceeds US $ 100 billion • Website of FX futures in CME http: //www. cmegroup. com/trading/fx/ 4

4. 5

4. 5

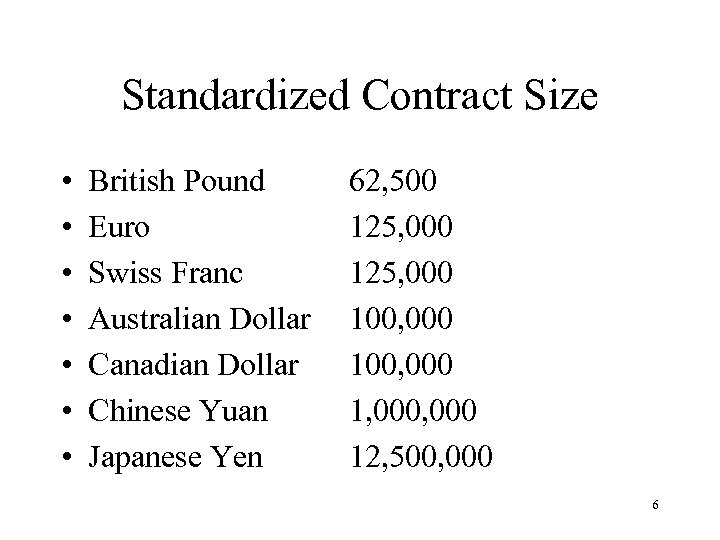

Standardized Contract Size • • British Pound Euro Swiss Franc Australian Dollar Canadian Dollar Chinese Yuan Japanese Yen 62, 500 125, 000 100, 000 1, 000 12, 500, 000 6

Standardized Contract Size • • British Pound Euro Swiss Franc Australian Dollar Canadian Dollar Chinese Yuan Japanese Yen 62, 500 125, 000 100, 000 1, 000 12, 500, 000 6

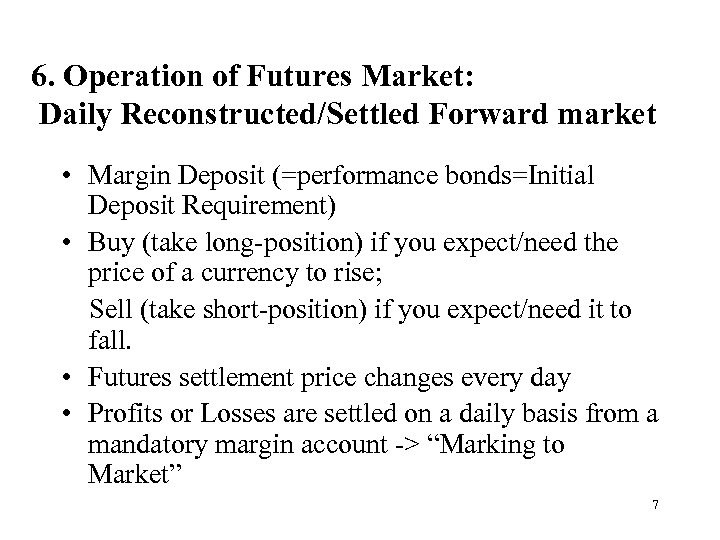

6. Operation of Futures Market: Daily Reconstructed/Settled Forward market • Margin Deposit (=performance bonds=Initial Deposit Requirement) • Buy (take long-position) if you expect/need the price of a currency to rise; Sell (take short-position) if you expect/need it to fall. • Futures settlement price changes every day • Profits or Losses are settled on a daily basis from a mandatory margin account -> “Marking to Market” 7

6. Operation of Futures Market: Daily Reconstructed/Settled Forward market • Margin Deposit (=performance bonds=Initial Deposit Requirement) • Buy (take long-position) if you expect/need the price of a currency to rise; Sell (take short-position) if you expect/need it to fall. • Futures settlement price changes every day • Profits or Losses are settled on a daily basis from a mandatory margin account -> “Marking to Market” 7

