Lecture 3.ppt

- Количество слайдов: 29

Future value of money Allocation of Funds and Interest Rates The interest rate Distinctions among valuation concepts Research work 1. Financial planning: methods, principals, mechanisms. 2. Methods of profit forming and management. 1. 2. 3.

Future value of money Allocation of Funds and Interest Rates The interest rate Distinctions among valuation concepts Research work 1. Financial planning: methods, principals, mechanisms. 2. Methods of profit forming and management. 1. 2. 3.

Secondary Market Ú transactions do not increase the total amount of financial assets outstanding but Ú enhances the primary or direct market for securities

Secondary Market Ú transactions do not increase the total amount of financial assets outstanding but Ú enhances the primary or direct market for securities

Over-the-counter market (ОТC) Ú most corporate bonds and a growing number of stocks are traded OTC Ú has become highly mechanized, with market participant linked together by a telecommunications network Ú The National Association of Securities Dealers Automated Quotation Service (NASDAQ) maintains this network, and price quotations are instantaneous

Over-the-counter market (ОТC) Ú most corporate bonds and a growing number of stocks are traded OTC Ú has become highly mechanized, with market participant linked together by a telecommunications network Ú The National Association of Securities Dealers Automated Quotation Service (NASDAQ) maintains this network, and price quotations are instantaneous

Allocation process is affected Ú capital rationing Ú government restrictions, Ú institutional constraints

Allocation process is affected Ú capital rationing Ú government restrictions, Ú institutional constraints

If risk is held constant, economic units willing to pay the highest expected return The economic units bidding the highest prices will have the most promising investment opportunities. Savings will tend to be allocated to the most efficient uses

If risk is held constant, economic units willing to pay the highest expected return The economic units bidding the highest prices will have the most promising investment opportunities. Savings will tend to be allocated to the most efficient uses

Depending expected returns and risk Ú Different financial instruments have different degrees of risk. Ú So to compete for funds, these instruments must provide different expected returns, or yields Ú The higher the risk of a security, the higher the expected return that must be offered to the investor. Ú If all securities had exactly the same risk characteristics, they would provide the same expected returns if markets were in balance.

Depending expected returns and risk Ú Different financial instruments have different degrees of risk. Ú So to compete for funds, these instruments must provide different expected returns, or yields Ú The higher the risk of a security, the higher the expected return that must be offered to the investor. Ú If all securities had exactly the same risk characteristics, they would provide the same expected returns if markets were in balance.

Default Risk Ú danger that the borrower may not meet payments due on principal or interest Ú investors demand a risk premium (or extra expected return) to invest in securities that are not default free

Default Risk Ú danger that the borrower may not meet payments due on principal or interest Ú investors demand a risk premium (or extra expected return) to invest in securities that are not default free

Marketability (or liquidity ) Ú owner's ability to convert it into cash. There are two dimensions to marketability: Ú the price realized Ú the amount of time required to sell the asset.

Marketability (or liquidity ) Ú owner's ability to convert it into cash. There are two dimensions to marketability: Ú the price realized Ú the amount of time required to sell the asset.

For financial instruments, marketability Ú is judged in relation to the ability to sell a significant volume of securities in a short period of time without significant price concession Ú the more marketable the security, the greater the ability to execute a large transaction near the quoted price

For financial instruments, marketability Ú is judged in relation to the ability to sell a significant volume of securities in a short period of time without significant price concession Ú the more marketable the security, the greater the ability to execute a large transaction near the quoted price

Maturity Ú relationship between yield and maturity for securities differing only in the length of time (or term) to maturity is called the term structure of interest rates Ú the longer the maturity, the greater the risk of fluctuation in the market value of the security.

Maturity Ú relationship between yield and maturity for securities differing only in the length of time (or term) to maturity is called the term structure of interest rates Ú the longer the maturity, the greater the risk of fluctuation in the market value of the security.

Interest income Ú one category of securities is taxable to taxable investors Ú interest income from state and local government securities is tax exempt Ú state and local issues sell in the market at lower yields to maturity than Treasury and corporate securities of the same maturity

Interest income Ú one category of securities is taxable to taxable investors Ú interest income from state and local government securities is tax exempt Ú state and local issues sell in the market at lower yields to maturity than Treasury and corporate securities of the same maturity

Call feature allows company to retire bonds periodically with cash payments or by buying bonds in the secondary market.

