e56bc3e0c4dc7c4a84ce36b0e8fd9c5c.ppt

- Количество слайдов: 21

Futures and Options on Foreign Exchange 9 Chapter Nine Chapter Objective: • This chapter discusses exchange-traded currency futures contracts, options contracts, and options on currency futures. Chapter Outline w Futures Contracts: Preliminaries w Currency Futures Markets w Basic Currency Futures Relationships w Eurodollar Interest Rate Futures Contracts w Options Contracts: Preliminaries w Currency Options Markets w Currency Futures Options 1

Futures and Options on Foreign Exchange 9 Chapter Nine Chapter Objective: • This chapter discusses exchange-traded currency futures contracts, options contracts, and options on currency futures. Chapter Outline w Futures Contracts: Preliminaries w Currency Futures Markets w Basic Currency Futures Relationships w Eurodollar Interest Rate Futures Contracts w Options Contracts: Preliminaries w Currency Options Markets w Currency Futures Options 1

9. 1 Futures Contracts w A futures contract is like a forward contract: n It specifies that a certain currency will be exchanged for another at a specified time in the future at prices specified today. w A futures contract is different from a forward contract: n Futures are standardized contracts trading on organized exchanges with daily resettlement through a clearinghouse - marked to market. w Standardizing Features: contract size, delivery month, daily resettlement - marked to market w Initial Margin: about 2 -5 % of contract value, cash or T-bills held in a street name at your brokers. w Participants’ losses or profits are realized daily instead of at maturity as with a forward contract. w Because of marking to market, the futures price converges through time to the spot price on the last day of trading in the contract. 2

9. 1 Futures Contracts w A futures contract is like a forward contract: n It specifies that a certain currency will be exchanged for another at a specified time in the future at prices specified today. w A futures contract is different from a forward contract: n Futures are standardized contracts trading on organized exchanges with daily resettlement through a clearinghouse - marked to market. w Standardizing Features: contract size, delivery month, daily resettlement - marked to market w Initial Margin: about 2 -5 % of contract value, cash or T-bills held in a street name at your brokers. w Participants’ losses or profits are realized daily instead of at maturity as with a forward contract. w Because of marking to market, the futures price converges through time to the spot price on the last day of trading in the contract. 2

Daily Resettlement = Marking to Market Example: On Monday morning you take a long position in SF futures contract that matures on Wednesday afternoon at $0. 75/SF. 1. At the close of trading on Monday the futures price has risen to $0. 755. Because of the daily settlement you receive a cash profit of $625 =125, 000 x (0. 755 -0. 75) 2. At Tuesday close the price has declined to $0. 743. You must pay the $1500 loss (125, 000 x [0. 743 -0. 755]) to the other side of the contract. 3. At Wednesday close, the price drops to $0. 74, and the contract matures. You pay $375 loss to the other side and take the delivery of the SF, paying the prevailing price of $0. 74. You have a net loss on the contract of $1250 (625 -1500 -375) You can also close out your long position with an offsetting trade, if you don’t want the delivery of the SF. 3

Daily Resettlement = Marking to Market Example: On Monday morning you take a long position in SF futures contract that matures on Wednesday afternoon at $0. 75/SF. 1. At the close of trading on Monday the futures price has risen to $0. 755. Because of the daily settlement you receive a cash profit of $625 =125, 000 x (0. 755 -0. 75) 2. At Tuesday close the price has declined to $0. 743. You must pay the $1500 loss (125, 000 x [0. 743 -0. 755]) to the other side of the contract. 3. At Wednesday close, the price drops to $0. 74, and the contract matures. You pay $375 loss to the other side and take the delivery of the SF, paying the prevailing price of $0. 74. You have a net loss on the contract of $1250 (625 -1500 -375) You can also close out your long position with an offsetting trade, if you don’t want the delivery of the SF. 3

9. 2 Currency Futures Markets w The Chicago Mercantile Exchange (CME) is by far the largest. w Others include: n n The Philadelphia Board of Trade (PBOT) The Mid. America commodities Exchange The Tokyo International Financial Futures Exchange The London International Financial Futures Exchange w Expiry cycle: March, June, September, December. w Delivery date 3 rd Wednesday of delivery month. w Last trading day is the second business day preceding the delivery day. w CME hours 7: 20 a. m. to 2: 00 p. m. CST. 4

