c5833da2ddfc6b168b07aa447ba9879a.ppt

- Количество слайдов: 38

Future for Investors Prof. Jeremy J. Siegel ~ The Wharton School FPA Symposium ~ May 23, 2006

Future for Investors Prof. Jeremy J. Siegel ~ The Wharton School FPA Symposium ~ May 23, 2006

The Verdict of History Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

The Verdict of History Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

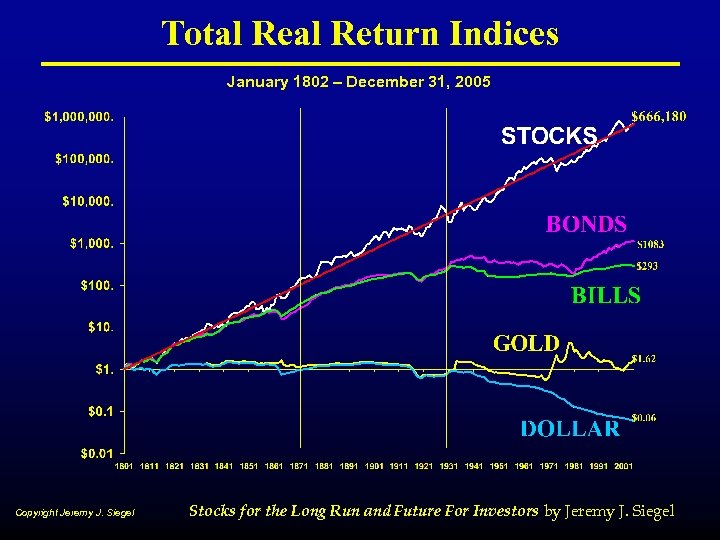

Total Return Indices January 1802 – December 31, 2005 Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Total Return Indices January 1802 – December 31, 2005 Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

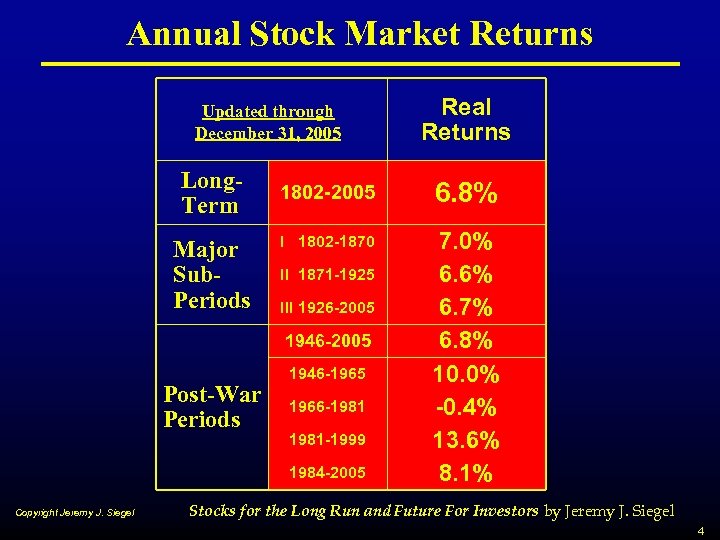

Annual Stock Market Returns Updated through December 31, 2005 Long. Term Major Sub. Periods 1802 -2005 6. 8% I 1802 -1870 7. 0% 6. 6% 6. 7% 6. 8% 10. 0% -0. 4% 13. 6% 8. 1% II 1871 -1925 III 1926 -2005 1946 -2005 Post-War Periods 1946 -1965 1966 -1981 -1999 1984 -2005 Copyright Jeremy J. Siegel Real Returns Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 4

Annual Stock Market Returns Updated through December 31, 2005 Long. Term Major Sub. Periods 1802 -2005 6. 8% I 1802 -1870 7. 0% 6. 6% 6. 7% 6. 8% 10. 0% -0. 4% 13. 6% 8. 1% II 1871 -1925 III 1926 -2005 1946 -2005 Post-War Periods 1946 -1965 1966 -1981 -1999 1984 -2005 Copyright Jeremy J. Siegel Real Returns Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 4

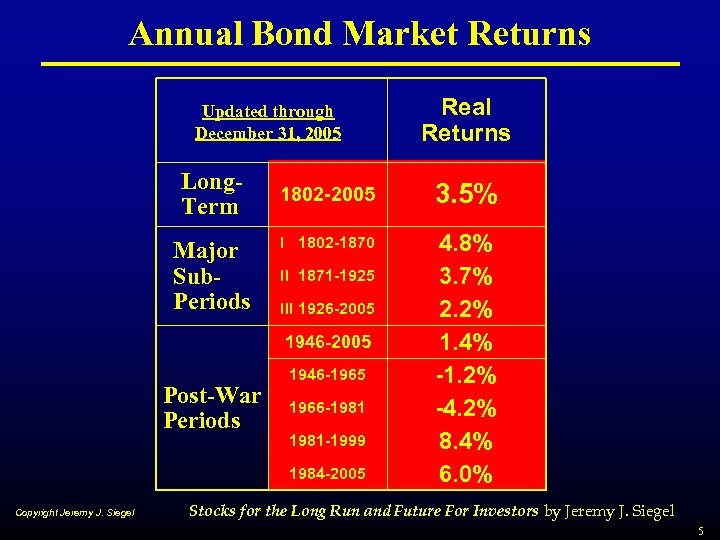

Annual Bond Market Returns Updated through December 31, 2005 Long. Term Major Sub. Periods 1802 -2005 3. 5% I 1802 -1870 4. 8% 3. 7% 2. 2% 1. 4% -1. 2% -4. 2% 8. 4% 6. 0% II 1871 -1925 III 1926 -2005 1946 -2005 Post-War Periods 1946 -1965 1966 -1981 -1999 1984 -2005 Copyright Jeremy J. Siegel Real Returns Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 5