Call feature allows company to retire bonds periodically with cash payments or by buying bonds in the secondary market.

Inflation Ú inflation expectations have a substantial influence on interest rates overall Ú nominal (observed) rate of interest on a security embodies a premium for inflation Ú the higher the expected inflation, the higher the nominal yield on the security; Ú and the lower the expected inflation, the lower the nominal yield.

Inflation Ú inflation expectations have a substantial influence on interest rates overall Ú nominal (observed) rate of interest on a security embodies a premium for inflation Ú the higher the expected inflation, the higher the nominal yield on the security; Ú and the lower the expected inflation, the lower the nominal yield.

If the annual real rate of interest in the economy was 4 % for low-risk securities and inflation of 6 % per annum was expected over the next 10 years, this would imply a yield of 10 % for 10 -year, highgrade bonds

If the annual real rate of interest in the economy was 4 % for low-risk securities and inflation of 6 % per annum was expected over the next 10 years, this would imply a yield of 10 % for 10 -year, highgrade bonds

Simple interest rate interest that is paid (earned) on only the original amount, or principal, borrowed (lent). SI=P 0 (i)(n) where SI = simple interest in dollars P 0 = principal, or original amount borrowed (lent) at time period i = interest rate per time period n = number of time periods

Simple interest rate interest that is paid (earned) on only the original amount, or principal, borrowed (lent). SI=P 0 (i)(n) where SI = simple interest in dollars P 0 = principal, or original amount borrowed (lent) at time period i = interest rate per time period n = number of time periods

Example Ú assume that you deposit $100 in a savings account paying 8 percent simple interest and keep it there for 10 years. At the end of 10 years, the amount of interest accumulated is determined as follows: Ú $80 = $100(0. 08)(10) Ú To solve for the future value (also known as the terminal value) of the account at the end of 10 years (FV), we add the interest earned on the principal only to the original amount invested. Therefore Ú FV 10 = $100 + [$100(0. 08)(10)] = $180

Example Ú assume that you deposit $100 in a savings account paying 8 percent simple interest and keep it there for 10 years. At the end of 10 years, the amount of interest accumulated is determined as follows: Ú $80 = $100(0. 08)(10) Ú To solve for the future value (also known as the terminal value) of the account at the end of 10 years (FV), we add the interest earned on the principal only to the original amount invested. Therefore Ú FV 10 = $100 + [$100(0. 08)(10)] = $180

Future value of an account at the end of n periods Ú FVn = P 0 + SI = P 0 + P 0(i)(n) or, equivalently FVn = P 0[1 + (i)(n)] Account's present value PVo = Po = FVn/[1+(i)(n)]

Future value of an account at the end of n periods Ú FVn = P 0 + SI = P 0 + P 0(i)(n) or, equivalently FVn = P 0[1 + (i)(n)] Account's present value PVo = Po = FVn/[1+(i)(n)]

The compound interest Ú interest paid (earned) on a loan (an investment) is periodically added to the principal Ú as a result, interest is earned on interest as well as the initial principal Ú it is this interest-on-interest, or compounding, effect that accounts for the dramatic difference between simple and compound interest

The compound interest Ú interest paid (earned) on a loan (an investment) is periodically added to the principal Ú as a result, interest is earned on interest as well as the initial principal Ú it is this interest-on-interest, or compounding, effect that accounts for the dramatic difference between simple and compound interest

Future (or Compound) Value Ú person who deposits $100 into a savings account. If the interest rate is 8 %, compounded annually, how much will the $100 be worth at the end of a year? FV 1 = P 0(1 + i)= $100(1+0. 08) = $108 Ú The $100 initial deposit will have grown to $108 at the end of the first year at 8 percent compound annual interest. Going to the end of the second year, $108 becomes $116. 64, as $8 in interest is earned on the initial $100, and $0. 64 is earned on the $8 in interest credited to our account at the end of the first year

