bbeb2a3bf4b193c6f5ab743d24f1d2db.ppt

- Количество слайдов: 54

Future of American Monetary Policy 美国货币政策的未来 The Fed 美国联邦储备银行 Andrew K. Rose 安德鲁 K 罗斯 Associate Dean and Chair of Faculty 副院长,教员主席 UC Berkeley, Haas School of Business 1 加州大学伯克利分校哈斯商学院

Seminar Outline 讲座概要 1. Who cares? 谁会关心? 2. Functions of the Fed 美联储的职能 3. Traditional Monetary policy 传统的货币政策 4. Non-Traditional Monetary Policy 非传统的货币政策 5. Monetary Policy Challenges 货币政策所面临的挑战 2

1. Who Cares about Central Banks 谁会关心中央银行 a. Motivation 动机 3

1. a. Why Care? 为什么要关心? • Central banks influence: 中央银行会影响: Interest rates, credit conditions, financial stability 利率水平,信贷条件,金融稳定 Economic activity, unemployment, inflation 经济活动,失业情况,通货膨胀 Exchange rates and international competitiveness 汇率和国际竞争力 • Central banks influence business conditions 中央银行影响商业环境 4

2. What do Central Banks Do? 中央银行做什么? a. Functions 主要职能 5

2. Functions of the Fed 美联储的主要职能 Monetary policy 货币政策 Stable prices (Typical)稳定物价(典型功能) PBo. C: “The objective of the monetary policy is to maintain the stability of the value of the currency and thereby promote economic growth” 中国人民银行:“货币政策的目标就是要维护币值稳定从而促进经济发展。” Full employment (unusual for an OECD central bank) 提高就业水平(对于一个OECD国家的中央银行,不是很寻常的职能) Financial stability (contain systemic risks) 金融稳定(包含系统风险) Supervision & Regulation of banks (Safety/Soundness) 对于银行的监管和政策规定(安全性/稳健性) Payments system 支付系统 Government’s bank 政府的银行 6

3. Traditional Monetary Policy 传统的货币政策 a. Goals 目标 b. Structure & FOMC 结构和美国联邦公开 市场委员会 c. Mechanics 机制 7

3. a. Monetary Policy: Dual Goals 货币政策:双重目标 Price stability 价格稳定 Sustainable growth / full employment 可持续 增长 / 充分就业 This “dual mandate” is distinct. 这个“双重使命”非常独特。 8

3. a. Trying to achieve monetary policy goals is a bit like: Driving in the fog on a curvy road with cliffs on both sides, where there are long and variable lags between when you turn the steering wheel and when the wheels actually turn. The cliffs on one side represent inflation and the cliffs on the other side represent recession and unemployment. Central banks try to figure out “targets” so that they neither: Turn the wheel too hard and unexpectedly get inflation or Turn the wheel too little and fall off the cliff into a recession. The fog represents how difficult it is to actually see what is going on in terms of employment, inflation, and growth. People debate which way the wheel should be turned. Who are those people? 9

3. a. 争取达到货币政策的目标就像是: 在大雾里边开车,路上弯弯曲曲,两边都是悬崖,而且你 在打方向盘的时候,方向盘和车轮之间还存在长短不一 的时间差 路两边的悬崖,一边代表通货膨胀,一边代表衰退和失 业 中央银行需要找到“目标”,这样他们可以避免: 把方向盘打得太猛以至于造成预料之外的通货膨胀,或者 把方向盘打得不够从而造成经济衰退 路上的雾代表着实际上很难看清真实的失业,通货膨胀, 以及经济增长的情况 人们争论究竟应当怎样打方向盘 那这些争论的人是谁呢? 10

3. b. Monetary Policy: Structure Who: Federal Open Market Committee (FOMC) 5 Federal Reserve presidents vote. All 12 attend. 7 members of the Board of Governors [Monetary Policy Committee for PBo. C] When: FOMC typically meets 8 times per year [Quarterly for PBo. C] What: FOMC Directives / Announcements / Statements http: //www. federalreserve. gov/newsevents/press/monetary/20130918 a. htm [http: //www. pbc. gov. cn/publish/english/970/index. html for PBo. C] 11

![3. b. 货币政策:结构 相关方: 美国联邦公开市场委员会 (FOMC) 全体 12位主席出席,5位主席轮流投票 7位理事会成员 [中国人民银行货币政策委员会] 时间: FOMC通常在一年之内会面 8次 [中国人民银行是每季度一次] 3. b. 货币政策:结构 相关方: 美国联邦公开市场委员会 (FOMC) 全体 12位主席出席,5位主席轮流投票 7位理事会成员 [中国人民银行货币政策委员会] 时间: FOMC通常在一年之内会面 8次 [中国人民银行是每季度一次]](https://present5.com/presentation/bbeb2a3bf4b193c6f5ab743d24f1d2db/image-12.jpg)

3. b. 货币政策:结构 相关方: 美国联邦公开市场委员会 (FOMC) 全体 12位主席出席,5位主席轮流投票 7位理事会成员 [中国人民银行货币政策委员会] 时间: FOMC通常在一年之内会面 8次 [中国人民银行是每季度一次] 做什么: FOMC的指令 / 公告 / 声明 http: //www. federalreserve. gov/newsevents/press/monetary/20130918 a. htm [http: //www. pbc. gov. cn/publish/english/970/index. html for PBo. C] 12