Annual Bond Market Returns Updated through December 31, 2005 Long. Term Major Sub. Periods 1802 -2005 3. 5% I 1802 -1870 4. 8% 3. 7% 2. 2% 1. 4% -1. 2% -4. 2% 8. 4% 6. 0% II 1871 -1925 III 1926 -2005 1946 -2005 Post-War Periods 1946 -1965 1966 -1981 -1999 1984 -2005 Copyright Jeremy J. Siegel Real Returns Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 5

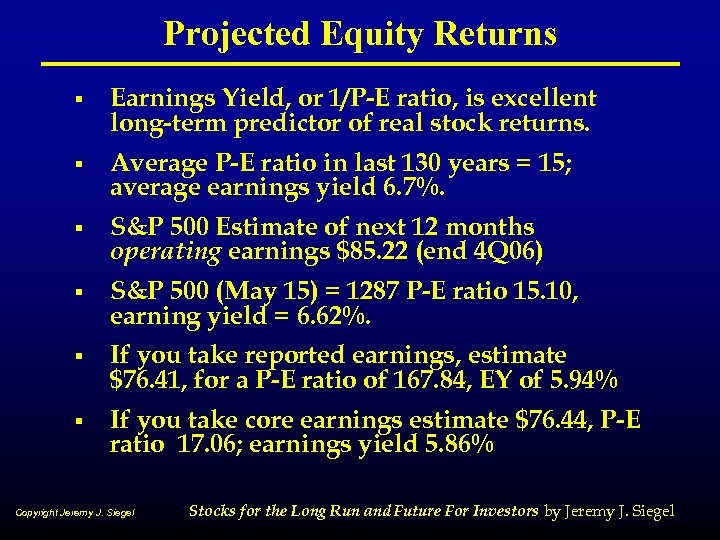

Projected Equity Returns § Earnings Yield, or 1/P-E ratio, is excellent long-term predictor of real stock returns. § Average P-E ratio in last 130 years = 15; average earnings yield 6. 7%. § S&P 500 Estimate of next 12 months operating earnings $85. 22 (end 4 Q 06) § S&P 500 (May 15) = 1287 P-E ratio 15. 10, earning yield = 6. 62%. § If you take reported earnings, estimate $76. 41, for a P-E ratio of 167. 84, EY of 5. 94% § If you take core earnings estimate $76. 44, P-E ratio 17. 06; earnings yield 5. 86% Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Projected Equity Returns § Earnings Yield, or 1/P-E ratio, is excellent long-term predictor of real stock returns. § Average P-E ratio in last 130 years = 15; average earnings yield 6. 7%. § S&P 500 Estimate of next 12 months operating earnings $85. 22 (end 4 Q 06) § S&P 500 (May 15) = 1287 P-E ratio 15. 10, earning yield = 6. 62%. § If you take reported earnings, estimate $76. 41, for a P-E ratio of 167. 84, EY of 5. 94% § If you take core earnings estimate $76. 44, P-E ratio 17. 06; earnings yield 5. 86% Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Bond Returns and Equity Premium n Ten year at 5. 15%, 30 -year at 5. 26% n If we subtract 2. 5% for inflation, we get a real yield of 2. 65% and 2. 76%. n TIPs yields are 2. 46% and 2. 39%. n Equity Premium is almost 4% now. n Long-Term Equity Premium = 3%. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Bond Returns and Equity Premium n Ten year at 5. 15%, 30 -year at 5. 26% n If we subtract 2. 5% for inflation, we get a real yield of 2. 65% and 2. 76%. n TIPs yields are 2. 46% and 2. 39%. n Equity Premium is almost 4% now. n Long-Term Equity Premium = 3%. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

The Future for Investors Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

The Future for Investors Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

What Happened to the Original S&P 500 Formulated in 1957? Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

What Happened to the Original S&P 500 Formulated in 1957? Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