9. 2 Currency Futures Markets w The Chicago Mercantile Exchange (CME) is by far the largest. w Others include: n n The Philadelphia Board of Trade (PBOT) The Mid. America commodities Exchange The Tokyo International Financial Futures Exchange The London International Financial Futures Exchange w Expiry cycle: March, June, September, December. w Delivery date 3 rd Wednesday of delivery month. w Last trading day is the second business day preceding the delivery day. w CME hours 7: 20 a. m. to 2: 00 p. m. CST. 4

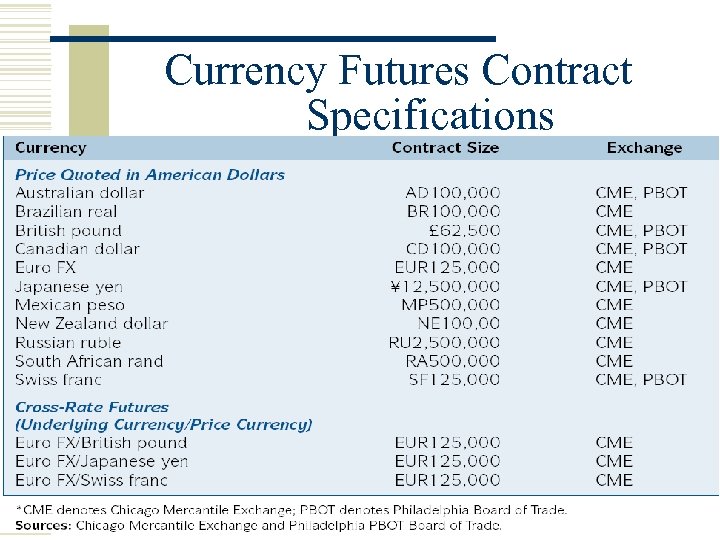

Currency Futures Contract Specifications 5

Currency Futures Contract Specifications 5

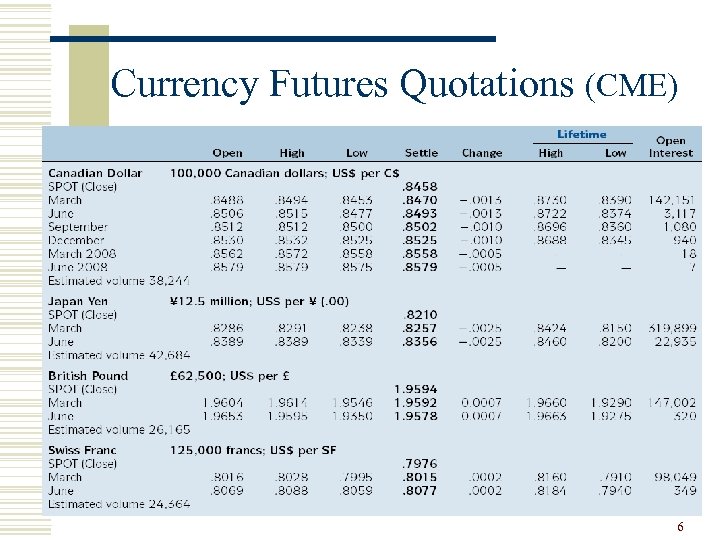

Currency Futures Quotations (CME) 6

Currency Futures Quotations (CME) 6

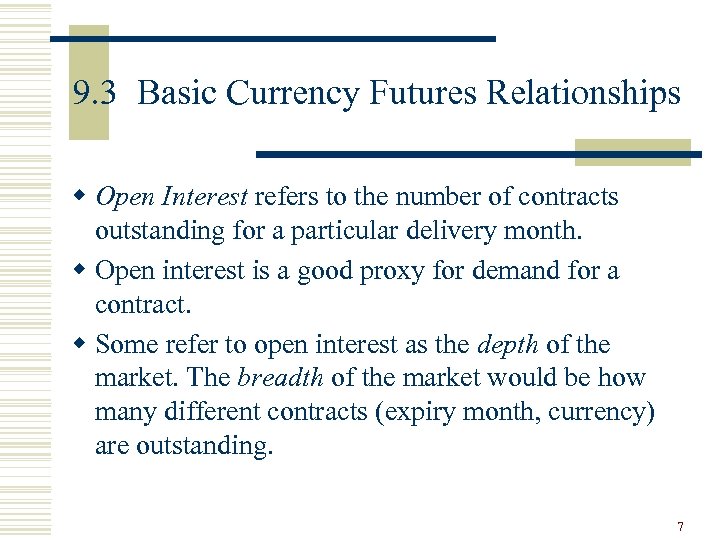

9. 3 Basic Currency Futures Relationships w Open Interest refers to the number of contracts outstanding for a particular delivery month. w Open interest is a good proxy for demand for a contract. w Some refer to open interest as the depth of the market. The breadth of the market would be how many different contracts (expiry month, currency) are outstanding. 7