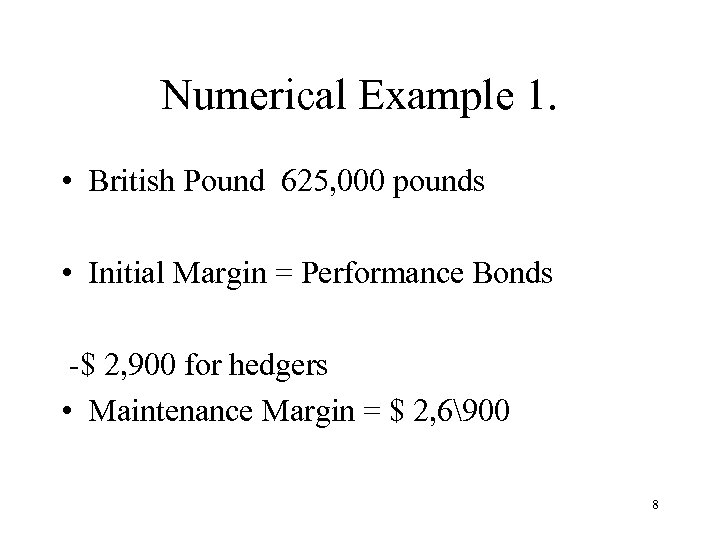

Numerical Example 1. • British Pound 625, 000 pounds • Initial Margin = Performance Bonds -$ 2, 900 for hedgers • Maintenance Margin = $ 2, 6900 8

Numerical Example 1. • British Pound 625, 000 pounds • Initial Margin = Performance Bonds -$ 2, 900 for hedgers • Maintenance Margin = $ 2, 6900 8

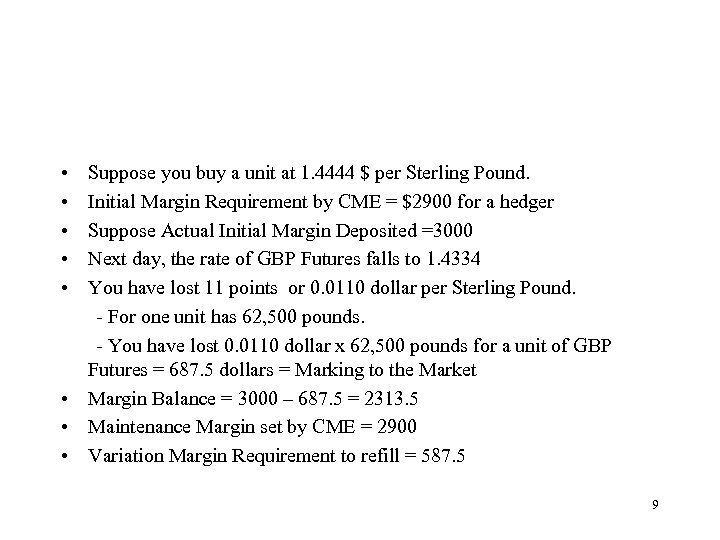

• • • Suppose you buy a unit at 1. 4444 $ per Sterling Pound. Initial Margin Requirement by CME = $2900 for a hedger Suppose Actual Initial Margin Deposited =3000 Next day, the rate of GBP Futures falls to 1. 4334 You have lost 11 points or 0. 0110 dollar per Sterling Pound. - For one unit has 62, 500 pounds. - You have lost 0. 0110 dollar x 62, 500 pounds for a unit of GBP Futures = 687. 5 dollars = Marking to the Market • Margin Balance = 3000 – 687. 5 = 2313. 5 • Maintenance Margin set by CME = 2900 • Variation Margin Requirement to refill = 587. 5 9

• • • Suppose you buy a unit at 1. 4444 $ per Sterling Pound. Initial Margin Requirement by CME = $2900 for a hedger Suppose Actual Initial Margin Deposited =3000 Next day, the rate of GBP Futures falls to 1. 4334 You have lost 11 points or 0. 0110 dollar per Sterling Pound. - For one unit has 62, 500 pounds. - You have lost 0. 0110 dollar x 62, 500 pounds for a unit of GBP Futures = 687. 5 dollars = Marking to the Market • Margin Balance = 3000 – 687. 5 = 2313. 5 • Maintenance Margin set by CME = 2900 • Variation Margin Requirement to refill = 587. 5 9