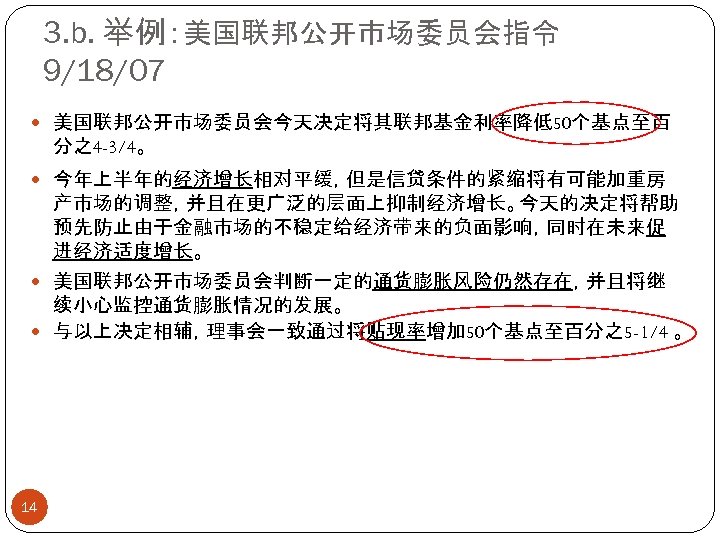

3. b. Example: FOMC directive 9/18/07 The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 4 -3/4 percent. Economic growth was moderate during the first half of the year, but the tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today’s action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time. The Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully. In a related action, the Board of Governors unanimously approved a 50 -basis-point decrease in the discount rate to 5 -1/4 percent. 13

3. b. 举例:美国联邦公开市场委员会指令 9/18/07 美国联邦公开市场委员会今天决定将其联邦基金利率降低50个基点至百 分之4 -3/4。 今年上半年的经济增长相对平缓,但是信贷条件的紧缩将有可能加重房 产市场的调整,并且在更广泛的层面上抑制经济增长。今天的决定将帮助 预先防止由于金融市场的不稳定给经济带来的负面影响,同时在未来促 进经济适度增长。 美国联邦公开市场委员会判断一定的通货膨胀风险仍然存在,并且将继 续小心监控通货膨胀情况的发展。 与以上决定相辅,理事会一致通过将贴现率增加 50个基点至百分之5 -1/4 。 14

3. b. FOMC • There was a large change in the nature of the FOMC statement following the crisis: quantitative easing. 金融危机之后,在FOMC的声明中出现了比较大的变化:量 化宽松 • We need to understand the mechanics of monetary policy to 我们需要了解货币政策的技术细节以便 understand why this change happened, and 理解为什么会出现这样的变化 what this means for business conditions in the future and around the world. 这个变化对于商业环境和世界其他市场的影响是什么 15

3. c. Monetary Policy Mechanics 货币政策的技术细节 1. 2. 3. 4. 16 Reserves and bank balance sheets储备金和 银行的资产负债表 Open market operations公开市场操作 Discount lending贴现贷款 Targeting目标选择

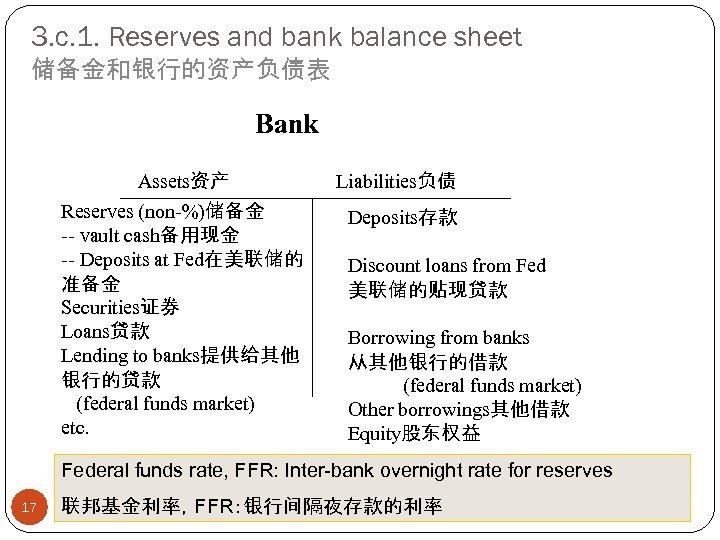

3. c. 1. Reserves and bank balance sheet 储备金和银行的资产负债表 Bank Assets资产 Reserves (non-%)储备金 -- vault cash备用现金 -- Deposits at Fed在美联储的 准备金 Securities证券 Loans贷款 Lending to banks提供给其他 银行的贷款 (federal funds market) etc. Liabilities负债 Deposits存款 Discount loans from Fed 美联储的贴现贷款 Borrowing from banks 从其他银行的借款 (federal funds market) Other borrowings其他借款 Equity股东权益 Federal funds rate, FFR: Inter-bank overnight rate for reserves 17 联邦基金利率,FFR:银行间隔夜存款的利率

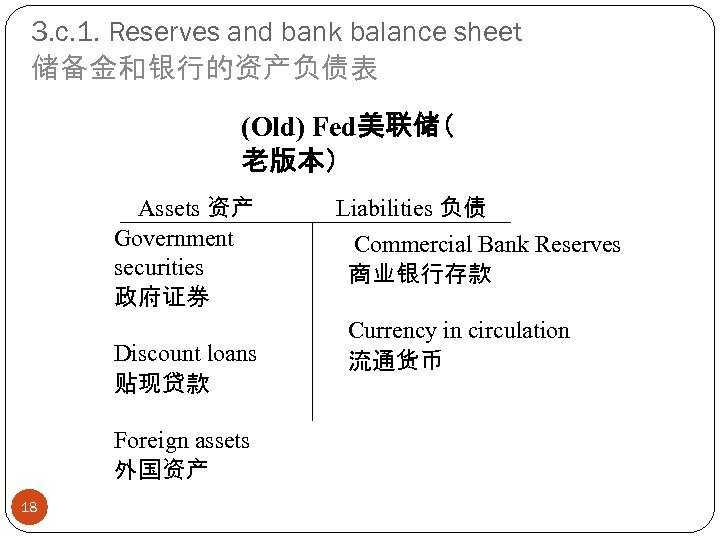

3. c. 1. Reserves and bank balance sheet 储备金和银行的资产负债表 (Old) Fed美联储( 老版本) Assets 资产 Government securities 政府证券 Discount loans 贴现贷款 Foreign assets 外国资产 18 Liabilities 负债 Commercial Bank Reserves 商业银行存款 Currency in circulation 流通货币