9. 3 Basic Currency Futures Relationships w Open Interest refers to the number of contracts outstanding for a particular delivery month. w Open interest is a good proxy for demand for a contract. w Some refer to open interest as the depth of the market. The breadth of the market would be how many different contracts (expiry month, currency) are outstanding. 7

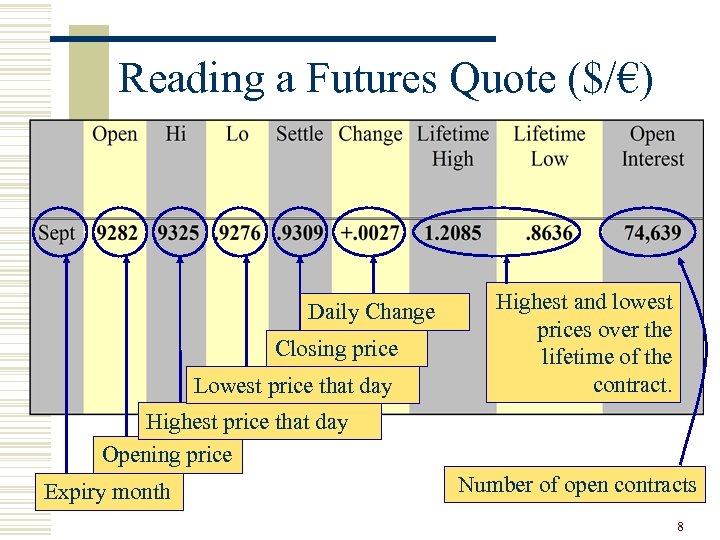

Reading a Futures Quote ($/€) Daily Change Closing price Lowest price that day Highest and lowest prices over the lifetime of the contract. Highest price that day Opening price Expiry month Number of open contracts 8

Reading a Futures Quote ($/€) Daily Change Closing price Lowest price that day Highest and lowest prices over the lifetime of the contract. Highest price that day Opening price Expiry month Number of open contracts 8

