4f9daf98dd786b641e98d1d6546e77d0.ppt

- Количество слайдов: 35

Fundraising for Your Organization Focus Area: Grants Education Instructor: Vince Franco Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Fundraising for Your Organization Focus Area: Grants Education Instructor: Vince Franco Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

For additional help Technical Assistance Hotline 1 -866 -973 -2760 Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

For additional help Technical Assistance Hotline 1 -866 -973 -2760 Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Course Description & Objectives Course Description: The purpose of this training session is to help you diagnose the fundraising process, understand the components of a multiple-source plan, utilize best practices, create a planned giving system, and conduct fundraising events. Course Objectives: After this course, attendees will be able to: • Understand the opportunities of fundraising • Describe the components of a multiple-source fundraising plan • Utilize best practices to establish an overall plan • Understand create a planned giving system • Develop and conduct a fundraising event Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Course Description & Objectives Course Description: The purpose of this training session is to help you diagnose the fundraising process, understand the components of a multiple-source plan, utilize best practices, create a planned giving system, and conduct fundraising events. Course Objectives: After this course, attendees will be able to: • Understand the opportunities of fundraising • Describe the components of a multiple-source fundraising plan • Utilize best practices to establish an overall plan • Understand create a planned giving system • Develop and conduct a fundraising event Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Your Presenter Vince Franco Grants Compliance Manager Native Learning Center (NLC) 6363 Taft Street Hollywood, Florida 33024 Vincent. Franco@semtribe. com 1 -954 -985 -2300 Ext. 10651 Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Your Presenter Vince Franco Grants Compliance Manager Native Learning Center (NLC) 6363 Taft Street Hollywood, Florida 33024 Vincent. Franco@semtribe. com 1 -954 -985 -2300 Ext. 10651 Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

How to interact during the presentation. Use the raised hand tool at the top of the screen to select: Raise Hand, Agree, Disagree, Step Away, and other options. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

How to interact during the presentation. Use the raised hand tool at the top of the screen to select: Raise Hand, Agree, Disagree, Step Away, and other options. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

How to Chat During the Presentation To send a message to everyone, simply type your message in the chat pod and hit enter or click the send icon. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

How to Chat During the Presentation To send a message to everyone, simply type your message in the chat pod and hit enter or click the send icon. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

• Key Findings Topics • Government Grants • Foundation and Corporate Funding • Planned Giving, Bequests, and Gifts from Individuals • Revenue from Membership Dues, Product Sales, and Service Fees • Fundraising Events • Other Opportunities Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