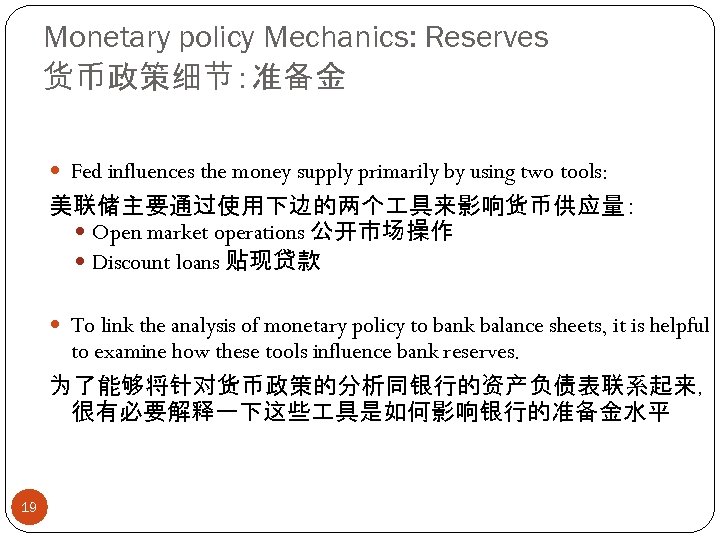

Monetary policy Mechanics: Reserves 货币政策细节:准备金 Fed influences the money supply primarily by using two tools: 美联储主要通过使用下边的两个 具来影响货币供应量: Open market operations 公开市场操作 Discount loans 贴现贷款 To link the analysis of monetary policy to bank balance sheets, it is helpful to examine how these tools influence bank reserves. 为了能够将针对货币政策的分析同银行的资产负债表联系起来, 很有必要解释一下这些 具是如何影响银行的准备金水平 19

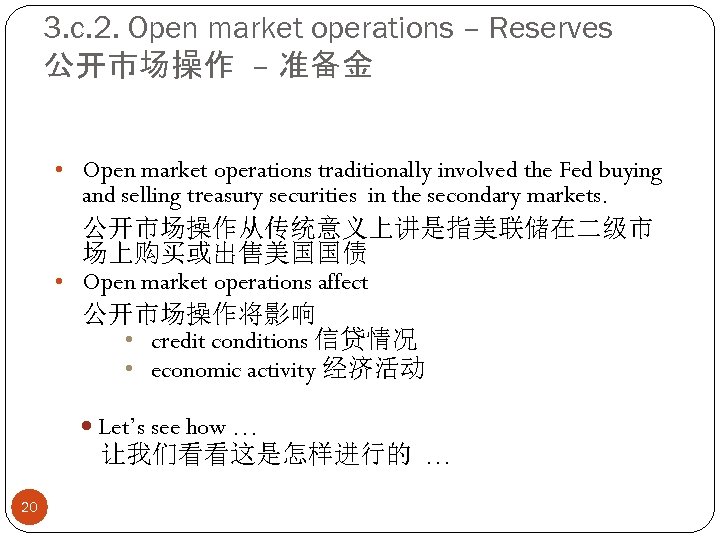

3. c. 2. Open market operations – Reserves 公开市场操作 – 准备金 • Open market operations traditionally involved the Fed buying and selling treasury securities in the secondary markets. 公开市场操作从传统意义上讲是指美联储在二级市 场上购买或出售美国国债 • Open market operations affect 公开市场操作将影响 • credit conditions 信贷情况 • economic activity 经济活动 Let’s see how … 让我们看看这是怎样进行的 … 20