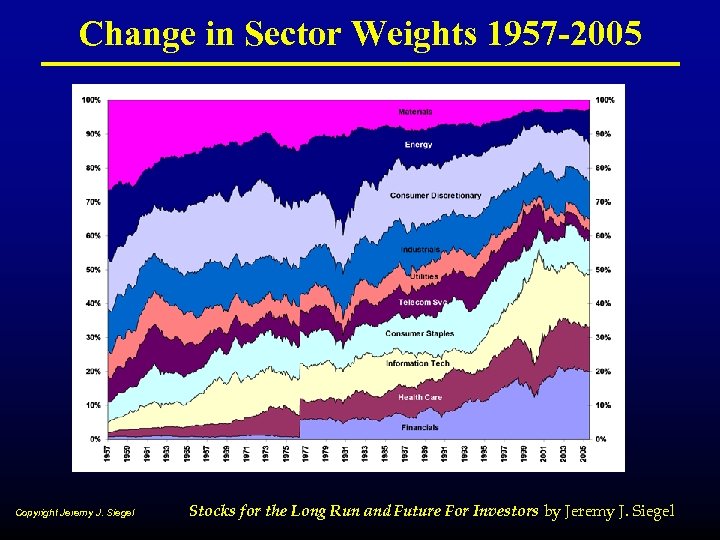

Change in Sector Weights 1957 -2005 Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Change in Sector Weights 1957 -2005 Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Portfolio Performance n The dynamic, updated, S&P 500 Index that serves as a benchmark returned 10. 85% per year from March 1, 1957 through Dec. 31, 2003 n A portfolio of original companies, where no transactions took place except for reinvestment of dividends, returned 11. 40% per year, and did so with lower risk! n Why? New firms overvalued when put in index. New firms Lagged in 9 of ten sectors. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Portfolio Performance n The dynamic, updated, S&P 500 Index that serves as a benchmark returned 10. 85% per year from March 1, 1957 through Dec. 31, 2003 n A portfolio of original companies, where no transactions took place except for reinvestment of dividends, returned 11. 40% per year, and did so with lower risk! n Why? New firms overvalued when put in index. New firms Lagged in 9 of ten sectors. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

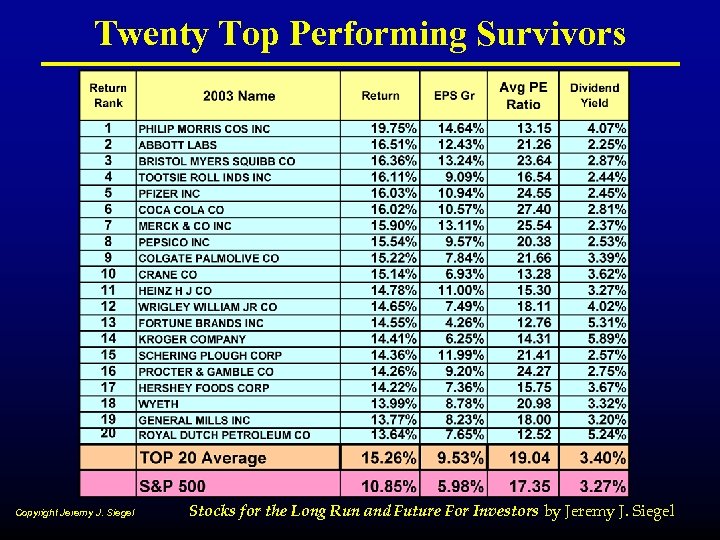

Twenty Top Performing Survivors Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Twenty Top Performing Survivors Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Top Twenty on April 10, 2006 Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Top Twenty on April 10, 2006 Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

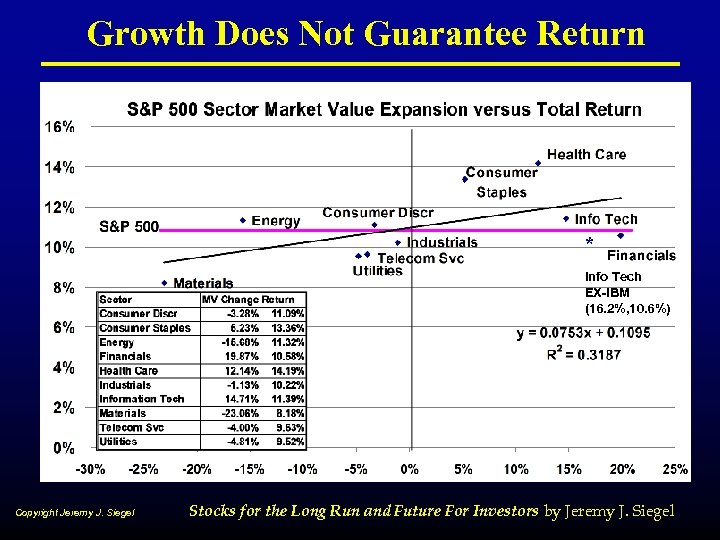

Growth Does Not Guarantee Return * Info Tech EX-IBM (16. 2%, 10. 6%) Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Growth Does Not Guarantee Return * Info Tech EX-IBM (16. 2%, 10. 6%) Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