• Key Findings Topics • Government Grants • Foundation and Corporate Funding • Planned Giving, Bequests, and Gifts from Individuals • Revenue from Membership Dues, Product Sales, and Service Fees • Fundraising Events • Other Opportunities Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Key Findings According to The Giving Institute’s Giving USA 2012 Annual Report on Philanthropy in 2011, the total estimated charitable giving in the United States increased 4. 0% from 2010 to $298 billion. This increase reflects similar growth in giving by individuals and a strong year for giving by bequests (giving of personal property by will). Let’s look a some specific areas. • Giving by individuals increased 3. 9% to $217 billion. • Giving by bequests increased 12. 2% to $24 billion. • Giving by foundations increased 1. 8% to $41 billion. • Giving by corporations held steady at $14 billion. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Key Findings According to The Giving Institute’s Giving USA 2012 Annual Report on Philanthropy in 2011, the total estimated charitable giving in the United States increased 4. 0% from 2010 to $298 billion. This increase reflects similar growth in giving by individuals and a strong year for giving by bequests (giving of personal property by will). Let’s look a some specific areas. • Giving by individuals increased 3. 9% to $217 billion. • Giving by bequests increased 12. 2% to $24 billion. • Giving by foundations increased 1. 8% to $41 billion. • Giving by corporations held steady at $14 billion. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Key Findings • Giving to religion decreased 1. 7% to $95 billion. • Giving to education increased 4. 0% to $38 billion. • Giving to foundations decreased 6. 1% to $25 billion. • Giving to human services increased 2. 5% to $14 billion. • Giving to health organizations increased 2. 7% to $24 billion. • Giving to public/society benefit organizations increased 4. 0% to $21 billion. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Key Findings • Giving to religion decreased 1. 7% to $95 billion. • Giving to education increased 4. 0% to $38 billion. • Giving to foundations decreased 6. 1% to $25 billion. • Giving to human services increased 2. 5% to $14 billion. • Giving to health organizations increased 2. 7% to $24 billion. • Giving to public/society benefit organizations increased 4. 0% to $21 billion. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Key Findings • Giving to arts, culture and humanities increased 4. 1% to $13 billion. • Giving to international affairs increased 7. 6% to $22 billion. • Giving to environmental and animal organizations increased 4. 6% to $8 billion. • Giving to individuals increased 9. 0% to $4 billion. • Unallocated giving totaled $9 billion in 2011. This amount includes itemized deductions by individuals and households. It also includes gifts to government entities, which do not report charitable contributions. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Key Findings • Giving to arts, culture and humanities increased 4. 1% to $13 billion. • Giving to international affairs increased 7. 6% to $22 billion. • Giving to environmental and animal organizations increased 4. 6% to $8 billion. • Giving to individuals increased 9. 0% to $4 billion. • Unallocated giving totaled $9 billion in 2011. This amount includes itemized deductions by individuals and households. It also includes gifts to government entities, which do not report charitable contributions. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Key Findings • Religion received the largest share of 2011 charitable gifts at 32%. • 2 nd place was Education at 13%. • 3 rd place was Human Services at 12%. • 4 th place was Foundations at 9%. • 5 th place tie between International Affairs and Health at 8%. • 7 th place was Public/Society Benefit Organizations at 7%. • The remainder: Arts and Culture at 4%, Environmental and Animals at 3%, and Individuals at 1%. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Key Findings • Religion received the largest share of 2011 charitable gifts at 32%. • 2 nd place was Education at 13%. • 3 rd place was Human Services at 12%. • 4 th place was Foundations at 9%. • 5 th place tie between International Affairs and Health at 8%. • 7 th place was Public/Society Benefit Organizations at 7%. • The remainder: Arts and Culture at 4%, Environmental and Animals at 3%, and Individuals at 1%. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Government Grants • $400 billion in federal grants each year • Electronic access through Grants. gov to more than 900 individual grant programs offered by all federal grantmaking agencies. • Some funding is just for Native Americans, which has tripled since 1989. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Government Grants • $400 billion in federal grants each year • Electronic access through Grants. gov to more than 900 individual grant programs offered by all federal grantmaking agencies. • Some funding is just for Native Americans, which has tripled since 1989. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Government Grants • Grants. gov www. grants. gov is designed to help you search for grant opportunities throughout the federal government. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Government Grants • Grants. gov www. grants. gov is designed to help you search for grant opportunities throughout the federal government. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Government Grants • You have options: Search the Find Grant Opportunities online, in real time. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Government Grants • You have options: Search the Find Grant Opportunities online, in real time. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Government Grants • Subscribe and receive email alerts detailing new grant postings. • You can also conduct a detailed search using different criteria. Let’s look a little closer at these options. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Government Grants • Subscribe and receive email alerts detailing new grant postings. • You can also conduct a detailed search using different criteria. Let’s look a little closer at these options. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