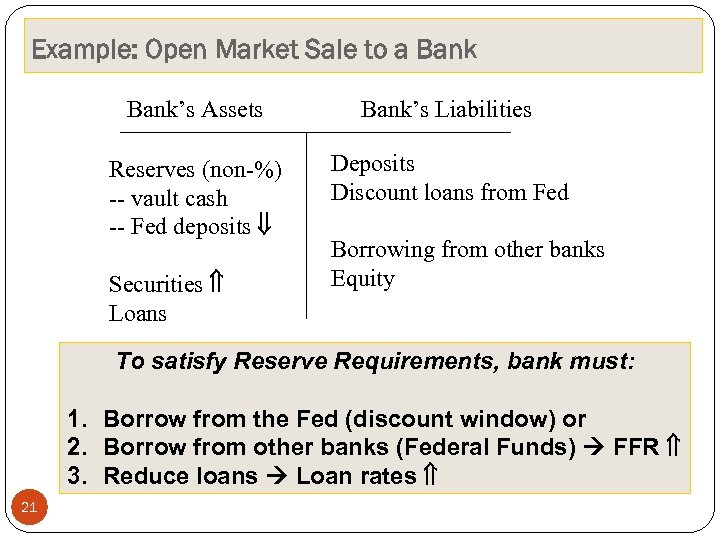

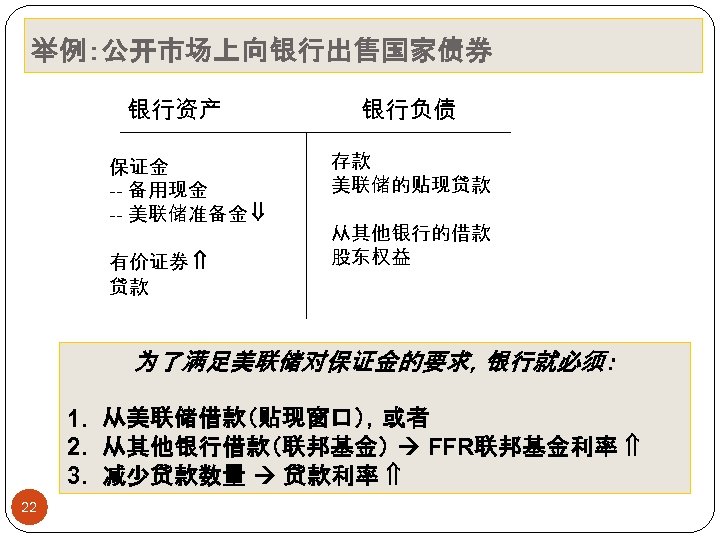

Example: Open Market Sale to a Bank’s Assets Bank’s Liabilities Reserves (non-%) -- vault cash -- Fed deposits Deposits Discount loans from Fed Securities Loans Borrowing from other banks Equity To satisfy Reserve Requirements, bank must: 1. 2. 3. 21 Borrow from the Fed (discount window) or Borrow from other banks (Federal Funds) FFR Reduce loans Loan rates

举例:公开市场上向银行出售国家债券 银行资产 保证金 -- 备用现金 -- 美联储准备金 有价证券 贷款 银行负债 存款 美联储的贴现贷款 从其他银行的借款 股东权益 为了满足美联储对保证金的要求,银行就必须: 1. 2. 3. 22 从美联储借款(贴现窗口),或者 从其他银行借款(联邦基金) FFR联邦基金利率 减少贷款数量 贷款利率

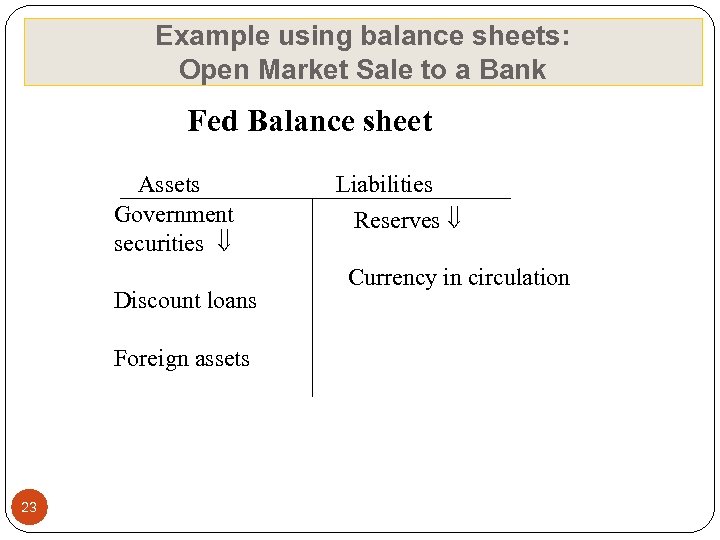

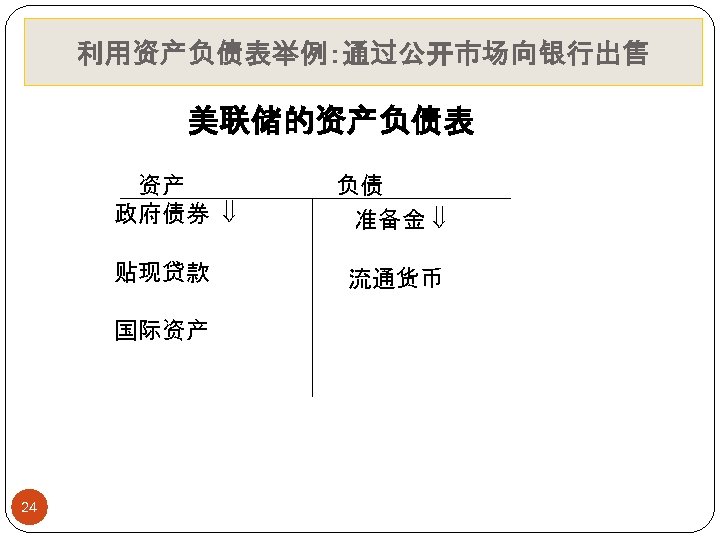

Example using balance sheets: Open Market Sale to a Bank Fed Balance sheet Assets Government securities Discount loans Foreign assets 23 Liabilities Reserves Currency in circulation

利用资产负债表举 Bank Open Market Sale to a例:通过公开市场向银行出售 美联储的资产负债表 资产 政府债券 贴现贷款 国际资产 24 负债 准备金 流通货币