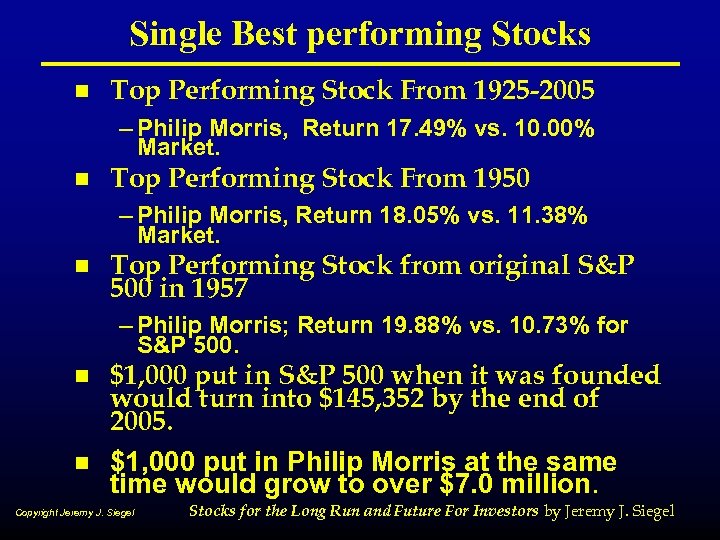

Single Best performing Stocks n Top Performing Stock From 1925 -2005 – Philip Morris, Return 17. 49% vs. 10. 00% Market. n Top Performing Stock From 1950 – Philip Morris, Return 18. 05% vs. 11. 38% Market. n Top Performing Stock from original S&P 500 in 1957 – Philip Morris; Return 19. 88% vs. 10. 73% for S&P 500. n n $1, 000 put in S&P 500 when it was founded would turn into $145, 352 by the end of 2005. $1, 000 put in Philip Morris at the same time would grow to over $7. 0 million. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Single Best performing Stocks n Top Performing Stock From 1925 -2005 – Philip Morris, Return 17. 49% vs. 10. 00% Market. n Top Performing Stock From 1950 – Philip Morris, Return 18. 05% vs. 11. 38% Market. n Top Performing Stock from original S&P 500 in 1957 – Philip Morris; Return 19. 88% vs. 10. 73% for S&P 500. n n $1, 000 put in S&P 500 when it was founded would turn into $145, 352 by the end of 2005. $1, 000 put in Philip Morris at the same time would grow to over $7. 0 million. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

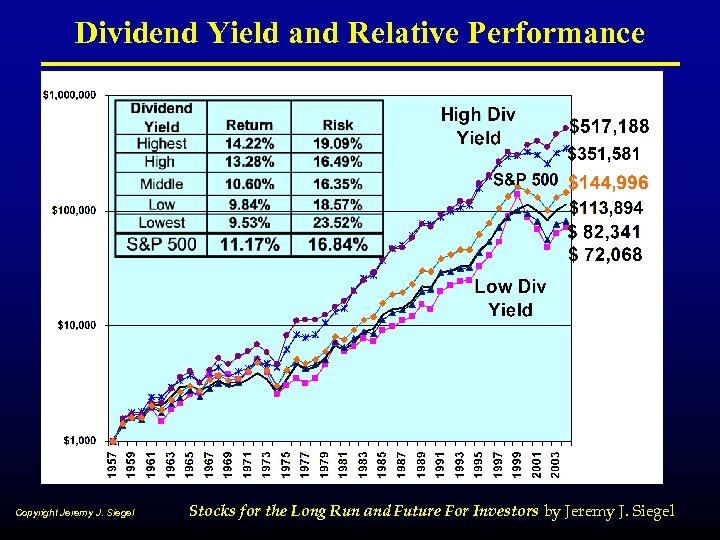

Dividend Yield and Relative Performance Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Dividend Yield and Relative Performance Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

The Next Fifty Years The Aging of the Population The Most Critical Long-term Economic Issue Facing the Developed World Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 17

The Next Fifty Years The Aging of the Population The Most Critical Long-term Economic Issue Facing the Developed World Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 17

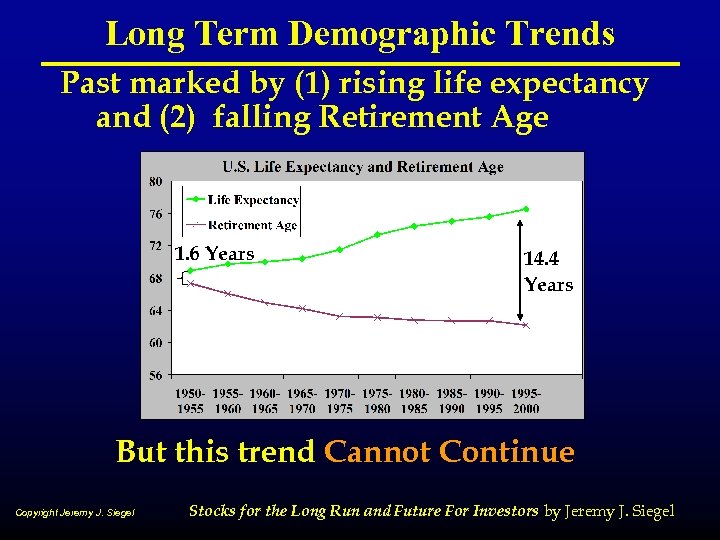

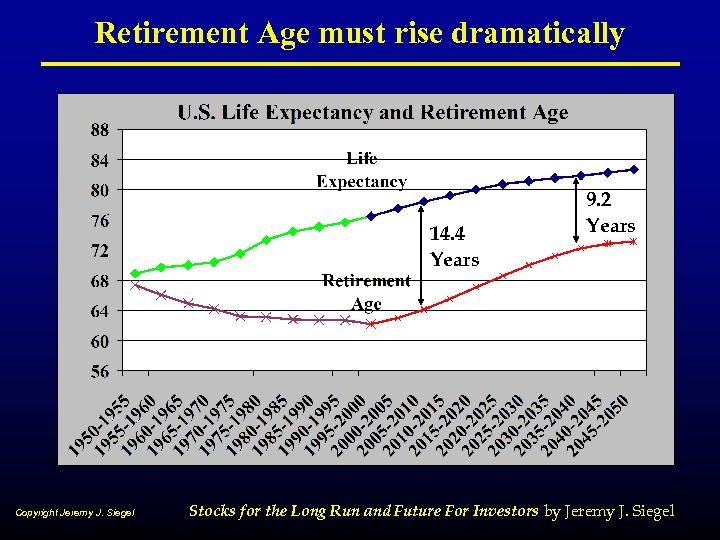

Long Term Demographic Trends Past marked by (1) rising life expectancy and (2) falling Retirement Age 1. 6 Years 14. 4 Years But this trend Cannot Continue Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Long Term Demographic Trends Past marked by (1) rising life expectancy and (2) falling Retirement Age 1. 6 Years 14. 4 Years But this trend Cannot Continue Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