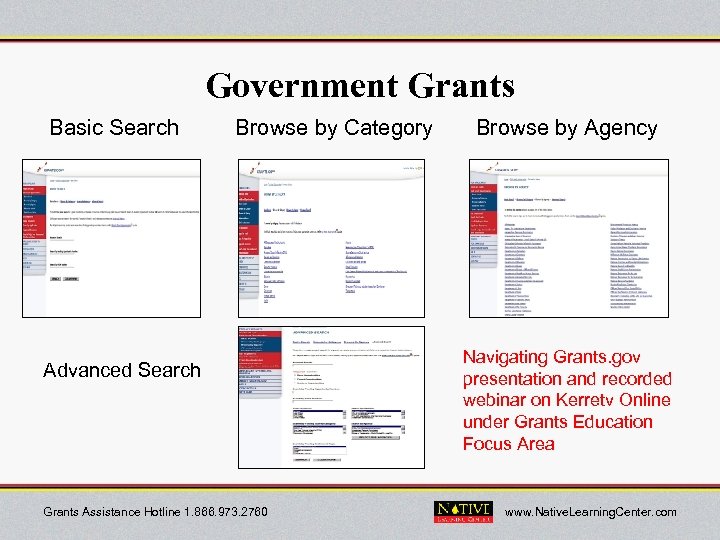

Government Grants Basic Search Browse by Category Advanced Search Grants Assistance Hotline 1. 866. 973. 2760 Browse by Agency Navigating Grants. gov presentation and recorded webinar on Kerretv Online under Grants Education Focus Area www. Native. Learning. Center. com

Government Grants Basic Search Browse by Category Advanced Search Grants Assistance Hotline 1. 866. 973. 2760 Browse by Agency Navigating Grants. gov presentation and recorded webinar on Kerretv Online under Grants Education Focus Area www. Native. Learning. Center. com