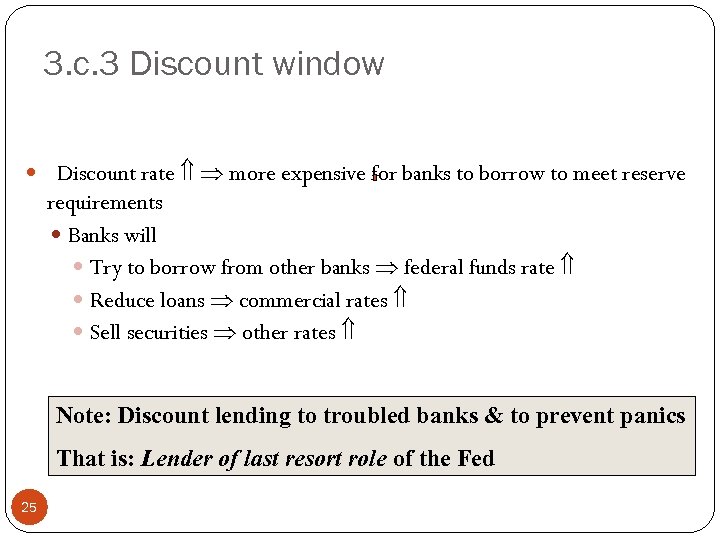

3. c. 3 Discount window Discount rate more expensive for banks to borrow to meet reserve requirements Banks will Try to borrow from other banks federal funds rate Reduce loans commercial rates Sell securities other rates Note: Discount lending to troubled banks & to prevent panics That is: Lender of last resort role of the Fed 25

3. c. 3 贴现窗口 贴现率 银行借款成本上升,满足准备金要求的成本上升 银行将会 向其他银行借款 联邦基金利率 减少贷款数量 商业贷款利率 出售有价证券 其他利率 注意:向有困难的银行通过贴现贷款而避免市场恐慌 这是:美联储作为最后贷款人的角色 26

3. c. 4. Targeting How does the Fed know the appropriate value of securities to purchase or the rate at which it should charge banks to borrow (discount loans) or the level of reserve requirements when changes in these actions only influence prices and employment with long variable lags? One way is for the Fed to target the federal funds rate because its an easy-to -observe, though limited, indicator of credit conditions. Example: Buy Treasury securities through Open Market Operations until the targeted FFR is achieved. Then, wait, and see how this influences prices and unemployment. Then, decide if it wants to alter the targeted FFR. 27

3. c. 4. 目标设定 美联储是如何知道究竟购买多少有价证券,或者应当向银行收 取多少借款利息(贴现贷款),或者当上述的这些行动仅仅会对 市场价格水平和就业率情况产生很长的滞后作用的时候,商业 银行的存款准备金应该维护在什么水平? 一种方法就是美联储可以通过设定联邦基金利率目标,因为这 是一个虽然有限,但是很容易观察的有关信贷条件的指标。例如: 在公开市场上购买国债,直到达到联邦基金目标利率为止 然后,观察这样的行动如何影响物价水平和失业情况 然后决定是否改变联邦基金的目标利率 28

3. c. 4 FOMC: directive 9/18/07 The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 4 -3/4 percent. Economic growth was moderate during the first half of the year, but the tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today’s action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time. The Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully. In a related action, the Board of Governors unanimously approved a 50 -basis-point decrease in the discount rate to 5 -1/4 percent. 29

3. c. 4 举例:美国联邦公开市场委员会指令 9/18/07 美国联邦公开市场委员会今天决定将其联邦基金利率降低50个基点至百 分之4 -3/4。 今年上半年的经济增长相对平缓,但是信贷条件的紧缩将有可能加重房 产市场的调整,并且在更广泛的层面上抑制经济增长。今天的决定将帮助 预先防止由于金融市场的不稳定给经济带来的负面影响,同时在未来促 进经济适度增长。 美国联邦公开市场委员会判断一定的通货膨胀风险仍然存在,并且将继 续小心监控通货膨胀情况的发展。 与以上决定相辅,理事会一致通过将贴现率增加 50个基点至百分之5 -1/4 。 30

4. Non-Traditional Monetary Policy 非传统的货币政策 a. b. c. d. e. 31 Traditional monetary policy did not work 传统 的货币政策失效 Fed implements quantitative easing 美联储开 始实行量化宽松政策 New FOMC statement 新的FOMC声明 “New” balance sheet “新的”资产负债表 Challenges: “Tapering” 挑战:“逐渐减少”

4. a. Traditional Monetary Policy did not work By 2009, the Federal Funds Target Rate had fallen to zero. It was no longer an effective indicator of credit conditions. Also, because of liquidity fears, short-term interests became “disconnected” from longer rates, which further reduced the usefulness of targeting the FFR. Banks did not use the discount window much because of the stigma associated with borrowing directly from the Fed. But, there were fears of deflation, which would push the real value of debt up and would push real wages up (and hence encourage more unemployment) What to do? 32

4. a. 传统的货币政策失效 到 2009年,美联储的联邦基金目标利率降低到 0 联邦基金利率不再能够真实反映实际的信贷情况 还有,由于对于流动性的恐惧,短期利率和长期利率“ 脱钩”,这更造成了联邦基金目标利率的有效性 商业银行不再经常使用贴现窗口这一 具,因为从 美联储借款往往充满了屈辱 但是,市场上也存在对于通货紧缩的恐惧。通货紧 缩将推升实际的债务总值,以及 资水平(因而将 会导致更高的失业率) 那怎么办? 33