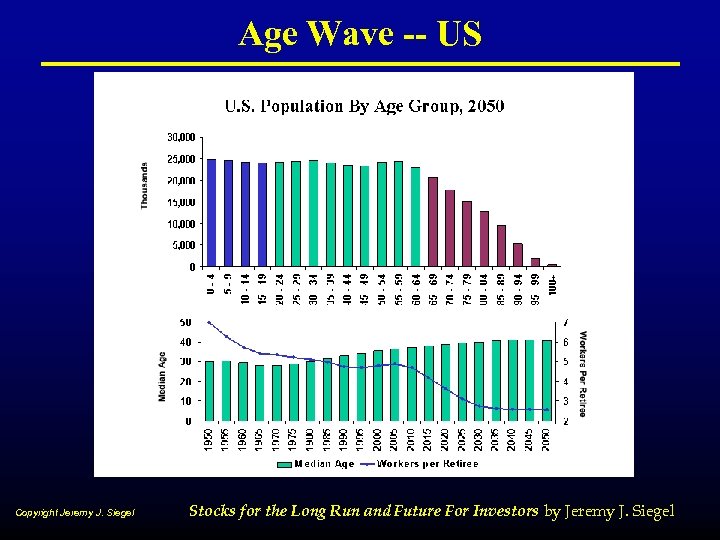

Age Wave -- US Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Age Wave -- US Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

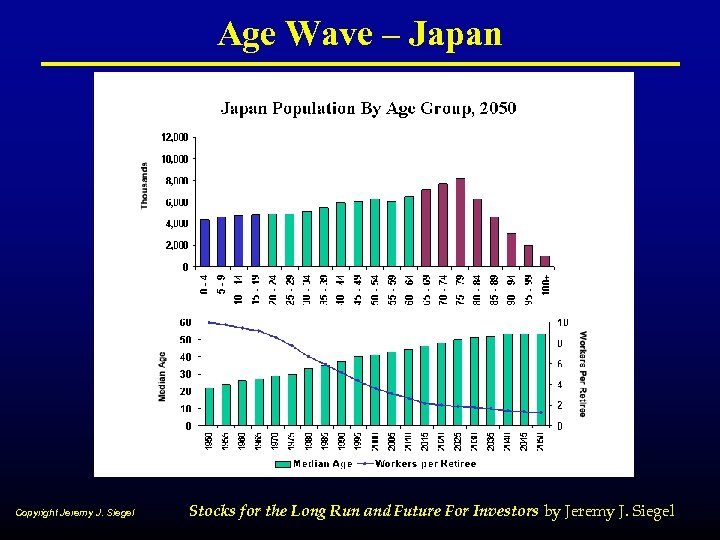

Age Wave – Japan Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Age Wave – Japan Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Big Questions The Biggest Questions Facing the Developed World Who Will Produce the Goods? Who Will Buy the Assets? Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Big Questions The Biggest Questions Facing the Developed World Who Will Produce the Goods? Who Will Buy the Assets? Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Retirement Age must rise dramatically 14. 4 Years Copyright Jeremy J. Siegel 9. 2 Years Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Retirement Age must rise dramatically 14. 4 Years Copyright Jeremy J. Siegel 9. 2 Years Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

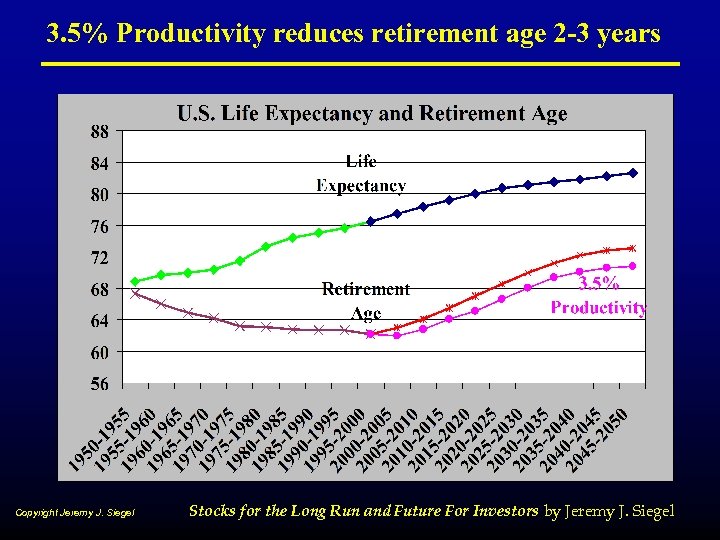

Productivity Growth and Retirement n Can faster productivity growth help the Aging Problem? n Let us be extraordinarily optimistic and assume future productivity growth averages 3 ½ % per year, 70% above long term average of 2. 2%. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Productivity Growth and Retirement n Can faster productivity growth help the Aging Problem? n Let us be extraordinarily optimistic and assume future productivity growth averages 3 ½ % per year, 70% above long term average of 2. 2%. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

3. 5% Productivity reduces retirement age 2 -3 years Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