Future (or Compound) Value Ú person who deposits $100 into a savings account. If the interest rate is 8 %, compounded annually, how much will the $100 be worth at the end of a year? FV 1 = P 0(1 + i)= $100(1+0. 08) = $108 Ú The $100 initial deposit will have grown to $108 at the end of the first year at 8 percent compound annual interest. Going to the end of the second year, $108 becomes $116. 64, as $8 in interest is earned on the initial $100, and $0. 64 is earned on the $8 in interest credited to our account at the end of the first year

The future value at the end of the second year is Ú FV 2 = FV 1(1 + i) = P 0(1 + i)2 = $108(1. 08) = $100(1. 08)2 = $116. 64 At the end of 3 years, the account would be worth Ú FV 3 = FV 2(1 + i) = FV 1(1 + i) = P 0(1 + i)3 = $116. 64(1. 08) = $108(1. 08 X 1. 08) = $100(1. 08)3 = $125. 97

The future value at the end of the second year is Ú FV 2 = FV 1(1 + i) = P 0(1 + i)2 = $108(1. 08) = $100(1. 08)2 = $116. 64 At the end of 3 years, the account would be worth Ú FV 3 = FV 2(1 + i) = FV 1(1 + i) = P 0(1 + i)3 = $116. 64(1. 08) = $108(1. 08 X 1. 08) = $100(1. 08)3 = $125. 97

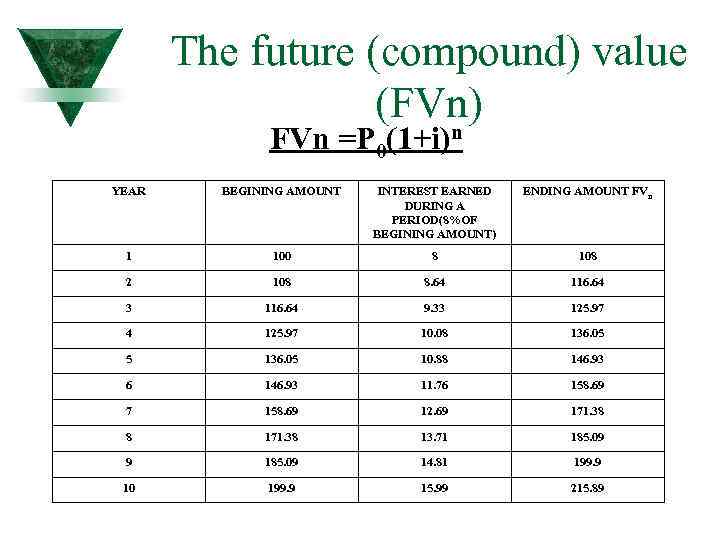

The future (compound) value (FVn) n FVn =P 0(1+i) YEAR BEGINING AMOUNT INTEREST EARNED DURING A PERIOD(8%OF BEGINING AMOUNT) ENDING AMOUNT FVn 1 100 8 108 2 108 8. 64 116. 64 3 116. 64 9. 33 125. 97 4 125. 97 10. 08 136. 05 5 136. 05 10. 88 146. 93 6 146. 93 11. 76 158. 69 7 158. 69 12. 69 171. 38 8 171. 38 13. 71 185. 09 9 185. 09 14. 81 199. 9 10 199. 9 15. 99 215. 89

The future (compound) value (FVn) n FVn =P 0(1+i) YEAR BEGINING AMOUNT INTEREST EARNED DURING A PERIOD(8%OF BEGINING AMOUNT) ENDING AMOUNT FVn 1 100 8 108 2 108 8. 64 116. 64 3 116. 64 9. 33 125. 97 4 125. 97 10. 08 136. 05 5 136. 05 10. 88 146. 93 6 146. 93 11. 76 158. 69 7 158. 69 12. 69 171. 38 8 171. 38 13. 71 185. 09 9 185. 09 14. 81 199. 9 10 199. 9 15. 99 215. 89

The future value interest factor at i% for n periods (FVIFi, n ) FVn = Po(FVIFi, n) For example, the future value interest factor at 8 percent for nine years (FVIF 8% 9) is located at the intersection of the 8% column with the 9 -period row and equals 1. 999. This 1. 999 figure means that $1 invested at 8 percent compound interest for nine years will return roughly $2—consisting of initial principal plus accumulated interest