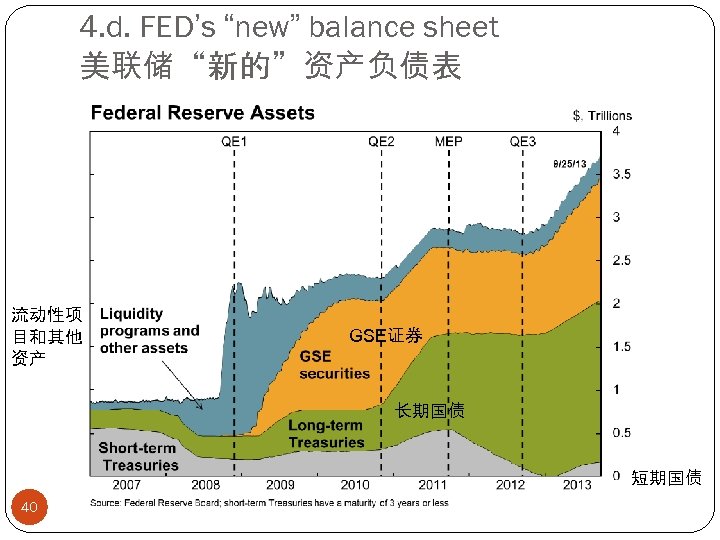

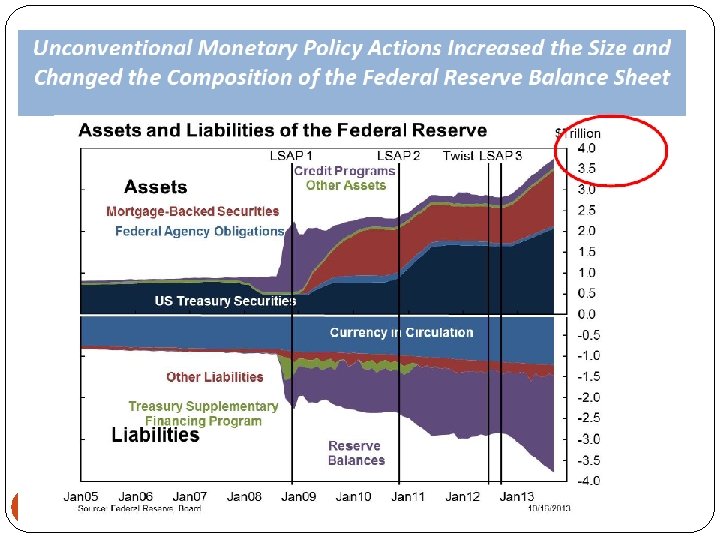

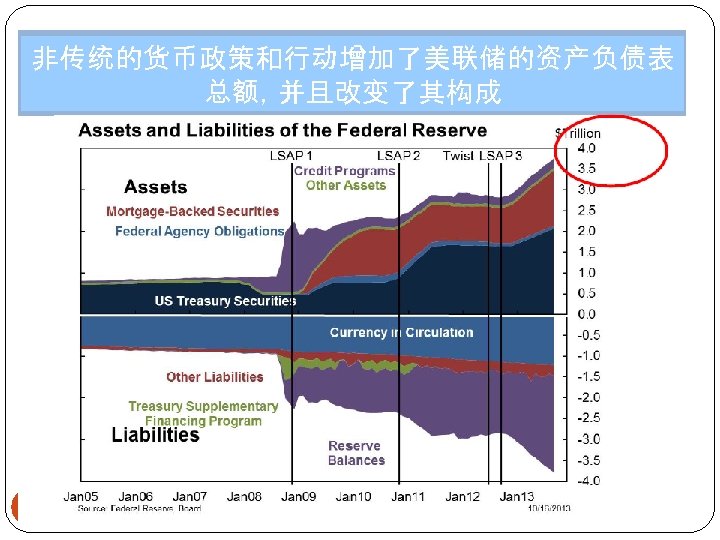

4. b. Fed adds “Quantitative Easing” (QE) QE 1: 11/2008 - 6/2010: Large-scale asset purchases of $600 billion of mortgage-backed securities from banks. QE 2: 10/2010 – 6/2011: large-scale purchases of about $600 billion in long-term Treasury securities. QE 3: 9/2012 - … : $85 billion/month of mortgage-backed securities and long-term Treasury securities. Boosted the Fed’s balance sheet by almost $3 trillion. Also: “Forward Guidance” Fed seeks to “guide the economy” by telling us what they will do in advance, especially to FFR and QE 34

4. b. 美联储推出了“量化宽松(QE)”政策 量化宽松(QE) QE 1: 11/2008 - 6/2010: 大规模地从商业银行手中购买 了价值 6000亿美元的抵押贷款证券 QE 2: 10/2010 – 6/2011: 大规模地购买了价值 6000亿美 元的美国国债 QE 3: 9/2012 - … : 每月购买价值 850亿美元的抵押贷款 证券和美国长期国债 将美联储的资产负债表总额增加了近三万亿美元 还有:“前瞻性指导” 美联储尝试着通过告诉我们它将怎样做,特别是怎样 设定联邦基金利率和量化宽松的规模,来“指导经济的 走势”。 35

4. c. FOMC: statement: Sept. 18, 2013 Information received since the Federal Open Market Committee met in July suggests that economic activity has been expanding at a moderate pace… the unemployment rate remains elevated. Apart from fluctuations due to changes in energy prices, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable. The Committee expects that…economic growth will pick up from its recent pace and the unemployment rate will gradually decline 36

4. c. FOMC: 2013年 9月18日声明 在联邦公开市场委员会(FOMC)七月份会议之后, 我们收到的信息表明经济活动的开展速度比较缓和 … 失业率维持在比较高的水平 除了由于能源价格的变化造成的波动之外,通货膨 胀水平处于委员会的长期目标之下,但是长期通货 膨胀的预期保持不变。 委员会预计 … 经济增长的速度将会从现在的水平 上开始加快,而失业率将会逐渐降低 37

Continued the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases. Accordingly, the Committee decided to continue purchasing additional agency mortgagebacked securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and [it] anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 61/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored 38