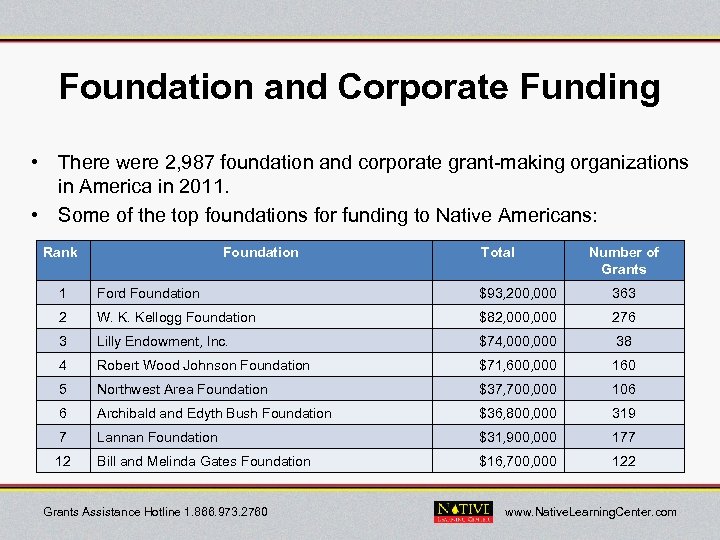

Foundation and Corporate Funding • There were 2, 987 foundation and corporate grant-making organizations in America in 2011. • Some of the top foundations for funding to Native Americans: Rank Foundation Total Number of Grants 1 Ford Foundation $93, 200, 000 363 2 W. K. Kellogg Foundation $82, 000 276 3 Lilly Endowment, Inc. $74, 000 38 4 Robert Wood Johnson Foundation $71, 600, 000 160 5 Northwest Area Foundation $37, 700, 000 106 6 Archibald and Edyth Bush Foundation $36, 800, 000 319 7 Lannan Foundation $31, 900, 000 177 12 Bill and Melinda Gates Foundation $16, 700, 000 122 Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundation and Corporate Funding • There were 2, 987 foundation and corporate grant-making organizations in America in 2011. • Some of the top foundations for funding to Native Americans: Rank Foundation Total Number of Grants 1 Ford Foundation $93, 200, 000 363 2 W. K. Kellogg Foundation $82, 000 276 3 Lilly Endowment, Inc. $74, 000 38 4 Robert Wood Johnson Foundation $71, 600, 000 160 5 Northwest Area Foundation $37, 700, 000 106 6 Archibald and Edyth Bush Foundation $36, 800, 000 319 7 Lannan Foundation $31, 900, 000 177 12 Bill and Melinda Gates Foundation $16, 700, 000 122 Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundations and Corporate Funding • Some of the top Native American corporate funders include: Rank Corporation Total Type of Funding 1 Sanofi-aventis Patient Assistance Foundation $392, 700, 000 Grants and Product 2 Novartis Patient Assistance Foundation $239, 500, 000 Grants and Product 3 Bank of America Charitable Foundation $197, 900, 000 Grants 4 Wal-Mart Foundation $164, 500, 000 Grants 5 JP Morgan Chase Foundation $133, 700, 000 Grants 6 GE Foundation $112, 200, 000 Grants 7 Wells Fargo Foundation $96, 400, 000 Grants 10 Verizon $59, 300, 000 Grants 18 UPS Foundation $49, 300, 000 Grants 23 BP Foundation $31, 200, 000 Grants Go to: http: //foundationcenter. org/findfunders/top 50 giving. html for more information on the 50 largest corporate funders. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundations and Corporate Funding • Some of the top Native American corporate funders include: Rank Corporation Total Type of Funding 1 Sanofi-aventis Patient Assistance Foundation $392, 700, 000 Grants and Product 2 Novartis Patient Assistance Foundation $239, 500, 000 Grants and Product 3 Bank of America Charitable Foundation $197, 900, 000 Grants 4 Wal-Mart Foundation $164, 500, 000 Grants 5 JP Morgan Chase Foundation $133, 700, 000 Grants 6 GE Foundation $112, 200, 000 Grants 7 Wells Fargo Foundation $96, 400, 000 Grants 10 Verizon $59, 300, 000 Grants 18 UPS Foundation $49, 300, 000 Grants 23 BP Foundation $31, 200, 000 Grants Go to: http: //foundationcenter. org/findfunders/top 50 giving. html for more information on the 50 largest corporate funders. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundation and Corporate Funding Another excellent source of foundation and corporate grants is through the Foundation Center at www. foundationcenter. org. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundation and Corporate Funding Another excellent source of foundation and corporate grants is through the Foundation Center at www. foundationcenter. org. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundation and Corporate Funding • Foundation Center provides for a foundation search. • http: //foundationcenter. org/gainknowledge/research/pdf/ff_nativeamerican. pdf is a site dedicated to funding for Native American issues. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundation and Corporate Funding • Foundation Center provides for a foundation search. • http: //foundationcenter. org/gainknowledge/research/pdf/ff_nativeamerican. pdf is a site dedicated to funding for Native American issues. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundation and Corporate Funding Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Foundation and Corporate Funding Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Planned Giving • Planned Giving is an area of fundraising that refers to several specific types of gifts to a nonprofit organization. • Funded with money, equity, securities, property or other assets. • Based on tax laws of the United States. • Complex arrangements that usually require more planning. • Donors establish Planned Giving as either: – A gift to a nonprofit at the time of his/her death. – A way to invest money so that the donor receives benefits during his/her life, then bequeaths the remaining funds to the nonprofit. • Popular system with colleges, hospitals, museums, and community foundations. Usually devoted to capital projects and endowments. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Planned Giving • Planned Giving is an area of fundraising that refers to several specific types of gifts to a nonprofit organization. • Funded with money, equity, securities, property or other assets. • Based on tax laws of the United States. • Complex arrangements that usually require more planning. • Donors establish Planned Giving as either: – A gift to a nonprofit at the time of his/her death. – A way to invest money so that the donor receives benefits during his/her life, then bequeaths the remaining funds to the nonprofit. • Popular system with colleges, hospitals, museums, and community foundations. Usually devoted to capital projects and endowments. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Planned Giving • Bequests are planned gifts that transfer wealth during or after a donor’s lifetime by means of a will or trust. They can take several forms for a nonprofit. – Being provided with cash, securities (stocks), property or an estate. – Being named as a beneficiary of an insurance policy. – Being named as the recipient of an IRA, an investment, or retirement fund. – Being named as part of a donor’s Charitable Remainder Trust or Charitable Lead Trust • Example: The donor designated that 35 percent of her gross estate be given to the Humane Society. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Planned Giving • Bequests are planned gifts that transfer wealth during or after a donor’s lifetime by means of a will or trust. They can take several forms for a nonprofit. – Being provided with cash, securities (stocks), property or an estate. – Being named as a beneficiary of an insurance policy. – Being named as the recipient of an IRA, an investment, or retirement fund. – Being named as part of a donor’s Charitable Remainder Trust or Charitable Lead Trust • Example: The donor designated that 35 percent of her gross estate be given to the Humane Society. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Planned Giving • Gifts from Individuals are also known as donations. • Usually a donation from an individual or an organization is given to a nonprofit organization, charity or private foundation. • Donations are commonly in the form of cash, but can also take the form of real estate, motor vehicles and boats, securities, clothing, and other assets. • Donations often represent the primary source of funding for many nonprofit organizations! • Donations from an individual can provide him/her with an income tax deduction. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Planned Giving • Gifts from Individuals are also known as donations. • Usually a donation from an individual or an organization is given to a nonprofit organization, charity or private foundation. • Donations are commonly in the form of cash, but can also take the form of real estate, motor vehicles and boats, securities, clothing, and other assets. • Donations often represent the primary source of funding for many nonprofit organizations! • Donations from an individual can provide him/her with an income tax deduction. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Membership Dues, Product Sales, and Service Fees • Membership Dues can be a significant source of revenue for nonprofit organizations, such as museums, zoos, art galleries, and the like. • However, some nonprofits promote their individual memberships as all or partially tax deductible. This might be the case depending on the benefits given in return for dues. • Be sure to check with a tax advisor on both sides of this issue. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Membership Dues, Product Sales, and Service Fees • Membership Dues can be a significant source of revenue for nonprofit organizations, such as museums, zoos, art galleries, and the like. • However, some nonprofits promote their individual memberships as all or partially tax deductible. This might be the case depending on the benefits given in return for dues. • Be sure to check with a tax advisor on both sides of this issue. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Membership Dues, Product Sales, and Service Fees • Fundraising through Product Sales, such as candy, magazines, or special/unique items, seems simple. It can be as successful as the Girl Scouts or it can leave the nonprofit weary and wondering if it was worth the effort of time and energy, and the money. – You need enthusiastic volunteers to fundraise with your products! – You need an outstanding product(s) that will result in outstanding results! – You need superb fundraising coordination from order taking to delivery! • Be sure the product is compatible with your mission, or UBIT. • Go to www. efundraising. com, a subsidiary of Reader’s Digest Company, for more information potential products for fundraising. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Membership Dues, Product Sales, and Service Fees • Fundraising through Product Sales, such as candy, magazines, or special/unique items, seems simple. It can be as successful as the Girl Scouts or it can leave the nonprofit weary and wondering if it was worth the effort of time and energy, and the money. – You need enthusiastic volunteers to fundraise with your products! – You need an outstanding product(s) that will result in outstanding results! – You need superb fundraising coordination from order taking to delivery! • Be sure the product is compatible with your mission, or UBIT. • Go to www. efundraising. com, a subsidiary of Reader’s Digest Company, for more information potential products for fundraising. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Membership Dues, Product Sales, and Service Fees • Can a nonprofit charge for Service Fees? In a word, yes. Many nonprofits count on fees from services they offer to members or clients as part of their annual revenue stream. • Beware of UBIT, as the fee must be associated with your mission. • Rather than charge a fee, some nonprofits have “voluntary” donations. You can make a suggestion, do not coerce or shame anyone into making a donation. It has to be voluntary. • Give ranges to make it easier, such as $25 to $50. • Donations depend greatly on the mission of your nonprofit. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Membership Dues, Product Sales, and Service Fees • Can a nonprofit charge for Service Fees? In a word, yes. Many nonprofits count on fees from services they offer to members or clients as part of their annual revenue stream. • Beware of UBIT, as the fee must be associated with your mission. • Rather than charge a fee, some nonprofits have “voluntary” donations. You can make a suggestion, do not coerce or shame anyone into making a donation. It has to be voluntary. • Give ranges to make it easier, such as $25 to $50. • Donations depend greatly on the mission of your nonprofit. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Fundraising Events Some nonprofits have funding needs that are not easily satisfied with membership dues, products sales, or service fees. They find that their biggest revenue generator is often a Fundraising Event. • Be sure to consider your resources, such as workforce, lead time, and venue. Your event is only limited by your resource base. • Fundraising Dinners, for a good cause is an old standby. • Entertainment, such as a concert, teamed a dinner could work. • Family Fun for parents and children is a money-making idea. • Gala Ball, even an affordable version, could spark donations. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Fundraising Events Some nonprofits have funding needs that are not easily satisfied with membership dues, products sales, or service fees. They find that their biggest revenue generator is often a Fundraising Event. • Be sure to consider your resources, such as workforce, lead time, and venue. Your event is only limited by your resource base. • Fundraising Dinners, for a good cause is an old standby. • Entertainment, such as a concert, teamed a dinner could work. • Family Fun for parents and children is a money-making idea. • Gala Ball, even an affordable version, could spark donations. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Fundraising Events • Fashion Show with an admission and event sale or auction. • Silent auction with in-kind donations can go a long way. • Tournaments give supporters a chance to complete. Such as a golf, fishing, rodeo, or other sport tournament, complete with sales, refreshments, entrance fees, prizes, and more. • Sometime the outreach or goodwill goes further than the profit. • Educate the public about the nonprofit, gain exposure, recruit new donors and volunteers, and solicit donations. • Go to: http: //www. fundraisingip. com/ for more ideas. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Fundraising Events • Fashion Show with an admission and event sale or auction. • Silent auction with in-kind donations can go a long way. • Tournaments give supporters a chance to complete. Such as a golf, fishing, rodeo, or other sport tournament, complete with sales, refreshments, entrance fees, prizes, and more. • Sometime the outreach or goodwill goes further than the profit. • Educate the public about the nonprofit, gain exposure, recruit new donors and volunteers, and solicit donations. • Go to: http: //www. fundraisingip. com/ for more ideas. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Other Opportunities • Select a Domain and set up a Fundraising Website – Promote your mission, accomplishments, and events – Solicit and accept online donations. • Develop a Social Media Strategy – Create a page (not a group) on Facebook or Linked. In • Raise funds through Groupon at www. groupon. com/grassroots. • Establish an account with a Fundraising Vendor. Go to: www. igive. com for more information, and/or to register. • Collect mobile donations via an SMS text donation campaign through www. mgive. com or www. mobilecause. com. • Develop a mobile Fundraising App at www. appmakr. com. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Other Opportunities • Select a Domain and set up a Fundraising Website – Promote your mission, accomplishments, and events – Solicit and accept online donations. • Develop a Social Media Strategy – Create a page (not a group) on Facebook or Linked. In • Raise funds through Groupon at www. groupon. com/grassroots. • Establish an account with a Fundraising Vendor. Go to: www. igive. com for more information, and/or to register. • Collect mobile donations via an SMS text donation campaign through www. mgive. com or www. mobilecause. com. • Develop a mobile Fundraising App at www. appmakr. com. Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Review • Key Findings • Government Grants • Foundation and Corporate Funding • Planned Giving, Bequests, and Gifts from Individuals • Revenue from Membership Dues, Product Sales, and Service Fees • Fundraising Events • Other Opportunities Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Review • Key Findings • Government Grants • Foundation and Corporate Funding • Planned Giving, Bequests, and Gifts from Individuals • Revenue from Membership Dues, Product Sales, and Service Fees • Fundraising Events • Other Opportunities Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

For additional help Technical Assistance Hotline 1 -866 -973 -2760 Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

For additional help Technical Assistance Hotline 1 -866 -973 -2760 Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Survey Time! Your feedback is valuable to us. Please complete the survey from the link below. http: //www. surveymonkey. com/s/QP 5 VJNT Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Survey Time! Your feedback is valuable to us. Please complete the survey from the link below. http: //www. surveymonkey. com/s/QP 5 VJNT Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Thank You! Please visit our Website www. Native. Learning. Center. com Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Thank You! Please visit our Website www. Native. Learning. Center. com Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Next Webinar! Getting Started with Investing Focus Area: Financial Wellness Date: October 3, 2012 Time: 2: 00 -3: 00 pm EST Instructor: Jared Forman Registration is free! Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com

Next Webinar! Getting Started with Investing Focus Area: Financial Wellness Date: October 3, 2012 Time: 2: 00 -3: 00 pm EST Instructor: Jared Forman Registration is free! Grants Assistance Hotline 1. 866. 973. 2760 www. Native. Learning. Center. com