The future value interest factor at i% for n periods (FVIFi, n ) FVn = Po(FVIFi, n) For example, the future value interest factor at 8 percent for nine years (FVIF 8% 9) is located at the intersection of the 8% column with the 9 -period row and equals 1. 999. This 1. 999 figure means that $1 invested at 8 percent compound interest for nine years will return roughly $2—consisting of initial principal plus accumulated interest

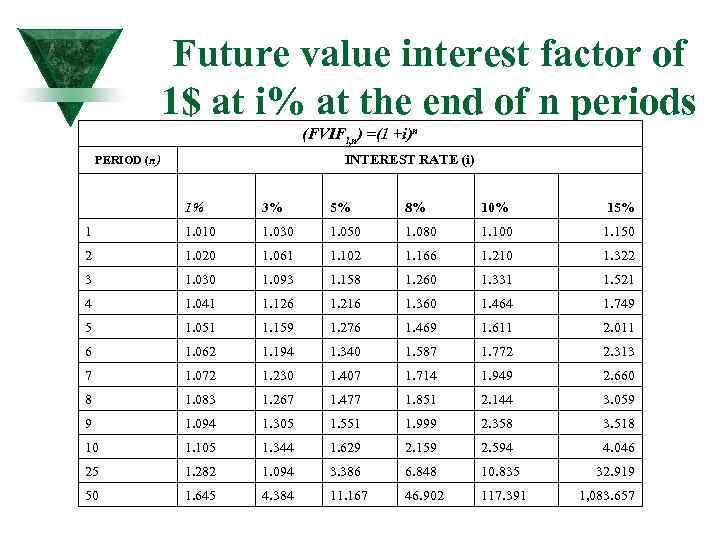

Future value interest factor of 1$ at i% at the end of n periods (FVIFi, n) =(1 +i)n PERIOD (n) INTEREST RATE (i) 1% 3% 5% 8% 10% 15% 1 1. 010 1. 030 1. 050 1. 080 1. 100 1. 150 2 1. 020 1. 061 1. 102 1. 166 1. 210 1. 322 3 1. 030 1. 093 1. 158 1. 260 1. 331 1. 521 4 1. 041 1. 126 1. 216 1. 360 1. 464 1. 749 5 1. 051 1. 159 1. 276 1. 469 1. 611 2. 011 6 1. 062 1. 194 1. 340 1. 587 1. 772 2. 313 7 1. 072 1. 230 1. 407 1. 714 1. 949 2. 660 8 1. 083 1. 267 1. 477 1. 851 2. 144 3. 059 9 1. 094 1. 305 1. 551 1. 999 2. 358 3. 518 10 1. 105 1. 344 1. 629 2. 159 2. 594 4. 046 25 1. 282 1. 094 3. 386 6. 848 10. 835 32. 919 50 1. 645 4. 384 11. 167 46. 902 117. 391 1, 083. 657

Future value interest factor of 1$ at i% at the end of n periods (FVIFi, n) =(1 +i)n PERIOD (n) INTEREST RATE (i) 1% 3% 5% 8% 10% 15% 1 1. 010 1. 030 1. 050 1. 080 1. 100 1. 150 2 1. 020 1. 061 1. 102 1. 166 1. 210 1. 322 3 1. 030 1. 093 1. 158 1. 260 1. 331 1. 521 4 1. 041 1. 126 1. 216 1. 360 1. 464 1. 749 5 1. 051 1. 159 1. 276 1. 469 1. 611 2. 011 6 1. 062 1. 194 1. 340 1. 587 1. 772 2. 313 7 1. 072 1. 230 1. 407 1. 714 1. 949 2. 660 8 1. 083 1. 267 1. 477 1. 851 2. 144 3. 059 9 1. 094 1. 305 1. 551 1. 999 2. 358 3. 518 10 1. 105 1. 344 1. 629 2. 159 2. 594 4. 046 25 1. 282 1. 094 3. 386 6. 848 10. 835 32. 919 50 1. 645 4. 384 11. 167 46. 902 117. 391 1, 083. 657