继续 委员会决定在调整其购买规模之前,还需要继续等待收 集一些更多的证据,现在的购买速度将持续。因此,委 员会决定将继续按照每月400亿美元的规模购买抵押贷 款证券,以及每月450亿美元的规模购买美国长期国债。 在资产购买程序结束之后,和经济复兴到来之前的很长 一段时间内,货币政策将维持在一个高度适应的姿态 委员会决定将其联邦基金目标利率维持在 1/4百分点,并 且 委员会认为,只要是失业率水平在 6 -1/2百分比之上,那么联 邦基金利率维持在这个非常低的水平就是非常适合的。 通货膨胀率在未来的一到两年内,预计将不会超出委员会 所设定的2%这个长期目标的0. 5个百分点,并且,长期通 货膨胀的预期一直处于很好的控制之内 39

4. d. FED’s “new” balance sheet 美联储“新的”资产负债表 流动性项 目和其他 资产 GSE证券 长期国债 短期国债 40

4. b. FED’s new procedure … results of 41

非传统的货币政策和行动增加了美联储的资产负债表 4. b. FED’s new procedure … results of 总额,并且改变了其构成 42

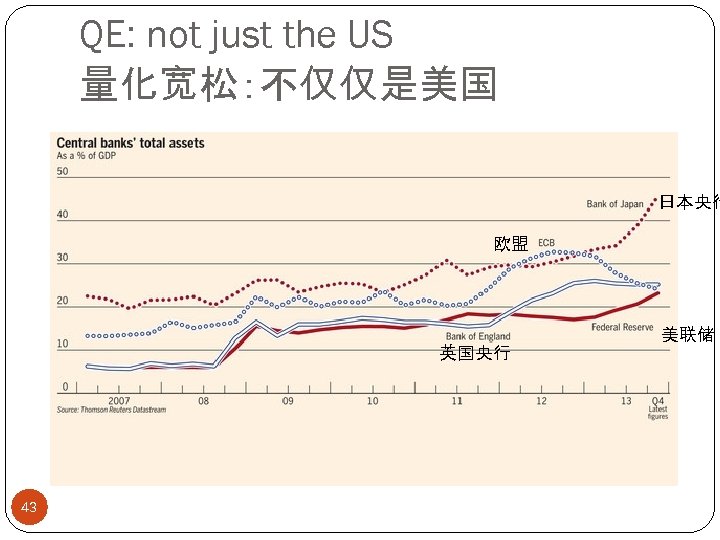

QE: not just the US 量化宽松:不仅仅是美国 日本央行 欧盟 美联储 英国央行 43

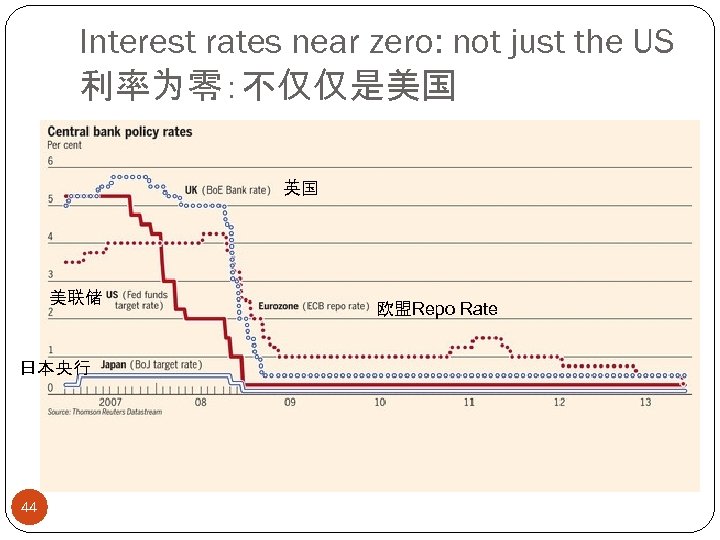

Interest rates near zero: not just the US 利率为零:不仅仅是美国 英国 美联储 日本央行 44 欧盟Repo Rate

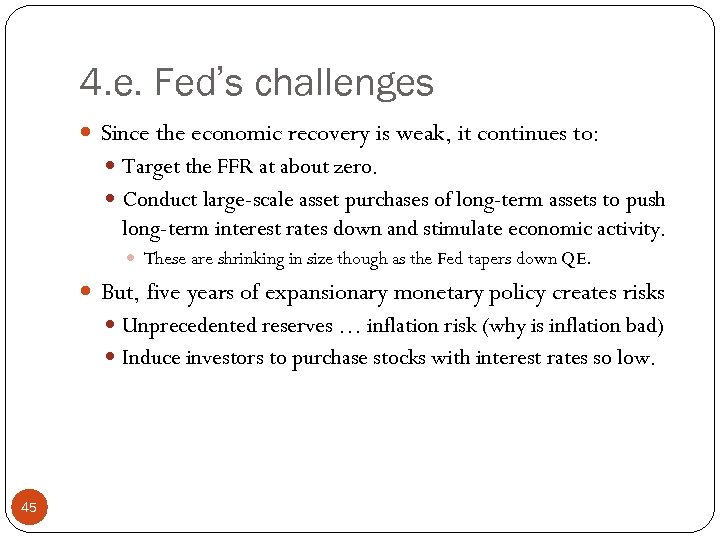

4. e. Fed’s challenges Since the economic recovery is weak, it continues to: Target the FFR at about zero. Conduct large-scale asset purchases of long-term assets to push long-term interest rates down and stimulate economic activity. These are shrinking in size though as the Fed tapers down QE. But, five years of expansionary monetary policy creates risks Unprecedented reserves … inflation risk (why is inflation bad) Induce investors to purchase stocks with interest rates so low. 45