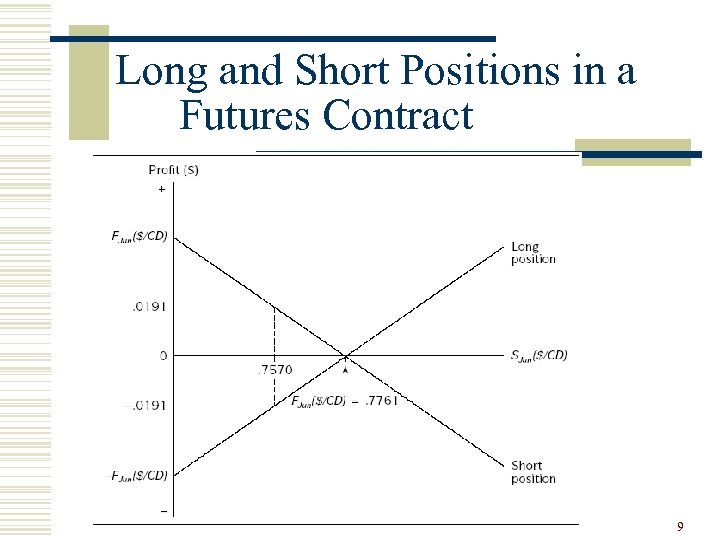

Long and Short Positions in a Futures Contract 9

Long and Short Positions in a Futures Contract 9

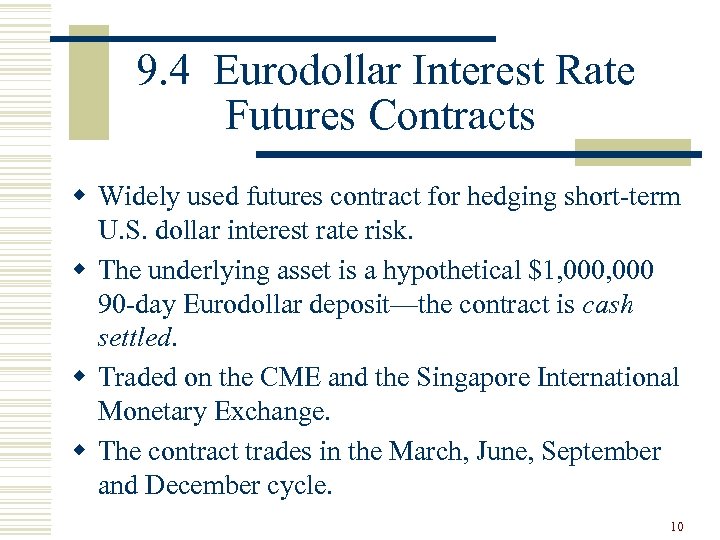

9. 4 Eurodollar Interest Rate Futures Contracts w Widely used futures contract for hedging short-term U. S. dollar interest rate risk. w The underlying asset is a hypothetical $1, 000 90 -day Eurodollar deposit—the contract is cash settled. w Traded on the CME and the Singapore International Monetary Exchange. w The contract trades in the March, June, September and December cycle. 10

9. 4 Eurodollar Interest Rate Futures Contracts w Widely used futures contract for hedging short-term U. S. dollar interest rate risk. w The underlying asset is a hypothetical $1, 000 90 -day Eurodollar deposit—the contract is cash settled. w Traded on the CME and the Singapore International Monetary Exchange. w The contract trades in the March, June, September and December cycle. 10

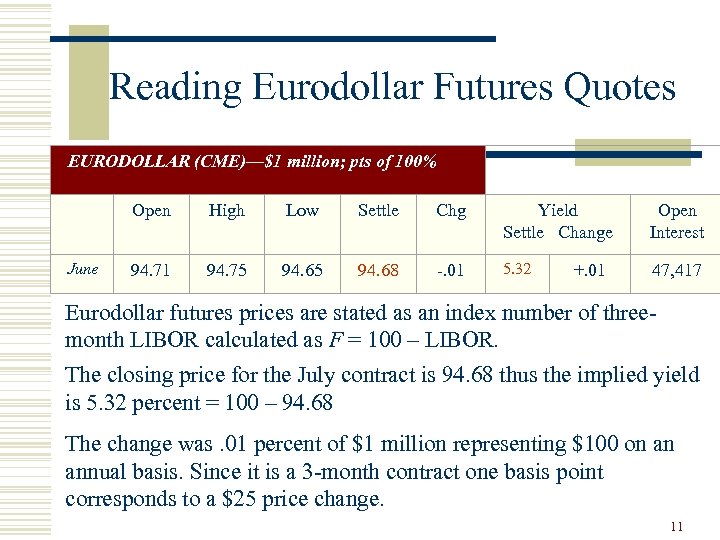

Reading Eurodollar Futures Quotes EURODOLLAR (CME)—$1 million; pts of 100% Open High Low Settle Chg Yield Settle Change Open Interest June 94. 71 94. 75 94. 68 -. 01 5. 32 47, 417 +. 01 Eurodollar futures prices are stated as an index number of threemonth LIBOR calculated as F = 100 – LIBOR. The closing price for the July contract is 94. 68 thus the implied yield is 5. 32 percent = 100 – 94. 68 The change was. 01 percent of $1 million representing $100 on an annual basis. Since it is a 3 -month contract one basis point corresponds to a $25 price change. 11

Reading Eurodollar Futures Quotes EURODOLLAR (CME)—$1 million; pts of 100% Open High Low Settle Chg Yield Settle Change Open Interest June 94. 71 94. 75 94. 68 -. 01 5. 32 47, 417 +. 01 Eurodollar futures prices are stated as an index number of threemonth LIBOR calculated as F = 100 – LIBOR. The closing price for the July contract is 94. 68 thus the implied yield is 5. 32 percent = 100 – 94. 68 The change was. 01 percent of $1 million representing $100 on an annual basis. Since it is a 3 -month contract one basis point corresponds to a $25 price change. 11