3. 5% Productivity reduces retirement age 2 -3 years Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Immigration? n The number of immigrants to the US over the next 45 years needed to keep the retirement age in the mid 60 s would be about one-half billion, far in excess of the current population. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Immigration? n The number of immigrants to the US over the next 45 years needed to keep the retirement age in the mid 60 s would be about one-half billion, far in excess of the current population. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

But there is Hope n Outside the developed countries, the population of the world is much younger. n Let’s look at India. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

But there is Hope n Outside the developed countries, the population of the world is much younger. n Let’s look at India. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

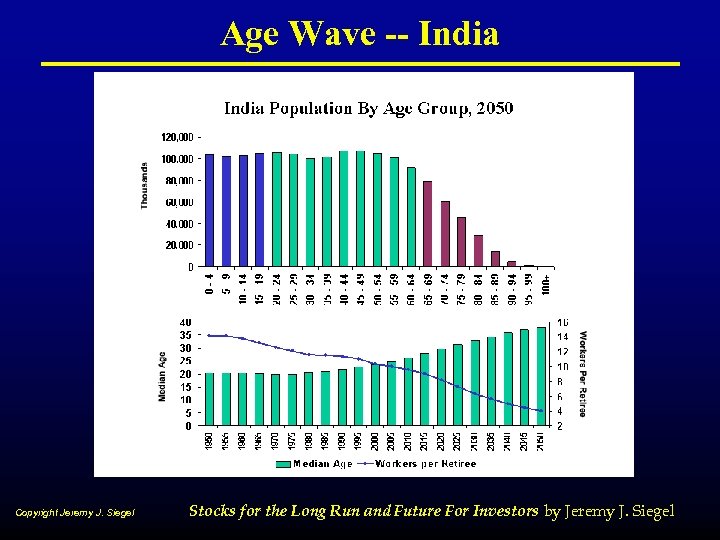

Age Wave -- India Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Age Wave -- India Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Trade Deficits and Aging n Throughout history, the “old” have sold assets to the young in exchange for goods. n Today in US, Florida’s retirees sell assets to and import goods from other 49 states. n In the future the US will sell its assets to the rest of the world. n Success depends on rapid growth in the developing world. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Trade Deficits and Aging n Throughout history, the “old” have sold assets to the young in exchange for goods. n Today in US, Florida’s retirees sell assets to and import goods from other 49 states. n In the future the US will sell its assets to the rest of the world. n Success depends on rapid growth in the developing world. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