4. e. Fed’s challenges 美联储面临的挑战 由于经济复兴的趋势很弱,美联储不得不持续: 将联邦基金目标利率设置在接近于0 大规模购买长期金融资产以便压低长期市场利率,从 而刺激经济发展 这种购买活动在规模上正在变得越来越小,因为美联储在不断 消减QE规模 但是,持续了五年的宽松的货币政策也产生了风险: 从未有过的准备金规模 … 通货膨胀风险 (为什么通 货膨胀是不好的呢?) 利率如此的低,诱导投资人购买大量股票 46

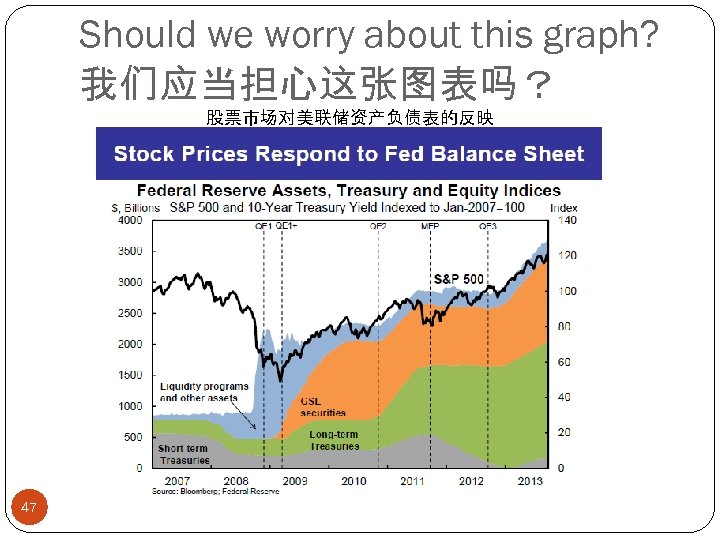

Should we worry about this graph? 我们应当担心这张图表吗? 股票市场对美联储资产负债表的反映 47

4. 3. Fed’s Challenges and Tapering 美联储面临的挑战:QE逐渐减少 How rapidly can the FED reduce its purchases of long-term Treasury and mortgage-backed securities: “Tapering? ” 美联储削减国债和抵押贷款债券购买规模的速度有多快:“ 逐渐减少”? How will the Fed know that economic growth has reached its “long-run potential” rate, or when unemployment is at some “natural” level, so that it knows when to “taper? ” 美联储如何知道什么时候经济增长到达了其“长期的潜力 水平”,或者,失业率降低到了“自然水平”,然后可以开始 削减QE? 48

5. Challenges for the Rest of the World 世界其他地区面临的挑战 a. When will Interest Rates Rise? 利率 什么时间开始上升? b. What Will Happen Then? 利率上 升之后,会发生什么? 49

US Interest Rates: Low for Longer Fed expects short-term interest rates to remain ≈0% until US economy recovers Full employment (5% unemployment, 2% inflation) by end of 2016? Bond Markets agreed 2 -year Treasuries pay. 2% 5 -year Treasuries pay. 7% Tapering of QE likely to end before 2015 Monthly size falling by $10 bn each FOMC (now $65 bn) 50

美国利率:很长时间内会维持在比 较低的水平 美联储预计短期利率水平会维持在接近于0的水平, 直至美国经济开始好转 全民就业(失业率5%,通货膨胀率2%)直至 2016年? 债券市场同样美联储的看法 2年期美国国债利率. 2% 5年期美国国债利率. 7% QE削减预计在 2015年之前就可以停止 现在每一次FOMC会议之后,每个月的购买规模就减 少 100亿美元 51

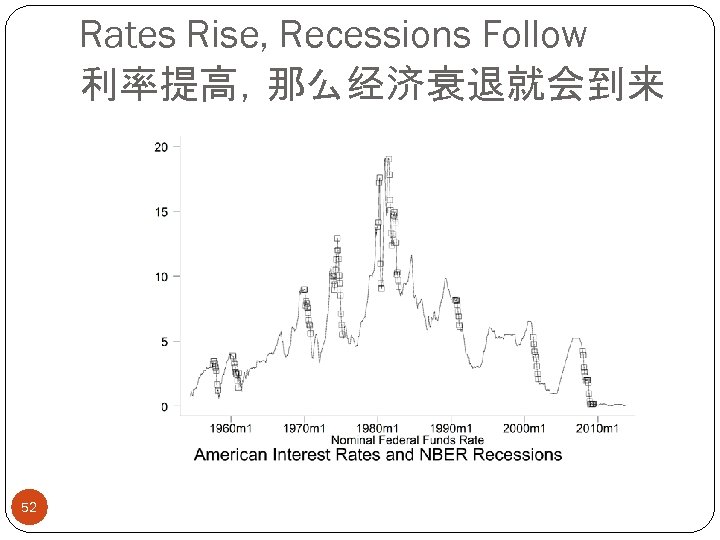

Rates Rise, Recessions Follow 利率提高,那么经济衰退就会到来 52

Danger for Rest of the World? When US Interest Rates Rise, Countries that Peg to US$ must match unless heavy capital controls exist Historically, associated with currency crises Ex: Fed raises rates in mid-1990 s, Mexican, Asian Crises follow Over 40 countries still formally tied to US$, more informally Will China’s slowly relaxing capital controls provide insulation? 53

世界其他地区面临危险? 当美国的利率水平上升的时候,那些将其本国货币 和美元挂钩的国家就必须也要提高其利率水平,除 非那些国家有很强的货币管控措施 历史上和货币有关的经济危机: 例如:美联储在 90年代中期提高利率,接着就发生了墨 西哥和亚洲金融危机 目前有40多个国家正式将其本国货币通美元挂钩, 有更多的国家不正式挂钩 中国逐渐放松的货币管制会提供绝缘层吗? 54

bbeb2a3bf4b193c6f5ab743d24f1d2db.ppt