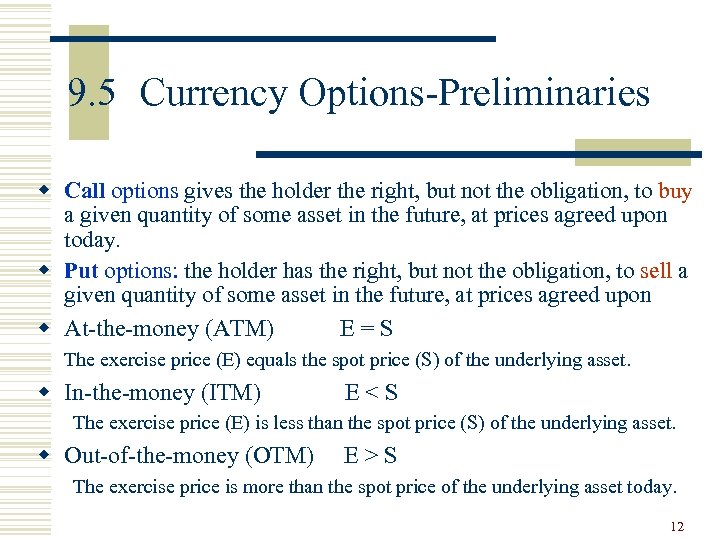

9. 5 Currency Options-Preliminaries w Call options gives the holder the right, but not the obligation, to buy a given quantity of some asset in the future, at prices agreed upon today. w Put options: the holder has the right, but not the obligation, to sell a given quantity of some asset in the future, at prices agreed upon w At-the-money (ATM) E = S The exercise price (E) equals the spot price (S) of the underlying asset. w In-the-money (ITM) E < S The exercise price (E) is less than the spot price (S) of the underlying asset. w Out-of-the-money (OTM) E > S The exercise price is more than the spot price of the underlying asset today. 12

9. 5 Currency Options-Preliminaries w Call options gives the holder the right, but not the obligation, to buy a given quantity of some asset in the future, at prices agreed upon today. w Put options: the holder has the right, but not the obligation, to sell a given quantity of some asset in the future, at prices agreed upon w At-the-money (ATM) E = S The exercise price (E) equals the spot price (S) of the underlying asset. w In-the-money (ITM) E < S The exercise price (E) is less than the spot price (S) of the underlying asset. w Out-of-the-money (OTM) E > S The exercise price is more than the spot price of the underlying asset today. 12

Currency Options Markets w Originally traded OTC w PHLX w OTC volume is much bigger than exchange volume. ($130 Bil. vs. $3 Bil. Per day) w Trading is in six major currencies against the U. S. dollar. w Options contract sizes are half of the futures contracts 13

Currency Options Markets w Originally traded OTC w PHLX w OTC volume is much bigger than exchange volume. ($130 Bil. vs. $3 Bil. Per day) w Trading is in six major currencies against the U. S. dollar. w Options contract sizes are half of the futures contracts 13

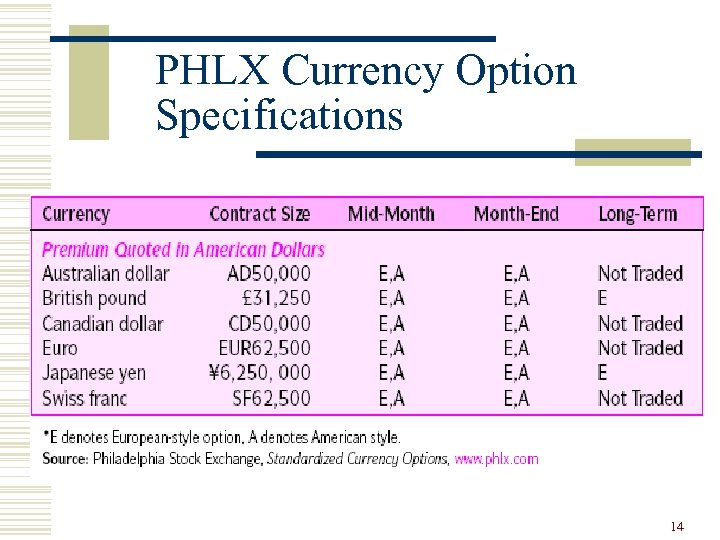

PHLX Currency Option Specifications 14

PHLX Currency Option Specifications 14

Currency Futures Options w Currency futures options are an option on a currency futures contract. w Exercise of a currency futures option results in a long futures position for the holder of a call or the writer of a put. w Exercise of a currency futures option results in a short futures position for the seller of a call or the buyer of a put. w If the futures position is not offset prior to its expiration, foreign currency will change hands. 15