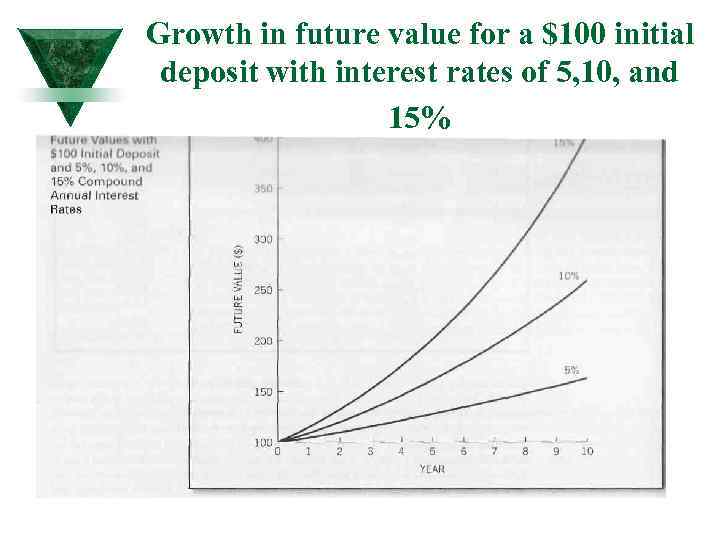

Growth in future value for a $100 initial deposit with interest rates of 5, 10, and 15%

Growth in future value for a $100 initial deposit with interest rates of 5, 10, and 15%

Liquidation Value versus Going-Concern Value Liquidation value - amount of money that could be realized if an asset or a group of assets (e. g. , a firm) is sold separately from its operating organization BUT Going-concern value - amount the firm could be sold for as a continuing operating business

Liquidation Value versus Going-Concern Value Liquidation value - amount of money that could be realized if an asset or a group of assets (e. g. , a firm) is sold separately from its operating organization BUT Going-concern value - amount the firm could be sold for as a continuing operating business

Book Value versus Market Value Ú Book value of an asset is the accounting value of the asset—the asset's cost minus its accumulated depreciation. Ú Book value of a firm is equal to the dollar difference between the firm's total assets and its liabilities and preferred stock as listed on its balance sheet. Ú Market value of an asset is simply the market price at which the asset (or a similar asset) trades in an open marketplace.

Book Value versus Market Value Ú Book value of an asset is the accounting value of the asset—the asset's cost minus its accumulated depreciation. Ú Book value of a firm is equal to the dollar difference between the firm's total assets and its liabilities and preferred stock as listed on its balance sheet. Ú Market value of an asset is simply the market price at which the asset (or a similar asset) trades in an open marketplace.

Market Value versus Intrinsic Value Ú Market value of a security is the market price of the security. For an actively traded security, it would be the last reported price at which the security was sold. For an inactively traded security, an estimated market price would be needed. Ú Intrinsic value of a security is what the price of a security should be if properly priced based on all factors bearing on valuation assets, earnings future prospects , management and so on. In short the intrinsic value of a security is its economic value

Market Value versus Intrinsic Value Ú Market value of a security is the market price of the security. For an actively traded security, it would be the last reported price at which the security was sold. For an inactively traded security, an estimated market price would be needed. Ú Intrinsic value of a security is what the price of a security should be if properly priced based on all factors bearing on valuation assets, earnings future prospects , management and so on. In short the intrinsic value of a security is its economic value

A bond a security that pays a stated amount of interest to the investor, period after period, until it is finally retired by the issuing company Bond’s face value is usually $1, 000 per bond. The bond almost always has a stated maturity, which is the time when the company is obligated to pay the bondholder the face value of the instrument. If, for example, the coupon rate is 12 percent on a $l, 000 face-value bond, the company pays the holder $120 each year until the bond matures

A bond a security that pays a stated amount of interest to the investor, period after period, until it is finally retired by the issuing company Bond’s face value is usually $1, 000 per bond. The bond almost always has a stated maturity, which is the time when the company is obligated to pay the bondholder the face value of the instrument. If, for example, the coupon rate is 12 percent on a $l, 000 face-value bond, the company pays the holder $120 each year until the bond matures

Perpetual Bonds this bond carries the obligation of the British government to pay a fixed interest payment in perpetuity. The present value of a perpetual bond would simply be equal to the capitalized value of an infinite stream of interest payments

Perpetual Bonds this bond carries the obligation of the British government to pay a fixed interest payment in perpetuity. The present value of a perpetual bond would simply be equal to the capitalized value of an infinite stream of interest payments