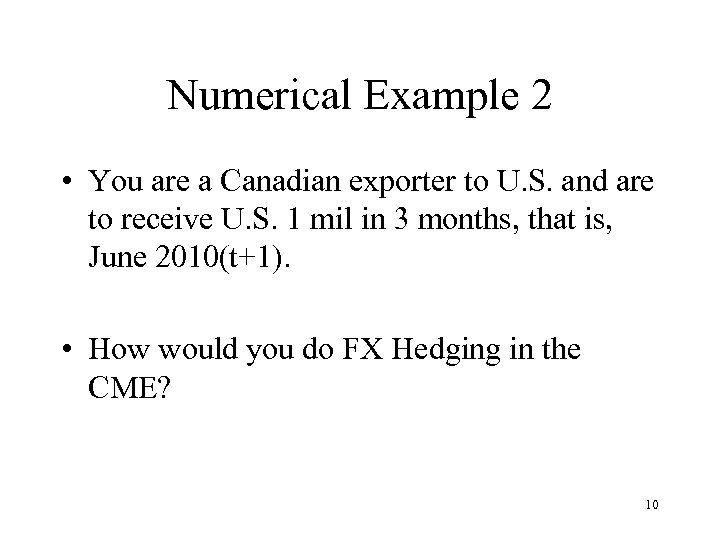

Numerical Example 2 • You are a Canadian exporter to U. S. and are to receive U. S. 1 mil in 3 months, that is, June 2010(t+1). • How would you do FX Hedging in the CME? 10

Numerical Example 2 • You are a Canadian exporter to U. S. and are to receive U. S. 1 mil in 3 months, that is, June 2010(t+1). • How would you do FX Hedging in the CME? 10

• To start: Performance bond = U. S. $ 3300 for a hedger • Mindset: You have to put on the U. S. shoes-Act and think like you are a U. S. citizen for SU. S $. /C$ • What to do? You are (buying/selling) Canadian Dollar Futures (CD) in CME, which will expire/deliver on March 2010. • How much? Each unit = C $100, 000 So you buy 1/S = 1/0. 82 =about 12 units of CD for $100, 000 for the corresponding rate = 0. 8159 at 10: 25: 30 AM CST 2/09/2009. Thus you pay 0. 8159 x 100, 000 x 12 = U. S. $ 978, 900. You have to get it from Spot Market at the current Spot rate St. 11

• To start: Performance bond = U. S. $ 3300 for a hedger • Mindset: You have to put on the U. S. shoes-Act and think like you are a U. S. citizen for SU. S $. /C$ • What to do? You are (buying/selling) Canadian Dollar Futures (CD) in CME, which will expire/deliver on March 2010. • How much? Each unit = C $100, 000 So you buy 1/S = 1/0. 82 =about 12 units of CD for $100, 000 for the corresponding rate = 0. 8159 at 10: 25: 30 AM CST 2/09/2009. Thus you pay 0. 8159 x 100, 000 x 12 = U. S. $ 978, 900. You have to get it from Spot Market at the current Spot rate St. 11

• Forward Contract Suppose that at the expiry date in June 2009, the CD M 06 is 0. 8400. You win the net of (0. 84000. 8159) x 100, 000 x 12 U. S. dollars. (St+1 – F) times 1 million -(a) • Initial FX Risk Exposure of Business However, that forward rate is close to the spot rate in June 2009. You have lost (St+1 –St ) times 1 million –(b) • (a) makes up the whole or part of (b). -When F = St, then F-St = 0, it is a perfect coverage. . F- St is inevitable change not to be covered. , 12

• Forward Contract Suppose that at the expiry date in June 2009, the CD M 06 is 0. 8400. You win the net of (0. 84000. 8159) x 100, 000 x 12 U. S. dollars. (St+1 – F) times 1 million -(a) • Initial FX Risk Exposure of Business However, that forward rate is close to the spot rate in June 2009. You have lost (St+1 –St ) times 1 million –(b) • (a) makes up the whole or part of (b). -When F = St, then F-St = 0, it is a perfect coverage. . F- St is inevitable change not to be covered. , 12