Currency Futures Options w Currency futures options are an option on a currency futures contract. w Exercise of a currency futures option results in a long futures position for the holder of a call or the writer of a put. w Exercise of a currency futures option results in a short futures position for the seller of a call or the buyer of a put. w If the futures position is not offset prior to its expiration, foreign currency will change hands. 15

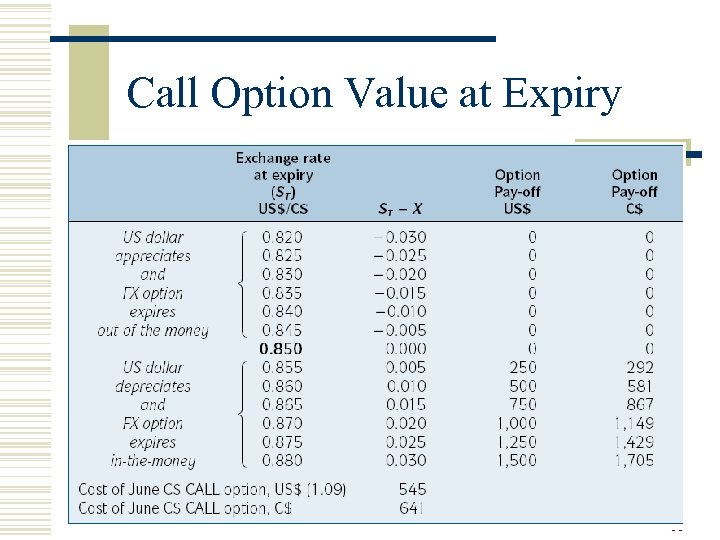

Call Option Value at Expiry 16

Call Option Value at Expiry 16

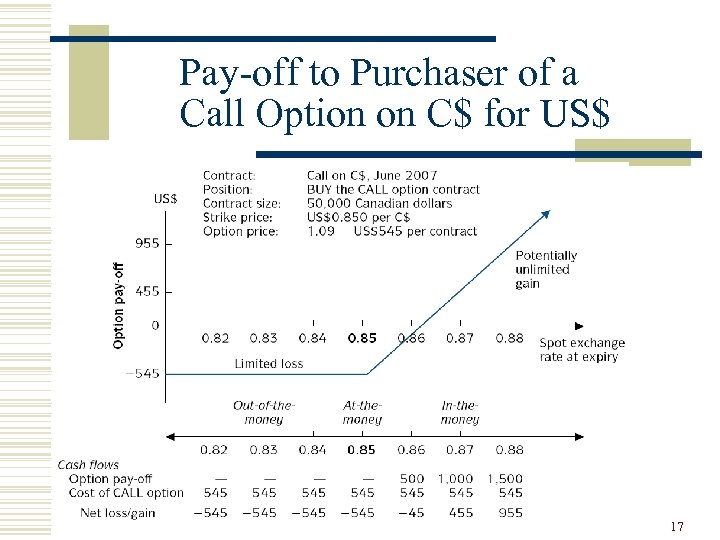

Pay-off to Purchaser of a Call Option on C$ for US$ 17