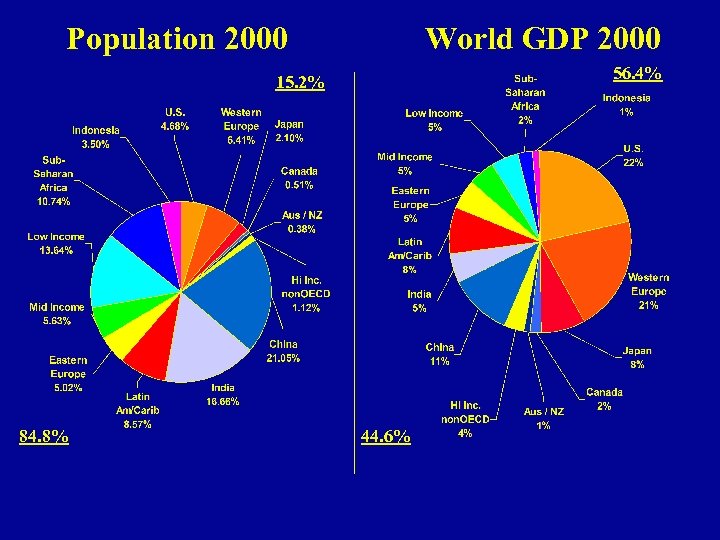

Population 2000 World GDP 2000 56. 4% 15. 2% 84. 8% 44. 6%

Population 2000 World GDP 2000 56. 4% 15. 2% 84. 8% 44. 6%

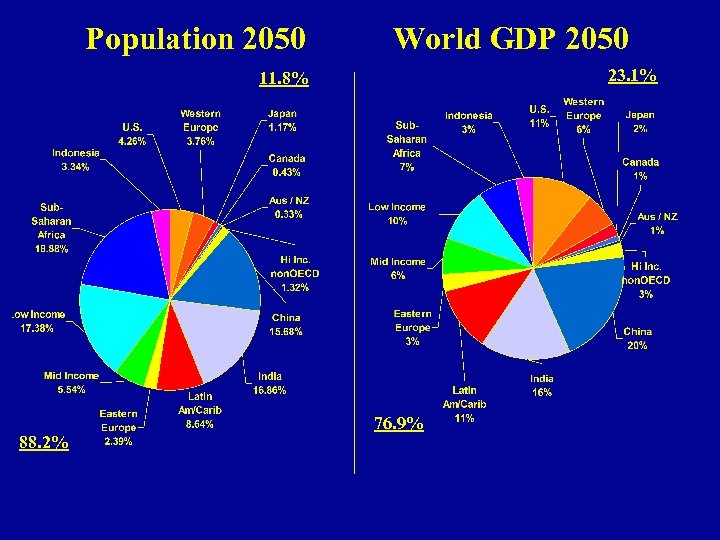

Population 2050 World GDP 2050 23. 1% 11. 8% 88. 2% 76. 9%

Population 2050 World GDP 2050 23. 1% 11. 8% 88. 2% 76. 9%

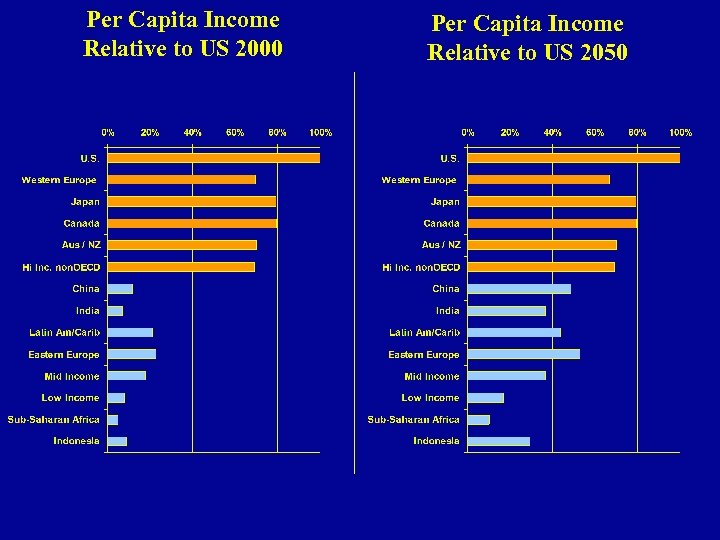

Per Capita Income Relative to US 2000 Per Capita Income Relative to US 2050

Per Capita Income Relative to US 2000 Per Capita Income Relative to US 2050

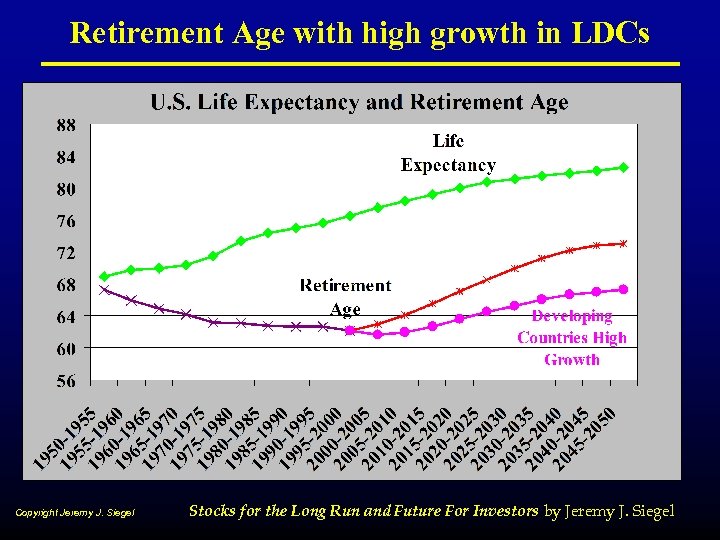

Retirement Age with high growth in LDCs Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Retirement Age with high growth in LDCs Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

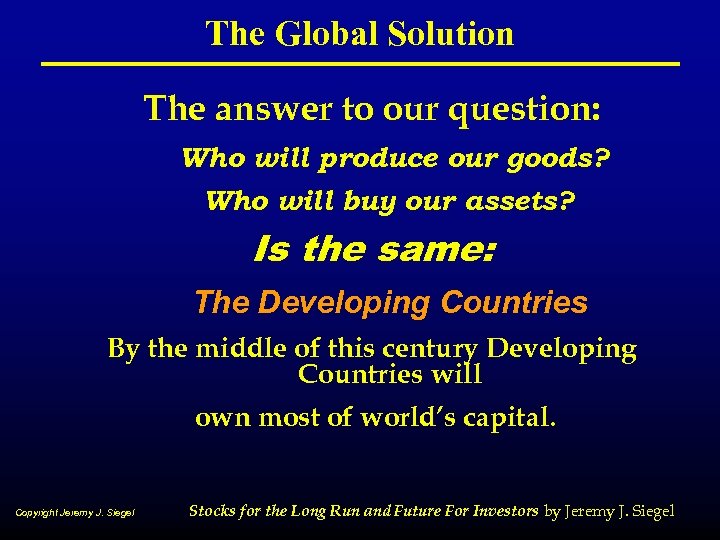

The Global Solution The answer to our question: Who will produce our goods? Who will buy our assets? Is the same: The Developing Countries By the middle of this century Developing Countries will own most of world’s capital. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

The Global Solution The answer to our question: Who will produce our goods? Who will buy our assets? Is the same: The Developing Countries By the middle of this century Developing Countries will own most of world’s capital. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

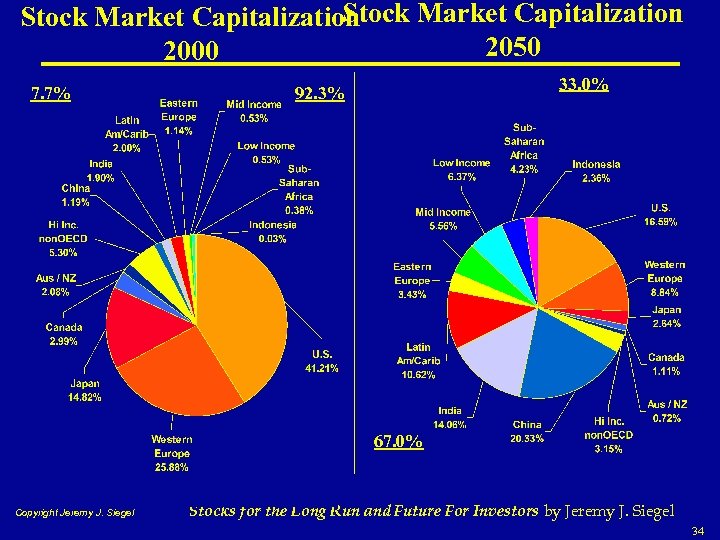

Stock Market Capitalization 2050 2000 7. 7% 33. 0% 92. 3% 67. 0% Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 34