Pay-off to Purchaser of a Call Option on C$ for US$ 17

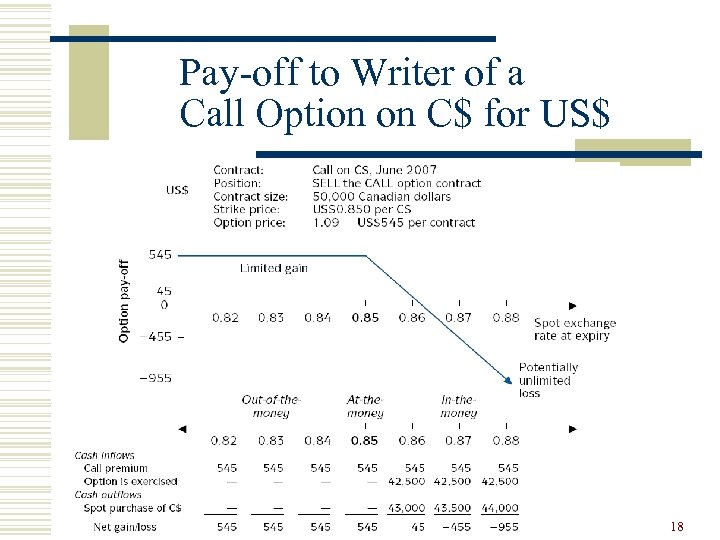

Pay-off to Writer of a Call Option on C$ for US$ 18

Pay-off to Writer of a Call Option on C$ for US$ 18

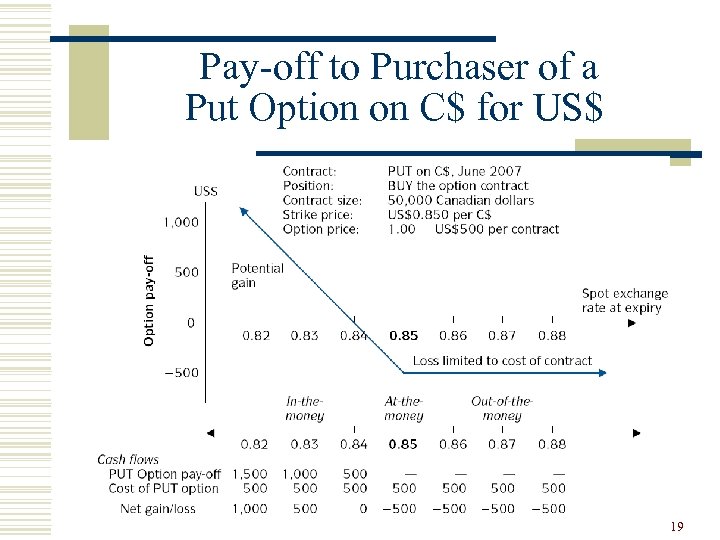

Pay-off to Purchaser of a Put Option on C$ for US$ 19

Pay-off to Purchaser of a Put Option on C$ for US$ 19

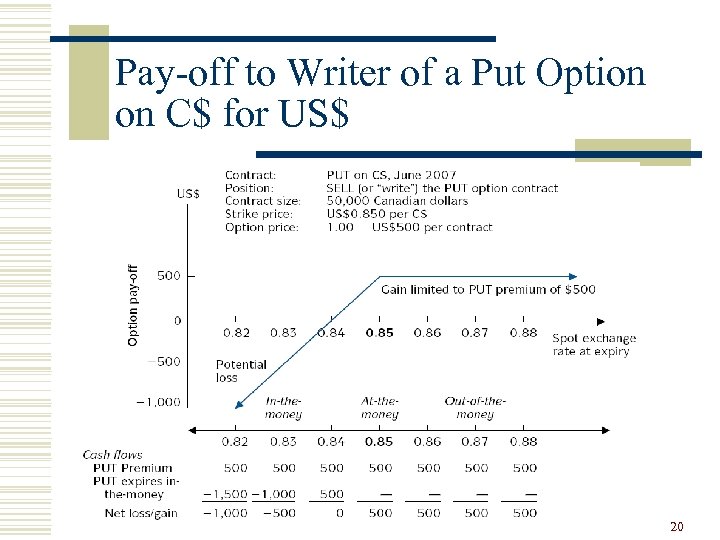

Pay-off to Writer of a Put Option on C$ for US$ 20

Pay-off to Writer of a Put Option on C$ for US$ 20

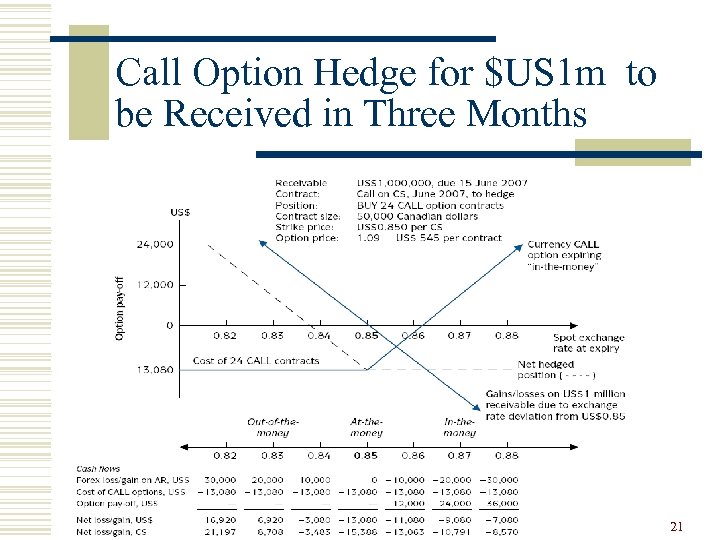

Call Option Hedge for $US 1 m to be Received in Three Months 21

Call Option Hedge for $US 1 m to be Received in Three Months 21