Stock Market Capitalization 2050 2000 7. 7% 33. 0% 92. 3% 67. 0% Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 34

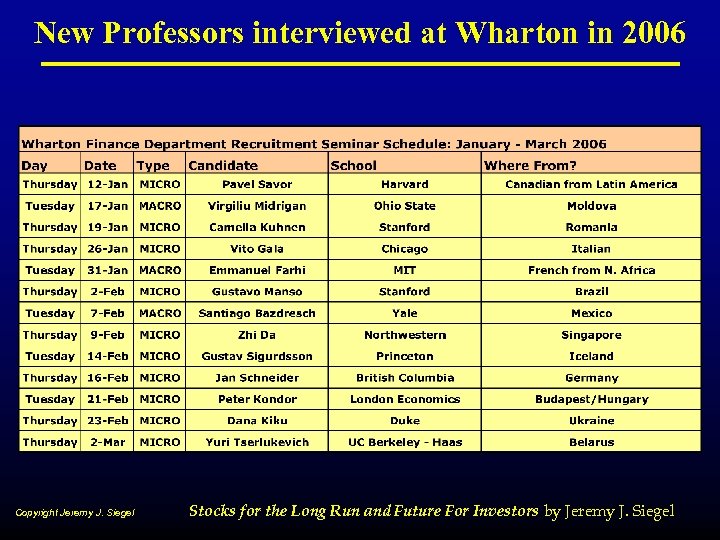

New Professors interviewed at Wharton in 2006 Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

New Professors interviewed at Wharton in 2006 Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

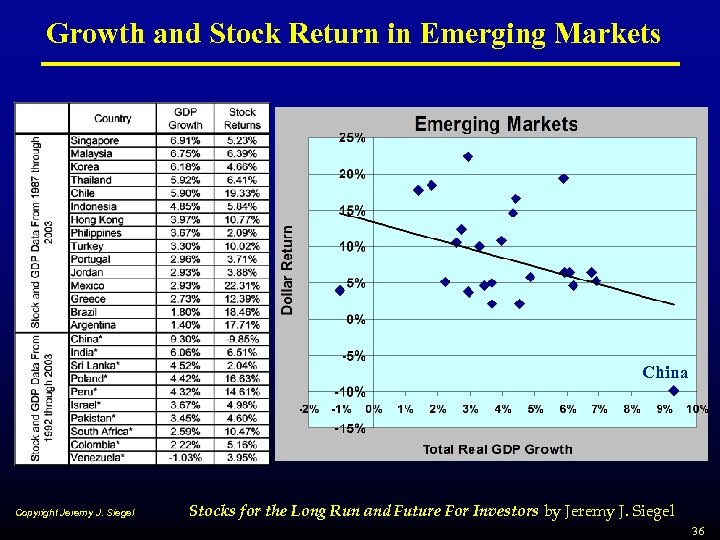

Growth and Stock Return in Emerging Markets China Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 36

Growth and Stock Return in Emerging Markets China Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 36

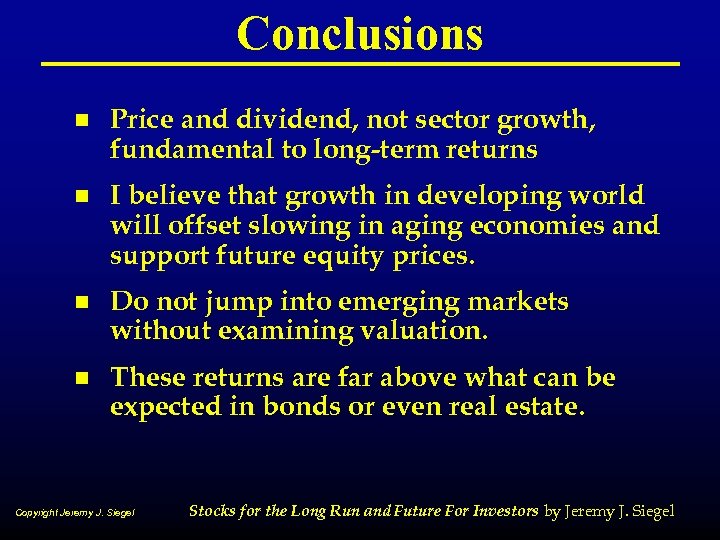

Conclusions n Price and dividend, not sector growth, fundamental to long-term returns n I believe that growth in developing world will offset slowing in aging economies and support future equity prices. n Do not jump into emerging markets without examining valuation. n These returns are far above what can be expected in bonds or even real estate. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Conclusions n Price and dividend, not sector growth, fundamental to long-term returns n I believe that growth in developing world will offset slowing in aging economies and support future equity prices. n Do not jump into emerging markets without examining valuation. n These returns are far above what can be expected in bonds or even real estate. Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel

Visit Jeremy. Siegel. com Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 38

Visit Jeremy. Siegel. com Copyright Jeremy J. Siegel Stocks for the Long Run and Future For Investors by Jeremy J. Siegel 38